Accrual Estimates for Grant Programs

- 格式:pdf

- 大小:361.41 KB

- 文档页数:28

1、assets(资产):economicresources owned by the business that will benefit futureoperation,GAAP requires theyare valued at cost,notmarketvalue.2、Liabilities(负债):aredebets,the person or persons to whom they are owed are calledcreditors.3、Shareholders’equity(所有者权益):Creditors have legalpriority over theowners’claims.theshareholders’equity is theresidual amount.4、Revenues(收入):are increasesin stockholders’equityresulting from the costs ofselling goods,rending servicesor performing other businessactivities5、Expenses(费用):are decreasesin stockholders’equityresulting from the costs ofselling goods,rending serviceser performing other businessactivities.6、Balance sheet(资产负债表):is alisting of a company’s assets, liabilities and owners’ equity on a given date.it is designedto portray the financialposition of the company at aparticular time.7、Statement of owner’s equity(所有者权益表):shows the changestake place in the owner’scapital during a period of time net income or notloss.withdrawals,and owner’sinvestment for a business.8、Cash flow statement(现金流量表):reports cash receipt andpayments as well as cashinflows and actflows in threegroups:operatingactivites.investingactivites.and financingactivites.9、The income statement(利润表):reports the net income or nerless for the income: revenues-expenses.10、Accrual accounting(权责发生制):requires adjustment for prepaid unearned and accrued items thereforeit reports revenues when earnedand expenses when the expiration of benefit incurred.11、The matching rule(配比原则):states that expenses must be assigned to the accounting period in which they are used to produce revenue.12.going concern principle(持续经营):assumes that a business will continue for an indefinite period.13. time period principle(会计期间):an entity’s activities are divided into specific time periods.such as a year14. full disclosure(充分批露原则):financial statements must report all relevant information about the operations and financial position of the entity15.Consistency principle(一致性原则):an entry must use the same accounting methods period after period so that the financial statements of succeeding period will be comparable.16.materiality principle(重要性原则):an amount may be ignored if its affect on the financialstatements is not important to its users.17.conservatism principle(稳健性原则):the least optimistic estimate should be selected when two estimates of amounts to be received or paid are aboutequality likely;it is better to understate than over values.18.busniness entity principle(会计主体):each entity must keep accounting records and people reports that are distinct from those of the owner and any other entity.19.。

英语会计知识点总结IntroductionAccounting is a systematic process of recording, analyzing, and interpreting financial information of a business. It is an essential tool for business managers to make decisions, monitor performance, and report to stakeholders. This summary aims to highlight key accounting concepts, principles, and practices that are crucial for understanding and applying accounting knowledge.Accounting PrinciplesThere are generally accepted accounting principles (GAAP) that guide the preparation of financial statements and reports. These principles ensure consistency, comparability, and transparency in financial reporting. The basic accounting principles include:1. Going Concern Assumption: The assumption that a business will continue to operate in the foreseeable future.2. Accrual Basis: Recording revenues and expenses when they are earned or incurred, regardless of when cash is received or paid.3. Consistency: Using the same accounting methods and procedures from one period to another for comparability.4. Materiality: Reporting financial information that is significant and relevant to users.5. Cost Principle: Recording assets at their historical cost, not their current market value.6. Dual Aspect Principle: Every transaction has two aspects – a debit and a credit, which must be recorded in the accounting system.Financial StatementsFinancial statements are the end products of the accounting process. They provide a summary of the financial performance and position of a business. The main financial statements include:1. Income Statement: A report of revenues, expenses, and net income or loss for a specific period.2. Balance Sheet: A snapshot of the assets, liabilities, and equity of a business at a specific point in time.3. Cash Flow Statement: A report of cash inflows and outflows from operating, investing, and financing activities.4. Statement of Changes in Equity: A summary of changes in equity capital, including share capital, retained earnings, and other reserves.Accounting CycleThe accounting cycle is a series of steps that are performed to process financial transactions and produce financial statements. The steps in the accounting cycle include:1. Analyzing Transactions: Identifying and analyzing the financial effects of business transactions.2. Journalizing: Recording transactions in a chronological order in the general journal.3. Posting to Ledger: Transferring journal entries to individual accounts in the general ledger.4. Adjusting Entries: Making adjusting entries at the end of the accounting period to reflect accruals, deferrals, and estimates.5. Trial Balance: Preparing a trial balance to ensure that total debits equal total credits in the general ledger.6. Financial Statements: Preparing income statement, balance sheet, and other financial reports based on the trial balance.7. Closing Entries: Recording closing entries to transfer revenue and expense account balances to the income summary account.8. Post-Closing Trial Balance: Preparing a post-closing trial balance to ensure that temporary accounts have been closed and permanent accounts have the correct balances. Inventory Valuation MethodsInventory valuation is important for determining the cost of goods sold and the value of ending inventory. There are several inventory valuation methods, including:1. First-In, First-Out (FIFO): Assuming that the oldest units are sold first and the newest units remain in ending inventory.2. Last-In, First-Out (LIFO): Assuming that the newest units are sold first and the oldest units remain in ending inventory.3. Weighted Average Cost: Calculating the average cost per unit based on the total cost of goods available for sale.4. Specific Identification: Identifying the actual cost of each specific unit in the inventory. Depreciation MethodsDepreciation is the process of allocating the cost of a tangible asset over its useful life. Common depreciation methods include:1. Straight-Line Method: Allocating an equal amount of depreciation expense each accounting period.2. Declining Balance Method: Allocating a higher depreciation expense in the early years of an asset’s life.3. Units of Production Method: Allocating depreciation expense based on the actual usage or production of the asset.Revenue RecognitionRevenue recognition is the process of recording revenue when it is earned and realizable. The key principles of revenue recognition include:1. Recognition Criteria: Revenue should be recognized when it is earned, measurable, and collectible.2. Performance Obligation: Revenue should be allocated to each distinct performance obligation in a contract.3. Time of Transfer: Revenue should be recognized at the time of transfer of goods or services to the customer.4. Principal versus Agent: Revenue should be recognized based on whether the entity is a principal or an agent in a transaction.Financial AnalysisFinancial analysis involves using financial information to assess the performance and financial position of a business. Common financial analysis techniques include:1. Ratio Analysis: Calculating and interpreting financial ratios to evaluate liquidity, profitability, solvency, and efficiency.2. Trend Analysis: Analyzing the trend of key financial indicators over multiple periods to identify patterns and changes.3. Vertical Analysis: Comparing each line item on the financial statements to a common base, such as total revenue or total assets.4. Horizontal Analysis: Comparing financial data from different periods to identify changes and trends.ConclusionAccounting knowledge is fundamental for business managers, investors, creditors, and other stakeholders to understand and evaluate the financial health of a business. This summary provides an overview of key accounting concepts, principles, and practices that are essential for effective financial management and decision-making. By understanding and applying these accounting principles, individuals can make informed financial decisions and contribute to the success of their business endeavors.。

