金融专业英语复习1

- 格式:doc

- 大小:182.58 KB

- 文档页数:9

TEST BANKThis part of the Instructor's Manual presents a test bank of true/false statements, multiple choice questions, and, where appropriate, additional problems. The problems are similarto those in the text and may be used for additional assignments or test questions.Chapter 1THE ROLE OF FINANCIAL MARKETSTRUE/FALSEF 1. The power to create money is given by the Constitution to the Federal Reserve.F 2. Since M-2 excludes time deposits, M-2 is a less comprehensive measure of the money supply than M-1.T 3. When individuals withdraw cash from checking accounts, the money supply is unaffected.F 4. The yield curve relates risk and interest rates.T 5. During most historical periods, the yield curve has been positively sloped.T 6. A negatively sloped yield curve is associated with the anticipation that interest rates will decline.F 7. Only paper can perform the function of money.T 8. Stocks and bonds are an alternative to money as astore of value.T 9. What serves for money in France may not be money in another country.F 10. The U.S. Treasury creates most of the nation's money supply.F 11. When individuals deposit cash in a demand deposit, the money supply is reduced.F 12. M-1 includes savings accounts in commercial banks.T 13. A positively-sloped yield curve forecasts the interest rates will rise.F 14. Since investors prefer short-term securities tolonger-term securities, the yield curve is always positively sloped.MULTIPLE CHOICEa 1. M-1 includes coins, currency, and .a. demand depositsb. savings accountsc. certificates of depositd. time depositsb 2. The power to create money is given by the Constitution toa. state governmentsb. Congressc. the Federal Reserved. commercial banksc 3. The term structure of interest rates relatesa. risk and yieldsb. yields and bond ratingsc. term and yieldsd. stock and bond yieldsb 4. The term structure of interest rates indicates thea. relationship between risk and yieldsb. relationship between the time and yieldsc. the difference between borrowing and lendingd. the difference between the yield (interest rate)on government and corporate debtc 5. Money serves asa. a substitute for equityb. a precaution against inflationc. a medium of exchanged. a risk-free liabilityc 6. An asset is liquid if it is easilya. converted into cashb. marketedc. converted into cash without lossd. soldd 7. M-2 includes1. demand deposits2. savings accounts3. small certificates of deposita. 1 and 2b. 2 and 3c. 1 and 3d. all three。

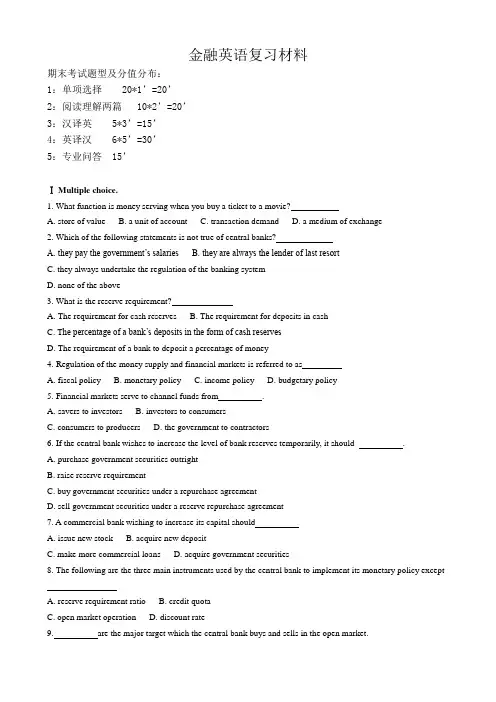

金融英语复习材料期末考试题型及分值分布:1:单项选择 20*1’=20’2:阅读理解两篇 10*2’=20’3:汉译英 5*3’=15’4:英译汉 6*5’=30’5:专业问答 15’Ⅰ Multiple choice.1. What function is money serving when you buy a ticket to a movie?A. store of valueB. a unit of accountC. transaction demandD. a medium of exchange2. Which of the following statements is not true of central banks?A. they pay the government’s salariesB. they are always the lender of last resortC. they always undertake the regulation of the banking systemD. none of the above3. What is the reserve requirement?A. The requirement for cash reservesB. The requirement for deposits in cashC. T he percentage of a bank’s deposits in the form of cash reservesD. The requirement of a bank to deposit a percentage of money4. Regulation of the money supply and financial markets is referred to asA. fiscal policyB. monetary policyC. income policyD. budgetary policy5. Financial markets serve to channel funds from .A. savers to investorsB. investors to consumersC. consumers to producersD. the government to contractors6. If the central bank wishes to increase the level of bank reserves temporarily, it should .A. purchase government securities outrightB. raise reserve requirementC. buy government securities under a repurchase agreementD. sell government securities under a reserve repurchase agreement7. A commercial bank wishing to increase its capital shouldA. issue new stockB. acquire new depositC. make more commercial loansD. acquire government securities8. The following are the three main instruments used by the central bank to implement its monetary policy exceptA. reserve requirement ratioB. credit quotaC. open market operationD. discount rate9. are the major target which the central bank buys and sells in the open market.A. financial institution bondsB. corporate bondsC. stocksD. government securities10. Financial intermediaries are institutionsA. that borrow funds from investors in productive facilitiesB. that act as middlemen in transferring funds from ultimate lenders to ultimate borrowersC. that lend funds to small saversD. all of the above11. Financial markets can be classified asA. debt and equity marketsB. primary and secondary marketC. money and capital marketsD. all of the above12. Commercial banks participate in the money market asA. lenders onlyB. borrowers onlyC. both lender and borrowersD. trustees only13. The major expense of commercial bank isA. wages and salariesB. dividend payments to stockholdersC. interest on depositsD. taxes14. Stocks are also referred to asA. securitiesB. equitiesC. sharesD. all of above15. Which of the following is not a type of bond?A. corporateB. treasuryC. EurodollarD. municipal16. Which of the following is a debt instrument found in the capital market?A.U.S. treasury billB. commercial paperC. residential mortgageD. demand deposit17. The foreign exchange market is organized asA. a physical marketB. a capital marketC. a speculative marketD. over-the-counter market18. Exchange control require the governmentA. to ensure that the foreign-exchange market is perfectly competitiveB. to stop buying foreign exchangeC. to sell more foreign exchange than it buysD. to balance inflows and outflows of foreign exchange at the current exchange rate19. The forward rate is calculated by adjusting the spot rate by aA. premiumB. discountC. marginD. difference20. When the U.S. real interest rate is low, owning U.S. assets is and so U.S. net foreign investment isA. more attractive…highB. more attractive…lowC. less attractive…highD. less attractive…low21.The main liability on a bank balance sheet is ______.A. depositsB. capital and reservesC. loans and overdraftsD. cash22. Why must the liabilities and assets of a bank be actively managed? ______.A. Because assets and liabilities are not evenly matched on the same time scaleB. Because assets and liabilities are evenly matchedC. Because the interbank market uses LIBORD. Because assets and liabilities can be underwritten23. Financial intermediaries by "borrowing short and lending long" find themselves in difficult financial situations becauseA. short-term rates are fallingB. long-term rates are risingC. deposits increase too rapidlyD. short-term rates rise relative to rates of their holdingsE. long-term rates rise more sharply than short-term rates24. Banks manage their assets considering ______.A. riskB. some optimum combination of the aboveC. earningsD. liquidity25. Indirect finance is also known as .A. financial intermediationB. intangible financeC. disintermediationD. the futures market26. Which of the following financial institutions have the most assets?A. life insurance companyB. private pension fundsC. commercial banksD. credit unions27. By purchasing government securities commercial banks are .A. borrowing from the governmentB. acquiring earning assetsC. making a “loan” to the governmentD. both B and C28. Which of the following financial intermediaries operate in primary securities markets?A. brokersB. dealersC. commercial banksD. investment banks29.Which of the following would be considered a disadvantage of allocating resources using a market system?A. Income will tend to be unevenly distributed.B. Significant unemployment may occur.C. The wastage of scarce economic resources cannot be prevented.D. A misallocation of resources may occur where there is a discrepancy between private and social costs.30. Which of the following is not a factor of production according to economists?A. LandB. LaborC. EntrepreneurshipD. Trademark31. Which of the following is not a function of money?A. To act as a medium of exchangeB. To act as a unit of accountC. To act as a store of valueD. To act as a means of paymentE. To provide a double coincidence of want.32. Legal tender includes .A. coins onlyB. notes onlyC. notes and coinsD. notes, coins and checks33. Commercial bank deposits with the central bank are part of the bank’sA. net worthB. demand depositsC. loan portfolioD. reserves34. The key factor limiting how much a commercial bank has immediately available to lend is the amount of itsA. demand depositsB. excess reservesC. vault cashD. savings deposits35. Which of the following central bank action would be appropriate to combat rapid inflation?A. A reduction in the discount rateB. A reduction in reserve requirementC. A cut in taxD. A sale of government securities36. A commercial bank wishing to increase its capital shouldA. issue new stockB. acquire new depositsC. make more commercial loansD. acquire government securities37. The price in the foreign market is calledA. the trade surplusB. the money priceC. the exchange rateD. the currency rate37. Monetary policy and policy are the two basic tools used by the government to influence the course of economic activity.A. accountingB. fiscalC. financialD.trade38. if the nominal rate of interest is 10 percent and the expected rate of inflation is 7 percent, the real rate of interest is .A.27 percentB. minus 3 percentC. plus 3 percentD. minus 27 plus39. A money market instrument usually used for import/export payment is known as .A. repurchase agreementB. EurodollarC. Certificate of depositD. Banker’s acceptance40. Bonds that can be changed to shares of common stock are said to be .A. callableB. general obligationC. convertibleD. zero-coupon41. Preferred stockholders receive .A. coupon paymentsB. fixed dividend paymentsC. variable dividend paymentsD. payment in the form of additional stock42. Bank manage their assets considering .A. riskB. liquidityC. earningsD. some optimum combination of the above43. Which of the following would be considered a loan secured by real estate?A. A credit card loanB. Subordinated debtC. Bank capitalD. A mortgage44. will be either the sole or the main source of a project loan repayment.A. capital fundsB. investment gainsC. the cash flow arising from the projectsD. all of the above45. In a syndicated loan, handles the negotiations with the borrower, prepares the relevant documentation and disburses the full amount of the loan to the borrower.A. the lead bankB. the accounting bankC. the participating bankD. the agent bank46. Repayment of a borrowing for working capital purposes usually comes from .A. profitsB. sale of fixed assetsC. cash flowD. capital introduced47. A loan agreement is normally prepared by and reviewed by .A. the lending bank’s legal counsel…the borrower’s attorneyB. the borrower’s attorney …the lending bank’s legal counselC. a third party other than the lending bank and the borrower… the lending bank’s legal counselD. none of the above48. For the most bank, are the largest and most obvious source of credit risk.A. guaranteesB. interbank transactionsC. loansD. equities49. A customer has deposited a gold watch with the bank for safe-keeping. This is an example ofA. lienB. pledgeC. bailmentD. mortgage50. A pledge provides a bank with .A. possession of the goodsB. rights over items held in safe custodyC. legal ownership of the goodsD. the ability to transfer interests in certain assets51. Which of the following is true of a mortgage?A. the mortgage retains possession of the mortgaged propertyB. the mortgagor retains possession of the mortgaged propertyC. the lender acquires the right to retain the mortgaged property until the mortgaged debt is repaidD. none of the above汉译英练习题:1.我们银行经办定期存款、活期存款和定活两便存款。

