商业银行管理Bank Managment&Financial Services(7th)第18章课后题答案

- 格式:doc

- 大小:95.50 KB

- 文档页数:15

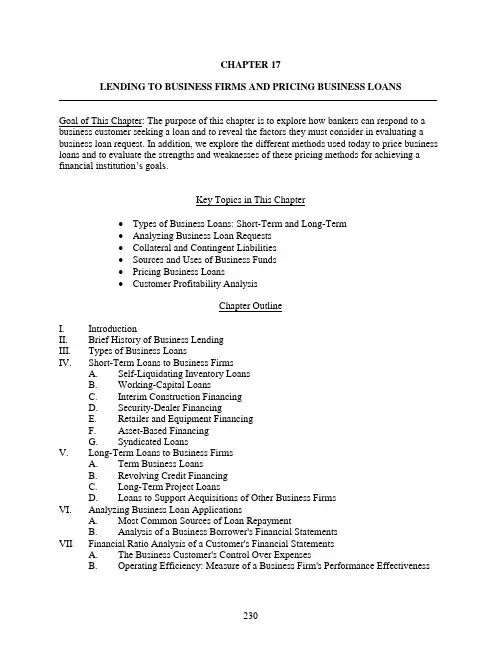

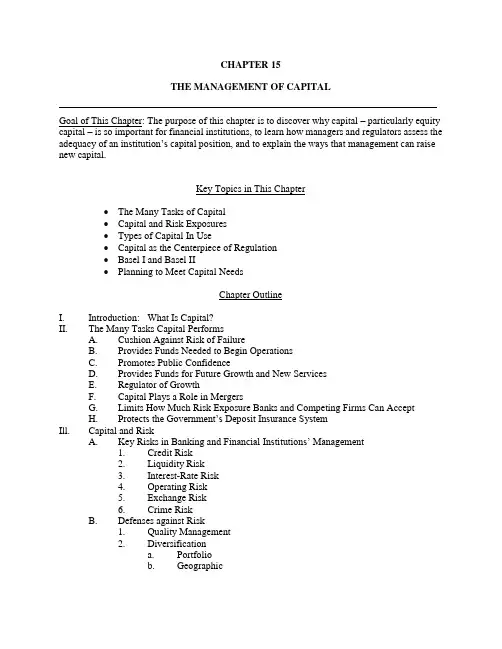

CHAPTER 17LENDING TO BUSINESS FIRMS AND PRICING BUSINESS LOANSGoal of This Chapter: The purpose of this chapter is to explore how bankers can respond to a business customer seeking a loan and to reveal the factors they must consider in evaluating a business loan request. In addition, we explore the different methods used today to price business loans and to evaluate the strengths and weaknesses of these pricing methods for achieving a financial institution’s goals.Key Topics in This Chapter∙Types of Business Loans: Short-Term and Long-Term∙Analyzing Business Loan Requests∙Collateral and Contingent Liabilities∙Sources and Uses of Business Funds∙Pricing Business Loans∙Customer Profitability AnalysisChapter OutlineI. IntroductionII. Brief History of Business LendingIII. Types of Business LoansIV. Short-Term Loans to Business FirmsA. Self-Liquidating Inventory LoansB. Working-Capital LoansC. Interim Construction FinancingD. Security-Dealer FinancingE. Retailer and Equipment FinancingF. Asset-Based FinancingG. Syndicated LoansV. Long-Term Loans to Business FirmsA. Term Business LoansB. Revolving Credit FinancingC. Long-Term Project LoansD. Loans to Support Acquisitions of Other Business FirmsVI. Analyzing Business Loan ApplicationsA. Most Common Sources of Loan RepaymentB. Analysis of a Business Borrower's Financial StatementsVII Financial Ratio Analysis of a Customer's Financial StatementsA. The Business Customer's Control Over ExpensesB. Operating Efficiency: Measure of a Business Firm's Performance Effectiveness230C. Marketability of the Customer's Product or ServiceD. Coverage Ratios Measuring the Adequacy of EarningsE. Liquidity Indicators for Business CustomersF. Profitability IndicatorsG. The Financial Leverage Factor as a Barometer of a Business Firm's CapitalStructureVIII Comparing a Business Customer’s performance to the Performance of Its IndustryA.Contingent LiabilitiesB.Environmental LiabilitiesIX. Preparing Statements of Cash Flows from Business Financial StatementsA. Cash Flow StatementsB. Pro Forma Statements of Cash Flow and Balance SheetsC. The Loan Officer's Responsibility to the Lending Institution and the Customer X. Pricing Business LoansA.The Cost-Plus Loan pricing MethodB.The Price Leadership ModelC.Below-Prime Market PricingD.Customer Profitability Analysis (CPA)1.An Example of Annualized Customer profitability Analysis2.Earnings Credits for Customer Deposits3.The Future of Customer Profitability AnalysisXI. Summary of the ChapterConcept Checks17-1. What special problems does business lending present to the management of a business lending institution?While business loans are usually considered among the safest types of lending (their default rate, for example, is usually well below default rates on most other types of loans), these loans average much larger in dollar volume than other loans and, therefore, can subject an institution to excessive risk of loss and, if a substantial number of loans fail, can lead to failure. Moreover, business loans are usually much more complex financial deals than most other kinds of loans, requiring larger numbers of personnel with special skills and knowledge. These additional resources required increase the magnitude of potential losses unless the business loan portfolio is managed with great care and skill.23117-2. What are the essential differences among working capital loans, open credit lines,asset-based loans, term loans, revolving credit lines, interim financing, project loans, and acquisition loans?a. Working Capital Loans -- Loans to fund the current assets of a business, such asaccounts receivable, inventories, or to replenish cash.b. Open Credit Lines -- A credit agreement allowing a business to borrow up to aspecified maximum amount of credit at any time until the point in time when thecredit line expires.c. Asset-based Loans -- Credit whose amount and timing is based directly upon thevalue, condition, and maturity of certain assets held by a business firm (such asaccounts receivable or inventory) with those assets usually being pledged ascollateral behind the loan.d. Term Loans -- Business loans that have an original maturity of more than one yearand normally are used to fund the purchase of new plant and equipment or toprovide for a permanent increase in working capital.e. Revolving Credit Lines -- Lines of credit that promise the business borrower accessto any amount of borrowed funds up to a specified maximum amount; moreover,the customer may borrow, repay, and borrow again any number of times until thecredit line reaches its maturity date.f. Interim Financing -- Bank funding to start construction or to complete constructionof a business project in the form of a short-term loan; once the project is completed,long-term funding will normally pay off and replace the interim financing.g. Project Loans -- Credit to support the start up of a new business project, such as theconstruction of an offshore drilling platform or the installation of a new warehouseor assembly line; often such loans are secured by the property or equipment that arepart of the new project.h. Acquisition Loans--Loans to finance mergers and acquisitions of businesses.Among the most noteworthy of these acquisition credits are leveraged buyouts offirms by small groups of investors.17-3. What aspects of a business firm's financial statements do loan officers and credit analysts examine carefully?232Loan officers and credit analysts examine the following aspects of a business firm's financial statements:a. Control Over Expenses? Key ratios here include cost of goods sold/net sales;selling, administrative and other expenses/net sales; wages and salaries/net sales;and interest expenses on borrowed funds/net sales.b. Activity or Efficiency? Important ratios here are net sales/total assets, and fixedassets, accounts and notes receivable, and cost-of-goods sold divided by averageinventory levels.c. Marketability of a Product, Service, or Skill? Key ratio measures in this area are thegross profit margin, or net sales less cost of goods sold to net sales, and the netprofit margin, or net income after taxes to net sales.d. Coverage? Important measures here include interest coverage (such as before-taxincome and interest payments divided by total interest payments), coverage ofinterest and principal payments (such as earnings before interest and taxes dividedby annual interest payments plus principal payments adjusted for the tax effect),and the coverage of all fixed payments (such as before-tax income plus interestpayments plus lease payments divided by interest payments plus lease payments).e. Profitability Indicators? Key barometers in this area can include such ratios asbefore-tax net income divided by total assets, net worth, or sales, and after-tax netincome divided by total assets, net worth, or total sales.f. Liquidity Indicators? Important ratio measures here usually include the currentratio (current assets divided by current liabilities), and the acid-test liquidity ratio(current assets less inventories divided by