China_Regional_Aviation_Market_Outlook_2014-2033

- 格式:pdf

- 大小:10.22 MB

- 文档页数:40

经济新词汇的英语翻译Controlling Stake控制股Market Segment分块市场Marking Budget营销预算Specialty Shop专营商店Promotion Budget促销预算Networks for sales and service销售和服务网络Market Demand市场需求Brand Recognition品牌认可/认同Industrial Complex工业生产基地/综合体Marketing Savvy营销知识/技能Listed Companies上市公司Premium Brands优质品牌Distribution Channels销售渠道Access to Market市场准入Mergers and Acquisitions兼并与收购,并购CEPA (Closer Economic Partnership Arrangements)内地和香港更紧密经贸关系安排QFII (Qualified Foreign Institutional Investor)外国机构投资者机制, 意思是指合格的外国投资者制度,是QDII制的反向制度。

QDII (Qualified Domestic Institutional Investors)认可本地机构投资者机制,是允许在资本帐项未完全开放的情况下,内地投资者往海外资本市场进行投资。

Avian Influenza禽流感NPC & CPPCC两会3G (Third Generation) Moblie第三代移动通信Comparatively Prosperous小康Six-Party Talk (DPRK Nuke Talk)六方会谈(朝鲜核问题会谈)NPL (Non-performing loans)不良债权Farmers, Rural Areas, Agriculture Production三农Three Greens三绿SARS (Severe Acute Respiratory Syndrome)严重急性呼吸系统综合症(非典型性肺炎)Windows Longhorn微软即将推出的下一代操作系统(长牛角)Little Smart小灵通(中国网通和中国电信联合推出的移动通信产品,实行单向收费)IPO (Initial Public Offering)首次公开发行(是公司上市的标志)Sino-US Joint Commission on Commerce and Trade (JCCT)中美联合商贸委员会Floating RMB浮动元JV (Joint Venture)合资企业Wi-Fi (Wireless Internet Access)无线互联网接入Lunar Probe Project登月计划Anti-dumping反倾销Shenzhou V神州5号WEF (World Economic Forum)世界经济论坛World Economic Development Summit世界经济发展高峰会Boao Forum for Asia博鳌亚洲论坛AMC (Asset Management Company)资产管理公司Get the Green Light获得批准Distressed Asset (DA)不良资产Chinese Academy of Social Sciences中国社会科学院SMS (Short Message Service)短信息服务MMS (Multimedia Message Service)多媒体信息服务(基于3G技术)Ex-CEO前CEONational Council Social Security Fund 国家社会保障基金Energy Conservation能源保护China Household Electrical Appliances Association中国家用电器协会China-US Mediation Center中美调停中心Make One´s Debut首次登场National Development and Reform Commission (NDRC)国家发展和改革委员会Tax Rebate出口退税Stable and Rapid Economic Growth Without Fluctuations 稳定快速无大起大落的经济增长Portal Website门户网站Image Ambassador形象大使Propellant推动者GMBH股份有限公司Tender标书Future Exchange期货交易TT (Technology Transfer)技术转让ISP (Internet Service PRovider)互联网服务提供商Approval Rate支持率Portfolio Investment证券投资Worldwide Economy Uniformity世界经济一体化JIT (Just-In-Time) Manufacturing System准时制造系统EMCS (Engineer, Manufacture and Customer Service) 工程,生产和客户服务Well-off Society小康社会Interim Constitution临时宪法FDA (Food and Drug Adminstration)美国食品药品管理局Sui Generis独特的NIEO (New International Economic Order)新的国际经济新秩序Tariff Barrier关税壁垒MNC (Multinational Company)跨国公司FDI (Foreign Direct Investment)外国直接投资Economic Integration经济一体化Keep RMB Rate at Its Current Level保持人民币汇率Exchange Rate Mechanism汇率机制Transitional Grace Period过渡时期优惠期International Transaction国际交易Speculative Capital投机资本Current Account经常项目On the Condition of Anonymity匿名Sand Storm沙尘暴Protectionist Measures保护主义措施WTO ProtocolWTO协议Conform to WTO Spirits and Agreements遵循WTO精神和条款Dispute-Settling Mechanism争端解决机制Subsidy Act补贴行为Steer the Big Ship of China´s Economy掌控中国经济的大船Balanced and Relatively-Fast Economic Growth平衡相对快速的经济增长Deep-Seated Problems根深蒂固的问题Decision-Making Mechanism决策机制Scrutiny From Every Corner of Society来自社会各方面的监督Peaceful Reunification和平统一All-round, Coordinated and Sustainable Development 全面协调可持续发展Revitalize Old Industrial Bases振兴老工业基地Four Major Tasks: Restructure State Firms, Promote the Non-State Sector, Optimize Industrial Mix and Absorb More Investment四项任务:重组国有企业,促进非公有行业,优化工业结构,吸收更多投资International Community国际社会A Fair, Equitable and Non-discriminary Multilateral Trading System公平、公正、非歧视的多边贸易体制Initial Stage Success初步胜利Memorandum of Understanding (MOU)谅解备忘录Payment in Arrear拖欠的付款Farmers-Turned-Construction-Workers农民工Soft Landing软着陆Exceed the Benchmark突破xxx大关Manned Spaceflight载人航天飞行Overall National Strength综合国力Unswerving Stance坚定不移的立场Traffic Volume流量(点击量)WAP (Wireless Application Protocol)无线应用协议Three Representatives三个代表PAS (Personal Access Phone System)个人接入电话系统China Consumers Association中国消费者协会GM (Genetically Modified)转基因HPAI (High Pathogenic AI)高致病禽流感Ultimatum最后通牒Trade Consultation贸易磋商RTA (Regional Trade Arrangements)区域贸易安排Ownership Structure所有制结构China-US Joint Commission on Commerce and Trade (JCCT)中美商贸联委会IPR (Intellectual Property Rights)知识产权China Association of Enterprises中国企业联合会MES (Market Economy Status)市场经济地位MET (Market Economy Treatment)市场经济待遇Optimal Allocation of Resources资源最优配置High-level Talks高层会谈WAPI无线局域网鉴别与保密基础结构Reorganization and Transformation into Stock Company股份制改造和重组Tax Rebates出口退税Conglomerate企业集团Production VAT生产型 VATConsumption VAT消费型 VATAll disputes shall, first of all, be settled amicably by negotiation.一切争端应首先通过友好会谈进行解决。

