经济学人双语2012考研必备

- 格式:doc

- 大小:108.00 KB

- 文档页数:17

考研英语:《经济学人》选读《经济学人》一直是考研阅读的命题来源之一,平日里我们可以利用碎片时间稍加阅读一些文章,领会政经类文章的写作手法,适当拓展自己的词汇量,也是不错的练习。

Britain Dug prohibition英国禁毒Banning the east African stimulant may backfire东非的兴奋剂禁令可能会适得其反OUTSIDE a newsagent's shop in the Clapham Road, a south London thoroughfare, a man sucks on a rolled-up cigarette and asks passers-by whether they want to buy some cannabis。

在伦敦大街南部的克拉彭路的一个报刊亭旁,一个人正叼着卷烟问路人他们是否需要大麻。

But shoppers seem more interested in khat, a mild narcotic popular with Ethiopians, Somalis and Yemenis。

但消费者似乎对阿拉伯茶—在俄塞俄比亚人、索马里人和也门人群中颇受欢迎的一种轻度镇定剂。

Inside, the shopkeeper pulls out bundles of the yellowish leaf and explains that it is the last batch he will sell。

店里内部,店主拿出少许淡黄色叶片并说明这些是他将卖出的最后一批货了。

“After tomorrow, they stop, no more,” he says。

“明日之后,再没有这些东西了,”他说。

On June 24th the sale of khat was prohibited in Britain,almost a year after Theresa May, the home secretary, told the House of Commons that she intended to ban it。

经济学家》读译参考(第10篇):禽流感——不祥之兆第10篇Feb 23rd 2006From The Economist print editionOminousFOR most of the past three years, the highly pathogenic bird fluk________①as H5N1 has been found mainly in Asia. Suddenly it has arrived in many countries in Europe, triggering widespread alarm. The detection of the virus in wild birds across Europe is certainly a cause for concern, particularly to Europe's poultry farmers▲, wh o are rightfully worried that the presence of the virus in wild birds will increase the risk to their flocks. However, in the m_________②of a European debate about the benefits of vaccinating chickens and whether or not poultry should be brought indoors, there is a danger that far more significant events elsewhere will be ★overlooked[1].In particular, most attention should be f________③on the fact that bird flu is now widespread in the poultry flocks of two nations in Africa—Egypt and Nigeria—and in India. And on the fact that, in Nigeria, the disease is continuing to spread despite great efforts undertaken by the government. An outbreak in Afghanistan also appears to be inevitable.Arguably, these matter much more than the (also inevitable) arrival of the disease in Europe▲. Poor countries with large rural populations are in a far weaker position to handle, and ★stamp out[2], outbreaks of bird flu in poultry, through both ★culling[3] and the prevention of the movement of animals in the surrounding areas. In Africa and India, chickens and ducks are far more likely to be found ★roaming[4] in people's backyards, where they can mingle with humans, other d________④ animals and wildlife, thus spreading the disease. In Europe, by c_______⑤, most poultry are kept in regulated commercial farms.The opening up of a new African front for the bird-flu virus▲ is a problem because eradication there will be tremendously difficult. There is a high risk that the disease will spread to other countries on the continent and it could easily become endemic—as it has in Asia. This offers the virus huge new scope to mutate▲ and become a disease that can pass between humans. The virus is certainly mutating—genetic changes have already affected its biological behaviour, although apparently not yet its transmission between humans. Experts are unsure as to how much, and what kind, of genetic changes would be required for the virus to become a globalhealth threat. N_____⑥ do they know how long this process might take. But to ★dwell o n[5] the increased risk of a pandemic of influenza is to miss a serious point about the direct risks posed by the loss of a large numbers of chickens and ducks across Africa. For some time, the United Nations Food and Agriculture Organisation has been warning that if avian flu gets out of c_______⑦ in Africa, it will have a devastating impact on the livelihoods of millions of people. Poultry is a vital source of protein. For example, it provides almost 50% of the protein in the diet of Egyptians. The spread of a disease that is highly lethal to poultry, and requires culling, could have a ★dire[6] nutritional impact, there as elsewhere▲. Africa would also have to contend with huge economic losses. People who ★scratch out[7] a living in poor African nations simply cannot a_______⑧to lose their chickens. Most of the world's poor live in rural areas and depend on agriculture. In Africa, rather a lot of these poor people depend heavily on their poultry. It is easy to see why some believe that bird flu could turn out to be primarily a development—rather than just a health—issue for the whole African continent.No game of chickenWhat can be done? It is clear that the movement and trade of poultry is making a big contribution to the spread of the virus. That trade needs tighter regulation, as does the movement of live birds from countries with H5N1 infections. In such places trade should be suspended u_______⑨ flocks have been cleaned up.In addition, Nigeria and surrounding countries need seriouspublic-education campaigns about the danger of contact with dead birds. When outbreaks o______⑩, governments should immediately offer realistic compensation to farmers for birds lost to disease and culling▲. Without this, poor farmers will be tempted to hide bird-flu outbreaks and continue to sell poultry that should be culled. Farming practices that mix poultry species in farms or live animal markets are a danger too, and must be addressed—although that might take longer. The effort would be helped if those in the poultry industry and governments in poultry-exporting nations would stop simply pointing to the risks posed by wild birds and start paying more attention to the movement of animals, products and people from infected to un-infected regions and countries.Unusually for a complex probl em with international ★ramifications[8], money is available to make a serious attempt at tackling it▲—$1.9 billion was pledged by the world's wealthier nations last month in Beijing. There is no excuse for delay, unless we want more dead people to followlots more dead ducks.☆★注释☆★[1]overlook vt.(1)俯瞰,俯视The house on the hill overlooks the village.从小山上的房子可以俯视村庄。

(考研英语阅读原文很多来自《经济学人》,希望大家好好看看)印度的救赎IN MAY America’s Federal Reserve hinted that it would soon start to reduce its vast purchases of Treasury bonds. As global investors adjusted to a world without ultra—cheap money, there has been a great sucking of funds from emerging markets。

Currencies and shares have tumbled, from Brazil to Indonesia, but one country has been particularly badly hit。

今年五月,美国联邦储备委员会(Federal Reserve)暗示,它将很快开始缩减大量购买国债的规模。

随着全球投资者开始调整策略,以适应没有超廉价资金的世界,大量资金开始逃离新兴市场.从巴西到印度尼西亚,货币及股票纷纷暴跌,但有一个国家受创尤其严重.Not so long ago India was celebrated as an economic miracle. In 2008 Manmohan Singh,the prime minister,said growth of 8—9% was India’s new cruising speed. He even predicted the end of the “chronic poverty,ignorance and disease, which has been the fate of millions of our countrymen for centuries”. Today he admits the outlook is difficult. The rupee has tumbled by 13% in three months。

