Unextendible Product Bases and Bound Entanglement

- 格式:pdf

- 大小:140.75 KB

- 文档页数:4

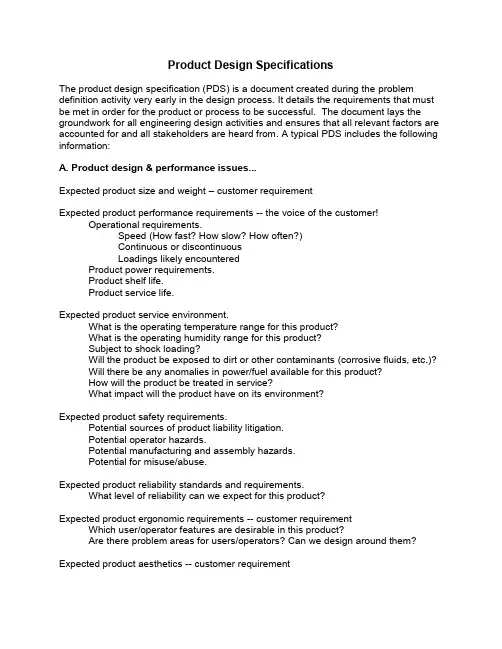

Product Design SpecificationsThe product design specification (PDS) is a document created during the problem definition activity very early in the design process. It details the requirements that must be met in order for the product or process to be successful. The document lays the groundwork for all engineering design activities and ensures that all relevant factors are accounted for and all stakeholders are heard from. A typical PDS includes the following information:A. Product design & performance issues...Expected product size and weight – customer requirementExpected product performance requirements -- the voice of the customer!Operational requirements.Speed (How fast? How slow? How often?)Continuous or discontinuousLoadings likely encounteredProduct power requirements.Product shelf life.Product service life.Expected product service environment.What is the operating temperature range for this product?What is the operating humidity range for this product?Subject to shock loading?Will the product be exposed to dirt or other contaminants (corrosive fluids, etc.)?Will there be any anomalies in power/fuel available for this product?How will the product be treated in service?What impact will the product have on its environment?Expected product safety requirements.Potential sources of product liability litigation.Potential operator hazards.Potential manufacturing and assembly hazards.Potential for misuse/abuse.Expected product reliability standards and requirements.What level of reliability can we expect for this product?Expected product ergonomic requirements -- customer requirementWhich user/operator features are desirable in this product?Are there problem areas for users/operators? Can we design around them? Expected product aesthetics -- customer requirementExpected product maintenance requirements.Can product be maintenance-free?If routine maintenance is required, can it be done by the owner/operator?Will professional maintenance be required?Possible off-the-shelf component parts.Which parts of this product be purchased instead of being made by us?Is the quality and reliability of purchases parts adequate for this design? Material requirements..What are the strength requirements?What are the rigidity/compliance requirements?Is product weight of importance?Expected product recycling potential and expected disposalDoes the disposal of this product constitute an environmental hazard?Can parts of this product be effectively recycled by existing processes? Manufacturing process requirements and limitations.Is protection from the environment necessary?Is there a customer preference for a particular finish?How do we minimize environmental impact?Product packaging requirements.Can we use environmentally friendly packaging and packing materials?How much packaging and packing materials are really necessary? Applicable codes and standards to be checked.Patents to be checked.Processes to research/benchmark. (special processes needed for fabrication?) Product part and prototype testing requirements.B. Market issues...Potential customer baseWho will buy this product? Why?Have you listed all potential classes of customers?Can we tap into a new segment of the market? How?Market constraints on product.Who is buying this type product? (customer base)What is currently selling?What is currently not selling?Expected product competition (These will be benchmarked)What are the strengths of each competing product? Can we incorporate them?What are the weaknesses of each competing product? Can we improve?What are the market shares of competing products?Target product price -- OEM and MSRPTarget production volume and market share.Is there a market for this product? How do you know?Is the potential market sufficiently large to justify investment in a new product?Is the new product sufficiently better than the competition?Expected product distribution environment.How will the packaged product be treated in shipping, storage, and on the shelf?Are adequate shipping facilities available?Will installation require a professional?C. Capability issues....Company constraints on product design, manufacture, and distribution.What are our manufacturing capabilities?Should we manufacture ourselves or outsource?Schedule requirements -- time to market.When should we have this product to market to capture maximum market share?How much time should we allocate to design?How much time do we need to implement a manufacturing process?Writing a PDSStart writing your PDS early in the design process, typically as soon as you have established engineering requirements and done sufficient research.The PDS is a living document, that is, it will get larger as more about the design is known. That being said, you should not change existing specifications unless a major design change is encountered. Remember, the PDS represents what you are trying to achieve, you should NEVER change it to what has already been achieved.Write a PDF is list format, not as an essay.Quantify your parameters. Use target goals. So not “Light Weight” but rather “weight to be less than 3 kilograms”. If you are unsure of a specific parameter, estimate a value and adjust your PDF at a later date.Example (source: Stuart Pugh, Total Design, Addison Wesley, 1991) Surveyor’s Pole Stand. A surveyor’s pole is used in land surveyi ng for level and distance measurement. It is held vertically at a distance from a measuring device (a theodolite), which is operated by a surveyor. To allow the surveyor to operate independently, a self-supporting surveyor’s pole is necessary.The Product Design Specification (PDS) for the self-supporting pole is as follows: Performance: To be fixable in position within one minute. Its lower end to contactthe ground, even when on irregular terrain. For use on soft or hard ground. Thepole to be adjustable for angle so that it stands vertically on slopes up to 1 in 4.Size: Pole to be 2 m long and showi ng a “face” of 25 mm. A suitable base sizecould be X points on a circle not less than 600 mm in diameter. To fit in the trunkof an auto 1 m x 0.5 m x 0.5 m.Cost: Manufacturing cost plus $20Quantity: Batches of 2000 – 5000 for domestic and international markets. Maintenance: Minimal (e.g., oiling allowed)Finish: Corrosion resistant to enable continued usage in environment specified. Materials: Light-weight – transportable – not easily damaged by impact.Weight: Five kilograms maximum.Aesthetics: Must present an image of robustness, reliability, and compactness.Product life: Twenty years.Customer: Surveyors in government and private sectors, domestic and international. Standards/specifications: To be checked.Politics: Not applicable.Life in service: Five yearsReliability: Maximum 3% failure rate over service life.Safety: Should not have sharp projections; should be capable of being set up with gloved hands.Environment: Temperature range -20°C to 100°C; resistant to water, salt, dust, wind, ice, rocks, common solvents, oil, gasoline and the like; shock proof to 10 g; wind speeds up to 25 mph.Shelf life: Five years.Packing: Standard pallets to appropriate ISO standards.Time-scale: Production to start nine months from specification date.Testing: Prototypes to be proven to meet PDS. No testing of production models (except for sampling).Ergonomics: Must be convenient to handle and store, easy to set up and dismantle, and be capable of set up by one person.Competition: To be analyzed.Market: Worldwide. Trends to be analyzed.Patents: To be checked.Manufacturing facility: Adequate capacity and suitable tools available.Company constraints: None at this stage.Processes: Batch production.。