current liabilities).g. Leverage indicators? Ratios indicating trends in this dimension of businessperformance usually include the leverage ratio (total liabilities/total assets or networth), the capitalization ratio (of long-term debt divided by total long-termliabilities and net worth), and the debt-to-sales ratio (of total liabilities divided bynet sales).One problem with employing ratio measures of business performance is that they only reflect symptoms of a possible problem but usually don't tell us the nature of the problem or its causes. Management must look much more deeply into the reasons behind any apparent trend in a ratio. Moreover, any time the value of a ratio changes, that change could be due to a shift in the numerator of the ratio, in the denominator, or both.23317-4. What aspect of a business firm's operations is reflected in its ratio of cost of goods sold to net sales? In its ratio of net sales to total assets? In its GPM ratio? Its ratio of income before interest and to taxes to total interest payments? Its acid-test ratio? In its ratio of before-tax net income to net worth? Its ratio of total liabilities to net sales? What are the principal limitations of these ratios? The ratio of cost of goods sold to net sales is a widely used indicator of a business firm's expense controls and operating efficiency. The ratio of net sales to total assets reflects activity or efficiency, while the gross profit margin (GPM) measure reflects the marketability of a business's products or services. A firm's ratio of income before interest expense and taxes indicates how effectively a business is covering its interest expenses through the generation of before-tax income. Theacid-test ratio provides a rough measure of a firm's liquidity position, while the ratio of before-tax income to net worth represents a measure of profitability. Finally, the ratio of liabilities to sales is an indicator of management's use of financial leverage. These ratios are affected by changes in the numerator or the denominator or both; a financial or credit analyst would want to know the source of any change in a ratio's value. These ratios only measure problem symptoms; you must dig deeper to find the cause.17-5. What are contingent liabilities and why might they be important in deciding whether to approve or disapprove a business loan request?Contingent liabilities include such pending or possible future obligations as lawsuits against a business firm, and warranties or guarantees the firm has given to others regarding the quality, safety, or performance of its product or service. Another example is a credit guaranty in which the firm may have pledged its assets or credit to back up the borrowings of another business, such as a subsidiary. Environmental damage caused by a business borrower also has recently become of great concern as a contingent liability for many banks because a bank foreclosing on business property for nonpayment of a loan could become liable for cleanup costs, especially if the bank becomes significantly involved with a customer's business or treats foreclosed property as an investment rather than a repossessed asset that is quickly liquidated to recover the unpaid balance on a loan. Loan officers must be aware of all contingent liabilities because any or all of them could become due and payable claims against the business borrower, weakening the firm's ability to repay its loan to the bank.17-6. What is cash flow analysis and what can it tell us about a bus iness borrower’s financial condition and prospects?A cash flow statement shows the changes in a business firm's assets and liabilities as well as its flow of net profit and noncash expenses (such as depreciation) over a specific time period. It shows where the firm raised its operating capital during the time period under examination and how it spent or used those funds in acquiring assets or paying down liabilities. From the perspective of a loan officer the cash flow statement indicates whether the firm is relying heavily upon borrowed funds and sales of assets. These are two less desirable funding sources from the point of view of lending money to a business firm. In contrast, loan officers usually prefer to focus upon cash flow - whether the firm is generating sufficient cash flow (net income plus noncash expenses) to repay most of its debt.23417-7. What is a pro forma statement of cash flows and what is its purpose?A pro forma statement of cash flows estimates the borrower’s future cash flows. I t is supposed to provide insight into the future cash flows of the borrower and its ability to repay the loan.17-8. Should a loan officer ever say no to a business firm requesting a loan? Please explain when and where.Loan officers will inevitably be confronted with some loan requests that will have to be flatly rejected, particularly in those cases where the borrower has falsified information or has a credit history of continually "walking away" from debt obligations. Even in these cases, however, the loan officer should be as polite as possible, suggesting to the customer what needs to be changed or improved for the future to permit the customer to be seriously considered for a loan.17-9. What methods are used today to price business loans?The following methods are in use today to price business loans:a. Cost-plus pricing d. Customer Profitability Analysisb. Price leadership pricing modelc. Below prime market pricingCost-plus-profit pricing requires the bank to estimate the total cost involved in making aloan and then adds to that cost estimate a small margin for profit.The price-leadership model, on the other hand, bases the loan rate upon a national or international rate (such as prime or LIBOR) posted by major banks and then adds a small increment on top for profit or risk.The below prime market prices a loan on the basis of cost of borrowing in the money market plus a small profit margin.Customer profitability analysis looks at all the revenues and costs involved in serving a customer and then requires the bank to calculate the net rate of return from this particular customer.17-10. Suppose a bank estimates that the marginal cost of raising loanable funds to make a $10 million loan to one of its corporate customers is 4 percent, its nonfunds operating costs to evaluate this loan are 0.5 percent, the default risk premium on the loan is 0.375 percent, a term risk premium of 0.625 percent is to be added, and the bank’s desired profit margin is 0.25 percent. What loan rate should be quoted this borrower? How much interest will the borrower pay in a year?235The loan rate quoted for this $10 million corporate loan would be:Loan Rate = 4 percent Loan Funds Cost + .5 percent Non-funds Operating Cost+ .375 percent default risk premium+ .625 percent term risk premium+ .25 percent profit margin= 5.75 percentBased on a $10 million loan this customer will pay in interest in a year:$10,000,000*.0575 = $575,000.17-11. What are the principal strengths and weaknesses of the different loan-pricing methods in use?Cost plus pricing is the simplest loan pricing model. However, it assumes that a lending institution can accurately know what its costs are and often they don’t.Price leadership