Regional container port competition and co-operation_the case of HK and South China

- 格式:pdf

- 大小:899.49 KB

- 文档页数:12

Booking number:订舱号码Vessel:船名Voyage:航次CY Closing DATE:截柜日期,截关日closing Date/Time:截柜日期SI CUT OFF date/time:截提单补料日期/时间Expiry date:有效期限,到期日期Sailing date:航行日期 / 船离开港口的日期ETA (ESTIMATED TIME OF ARRIVAL):预计到达时间,到港日ETD(ESTIMATED TIME OF DELIVERY):开船日ETC(ESTIMATED TIME OF CLOSING):截关日Port of loading(POL):装货港Loading port:装货港From City:起运地EXP(export):出口Final destination:目的港,最终目的地Place of Delivery(POD)或To City:目的地,交货地Port of discharge:卸货港Discharge port:卸货港Load Port: 卸货港Dry:干的/不含液体或湿气Quantity:数量cargo type:货物种类container number:集装箱号码container:集装箱specific cargo container:特种货物集装箱Number of container:货柜数量container Size:货柜尺寸CU.FT :立方英尺Cont Status:货柜状况seal number:封条号码seal No:封条号码seal type:封条类型weight:重量Gross weight:总重(一般是含柜重和货重)Net Weight:净重Actual weight:实际重量,货车,集装箱等运输工具装载后的总重量Laden:重柜remarks:备注remarks for Terminal:堆场/码头备注piace of receipt:收货地Commodity:货物品名intended:预期ETD:预计开船日期Booking NO: SO号码/订仓号码Shipper:发货人Container No(Number):集装箱号码Equipment Number:货柜号码Reefer Tetails:冷柜参数contact:联络人,联系方式contact person:联络人intended fcl container delivery CUT-OFF:指定的重柜交柜时间,装箱整箱交付截止intended shipping instruction CUT-OFF:指定的文件结关时间,航运指示截止DOC CUT-OFF:文件结关时间(可能没有额外指定,按船公司一般的规律)像上面都是有特指的)Cargo nature:货物种类booking Party:订舱单位Full return location:还重地点Full return CY:还重截关时间Awkward:Break bulk:service contract NO:服务合同编号,equipment size/type:柜型尺寸SI CUT: 截提单补料或截关BKG Staff: BKG是Booking的简写,那就是订舱人员Regional BKG#:预订区域,Sales Rep: 销售代表BILL of Lading#:提单号,提单方案Expected Sail Date:Empty Pick up CY:提空柜地点Empty Pick up Date:提空柜时间,提柜有效期Pre Carrier: 预载Est.Arrival Date:EIS到达时间CY CUT: 结关时间(具体还不清楚是码头截重柜还是截海关放行条时间)CY open: 整柜开仓时间Port of delivery:交货港口Receive Term: 接收期限Delivery Term: 交货期限Ocean Route Type: 海运路线类型,多指印度洋航线类型EQ Type/Q'ty:集装箱数量,类型 EQ是Equipment的简写Address:地址Special cargo information: 特别货物信息Please see attached,if exists: 如果有,请见附档/如果存在,请参阅附件Shipper'own container:托运人自己的集装箱Dangerous:危险或危险品 / 危险标志Internal:中心的,内部的Released: 释放,放行MT就是指吨,英文叫METRE TONECustomer:客户FCL full container load:整柜FCL:整箱,整箱货LCL less than container load :拼箱,拼箱货Carrier:承运人Trucker:拖车公司/运输公司Tractor NO:车牌号码Depot:提柜地点Pickup Location:提柜地点Stuffing:装货地点Terminal:还柜地点Return Location:交柜地点Full Container Address:还重柜地点revised:修改后,已经校正,已经修订Size/Type:柜型尺寸尺寸/种类Discharge Port:卸货港Destination:目的地Special Type:特殊柜型S/O No:订舱号Shipping Order No. :托运单号码Temp:温度Vent:通风Humidity:湿度PTI:检测Genset:发电机Instruction:装货说明Special Requirement:特殊要求GWT:(货物毛重)限重/柜,一般是柜和货物的总重量SOC:货主的集装箱Feeder Vessel/Lighter:驳船航次WT(weight) :重量G.W.(gross weight) :毛重N.W.(net weight) :净重MAX (maximum) :最大的、最大限度的MIN (minimum):最小的,最低限度M 或MED (medium) :中等,中级的P/L (packing list) :装箱单、明细表船公司的集装箱箱门上英文表示:1.GROSS WT 71,650 LB. 32,500 KG总重/ 表示该柜的柜重和可以装载货物重量之和的总重是71650磅或32500千克2.PAYLOAD 60,850 LB. 27600 KG有效载荷 /表示该柜容许装载的最大货物重量,27600千克但是并不表示运输中的货物就能够装那么重3.TARE WT. 10,800 LB 4,900 KG车身重量的扣除 / 表示该柜的自身重量 4900千克4.CUBE 3,040 CU.FT. 86.0 CU.M立方 /表示该柜可以的内容积,也就是可以装货的最大体积是 3040立方英尺或6立方米5.MAX.G.W. 30.480 KGS 67.200 LBS总重/ 表示该柜的柜重和可以装载货物重量之和的总重 30480千克6.TARE 4.850 KGS 10.690 LBS车身重量的扣除 / 表示该柜的自身重量 4850千克7.MAX.C.W 25.630 KGS 56.510 LBS有效载荷 /表示该柜容许装载的最大货物重量, 25630千克但是并不表示运输中的货物就能够装那么重8.CU.CAP. 86.0 CU.M 3,040 CU.FT.立方 /表示该柜可以的内容积,也就是可以装货的最大体积 86立方米9. MGW. 32,500 KGS 71.650 LBS总重/ 表示该柜的柜重和可以装载货物重量之和的总重 32500千克. 28,600 KGS 63.050 LBS净重 / 有效载荷 /表示该柜容许装载的最大货物重量,28600千克但是并不表示运输中的货物就能够装那么重欢迎您的下载,资料仅供参考!致力为企业和个人提供合同协议,策划案计划书,学习资料等等打造全网一站式需求。

国际贸易英语词汇集锦缩略语:1 C&F (cost freight)成本加运费价2 T/T (telegraphic transfer)电汇3 D/P (document against payment)付款交单4 D/A (document against acceptance)承兑交单5 C.O (certificate of origin)一般原产地证6 G.S.P. (generalized system of preferences)普惠制7 CTN/CTNS (carton/cartons)纸箱8 PCE/PCS (piece/pieces)只、的个、的支等9 DL/DLS (dollar/dollars)美元10 DOZ/DZ (dozen)一打11 PKG (package)一包,一捆,一扎,一件等12 WT (weight)重量13 G.W. (gross weight)毛重14 N.W. (net weight)净重15 C/D (customs declaration)报关单16 EA (each)每个,各17 W (with)具有18 w/o (without)没有19 FAC (facsimile)传真20 IMP (import)进口21 EXP (export)出口22 MAX (maximum)最大的、的最大限度的23 MIN (minimum)最小的,最低限度24 M 或MED (medium)中等,中级的25 M/V (merchant vessel)商船26 S.S (steamship)船运27 MT或M/T (metric ton)公吨28 DOC (document)文件、的单据29 INT (international)国际的30 P/L (packing list)装箱单、的明细表31 INV (invoice)发票32 PCT (percent)百分比33 REF (reference)参考、的查价34 EMS (express mail special)特快传递35 STL. (style)式样、的款式、的类型36 T或LTX或TX(telex)电传37 RMB (renminbi)人民币38 S/M (shipping marks)装船标记39 PR或PRC (price) 价格40 PUR (purchase)购买、的购货41 S/C (sales contract)销售确认书42 L/C (letter of credit)信用证43 B/L (bill of lading)提单44 FOB (free on board)离岸价45 CIF (cost,insurance&freight)成本、的保险加运费价补充:CR=credit贷方,债主DR=debt借贷方(注意:国外常说的debt card,就是银行卡,credit card就是信誉卡。

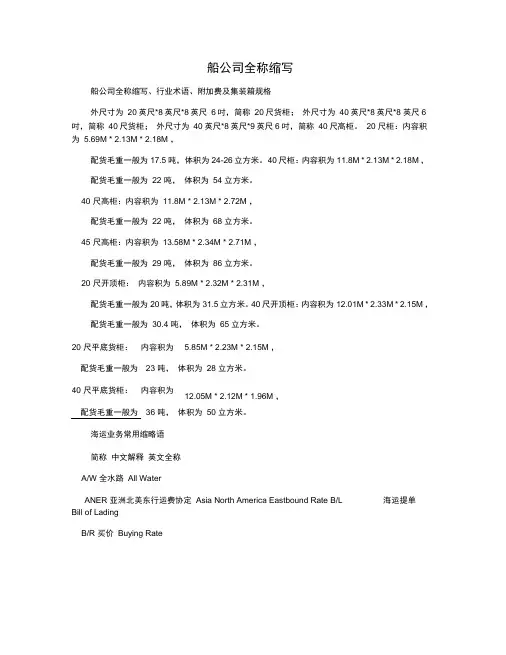

船公司全称缩写船公司全称缩写、行业术语、附加费及集装箱规格外尺寸为20英尺*8英尺*8英尺6吋,简称20尺货柜;外尺寸为40英尺*8英尺*8 英尺6吋,简称40尺货柜;外尺寸为40英尺*8英尺*9英尺6吋,简称40尺高柜。

20 尺柜:内容积为 5.69M * 2.13M * 2.18M ,配货毛重一般为17.5 吨,体积为24-26 立方米。

40 尺柜:内容积为11.8M * 2.13M * 2.18M ,配货毛重一般为22 吨,体积为54 立方米。

40 尺高柜:内容积为11.8M * 2.13M * 2.72M ,配货毛重一般为22 吨,体积为68 立方米。

45 尺高柜:内容积为13.58M * 2.34M * 2.71M ,配货毛重一般为29 吨,体积为86 立方米。

20 尺开顶柜:内容积为5.89M * 2.32M * 2.31M ,配货毛重一般为20 吨,体积为31.5 立方米。

40 尺开顶柜:内容积为12.01M * 2.33M * 2.15M ,配货毛重一般为30.4 吨,体积为65 立方米。

20 尺平底货柜:内容积为 5.85M * 2.23M * 2.15M ,配货毛重一般为23 吨,体积为28 立方米。

40 尺平底货柜:内容积为12.05M * 2.12M * 1.96M ,配货毛重一般为36 吨,体积为50 立方米。

海运业务常用缩略语简称中文解释英文全称A/W 全水路All WaterANER 亚洲北美东行运费协定Asia North America Eastbound Rate B/L 海运提单Bill of LadingB/R 买价Buying RateBAF 燃油附加费Bunker Adjustment FactorC&F 成本加海运费COST AND FREIGHTC.C 运费到付CollectC.S.C 货柜服务费Container Service ChargeC.Y. 货柜场Container YardC/(CNEE) 收货人ConsigneeC/O 产地证Certificate of OriginCAF 货币汇率附加费Currency Adjustment FactorCFS 散货仓库Container Freight StationCFS/CFS 散装交货(起点/ 终点)CHB 报关行Customs House BrokerCIF 成本,保险加海运费COST,INSURANC,E FRIGHTCIP 运费、保险费付至目的地Carriage and Insurance Paid To COMM 商品CommodityCPT 运费付至目的地Carriage Paid ToCTNR 柜子ContainerCY/CY 整柜交货(起点/ 终点)D/A 承兑交单Document Against Acceptance到港通知Delivery OrderD/OD/P 付款交单Document Against PaymentDAF 边境交货Delivered At FrontierDDC 目的港码头费Destination Delivery ChargeDDP 完税后交货Delivered Duty Paid未完税交货Delivered Duty UnpaidDDUDEQ 目的港码头交货Delivered Ex QuayDES 目的港船上交货Delivered Ex ShipDoc# 文件号码Document NumberEPS 设备位置附加费Equipment Position SurchargesEx 工厂交货Work/Ex FactoryF/F 货运代理Freight ForwarderFAF 燃料附加费Fuel Adjustment FactorFAK 各种货品Freight All KindFAS 装运港船边交货Free Alongside ShipFCA 货交承运人Free CarrierFCL 整柜Full Container LoadFeeder Vessel/Lighter 驳船航次FEU 40‘柜型Forty-Foot Equivale nt Unit 40 'FMC 联邦海事委员会Federal Maritime Commission FOB 船上交货Free On BoardGRI 全面涨价General Rate IncreaseH/C 代理费Handling ChargeHBL 子提单House B/LI/S 内销售Inside SalesIA 各别调价Independent ActionL/C 信用证Letter of CreditLand Bridge 陆桥LCL 拼柜Less Than Container LoadM/T 尺码吨(即货物收费以尺码计费)Measurement Ton MB/L 主提单Master Bill Of LoadingMLB 小陆桥,自一港到另一港口Minnie Land BridgeMother Vessel主线船海运费 Ocean操作 Operation 预付 PrepaidMTD 多式联运单据 Multimode Transport DocumentN/F 通知人 NotifyNVOCC 无船承运人 Non Vessel Operating Common Carrier O/F Freight OBL 海运提单 Ocean (or original )B/LOCP 货主自行安排运到内陆点 Overland Continental Point OPORC 本地收货费用(广东省收取) Origin Receive Charges P.PPCS 港口拥挤附加费 Port Congestion SurchargePOD 目地港 Port Of DestinationPOL 装运港 Port Of LoadingPSS 旺季附加费 Peak Season SurchargesS/(Shpr ) 发货人 ShipperS/C 售货合同 Sales ContractS/O 装货指示书 Shipping OrderS/R 卖价 Selling RateS/S Spread Sheet Spread SheetSC 服务合同 Service ContractSSL 船公司 Steam Ship LineT.O.C 码头操作费 Terminal Operations OptionT.R.C 码头收柜费 Terminal Receiving ChargeT/S 转船,转运 Trans-ShipT/T 航程 Transit TimeTEU 20‘柜型 Twenty- Foot Equivalent Unit 20 'THC 码头操作费 Terminal Handling ChargesTTL 总共 TotalTVC/ TVR 定期定量合同 Time Volume Contract/ RateVOCC 船公司Vessel Operating Common CarrierW/M 即以重量吨或者尺码吨中从高收费Weight or Measurement ton W/T 重量吨(即货物收费以重量计费) Weight TonYAS 码头附加费Yard Surcharges各类附加费缩写简析1 、BAF 燃油附加费,大多数航线都有,但标准不一。