2012年1月经济学人文章(英汉双语对照)Contents[2012.01.31]Libya bitten, Syria shy一朝被利比亚咬,十年怕叙利亚 (1)[2012.01.28]Ant tribes and mortgage slaves 蚁族与房奴 (2)[2012.01.28]Who goes to the gallows? 谁该上绞架?—公众关注吴英案 (3)[2012.01.28]Black, white and blood red 黑色白色与血色 (5)[2012.01.25]Phew, the Oscars are still irrelevant 奥斯卡奖还是不靠谱 (6)[2012.01.23]Gender & tennis: Coming up short 女网的不足 (8)[2012.01.23]China's labour force 中国的劳动力大军 (10)[2012.01.21]Not quite too late 还不算太晚 (11)[2012.01.21]Guatemala's new president: Quick march 新总统必须加快改革 (13)[2012.01.21]Party of two,二人成双 (15)[2012.01.19]The Nordic cure for a hangover治疗宿醉的北欧疗法 (18)[2012.01.16]IN SEARCH OF SERENDIPITY 寻找偶遇 (19)[2012.01.07]The dangers of demonology 妖魔化的风险 (23)[2012.01.07]A murder that changed Britain 改变英国的凶杀案 (26)[2012.01.07]Dutchmen grounded 搁浅的荷兰人 (29)[2012.01.07]New film: "The Iron Lady” 新电影:《铁娘子》 (33)[2012.01.07]Chinese condoms: Reds in the bed 床上的红色安全套 (34)[2012.01.05]A World of Mist 照片散文-雾的世界 (36)[2012.01.02]Take five 目标:攻克五种癌症 (40)[2012.01.31]Libya bitten, Syria shy一朝被利比亚咬,十年怕叙利亚Syria and the UN叙利亚和联合国Libya bitten, Syria shy一朝被利比亚咬,十年怕叙利亚Jan 31st 2012, 20:59 by R.L.G. | NEW YORKIN 2005 all the world's countries signed up, in theory, to a new norm called the "responsibility to protect". In short, the idea is that a government is sovereign because it protects its people. When it cannot do so—or worse, is the perpetrator of mass violence against its own—the responsibility to protect them may devolve to the international community. For a while, this norm was mostly airy, referred to when other countries or United Nations diplomats got involved to stop violence in its earliest phases. But some construe the "responsibility to protect" as a mandate for "liberal interventionism": the right of outside countries to step in militarily when abuses get serious enough. 2005全世界所有的国家从理论上签订了一种新的国际规则,名曰“保护责任”。

考研英语外刊《经济学家》读译参考之五十六:新意-中国日益关注创新Something new新意(陈继龙编译)Aug 3rd 2006 | BEIJINGFrom The Economist print editionAFTER years of prospering as the world's workshop, China now wants to be its laboratory as well. “Innovation”has become a national buzzword[1], and Chinese leaders have been tossing it into their speeches since the beginning of the year, when President Hu Jintao started an ambitious campaign to drive China's economy further up the value chain. (1)True, new campaigns and catchphrases[2] are declared by the government and the Communist Party in China all the time, and mostly end up fizzling out[3] in puddles[4] of rhetoric. But there are signs that the government i_______①to back its innovation campaign with more than just words.中国作为“世界工场”,多年来发展蒸蒸日上,但现在它也希望成为“世界实验室”。

“创新”已经成为举国上下一个时髦词儿。

今年年初,胡锦涛主席启动了一项雄心勃勃的规划,旨在推动中国经济进一步与价值链接轨。

《经济学家》读译参考(第8篇):切尼打鹌鹑,误伤老律师Part AFeb 16th 2006From The Economist print editionReady, fire, aim预备!开火!瞄准!!Foreword:A vice-president, a ★quail[1] and the first glimmer of class warfare in hunting引言:一位副总统,一只鹌鹑,等级矛盾第一次在打猎中凸现。

is (1)a goldmine for both trivia addicts and congenital time-wasters.▲ Do you want to find out about American politicians who were killed in duels (17a______①_____ to the site)? Or about politicians who were murdered (86)? Or politicians who have been to outer space (6)? Or politicians who died while hunting or fishing (14)? Just point and click. But as yet the site doesn't have an entry for politicians who almost kill the poor ★saps[2] they are hunting or fishing with.对于喜欢捕风捉影的人和那些天生爱好浪费时间的人而言,政治墓园网站()是一个极佳去处。

您想知道有多少美国政治家在决斗中丧生吗(该网站认为是17人)?有多少政治家遭谋杀(86人)?有多少政治家曾去过外太空(6人)?又有多少政治家在打猎或钓鱼时不幸身亡(14人)?点击便知。

经济学⼈中英双语对照精读笔记合集汇总1、经济学⼈中英双语对照精读笔记TE20210529,Leaders | Two states or one? 两个国家还是⼀个?TE20210605,Leaders | Geopolitics and business 地缘政治和商业TE20210612,Leaders | Bunged up 绿⾊能源的发展瓶颈TE20210619,Leaders | Broadbandits ⽹络盗匪TE20210626,Asia | Unlawfully wed ⼩⼩新娘TE20210703,Leaders | The long goodbye 漫长的告别TE20210710,Leaders | Fault lines in the world economy 世界经济断层线TE20210717,Leaders | Rule of lawlessness 南⾮法治之战TE20210724,Leaders | No safe place ⽆处容⾝TE20210724,China | Surfing: Mother ocean 乘风破浪的姐姐,浪尖上的新风尚TE20210731,Leaders | Dashed hopes 破灭的希望,新兴国家的出路在何⽅?TE20210814,Leaders | Last Chance 美国还能拯救阿富汗?TE20210821,Leaders | Biden’s debacle 拜登⼤溃败TE20210904,Asia | Prostitution in Indonesia: Perverse outcomes 印度尼西亚卖淫问题:反常的结果TE20210911,Leaders | Why nations that fail women fail 为什么辜负⼥性的国家会失败?TE20211016,Leaders | The energy shock 能源冲击TE20211023,Leaders | Instant economics 即时经济2、其它外刊中英双语对照精读笔记内部揭秘:《经济学⼈》图表原来是⽤这些⼯具制作的出乎意料,权威杂志《⾃然》报道祝融号⽕星探测器的最新情况太阳报世界独家爆料:以权谋私、出轨⼥助理!英国卫⽣⼤⾂汉考克与⼥下属办公室热吻摸臀《柳叶⼑》最新研究论⽂:新冠病毒让⼈变笨!The Year Flu Disappeared 流感消失的那⼀年美国亏⽋那些冒着⽣命危险帮助过他们的阿富汗⼈解密美国情报局对情报质量是如何定义的?俄罗斯总理不为⼈知的⼀⾯,竟然出了⼀道初中数学题。

考研英语《经济学⼈》翻译实践+词汇积累(6)This picture of dedication and loneliness stands in sharp contrast to the popular image. Mr Zhang says he is as disgusted as the general public is with official corruption. He notes that, like many civil servants, he works in a job without the kind of power that could be abused. The leaders in his office work longer hours than he does and still ride bicycles to work.虽尽⼼尽⼒,但总感到孤独,与⼤众对公务员的印象形成鲜明对⽐。