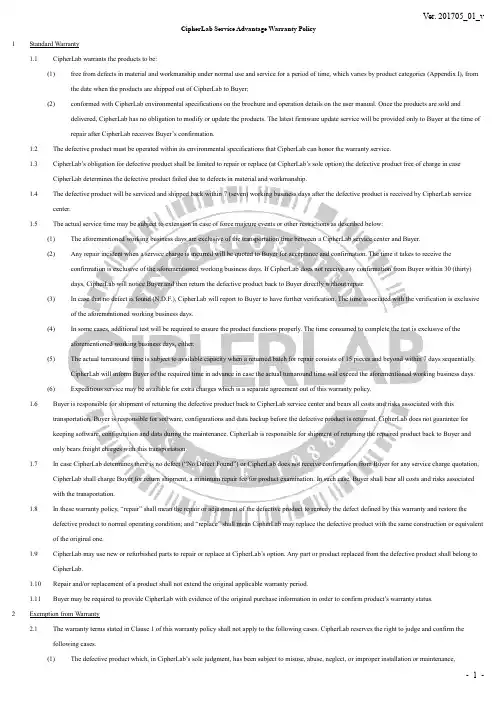

CipherLab Service Advantage Warranty Policy1Standard Warranty1.1CipherLab warrants the products to be:(1)free from defects in material and workmanship under normal use and service for a period of time, which varies by product categories (Appendix I), fromthe date when the products are shipped out of CipherLab to Buyer;(2)conformed with CipherLab environmental specifications on the brochure and operation details on the user manual. Once the products are sold anddelivered, CipherLab has no obligation to modify or update the products. The latest firmware update service will be provided only to Buyer at the time ofrepair after CipherLab receives Buyer’s confirmation.1.2The defective product must be operated within its environmental specifications that CipherLab can honor the warranty service.1.3CipherLab’s obligation for defective product shall be limited to repair or replace (at CipherLab’s sole option) the defective product free of charge in caseCipherLab determines the defective product failed due to defects in material and workmanship.1.4The defective product will be serviced and shipped back within 7 (seven) working business days after the defective product is received by CipherLab servicecenter.1.5The actual service time may be subject to extension in case of force majeure events or other restrictions as described below:(1)The aforementioned working business days are exclusive of the transportation time between a CipherLab service center and Buyer.(2)Any repair incident when a service charge is incurred will be quoted to Buyer for acceptance and confirmation. The time it takes to receive theconfirmation is exclusive of the aforementioned working business days. If CipherLab does not receive any confirmation from Buyer within 30 (thirty)days, CipherLab will notice Buyer and then return the defective product back to Buyer directly without repair.(3)In case that no defect is found (N.D.F.), CipherLab will report to Buyer to have further verification. The time associated with the verification is exclusiveof the aforementioned working business days.(4)In some cases, additional test will be required to ensure the product functions properly. The time consumed to complete the test is exclusive of theaforementioned working business days, either.(5)The actual turnaround time is subject to available capacity when a returned batch for repair consists of 15 pieces and beyond within 7 days sequentially.CipherLab will inform Buyer of the required time in advance in case the actual turnaround time will exceed the aforementioned working business days.(6)Expeditious service may be available for extra charges which is a separate agreement out of this warranty policy.1.6Buyer is responsible for shipment of returning the defective product back to CipherLab service center and bears all costs and risks associated with thistransportation. Buyer is responsible for software, configurations and data backup before the defective product is returned. CipherLab does not guarantee forkeeping software, configuration and data during the maintenance. CipherLab is responsible for shipment of returning the repaired product back to Buyer andonly bears freight charges with this transportation.1.7In case CipherLab determines there is no defect (“No Defect Found”) or CipherLab does not receive confirmation from Buyer for any service charge quotation,CipherLab shall charge Buyer for return shipment, a minimum repair fee for product examination. In such case, Buyer shall bear all costs and risks associatedwith the transportation.1.8In these warranty policy, “repair” shall mean the repair or adjustment of the defective product to remedy the defect defined by this warranty and restore thedefective product to normal operating condition; and “r eplace” shall mean CipherLab may replace the defective product with the same construction or equivalent of the original one.1.9CipherLab may use new or refurbished parts to repair or replace at CipherLab’s option. Any part or product replaced from the defective product shall belong toCipherLab.1.10Repair and/or replacement of a product shall not extend the original applicable warranty period.1.11Buyer may be required to provide CipherLab with evidence of the original purchase information in order to confirm product’s warranty status.2Exemption from Warranty2.1The warranty terms stated in Clause 1 of this warranty policy shall not apply to the following cases. CipherLab reserves the right to judge and confirm thefollowing cases.(1)The defective product which, in CipherLab’s sole judgment, has been subject to misuse, abuse, neglect, or improper installation or maintenance,unauthorized repair or installation, modifications or alterations of the product;(2)Parts, materials or equipment not manufactured by CipherLab.(3)Liquid leakage or anything attached to the defective product;(4)Imperfections resulted from normal wear and use, including but not limited to scratches, dents etc;(5)Damaged, modified or un-recognizable product serial number sticker(6)Purchased software(7)Defects resulted from force majeure events, including but not limited to acts of God, earthquake, flood;(8)Incomplete charge resulted in product performance;2.2CipherLab shall not be bound by any unauthorized representation or warranty made by any other person, including but not limited to resellers, distributors,dealers, and employees of CipherLab.2.3CipherLab shall not be held liable for indirect, incidental or consequential damages, and shall not have liability exceed that actual amount paid for the defectiveproduct. In no event shall CipherLab be held liable for damages incurred by resellers or their Buyer as a result of use of a product beyond its intended use.2.4In the event that CipherLab expressly offers other versions of warranty terms in written (“special warranty terms”), the special warranty terms shall prevail.3Extended Warranty3.1Extended Warranty is applicable to selected mobile computer categories (Appendix II) at the expense of Buyer.3.2Extended Warranty does not cover scan engine, decoder board, accessories and peripherals.3.3Extended Warranty is prolonged from Standard Warranty with the same coverage as stated in Clauses 1 and 2 of this warranty policy. One-year and two-yearterms are at Buyer’s option. A full period of Extended Warranty is limited to 4 (four) years in total exclusive of the 1st year Standard Warranty.3.4Buyer must meet the engagement with CipherLab prior to expiration of the existing term.(1)Buyer has to purchase one year to four- years Extended Warranty before the Standard Warranty expires.(2)Buyer is eligible for renewal of the same term of Extended Warranty before it gets expired. Buyer can only renew one-year term with previous purchase ofone-year Extended Warranty, and Buyer can only renew two-year term with previous purchase of two-year Extended Warranty.(3)If Buyer fails to renew Extended Warranty by the due date, the warranty will be discontinued as it expires without a notice.3.5The defective product will be serviced and shipped back within 5 (five) working business days after the defective product is received by CipherLab servicecenter.3.6Besides the additional terms and conditions above for extended warranty, the content of Clauses 1 and 2 of this warranty policy also applies for extendedwarranty.4Comprehensive Warranty4.1Comprehensive Warranty is applicable to selected mobile computer categories (Appendix III) at the expense of Buyer.4.2Comprehensive Warranty does not cover accessories and peripherals.4.3Comprehensive Warranty is a Three-year service program. at Buyer’s option. The aforementioned three-year term is inclusive of the 1st year Standard Warranty.Buyer must purchase the program within 60 (sixty) days after the shipping date.4.4The defective product will be serviced and shipped back within 2 (two) working business days after the defective product is received by CipherLab servicecenter.4.5The following items are also covered under comprehensive warranty during normal usage but not covered under standard and extended warranty. CipherLabreserves the right to judge and confirm the following items.(1)Damaged housings(2)Cracked or broken displays(3)Cracked or damaged dust window(4)Cracked keypads(5)Damaged stylus(6)Damaged hand straps(7)Damaged battery cover.4.6CipherLab will provide transportation between a CipherLab service center and Buyer.4.7Besides the additional terms and conditions above for Comprehensive warranty, the content of Clauses 1 and 2 of this warranty policy also applies forComprehensive warranty.5Product Repair Procedure5.1Buyer must have registered an account with CipherLab for repair and warranty services. A registration form must be filled up and returned to CipherLab to set upthe account. CipherLab will reply to Buyer with Account ID and Password. The Account ID is unique and exclusive for each Buyer and the registration isrequired once for all, Buyer shall safeguard the Account ID and Password.5.2Buyer logs in the E-RMA System of CipherLab at /Default.aspx with the above registered credential and follows throughinstructions before sending a defective product back to CipherLab service center.5.3Buyer is responsible for software, configurations and data backup before the defective product is returned. CipherLab does not guarantee for keeping software,configuration and data during the maintenance.5.4Accessories, including but not limited to cables, batteries, batteries covers and power converters /adapters, are not required to ship back with the defectiveproduct unless they are defective themselves. All shipped items must be recorded in order in the E-RMA System, CipherLab will mark the status in the E-RMA System when the items are checked upon arrival.5.5Each RMA number is generated by CipherLab system automatically when Buyer files the case and is only valid for 45 days. Once it gets expired beforeCipherLab service center receives the defective product, the RMA number will be deleted automatically and Buyer has to file the case again for another validRMA number.5.6Repaired products are shipped back to Buyer by the term agreed ahead. Please make sure the Buyer’s information in the CipherLab E-RMA system is correct.6Notes6.1The CipherLab Warranty Policy as announced on CipherLab E-RMA System is the standard version. CipherLab reserves the right to modify, explain and stateabout the warranty terms and conditions. The notification will be announced on CipherLab E-RMA System if there’s any modification.6.2This policy may be translated into different languages. However, the English version should be the standard and prevail the others whenever there is discrepancyin comprehension due to translation.Appendix I – List of Products to which Standard Warranty is applicable.Appendix II – List of Products to which Extended Warranty is applicable.•8000 Series •8200 Series •8600 Series •9200 Series •9700 Series•CP50 Series•CP55 Series•CP60 Series•RS30 Series•RS31 Series•RS50 SeriesAppendix III – List of Products to which Comprehensive Warranty is applicable.•8000 Series •8200 Series •8600 Series •9200 Series •9700 Series•CP50 Series•CP55 Series•CP60 Series•RS30 Series•RS31 Series•RS50 Series。

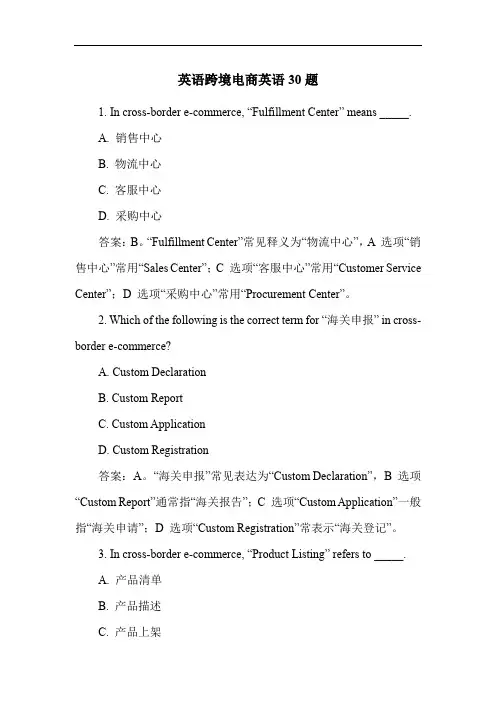

英语跨境电商英语30题1. In cross-border e-commerce, “Fulfillment Center” means _____.A. 销售中心B. 物流中心C. 客服中心D. 采购中心答案:B。

“Fulfillment Center”常见释义为“物流中心”,A 选项“销售中心”常用“Sales Center”;C 选项“客服中心”常用“Customer Service Center”;D 选项“采购中心”常用“Procurement Center”。

2. Which of the following is the correct term for “海关申报” in cross-border e-commerce?A. Custom DeclarationB. Custom ReportC. Custom ApplicationD. Custom Registration答案:A。

“海关申报”常见表达为“Custom Declaration”,B 选项“Custom Report”通常指“海关报告”;C 选项“Custom Application”一般指“海关申请”;D 选项“Custom Registration”常表示“海关登记”。

3. In cross-border e-commerce, “Product Listing” refers to _____.A. 产品清单B. 产品描述C. 产品上架D. 产品评价答案:C。

“Product Listing”常见释义为“产品上架”,A 选项“产品清单”常用“Product List”;B 选项“产品描述”常用“Product Description”;D 选项“产品评价”常用“Product Review”。