关于国产飞机c 919英语作文全文共3篇示例,供读者参考篇1The C919, a domestically produced commercial aircraft, marks a significant milestone in China's aerospace industry. Developed by the Commercial Aircraft Corporation of China (COMAC), the C919 is designed to compete with Boeing and Airbus in the global market.The C919 is a narrow-body jet with a capacity of 158 to 168 passengers, making it suitable for domestic and regional flights. It features advanced technologies, including a fly-by-wire flight control system, advanced avionics, and state-of-the-art engines. The aircraft's design emphasizes fuel efficiency, reduced emissions, and passenger comfort.One of the key advantages of the C919 is its competitive pricing compared to Western counterparts. By offering ahigh-quality product at a lower cost, COMAC aims to attract airlines looking to expand their fleets without breaking the bank. Additionally, the C919 is backed by strong government support, ensuring that it meets international safety and quality standards.The C919 has already garnered interest from several domestic and international airlines, with over 600 orders placed as of 2021. This demonstrates the growing confidence in China's ability to produce high-quality commercial aircraft that can rival industry giants.Despite its promising outlook, the C919 has faced challenges, including delays in production and certification. However, COMAC remains committed to overcoming these obstacles and delivering a world-class aircraft that meets the needs of airlines and passengers alike.In conclusion, the C919 represents China's ambition to establish itself as a major player in the global aviation industry. With its cutting-edge technology, competitive pricing, and strong government support, the C919 has the potential to revolutionize the commercial aircraft market and elevate China to new heights in aerospace manufacturing.篇2Title: The Development of China's Homegrown Aircraft C919IntroductionChina's homegrown aircraft C919, developed by the Commercial Aircraft Corporation of China (COMAC), has beenmaking waves in the aviation industry. With its maiden flight in 2017, the C919 marked a significant milestone in China's efforts to establish itself as a major player in the global aviation market. In this paper, we will discuss the development of the C919, its features, and the challenges and opportunities it presents for the Chinese aviation industry.Development of the C919The development of the C919 began in 2008, with the goal of creating a narrow-body, twin-engine jet airliner that would compete with the Boeing 737 and Airbus A320. The aircraft was designed to seat between 158 and 168 passengers and have a range of approximately 4,075 to 5,555 kilometers. COMAC assembled a team of engineers and designers to work on the project, drawing on expertise from both domestic and international sources.Features of the C919The C919 boasts a number of advanced features that set it apart from its competitors. These include a state-of-the-art flight control system, advanced avionics, and an aerodynamically efficient design. The aircraft is also equipped with anext-generation engine, the CFM LEAP-1C, which provides improved fuel efficiency and reduced noise levels. In addition, the C919 is equipped with a comprehensive suite of safety features, including redundant systems and enhanced pilot training programs.Challenges and OpportunitiesDespite its technological advancements, the C919 faces several challenges in the global aviation market. One of the main challenges is competition from established manufacturers such as Boeing and Airbus, who have a strong foothold in the industry. In addition, the C919 must undergo rigorous testing and certification processes before it can be commercially launched, which can be a time-consuming and expensive endeavor.However, the C919 also presents significant opportunities for the Chinese aviation industry. By developing its own aircraft, China can reduce its reliance on foreign manufacturers and establish itself as a major player in the global aviation market. The C919 also has the potential to drive innovation in the industry, leading to the creation of new technologies and job opportunities in China.ConclusionIn conclusion, the development of the C919 represents a major step forward for the Chinese aviation industry. With its advanced features and competitive pricing, the C919 has the potential to capture a significant share of the global market for narrow-body aircraft. While the aircraft faces challenges in the industry, its successful launch would mark a major achievement for China and reaffirm its position as a leader in aviation technology.篇3The C919 is a narrow-body commercial aircraft designed and produced by the Commercial Aircraft Corporation of China (COMAC). It is intended to compete with the Boeing 737 and Airbus A320 series in the global market. The development of the C919 began in 2008, and its maiden flight took place in 2017. Since then, the C919 has undergone rigorous testing and certification processes, with the goal of entering commercial service in the near future.The C919 represents a significant milestone in China's efforts to establish itself as a major player in the global aviation industry.With a capacity of 158 to 168 passengers and a range of up to 4,075 kilometers, the C919 is well-suited for both domestic and international routes. It is powered by two LEAP-1C engines from CFM International, a joint venture between General Electric and Safran Aircraft Engines.One of the key selling points of the C919 is its fuel efficiency and advanced technology. The aircraft is made predominantly of composite materials, which reduces its weight and increases its aerodynamic efficiency. This, in turn, lowers fuel consumption and operating costs for airlines. The C919 also features a modern cockpit design with state-of-the-art avionics and fly-by-wire controls, enhancing safety and ease of operation.In addition to its technical prowess, the C919 is also designed with passenger comfort in mind. The cabin is spacious and well-appointed, with larger windows and overhead bins compared to its competitors. Airlines have the option to customize the interior of the aircraft to suit their branding and service offerings, providing a unique and tailored experience for passengers.Despite its promising features, the C919 faces stiff competition in the global market. Boeing and Airbus have a well-established presence and customer base, making itchallenging for a newcomer like COMAC to break into the industry. Additionally, the C919 has faced delays in its development and certification process, which has led to skepticism from potential customers and industry analysts.However, the Chinese government has shown strong support for the C919 project, viewing it as a strategic initiative to boost the country's aerospace industry and reduce dependence on foreign aircraft manufacturers. Chinese airlines, such as China Eastern and Air China, have placed orders for the C919, signaling confidence in the aircraft's capabilities and potential.In conclusion, the C919 represents a bold step forward for China's aviation ambitions. With its advanced technology, fuel efficiency, and passenger comfort features, the C919 has the potential to compete on a global scale. While challenges remain, the C919 is a testament to China's growing expertise and innovation in the aerospace sector. It will be interesting to see how the C919 performs in commercial service and its impact on the aviation industry as a whole.。