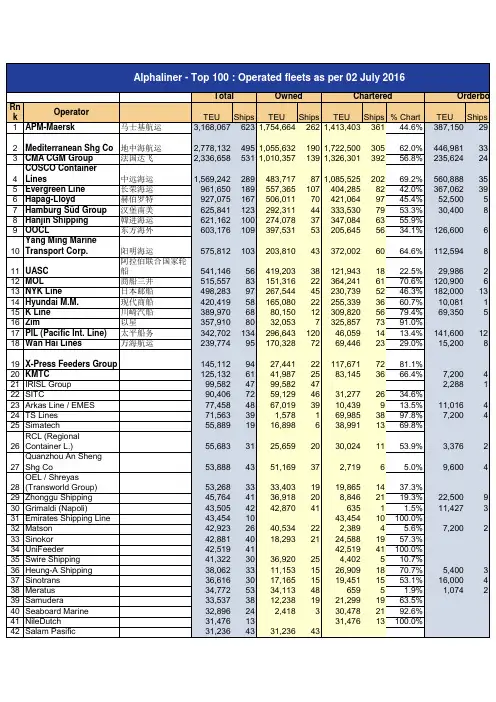

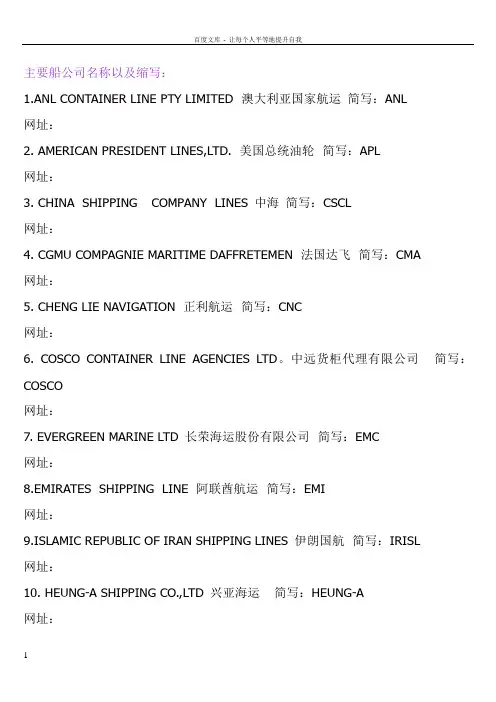

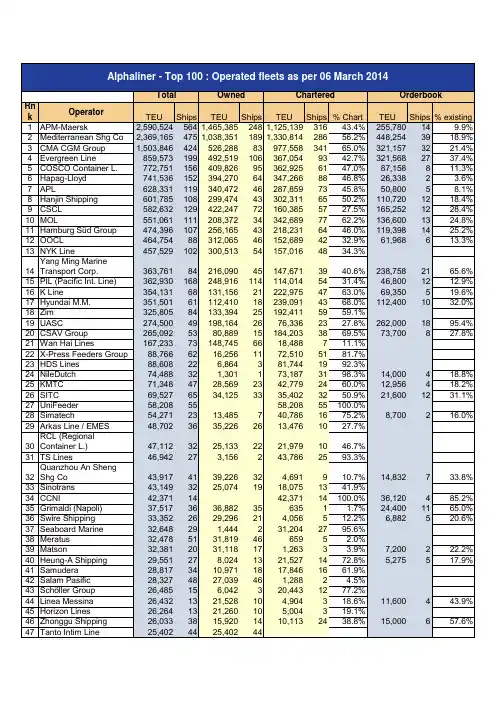

主要船公司名称以及缩写:1.ANL CONTAINER LINE PTY LIMITED 澳大利亚国家航运简写:ANL网址:2. AMERICAN PRESIDENT LINES,LTD. 美国总统油轮简写:APL网址:3. CHINA SHIPPING COMPANY LINES 中海简写:CSCL网址:4. CGMU COMPAGNIE MARITIME DAFFRETEMEN 法国达飞简写:CMA网址:5. CHENG LIE NAVIGATION 正利航运简写:CNC网址:6. COSCO CONTAINER LINE AGENCIES LTD。

中远货柜代理有限公司简写:COSCO网址:7. EVERGREEN MARINE LTD 长荣海运股份有限公司简写:EMC网址:8.EMIRATES SHIPPING LINE 阿联酋航运简写:EMI网址:9.ISLAMIC REPUBLIC OF IRAN SHIPPING LINES 伊朗国航简写:IRISL网址:10. HEUNG-A SHIPPING CO.,LTD 兴亚海运简写:HEUNG-A网址:11. HYUNDAI MERCHANT MARINE LTD.现代商船有限公司简写:HMM网址:12. HANJIN SHIPPING CO.,LTD 韩进海运简写:HJ网址:13.HAPAG-LLOYD(H.K) LTD赫伯罗特有限公司简写:HPL网址:14. K-LINE KAWASAKI KISEN KAISHA LTD川崎汽船简写:“K”LINE网址:15. KOREA MARINE TRANSPORT CO.,LTD 韩国高丽海运简写:KMTC网址:16. LLOYD TRIESTINO LTD(ITALIA MARITTIMA .S.P.A)意大利邮船简写:LT 网址:17. MAERSK SHIPPING CO.LTD马士基航运有限公司简写:MSK网址:18. MISC INTERGROUP SHIPPING LTD 威球船务(马来西亚航运)简写:MISC 网址:19. MOL (CHINA)CO.,LTD 商船三井(中国)有限公司简写:MOL网址:20. MEDITERRANEAN SHIPPING COMPANY 地中海航运简写:MSC网址:21. CSAV GROUP(CHINA)SHIPPING COMPANY LTD 南美油轮(又叫北欧亚)简写:NORASIA NCL网址:22.NIPPON YUSEN KAISHA 日本邮船简写:NYK 网址:23. OOCL (CHINA) LTD东方海外中国公司简写:OOCL网址:24. PACIFIC INTERNATIONAL LINES太平船务有限公司简写:PIL 网址:25. REGIONAL CONTAINER LINES 宏海船务有限公司简写:RCL网址:26. T.S.LINES 德翔船务简写:TSL网址:27. WAN HAI LINES LTD万海航运股份有限简写:WHL网址:28. YANG MING LINES 阳明海运股份公司简写:YML网址:29. ZIM ISRAEL NAVIGATION (CHINA) CO.,LTD 以星轮船简写:ZIM 网址:30.UASC 阿拉伯联合航运简写:UASC 网址:31.SYMS LINE 山东烟台海运简写:SYMS 网址:。

基于两区制空间杜宾模型的我国港口空间竞争强度分析梁晶李承杰【摘要】为进一步了解我国港口空间竞争格局,完善区域港口协调发展政策,基于我国128个规模以上港口2008―2017年的面板数据,运用两区制空间杜宾模型对不同规模、不同地理区位和不同整合力度下港口空间竞争强度的差异情况进行研究。

结果表明:大型港口之间的空间竞争强度要大于小型港口,大型港口面临周边港口空间竞争的响应系数为0.546,小型港口为0.168;沿海港口相比内河港口对周边港口的竞争更加敏感,沿海港口面临周边港口空间竞争的响应系数为0.572,内河港口为0.237;港口整合可以降低港口空间竞争强度,整合力度大的区域其港口面临周边港口空间竞争时的响应系数为0.401,其空间竞争强度要比其他区域小0.155。

【关键词】港口空间竞争;空间计量;两区制空间杜宾模型0引言2001年,我国港口管理权开始由中央下放到地方政府,从而形成了“一港一城”的港口治理模式。

这种治理模式激发了港口城市走“以港兴城”发展道路的意愿,使得区域港口重复投资建设的现象屡见不鲜,限制了区域港口群将港口资源优势转化为经济优势的能力。

为此,交通运输部发布《全国沿海港口布局规划》和《全国内河航道与港口布局规划》,以规划港口的空间布局推动港口协调发展。

2008年国际金融危机爆发,航运业陷入低迷,港口在地理空间上的竞争进一步加剧。

因此,从空间的角度研究在不同规模、不同地理区位和不同整合力度下的我国港口竞争形态,有助于了解我国港口空间竞争格局,完善区域港口协调发展政策。

国内外学者主要围绕港口竞争力评价[1-2]、港口竞合关系[3-4]和港口竞争策略[5-6]等方面展开研究,对港口竞争的实证考察大都注重逻辑推理和计量分析。

近年来,逐渐有学者将空间因素引入到港口竞争研究中来。

AXEL[7]以欧洲五大区域的92个集装箱港口为对象,对港口发展的空间竞争进行研究。

PATRICK等[8]采用空间滞后模型证明了荷兰内陆港口的发展受到港口空间竞争的影响,与其他强大的港口距离较近并不一定有利于港口自身的发展。

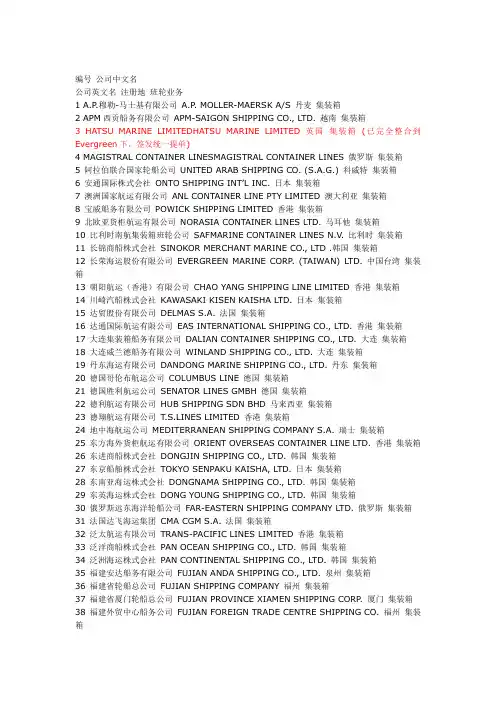

编号公司中文名公司英文名注册地班轮业务1 A.P.穆勒-马士基有限公司A.P. MOLLER-MAERSK A/S 丹麦集装箱2 APM西贡船务有限公司APM-SAIGON SHIPPING CO., LTD. 越南集装箱3 HATSU MARINE LIMITEDHATSU MARINE LIMITED 英国集装箱(已完全整合到Evergreen下,签发统一提单)4 MAGISTRAL CONTAINER LINESMAGISTRAL CONTAINER LINES 俄罗斯集装箱5 阿拉伯联合国家轮船公司UNITED ARAB SHIPPING CO. (S.A.G.) 科威特集装箱6 安通国际株式会社ONTO SHIPPING INT’L INC. 日本集装箱7 澳洲国家航运有限公司ANL CONTAINER LINE PTY LIMITED 澳大利亚集装箱8 宝威船务有限公司POWICK SHIPPING LIMITED 香港集装箱9 北欧亚货柜航运有限公司NORASIA CONTAINER LINES LTD. 马耳他集装箱10 比利时南航集装箱班轮公司SAFMARINE CONTAINER LINES N.V. 比利时集装箱11 长锦商船株式会社SINOKOR MERCHANT MARINE CO., LTD .韩国集装箱12 长荣海运股份有限公司EVERGREEN MARINE CORP. (TAIWAN) LTD. 中国台湾集装箱13 朝阳航运(香港)有限公司CHAO YANG SHIPPING LINE LIMITED 香港集装箱14 川崎汽船株式会社KAWASAKI KISEN KAISHA LTD. 日本集装箱15 达贸股份有限公司DELMAS S.A. 法国集装箱16 达通国际航运有限公司EAS INTERNATIONAL SHIPPING CO., LTD. 香港集装箱17 大连集装箱船务有限公司DALIAN CONTAINER SHIPPING CO., LTD. 大连集装箱18 大连威兰德船务有限公司WINLAND SHIPPING CO., LTD. 大连集装箱19 丹东海运有限公司DANDONG MARINE SHIPPING CO., LTD. 丹东集装箱20 德国哥伦布航运公司COLUMBUS LINE 德国集装箱21 德国胜利航运公司SENATOR LINES GMBH 德国集装箱22 德利航运有限公司HUB SHIPPING SDN BHD 马来西亚集装箱23 德翔航运有限公司T.S.LINES LIMITED 香港集装箱24 地中海航运公司MEDITERRANEAN SHIPPING COMPANY S.A. 瑞士集装箱25 东方海外货柜航运有限公司ORIENT OVERSEAS CONTAINER LINE LTD. 香港集装箱26 东进商船株式会社DONGJIN SHIPPING CO., LTD. 韩国集装箱27 东京船舶株式会社TOKYO SENPAKU KAISHA, LTD. 日本集装箱28 东南亚海运株式会社DONGNAMA SHIPPING CO., LTD. 韩国集装箱29 东英海运株式会社DONG YOUNG SHIPPING CO., LTD. 韩国集装箱30 俄罗斯远东海洋轮船公司FAR-EASTERN SHIPPING COMPANY LTD. 俄罗斯集装箱31 法国达飞海运集团CMA CGM S.A. 法国集装箱32 泛太航运有限公司TRANS-PACIFIC LINES LIMITED 香港集装箱33 泛洋商船株式会社PAN OCEAN SHIPPING CO., LTD. 韩国集装箱34 泛洲海运株式会社PAN CONTINENTAL SHIPPING CO., LTD. 韩国集装箱35 福建安达船务有限公司FUJIAN ANDA SHIPPING CO., LTD. 泉州集装箱36 福建省轮船总公司FUJIAN SHIPPING COMPANY 福州集装箱37 福建省厦门轮船总公司FUJIAN PROVINCE XIAMEN SHIPPING CORP. 厦门集装箱38 福建外贸中心船务公司FUJIAN FOREIGN TRADE CENTRE SHIPPING CO. 福州集装箱39 福建鑫安船务有限公司FUJIAN XINAN SHIPPING CO., LTD. 福州集装箱40 高丽海运株式会社KOREA MARINE TRANSPORT CO., LTD. 韩国集装箱41 韩进海运株式会社HANJIN SHIPPING CO., LTD. 韩国集装箱42 韩星海运株式会社HANSUNG LINE CO., LTD. 韩国集装箱43 汉堡南美航运公司HAMBURG SUDAMERIKANISCHE DAMPFSCHIFFFAHRTS-GESELLSCHAFT KG 德国集装箱44 浩达船务有限公司FAIR WIND SHIPPING COMPANY LIMITED 香港集装箱45 荷兰塔斯曼东方航运公司TASMAN ORIENT LINE C.V. 荷兰集装箱46 赫伯罗特货柜航运有限公司HAPAG-LLOYD CONTAINER LINE GMBH 德国集装箱47 华轮威尔森航运公司WALLENIUS WILHELMSEN ASA 挪威集装箱48 环球船务有限公司UNI-WORLD SHIPPING LIMITED 香港集装箱49 建恒海运股份有限公司KIEN HUNG SHIPPING CO., LTD. 中国台湾集装箱(已被HAMBURG SUB 收购)50 江苏连云港海运公司JIANGSU LIANYUNGANG MARINE SHIPPING CO. 连云港集装箱51 江苏远东海运有限公司JIANGSU FAR EAST SHIPPING CO., LTD. 南京集装箱52 江苏远洋运输公司JIANGSU OCEAN SHIPPING CO. 南京集装箱53 捷尼克株式会社GENEQ CORPORATION 日本集装箱54 金星轮船有限公司GOLD STAR LINE LTD. 香港集装箱55 京汉海运有限公司CO HEUNG SHIPPING CO., LTD. 香港集装箱56 立荣海运股份有限公司UNIGLORY MARINE CORPORATION 中国台湾集装箱(已被Evergreen整合)57 连云港船务公司LIANYUNGANG SHIPPING CORP. 连云港集装箱58 鲁丰航运有限公司LU FENG SHIPPING CO., LTD. 青岛集装箱59 马来西亚大众海运有限公司PERKAPALAN DAI ZHUN SDN.BHD. 马来西亚集装箱60 马来西亚国际船运有限公司MALAYSIA INTERNATIONAL SHIPPING CORPORATION BERHAD 马来西亚集装箱61 马鲁巴航运有限公司MARUBA S.C.A. 阿根廷集装箱62 美国莱克斯轮船有限公司LYKES LINES LIMITED, LLC 美国集装箱63 美国轮船有限公司U.S. LINES LIMITED 百慕大集装箱64 美国天美轮船有限公司TMM LINES LIMITED 美国集装箱65 美国西部汽船公司GREAT WESTERN STEAMSHIP COMPANY 美国集装箱66 美国总统轮船有限公司AMERICAN PRESIDENT LINES LIMITED 美国集装箱67 民生轮船有限公司MIN SHENG SHIPPING COMPANY LTD. 重庆集装箱68 南京远洋运输股份有限公司NANJING OCEAN SHIPPING CO., LTD. 南京集装箱69 南西海运株式会社NANSEI KAIUN CO., LTD. 日本集装箱70 南星海运株式会社NAMSUNG SHIPPING CO., LTD. 韩国集装箱71 宁波海运(集团)总公司NINGBO MARINE (GROUP) COMPANY 宁波集装箱72 宁波远洋运输有限公司NINGBO OCEAN SHIPPING CO., LTD. 宁波集装箱73 青岛华青船务有限公司QINGDAO HUAQING SHIPPING CO., LTD. 青岛集装箱74 日中海运株式会社JAPAN-CHINA SHIPPING CO., LTD. 日本集装箱75 瑞航船务有限公司FORTUNE SHIPPING LIMITED 香港集装箱76 萨姆达拉船务公司SAMUDERA SHIPPING LINE LTD. 新加坡集装箱77 山东海丰航运有限公司SITC STEAMSHIP’S CO., LTD. 青岛集装箱78 山东省国际海运公司SHANDONG PROVINCE MARINE SHIPPING CO. 青岛集装箱79 山东省烟台国际海运公司SHANDONG PROVINCE YANTAI INTERNATIONAL MARINE SHIPPING CO. 烟台集装箱80 商船三井株式会社MITSUI O.S.K. LINES LTD. 日本集装箱81 上海长江轮船公司SHANGHAI CHANGJIANG SHIPPING CORP. 上海集装箱82 上海泛亚航运有限公司SHANGHAI PANASIA SHIPPING CO., LTD. 上海集装箱83 上海海华轮船有限公司SHANGHAI HAI HUA SHIPPING CO., LTD. 上海集装箱84 上海快航株式会社SHANGHAI SUPER EXPRESS CO., LTD. 日本集装箱85 上海浦海航运有限公司SHANGHAI PUHAI SHIPPING CO., LTD. 上海集装箱86 上海市锦江航运有限公司SHANGHAI JINJIANG SHIPPING CO., LTD. 上海集装箱87 上海天海海运有限公司SHANGHAI TMSC MARINE SHIPPING CO., LTD. 上海集装箱88 神原汽船株式会社KAMBARA KISEN CO., LTD. 日本集装箱89 泰国宏海箱运有限公司REGIONAL CONTAINER LINES PUBLIC COMPANY LIMITED 泰国集装箱90 太平船务有限公司PACIFIC INTERNATIONAL LINES (PTE) LTD 新加坡集装箱91 天津市海运股份有限公司TIANJIN MARINE SHIPPING CO., LTD. 天津集装箱92 天敬海运株式会社CK LINE CO., LTD. 韩国集装箱93 天神国际海运有限公司TIANJIN-KOBE INTERNATIONAL MARINE SHIPPING CO., LTD. 天津集装箱94 铁行渣华有限公司P&O NEDLLOYD B.V. 荷兰集装箱95 万海航运股份有限公司WAN HAI LINES LTD. 中国台湾集装箱96 现代商船株式会社HYUNDAI MERCHANT MARINE CO., LTD. 韩国集装箱97 香港安通国际航运有限公司DYNA INTERNATIONAL SHIPPING LTD. 香港集装箱98 香港明华船务有限公司HONG KONG MING WAH SHIPPING CO., LTD. 香港集装箱99 协和海运株式会社KYOWA SHIPPING CO., LTD. 日本集装箱100 新东船务有限公司NEW ORIENT SHIPPING LTD. 香港集装箱101 新海丰航运(香港)有限公司SITC CONTAINER LINES (HK) COMPANY LIMITED 香港集装箱102 新华海运(私人)有限公司SIN HUA SHIPPING PTE. LTD. 新加坡集装箱103 新加坡海运集团私人有限公司SEA CONSORTIUM PTE LTD. 新加坡集装箱104 兴亚海运株式会社HEUNG-A SHIPPING CO., LTD. 韩国集装箱105 亚利安莎航运有限公司ALIANCA NAVEGACAO E LOGISTICA LTDA. 巴西集装箱106 延边现通海运集团有限公司YAN BIAN HYUNTONG SHIPPING GROUP CO., LTD. 延吉集装箱107 阳明海运股份有限公司YANG MING MARINE TRANSPORT CORP. 中国台湾集装箱108 伊朗伊斯兰共和国航运公司ISLAMIC REPUBLIC OF IRAN SHIPPING LINES 伊朗集装箱109 以星轮船有限公司ZIM ISRAEL NAVIGATION CO., LTD. 以色列集装箱更名为:以星综合航运有限公司ZIM INTEGRATED SHIPPING SERVICES CO., LTD110 亿通航运股份有限公司YI TONG LINES CO., LTD. 中国台湾集装箱111 意大利邮船公司LLOYD TRIESTINO DI NAVIGAZIONE S.P.A. 意大利集装箱112 印度国家航运公司THE SHIPPING CORPORATION OF INDIA LTD. 印度集装箱113 正利航业股份有限公司CHENG LIE NAVIGATION CO., LTD. 中国台湾集装箱114 智利航运国际有限公司COMPANIA CHILENA DE NAVEGACION INTEROCEANICA S.A. 智利集装箱115 智利南美轮船公司COMPANIA SUD AMERICANA DE VAPORES S.A. 智利集装箱116 中海集装箱运输(香港)有限公司CHINA SHIPPING CONTAINER LINES (HONG KONG) CO., LTD. 香港集装箱117 中海集装箱运输(亚洲)有限公司CHINA SHIPPING CONTAINER LINES (ASIA) CO., LTD. 英属维尔京群岛集装箱118 中海集装箱运输股份有限公司CHINA SHIPPING CONTAINER LINES CO., LTD. 上海集装箱119 中通国际海运有限公司CENTRANS INT’L MARINE SHIPPING CO., LTD. 香港集装箱120 中外运集装箱运输有限公司SINOTRANS CONTAINER LINES CO., LTD. 上海集装箱121 中远集装箱运输有限公司COSCO CONTAINER LINES CO., LTD. 上海集装箱122 重庆市海运有限责任公司CHONGQING MARINE SHIPPING CO., LTD. 重庆集装箱123 珠海北洋轮船有限公司ZHUHAI BEIYANG SHIPPING CO., LTD. 珠海集装箱124 暹逻航运国际有限公司SIAM PAETRA INTERNATIONAL CO., LTD. 泰国集装箱125 日本邮船株式会社NIPPON YUSEN KABUSHIKI KAISHA 日本集装箱、滚装船126 奥林汽船株式会社ORIENT FERRY, LTD. 日本客货127 丹东国际航运有限公司DANDONG INTERNATIONAL FERRY CO., LTD. 丹东客货128 韩国大仁轮渡有限公司KOREA DA-IN FERRY CO., LTD. 韩国客货129 黄海轮渡株式会社YELLOW SEA FERRY CO., LTD. 韩国客货130 津川国际客货航运(天津)有限公司TIANJIN-INCHON INTERNATIONAL PASSENGER & CARGO SHIPPING CO., LTD. 天津客货131 秦皇岛秦仁海运有限公司QIN-IN FERRY CO., LTD. 秦皇岛客货132 荣成大龙海运有限公司RONGCHENG GREAT DRAGON SHIPPING CO., LTD. 荣成客货133 荣成华东海运有限公司HUADONG FERRY CO., LTD. 威海客货134 上海国际轮渡有限公司SHANGHAI INTERNATIONAL FERRY CO., LTD. 上海客货135 上海仁川国际轮渡有限公司SHANGHAI INCHON INTERNATIONAL FERRY CO., LTD. 上海客货136 上海游轮公司SHANGHAI CRUISE CO., LTD. 韩国客货137 水晶航运有限公司CRYSTAL FERRY CO., LTD. 韩国客货138 天津津神客货轮船有限公司TIANJIN JINSHEN FERRY CO., LTD. 天津客货139 威海威东航运有限公司WEIHAI WEIDONG FERRY CO., LTD. 威海客货140 烟台中韩轮渡有限公司YANTAI ZHONGHAN FERRY CO., LTD. 烟台客货141 中日国际轮渡有限公司CHINA-JAPAN INTERNATIONAL FERRY CO., LTD. 上海客货142 广西防城港市海洋运输公司GUANGXI FANGCHENG PORT OCEAN SHIPPING CO. 防城港客运143 信德中旅喷射飞航(广州)有限公司TURBOJET FERRY SERVICES (GUANGZHOU) LIMITED 香港客运144 毅发船务有限公司JUMBO RICH SHIPPING LIMITED 香港客运145 丽星邮轮(香港)有限公司STAR CRUISES (HK) LIMITED 香港旅游船146 太平洋(海南)邮轮有限公司PACIFIC CRUISES (HAINAN) LTD. 香港旅游船147 太阳神豪华邮轮有限公司APOLLO LUXURY CRUISES CO., LTD 英属维尔京群岛旅游船148 天运船务公司SKY-HIGH FORTUNE MARITIME INC. 利比里亚旅游船149 邮轮客运(香港)有限公司CRUISE FERRIES (HK) LIMITED 香港旅游船150 中国海洋豪华邮轮有限公司CHINA OCEAN DELUXE CRUISES LIMITED 香港旅游船。

