成本会计专业题英文版

- 格式:doc

- 大小:149.00 KB

- 文档页数:37

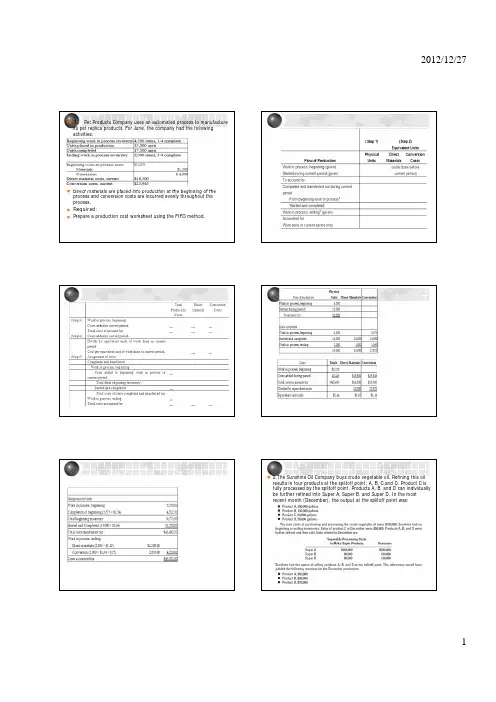

1.Pet Products Company uses an automated process to manufactureits pet replica products. For June, the company had the followingactivities:Direct materials are placed into production at the beginning of theprocess and conversion costs are incurred evenly throughout theprocess.Required:Prepare a production cost worksheet using the FIFO method.2.The Sunshine Oil Company buys crude vegetable oil. Refining this oilresults in four products at the splitoff point: A, B, C,and D. Product C isfully processed by the splitoff point. Products A, B, and D can individuallybe further refined into Super A, Super B, and Super D. In the mostrecent month (December), the output at the splitoff point was:Computation of gross-margin percentages:3.The Carvelli Company is a manufacturer of housewares anduses standard costing. Manufacturing overhead (both variableand fixed) is allocated to products on the basis of budgetedmachine-hours. The budget for 2007 included:Variable manufacturing overhead $9 per machine-hourFixed manufacturing overhead $72,000,000Denominator level 4,000,000 machine-hoursSuppose that 3,500,000 machine-hours were allowed foractual output produced in 2007, but 3,800,000 actualmachine-hours were used. Actual manufacturing overheadwas $36,100,000, variable, and $72,200,000, fixed.Compute (a) the variable manufacturing overhead spendingand efficiency variances and (b) the fixed manufacturingoverhead spending and production-volume variances45.Madzinga’s Draperies manufactures curtains. A certain window requires the following:Direct materials standard10 square yards at $5 per yard Direct manufacturing labor standard 5 hours at $10 During the second quarter, the company made 1,500 curtains and used 14,000 square yards of fabric costing $68,600. Direct labor totaled 7,600 hours for $79,800. Required:a. Compute the direct materials price and efficiency variances for the quarter.b. Compute the direct manufacturing labor price and efficiency variances for the quarter.。