Zhang Minfu说,与普通⼤众⼀样,⾃⼰也痛恨贪腐。

他特别提醒,如同众多公务员那般,⾃⼰没有可滥⽤的职权。

其办公室的领导⼯作时间⽐他还长,现在仍是蹬车上班。

译后习得Dedication解释:V-T If you say that someone has dedicated themselves to something, you approve of the fact that they have decided to give a lot of time and effort to it because they think that it is important.投⾝举例:For the next few years, she dedicated herself to her work.随后的⼏年⾥,她全⾝⼼地投⼊⼯作。

解释:ADJ投⾝于…的举例:He's quite dedicated to his students.他奉献很多给他的学⽣们。

Digest Of The. Economist. 2006(2-3)Moving marketsShifts in trading patterns are making technology ever more importantAN INVESTOR presses a button, sending 1,000 small “buy” orders to a stock exchange. The exchange's computer system instantly kicks in, but a split second later, 99% of the orders are cancelled. Having found the best price, the investor makes his trade discreetly, leaving no visible trace on the market—all in less time than it takes to blink. His stealth strategy remains intact.Events like this happen many times a day, as floods of orders from active hedge funds and “algorithmic” traders—who use automated programs to buy and sell—rush through the information-technology systems of the world's exchanges. The average transaction size on leading stock exchanges has fallen from about 2,000 shares in the mid-1990s to fewer than 400 today, although total trading volume has soared. But exchanges' systems have to cope with more than just a growing onslaught of “buy” and “sell” messages. Customers want to trade in more complicated ways, combining different types of assets on different exchanges at once. Then, as always, there is regulation. All this is pushing technology further to the fore.Recent embarrassments at the Tokyo Stock Exchange have illustrated what can happen when systems fail to keep up with the times. In just the past few months, the importance of technology has been plain in mergers (those of the New York Stock Exchange and Archipelago, and NASDAQ and INET); collaborations (the decision by the New York Board of Trade to use the Chicago Board of Trade's trading platform); and the creation of off-exchange trading networks (including one unveiled recently by Citigroup).Technology is hardly a new element in financial markets: the advent of electronic trading in the 1980s (first in Europe, later in America) helped to globalise financial markets and drove up trading volumes. But having slowed after the dotcom bubble it is now demanding ever more of exchanges' and intermediaries' attention. Investors can now deal more easily with exchanges or each other, bypassing traditional routes. As customers' demands and bargaining power have increased, so the exchanges have had to ramp up their own systems. “Technology created the monster that has to be ad dressed by more technology,” says Leslie Sutphen of Calyon Financial, a big futures broker.Aite Group, a research firm, reckons that in America alone the securities and investment industry spent $26.4 billion last year on IT (see chart), and may spend $30 billion in 2008. Sell-side firms spend most: J.P. Morgan Chase and Morgan Stanley each splashed out more than $2 billion in 2004, while asset-management firms such as State Street Global Advisors, Barclays Global Investors and Fidelity Investments spent between $250m and $350m apiece. With brokerage fees for trades whittled down, many have concluded that better technology is one way to cut trading costs and keep customers.Testing all enginesGlobal growth is looking less lopsided than for many yearsLARR Y SUMMERS, a Treasury secretary under Bill Clinton, once said that “the world economy is flying on one engine” to describe its excessive reliance on American demand. Now growth seems to be becoming more even at last: Europe and Japan are revving up, as are most emerging economies. As a result, if (or when) the American engine stalls, the global aeroplane will not necessarily crash.For the time being, America's monetary policymakers think that their economy is still running pretty well. This week, as Alan Greenspan handed over the chairmanship of the Federal Reserve to Ben Bernanke, the Fed marked the end of Mr Greenspan's18-year reign by raising interest rates for the 14th consecutive meeting, to 4.5%. The central bankers also gave Mr Bernanke more flexibi lity by softening their policy statement: they said that further tightening “may be needed”rather than “is likely to be needed”, as before.Most analysts expect the Fed to raise rates once or twice more, although the economy slowed sharply in late 2005. Real GDP growth fell to an annual rate of only 1.1% in the fourth quarter, the lowest for three years. Economists were quick to ascribe this disappointing number to special factors, such as Hurricane Katrina and a steep fall in car sales—the consequence of generous incentives that had encouraged buyers to bring purchases forward to the third quarter. The consensus has it that growth will bounce back to an annual rate of over 4% in the first quarter and stay strong thereafter.This sounds too optimistic. A rebound is indeed likely in this quarter, but the rest of the year could prove disappointing, as a weakening housing market starts to weigh on consumer spending. In December sales of existing homes fell markedly and the stock of unsold homes surged. Economists at Goldman Sachs calculate that, after adjusting for seasonal patterns, the median home price has fallen by almost 4% since October. Experience from Britain and Australia shows that even a soft landing for house prices can cause an acute slowdown in consumer spending.American consumers have been the main engine not just of their own economy but of the whole world's. If that engine fails, will the global economy nose-dive? A few years ago, the answer would probably have been yes. But the global economy may now be less vulnerable. At the World Economic Forum in Davos last week, Jim O'Neill, the chief economist at Goldman Sachs, argued convincingly that a slowdown in America need not lead to a significant global loss of power.Start with Japan, where industrial output jumped by an annual rate of 11% in the fourth quarter. Goldman Sachs has raised its GDP growth forecast for that quarter (the official number is due on February 17th) to an annualized 4.2%. That would pushyear-on-year growth to 3.9%, well ahead of America's 3.1%. The bank predicts average GDP growth in Japan this year of 2.7%. It thinks strong demand within Asia will partly offset an American slowdown.Japan's labour market is also strengthening. In December the ratio of vacancies to job applicants rose to its highest since 1992 (see chart 1). It is easier to find a job now than at any time since the bubble burst in the early 1990s. Stronger hiring by firms is also pushing up wages after years of decline. Workers are enjoying the biggest rise in bonuses for over a d ecade.Pass the parcelOnline shoppers give parcels firms a new lease of lifeTHINGS must be going well in the parcels business. At $2.5m for a 30-second TV commercial during last weekend's Super Bowl, an ad from FedEx was the one many Americans found the most entertaining. It showed a caveman trying to use a pterodactyl for an express delivery, only to watch it be gobbled up on take-off by a tyrannosaur. What did the world do before FedEx, the ad inquired? It might have asked what on earth FedEx did before the arrival of online retailers, which would themselves be sunk without today's fast and efficient delivery firms.Consumers and companies continue to flock in droves to the internet to buy and sell things. FedEx reported its busiest period ever last December, when it handled almost 9m packages in a single day. Online retailers also set new records in America. Excluding travel, some $82 billion was spent last year buying things over the internet, 24% more than in 2004, according to comScore Networks, which tracks consumer behaviour. Online sales of clothing, computer software, toys, and home and garden products were all up by more than 30%. And most of this stuff was either posted or delivered by parcel companies.The boom is global, especially now that more companies are outsourcing production. It is becoming increasingly common for products to be delivered direct from factory to consumer. In one evening just before Christmas, a record 225,000 international express packages were handled by UPS at a giant new air-cargo hub, opened by the American logistics firm at Cologne airport in Germany. “The internet has had a profound effect on our business,” says David Abney, UPS's international president. UPS now handles more than 14m packages worldwide every day.It is striking that postal firms—once seen as obsolete because of the emergence of the internet—are now finding salvation from it. People are paying more bills online and sending more e-mails instead of letters, but most post offices are making up for that thanks to e-commerce. After four years of profits, the United States Postal Service has cleared its $11 billion of debt.Firms such as Amazon and eBay have even helped make Britain's Royal Mail profitable. It needs to be: on January 1st, the Royal Mail lost its 350-year-old monopoly on carrying letters. It will face growing competition from rivals, such as Germany's Deutsche Post, which has expanded vigorously after partial privatisation and now owns DHL, another big international delivery company.Both post offices and express-delivery firms have developed a range of services to help ecommerce and eBay's traders—who listed a colossal 1.9 billion items for sale last year. Among the most popular services are tracking numbers, which allow people to follow the progress of their deliveries on the internet.A question of standardsMore suggestions of bad