Accounting is a systematic method of recording,summarizing,analyzing,and reporting financial transactions and data.It is a fundamental part of business management and financial decisionmaking,providing essential information to various stakeholders, including investors,creditors,managers,and regulators.The Role of Accounting in Business1.RecordKeeping:Accounting begins with the recording of financial transactions.Every sale,purchase,payment,and receipt is documented in the companys books.This ensures that all financial activities are tracked and can be reviewed for accuracy.2.Financial Reporting:Through the process of accounting,businesses are able to compile and present financial statements such as the balance sheet,income statement,and cash flow statement.These reports provide a snapshot of the companys financial health at a given point in time.3.Budgeting and Forecasting:Accounting data is used to create budgets and financial forecasts.These tools help businesses plan for the future,allocate resources effectively, and make strategic decisions.4.Performance Measurement:Accounting provides the means to measure and evaluate a companys performance over time.Key performance indicators KPIs such as return on investment ROI,profit margins,and asset turnover ratios are derived from accounting data.pliance and Regulation:Businesses must comply with various financial reporting standards and regulations.Accounting ensures that financial records are accurate and in line with legal requirements,reducing the risk of penalties and fines.6.Internal Control:Accounting processes help to establish and maintain internal controls within an organization.These controls are designed to prevent fraud,errors,and financial mismanagement.Principles and Concepts of Accounting1.Double Entry System:This is a fundamental principle of accounting where every transaction is recorded twice as a debit and a credit to ensure that the accounting equation Assets Liabilities Owners Equity remains balanced.2.Accrual Basis Accounting:Under this method,revenues and expenses are recordedwhen they are earned or incurred,not when cash is received or paid.This provides a more accurate representation of a companys financial performance over a specific period.3.Conservatism:This principle suggests that accountants should exercise caution when making estimates and judgments.It is better to underreport profits than to overstate them.4.Materiality:Information is considered material if its omission or misstatement could influence the decisions of users relying on the financial statements.5.Going Concern:This assumption means that the business is expected to continue operating for the foreseeable future.It underpins the preparation of financial statements.6.Consistency:Once an accounting policy is adopted,it should be consistently applied from one period to the next,ensuring comparability of financial statements over time.Accounting Profession and EthicsThe accounting profession is governed by a set of ethical standards and professional codes of conduct.Accountants are expected to maintain integrity,objectivity,and confidentiality.They must also adhere to the principles of independence and professional skepticism when auditing financial statements.In conclusion,accounting is more than just a set of numbers it is a critical component of business operations that influences strategic planning,performance evaluation,and compliance with financial regulations.It is a discipline that requires precision,adherence to principles,and a commitment to ethical practices.。

会计专业英语名词解释Chapter 11. Accounting: Accounting is the process of identifying, measuring, recording, andcommunicating economic information to permit informed judgments and decisions by users of the information.2. Accrual basis accounting: Accrual basis accounting refers to an accounting methodthat records financial events based on economic activity rather than financial activity.Under accrual accounting, revenue is recorded when it is earned and realized, regardless of when actual payment is received. Similarly, expenses are matched with revenue regardless of when they are actually paid.3. Balance sheet: Balance sheet is the financial statement showing the financial positionof an entity by summarizing its assets, liabilities, and owner’s equity at one sp ecific date.4. Business entity: Business entity refers to an economic unit that controls resources,incurs obligations, and engages in business activities.5. CAS: Chinese Accounting Standards refer to the accounting concepts, measurementtechniques, and standards of presentation used in financial statements made by the PRC Financial Apartment.6. Cash basis accounting: Cash basis accounting is a method of bookkeeping thatrecords financial events based on cash flows and cash position. Revenue is recognized when cash is received and expense is recognized when cash is paid out.7. Conservatism: Conservatism states that when alternative accounting valuations areequally possible, the accountant should select the one that is least likely to overstate assets and income in the current period.8. Consistency: Consistency means that a company uses the same accountingprinciples and methods from year to year.9. Continuity: Continuity refers to an accounting assumption, also known as thegoing-concern assumption, that the company will continue to operate in the near future, unless substantial evidence to the contrary exists.10. Corporation: Corporation is a business organized as a separate legal entity understate corporation law and having ownership divided into transferable shares of stock.11. Cost principle: Cost principle is a widely used principle of accounting for assets at theiroriginal cost to the current owner.12. Financial accounting: Financial accounting refers to the development and use ofaccounting information describing the financial position of an entity and the results of its operations.13. Financial position: Financial position refers to the financial resources and obligationsof an organization, as described in a balance sheet.14. Financial reporting: Financial reporting refers to the process of periodically providing“general-purpose”financial information (such as financial statements) to persons outside the business organization.15. Financial statements: Financial statements refer to the four related accounting reportsthe summarize the current financial position of an entity and the results of its operations for the preceding year ( or other time period).16. Full disclosure principle: Full disclosure principle requires that circumstances andevents that make a difference to financial statement users be disclosed.17. Going-concern assumption: Go-concern assumption is an assumption by accountantsthat a business will operate indefinitely unless specific evidence to the contrary, such as impending bankruptcy, exists.18. Historical cost: The historical cost of an asset is the exchange price in the transactionin which the asset was acquired.19. Matching principle: Matching principle is an accounting principle that dictates thatexpenses be matched with revenue in the period in which efforts are made to generate revenue.20. Materiality: Materiality refers to the magnitude of an omission or misstatement ofaccounting information that, considering the circumstances, makes it likely that the judgment of a reasonable person relying on the information would have been influenced by the omission or misstatement.21. Market value: Market value is the estimated amount for which a property shouldexchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion,22. Net realizable value: The net realizable value of an asset is the amount of cash (or theequivalent) that could be obtained on the date of the balance sheet by selling the asset in its present condition, in an orderly liquidation.23. Income statement: Income statement is a financial statement indicating theprofitability of a business over a preceding time period.24. Partnership: Partnership is a business owned by two or more persons associated aspartners.25. Present value: The present value of an asset is the net amount of discounted futurecash inflows less the discounted future cash outflows relating to the asset.26. Proprietorship: Partnership is a business owned by one person.27. Relevance: Accounting information is relevant if it can make a difference in a