overcomes the problems of accurately predicting what the costs of a loan will be to a lending institution. However, it is still difficult to assign risk premiums to loans. In addition, using something like the prime rate as the base rate has been challenged by LIBOR and other market based rates.Below prime market pricing uses LIBOR as the base rate and includes only a small profit margin as part of the loan price. This works well for short term loans for large, well known corporations but is not generally used for small and medium sized companies or longer term loans Customer profitability analysis is similar to cost plus pricing but differs in that it considers the whole customer relationship into account when pricing a loan. Customer profitability analysis has become increasingly sophisticated as computer models have been designed to help with the analysis.17-12. What is customer profitability analysis? What are its advantages for the borrowing customer and the lender?Customer profitability analysis is a loan pricing metho d that takes into account the lender’s entire relationship with the customer when pricing the loan. It is based on the difference between revenues from loans and other services provided and expenses from providing loans and other services is taken over net loanable funds. Net loanable funds are those funds used in excess of the customer’s deposits. If the calculated net rate of return from a customer’s relationship is positive the loan is made and if it is not, the rate is raised or the loan is not made. Because it takes the entire relationship into account it gives a better picture of what customer relationships are profitable. The chief problem with it is that it is a more complex model and takes an accurate picture of all of the relationships the lender has with the customer. It has also become increasingly complex as computer systems have put in place to help with the analysis of the total relationship a customer has with a lender.236Problems17-1. From the descriptions below please identify what type of business loan is involved.Based upon the descriptions given in the text the type of business loan being discussed is:A. Interim construction financing.B. Retailer financing or floorplanning loan.C. Asset-based financing or factoring.D. Self-liquidating inventory loan.E. Working capital loan.F. Security capital loan.G. Term loan.H. Acquisition loan or leveraged buyout.I. Revolving credit line.J. Project loan.17-2. As a new credit trainee for Evergreen National Bank, you have been asked to evaluate the financial position of Hamilton Steel Castings, which has asked for renewal of and an increase in its 6-month credit line. Hamilton now requests a $7 million credit line and you must draft your first credit opinion for a senior credit analyst. Unfortunately, Hamilton just changed management, and its financial report for the last six months was not only late but also garbled. As best as you can tell, its sales, assets, operating expenses, and liabilities for the six month period concluded display the following patterns (see textbook). Hamilton has a 16 year relationship with the bank and has routinely received and paid off a credit line of $4 to $5 million. The department’s senior analyst tells you to prepare because you will be asked for your opinion of this loan request (though you have been led to believe the loan will be approved anyway, because Hamilton’s president serves on Evergreen’s board of directors).What will you recommend if asked? Is there any reason to question the latest data supplied by this customer? If this loan request is granted what do you think the customer will do with the funds?The figures given in the case as well as the supporting background information suggest several developing problems. Hamilton has had a recent shakeup in its senior management, which usually leads to looser control of the firm until the new management gains sufficient experience. Among the obvious problems are declines in sales (from $48.1 million to $39.7 million) in the past six months. Hamilton's cost of goods sold dropped but by less than the decline in sales, thereby squeezing the firm's margin and net income. We note too that the firm, faced with declining cash flows, has been forced to rely more heavily on borrowings which will mean that the bank's position will be less secure. Current assets have also declined while current liabilities are on the rise, thus reducing the firm's net liquidity position. The bank's relationship with Hamilton needs to be reviewed carefully with an eye to gaining additional collateral or reducing the bank's total credit commitment to the firm.237Additional information that would be desirable and helpful, if not essential, should include:1) Past financial statements for the last two or three years, preferably on a monthlybasis. This could help us verify seasonality and improvement.2) Industry outlook for the next six to eighteen months would also help in reinforcingHamilton's ability to service the debt from the summer and fall cash flows.3) Additionally, information about the company's suppliers, other creditors,customers, and competitors would be helpful.4) Also, more information about other relationships that Hamilton has with Evergreenwould certainly be helpful.In summary, the more information we have, the better our analysis and subsequent decisions will be.17-3. From the data given in the following table (see textbook), please construct as many of the financial ratios discussed in this chapter as you can and then indicate the dimension of a business firm’s performance each ratio represents.238239 Among the many financial ratios that could be computed given the data in this problem are the following:Expense Control Ratios Operating Efficiency MeasuresWages and Salaries = 61 = .0897 Inventory Turnover Ratio = 520 = 4.81 x Net Sales 680 108Overhead Expenses = 29 = .0426 Net Sales/ = 680 1.115 x Net Sales 680 Total Assets 610Depreciation Expenses = 15 = .0221 Net Sales/ = 680 = 2.26 x Net Sales 680 Fixed Assets 301Interest Expense = 18 = .0265 Net Sales/Accounts = 680 = 7.16 x Net Sales 680 Receivable 95Cost of Goods Sold/ = 520 = .7647 Average = 95 / 680 /360 = 50.29 days Net Sales 680 Collection PeriodTaxes/Net Sales = 2 / 680 = .0029 Marketability IndicatorsCoverage Ratios GPM = 680 – 520 = .2353 680Interest Coverage = 25 = 1.39 x18 NAM = 5 = .0074680Coverage of Principal and Interest Payments = 24.36% .35)- (155 1825=+Profitability Measures Liquidity IndicatorsBefore-Tax Net Income/ = 7 = .0115 Current Ratio = $213 = 1.121 xTotal Assets 610 $190After-Tax Net lncome/ = 5 = .0082 Acid-Test Ratio= $213 - $108 = .55 xTotal Assets 610 $190Before-Tax Net Income/ = 7 = .0875 N et Liquid Assets = $213 - $108 -Net Worth or Equity 80 $190 = - 85CapitalNet Working Capital = $213 - $190 After-Tax Net lncome/= 5 = .0625 = $23Net Worth or Equity 80CapitalLeverage RatiosBefore-Tax Net Income/ = 7 = .0103 Total Liabilities/Total 530 = .8689 Sales 680 Assets = 610 After-Tax Net lncome/ = 5 = .0074 Long-Term debt = 325 = .8025Sales 680 Long-Term Liabilities 405Debt-to-Sales Ratio = Total Liabilities = 530 = .7794Net Sales 68017-4. Conway Corporation has placed a term loan request