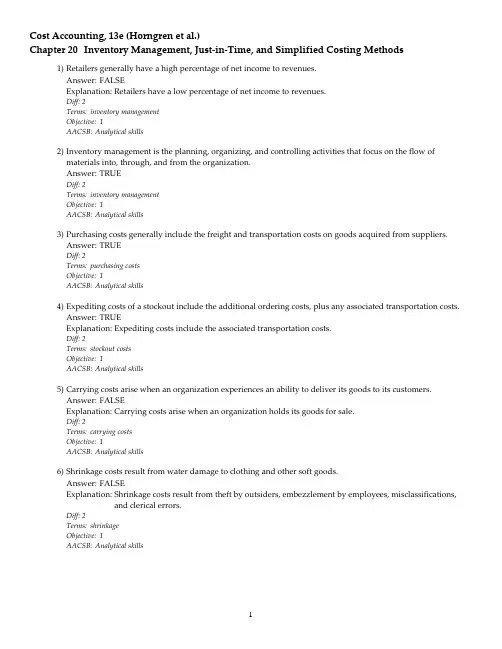

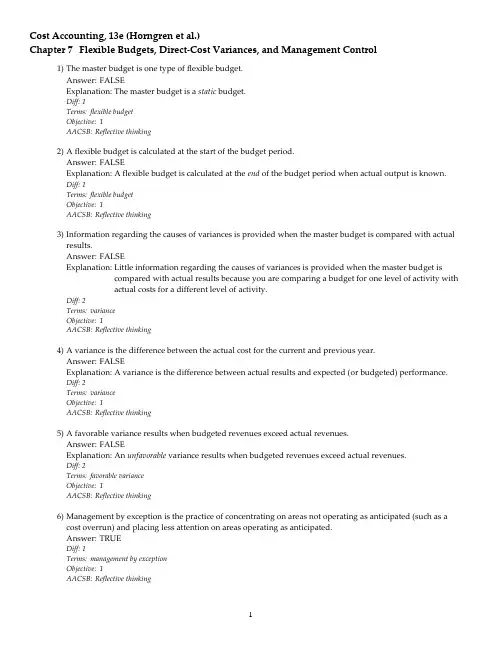

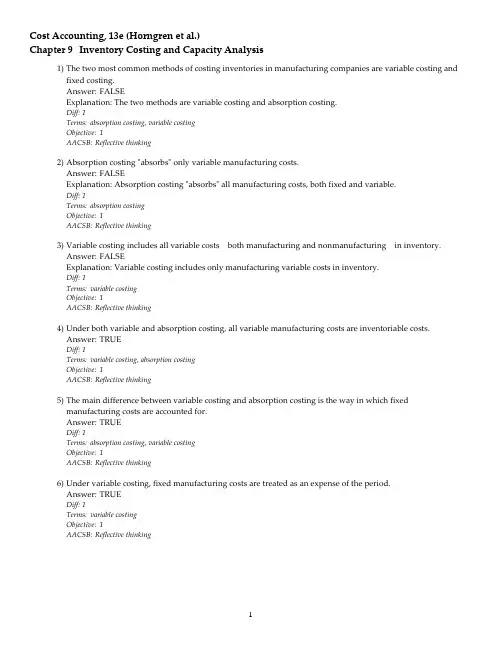

Cost Accounting, 13e (Horngren et al.)Chapter 6 Master Budget and Responsibility Accounting1) Few businesses plan to fail, but many of those that don't succeed have failed to plan.Answer: TRUEDiff: 1Terms: master budgetObjective: 1AACSB: Analytical skills2) The master budget reflects the impact of operating decisions, but not financing decisions.Answer: FALSEExplanation: The master budget reflects the impact of operating decisions and financing decisions.Diff: 1Terms: master budgetObjective: 1AACSB: Communication3) Budgeted financial statements are also referred to as pro forma statements.Answer: TRUEDiff: 1Terms: financial budgetObjective: 1AACSB: Reflective thinking4) Budgeting includes only the financial aspects of the plan and not any nonfinancial aspects such as thenumber of physical units manufactured.Answer: FALSEExplanation: Budgeting includes both financial and nonfinancial aspects of the plan.Diff: 2Terms: financial budgetObjective: 1AACSB: Reflective thinking5) Budgeting helps management anticipate and adjust for trouble spots in advance.Answer: TRUEDiff: 1Terms: budgetObjective: 1AACSB: Reflective thinking6) Budgets can play both planning and control roles for management.Answer: TRUEDiff: 1Terms: budgetObjective: 1AACSB: Reflective thinking7) Long-run planning and short-run planning are best performed independently of each other.Answer: FALSEExplanation: Long-run planning and short-run planning are best performed as a part of an overall strategic planning process since they influence each other.Diff: 2Terms: planningObjective: 1AACSB: Reflective thinking8) Operating decisions deal with how to best use the limited resources of an organization.Answer: TRUEDiff: 2Terms: master budgetObjective: 1AACSB: Ethical reasoning9) Investing decisions deal with how to obtain the funds to acquire resources.Answer: FALSEExplanation: Financing decisions deal with obtaining funds.Diff: 2Terms: master budgetObjective: 1AACSB: Ethical reasoning10) Budgeted financial statements are called pro forma statements.Answer: TRUEDiff: 2Terms: pro forma statementsObjective: 1AACSB: Reflective thinking11) After a budget is agreed upon and finalized by the management team, the amounts should not be changedfor any reason.Answer: FALSEExplanation: Budgets should not be administered rigidly, but rather should be adjusted for changing conditions.Diff: 2Terms: master budgetObjective: 2AACSB: Ethical reasoning12) Even in the face of changing conditions, attaining the original budget is critical.Answer: FALSEExplanation: Changing conditions usually call for a change in plans. Attaining the budget should not be an end in itself.Diff: 3Terms: master budgetObjective: 2AACSB: Reflective thinking13) Lower-level managers will not actively participate in the budget process if they perceive upper managementdoes not believe in the process.Answer: TRUEDiff: 3Terms: master budgetObjective: 2AACSB: Communication14) A four-quarter rolling budget encourages management to be thinking about the next 12 months.Answer: TRUEDiff: 2Terms: rolling budgetObjective: 2AACSB: Reflective thinking15) A rolling budget is the same as a continuous budget.Answer: TRUEDiff: 2Terms: rolling budgetObjective: 2AACSB: Reflective thinking16) Research has shown that challenging budgets (rather than budgets that can be easily attained) are energizingand improve performance.Answer: TRUEDiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking17) The revenue budget and the budgeted income statement are used to prepare the budgeted balance sheet andthe budgeted statement of cash flows.Answer: FALSEExplanation: The cash budget and the budgeted income statement are necessary to prepare the budgeted balance sheet and budgeted statement of cash flows.Diff: 2Terms: master budgetObjective: 3AACSB: Reflective thinking18) It is best to compare this year's performance with last year's actual performance rather than this year'sbudget.Answer: FALSEExplanation: It is best to compare this year's performance with this year's budget because inefficiencies and different conditions may be reflected in last year's actual performance amounts.Diff: 3Terms: master budgetObjective: 2AACSB: Reflective thinking19) When administered wisely, budgets promote communication and coordination among the various subunitsof the organization.Answer: TRUEDiff: 2Terms: budgetObjective: 2AACSB: Communication20) Preparation of the budgeted income statement is the final step in preparing the operating budget.Answer: TRUEDiff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking21) The sales forecast should primarily be based on statistical analysis with secondary input from sales managersand sales representatives.Answer: FALSEExplanation: The sales forecast should be primarily based on input from sales managers and salesrepresentatives with secondary input from statistical analysis.Diff: 3Terms: operating budgetObjective: 3AACSB: Reflective thinking22) The usual starting point in budgeting is to forecast net income.Answer: FALSEExplanation: The usual starting point in budgeting is to forecast sales demand and revenues.Diff: 2Terms: operating budgetObjective: 3AACSB: Reflective thinking23) The revenues budget should be based on the production budget.Answer: FALSEExplanation: The production budget should be based on the revenues budget.Diff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking24) The operating budget is that part of the master budget that includes the capital expenditures budget, cashbudget, budgeted balance sheet, and the budgeted statement of cash flows.Answer: FALSEExplanation: Described is the financial budget part of the master budget, not the operating budget.Diff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking25) Since fixed manufacturing overhead is fixed, it is not normally included in the operating budget.Answer: FALSEExplanation: Fixed manufacturing is normally included in the operating budget.Diff: 2Terms: operating budgetObjective: 3AACSB: Reflective thinking26) The manufacturing labor budget depends on wage rates, production methods, and hiring plans.Answer: TRUEDiff: 2Terms: operating budgetObjective: 3AACSB: Reflective thinking27) The manufacturing labor budget depends on wage rates, production methods, and hiring plans.Answer: TRUEDiff: 2Terms: operating budgetObjective: 3AACSB: Reflective thinking28) If inventoriable costs in the operating budget are going to be in accordance with Generally AcceptedAccounting Principles (GAAP), they include only variable manufacturing costs.Answer: FALSEExplanation: If inventoriable costs in the operating budget are going to be in accordance with Generally Accepted Accounting Principles (GAAP), they include variable and fixed manufacturing costs.Diff: 3Terms: operating budgetObjective: 3AACSB: Reflective thinking29) Activity-based budgeting provides better decision-making information than budgeting based solely onoutput-based cost drivers (units produced, units sold, or revenues).Answer: TRUEDiff: 2Terms: activity-based budgetingObjective: 3AACSB: Communication30) Activity-based costing analysis takes a long-run perspective and treats all activity costs as variable costs.Answer: TRUEDiff: 3Terms: activity-based budgetingObjective: 3AACSB: Reflective thinking31) Activity-based budgeting (ABB) focuses on the budgeting cost of activities necessary to produce and sellproducts and services.Answer: TRUEDiff: 1Terms: activity-based budgetingObjective: 3AACSB: Reflective thinking32) Activity-based budgeting would permit the use of multiple drivers and multiple cost pools in the budgetingprocess.Answer: TRUEDiff: 2Terms: activity-based budgetingObjective: 3AACSB: Reflective thinking33) Activity-based budgeting and kaizen budgeting are really equivalent in meaning.Answer: FALSEExplanation: Activity-based budgeting and kaizen budgeting are not equivalent in meaning.Diff: 2Terms: activity-based budgeting, kaizen budgetingObjective: 3AACSB: Reflective thinking34) If budgeted amounts change, the kaizen approach can be used to examine changes in the budgeted results.Answer: FALSEExplanation: If budgeted amounts change, sensitivity analysis can be used to examine changes in the budgeted results.Diff: 2Terms: kaizen budgeting, sensitivity analysisObjective: 4AACSB: Reflective