财务管理英文笔试题

- 格式:doc

- 大小:27.21 KB

- 文档页数:9

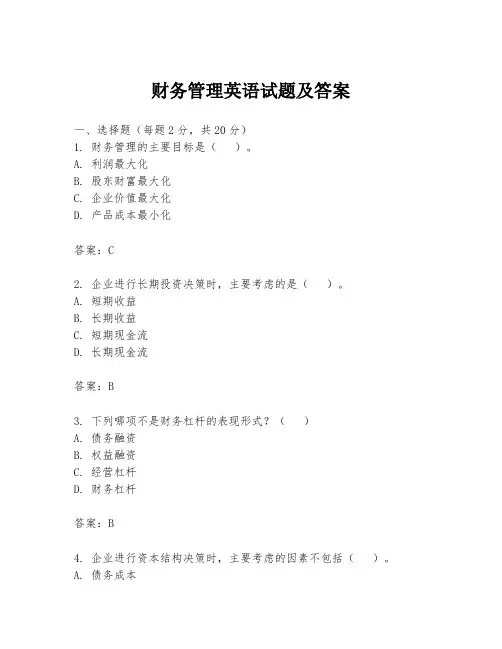

财务管理英语试题及答案一、选择题(每题2分,共20分)1. 财务管理的主要目标是()。

A. 利润最大化B. 股东财富最大化C. 企业价值最大化D. 产品成本最小化答案:C2. 企业进行长期投资决策时,主要考虑的是()。

A. 短期收益B. 长期收益C. 短期现金流D. 长期现金流答案:B3. 下列哪项不是财务杠杆的表现形式?()A. 债务融资B. 权益融资C. 经营杠杆D. 财务杠杆答案:B4. 企业进行资本结构决策时,主要考虑的因素不包括()。

A. 债务成本B. 权益成本C. 税收影响D. 市场风险答案:D5. 企业进行股利政策决策时,主要考虑的因素不包括()。

A. 企业的盈利能力B. 企业的资本需求C. 股东的偏好D. 企业的行业地位答案:D6. 下列哪项不是影响企业价值的因素?()A. 企业的盈利能力B. 企业的资本结构C. 企业的市场规模D. 企业的社会责任答案:D7. 企业进行财务预测时,通常不使用的方法包括()。

A. 销售百分比法B. 现金流量表法C. 资产负债表法D. 历史数据法答案:B8. 企业进行财务分析时,主要分析的财务报表不包括()。

A. 利润表B. 资产负债表C. 现金流量表D. 所有者权益变动表答案:D9. 企业进行风险管理时,通常不采用的方法是()。

A. 风险分散B. 风险转移C. 风险接受D. 风险创造答案:D10. 企业进行跨国财务管理时,主要考虑的因素不包括()。

A. 汇率变动B. 政治风险C. 经济周期D. 企业规模答案:D二、判断题(每题1分,共10分)1. 财务管理的核心是资金的筹集、使用和分配。

()答案:√2. 企业的财务目标与股东的财富最大化目标是一致的。

()答案:×3. 财务杠杆可以增加企业的财务风险,但不会提高企业的收益。

()答案:×4. 企业的资本结构决策只与债务和权益的相对比例有关。

()答案:×5. 股利政策对企业的市场价值没有影响。

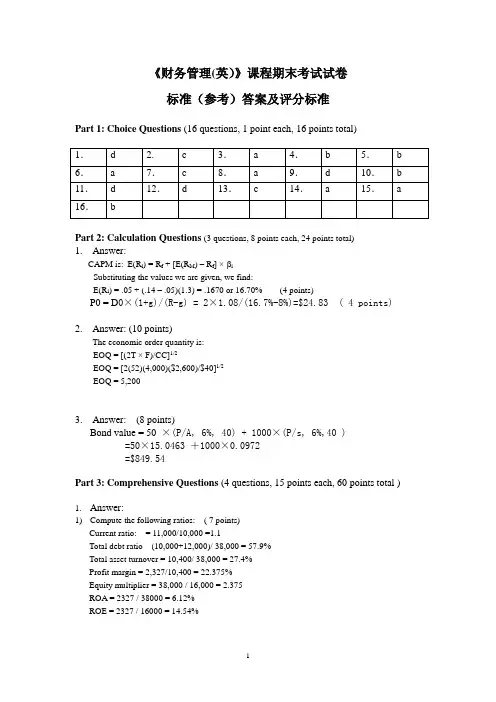

《财务管理(英)》课程期末考试试卷标准(参考)答案及评分标准Part 1: Choice Questions (16 questions, 1 point each, 16 points total)Part 2: Calculation Questions (3 questions, 8 points each, 24 points total)1.Answer:CAPM is: E(R i) = R f + [E(R M) – R f] × iSubstituting the values we are given, we find:E(R i) = .05 + (.14 – .05)(1.3) = .1670 or 16.70% (4 points)P0 = D0×(1+g)/(R-g) = 2×1.08/(16.7%-8%)=$24.83 ( 4 points)2.Answer: (10 points)The economic order quantity is:EOQ = [(2T × F)/CC]1/2EOQ = [2(52)(4,000)($2,600)/$40]1/2EOQ = 5,2003.Answer: (8 points)Bond value = 50×(P/A, 6%, 40) + 1000×(P/s, 6%,40 )=50×15.0463 +1000×0.0972=$849.54Part 3: Comprehensive Questions (4 questions, 15 points each, 60 points total ) 1.Answer:1)Compute the following ratios: ( 7 points)Current ratio: = 11,000/10,000 =1.1Total debt ratio (10,000+12,000)/ 38,000 = 57.9%Total asset turnover = 10,400/ 38,000 = 27.4%Profit margin = 2,327/10,400 = 22.375%Equity multiplier = 38,000 / 16,000 = 2.375ROA = 2327 / 38000 = 6.12%ROE = 2327 / 16000 = 14.54%2)Using Du Pont Identity to compute the ROE ( 4 points)ROE = Profit margi n×Equity multiplier×Total asset turnover= 22.375%×2.375 ×27.4% = 14.56%3)( 4 points)The plowback ratio, b, is one minus the payout ratio, so:b = 1 – .20 = .80we can use the sustainable growth rate equation to get:Sustainable growth rate = (ROE × b) / [1 – (ROE × b)]= [0.1454(.80)] / [1 – 0.1454(.80)]= .1317 or 13.17%2.Answer:( 15 points)3.Answer:1) Annual depreciation = $618,000 ÷ 3 = $206,000Taxes = ($265,000 - $206,000) ⨯ .34 = $20,060OCF = $265,000 – $20,060 = $244,940 (4 points)2) After tax Salvage value = $60,000 ⨯ (1 - .34)] = 39,600 ( 3 points)CF 0 = -$618,000 + (-$23,000) = -$641,000 CF1—CF2 = $244,940CF 3 = $244,940 + [$60,000 ⨯ (1 - .34)] + $23,000 = $307,5404)321)09.1(540,307$)09.1(940,244$)09.1(940,244$000,641$NPV +++++-== $27,354.00 ( 4 points)4. (15 points)The Capital Structure QuestionCapital Structure and the Cost of CapitalThe Effect of Financial LeverageThe Basics of Financial LeverageCorporate Borrowing and Homemade Leverage ( 3 points)Case I: M&M Capital Structure and the Cost of Equity Capital ( 3 points)M&M Proposition I: The Pie ModelThe Cost of Equity and Financial Leverage: M&M Proposition II Business and Financial RiskCase II: M&M Propositions I and II with Corporate Taxes ( 4 points)The Interest Tax ShieldTaxes and M&M Proposition ITaxes, the WACC, and Proposition IICase III: M&M Propositions I and II with Corporate Taxes and Bankruptcy Costs ( 4 points)Direct Bankruptcy Costs Indirect Bankruptcy CostsTaxes and Bankruptcy Costs , M&M Proposition ITaxes and Bankruptcy Costs , the WACC, Proposition IISummery: Optimal Capital Structure ( 1 point)Optimal Capital Structure and the Cost of Capital。