decisionby helping users predict the outcomes of past, present, and future events or confirm or correct prior expectations. To be relevant, accounting information should have either predictive or feedback value, or both. In addition, it should be timely,28. Reliability: Reliable information is reasonably free from error and bias, and faithfullyrepresents what it is intended to represent. That is, to be reliable, information should be verifiable, neutral, and possess representational faithfulness,29. Revenue recognition principle: An accounting principle that dictates that revenue berecognized in the accounting period in which it is earned.30. Statement of cash flow: A financial statement summarizing the cash receipts and cashpayments of the business over the same time period covered by the income statement.31. Statement of owner’s equity: A financial statement explaining certain changes in theamount of the owner’s equity (investment) in the business.1. Asset: Assets mean the entire property of a person, association, corporation, or estateapplicable or subject to the payment of debts.2. Operating cycle: The operating cycle is the time span from when cash is used toacquire goods and service and until cash is received from the sale of goods and service.3. Cash: cash refers to an exchange medium launched into circulation which is availablefor any ordinary use and can be used to purchase goods or services or repay debts.4. Cash equivalents: Cash equivalents are short-term, highly liquid investments or otherassets that readily convertible to cash and sufficiently close to their due date.5. Internal control: Internal control means all policies and procedures used to protectassets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies.Chapter 31. Receivables: Receivables refer to the monetary claims against business, individualsand other debtors.2. Accounts receivable: Accounts receivables are amounts due from customers for creditsales. This section begins by describing how accounts receivables occur. It includes receivables that occur when customers use credit cards issued by third parties and when a company gives credit directly to customers.3. Installment accounts receivables: Installment accounts receivables are amounts overan extended time period.4. Commercial discounts: Commercial discounts refer to a certain sum of moneydeducted from listed prices.5. Cash discounts: Cash discounts refer to a deduction from gross invoice price, whichare an inducement offered to the buyer to encourage the payments of goods within a specific period of time.6. The percentage-of-sale method: The percentage-of-sale method estimates somepercentage of credit sales would turn out to be uncollectible, in which the percentage of bad debts to credit sales should be properly estimated with the past experience. 7. The percentage-of-receivable method: The percentage-of-receivable methodestimates the uncollectible with a percentage of the ending balance of accounts receivables rather than credit sales.8. The aging method: The aging method analyzes the age structure of the accountbalance. In this method, an aging schedule is prepared, classifying the length of time that has passes since the sale that gave rise to them.9. The allowance method: The allowance method is the most usual way that companiesuse to record uncollectible accounts. In calculating uncollectible accounts, an account allowances for uncollectible receivable is set up.10. Promissory note: A promissory note is a written promise to pay a certain sum ofmoney on demand or at a fixed and determinable future time, generally over 30 or 60 days.1. Inventory: Inventory is the total amount if goods and/or materials contained in a storeor factory at any given.2. Product costs: Product costs are those costs that “attach”to the inventory. Suchcharges include freight charges on goods purchased, other direct costs of acquisition, and labor and other production costs incurred in processing the goods up to the time of sale.3. The perpetual inventory system: The perpetual inventory system requires thatseparate inventory ledger be maintained for each goods.4. The periodic inventory system: The periodic inventory system requires a companydetermines the quantity of inventory on hand only periodically, under which the cost of ending inventory is subtracted from the cost of goods available for sale, then the cost of goods sold are determined.5. The specific identification method: The specific identification method can be usedwhen units in the ending inventory can be identified as coming from specific purchases.6. The weighted average cost method: The weighted average cost method assumes thatthe goods available for sale have the same cost per unit. Under this method, the cost of goods available for sale is allocated on the basis of the weighted-average unit c0st.7. The first-in, first-out (FIFO) method: The first-in, first-out (FIFO) method is base on theassumption that the costs of the first items acquired should be assigned to the first item sold.Chapter 51. Accelerated depreciation: Accelerated depreciation is a method of depreciation thatcall for recognition of relatively large amounts if depreciation in the early years of an asset’s useful life and relatively small amounts in the later years.2. Depreciable value: Depreciable value is the amount of the acquisition cost to beallocated as depreciation over the total useful life of an asset. It is the difference between the total acquisition cost and the estimated residual value.3. Depreciation: Depreciation is the systematic allocation of the cost of an asset toexpress over the years of its estimated useful life.4. Fair market value: Fair market value is the value of an asset based on the price forwhich a company could sell the asset to an independent third party.5. Impairment: Impairment is a change in economic conditions which reduces theeconomic usefulness of an asset.6. Residual value: Residual value is the amount a company expects to receive fromdisposal of an asset at the end of its useful life.7. Useful life: Useful life refers to the shorter of the physical life or the economic life of anasset.1. Amortization: The systematic write-off to expense of the cost of an intangible assetover the period of its economic usefulness.2. Copyright: A grant by the state government covering the right to publish, sell, orotherwise control literary or artistic products for the life of the author plus 50 years. 3. Franchises: Agreements entered into by two parties in which, for a fee, one party (thefranchisor) gives the other party (the franchisee) rights to perform certain functions or sell certain products or services.4. Goodwill: The present value of expected future earnings of a business in excess of theearnings normally realized in the industry.5. Identifiable intangible asset: Intangibles that can be purchased or sold separately fromthe other assets of the company.6. Intangible assets: Those assets which are used in the operation of a business butwhich have no physical substance and are not current.7. Leases (or leaseholds): Intangible assets because a right to use the property is heldby the lessee.8. Patent: An exclusive right granted by the state government giving the owner control ofthe manufacturing, sale, or other use of an invention for a period of years from the date of filling.9. Research and development costs: Expenditures that may lead to patent, copy rights,new processes and new products.10. Trademarks: Distinctive identifications of a manufactured product or of a service,taking the form of a name, a sign, a slogan, a logo, or an emblem.Chapter 71. Available-for-sale securities: Securities that may be sold in the future.2. Consolidated financial statements: Financial statements that present the assets andliabilities controlled by the parent company and the aggregate profitability of the affiliated companies.3. Cost method: An accounting method in which the investment in common stock isrecorded at cost and revenue is recognized only when cash dividends are received.4. Debt investments: Investments in government and corporation bonds.5. Equity method: An accounting method in which the investment in common stock isinitially recorded at cost and the investment account is then adjusted annually to show the investor’s equity in the investee.6. Fair value: Amount for which a security could be sold in a normal market.7. Held-to-maturity securities: Debt securities that investor has the intent and ability tohold to maturity.8. Investment portfolio: A group