thinking35) Computer-based financial planning models are mathematical statements of the interrelationships amongoperating activities, financial activities, and other factors that affect the budget.Answer: TRUEDiff: 1Terms: financial planning modelsObjective: 4AACSB: Use of Information Technology36) Most computer-based financial planning models have difficulty incorporating sensitivity (what-if) analysis.Answer: FALSEExplanation: Computer-based financial planning models easily assist management with sensitivity (what-if) analysis.Diff: 2Terms: financial planning models, sensitivity analysisObjective: 4AACSB: Use of Information Technology37) Sensitivity analysis is a "what-if" technique that examines how a result will change if the original predictionor assumptions change.Answer: TRUEDiff: 2Terms: sensitivity analysisObjective: 4AACSB: Reflective thinking38) If we increase the selling price of our product, we should probably expect a decline in the number of theseproducts sold.Answer: TRUEDiff: 2Terms: sensitivity analysisObjective: 4AACSB: Analytical skills39) If we increase the selling price of our product, we can always expect an increase in total revenue.Answer: FALSEExplanation: If we increase the selling price of our product, we may experience either an increase in total revenue or a decrease in total revenue due to the uncertain effect of the price increase on thequantity demanded.Diff: 2Terms: sensitivity analysisObjective: 4AACSB: Analytical skills40) Sensitivity analysis incorporates continuous improvement into budgeted amounts.Answer: FALSEExplanation: Kaizen budgeting incorporates continuous improvement into budgeted amounts.Diff: 1Terms: sensitivity analysis, kaizen budgetingObjective: 5AACSB: Reflective thinking41) Companies implementing kaizen budgeting believe that employees who actually do the job have the bestknowledge of how the job can be done better.Answer: TRUEDiff: 1Terms: kaizen budgetingObjective: 5AACSB: Reflective thinking42) The Japanese use kaizen to mean financing alternatives.Answer: FALSEExplanation: The Japanese use kaizen to mean continuous improvement.Diff: 1Terms: kaizen budgetingObjective: 5AACSB: Multiculturalism and diversity43) Kaizen budgeting does not make sense for profit centers.Answer: FALSEExplanation: Kaizen budgeting can be used in any type of responsibility center.Diff: 2Terms: kaizen budgetingObjective: 5AACSB: Multiculturalism and diversity44) Kaizen budgeting encourages small incremental changes, rather than major improvements.Answer: TRUEDiff: 1Terms: kaizen budgetingObjective: 5AACSB: Multiculturalism and diversity45) Kaizen budgeting allows for budgeting of small incremental increases in costs each budgeting period toallow for the effects of normal inflation.Answer: FALSEExplanation: Kaizen budgeting allows for budgeting of small incremental decreases in costs each budgeting period.Diff: 2Terms: kaizen budgetingObjective: 5AACSB: Multiculturalism and diversity46) A responsibility center is a part, segment, or subunit of an organization, whose manager is accountable for aspecified set of activities.Answer: TRUEDiff: 1Terms: responsibility centerObjective: 6AACSB: Reflective thinking47) Each manager, regardless of level, is in charge of a responsibility center.Answer: TRUEDiff: 2Terms: responsibility centerObjective: 6AACSB: Reflective thinking48) In a profit center, a manager is responsible for investments, revenues, and costs.Answer: FALSEExplanation: In a profit center, a manager is responsible for revenues, and costs, but not investments.Diff: 1Terms: profit centerObjective: 6AACSB: Reflective thinking49) A packaging department is MOST likely a profit center.Answer: FALSEExplanation: A packaging department is most likely a cost center.Diff: 2Terms: profit centerObjective: 6AACSB: Analytical skills50) Variances between actual and budgeted amounts inform management about performance relative to thebudget.Answer: TRUEDiff: 1Terms: responsibility accountingObjective: 651) An organization structure is an arrangement of lines of responsibility within the entity.Answer: TRUEDiff: 1Terms: organization structureObjective: 6AACSB: Communication52) A responsibility center can be structured to promote better alignment of individual and company goals.Answer: TRUEDiff: 2Terms: responsibility centerObjective: 6AACSB: Communication53) Management will most likely behave the same way if a department is structured as a revenue center or if thesame department is structured as a profit center.Answer: FALSEExplanation: Management will most likely behave differently if a department is structured as a revenue center than if the same department is structured as a profit center due to the incentives to control costs aswell as revenues in a profit center.Diff: 2Terms: revenue center, profit centerObjective: 6AACSB: Reflective thinking54) Responsibility accounting focuses on control, not on information and knowledge.Answer: FALSEExplanation: Responsibility accounting focuses on information and knowledge, not on control.Diff: 2Terms: responsibility accountingObjective: 7AACSB: Communication55) The fundamental purpose of responsibility accounting is to fix blame when budgets are not achieved.Answer: FALSEExplanation: The fundamental purpose of responsibility accounting is to gather information when budgets are not achieved.Diff: 2Terms: responsibility accountingObjective: 7AACSB: Communication56) Human factors are crucial parts of budgeting.Answer: TRUEDiff: 2Terms: responsibility accountingObjective: 8AACSB: Reflective thinking57) Budgetary slack provides management with a hedge against unexpected adverse circumstances.Answer: TRUEDiff: 2Terms: responsibility accountingObjective: 858) Most costs can be easily controlled because they are under the sole influence of one manager.Answer: FALSEExplanation: Few costs are clearly under the sole influence of one manager.Diff: 3Terms: controllable costObjective: 8AACSB: Reflective thinking59) Performance reports of responsibility centers may include uncontrollable items to influence behavior that isin alignment with corporate strategy.Answer: TRUEDiff: 2Terms: controllable costObjective: 8AACSB: Reflective thinking60) When the operating budget is used as a control device, managers are more likely to be motivated to budgethigher sales than actually anticipated.Answer: FALSEExplanation: When the operating budget is used as a control device, managers are less likely to be motivated to budget higher sales than actually anticipated.Diff: 3Terms: operating budget, budgetary slackObjective: 8AACSB: Ethical reasoning61) Budgeting slack is most likely to occur when a firm uses the budget only as a planning device and not forcontrol.Answer: FALSEExplanation: Budgeting slack is most likely to occur when a firm uses the budget for control.Diff: 3Terms: controllable cost, budgetary slackObjective: 8AACSB: Reflective thinking62) If a cost is considered controllable, it indicates that all aspects of the cost are under the control of the managerof the responsibility center to which that cost is assigned.Answer: FALSEExplanation: A controllable cost is any cost that is primarily subject to the influence of a given responsibility manager.Diff: 2Terms: controllable costObjective: 8AACSB: Reflective thinking63) To create greater commitment to the budget, top-management should create the budget and then share itwith lower-level managers.Answer: FALSEExplanation: To create greater commitment to the budget, lower-level managers should participate in creating the budget.Diff: 3Terms: responsibility accountingObjective: 8fluctuations.Answer: TRUEDiff: 2Terms: responsibility accountingObjective: 8AACSB: Multiculturalism and diversity65) The possibility of exchange rate fluctuations does not influence the budgeting procedures in a multinationalcorporation.Answer: FALSEExplanation: The possibility of exchange rate fluctuations influences the budgeting procedures in a multinational corporation.Diff: 2Terms: responsibility accountingObjective: 8AACSB: Multiculturalism and diversity66) Because of the possibility of exchange rate fluctuations, managers of multinational corporations shouldignore subjective factors in their performance evaluations.Answer: FALSEExplanation: The possibility of exchange rate fluctuations increases the importance of subjective factors in performance evaluations of multinational corporations.Diff: 2Terms: responsibility accountingObjective: 8AACSB: Multiculturalism and diversity67) A key use of sensitivity analysis is for cash-flow budgeting.Answer: TRUEDiff: 1Terms: sensitivity analysis, cash budgetObjective: AAACSB: Analytical skills68) The self-liquidating cycle is the movement from cash to inventories to receivables and back to cash.Answer: TRUEDiff: 1Terms: cash budgetObjective: AAACSB: Reflective thinking69) A budget:A) is the quantitative expression of a proposed plan of action by managementB) is an aid to coordinate what needs to be doneC) generally includes both financial and nonfinancial aspects of the planD) serves as a blueprint for the company to follow in an upcoming periodE) All of the above are correct.Answer: EDiff: 1Terms: budgetObjective: 1AACSB: Reflective thinkingA) units manufacturedB) cash collections from customersC) units soldD) number of new products introducedAnswer: BDiff: 1Terms: budgetObjective: 1AACSB: Reflective thinking71) Budgeting is used to help companies:A) plan to better satisfy customersB) anticipate potential problemsC) focus on opportunitiesD) All of these answers are correct.Answer: DDiff: 2Terms: master budgetObjective: 1AACSB: Communication72) A master budget:A) includes only financial aspects of a plan and excludes nonfinancial aspectsB) is an aid to coordinating what needs to be done to implement a planC) includes broad expectations and visionary resultsD) should not be altered after it has been agreed uponAnswer: BDiff: 2Terms: master budgetObjective: 1AACSB: Reflective thinking73) Operating decisions PRIMARILY deal with:A) the use of scarce resourcesB) how to obtain funds to acquire resourcesC) acquiring equipment and buildingsD) satisfying stockholdersAnswer: ADiff: 2Terms: operating budgetObjective: 1AACSB: Reflective thinking74) Financing decisions PRIMARILY deal with:A) the use of scarce resourcesB) how to obtain funds to acquire resourcesC) acquiring equipment and buildingsD) preparing financial statements for stockholdersAnswer: BDiff: 2Terms: financial budgetObjective: 175) Budgeting provides all of the following EXCEPT:A) a means to communicate the organization's short-term goals to its membersB) support for the management functions of planning and coordinationC) a means to anticipate problemsD) an ethical framework for decision makingAnswer: DDiff: 2Terms: master budgetObjective: 1AACSB: Communication76) If initial budgets prove unacceptable, planners achieve the MOST benefit from:A) planning again in light of feedback and current conditionsB) deciding not to budget this yearC) accepting an unbalanced budgetD) using last year's budgetAnswer: ADiff: 2Terms: master budgetObjective: 1AACSB: Communication77) Operating budgets and financial budgets:A) combined form the master budgetB) are prepared before the master budgetC) are prepared after the master budgetD) have nothing to do with the master budgetAnswer: ADiff: 1Terms: operating budget, financial budget, master budgetObjective: 1AACSB: Reflective thinking78) A good budgeting system forces managers to examine the business as they plan, so they can:A) detect inaccurate historical recordsB) set specific expectations against which actual results can be comparedC) complete the budgeting task on timeD) get promoted for doing a good jobAnswer: BDiff: 2Terms: master budgetObjective: 1AACSB: Communication79) A budget can do all of the following EXCEPT:A) promote coordination among subunitsB) determine actual profitabilityC) motivate managersD) motivate employeesAnswer: BDiff: 2Terms: budgetObjective: 280) A budget should/can do all of the following EXCEPT:A) be prepared by managers from different functional areas working independently of each otherB) be adjusted if new opportunities become available during the yearC) help management allocate limited resourcesD) become the performance standard against which firms can compare the actual resultsAnswer: ADiff: 3Terms: master budgetObjective: 2AACSB: Reflective thinking81) A limitation of comparing a company's performance against actual results of last year is that:A) it includes adjustments for future conditionsB) feedback is no longer a possibilityC) past results can contain inefficiencies of the past yearD) the budgeting time period is set at one yearAnswer: CDiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking82) Challenging budgets tend to:A) decrease line-management participation in attaining corporate goalsB) increase failureC) increase anxiety without motivationD) motivate improved performanceAnswer: DDiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking83) Actual results should NOT be compared against past performance because:A) past results may contain mistakes and substandard performanceB) past results will never happen againC) past performance is an indicator of future performanceD) future conditions will be similar to past conditionsAnswer: ADiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking84) A company's actual performance should be compared against budgeted amounts for the same accountingperiod so that:A) adjustments for future conditions can be includedB) no feedback is possibleC) inefficiencies of the past year can be includedD) a rolling budget can be implementedAnswer: ADiff: 2Terms: master budgetObjective: 2AACSB: Ethical reasoning85) It is advantageous to coordinate budgets with:A) suppliersB) customersC) the marketing and production departmentsD) All of these answers are correct.Answer: DDiff: 3Terms: master budgetObjective: 2AACSB: Reflective thinking86) A budget can help implement:A) strategic planningB) long-run planningC) short-run planningD) All of these answers are correct.Answer: DDiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking87) To gain the benefits of budgeting ________ must understand and support the budget.A) management at all levelsB) customersC) suppliersD) All of these answers are correct.Answer: ADiff: 3Terms: master budgetObjective: 2AACSB: Communication88) Participation of line managers in the budgeting process helps to create:A) greater commitmentB) greater anxietyC) more fraudD) better past performanceAnswer: ADiff: 2Terms: master budgetObjective: 2AACSB: Communication89) Line managers who feel that top management does not believe in the budget are MOST likely to:A) pick up the slack and participate in the budgeting processB) be motivated by the budgetC) spend little time on the budgeting processD) convert the budget to a shorter more reasonable time periodAnswer: CDiff: 2Terms: master budgetObjective: 2AACSB: Communication90) The time coverage of a budget should be:A) one yearB) guided by the purpose of the budgetC) cover design through manufacture and sale of the productD) shorter rather than longerAnswer: BDiff: 2Terms: master budgetObjective: 2AACSB: Reflective thinking91) Rolling budgets help management to:A) better review the past calendar yearB) deal with a 5-year time frameC) focus on the upcoming budget periodD) rigidly administer the budgetAnswer: CDiff: 2Terms: rolling budgetObjective: 2AACSB: Reflective thinking92) Budgets should:A) be flexibleB) be administered rigidlyC) only be developed for short periods of timeD) include only variable costsAnswer: ADiff: 2Terms: master budgetObjective: 293) Operating budgets include all of the following EXCEPT:A) the revenues budgetB) the budgeted income statementC) the administrative costs budgetD) the budgeted balance sheetAnswer: DDiff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking94) Operating budgets include the:A) budgeted balance sheetB) budgeted income statementC) capital expenditures budgetD) budgeted statement of cash flowsAnswer: BDiff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking95) The operating budget process generally concludes with the preparation of the:A) production budgetB) distribution budgetC) research and development budgetD) budgeted income statementAnswer: DDiff: 1Terms: operating budgetObjective: 3AACSB: Reflective thinking96) Which budget is NOT necessary to prepare the budgeted balance sheet?A) cash budgetB) budgeted statement of cash flowsC) budgeted income statementD) revenues budgetAnswer: BDiff: 1Terms: master budgetObjective: 3AACSB: Reflective thinking97) Financial budgets include the:A) capital expenditures budgetB) production budgetC) marketing costs budgetD) administrative costs budgetAnswer: ADiff: 1Terms: financial budgetObjective: 3。