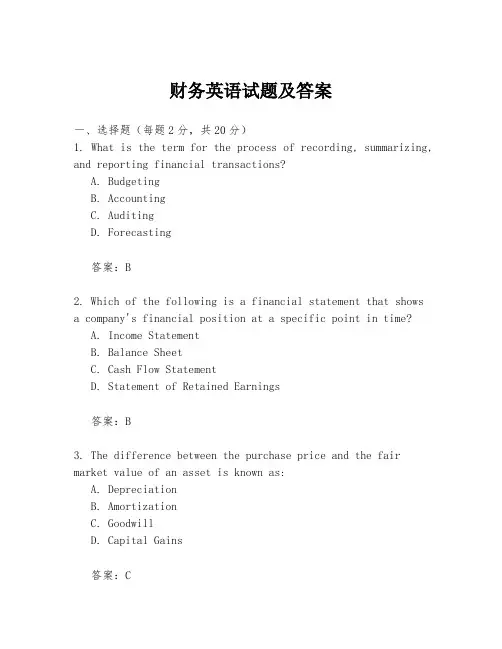

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

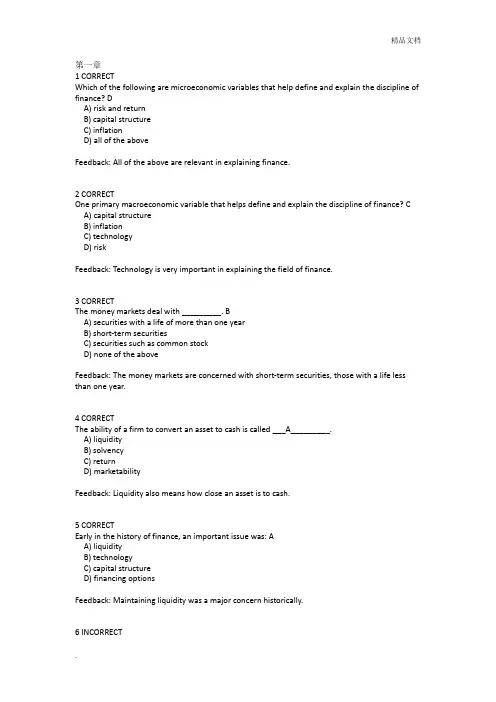

第一章1 CORRECTWhich of the following are microeconomic variables that help define and explain the discipline of finance? DA) risk and returnB) capital structureC) inflationD) all of the aboveFeedback: All of the above are relevant in explaining finance.2 CORRECTOne primary macroeconomic variable that helps define and explain the discipline of finance? CA) capital structureB) inflationC) technologyD) riskFeedback: Technology is very important in explaining the field of finance.3 CORRECTThe money markets deal with _________. BA) securities with a life of more than one yearB) short-term securitiesC) securities such as common stockD) none of the aboveFeedback: The money markets are concerned with short-term securities, those with a life less than one year.4 CORRECTThe ability of a firm to convert an asset to cash is called ___A_________.A) liquidityB) solvencyC) returnD) marketabilityFeedback: Liquidity also means how close an asset is to cash.5 CORRECTEarly in the history of finance, an important issue was: AA) liquidityB) technologyC) capital structureD) financing optionsFeedback: Maintaining liquidity was a major concern historically.6 INCORRECTThe __________C_________ is the most common form of business organization in the U.S.A) corporationB) partnershipC) sole proprietorshipD) none of the aboveFeedback: There are more sole proprietorships than any other form of business organization.7 CORRECTThe _________C___________ has more sales in dollars than any other form of business organization.A) sole proprietorshipB) partnershipC) corporationD) none of the aboveFeedback: The corporation is the most important in terms of dollars.8 CORRECTOne major disadvantage of the sole proprietorship is _____B___________.A) simplicity of decision-makingB) unlimited liabilityC) low operational costsD) none of the aboveFeedback: The owners of a sole proprietorship are personally liable.9 CORRECTThe appropriate firm goal in a capitalist society is ______B__________.A) profit maximizationB) shareholder wealth maximizationC) social responsibilityD) none of the aboveFeedback: The goal is to maximize the wealth of shareholders.10 CORRECTThe agency problem will occur in a business firm if the goals of ______C______ and shareholders do not agree.A) investorsB) the publicC) managementD) none of the above第二章Feedback: The goals of management may be different from those of shareholders.The accounting statements that a firm is required to file include all but one of these. BA) Balance SheetB) Statement of Accounts ReceivableC) Income StatementD) Statement of Cash FlowsFeedback: The required statements include the income statement, balance sheet and statement of changes in cash flows. The statement of changes in owners equity (or retained earnings) is also required by Generally Accepted Accounting Principles but is not covered in this text.2 CORRECTThe _______A________ shows the firm's operating results over a period of time.A) Income StatementB) Statement of Cash FlowsC) Balance SheetD) None of the aboveFeedback: The Income Statement represents a moving picture of a firm's revenues and expenses.3 CORRECTAll of the following except one are tax-deductible expenses. CA) interest expenseB) depreciationC) common stock dividendsD) income taxesFeedback: Common stock dividends are not tax deductible to a firm.4 CORRECTAll of the following are non-operating expenses except ______B_______.A) interest expenseB) cost of goods soldC) preferred stock dividendsD) taxesFeedback: The cost of goods sold is an operating expense.5 CORRECTBondholders receive _____C________ from the business firm.A) preferred dividend paymentsB) common stock paymentsC) interest paymentsD) royaltiesFeedback: Bondholders are typically paid interest semi-annually.6 CORRECTThe ratio of net income to common shares outstanding is called _____B_________.A) price/earnings ratioB) earnings per shareC) dividends per shareD) none of the aboveFeedback: This is called the earnings per share (EPS).7 CORRECTUsually, firms with high price/earnings ratios are _____A_______ firms.A) growthB) decliningC) matureD) none of the aboveFeedback: A high p/e ratio indicates a firm with strong growth prospects8 CORRECTOne of the limitations of the _____C_______ is that it is based on historical costs.A) income statementB) statement of cash flowsC) balance sheetD) none of the aboveFeedback: The balance sheet uses historical costs.9 INCORRECTA source of funds is a: DA) decrease in a current assetB) decrease in a current liabilityC) increase in a current liabilityD) a and c aboveFeedback: A decrease in current assets is equivalent to an increase in current liabilities.10 INCORRECTShort-term financing for a business firm includes: BA) bondsB) accounts payableC) stockholder's equityD) mortgagesFeedback: The other three answers represent long-term financing.第三章Trend analysis allows a firm to compare its performance to: DA) other firms in the industryB) other time periods within the firmC) other industriesD) all of the aboveFeedback: Trend analysis gives an analyst a long-term perspective. As a security analyst and a portfolio manager with Oppenheimer Capital, Dick Glasebrook spoke to a Senior Finance Managers’ Meeting at the Boeing Company on May 4, 1999. He said it is one thing to compare afirm’s performan ce against competitors within the same industry. But investors are not limited to specific industries. In fact, investors seek to diversify their investments across many different industries. So management should also compare performance to any well run company--both in and outside of their industry.2Ratio analysis allows a firm to compare its performance to: DA) other firms in the industryB) other time periods within the firmC) other industriesD) all of the aboveFeedback: Trend analysis gives an analyst a long-term perspective. As a security analyst and a portfolio manager with Oppenheimer Capital, Dick Glasebrook spoke to a Senior Finance Managers’ Meeting at the Boeing Company on May 4, 1999. He said it is one thing to compare a firm’s performance against competitors within the same industry. But investors are not limited to specific industries. In fact, investors seek to diversify their investments across many different industries. So management should also compare performance to any well run company--both in and outside of their industry.3Usually, a firm's suppliers are most interested in its ___D_____ ratios.A) profitabilityB) debtC) asset utilizationD) liquidityFeedback: The suppliers are most interested in getting paid, as shown by the liquidity of the firm.4 CORRECT__________D_____ would be most interested in a firm's debt utilization ratios.A) bondholdersB) stockholdersC) short-term creditorsD) Both A and BFeedback: Debt is indicated by a firm issuing bonds but is also a function of the debt to equity relationship or the degree of financial leverage. Both bond holders and stockholders are interested in this relationship although frof opposing viewpoints.5 CORRECTThe _______C______ ratio indicates the return firm shareholders are earning.A) return on assetsB) return on investmentC) return on equityD) net profit marginFeedback: The shareholders represent equity, or ownership in the firm.6 CORRECTWhich of the following is an example of a profitability ratio? CA) Quick ratioB) Average collection periodC) Return on equityD) Times interest earnedFeedback: This is the only profitability ratio that is listed. All profitability ratios have net income in the denominator.7Total asset turnover will indicate if there is a problem with the ___C______ ratio.A) debt to assetsB) times interest earnedC) fixed asset turnoverD) currentFeedback: Fixed asset turnover is part of total asset turnover.8 CORRECTAll of the following are asset utilization ratios except: DA) average collection periodB) inventory turnoverC) receivables turnoverD) return on assetsFeedback: Return on assets is a profitability ratio. Any ratio with net income in the denominator is a profitability ratio.9 CORRECTIf a firm's debt ratio is 55%, this means ____C__ of the firm's assets are financed by equity financing.A) 55%B) 50%C) 45%D) not enough information to answer questionFeedback: The equity portion plus the debt portion must add up to 100%.10 CORRECTAll of the following can present problems for ratio analysis except: DA) inflationB) inventory accounting methodsC) disinflationD) all of the aboveFeedback: These all may cause problems.第四章Planning for future growth is called: CA) capital budgetingB) working capital managementC) financial forecastingD) none of the aboveFeedback: This involves looking ahead to the future.2 INCORRECTWhich one of the following is NOT a tool of financial forecasting? BA) cash budgetB) capital budgetC) pro forma balance sheetD) pro forma income statementFeedback: The other three are all tools used by an analyst.3 CORRECTThe first step in developing a pro forma income statement is to: AA) build a sales forecastB) determine the production scheduleC) determine cost of goods soldD) none of the aboveFeedback: A sales forecast begins the process.4 INCORRECTPro forma statements are _B______ statements.A) actualB) projectedC) a previous year'sD) none of the aboveFeedback: Pro forma statements are based on estimates or projections.5 INCORRECTAll of the following compose cost of goods sold except ______D__________.A) raw materialB) laborC) overheadD) all of the above are part of cost of goods soldFeedback: The cost of good sold involves all three of these items.6 INCORRECTFinancial managers use the ______B_______ to plan for monthly financing needs.A) capital budgetB) cash budgetC) pro forma income statementD) none of the aboveFeedback: The cash budget allows for planning cash needs.7 INCORRECTThe payments that a firm collects from its customers are called _______C________.A) cash disbursementsB) cash outflowsC) cash receiptsD) none of the aboveFeedback: Cash receipts represent cash coming into the firm.8 INCORRECTExamples of cash disbursements are all but _________B________.A) payment for materials purchasedB) collection of accounts receivableC) payment of dividendsD) payment of taxesFeedback: The collection of accounts receivable is an example of a cash receipt, not a cash disbursement.9 CORRECTIn developing the pro forma balance sheet, we get common stock from __________A_______.A) the firm's previous balance sheetB) the firm's cash budgetC) the firm's income statementD) none of the aboveFeedback: Common stock appears on the balance sheet.10 INCORRECTThe percent of sales method of financial forecasting shows us the relationship between________D___ and financing needs.A) changes in the level of liabilitiesB) changes in the level of assetsC) changes in debtD) changes in the level of salesFeedback: It compares the relationship between balance sheet items and sales.第五章An example of a semi-variable cost is: DA) rentB) raw materialC) depreciationD) utilitiesFeedback: The other three represent fixed or variable costs.2 CORRECT_________A____ is the point at which firm profit is equal to zero.A) breakevenB) operating breakevenC) financial leverageD) combined breakevenFeedback: This is the point where the firm's revenues equal its expenses.3 INCORRECTIn breakeven analysis, if fixed costs rise, then the breakeven point will _____B_____.A) fallB) riseC) stay the sameD) none of the aboveFeedback: This implies that a larger quantity will have to be sold in order to break even.4 INCORRECTIn the breakeven formula, Price - Variable Cost is called the___C__________.A) breakeven pointB) leverageC) contribution marginD) none of the aboveFeedback: This implies that a larger quantity will have to be sold in order to cover the additional fixed costs and still break even.5 INCORRECTWhich of the following types of firms may operate with high operating leverage? BA) a doctor's officeB) an auto manufacturing facilityC) a mental health clinicD) none of the above would have high operating leverageFeedback: This implies a high break-even point and high operating expenses.6 INCORRECTThe __________C__________ is the percentage change in operating income that results from a percentage change in sales.A) degree of financial leverageB) breakeven pointC) degree of operating leverageD) degree of combined leverageFeedback: This is called the degree of operating leverage (DOL).7 CORRECTIf interest expenses for a firm rise, we know that firm has taken on more ______A________.A) financial leverageB) operating leverageC) fixed assetsD) none of the aboveFeedback: Financial leverage refers to interest expense on debt.8 INCORRECTThe ________B________ is the percentage change in earnings per share that results from a percentage change in operating income.A) degree of combined leverageB) degree of financial leverageC) breakeven pointD) degree of operating leverageFeedback: This is known as the degree of financial leverage (DFL).9 INCORRECTCombined leverage is the percentage change in relationship between sales and ______C______.A) operating incomeB) operating leverageC) earnings per shareD) breakeven pointFeedback: This combines operating leverage and financial leverage.10 INCORRECTA highly leveraged firm is ____B______ risky than its peers.A) lessB) moreC) the sameD) none of the aboveFeedback: Leverage is equivalent to risk, because it implies a higher level of fixed costs.