behaviour by tobacco companies. MaybeANOTHER round has just been fought in the battle between tobacco companies and those who regard them as spawn of the devil. In a paper just published in the Lancet, with the provocative title “Secret science: tobacco industry research on smoking behaviour and cigarette toxicity”, David Hammond, of Waterloo University in Canada and Neil Collishaw and Cynthia Callard, two members of Physicians for a Smoke-Free Canada, a lobby group, criticise the behaviour of British American Tobacco (BAT). They say the firm considered manipulating some of its products in order to make them low-tar in the eyes of officialdom while they actually delivered high tar and nicotine levels to smokers.It was and is no secret, as BAT points out, that people smoke low-tar cigarettes differently from high-tar ones. The reason is that they want a decent dose of the nicotine which tobacco smoke contains. They therefore pull a larger volume of air through the cigarette when they draw on a low-tar rather than a high-tar variety. The extra volume makes up for the lower concentration of the drug.But a burning cigarette is a complex thing, and that extra volume has some unexpected consequences. In particular, a bigger draw is generally a faster draw. That pulls a higher proportion of the air inhaled through the burning tobacco, rather than through the paper sides of the cigarette. This, in turn, means more smoke per unit volume, and thus more tar and nicotine. The nature of the nicotine may change, too, with more of it being in a form that is easy for the body to absorb.According to Dr Hammond and his colleagues, a series of studies conducted by BAT's researchers between 1972 and 1994 quantified much of this. The standardised way of analysing cigarette smoke, as laid down by the International Organisation for Standardisation (ISO), which regulates everything from computer code to greenhouse gases, uses a machine to make 35-millilitre puffs, drawn for two seconds once a minute. The firm's researchers, by contrast, found that real smokers draw 50-70ml per puff, and do so twice a minute. Dr Hammonds's conclusion is drawn from the huge body of documents disgorged by the tobacco industry as part of various legal settlements that have taken place in the past few years, mainly as a result of disputes with the authorities in the United States.Dr Hammond suggests, however, the firm went beyond merely investigating how people smoked. A series of internal documents from the late 1970s and early 1980s shows that BAT at least thought about applying this knowledge to cigarette design.A research report from 1979 puts it thus: “There are three major design featur es which can be used either individually or in combination to manipulate delivery levels; filtration, paper permeability, and filter-tip ventilation.” A conference paper from 1983 says, “The challenge would be to reduce the mainstream nicotine determined by standard smoking-machine measurement while increasing the amount that would actually be absorbed by the smoker”. Another conference paper, from 1984, says: “We should strive to achieve this effect without appearing to have a cigarette that cheats the league table. Ideally it should appear to be no different from a normal cigarette...It should also be capable of delivering up to 100% more than its machine delivery.”Thanks to the banksCollege students learn more about market ratesA GOOD education may be priceless, but in America it is far from cheap—and it is not getting any cheaper. On February 1st Congress narrowly passed the Deficit Reduction Act, which aims to slim America's bulging budget deficit by, among other things, lopping $12.7 billion off the federal student-loan programme. Interest rates on student loans will rise while subsidies fall.Family incomes, grant aid and federal loans have all failed to keep pace with the growth in the cost of tuition. “The funding gap between what students can afford and what higher education costs has got wider and wider,” says Claire Mezzanotte of Fitch, a ratings agency. Lenders are rushing to bridge the gap with “private” student loans—loans that are free of government subsidies and guarantees.Virtually non-existent ten years ago, private student loans in the 2004-05 school year amounted to $13.8 billion—a compound annual growth rate of almost 30%—and they are expected to double in the next three years. According to the College Board, an association of schools and colleges, private student loans now make up nearly 22% of the volume of federal student loans, up from a mere 5% in 1994-95.The growth shows little sign of slowing. Education costs continue to climb while pressure on Congress to pare down the budget deficit means federal aid will, at best, stay at current levels. Meanwhile, the number of students attending colleges and tradeschools is expected to soar as the children of post-war baby-boomers continue matriculating.Private student loans are popular with lenders because they are profitable. Lenders charge market rates for the loans (the rates on federal student loans are capped) before adding up-front fees, which can themselves be around 6-7% of the loan. Sallie Mae, a student-loan company and by far the biggest dispenser of private student loans, disclosed in its most recent report that the average spread on its private student lending was 4.75%, more than three times the 1.31% it made on its federally backed loans.All of this is good news when lenders are hungry for new areas of growth in the face of a cooling mortgage market. Private student loans, says Matthew Snowling of Friedman, Billings, Ramsey, an investment bank, are probably “the fastest-growing segment of consumer finance—and by far the most profitable one—at a time when finding asset growth is challenging.” Last December J.P. Morgan, which already had a sizeable education-finance unit, snapped up Collegiate Funding Services, a Virginia-based provider of federal and private student loans. Companies from Bank of America to GMAC, the financing arm of General Motors, have jumped in. Other consumer-finance companies, such as Capital One, are whispered to be eyeing the market.In the beginning...How life on Earth got going is still mysterious, but not for want of ideasNEVER make forecasts, especially about the future. Samuel Goldwyn's wise advice is well illustrated by a pair of scientific papers published in 1953. Both were thought by their authors to be milestones on the path to the secret of life, but only one has so far amounted to much, and it was not the one that caught the public imagination at the time.James Watson and Francis Crick, who wrote “A structure for deoxyribose nucleic acid”, have become as famous as rock stars for asking how life works and thereby starting a line of inquiry that led to the Human Genome Project. Stanley Miller, by contrast, though lauded by his peers, languishes in obscurity as far as the wider world is concerned. Yet when it appeared, “Production of amino acids under possible primitive Earth conditions” was expected to begin a scientific process that would solve a problem in some ways more profound than how life works at the moment—namely how it got going in the first place on the surface of a sterile rock 150m km from a small, unregarded yellow star.Dr Miller was the first to address this question experimentally. Inspired by one of Charles Darwin's ideas, that the ingredients of life might have formed by chemical reactions in a “warm, little pond”, he mixed the gases then thought to have formed the atmosphere of the primitive Earth— methane, ammonia and hydrogen—in a flask half-full of boiling water, and passed electric sparks, mimicking lightning, through them for several days to see what would happen. What happened, as the name of the paper suggests, was amino acids, the building blocks of proteins. The origin of life then seemed within grasp. But it has eluded researchers ever since. They are still looking, though, and this week several of them met at the Royal Society, in London, to review progress.The origin question is really three sub-questions. One is, where did the raw materials for life come from? That is what Dr Miller was asking. The second is, how did those raw materials spontaneously assemble themselves into the first object to which the term “alive” might reasonably be applied? The third is, how, having once come into existence, did it survive conditions in the early solar system?The first question was addressed by Patrick Thaddeus, of the Harvard-Smithsonian Centre for Astrophysics, and Max Bernstein, who works at the Ames laboratory, in California, part of America's space agency, NASA. As Dr Bernstein succinctly put it, the chemical raw materials for life, in the form of simple compounds that could then be assembled into more complex biomolecules, could come from above, below or beyond.Full to burstingRising levels of carbon dioxide will dump even more water into the oceansTHE lungs of the planet, namely green-leafed plants that breathe in carbon dioxide and breathe out oxygen, also put water vapour into the atmosphere. Just as people lose water through breathing (think of the misted mirror used to check for vital signs), so, too, do plants. The question is, what effect will rising concentrations of carbon dioxide have on this? The answer, published in this week's Nature by Nicola Gedney of Britain's Meteorological Office and her colleagues, would appear to be, less water in the atmosphere and more in the oceans.Measurements of the volume of water that rivers return to the oceans show that, around the world, rivers have become fuller over the past century. In theory, there are many reasons why this could