4. What does “Drop Shipping” mean in cross-border e-commerce?A. 直接发货B. 代发货C. 批量发货D. 延迟发货答案:B。

高三经济全球化英语阅读理解30题1<背景文章>Economic globalization refers to the increasing interdependence of world economies as a result of the growing scale of cross-border trade of commodities and services, flow of international capital and wide and rapid spread of technologies. It is a complex phenomenon that has been evolving over centuries.In ancient times, trade routes such as the Silk Road connected different regions and promoted the exchange of goods and cultures. This was an early form of economic globalization. During the Age of Exploration, European powers expanded their trade networks around the world, further accelerating the process.The Industrial Revolution brought significant changes. Advances in transportation and communication technologies made it possible to move goods and information more quickly and efficiently. This led to a massive increase in international trade and investment.One of the main characteristics of economic globalization is the integration of markets. Companies can now sell their products and services in markets all over the world. This has led to increased competition and has forced businesses to become more efficient and innovative. Anothercharacteristic is the mobility of labor. Skilled workers can move to different countries in search of better job opportunities.Globalization also has its challenges. It can lead to job losses in some industries as companies move production to countries with lower labor costs. It can also widen the gap between rich and poor countries. However, it also offers many opportunities. It can promote economic growth, improve living standards and facilitate the spread of knowledge and technology.In conclusion, economic globalization is a powerful force that is shaping the world economy. It has brought many benefits, but also poses challenges that need to be addressed.1. What is economic globalization mainly the result of?A. The growth of domestic trade.B. The increasing scale of cross-border trade, flow of international capital and spread of technologies.C. The decline of traditional industries.D. The isolation of world economies.答案:B。