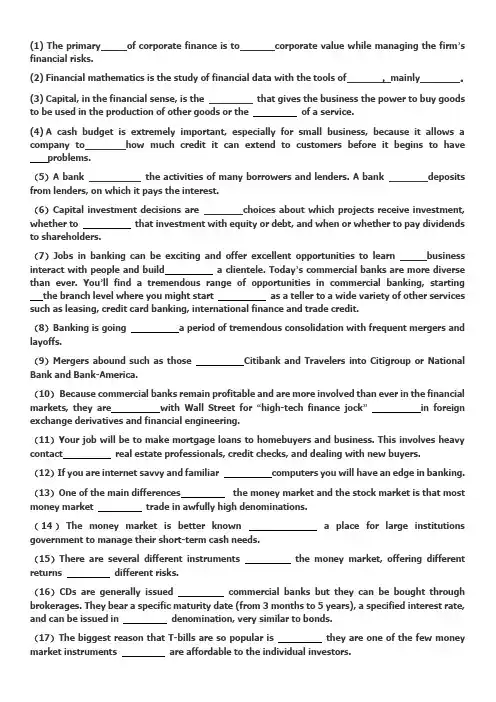

(1) The primary of corporate finance is to corporate value while managing the firm’s financial risks.(2)Financial mathematics is the study of financial data with the tools of ,mainly 。

(3)Capital, in the financial sense, is the that gives the business the power to buy goods to be used in the production of other goods or the of a service.(4)A cash budget is extremely important, especially for small business, because it allows a company to how much credit it can extend to customers before it begins to have problems.(5)A bank the activities of many borrowers and lenders. A bank deposits from lenders, on which it pays the interest.(6)Capital investment decisions are choices about which projects receive investment, whether to that investment with equity or debt, and when or whether to pay dividends to shareholders.(7)Jobs in banking can be exciting and offer excellent opportunities to learn business interact with people and build a clientele. Today’s commercial banks are more diverse than ever. You’ll find a tremendous range of opportunities in commercial banking, starting the branch level where you might start as a teller to a wide variety of other services such as leasing, credit card banking, international finance and trade credit.(8)Banking is going a period of tremendous consolidation with frequent mergers and layoffs.(9)Mergers abound such as those Citibank and Travelers into Citigroup or National Bank and Bank-America.(10)Because commercial banks remain profitable and are more involved than ever in the financial markets, they are with Wall Street for “high-tech finance jock”in foreign exchange derivatives and financial engineering.(11)Your job will be to make mortgage loans to homebuyers and business. This involves heavy contact real estate professionals, credit checks, and dealing with new buyers.(12)If you are internet savvy and familiar computers you will have an edge in banking.(13)One of the main differences the money market and the stock market is that most money market trade in awfully high denominations.(14)The money market is better known a place for large institutions government to manage their short-term cash needs.(15)There are several different instruments the money market, offering different returns different risks.(16)CDs are generally issued commercial banks but they can be bought through brokerages. They bear a specific maturity date (from 3 months to 5 years), a specified interest rate, and can be issued in denomination, very similar to bonds.(17)The biggest reason that T-bills are so popular is they are one of the few money market instruments are affordable to the individual investors.(18)A bankers’ acceptance is a short-term credit investment created a non-financial firm and guaranteed by a bank to make payment. Acceptances are traded discounts from face value in the secondary market.(19)A commercial bank offers a wide range of savings programs for customers. Along with standard savings accounts, the commercial bank may also interest bearing checking accounts, certificates of deposit, and other savings strategies that are to provide a small but consistent return in exchange for doing business with the bank.(20)Sometimes people might use an interest checking account instead of a savings account. If you really plan not to your money for a few months, it makes sense to use a savings account .(21)A fixed rate mortgage is a mortgage in which the does not change during the term of the loan.(22)A typical checking account is through careful posting of deposits and withdrawals. The account holder has a supply of official checks which all of the essential routing and mailing information.(23)In recent years there have been some unfortunate scams involving bank drafts that are pony. Since printers are now so capable of very realistic appearing checks, people have been into taking bank drafts that don’t truly have any value.(24)Credit card use often problematic when the holder more debt than a regular monthly payment can cover.(25)Trough open market operations, a central bank influences the money in an economy directly. Each time it buys securities, exchanging money for the security, it the money supply. Conversely, selling of securities lowers the money supply.(26)Central bank generally money by currency notes and “selling” them to the public for interest-bearing assets, such as government bonds.(27)Typically a central bank certain types of short-term interest rates. These the stock and bond market as well as mortgage and other interest rates.(28)All banks are required to a certain percentage of their assets as capital, a rate which may be by the central bank or the banking supervisor.(29)The mechanism to move the market towards a “target rate” is generally to money or borrow money in theoretically unlimited quantities, until the targeted market is sufficiently to the target.(30)Most countries control bank mergers and are wary of concentration in this industry the danger of groupthink and runaway lending bubbles a single point of failure, the credit culture of the few large banks.(31)The currency trader should also decide the time that he will be using to trade in order to determine which trend will be the most important.(32)The bid is the price at which dealers are willing to dollars (base currency) in terms of yen (quote currency) and users of our trading platform can dollars in terms of yen.(33)The order remains active until the end of the trading day(5:00 PM EST), unless it isor canceled by the trader.(34)A GTC order remains active until it is canceled by the currency trader or until the order is executed. It is the responsibilities to a GTC order.(35)The Foreign Exchange Market is where the majority of buying and selling of world takes place.(36)When placing a limit order, the trader also specifies the for which the order is to remain active while it is not executed.(37)Interest Rate Risk is the number one source of risk to fixed-income investors, because it’s the cause of price volatility in the bond market.(38)In the of bonds, interest rate risk translates market risk: The behavior of interest rate, in general, affects all bonds and cuts all sectors of the market-even the U.S Treasury market.(39)When market interest rates rise, bond prices fall, and vice versa. And as interest rates become more volatile, do bond prices.(40)This is a type of bond that makes no coupon payments but is issued at a considerable discount to par value. For example, let’s say a zero-coupon bond with a $1000 par value and 10 years to maturity is at $600; you’d be paying $600 for a bond that will be worth $1000 in 10 years.(41)Bonds have a of characteristics of which you need to be aware. All of these factors play a role in determining the value of a bond and the extent to it fits in your portfolio.(42)In general, fixed-income securities are classified the length of time before maturity. These are the three main categories.(1)金融管理是商业管理的重要方面之一,没有合适的金融计划,企业是不可能成功的。

名词解释:Credit refers to a behavior of borrowing and lending with the feature of repayment of the principals plus interests . Financial markets refer to the whole of the places and activities of the financing and transactions of financial instruments. Sale on commission(推销): It refers to the case in which investment bankers sell securities on behalf of issuers and earn from what they have sold, but have no obligation to take up what’s left as medium of Money demand refers to the quantity of money that the whole economy needs exchange, means of payment and store of value under certain economic condition. Inflation is a continuous and obvious rise of the price level caused by great increase of money supply and it reduces the purchasing power of each unit of a currency. 二1 General equivalent 一般等价物2 Public credit 国家信用3 Default risk 违约风险4 Repurchase agreement(RP)回购协议5 Interest-rate future 利率期货6 Re-discount 再贴现7 Compound interest 复利8 Liquidity preference 流动偏好即货币需求9 Speculative motive 投机动机10 Adverse selection 逆向选择11 Require reserves 存款准备金12 Overdraft 透支13 Time lag 时滞14 velocity of money 货币流通速度15 money stock 货币存量16 derivative deposit 派生存款17 excess reserve 超额储备18 Money multiplier 货币乘数19 Endogenous 内生性判断题T F 1. When a central bank carries out expansionary monetary policy, bank reserves R will increase. T F 2. The monetary base consists of banking system reserves and the currency held by the non-bank public T F 3. The moral hazard arises before a financial transaction begins. T F 4. As is subject to time limit, the commercial credit can only be short-term one. T F 5. Sale on commission refers to the case in which investment bankers sell securities on behalf of issuers and earn from what they have sold, but have no obligation to take up what’s what’s left. left. T F 6. 6. If If If a a a central central central bank bank bank wants wants wants to to to cool cool cool an an an inflationary inflationary inflationary boom, boom, boom, it it it will will will raise raise raise the the the discount discount discount rate, rate, which which will will will lead lead lead to to to a a a general general general interest interest interest rates rates rates rise rise rise for for for loans, loans, loans, decreasing decreasing decreasing the the the demand demand demand for for borrowing. T F 7. 7. A A A central central central bank bank bank is is is the the the financial financial financial institution institution institution that that that can can can gain gain gain profit profit profit in in in its its its operation operation operation and and businesses, but it is not a profit-seeker. T F 8. When a central bank carries out tight monetary policy, interest rates fall. T F 9. The theory of “Quantity theory of money” means that an increase in prices of all goods and and services services services leads leads leads to to to an an an increase increase increase in in in the the the supply supply supply of of of money money money when when when everything everything everything remains remains unchanged. T F 1010. Banker’s credit is an indirect credit . Banker’s credit is an indirect credit英译汉英译汉1. On the one hand, although the central bank does not make loans to enterprises and can not derive derive deposits deposits deposits directly, directly, it it controls controls controls the the the sources sources sources of of of commercial commercial commercial banks` banks` banks` money money money creation creation —the creation creation and and and supply supply supply of of of the the the monetary monetary monetary base; base; base; and and and on on on the the the other other other hand hand hand commercial commercial commercial banks` banks` banks` money money creation creation through through through taking taking taking in in in deposits deposits deposits and and and granting granting granting loans loans loans is is is based based based on on on the the the central central central bank's bank's bank's monetary monetary base. 一方面,尽管中央银行并不直接为企业发放贷款,尽管中央银行并不直接为企业发放贷款,也不能产生派生存款,也不能产生派生存款,也不能产生派生存款,但是中央银行却控但是中央银行却控制着商业银行创造货币的源泉——基础货币的供给和创造。