be so, but some have already been discounted. Research has established, for example, that it is not, overall, raining—or snowing, hailing or sleeting—any more than it used to. But there are other possibilities. One concerns changes in land use, such as deforestation and urbanisation. The soil in rural areas soaks up the rain and trees breathe it back into the atmosphere, whereas the concrete in urban areas transfers rainwater into drains and hence into rivers. Another possibility is “solar dimming”, in which aerosol particles create a hazy atmosphere that holds less water. And then there is the direct effect of carbon dioxide on plant transpiration.Dr Gedney used a statistical technique called “optimal fingerprinting” or “detection and attribution” to identify which of these four factors matter. Her team carried out five simulations of river flow in the 20th century. In the first of these they allowed all four explanations to vary: rainfall, haze, atmospheric carbon dioxide and land use. They then held one of them constant in each of the next four simulations. By comparing the outcome of each of these with the first simulation, the team gained a sense of its part in the overall picture. So, for example, they inferred the role of land use by deducting the simulation in which it was fixed from the simulation in which it varied.As with any statistical analysis, the results are only as good as the model, the experimental design and the data. Dr Gedney and her colleagues acknowledge that their model does not fully take into account the use of water to irrigate crops—particularly important in Asia and Europe—nor the question of urban growth. They argue, however, that these aspects, taken together, would remove water from rivers, which makes their conclusion all the more striking. And it is this: fuller rivers cannot be explained by more rainfall or haze or changes in land use, but they can be explained by higher concentrations of atmospheric carbon dioxide.The mechanism is straightforward. A plant breathes through small holes, called stomata, found in its leaves. Plants take in carbon dioxide, and when the atmosphere is relatively rich in this gas, less effort is needed. The stomata stay closed for longer, and less water is lost to the atmosphere. This means that the plant doesn't need to draw as much moisture from the soil. The unused water flows into rivers.The great tech buy-out boomWill the enthusiasm of private-equity firms for investing in technology and telecoms end in tears, again?PRIME COMPUTERS, Rhythm NetConnections and XO Communications—all names to drain the blood from the face of a private-equity investor. Or so it was until recently, when investing in technology and telecoms suddenly became all the rage for private-equity companies. These investment firms—labelled “locusts” by unfriendly Europeans—generally make their money by buying big controlling stakes in companies, improving their efficiency, and then selling them on.In the late 1980s, Prime Computers became private equity's first great “tech wreck”, humiliating investors who thought they understood the technology business and could nurture the firm back to health away from the shorttermist pressures of the public stockmarket. After Prime failed, private-equity firms spent the best part of a decade focusing solely on the old economy. Only in the late 1990s, when the new economy was all the rage, did they pluck up the courage to return to tech and telecoms—a decision some of the grandest names in the industry were soon to regret. Hicks, Muse, Furst and Tate (Rhythm NetConnections) and Forstmann Little (XO) have both been shadows of their old selves since losing fortunes on telecoms.Now, investing in technology and telecoms is once again one of the hottest areas in the super-heated privateequity market. The multi-billion-dollar question is: will this round of investment end any less horribly than the previous two?Last month TDC, a Danish phone company, was finally acquired after a bid of $15.3 billion by a consortium including European giants Permira Advisors and Apax Partners, and American veterans Kohlberg Kravis Roberts (KKR), Blackstone Group and Providence Equity Partners. In the past five years, there has been private-equity involvement in about 40% of telecoms deals in Europe.On the other side of the Atlantic, the action has focused mainly on technology, rather than telecoms. Last summer, a consortium including Silver Lake Partners and KKR completed the biggest private-equity tech deal to date, buying SunGard Data Systems, a financial-technology firm, for $11.3 billion. Since then the deals have continued to flow. The $1.2 billion acquisition of Serena Software by Silver Lake is due to be completed by the end of March. Blackstone and others are said to be circling two IT outsourcing firms—Computer Sciences and ACS.There are reasons to hope that this time will be different. In telecoms, for instance, private-equity firms are mostly trying to buy established firms—often former national monopolists—that, while they might be threatened by internet telephony, have strong cash flow, physical assets and plenty of scope to improve the quality of management. These are the sorts of characteristicsprivate-equity investors thrive on. By contrast, the disastrous investments in the late 1990s were in new telecoms firms that were building their operations.In technology, private-equity interest has grown as the industry has matured, and cash-flow and profitability have become more predictable. Until recently, it has been the norm for tech firms to plough back all their profit and cashflow into investing in the business. They have carried no debt and paid no dividends. Now private-equity firms see the opportunity to pursue their classic strategy of buying firms by borrowing against cashflow, and then returning money to shareholders. Glenn Hutchins of Silver Lake thinks the tech sector is now in a similar condition to the old economy in America in the early 1980s, which is when private equity first started to have an impact, by restructuring and consolidating many industries.How to live for everThe latest from the wacky world of anti-senescence therapyDEATH is a fact of life—at least it has been so far. Humans grow old. From early adulthood, performance starts to wane. Muscles become progressively weaker, cognition fails. But the point at which age turns to ill health and, ultimately, death is shifting—that is, people are remaining healthier for longer. And that raises the question of how death might be postponed, and whether it might be postponed indefinitely.Humans are certainly living longer. An American child born in 1970 could expect to live 70.8 years. By 2000, that had increased to 77 years. Moreover, an adult still alive at the age of 75 in 2002 could expect a further 11.5 years of life.Much of this change has been the result of improved nutrition and better medicine. But to experience a healthy old age also involves maintaining physical and mental function. Age-related non-pathological changes in the brain, muscles, joints, immune system, lungs and heart must be minimised. These changes are called “senescence”.Research shows that exercise can help to maintain physical function late in life and that exercising one's brain can limit the progression of senescence. Other work—on the effects of caloric restriction, consuming red wine and altering genes in yeast, mice and nematodes—has shown promise in slowing senescence.The approach advocated by Aubrey de Grey of the University of Cambridge, in England, and presented at last week's meeting of the American Association for the Advancement of Science, is rather more radical. As an engineer, he favours intervening directly to repair the changes in the body that are caused by ageing. This is an approach he dubs “strategies for engineered negligible senescence”. In other words, if ageing humans can be patched up for 30 years, he argues, science will have developed sufficiently to make further repairs more effective, postponing death indefinitely.Dr de Grey's ideas, which are informed by literature surveys rather than experimental work, have been greeted with scorn by those working at developing such repair kits. Steven Austad, a gerontologist based at the University of Texas, warns that such therapies are many years away and may never arrive at all. There are also the side effects to consider. While mice kept onlow-calorie diets live longer than their fatter friends, the skinny mice are less fertile and are sometimes sterile. Humans wishing both to prolong their lives and to procreate might thus wish to wait until their child-bearing years were behind them before embarking on such a diet, although, by then, relatively more age-related damage will have accumulated.No one knows exactly why a low-calorie diet extends the life of mice, but some researchers think it is linked to the rate at which cells divide. There is a maximum number of times that a human cell can divide (roughly 50) before it dies. This is because the ends of chromosomes, structures called telomeres, shorten each time the cell divides. Eventually, there is not enough left for any further division.Cell biologists led by Judith Campisi at the Lawrence Berkeley National Laboratory in California doubt that every cell has this dividing limit, and believe that it could be only those cells that have stopped dividing that cause ageing. They are devising an experiment to create a mouse in which senescent cells—those that no longer divide—are prevented from accumulating. They plan to activate a gene in the mouse that will selectively eliminate senescent cells. Such a mouse could demonstrate whether it is。