of stocks in different corporations held for investmentpurposes.9. Long-term investments: Investments that are not readily marketable and thatmanagement does not intend to convert into cash within the next year or operating cycle, whichever is longer.10. Parent company: A company that owns more than 50% of the common stock ofanother entity.11. Short-term investments: Investments that are readily marketable and intend to convertinto cash within the next year or operating cycle, whichever is longer.12. Stock investments: Investments in the capital stock of corporations.13. Subsidiary (affiliated) company: A company in which more than 50% of its stock isowned by another company.14. Trading securities: Securities bought and held primarily for sale in the near term togenerate income on short-term price differences.Chapter 81. Amortization table: A schedule that indicates how installment payments are allocatedbetween interest expense and repayments of principal.2. Capital lease: A lease contract which, in essence, finances the eventual purchase bythe lessee of leased property. The lessor accounts for a capital lease as a sale of property; the lessee records an asset and a liability equal to the present value of the future lease payments. A capital lease is also called a financing lease.3. Commercial paper: Very short-term notes payable issued by financially strongcorporations. They are highly liquid from the investor’s point of view.4. Commitments: Contracts for the future transactions.5. Contra-liability account: A ledger account which is deducted from or offset against arelated liability account in the balance sheet; for example, Discount on Notes Payable.6. Convertible bond: One which may be changed at the option of the bondholder for aspecific number of shares of common stock.7. Deferred income taxes: Income taxes upon income which already has been reportedfor financial reporting purposes, but which will not be reported in income tax returns until future periods.8. Discount on notes payable: A contra-liability account representing any interestcharges applicable to future periods included in the face amount of a note payable.Over the life of the note, the balance of the Discount on Notes Payable account is amortized into Interest Expense.9. Deducted bond: Debenture bonds refer to an unsecured bond.10. Estimated liabilities: Liabilities which appear in financial statements at estimatedamounts.11. Long-term liabilities: Obligations that are not due for at least a year.12. Loss contingency: A possible loss, or expense, stemming from past events, that willbe resolved as to existence and amount by some future event.13. Mortgage bonds: Bonds secured by the pledge of specific assets.14. Operating lease: A lease contract which is in essence a rental agreement. The lesseehas the use of the leased property, but the lessor retains the usual risks and rewards of ownership. The periodic lease payments are accounted for as rent expense by the lessee and as rental revenue by the lessor.Chapter 91. Income: Income is defined as increases in economic benefits during the reportingperiod in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Income encompasses both revenue and gains.2. Revenue: Revenue is income that arises in the course of ordinary activities of anentity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.3. Gains: Gains represent other items that meet the definition of income and may, or maynot arise in the course of the ordinary activities of an entity.4. Accrued revenue: Accrued revenue is the revenue that has been earned but not yetcollected.5. Trade discounts: Trade discounts depend on the volume of the business or size oforder from the customer.6. Cash discounts: Cash discounts are offered to customers by some companies toencourage prompt payment of bills.7. Expenses: Expenses are outflows or using up of assets as part of operations of abusiness to generate sales.8. Employee expenses: Employee expenses are the entitlements which employeesaccumulate as a result of rendering their services to an employer.9. Depreciation (amortization): Depreciation is a periodic expense of operations and isassociated with the consumption or loss of service potential of non-current assets. 10. Bad (doubtful) debts expense: Bad debts expense is, in effect, a reduction of the“receivables” asset.11. Income taxes expense: Income taxes expense is the expense recognized in theaccounting records on an accrual basis that applies to income from continuing operations.12. Profit: Profit is the ultimate result of various operating activities of the enterprise in areporting period.13. Accounting policies: Accounting policies are the specific principles, bases,conventions, rules and practices adopted by an entity in preparing and presenting financial statements.14. Applicable profit: Applicable profit is assets that can be distributed to all kinds ofbeneficiaries.Chapter 101. Owner’s equity: Owner’s equity refers to the sources invested by owners or formed inthe course of the production and operation or other sourced shared by owners.2. Par value: The par value is an arbitrary dollar amount assigned to each share.3. Treasury stock: Treasury stock may be defined as shares of a corporation’s owncapital stock that have been issued and later reacquired by the issuing company but that have not been canceled or permanently retired.4. Capital reserve: Capital reserve refers to the capital which isn’t viewed as the paid-incapital or capital stock.5. Undistributed profit: Undistributed profit is the profit that is not distributed toshareholders but retained to the later years.Journal entries1. A company had the following transactions during January: Using the net method ofrecording purchases, prepare the journal entries to record these January transactions.Jan.2 Purchased merchandise, invoice price of $20 000, with terms 2/10, n/30.4 Received a credit memorandum for $4 000, the invoice price on merchandisereturned from the purchase of January 2.12 Purchased merchandise, invoice price of $15 000, with terms 3/15, n/30.26 Paid for the merchandise purchased on January 12.30 paid for the merchandise purchased on January 2.Answer:Jan.2 Merchandise …………………………………………………….19 600Accounts payable………………………………………………………19 6004 Accounts payable…………………………………………………3 920Merchandise………………………………………………………………3 92012 Merchandise……………………………………………………..14 550Accounts payable………………………………………………………14 55026 Accounts payable………………………………………………..14 550Cash……………………………………………………………………..14 55030 Accounts payable………………………………………………..15 680Expense (400)Cash………………………………………………………………………16 0802. The following series of transactions occurred during 2010 and 2011, when LinwoodCo. sold merchandise to John Moore. Linwood’s annual accounting period ends on December 31.10/01/2010 Sold $12 000 of merchandise to John Moore, terms 2/10, n/3011/15/2010 Moore reports that he cannot pay the account until the early next year. He agrees to exchange the account for a 120-day, 12% note receivable.12/31/2010 Prepared the adjusting journal entry to record accrued interest on the note.03/15/2011 Linwood receives a check from Moore for the maturity value (with interest) of the note.03/22/2011 Linwood receives notification that Moore’s check is being returned for nonsufficient funds (NSF).12/31/2011 Linwood writes off Moore’s account as uncollectible.Prepared Linwood Co.‘s journal entries to record the above transactions.The company uses the allowance method to account for its bad debt expenses.Answer:Oct.1, 2010 Accounts receivable—Moore……………………………..12 000Sales……………………………………………………………..12 000 Nov.15, 2010 Notes receivable……………………………………………12 000Accounts receivable—Moore........................................12 000 Dec.31,2010 Interest receivable (184)Interest revenue (184)($12 000 x 0.12 x 46/360 = $184)Mar.15, 2011 Cash…………………………………………………………..12 480Notes receivable………………………………………………...12 000Interest receivable (184)Interest earned (296)($12 000 x 0.12 x 74/360 = $296)Mar.22, 2011 Accounts receivable—Moore……………………………….12 480Cash…………………………………………………………….12 480 Dec.31, 2011 Allowance for doubtful accounts……………………………12 480Accounts receivable—Moore…………………………………12 4803. (a) A company purchased a patent on January 1, 2006, for $2 500 000. The patent’slegal life is 20 years but the company estimates that the patent’s useful life will only be5 years from the date of acquisition. On June 30, 2006, the company paid legal costsof $162 000 in successfully defending the patent in an infringement suit. Prepare the journal entry to amortize the patent at year end on December 31, 2006.