第六章Working capital management involves the financing and management of the __C_____ assets of the firm.A) fixedB) totalC) currentD) none of the aboveFeedback: Working capital management deals with the financing and management of currentassets.2 INCORRECTAn asset sold at the end of a specified time period is called a ______B_______ asset.A) temporary currentB) self-liquidatingC) currentD) permanent currentFeedback: A self-liquidating asset is one that will be sold after a certain amount of time.3 CORRECTFixed assets are usually financed with _______A______ funds.A) long-termB) short-termC) permanentD) none of the aboveFeedback: Fixed assets are by definition long-term assets.4 INCORRECT_________B_____ is usually used to finance self-liquidating assets.A) Long-term financingB) Short-term financingC) Permanent financingD) none of the aboveFeedback: These are short-term or temporary assets.5 INCORRECTShort-term interest rates, in a normal economy, are generally ____C____ than long-term rates.A) higherB) the sameC) lowerD) none of the aboveFeedback: Long-term interest rates are normally higher than short-term interest rates to compensate for uncertainty or risk.6 INCORRECTThe expectations hypothesis says that _____B____ interest rates are a function of _______ interest rates.A) short-term; long-termB) long-term; short-termC) short-term; short-termD) none of the aboveFeedback: This theory says that long-term interest rates reflect the average of short-term expected rates.7 INCORRECTInsurance companies would tend to invest in ______C____ securities.A) short-termB) intermediate termC) long-termD) not enough information to answerFeedback: An insurance company would prefer long-term securities because they are more conservative or safer.8 INCORRECTThe _________D_____ theory says that investors must be paid a premium to hold long-term securities.A) expectations hypothesisB) time value theoryC) segmentationD) liquidity premiumFeedback: This is the liquidity premium.9 INCORRECTShort-term financing plans with high liquidity have: BA) high return and high riskB) moderate return and moderate riskC) low profit and low riskD) none of the aboveFeedback: This is known as a "middle-of-the-road" approach.10 INCORRECTLong-term financing plans with low liquidity have: BA) high return and high riskB) moderate return and moderate riskC) low return and low riskD) none of the aboveFeedback: This is also known as a "middle-of-the-road" approach.第七章The transaction motive for holding cash is for BA) a safety cushionB) daily operating requirementsC) compensating balance requirementsD) none of the aboveFeedback: This is money for everyday transactions.2 CORRECTWhich of the following motives for holding cash is required by the bank before loaning money? AA) compensating balance motiveB) transactions motiveC) precautionary motiveD) none of the aboveFeedback: This can be considered a form of collateral.3 INCORRECTThe difference between the cash balance on the firm's books and the balance shown on the bank's books is called: BA) the compensating balanceB) floatC) a safety cushionD) none of the aboveFeedback: Float implies that it takes time for checks to clear.4 CORRECTElectronic funds transfer has _____A_____ the use of float.A) reducedB) increasedC) had no effect onD) none of the aboveFeedback: Electronic funds transfer (EFT) has moved cash more quickly and reduced float.5 INCORRECTThe most utilized marketable security by most firms is the: DA) Treasury bondB) Agency securityC) Certificate of DepositD) Treasury billFeedback: Treasury bills (T-Bills) are very safe, popular investments.6 INCORRECTOf the following marketable securities, which are guaranteed by the Federal government? DA) agency securitiesB) negotiable certificates of depositC) banker's acceptancesD) none of the aboveFeedback: None of these are backed by the government.7 INCORRECTThe 5 C's of credit include: DA) conditionsB) collateralC) characterD) all of the aboveFeedback: The other two C's of credit are capacity and capital.8 INCORRECT BThe use of safety stock by a firm will:A) reduce inventory costsB) increase inventory costsC) have no effect on inventory costsD) none of the aboveFeedback: Safety stock is extra inventory a firm keeps in case of unforseen circumstances.9 INCORRECTAll of these factors are used in credit policy administration except: CA) credit standardsB) terms of tradeC) dollar amount of receivablesD) collection policyFeedback: The other three choices are the primary policy variables to consider.10 CORRECTFirms aim to hold ___A___ cash balances since cash is a non-interest earning asset.A) lowB) averageC) highD) none of the aboveFeedback: A firm does not want to keep too much cash on hand because it will lose interest (by not keeping the money in a bank).第八章The largest provider of short-term credit for a business is: BA) banking organizationsB) suppliers to the firmC) commercial paperD) EurodollarsFeedback: This is also known as trade credit.2 INCORRECTThe number of days until the firm is past due to a supplier is called the: CA) discount periodB) term to creditC) payment periodD) none of the aboveFeedback: The payment period is the number of days a firm has to pay its bill.3 INCORRECTIf a firm is given trade credit terms of 2/10, net 30, then the cost of the firm failing to take the discount is: CA) 2%B) 30%C) 36.72%D) 10%Feedback: This is calculated using formula 8-1 in this chapter.4 CORRECTThe interest rate given by a bank to its most creditworthy customers is the: AA) prime rateB) LIBOR rateC) federal funds rateD) discount rateFeedback: This is the "best" interest rate charged to people with excellent credit.5 INCORRECTWhich of the following types of bank loans generally have the highest effective rate of interest? DA) simple interest loanB) discount interest loanC) loan with a compensating balanceD) installment loanFeedback: Installment loans tend to be the most expensive.6 INCORRECTIf a firm needs to borrow $100,000, at 8% interest, to finance working capital needs and a 20% compensating is required, then the firm should borrow ____C______.A) $100,000B) $80,000C) $125,000D) $108,000Feedback: The formula to calculate this is: amount needed/(1-c), where c = the compensating balance percentage.7 CORRECTIf a bank offers a firm a simple interest loan of $1000 for 120 days at a cost of $60 interest, what is the effective rate of interest on the loan? AA) 18.00%B) 6.00%C) 20.00%D) none of the aboveFeedback: This is calculated by using formula 8-2 in this chapter.8 INCORRECTIf a company raises money to finance short-term needs by selling its accounts receivable to another party, this is called ___________. CA) pledgingB) warehousingC) factoringD) none of the aboveFeedback: Factoring means selling the accounts receivable outright.9 INCORRECTThe most restrictive policy for using inventory as collateral for short-term borrowing is called: BA) blanket inventory lienB) warehousing inventoryC) trust receiptD) factoringFeedback: This is a complex method of inventory financing wherein the lender takes control of the inventory.10 CORRECTA type of accounts receivable financing where a firm uses its receivables as collateral is called: AA) pledgingB) securitizationC) factoringD) warehousingFeedback: Pledging means using accounts receivable as collateral.第九章Both the future and present value of a sum of money are based on: CA) interest rateB) number of time periodsC) both a and bD) none of the aboveFeedback: These two factors are used in time value of money calculations.2 INCORRECTAn annuity is ___________________. CA) more than one paymentB) a series of unequal but consecutive paymentsC) a series of equal and consecutive paymentsD) a series of equal and non-consecutive paymentsFeedback: An annuity is a stream of equal payments to be received in the future.3 CORRECTIf you have $1000 and you plan to save it for 4 years with an interest rate of 10%, what is the future value of your savings? AA) $1464.00B) $1000.00C) $1331.00D) cannot be determinedFeedback: This is calculated by using formua 9-1 in this chapter.4 INCORRECTTime value of money is an important finance concept because: DA) it takes risk into accountB) it takes time into accountC) it takes compound interest into accountD) all of the aboveFeedback: Time value of money incorporates all of these concepts.5 INCORRECTThe present value of a dollar to be received in the future is: CA) more than a dollarB) equal to a dollarC) less than a dollarD) none of the aboveFeedback: The reason is because you can earn interest on the money.6 CORRECTThe future value of a dollar that you invest today is: AA) more than a dollarB) equal to a dollarC) less than a dollarD) none of the aboveFeedback: Again, the reason is because the money can earn interest.7 INCORRECTThe future value of an annuity is: CA) less than each annuity paymentB) equal to each annuity paymentC) more than each annuity paymentD) none of the aboveFeedback: The reason has to do with compound interest (or interest earning more interest).8 INCORRECTThe concepts of present value and future value are:DA) directly related to each otherB) not related to each otherC) proportionately related to each otherD) inversely related to each otherFeedback: They are essentially opposite sides of a coin.9 INCORRECTIf you win the lottery and you choose to have your proceeds distributed to you over atwenty-year time period, with the first payment coming to you one year from today, which calculation would you use to calculate the worth of those proceeds to you today? DA) future value of a lump sumB) future value of an annuityC) present value of a lump sumD) present value of an annuityFeedback: This is shown by formula 9-4 in this chapter. But this is not a typical situation. Most lotteries (let’s say $1 Million over 20 years), will pay you the first payment today and $50,000 each year for the next 19 years. This is actually an “annuity due” which is not covered in this text. Y ou’d have to calculate the present value of the annuity for 19 years and add the initial $50,000 you received today.10 CORRECTYou have $1000 you want to save. If four different banks offer four different compounding methods for interest, which method should you choose to maximize your $1000? AA) compounded dailyB) compounded quarterlyC) compounded semi-annuallyD) compounded annuallyFeedback: The more often interest is compounded the faster it will grow because you will begin to earn interest on the interest sooner.第十章In valuing a financial asset, you use these variables: DA) present value of future cash flowsB) discount rateC) required rate of returnD) all of the aboveFeedback: All of these are needed in order to value an asset.2 CORRECTThe principal amount of a bond at issue is called: AA) par valueB) coupon valueC) present value of an annuityD) present value of a lump sumFeedback: This is also known as the face value or stated value.3 INCORRECT BIf a bond's value rises above its par value during its life, interest rates have:A) gone upB) gone downC) stayed the sameD) there is no correlation with interest ratesFeedback: There is an inverse relationship between bond prices and interest rates (or yields).4 INCORRECTThe basic "rent" that you are charged when you borrow money is called: CA) inflation premiumB) risk premiumC) real rate of returnD) none of the aboveFeedback: This is known as the opportunity cost in economics.5 INCORRECTAs time to maturity draws near, a bond's value approaches: BA) zeroB) parC) the coupon paymentD) none of the aboveFeedback: The bond price gets closer to its face value the closer it is to maturity (see figure 10-2 in this chapter).6 INCORRECTOne characteristic of preferred stock is that:DA) it has no maturity dateB) it is a hybrid security with characteristics of both common stock and debtC) it pays a fixed dividend paymentD) all of the aboveFeedback: Preferred stock is described by all of the above characteristics.7 CORRECTCommon stock that has no growth in dividends is valued as if it were: AA) preferred stockB) a bondC) an optionD) none of the aboveFeedback: It is treated the same as preferred stock.8 INCORRECT。