金融英语复习本本一、简介金融英语是金融领域中不可或缺的一门语言。

随着全球经济一体化的加深,金融交流的频率越来越高,掌握金融英语已成为金融从业人员必备的能力之一。

本复习本旨在帮助读者复习和巩固金融英语的基础知识和词汇,提升金融英语水平。

二、重要概念以下是金融英语中的一些重要概念,读者需要熟悉并理解这些概念的含义:1. 货币政策货币政策是指中央银行通过改变货币供应量、利率等手段来影响经济活动和价格水平的政策。

在金融英语中,常用词汇有:货币供应量(money supply)、利率(interest rate)、量化宽松(quantitative easing)等。

2. 金融市场金融市场是指供求金融资产(如货币、股票、债券等)的场所。

金融市场分为股票市场、债券市场、外汇市场等。

在金融英语中,常用词汇有:交易所(exchange)、证券(security)、资产管理(asset management)等。

3. 风险管理风险管理是指金融机构或投资者为降低投资风险而采取的一系列措施。

主要包括风险评估和风险控制等。

在金融英语中,常用词汇有:风险管理政策(risk management policy)、风险模型(risk model)、风险敞口(risk exposure)等。

三、常用词汇以下是金融英语中常用的词汇,读者可以通过复习并记忆这些词汇来提升自己的金融英语水平。

•资本市场(capital market)•企业融资(corporate financing)•证券交易所(stock exchange)•股票(stock)•债券(bond)•证券投资(securities investment)•期货(futures)•期权(options)•金融衍生品(financial derivatives)•银行业务(banking business)•商业银行(commercial bank)•中央银行(central bank)•利率调整(interest rate adjustment)•外汇市场(foreign exchange market)•汇率(exchange rate)•国际支付(international payment)•金融风险(financial risk)•投资组合(investment portfolio)•保险业务(insurance business)•保险合同(insurance contract)四、实例分析为了帮助读者更好地理解金融英语的应用,下面将通过一个实例来进行分析。

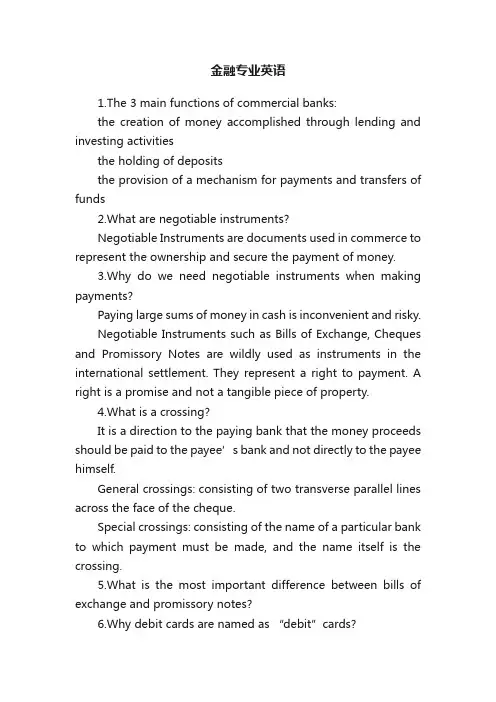

金融专业英语1.The 3 main functions of commercial banks:the creation of money accomplished through lending and investing activitiesthe holding of depositsthe provision of a mechanism for payments and transfers of funds2.What are negotiable instruments?Negotiable Instruments are documents used in commerce to represent the ownership and secure the payment of money.3.Why do we need negotiable instruments when making payments?Paying large sums of money in cash is inconvenient and risky.Negotiable Instruments such as Bills of Exchange, Cheques and Promissory Notes are wildly used as instruments in the international settlement. They represent a right to payment. A right is a promise and not a tangible piece of property.4.What is a crossing?It is a direction to the paying bank that the money proceeds should be paid to the payee’s bank and not directly to the payee himself.General crossings: consisting of two transverse parallel lines across the face of the cheque.Special crossings: consisting of the name of a particular bank to which payment must be made, and the name itself is the crossing.5.What is the most important difference between bills of exchange and promissory notes?6.Why debit cards are named as “debit”cards?The amount of the purchase is immediately debited from the account and no credit is involved.7.fiduciary /fi‘dju:?i?ri/ a. 受托的n.受托人A company director owes a fiduciary duty to the company7.The three most-commonly used means of international settlement: remittancecollectiondocumentary creditThe other two means: standby L/C & bonds9.A documentary collection gives greater security than settlement on open account, because the importer cannot take possession of the goods without either making payment or accepting a bill of exchange. The banks concerned are under no obligation to pay.10.Can the exporter be sure at the time of dispatch of the goods that the buyer will actually pay the sum owed?No.So this form of settlement is therefore most appropriate in the following cases:if the exporter has no doubt about the buyer’s willingness and ability to pay;if the political, economic and legal environment in the importing country is considered to be stable;if the buyer’s cou ntry has placed no restrictions on imports (e.g. exchange controls) or has issued all the necessary authorizations.11Q: Why can the exporter retain control of the goods until payment or acceptance?Q: why under D/P condition, it is unnecessary to include abill of exchange?How to complete a instruction order? p25212.Clean Collection: a draft or cheque unsupported by documents Documentary Collectioin: documents with or without a draftQ: The disadvantages of clean collection13.The differences between them primarily lie in 4 aspects as follows:Whether there are banker’s credit involved in.Which party is the principal.When does the exporter ship goods.Which party is the drawee of the draft.Can you list any others?13.: What’s the contrast between negot iation and comfirmation?Negotiation advances are with recourse, so that if payment is not ultimately forthcoming from the issuing bank, the negotiating bank will be able to claim repayment from the beneficiary of the advance, plus interest. Confirmation advances are without recourse.14.Can the seller receive payment immediately after presenting the complying documents?In practice, this means that instead of receiving immediate payment on presentation of the documents (at sight), the seller’s draft is returned to him accepted on face by the nominated bank.15On what conditions can a transferable be used?When the supplier of goods sells them through a middleman and does not deal directly with the ultimate buyer.16.Why there is a need for a first beneficiary and a secondbeneficiary?The middleman may not wish to arrange a documentary L/C by himself, or his banker may not be willing to issue a credit on his behalf. Thus the middleman will approach the ultimate buyer and ask him to arrange a transferable credit in the middleman’s favor, which entitles the middleman as the first beneficiary. This transferable credit will allow the first beneficiary to request the bank authorized to pay, incur a deferred payment undertaking, accept or negotiate, or in the case of a freely negotiable credit, the bank specifically authorized as the transferring bank to make the credit available to one or more third parties known as “second beneficiaries”.17.What are the similarities and differences between transferable and back-to-back L/C?They are used in the same situations when the supplier of the goods and the ultimate buyer deal through a middleman, but the rights and obligations of the parties differ between them.17.When does the “back-to-back”aspect comes into play?The middleman applies to his bankers to issue one documentary credit on his behalf, but his bankers are not satisfied with his creditworthiness and insist that the middleman obtain a documentary credit in his favor from the ultimate buyer as security for one which the middleman has applied for in favor of the original seller.19. A revocable documentary credit gives the applicant maximum flexibility, since it can be amended, revoked or cancelled without the beneficiary’s consent and even without prior notice to the beneficiary up to the moment of payment by the bank at which the issuing bank has made the credit available.So the revocable documentary credit involves risks to the beneficiary. The seller may face the problem of obtaining payment directly from the buyer.In contrast, an irrevocable credit gives the beneficiary greater assurance of payment, for it cannot be cancelled or modified without express consent of the issuing bank, the confirming bank (if any) and the beneficiary.20Why can the beneficiary obtain a double assurance of payments under a confirmed credit?Because a confirmed credit represents the undertaking of both the issuing bank and the confirming bank.21..On what condition does the beneficiary require a confirmed credit?If the classification of the credit and the financial standing of the issuing bank are not satisfactory to the beneficiary, he may desire the credit confirmed by another bank.22.Q: Which kind of bonds gives maximum protection to the principal?。