1、绝对优势(Absolute advantage)如果一个国家用一单位资源生产的某种产品比另一个国家多,那么,这个国家在这种产品的生产上与另一国相比就具有绝对优势。

2、逆向选择(Adverse choice)在此状况下,保险公司发现它们的客户中有太大的一部分来自高风险群体。

3、选择成本(Alternative cost)如果以最好的另一种方式使用的某种资源,它所能生产的价值就是选择成本,也可以称之为机会成本。

4、需求的弧弹性(Arc elasticity of demand)如果P1和Q1分别是价格和需求量的初始值,P2 和Q2 为第二组值,那么,弧弹性就等于-(Q1-Q2)(P1+P2)/(P1-P2)(Q1+Q2)5、非对称的信息(Asymmetric information)在某些市场中,每个参与者拥有的信息并不相同。

例如,在旧车市场上,有关旧车质量的信息,卖者通常要比潜在的买者知道得多。

6、平均成本(Average cost)平均成本是总成本除以产量。

也称为平均总成本。

7、平均固定成本( Average fixed cost)平均固定成本是总固定成本除以产量。

8、平均产品(Average product)平均产品是总产量除以投入品的数量。

9、平均可变成本(Average variable cost)平均可变成本是总可变成本除以产量。

10、投资的β(Beta)β度量的是与投资相联的不可分散的风险。

对于一种股票而言,它表示所有现行股票的收益发生变化时,一种股票的收益会如何敏感地变化。

11、债券收益(Bond yield)债券收益是债券所获得的利率。

12、收支平衡图(Break-even chart)收支平衡图表示一种产品所出售的总数量改变时总收益和总成本是如何变化的。

收支平衡点是为避免损失而必须卖出的最小数量。

13、预算线(Budget line)预算线表示消费者所能购买的商品X和商品Y的数量的全部组合。

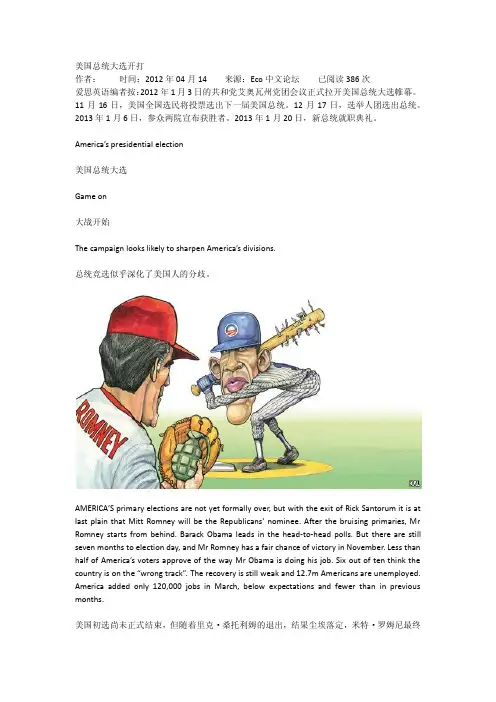

美国总统大选开打作者:时间:2012年04月14 来源:Eco中文论坛已阅读386次爱思英语编者按:2012年1月3日的共和党艾奥瓦州党团会议正式拉开美国总统大选帷幕。

11月16日,美国全国选民将投票选出下一届美国总统。

12月17日,选举人团选出总统。

2013年1月6日,参众两院宣布获胜者。

2013年1月20日,新总统就职典礼。

America’s presidential election美国总统大选Game on大战开始The campaign looks likely to sharpen America’s divisions.总统竞选似乎深化了美国人的分歧。

AMERICA’S primary elections are not yet formally over, but with the exit of Rick Santorum it is at last plain that Mitt Romney will be the Republicans’ nominee. After the bruising primaries, Mr Romney starts from behind. Barack Obama leads in the head-to-head polls. But there are still seven months to election day, and Mr Romney has a fair chance of victory in November. Less than half of America’s voters approve of the way Mr Obama is doing his job. Six out of ten think the country is on the “wrong track”. The recovery is still weak and 12.7m Americans are unemployed. America added only 120,000 jobs in March, below expectations and fewer than in previous months.美国初选尚未正式结束,但随着里克·桑托利姆的退出,结果尘埃落定,米特·罗姆尼最终将成为共和党的提名人。

economist(经济学人)精品文章中英对照(合集五篇)第一篇:economist(经济学人)精品文章中英对照Whopper to go 至尊汉堡,打包带走Will Burger King be gobbled up by private equity? 汉堡王是否会被私人股本吞并?Sep 2nd 2010 | NEW YORKSHARES in Burger King(BK)soared on September 1st on reports that the fast-food company was talking to several private-equity firms interested in buying it.How much beef was behind these stories was unclear.But lately the company famous for the slogan “Have It Your Way” has certainly not been having it its own way.There may be arguments about whether BK or McDonald’s serves the best fries, but there is no doubt which is more popular with stockmarket investors: the maker of the Big Mac has supersized its lead in the past two years.有报道披露,快餐企业汉堡王(BK)正在与数个有收购意向的私人股本接洽,9月1日,汉堡王的股值随之飙升。