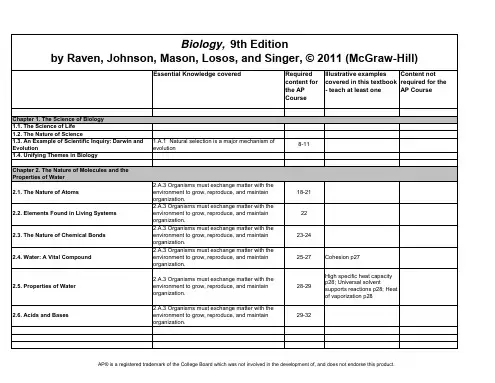

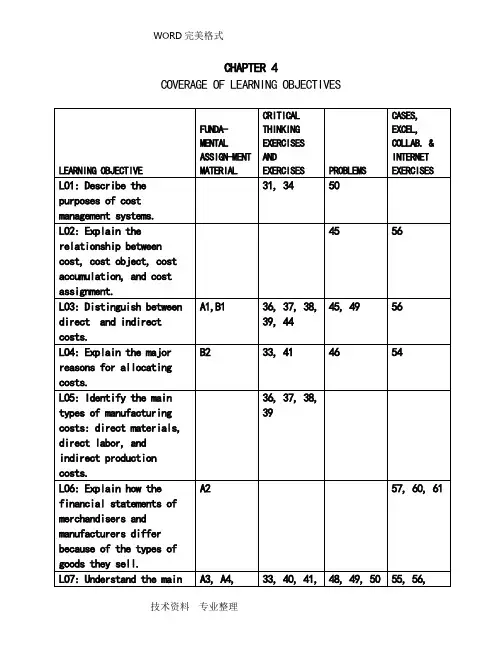

CHAPTER 4 COVERAGE OF LEARNING OBJECTIVESCHAPTER 4Cost Management Systems and Activity-Based Costing4-A1 (20-30 min.)See Table 4-A1 on the following page.4-A2 (25-30 min.)1. Merchandise Inventories, 1,000 devices @ $97 $97,0002. Direct materials inventory $ 40,000Work-in-process inventory 0 Finished goods inventory 97,000 Total inventories $137,000 3.NILE ELECTRONICS PRODUCTSStatement of Operating IncomeFor the Year Ended December 31, 20X9Sales (9,000 units at $170) $1,530,000 Cost of goods sold:Beginning inventory $ 0Purchases 970,000Cost of goods available for sale $ 970,000Less ending inventory 97,000Cost of goods sold (an expense) 873,000 Gross margin or gross profit $ 657,000 Less other expenses: selling & administrative costs 185,000 Operating income (also income before taxesin this example) $ 472,000TABLE 4-A1STATEMENT OF OPERATING INCOME OPERATING INCOME BY PRODUCT LINEEXTERNAL REPORTING PURPOSE INTERNAL STRATEGIC DECISION MAKING PURPOSECustom Large SmallDetailed Std. Std. Cost Type, Assignment Method Sales $155,000 $30,000 $45,000 $80,000Cost of goods sold:Direct material 40,000 5,000 15,000 20,000 Direct, Direct TraceIndirect manufacturing 41,000 28,0001 5,000 8,000 Indirect, Alloc. – Mach. Hours81,000 33,000 20,000 28,000Gross profit 74,000 (3,000) 25,000 52,000Selling and administrative expenses:Commissions 15,000 1,500 3,500 10,000 Direct, Direct Trace Distribution to warehouses 10,400 1,0002 3,000 6,400 Indirect, Allocation - Weight Total selling and admin. expenses 25,400 2,500 6,500 16,400Contribution to corporate expensesand profit 48,600 $(5,500) $18,500 $35,600Unallocated expenses:Administrative salaries 8,000Other administrative expenses 4,000Total unallocated expenses 12,000Operating income before tax $ 36,6001 Total machine hours is 1,400 + 250 + 400 = 2,050. Indirect manufacturing cost per machine hour is then $41,000 ÷ 2,050 = $20. The al location to custom detailed is $20 × 1,400 machine hours = $28,000.2 Total weight shipped is 25,000 kg + 75,000 kg + 160,000 kg = 260,000 kg. Indirect distribution costs per kilogram is then $10,400 ÷ 260,000 kg = $0.04. The allocation to custom detailed is $0.04 × 25,000 kg = $1,000.技术资料专业整理4. ORINOCO, INC.Statement of Operating IncomeFor the Year Ended December 31, 20X9Sales (9,000 units at $170)$1,530,000Cost of goods manufactured and sold:Beginning finished goods inventory $ 0Cost of goods manufactured:Beginning WIP inventory $ 0Direct materials used 530,000Direct labor 290,000Indirect manufacturing 150,000Total mfg. costs to account for $970,000Less ending work-in-process inventory 0 970,000Cost of goods available for sale $970,000Less ending finished goods inventory 97,000Cost of goods sold (an expense) 873,000Gross margin or gross profit $ 657,000 Less other expenses: selling and administrative costs 185,000Operating income (also income before taxesin this example) $ 472,0005. The balance sheet for the merchandiser (Nile) has just one line forinventories, the ending inventory of the items purchased for resale.The balance sheet for the manufacturer (Orinoco) has three items:direct materials inventory, work-in-process inventory, and finishedgoods inventory.The income statements are similar except for the computation of cost of goods available for sale. The merchandiser (Nile) simply showspurchases for the year plus beginning inventory. In contrast, themanufacturer (Orinoco) shows beginning work-in-process inventory plusthe three categories of cost that comprise manufacturing cost (directmaterials used, direct labor, and factory (or manufacturing) overhead)and then deducts the ending work-in-process inventory. The manufacturer then adds the beginning finished goods inventory to this cost of goodsmanufactured to get the cost of goods available for sale.6. The purpose is providing aggregate measures of inventory value and costof goods manufactured for external reporting to investors, creditors,and other external stakeholders.4-A3 (10-15 min.)There can be many justifiable answers for each item other than thelisted cost driver and behavior. The purpose of this exercise is togenerate an active discussion regarding those chosen by First Bank’smanagers. One point that should be emphasized is that many timesmanagers choose cost drivers that are not the most plausible or reliable because of lack of data availability. Cost drivers are also used as abasis to allocate activity and resource costs and so the availability of data is often an important consideration.ActivityOr CostResource Cost Driver Behaviora.* R Number of square feet Fb.** R Number of person hours Fc. R Number of computer transactions Vd. A Number of schedulese. R Number of person hours Ff. R Number of loan inquiries Vg.*** A Number of investmentsh. A Number of applicationsi. R Number of person hours Vj. R Number of minutes Vk. R Number of person hours Fl. A Number of loans* An argument can be made that maintenance of the building is an activity.If this was the case, resources such as supplies and labor would be resources consumed, and several resource cost drivers would be needed. In addition, a separate resource and associated cost driver would be needed for insurance costs. However, the company had a contract for maintenance (fixed price), so this was a fixed-cost resource that was added to other occupancy costs such as insurance. The cost driver chosen for all these occupancy costs was square feet occupied by the various departments.** Normally, the cost driver used for any labor resource is person hours.It is assumed that the staff person hours used are regular hours rather than overtime or temporary labor hours. Thus, the cost is fixed with respect to changes in hours used. As the hours used increases (decreases) theutilization of the resources increases (decreases) and eventually, management will need to make a decision whether to expand capacity (or whether to cutback on labor). This is an example of a step cost that is fixed over wideranges of cost-driver level.*** Students may try to determine the cost behavior of activities even thoughthe problem requirements do not ask for it. Point out that activities almostalways have mixed cost behavior because they consume various resources. Someof these are fixed-cost and others variable-cost resources. For example, theactivity “research to evaluate a loan application” consumes such fixed-costresources as manager labor time and computers (assumed owned by the bank).This activity also consumes variable-cost resources such as telecommunicationstime and external computing services.4-A4 (20-30 min.)1. The first step is to determine the cost per cost-driver unit for eachactivity:Monthly Cost- Cost perManufacturing Driver DriverActivity [Cost driver] Overhead Activity UnitMaterial Handling [Direct materials cost] $12,000 $200,000$ 0.06Engineering [Engineering change notices] 20,000 20 1,000.00Power [Kilowatt hours] 16,000 400,000 0.04Total Manufacturing Overhead $48,000Next, the costs of each activity can be allocated to each of the threeproducts:PHYSICAL FLOW / ALLOCATED COSTCost Senior Basic DeluxeMaterial Handling$.06 × 25,000 = $1,500$.06 × 50,000 = $ 3,000$.06 × 125,000 = $ 7,5 Engineering $1,000 × 13 = 13,000$1,000 × 5 = 5,000$1,000 × 2 = 2,000Power $.04 × 50,000 = 2,000$.04 × 200,000 = 8,000$.04 × 150,000 = 6,000 Total $16,500 $16,000 $15,5002. Overhead rate based on direct labor costs:Rate = Total manufacturing overhead ÷ Total direct labor cost= $48,000 ÷ $8,000 = $6.00/DL$Overhead allocated to each product is:Senior: $6.00 × 4,000 = $24,000Basic: $6.00 × 1,000 = 6,000Deluxe: $6.00 × 3,000 = 18,000Total $48,000Notice that much less manufacturing overhead cost is allocated to Basic using direct labor as a cost driver. Why? Because Basic uses only asmall amount of labor but large amounts of other resources, especially power.3. The product costs in requirement 1 are more accurate if the costdrivers are good indicators of the causes of the costs -- they are both plausible and reliable. For example, kilowatt hours is certainly abetter measure of the cost of power costs than is direct labor hours.Therefore, the allocation of power costs in requirement 1 is certainly better than in requirement 2. Materials handling and engineering arelikewise more plausible. A manager would be much more confident in the manufacturing overhead allocated to products in requirement 1.Remember, however, that there are incremental costs of data collection associated with the more accurate ABC system. The benefit/costcriteria must be applied in deciding which costing system is “best.”4-B1 (20-30 min.)See Table 4-B1 on the following page.4-B2 (25-30 min.)1. $1,080,000 ÷ 45,000 hours = $24 per direct-labor hour2. (a) $585,000 ÷ 15,000 hours = $39 per direct-labor hour(b) $495,000 ÷ 30,000 hours = $16.50 per direct-labor hour3. (a) $585,000 ÷ 97,500 hours = $6 per machine hour(b) $495,000 ÷ 30,000 hours = $16.50 per direct-labor hour4. (a) $24 × (1.0 + 14.0) = $360.00$24 × (1.5 + 3.0) = $108.00$24 × (1.3 + 8.0) = $223.20(b) ($39 × 1.0) + ($16.50 × 14.0) = $39.00 + $231.00 = $270.00($39 × 1.5) + ($16.50 × 3.0) = $58.50 + $ 49.50 = $108.00($39 × 1.3) + ($16.50 × 8.0) = $50.70 + $132.00 = $182.70(c) ($6 × 12.0) + ($16.50 × 14.0) = $ 72.00 + $231.00 = $303.00($6 × 17.0) + ($16.50 × 3.0) = $102.00 + $ 49.50 = $151.50($6 × 14.0) + ($16.50 × 8.0) = $ 84.00 + $132.00 = $216.00(d) First consider using departmental instead of firm-wide rates (partb vs. part a). Departmental rates that use direct-labor hours asthe base decrease the cost applied to units of A and C and leave B unaffected. Other products that use relatively less assembly time will increase in cost. Now examine changing to a base of machine hours in machining (part c vs. part a). Product B is the only one with an increase in cost in (c) compared to (a). Why? Because B's uses only 16% of the direct labor hours used for A, B, and C, so it is is allocated only 16% of the costs allocated on the basis ofdirect labor hours. But it uses 40% of the machine hours, andthere is allocated 40% of costs that are allocated on the basis on machine hours. Therefore, it receives relatively more costs with a base of machine hours than with a base of direct-labor hours.TABLE 4-B1STATEMENT OF OPERATING INCOME OPERATING INCOME BY PRODUCT LINEThousands of Dollars Lawn HandScooter Mower Tool Cost Type,Parts Parts Parts Assignment Method Sales $990 $350 $380 $260Cost of goods sold:Direct material 400 175 125 100 Direct, Direct Trace Indirect manufacturing 94 68 1 14 12 Indirect – Mach.Hrs494 243 139 112Gross profit 496 107 241 148Selling and administrative expenses:Commissions 55 25 20 10 Direct, Direct Trace Distribution to warehouses 150 20 2 80 50 Indirect - Weight Total selling and administrative expenses 205 45 100 60Contribution to corporate expenses and profit 291 $ 62 $141 $ 88Unallocated expenses:Corporate salaries 11Other general expenses 17Total unallocated expenses 28Operating income before tax $2631 Total machine hours is 8,500 + 1,750 + 1,500 = 11,750. Indirect manufacturing cost per machine hour isthen $94,000 ÷ 11,750 = $8. The allocation to scooter parts is $8 × 8,500 machine hours = $68,000.2 Total weight shipped is 100,000 kg + 400,000 kg + 250,000 kg = 750,000 kg. Indirect distribution costs perkilogram is then $150,000 ÷ 750,000 kg = $0.20. The allocation to scooter parts is $0.20 × 100,000 kg = $20,000.技术资料专业整理4-B3 (30-35 min.)1.The existing system allocates all costs based on direct labor cost. The rate for allocating indirect production costs is:Estimated indirect production cost ÷ Estimated direct labor cost= ¥24,500,000 ÷ ¥35,000,000 = 70%That is, each time ¥1 is spent on direct labor, Watanabe adds ¥0.7 of indirect production cost to the cost of the product.2. Under an ABC system, Watanabe would allocate indirect production costs separately for each activity. This would result in the following four allocation rates:Receiving: Receiving co sts ÷ Direct material cost=¥4,800,000 ÷ 60,000,000 = ¥0.08 per ¥1of dir. mat. Assembly: Assembly costs ÷ Number of control units=¥13,800,000 ÷ 92,000 = ¥150 per control unitQual. Control: Quality control cost ÷ QC hours=¥1,800,000 ÷ 600 = ¥3,000 per QC hourShipping: Shipping cost ÷ # of boxes shipped=¥4,100,000 ÷ 8,200 = ¥500 per box shipped3. (a) The cost will contain 3 components (in thousands of yen):Direct material ¥ 8,000Direct labor 2,000Indirect production cost (¥2,000 × .7 = 1,400) 1,400Total cost ¥11,400Price (¥11,400 × 1.3)¥14,820(b) The cost will have 7 components, 4 of them allocating indirect production costs (totals in thousands of yen):Direct materials ¥ 8,000Direct labor 2,000Receiving (¥0.08 × 8,000)¥640Assembly (¥150 × 5,000)750Quality control (¥3,000 × 50)150Shipping (¥500 × 600) 300Total indirect production cost 1,840Total cost ¥11,840 Price (11 ,840 × 1.3)¥15,3924. The order from Nissan requires a relatively large amount of receiving, quality control, and shipping resources compared to the relative amount of labor required. This makes its indirect production costs are relatively expensive relative to the labor required. The following illustrates why an allocation on the basis of labor cost results in less costs than allocations based on the four activities:Budgeted Cost- Nissan Cost- NissanActivity Allocation Base Allocation Base Percentage Direct materials 60,000,000 8,000,000 13.3%Direct labor 35,000,000 2,000,000 5.7 Receiving 60,000,000 8,000,000 13.3 Assembly 92,000 5,000 5.4 Quality control 600 50 8.3 Shipping 8,200 600 7.3Using the single direct-labor cost-allocation base, this order would receive 5.7% of all indirect production costs. The main reason that indirect production costs for this order under the ABC system are relatively high is the large relative cost of materials that drives a large allocation (13.3%) of receiving costs to this order. The allocations of both quality control and shipping costs are slightly larger that they would be using a direct-labor cost-allocation base, while the allocation of assembly costs is slightly smaller.4-B4 (50-60 min.)1. A summary of the analyses follows.Pen Cell-PhoneCasings Casings CompanyBase Gross Profit Percentage* 1.25% 38.75% 8.07% Plan Gross Profit Percentage** 10.80% 37.20% 17.40% Support of Product Manager? Strong NoneSupport of President? Moderate* See Exhibit 4-6 on p. 136 of the text.