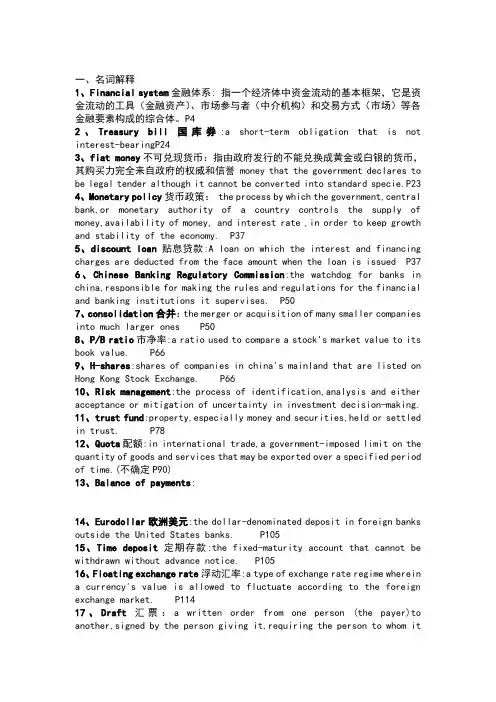

一、名词解释1、Financial system金融体系: 指一个经济体中资金流动的基本框架,它是资金流动的工具(金融资产)、市场参与者(中介机构)和交易方式(市场)等各金融要素构成的综合体。

P42、Treasury bill国库券:a short-term obligation that is not interest-bearingP243、fiat money不可兑现货币:指由政府发行的不能兑换成黄金或白银的货币,其购买力完全来自政府的权威和信誉 money that the government declares tobe legal tender although it cannot be converted into standard specie.P23 4、Monetary policy货币政策: the process by which the government,central bank,or monetary authority of a country controls the supply of money,availability of money, and interest rate ,in order to keep growth and stability of the economy. P375、discount loan贴息贷款:A loan on which the interest and financing charges are deducted from the face amount when the loan is issued P376、Chinese Banking Regulatory Commission:the watchdog for banks in china,responsible for making the rules and regulations for the financial and banking institutions it supervises. P507、consolidation合并:the merger or acquisition of many smaller companies into much larger ones P508、P/B ratio市净率:a ratio used to compare a stock's market value to its book value. P669、H-shares:shares of companies in china's mainland that are listed on Hong Kong Stock Exchange. P6610、Risk management:the process of identification,analysis and either acceptance or mitigation of uncertainty in investment decision-making.11、trust fund:property,especially money and securities,held or settledin trust. P7812、Quota配额:in international trade,a government-imposed limit on the quantity of goods and services that may be exported over a specified periodof time.(不确定P90)13、Balance of payments:14、Eurodollar欧洲美元:the dollar-denominated deposit in foreign banks outside the United States banks. P10515、Time deposit定期存款:the fixed-maturity account that cannot be withdrawn without advance notice. P10516、Floating exchange rate浮动汇率:a type of exchange rate regime whereina currency's value is allowed to fluctuate according to the foreign exchange market. P11417、Draft汇票:a written order from one person (the payer)to another,signed by the person giving it,requiring the person to whom itis addressed to pay on demand or at some fixed future date ,a certain sum of money,to either the person identified as payee or to any person presenting the bill. P14018、Secondary market: a financial market in which securities that have been previously issued can be resold. P15219、Security证券,抵押品:an investment instrument issued by a corporation,government,or other organization which offers evidence of debt or equity. P15220、common stock普通股:a share of ownership in a corporation carrying voting rights that can be exercised in corporate decisions. P163 21、Futures期货:a standardized contract,traded on a futures exchange,to buy or sell a certain underlying instrument at a certain date in the future,at a specified price.22、Option期权:a privilege sold by one party to another that offers the buyer the right,but not the obligation,to buy or sell a security at an agreed-upon price during a certain period of time or on a specific date.二、课后翻译题:1、共同基金是向大众出售股票的机构,并用由此所得的收益选择购买各种类型的股票或者债券,或者投资组合,或者同时购买股票和债券的投资组合。

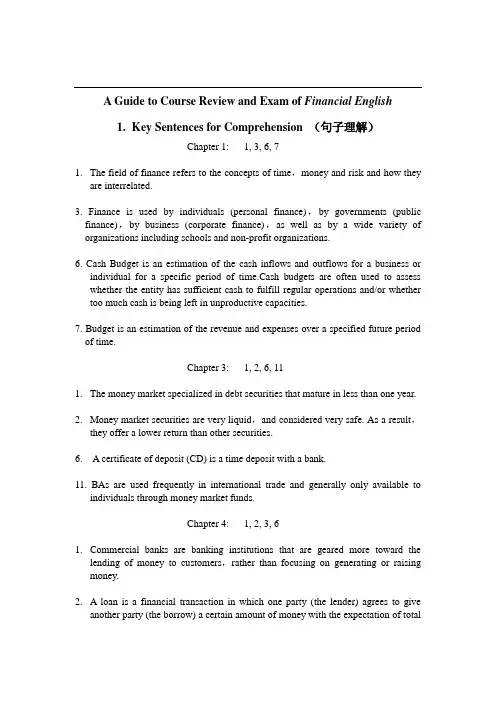

A Guide to Course Review and Exam of Financial English1.Key Sentences for Comprehension (句子理解)Chapter 1: 1, 3, 6, 71.The field of finance refers to the concepts of time,money and risk and how theyare interrelated.3. Finance is used by individuals (personal finance),by governments (public finance),by business (corporate finance),as well as by a wide variety of organizations including schools and non-profit organizations.6. Cash Budget is an estimation of the cash inflows and outflows for a business orindividual for a specific period of time.Cash budgets are often used to assess whether the entity has sufficient cash to fulfill regular operations and/or whether too much cash is being left in unproductive capacities.7. Budget is an estimation of the revenue and expenses over a specified future period of time.Chapter 3: 1, 2, 6, 111.The money market specialized in debt securities that mature in less than one year.2.Money market securities are very liquid,and considered very safe. As a result,they offer a lower return than other securities.6. A certificate of deposit (CD) is a time deposit with a bank.11. BAs are used frequently in international trade and generally only available toindividuals through money market funds.Chapter 4: 1, 2, 3, 6mercial banks are banking institutions that are geared more toward thelending of money to customers,rather than focusing on generating or raising money.2. A loan is a financial transaction in which one party (the lender) agrees to giveanother party (the borrow) a certain amount of money with the expectation of totalrepayment.3. Most loan applications are handled by banks or other professional lendinginstitutions. They may use any number of criteria to determine if a potential borrower is eligible for a loan.6. A savings account typically refers to an account in which one places money to earna small amount of interest.Chapter 10: 1, 5, 7, 81. A bond is simply an “IOU”in which an investor agrees to loan money to a company or government in exchange for a predetermined interest rate.A bond is fixed income security.5. The issuer of a bond is a crucial factor to consider,as the issuer’s stability is your main assurance of getting paid back.7. Generally speaking,bonds are exposed to five major types of risks: interest rate risk,purchasing power risk,business/financial risk,liquidity risk,and call risk.8. Most bond transactions can be completed through a full service or discount brokerage.Chapter 11: 1, 3, 4, 6, 71. A mutual fund is a professionally managed type of collective investment scheme that poors money from many investors and invests it in stocks,bonds,short-term money market instruments,and/or other securities.3.The advantages of mutual funds are professional management diversification,economies of scale,simplicity,and liquidity.4.The disadvantages of mutual funds are high costs over-diversification possible taxconsequences,and the inability of management to guarantee a superior return.6.Mutual funds have lots of costs.7. Costs can be broken down into ongoing fees (represented by the expense ratio) and transaction fees (loans).Chapter 13: 1, 2, 4, 7, 81.Futures are contractual agreements made between two parties through a regulatedfutures exchange. The parties agree to buy or sell an asset livestock,a foreign currency,or some other item —at a certain time in the future at a mutually agreed upon price.2. A futures contract is a binding agreement between a seller and a buyer to make(seller) and to take (buyer) deliver of the underlying commodity (or financial instrument) at a specified future date with agreed upon payment terms.4. It is possible to calculate a theoretical fair value for a futures contract. The fair value of a futures contract should approximately equal the current value of the underlying shares or index plus an amount referred to as the “cost of carry”.7.The key to any hedge is that a futures position is taken opposite to the position inthe cash market. That is,the nature of cash market position determines the hedge in the futures market.8. Participants in the futures market have been classified as either hedgers orspeculators.Chapter 14: 1, 3, 4, 6, 7, 81.An option is a contract giving the buyer the right but not the obligation to buy orsell an underlying asset at a specific price on or before a certain date.3. A call gives the holder the right to buy an asset at a certain price within a specificperiod of time.4. A put gives the holder the right to sell an asset at a certain price within a specificperiod of time.6.Buyers are often referred to as holders and sellers are also referred to as writers.7.The price at which an underlying stock can be purchased or sold is called thestrike price.8.The total cost of an option is called the premium,which is determined by factorsincluding the stock price,strike price and time remaining until expiration.2.Special Terms (术语互译)Chapter 1: Finance1.Hedge funds 对冲基金2.Financial risk management 金融风险管理3.Personal finance 个人财务4.Working capital 流动资本5.Capital budget 资本预算6.Cash budget 现金预算7.Savings account 储蓄账户Chapter 3: Money Market1.bankers’ acceptance (BA)银行承兑mercial paper 商业票据3.repurchase agreement (repos) 回购协议4.fixed-income security有固定收益保证的证券5.face (par) value 面值6.maturity date 到期日Chapter 4: Commercial Banks and Services1.telegraphic transfer (TT,T/T) 电汇2.term deposit 定期存款3.off balance sheet exposure 资产负债表外的风险4.principal 本金5.lines of credit (LOC) 信贷额度6.savings account 储蓄账户7.credit rating 信用等级8.money order 汇票Chapter 10: Bond Basicsernment Bonds 政府债券2.Municipal Bonds 市政债券3.Corporate Bonds 公司债券4.Zero-Coupon Bonds 零息债券5.Exposure to Risk 债券风险6.Treasury bond 长期国债(国库券)7.Treasury notes 中期国债8.Treasury bill 短期国库券9.Callable bonds 可赎回债券Chapter 11: Mutual Funds1.no-load fund 免佣基金2.aggressive growth funds 进取型增长基金3.capital gain 资本盈利4.economics of scale 规模经济5.professional management 专业管理6.equity funds 股票基金7.balanced funds 均衡基金8.specialty funds 专向基金9.index funds 指数基金 asset value (NA V) 资产净值Chapter 13: Futures Market1.futures market 期货市场2.financial futures 金融期货modity futures 商品期货4.initial margins 初始保证金5.futures transaction 期货交易6.futures position 期货头寸7.open outcry 公开叫价8.settlement price 结算价格9.date of delivery 交割期10.market order 市价订单Chapter 14: Options1.financial derivatives 金融衍生品2.hedging 套期保值3.premium 期权总成本4.strike price 敲定价格5.long position 多头;超买6.short position 空头;超卖7.intrinsic value 隐含价值8.employee stock option 员工认股权9.calls 看涨期权10.puts 看跌期权3.Key sentences for translation (单句翻译)Chapter 1: 5Chapter 3: 4Chapter 4: 6uChapter 10: 5Chapter 11: 2Chapter 13: 5Chapter 14: 2参考翻译(句子顺序为任意排列,复习时需要确保英汉对应)1.Business are classified into nonfinancial and financial business. These entities borrow funds in the debt market and raise funds in the eduity market.商业企业可分为非金融和金融两大类。