这些报道究竟有多少真材实料不得而知。

汉堡王的著名口号是“我选我味”,但如今显然它身不由己,心中五味杂陈。

汉堡王和麦当劳哪家薯条最好吃,食客们一直争论不休,但股票投资人更喜欢哪家股票,却一目了然:过去两年里,巨无霸麦当劳一直在扩大自己的优势。

2012年考研英语一分析阅读今年的考研阅读理解部分,整体的文章难度较前两年继续偏易。

四篇文章选材继续是国外的经典报刊杂志,社会科学、人文科学、自然科学的文章统统涉猎其中。

文章不偏不难,但是选项设置依旧陷阱重重,相信各位同学背熟了大部分单词,经过培训和一段时间的练习,可以取得一个不错的成绩。

第一篇来自时代周刊(Times)2011年3月24日的文章Herd Mentality,即我们常说的从众心理。

文章以R的一本书作为引子,通过几次明显的态度转变,最终得出了对从众心理的质疑态度。

文后五道题目,前四题均为细节题,最后一题是态度题。

根据顺序原则,可以轻松将前四题答案的范围框定在一三四五段内。

这篇文章再次印证了考研阅读理解的出题思路仍旧以细节题的考察为主,考察辨别细微差别的能力。

细节题解题核心考察定位的能力,即查找与替换的能力。

根据题干中的已知信息回文找到解题区域是非常简单的,但是我相信大家会碰到一个问题,明明知道答案就在这个句子当中,但是就是看不懂或者看得模棱两可。

这几年的考题(除了2010年),考生都能看懂文章的大意,但是正是由于这样,导致很多同学容易望文生义,主观地选择心中的答案,或者模糊地选择了最像答案的答案,导致了错误的出现。

其实解决这类问题的关键就是返回原文,进行仔细地对应,选出同义替换的选项。

说到底,还是在准备考研的时候,考生还是要回归根本,其实这里就是大家所面临严峻的单词和句法的问题了。

第二篇文章涉及美国佛蒙特洋基核反应堆的一些事情,考了一题词义题,一题推理。

其余均为细节题,由于各个题干有明显的定位信息,答案区域依旧明显。

第三篇文章除了第二题的推理题和最后一题的主旨题,其他继续考察细节题。

其中第一题非常简单,考察的思路与08年第一篇文章的第三题有异曲同工之妙,再次告诫各位考生,历年真题的重现率和重要性。

第四篇文章出自《经济学人》,《经济学人》几乎是历年考研命题委员会必备的考题库。

本文讲的是美国公务员改革相关的问题。

TEXT 1Rebuilding the American dream machine重建美国梦机器Jan 19th 2006 | NEW YORKFrom The Economist print editionFOR America's colleges, January is a month ofreckoning. Most applications for the next academicyear beginning in the autumn have to be made by theend of December, so a university's popularity is put toan objective standard: how many people want toattend. One of the more unlikely offices to have beenflooded with mail is that of the City University ofNew Y ork (CUNY), a public college that lacks,among other things, a famous sports team, bucoliccampuses and raucous parties (it doesn't even havedorms), and, until recently, academic credibility.对美国的大学而言,一月是一个清算的月份。

大多数要进入将于秋季开学的下一学年学习的申请必须在12月底前完成,因此一所大学的声望就有了客观依据:申请人的多少。

纽约城市大学,一所公立学院,与其他学校相比,它没有一支声名显赫的运动队,没有田园诗一般的校园,也没有喧嚣嘈杂的派对——甚至连宿舍都没有,而且,直到最近也没取得学术上的可信度,可就是这所大学的办公室塞满了学生们寄来的申请函,这简直有些令人难以置信。

经济学人杂志双语阅读汇总

介绍

经济学人杂志(The Economist)是一份全球性的英语经济、政治、科技及文化类杂志,由英国经济学人报纸有限公司出版。

本文将对经济学人杂志的双语阅读栏目进行汇总,介绍其中的一些优秀文章和关键观点。

双语阅读栏目概述

经济学人杂志的双语阅读栏目是为了帮助英语学习者提高阅读能力而设立的。

该栏目为读者提供了一篇原文和相应的中文翻译,使得读者可以在阅读原文的同时,对照翻译理解文章内容。

这对于提高读者的英语阅读理解能力非常有帮助。

精选文章1.。

经济学家》读译参考(第12篇):并非科幻小说——《直觉》畅销书书评From The Economist print edition[size=4][b]Not science fictionTHE recent stem-cell scandal in South Korea may have made front-page news across the world, but(1)few readers are likely to bet that a literary novel set in a laboratory and based on scientific research might end up being a ★page-turner[1]. Readers of “Intuition”, however, will battle with themselves over whether to savour Allegra Goodman's exquisite★filleting[2] of character, as the scientists are themselves dissected like their experimental mice, or to rush ★headlong[3] to find out what h________① next.In an under-funded Harvard laboratory, the ★dogged[4], unglamorous★slog[5] towards finding a cure for cancer is u_______② way. Suddenly one research assistant's experiment ★bears [6]fruit. After mice infected with human breast-cancer cells are injected with Cliff's R-7 virus, their tumours melt away in 60% of the population. But are Cliff's results too good to be true? (2)The question of whether the R-7 results were★fiddled[7] powers the remainder of the book.Ms Goodman follows the good novelist's ★credo[8] that plot ★proceeds from[9] character; and (3)she follows the good scientist's credo that objective truth is inexorably ★coloured[10] by whoever ★stands[11] to lose or gain by it. All the researchers in “Intuition” are sympathetic, and they are all ★screwed up[12]. Sandy, co-director of the lab, is a ★charismatic[13] dynamo[14], but too enamoured with worldly glory. His brilliant, shy partner Marion has ★impeccable[15] research standards, but is undermined by chronic self-doubt. By contrast, Cliff is ★glibly[16] over-c_________③. Robin, R-7's ★whistle-blower[17] (also Cliff's former girlfriend), is a natural scientist, but her determination to uncover fraud may be driven by romantic disappointment. Robin is heeding her intuition, and “young researchers had their intuition ★tamped down[18] lest, like the ★sorcerer's[19] apprentice, they flood the lab with their conceits.”What a relief to find a novel that does not take place in the literary salons of London or New York. (4)Ms Goodman manages fully to inhabit another profession's world. Her characters so live and breathe on the page that they could get up and m_______④you a cup of coffee while you finish another chapter. (5)Her writing is rich, so rich it would be easy tomiss how skilful is the prose itself. Exciting and, for most, exotic as well, “Intuition” is a ★stunning[20] achieve ment.参考译文(TRANSLATED BY CHENJILONG)并非科幻小说韩国最近发生的干细胞丑闻或许已成为世界各地的头条新闻,不过几乎没有读者会相信,一本以实验室为背景、基于科学研究的小说到头来竟然让他们爱不释手。