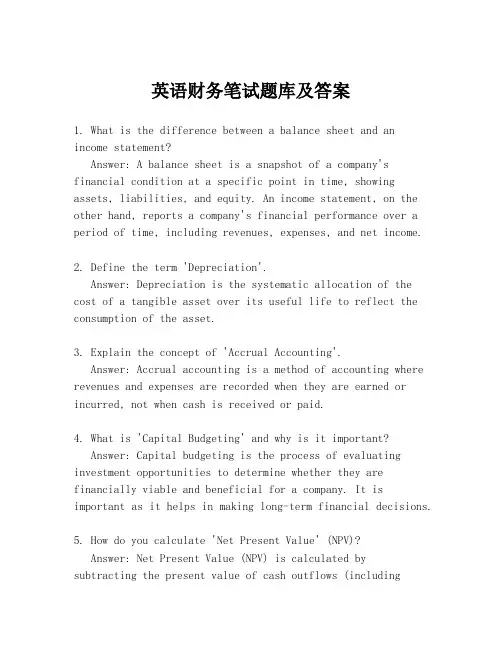

英语财务笔试题库及答案1. What is the difference between a balance sheet and an income statement?Answer: A balance sheet is a snapshot of a company's financial condition at a specific point in time, showing assets, liabilities, and equity. An income statement, on the other hand, reports a company's financial performance over a period of time, including revenues, expenses, and net income.2. Define the term 'Depreciation'.Answer: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life to reflect the consumption of the asset.3. Explain the concept of 'Accrual Accounting'.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.4. What is 'Capital Budgeting' and why is it important?Answer: Capital budgeting is the process of evaluating investment opportunities to determine whether they are financially viable and beneficial for a company. It is important as it helps in making long-term financial decisions.5. How do you calculate 'Net Present Value' (NPV)?Answer: Net Present Value (NPV) is calculated bysubtracting the present value of cash outflows (includinginitial investment) from the present value of cash inflows over a period of time, using a discount rate.6. What is 'Financial Leverage' and how does it affect a company?Answer: Financial leverage refers to the use of borrowed funds to increase the return on equity. It affects a company by increasing the risk and potential return on investment.7. Describe the 'Time Value of Money'.Answer: The time value of money is the concept that a sum of money is worth more now than the same sum in the future due to its potential earning capacity.8. What is 'Earnings Per Share' (EPS)?Answer: Earnings Per Share (EPS) is a financial metric calculated as the company's net income divided by the outstanding shares of its common stock, indicating the profit allocated to each share.9. Explain the 'Cash Conversion Cycle'.Answer: The cash conversion cycle is the length of time it takes for a company to convert its investment in inventory and receivables into cash.10. What is 'Break-Even Analysis' and how is it used?Answer: Break-even analysis is a method used to determine the number of units a company must sell to cover its costs and make a profit. It is used to evaluate the financial viability of a project or business.11. Define 'Working Capital'.Answer: Working capital is the difference between a company's current assets and current liabilities, representing the funds available for day-to-day operations.12. What is 'Liquidity Ratio' and how is it calculated?Answer: Liquidity ratio is a measure of a company'sability to pay short-term obligations. It is calculated by dividing current assets by current liabilities.13. Explain 'Return on Investment' (ROI).Answer: Return on Investment (ROI) is a financial metric that measures the profitability of an investment. It is calculated by dividing the net profit from the investment by the initial cost of the investment.14. What is 'Inflation' and how does it affect financial statements?Answer: Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. It affects financial statements by reducing the real value of assets and increasing the cost of goods and services.15. Define 'Audit' in the context of finance.Answer: An audit is a systematic review and examination of a company's financial records, typically performed by an independent third party, to ensure accuracy, compliance with regulations, and to detect fraud.。