DECISION MAKING AND RELEVANT INFORMATIONTRUE/FALSE1. A decision model is a formal method for making a choice, frequently involving bothquantitative and qualitative analyses.Answer: True Difficulty: 1 Objective: 12. Feedback from previous decisions uses historical information and, therefore, isirrelevant for making future predictions.Answer: False Difficulty: 2 Objective: 1Historical costs may be helpful in making future predictions, but are not relevant costs for decision making.3. The amount paid to purchase tools last month is an example of a sunk cost.Answer: True Difficulty: 2 Objective: 24. For decision making, differential costs assist in choosing between alternatives.Answer: True Difficulty: 1 Objective: 25. For a particular decision, differential revenues and differential costs are always relevant.Answer: True Difficulty: 1 Objective: 26. A cost may be relevant for one decision, but not relevant for a different decision.Answer: True Difficulty: 2 Objective: 27. Revenues that remain the same for two alternatives being examined are relevantrevenues.Answer: False Difficulty: 1 Objective: 2Revenues that remain the same between two alternatives are irrelevant for that decision since they do not differ between alternatives.8. Sunk costs are past costs that are unavoidable.Answer: True Difficulty: 1 Objective: 29. Quantitative factors are always expressed in numerical terms.Answer: True Difficulty: 2 Objective: 310. Qualitative factors are outcomes that are measured in numerical terms, such as the costsof direct labor.Answer: False Difficulty: 1 Objective: 3Quantitative factors are outcomes that are measured in numerical terms, such as thecosts of direct labor.11. If a manufacturer chooses to continue purchasing direct materials from a supplierbecause of the ongoing relationship that has developed over the years, the decision is based on qualitative factors.Answer: True Difficulty: 2 Objective: 312. Relevant revenues and relevant costs are the only information managers need to selectamong alternatives.Answer: False Difficulty: 3 Objective: 3Qualitative factors, as well as relevant revenues and relevant costs need to beconsidered when selecting among alternatives.13. Full costs of a product are relevant for one-time-only special order pricing decisions.Answer: False Difficulty: 2 Objective: 3Incremental costs of a product are relevant for one-time-only special order pricingdecisions.14. Full costs of a product include variable costs, but not fixed costs.Answer: False Difficulty: 1 Objective: 3Full costs of a product include variable and fixed costs for all business functions in the value chain.15. For one-time-only special orders, variable costs may be relevant but not fixed costs.Answer: True Difficulty: 2 Objective: 316. The price quoted for a one-time-only special order may be less than the price for along-term customer.Answer: True Difficulty: 2 Objective: 317. Bid prices and costs that are relevant for regular orders are the same costs that arerelevant for one-time-only special orders.Answer: False Difficulty: 2 Objective: 3Since long-term costs are relevant for regular orders and short-term costs are relevant for one-time-only special orders, the relevant costs differ.18. An incremental product cost is generally a fixed cost.Answer: False Difficulty: 1 Objective: 4An incremental product cost is generally a variable cost.19. If Option 1 costs $100 and Option 2 costs $80, then the differential cost is $180.Answer: False Difficulty: 1 Objective: 4If Option 1 costs $100 and Option 2 costs $80, then the differential cost is $20.20. Producing another 10,000 units may increase the fixed cost of rent.Answer: True Difficulty: 3 Objective: 4True, if additional capacity must be added to accommodate the additional production needs.21. Absorption cost per unit is the best product cost to use for one-time-only special orderdecisions.Answer: False Difficulty: 2 Objective: 4Variable cost per unit is the best cost to use for one-time-only special order decisions.22. Sometimes qualitative factors are the most important factors in make-or-buy decisions.Answer: True Difficulty: 2 Objective: 423. If a company is deciding whether to outsource a part, the reliability of the supplier is animportant factor to consider.Answer: True Difficulty: 2 Objective: 424. Outsourcing is risk free to the manufacturer because the supplier now has theresponsibility of producing the part.Answer: False Difficulty: 2 Objective: 4Outsourcing has risks since the manufacturer is dependent on the supplier for a quality product, delivered in a timely manner, for a reasonable price.25. When a firm maximizes profits it will simultaneously minimize opportunity costs.Answer: True Difficulty: 3 Objective: 526. In a make-or-buy decision when there are alternative uses for capacity, the opportunitycost of idle capacity is relevant.Answer: True Difficulty: 3 Objective: 527. When opportunity costs exist, they are always relevant.Answer: True Difficulty: 3 Objective: 528. When capacity is constrained, relevant costs equal incremental costs plus opportunitycosts.Answer: True Difficulty: 2 Objective: 529. If the $17,000 spent to purchase inventory could be invested and earn interest of $1,000,then the opportunity cost of holding inventory is $17,000.Answer: False Difficulty: 2 Objective: 5The opportunity cost of holding inventory is $1,000.30. The choice is not really whether to make or buy, but rather how to best utilize availableproduction capacity.Answer: True Difficulty: 1 Objective: 531. For short-run product-mix decisions, managers should focus on minimizing total fixedcosts.Answer: False Difficulty: 2 Objective: 6For short-run product mix decisions, managers should focus on maximizing totalcontribution margin.32. For short-run product-mix decisions, maximizing contribution margin will also result inmaximizing operating income.Answer: True Difficulty: 2 Objective: 633. Regardless of the restraining resource, to maximize profits managers should producemore of the product with the greatest contribution margin per unit.Answer: False Difficulty: 2 Objective: 6To maximize profits, managers should produce more of the product with the greatest contribution margin per unit of the constraining resource.34. Management should focus on per unit costs when deciding whether to discontinue aproduct or not.Answer: False Difficulty: 2 Objective: 7Management should focus on total costs when deciding whether to discontinue aproduct or not.35. Avoidable variable and fixed costs should be evaluated when deciding whether todiscontinue a product, product line, business segment, or customer.Answer: True Difficulty: 2 Objective: 736. Depreciation allocated to a product line is a relevant cost when deciding to discontinuethat product.Answer: False Difficulty: 2 Objective: 7Depreciation is a sunk cost and never relevant.37. A company is considering adding a fourth product to use available capacity. A relevantfactor to consider is that corporate costs can now be allocated over four products rather than only three.Answer: False Difficulty: 3 Objective: 7It appears that corporate costs will not change in total, and therefore are not relevant costs for deciding whether to add a fourth product.38. When replacing an old machine with a new machine, the purchase price of the newmachine is a relevant cost.Answer: True Difficulty: 1 Objective: 839. When replacing an old machine with a new machine, the book value of the old machineis a relevant cost.Answer: False Difficulty: 1 Objective: 8The original price of the old machine is a past cost and therefore an irrelevant cost. 40. Replacing an old machine will increase operating income in the long run, but not forthis year. A manager may choose not to replace the machine if performance evaluations are based on performance over a single year.Answer: True Difficulty: 2 Objective: 941. Linear programming is a tool that maximizes total contribution margin of a mix ofproducts with multiple constraints.Answer: True Difficulty: 1 Objective: AMULTIPLE CHOICE42. Feedback regarding previous actions may affecta. future predictions.b. implementation of the decision.c. the decision model.d. all of the above.Answer: d Difficulty: 2 Objective: 143. Place the following steps from the five-step decision process in order:A = Make predictions about future costsB = Evaluate performance to provide feedbackC = Implement the decisionD = Choose an alternativea. D C A Bb. C D A Bc. A D C Bd. D C B AAnswer: c Difficulty: 2 Objective: 144. The formal process of choosing between alternatives is known asa. a relevant model.b. a decision