来源于/wordpress/(The Economist《经济学人》中文版)和/(《The Economist》《经济学人》中文版)11月10, 2008[2008.11.08] 美国大选:无限期望America's election:Great expectationsNO ONE should doubt the magnitude of what Barack Obama achieved this week. When the president-elect was born, in 1961, many states, and not just in the South, had laws on their books that enforced segregation, banned mixed-race unions like that of his parents and restricted voting rights. This week America can claim more credibly that any other western country to have at last become politically colour-blind. Other milestones along the road to civil rights have been passed amid bitterness and bloodshed. This one was marked by joy, white as well as black (see article).相信无人质疑奥巴马于本周取胜的重要意义。

这位新总统出生于1961年,那时美国很多州的法律都要求强化种族分离、禁止像奥巴马父母那样的跨族通婚、限制选举权利;这些不仅限于南部地区,而出现在全国范围内。

Internet economies: Going local 互联网经济走向本土化THE internet is flattening the world. Or so they say. Yet new statistics from the OECD, a rich-country think-tank, and Boston Consulting Group (BCG) show that the global “network of networks” is shaped by local f orces.互联网正在让世界变平。

或者说他们是这么说。

然而,富国智库经合组织和波士顿咨询集团发布的新统计数据表明本土力量塑造了全球的“综合网络”。

The OECD’s statistics on broadband internet access in its member countries have long been closely watched (in particular the mediocre ranking of America, which still lags behind most of Europe in high-speed links). The organisation has now broken out numbers on wireless broadband subscriptions. And the national differences turn out to be even bigger (see chart).长期以来,经合组织关于其成员国宽带连接情况的统计数据一直备受关注(美国居中的排名尤其受到了关注,美国在高速连接方面仍然落后于大多数欧洲国家)。

目前经合组织统计出了无线宽带用户的数量。

结果表明国与国之间的差异更大了。

BCG, for its part, in a new study of 46 countries, looks at how businesses, consumers and governments use the net. The data show that different countries have distinct internet economies. Britain’s internet infrastruct ure rates poorly, mainly because of its slow broadband speeds, but it has the highest per-person online spending and its government agencies are very active. Hong Kong, by contrast, tops the world in connectivity, but its consumers prefer to spend their money offline.波士顿咨询公司对46个国家进行了新研究,关注了企业、消费者和政府的网络使用情况。

数据表明不同的国家具有不同的互联网经济。

英国的互联网基础设施排名比较靠后,主要是因为其宽带速度缓慢,但是英国每个人的网上消费是最高的,其政府机构也非常活跃。

相比之下,香港就其连接情况而言位居世界第一,但是香港的消费者不喜欢在网上消费。

The differences spring from a country’s political and economic heritage. South Korea, for instanc e, has more political ambition than Britain to lead in broadband. If the British like to shop online it is not least because they also like to use credit cards, the easiest means to pay online. In Hong Kong, with its dense retail infrastructure, there is not much need for consumers to shop virtually.一个国家的政治和经济状况导致了不同的情况。

比如,韩国在宽带建设方面比英国更加雄心勃勃。

如果英国人喜欢网上购物,这尤其是因为他们也喜欢使用网上支付最简便的方法——信用卡。

在香港,零售商店随处可见,实际上消费者并不怎么需要购物。

To compare countries, BCG has come up with an “e-intensity index”. South Korea, Denmark and Sweden come out on top, whereas India, Egypt and Indonesia wind up at the bottom. Some countries, including Britain and Japan, do much better than would be expected given their GDP per person; others—Saudi Arabia and Italy—do worse.为了比较各国的情况,波士顿咨询公司创造了“电子密度指数”。

韩国、丹麦和瑞典位居前列,而印度、埃及和印尼则是垫底。

要是将其人均国内生产总值考虑在内,英国和日本等一些国家的名次会比预期靠前得多,沙特和意大利等其他国家则会更加靠后。

Some of these differences will certainly go away, says Paul Zwillenberg of BCG. But overall, hepredicts, the internet will continue to become more and more local: cultures are different, so the more people go onli ne, the more the internet will resemble them. “There will be hundreds of internet flavours,” he says.波士顿咨询公司的保罗•兹韦伦勃格表示,其中的一些差异以后必定会消失。

但是他预测,总体而言,互联网将越来越本土化:文化不同,因此上网的人越多,互联网就会越像他们。

他说:“今后会出现数百种互联网。

”Back to black 返璞归真ONE common trend in many Western countries, regardless of the health of their recorded-music markets, is clear: vinyl is back. Sales of LPs were up in both Britain and Germany last year. In America vinyl sales are running 39% above last year’s level (see chart). In Spain sales have risen from 16,000 in 2005 to 104,000 in 2010. That is an increase from a tiny base, but any rise in media sales in Spain’s ravaged market is noteworthy.很多西方国家,无论其唱片市场是否健康发展,他们的一个共同趋势都很明显:唱片又开始盛行。

去年,黑胶唱片的销量在英国和德国纷纷上涨。

美国,唱片销量比去年上升了39%(见图表)。

西班牙,唱片销量从2005年的16000上升到2010年的104000,该增长的基数很低,但是西班牙市场曾严重受挫,因此任何媒体销量的增长都是值得注意的。

This is a second revival for vinyl. The first, in the late 1990s, was driven largely by dance music. Teenagers bought Technics turntables and dreamed of becoming disc jockeys in Ibiza. But being a DJ is difficult and involves lugging heavy crates. Many have now gone over to laptops and memory sticks.这是黑胶唱片的第二次复兴。

于上世纪90年代末期出现的第一次复兴,主要是由蹦迪音乐促发的。

伊比沙岛的青少年们购买工艺唱盘机,梦想在成为摇滚音乐演奏者(DJ)。

但是成为DJ是非常困难的,而且还需要携带很多沉重的板条箱。

很多人现在选择使用笔记本电脑和记忆棒。

These days the most fervent vinyl enthusiasts are mostly after rock music. Chris Muratore of Nielsen, a research firm, says a little over half the top-selling vinyl albums in America this year have been releases by indie bands such as Bon Iver and Fleet Foxes. Last year’s bestselling new vinyl album was “The Suburbs” by Arcade Fire. Most of the other records sold are reissues of classic albums. Those idiosyncratic baby-boomers who were persuaded to trade in their LPs for CDs 20 years ago are now being told to buy records once again.目前,最热情的唱片狂热者基本上是摇滚乐的追随者。