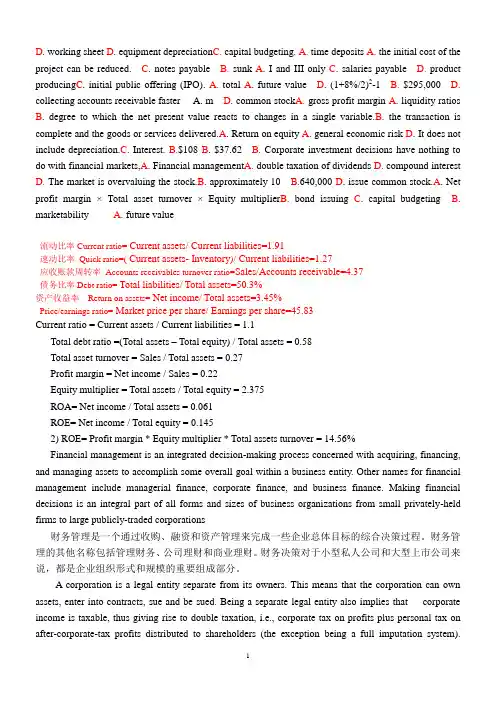

D. working sheet D. equipment depreciation C. capital budgeting. A. time deposits A. the initial cost of the project can be reduced. C. notes payable B. sunk A. I and III only C. salaries payable D. product producing C. initial public offering (IPO). A. total A. future value D. (1+8%/2)2-1 B. $295,000 D. collecting accounts receivable faster A. m D. common stock A. gross profit margin A. liquidity ratios B. degree to which the net present value reacts to changes in a single variable.B. the transaction is complete and the goods or services delivered.A. Return on equity A. general economic risk D. It does not include depreciation.C. Interest. B.$108 B. $37.62 B. Corporate investment decisions have nothing to do with financial markets,A. Financial management A. double taxation of dividends D. compound interest D. The market is overvaluing the stock.B. approximately 10 B.640,000 D. issue common stock.A. Net profit margin ×Total asset turnover ×Equity multiplier B.bond issuing C. capital budgeting B. marketability A. future value流动比率Current ratio= Current assets/ Current liabilities=1.91速动比率Quick ratio=( Current assets- Inventory)/ Current liabilities=1.27应收账款周转率Accounts receivables turnover ratio=Sales/Accounts receivable=4.37债务比率Debt ratio= Total liabilities/ Total assets=50.3%资产收益率Return on assets= Net income/ Total assets=3.45%Price/earnings ratio= Market price per share/ Earnings per share=45.83Current ratio = Current assets / Current liabilities = 1.1Total debt ratio =(Total assets – Total equity) / Total assets = 0.58Total asset turnover = Sales / Total assets = 0.27Profit margin = Net income / Sales = 0.22Equity multiplier = Total assets / Total equity = 2.375ROA= Net income / Total assets = 0.061ROE= Net income / Total equity = 0.1452) ROE= Profit margin * Equity multiplier * Total assets turnover = 14.56%Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Other names for financial management include managerial finance, corporate finance, and business finance. Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations财务管理是一个通过收购、融资和资产管理来完成一些企业总体目标的综合决策过程。

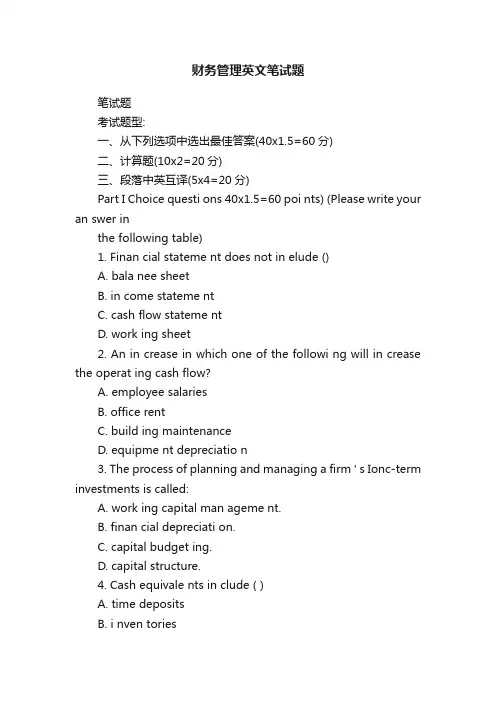

财务管理英文笔试题笔试题考试题型:一、从下列选项中选出最佳答案(40x1.5=60分)二、计算题(10x2=20分)三、段落中英互译(5x4=20分)Part I Choice questi ons 40x1.5=60 poi nts) (Please write your an swer inthe following table)1. Finan cial stateme nt does not in elude ()A. bala nee sheetB. in come stateme ntC. cash flow stateme ntD. work ing sheet2. An in crease in which one of the followi ng will in crease the operat ing cash flow?A. employee salariesB. office rentC. build ing maintenanceD. equipme nt depreciatio n3. The process of planning and managing a firm ' s Ionc-term investments is called:A. work ing capital man ageme nt.B. finan cial depreciati on.C. capital budget ing.D. capital structure.4. Cash equivale nts in clude ( )A. time depositsB. i nven toriesC. acco unts receivableD. prepaid expe nses5. The internal rate of return for a project will in crease if:A. the initial cost of the project can be reduced.B. the total amount of the cash in flows is reduced.C. the required rate of return is reduced.D. the salvage value of theproject is omitted from the an alysis.6. Which of the following belongs to current liabilities?( )A. mortgages payableB. prepaid expe nsesC. no tes payableD. bonds payable7. You spent $500 last week fixing the transmission in your car. Now, thebrakes are acting up and you are trying to decide whether to fix them ortrade the car in for a newer model. In analyzing the brake situation, the $500 you spe nt fixing the tran smissi on is a(n) _ cost.A. opport unityB.sunkC. in creme ntalD. fixed8. Which of the following statements are correct concerning diversifiable risks?I. Diversifiable risks can be essentially eliminated by investing inseveral securities.II. The market rewards investors for diversifiable risk bypaying a risk premium.III. Diversifiable risks are gen erally associated with an in dividualfirm or in dustry.IV. Beta measures diversifiable risk.9. Which of the following is a liability account?B. additi onal paid-i n capitalD. accumulated depreciati on10. Acco untants employed by large corporati ons may work in the areas of the followi ng except ()A. product costi ng and pric ingB. budget ing11. A corporation ' s first sale of equity made available to the public is called a(n): ()A. share repurchase program.B. private placeme nt.C. in itial public offeri ng (IPO).D.seas oned equity offeri ng (SEO).12. Stan dard deviati on measures __ risk.A. totalB. non diversifiableC. un systematicD. systematic13. ( ) is the value at some future time of a prese nt amount of mon ey,or a series of payme nts, evaluated at a give n in terest rate.A. future valueB. prese nt valueC. i ntri nsic valueD.market value14. Ellesmere Corporati on issues 1 millio n $1 par value bon ds. The stated interest rate is 8% per year and the interest is paid twice a year. WhatA. I and III onlyB. II and IV onlyC. I and IV onlyD. II and III only A. prepaid in sura nee C. salaries payable C. internal audit ing D. product produc ingis the real in terest rate of the bond?()A. 6%B.4%C. 10%D. (1+8%/2) 2-115. Your firm purchased a warehouse for $335,000 six years ago. Four years ago, repairs were madeto the building which cost $60,000. The annual taxes on the property are $20,000. The warehouse has a curre nt book value of $268,000 and a market value of $295,000. The warehouse is totally paidfor and solely owned by your firm. If the compa ny decides to assig n this warehouse to a new project, what value, if any, should be included in the in itial cash flow of the project for this build ing? ( )A. $268,000B. $295,000C. $395,000D. $515,00016. Which one of the following will decrease the operating cycle?A. pay ing acco unts payable fasterB. disc on ti nuing the disco unt give n for early payme nt of an acco unts receivableC. decreas ing the inven tory turno ver rateD. collect ing acco unts receivable faster17. Assumethat divide nds of a commorstock will be main tai ned at D forever, and the required return of the stockholder is r, the par value of the stock is m, the value of the stock is ()A. mB. m+DC. m+D/rD. D/r18. Which of the follow ing items has the most risk?( )A. treasury billB. corporate bondC. preferred stockD. com mon stock19. ( ) equals the gross profit divided by net sales of a firm.A. gross profit marginB. net profit marginC. return on investmentD. retur n on equity20. ( ) is the ratios that measure a firm ' s ability to meet short -term obligati onsA. liquidity ratiosB. leverage ratiosC. coverage ratiosD.activity ratios21.Sensitivity analysis helps you determine the:A. range of possible outcomes give n possible ran ges forevery variable.B. degree to which the net prese nt value reacts to cha nges in a sin gle variable.C. net prese nt value give n the best and the worst possible situatio ns.D. degree to which a project is reliant upon the fixed costs.22. Accord ing GAAP reve nue is recog ni zed as in come whe n: ()A. a con tract is sig ned to perform a service or deliver a good.B. the transaction is complete and the goods or services delivered.C. payme nt is received.D. in come taxes are paid.E. all of the above.23. ( ) is the result of Net Profit Margin xtotal asset turnover x(total assets/shareholders ' equity)A. Retur n on equityB. return on in vestme ntC. curre nt ratioD. quick ratio24. Gover nment tax law adjustme nt is ( ) to a firm.A. gen eral econo mic riskB. in flati on and deflati on riskC.firm-specific risk25. Which of the followi ng stateme nts concerning the in come stateme nt is not true?A. It measures performa nee over a specific period of time.B. It determ ines after-tax in come of the firm.C. It in cludes deferred taxes.D. It does not in clude depreciatio n.E. it treats in terest as an expe nse.26. Which of the follow ing is not a non cash deducti on?A. Depreciati on.B. Deferred taxes.C. I nterest.D. Two of the aboveE. All of the above.27.Sasha Corp had an ROA of 10%. Sasha' s profit margin was 6% on sales of $180. What are total assets? ()A.$300B.$108C.$48. D$162.28. Calculate net in come based on the follow ing in formati on ( )Sales = $200.00Cost of goods sold = $100.00Depreciation = $18.00In terest paid = $25.00Tax rate = 34%A. $16.50B. $37.62C. $34.60D. $4.6029. Which of the followi ng is not true? ()A. Finan cial markets can be used to adjust con sumpti on patter ns over time.B. Corporate investment decisions have nothing to do with financial markets,C. Finan cial markets deal with cash flows over time.D. Investment decisions rely on the economic principles of financial markets.E. None of the above.30. ( ) is concerned with the acquisition, financing, and managementof assets with some overall goal in mind.A. Financial managementB. Profit maximizationC. Agency theoryD. Social resp on sibility31. A major disadvantage of the corporate form of organization is the().A. double taxati on of divide ndsB. i nability of the firm to raiselarge sums of additi onal capitalC. limited liability of shareholdersD. limited life of the corporateform.32. Interest paid (earned) on both the original prin cipal borrowed (le nt) and previous in terest earned is ofte n referred to as).(A. present valueB. simple interestC. future valueD. compo undin terest33. If the intrin sic value of a share of com mon stock is lesstha n its market value, which of the followi ng is the most reas on able con clusi on?。