model.c. an alternative model.d. a prediction model.Answer: b Difficulty: 1 Objective: 145. Ruggles Circuit Company manufactures circuit boards for other firms. Management isattempting to search for ways to reduce manufacturing labor costs and has received a proposal from a consulting company to rearrange the production floor next year. Using the information below regarding current operations and the new proposal, which of the following decisions should management accept?Currently Proposed Required machine operators 5 4.5Materials-handling workers 1.25 1.25Employee average pay $8 per hour $9 per hourHours worked per employee 2,100 2,000a. Do not change the production floor.b. Rearrange the production floor.c. Either, because it makes no difference to the employees.d. It doesn't matter because the costs incurred will remain the same.Answer: b Difficulty: 2 Objective: 1Current operations: 5 workers x 2,100 hours x $8.00 = $84,000Proposal: 4.5 workers x 2,000 hours x $9.00 = $81,000THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 46 AND 47.LeBlanc Lighting manufactures small flashlights and is considering raising the price by 50 cents a unit for the coming year. With a 50-cent price increase, demand is expected to fall by 3,000 units.Currently Projected Demand 20,000 units 17,000 unitsSelling price $4.50 $5.00Incremental cost per unit $3.00 $3.0046. If the price increase is implemented, operating profit is projected toa. increase by $4,000.b. decrease by $4,000.c. increase by $6,000.d. decrease by $4,500.Answer: a Difficulty: 2 Objective: 1[17,000 x ($5 - $3)] – [20,000 x ($4.50 - $3.00)] = increase of $4,00047. Would you recommend the 50-cent price increase?a. No, because demand decreased.b. No, because the selling price increases.c Yes, because contribution margin per unit increases.d. Yes, because operating profits increase.Answer: d Difficulty: 2 Objective: 148. For decision making, a listing of the relevant costsa. will help the decision maker concentrate on the pertinent data.b. will only include future costs.c. will only include costs that differ among alternatives.d. should include all of the above.Answer: d Difficulty: 2 Objective: 249. Sunk costsa. are relevant.b. are differential.c. have future implications.d. are ignored when evaluating alternatives.Answer: d Difficulty: 1 Objective: 250. A computer system installed last year is an example ofa. a sunk cost.b. a relevant cost.c. a differential cost.d. an avoidable cost.Answer: a Difficulty: 1 Objective: 251. Costs that CANNOT be changed by any decision made now or in the future area. fixed costs.b. indirect costs.c. avoidable costs.d. sunk costs.Answer: d Difficulty: 1 Objective: 252. In evaluating different alternatives, it is useful to concentrate ona. variable costs.b. fixed costs.c. total costs.d. relevant costs.Answer: d Difficulty: 1 Objective: 253. Which of the following costs always differ among future alternatives?a. Fixed costsb. Historical costsc. Relevant costsd. Variable costsAnswer: c Difficulty: 1 Objective: 254. Which of the following costs are never relevant in the decision-making process?a. Fixed costsb. Historical costsc. Relevant costsd. Variable costsAnswer: b Difficulty: 1 Objective: 2THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 55 AND 56.Jim’s 5-year-old Geo Prizm requires repairs estimated at $3,000 to make it roadworthy again. His friend, Julie, suggested that he should buy a 5-year-old used Honda Civic instead for $3,000 cash. Julie estimated the following costs for the two cars:Geo Prizm Honda Civic Acquisition cost $15,000 $3,000Repairs $ 3,000 ---Annual operating costs(Gas, maintenance, insurance) $ 2,280 $2,10055. The cost NOT relevant for this decision is(are)a. the acquisition cost of the Geo Prizm.b. the acquisition cost of the Honda Civic.c. the repairs to the Geo Prizm.d. the annual operating costs of the Honda Civic.Answer: a Difficulty: 2 Objective: 256. What should Jim do? What are his savings in the first year?a. Buy the Honda Civic; $9,780b. Fix the Geo Prizm; $5,518c. Buy the Honda Civic; $180d. Fix the Geo Prizm; $5,280Answer: c Difficulty: 2 Objective: 2Geo ($3,000 + $2,280) - Honda ($3,000 + $2,100) = $180 cost savings with the Honda option57. Quantitative factorsa. include financial information, but not nonfinancial information.b. can be expressed in monetary terms.c. are always relevant when making decisions.d. include employee morale.Answer: b Difficulty: 2 Objective: 358. Qualitative factorsa. generally are easily measured in quantitative terms.b. are generally irrelevant for decision making.c. may include either financial or nonfinancial information.d. include customer satisfaction.Answer: d Difficulty: 2 Objective: 359. Historical costs are helpfula. for making future predictions.b. for decision making.c. because they are quantitative.d. with none of the above.Answer: a Difficulty: 2 Objective: 360. When making decisionsa. quantitative factors are the most important.b. qualitative factors are the most important.c. appropriate weight must be given to both quantitative and qualitative factors.d. both quantitative and qualitative factors are unimportant.Answer: c Difficulty: 2 Objective: 361. Employee morale at Dos Santos, Inc., is very high. This type of information is knownasa. a qualitative factor.b. a quantitative factor.c. a nonmeasurable factor.d. a financial factor.Answer: a Difficulty: 1 Objective: 362. Roberto owns a small body shop. His major costs include labor, parts, and rent. In thedecision-making process, these costs are considered to bea. fixed.b. qualitative factors.c. quantitative factors.d. variable.Answer: c Difficulty: 1 Objective: 363. One-time-only special orders should only be accepted ifa. incremental revenues exceed incremental costs.b. differential revenues exceed variable costs.c. incremental revenues exceed fixed costs.d. total revenues exceed total costs.Answer: a Difficulty: 3 Objective: 364. When deciding to accept a one-time-only special order from a wholesaler, managementshould do all EXCEPTa. analyze product costs.b. consider the special order’s impact on future prices of their products.c. determine whether excess capacity is available.d. verify past design costs for the product.Answer: d Difficulty: 3 Objective: 365. When there is excess capacity, it makes sense to accept a one-time-only special orderfor less than the current selling price whena. incremental revenues exceed incremental costs.b. additional fixed costs must be incurred to accommodate the order.c. the company placing the order is in the same market segment as your currentcustomers.d. it never makes sense.Answer: a Difficulty: 3 Objective: 3THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 66 THROUGH 69. Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:Variable costs:Direct materials $40Direct labor 20Manufacturing support 35Marketing costs 15Fixed costs:Manufacturing support 45Marketing costs 15Total costs 170Markup (50%) 85Targeted selling price $25566. What is the full cost of the product per unit?a. $110b. $170c. $255d. $85Answer: b Difficulty: 3 Objective: 3$40 + $20 + $35 + $15 + $45 + $15 = $17067. What is the contribution margin per unit?a. $85b. $110c. $145d. $255Answer: c Difficulty: 3 Objective: 3$255 – ($40 + $20 + $35 + $15) = $14568. For Welch Manufacturing, what is the minimum acceptable price of this special order?a. $110b. $145c. $170d. $255Answer: a Difficulty: 3 Objective: 3$40 + $20 + $35 + $15 = $11069. What is the change in operating profits if the 1,000 unit one-time-only special order isaccepted for $180 a unit by Welch?a. $70,000 increase in operating profitsb. $10,000 increase in operating profitsc. $10,000 decrease in operating profitsd. $75,000 decrease in operating profitsAnswer: a Difficulty: 3 Objective: 3$180 – ($40 + $20 + $35 + $15) = $70; 1,000 x $70 = $70,000 increase70. Ratzlaff Company has a current production level of 20,000 units per month. Unit costsat this level are:Direct materials $0.25Direct labor 0.40Variable overhead 0.15Fixed overhead 0.20Marketing - fixed 0.20Marketing/distribution - variable 0.40Current monthly sales are 18,000 units. Jim Company has contacted Ratzlaff Company about purchasing 1,500 units at $2.00 each. Current sales would not be affected by the one-time-only special order, and variable marketing/distribution costs would not beincurred on the special order. What is Ratzlaff Company’s change in operating profits if the special order is accepted?a. $400 increase in operating profitsb. $400 decrease in operating profitsc. $1,800 increase in operating profitsd. $1,800 decrease