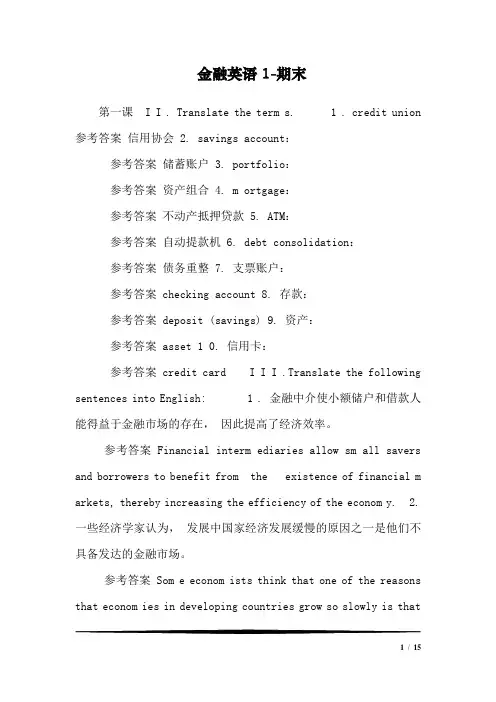

金融英语1-期末第一课 I I . Translate the term s. 1 . credit union 参考答案信用协会 2. savings account:参考答案储蓄账户 3. portfolio:参考答案资产组合 4. m ortgage:参考答案不动产抵押贷款 5. ATM:参考答案自动提款机 6. debt consolidation:参考答案债务重整 7. 支票账户:参考答案 checking account 8. 存款:参考答案 deposit (savings) 9. 资产:参考答案 asset 1 0. 信用卡:参考答案 credit card I I I .Translate the following sentences into English: 1 . 金融中介使小额储户和借款人能得益于金融市场的存在,因此提高了经济效率。

参考答案 Financial interm ediaries allow sm all savers and borrowers to benefit from the existence of financial m arkets, thereby increasing the efficiency of the econom y. 2. 一些经济学家认为,发展中国家经济发展缓慢的原因之一是他们不具备发达的金融市场。

参考答案 Som e econom ists think that one of the reasons that econom ies in developing countries grow so slowly is that1/ 15they do not have well-developed financial m arkets. 3. 你把钱存入支票账户,在需要付款或获取现金时你可以开支票。

参考答案 You deposit m oney into a checking account and then write checks when you need topay for som ething or get cash.4. 储蓄账户是一种安全、方便的存款方式。

1*10 单选2*5 判断)中英互译8*5(中译英3,英译中2 5*6 名词解释小作文10*1+论据(5到6句话)结论单项选择比考点港币hongkongHKDGermany 德国马克(Deutsche Mark)DEM瑞士法郎SWITZERLAND 瑞士CHFsweden 瑞典瑞典克朗SEK Belgium 比利时比利时法郎BEF 加拿大元Canada CAD美元USDGREAT BRITAIN 英镑GBPItaly 意大利里拉ITLholland 荷兰盾NLG挪威克郎norway NOK 丹麦克朗denmark DKKfrance 法国法郎FRF日元JPY澳元Aud西班牙ESP0.01% one hundredth of one percent 基点名词解释Central bank:and government by the central to formulate a financial institution designated implement monetary policy and to supervise and regulate the financial industry中央政府指定的金融机构,负责制定和实施货币政策,监督和规范金融行业。

)活期储蓄存款:Savings(current)deposit(Savings deposit is a method of deposit that sets no limit on length of maturity,timeand amount of deposit and withdrawn.储蓄存款是一种对存款期限、期限和存款额不设限制的存款方式。

Time deposit (定期存款):It is a kind of deposit with a definite length of maturity ,deposited and, withdrawn together with the interest in a lump sum or by installment它是一种具有一定期限的存款物,存放和提取,连同对一次或分期付款的利息。

金融英语期末复习Ⅰ.Choose correct answer.1.The dollar,the mark and the yen are all________A.currenciesB.fundsC.monies2.Current account means a demand account , which is called ________ in the West.A. fixed accountB. time accountC. checking accountD. term account3.To get a refund , you usually have to show the ________.A. receiptB. recipeC. paymentD. Invoice4.Regular bank statements will be sent to you by post , listing recent ________.A. paymentB. eventsC. transactionsD. interest5. I am sorry , sir. We find this One hundred-dollar note is ________.A. dirtyB. intactC. counterfeitD. True6. If the addition in the ease of one borrower is 800 basic points , then that borrower will pay a rate that is 8% _________base rate , each basic point adding 0.01%.A. belowB. as high asC. aboveD. of7. _________ is a loan that is made for a long period to help someone buy or improvea home.A. An educational loanB.A personal consumer loanC. A card loanD. A mortgage8.Borrowed money that has to be paid back constitutes a ________ .A.debtB.fundC.subsidy9.All the money received by a person or a company is known as_____ . .A.aidB.incomeC.wages10.The interest rate of the loan depends upon the ________ .A.amount of the loanB.term of the loanC.mortgagee of the loanD.guarantee of the loan11.I am sorry that Russian ruble is not ________ ,so we can'tmake the conversion for you.A.currencyB.freelyC.our currencyD.freely convertible12.________ Would you like to have it,in RMB or in US dollars ?A.WhyB.How muchC.How manyD.How13.I want to________ 500 Australian dollars for RMB Yuan.A.changeB.takeC.exchangeD.convert14.Why is the money I have received less than the ________ remittance amount ?A.originalB.paimaryC.sourceD.raw15.I am expecting a one hundred-pound________ from London .Has it arrived ?A.exchangeB.remittanceC.cashD.traveler's check16.Stock are also referred to as ________ .A.SecuritiesB.equityD.A,B,C17.What is the advantage of investing in bonds?A.bonds are generally of lower risk than stocks.B.bonds offer a good return.C.bonds do not mature.D.all of the above.18.________ have a higher priority than ________ when the firm is in trouble.A.stockholders ,bondholders ./doc/7015361533.html,mon shareholders ,bondholders .C.bondholders ,stockholders .D.preferred stockholders ,bondholders.19.A person who reviews the insurance proposal and decides whether the company should assume a particular risk is called a________.A.insurerB.claim adjusterC.insurance underwriterD. insured20.Your home insurance premium will be higher if you live ina ________ area .A.big riskB.riskyC.high riskD.lower risk21.A person who has taken out insurance cover is konwn as the ________.A.insurerC.insuranceD.beneficiary22. Telegraphic transfer is the quickest way and the commission is higher. _________ is cheaper , but it will take a longer time.A. Demand draftB. Telegraphic transferC. Bank acceptance draft D .Commercial acceptance draft23. The business of any insurance company is to pay ________ to the insured in the case of a loss in return for the payment of premiums.A. fundsB. claimsC. interestsD. principalsⅡ.Complete the sentences with the following expressions. withdraw , balance , sign , valid , payinterest , report a loss , cash , save , apply1.You can make a(an) _withdrawal_ at any time if you wish with your current deposit account.2.Overdraft means that the depositor writes the check for the amount exceeding _balance_ in his current account.3.Driving license is _invalid_ ,we can not open the account with it.4.To open a checking account the customer is to present his or her specimen _sign_.5.He made a(an) _payment_by writing a check.6.A time account is better than a current because your money earn _interest_.7.If you lose your _passbook_,don′t panic. Just call you bank immediately to makea(an) _ report a loss_.8.The bank is closed now ,you can′t _cash_your check today.9.Don′t keep your _save_ under the pillow, they'll be safer in the bank.10.Before doing business with banks, people have to make a(an) _application_ to open an account.Ⅲ.Translate the following terms.1.最低余额(1’) __________________2..浮动利率__________________3.担保贷款__________________4.股息、红利__________________5.直接标价法与间接标价法__________________6.bull and bear market __________________7.closed-end fund __________________8.insurance contract __________________9.property insurance __________________10.settle a claim __________________11.定期存款的利率比活期存款高。