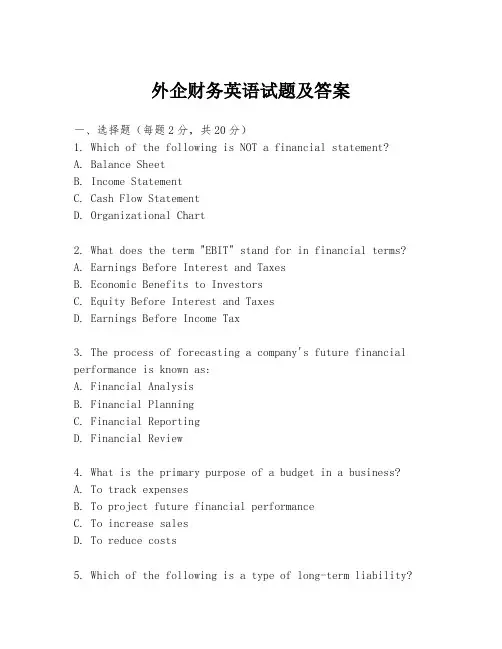

外企财务英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Organizational Chart2. What does the term "EBIT" stand for in financial terms?A. Earnings Before Interest and TaxesB. Economic Benefits to InvestorsC. Equity Before Interest and TaxesD. Earnings Before Income Tax3. The process of forecasting a company's future financial performance is known as:A. Financial AnalysisB. Financial PlanningC. Financial ReportingD. Financial Review4. What is the primary purpose of a budget in a business?A. To track expensesB. To project future financial performanceC. To increase salesD. To reduce costs5. Which of the following is a type of long-term liability?A. Accounts PayableB. Notes PayableC. Bonds PayableD. Sales Tax Payable6. The term "ROI" refers to:A. Risk of InvestmentB. Return on InvestmentC. Revenue of InvestmentD. Rate of Interest7. What does "GAAP" stand for?A. General Accounting and Auditing PrinciplesB. Globally Accepted Accounting PracticesC. Generally Accepted Accounting PrinciplesD. Government Accounting and Auditing Procedures8. A company's "working capital" is calculated by:A. Current Assets - Current LiabilitiesB. Total Assets - Total LiabilitiesC. Fixed Assets - Current LiabilitiesD. Current Liabilities / Current Assets9. Which of the following is a non-cash expense?A. RentB. UtilitiesC. DepreciationD. Salaries10. The financial statement that shows the changes in a company's equity over a period of time is:A. Balance SheetB. Income StatementC. Statement of Cash FlowsD. Statement of Retained Earnings二、填空题(每题1分,共10分)11. The __________ is a document that provides a snapshot ofa company's financial condition at a specific point in time.12. __________ is the process of allocating resources to achieve the company's goals.13. A __________ is a financial statement that shows the sources and uses of cash during a specific period.14. __________ are short-term obligations that a company must pay within one year.15. The __________ is the difference between the cost of an asset and its depreciation.16. __________ is the amount of money that a company expects to receive for the sale of goods or services that have been delivered but not yet paid for by customers.17. __________ is the process of evaluating the financial performance of a company.18. __________ are the costs associated with the production of goods or services that have not yet been sold.19. __________ is the process of recording financial transactions in a company's accounting records.20. The __________ is a document that shows the company's net income and expenses over a specific period.三、简答题(每题5分,共30分)21. Explain the difference between "Operating Leverage" and "Financial Leverage."22. Describe the purpose of a "Statement of Changes in Equity."23. What is the role of "Debt Financing" in a company's capital structure?24. Discuss the importance of "Internal Controls" infinancial management.四、计算题(每题5分,共20分)25. Given the following data for a company:- Sales = $500,000- Cost of Goods Sold = $300,000- Operating Expenses = $80,000- Depreciation = $20,000- Interest Expense = $10,000- Taxes = 30% of EBITCalculate the company's EBIT and Net Income.26. If a company has Current Assets of $120,000 and Current Liabilities of $60,000, calculate the company's Working Capital.27. A company has a Return on Investment (ROI) of 15%. If the initial investment was $100,000, calculate the amount of the return.五、论述题(共20分)28. Discuss the role of "Financial Forecasting" in strategic business planning and provide examples of how it can be used to make informed business decisions.答案:一、选择题1. D2. A3. B4. B5. C6. B7. C8. A9. C10. D二、填空题11. Balance Sheet12. Budgeting13. Cash Flow Statement14. Current Liabilities15. Book Value16. Accounts Receivable17. Financial Analysis18.。

财经英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial instrument?A. StockB. BondC. CommodityD. Insurance policyAnswer: D2. In financial markets, what is the term for the difference between the buying and selling prices of a security?A. SpreadB. DividendC. YieldD. Interest rateAnswer: A3. What is the term used to describe the risk of a security's value changing due to market fluctuations?A. Credit riskB. Market riskC. Liquidity riskD. Operational riskAnswer: B4. Which of the following is not a type of financial statement?A. Balance sheetB. Income statementC. Cash flow statementD. Profit and loss statementAnswer: D5. What is the term for the process of evaluating an investment based on various factors to determine its potential return and risk?A. Due diligenceB. Portfolio managementC. Financial analysisD. Risk assessmentAnswer: C6. What does GDP stand for in economics?A. Gross Domestic ProductB. Gross Domestic ProfitC. Gross Domestic PerformanceD. Gross Domestic PriceAnswer: A7. In the context of finance, what does the acronym "IPO" stand for?A. Initial Public OfferingB. International Profit OrganizationC. International Portfolio OrganizationD. International Product OfferingAnswer: A8. What is the term for a financial contract that gives the buyer the right, but not the obligation, to buy or sell anunderlying asset at a specified price on or before a certain date?A. Call optionB. Put optionC. Forward contractD. Futures contractAnswer: A9. Which of the following is not a component of the financial system?A. BanksB. Securities exchangesC. Insurance companiesD. Manufacturing companiesAnswer: D10. What is the term used to describe the process of determining a company's value based on its financial performance and potential for future growth?A. ValuationB. ForecastingC. BudgetingD. AuditingAnswer: A二、填空题(每题2分,共20分)1. The process of converting cash into other assets is known as ____________.Answer: investing2. A __________ is a financial institution that acceptsdeposits, offers loans, and provides other financial services. Answer: bank3. The __________ is a document that outlines the terms and conditions of a loan, including the interest rate and repayment schedule.Answer: loan agreement4. __________ is the risk that a borrower may default ontheir loan payments.Answer: credit risk5. A __________ is a financial statement that shows acompany's financial position at a specific point in time. Answer: balance sheet6. __________ is the process of evaluating a company'sfinancial health by analyzing its financial statements. Answer: financial analysis7. The __________ is a financial statement that shows a company's revenues, expenses, and net income over a specific period.Answer: income statement8. __________ is the risk that a security's value maydecrease due to a decline in the overall market.Answer: market risk9. A __________ is a financial instrument that represents an ownership interest in a company.Answer: stock10. __________ is the risk that a security may be difficult to sell at a desired price.Answer: liquidity risk三、简答题(每题10分,共20分)1. Explain the difference between a stock and a bond. Answer: A stock represents ownership in a company and typically offers the potential for capital appreciation and dividends. A bond, on the other hand, is a debt instrument issued by a company or government, promising to pay periodic interest and return the principal at maturity.2. What are the main factors that influence a company'scredit rating?Answer: The main factors that influence a company's credit rating include its financial stability, debt levels, profitability, management quality, industry position, and economic conditions. Credit rating agencies assess these factors to determine the likelihood of the company meetingits financial obligations.四、论述题(每题15分,共30分)1. Discuss the importance of diversification in an investment portfolio.Answer: Diversification is crucial in an investment portfolio as it helps to spread risk across a variety of investments, reducing the impact of a poor-performing asset on the overall portfolio. By investing in different asset classes, sectors, and geographical regions, investors can potentially achievebetter returns and lower volatility. Diversification also allows for the exploitation of different market opportunities and can protect against unforeseen events that may affect specific investments.2. Explain the role of financial statements in business decision-making.Answer: Financial statements play a vital role in business decision。