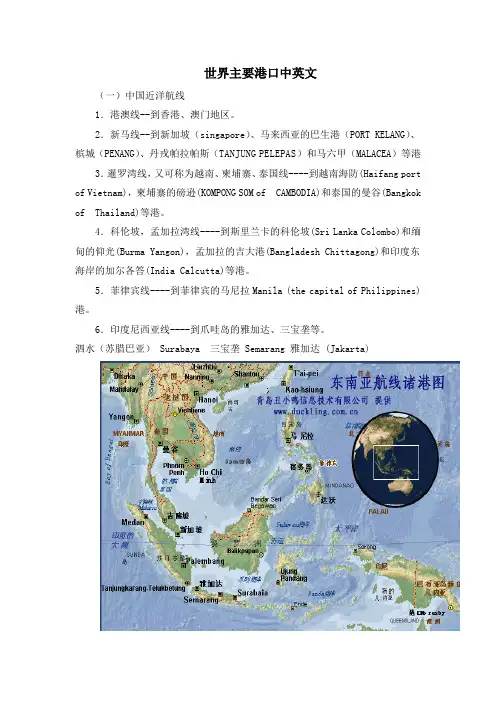

世界主要港口中英文(一)中国近洋航线1.港澳线--到香港、澳门地区。

2.新马线--到新加坡(singapore)、马来西亚的巴生港(PORT KELANG)、槟城(PENANG)、丹戎帕拉帕斯(TANJUNG PELEPAS)和马六甲(MALACEA)等港3.暹罗湾线,又可称为越南、柬埔寨、泰国线----到越南海防(Haifang port of Vietnam),柬埔寨的磅逊(KOMPONG SOM of CAMBODIA)和泰国的曼谷(Bangkok of Thailand)等港。

4.科伦坡,孟加拉湾线----到斯里兰卡的科伦坡(Sri Lanka Colombo)和缅甸的仰光(Burma Yangon),孟加拉的吉大港(Bangladesh Chittagong)和印度东海岸的加尔各答(India Calcutta)等港。

5.菲律宾线----到菲律宾的马尼拉Manila (the capital of Philippines)港。

6.印度尼西亚线----到爪哇岛的雅加达、三宝垄等。

泗水(苏腊巴亚) Surabaya 三宝垄 Semarang 雅加达 (Jakarta)7.澳大利亚新西兰线----到澳大利亚的悉尼、墨尔本、布里斯班和新西兰的奥克兰、惠灵顿。

布里斯班(澳大利亚)---Brisbane,AUSTRALIA墨尔本---MELBOURNE 悉尼---SYDNEY,奥克兰(新西兰) ---AUCKLAND, New Zealand 惠灵顿---WELLINGTON9.日本线----到日本九州岛的门司和本州岛神户、大阪、名古屋、横滨和川崎等港口。

日本(Japan)神户港(Port of Kobe)名古屋港(Port of Nagoya)横滨港(The Port of Yokohama)川崎港(Port of Kawasaki)大阪港(Port of Osaka)东京港(Port of Tokyo)千叶港(Port of Chiba)10.韩国线----到釜山、仁川等港口。

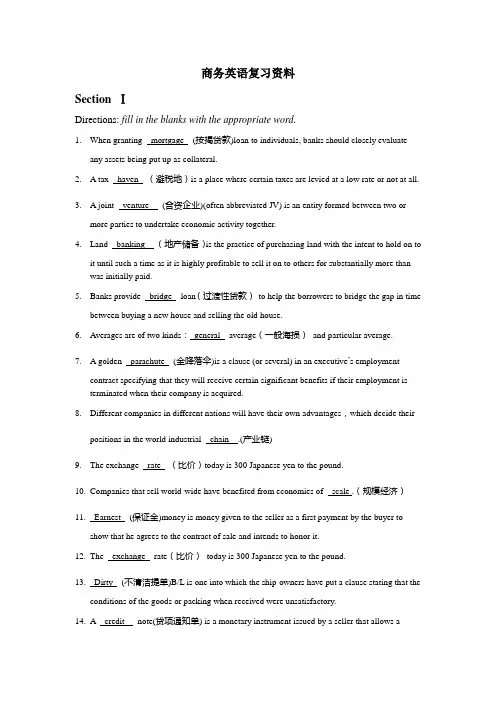

商务英语复习资料SectionⅠDirections: fill in the blanks with the appropriate word.1.When granting mortgage (按揭贷款)loan to individuals, banks should closely evaluateany assets being put up as collateral.2. A tax haven (避税地)is a place where certain taxes are levied at a low rate or not at all.3. A joint venture (合资企业)(often abbreviated JV) is an entity formed between two ormore parties to undertake economic activity together.nd banking (地产储备)is the practice of purchasing land with the intent to hold on toit until such a time as it is highly profitable to sell it on to others for substantially more than was initially paid.5.Banks provide bridge loan(过渡性贷款)to help the borrowers to bridge the gap in timebetween buying a new house and selling the old house.6.Averages are of two kinds:general average(一般海损)and particular average.7. A golden parachute (金降落伞)is a clause (or several) in an executive’s employmentcontract specifying that they will receive certain significant benefits if their employment is terminated when their company is acquired.8.Different companies in different nations will have their own advantages,which decide theirpositions in the world industrial chain .(产业链)9.The exchange rate (比价)today is 300 Japanese yen to the pound.panies that sell world-wide have benefited from economies of scale .(规模经济)11.Earnest (保证金)money is money given to the seller as a first payment by the buyer toshow that he agrees to the contract of sale and intends to honor it.12.The exchange rate(比价)today is 300 Japanese yen to the pound.13.Dirty (不清洁提单)B/L is one into which the ship-owners have put a clause stating that theconditions of the goods or packing when received were unsatisfactory.14.A credit note(贷项通知单) is a monetary instrument issued by a seller that allows abuyer to purchase an item or service from that seller on a future date.15.INCOTERMS (国际贸易术语解释通则)are a set of international rules published by theInternational Chamber of Commerce,Paris,for deciding the exact meaning of the chief terms used in foreign-trade contracts.SectionⅡDirections: translate the following terms and expressions from Chinese into English.1. 跨国公司(multinational company或transnational corporation或MNC)2. 百货批发(general wholesale)3. 半成品(semi-finished product或intermediate goods)4. 报关(declare sth at customs或apply to customs)5. 不冻港(ice-free port或open port)6. 法人(artificial person或legal person或legal entity)7. 多式联运(multimodal transport或forwarding)8. 多米诺(骨牌)效应(domino effect)9. 集装箱(container)10. AA制(go Dutch 或go fifty-fifty)11. 处理价(bargain price或reduced price)12. 报盘(quotation)13. 净重(net weight)14. 唛头(shipping marks)15. 不可抗力(an act of God与force majeure)16. 代理人(man of business)17. 舱位(shipping space)18. 超前消费(excessive consumption)SectionⅢDirections: translate the following terms and expressions from English into Chinese.1. go Dutch(AA制)2. force majeure(不可抗力)3. best-seller(畅销)4. shelf life (pull date保质期)5. BRIC group(金砖四国)6. net weight(净重)7. bill of exchange(draft汇票)8. trade quotas(贸易配额)9. adverse balance(逆差)10. bar code(条形码)11. offer(报价或报盘)12. pyramid selling(传销)13. counter-offer(还价或还盘)14. domino effect(多米诺骨牌效应)15. artificial person(legal person法人)16. down-market goods(低档货)17. Bretton Woods system(布雷顿森林体系18. cash on delivery(货到付款)19. futures market(期货市场)20. break even(收支平衡)SectionⅣDirections: translate the following sentences from Chinese into English.1.我们通常用个案分析为客户提供咨询服务。

内容摘要集装箱堆场的管理是集装箱运输管理中比较重要的一个环节,近年来,我国集装箱的吞吐量飞速增长,前方集装箱堆场的能力有所局限,人们开始关注后方集装箱堆场的管理及其建设。