** See Panel B of Exhibit 4-B4 that follows.Exhibit 4-B4, Panels A and B on the following pages can be used to explain the impact of the controller’s idea using the process map of the traditional costing system and the related financial reports. Notice that the $80,000 annual decrease in the cost of engineers needs to be converted to a $20,000 quarterly savings. The controller’s idea will result in an increase of 9.55%in the gross profit of the pen-casings line but a decrease of 1.55% in thecell-phone line. The product manager of pen casings would probably give strong support to the idea but the cell-phone casings manager would most likely not support the idea.Although the company-level gross profit margin improves, the president’s support may not be strong. Why? There is not a strong consensus among product-line managers. Top management is normally hesitant to support actions that do not have the unanimous support among product-line managers unless there is solid evidence of material improvement in profitability. While the current loss would be reversed, the return on sales is still nominal at 3,500 ÷ $480,000 = .73%.Exhibit 4-B4: Panel AProcess Map of Traditional Cost System[Direct Labor Hours = 4,500 +Exhibit 4-B4: Panel BPRO-FORMA FINANCIAL REPORTS:TRADITIONAL COST ALLOCATION SYSTEMSTATEMENT OF OPERTING INCOME CONTRIBUTION TO CORPORATE COSTSAND PROFIT [EXTERNAL REPORTING PURPOSE] [INTERNAL STRATEGIC DECISION MAKINGAND OPERATIONAL-CONTROL PURPOSE]Pen Casings Cell Phone CasingsSales $480,000 $360,000 $120,000 1 Cost of goods sold:Direct material 46,500 22,500 24,000 2 Direct labor 150,000 135,000 15,000Indirect manufacturing 200,000 163,636 3 36,364 4 Cost of goods sold 396,500 321,136 75,364 Gross profit 83,500 $ 38,864 $ 44,636 Corporate expenses (unallocated) 80,000Operating income $ 3,500Gross profit margin 17.40% 10.80% 37.20%1. $80,000 × .75 × 22. $12,000 × 23. $200,000 × [4,500/(4,500 + 1,000)]4. $200,000 × [1,000/(4,500 + 1,000)]5. $83,500/$480,000技术资料专业整理Perhaps the most important factor bearing on the president’s support is lack of confidence in the accuracy of the cost and hence gross margin figures. She probably will inquire whether the shift in the consumption percentages by the two activities is captured by the traditional costing system. Does the change in allocation rates from 90:10 to 82:18 based on direct labor hour changes accurately capture the impact of the operational changes? An informal analysis of the controller’s idea might look like the following table.Based on the informal analysis, the President probably would expect the profitability of cell-phone casings to improve and the profitability of pen casings to be unaffected. This disagrees with the numerical analysis. Given the propensity of managers to embrace numerical results, less weight will likely be given this analysis compared to the “objective” numbers. As a result, she may question the validity of the numerical analysis as well as the value of the traditional costing system!Finally, the focus of improvement efforts should be directly on the pen-casing product line. This initiative deals mostly with the cell-phone line. What can be done to improve profitability of the pen casings? Can prices be raised without losing too much volume? Can operational improvements be made to lower the indirect manufacturing costs? The controller’s idea is worthy of some support but it does not address the profitability issue head on.2. Exhibit 4-B4, Panel C on the following page is a process map that can be used to explain the impact of the controller’s idea. Panel D at the end of the solution provides a detailed evaluation of the controller’s idea.Pen Cell-PhoneCasings Casings Company Base Gross Profit Percentage* 16.22% (28.63%) 8.07% Plan Gross Profit Percentage** 17.26% 17.81% 17.40% Support of Product Manager? Neutral StrongSupport of President? Strong* See the table on p. 139 of the text.** See panel D of Exhibit 4-B4 that follows.The controller’s idea will result in a slight increase in the gross profit of the pen-casings line but a dramatic turnaround in the profitability of thecell-phone line. The product manager of pen casings would probably be neutral or slightly positive about the idea because the idea does not focus on operational improvements that directly affect the pen-casings line. The cell-phone casings manager would give strong support to the idea – this may save his/her job! The president would strongly support this idea while encouraging all managers involved to keep up the good work. Also, note that the numbers agree with the informal analysis – generating confidence in the integrity of the cost accounting system.Exhibit 4-B4, Panel CProcess Map for ABC SystemExhibit 4-B4: Panel DPRO-FORMA FINANCIAL REPORTS FOR LOPEZ PLASTICS COMPANY:ACTIVITY-BASED COST ALLOCATION SYSTEMSTATEMENT OF OPERTING INCOME CONTRIBUTION TO CORPORATE COSTSAND PROFIT [EXTERNAL REPORTING PURPOSE] [INTERNAL STRATEGIC DECISION MAKINGAND OPERATIONAL-CONTROL PURPOSE]Pen Casings Cell Phone Casings Sales $480,000 $360,000 $120,000 Cost of goods sold:Direct material 46,500 22,500 24,000 Direct labor 150,000 135,000 15,000Processing activity 154,000 126,000 128,000 2Production support activity 46,000 14,375 3 31,625 4 Cost of goods sold 396,500 297,875 98,625 Gross profit 83,500 $ 62,125 $ 21,375 Corporate expenses (unallocated) 80,000Operating loss $ 3,500Gross profit margin 17.26% 17.81%1. $154,000 × [4,500 labor hours/(4,500 labor hours + 1,000 labor hours)]2. $154,000 × [1,000 labor hours/(4,500 labor hours + 1,000 labor hours)]3. $46,000 × [5 distinct parts/(5 distinct parts + 11 distinct parts)]4. $46,000 × [11 distinct parts/(5 distinct parts + 11 distinct parts)]技术资料专业整理3. As vice president, you probably are pleased with the new ABC system. The cost drivers that are used to allocate activity costs appear to be plausible and reliable and thus probably represent a sound cause-effect model of operations. This will improve both the accuracy of product costing and operating managers’ control over costs. Operating managers will be pleased with the ABC system because it helps them understand how their day-to-day work impacts costs and profits. From a behavioral perspective, this should behighly motivational.This problem emphasizes the importance of the cost-accounting system to managers. Different systems can result in significantly different management decisions. In this case, the product-line managers’ support for the controller’s idea changes when an ABC system is used to evaluate the idea. Although the company-level gross margins do not change, it is possible thatthe president would strongly support the idea based on ABC data. Why? Neither of the product-line managers is against the idea, and one strongly supports it. In addition, the president may have more confidence in the accuracy of the ABC analysis. The substantial losses of the current quarter have been completely eliminated and the serious profitability problem of the cell-phone casing product line has been reversed.4-1 A cost management system is a collection of tools and techniques that identifies how management’s decisions affect costs. The three purposesof a CMS are to provide1.cost information for operational control,2.cost information for strategic decisions, and3.measures of inventory value and cost of goods manufactured (orpurchased) for external reporting to investors, creditors, and otherexternal stakeholders.4-2 a. The production manager needs operational control information.b. Setting the product mix is a strategic decision.c. The cost of inventory that appears on the balance sheet is information that is used by external investors, creditors, and other stakeholders.4-3 Cost objects are any items for which decision makers desire a separate measurement of costs. They include departments, products, services, territories, and customers.4-4 No. Products are one of the main cost objects for most companies, but departments are also important cost objects because they represent a logical grouping of activities for which managers desire a separate determination of costs.4-5 The major purpose of a detailed cost-accounting system is to measure costs for decision making and financial reporting. Cost accounting systems become more detailed as management seeks more accurate data for decision making.4-6 The two major processes performed by a cost accounting system are cost accumulation and cost assignment. Cost accumulation is collecting costs by some “natural” classification, such as materials or labor, or by activities performed such as order processing or machine processing. Cost assignment is attaching costs to one or more cost objects, such as activities, processes, departments, customers, or products.4-7 Managers make important decisions on a daily basis. They base these decisions in large part on financial data provided by the cost accounting system. So it is critically important that the cost accounting system provide accurate and reliable financial information.4-8 Managers can specifically and exclusively identify direct costs with a given cost object (that is, directly trace them) in an economically feasible way. Indirect costs cannot be so identified. However, managers can usually identify a plausible and reliable cost driver to use to allocate resourcecosts to cost objects that consume the resources. When direct tracing is not economically feasible and a plausible and reliable cost driver cannot be found, costs should remain unallocated.4-9 Yes, the same cost (for example, the department supervisor's salary)can be direct with respect to a department but indirect with respect to the variety of products flowing through a department (e.g., tables, chairs, and cabinets).4-10 Some costs can be physically linked with a department (or a product), but not in an economically feasible way. An example is the use of departmental meters for measuring power usage. Such devices could measure power costs as direct costs of a department. The alternative is to regard factory power costs as indirect costs of individual departments. Managers often decide whether the resulting increased accuracy provided by individual power meters is worth their additional cost; thus, the test of economic feasibility will decide whether a particular cost is regarded as direct or indirect.4-11 The four purposes of cost allocation are (1) to predict the economic effects of strategic and operational control decisions, (2) to obtain desired motivation, (3) to compute income and asset valuations, and (4) to justify costs or obtain reimbursement.4-12 Generally Accepted Accounting Principles (GAAP) require publically-held companies to allocate all production-related costs and only production-related costs to its products for financial reporting to the public.4-13 No. The costs in a cost pool are not physically traced to cost objects. Only direct costs are traced to cost objects. A cost pool contains indirect costs that are allocated to cost objects using a single cost-allocation base.4-14 Some possible terms are reallocate, assign, distribute, redistribute, load, apportion, reapportion, and burden.4-15 For financial statement purposes, the typical accounting system does not allocate costs associated with value-chain functions other than production to the physical units produced. However, for guiding decisions regarding product-pricing and product-mix decisions, many companies allocate all costs, including R&D, design, marketing, distribution, and customer service costs. However, the allocations of these costs may not be embedded in the system that generates financial statements.4-16 Yes. The two criteria that should be met before using any measure as a cost-allocation base are economic plausibility and reliability. A measure should be plausible – make common sense. If managers cannot easily understand the logical relationship between a cost allocation-base and the costs of an activity or resource, managers will perceive the resulting allocations as arbitrary.4-17 Production maintenance costs are normally indirect. Sales commissions normally can be directly traced to specific products. The costs associated with process design are normally unallocated because it is too difficult to identify plausible and reliable cost-allocation bases, although some companies elect to allocate them.4-18 Generally not. They are direct as far as the physical product is concerned, but in accounting for their cost it would usually be impractical (too costly) to keep records of the amount of glue or tacks used in each unit of product. A more feasible method would be to consider these as supplies (indirect materials).4-19 Depreciation related to production activities is a product cost, not a period cost. Hence, it will become an expense as a part of manufacturing cost of goods sold. Thus, depreciation is not always an immediate expense.。