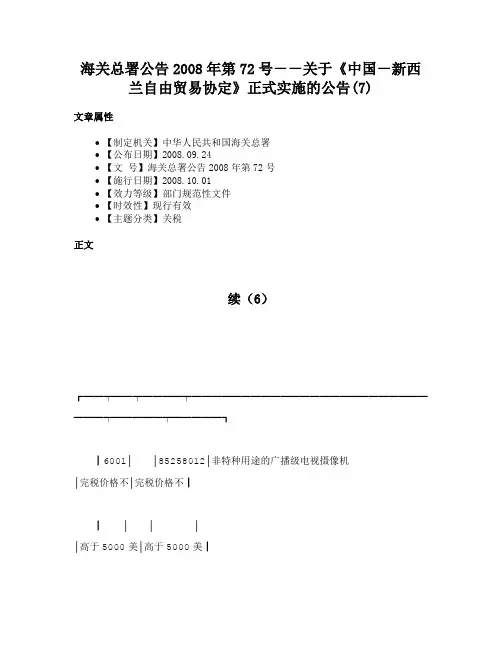

海关总署公告2008年第72号--关于《中国-新西兰自由贸易协定》正式实施的公告(7)文章属性•【制定机关】中华人民共和国海关总署•【公布日期】2008.09.24•【文号】海关总署公告2008年第72号•【施行日期】2008.10.01•【效力等级】部门规范性文件•【时效性】现行有效•【主题分类】关税正文续(6)┏━━┯━━┯━━━━┯━━━━━━━━━━━━━━━━━━━━━━━━━━━┯━━━━━┯━━━━━┓┃6001││85258012│非特种用途的广播级电视摄像机│完税价格不│完税价格不┃┃││││高于5000美│高于5000美┃┃││││元:35%;│元:20%;┃┃││││完税价格高│完税价格高┃┃││││于5000美元│于5000美元┃┃││││,3%加│,3%加6800┃┃││││12960元│元┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6002││85258013│非特种用途的其他电视摄像机│完税价格不│完税价格不┃┃││││高于5000美│高于5000美┃┃││││元:35%;│元:20%;┃┃││││完税价格高│完税价格高┃┃││││于5000美元│于5000美元┃┃││││,3%加│,3%加6800┃┃││││12960元│元┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6003││85261010│导航用雷达设备│2│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6004││85261090│其他雷达设备│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6005││85269110│机动车辆用│2│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6006││85269190│其他无线电导航设备│2│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6007││85269200│无线电遥控设备│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6008││85271200│不需外接电源袖珍盒式磁带收放机│20│16┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6009││85271300│不需外接电源收录(放)音组合机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6010││85271900│不需外接电源无线电收音机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6011││85272100│需外接电源汽车收录(放)音组合机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6012││85272900│需外接电源汽车用无线电收音机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6013││85279100│其他收录(放)音组合机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6014││85279200│带时钟的收音机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6015││85279900│其他收音机│27│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6016││85284910│其他彩色阴极射线管监视器│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6017││85284990│其他黑白或单色的阴极射线管监视器│19│15.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6018││85285910│其他彩色监视器│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6019││85285990│其他黑白或单色的监视器│19│15.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6020││85286910│其他彩色投影机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6021││85286990│其他黑白或单色的投影机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6022││85287110│不带显示屏的彩色卫星电视接收机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6023││85287180│不带显示屏的其他彩色电视接收机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6024││85287190│不带显示屏的其他黑白或单色的电视接收机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6025││85287211│其他彩色模拟电视接收机,带阴极射线显像管的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6026││85287212│其他彩色数字电视接收机,带阴极射线显像管的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6027││85287219│其他彩色电视接收机,带阴极射线显像管的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6028││85287221│其他彩色模拟电视接收机,带液晶显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6029││85287222│其他彩色数字电视接收机,带液晶显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6030││85287229│其他彩色电视接收机,带液晶显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6031││85287231│其他彩色模拟电视接收机,带等离子显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6032││85287232│其他彩色数字电视接收机,带等离子显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6033││85287239│其他彩色电视接收机,带等离子显示器的│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6034││85287291│其他彩色模拟电视接收机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6035││85287292│其他彩色数字电视接收机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6036││85287299│其他彩色电视接收机│30│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6037││85287300│其他黑白或单色的电视接收机│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6038││85291010│雷达及无线电导航设备天线及零件│ 1.5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6039││85291090│其他无线电设备天线及其零件│2│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6040││85299041│特种用途电视摄像机、静像视频摄像机及其他视频摄录一体│8│ 6.4┃┃│││机,数字相机零件││┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6041││85299042│非特种用途的取像模块│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6042││85299049│其他电视摄像机、静像视频摄像机及其他视频摄录一体机、数│12│9.6┃┃│││字相机零件││┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6043││85299050│雷达及无线电导航设备零件│ 1.5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6044││85299060│收音机及其组合机的其他零件│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6045││85299081│彩色电视机零件│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6046││85299082│等离子显像组件及其零件│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6047││85301000│铁道或电车道用电气信号等设备│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6048││85308000│其他用电气信号、安全、交通设备│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6049││85309000│税号85.30所列设备的零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6050││85311000│防盗或防火报警器及类似装置│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6051││85318010│蜂鸣器│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6052││85318090│其他电气音响或视觉信号装置│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6053││85351000│电路熔断器(电压>1000V)│14│11.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6054││85352100│电压<72.5KV自动断路器│14│11.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6055││85352900│电压≥72.5KV自动断路器│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6056││85353000│隔离开关及断续开关│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6057││85354000│避雷器、电压限幅器及电涌抑制器│18│14.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6058││85359000│其他>1000V电路开关等电气装置│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6059││85361000│熔断器(电压≤1000V)│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6060││85362000│电压≤1000V自动断路器│9│7.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6061││85363000│电压≤1000V其他电路保护装置│9│7.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6062││85364100│电压≤60V的继电器│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6063││85364900│电压>60V的继电器│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6064││85366100│电压≤1000V的灯座│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6065││85367000│光导纤维、光导纤维束或光缆用连接器│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6066││85371011│可编程序控制器│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6067││85371019│其他数控装置│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6068││85371090│其他电力控制或分配的装置│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6069││85372010│电压≥500KV高压开关装置│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6070││85372090│其他电力控制或分配装置│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6071││85381010│子目号8537.2010所列装置的零件│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6072││85381090│税号85.37货品用的其他盘、板等│7│ 5.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6073││85389000│税号85.35、85.36或85.37装置的零件│7│ 5.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6074││85391000│封闭式聚光灯│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6075││85392110│科研、医疗专用卤钨灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6076││85392120│火车、航空器及船舶用卤钨灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6077││85392130│机动车辆用卤钨灯│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6078││85392190│其他卤钨灯│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6079││85392210│科研、医疗用功率≤200W白炽灯泡│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6080││85392290│其他用功率≤200W白炽灯泡│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6081││85392910│科研、医疗专用其他白炽灯泡│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6082││85392920│火车、航空及船舶用其他白炽灯泡│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6083││85392930│机动车辆用其他白炽灯泡│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6084││85392991│电压≤12V未列名的白炽灯泡│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6085││85392999│其他未列名的白炽灯泡│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6086││85393110│科研、医疗专用热阴极荧光灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6087││85393120│火车、航空器、船舶用热阴极荧光灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6088││85393191│紧凑型荧光灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6089││85393199│其他热阴极荧光灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6090││85393210│科研医疗用汞或钠蒸汽灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6091││85393220│火车、飞机及船舶用汞或钠蒸汽灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6092││85393290│其他用途的汞或钠蒸汽灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6093││85393910│科研、医疗专用其他放电灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6094││85393920│火车、航空器、船舶用其他放电灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6095││85393990│其他用途的其他放电灯管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6096││85394100│弧光灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6097││85394900│紫外线或红外线灯│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6098││85399000│税号85.39所列货品的零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6099││85401100│彩色阴极射线电视显像管│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6100││85401200│黑白或单色阴极射线电视显像管│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6101││85402010│电视摄像管│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6102││85402090│变像管、图像增强管及光阴极管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6103││85404000│点距<0.4mm彩色数据/图形显示管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6104││85405000│黑白或其他单色数据/图形显示管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6105││85406010│雷达显示管│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6106││85406090│其他阴极射线管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6107││85407100│磁控管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6108││85407200│速调管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6109││85407900│其他微波管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6110││85408100│接收管或放大管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6111││85408900│其他电子管│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6112││85409110│电视显像管零件│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6113││85409120│雷达显示管零件│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6114││85409190│其他阴极射线管零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6115││85409910│电视摄像管零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6116││85409990│其他热电子管、冷阴极管零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6117││85431000│其他粒子加速器│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6118││85432010│输出信号频率<1500MHZ的通用信号发生器│15│12┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6119││85432090│输出信号频率≥1500MHZ的通用信号发生器│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6120││85437093│电篱网激发器│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6121││85441100│铜制绕组电线│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6122││85441900│其他绕组电线│20│16┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6123││85442000│同轴电缆及其他同轴电导体│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6124││85443020│机动车辆用点火布线组及其他布线组│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6125││85443090│车辆用点火布线组│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6126││85444921│1000V≥耐压>80V无接头电缆│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6127││85444929│1000V≥耐压>80V无接头电导体│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6128││85446012│额定电压不超过35千伏的电缆│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6129││85446013│额定电压超过35千伏,但不超过110千伏的电缆│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6130││85446014│额定电压超过110千伏,但不超过220千伏的电缆│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6131││85446019│其他额定电压超过1000伏的电缆│8.4│ 6.7┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6132││85446090│耐压>1KV的其他电导体│21│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6133││85451100│炉用碳电极│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6134││85451900│其他碳电极│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6135││85452000│碳刷│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6136││85459000│灯碳棒、电池碳棒及其他石墨制品│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6137││85461000│玻璃制绝缘子│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6138││85462010│输变电线路绝缘瓷套管│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6139││85462090│其他陶瓷制绝缘子│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6140││85469000│其他材料制绝缘子│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6141││85471000│陶瓷制绝缘零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6142││85472000│塑料制绝缘零件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6143││85479010│内衬绝缘材料的贱金属导管及其接头│10│8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6144││85479090│其他材料制绝缘配件│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6145││85481000│电池废碎料及废电池│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6146││85489000│85章其他未列名的电气零件│12│9.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6147││86011011│微机控制的外部直流电动铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6148││86011019│由外部直流电驱动的其他铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6149││86011020│由外部交流电驱动的铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6150││86011090│由其他外部电力驱动的铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6151││86012000│由蓄电池驱动的铁道电力机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6152││86021010│微机控制的柴油电力铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6153││86021090│其他柴油电力铁道机车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6154││86029000│其他铁道机车及机车煤水车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6155││86031000│由外电力驱动铁道及电车道用机动客车、货车、敞车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6156││86039000│其他铁道及电车道用机动客车、货车、敞车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6157││86040011│隧道限界检查车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6158││86040012│钢轨在线打磨列车│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6159││86040019│铁道及电车道用其他检验车及查道车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6160││86040091│电气化接触网架线机(轨行式)│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6161││86040099│铁道及电车道用其他维修或服务车│7│ 5.6┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6162││86050010│铁道及电车道用非机动客车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6163││86050090│铁道及电车道用其他非机动客车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6164││86061000│铁道及电车道用非机动油罐货车及类似车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6165││86063000│铁道及电车道用非机动自卸货车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6166││86069100│铁道及电车道用非机动带篷及封闭货车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6167││86069200│铁道及电车道用非机动厢高>60cm敞篷货车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6168││86069900│税号86.06所列其他未列名非机动车│5│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6169││86071100│铁道及电车道机车的驾驶转向架│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6170││86071200│铁道及电车道机车非驾驶转向架│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6171││86071910│铁道及电车道机车用车轴│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6172││86071990│转向轮及其零件│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6173││86072100│铁道及电车道机车用空气制动器及其零件│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6174││86072900│铁道及电车道机车用非空气制动器│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6175││86073000│铁道及电车道机车用钩、联结器、缓冲器及其零件│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6176││86079100│铁道及电车道机车用其他零件│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6177││86079900│铁道及电车道非机车用其他零件│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6178││86080010│轨道自动计轴设备│3│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6179││86080090│铁道及电车道轨道固定装置及附件│4│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6180││86090010│20英尺的集装箱│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6181││86090020│40英尺的集装箱│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6182││86090030│45、48、53英尺的集装箱│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6183││86090090│其他集装箱│10.5│8.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6184││87011000│手扶拖拉机│9│7.2┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6185││87012000│半挂车用的公路牵引车│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6186││87013000│履带式牵引车、拖拉机│6│ 4.8┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6187││87019011│轮式拖拉机│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6188││87019019│其他拖拉机│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6189││87019090│其他牵引车│8│ 6.4┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6190││87021020│机坪客车│4│0┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6191││87021091│≥30座大型客车(柴油型)│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6192││87021092│≥20座,但≤29座的客车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6193││87021093│≥10座,但≤19座的客车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6194││87029010│≥30座大型客车(非柴油型)│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6195││87029020│≥20座,但≤29座的客车(非柴油型)│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6196││87029030│≥10座,但≤19座的客车(非柴油型)│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6197││87031011│全地形车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6198││87031019│其他高尔夫球车及类似车辆│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6199││87031090│雪地行走专用车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6200││87032130│排气量≤1000ml的小轿车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6201││87032190│排气量≤1000ml的其他车辆│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6202││87032230│1L<排气量≤1.5L的小轿车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6203││87032240│1L<排气量≤1.5L的越野车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6204││87032250│1L<排气量≤1.5L,≤9座的小客车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6205││87032290│1L<排气量≤1.5L的其他车辆│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6206││87032314│1.5L<排气量≤2.5L的小轿车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6207││87032315│1.5L<排气量≤2.5L的越野车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6208││87032316│1.5L<排气量≤2.5L,≤9座的小客车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6209││87032319│1.5L<排气量≤2.5L的其他车辆│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6210││87032334│2.5L<排气量≤3L的小轿车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6211││87032335│2.5L<排气量≤3L的越野车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6212││87032336│2.5L<排气量≤3L,≤9座的小客车│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6213││87032339│2.5L<排气量≤3L的其他车辆│25│20┃┠──┼──┼────┼───────────────────────────┼─────┼─────┨┃6214││87032430│排气量>3000ml的小轿车│25│20┃。

世界各国驻华大使馆网址总汇以及联系方式联系电话欧洲地区爱尔兰 奥地利 http://www.bmeia.gv.at/index.php?id=66735&L=6比利时 www.diplomatie.be/beijing/ 签证中心 丹麦 www.ambbeijing.um.dk/zh德国 www.peking.diplo.de 或 俄罗斯 芬兰 荷兰 挪威 /瑞典 /Start____20761.aspx瑞士 http://www.eda.admin.ch土耳其 法国 签证中心:https://希腊 匈牙利 罗马尼亚 http://beijing.mae.ro/index.php?lang=en意大利http://www.ambpechino.esteri.it/ambasciata_pechino 签证中心:/英国 签证中心:http://www.vfs-uk-cn.西班牙 冰岛 /cn捷克 /wwwo/default.asp?idj=15&amb=60保加利亚 http://www.chinaembassy.bg/拉脱维亚 /com/sudan/斯洛文尼亚 http://beijing.embassy.si/en爱沙尼亚 http://www.peking.vm.ee/chn未完待续。