(b) Suxia Company purchased a franchise from Yanyan Food Company for $400 000on January 1, 2006. The franchise is for an indefinite time period and gives Suxia Company the exclusive rights to sell Yanyan Wings in a particular territory. Prepare the journal entry to record the acquisition of the franchise and any necessary adjusting entry at year end on December 31, 2006.(c) Chenghe Company incurred research and development costs of $500 000 in 2006in developing a new product. Prepare the necessary journal entries during 2006 to record these events and any adjustments at year end on December 31, 2006.Answer:JOURNAL ENTRIES(a) December 31, 20×6Amortization Expense …………………………………………..518 000Patent………………………………………………………………… 518 000 (To record patent amortization.)$2 500 000 ÷ 5 years ……………………..$500 000$162 000 ÷ 54 months = …………………….$3 000$3 000×6……………………………………. $18 000$518 000(b) January 1, 20×6Franchise ………………………………………………………..400 000Cash………………………………………………………………. 400 000(To record acquisition of T astee Food franchise.)December 31, 20×6No amortization of the franchise is required since its life is indefinite.(c) 20×6Research and Development Expense……………………….. 500 000Cash………………………………………………………………. 500 000 (To record research and development expense for the Current year.)December 31—no entry.4. Suxia Company had the following transactions pertaining to short-term investments inequity securities.Jan.1 Purchased 900 shares of Chenghe Company stock for $9 450 cash plus brokerage fees of $ 270June.1 Received cash dividends of $0.50 per share on Chenghe Company stock.Sept.15 Sold 400 shares of Chenghe Company stock for $ 4 300 less brokerage fees of $100Dec.1 Received cash dividends of $0.50 per share on Chenghe Company stock.(a) Journalize the transactions.(b) Indicate the income statement effects of the transactions.Answer:(a) Jan. 1 Stock Investments……………………………………….. 9 720Cash..................................................................... 9 720 June 1 Cash (900 × $0.50) .. (450)Dividend Revenue (450)Sept. 15 Cash ($4 300 – $100)…………………………………. 4 200Loss on Sale of Stock Investments (120)Stock Investments (400 × ($9 720 ÷ 900)) ......................4 320 Dec. 1 Cash (500 × $0.50). (250)Dividend Revenue (250)(b) Dividend Revenue is reported under Other Revenues and Gains on theincome statement. Loss on Sale of Stock Investments is reported under Other Expenses and Losses on the income statement.5. Presented below are the three independent situations:(a) Henry Corporation purchased $ 400 000 of its bonds on June 30, 2005 at 102 andimmediately retired them. The carrying value of the bonds on the retirement date was $ 367 200. The bonds pay semiannual interest and the interest payment due on June 30, 2005 has been made and recorded.(b) Rose, Inc., purchased $600 000 of its bonds at 96 on June 30, 2005 andimmediately retired them. The carrying value of the bonds on the retirement date was $ 590 000. The bonds pay semiannual interest and the interest payment due on June 30, 2005 has been made and recorded.(c) Sealy Company has $200 000, 10%, 12-year convertible bonds outstanding.These bonds were sold at face value and pay semiannual interest on June 30 and December 31 of each year. The bonds are convertible into 80 shares of Sealy $ 5 par value common stock for each $ 1 000 par value bond. On December 31, 2005 after the bond interest has been paid, $ 50 000 par value of bonds were converted.The market value of Sealy’s common stock was $ 48 per share on December 31, 2005.Instruction: For each of the independent situations, prepare the journal entry to record the retirement or conversion of the bonds.Answer:(a) June 30 Bonds Payable……………………………………………. 400 000Loss on Bond Redemption……………………………….. 40 800Discount on Bonds Payable ………………………………………...32 800Cash …………………………………………………………………408 000($400 000 – $367 200 = $32 800)($400 000 × 102% = $408 000)(b) June 30 Bonds Payable……………………………………………. 600 000Discount on Bonds Payable………………………………………... 10 000Gain on Bond Redemption ………………………………………….14 000Cash………………………………………………………………… 576 000($600 000 – $590 000 =$10 000)($600 000 × 96% =$576 000)(c) Dec. 31 Bonds Payable………………………………………………. 50 000Common Stock…………………………………………………….. 20 000Paid-in Capital in Excess of Par …………………………………..30 000($5 × 80 × 50 =$20 000)6. Maia’s Bike Shop uses the perpetual inventory system and had the followingtransactions during the month of May:May 3 Sold merchandise to a customer on credit for $ 600, terms 2/10, n/30. The cost of the merchandise sold was $ 350.May 4 Sold merchandise to a customer for cash of $ 425. The cost of themerchandise was $ 250.May 6 Sold merchandise to a customer on credit for $ 1 300, terms 2/10, n/30. The cost of the merchandise sold was $ 750.May 8 The customer from May 3 returned merchandise with a selling price of $ 100.The cost of the merchandise returned was $ 55.May 15 The customer from May 6 paid the full amount due, less any appropriate discounts earned.May 31 The customer from May 3 paid the full amount due, less any appropriate discounts earned.Prepare the required journal entries that Maia’s Bike Shop must make to record these transactions.。

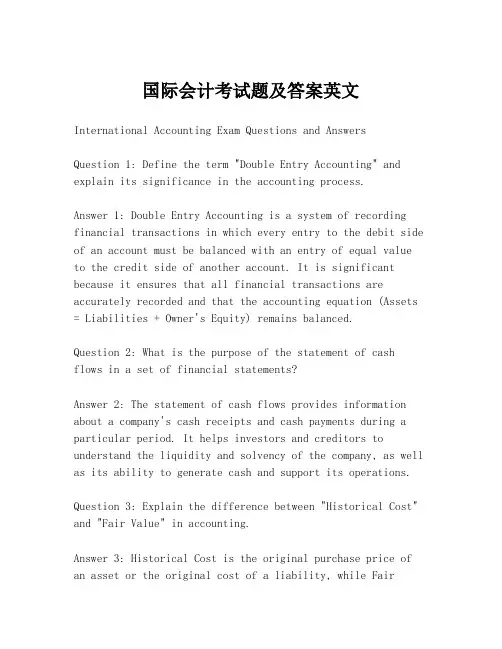

国际会计考试题及答案英文International Accounting Exam Questions and AnswersQuestion 1: Define the term "Double Entry Accounting" and explain its significance in the accounting process.Answer 1: Double Entry Accounting is a system of recording financial transactions in which every entry to the debit side of an account must be balanced with an entry of equal value to the credit side of another account. It is significant because it ensures that all financial transactions are accurately recorded and that the accounting equation (Assets = Liabilities + Owner's Equity) remains balanced.Question 2: What is the purpose of the statement of cash flows in a set of financial statements?Answer 2: The statement of cash flows provides information about a company's cash receipts and cash payments during a particular period. It helps investors and creditors to understand the liquidity and solvency of the company, as well as its ability to generate cash and support its operations.Question 3: Explain the difference between "Historical Cost" and "Fair Value" in accounting.Answer 3: Historical Cost is the original purchase price of an asset or the original cost of a liability, while FairValue is the estimated amount for which an asset could be exchanged or a liability settled between knowledgeable,willing parties in an arm's length transaction. Historical Cost is used in the preparation of financial statements under the accrual basis of accounting, whereas Fair Value is often used for valuation purposes, particularly in the context of financial instruments.Question 4: What are the main components of the International Financial Reporting Standards (IFRS)?Answer 4: The main components of IFRS include the IFRS Standards, the International Accounting Standards (IAS), the Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC), and theStandards Advisory Council (SAC). These components provide a comprehensive set of rules and guidelines for the preparation and presentation of financial statements.Question 5: Describe the process of preparing a balance sheet.Answer 5: Preparing a balance sheet involves listing all of a company's assets, liabilities, and equity at a specific point in time. Assets are listed on the left side of the balance sheet and are categorized as current (short-term) or non-current (long-term). Liabilities are listed on the right side and are also categorized as current or non-current. Theequity section shows the owner's investment and retained earnings. The balance sheet must always balance, reflectingthe equation: Assets = Liabilities + Equity.Question 6: What is the role of an auditor in the financial reporting process?Answer 6: An auditor's role is to provide an independent assessment of a company's financial statements to ensure they are free from material misstatement and are presented fairly, in all material respects, in accordance with the applicable financial reporting framework, such as IFRS or Generally Accepted Accounting Principles (GAAP). The auditor's report provides assurance to stakeholders that the financial statements are reliable.Question 7: Explain the concept of "Conservatism" infinancial accounting.Answer 7: Conservatism is a principle in financial accounting that suggests that accountants should exercise caution when making estimates