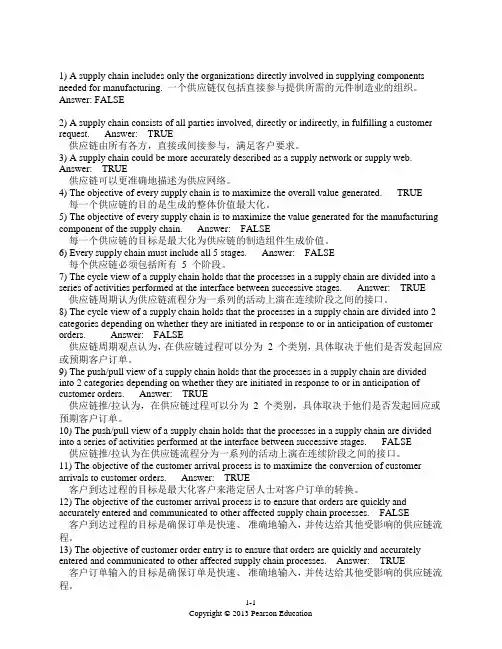

1) A supply chain includes only the organizations directly involved in supplying components needed for manufacturing.一个供应链仅包括直接参与提供所需的元件制造业的组织。

Answer: FALSE2) A supply chain consists of all parties involved, directly or indirectly, in fulfilling a customer request. Answer: TRUE供应链由所有各方,直接或间接参与,满足客户要求。

3) A supply chain could be more accurately described as a supply network or supply web. Answer: TRUE供应链可以更准确地描述为供应网络。

4) The objective of every supply chain is to maximize the overall value generated. TRUE每一个供应链的目的是生成的整体价值最大化。

5) The objective of every supply chain is to maximize the value generated for the manufacturing component of the supply chain. Answer: FALSE每一个供应链的目标是最大化为供应链的制造组件生成价值。

6) Every supply chain must include all 5 stages. Answer: FALSE每个供应链必须包括所有 5 个阶段。

7) The cycle view of a supply chain holds that the processes in a supply chain are divided into a series of activities performed at the interface between successive stages. Answer: TRUE供应链周期认为供应链流程分为一系列的活动上演在连续阶段之间的接口。

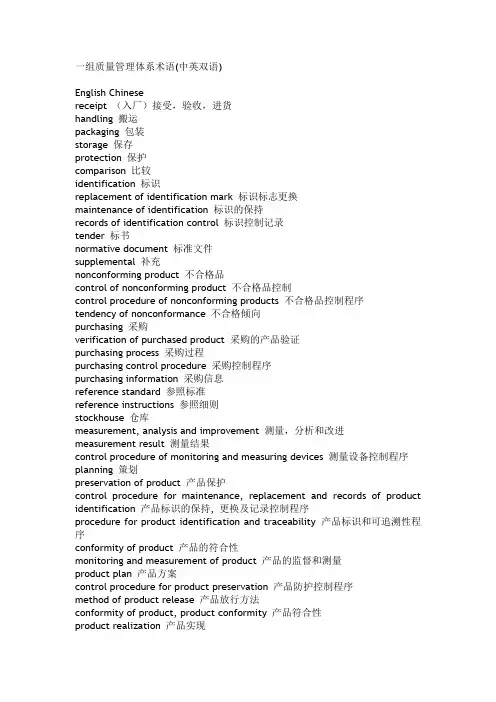

一组质量管理体系术语(中英双语)English Chinesereceipt (入厂)接受,验收,进货handling 搬运packaging 包装storage 保存protection 保护comparison 比较identification 标识replacement of identification mark 标识标志更换maintenance of identification 标识的保持records of identification control 标识控制记录tender 标书normative document 标准文件supplemental 补充nonconforming product 不合格品control of nonconforming product 不合格品控制control procedure of nonconforming products 不合格品控制程序tendency of nonconformance 不合格倾向purchasing 采购verification of purchased product 采购的产品验证purchasing process 采购过程purchasing control procedure 采购控制程序purchasing information 采购信息reference standard 参照标准reference instructions 参照细则stockhouse 仓库measurement, analysis and improvement 测量,分析和改进measurement result 测量结果control procedure of monitoring and measuring devices 测量设备控制程序planning 策划preservation of product 产品保护control procedure for maintenance, replacement and records of product identification 产品标识的保持, 更换及记录控制程序procedure for product identification and traceability 产品标识和可追溯性程序conformity of product 产品的符合性monitoring and measurement of product 产品的监督和测量product plan 产品方案control procedure for product preservation 产品防护控制程序method of product release 产品放行方法conformity of product, product conformity 产品符合性product realization 产品实现planning of product realization 产品实现策划product characteristics 产品特性input to product requirements 产品要求的输入product status 产品状态final acceptance of product 产品最后验收procedure 程序program documents 程序文件continual improvement 持续改进procedure for continual improvement of quality management system 持续改进质量体系程序adequacy 充分性storage location 存放地点agency personnel 代理人员submission of tenders 递交标书adjustment 调整,调节statutory and regulatory requirements 法律法规要求rework, vt 返工repair, vt 返修subcontractor 分承包方annex 附录improvement 改进improvement actions 改进措施on-the-job training 岗位技能培训responsibility of individual department and post 各部门, 各岗位职责change identification 更改标记change order number 更改单编号process sheets 工艺单process specification 工艺规程procedure(process card) 工艺规程(工艺卡)process characteristics 工艺特性Job Description Format 工种描述单work environment 工作环境impartiality 公正性functional requirements 功能要求supplier 供方supplier evaluation procedure 供方评价程序supplier provided special processes 供方提供的特殊过程verification at supplier's premises 供方现场验证supply chain 供应链criteria for supplier selection, evaluation and re-evaluation 供应商选择、评估和再评估准则communication 沟通customer 顾客customer property 顾客财产control procedure for customer property 顾客财产控制程序customer feedback 顾客反馈Customer Service Contact Form 顾客服务联系表customer cummunications 顾客沟通customer satisfaction 顾客满意statistical analysis of customer satisfaction 顾客满意度统计分析customer complaint 顾客投诉identificaion of customer requirements 顾客要求的识别management review 管理评审records from management review 管理评审记录management review control procedure 管理评审控制程序management representative 管理者代表management responsibility 管理职责specified limits of acceptability 规定的可接受界限specified use 规定的用途process 过程complexity of processes 过程的复杂性monitoring and measurement of processes 过程的监视和测量operation of process 过程的运行status of processes 过程的状态process approach 过程方法process controls 过程控制process control documents 过程控制文件process performance 过程业绩appropriateness 合适性changes to contractor 合同的更改contract review control procedure 合同评审控制程序internet sales 互联网销售environmental conditions 环境条件monogram pragram requirements 会标纲要要求type of activities 活动类型infrastructure 基础建设infrastructure 基础设施fundamentals and vocabulary 基础与词汇control of records 记录控制technical specificaion 技术规范process trace sheet 加工跟踪单monitoring and measurement 监视和测量monitoring and measuring device 监视和测量装置control of monitoring and measuring devices 监视和测量装置控制check method 检查方法frequency of checks 检查频次calibration status 检定状态inspection and test control procedure 检验和试验控制程序identification procedure for inspection and test status 检验和试验状态标识程序inspection witness point 检验见证点inspection hold point 检验停止点buildings 建筑物delivery 交付post-delivery activities 交付后的活动delivery activities 交付活动interface 接口acceptance of contract or orders 接受合同或定单type of medium 介质类型experience 经验correction action 纠正措施Corrective action response time 纠正措施答复时间,纠正措施响应时间management procedure for corrective actions 纠正措施管理程序corrective action response times 纠正措施响应时间development activity 开发活动traceability mark 可追溯性标志objectivity 客观性Customer Service Log 客户服务记录簿control feature 控制特性,控制细节control features 控制细则periodic assessment of stock 库存定期评估justification 理由routine 例程,惯例,常规质量职能分配表论证范围internal communication 内部沟通internal audit 内部审核internal audit procedure 内部审核程序internally controlled standard 内控标准internal audit 内审results of internal and external audits 内外部审核结果competence 能力training 培训training needs 培训需要evaluate 评价records of the results of the review 评审结果的记录review output 评审输出review input 评审输入Purchase Requisition 请购单authority 权限validation 确认concession 让步human resources 人力资源job training of personnel 人员岗位培训qualification of personnel 人员资格equipment control procedure 设备控制程序device type 设备类型order of design changes 设计更改通知单design and development control procedure 设计和开发控制程序design and development 设计开发design and development planning 设计开发策划control of design and development changes 设计开发更改控制design and development review 设计开发评审design and development validation 设计开发确认design and development outputs 设计开发输出design and development inputs 设计开发输入design and development verification 设计开发验证design validation 设计确认design documentation 设计文件编制design acceptance criteria 设计验收准则design verification 设计验证audit program 审核大纲conduct of audits 审核行为audit criteria 审核准则production process control 生产过程控制production process control procedure 生产过程控制程序production and service provision 生产和服务提供control of production and service provision 生产和服务提供的控制validation of processes for production and service provision 生产和服务提供过程的确认production order 生产令identification and traceability 识别和可追溯性identification and traceability maintenance and replacement 识别和可追溯性维护与替换invalidate 使失效market survey 市场调研suitability 适宜性scope 适用范围controlled condition 受控状态terms and definitions 术语与定义analysis of data 数据分析sequence 顺序transfer of ownership 所有权转移system document 体系文件statistical technique 统计方法outsource(vt) a process 外包过程external source 外部来源documents of external origin 外来文件outsource, vt 外协unique identification 唯一的标识maintenance 维护Document Change Control 文件更改控制Request For Document Change (RDC) 文件更改需求单control of documents 文件控制documentation requirements 文件要求enquiry 问询,询价field nonconformity analysis 现场不符合分析relevance 相关性interaction 相互作用detail design 详细设计,详图设计,零件设计,施工设计sales department 销售部sales contract 销售合同checklist 校验表,一览表,检查一览表calibration 校准submission of action plans 行动计划的递交documented procedures 形成文件的程序documented statement 形成文件的声明performance requirements 性能要求licensee responsibilities 许可证持有者责任acceptance criteria 验收准则verification arrangement 验证安排verification results 验证结果customer focus 以客户为关注点,以客户为焦点awareness 意识introduction 引言,概述,介绍normative references 引用标准application 应用visit to user 用户访问review of requirements related to the product 有关产品的要求评审competent 有能力的effectiveness 有效性determination of requirements related to the product 与产品有关的要求的确定customer-related processes 与顾客有关的过程preventive action 预防措施management procedure for preventive actions 预防措施管理程序planned results 预期的结果intended use 预期的用途procedure for competence, knowledge and training of personnel 员工能力, 知识和培训程序personnel training procedure 员工培训程序supporting services 支持性服务functions 职能部门responsibility 职责assignment of responsibility 职责分工workmanship 制造工艺manufacturing acceptance criteria 制造验收准则quality policy 质量方针quality programs 质量纲领quality management system 质量管理体系quality management system planning 质量管理体系策划performance of the quality management system 质量管理体系业绩quality plan 质量计划quality records 质量记录quality objectives 质量目标quality audit 质量审核quality manual 质量手册quality problem handling form 质量问题处理单quality requirements 质量要求allocation table of quality responsibilities 质量职能分配表availability of resources 资源的可获得性resource management 资源管理allocation of resources 资源配置provision of resources 资源提供general requirements 总要求,一般要求constituent part 组成部件organization 组织continual improvement of the organization 组织的持续改进size of organization 组织的规模Organizational Diagram 组织机构图final acceptance 最终验收work instructions 作业指导书。