但是后方堆场管理研究很少,现状比较的混乱,区域竞争又十分的激烈,所以只有合理科学的管理,才能提高堆场的利用率,降低成本,获得利润。

本文以后方集装箱管理为背景研究其堆场场位的合理划分和方法,通过分析集装箱堆场作业现状,发现目前运作所存在的一定的问题。

对其提出自己的看法以及改进的方案。

本文重点研究讨论进场箱的区位划分和减少后方堆场的翻箱倒箱率。

运用六西格玛理论管理集装箱堆场并对集装箱后方堆场的发展进行展望。

关键词:集装箱、后方堆场、管理、翻箱倒箱、六西格玛ABSTRACTContainer yard management is important in the management of container transport. In recent years, the rapid increasing of port container, it is beginning to pay attention to backup yard container management and construction, because of the stack limitation of marshalling yard. Management of the backup yard, however research is so little, comparing the status quo of chaos, regional competition is fierce, so the only reasonable scientific management, in order to improve the utilization of yard, reduce costs, and search for profit.In this paper, after the container management side of their yard for the background research of a reasonable division of the market place and methods of operation through the analysis of the status quo container yard and found the existence of the current operation of certain problems will arise. Put forward their own views and to improve the program. This article focuses on the approach me to discuss the regional division and to reduce the rear yard box back to the turn rate.Six Sigma management theory of the use of container yard,Container backup yard and the development prospects. Give to the Managers a little reference of the backup yard.KEYWORDS:Containers, Container yard, management, mould turnover, Six Sigma正文目录第一章引言 (1)第一节选题背景和意义 (1)第二节我国集装箱后方堆场状况 (2)一、集装箱箱位规划的现状 (2)二、集装箱翻箱捣箱现状 (2)三、集装箱堆场管理现状 (2)第三节研究的主要内容 (4)第二章集装箱后方堆场相关概念及理论介绍 (5)第一节堆场业务介绍 (5)一、集装箱堆场相关术语概述 (5)二、集装箱后方堆场翻箱倒箱介绍 (7)三、集装箱堆场的功能 (8)四、集装箱进出场业务过程 (13)第二节集装箱堆场的规划方法 (14)一、集装箱场区规划概述 (14)二、集装箱场区规划相关规则 (15)三、六西格玛理论介绍 (16)第三章宁波市宏达货柜储运有限公司管理优化 (18)第一节公司简介 (18)第二节宏达集装箱场区管理现状分析 (18)一、集装箱堆场场位划分现状分析 (19)二、堆场人员管理现状分析 (20)三、堆场信息传递现状分析 (21)第三节宏达货柜集装箱场区规划及管理建议 (22)一、场区规划分布优化 (22)二、堆场人员管理优化 (23)三、六西格玛管理优化 (24)第四章总结 (29)第一节工作总结 (29)第二节展望宁波集装箱后方堆场业 (29)参考文献 (31)致谢 (32)第一章引言第一节选题背景和意义在经济全球化和信息化的推动下,现代物流业从原来的单纯提供运输服务,发展到以现代科技、管理和信息技术为依靠的综合物流服务。

物流术语基础术语物品 goods物流 logistics物流活动 logistics activity物流管理 logistics management供应链 supply chain供应链管理 supply chain management服务 service物流服务 logistics service一体化物流服务 integrated logistics service物流系统logistics system第三方物流 the third party logistics物流设施 logistics establishment物流中心 logistics center配送中心 distribution center分拨中心 distribution center物流园区 logistics park物流企业 logistics enterprise物流作业 logistics operation物流模数 logistics modulus物流技术 logistics technology物流成本 logistics cost物流网络 logistics network物流信息 logistics information物流单证 logistics documents物流联盟 logistics alliance物流作业流程 logistics operation process企业物流 internal logistics供应物流supply logistics生产物流production logistics销售物流 distribution logistics社会物流 external logistics军事物流 military logistics项目物流 project logistics国际物流 International logistics虚拟物流 virtual logistics精益物流 lean logistics反向物流reverse logistics回收物流 return logistics废弃物物流 waste material logistics货物运输量 freight volume货物周转量 turnover volume of freight transport军事物资 military material筹措 raise军事供应链 military supply chain军地供应链管理 military supply chain management军事物流一体化 integration of military logistics and civil logistics 物流场 logistics field战备物资储备 military repertory of combat readiness全资产可见性 total asset visibility配送式保障 distribution-mode support作业服务术语托运 consignment承运 carriage承运人 carrier运输 transportation道路运输 road transport水路运输 waterway transport铁路运输 railway transport航空运输 air transport管道运输 pipeline transport门到门服务 door to door service直达运输 through transportation中转运输 transfer transportation甩挂运输 drop and pull transport整车运输 transportation of truck-load零担运输 sporadic freight transportation联合运输 combined transport联合费率 joint rate联合成本 joint cost仓储 warehousing储存 storing库存 inventory库存成本 inventory cost保管 storage仓单 storage invoice仓单质押融资 Warehouse receipt hypothecating/ Depot bill pledge 库存商品融资Inventory Financing仓储费用 warehousing fee订单满足率 fill rate货垛 goods stack堆码 stacking?配送 distribution拣选 order picking分类 sorting集货 goods consolidation共同配送 joint distribution装卸 loading and unloading搬运 handling carrying包装 package/packaging销售包装 sales package运输包装 transport package流通加工 distribution processing检验inspection增值物流服务 value-added logistics service定制物流customized logistics物流客户服务 logistics customer service物流运营服务 logistics operation service物流服务质量 logistics service quality?物品储备 goods reserves缺货率 stock-out rate货损率 cargo damages rate商品完好率 rate of the goods in good condition 基本运价freight unit price理货 tally组配 assembly订货周期 order cycle time库存周期 inventory cycle time技术与设施设备术语标准箱 twenty-feet equivalent unit (TEU)集装运输 containerized transport托盘运输 pallet transport货物编码 goods coding四号定位 four number location零库存技术 zero-inventory technology单元装卸 unit loading & unloading气力输送法 pneumatic conveying system生产输送系统 production line system分拣输送系统 sorting & picking system自动补货 automatic replenishment自动存储取货系统 automated storage & retrieval system (AS/RS) 集装化 containerization?散装化 in bulk托盘包装 palletizing直接换装 cross docking物流系统仿真 logistics system simulation冷链cold chain自营仓库 private warehouse公共仓库 public warehouse自动仓库 automated storage & retrieval system 立体仓库 stereoscopic warehouse交割仓库 transaction warehouse交通枢纽 traffic hinge集装箱货运站container freight station (CFS)?集装箱码头 container terminal控湿储存区 humidity controlled space?冷藏区 chill space冷冻区 freeze space收货区 receiving space区域配送中心 regional distribution center (RDC) 公路集装箱中转站 inland container depot?铁路集装箱场 railway container yard专用线 special railway line基本港口 base port周转箱 container叉车 fork lift truck?叉车属具 attachments of fork lift trucks托盘 pallet?称量装置 load weighing devices工业用门 industrial door货架 goods shelf重力货架系统 live pallet rack system移动货架系统 mobile rack system驶入货架系统 drive-in rack system集装袋 flexible freight bags集装箱 container特种货物集装箱 specific cargo container 集装单元器具 palletized unit implants全集装箱船 full container ship码垛机器人 robot palletizer起重机械 hoisting machinery牵引车 tow tractor升降台 lift table (LT)输送机 conveyors箱式车 box car自动导引车 automatic guided vehicle (AGV) 自动化元器件 element of automation手动液压升降平台车scissor lift table零件盒 working accessories条码打印机 bar code printer站台登车桥 dock levelers信息术语条码 bar code商品标识代码 identification code for commodity产品电子编码 Electronic Product Code (EPC)EPC序列号 serial number对象名称解析服务 object name service (ONS)对象分类 object class位置码 location number (LN)?贸易项目 trade item物流单元 logistics unit全球贸易项目标识代码 global trade item number应用标识符 application identifier (AI)物流信息编码 logistics information code自动数据采集 automatic data capture (ADC)自动识别技术auto identification条码标签 bar code tag条码识读器 bar code reader条码检测仪 bar code verifier条码系统 bar code system条码自动识别技术 bar code auto ID射频标签 RFID tag射频识读器 RFID reader射频识别 radio frequency identification (RFID)射频识别系统 RFID systemEPC系统 EPC system数据元 metadata报文 message实体标记语言 Physical Markup Language (PML)电子数据交换 electronic data interchange (EDI)电子通关 electronic clearance电子认证 electronic authentication电子报表 e-report电子采购 e-procurement电子合同 e-contract电子商务 e-commerce (EC)电子支付 e-payment地理信息系统 geographical information system (GIS) 全球定位系统global positioning system (GPS)智能交通系统 intelligent transportation system (ITS) 货物跟踪系统 goods-tracked system仓库管理系统 warehouse management system (WMS)销售时点系统point of sale (POS)电子订货系统 electronic order system (EOS)计算机辅助订货系统 computer assisted ordering (CAO)拉式订货系统 pull order system永续存货系统 perpetual inventory system虚拟仓库 virtual warehouse物流信息系统 logistics information system (LIS)物流信息技术 logistics information technology物流信息分类 logistics information sorting分布式的网络软件 savant管理术语仓库布局 warehouse layoutABC分类管理 ABC classification安全库存 safety stock经常库存 cycle stock库存管理 inventory management库存控制 inventory control供应商管理库存 vendor managed inventory (VMI)定量订货制 fixed-quantity system (FQS)定期订货制 fixed-interval system (FIS)经济订货批量 economic order quantity (EOQ)连续补货计划 continuous replenishment program (CRP)联合库存管理 joint managed inventory (JMI)前置期 lead time?物流成本管理 logistics cost control物流绩效管理 logistics performance management物流战略 logistics strategy物流战略管理 logistics strategy management物流质量管理 logistics quality management物流资源计划 logistics resource planning (LRP)供应链联盟 supply chain alliance供应商关系管理 supplier relationships management (SRM)准时制 just in time (JIT)?准时制物流 just-in-time logistics?有效客户反应 efficient customer response (ECR)快速反应 quick response (QR)?物料需求计划 material requirements planning (MRP)制造资源计划 manufacturing r esource planning (MRPⅡ)配送需求计划 distribution requirements planning (DRP)配送资源计划distribution resource planning (DRPⅡ)企业资源计划 enterprise resource planning (ERP)协同计划、预测与补货collaborative planning,forecasting and replenishment (CPFR) 服务成本定价法 cost-of-service pricing服务价值定价法 value-of-service pricing业务外包 outsourcing流程分析法 process analysis延迟策略 postponement strategy业务流程重组 business process reengineering(BPR)物流流程重组 logistics process reengineering有形损耗 tangible loss无形损耗 intangible loss?总成本分析 total cost analysis物流作业成本法 logistics activity-based costing效益悖反 trade off国际物流术语多式联运 multimodal transport国际多式联运 international multimodal transport国际航空货物运输 international airline transport国际铁路联运 international through railway transport班轮运输liner transport?租船运输 shipping by chartering大陆桥运输 land bridge transport保税运输 bonded transport转关运输Tran-customs transportation报关 customs declaration报关行 customs broker不可抗力 accident beyond control保税货物 bonded goods海关监管货物cargo under custom’s supervision拼箱货 less than container load (LCL)整箱货 full container load (FCL)通运货物 through goods转运货物 transit cargo自备箱shipper’s own container到货价格 delivered price出厂价 factory price成本加运费cost and freight (CFR)出口退税 drawback过境税 transit duty海关估价 customs ratable price等级标签 grade labeling等级费率 class rate船务代理 shipping agency国际货运代理 international freight forwarding agent无船承运业务 non vessel operating common carrier business 无船承运人 NVOCC non vessel operating、common carrier索赔 claim for damages理赔 settlement of claim国际货物运输保险 international transportation cargo insurance 原产地证明 certificate of origin进出口商品检验 commodity inspection清关 clearance滞报金 fee for delayed declaration装运港船上交货 free on board (FOB)进料加工 processing with imported materials来料加工 processing with supplied materials保税仓库 boned warehouse保税工厂 bonded factory保税区 bonded area保税物流中心 bonded logistics center保税物流中心A型 bonded logistics center of A type保税物流中心B型 bonded logistics center of B type融通仓 financing warehouse出口监管仓库 export supervised warehouse出口加工区 export processing zone定牌包装 packing of nominated brand中性包装 neutral packing提单(海运提单) bill of lading。