北美地区加拿大 http://geo.international.gc.ca/asia/china/menu-ch.asp美国 /墨西哥 /china/亚太地区澳大利亚 .au新西兰 /阿联酋 /菲律宾 /韩国 /日本 .emb-japan.go.jp/斯里兰卡 /新加坡 .sg/beijingchi/以色列 .il印度 /叙利亚 /en/index.html吉尔吉斯斯坦 /马来西亚 .my/perwakilan/beijing阿塞拜疆 http://beijing.embassy.si/en塔吉克斯坦 /哈萨克斯坦 /蒙古 /沙特阿拉伯 .sa/Detail.asp?InSectionID=3302&InNewsItemID=33138泰国上海总领事馆 /越南 https://.vn/vnemb.china/zh/缅甸 /chinese/尼泊尔 /菲律宾 /未完待续。

外贸网址大全国际贸易网络营销常用网址搜集,高手、刚进门槛的都适用。

一、实用网址网站名称网址简介——中国中华人民共和国商务部 最权威的外贸法律、法规及相关信息。

驻各国或地区的商务参赞处的分网站提供该国的法律、法规、人文、地理和交易习惯。

中华人民共和国国家质量监督检验检疫总局 最权威的与进出口检验检疫相关的法律、法规及信息。

中华人民共和国海关总署 最权威的与通关相关的法律、法规及信息。

国家外汇管理局 最权威的与外汇账户、结汇、核销相关的法律、法规及信息。

国家税务总局 最权威的与出口退税相关的法律、法规及信息。

中国出口商品交易会 提供广交会的最新信息。

参加广交会的企业名录。

阿里巴巴 在国内外享有盛名的在线交易市场。

发布供求信息,寻求合作伙伴,进行商旅交流。

中国制造网 企业目录,供求信息,产品列表。

中国贸易指南 由中国贸易指南编委会组织实施的外经贸信息服务项目。

经贸商情市场信息、外经贸政策法规信息和经济环境信息、中国出口商品数据库、世界进口商名录数据库等。

权威的信息。

易创电子商贸网 企业目录,供求信息,产品列表。

中国小商品网 小商品行业的BTOB资讯网站。

中国塑料模具网 找塑料模具的厂家和信息到这里来。

——香港香港贸易发展局 香港贸易发展局官方网站。

政策法规,贸易活动,企业目录,供求信息。

e大中华 企业目录,供求信息。

TradeBIG 企业目录,供求信息。

易贸通 在线B2B交易市场, 使用方便。

——印度trade-india 印度进口商名录,出口商黄页,国际进出口商目录,供求信息。

indiaMART 印度的在线B2B交易市场,企业名录,供求信息。

操作方便。

——澳洲澳大利亚黄页 .au 澳大利亚黄页,信息丰富。

AUussie .au 澳大利亚商业目录。

信息量大。

Australia Trade Now 澳大利亚在线交易市场。

[印度]OzLines .au 澳大利亚网站目录指南。

AVIATION TRAINING SEMINAR INTRODUCTION TO AIRLINE INSURANCE 21st– 23rd May 2012Tim BlakeyManaging DirectorRegional Head – Asia AviationAviation and Aerospace•What is a hull•airframe•engines•instruments•excludes technical records•Principle of indemnity - ‘insured value’•pay for•replace•make good•‘Agreed value’•amount agreed at time of attachment •no depreciation•insurers waive rights to replace•versus …Insured value‟•Agreed value applicable•Commercial operators / higher valued aircraft •Airlines•Financed aircraft•Issues?•older aircraft•addition of finance charges•depreciation of value over the years•separate values on enginesHull - considerations •Exclusions•War and allied perils •Mechanical breakdown •Nuclear risks •Airworthiness •Geographical limits •Pilots•Uses•Typical deductiblesWide-body US$ 1,000,000Hybrid US$ 750,000Narrow-body US$ 500,000Turbo-prop US$ 100,000Deductibles (continued)•In the event of loss involving more than one aircraft in a fleet, only largest deductible applies•No deductibles apply in event of total lossTotal loss only (TLO) insurance•General•available separately•can be incorporated into all risk policy•Advantages•increases insured values•slightly cheaper•non-contributory with all risks•Limitations•only available for small proportion of value•Other uses•banks and financiers can increase SLV on long-term financing BUT insurable interest needs to be shownInsurance of spares and equipment.Usually placed with hull policy although occasionally placed separately in marine market Spares•Covering:Engines/APU/ground support equipment/airside transport •Deductible:US$10,000 each loss •Sum insured :Expressed as …any one sending/any one occurrence‟ •Exclusions:Unexplained shortfall. Loss or damage whilst underprocess wear and tear •Basis of cover :Usually …insured value‟. High valued item such as enginesallowed …agreed values‟ when financing requires itAirline liability•Three distinct areas to consider:1.liability to passengers, cargo and mail carried by the airline and for whichthey have accepted responsibility for2.liability to third parties i.e. property damage (buildings), other aircraft on theground, services providers property etc3.general third party liability i.e. baggage handling, maintenance work onthird party aircraft etcAircraft Liability - how may liability arise•Passenger legal liability•International carriage•Warsaw Convention (established 1929) and amended by the Hague Protocol in 1955•Montreal Convention (Treaty adopted by meeting of ICAO member states in1999 and imposed strict liability limits for proven damages) recently amended by MC99•Special contracts•voluntary ie IATA Intercarrier Agreement – an agreement that sees claimants cases judged by the laws of their country of domicile•Non-international carriage•Domestic laws•EU regulationsAirline Liability - how may liability arise?Continued•Baggage/cargo legal liability•International carriage•Warsaw Convention•Montreal Convention•Non-international carriage•Domestic legislation•Mail legal liability•handled under separate international conventions unless treated as baggage or cargo•Third party legal liability•International law•Strict liability•ContractNon-aircraft liabilityNon aircraft liability•Premises•liability arising out of the use of buildings (sales offices, hangars etc) – An airline policy does not cover damage to the actual premises but liability arising from your occupation of the building•Hangarkeepers•liability arising from damage to third party aircraft in the care, custody and control of the insured (aircraft being stored in the Insureds hangar) •Products•liability arising out of the supply of goods/services to third parties (maintenance, catering)•liability which may arise once an aircraft has been sold or returned to a Lessor.Limit of liability - considerations•Passenger capacity of aircraft •Passenger mix/profile•Route structure•Jurisdiction•“Negligent entrustment”•Impositions by•Lessors•Licensing authorities•Airport authoritiesGeneral policy exclusionsExclusions1. Liability assumed by the insured under any contract or agreement unless suchliability would have attached to the insured even in the absence of such contract or agreement2. Vehicles and automobiles owned/leased/loaned and operated by the Insuredupon the public highway3. Bodily injury to or sickness, disease or death of any employee arising out of and inthe course of his/her employment4. Damage to property owned, rented, leased, loaned or occupied by the insured.General policy exclusionsContinued5. Noise and pollution hazards (as AVN 46B or equivalent)6. War and allied perils (as AVN 48B or equivalent)7. Radioactive Contamination Exclusion Clause (as AVN 38 or equivalent)8. Tour operators'/travel agents' activities except with respect to the provisionsof a Contract of Carriage by Air9. Advertising activities10. Promotional activities and/or sponsorship activities except those directlyrelated to the operation of aircraft or such activities conducted on airportpremises.Other issues•Liability War coverage•Extended Coverage Endorsement (Aviation Liabilities) AVN52E•Excludes atomic or nuclear weapons of war•Passengers / Cargo (covered for the full policy limit)•Third parties (limited coverage, normally to USD150 million but somehigher limits have been placed)•Deductibles•Baggage and personal effects: USD1,250 any one claim•Cargo: USD10,000 any one Air Waybill•Aircraft third party: Nil•Non-aircraft third party: variousAirline Historical Premium and Claims3,500Premium Hull Liability Attritional3,0002,5002,0001,5001,00050020022003200420052006200720082009201020113.4%0.7% 3.2%-1.0% 3.9%-6.9% 3.5%-4.5% 1.4% 3.6% 1.0%-3.6%-100.00%-50.00%0.00%50.00%100.00%150.00%200.00%Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar0.00150.00300.00450.00600.00750.00900.00Prem Avg. % Change Max % Change Min % Change Annual AvgAirline Renewals – Actual Lead Premium % Change2011 Change: -1.2 % Pe rc en tageC han g esPremium USD millions No. of Renewals: 1 4 5 20 16 17 36 10 8 14 43 59 2012 Change: +1.9 %-8.1%-0.4%-5.9%-0.2%-16.9%-15.2%-5.2%-7.7%0.0%-9.3%-1.1%-13.4%-100.00%-50.00%0.00%50.00%100.00%150.00%200.00%AprMayJunJulAugSepOctNovDecJanFebMar0.00150.00300.00450.00600.00750.00900.00PremAvg. % ChangeMax % ChangeMin % ChangeAnnual AvgAirline Renewals – As If Lead Rate % Change2011 Change: -7.5 %P e r c e n t a g e C h a n g e sPremium USD millionsNo. of Renewals:145201617361081443592012 Change: -3.9 %Major Airline LossesMajor Loss Total (xs $10m) : $ 506,083,611Overall for 2011 to date:$ 682,367,1115001,0001,5002,0002,500JanFebMarAprMayJunJulAugSepOctNovDec2009 Losses2010 Losses2011 LossesFigures exclude attritional lossesOperator Air Asia Manx2 IbexGeorgian AirwaysChina Cargo Airlines Merpati Nusantara Cathay Pacific Omega Air Sol Lineas Aereas Asiana SpiceJet EgyptAirCaribbean Airlines First Air Gulf Air Turkish Airlines TAMELOT (Lufthansa)Date of Loss 10th Jan 10th Feb 11th Mar 4th April 17th April07th May 16th May 18th May 18th May28th July 28th July 29th July 30th July20th Aug 29th Aug 2nd Sep 16th Sep1st NovAircraft typeA320 Metro Spares CRJ B777-200F CAI MA60 A340-400 B707-230B Saab 340 B747-400F B737 B777-200 B737-800 B737-200 A320-200 A340-300 EMB190 B767-300ERLocation Malaysia Ireland Japan Congo Copenhagen Indonesia Inflight USA Argentina South KoreaIndia Egypt Guyana Resolute Kochi MumbaiEcuador WarsawMonthly Split of AFV and PremiumAug 1.3%Nov 23.7%Dec 45.0%Sep 0.7%Jul 9.1%Jan 0.1%Feb 0.1%Mar 0.2%Apr 8.2%May 3.7%Jun 2.3%Oct 5.5%AFV – Split by MonthsPremium – Split by MonthsAug 2.6%Nov 18.8%Dec 40.9%Sep 1.5%Jul 12.1%Jan 0.8%Feb 0.4%Mar 1.6%Apr 6.7%May 3.6%Jun 3.3%Oct 7.7%(3,000)(2,000)(1,000)01,0002,0003,0004,0005,0006,0007,0008,000200220032004200520062007200820092010201110 Year Rolling Profit/LossAirline Historical Rolling Profit/Loss(3,000)(2,000)(1,000)01,0002,0003,0004,0005,0006,0007,0008,00020022003200420052006200720082009201020115 Year Rolling Profit/Loss(3,000)(2,000)(1,000)1,0002,0003,0004,0005,0006,0007,0008,00020022003200420052006200720082009201020113 Year Rolling Profit/LossAverage Annual Profit 10 Years: $732mAverage Annual Profit 5 Years: $119mAverage Annual Profit 3 Years: $229m2011 Annual ReviewTheoretical Underwriting Result5001,0001,5002,0002,500U S $ M i l l i o n sNet Lead Current Premium All Airlines: USD 2,100mHull Losses: USD 584mLiability Losses: USD 98mAttritional Losses: USD 400mINCOMEOUTGOINGNet Underwriting Result: Net Profit of USD 492 millionR/I Costs: USD 375mTrading Costs: USD 150mUSD 2,100 millionUSD 1,608 million2012 Outlook•We anticipate that market conditions will follow on from Q4 2011 unless any of the following factors occur or influence the insurance industry•A major Aviation market loss or series of “regular” accidents•Withdrawal of a major market or an overall and meaningful shrinkage of capacity. •An insurance industry capital crunch arising out of the Euro-Zone debt crisis.•On the capacity side we have in fact seen additional markets emerge in 2011 ie ICIC Lombard, Argo and HDI Gerling. We also believe that there are other insurers and additional capital interested in entering the aviation sector.•The only other possible counter to the current conditions is the reinsurance market. Generally this remains favourable to direct insurers although a loss such as the recent Reno Air race incident (USD 400m) can and will a targeted impactMarsh LtdAviation and Aerospace PracticeTower PlaceLondon EC3R 5BUTel: 020 7357 1000Fax: 020 7929 2705This PowerPoint™ presentation is based on sources we believe reliable and should be understood to be general risk management and insurance information only.Marsh Ltd. is authorised and regulated by the Financial Services Authority for insurance mediation activities only.© Copyright 2011 Marsh Ltd All rights reservedLeadership, Knowledge, Solutions…Worldwide.。