and judgments. It involves recognizing potential losses immediately but delaying the recognition of gains until they are realized. This principle helps to avoid overstatement of assets and income, thus providing a more prudent and cautious view of a company's financial position.Question 8: What is the difference between "Revenue Recognition" and "Matching Principle"?Answer 8: Revenue Recognition is the process of recognizing revenue in the accounting records when it is earned or realizable and has been measured reliably. The Matching Principle, on the other hand, is the accounting concept that requires expenses to be recognized in the same period as therevenues they helped to generate. This ensures that the financial statements reflect the actual performance of the company for a given period.Question 9: Describe the purpose of the "Going Concern" assumption in financial accounting.Answer 9: The Going Concern assumption is the basis for preparing financial statements under the accrual basis of accounting. It assumes that the business will continue to operate for the foreseeable future and that it is not in the process of liquidation or bankruptcy. This assumption allows accountants to spread the costs of assets over their useful lives and to recognize revenues and expenses when they are earned or incurred, rather than when cash is received or paid.Question 10: What is the "Materiality" concept in the context of financial statements?Answer 10: Materiality is a concept in financial accounting that refers to the significance of an item or event inrelation to the financial statements. Information is considered material if its omission or misstatement could influence the economic decisions of users taken on the basisof the financial statements. The assessment of materiality depends on the size and nature of the item, the nature of the financial statements, and the needs of the users.End of Exam。

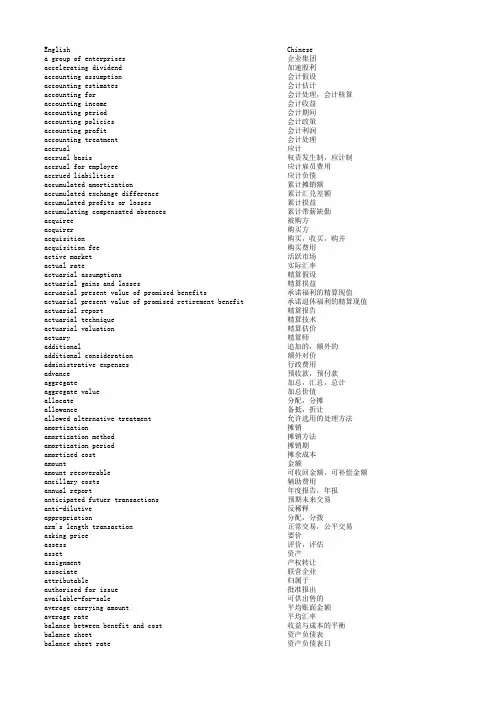

Englisha group of enterprisesaccelerating dividendaccounting assumptionaccounting estimatesaccounting foraccounting incomeaccounting periodaccounting policiesaccounting profitaccounting treatmentaccrualaccrual basisaccrual for employeeaccrued liabilitiesaccumulated amortizationaccumulated exchange differenceaccumulated profits or lossesaccumulating compensated absencesacquireeacquireracquisitionacquisition feeactive marketactual rateactuarial assumptionsactuarial gains and lossesacruarial present value of promised benefitsactuarial present value of promised retirement benefit actuarial reportactuarial techniqueactuarial valuationactuaryadditionaladditional considerationadministrative expensesadvanceaggregateaggregate valueallocateallowanceallowed alternative treatmentamortizationamortization methodamortization periodamortized costamountamount recoverableancillary costsannual reportanticipated futuer transactionsanti-dilutiveappropriationarm's length transactionasking priceassessassetassignmentassociateattributableauthorised for issueavailable-for-saleaverage carrying amountaverage ratebalance between benefit and costbalance sheetbalance sheet ratebalance sheet liability methodbank overdraftsbasic earnings per sharebeginning of the periodbenchmark treatmentsbeneficiarybest estimatebid bondsbid pricebillsbinding sale agreementboard of directorsbonusbonus issuebonus planborrowing aggreementsborrowing costbottom-up testbranchbrokeragebusiness combinationbusiness combination which is an acquisition business segmentbuy backbuying segmentcall optioncallablecallable debtcapcapitalcapital approachcapital asset pricing modelcapital commitmentcapital contributionscapital gaincapital maintenancecapital trasactionscapitalisationcapitalization issuescapitalization ratecarry forwardcarry forward of unused tax creditcarry forward of unused tax lossescarrying amountcarrying back a tax losscashcash basiscash equivalentscash flowcash flow riskcash flow statementscash generating unitcash in bankscash inflowcash on handcash outflowcertificates of depositchanges in accounting policieschanges in financial positioncharge againstchief executive officerclass of assetsclassificationclearing houseclosing ratecollateralcollateralised borrowingcollectabilitycollection costcombination of sharescombinecombined entitycombined resultcombining and segmenting construction contract combining enterprisecommissioncommitmentcommitment feecommodity contractcommodity future contractcmmodity-based contractcommon sharecomparabilitycomparable unconrolled price method comparative periodcompensated absencescompensationcompound instrumentcomputer softwareconcentration of credit riskconsiderationconsistencyconsolidated balance sheetconsolidated financial statementsconsolidated groupconsolidated income statementconsolidationconsolidation of sharesconsolidation procedureconstant rate of returnconstruction contractconstruction overheadconstructive obligationconsumablecontingenciescontingent assetcontingent commitmentscontingent gainscontingent liabilitiescontingent lossescontingent rentalcontingently issuable sharescontractcontractorcontractual obligationcontractual provisioncontractual rightcontributecontributioncontrolconventionconversion optionconversion rightconvertconvertibleconvertible bondscopyrightcorporate assetscorridorcostcost methodcost of acquisitioncost of an investmentcost of conversioncost of disposalcost of goods soldcost of inventoriescost of laborcost of purchasecost of salescost of sales methodcost recovery approachcost savingcost-plus contractcost-plus methodcosts of acquisitioncosts of materialcosts of registeringcosts to completecounterpartycreditcredit facilitiescredit riskcredit termcreditorcreditworthinesscumulative preference dividends cunulative preferred sharecurrency riskcurrency swapcurrency traslation differences cunrrent and expected profitabilty current assetscurrent costcurrent cost approachcurrent cost financial statements current interest ratecurrent investmentscurrent liabilitiescurrent periodcurrent salary approchcurrent service costcurrent taxcurtailmentcustomer loyaltydate of acquisitiondate of contributiondate of the reportdate of the valuationday-to-day activitydealing securitiesdebt defaultdebt instrumentdebt securitydebt-equity ratiodeclinedeductible temporary differences defaultdeferral methoddeferred compensationdeferred compensation arrangement deferred foreign exchange gain or loss deferred incomedeferred paymentdeferred payment termsdeferred revenuedeferred tax assetdeferred tax liabilitiesdeferred taxesdefined benefit liabilitydefined benefit obligationdefined benefit plansdefined contribution plansdegree of comparabilitydeliverydemand depositsdemonstrably committeddeposit withdrawaldepreciable amountdepreciable assetdepreciationdepreciation methoddepreciation ratederecognise(a financial instrument) derecognitionderivate financial instruments derivativedevelopment costdevelopment expenditure development phrasediluted earnings per sharedilutivedilutive optiondilutive potential ordinary shares diminishing balance methoddirect effectdirect increment costdirect investmentdirect labordirector methoddirect relationshipdirectly attributable expenditure dischargedisclosedisosurediscontinued operations disecontinuing operationdiscountdiscount ratedisposaldisposal considerationdisposal of subsidiariesdisposalsdistress saledistributiondistribution costsdividend incomedividend receivabledividend yielddividendsdividends policydocumentary creditdownstream transactionsearningsearnings per shareearnings-generating capacity economic benefitseconomic lifeeconomic performanceeffective dateeffective intesest methodeffective yieldeliminateembedded derivativeemployee benefitemployee benefit costemployee share ownership plan employment termination indemnityend of the periodentityequityaquity capitalequity compensation benefitsequity compensation plansequity financial instrumentequity instrumentsequity issueequity methodequity securitiesestimated valueevalateevents after the balance sheet dateexchange rateexchange controlsexchange differencesexchange lossexchange of assetsexecutionexecutory contractexercise dateexercise priceexisting useexpected growth rateexpected valueexpenditures carried forwordexpensesexperience adjustmentsexpiryexpiry dateexplanatory notesexplorationexposureex-rightsextend the termexternal customerextinguishextinguishment of debtextractionextraordinary itemsface of the balance sheetface of the income statementfair presentationfair valuefaithful representationfeefellow subsidiaryFIFO