船东及船公司简称世界船东公司中文名公司英文名注册地班轮业务A.P.穆勒-马士基有限公司A.P. MOLLER-MAERSK A/S 丹麦集装箱APM西贡船务有限公司APM-SAIGON SHIPPING CO., LTD. 越南集装箱HATSU MARINE LIMITEDHATSU MARINE LIMITED 英国集装箱MAGISTRAL CONTAINER LINESMAGISTRAL CONTAINER LINES 俄罗斯集装箱阿拉伯联合国家轮船公司UNITED ARAB SHIPPING CO. (S.A.G.) 科威特集装箱安通国际株式会社ONTO SHIPPING INT’L INC. 日本集装箱澳洲国家航运有限公司ANL CONTAINER LINE PTY LIMITED 澳大利亚集装箱宝威船务有限公司POWICK SHIPPING LIMITED 香港集装箱北欧亚货柜航运有限公司NORASIA CONTAINER LINES LTD. 马耳他集装箱比利时南航集装箱班轮公司SAFMARINE CONTAINER LINES N.V. 比利时集装箱长锦商船株式会社SINOKOR MERCHANT MARINE CO., LTD .韩国集装箱长荣海运股份有限公司EVERGREEN MARINE CORP. (TAIWAN) LTD. 中国台湾集装箱朝阳航运(香港)有限公司CHAO YANG SHIPPING LINE LIMITED 香港集装箱川崎汽船株式会社KAWASAKI KISEN KAISHA LTD. 日本集装箱达贸股份有限公司DELMAS S.A. 法国集装箱达通国际航运有限公司EAS INTERNATIONAL SHIPPING CO., LTD. 香港集装箱大连集装箱船务有限公司DALIAN CONTAINER SHIPPING CO., LTD. 大连集装箱大连威兰德船务有限公司WINLAND SHIPPING CO., LTD. 大连集装箱丹东海运有限公司DANDONG MARINE SHIPPING CO., LTD. 丹东集装箱德国哥伦布航运公司COLUMBUS LINE 德国集装箱德国胜利航运公司SENATOR LINES GMBH 德国集装箱德利航运有限公司HUB SHIPPING SDN BHD 马来西亚集装箱德翔航运有限公司T.S.LINES LIMITED 香港集装箱地中海航运公司MEDITERRANEAN SHIPPING COMPANY S.A. 瑞士集装箱东方海外货柜航运有限公司ORIENT OVERSEAS CONTAINER LINE LTD. 香港集装箱东进商船株式会社DONGJIN SHIPPING CO., LTD. 韩国集装箱东京船舶株式会社TOKYO SENPAKU KAISHA, LTD. 日本集装箱东南亚海运株式会社DONGNAMA SHIPPING CO., LTD. 韩国集装箱东英海运株式会社DONG YOUNG SHIPPING CO., LTD. 韩国集装箱俄罗斯远东海洋轮船公司FAR-EASTERN SHIPPING COMPANY LTD. 俄罗斯集装箱法国达飞海运集团CMA CGM S.A. 法国集装箱泛太航运有限公司TRANS-PACIFIC LINES LIMITED 香港集装箱泛洋商船株式会社PAN OCEAN SHIPPING CO., LTD. 韩国集装箱泛洲海运株式会社PAN CONTINENTAL SHIPPING CO., LTD. 韩国集装箱福建安达船务有限公司FUJIAN ANDA SHIPPING CO., LTD. 泉州集装箱福建省轮船总公司FUJIAN SHIPPING COMPANY 福州集装箱福建省厦门轮船总公司FUJIAN PROVINCE XIAMEN SHIPPING CORP. 厦门集装箱福建外贸中心船务公司FUJIAN FOREIGN TRADE CENTRE SHIPPING CO. 福州集装箱福建鑫安船务有限公司FUJIAN XINAN SHIPPING CO., LTD. 福州集装箱高丽海运株式会社KOREA MARINE TRANSPORT CO., LTD. 韩国集装箱韩进海运株式会社HANJIN SHIPPING CO., LTD. 韩国集装箱韩星海运株式会社HANSUNG LINE CO., LTD. 韩国集装箱汉堡南美航运公司HAMBURG SUDAMERIKANISCHE DAMPFSCHIFFFAHRTS-GESELLSCHAFT KG 德国集装箱浩达船务有限公司FAIR WIND SHIPPING COMPANY LIMITED 香港集装箱荷兰塔斯曼东方航运公司TASMAN ORIENT LINE C.V. 荷兰集装箱赫伯罗特货柜航运有限公司HAPAG-LLOYD CONTAINER LINE GMBH 德国集装箱华轮威尔森航运公司WALLENIUS WILHELMSEN ASA 挪威集装箱环球船务有限公司UNI-WORLD SHIPPING LIMITED 香港集装箱建恒海运股份有限公司KIEN HUNG SHIPPING CO., LTD. 中国台湾集装箱江苏连云港海运公司JIANGSU LIANYUNGANG MARINE SHIPPING CO. 连云港集装箱江苏远东海运有限公司JIANGSU FAR EAST SHIPPING CO., LTD. 南京集装箱江苏远洋运输公司JIANGSU OCEAN SHIPPING CO. 南京集装箱捷尼克株式会社GENEQ CORPORATION 日本集装箱金星轮船有限公司GOLD STAR LINE LTD. 香港集装箱京汉海运有限公司CO HEUNG SHIPPING CO., LTD. 香港集装箱立荣海运股份有限公司UNIGLORY MARINE CORPORATION 中国台湾集装箱连云港船务公司LIANYUNGANG SHIPPING CORP. 连云港集装箱鲁丰航运有限公司LU FENG SHIPPING CO., LTD. 青岛集装箱马来西亚大众海运有限公司PERKAPALAN DAI ZHUN SDN.BHD. 马来西亚集装箱马来西亚国际船运有限公司MALAYSIA INTERNATIONAL SHIPPING CORPORATION BERHAD 马来西亚集装箱马鲁巴航运有限公司MARUBA S.C.A. 阿根廷集装箱美国莱克斯轮船有限公司LYKES LINES LIMITED, LLC 美国集装箱美国轮船有限公司U.S. LINES LIMITED 百慕大集装箱美国天美轮船有限公司TMM LINES LIMITED 美国集装箱美国西部汽船公司GREAT WESTERN STEAMSHIP COMPANY 美国集装箱美国总统轮船有限公司AMERICAN PRESIDENT LINES LIMITED 美国集装箱民生轮船有限公司MIN SHENG SHIPPING COMPANY LTD. 重庆集装箱南京远洋运输股份有限公司NANJING OCEAN SHIPPING CO., LTD. 南京集装箱南西海运株式会社NANSEI KAIUN CO., LTD. 日本集装箱南星海运株式会社NAMSUNG SHIPPING CO., LTD. 韩国集装箱宁波海运(集团)总公司NINGBO MARINE (GROUP) COMPANY 宁波集装箱宁波远洋运输有限公司NINGBO OCEAN SHIPPING CO., LTD. 宁波集装箱青岛华青船务有限公司QINGDAO HUAQING SHIPPING CO., LTD. 青岛集装箱日中海运株式会社JAPAN-CHINA SHIPPING CO., LTD. 日本集装箱瑞航船务有限公司FORTUNE SHIPPING LIMITED 香港集装箱萨姆达拉船务公司SAMUDERA SHIPPING LINE LTD. 新加坡集装箱山东海丰航运有限公司SITC STEAMSHIP’S CO., LTD. 青岛集装箱山东省国际海运公司SHANDONG PROVINCE MARINE SHIPPING CO. 青岛集装箱山东省烟台国际海运公司SHANDONG PROVINCE YANTAI INTERNATIONAL MARINE SHIPPING CO. 烟台集装箱商船三井株式会社MITSUI O.S.K. LINES LTD. 日本集装箱上海长江轮船公司SHANGHAI CHANGJIANG SHIPPING CORP. 上海集装箱上海泛亚航运有限公司SHANGHAI PANASIA SHIPPING CO., LTD. 上海集装箱上海海华轮船有限公司SHANGHAI HAI HUA SHIPPING CO., LTD. 上海集装箱上海快航株式会社SHANGHAI SUPER EXPRESS CO., LTD. 日本集装箱上海浦海航运有限公司SHANGHAI PUHAI SHIPPING CO., LTD. 上海集装箱上海市锦江航运有限公司SHANGHAI JINJIANG SHIPPING CO., LTD. 上海集装箱上海天海海运有限公司SHANGHAI TMSC MARINE SHIPPING CO., LTD. 上海集装箱神原汽船株式会社KAMBARA KISEN CO., LTD. 日本集装箱泰国宏海箱运有限公司REGIONAL CONTAINER LINES PUBLIC COMPANY LIMITED 泰国集装箱太平船务有限公司PACIFIC INTERNATIONAL LINES (PTE) LTD 新加坡集装箱天津市海运股份有限公司TIANJIN MARINE SHIPPING CO., LTD. 天津集装箱天敬海运株式会社CK LINE CO., LTD. 韩国集装箱天神国际海运有限公司TIANJIN-KOBE INTERNATIONAL MARINE SHIPPING CO., LTD. 天津集装箱铁行渣华有限公司P&O NEDLLOYD B.V. 荷兰集装箱万海航运股份有限公司WAN HAI LINES LTD. 中国台湾集装箱现代商船株式会社HYUNDAI MERCHANT MARINE CO., LTD. 韩国集装箱香港安通国际航运有限公司DYNA INTERNATIONAL SHIPPING LTD. 香港集装箱香港明华船务有限公司HONG KONG MING WAH SHIPPING CO., LTD. 香港集装箱协和海运株式会社KYOWA SHIPPING CO., LTD. 日本集装箱新东船务有限公司NEW ORIENT SHIPPING LTD. 香港集装箱新海丰航运(香港)有限公司SITC CONTAINER LINES (HK) COMPANY LIMITED 香港集装箱新华海运(私人)有限公司SIN HUA SHIPPING PTE. LTD. 新加坡集装箱新加坡海运集团私人有限公司SEA CONSORTIUM PTE LTD. 新加坡集装箱兴亚海运株式会社HEUNG-A SHIPPING CO., LTD. 韩国集装箱亚利安莎航运有限公司ALIANCA NAVEGACAO E LOGISTICA LTDA. 巴西集装箱延边现通海运集团有限公司YAN BIAN HYUNTONG SHIPPING GROUP CO., LTD. 延吉集装箱阳明海运股份有限公司YANG MING MARINE TRANSPORT CORP. 中国台湾集装箱伊朗伊斯兰共和国航运公司ISLAMIC REPUBLIC OF IRAN SHIPPING LINES 伊朗集装箱以星轮船有限公司ZIM ISRAEL NAVIGATION CO., LTD. 以色列集装箱亿通航运股份有限公司YI TONG LINES CO., LTD. 中国台湾集装箱意大利邮船公司LLOYD TRIESTINO DI NAVIGAZIONE S.P.A. 意大利集装箱印度国家航运公司THE SHIPPING CORPORATION OF INDIA LTD. 印度集装箱正利航业股份有限公司CHENG LIE NAVIGATION CO., LTD. 中国台湾集装箱智利航运国际有限公司COMPANIA CHILENA DE NAVEGACION INTEROCEANICA S.A. 智利集装箱智利南美轮船公司COMPANIA SUD AMERICANA DE VAPORES S.A. 智利集装箱中海集装箱运输(香港)有限公司CHINA SHIPPING CONTAINER LINES (HONG KONG) CO., LTD. 香港集装箱中海集装箱运输(亚洲)有限公司cHINA SHIPPING CONTAINER LINES (ASIA) CO., LTD. 英属维尔京群岛集装箱中海集装箱运输股份有限公司CHINA SHIPPING CONTAINER LINES CO., LTD. 上海集装箱中通国际海运有限公司CENTRANS INT’L MARINE SHIPPING CO., LTD. 香港集装箱中外运集装箱运输有限公司SINOTRANS CONTAINER LINES CO., LTD. 上海集装箱中远集装箱运输有限公司COSCO CONTAINER LINES CO., LTD. 上海集装箱重庆市海运有限责任公司CHONGQING MARINE SHIPPING CO., LTD. 重庆集装箱珠海北洋轮船有限公司ZHUHAI BEIYANG SHIPPING CO., LTD. 珠海集装箱暹逻航运国际有限公司SIAM PAETRA INTERNATIONAL CO., LTD. 泰国集装箱日本邮船株式会社NIPPON YUSEN KABUSHIKI KAISHA 日本集装箱、滚装船奥林汽船株式会社ORIENT FERRY, LTD. 日本客货丹东国际航运有限公司DANDONG INTERNATIONAL FERRY CO., LTD. 丹东客货韩国大仁轮渡有限公司KOREA DA-IN FERRY CO., LTD. 韩国客货黄海轮渡株式会社YELLOW SEA FERRY CO., LTD. 韩国客货津川国际客货航运(天津)有限公司TIANJIN-INCHON INTERNATIONAL PASSENGER & CARGO SHIPPING CO., LTD. 天津客货秦皇岛秦仁海运有限公司QIN-IN FERRY CO., LTD. 秦皇岛客货荣成大龙海运有限公司RONGCHENG GREAT DRAGON SHIPPING CO., LTD. 荣成客货荣成华东海运有限公司HUADONG FERRY CO., LTD. 威海客货上海国际轮渡有限公司SHANGHAI INTERNATIONAL FERRY CO., LTD. 上海客货上海仁川国际轮渡有限公司SHANGHAI INCHON INTERNATIONAL FERRY CO., LTD. 上海客货上海游轮公司SHANGHAI CRUISE CO., LTD. 韩国客货水晶航运有限公司CRYSTAL FERRY CO., LTD. 韩国客货天津津神客货轮船有限公司TIANJIN JINSHEN FERRY CO., LTD. 天津客货威海威东航运有限公司WEIHAI WEIDONG FERRY CO., LTD. 威海客货烟台中韩轮渡有限公司YANTAI ZHONGHAN FERRY CO., LTD. 烟台客货中日国际轮渡有限公司CHINA-JAPAN INTERNATIONAL FERRY CO., LTD. 上海客货广西防城港市海洋运输公司GUANGXI FANGCHENG PORT OCEAN SHIPPING CO. 防城港客运信德中旅喷射飞航(广州)有限公司TURBOJET FERRY SERVICES (GUANGZHOU) LIMITED 香港客运毅发船务有限公司JUMBO RICH SHIPPING LIMITED 香港客运丽星邮轮(香港)有限公司STAR CRUISES (HK) LIMITED 香港旅游船太平洋(海南)邮轮有限公司PACIFIC CRUISES (HAINAN) LTD. 香港旅游船太阳神豪华邮轮有限公司APOLLO LUXURY CRUISES CO., LTD 英属维尔京群岛旅游船天运船务公司SKY-HIGH FORTUNE MARITIME INC. 利比里亚旅游船邮轮客运(香港)有限公司CRUISE FERRIES (HK) LIMITED 香港旅游船中国海洋豪华邮轮有限公司CHINA OCEAN DELUXE CRUISES LIMITED 香港旅游船船公司简称与缩写船公司简称与缩写公司简称缩写澳大利亚国家航运公司澳国航运ANL美国总统轮船私人有限公司美国总统APL邦拿美船务有限公司邦拿美BNML波罗的海航运公司波罗的海BOL中波轮船股份公司中波C-P南美邮船公司南美邮船CLAN S.A.南美智利国家航运公司智利航运CCNI中日国际轮渡有限公司中日轮渡CHINJIF天敬海运天敬海运CK法国达飞轮船公司达飞轮船CMA京汉海运有限公司京汉海运CO-HEUNG中国远洋集装箱运输有限公司中远集运COSCO朝阳商船有限公司朝阳商船CHOYANG达贸国际轮船公司达贸国际DELIMAS德国胜利航运公司德国胜利SENATOR埃及国际轮船公司埃及船务EIL长荣海运股份有限公司长荣海运EVERGREEN远东轮船公司远东轮船FESCO金发船务有限公司金发船务GFNG浩洲船务公司浩洲船务HCSC韩进海运有限公司韩进海运HANJIN香港航运有限公司香港海运HKMSH香港明华船务有限公司香港明华HKMW赫伯罗特船务有限公司赫伯罗特HAPPAG-LLOYD现代商船有限公司现代商船HYUNDAI上海海隆轮船有限公司海隆轮船HNT金华航运有限公司金华航运JH川崎汽船株式会社川崎汽船K LINE高丽海运株氏会社高丽海运KMTC七星轮船有限公司七星轮船SSCL上海育海航运公司育海航运SYH上海中福轮船公司中福轮船SZFSC墨西哥航运有限公司墨西哥航运TMM上海天海货运有限公司天海货运TMSC东航船务有限公司东航船务TOHO宁波泛洋船务有限公司宁波泛洋TOS阿拉伯联合国家轮船公司阿拉伯轮船UASC立荣海运股份有限公司立荣海运UNIGLORY环球船务有限公司环球船务UNIWD万海航运股份有限公司万海航运WANHAI伟航船务有限公司伟航船务WH阳明海运股份有限公司阳明海运YANGMING以星轮船船务有限公司以星轮船ZIM浙江远洋运输公司浙江远洋ZOSCO联丰船务有限公司联丰船务LIFEN意大利邮船公司意大利邮船LT马来西亚国际航运有限公司马来西亚航运MISC商船三井有限公司商船三井MOL地中海航运公司地中海航运MSC马士基海陆有限公司马士基海陆MAERSK SEALAND 民生神原海运有限公司民生神原MSKM太古船务代理有限公司太古船代NGPL铁行渣华船务有限公司铁行渣华P&O NEDLLOYD新加坡海皇轮船有限公司海皇轮船NOL北欧亚航运有限公司北欧亚航运NORASIA宁波远洋运输公司宁波远洋NOSCO南星海运株式会社南星海运NS沙特阿拉伯国家航运公司沙特航运NSCSA日本邮船有限公司日本邮船NYK东方海外货柜航运有限公司东方海外OOCL萨姆达拉船务有限公司萨姆达拉SAMUDERA太平船务有限公司太平船务PIL泛洋商船株式会社泛洋商船POBU瑞克麦斯轮船公司瑞克麦斯RICKMERS美商海陆联运(中国)有限公司美商海陆S/L南非国家轮船有限公司南非轮船SAF东映海运有限公司东映海运SBL上海国际轮渡有限公司国际轮渡SFCO中海发展股份有限公司中海发展CSD长锦有限公司长锦公司SINKO上海市锦江航运有限公司锦江船代JINJIANG中外运(集团)总公司中外运SINOTRANS志晓船务有限公司志晓船务SSC中国海运集团中海航运CHINA SHIPING宏海(东南亚)海运轮船公司宏海航运RCL承运人代码及英文简称[推荐]代码公司中文名称公司英文名称ABC ABC货柜航运公司A.B.C CONTAINTER LINEACBL 美国商业驳船航运公司American Commercial Barge Line company ACGR 冠航集团Ace GroupACL 大西洋集装箱航运公司Atlantic Contaier LineACT 联合集装箱运输公司(英)Associated Container Transportation AECS 澳大利亚欧洲集装箱服务公司Australia Europe Container Service AEL 美欧轮船公司American-European LinesAEXL 美国出口航运公司American Export LinesAFS 亚运香港船务有限公司Asia Fortune(HK) Shipping ltd.AFSC 非洲轮船公司(英)African Steamship Co.AJCL 澳大利亚-日本集装箱航运公司Australia Japan Container Line AMCL 美国商业轮船公司American commercial Lines, Incorporated AMISCL 美国伊拉克轮船公司American Iraqi Shipping Company, Ltd. AML 美国邮船公司American Mail LineAMPTC 阿拉伯海上石油运输公司Arab Maritime Petroleum transport Co. AND 亚得利亚航运公司(意大利)Adriatica Di Navigazione SpaANL 澳州国家航运Austrilian National LineANST 阿里亚国家航运公司(伊朗)Arya National Shipping LinesAOR 挪亚AORASIAAPL 美国总统轮船公司American Predsident lines Ltd.ASC 阿拉斯加轮船公司(美)Alaska Steamship CompanyASS 阿莱德ASTA 朝日油轮公司(日)Asahe-TankerATL 亚洲货运中心Asia Terminal LimitedATTL 大西洋轮船运输公司Atlantic Transport lineAWP 澳大利亚西太平洋轮船公司Australia West Pasific LineBEN 边行集装箱运输公司(英国)Ben Line Containers Ltd.BK 刚兴船务有限公司Kong Hing Agemcy LtdBOL 波罗地海远东航运公司Baltic Orient LineBONA 邦拿美Bonami LineBRN 保加利亚河运公司Bulgarian River NavigationBSC 孟加拉国海运公司Bangladesh Shipping Co.BSP 巴尔的摩定期轮船公司(美)Baltimore Steam PacketBTC 伯利恒运输公司(美)Bethlehemm Transportation Co.CAT 美国加拿大大西洋转运公司Canada Atlantic transit Company of UnitedStates12.0pt;font-family:CAU 澳大利亚集装箱航运公司Australia Container LineCCC 罗经集装箱运输公司(美)Compass Container CorporationCCCO 加利福尼亚货物集装箱运输公司California Cargo ContainerCCL 加利福尼亚集装箱航运公司(美)California Container LineCCNI 华林船公司CCX 嘉庆航运公司(台湾)Char Ching Marine Co.CGL 加拿大海湾航运公司Canadian Gulf LineCGM 法国航海总公司Compagnie General Maritime Et FinaciereCHF 侨丰船务有限公司Chiao Feng Shipping ltd.CHP 中波轮船有限公司Chinese-Polish Joint Stock Shipping Co.CJF 中日国际轮渡有限公司CHINA-JAPAN INTERNATIONAL FERRY CO.,LTD.CKS 天敬海运株式会社CHUN KYUNG Shipping Co.,Ltd.CLO 克卢租箱公司(德国)Clou Container Leasing GmbHCLS 朝联货柜有限公司Chiu Lun Container Co.,LtdCMA 法国达飞轮船有限公司Compagnie Maritime DaffertemetCMCL 招商货柜航运有限公司China Merchants Co.,ltd.CMSNC 招商局轮船股份有限公司(香港)China Merchants Steam Navigation Company, Ltd CNCC 中国租船公司China National Chartering CorporationCNS 加拿大国家轮船公司Canadian National SteamshipsCOCENAVE 多西和流域航运公司(巴西)Vale do Rio Doce NavegacaoCOH 京汉船务有限公司Coheung Shipping Co.,ltd.COMANAV 摩洛哥航运公司Compagnie Marocaine de NavigationCOMAUNAM 毛里塔尼亚航运公司Compagnie Mauritanienne de Navigation Maritimestyle='font-size: 12.0pt;font-family:CON 康曲兰士集装箱公司(德国)Contrans GmbhCOSCO 中国远洋运输集团COSCO GroupCPN 太平洋西北集装箱航运公司Pacific North West Container LineCPV 秘鲁轮船公司Corporacion Peruana de VaporesCRN 联华航业有限公司Chrina Overseas Company ltd.CSAV 南美洲轮船公司(智利)Compagnia Sudamericana de VaporesCSC 中海船公司China Shipping co.,ltd.CSL 加拿大轮船公司Canada Steamship Lines,Ltd.CTI 国际集装箱运输公司(美国)Container Transport InternationalCTN 突尼斯航运公司Compagnie Tunisienne de NavigationCUCMS 苏伊士运河货运总公司Compagnie Universelle du Canal Maritie de Suezstyle='font-size: 12.0pt;font-family:CYL 朝阳海运Cho Yang Shipping ltd.DFDS 联合轮船公司(丹麦)Det Forende DampskebsselskabDMS 法国达贸轮船有限公司DELMASDSR 德意志罗斯托克航运公司(德国)Deufracht Seereederei RostockDVR 戴尔马维埃热航运公司(法国)Delmas-Vieljeux Socia Navale ChargeursDY 东映海运株式会社PEGASUS CONTAINER SERVICEDYWW 东映自备箱DZ 德利船公司E&A 东方及澳大利亚航运公司Eastern and Australia LineEAC 宝隆轮船公司(丹麦)East Asiatic Co.Ltd.EANSL 东非国营航运公司East African National Shipping LineECT 欧洲联合码头公司Europe combined TerminalEFFDEA 阿根廷国家内河航运公司Empresa FLota Fluvial del Estado ArgentionEGSEL 和荣船务企业有限公司(香港)Ever Glory Shipping Enterprises LtdELMA 阿根廷轮船公司Empresas Lineas Maritimas ArgentinasEMPREMAR 国家海运公司(智利)Empresa Maritima del EstdoENASA 亚马逊河航运公司(巴西)Empresa Navegacao da Amazonia,Sociedade anonima ESCO 东方轮船公司Estern Steamship CompanyESL 东方轮船公司(菲律宾)Eastern Shipping Lines IncorporatedEVG 长荣海运股份有限公司Evergreen Marine Corp. Ltd.EXC 昌宏船务有限公司Excelsior Shipping Co.,ltd.FEC 外总FECFESC 远东国际海运公司FESCOFINL 芬兰轮船公司Finnlines LimitedFPL 远东航运公司(俄罗斯)Far Eastern Shipping Co.FREE FREE USEFRONAPE 国家油船公司(巴西)Frota Nacional de PetroleirosFSPL 中央汽船FTI 富腾船务有限公司Fieet Trans International LtdFUJL 富士汽船Fuji Steamship Co., LtdFWSC 陆海英之杰船务有限公司Land-Ocean Inchacape International Container Transport Co.,Ltd.FWSL 友航轮船有限公司Fairweather Steamship Co., Ltd.GBE 金庆联运有限公司Golden Boxes Express letGEKA 通用海运公司(日本)General Kaiun Shipping Co.GF 金发船务有限公司GOFORGG 源源船务有限公司Guan Guan Shipping ltd.GLE 大湖和欧洲班轮公司Great Lakes and European LinesGOL 高洲轮船有限公司Golf Ocean Lines Ltd.GONC 海昌航运有限公司Great Oversea Navigation Co.Ltd.GSC 加纳航运公司Ghana Shipping CorporationGSL 金星航运公司Gold Star LineGSNC 通用轮船运输公司(英)General Steam Navigation CompanyGST 金斯塔租箱公司(美国)Genstar Container Corp.GWS GREAT WESTERN STEAMSHIP CO.HAIX 上海海兴船务公司HAI XING SHIPPING CO., LTDHAKAI 八产海运公司(日本)Hachinohe-KaiunHAL 兴亚HAM 向大Hamda Shipping Co., Ltd.HAS 上海海华轮船有限公司SHANGHAI HAI HUA SHIPPING CO., LTDHASAGY 上海海华国际船务代理有限公司SHANGHAI HAI HUA INTERNATIONAL SHIPPING AGENCYHFL 海富HAI FUHJS 韩进海运Hanjin Shipping ltd.HKEL 香港邮船有限公司HongKong Export Lines Ltd.HKIS 香岛轮船有限公司Hong Kong Islands Shipping Ltd.HKM 香港海运Hong Kong MaritimeHLC 赫伯罗特航运公司(德国)Hapag LloydHMM 现代商船株式会社HYUNDAI Merchant Marine ltd.HSL 富泽有限公司Hope Sea LtdICCU ICCU集装箱集团(意大利)ICCU Container GroupICSN 印华轮船公司Indo-China Steam Navigation Co.,Ltd.IEA 多式联运设备公司(美国)Intermodal Equipment AssociatesILO 国际海洋租箱公司(美国)Interocean Leasing Ltd.INB 英特浦尔集装箱公司(美国)Interpool Ltd. IntuIRI 伊朗ISA 国际航运公司(波多黎哥)International Shipping AgencyITL 伊特尔国际租箱公司(美国)Ited Containers International Corp.IWT 依洛瓦底江航运公司(缅甸)Irawaddy Water Transport Corporation船公司简介澳大利亚国家航运有限公司-ANL(澳大利亚)ANL CONTAINER LINE PTY Ltd.au/index.php3美国总统轮船有限公司-APL(美国)American President Lines Co., Ltd京汉航运有限公司-CHS(中国香港)CO-HEUNG MARINE SHIPPING CO., LTD./智利航运国际有限公司-CCNI(智利)COMPANIA CHILENA DE NAVEGACION INTEROCEANICA S.A. ni.cl/智利南美轮船公司-CSAV(智利)COMPANIA SUD AMERICANA DE VAPORES S.A.http://www.village.it/csav/中国远洋运输(集团)总公司(中国)中远集装箱运输有限公司COSCO CONTAINER LINES CO., LTD.中国海运集团总公司-CSC(中国)中海集装箱运输有限公司China Shipping (group) Company[/url]法国达飞轮船有限公司-CMA-CGM(法国)CMA CGM-the French Line达贸国际轮船公司-DELMAS(法国)DELMAS S.A.德国胜利航运-环球航线服务-DSR(德国)SENATOR LINES GMBH长荣海运股份有限公司-EMC(中国台湾)Evergreen Marine Corporation远东海洋轮船公司-FESCO(俄罗斯)Far-Eastern Shipping Co., Ltdwww.fesco.ru德国赫伯罗特轮船公司HAPAG-LLOYD(德国) HAPAG-LLOYD CONTAINER LINE GMBH/韩进海运-HANJIN(韩国)HANJIN SHIPPING CO., LTD.现代商船有限公司-HYUNDAI(韩国)Merchant Marine Co.,Ltd株式会社韩星船舶-HSLN(韩国)Hansung Shipping Co.,Ltd伊朗伊斯兰共和国航运公司-IROSL(伊朗)ISLAMIC REPUBLIC OF IRAN SHIPPING LINES /锦江航运有限公司-JINJIANG(中国)SHANGHAI JINJIANG SHIPPING CO. Ltd/banqi/cgs/jj.html神原汽船株式会社-KMB(日本)KAMBARA KISEN CO., LTD.http://www.kambara-kisen.co.jp/c/overview/日本川崎汽船株式会社- K-Line(日本)Kawasaki Kisen Xaisha, Ltd.高丽海运株式会社-KMTC(韩国)Korea Marine Transport Co.,Ltdwww.kmtc.co.kr意大利邮船公司- LLT(意大利)Lloyd Triestino Shipping Companyhttp://www.lloydtriestino.it/马士基航运有限公司-MAERSK SEALAND(丹麦)马来西亚国际船运有限公司-MISC(马来西亚)MALAYSIA INTERNATIONAL SHIPPING CORPORATION BERHAD /[/url]日本大阪商船三井船务株式会社-MOSK(日本)Mitsui O.S.K.Lines Co.,Ltdhttp://www.mol.co.jp地中海航运公司-MSC(瑞士)Meditterranean Shipping Company S.A./民生轮船有限公司- MSH(中国)Minsheng Shipping Co., Ltd./北欧亚海运有限公司-NORASIA(马耳他)/沙特阿拉伯国家航运有限公司–NSCSA(沙特阿拉伯)The National Shipping Company of Saudi Arabia /日本邮船中国有限公司-NYK(日本)Nippon Yusen Kaisha东方海外货柜航运有限公司-OOCL(中国香港)OrientOverseas Container Line, Inc.铁行渣华船务有限公司- P&O Nedlloyd(英国)P&O Nedlloyd Ltd中国外轮代理总公司-PENAVICO(中国)China Ocean Shipping Agency.太平船务有限公司- PIL(新加坡)Pacific International Lines LTd.印度国家航运-SCI(印度)the shipping corporation of India Ltd山东海丰国际航运集团有限公司-SITC(中国) SITC MARITIME(GROUP)CO.LTD中国外运(集团)总公司-SINOTRANS(中国)中外运集装箱运输有限公司SINOTRANS CONTAINER LINES CO., LTD.长锦商船船务有限公司-SKR(韩国)Sinokor Merchant Marine Co., Ltdhttp://www.sinokor.co.kr萨姆达拉船务有限公司-SSL(新加坡)SAMUDERA SHIPPING LINE LTD山东省烟台国际海运公司–SYMS(中国)SHANDONG YANTAI INT’L MARINE SHIPPING Co.Ltd天津海运股份有限公司-TMS(中国)TIANJIN MARINE SHIPPING CO .Ltd/banqi/cgs/tjhy.html美国美商纵横联运有限公司(美国)Translink Shipping Inc.阿拉伯联合国家轮船公司-UASC(科威特)UNITED ARAB SHIPPING CO.S.A.G..kw/立荣海运股份有限公司-UNI-GLORY(中国台湾)UNIGLORY LINE/UGL/index.htm万海航运股份有限公司-WANHAI(中国台湾)Wan Hai Lines Ltd阳明海运股份有限公司-YML(中国台湾)YANG MING MARINE TRANSPORT CORP. 以星综合航运有限公司-ZIM(以色列)ZIM ISRAEL NAVIGATION CO., LTD [url=http://www.zim.co.il/]www.zim.co.il。