with its lender and submitted the following balance sheet entries for the year just concluded and the pro forma balance sheet expected by the end of the current year. Construct a pro forma Statement of Cash Flows for the current year using the consecutive balance sheets and some additional needed information. The forecast net income for the current year is $217 million with $65 million being paid out in dividends. The depreciation expense for the year will be $100 million and planned expansions will require the acquisition of $300 million in fixed assets at the end of the current year. As you examine the pro forma Statement of Cash Flows, do you detect any changes that might be of concern either to the lender’s credit analyst, loan officer, or both?240The Sources and Uses of Funds Statement for Conway Corporation would appear as follows: Cash Flows from OperationsNet income 217Add: Depreciation 100Subtract: increase in acc/rec (192)Subtract: increase in inventory (79)Subtract: increase in other assets (21)Add: increase in accounts payable 103Subtract: decrease in taxes payable (111)Net cash flow from operations 17Cash Flows from Investment ActivitiesAcquisition of fixed assets (300)Net cash flow from investment activities (300)Cash Flows from Financing ActivitiesIncrease in notes payable 217Increase in long term debt 59Dividends paid (65)Net Cash Flows from Financing Activities 211Increase (Decrease) in Cash (72)There are several areas of possible concern for a bank loan officer viewing Conway's projected figures. First, the firm is relying heavily upon increasing debt of all kinds to finance its growth in assets. The increase in notes payable of $217 million indicates growing reliance on bank debt supplemented by sizable increases in supplier-provided credit (accounts payable) and long-term debt obligations (most likely, bonds) with no change in funds provided by issuing stock. The bank could experience a serious weakening in the strength of its claim against the firm as other creditors post a more substantial claim against Conway's assets.Conway is projecting a sizable increase in its retained earnings (undivided profits) which suggests that management is counting on a year of strong earnings. However, both accounts receivable and inventories (as well as net fixed assets) are growing rapidly, perhaps reflecting troubles in collecting from the firm's customers and in marketing Conway's products and services. The bank's loan officer would want to explore with the company the bases for its projected jump in net income and why accounts receivable and inventories are expected to rise in such large amounts.24124217-5 Morbet Corporation is an new business client for First Commerce National Bank and has asked for a one-year, $10 million loan at an annual interest rate of 7 percent. The company plans to keep a 5 percent $2 million CD with the bank for the loan’s duration. The loan officer in charge of the case recommends at least an 8 percent annual before tax rate of return over all costs. Using Customer Profitability Analysis (CPA) the loan committee hopes to estimate the followingrevenues and expenses which it will project using the amount of the loan requested as a base for the calculations:Estimated Revenues:Interest Income from Loan $10,000,000*.07 = $700,000Loan Commitment Fee $10,000,000*.01 = $100,000Cash Management Fee $10,000,000*.03 = $300,000Trust Service Fee $10,000,000*.02 = $200,000Total Revenues $1,300,000Estimated Expenses:Interest on Deposit $2,000,000*.05 = $100,000Expected Cost of Additional Funds $10,000,000*.03 = $300,000Labor Costs and Other Operating Costs $10,000,000*.02 = $200,000Costs of Processing the Loan $10,000,000*.015 = $150,000Total Expenses $750,000Net Before Taxes Rate of Return = 6.875%or 06875.000,000,8$000,750$000,300,1$=- a. Should this loan be approved on the basis of the suggested terms?No, it should not because the bank is earning less than the 8 percent annual before tax rate of return.b. What adjustments could be made to improve this loan’s projected return?The fees that are charged could be made higher and the lender could try and find a way to reduce the expenses on the loan. Both of these would have the effect of increasing the rate of return on the loan.c. How might competition from other prospective lenders impact the adjustments you have recommended?In particular, it would be difficult to raise fees for this customer if they can get these same services from other lenders more cheaply. It would not necessarily cause a direct impact on expenses but other lenders might already be more efficient in providing these services and they may already be charging a lower interest rate on this loan based on the customer profitability analysis.17-6. As a loan officer for Starship National Bank, you have been responsible for the bank’s relationship with USF Corporation, a major producer of remote control devices for activating television sets, VCRs, and other audio video equipment. USF has just filed a request for renewal of its $10 million line of credit, which will cover approximately 10 ½ months. USF also regularly uses several other services sold by the bank. Applying the Customer Profitability Analysis and using the most recent year as a guide, you estimate that the expected revenues from this commercial loan customer and the expected costs of serving this customer will consist of the following (see textbook).The bank’s credit analy sts estimated the customer will probably keep an average deposit balance of $2,125,000 for the year the line is active. What is the expected net rate of return from this proposed loan renewal if the customer actually draws down the full amount of the requested line? What decision should the bank make under the foregoing assumptions? If you decide to turn down this request, under what assumptions regarding revenues, expenses, and customer- deposit balances would you be willing to make this loan?The expected revenues and costs from continuing the present relationship between Enterprise National Bank and USF Corporation were given in this problem and the reader is asked to estimate the expected net rate of return if the bank renews its loan to USF.The total of expected revenues and expected costs is:Expected Revenues Expected CostsInterest Revenue $700,000 Deposit Interest $ 106,250 Commitment Fees 100,000 Cost of Other Funds Raised 475,000 Deposit Service 4,500 Wire Transfer Costs 1,300 (Maintenance) Fees Loan Processing Costs 12,400 Wire Transfer Fees 3,500 Record keeping Expenses 4,500 Agency Fees 8,800 Account Activity Cost 19,000 Total Expected $816,800 Total Expected Costs $ 618,450 RevenuesGiven: Total Expected Revenues = $816,800Total Expected Costs = $618,450Net Revenue = $816,800 - $618,450 = $198,350Net Funds Loaned = $10,000,000 - $2,125,000 = $7,875,000Expected Net Rate of Return = $198,350/ $7,875,000 = .0252 or 2.52%Because the estimated net rate of return is positive, the bank should strongly consider approving the loan as requested because the bank can earn a premium over its costs.If you decide to turn down this request, under what assumptions regarding revenues, expenses, and customer-maintained deposit balances would you make this loan?243。