终于毕业了,估计短期内也不会有机会去踩踏美国的国土了。

趁修电脑之前把所有我在美国两内收藏的东西分享出来。

希望对Uindy的学弟学妹们有帮助,有什么需要的也可以给我留言哦~~~所有分类还是根据我收藏夹的分类来:American traveling:Air Tickets:国际:美中中美机票打折特价价格查询预定参考/backchina/必要的时候可以根据机票代理list逐个询问机票,不过速度有点慢,时间紧迫的话最好直接电话联系,我曾经试过同时跟20个客服聊到凌晨。

为了省钱,大家要有耐心呢。

飞网中国/美中中美机票价格信息发布寻找同行机票代理最新美国签证预约时间发布Powered By People,同样可以根据travelsuperlink的方法找客服查询机票。

这个网站最强大的功能是可以让客服主动联系你。

首先注册一个账号,登陆后在导航栏里点击E-mail查询机票,然后输入他需要的信息,在你发送的同时,这个网站的所有客服就会收到你的信息,然后在一个工作日左右的时间内通过E-mail给你答复,你只要等待,然后在你的邮箱里慢慢比较机票就ok了。

另外列出个相关网站,不过我没用过,大家自己看着办哈。

凯腾网- 全球机票专家/航班查询,国际机票,国际机票预定,留学生机票,探亲机票,移民机票,旅游保险国内:我说的国内是指美国国内ITA/cvg/dispatch/prego;jsessionid=8FAEF39734D51E9C94A196 7D461CB655kayak/以上两个是美国机票查询系统,可以通过他们横向比较各机票网站各航空公司在同一时期给出的票价。

Priceline/这是两年来我们用得最多的网站,其实有时候他的国际机票票价也不会太贵。

Orbitz/App/DPTLandingPageSearch?OSC=JPv2tKhobT!-30776330!18319 2437!7001!-1&z=c1a2&r=qstudent universe/这个网站需要用学校的邮箱注册,因为那里的优惠机票只针对学生。