世界港口码头缩写(2008-01-13 14:19:38)转载分类:业务资料标签:杂谈世界港口码头缩写ATI- Asian Terminals Incorporated .ph马尼拉南港唯一的集装箱集散和多种货物港口经营者。

为了增强南港的集散能力,ATI 始终坚持发展和管理遍布全国的战略港口和物流中心。

DPI - Adelaide 南澳大利亚唯一的集装箱码头。

这里拥有完善的港内公路和铁路直运系统。

此外还配有汽车处理设备。

JNPT- Jawaharlal Nehru Port Trust 印度最繁忙的港口孟买的贾瓦哈拉尔"尼赫鲁港,码头每年可处理 1 百万个以上标准集装箱的货物,并正在参与一项散装货物码头的重新开发计划,该计划拟将其货物吞吐能力增加 130 万个标准集装箱。

NSICT- Nhava Sheva International Container Terminal,Pvt., Ltd http://www.nsict.co.inNSICT 是印度第一个私人运营的集装箱港口。

它由 Peninsular and Oriental Steam Navigation Company 的子公司英国铁行港口公司 (P&O Ports) 运营。

孟买新港国际集装箱码头(NSICT)该港口的建设成本为 2 亿 5 千万美元,是同等规模港口建设项目中花费时间最短的项目。

目前,根据 Jawaharlal Nehru Port Trust (JNPT) 与印度政府的建设一运营一移交协议,该港口由Jawaharlal Nehru Port Trust (JNPT) 进行管理。

NSICT 包括 600 米长的船埠线、13.5 米深的船舶泊位和 30 公顷的集装箱堆场。

货物吞吐量可达 110 万个标准集装箱,并能满足第五代船只的运输需求。

LCIT- Laem Chabang International Terminal Co., Ltd. 成立于 1996 年,投入成本超过 8200 万美元,是泰国最先进的集装箱码头。