CHAPTER 12MANAGING AND PRICING DEPOSIT SERVICESGoal of This Chapter: This chapter has multiple goals. One of the most important is to learn about the different types of deposits financial institutions offer and, from the perspective of a manager, to discover which types of deposits are among the most profitable to offer their customers. We also want to explore how an institution’s cost of funding can be determined and examine the different methods open to institutions to price the deposits and deposit-related services they sell to the public.Key Topics in This Chapter•Types of Deposit Accounts Offered•The Changing Mix of Deposits and Deposit Costs•Pricing Deposit Services and Deposit Interest Rates•Conditional Deposit Pricing•Rules for Deposit Insurance Coverage•Disclosure of Deposit Terms•Lifeline BankingChapter OutlineI. Introduction: The Importance of Deposits and the Challenge of Managing DepositsII. Types of Deposits Offered by Banks and Other Depository InstitutionsA. Transaction (Payments) Deposits1. Noninterest-Bearing Demand Deposits2. Interest-Bearing Demand Depositsa. NOW Accountsb. Money Market Deposit Accounts (MMDAs)c. Super NOWsB. Nontransaction (Savings or Thrift) Deposits1. Passbook Savings Deposits2. Statement Savings Deposits3. Time Deposits4. Individual Retirement Accounts (IRAs)5. Keogh Plans6. Roth IRAsIll. Interest Rates Offered on Different Types of DepositsA. The Composition of Bank Deposits1. Trend Toward Interest-Bearing and Nontransaction Deposits2. The Importance of Core Deposits3. Changes in the Relative Importance of Other Types of Deposits163B. Cost of Different Deposit AccuntsIV. Pricing Deposit-Related ServicesV. Pricing Deposits at Cost Plus Profit MarginA. Estimating Deposit Service CostsB. An Example of Pooled Funds CostingVI. Using Marginal Cost to Set Interest Rates on DepositsA. Conditional PricingVII. Pricing Deposits Based on the Total Customer RelationshipA. The Role That Pricing and Other Factors Play When Customers Choose aDepository Institution to Hold Their AccountsVIII. Basic (Lifeline) Banking: Key Services for Low-Income CustomersIX. Summary of the ChapterConcept Checks12-1. What are the major types of deposit plans depository institutions offer today?Deposit plans can be divided broadly into transaction deposits, thrift or nontransaction deposits, and hybrid deposits. The primary function of transaction deposits is to make payments and these deposits include regular checking accounts and NOW accounts. The principal function of thrift deposits is to serve as accumulated savings and include passbook and statement savings accounts, CDs, and other time deposit accounts. Hybrid deposits combine transactions and thrift features and include money-market deposit accounts and Super NOWs.12-2. What are core deposits and why are they so important today?Core deposits are the most stable components of a depositary institution’s funding base and usually include smaller-denomination savings and third-party payments accounts. They are characterized by relatively low interest-rate elasticity. Holding a substantial proportion of core deposits has an advantage in having access to a stable and cheaper source of funding with relatively low interest-rate risk.12-3. How has the composition of deposits changed in recent years?There has been a shift in the public’s holdings of deposits toward greater relative proportions of the highest-yielding time deposits and toward hybrid accounts that maximize depositor returns, while still giving them access to deposited funds to make payments.12-4. What are the consequences for the management and performance resulting from recent changes in deposit composition?While depository institutions would prefer to sell only the cheapest deposits to the public, it is predominately public preference that determines which types of deposits will be created. Institutions that do not wish to conform to customer preferences will simply be outbid for deposits by those who do. Managers who fail to stay abreast of changes in their competitors’ deposit pricing and marketing programs stand to lose both customers and profits.16412-5. Which deposits are the least costly for depository institutions? The most costly?Commercial checkable deposits, particularly regular noninterest bearing demand deposits, are usually the least costly. The most costly deposits are passbook savings accounts having substantial deposit and withdrawal activity and higher interest-rate time deposits.12-6. First State Bank of Pine is considering a change of marketing strategy in an effort to lower its cost of funding and maximize profitability. The new strategy calls for aggressive advertising of new commercial checking accounts and interest-bearing household checkable deposits andde-emphasizes regular and special checking accounts. What are the possible advantages and possible weaknesses of this new marketing strategy?The cost data presented in the text suggest that certain kinds of checkable deposits are often among the least-cost deposits a bank can sell (especially because of low or nonexistent interest rates paid) so First State Bank may be able to achieve some of its profit and cost goals with the proposed new strategy. Moreover, adjusted for revenues generated through the use of deposited funds, interest-bearing checking accounts appear to be more profitable than regular (noninterest-bearing) accounts and commercial checking services more profitable than retail (personal) checking services. However, the deposit services that First State Bank wants to pursue more aggressively tend to be more interest-sensitive and less loyal to a bank and, thus First State Bank may be adding to its liquidity problem with the new strategy.12-7. Describe the essential differences between the following deposit pricing methods in use today: cost-plus pricing, conditional pricing, and relationship pricing?Cost-plus deposit pricing encourages banks to determine what costs they are incurring in labor and management time, materials, etc., in offering each deposit service. Cost-plus pricing generally calls for a bank to charge deposit service fees adequate to cover all the costs of offering the service plus a small margin for profit. Conditional pricing is used today as a tool by banks to attract the kinds of depositors they want to have as customers. With this pricing technique a bank will post a schedule of offered interest rates or fees assessed for deposits of varying sizes and based on account activity. Generally larger volume deposits carry higher interest returns to the depositor or are assessed lower service charges, encouraging customers to hold a high average deposit balance which gives the bank more funds to invest in earning assets. Finally, relationship pricing involves basing fees charged a customer on the number of services and the intensity of use of services the customer purchases from a bank.12-8. A bank determines from an analysis of its cost-accounting figures that for each $500 minimum-balance checking account it sells account processing and other operating costs will average $4.87 per month and overhead expenses will run an average of $1.21 per month. The bank hopes to achieve a profit margin over these particular costs of 10 percent of total monthly costs. What monthly fee should the bank charge a customer who opens one of these checking accounts?165The relevant formula is:Unit Price Operating Overhead PlannedCharged = Expense + Expense + Profit Marginper Month Per Unit Per Unit Per UnitIn this case:Unit Price Charged Per Month = $4.87 + $1.21 + 0.10 x ($4.87 + $1.21) = $6.6912-9. To price deposits successfully, service providers must know their costs. How are these costs determined using the historical average cost approach? The marginal cost of funds approach? What are the advantages and disadvantages of each approach?The historical average cost approach looks at the past. It asks the following question:what funds has the bank raised to date and what did they cost? The marginal cost deposit-pricing