in operating profitsAnswer: c Difficulty: 3 Objective: 3Manufacturing cost per unit = $0.25 + $0.40 + $0.15 = $0.801,500 x ($2.00 - $0.80) = $1,800 increase71. Black Tool Company has a production capacity is 1,500 units per month, but currentproduction is only 1,250 units. The manufacturing costs are $60 per unit and marketing costs are $16 per unit. Doug Hall offers to purchase 250 units at $76 each for the next five months. Should Black accept the one-time-only special order if only absorption-costing data are available?a. Yes, good customer relations are essential.b. No, the company will only break even.c. No, since only the employees will benefit.d. Yes, since operating profits will most likely increase.Answer: d Difficulty: 3 Objective: 3Since the $60 absorption cost per unit is most likely not all variable costs and since the entire $16 per unit of marketing costs may not be incurred, operating profits will most likely increase.THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 72 THROUGH 75. Grant’s Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:Direct materials $455Direct labor 300Variable manufacturing support 45Fixed manufacturing support 100Total manufacturing costs 900Markup (60%) 540Targeted selling price $1440Grant’s Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.72. For Grant’s Kitchens, what is the minimum acceptable price of this one-time-onlyspecial order?a. $830b. $930c. $785d. $1440Answer: a Difficulty: 2 Objective: 3$455 + $300 + $45 + $30 = $83073. Other than price, what other items should Grant’s Kitchens consider before acceptingthis one-time-only special order?a. Reaction of shareholdersb. Reaction of existing customers to the lower price offered to Ms. Wangc. Demand for cherry cabinetsd. Price is the only consideration.Answer: b Difficulty: 2 Objective: 374. If Ms. Wang wanted a long-term commitment for supplying this product, this analysisa. would definitely be different.b. may be different.c. would not be different.d. does not contain enough information to determine if there would be a difference.Answer: a Difficulty: 2 Objective: 375. If there was limited capacity, all of the following amounts would change EXCEPTa. opportunity costs.b. differential costs.c. variable costs.d. the minimum acceptable price.Answer: c Difficulty: 3 Objective: 5THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 76 AND 77. Northwoods manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $90 per table, consisting of 80% variable costs and 20% fixed costs. The company has surplus capacity available. It is Northwoods’ policy to add a 50% markup to full costs.76. Northwoods is invited to bid on a one-time-only special order to supply 100 rustictables. What is the lowest price Northwoods should bid on this special order?a. $6,300b. $7,200c. $9,000d. $13,500Answer: b Difficulty: 2 Objective: 3$90 x 80% x 100 tables = $7,20077. A large hotel chain is currently expanding and has decided to decorate all new hotelsusing the rustic style. Northwoods Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Northwoods should bid on this long-term order?a. $63b. $72c. $90d. $135Answer: d Difficulty: 2 Objective: 3$90 + ($90 x 50%) = $13578. Cochran Corporation has a plant capacity of 100,000 units per month. Unit costs atcapacity are:Direct materials $4.00Direct labor 6.00Variable overhead 3.00Fixed overhead 1.00Marketing - fixed 7.00Marketing/distribution - variable 3.60Current monthly sales are 95,000 units at $30.00 each. Suzie, Inc., has contactedCochran Corporation about purchasing 2,000 units at $24.00 each. Current sales would not be affected by the one-time-only special order. What is Cochran’s change inoperating profits if the one-time-only special order is accepted?a. $14,800 increaseb. $17,200 increasec. $22,000 increased. $33,200 increaseAnswer: a Difficulty: 3 Objective: 3($4.00 + 6.00 + 3.00 + 3.60) = $16.60($24.00 – 16.60) x 2,000 = $14,800 increase79. The sum of all the costs incurred in a particular business function (for example,marketing) is called thea. business function cost.b. full product cost.c. gross product cost.d. multiproduct cost.Answer: a Difficulty: 1 Objective: 380. The sum of all costs incurred in all business functions in the value chain (productdesign, manufacturing, marketing, and customer service, for example) is known as thea. business cost.b. full product cost.c. gross product cost.d. multiproduct cost.Answer: b Difficulty: 1 Objective: 381. Problems that should be avoided when identifying relevant costs include all EXCEPTa. assuming all variable costs are relevant.b. assuming all fixed costs are irrelevant.c. using unit costs that do not separate variable and fixed components.d. using total costs that separate variable and fixed components.Answer: d Difficulty: 2 Objective: 482. The BEST way to avoid misidentification of relevant costs is to focus ona. expected future costs that differ among the alternatives.b. historical costs.c. unit fixed costs.d. total unit costs.Answer: a Difficulty: 2 Objective: 483. Factors used to decide whether to outsource a part includea. the supplier’s cost of direct materials.b. if the supplier is reliable.c. the original cost of equipment currently used for production of that part.d. past design costs used to develop the current composition of the part.Answer: b Difficulty: 2 Objective: 484. Relevant costs of a make-or-buy decision include all EXCEPTa. fixed salaries that will not be incurred if the part is outsourced.b. current direct material costs of the part.c. special machinery for the part that has no resale value.d. material-handling costs that can be eliminated.Answer: c Difficulty: 3 Objective: 485. Which of following are risks of outsourcing the production of a part?a. Unpredictable qualityb. Unreliable deliveryc. Unscheduled price increasesd. All of the above are risks of outsourcing.Answer: d Difficulty: 1 Objective: 486. Which of the following minimize the risks of outsourcing?a. The use of short-term contracts that specify priceb. The responsibility for on-time delivery is now the responsibility of the supplierc. Building close relationships with the supplierd. All of the above minimize the risks of outsourcing.Answer: c Difficulty: 3 Objective: 487. The cost to produce Part A was $10 per unit in 20x3 and in 20x4 has increased to $11per unit. In 20x4, Supplier XYZ has offered to supply Part A for $9 per unit. For the make-or-buy decision,a. incremental revenues are $2 per unit.b. incremental costs are $1 per unit.c. net relevant costs are $1 per unit.d. differential costs are $2 per unit.Answer: d Difficulty: 2 Objective: 488. When evaluating a make-or-buy decision, which of the following does NOT need to beconsidered?a. Alternative uses of the production capacityb. The original cost of the production equipmentc. The quality of the supplier's productd. The reliability of the supplier's delivery scheduleAnswer: b Difficulty: 2 Objective: 489. For make-or-buy decisions, a supplier's ability to deliver the item on a timely basis isconsidereda. a qualitative factor.b. a relevant cost.c. a differential factor.d. an opportunity cost.Answer: a Difficulty: 1 Objective: 490. The incremental costs of producing one more unit of product include all of thefollowing EXCEPTa. direct materials.b. direct labor.c. variable overhead costs.d. fixed overhead costs.Answer: d Difficulty: 2 Objective: 491. Direct materials $40, direct labor $10, variable overhead costs $30, and fixed overheadcosts $20. In the short term, the incremental cost of one unit isa. $30.b. $50.c. $80.d. $100.Answer: c Difficulty: 2 Objective: 492. Unit cost data can MOST mislead decisions bya. not computing fixed overhead costs.b. computing labor and materials costs only.c. computing administrative costs.d. not computing unit costs at the same output level.Answer: d Difficulty: 1 Objective: 493. Schmidt Sewing Company incorporates the services of Deb's Sewing. Schmidtpurchases pre-cut dresses from Deb's. This is primarily known asa. insourcing.b. outsourcing.c. relevant costing.d. sunk costing.Answer: b Difficulty: 1 Objective: 494. Pearce Sign Company manufactures signs from direct materials to the finished product.This is considereda. insourcing.b. outsourcing.c. relevant costing.d. sunk costing.Answer: a Difficulty: 1 Objective: 495. Which of the following would NOT be considered in a make-or-buy decision?a. Fixed costs that will no longer be incurredb. Variable costs of productionc. Potential rental income from space occupied by the production aread. Unchanged supervisory costsAnswer: d Difficulty: 2 Objective: 4。