国际货运代理相关英语表达(上)Unit 11. freight forwarder 货运代理人2. letter of credit 信用证3. the mode of transport 运输模式4. freight cost 运费5. the Forwarder’s Certificate of Receipt 货运代理人收货证明书6. the Forwarder’s Certificate of Transport 货运代理人运输证明书7. container cargo 集装箱货物8. foreign exchange trading 外汇交易9. exporting strategy 出口战略10. cargo transportation 货物运输11. customs clearance 清关12. commission agent 委托代理人13. country of transshipment 转运国14. movements of goods 货物运输15. shipping space 舱位16. a bill of lading 提单17. transit country 转口国18. trade terms 贸易条款19. general cargo 杂货20. special cargoes 特殊货物21. a comprehensive package of service 全面的一揽子服务22. trade contract 贸易合同23. relevant documents 相关单据24. take delivery of the goods 提货Unit 2.1. FOB (FREE ON BOARD) 船上交货2. CIP (COST INSURANCE AND FREIGHT) 运费,保费付至3. CFR (COST AND FREIGHT ) 成本加运费4. FCA (FREE CARRIER) 货交承运人5. CPT (CARRIAGE PAID TO) 运费付至6. CIF (COST INSURANCE AND FREIGHT) 成本,保费加运费7. insurance premium 保险费8. multi-modal transport 多式联运9. inland waterway transport 内河运输10. amendment 修改11. carrier 承运人12. ICC- International Chamber of Commerce 国际商会13. Incoterms 国际贸易术语通则14. insurance policy 保险单15. packing costs 包装费用16. transfer of risks 风险转移17. ship’s rail 船舷18. clear the goods for export 办理货物出口清关手续19. sea transport 海运20. the named of shipment 指定装运港21. exchange control 外汇控制22. seller’s premise 卖方所在地23. the named port of destination 指定目的港Unit 31. time of shipment 装船时间2. partial shipment 分批装运3. transshipment 转船4. shipping documents 运输单据5. ports of call 停靠港6. expiry date 有效期7. obligation 责任,义务8. terms of shipment 装运条款9. presentation of documents 交单10. remittance 汇付11. UCP-Uniform Customs and Practice of Documentary Credit, Icc Publication N500,1993 《跟单信用证统一惯例》国际商会第500号出版物12. liner transport 班轮运输13. sailing schedule 船期表14. dispatch money 速遣费15. bunker surcharge 燃油附加费16. shipping by chartering 租船运输17. liner freight tariff 班轮运价表18. weight ton 重量吨19. measurement ton 尺码吨20. transshipment additional 转船附加费21. port of loading 装运港22. shipment date 装运有效期23. the latest date fro shipment 最迟装运期Unit 4.1. insurable interest 保险利益原则2. utmost good faith 最大诚信原则3. indemnity 赔偿原则4. Insurance certificate 保险凭证5. Endorsement 批单6. PICC Ocean Marine Cargo Clauses 中国人民保险公司海上货物运输保险条款7. Constructive total loss 推定全损8. general average 共同海损9. With Particular Average/ With Average 水渍险10. the subject matter insured 保险标的11. Natural Calamities 自然灾害12. particular average 单独海损13. bulk cargo 散货14. insurance broker 保险经纪人15. inherent vice 内在缺陷16. actual total loss 实际全损17. the insure 保险人18. the insured 被保险人19. heavy weather 恶劣天气20. Free of Particular Average 平安险21. in transit 运输中22. All risks 一切险23. partial loss 部分损失24. War Risks 战争险25. Perils of the sea 海上风险26. insurance coverage 承保范围27. salvage charges 救助费用28. theft, pilferage &non-delivery risks 偷窃提货不着险29. fresh water and/or rain damage risks 淡水雨淋险30. shortage risks 短量险31. intermixture and contamination risks 混杂,玷污险32. leakage risks 渗漏险33. clash and breakage risks 碰损,破碎险34. taint of odour risks 串味险35. sweat and heating risks 受潮,受热险36. hook damage risks 钩损险37. breakage of packing risks 包装,破裂险38. rust risks 锈损险39. grounding 坐浅40. overturn 翻船41. port of distress 避难港42. volcanic eruption 火山爆发43. consideration 对价44. tsunami 海啸45. strand 搁浅Unit 51. carriage of goods by sea 海上货物运输2. endorsement 背书,签注3. mate’s receipt 大副收据,收货单4. shipping conference 班轮公会5. shipping documents 货运单证,船运单据6. shipper 托运人7. tariff 运价表8. containerization 集装箱化9. manifest 舱单10. liner service 班轮运输11. tramp service 不定期船运输12. trans-shipment paint 转运地13. freight rate 运费率14. tariff rate 运费表15. freight manifest 运费清单16. shipping note 托运单17. shipping order 装货单18. port authorities 港务局19. supply and demand 供求20. conference lines 班轮公会航线21. non-conference lines 非班轮公会航线22. non-vessel operating common carries(NVOCC) 无营运船公共承运人23. common carrier 公共承运人24. sea waybill 海运单25. a document of title 物权凭证26. stowage plan 积载图27. international trade 国际贸易28. shipping market 航运市场29. delivery order 提货单30. contract of carriage 货物运输合同31. pattern of international trade 国际贸易方式32. receipt of goods 货物收据33. scheduled service 定期航运34. trade routes 贸易路线35. member lines 会员公司36. price competition 运价竞争37. pose a challenge to 对……提出了挑战38. be attributable to 可归因于39. come to terms with 达成协议40. non-negotiable document 不可流通单证Unit61. bank draft 银行汇票2. documentary credit 跟单信用证3. issuing bank 开证行4. negotiating bank 议讨银行5. terms of the credit 信用证条款6. methods of payment 付款方式7. electronic data processing 电子数据处理8. interest rate 利息率9. an irrevocable confirmed L/C 不可撤消的,保兑的使用证10. blank bill of lading 不记名提单11. title to the goods 货物所有权12. straight bill of lading 记名提单13. order bills of lading 指示提单14. on-board bill of lading 已装船提单15. received-for-shipment bill of lading 备运提单16. clean bill of lading 清洁提单17. foul bill of lading 不清洁提单18. direct bill of lading 直达提单19. transshipment bill of lading 转船提单20. through bill of lading 联运提单21. long form bill of lading 全式提单22. short form bill of lading 略式提单Unit 71. bale/or grain capacity 包装容积2. time chartering 定期租船3. bareboat chartering 光船租船4. NYPE-The New York Produce Exchange Time Charter 土产格式5. hire/purchase contract 租购合同6. Voyage chartering 航次租船7. Grain capacity 散装容积8. Time charter on trip basis 航次期租9. Contract of afreightment 包运合同10. TCT-Trip Chartering 航次期租11. Operating expense 经营费用12. charter party 租船合同13. nautical operation 航行操作14. maintenance of the vessel 船舶维修15. supervision of the cargo 货物监管16. Gencon form 金康格式17. payment of hire 支付租金18. a designated manned ship 一艘特定的配备船员的船19. maintenance of the vessel 船舶维修20. trading limits 航区限制21. BIMCO 波罗地海国际航运协会22. BALTIME form-Baltime Uniform Time Charter Party波尔的姆统一定期租船合同23. BARECON form-The BARECON Standard Bare boat Charter贝尔康标准光船租船合同Unit 81.contract of affreightment /contract of carriage (COA)货物运输合同2.insufficient packing 包装不良3.international sales of goods 国际货物销售4.negotiable document 可转让单据5.shipped bills of lading 已装船提单6.shipping company 船公司7.ship’s name 船名8.short shipment 短装9.carrier 承运人10.shipper 托运人11.endorsement in blank 空白背书12.special endorsement 记名背书13.transfer of bill of lading 提单转让14.holder of bill of lading 提单持有人15.anti-dated bill of lading 倒签提单16.advanced bill of lading 预借提单17.received for shipment bill of lading 收货待运提单18.multi-modal/combined/intermodal bill of lading 多式联运提单19.through/transshipment bill of lading 海洋联运提单Unit 91. pre-printed form 预订格式2. freight and other charges 运费和其他费用3. letter of credit transactions 信用证交易4. Arrival Notice 到货通知5. letter of indemnity 保函6. Cargo’s apparent ord er and condition 货物外表状态7. original bill of lading 正本提单8. Notify Party 通知方9. paramount Clause 首要条款10. Unknown clause 不知条款11. Jurisdiction clause 管辖权12. Refrigerated cargo clause 冷藏货条款13. bulk cargo clause 散装货条款14. port of discharging 卸货港15. shipping mark 运输标志16. EDI-Electronic Data Interchange 电子数据交换17. seaworthiness 适航18. cargo worthiness 适货19. copy 副本20. full set 全套1. liner freight rate 班轮运费率2. stowage factor 积载因数3. break bulk cargo 杂货,散件货物4. bunker adjustment factor (BAF) 燃油价格调整因数5. currency adjustment factor (CAF) 货币贬值调整因数6. ocan freight rate 海运运费率7. ocan freight 海运运费8. liner operator 班轮营运人9. maintenance 维护保养10. surcharge 附加费11. stores 物料12. tramp rate 不定期船运费率13. fixed costs 固定成本14. variable costs 可变成本15. adjustment factors 调整因数16. port congestion surcharges 港口拥挤附加费17. conference tariff 公会运价表18. non-conference tariff 非公会运价表19. freight prepaid 预付运费20. freight to collect 到付运费21. bilateral tariff 双边运价表22. freight agreement 运价协议23. heavy lift additional 超重附加费国际货运代理相关英语表达(下)Unit 101. liner freight rate 班轮运费率2. stowage factor 积载因数3. break bulk cargo 杂货,散件货物4. bunker adjustment factor (BAF) 燃油价格调整因数5. currency adjustment factor (CAF) 货币贬值调整因数6. ocean freight rate 海运运费率7. ocean freight 海运运费8. liner operator 班轮营运人9. maintenance 维护保养10. surcharge 附加费11. stores 物料12. tramp rate 不定期船运费率13. fixed costs 固定成本14. variable costs 可变成本15. adjustment factors 调整因数16. port congestion surcharges 港口拥挤附加费17. conference tariff 公会运价表18. non-conference tariff 非公会运价表19. freight prepaid 预付运费20. freight to collect 到付运费21. bilateral tariff 双边运价表22. freight agreement 运价协议23. heavy lift additional 超重附加费Unit 111. Entry Inwards 进口报关单2. Entry Outwards 出口报关单3. Export Declaration 出口申报单4. Import Manifest 进口舱单5. Inward Permit 进口许可证6. Bill of Entry 报关单7. Crew list 船员名单8. Customs clearance 结关(证书)9. Customs Declaration 海关申报10. Export Manifest 出口舱单11. customs tariff 关税税则12. customs examination 海关检查13. bonded warehouse 保税仓库14. port clearance 结关单15. procedural and documentary details 程序和文件的细则16. customs invoice 海关发票17. goods (held ) in the bond 保税货物18. customs frontier 关境19. customs broker 报关行20. customs drawback 海关退税21. health certificate (检疫)健康证书22. load line 载重线23. Outward Export Permit 进口许可证24. packaging list 包装单25. policy of insurance 保险单26. safety equipment 安全设备27. safety radio telegraphy 安全无线电报28. stores list 物料清单29. Shipping Bill 出口货物明细单;装船通知单Unit 121. limitation of liability 责任范围限制2. intermodal transport 多式联运3. inherent vice 固有缺陷4. long haul 长途运输5. carriage of goods by road 国内经济6. rail transport 铁路运输7. road transport 公路运输8. consignor 发货人9. distribution 分发,赔销10. domestic economy 国内经济11. Conventional de Merchandises PAR Routes (CMR) 国际公路货物运输合同公约12. railway consignment note 铁路托运单13. cash on delivery 现款交货14. railway advice 铁路货运通知单15. carriage of goods by road 公路货物运输16. free on rail 铁路交货价17. special marks 特殊标识18. railroad bill of lading 铁路货运提单19. right of disposal 处置权Unit 131. combined transport 合并运输2. carrying capacity 运载能力3. international forwarder 国际货运代理4. freight charges 货物运费5. consolidation services 合并运输服务6. tariff rates 关税率7. cargo transportation 货物运输8. groupage transport 合并运输9. full container load 整箱货10. container freight station 集装箱货运站11. Master Ocean Bill of Lading 船长海运提单12. marine division 航运处13. House Bill of Lading 货运代理提单14. unloading port 卸货港15. general cargo 杂货16. inland waterway 内陆水道17. merchant service 商船营运18. less than carload lot (LCL) 零担货物运输Unit 141. multimodal transport 多式联运2. transshipment point 转运点3. insurance coverage 保险责任范围4. full container loads 集装箱整箱货5. liability insurance 责任保险6. air freight 空运货物7. flat rate 统一费用8. freight rate 货运价格9. land bridge 陆桥运输10. tying-up of capital 资金紧张11. Bill of health 健康证书12. cargo survey 货检13. cargo handling 货物装卸14. mini-bridge 小陆桥运输15. carriage of goods by sea 海上货物运输16. shipping agency 航运代理公司17. cargo declaration 货物申报18. sea train 火车车厢运输船19. the settlement of claims 货物索赔20. inter-containental 洲际间的Unit 151. logistics 物流2. warehousing 仓储3. fleet 船队4. enterprise 企业5. work-in-process 正在加工的产品6. inventory 库存7. carrier 承运人8. procurement 采购9. finished product 制成品10. assembly plant 装配厂11. manufacturing support 制造支持12. the work of logistics 物流模块13. transportation integration 运输整合14. facility network 设备网络15. strategic positioning 战略定位16. competitive performance 竞争性绩效17. the Council of Logistics Management 美国物流管理协会18. supply chain management 供应链管理19. order processing 定单处理20. collection 收货21. value chain 价值链22. market distribution 市场分销23. retail store 零售店Unit 161. business correspondence 商务通信,商务信函2. complimentary close 结尾敬语3. copy notations 抄送4. inside address 封内地址5. modified block style 改良齐头式6. official title 官衔,头衔7. return address 回信地址,发信人地址8. subject line 事由9. reference initials 写信人及秘书姓名的首字母缩写(作日后参考)10. letterhead 信头11. diplomacy 外交手腕,交际手腕12. format/style 格式13. conciseness 简洁14. salutation 称呼15. enclosure 附件16. postscript 附笔17. Re: 事由18. signature 签名19. proofread 校对Unit 171. target audience 目标客户2. vendor 卖主3. mortgage 抵押4. copyright infringement 侵犯著作权5. litigation 诉讼6. e-business 在线企业7. sales representative 销售代表8. currency conversion 货币兑换9. outsourcing 外包10. intellectual property 知识产权11. business partner 商业伙伴12. sector of the economy 经济部门13. write checks 开发票14. digital certificate 数字证书15. online transaction 在线交易16. smart card 智能卡17. virtual office 虚拟办公室18. e-commerce 电子商务19. shipment provider 收货人20. real-time trading 实时交易21. financial activity 金融活动22. seasoned professional 经验丰富的专业人士23. privacy invasion 侵犯隐私24. digital signature 数字签名25. vice president 副总裁26. geographic boundary 地理边界27. cash checks 兑现支票28. trade tocks 买卖股票29. digital cash 数字现金30. voice mail 语音邮件31. individual preference 个人偏好Unit 181. passive voice 主动语态2. tele-printer 电传打字机3. recipient 收件人/收信人4. abbreviation 缩写/缩写词5. layout 格式/布局6. fax 传真7. punctuation marks 标点符号8. transmission 传输,传送9. common practices 一般做法10. CCPIT (China Council for the Promotion of International Trade) 中国对外贸易促进委员会11. ASAP (as soon as possible) 尽快12. SHIPMT (shipment) 装运13. BK (bank) 银行14. UR (your) 你方是15. S.S. East Wind 东风轮16. a full signature 签全名17. salutation 标题18. complimentary close 礼貌结束语19. telex message 电传20. fax message 传真21. simplified word (电传)简化字22. Best RGDS 祝商安23. telecommunication 电子通讯24. layout of telexes 电传布局Unit 191. Cargo Manifest 货物舱单2. Neutral AWB (The Air Waybill) 中性航空运输单3. Check list 核查单4. Consolidated shipment 集运货物5. Master Air Waybill 主运单6. House Air Waybill 分运单7. fully loaded aircraft 满载飞机8. non-negotiable/nontransferable 不可转让的9. air transportation 空运10. documentary credit 跟单信用证11. shipping documents 货运文件12. consolidated airfreight 集运货物/合并装运货物13. air transportation regulations 航空运输规则Unit 201. Class Rates 等级运价2. Hazardous goods 危险品3. General Cargo Rates 普通运价4. Minimum Charges 最低运价5. Valuable cargo 贵重货物6. Special Commodity Rates 指定商品运价7. Insurance costs 保险费8. Chargeable Weight 计费重量9. currency adjustment 货币调整10. gross weight 毛重11. high density cargo 高密度货物12. volume weight 体积重量13. contract FAK rates (freight-of- all-kinds) FAK合同运价Unit211. FIATA 国际货运代理协会2. Non-governmental organization 非政府性组织3. Fastest-changing industry 发展最迅速的产业4. International Air Transport Association 国际航空运输协会5. Global airline network 全球航空公司网络6. Advisory bodies 咨询机构7. Private international organization 国际民间组织8. Freight forwarding industry 货运代理业9. Airline cooperation 航空公司协作10. Airfreight Institute 航空货物研究机构11. Multimodal Transport Institute 多式联运研究机构12. Advisory Body Legal Matters 法律事务咨询委员会13. Forwarders Certificate of Transport 货运代理运输证书14. International Union of railways 国际铁路工会15. Advisory Body Dangerous Goods 危险货物咨询委员会16. FIATA Warehouse Receipt (货运代理)仓库收据17. FIATA Forwarding Instructions (货运代理)运送指示390种外贸单证名称中英文互译mercial invoice 商业发票2.Proforma invoice形式发票3.Received invoice收讫发票4.Certificate invoice证实发票5.Detailed invoice详细发票6.Neutral invoice 中性发票7.Manufacture invoice 厂家发票8.Bank’s invoice 银行发票9.Preliminary /provisional invoice 临时发票10.Customs invoice 海关发票11.Consular invoice 领事发票12.Packing list 装箱单13.Weight list 重量单14.Measurement list 尺码单15.Insurance poliy 保险单16.Insurance Certificate 保险凭证bined Insurance Certificate 联合保险凭证18.Open policy 预约保险单19.Cover note暂保单20.Endorsement批单21.Certificat e oforigin of the Pepoles’ Republic of China中华人民共和国原产地证22.Generalized system of preferences certificate of orgin from A 普惠制产地证23.Ispection certificate商检证书24.Qulity certificate品质检验证书25.Quanty certificate数量检验证书26.Weight certificate重量检验证书27.Phytosanitary certificate植物检疫证书28.Veterinary certificate兽医检验证书29.Sanitary/Health certificate卫生/健康检验证书30.Disinfection certificate 消毒检验证书31.Fumigation certificate熏蒸证书32.Certificate of analysis 分析证34.Export /import license进出口许可证35.Special customs invoice 美国海关发票36.Canada customs invoice 加拿大海关发票bined certificate of value and origin 澳大利亚海关发票38.From59A certificate of origin for export to Newzealand新西兰海关发票39.FromC 西非海关发票40.L/C=letter of credit 信用证41.Bill of exchange / draft 汇票42.Beneficiary’s certificate/s tatement 受益人证明/寄单证明43.Booking note 托运单/下货纸44.B/L提单45.Direct B/L直达提单46.Transhipment B/L转运提单bined transport B/L联合提单48.Container B/L集装箱提单49. Charter Party B/L)租船提单50.Airway bill 空运单51.Shipper’s letter of instruction 货物托运书52.Railway bill 铁路运单53.Shipping advice/ Declaration of shipment 装运通知54.Captain receipt 船长收据55.Itinerary certificate航程证明56.Certificate of sample寄样证明57.Shipping order (s/o) 装货单58.Mate’s receipt大副收据59.Dock receipt 集装箱场站数据60.Delivery order 提货单61.Equipment intechange receipt 设备交接单62.Manifest载货清单/舱单63.Cargo receipt 承载货物收据64.Sea way bill海运单65.Master air way bill航空主运单66.House air way bill航空分运单67.Numerical container list集装箱装载清单68.Export freight manifest出口载货运费清单69.Entry inwards进口报关单70. Authoriztion letter for customs declaration/ Power of attorney(POA)报关委托书72. Telex release /Surrendered B/L 电放提单73. Instrument for the collecting/verifying and writing-off of export proceeds in foreign exchange/verifying and writing-off instrument外汇核销单74. Export drawback出口退税单75.Bank statement/note/receipt 银行水单76.Electronic bill of lading电子提单77.Letter of indemnity保函78.Original bill of lading正本提单79.Customs clearance结关证书80.Entry outwards出口报关单81.Export manifest 出口载货清单/出口舱单82.Inward permit 进口许可证83.Outwards Export permit 出口许可证84.Shipping bill 出口货物明细单/装船通知单85.Export declaration 出口申报单86.Stores list 物料单87.Railway consignment note 铁路托运单88.Cargo declaration 货物申请表89.Railway advice铁路货运通知单90.consignment note 运单91.Bill of health 健康证书92.Straight B/L 记名提单93.Order B/L 指示提单94.On-board B/L 已装船提单95.Received-for-shipping B/L备运提单96.Clean B/L 清洁提单97.Foul B/L不清洁提单98.Black B/L 不记名提单99.Through B/L 联运提单100.Long form B/L 全式提单101.Short B/L略式提单102.Valued policy 定值保险单103.V oyage policy 航次保险单104.Loading list or cargo list 装货清单105.Damgerous cargo list 危险品清单106.Damage cargo list 货物残损单107.Cargo tracer货物查单108.Notice of readiness 准备就结通知书nding permit card登陆卡110.On deck B/L 舱面提单111.Minimun freight B/L 最底运费提单112.Standby L/C 备用信用证113. Irrevocable L/C 不可撤消的信用证114. Revocable L/C 可撤消的信用证115. Confirmed L/C 保兑信用证116. Documentary L/C跟单信用证117. Sight L/C既期信用证118. Usance L/C远期信用证119. Transferable Credit 可转让信用证120. Revolving Credit 循环信用证121. Reciprocal Credit 对开信用证122. Rack to Back Credit 背对背信用证123. MultimodaL Transport B/L or Intermodal Transport B/L 多式联运提单124. Anti-dated B/L 倒签提单125. Advanced B/L 预借提单126. Stale B/L 过期提单127. Freight Prepaid B/L运费预付提单128. Freihgt to Collect B/L 运费到付提单129. Minimum B/L 最低运费提单130. Omnibus B/L 合并提单131. Combined B/L并装提单132. Separte B/L 分提单133. Switch B/L 交换提单134. Parcel Receipt B/L包裹提单135.货运代理给进口代理的通知forwarder's advice to import agent 136. 货运代理给出口商的通知forwarder's advice to exporter 137.货运代理发票forwarder's invoice138.货运代理收据证明forwarder's certificate of receipt139. 货运代理人仓库收据forwarder's warehouse receipt140.货物收据goods receipt141.港口费用单port charges documents142.入库单warehouse warrant143. 装卸单handling order144.通行证gate pass145.运单waybill146.通用(多用)运输单证universal (multipurpose) transport document 147.承运人货物收据goods receipt, carriage148.全程运单house waybill149.副本提单bill of lading copy150.空集装箱提单empty container bill151.油轮提单tanker bill of lading152.内河提单inland waterway bill of lading153.不可转让的海运单证(通用) non-negotiable maritime transport document (generic)154.无提单提货保函letter of indemnity for non-surrender of bill of lading155.货运代理人提单forwarder's bill of lading156.陆运单road list-SMGS157.押运正式确认escort official recognition158.分段计费单证recharging document159.公路托运单road cosignment note160.分空运单substitute air waybill161.国人员物品申报crew's effects declaration162.乘客名单passenger list163.铁路运输交货通知delivery notice(rail transport)164.邮递包裹投递单despatch note (post parcels)165.货运代理人运输证书forwarder's certificate of transport166.联运单证(通用) combined transport document (generic)167.多式联运单证(通用) multimodal transport document (generic) 168.订舱确认booking confirmation169.要求交货通知calling foward notice170.运费发票freight invoice171.货物到达通知arrival notice(goods)172.无法交货的通知notice of circumstances preventing delvery (goods) 173.无法运货通知notice of circumstances preventing transport (goods) 174.交货通知delivery notice (goods)175.载货清单cargo manifest176.公路运输货物清单bordereau177.集装箱载货清单container manifes (unit packing list)178.铁路费用单charges note179.托收通知advice of collection180.船舶安全证书safety of ship certificate181. 无线电台安全证书safety of radio certificate182.设备安全证书safety of equipment certificate183.油污民事责任书civil liability for oil certificate184. 载重线证书loadline document185. 免于除鼠证书derat document186.航海健康证书maritime declaration of health187. 船舶登记证书certificate of registry189. 船用物品申报单ship's stores declaration190.出口许可证申请表export licence, application191. 出口结汇核销单exchange control declaration, exprot192.T出口单证(海关转运报关单)(欧共体用) despatch note moder T 193.T1出口单证(内部转运报关单)(欧共体用) despatch note model T1 194.T2出口单证(原产地证明书) despatch note model T2195.T5管理单证(退运单证)(欧共体用) control document T5196.铁路运输退运单re-sending consigment note197.T2L出口单证(原产地证明书)(欧共体用) despatch note model T2L 198.出口货物报关单goods declaration for exportation199. 离港货物报关单cargo declaration(departure)200.货物监管证书申请表application for goods control certificate 201.货物监管证书申请表goods control certificate202.商品检验申请表application for inspection certificate203. 原产地证书申请表application for certificate of origin,204. 原产地申明declaration of origin205. 地区名称证书regional appellation certificate206. 优惠原产地证书preference certificate of origin207.危险货物申报单dangerous goods declaration208.出口统计报表statistical doucument, export209.国际贸易统计申报单intrastat declaration210. 交货核对证明delivery verification certificate211. 进口许可证申请表application for import licence,212.无商业细节的报关单customs declaration without commercial detail213.有商业和项目细节的报关单customs declaration with commercial and item detail214.无项目细节的报关单customs declaration without item detail 215. 有关单证related document216.调汇申请application for exchange allocation217.调汇许可foreign exchange permit218.进口外汇管理申报exchange control declaration (import)219.内销货物报关单goods declaration for home use220.海关即刻放行报关单customs immediate release declaration 221. 海关放行通知customs delivery note222.到港货物报关单cargo declaration (arrival)223.邮包报关单customs deciaration (post parcels)224. 增值税申报单tax declaration (value added tax)225. 普通税申报单tax declaration (general)226. 催税单tax demand227. 禁运货物许可证embargo permit228. 海关转运货物报关单goods declaration for customs transit 229. TIF国际铁路运输报关单TIF form230. TIR国际公路运输报关单TIR carnet231. 欧共体海关转运报关单EC carnet232. EUR1欧共体原产地证书EUR 1 certificate of origin233.ATA 暂准进口海关文件ATA carnt234. 欧共体统一单证single administrative document235. 海关一般回复general response (Customs)236. 海关公文回复document response (Customs)237. 海关误差回复error response (Customs)238. 海关一揽子回复packae response (Customs)239. 海关计税/确认回复tax calculation /confirmation response (Customs)240. 配额预分配证书quota prior allocation certificate241. 最终使用授权书end use authorization242. 政府合同government contract243. 进口统计报表statistical document, import245. 跟单信用证开证申请书application for documentary credit 246. 先前海关文件/报文previous Customs document/message 247. 一致性证书 cettificate of conformity248. 测试报告 test report249. 产品性能报告 product performance report250. 产品规格型号报告 product specification report251. 工艺数据报告 process data report252. 首样测试报告 first sample test report253. 价格/销售目录 price /sales catalogue254. 参与方信息 party information255. 农产品加工厂证书 mill certificate256. 家产品加工厂证书 post receipt257. 邮政收据 post receipt258. 价值与原产地综合证书 combined certificate of value adn origin259. 移动声明A.TR.1 movement certificate A.TR.1260 质量数据报文 quality data message261. 查询 query262. 查询回复 response to query263. 订购单 purchase order264. 制造说明 manufacturing instructions265. 领料单 stores requisition266. 产品售价单 invoicing data sheet267. 包装说明 packing instruction268. 内部运输单 internal transport order269. 统计及其他管理用内部单证 statistical and oter administrative internal docu-ments270. 直接支付估价申请 direct payment valuation request 271. 直接支付估价单 direct payment valuation272. 临时支付估价单 rpovisional payment valuation273. 支付估价单 payment valuation274. 数量估价单 quantity valuation request275. 数量估价申请 quantity valuation request 276. 合同数量单 contract bill of quantities-BOQ 277. 不祭价投标数量单 unpriced tender BOQ 278. 标价投标数量单 priced tender BOQ279. 询价单 enquiry280. 临时支付申请 interim application for payment 281. 支付协议 agreement to pay282. 意向书 letter of intent283. 订单 order284. 总订单 blanket order285. 现货订单 sport order286. 租赁单 lease order287. 紧急订单 rush order288. 修理单 repair order289. 分订单 call off order290. 寄售单 consignment order291. 样品订单 sample order292. 换货单 swap order293. 订购单变更请求 purchase order change request 294. 订购单回复 purchase order response295. 租用单 hire order296. 备件订单 spare parts order297. 交货说明 delivery instructions298. 交货计划表 delivery schedule299. 按时交货 delivery just-in-time300. 发货通知 delivery release301. 交货通知 delivery note302. 发盘/报价 offer/quotation303. 报价申请 request for quote304. 合同 contract305. 订单确认 acknowledgement of order306. 形式发票 proforma invoice307. 部分发票 partial invoice308. 操作说明 operating instructions309. 铭牌 name/product plate310. 交货说明请求 request for delivery instructions 311. 订舱申请 booking request312. 装运说明 shipping instructions313. 托运人说明书(空运) shipper's letter of instructions(air) 314. 短途货运单 cartage order(local transport)315. 待运通知 ready for despatch advice316. 发运单 despatch order317. 发运通知 despatch advice318. 单证分发通知 advice of distrbution of documents319. 贷记单 credit note320. 佣金单 commission note321. 借记单 debit note322. 更正发票 corrected invoice323. 合并发票 consolidated invoice324. 预付发票 prepayment invoice325. 租用发票 hire invoice326. 税务发票 tax invoice327. 自用发票 self-billed invoice328. 保兑发票 delcredere invoice329. 代理发票 factored invoice330. 租赁发票 lease invoice331. 寄售发票 consignment invoice332. 代理贷记单 factored credit note333. 银行转帐指示 instructions for bank transfer334. 银行汇票申请书 application for banker's draft335. 托收支付通知书 collection payment advice336. 跟单信用证支付通知书 documentary credit payment advice337. 跟单信用证承兑通知书 documentary credit acceptance advice338. 跟单信用证议付通知书 documentary credit negotiation。