金融英语期末复习金融英语期末复习1. brokerA ) 经济人B ) 经纪人C ) 承销商2. life insuranceA ) 人寿保险B ) 财产保险C ) 海上保险3. capital adequacy ratioA ) 资本充足率B ) 资本利润率C ) 资金利用率4. run on a bankA ) 贷款B ) 存款C ) 挤兑5. financial crisisA ) 金融风险B ) 金融监管C ) 金融危机6. legal reserves requirementA ) 公开市场业务B ) 法定存款准备金C ) 再贴现率7. exchange rateA ) 汇率B ) 利率C ) 红利8. monetary marketA ) 资本市场B ) 票据市场C ) 货币市场9. optionA ) 期货B ) 期权C ) 互换10. common stockA ) 普通股B ) 优先股C ) 债券11. bull marketA ) 牛市B ) 熊市C ) 套利12. central bankA ) 中央银行B ) 商业银行C ) 投资银行13. simple interestA ) 复利B ) 单利C ) 本金14. liquidityA ) 流动性B ) 赢利性C ) 风险性15. balance sheetA ) 现金流量表B ) 利润表C ) 资产负债表16. off-shore bankingA ) 国际银行业务B ) 离岸银行业务C ) 结算业务17. structural improvementA ) 结构调整B ) 结构优化C ) 结构失调18. moral hazardA ) 道德风险B ) 逆向选择C ) 信息不对称19. fixed costA ) 固定成本B ) 边际成本C ) 平均成本20. stagflationA ) 通货膨胀B ) 通货紧缩C ) 滞胀21. Widespread affects not only the nation’s international balance of payment but also the sales of home industries.A ) speculatingB ) smugglingC ) streamliningD )stocktaking22. Banks will not make a loan to any borrower unless theymake sure the latter is .A ) prosperousB ) richC ) solventD ) honest23. The “Ford ”is designed to assist some outstanding scholars in their efforts to do outstanding researches.A ) FoundationB ) SponsorshipC ) FundD ) Funds24. All bondholders will be paid at value of the bond on maturity.A ) agreedB ) securityC ) paperD ) par25. For a deposit of $10000 at the annual interest rate of 6%, one may receive a total of $10600 on maturity for his and interest.A ) originalB ) stakeC ) principalD ) deposit26. In those years, many foreign investors withdrew from the country because of disappointing rate of investment.A ) gains ofB ) yield ofC ) return onD ) return of27. Majority businessmen benefit from the differencebetween price and wholesale price.A ) distributionB ) bitC ) lotD ) retail28. As a rule, the construction contactor has to submit to the client a sum about 10% of contract price as of contract performance.A ) mortgageB ) promiseC ) commitmentD ) security29. The investment of a firm may fell into two categories: the first is for investment in fixed assets, the second is for in its day-to-day operation.A ) turnoverB ) wagesC ) bonusD ) incentive30. In theory, those pertain to the firm’s assets.A ) accounts receivableB ) receivable accountsC ) payable accountsD ) accounts payable31. The percentage analysis of increases and decreases in corresponding items in comparative financial statements is called ______.A ) vertical analysisB ) horizontal analysisC ) external analysisD ) comparative analysis32. The documentary collection provides the seller with a greater degree of protection than shipping on ______.A ) open accountB ) bank's letter of guaranteeC ) banker's draftD ) documentary credit33. When GBP/USD rate goes from 1.6150 to 1.8500, we say the dollar ______.A ) appreciates by 12.70%B ) depreciates by 14.55%C ) depreciates by 12.70%D ) appreciates by 14.55%34. The price in the foreign exchange market is called ______.A ) the trade surplusB ) the currency rateC ) the money priceD ) the exchange rate35. What function is money serving when you buy a ticket toa movie? ______.A ) transaction demandB ) a medium of exchangeC ) store of valueD ) a unit of account36. These are four main methods of securing payment in international trade:(1) payment under documentary credit(2) open account(3) collection, that is document against payment or acceptance of a bill of exchange(4) payment in advanceFrom an exporter's point of view, the order of preference is ______.A ) (4) , (1) , (3) , (2)B ) (4) , (2) , (3) , (1)C ) (4) , (3) , (1) , (2)D ) (2) , (4) , (1) , (3)37. The risk that is specific to individual stocks is called ______.A ) systematic riskB ) country riskC ) unsystematic riskD ) market risk38. Money _____.A ) serves as the critical function of a medium of exchangeB ) facilitates trade in goods and servicesC ) overcomes the inefficiencies of barterD ) all of the above39. Mr Wang, a lawyer, is a better typist than his secretary, but he still has her to do the typing. What economic principle, much used in trade theory, does this illustrated? _____A ) absolute advantageB ) economies of scaleC ) diminishing returnsD ) comparative advantage40. The economics situation at home and abroad, including the interest rate, the exchange rate, ease money (expansion of money supply) or tight money (contraction of money supply), hasa long term influence on stock prices.41. The function of the World Bank is to provide a mechanism for supplying for long periods of time ——20 or 30 years ——theforeign exchange needed to rebuild and develop economies.42. Spot transactions are foreign exchange transactions that have to be settled promptly,forward transactions have to be settled on an agreed future date.43. Through years of reform efforts, China has developed a banking system consisting mainly of the wholly state-owned commercial banks and joint-equity commercial banks under the supervision of the central bank, the People's Bank of China.44. The use of foreign exchange arises because different nations have different monetary units and the currency of one country cannot be used for making payment in another country.45. Venture Capital company pools the partners’assets and use these assets to help a fresh enterprise to begin its new cause.46. One of the main functions of banks is to take in deposit from surplus regions and then make loans to the deficit regions.47. The implementation of the stabilization and structural measures has been a major factor underlying the resilience of the Chinese economy in the context of the crisis in Asian financial markets and the recent weakening of global economic activity.48. Asymmetric information is present in loan market because lenders have less information about the investment opportunities and activities of borrowers than borrowers do.49. The functions of futures markets are price discovery, price risk hedging, and market efficiency improving.Directions:Read the following passages, and determine whether the sentences are “Right”or “Wrong”. If there is not enough i nformation to answer “Right”or “Wrong”, choose “Doesn’t say”.Passage 1Liquidity is a measure of how quickly an item may be converted to cash. Therefore, cash is the most liquid asset. Account receivable is a relatively liquid asset because the business expects to collect the amount in cash in the near future. Supplies are less liquid than accounts receivable. Users of financial statements are interested in liquidity because business difficulties often arise owing to shortage of cash. How quickly can the business convert an asset to cash and pay a debt? How soon must a liability be paid? These are questions of liquidity.50. Long-term assets are all assets other than current assets.A ) rightB ) wrong C) Doesn’t say51. Supplies are less liquid than accounts receivable, and furniture and buildings are even less so.A) Right B ) Wrong C) Doesn’t52. People are interested in liabilities on the balance sheet because it is relatively liquid.A ) RightB )wrong C) Doesn’t sayPassage 2Whereas the money markets provide very short-term loans, the capital market takes account of medium and long-term loans. It serves the needs of industry and commerce, government and local authorities. Private sector firms borrow their working capital (currentassets minus current liabilities) from the money market, which used to be mainly via commercial banks; the role of banks as middlemen has now diminished, even for the working capital requirements. Private sector firms raise their fixed capital by the issue of shares or commercial paper bonds. Government andlocal authorities borrow medium and long-term capital by issuing gilt-edged stocks and bands. The main market place for lending and borrowing medium and long-term capital in the UK is the Stock Exchange in London. 53. An industrial corporate can meet its financial needs by seeking funds from the capital markets.A ) RightB )wrong C) Doesn’t say54. Nowadays a private business usually obtains its working capital through a commercial bank.A ) RightB )wrong C) Doesn’t say55. In the UK commercial banks often raise funds by issuing bands and stocks.A ) RightB )wrong C) Doesn’t sayPassage 3A commercial bank shall formulate its business rules, establish and improve its business management, the system of cash control and its security system in accordance with the stipulations of the People’s Bank of China. A commercial bank shall establish and improve its systems of examining and checking deposits, loans settlements and bad and doubtful accounts. The PBC can exercise examination of a commercial bank at any time in accordance with the relevant provisions. The personnel in charge of the examination and supervision should produce their legitimate at the time of conducting examination and supervision. A commercial bank shall provide financial accounting information, business contracts and other information about its business and management at the requestof the People’s Bank of China. A commercial bank is subject to the audit control by the auditing authorities in accordance with the audit law and regulations.57. The PBC can exercise examination of a commercial bank at any time.A ) RightB )wrongC ) Doesn’t say58. A commercial bank shall establish and improve its system of internal control according to law.A ) RightB )wrongC )D oesn’t say59. A member staff of the PBC should present his legitimate certificate for on-site examination.A ) RightB )wrongC ) Doesn’t say60. The auditing authorities can not exercise the audit control over a commercial bank.A ) RightB )wrongC ) Do esn’t say1. off-shore bankingA ) 离岸银行业务B ) 国际银行业务C ) 结算业务2. capital adequacy ratioA ) 资本充足率B ) 资本利润率C ) 资金利用率3. moral hazardA ) 信息不对称B ) 逆向选择C ) 道德风险4. structural improvementA ) 结构失调B ) 结构优化C ) 结构调整5. commercial bankA ) 中央银行B ) 商业银行C ) 投资银行6. dividendA ) 汇率B ) 利率C ) 红利7. legal reserves requirementA ) 再贴现率B ) 法定存款准备金C ) 公开市场业务8. compound interestA ) 复利B ) 单利C ) 本金9. balance sheetA ) 利润表B ) 现金流量表C ) 资产负债表10. average costA ) 固定成本B ) 边际成本C ) 平均成本11. monetary marketA ) 资本市场B ) 票据市场C ) 货币市场12. common stockA ) 普通股B ) 优先股C ) 债券13. liquidityA ) 风险性B ) 赢利性C ) 流动性14. bear marketA ) 牛市B ) 熊市C ) 套利15. brokerA ) 经纪人B ) 经济人C ) 承销商16. futureA ) 期货B ) 期权C ) 互换17. life insuranceA ) 财产保险B ) 人寿保险C ) 海上保险18. depositA ) 挤兑B ) 存款C ) 贷款19. financial crisisA ) 金融风险B ) 金融监管C ) 金融危机20. inflationA ) 通货膨胀B ) 通货紧缩C ) 滞胀21. The Bank of China has been recognized as the AAA bank by a Japanese credit Agency that is very authoritative in international financial community.A ) evaluatingB ) assessingC ) appraisalD ) rating22. Owing to his good reputation, Mr. White can buy things in nearby shop .A ) without moneyB ) on creditC ) for lock of moneyD ) at order23. For a deposit of $1000 at the annual interest rate of 5%, one may receive a total of $1050 on maturity for his and interest.A ) originalB ) stakeC ) principalD ) deposit24. If we mean to learn foreign advanced technology and management in the operation, we’d better establish a joint with foreign firm rather than work on your own.A )businessB ) corporationC ) firmD ) venture25. If you have a draft and is badly in need of money before maturity of payment, you may sell it at for cash to the bank or others at the commercial paper market.A ) discountB ) premiumC ) depreciationD ) expense26. We have to close down the branch bank in that region in that its is far from covering the expenses incurred.A ) currency B) depositC ) reserves D) earnings27. What function is money serving when you buy a ticket toa movie? ______.A) store of valueB) a medium of exchangeC) transaction demandD) a unit of account28. The price in the foreign exchange market is called ______.A) the trade surplus B) the exchange rateC) the money price D) the currency rate29. What’s the interest rate on a 20-year mortgage loan?30. Although capital market development is expected to speed up, banks in China, which currently provide about 75 percent of aggregate financing in the economy, are likely to continue to playing a dominant role in financing economic and technological development as well as the economic reform in the foreseeable future.31. The use of foreign exchange arises because different nations have different monetary units and the currency of one country cannot be used for making payment in another country.32. In international trade, there exists the need for financing and the associated interest rate and credit risks, which are always accompanied by foreign exchange risk.33. Through years of reform efforts, China has developed a banking system consisting mainly of the wholly state-owned commercial banks and joint-equity commercial banks under the supervision of the central bank, the People's Bank of China.。