专业英语作业Topic 1:Agency is an area of commercial institution dealing with a contractual or quasi-contractual, or non-contractual set of relationships when a person, called the agent, is authorized to act on behalf of another (called the principal) to create a legal relationship with a third party.Money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames.Capital market is a market for securities (debt or equity), where business enterprises and governments can raise long-term funds. It is defined as a market in which money is provided for periods longer than a year.Spontaneous financing refers to the automatic source of short term funds arising in the normal course of short term course of business. Trade credit and out standing expenses are examples of spontaneous financing.Financial intermediary is a financial institution that connects surplus and deficit agents. Secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan.Unsecured Loan A loan that is issued and supported only by the borrower's creditworthiness, rather than by some sort of collateral.Marketability is a measure of the ability of a security to be bought and sold for a price at which similar items are dealling.Perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. Hedge-matching In asset management, the coordination of an organization's cash inflows with cash outflows by matching the maturity of income generating assets (such as certificates of deposit) with the maturity of interest incurring liabilities (debts).Topic 2:美国IBM从1984年左右开始由兴到衰,由年盈利66亿美元到1992年亏损达49.7亿美元。

财务管理英文题库及答案1. Question: What is the primary goal of financial management in a business?Answer: The primary goal of financial management in a business is to maximize the value of the firm to its shareholders by making optimal investment and financing decisions.2. Question: What is the difference between a current asset and a non-current asset?Answer: A current asset is an asset that is expected to be converted to cash or used up within one year or one operating cycle of the business. A non-current asset, on the other hand, is an asset that is not expected to be converted to cash or used up within one year or one operating cycle.3. Question: Explain the concept of Time Value of Money (TVM).Answer: The Time Value of Money (TVM) is a financial concept that states that a sum of money received today isworth more than the same sum received in the future due toits potential earning capacity. This principle is fundamental to finance and is used to evaluate the relative worth of money at different points in time.4. Question: What is the formula for calculating the presentvalue of a future sum of money?Answer: The formula for calculating the present value (PV) of a future sum of money (FV) is: PV = FV / (1 + r)^n, where r is the discount rate and n is the number of periods.5. Question: Define the term 'Leverage' in the context of financial management.Answer: Leverage in financial management refers to the use of borrowed funds to increase the potential return of an investment. It is a strategy that can amplify gains but also increases the risk of losses if the investment does not perform as expected.6. Question: What is the DuPont Identity and how is it usedin financial analysis?Answer: The DuPont Identity is a formula used to break down the return on equity (ROE) into three parts: net profit margin, asset turnover, and financial leverage. It is used in financial analysis to understand the drivers of a company's profitability and to compare it with other companies.7. Question: How does inflation affect a company's financial statements?Answer: Inflation affects a company's financial statements by reducing the purchasing power of money. It can lead to higher costs for raw materials and labor, which can decrease profit margins. Additionally, inflation can cause assets andliabilities to be understated, and it may affect the real value of reported earnings.8. Question: Explain the concept of Capital Budgeting and its importance.Answer: Capital Budgeting is the process of evaluating the profitability of long-term investments or projects. It is important because it helps a company decide which projects to undertake based on their potential to generate returns over time, considering the time value of money and the risks involved.9. Question: What is the difference between a fixed cost anda variable cost?Answer: A fixed cost is a cost that does not change with the level of production or sales, such as rent or salaries. A variable cost, however, changes in direct proportion to the level of production or sales, such as raw materials or direct labor costs.10. Question: Define the term 'Liquidity Ratios' and provide examples.Answer: Liquidity Ratios are financial metrics used to measure a company's ability to pay off its short-term debts. Examples include the Current Ratio (current assets divided by current liabilities) and the Quick Ratio (current assets minus inventory divided by current liabilities). These ratios help assess the liquidity position of a business.。