formulafinance chargefinance costsfinance incomefinance leasefinancial asset or liability held for trading financial assetsfinancial budgetingfinancial guaranteefinancial institutionfinancial instrumentfinancial interestfinancial liabilityfinancial or fiscal aidsfinancial performancefinancial policyfinancial positionfinancial reportfinancial reportingfinancial reviewfinancial rightsfinancial statementsfinancial structurefinancial supportfinancial yearfinancial year-to date basisfinancing activitiesfinancing arrangementfinancing devicefinished goodsfirm commitmentfirm purchase contractfirm sales contractfiscal policyfixed price contractfixed production overheadsfixed redemption valuefloating ratefloorforced transactionforeign activityforeign currencyforeign currency borrowingforeign currency hedgingforeign currency translationforeign entityforeign exchange gains and lossesforeign operationforeseeable lifeforgivable loansforward contractframeworkfranchise feefranchiseefranchisesfranchisorfrequency of actuarial valustionfull paidfundamental errorsfunding policyfunding riskfunds held for customersfurther costsfuture economic benefitsfuture contractgainsgeneral administrative expensegeneral disclosures(in financial statements) general price levelgeneral purchasing power approachgeneral purpose financial statementsgeneral salarygeographical segmentsgoing concerngoodwillgovernment assistancegovernment grantsgovernment procurementgrants related to assertsgrants related to incomegross carrying amountgross investment in the leasegross margin on salegross profitgroup administration pland(employee benefit) guarateed residual valueheadingshead-office expenseshedge accountinghedge effectivenesshedge itemhedginghedging instrumentheld for tradingheld-to-maturity investmenthire-purchase contracthistorical costhistorical cost systemhold harmless agreementholding companyhost contracthyperinflationhyperinflationary economyidentifiabilityidentifiable assertidentification of asserts and liabilitiesidentifyimmaterialimpairmentimpairment lossimpair of assetsimputed costimputed rate of interestincentiveinception of a leaseincidenceincomeincome approachincome from associatesincome statementincome statement liability methodincome taxincome tax assetsincome tax lawincome tax liabilitiesincome-producing assetsincremental borrowing rate of interest(lessee's) incremental shareindemnity claueseindirect methodindividual assetindividual liabilityinitial carrying valueinitial disclosure event(for a discontinuing operation) initial measurementinitial recognitioninsurance conractinsurance premiuminsurerintangible assetsintest cost (for an employee benefit plan)interest in joint venturesinterest incomeinterest or non-interest-bearing liabilities and provisions interest rate capsinterest rate callarsinterest rate floorsinterest rate implicit in a leaseinterest rate riskinterest rate swapinterest receivableinterest-bearing liabilityinterim financial reportinterim periodinternal management structureinternal organizational structureinternal profitinternally reported segmentinternally generated goodwilInternational Accounting Standard(IAS) International Accounting Standards Committee(IASC) intra-group transactioninventoriesinvesting activitiesinvesting enterpriseinvestmentinvestment earninginvestment performanceinvestment propertiesinvestment securitiesinvestment tax creditinvestor in a joint ventureinvoluntary liquidationissue of shareissued capitalitemjoint controljoint ownershipjoint productjoint venturejoint venture activitiesjoint venture agreementjointly controlled assetsjointly controlled entityjointly controlled operationjurisdictionlabourleaselease termlegal adviserlegal costslegal entitylegal mergerlegal obligationlegally enforceable rightlenderlender's returnlesseelessorletter of creditlevel yieldleveraged leaseliabilityliability methodlicenselicense feelicenseelicensing agreementlicensorlife insurance enterpriseLIFO formulaline-by-line reporting formatline-itemsliquidationliquidityliquidity riskloan syndication feeloan and receivables originated by the enterpriselong-term assetlong-term investmentlong-term loanlong-term receivableslosseslower of cost and market value maintenancemajority interestmanagementmandatory redemptionmanufacturing licencesmarginmarket interest ratemarket riskmarket valuemarketablemarketable securitiesmarketing rightmaster netting arrangement mastheadsmatchmatching conceptmatching of cost with revenues materalitymatrix appraochmatrix presentationmaturitymeasurementmeaurementmeasurement basesmedical costmergermineral extraction industries mineral rightminimum componentsminimum lease paymentsminority interestsmonetary assetsmonetary financial assetmonetary itemsmore likely than notmortgage servicing rightsmulti-employer(benefit) plans mutual fundsnature of expense methodnegative goodwillnegotiable papernet assets available for benefits net basisnet incomenet investmentnet investment in a foreign entity net investment in a leasenet lossnet monetery positionnet profitnet realisable valuenet result of operationnet selling priceneutralitynominal amountnominal considerationnon-cancellable leasenon-cash transactionnon-current assetsnon-marketable securitynon-monetary assetsnon-monetary benefitnon-monetary itemsnon-recoursenon-regencrative resourcesnormal capacity of production facilities note issuance facilitiesnotesnotes payablenotional amountobligating eventobligationoff-balance-sheet itemsoffer priceoffsettingon-balance-sheet itemsonerous contractoperating activitiesoperating assertsoperating costsoperating cycleoperating efficiencyoperating expensesoperating incomesoperating leaseoperating liabilitiesoperating policyoperating profitoperating segmentoptionoption contractoption pricing model valuationordinary activitiesordinary course of businessordinary itemordinary shareorganizational componentorganizational unitsoriginated loans and receivablesother claims payableother long-term employee benefitsother non-trade payablesoutright saleoutstandingoutstanding itemoutstanding sharesover the counter marketoverheadowener's equityownershippaid in capitalpar valueparent enterpriseparticipantspartly paidpartnershippast eventspast expensespast service costpatentpayablepayroll taxpensionpension planpercentage-of-completion methodperpetual debt instrumentsphysical wear and tearplan assets(for an employee benefit plan) pledgepoolpooling of interest methodportfoliopost-employment benefit planspost-employment benefitspotential benefitpotential ordinary sharepracticepredictabilitypreference sharepreferred capitalpremiumpre-opening costsprepaid expensepreparationprepaymentspresent obligationpresent valuepresent value of a defined benefit obligation presentationpresentation of financial statementprevious periodprice earings ratioprice quotationsprice riskpricingpricing modelprimary financial instrumentsprimary reporting formatprinciple-onlyprinciplepro forma informationpro rata basisprobable future economic benefitsprocessprocess of aggregationproduct life cycleprofit after taxprofit before taxprofit for the periodprofit sharingprofit sharing planprogress billingsprogress paymentproject managerprojected salary approchprojected unit credit methodpromissory notepronouncementproperty,plant and equipmentproportionate consolidationprospective applicationprovisonprovison for lossesprovision for taxes payableprovision for restructuringprudencepublic documentpublicly tradedpublishing titlepurchasepurchase methodpurchase priceput optionqualified actuaryqualifying assetsquotaquotationquoted market pricerates of returnraw materialsreal estaterealisable valuerealized profit and loss reasonable approximation reasonable profit allowance rebatesrebuttable presumption receiptsreceivablerecognitionrecognition criteria reconciliationrecoverrecoverabilityrecoverable amountredeemrediscountreductionrefinancingrefinancing agreementrefundregular way contract regulatorsreguilatory authorities reimbursementrelated partiesrelated partiy disclosures related partiy relationship related partiy transaction relevancereliabilityreliability of measurement reliable estimateremaining useful life remeasurerenewablerentalsreorganisation of the group repaymentrepayment of share capital replacement cost of an asset reportable segmentreporting currencyreporting datereporting enterprisereporting on a net basis reporting periodreporting practicerepricing daterepurchase agreementresale price method reschedule paymentsresearchresearch and development cost research phaseresidual