现代金融业务英语重点复习11.以营利为目的的企业profit-seeking businesses2.和……有许多共同特征share many common features with3.吸收存款mobilize savings4.将资金配置到生产部门allocate capital funds to finance productiveinvestment5.传导货币政策transmit monetary policy6.提供结算系统provide a payment system7.转换风险transform risks8.在经济中扮演重要角色play a unique/key role in the economy9.银行是公众资金的主要汇聚地Banks serves as a principaldepository of liquid funds for the public.10.金融体系的安全与效率the stability and efficiency of the financialsystem11.将吸收的存款转变为生产投资channel savings to productiveinvestment12.便于稀缺的金融资源的配置facilitate efficient allocation of scarcefinancial resources13.把货币政策传导给金融体系,直到整个国民经济transmit theimpulses of monetary policy to the whole financial system and ultimately to the real economy.14.不可或缺的国家支付机制indispensable national paymentmechanism15.经过二十多年的改革和对外开放through more than two decades ofreform and opening up to the outside world16.银行部门banking sector17.进入生机勃勃的发展阶段enter a stage of vigorous development18.过去的几年内,中国的银行改革进程明显加快the past few yearshave seen a marked acceleration of China’s banking reform19.明显的增强significant strengthening20.央行的监管和宏观调控能力the central bank’s capacity formaintaining financial stability and macroeconomic management21.实质性的提高substantial improvement22.银行业的开放openness of the banking industry23.P BC :the People’s Bank of China24.标志着第一阶段的开始mark the beginning of the first phrase25.是由当时实行的高度集中的计划经济管理体制所决定的bedictated by a highly centralized planned economic system26.国务院the State Council27.促进金融机构的多元化promote the diversification of financialinstitutions28.中国工商银行the Industrial and Commercial Bank of China29.中国农业银行the Agriculture Bank of China30.中国银行the Bank of China31.中国建设银行the China Constructive Bank32.专业银行specialized banks33.国有商业银行state-owned commercial banks34.股份制商业银行joint-equity commercial banks35.发展新的金融市场,金融机构和金融工具的迫切需要the urgentneed for developing new financial markets, institutions and instruments36.扭转金融秩序的混乱状况restore financial order37.抑制通货膨胀和经济过热address the inflationary pressure and signsof overheating38.房地产市场the real estate sector39.采取了综合性的一揽子治理措施introduce a comprehensivepackage of measures40.采取了一系列结构性调整的重大举措 a number of importantstructural measures were taken with particular significance for the banking sector41.实行人民币汇率并轨,统一外汇市场unification of theRenminbi(RMB) exchange rate and foreign exchange markets42.提供法律依据provide a legal basis for sth43.国际货币基金组织the International Monetary Fund44.经常项目下可兑换current account convertibility45.正式解除对贸易和劳务的国际支付的限制officially remove theremaining restrictions on international payments for trade and service transactions46.银行间货币市场the inter-bank money market47.流动性liquidity48.间接货币政策工具indirect monetary policy instruments49.极大地提高了货币政策的效应和宏观调控的有效性greatlyimprove transmission of monetary policy and effectiveness of macroeconomic management50.监管资源regulatory resources51.自律性self-discipline52.转制阶段a transition period53.银行业与证券业,保险业分离the segregation of banking businessfrom securities and insurance business54.政策性银行policy banks55.国家开发银行the State Development Bank56.中国农业发展银行the Agricultural Development Bank of China57.中国进出口银行the Export and Import Bank of China58.有利于政策性业务和商业银行业务的分离facilitate the separationof policy banking from commercial banking operations.59.给大型基础设施项目建设融资finance major infrastructural projects60.促进农业发展和国际贸易与投资promote agricultural developmentand international trade and investment61.中国入世后,银行业迎来了新的发展期China’s accession to theWorld Trade organization ushered in a new era of the banking system.62.随着中国日益融入世界经济,银行业面临着许多前所未有的挑战与机遇。

Question for Chapter 1 & 21.What’s the specialty of Treasury Securities?●Low risk●High liquidity.2.What’s the specialty of Money Market?●They are usually sold in large denominations;●The have low default risk;●They mature in one year or less from their original issue date. Most money marketinstruments mature in less than 120 days.3.Who are the participants of money market?●The government;●The Central Bank●Commercial Banks●Businesses●Investment Companies●Insurance Companies4.What market does international financial market include?They include Foreign exchange market, money market, capital market and gold market.5.What does international financial transaction include?It includes Purchases and sales of foreign currency, securities, gold bullion , an lending and borrowing.6.What does financial intermediary mean? Give 2 examples.Financial intermediary means financial service agent, such as Bank, credit union etc.7.What does foreign exchange influenced by?It is influenced by economic and political circumstances of the currencies of the relative countries.8.How to eliminate foreign exchange risk?The risk can be eliminated through forward transactions and foreign currency futures.9.What’s the difference between primary market and secondary market?Primary market: initial issue of bond / stockSecondary market: subsequent trading of bond / stock.10.What’s the difference between money market and capital market?Money market: short term debt instruments (maturity of less than one year) are traded;Capital market: long-term debt and equity instruments (maturity of one year of longer) are traded.11.Which methods could be used to balance the international payment deficit?●Import restriction;●Export promotion●Tighten monetary policy●Tighten fiscal policy●devaluation12.What are risky securities?Stock (shares) and corporate bonds. 3 products traded in Money market.●Treasury bills;●Inter-bank markets;●Commercial paper;●Negotiable certificates of deposit●Banker’s acceptance(any three of above will do) 2 words have similar meaning to characteristics.Specialty, mark, state, condition (any 2 of them will do)15.What’s the other word for “Borrower” and “Lender”?Borrower – debtorLender – Creditor16.What does “significance” mean? Defination17.What does APEC stand for?Asia-Pacific Economic Cooperation18.What’s the word has similar meaning as “mergers”?acquisitions19.What are the 3 functions of Central Bank?●Banker to the government;●Banker to the commercial banks;●Lender of last resort.20.What are the 3 steps for central Bank to turn its direct macro-economic control system into indirect control system?●Replaced the credit line system with the asset-liability management system from the 1stof January;●To reform the reserve requirement policy;●The central bank has reduced interest rates 3 times this year to regulate the macroeconomy.21.What’s Chinese central bank?The People’s Bank of China22.What does “par’ mean?It means face value.23.What does “yield” mean?It means return.24.Which two forms are there of inflation?●Demand-full inflation;●Cost-push inflation25.What does market risk include?●Exchange rate risk●Interest rate riskQuestion for Chapter 3 & 41.Who are primary issuers of capital market securities?P33●Governments and●corporations.2.Which interest rate is higher between long term and short term interest rate? WhyP33Long term interest rates are higher than short-term rates due to risk premiums. ernment can issue both stocks and bonds in the capital market. This statement is T/F?P33False. Governments never issue stocks. 2 ways that Corporation can finance its growth.P33●Debt●equity5.Capital market trading occurs only in the Secondary market. It is T/F?P34False. The trading occurs in both primary and secondary market.6.What’s the different between government notes & bonds?P34●notes have an original maturity of 1 to 10 years●bonds have an original maturity of 10 to 30 years.7.Corporate Bonds with high credit rating has lower interest rate, and vice versa. It is T/F?P35True. 2 ways that the investors earn returns from the shares.P35●Share price rise over time.●Dividend received from the company.9.Shareholders (Stockholders) have a lower priority than bondholders when the company is in trouble. It is T/F?P35True.10.What are the 2 marked Foreign Exchange rate method?P71●Direct method●Indirect method11.For direct foreign exchange rate method, the maxim is “buy high, sell low”, for indirect rates, the maxim is “buy low, sell high”. It is T/F?P50False.12.The system a foreign exchange dealer use is called SWIFT. It is T/F?P52False. It is called Reuters dealing system. 2 forms of foreign exchange conversion.P51●Spot transaction●Forward operation.14.What do financial derivatives include?P53-57●Spot transaction●Forward operations●Swaps●Futures●Currency and interest rate options15.Foreign exchange forward operation price in practice is higher than the spot price. It’s T/F?P54False. Foreign exchange forward operation price in practice is either higher or lower than the spot price16.Swaps contain 2 separable contract-deals. It’s T/F?P55False. Swaps contain 2 simultaneous inseparable contract-deals. It means the contract contains:●Buy and sell at the same time.●Contracts amount are the same.●Different maturity date, i.e. first for spot delivery, and the second for future delivery.17.Futures are forward transactions. Future contracts are customer made. It’s T/F?P56False. Future contracts are standardized in terms of quantity, settlement dates and quotation.18.What are the products traded on Future market?P56Commodity futures and financial futures.Commodity futures including:●Good●MetalsFinancial futures including:●Stocks●Interest rates●Currencies●Stock indexes19.What are the reasons caused the Asian Financial Crisis.P69●Huge deficit in current account●Inappropriate foreign investment policy●Excessive dependence on foreign loans especially short-term loans●Inappropriate foreign exchange policy●Excessive opening up of financial market●Imbalance of economic structure20.Central Bank is usually authorized to act as buying and selling agents of the exchange control authority. It’s T/F?P59False. It’s commercial banks.Question for Chapter 5 -81.What’s the relationship between commercial banks and customers?P81 Debtor-creditor relationship Principal-agent relationship2.What’s the intermediary services provided by commercial banks?P82 Settlement; trust service; Lease; Factoring.3.The Uniform Customs and Practices provide some basic principles: the autonomy of the documentary credit and the documentary credit deals with documents, not with goods. T/F?P87-88 true4.Under the Down or advance payment guarantees, the bank issues the guarantee in favour of buyer at the request of seller. T/F? P91 True5.Long-term commercial loans are often used to finance working capital needs. T/F?P95 False6.Give an example of off-balance sheet instruments.i.e. Finance Lease7.A buyer credit loan is usually arranged in support of a supply contract for capital goods and related service mainly from the country to provide loan. T/F?P96 T8.P91 – GuaranteesFor the 5 guarantees listed in the book, you need to know:The bank issues the bank guarantee at the request of____________, in favour of ________.9.What’s the difference between drafts and promissory notes?P98 Drafts: issued by seller, it is a payment orderPromissory notes: issued by buyer, it is a payment promise.9.ABC Company would like to sell their draft/promissory note to the bank. The face value of the draft/note is US$4m. If the cover rate is 80%, what’s the maximum funds ABC Company can borrow from the bank?P100 $3.20M10.A syndicated loan is negotiated between a group of borrowers and a single bank, but actually funded by several other banks. P102 FA syndicated loan is negotiated between a group of borrower and a single bank, but actuallyfunded by several other banks11.What’s the purpose of syndicated loan? P103To finance a major development, a project, a temporary imbalance of payments, a majorcapital investment program, a project cost over-run, acquisition of a company, short-termto long-term debt conversion, or rationalization of its schedule of long-term debtrepayment.12.The statements regarding ‘Forfaiting’: P98 - 99●Forfaiting provides a source of non-recourse finance through use of drafts, promissorynotes or other instruments representing sums due to the exporter.●Forfaiting provides an arrangement for larger sales being financed on a medium-termbasis.●Forfaiting banks require the institution to have a guarantee by an internationallyrecognized bank.●The most common currencies forfaiting deals are US dollars, Euros and Swiss francs.13.Under BOT, the vehicle company established specially by the sponsors carries out the construction and operations of the project. Who are the parties responsible for the finance of the BOT project?P105●The vehicle company;●sponsors14.What are investment banking activities?P149Securities underwriting, making a market in securities, and arranging mergers, acquisitions and restructuring.15.The regulatory framework for commercial bank and investment bank is the same.P151 f16.We use insurance to protect against the possibility of loss, usually financial loss. The fee we pay the insurance company for this purpose is called premium.P162 true17.Which risk that can be insured by insurance company?P161 pure risk18.Give 2 examples of debt securities:Government bond and corporation bond.19.Which securities represent the ownership of corporations?P183 Equity securities20.I nsurance is a way of managing risk and keeping things stay at its current situation?P1691 fInsurance is a way of managing risk and keeping things on the move.21.In china, the stock exchange is now in general non-profit-making legal entity.P186 T22.In securities trading, both spot trading and future trading are allowed.●P186 falseIn securities trading, only spot trading are allowed23.Preferred shares are somewhat like bonds. T/F?T24.Bond interest is paid first and then preferred dividends. T/F?T25.Preferred shareholders expect to receive dividends, they have no legal right to force the company to pay them. T/F?T26.Bond interest is paid before or after corporate income taxes is calculated?BEFORE27.Western countries usually use 5C loan credit appraisal method. What is 5C?P129It’s character, capacity, capital, collateral and conditions.28.The 5 loan grade is:Pass; Special mentioned; Substandard; Doubtful; Loss29.Underwriting securities means the investment banker promises to buy the securities and selling them to public. T/FT30.Principle of indemnity is usually contained in all insurance contracts for it is a legal base. T31.The payment methods commonly used by banks include mail transfer, demand draft and telegraphic transfer. T/F? T32.If there are more purchases than sales on it, which render its price up, it is called bull market, on the contrary, it is called bear market. T33.Financial markets facilitate the lending of funds from savers to those who wish to undertake investments. It is T/F? T34.Foreign bank notes are foreign exchange in the narrower sense. T/F?P51 F Foreign bank notes are not foreign exchange in the narrower sense35.Banks are prohibited from owning risky securities, such as stocks or corporate bonds. It is T/F?True.36.The purpose of insurance is to provide an opportunity for financial gain. T/FF37.Fundamentalists study the cause of market movement while technicians believe that the effect is all that they need to know. It is T/F? True.。