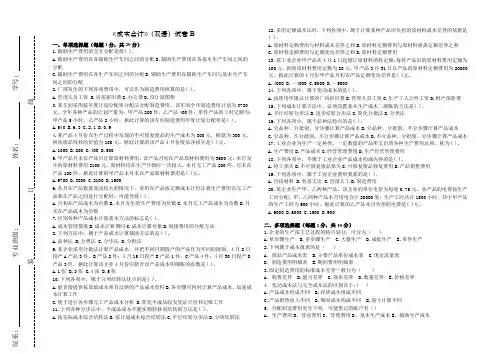

成本会计英语1、构成产品理论成本是()。

A、已耗费的⽣产资料转移的价值B、劳动者为⾃⼰劳动所创造的价值C、劳动者为社会劳动所创造的价值D、A和B2、企业为筹集⽣产经营所需资⾦⽽发⽣的各项费⽤,属于()。

A、管理费⽤B、制造费⽤C、财务费⽤D、⽣产费⽤3、成本项⽬是()。

A、⽣产费⽤按经济⽤途的分类B、⽣产费⽤按经济内容的分类C、⽣产费⽤按经济性质的分类D、⽣产费⽤按计⼊成本的⽅式分类4、停⼯损失不包括()期间发⽣的损失。

A、⼤修理停⼯B、⾃然灾害停⼯C、季节性停⼯D、原材料供应不⾜5、制造费⽤( )。

A、都是间接⽣产费⽤B、都是间接计⼊费⽤C、既包括间接⽣产费⽤,⼜包括直接⽣产费⽤D、都是直接计⼊费⽤6、不通过“应交税⾦”科⽬核算的有( )。

A、房产税B、车船使⽤税C、⼟地使⽤税D、印花税7、某⼚⽣产的甲产品顺序经过第⼀、第⼆两道⼯序加⼯,原材料在第⼀⼯序⽣产开始时投⼊90%,第⼆⼯序⽣产开始时投⼊10%,则第⼆⼯序⽉末在产品的投料率为()。

A、10%B、90%C、5%D、100%8、采⽤不计在产品成本法的使⽤范围是()。

A、⽉末在产品数量变化⼤B、⽉末在产品数量很少C、⽉末在产品数量多D、⽉末在产品数量均衡9、与⽣产的特点没有直接关系,不涉及成本计算对象,可以与基本成本计算⽅法结合使⽤的成本计算⽅法是( )。

A、品种法B、分批法C、分步法D、分类法10、品种法的成本计算对象是()。

A、产品品种B、产品类别C、产品批别D、产品的⽣产步骤11、成本还原的对象是()。

A、完⼯产品成本B、完⼯产品所耗各步骤半成品的综合成本C、最后步骤的完⼯产品成本D、各步骤半成品成本12、采⽤平⾏结转分步法时,完⼯产品与在产品之间分配费⽤,是指()之间的费⽤分配。

A、产成品与⽉末在产品B、产成品与⼴义在产品C、产成品的“份额”与⼴义在产品D、完⼯半成品与⽉末加⼯中的在产品13、下列辅助⽣产费⽤分配⽅法中,分配结果最为准确的是( )。

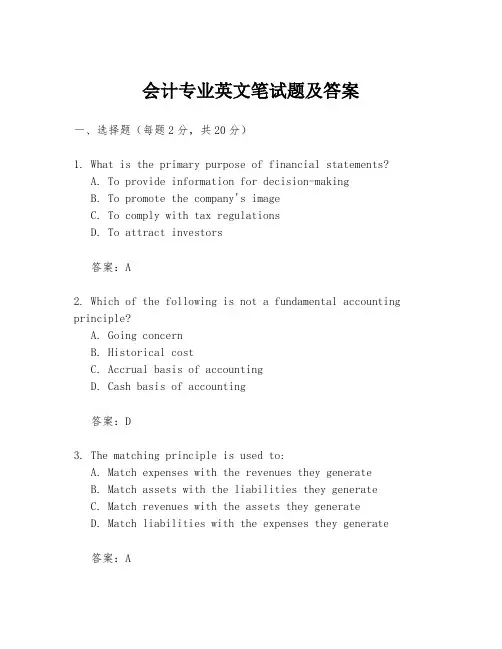

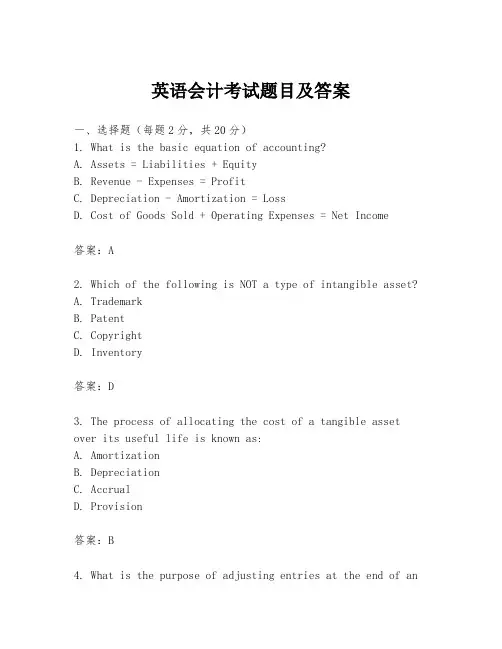

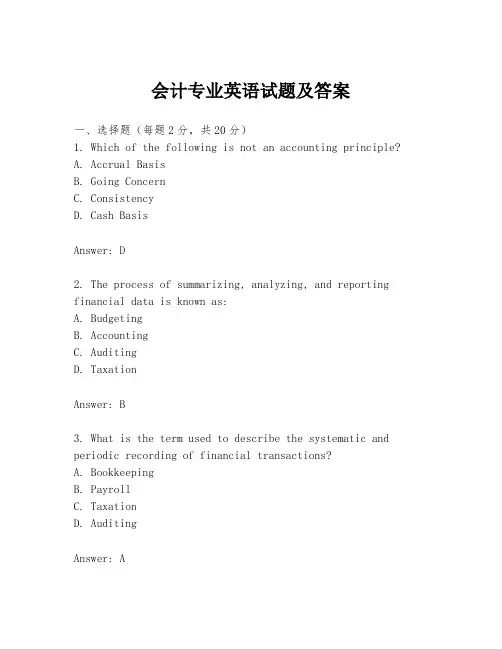

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。