valuationresidual valueresource embodying economic benefitsrestatementrestructure of the grouprestructuringresult of operationresults of operating activitiesretail methodretained earningsretentionretirementretirement benefitretirement benefit costsretirement benefit planretrospective applicationreturn of investmentreturn on capitalreturn on investmentreturn on plan assets(of an employee benefit plan) return on turnoverrevaluationrevaluation surplusrevalued amount of an assetrevenuereversalreverse acquisitionreverse purchase agreementreverse share splitreverse stock splitreversedreviewrewardrewards associated with a leased assetright issuerisk diversificationrisk exposurerisk poolingrisks associated with a leased assetroyaltysale and leaseback transactionsalessales revenuesecondary segment reporting formatsecured liabilitiessecuritisationsecuritized assetssegmentsegment accounting pilicessegment assetssegment disclouresegment expensesegment liabilitysegment reportingsegment resultsegment revenuesegmentalselling costsselling priceselling segmentsensitivityseparabilityseparate acquisitionseparate financial statementset-offsettlement valueshareshare capitalshare optionshare option planshare premiumshare splitshare warrantshareholder's equityshareholder's interestsshort sellershort-term employee benefitssick paysignificant influencesignificant transactionsinking fund arrangementsite labor costsite supervisionsocial security arrangementsocial security contributionsolvencyspecial participation rightspin-offspot ratestaff coststages of vertically integranted operations stamp dutystandard cost methodstandard letters of creditstanding interpretation committeestart-up coststate (employee benefit ) planstated interest ratestated valuestatement of accounting policystatement of changes in equitystock dividendstock optionstock purchase planstock aplitstraight-line methodstrategic investmentsubleasesubsequent changesubsequent costsubsequent expendituresubsequent measurementsubsidiariessubstance over formsubventionsucessive share purchasessum-of-the-units methodsupervisory non-management directorssuretysurplussurplus fundswapswap contractsynergysynthetic instrumentsystematic methodtangible assetstax assetstax basetax benefittax liabilitytax losstax loss for carry backtax loss for carry forwardtax payabletax planning opportunitiestaxable entitytaxable incometaxable profittaxable temporary differencetaxationtaxes on incometemporary investment termtermterminationterminationg benefitstermination indemnitiesthresholdtimelinesstime-weighted factortiming differencestitle to assetstop-down testtotal carrying amounttotal return swaptrade and other payablestrade and other receivablestrade discounttrade discount and rebatetrade investmenttrade liabilitiestrademarktransaction costs (financial instruments) transanction in foreign currencytransfertransfer pricetransitional liability ( defined benefit plans) transitional provisiontreasury sharestrue and fair viewtrust activitiestrust fundtrusteesultimate redemption valueunderlyingunderlying financial instrumentunderlying primary financial instrument understandabilityunearned finance incomeunguaranteed residual valueunit of production methoduniting of interestsunquotesunrealized gainunrealized lossunrealized profitunused tax creditunusual itemupstream activitesupstream productupstream transactionsuseful lifevacation payvalid expectationvaluationvariable production overheadsventurervested employee benefitsvoting rightwarrantwarrantywarranty costswarranty provisionsweighted average cost formulasweighted average cost methodwelfare planwholly-owned subsidiarywithholding taxwork in progresswork performed by the enterprises and capitalised working capitalwrite backwrite downwrite offwrite-down investories on an item by item basis writeryield企业集团加速股利会计假设会计估计会计处理,会计核算会计收益会计期间会计政策会计利润会计处理应计权责发生制,应计制应计雇员费用应计负债累计摊销额累计汇兑差额累计损益累计带薪缺勤被购方购买方购买,收买,购并购买费用活跃市场实际汇率精算假设精算损益承诺福利的精算现值承诺退休福利的精算现值精算报告精算技术精算估价精算师追加的,额外的额外对价行政费用预收款,预付款加总,汇总,总计加总价值分配,分摊备抵,折让允许选用的处理方法摊销摊销方法摊销期摊余成本金额可收回金额,可补偿金额辅助费用年度报告,年报预期未来交易反稀释分配,分拨正常交易,公平交易要价评价,评估资产产权转让联营企业归属于批准报出可供出售的平均账面金额平均汇率收益与成本的平衡资产负债表负债法银行透支基本每股收益期初基准处理方法受益方最佳估计投标保函出价票据约束性销售协议董事会奖金,红利红股奖金计划借款协议借款费用自下而上测试分支机构经纪人佣金,经纪人业务企业合并购买式企业合并业务分部回购采购分部看涨期权,买入期权可赎回的可赎回债券(利率)上限资本资本法资本资产定价模型资本承诺资本投入资本利得资本保全资本交易资本化资本化发行资本化比率结转后期未利用的税款抵扣结转后期未利用的可抵扣(应税利润额的)亏损结转后期账面金额可抵扣(应税利润额的)亏损抵前现金收付实现制现金等价物现金流量现金流量风险现金流量表现金产出单元银行存款现金流入库存现金现金流出存单会计政策变更财务状况变动借记,计入首席执行官,行政总裁,总经理资产类别归类,分类清算所期末汇率可回收性收账费用并股合并合并实体合并经营成果合并和分立的建造合同参与合并的企业佣金承诺承诺费,承约费商品合同商品期货合同以商品为基础的合同普通股可比性不加控制的可比价格法比较期间带薪缺勤补偿,报酬复合金融工具计算机软件信用风险集中对价一致性合并资产负债表合并财务报表合并集团合并收益表合并并股合并程序固定回报率建造合同施工间接费用推定义务易耗品或有事项或有资产或有承诺或有利得或有负债或有损失或有租金或有可发行股合同,合约承包商合同义务合同条款合同权利注资,出资出资,提存金控制惯例转换期权转换权转换可转换可转换债券版权总部资产区间成本成本法购买成本,收买成本,购并成本处置成本销售成本存货成本人工成本采购成本销售成本销售成本法成本回收法成本节省成本加成合同成本加成法购买成本材料成本注册费用完工尚未发生的成本对应方贷记,贷项信用便利信用风险赊销期限债权人信用可靠度累积优先股股利累积优先股货币风险货币互换货币折算差额当期和预期获利能力流动资产现行成本现行成本法现行成本财务报表现行利率短期投资流动负债当期当期工资法当期服务成本当期税金缩减顾客信赖,顾客忠诚购买日,收买日,购并日出资日报告日评估日日常活动交易性证券债务拖欠债务性工具债务性证券债务-权益比率下跌可抵扣暂时性差异违约递延法递延酬劳递延酬劳安排递延汇兑损益递延收益递延付款递延付款条件递延收入递延所得税资产递延所得税负债递延所得税设定受益计划设定提存计划可比程度交付,交割,交货;送达活期存款明确承诺提取存款应折旧金额应折旧资产折旧折旧方法折旧率终止确认(某一金融工具)终止确认(某一金融工具)衍生金融工具衍生工具开发费用开发支出开发阶段稀释每股收益稀释稀释选择权稀释性潜在普通股余额递减折旧法直接影响直接增量费用直接投资直接人工直接发直接关系可直接归属的支出解脱,解除披露披露已终止经营终止经营折价,折扣,贴水折现率处置处置收入子公司的处置处置亏本销售分派,分配销售费用,分销费用股利收益应收股利股利率股利股利政策跟单信贷下游交易,下销交易收益每股收益,每股盈利获利能力经济利益经济寿命经济业绩生效日期实际利率法实际收益率消除嵌入衍生工具雇员福利雇员福利费用期末实体权益权益资本权益计酬福利权益计酬计划权益性金融工具权益性工具股份发行权益法权益性证券估计价值评价,估价资产负债表日后事项汇率外汇管制汇兑差额汇兑损失资产交换执行待执行合同行使日行使价格现有用途,现行用途预期增长率预期价值,预期价值法结转后期的支出费用经验调整失效,满期,终止满期日,终止日说明性注释勘探风险敞口除权展期外部客户消除消除债务采掘非常项目资产负债表表内收益表表内公允表述,公允列报公允价值真实反映费,手续费伙伴子公司先进先出法筹资费用筹资成本融资收益融资租赁为交易而持有的金融资产或负债金融资产财务预算财务担保金融机构金融工具财务权益金融负债财务或财政援助财务业绩财务政策财务状况财务审阅,财务审核财务权利财务报表财务结构财务支持财务年度财务年度年初至今基础筹资活动筹资安排筹资手段产成品确定承诺确定购买合同确定销售合同财政政策固定造价合同固定制造费用固定赎回价值浮动利率,浮动汇率(利率)下限强制性交易国外业务外币外币借款外币套期外币交易国外实体汇兑损益国外经营预计寿命饶让贷款远期合同框架特许权费受让人(接受特许权人)特许权费特许人(授出特许权人)精算估价周期全额支付重大差错注资政策注资风险代客持有资金追加费用未来经济利益期货合同利得一般行政费用(财务报表中)一般披露要求一般物价水平一般购买力法通用财务报表一般工资水平地区分部持续经营商誉政府援助政府补助政府采购与资产相关的政府补助与收益相关的政府补助账面总金额融资租赁投资总额销售毛利毛利指南标题总部的费用套期会计套期有效性被套期项目套期套期工具为交易而持有持有至到期的投资租购合同历史成本历史成本制度损坏责任转移协议控股公司主合同恶性通货膨胀恶性通货膨胀经济可辨认性可辨认资产资产和负债的认定认定,辨认不重要减值减值损失资产减值推算成本,假计成本估算利率奖励租赁起始日发生率收益收益法来自联营企业的收益收益表收益表负债法所得税所得税资产所得税法所得税负债产生收益的资产(承租人)增量借款利率增量股份豁免条款间接法单个资产,个别资产单个负债,个别负债初始账面价值(终止经营的)初始披露事项初始计量初始确认保险合同保险费承保人无形资产(雇员福利计划的)利息成本合营企业中的权益利息收益附息或不附息的负债与准备利率上限利率上下限组合利率下限租约中的内含利率利率风险利率互换本金剥离中期财务报告中期内部管理结构内部组织结构内部利润内部报告分部自创商誉国际会计准则国际会计准则委员会集团内部交易存货投资活动投资企业投资投资收益投资业绩投资性房地产投资性证券投资税款抵减合营中的投资者非自愿清算股票发行已发行股本项目共同控制共同拥有合营产品合营企业合营活动合营协议共同控制资产共同控制实体共同控制景扬管辖区域,管辖范围人工租赁租赁期法律顾问律师费用法律实体法定兼并法定义务法定执行权贷款人出借方回报承租人出租人信用证平均收益率杠杆租赁负债负债法许可证许可证费,执照费许可证受让人许可协议许可证让予人人寿保险企业后进先出法逐项报告格式单列项目清算流动性流动性风险。

![CFA一级复习试题精华材料[FSA部分]](https://uimg.taocdn.com/4ec5efea76eeaeaad1f33074.webp)

Barriers to developing one universally accept set of financial reporting standard:1. Different standard-setting bodies and the regulatory authorities of different countries can and do disagree on the best treatment of a particular item or issue.2. Political pressures that regulatory bodies face from business groups and others who will be affected by changes in reporting stan dards.范文范例参考指导范文范例 参考指导IASB conceptual frameworkFundamental principles for preparing F/S: AA CC FG MN R 1. Going concern basis2. Accrual basis of accounting3. Fair presentation4. Consistency5. Materiality :free of misstatements or omissions ,重大性,重大的才是相关的6. Comparative information7. Aggregation :Aggregation of similar items and separation of dissimilar items.8.No offsetting,不允许相互抵消9.Reporting frequency:Coherent financial reporting framework:1. Transparency; 2. Comprehensiveness; 3. ConsistencyBarriers to creating a coherent financial reporting framework:1.Valuation;2.Standard setting: "principles-based" approach (IFRS); "rules-based" approach (GAAP);"objectives-oriented" approach;3.Measurement: "asset/liability" approach; "revenue/expense" approach;范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导The statement of changes in equity 范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导Cash Flow Statement — Memorizing TipsLiability:+ Δ + (ending – beginning) Assets: - Δ - (ending – beginning) Cash inflow: +Cash outflow: -范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导范文范例参考指导例:范文范例参考指导范文范例参考指导范文范例参考指导●Capitalize or Expense: capitalized today will be expensed in the future●Capitalized expenditures are classified as CFI. Expensed expenditures are classified as CFO●要理解:对比expensing的话,capitalizing会使assets更高,equity更高,income volatility更低,第一年的NI更高(因为没有费用),后几年的NI更低(因为费用摊到后面),CFO更高、CFI更低(因为capitalizing是CFI流出,expenditure是CFO流出),总现金流是不变的。