method focuses upon the weighted average cost of new funds raised from all of the different sources of funds the bank draws upon or plans to draw upon in the current period.12-10. How can the historical average cost and marginal cost of funds approaches be used to help select assets (such as loans) that a depository institution might wish to acquire?The historical average cost rate is called break-even because the institution must earn at least this rate on its earning assets (primarily loans and securities) just to meet the total operating costs of raising borrowed funds and the stockholders' required rate of return. Therefore, the institution will know the lowest rate of return that it can afford to earn on assets it might wish to acquire. The marginal cost of funds approach can be used as a guide to select loans and other assets because the institution interested in profit maximizing would want to be sure to cover its fund-raising costs.12-11. What factors do household depositors rank most highly in choosing a financial firm for their checking account? Their savings account? What about business firms?Studies cited in this chapter indicate that households (individuals and families) appear to consider, in rank order, the following factors in choosing an institution to hold their checking account: convenient location, availability of other services, safety, low fees and low minimum balances, and high deposit interest rates. In selecting an institution to hold their savings account households appear to consider, in rank order: familiarity, interest rate paid, transactional convenience, location, availability of payroll deduction, and any fees charged. Business firms, on the other hand, seem to consider such factors as the financial health of the lending institution, whether the institution will be a reliable source of credit in the future, the quality of managers, whether loans are competitively priced, the quality of financial advice given, and whether cash management and operations services are provided.12-12. What does the 1991 Truth in Savings Act require financial firms selling deposits inside the United States to tell their customers?166167The Truth in Savings Act requires financial firms to fully inform their deposit customers on the terms offered each depositor. The customer must be told when a new account is opened or if a deposit is renewed, what annual percentage yield (APY) is being offered and what minimum balance is required to receive that yield. Moreover, the depositor must be informed about any penalties or service fees which could reduce his or her expected yield. If the terms of a deposit are changed in a way that would reduce the depositor's return advance notice must be given to the account holder.12-13. Using the APY formula required by the Truth in Savings Act for the following calculation. Suppose that a customer holds a savings deposit for a year. The balance in the account stood at $2,000 for 180 days and $100 for the remaining days of the year. If the Savings bank paid this depositor $88.50 in interest earnings for the year, what APY did this customer receive?The correct formula is:⎥⎦⎤⎢⎣⎡+=1- )Balance Account Average Earned Interest (1 100 APY Period in Days 365In this instance,⎥⎦⎤⎢⎣⎡+=1 - )$1036.99$88.50 (1 100 APY 365365 orAPY = 8.53 percent,where the average account balance is:$1036.99 days365days 185 x $100 days 180 x $2000=+12-14. What is lifeline banking? What pressures does it impose on the managers of banks and other financial institutions?Lifeline banking consists of basic service packages offered by banks to customers not generally able to afford conventional bank service offerings. The essence of these services is that they carry low service fees and usually do not offer all of the features of banking services carrying full service fees. The pressure on managers to offer basic or lifeline services has aroused a big controversy. From a profit motive point of view banks should not offer unprofitable services. On the other hand, financial institutions are partially subsidized by government in the form of low-interest loans and deposit insurance and, therefore, have some public-service responsibilities which may include providing certain basic services to all potential customers, regardless of their income or social status.12-15. What does the Expedited Funds Availability Act require U.S. depository institutions to do?The Expedited Funds Availability Act mandates a time schedule that sets maximum delays for the receipt of deposit credit that depository institutions can use, and it requires them to inform their customers about their policies for making funds available for customer use.Problems12-1. Exeter National Bank has a funding mix to support its assets as follows:Cash and Interbank Dep 50 Core Deposits 50S.T. Securities 15 Large Negotiable CDs 150Total Loans, Gross 375 Brokered Deposits 65L.T. Securities 150 Other Deposits 140Other Assets 10 Money Mkt. Liabilities 95Total Assets 600 Other Liabilities 70Equity Capital 30Total Liab. & Eq. 600a. Evaluate the funding mix of deposits and nondeposit sources of funds employed by Exeter. Given the mix of its assets, do you see any potential problems? What changes would you like to see management of this bank make? Why?Core deposits/Assets = 8.33%Large Negotiable CDs/Assets = 25.00%Brokered Deposits/Assets = 10.83%Other Deposits/Assets = 23.33%Money Market Liabilities/Assets = 15.83%Other Liabilities/Assets = 11.67%Equity Capital/Assets = 5.00%The proportion of core deposits at Exeter is exceptionally low, while large CDs and other money-m arket borrowings make up more than 40 percent of the bank’s total funding sources. This funding mix tends to subject the bank to excessive vulnerability to quick withdrawal of funds and high interest-rate risk exposure. Exeter also appears to be excessively dependent on brokered deposits which are highly volatile and interest-sensitive. Adding in these brokered deposits, more than half of Exeter’s assets are funded with highly interest-sensitive deposits and money-market borrowings. Management needs to e xpand the bank’s core deposits and other more stable funds sources.b. Suppose market interest rates are projected to rise significantly. Does Exeter appear to face significant losses due to liquidity risk? Due to interest rate risk? Please be as specific as possible.168If interest rates rise, Exeter will experience higher interest costs immediately or within hours or a few days on at least 50 percent of its funding sources. Unfortunately all but $65 million of its $600 million in total assets are longer-term, inflexible assets whose interest yields cannot be adjusted as rapidly as the interest rates to be paid out on the bank’s liabilities. Other factors held equal, the bank’s earnings will be squeezed. Management needs to do some serious restructuring work on both sides of the bank’s balance sheet in moving toward more flexible-return assets and more flexible-cost liabilities, and to move toward greater use of interest-rate hedging techniques.12-2. Kalewood Savings Bank has experienced recent changes in the composition of its deposit (see the table; all figures in millions of dollars). What changes have recently occurred in Kalewood’s deposit mix? Do these changes suggest possible problems for management in trying to increase profitability and stabilize earnings?Types of Deposits ThisYearOneYearAgoTwoYearsAgoThreeYearsAgoRegular & Special Checking Accounts 235 294 337 378Interest Bearing Checking Accounts 392 358 329 287Regular (Passbook) Savings Dep. 501 596 646 709Money Market Deposit Accounts 863 812 749 725Retirement Deposits 650 603 542 498CDs under $100,000 327 298 261 244CDs $100,000 and over 606 587 522 495Regular and special checking accounts have declined sharply from $378 million to $235 million, while interest-bearing checking accounts rose from $287 million to $392 million. Passbook savings deposits have fallen by more than $200 million while money-market deposit accounts, retirement accounts, and