WARRANTY/DISCLAIMER OMEGA ENGINEERING, INC. warrants this unit to be free of defects inm a t e r i a l s a n d w o r k m a n s h i p f o r a p e r i o d o f 13 m o n t h s f r o m d a t e o f puchase. OMEGA’s WARRANTY adds an additional one (1) month grace period to the normal one (1) year product warranty to cover handling and shipping time. This ensures that OMEGA’s customers receive maximum coverage on each product. If the unit malfunctions, it must be returned to the factory for evaluation. OMEGA’s Customer Service Department will issue an Authorized Return (AR) number immediately upon phone or written request. Upon examination by OMEGA, if the unit is found to be defective, it will be repaired or replaced at no charge. OMEGA’s WARRANTY does not apply to defects resulting from any action of the purchaser, including but not limited to mishandling, improper interfacing, operation outside of design limits, improper repair, or unauthorized modification. This WARRANTY is VOID if the unit shows evidence of having been tampered with or shows evidence of having been damaged as a result of excessive corrosion; or current, heat, moisture or vibration; improper specification; misapplication; misuse or other operating conditions outside of OMEGA’s control. Components in which wear is not warranted, include but are not limited to contact points, fuses, and triacs.OMEGA is pleased to offer suggestions on the use of its various products. However, OMEGA neither assumes responsibility for any omissions or errors norassumesliability for any damages that result from the use of its products in accordance with information provided by OMEGA, either verbal or written. OMEGA warrantsonly that the parts manufactured by the company will be as specified and free of defects. OMEGA MAKES NO OTHER WARRANTIES OR REPRESENTATIONS OF ANY KIND WHATSOEVER, EXPRESSED OR IMPLIED, EXCEPT THAT OF TITLE, AND ALL IMPLIED WARRANTIES INCLUDING ANY WARRANTY OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE HEREBY DISCLAIMED. LIMITATION OF LIABILITY: The remedies of purchaser set forth herein are exclusive, and the total liability of OMEGA with respect to this order, whether based on contract, warranty, negligence, indemnification, strict liability or otherwise, shall not exceed the purchase price of the component upon which liability is based. In no event shall OMEGA be liable for consequential, incidental or special damages.CONDITIONS: Equipment sold by OMEGA is not intended to be used, nor shall it be used: (1) as a “Basic Component” under 10 CFR 21 (NRC), used in or with any nuclear installation or activity; or (2) in medical applicationsor used on humans. Should any Product(s) be used in or with any nuclear installation or activity, medical application, used on humans, or misused in any way, OMEGA assumes no responsibility as set forth in our basic WARRANTY/DISCLAIMER language, and, additionally, purchaser will indemnify OMEGA and hold OMEGA harmless from any liability or damage whatsoever arising out of the use of the Product(s) in such a manner.The information contained in this document is believed to be correct, but OMEGA accepts no liability for any errors it contains, and reserves the right to alter specifications without notice.WARNING: These products are not designed for use in, and should not be used for,human applications .Servicing North America:U.S.A.: Omega Engineering, Inc., One Omega Drive, P.O. Box 4047S tamford, CT 06907-0047 USA Toll-Free: 1-800-826-6342 (USA & Canada only)Customer Service: 1-800-622-2378 (USA & Canada only)Engineering Service: 1-800-872-9436 (USA & Canada only)Tel: (203) 359-1660 Fax: (203) 359-770e-mail:**************For Other Locations Visit /worldwideCNP Series1/16-1/8 DIN CONTROLLERRETURN REQUESTS/INQUIRIES Direct all warranty and repair requests/inquiries to the OMEGA Customer Service Department. BEFORE RETURNING ANY PRODUCT(S) TO OMEGA, PURCHASER MUST OBTAIN AN AUTHORIZED RETURN (AR) NUMBER FROM OMEGA’S CUSTOMER SERVICE DEPARTMENT (IN ORDER TO AVOID PROCESSING DELAYS). The assigned AR number should then be marked on the outside of the return package and on any correspondence.The purchaser is responsible for shipping charges, freight, insurance and proper packaging to prevent breakage in transit. OMEGA’s policy is to make running changes, not model changes, whenever an improvement is possible. This affords our customers the latest in technology and engineering.OMEGA is a registered trademark of OMEGA ENGINEERING, INC.© Copyright 2014 OMEGA ENGINEERING, INC. All rights reserved. This document may not be copied, photocopied, reproduced, translated, or reduced to any electronic medium or machine-readable form, in whole or in part, without the prior written consent of OMEGA ENGINEERING, INC.FOR WARRANTY RETURNS, please have the following information available BEFORE contacting OMEGA:1. Purchase Order number under which the product was PURCHASED,2. M odel and serial number of the product under warranty, and 3. R epair instructions and/or specific problems relative to the product.FORNON-WARRANTY REPAIRS, consultOMEGA for current repair charges. Have the following information available BEFORE contacting OMEGA:1. P urchase Order number to cover theCOST of the repair,2. Model and serial number of theproduct, and 3. Repair instructions and/or specific problems relative to the P8CNP6M5438/0914Refer to the Modbus Communications User Manual (Available from your supplier) for details.。

《跨境电商英语》期末试卷(A)Part 1. Useful Expressions (共15小题,每小题1 分, 合计15 分) Directions: The following is a list of terms related to Cross-border E-commerce. After reading it, you are required to write the corresponding English expression.1.预期利润2.企业文化3.营销活动4.社交媒体5.店铺描述6.关键词7.批发价8.数据分析9.属性词10.目标客户11.物流12.客户服务13.流量词14.品牌风格15.交易额Part 2. Translation(共6小题,16-20题每小题3分,21题10分, 合计25分)Directions: This part, numbered 11 to 15, is to test your ability to translate Chinese into English of the five sentences. No.16 is to test your translation ability of paragraph from English into Chinese.16.产业园区的建设对城市的可持续发展起到了至关重要的作用。