一、名词解释1、Financial system金融体系: 指一个经济体中资金流动的基本框架,它是资金流动的工具(金融资产)、市场参与者(中介机构)和交易方式(市场)等各金融要素构成的综合体。

P42、Treasury bill国库券:a short-term obligation that is not interest-bearingP243、fiat money不可兑现货币:指由政府发行的不能兑换成黄金或白银的货币,其购买力完全来自政府的权威和信誉 money that the government declares tobe legal tender although it cannot be converted into standard specie.P23 4、Monetary policy货币政策: the process by which the government,central bank,or monetary authority of a country controls the supply of money,availability of money, and interest rate ,in order to keep growth and stability of the economy. P375、discount loan贴息贷款:A loan on which the interest and financing charges are deducted from the face amount when the loan is issued P376、Chinese Banking Regulatory Commission:the watchdog for banks in china,responsible for making the rules and regulations for the financial and banking institutions it supervises. P507、consolidation合并:the merger or acquisition of many smaller companies into much larger ones P508、P/B ratio市净率:a ratio used to compare a stock's market value to its book value. P669、H-shares:shares of companies in china's mainland that are listed on Hong Kong Stock Exchange. P6610、Risk management:the process of identification,analysis and either acceptance or mitigation of uncertainty in investment decision-making.11、trust fund:property,especially money and securities,held or settledin trust. P7812、Quota配额:in international trade,a government-imposed limit on the quantity of goods and services that may be exported over a specified periodof time.(不确定P90)13、Balance of payments:14、Eurodollar欧洲美元:the dollar-denominated deposit in foreign banks outside the United States banks. P10515、Time deposit定期存款:the fixed-maturity account that cannot be withdrawn without advance notice. P10516、Floating exchange rate浮动汇率:a type of exchange rate regime whereina currency's value is allowed to fluctuate according to the foreign exchange market. P11417、Draft汇票:a written order from one person (the payer)to another,signed by the person giving it,requiring the person to whom itis addressed to pay on demand or at some fixed future date ,a certain sum of money,to either the person identified as payee or to any person presenting the bill. P14018、Secondary market: a financial market in which securities that have been previously issued can be resold. P15219、Security证券,抵押品:an investment instrument issued by a corporation,government,or other organization which offers evidence of debt or equity. P15220、common stock普通股:a share of ownership in a corporation carrying voting rights that can be exercised in corporate decisions. P163 21、Futures期货:a standardized contract,traded on a futures exchange,to buy or sell a certain underlying instrument at a certain date in the future,at a specified price.22、Option期权:a privilege sold by one party to another that offers the buyer the right,but not the obligation,to buy or sell a security at an agreed-upon price during a certain period of time or on a specific date.二、课后翻译题:1、共同基金是向大众出售股票的机构,并用由此所得的收益选择购买各种类型的股票或者债券,或者投资组合,或者同时购买股票和债券的投资组合。

共同基金的股东接受与投资组合相关的所有风险和收益。

并且如果投资组合价值升高,股东收益也随之增长;如果投资组合价值降低,股东就会遭受损失 P7A mutual fund is an institution that sells shares to the public and uses the proceeds to buy a selection,or portfolio,of various types of stocks,bonds,or both stocks and bonds.The shareholder of the matual fund accepts all the risks and returns associated with the portfolio.If the value of the portfolio rises,the shareholder benefits;if the value of the portfolio falls,the shareholder suffers the loss.2.中央银行执行国家所选择的货币政策。

其中最基础的就是要确定一国的货币形态,即法定货币,与黄金挂钩的货币(国际货币基金组织成员不允许使用这种货币),货币局或是货币联盟。

当一国货币确定之后,就涉及到某种形式的标准化货币的发行。

标准化货币本质上是一种本票,在一定条件下用票据交换货币的承诺。

Central banks implement a county's chosen monetary policy.At the most basic level,this involves establishing what form of currency the country may have,whether a fiat currency,gold-backed currency(disallowed for countries with membership of the IMF),currency board or a currency union.when the country has its own national currency,which is essentially a form of promissory note:a promise to exchange the vote for “money”under certain circumstances.3、对于中央银行应该是私有银行还是政府机构这一问题存在严重的分歧。

在这些问题上的激烈争论最后导致了一个妥协方案的产生。

按照美国传统,美国国会将相互制衡的系统进行了详细阐述,并写进1913年的《联邦储备法》,建立了拥有12个地区储备银行的联邦储备系统。

Serious disagreements existed over whether the central bank should be a private bank or a government institution.Because of the heated debateson these issues,a compromise was struck.In American tradition,Congress wrote an elaborate system of checks and balances into the Federal Reserve Act of 1913,which created the Federal Reserve System with its 12 regional Federal Reserve Banks.4、面对国内外复杂严峻的经济形势,中国人民银行在中共中央、国务院的正确领导下,深入学习、实践科学发展观,切实履行中央银行职责,妥善应付国际金融危机的强烈冲击,积极推进金融监管协调机制建设,着力加强金融风险监测和评估工作,加快推进存款保险制度设计工作,强化中央银行资产管理,推动理财产品健康发展,有力地保障了国家金融体系的稳定和安全。