both small and large ($100,000 +) CDs have all risen substantially. Management has several reasons to be concerned about these developments because the bank’s funds are shifting into accounts bearing significantly higher interest costs, while the bank is suffering substantial erosion in its core deposits represented by regular (passbook) savings deposits and small checking accounts. Thus, more interest-sensitive funds are supplanting deposits that are more loyal and less interest-elastic. The bank may find its profits are likely to be squeezed by higher interest costs and its earnings may become more volatile if market interest rates experience significant changes in the period ahead because a greater portion of the bank’s funding is coming from more interest-sensitive deposits. A possible offsetting advantage is the shift away from deposits that can be withdrawn without notice (i.e., regular and special checking accounts and passbook savings deposits) toward longer-term deposit instruments with fixed maturities, giving the bank a somewhat longer term and, perhaps, somewhat more predictable funding base.16912-3. First Metrocentre Bank posts the following schedule of fees for its household and small business checking accounts:•For average monthly account balances over $1500 there is no monthly maintenance fee and no charge per check or other draft.•For average monthly account balances of $1000 to $1500 a $2 monthly maintenance fee is assessed and there is a $.10 charge per check or charge cleared.•For average monthly account balances of less than $1000, a $4 monthly maintenance fee is assessed and there is a $.15 per check or per charge fee.What form of deposit pricing is this? What is First Metrocentre trying to accomplish with its pricing schedule? Can you foresee any problems with this pricing schedule?First Metrocentre Bank has posted a schedule of deposit fees that allows the customerservice-charge free checking for average monthly account balances over $1500. Lower balances are assessed an inverse monthly maintenance fee plus an increased per-check charge as the average monthly account balance falls. This is conditional deposit pricing designed to encourage more stable, larger-denomination accounts which would give the bank more money to use and, perhaps, a more stable funding base. The fees on under-$1000 accounts are stiff which may drive away many small depositors to other banks.12-4. Diamond Pit Association finds that it can attract the following amounts of deposits if it offers new depositors and those rolling over their maturing CDs the interest rates indicated below:Expected Volume of New DepositsRate of Interest Offered Depositors$ 10 million 5.00%15 million 5.2520 million 5.5026 million 5.7528 million 6.00Management anticipates being able to invest any new deposits raised in loans yielding 7 percent. How far should this thrift institution go in raising its deposit rate in order to maximize total profit (excluding interest costs)?Expected InflowsRateOfferedon NewFundsTotalInterestCostMarginalInterestCostMarginalCost RateMarginalRevenueRateExp. Diff.In Marg.Rev andCostTotalProfitsEarned$10 5.0% 0.5000 0.5000 5.000% 7.0% +2.0% $0.2000 15 5.25 0.7875 0.2875 5.750 7.0 +1.25 $0.2625 20 5.50 1.100 0.3125 6.250 7.0 +0.75 $0.3000 26 5.75 1.495 0.395 6.583 7.0 +.417 $0.325 28 6.00 1.680 0.185 9.250 7.0 -2.250 $0.280170Emerald Isle National Bank should raise its deposit rate to 5.75%, attracting $26 million in new deposits; because up to that point the marginal revenue rate is greater than the marginal cost rate and total profits are also rising. At 6.0%, the marginal cost rate is greater than the marginal revenue rate and total profits have fallen from a high of $0.325 million back down to $0.28 million. 12-5.Goldbrick Bank plans to launch a new deposit campaign next week in hopes of bringing in from $100 million to $600 million in new deposit money, which it expects to invest at a 7.75 percent yield. Management believes that an offer rate on new deposits of 5.75% would attract $100 million in new deposits and rollover funds. To attract $200 million, the bank would probably be forced to offer 6.25 percent. Goldbrick’s forecast suggests that $300 million might be available at 6.8%, $400 million at 7.25 percent, $500 million at 7.5 percent and $600 million at 7.65 percent. What volume of deposits should the bank try to attract to ensure that marginal cost does not exceed marginal revenue?Expected InflowsRateOfferedon NewFundsTotalInterestCostMarginalInterestCostMarginalCost RateMarginalRevenueRateExp. Diff.In Marg.Rev andCostsTotalProfitsEarned$100 5.75% 5.75 5.75 5.75% 7.75% +2.00% $2.00 $200 6.25% 12.50 6.75 6.75% 7.75% +1.00% $3.00 $300 6.80% 20.40 7.90 7.90% 7.75% -0.15% $2.85 $400 7.25% 29.00 8.60 8.60% 7.75% -0.85% $2.00 $500 7.50% 37.50 8.50 8.50% 7.75% -0.75% $1.25 $600 7.65% 45.90 8.40 8.40% 7.75% -0.65% $0.60 The marginal revenue rate is greater than the marginal cost rate up to $200 million in new deposits. At $300 million, the marginal cost rate of 7.90% is greater than the marginal revenue rate of 7.75%. Therefore, Goldbrick Bank should try and attract $200 million in new deposits.12-6. Bender Savings Bank finds that its basic checking account which requires a $400 minimum balance, costs the bank $2.65 per month in servicing costs (including labor and computer time) and $1.18 per month in overhead expenses. The savings bank also tries to build in a $0.50 per month profit margin on these accounts. What monthly fee should the bank charge each customer?Following the cost-plus-profit approach, the monthly fee should be:Monthly fee = $2.65 + $1.18 + $0.50 = $4.33 per month.Further analysis of customer accounts reveals that for each $100 above the$400 minimum in average balance maintained in its checking accounts, Bender Savings saves about 5 percent in operating expenses with each account. For a customer who consistently maintains an average balance of $1000 per month, how much should the bank charge in order to protect its profits margin?171172If the bank saves about 5 percent in operating expenses for each $100 held in balances above the $400 minimum, then a customer maintaining an average monthly balance of $1,000 should save the bank 30 percent in operating costs.The appropriate fee for this customer would be:[$2.65 -0.30 ($2.65)] + $1.18 + $0.50 = $1.855 + $1.18 + $0.50 = $3.535 per month.12-7. Chris Orange maintains a savings deposit with Santa Paribe Credit Union. This past year Chris received $13.64 in annual interest income from his savings account. His savings deposit had the following average balance each month:January $400 July $350February 250 August 425March 300 September 550April 150 October 600May 225 November 625June 300 December 300What was the annual percentage yield (APY) earned on Chris Orange's savings account?Chris's account had an average balance this year of:[$400 x 31 days + $250 x 28 days + $300 x 31 days + $150 x 30 days+ $225 x 31 days + $300 x 30 days + $350 x 31 days + $425 x 31 days + $550 x 30 days + $600 x 31 days + $625 x 30 days + $300 x 31 days]365 days= $373.56Then the APY must be:APY = 100 percent 3.651)$373.56$13.64(1365/365=⎥⎦⎤⎢⎣⎡-+12-8. The National Bank of Taraville quotes an APY of 5 percent on a one-year money market CD sold to one of the small businesses in town. The firm posted a balance of $2500 the first 90 days of the year, $3000 over the next 180 days, and $5000 for the remainder of the year. How much in total interest earnings did this small businesscustomer receive for the year?Using the APY formula we can fill in the variables whose values are known and find the unknown interest earnings. Thus:173 APY = 100 ⎥⎦⎤⎢⎣⎡-+1)Balance Average Earnings Interest (1365/3655% = 100 ⎥⎦⎤⎢⎣⎡-+1)$3397.26Earnings Interest (1365/365Where the account's average balance is found from: Average Balance = []days 365days 95 x $5000days 180 x $3000days 90 x $2500++= $3397.26Then:5% = 100 Earnings Interest x 0.029435$3397.26Earnings Interest =⎪⎭⎫ ⎝⎛or Interest Earnings = $169.86。