17. 如果遇到困难,请尽管与我们的客户服务部联系。

18.平台已同意对此纠纷进行调查。

19.中国跨境电商可能在未来几年保持高速增长。

20. 顾客如不满意可以全额退货。

21.First of all, the selected products should be suitable for air express delivery. These products should basically meet the following requirements: relatively small size and suitability to be delivered by express to reduce the cost of international logistics; high added value is required to be suitable to be packed for sale, and if thevalue of product is less than shipping then it is not the case; uniqueness: products need to be unique in order to continuously stimulate buyers to purchase and have high online transactions volume; reasonable price: if online prices are higher than local market prices, they may fail to attract buyers to order online.Part 3. Reading Comprehension (共15小题,每小题2 分, 合计30 分) Directions:Read the following passages. After reading them, you should decide whether each statement is true(T)or false(F).Passage 1, launched in 2014 as a cross-border B2B e-commerce platform, is built to facilitate small and medium sized Chinese enterprises. Average order size remains small for this reason. The variety of items listed, however, is not affected by the size of the businesses, and categories of products include clothes, bags, shoes, sports items, toys, jewelry, electronics, mobile phones, musical instruments, car parts, video games and many more. Europe, America and Australia are its major markets, and currently it owns 1.2 million domestic suppliers, 5.5 million buyers and 25 million kinds of products.The website does not charge a membership fee from either buyer or seller. Instead, it charges only a commission as a percentage of successful transaction amounts. This percentage ranges from 3 percent to 10 percent. Though the website remains free for sellers, a special value-added service called DHfactory has recently been added. Sellers can pay an annual fee to avail this service. The company is set to launch further exclusive services to complete better in the Chinese online wholesale market. Buyers and sellers are required to interact through the website. There is an escrow payment service that protects buyers and a customer service department to help solve disputes. is a transaction platform providing transaction services for both buyers and sellers in order to promote online trading. Based on the positioning, DHgate’s profit consists of two parts:①commission: serves as a transaction platform for buyers and sellers and charges the buyers a certain amount of commission for successful transactions, and ②service fee: since cross-border e-commerce is operated by users in more than 200 countries and one hundred thousand cities around the world, it is much more complicated than domestic e-commerce. Also, the whole transaction process of cross-border e-commerce takes more time, and buyers and sellers call for services of higher standards. The complicated and commercial features of these transactions determine that multiple services are needed in the whole cross-border transaction process. Given the characteristics, DHgate provides services like intensive logistics, financial service and agency service for some fees.Transaction commission: It is free to register, uphold product information and display them on . The buyer will only be charged commission based on the transaction volume for a successful transaction.Commission model: DHgate adopts the single commission rate model, which means that a fixed proportion of commission is charged according to the category. This model works with a multiple commission policy---when a single order is worth no less than USD 300, the commission rate is 4.5%.Service object: It expands from small and medium merchants to large foreign trade companies, manufacturers and brand owners.Platform expansion: Besides transaction platform, DHgate launched online cargo center for traditional foreign trade companies. In August 2013, DHgate launched a “global online cargo center” by cooperating with the merchants in Yiwu. Payment: DHpay has access to more than 30 payment means in the world.Logistics: online delivery, warehousing and concentrated freight services. The DHlink supports more than 20 logistics channels including EMS, UPS, DHL, etc. Credit: DHCredit cooperates with financial institutions to provide credit service.22.The website does not charge a membership fee from either buyer or seller.( )23.When a single order is worth no less than USD 3000, the commission rate is4.5%. ( )24.The service objects expand from small and medium merchants to large foreigntrade companies, manufacturers and brand owners. ( )25.DHgate is a third-party B2C cross-border transaction platform, committing tohelping Chinese SMEs to enter global market through cross-border e-commerce platform. ( )26.The DHlink doesn’t support logistics channels as EMS, UPS, DHL, etc. ( )Passage 2There are many factors that affect the sales of the store. One of those which can not be ignored must be product selecting. A shop with the intention of having higher flow, more exposure and more orders than others must not ignore the selection of goods. It can be said that product selecting is the basis of shop operations, and the first step to make a profit. Product selecting refers to selecting product which meets the demand of the target market from the supply market. Personnel in charge of product selecting must identify the needs of users and, on the other hand, select products with quality, price and appearance in line with the needs of the target market from many supplies in the market. The organic combination of suppliers, customers, personnel in charge of product selecting should be considered for the success of the product selecting.There is a variety of businesses in the current cross-border e-commerce platforms such as beauty, sports and entertainment, baby supplies, toys, shoes, clothing, etc. Of these businesses, some, called business of “red sea”, are fiercely competitive, such as jewelry industry, wedding, wig industry, etc. Others, called business of “blue sea”, are less competitive, but full of demands from buyers or now to be explored. Businesses of “red sea” are those with hotter competition, more sellers, more orders, larger investment, and lower profit, while business of “ blue sea” are those with less competition, fewer orders, smaller investment, but higher profit. It is wise of a freshman, who is short of human resources and finance supports, to do businesses of “blue sea” rather than those of “red sea”, more competitive but less profitable. Sellers differ with criteria for what kind of seller is small or medium-sized, because now there is no clear judgment. However, the seller should have a clear self-positioning while running his own online store.For correct market positioning, it is necessary to conduct market research which is concerned about the overall price level of the target market, the price level of the industry, the consumers’ preferences and so on.What has to be further conducted for a good market positioning is to analyze the competitive environment of the product, to do the segmentation of the market, and to test and adjust the market positioning through practice.Website positioning refers to the target market or consumer groups of the website. Product manager, through the understanding of the whole website positioning, has to analyze the categories of website in order to select the appropriate target products which meet the demands of customers.27.Product selecting is one of the factors that affect the sales of the store. ( )28.If you have less finance support, you are advised to do business of “red sea”.( )29.Product selecting should focus on many factors except product’s size and weight.( )30.For correct market positioning, it is necessary to conduct domestic marketresearch, but it is not necessary to study foreign markets. ( )31.Website poisoning refers to the target market or consumer groups of the website.( )Passage 3Consumption habit is the preference of consumer for a certain kind of commodity, brand or consuming behavior. In nature, it is a stable individual consuming behavior, formed gradually in the long term, and in turn influences consuming behavior. People in the United States attach more importance to the quality of commodity. Quality is vital for commodity to enter the US market, where the commodity with even a slight flaw will be put in the corner and sold in discount. Packaging is another important factor. Commodity should be both in good quality and in fine-decorated packaging to present impressive visual experience to customers. People in the United States highly value the efficiency, thinking wasting time as wasting life. They hope to receive satisfied goods soon after placing orders. Therefore, when setting shipping templates, it is advisable to set highly efficient logistic mode such as UPS, DHL, TNT and FedEx.Because of the United States’ large territory and its four time zones, buyers from different time zones shop online at different times. To raise the attention to the launched commodities, sellers should sum up experiences, choose and launch products in a time period when online purchasing occurs in high density.January is the high season for apparel sales, with winter clothes sold in discount in the United States. February 14th is the Valentine’s Day in this country, makinghorticultural products, fashion accessories, jewelry, watches, bags and gifts become hot sellers. Spring in America begins in March, which is the high season for horticultural products because of Easter in March.Horticultural products enjoy good sales volume in April in the US market. Sales for women’s shoes grow drastically due to the demand of wedding. In this ideal season for wedding, bridesmaids grown and wedding supplies are hot. Mother’s Day is on th e second Sunday of May. With this day’s coming, fashion accessories, jewelry, bags and greeting cards become popular items. Fathers’ Day is on the third Sunday of June, where in June also comes the graduation season. Therefore refrigeration appliances, mobile phones and other electronic products are also in their high season this month.The United States’ Independence Day is on July 4th. August sees students back to school, making this month a high season for clothing and shoes. Autumn comes in September, and it is the best selling season for apparel. Cosmetics are also in hot sales thanks to the autumn new products’ arrival.Halloween is on October 31st. Thanksgiving Day is on the fourth Thursday of November. With some major festivals’ arrival in winter, c osmetics, stuffed toys, and gifts come into high season for sales. Sales volume of fashion accessories, jewelry and watches in December occupies a quarter of the whole year.Approximately 37% of cross-border online buyers throughout the whole world are in Canada. But because of its vast territory and thin population, logistics is quite a challenge for remote areas in this country. Fortunately, 80% of Canada’s populations live in the areas less than 60 miles from the US borders, namely three major cities of Canada. Canada is a major market for the US Cross-border E-commerce, for its precise delivery time, and more preferable taxation rate than that in the United States.60% of Canadians purchase online from America. 38% of Canada’s populations live in Ontario, where the relatively low logistic fees and exchange rates fuel the Canadian’s online shopping behavior. In Canada, credit cards’ penetration rate is high. 81% of online payment is made by credit cards, followed by PayPal (42%). These factors promote the cross-border finance.Canadians are passionate about sports. 54% of Canada’s populations regularly take part in sports activities. As a result, there is a large demand for sports equipments and facilities. The top five favored sports in Canada are golf, ice hockey, baseball, swimming and basketball. As a part of many Canadians’ life, sports give Canada huge sports products consumption ability, with large demand for sports products. The five major sports products in Canada are gym shoes, sportswear, bicycles and accessories, golf equipments, and training devices. The retail volumes of these five products show an increasing trend. Among them, two traditional sports products, gym shoes and sportswear occupy half of the sports equipments market in Canada. China has strength and potential in exporting sportswear and gym shoes. Therefore, Chinese firms who wish to explore and expand overseas market are suggested to pay more attention to business opportunities in Canadian market, especially in sportswear and gym shoes market.32.Quality, packaging and logistics efficiency are factors that American peopleattach more importance to when they purchase online. ( )33.Refrigeration appliances, mobile phones and other electronic products arepopular items in May. ( )34.Sales volume of fashion accessories, jewelry and watches in December occupies50% of the whole year. ( )35.Logistics is quite a challenge for remote areas in Canada. ( )36.There is a large demand for sports equipments and facilities in Canada sinceCanadians work out regularly. ( )Part 4. Writing(共3小题,37-39题每小题10分, 合计30分)Directions:This part is to test your ability to do practical writing. Suppose you were a customer service representative. Now you are required to write reply letters to your customers according to the following information.37.38.39.《跨境电商英语》期末试卷(A)参考答案及评分标准Part 1. Useful Expressions (共15小题,每小题1 分, 合计15 分)1.expected profit2. corporate culture3. market campaign4. social media5. store description6. keyword7. wholesale price 8. data analysis9. attribute word 10. target customer11. logistics 12.customer service13. flow words 14. brand style15. transaction volumePart 2. Translation(共6小题,16-20题每小题3分,21题10分, 合计25分)16. The construction of industrial parks plays a crucial role in city’s sustainabledevelopment.17. In the event of difficulties, please do not hesitate to contact our CustomerService Department.18. The platform has given its approval for an investigation into the dispute.19. China’s Cross-border E-commerce will be likely to maintain rapid growth in thenext few years.20. Dissatisfied customers can return the product for a full refund.21. 首先就要有适宜通过并且适合通过航空快递运输的商品。

Ch9 第9章课后练习答案第1课I Fill in the blank and put the sentence into Chinese1.packaging industry; damage-free上海已增加了在包装业上的投资,以确保其包装的产品符合消费者对无损货物的要求。

2.added value制造商已开始意识到改进了的商品包装能极大地影响产品的增值。

yout;warehouse productivity.好的包装可对布局和设计以及整体的仓库生产率在正面的影响。

4.consumer ; interior; marketing设计用于吸引和告知最终客户的消费者包装,也指内部包装或市场包装。

5.industrial; customer工业包装在产品放上货架之前就被废弃了,而且客户可能甚至从未见到过它。

6.marketing ; packaging; color ; shape在销售作用中,包装向客户提供了有关产品的信息,也通过利用不同的色彩和形状促进产品的销售。

7.containment; utilization; convenience更明确地说,包装发挥了六个作用,即保护、容纳、利用、分配、交流和方便。

II Phrases translationmarketing package industrial package quality of products functions of packaging the domestic and world markets packaging industrydamage-free goodsUPC (Universal Product Code)III. Do you know the 6 main functions of packaging from the logistics perspective? Please discuss with your第2课I Fill in the blank and put the sentence into Chinese1.storage space; cube and weight好的包装能很好地与企业的物料搬运设备衔接、有效地利用储存空间和运输的体积和重量的限制。