NBER WORKING PAPER SERIESCHINA'S LAND MARKET AUCTIONS:EVIDENCE OF CORRUPTIONHongbin CaiJ. Vernon HendersonQinghua ZhangWorking Paper 15067/papers/w15067NATIONAL BUREAU OF ECONOMIC RESEARCH1050 Massachusetts AvenueCambridge, MA 02138June 2009The authors thank Yona Rubinstein for helpful comments and advice, as well as workshop participants at Brown University and Hong Kong University. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research.© 2009 by Hongbin Cai, J. Vernon Henderson, and Qinghua Zhang. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source.China's Land Market Auctions: Evidence of CorruptionHongbin Cai, J. Vernon Henderson, and Qinghua ZhangNBER Working Paper No. 15067June 2009JEL No. D44,H71,O38,O53,R14,R31,R52ABSTRACTThis paper studies the urban land market in China in 2003—2007. In China, all urban land is owned by the state. Leasehold use rights for land for (re)development are sold by city governments and are a key source of city revenue. Leasehold sales are viewed as a major venue for corruption, prompting a number of reforms over the years. Reforms now require all leasehold rights be sold at public auction. There are two main types of auction: regular English auction and an unusual type which we call a “two stage auction”. The latter type of auction seems more subject to corruption, and to side deals between potential bidders and the auctioneer. Absent corruption, theory suggests that two stage auctions would most likely maximize sales revenue for properties which are likely to have relatively few bidders, or are “cold”, which would suggest negative selection on property unobservables into such auctions. However, if such auctions are more corruptible, that could involve positive selection as city officials divert hotter properties to a more corruptible auction form. The paper finds that, overall, sales prices are lower for two stage auctions, and there is strong evidence of positive selection. The price difference is explained primarily by the fact that two stage auctions typically have just one bidder, or no competition despite the vibrant land market in Chinese cities.Hongbin CaiGuanghua School of Management and IEPR Peking UniversityBeijing 100871Chinahbcai@J. Vernon HendersonDepartment of EconomicsBox BBrown UniversityProvidence, RI 02912and NBERj_henderson@ Qinghua ZhangGuanghua School of Management Peking UniversityBeijing 100871Chinazhangq@This paper studies the urban land market in China in 2003-2007. Urban land is owned “by the people” and its allocation done by the state.1 In most cities, the local land bureau is responsible for the vast majority of allocations of land, allocated through auction sales of leasehold rights.2 In China, land markets have been viewed as very corrupt, prompting a number of reforms over the years. We will provide some institutional context below but a couple of quotes illustrate that corruption is an on-going issue. In 2004, the China Daily wrote“China’s Ministry of Lands and Resources announced new measures to crackdown on corruption and inefficiency in the land sector. The new rules forbidofficials to receive personal benefits from parties under their administration[italics added]. It is estimated that in 2003, the country faced 168,000 violationsof its Land Law.”Yet in June 2008, the Asian Times reported“Chinese government efforts to clean up land sales, a major source of officialcorruption…, face a rethink.…Illegal transfers, corruption in land deals,…are rampant in major cities, according to an investigation published by the National Audit Office (NAO) last week.…Governments in the 11 cities [studied by the NAO], including Beijing andShanghai, were also found to have misused 8.4 billion yuan from land-grant fees, Zhai Aicai, of the NAO, said in the report.….Some cities have given a flexible interpretation to the rules and the auction system has often existed in name only, resulting in a lack of competition among developers and the winning developer being able to secure the land at below its true marketvalue.”Today, after considerable reform, leaseholds are, in principle, all sold at public auction. There are two main types of auction in most cities: regular English auction and an unusual type of auction which we call a “two stage auction.” The raw data suggest that leaseholds sold at two stage auctions sell at steep price discounts, relative to English auctions. Why are there such sales price differentials; and, related, how do city officials choose auction type for any particular property? Absent corruption, in terms of maximizing expected sales revenue, the paper argues that two stage auctions would be best for properties which are likely to have relatively few bidders, or are “cold.”1 Rural land is owned by the village and allocations done by the village leadership.2 The central government (national asset committee) and the military may control portions of city land in particular cases, as for example the national capital Beijing.Allocating cold properties to two stage auctions would suggest negative selection on property unobservables, and would be one possible explanation for the price differential between the auction types. However estimation suggests that selection on unobservables into two stage auctions is in fact positive. The paper argues that two stage auctions are more corruptible, which would explain positive selection, as city officials divert “hot” properties to the more corruptible auction form. Consistent with how we think the corruption process works, much of the price differential between auction types seems to be explained by the fact that two stage auctions are much more likely to have just one bidder, or no competition, despite their benefiting from positive selection on unobservables and despite the vibrant land market in Chinese cities.The paper is organized as follows. We start with essential background information on Chinese land markets and especially the two auction formats. We then present a conceptual framework to model the key differences between the auction formats. In section 3, we discuss the data and patterns in the data. Section 4 estimates a reduced form model of price differences between the two auction types, and discusses instruments for auction type used to estimate selection into auction type. In Sections 5 and 6 we split the analysis of price differences into its two key components, accounting for joint selection into auction type and competition: whether a property is likely to sell competitively or not depending on auction type; and whether there are price differences across auction types, conditional on a property selling competitively.1. BackgroundIn the Maoist era and in the early reform years after 1978, land allocations were done by the state, with no market mechanisms involved. Starting in 1986, land administration changed with major reforms over the years (Ding and Knapp 2005, Valetta 2005). The first change was to charge new users for development rights and some incumbent users for use rights. After 1988, use rights for vacant land in the city were allocated through leaseholds, where, for a fixed sum, users obtained a long lease for a specified use (e.g., 70 years for residential land), subject to restrictions on intensity of development. In the 1990’s, many of these allocations were done by “negotiation” in a hidden process, wherereportedly leaseholds were often sold for a tiny fraction of market value. This had two consequences.First, leasehold sales are a major source of revenue for many cities, in essence potentially being a full Henry George tax, allocating all “surplus” land rents to the city. For example, in 2004 and 2005 for Chengdu, Suzhou and Chongqing, leasehold sales revenues ranged from 2.6% to 5% of local GDP. Cities have an expenditure budget and on-the-book revenue sources. On-the-book revenues account for about 70% of total expenditures. Leasehold sales revenues are mostly off-the-book revenues, which are used to effectively close the on-the-book deficit. Negotiated sales at well below market prices deprived cities of major revenues.Second, negotiated sales were reportedly inherently corrupt, resulting in some indictments of corrupt officials and a variety of reforms, one of which in 2004 was quoted above. Another reform in 2002 banned the secondary market for “land development rights,” which had allowed large traditional holders (e.g., state owned enterprises) to, in effect, privately sell off their own land use rights (Zhu, 2004, 2005). Today the local land bureau is supposed to be in charge of almost all allocations of land for (re)development. Finally and most critically for this paper, a third recent reform was a 2002 law which banned negotiated sales by the land bureau, with the last date for any negotiated sales being August 31, 2004. For the last 4 years at least, all urban land leasehold sales are to be done through public auctions, with details of all transactions posted to the public on the internet.How does the land market work? Local land use planning is done by an independent committee (albeit with 1-2 representatives from the land bureau on the committee). Given the overall land use plan for the city, at the beginning of each year, annual allocations are planned, based on existing urban land and converted rural land which should be ready for redevelopment during that year. Each plot of land is large with, in our sample, a median area of 22,300 square meters and a median sales price of USD $7 – 8 million. The committee decides the use and other constraints (like floor-area ratio) of each plot to be sold. Once the land becomes available during the year, the committee sets the reserve price, using a formula based on the appraised value submitted by, in principle, independent appraisal companies. Then the land is turned over to theland bureau which prepares it for sale (land for redevelopment in principle should be cleared), and chooses an auction type.There are three types of auction used in China’s land market. About 97% of sales in major cities are accounted for by two auction types, with the third type generally appearing only in Beijing and Shanghai. We ignore this third type of auction and our econometric specifications exclude Beijing and Shanghai.3 The two main types are guapai auction which we call two stage auction and paimai which is an English auction. English auctions are standard ascending auctions, usually publicly announced 20 working days before the auction. At announcement, basic details (e.g., use restrictions, reserve price, location) are publicized; and potential bidders for a small fee can obtain more detailed information, as well as inspect the site. Participation requires a cash deposit, usually about 10% of the reserve price, which is a non-trivial requirement given the large sizes and sales prices of such properties. English auctions are quite public, often video-taped with the press present. Winning bidders in principle must develop the land themselves.As with English auctions, two stage auctions are announced about 20 working days in advance; details of the plot are made public; and a deposit is required upon participation in the auction. A key difference is the auction format. With this type of auction, there are two stages. The first stage normally lasts 10 working days after the auction starts. In the second stage, at the end of the 10 working days, if more than one bidder is competing for the property, the auction ends on the spot with an English auction where only active bidders in the first stage are allowed to participate. If there is an ending English auction, it is generally less public than regular English auctions. In the first stage 3The third type is sealed bid, or zhaobiao auction. There, bidders submit sealed bids to the land bureau, which decides the winner according to a complicated score function, in which the submitted bid usually accounts for only 20-30% in weight. The remaining 70-80% of the weight goes to the credibility of the bidder and how much social responsibility the bidder is willing to take. Credibility is mainly reflected in two aspects: one is the quality and reputation of the projects the bidder has developed in the past; the other is the bidder’s financial capacity. As for social responsibility, this arises from Beijing’s recent attempt to curb rising housing prices. If a bidder is willing to commit to an upper bound on the housing price of the future development on this piece of land, then this bidder will get a higher score in terms of social responsibility. In a logit framework in looking at auction choices, we did an early test on the validity of the IIA assumption that dropping this third auction type does not affect the analysis of the choice between English and two stage auctions (Hausman-test of coefficient differences, when zhaobiao is added as a choice versus excluded). We could not reject the validity of the IIA assumption.during the 10 working days between the starting date of the auction and the potential ending English auction, after obtaining qualification, people may submit ascending bids in person or on-line. Bids as they arrive are immediately posted on the trading board of the land bureau, as well as typically on the internet, although the identity of bidders is not posted. If, at the end of 10 working days, there is only one remaining bidder, that bidder is assigned the property at his bid price (but not less than the reserve price). Otherwise, with competition, the auction is converted to an English auction.We will argue this first stage of a two stage auction allows for signaling of valuations for purposes of entry deterrence in non-corrupt contexts and for signaling in a potentially corrupt context, where the auction will be dominated by a corrupt bidder (in league with the land bureau).4 There are two fuzzy parts to the two stage auction format which we will argue are consistent with signaling, especially under corruption. While the auction is announced about 20 working days in advance, the exact date of the start of the first stage of the auction may not be announced at that time, but rather at an unspecified later date. Second, while bidders can apply during the announcement period before the first stage starts, it appears that approvals to participate can be delayed until after the first stage is under way.As detailed below, we use data on 2302 auction transactions from 2003 to 2007 in 15 cities, which use both auction types (as opposed to having only two stage auctions). In these cities English auctions account for 28% of auctions. In Figures 1 and 2 we present the indications from raw data that properties sell at a higher price under English as opposed to two stage auctions, and that English auctions are much more likely to be competitive. Figure 1 shows the distribution of unit sales price (price per sq. meter), by auction type for the sample; and Figure 2 shows the distribution of the ratio of sales to reserve prices. The raw data suggest that the distribution of unit sales prices for English auctions is shifted to the right of that for two stage auctions. Of course, the distribution of raw unit sales prices does not condition on property and market characteristics. While4 We conducted surveys of the land bureau officials of 20 cities covered in our sample. In our survey, we asked questions regarding the differences in the mechanism between the two auction formats, in addition to differences in the pattern of bidding behaviors. We also asked how the land bureau chooses between the two auction formats for each piece of land for sale. Our theory conjectures in the next section are informed by our survey findings.differentials in property characteristics could explain price differentials across auction types, below we show that will turn out not to be the case.In Figure 2, two stage auctions tend to be massed much more around 1.0 for “spread”, which is the ratio of sales to reserve prices. Both conceptually and in a particular sub-sample analyzed below where we know the number of bidders, a ratio of 1 implies that there is just one bidder and thus no competition. Ratios larger than 1 in the sub-sample imply multiple bidders and what we term a competitive auction. Of course, whether there is competition or not is influenced by reserve price; so, if there are differentials in setting reserve prices across auction types, that might explain the differential pattern by auction type in Figure 2. However, reserve prices are set by the outside committee before the choice of auction type by the land bureau; and, as we will see below in Table 4, reserve prices do not seem to affect the choice of auction type.5 Assuming that reserve prices are some fraction of an assessor’s estimate of true market value, a lack of competition is very surprising on its own. In these cities, auctions occur in a setting of rapid urban growth, with per capita urban incomes growing at about 10% a year and local population at 3-4 % a year. Given national restrictions on conversion of rural to urban land at the city fringes, this suggests there should be a high demand for land for new development.In the next section we outline a simple conceptual framework, which discusses our empirical hypotheses and the framework behind them. In the following sections, we turn to the econometric formulation looking at auction choices, sales prices, and the degree of competition. We document and explore the price differences between English and two stage auctions. As already noted a key issue concerns selection of properties into auction type and whether properties with better unobservables are more (positive selection) or less (negative selection) likely to sold by two stage auctions.5 As further evidence that reserve prices are set independently of auction type, in a MLE Heckman selection model where we allow auction type to be a determinant of reserve price, controlling for selection effects of auction type yields an insignificant rho, suggesting no correlation between those unobservables affecting auction choice and those affecting reserve price.2. Conceptual frameworkWe have not fully solved a theoretical model which covers all key aspects, for reasons that will become apparent. Rather we discuss the elements that are relevant and try to draw reasonable conjectures. We start with a discussion of how the two auction formats might be modeled in a world without corruption and how the choice of format affects outcomes. Then we ask how corruption possibilities might have differential implications for the two formats. Finally we discuss the land bureau’s choice of auction format.Assume for a leasehold auction there are N potential bidders, of which someendogenous number n pay an entry fee, C, and become active bidders.6 A key issue is how the choice of auction format may influence n. We assume auctions are independent private valuation. Specifically, a potential bidder i ’s valuation is 0i V v v i =+, where 0v is the (expected) common value that is the same for every bidder (based on property characteristics and local market conditions) and i v is the private value component only known to bidder i . i v ’s are i.i.d. 7We make the standard assumption that all bidders are risk neutral and maximize their expected payoff. Let i V F(V ∝)on i’s valuation, and let f(V) be the associated density function. A bidder’s payoff when winning the auction with a bid i B is i i i U =V B C −−.2.1 English auction.Since an English auction is outcome-equivalent to a second price Vickery auction, our setting is equivalent to that of Tan and Yilankaya (2006), who analyze a simultaneous move entry game in a second price auction with independent price valuations and participation costs. In a symmetric equilibrium of such a model a bidder will decide to enter the auction if and only if his valuation is above a certain value ˆV>r +C , where r is the reserve price and C is the entry cost. For a bidder with valuation exactly equal to ˆV, the only way he can get positive rent from entering the auction is if he is the lone6The entry fee consists of (i) cost of making cash deposit to qualify, (ii) cost of preparing documents to meet the qualification requirements, (iii) other transaction costs (e.g., time, consulting fee).7 Note that we assume the (expected) common value is common knowledge to all participants, thus the auction is treated as one with independent private valuation.bidder in the auction, in which case he gets a rent of ˆVr −. This case happens with probability 1ˆN F(V)−, such that all other potential bidders have valuations below ˆV . Therefore, the valuation threshold for entry ˆVmust satisfy 1ˆˆN F(V)(V r)=C −−. (1) From equation (1), we can solve for the valuation threshold for entry ˆVin equilibrium Clearly, ˆV is increasing in r,C,N . The probability of selling at the reserve price is 1ˆˆ1N NF(V)[F(V)]−−. Other possible outcomes in the auction are (1) that there are no bidders, which occurs with probability ˆ()N F V; and (2) that there are two or more bidders, so the auction is competitive with the winner being the highest valuation participant, j , who pays the second highest valuation 2()n j X V and makes an ex post rent 2()n j j V X V −. One can deriveexpected rents of entrants and expected revenue from the auction 8 .2.2 Two stage auctionThe two stage auction adds a first stage in which bidders in arbitrary pre-determined sequence (say, the time at which they learn of the auction) decide whether to enter the auction with a bid. Absent of entry fee (so every potential bidder will enter), there is no benefit of bidding early (e.g., see the last minute bidding literature such as Ockenfels and Roth, 2002). With entry fee, the advantage of bidding early is that a bidder can 8 In the bidding stage, each active bidder’s valuation has the truncated density function ofˆ()()/[1()]g V f V F V=−on . Let the associated distribution function be ()G V . Then the expected rent for active bidder i from the bidding game is 2()[()]()n n i i i i u V V X V dG V −=−∫∫∫, where ()iG V − denotes active bidders over the domain of 1ˆ[,]n iV V −. In the entry stage, bidder with probability of 11ˆ()[1()]N n N n n n N p C F V F V ˆ−−−−=−, where 1N n N C −− denotes the combination of N n −out of 1N −. Thus, the total expected rent for bidder i with valuation from entering the auction is 1()()Ni i n n i n U V p u V ==∑. Expected revenue is1122ˆˆ()[1()]()N N n n n n ER NF V F V r p X dG V −==−+∑∫∫∫.potentially signal that she drew a relatively high private valuation; we will suggest that the bid will signal her actual valuation. The point of the signal is to discourage future potential entrants who might have drawn somewhat higher valuations from entering the auction. For future bidders with somewhat higher valuations, they now know that, if they enter, the prior signaler is prepared to bid up to her valuation. That inferred valuation then defines the minimum price they have to pay. So their expected rent is based on the likelihood that they will win (no future entrants will have an even higher bid) and on the ex post rent (their valuation minus the current signaler’s valuation). Solving the general case with endogenous first stage entry sequence is daunting—whether an early entrant signals with what bid function, whether later entrants with higher valuations enter or not, and the complicated interactions between early and later signalers.Example.We illustrate the setting with a simple example. Suppose only one randomly selected person has the option to bid early and we consider a possible separating signalingequilibrium. Suppose bidder 1 chooses to enter in stage 1 by using a strictly increasing bidding schedule 1B(V ) when her valuation is For 1,V V < bidder 1 will choose to not enter the auction. Suppose her valuation is exactly V. Based on the Riley argument in the signaling literature, bidder 1 should use the lowest possible signal, the reserve price r . Moreover, in order for bidder 1 not to choose this signal when her valuation is just below V,her expected payoff from entering and signaling must be zero. Once bidder 1 reveals that her valuation is V, other potential bidders will enter only if their valuation is above ˆSV (V) , the solution to equation (1) with Vreplacing r and 2N − replacing 1N −. Other potential bidders understand that to win they must outbid bidder 1; but since bidder 1 has committed to enter the auction, she is willing to bid all the way to 1V . Thus, for the otherpotential bidders , the effective reserve price increases to 1V . Bidder 1 can win the auction only if no other potential bidders enter the auction, which happens with probability of 1ˆN SF(V (V))− . Therefore, we must have1ˆN S F(V (V))(V r)C −−= . (2) Note that since ˆSV (V)>V +C , comparing (2) and (1) reveals that V is significantly smaller than ˆ.VIn the bidding game if bidder 1 does not enter in the first stage, the other 1N − potential bidders play the same game as in an English auction: they first decide onwhether to enter in the second stage simultaneously, and then the active bidders bid in the English auction. Exactly as above, we can solve for the valuation threshold for entry, Note that ˆV is increasing in N , thusauction with N potential bidders.bidding function that is strictly increasing in 1V and truthfully reveals his valuation. Sucha bidding function satisfies the single crossing property, so it isn’t beneficial for lower valuation bidders to pretend to be higher types.Comparison: English versus two stage auction Since ˆV <V and ˆNSV <V ˆ, the probability of no sale is lower in a two stage auction than in an English auction. Since bidder 1 can discourage entry by other potential bidders with his early bid, he is more likely to enter in a two stage auction than in an English auction. And when bidder 1 does not enter, other bidders still are more likely to enter a two stage auction than an English auction. The intuition is that the simultaneous entry game in an English auction suffers from coordination failure: one bidder’s entry creates a negative externality for others. Thus, bidders may not enter the auction even when their valuation is significantly higher than the reserve price plus entry cost, for fear of being outbid by others. In contrast, bidder 1 in the sequential entry game of a two stage auction does not suffer from negative externalities from other bidders, thus having a stronger incentive to enter the auction. The flip side of this is that the probability of competitive bidding (two or more active bidders) is lower in a two stage auction than in an English auction, because the early entrant may deter later entrants.In terms of expected revenue, the comparison between two stage and English auctions is ambiguous in general. The intuition is that while a two stage auction has a higher probability of sale, the likelihood of competitive bidding is smaller than in an English auction. Thus, depending on parameter values, the expected revenue of the two stage auction can be greater or smaller than that of an English auction.In the Appendix, we show in a numerical example that the expected revenue of aWe conjecture that when land is “cold,” in the sense that the valuation is likely to be low ) or the potential demand (N) is small, a sale and some revenue is more likely under a two stage auction. We note N is unobserved in our data (as iscold properties which in an English auction might generate no active bidders, a two stage auction may generally be a better choice of auction for a revenue-maximizing land bureau, since the threshold valuations for entry are lower. If land is “hot” so an English auction is likely to attract many bidders, English auctions will tend to generate more revenue since two stage auctions may lead to entry deterrence. Thus we might expect a revenue-maximizing land bureau to steer hot properties towards English auctions. Thus overall, there would be negative selection on unobservables into two stage auctions. 2.3 Effect of corruptionSuppose corruption arises in the following way. Under a corrupt sale, a government official reaches an implicit agreement with a particular developer, say, developer 1, so that if he wins the land auction, she will provide special help (which could include weaker enforcement of development constraints or greater government investment in relevant infrastructure), in exchange for a bribery payment. Let Q be the value of the government official’s help to developer 1, and let q Q≤ be the bribery payment developer 1 makes to the government official, if he wins the auction. Define κQ q≡−as the net benefit to developer 1 from having an under-the-table deal with the government official.Assume the corrupt government official’s payoff function is given by ER+λq, where ER is the expected revenue from the land auction (that goes to the city coffers)λ=, the government and λ measures how corrupt the government official is. When 0。