银行是经济中最为重要的金融机构之一。

关于银行业务的起源,可谓是源远流长。

西方银行业的原始状态,可追溯到公元前的古巴比伦以及文明古国时期。

据大英百科全书记载,早在公元前6世纪,古巴比伦以有宜家“里吉比”银行。

又据考古家在阿拉伯沙漠发现的石碑证明,在公元前2000年以前,古巴比伦的寺院已在对外放款,而且“放款是采用由债务人开具类似本票的文书,交由寺院收执,且此项文书可以转让”。

公元前4世纪,希腊的寺院,公共团体,私人商号也可以从事各种金融活动,但只限于货币兑换业性质,还没有办理放款业务。

罗马在公元前200年也有类似于希腊银行业的出现,但较希腊银行业又有所进步,它不仅经营货币兑换业务,还经营贷放、信托等业务,同时对银行的管理与监督也有明文的法律条文。

罗马银行所经营的业务虽然不属于月信用放贷,但已具有近代银行的趋形。

人们供认的早起银行的萌发起源于文艺复兴时期的意大利。

银行以此之所以是bank,是由意大利文banca演变而来的。

在意大利文中,banca是长凳的意思。

最初的银行家均为祖居在意大利北部的伦巴蒂的犹太人。

在市场上人各一凳,据以经营货币兑换业务。

倘若有人遇到周转不灵,无力支付债务时们就会招致债主们的群起捣碎其长凳,兑换商的信用也是宣告破碎,所以破产为bankruptcy也源于此。

早起银行业的产生与国际贸易发展有着密切的联系。

中世纪的欧洲地中海沿岸各国,尤其是意大利的威尼斯‘热那亚等城市是著名的国际贸易中心,商贾云集,市场繁荣。

但由于当时社会的封建割据,货币制度混乱,各国商人所携带的铸币形状、成色、重量各不相同。

为了适应贸易发展的需要,必须进行货币兑换。

于是,单纯从事货币兑换并从从中收取手续费的专业货币商便开始出现和发展。

“货币经营业,即经营货币商品的商业,首先是从国际贸易中发展起来的。

自从各国有所不同的货币和当地货币兑换成本国货币,或者把不同的铸币同作为世界货币的,未铸币的纯银或纯金相交换,由此就产生了兑换也,他应当看成是近代货币经营的自然基础之一。

商业银行管理商业银行是国民经济中负有特殊社会责任的金融机构,承担着金融中介、资金融通和信用创造的重要功能。

商业银行管理是保障商业银行顺利运营、规范经营、维护金融市场稳定的重要环节,其质量直接关系到金融体系的健康发展和经济的稳定增长。

商业银行管理的定义商业银行管理是指商业银行内部制定和执行的一整套规章制度、组织架构和管理体系,旨在确保商业银行业务开展合规、有效,风险可控,效益最大化的一系列管理活动。

商业银行管理的基本原则客户导向商业银行管理应以客户为中心,从客户需求出发,提供优质的金融服务,建立长期稳定的客户关系,实现共赢。

风险管理商业银行管理要重视风险管理,建立完善的风险管理体系,保障商业银行经营的安全性和稳定性。

合规经营商业银行管理必须依法合规经营,遵循监管规定,规范自身行为,保障金融市场秩序。

效益最大化商业银行管理要追求效益最大化,提高盈利能力,为股东创造更大的经济回报。

商业银行管理的主要内容机构设置商业银行管理涉及机构设置,包括总行、分行、支行等各级机构的设立、职能划分和人员配置等,构建合理的组织结构。

内部控制商业银行管理需建立健全的内部控制机制,规范各项业务流程,防范操作风险、信用风险等各类风险。

人才培养商业银行管理需注重人才培养,建立科学的员工选拔、培训和激励机制,提高员工素质和专业水平。

信息技术商业银行管理需要整合先进的信息技术,提高金融服务的效率和便利性,推动数字化转型。

商业银行管理的挑战和对策新技术冲击随着科技的迅猛发展,商业银行管理面临新技术冲击,需要不断创新,加快数字化转型。

金融风险金融环境不确定性增加,商业银行面临更多金融风险,需要强化风险管理,提高风险应对能力。

客户需求变化随着社会发展,客户需求也在不断变化,商业银行管理要灵活适应市场需求,不断改进金融服务模式。

结语商业银行管理是一个复杂而又重要的领域,需要不断适应和积极应对各种挑战,实现稳健发展。

希望商业银行管理者能够不断提高管理水平,为金融市场的繁荣稳定和经济的可持续增长贡献力量。