财务管理其中考试题(英文)1..Finance, generally, deals withA) moneyB) marketsC) peopleD) all of the aboveAnswer: D2.Generally, a corporation is owned by the:A) ManagersB) Board of DirectorsC) ShareholdersD) All of the above.Answer: C3.The following are examples of real assets except:A) MachineryB) Common stockC) Office buildingsD) InventoryAnswer: B4.In finance, "short-term" meansA) less than three monthsB) less than six monthsC) less than one yearD) less than five yearsAnswer: C17. The treasurer usually oversees the following functions of a corporation except:A) Preparation of financial statementsB) Investor relationshipsC) Cash managementD) Obtaining financesAnswer: AType: DifficultPage: 618. The treasurer is usually responsible the following functions of a corporation except:A) Raising new capitalB) Cash managementC) Banking relationshipsD) Internal accountingAnswer: D20. The controller usually oversees the following functions of a corporation except:A) Cash managementB) Tax managementC) Internal accountingD) Preparation of financial statementsAnswer: A22. The following are advantages of separation of ownership and management ofcorporations except:A) Corporations can exist forever.B) Facilitate transfer of ownership without affecting the operations of the firm.C) Hire professional managersD) Incur agency costsAnswer: D24. The financial goal of a corporation is to:A) Maximize salesB) Maximize profitsC) Maximize the value of the firm for the shareholdersD) Maximize managers' benefitsAnswer: C26. In the principal-agent framework:A) Shareholders are the principalsB) Managers are the agentsC) Shareholders are the agentsD) Managers are the principalsE) A and BAnswer: ET F 30. A corporation has a legal existence of its own and is based on "articles of incorporation."Answer: True4. Present value of $110,000 expected to be received one year from today at an interestrate (discount rate) of 10% per year is:A) $121,000B) $100,000C) $110,000D) None of the aboveAnswer: BType: EasyPage: 14Response: PV = (110,000) / (1.1) = 100,0005. One year discount factor at a discount rate of 10% per year is:A) 1.1B) 1.0C) 0.909D) None of the aboveAnswer: CType: EasyPage: 14Response: Discount Factor = 1/1.1 = 0.9096. Present Value of $100,000 expected to be received at the end of one year at adiscount rate of 100% per year is:A) $50,000B) $200,000C) $100,000D) None of the aboveAnswer: AType: EasyPage: 14Response: PV = (100,000) / (1+1) = 50,0007. The one-year discount factor at an interest rate of 25% per year is:A) 1.25B) 0.8C) 0.25D) None of the aboveAnswer: BType: EasyPage: 14Response: Discount factor = 1/(1.25) = 0.810. If the one-year discount factor is 0.85, what is the present value of $120 to bereceived one year from today?A) $100B) $102C) $141.18D) None of the aboveAnswer: BType: MediumPage: 14Response: PV = (120)(0.85) = 10220. If the five-year present value annuity factor is 3.791 and four-year present valueannuity factor is 3.170, what is the present value at the $1 received at the end of five years?A) $0.621B) $1.61C) $0.315D) None of the aboveAnswer: AType: DifficultPage: 39Response: PV = (3.791 3.170)*(1) = 0.62121. If the three-year present value annuity factor is 2.723 and two-year present valueannuity factor is 1.859, what is the present value of $1 received at the end of the 3 years?A) $0.157B) $0.864C) $1.00D) None of the aboveAnswer: BType: DifficultPage: 39Response: PV = (2.723-1.859) *(1) = 0.86422. What is the present value annuity factor at a discount rate of 13% for 10 years?A) $5.4262B) $8.514C) $8.13D) None of the aboveAnswer: AType: MediumPage: 39Response: PV annuity factor = (1/0.13) (1/((0.13)(1.13^10))) = 5.426223. What is the present value annuity factor at an interest rate of 11% for 5 years?A) 8.514B) 6.145C) 3.6959D) None of the aboveAnswer: CType: MediumPage: 39Response: PV annuity factor = (1/0.11) (1/((0.11)(1.11^5))) = 3.695933.If the present value of $1.00 received n years from today at an interest rate of r is 0.270,then what is the future value of $1.00 invested today at an interest rate of r% for nyears?A) $1.00B) $3.70C) $1.70D) Not enough information to solve the problemAnswer: BType: DifficultPage: 40Response: FV = 1/(0.270) = 3.7034. If the future value of $1 invested today at an interest rate of r% for n years is 2.5937,what is the present value of $1 to be received in n years at r% interest rate?A) $0.3855B) $1.00C) $0.621D) None of the aboveAnswer: AType: DifficultPage: 40Response: PV = 1/2.5937 = 0.3855541.Mr. Hopper is expected to retire in 30 years and he wishes accumulate $1,000,000 in hisretirement fund by that time. If the interest rate is 12% per year, how much should Mr. Hopper put into the retirement fund each year in order to achieve this goal?A) $4,143.66B) $8,287.32C) $4,000D) None of the aboveAnswer: AType: DifficultPage: 40Response: Future value annuity factor = [(1/0.12) (1/(0.12*1.12^30)]*(1.12^30) =241.3827; payment = 1,000,000/241.3327 = 4143.6642. Mr. Hopper is expected to retire in 30 years and he wishes accumulate $750,000 inhis retirement fund by that time. If the interest rate is 10% per year, how muchshould Mr. Hopper put into the retirement fund each year in order to achieve thisgoal?A) $4,559.44B) $2,500C) $9,118.88D) None of the aboveAnswer: AType: DifficultPage: 40Response: Future value annuity factor = [(1/0.10) (1/(0.10*1.10^30)]*(1.10^30) =164.494; payment = 750,000/164.494 = 4559.4443. If you invest $100 at 12% APR for three years, how much would you have at the endof 3 years using simple interest?A) $136B) $140.49C) $240.18D) None of the aboveAnswer: AType: MediumPage: 40Response: FV = 100 + (100*0.12*3) = $1362.If a firm permanently borrows $50 million at an interest rate of 8%, what is the presentvalue of the interest tax shield? Assume a 35% tax rate.A) $8.00 millionB) $8.75 millionC) $17.50 millionD) $25.00 millionE) None of the aboveAnswer: CType: MediumPage: 490Response: PV of interest tax shield = (0.35)(50) = $17.5 million3. If a firm borrows $25 million for one year at an interest rate of 10%, what is thepresent value of the interest tax shield? Assume a 35% tax rate. (Approximately.)A) $1.591 millionB) $1.75 millionC) $1.00 millionD) $5.00 millionE) None of the aboveAnswer: AType: DifficultPage: 490Response: PV of interest tax shield = ((0.35)(50)(0.1))/1.1 = $1.5915. If the before-tax cost of debt is 10% and the corporate tax rate is 30%, calculate theafter-tax cost of debt:A) 10%B) 3%C) 7%D) none of the aboveAnswer: CType: EasyPage: 5256. A firm has a total value of $1 million and debt valued at $400,000. What is theafter-tax weighted average cost of capital if the after - tax cost of debt is 12% and the cost of equity is 15%?A) 13.5%B) 13.8%C) 27.0%D) It's impossible to determine the WACC without debt and equity betasAnswer: BType: MediumPage: 525Response: WACC = 0.4(0.12) + 0.6(0.15) = 0.048 + 0.09 = 0.1387.The CR Corp. maintains a debt-equity ratio of 0.5 The cost of equity for CR Corp. is 15%and the after-tax cost of debt is 9%. What is the after-tax weighted average cost ofcapital?A) 11.86%B) 12.00%C) 13.00%D) None of the aboveAnswer: CType: MediumPage: 525Response: (1/3)(9) + (2/3)(15) = 13%8. A firm is financed with 50% risk-free debt and 50% equity. The risk-free rate is10%, the firm's cost of equity capital is 20%, and the firm's marginal tax rate is 35%.What is the firm's weighted average cost of capital?A) 13.25%B) 10.00%C) 20.00%D) None of the aboveAnswer: AType: MediumPage: 525Response: (0.50)(1-0.35)(10) + (0.5)(20) = 13.2510. A firm is financed with 40% risk-free debt and 60% equity. The risk-free rate is 7%,the firm's cost of equity capital is 18%, and the firm's marginal tax rate is 35%.What is the firm's weighted average cost of capital?A) 18.00%B) 7.00%C) 13.60%D) 12.62%E) None of the aboveAnswer: DType: MediumPage: 525Response: (0.4)(1-0.35)(7) + (0.6)(18) = 12.62%11. Which of the following statements characterize(s) the weighted average cost ofcapital formula?A) It requires knowledge of the required return on the firm if it is all-equity financedB) It is based on book values of debt and equityC) It assumes the project is a carbon copy of the firmD) It can be used to take account of issue costs and other such financing side effectsAnswer: CType: DifficultPage: 52612. A firm is financed with 30% risk-free debt, 60% common equity and 10% preferredequity. The risk-free rate is 5%, the firm's cost of common equity is 15%, and that of preferred equity is 10%. The marginal tax rate is 30%. What is the firm'sweighted average cost of capital?A) 10.05%B) 11.05%C) 12.5%D) None of the aboveAnswer: BType: DifficultPage: 526Response: (0.3)(1-0.3)(5) + (0.6)(15) + (0.1)(10) = 11.0513. When the amount of debt is fixed, present value of tax-shield is calculated using:A) cost of debtB) cost of equityC) cost of capitalD) none of the aboveAnswer: AType: MediumPage: 527。

mba财务管理参考题目方向英文回答:1. Financial Statement Analysis.Vertical and horizontal analysis.Common-size financial statements.Trend analysis.DuPont analysis.Ratio analysis.2. Working Capital Management.Cash conversion cycle.Inventory management.Accounts receivable management. Accounts payable management.3. Capital Budgeting.Net present value (NPV)。

Internal rate of return (IRR)。

Payback period.Profitability index.4. Risk Management.Financial risk.Operational risk.Market risk.5. Investment Analysis.Bond valuation.Stock valuation.Portfolio management.6. Financial Planning and Forecasting. Financial planning process.Forecasting techniques.Sensitivity analysis.7. Management Accounting.Cost accounting.Budgeting.Performance measurement.Transfer pricing.8. Corporate Finance.Capital structure.Dividend policy.Mergers and acquisitions.9. Financial Ethics.Fiduciary duty.Conflicts of interest.insider trading.10. International Financial Management.Foreign exchange risk.Currency hedging.International investment.中文回答:1. 财务报表分析。

财务会计题库英文及答案1. Question: What is the purpose of the statement of cash flows in financial accounting?Answer: The purpose of the statement of cash flows is to provide information about the cash receipts and cash payments of an entity, showing how the changes in balance sheet accounts and income affect cash and cash equivalents, and to reveal the entity's financing and investing activities.2. Question: Explain the difference between a debit and a credit in double-entry bookkeeping.Answer: In double-entry bookkeeping, a debit is an entry on the left side of an account that either increases an asset or expense, or decreases a liability, equity, or revenue. A credit is an entry on the right side of an account that increases a liability, equity, or revenue, or decreases an asset or expense.3. Question: What is the accrual basis of accounting?Answer: The accrual basis of accounting is a method of accounting in which revenues and expenses are recognized when they are earned or incurred, not when cash is received or paid. This method provides a more accurate picture of a company's financial performance over a period of time.4. Question: How does depreciation affect a company's financial statements?Answer: Depreciation is a non-cash expense that allocates the cost of a tangible asset over its useful life. It affects the company's financial statements by reducing the asset's carrying value on the balance sheet and decreasing the net income on the income statement, which in turn can affect the retained earnings.5. Question: What is the primary goal of financial statement analysis?Answer: The primary goal of financial statement analysis is to assess the performance and financial condition of a company. It helps investors, creditors, and other stakeholders make informed decisions by evaluating the company's profitability, liquidity, solvency, and overall financial health.6. Question: What is the difference between a journal entry and a ledger entry?Answer: A journal entry records the initial transaction in the general journal, showing the date, accounts affected, and the amounts debited and credited. A ledger entry, on the other hand, is the posting of the journal entry to the appropriate accounts in the general ledger, which summarizes the transactions for each account.7. Question: Explain the matching principle in financialaccounting.Answer: The matching principle in financial accounting requires that expenses be recognized in the same period asthe revenues they helped to generate. This principle ensures that the income statement reflects the actual economic performance of the period and avoids distortions that could arise from recognizing revenues and expenses in different periods.8. Question: What is the purpose of adjusting entries?Answer: Adjusting entries are made at the end of an accounting period to ensure that the financial statements reflect the current financial position and performance of the company. They adjust for revenues and expenses that have been incurred but not yet recorded, or cash received or paid butnot yet recognized.9. Question: What is the difference between a budget and a forecast?Answer: A budget is a detailed financial plan thatoutlines expected revenues and expenses for a specific period, often used for internal management and control. A forecast,on the other hand, is a projection of future financial performance based on assumptions and trends, and is typically used for strategic planning and decision-making.10. Question: What is the role of the balance sheet infinancial accounting?Answer: The balance sheet is a financial statement that presents a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial stability. The balance sheet must always balance, with total assets equaling the sum of liabilities and equity.。