民航业词汇add air services from Shanghai to Copenhagen to 6 flights per week 将上海至哥本哈根航线增至每周6班adopt unfair pricing policy 采用不公平的定价政策ahead of schedule 提前完成计划air accident 航空事故air accident emergency rescuing maneuver “空难”紧急救援演习air cargo service 货运航线air cargo turnover 货运周转量Air China 国航Air China Chengdu Maintenance Base 国航工程技术分公司成都维修基地air fare 机票价格Air France 法航air passenger transportation market 客运商场air service 航线air ticket free sales agreement 机票自由销售协议air ticket office 售票网点air transportation consumers complaints 民航消费者投诉情况airline oversale 超售airworthiness certification 适航认证all types of A320-family aircrafts A320系列所有飞机alternate airport 备降机场American Express 美国运通American United 美联航apron capacity 停机坪容量apron expansion project 停机坪扩建工程Asian Logistics awarding ceremony 亚洲物流奖ATM Station 空管站ATMB Mid South Bureau 民航中南空管局avionics 航空电子学BBJ 波音商务喷气飞机be examined and accepted by 经…验收become an agent for …..'s low cost air tickets 代理。

Google搜索海外买家EMAIL的小技巧很多人说不会用google搜客户,这里分享下本人的一些经验,希望对大家搜客户有所帮助,以我的关键词tyre为例:1、产品名(Products name)+公共邮箱名后缀1)产品+通用邮箱后缀如:tyre @,tyre @,tyre @,tyre @2)产品+Yahoo各国邮箱后缀:@yahoo.co.jp,@, 如在http://www.yahoo.co.jp输入tyre @yahoo.co.jp”产品+Live各国邮箱后缀,@ 如输入"轮胎email"3) Google各国的版本搜索,譬如输入"轮胎Email"4)产品名称+importers+email产品名称+distributors+email产品名称+wholesaler+email产品名称+buyer+email产品名称+supplier+emailemail还可用@代替5)产品+地区公共邮箱后缀或“ 产品+buy+地区邮箱”美国:@,@,@,@,@,@,@ver ;德国@t-online.de,@multi-industrie.de;法国:@wannado.fr,@,@,@club-internet.fr;日本@yahoo.co.jp,@candel.co.jp;英国@,@,@sltnet.lk;印度@ @.in @ @sancharnet.in @ @del .in新西兰@俄罗斯@yandex.ru @mail.ru德国@t-online.de @multi-industrie.de香港@ @ @ @ @ @m @ @台湾省@.tw @ @新加坡@.sg以色列:@.il;@candel.co.jp;@.il @.il @fastmail.fm赞比亚:@zamnet.zm阿根廷:@.ar; @.ar马其顿:@.mk几内亚:@.gn墨西哥:@.mx法国:@wannado.fr @ @ @club-internet.fr津巴布韦:@africaonline.co.zw;@samara.co.zw;@zol.co.zw;@mweb.co.zw科特迪瓦:@aviso.ci;@africaonline.co.ci;@纳米比亚:@.na;@;@iway.na;@尼泊尔:@.np;@.np;@.np蒙古:@; @mail.mn汤加:@kalianet.to;阿塞拜疆:@mail.ru日本@yahoo.co.jp @candel.co.jp阿曼@.om南非@webmail.co.za @vodamail.co.za @爱尔兰@indigo.ie @沙特阿拉伯@.sa瑞典@caron.se希腊@.gr @otenet.gr泰国@ @澳大利亚@ @.all @.au @.au @eunet.at卡塔尔@.qa英国@ @ @sltnet.lk加拿大@ @马来西亚@.my韩国的@/net @ @() @ @ @ @ @yahoo.co.kr巴基斯坦: @.pk @ @.in @ @sancharne t.in @.in @.in阿拉伯联合酋长国@.ae科威特:@越南:@hn.vnn.vn @hcm.fpt.vn @hcm.vnn.vn孟加拉:@意大利:@xxx.meh.es @terra.es @libero.it科特迪瓦:@aviso.ci @africaonline.co.ci @纳米比亚:@.na @ @iway.na @阿塞拜疆:@mail.ru印尼:@.id巴西:@联合国:@ @日耳曼:@奥地利:@eunet.at波兰:@ @poczta.onet.pl挪威:@埃及:@其他国家的公共EMAIL后缀可以通过自己的客户EMAIL后缀或者在Google搜索"国家名称+email",2、B2B采购信息+email到Google搜索一般B2B都有公布采购信息的部分信息,如公司名称,地址等,要想获得此公司的EMAI L可采取在Google搜索此买家的"电话+EMAIL","公司名称+Email"等等3、公司名称后缀+产品名称+EMAIL中国的是Co., LTD,美国是INC;LLC等,意大利是S.R.L; 西班牙是S.P.A.等等4、展会搜索展商EMAIL先通过Google搜索展览会,找出展商列表,再到Google搜索展商名称+EMAIL5、行业品牌的distributor或dealer的EMAIL搜索6、用alexa找出跟行业品牌链接的网站在Alexa的Trafic ranking里输入 可以找出的related link网站,这些公司的EMAIL找出来,是否有商机呢?7、世界各地的协会/工会网站找出协会会员,再到Google搜索EMAIL。

标准海外仓入库用户手册版本管理:WINIT战略发展部目录-标准海外仓入库1.产品概述 (3)1.1.产品定义 (3)1.2.适用群体 (3)1.3.适用范围 (3)1.4.产品特点 (4)1.5.产品图示 (4)2.产品说明 (4)2.1.“上门提货”服务 (4)2.2.“验货仓收货”服务 (5)2.3.“验货仓验货”服务 (6)2.4.“送港”服务 (6)2.5.“出口报关”服务 (6)2.6.“跨国物流”服务 (7)2.7.“进口报关”服务 (7)2.8.“代缴进口税费和杂费”服务 (7)2.9.“海外仓入库”服务 (7)2.10.“卖家自抬头报关”服务 (7)2.11.“整柜散装卸货”服务 (9)2.12.“索赔”服务 (10)3.WINIT系统操作介绍 (10)3.1.万邑联系统说明 (10)3.2.万邑联操作说明 (10)用户登录 (10)新功能引导 (11)产品注册 (11)海外仓入库 (15)4.常见问题 (18)4.1.系统下单常见问题 (18)4.11.账户注册&产品建立 (18)4.12.海外仓入库管理 (18)4.2.国际物流常见问题 (19)5.相关附件 (20)1.产品概述1.1.产品定义标准海外仓入库(下称“本产品”)是指为广大卖家提供从国内某个指定地点(卖家仓库门口或WINIT国内仓库门口)到WINIT海外仓上架完成的点到点物流活动。

本产品包含八个必选服务和四个可选服务:必选服务有:➢验货仓收货服务➢验货仓验货➢送港➢出口报关➢跨国物流➢进口报关➢代缴进口税费和杂费➢海外仓入库可选服务有:➢上门提货➢卖家自抬头报关➢海运柜散货卸货(美东仓不提供此服务)➢索赔服务1.2.适用群体本产品适用于大中华地区(包含中国大陆,香港,台湾)的卖家。

1.3.适用范围本产品适用于大中华地区(包含中国大陆,香港,台湾)所有使用WINIT海外仓的跨境电子商务卖家;卖家将货物发往WINIT海外仓库,WINIT根据客户指令进行分拣货物,完成货物上架。

中国驻各国商务参赞处网址

约旦

埃塞俄比亚

美国/index.shtml

法国/index.shtml 日本/index.shtml

印度/

尼日利亚/

澳大利亚/

菲律宾/

南非/

墨西哥

拉托维亚

马来西亚

新加坡

韩国/

马来西亚/

西班牙/

尼泊尔/

以色列/

塞浦路斯/

越南

罗马尼亚

土耳其

卡塔尔

斯里兰卡

斐济

香港

印尼

瑞典

毛里求斯

多哥/

刚果/

芬兰/

克罗地亚/

立陶宛/

乌干达/

泰国/

文莱/

匈牙利/

埃及/index.shtml 英国/index.shtml 孟加拉/

德国/

巴西

加拿大

波兰

沙特

肯尼亚

意大利

阿联酋

伊朗

巴基斯坦/

俄罗斯/

摩洛哥/

科威特/

黎巴嫩/

斯洛文尼亚/

奥地利

新西兰

塞拉里昂

叙利亚

亚美尼亚

也门

瑞士

摩尔多瓦

保加利亚

哥伦比亚/。