⑴FCA (Free Carrier)货交承运人(2)F AS (Free Alongside Ship)装运港船边交货(3)F OB (Free on Board)装运港船上交货(4)C FR (Cost and Freight)本钱加运费(5)C IF (Costjnsurance and Freight)本钱、保险费加运费(6)C PT (Carriage Paid To)运费付至目的地(7)CIP (Carriage and Insurance Paid To)运费、保险费付至目的地(8)DAF (Delivered At Frontier)边境交货(9)D ES (Delivered Ex Ship)目的港船上交货(10)DEQ (Delivered Ex Quay)目的港码头交货(11)DDU (Delivered Duty Unpaid)未完税交货(12)DDP (Delivered Duty Paid)完税后交货主要船务术语简写:(1)O RC (Origen Recevie Charges)本地收货费用(广东省收取)(2)T HC (Terminal Handling Charges)码头操作费(香港收取)(3)B AF (Bunker Adjustment Factor)燃油附加费(4)C AF (Currency Adjustment Factor)货币贬值附加费(5)Y AS (Yard Surcharges)码头附加费(6)E PS (Equipment Position Surcharges)设备位置附加费(7)D DC (Destination Delivery Charges)目的港交货费(8)P SS (Peak Season Sucharges)旺季附加费(9)P CS (Port Congestion Surcharge)港口拥挤附加费(10)DOC (DOcument charges)文件费(11 )O/F (Ocean Freight)海运费(12)B/L (Bill of Lading)海运提单(13)MB/L(Master Bill of Lading)船东单(14)MTD (Multimodal Transport Document)多式联运单据(15)L/C (Letter of Credit)信用证(16)C/O (Certificate of Origin)产地证(17)S/C (Sales Confirmation)销售确认书(Sales Contract)销售合同(18)S/O (Shipping Order)装货指示书(19)W/T (Weight Ton)重量吨(即货物收费以重量计费)(20)M/T (Measurement Ton)尺码吨(即货物收费以尺码计费)(21)W/M(Weight or Measurement ton)即以重量吨或者尺码吨中从高收费(22)CY (Container Yard)集装箱(货柜)堆场(23)FCL (Full Container Load)整箱货(24)LCL (Less than Container Load)拼箱货(散货)(25)CFS (Container Freight Station)集装箱货运站(26)TEU (Twenty-feet Equivalent Units) 20英尺换算单位(用来计算货柜量的多少)(27)AAV (All Water)全水路(主要指由美国西岸中转至东岸或内陆点的货物的运输方式)(28)MLB(Mini Land Bridge)迷你大陆桥(主要指由美国西岸中转至东岸或内陆点的货物的运输方式)(29)NVOCC(Non-Vessel Operating Common Carrier)无船承运人出口国交货的贸易术语三组在进口国交货的贸易术语有五种:一、装运港船上交货价(FOB)英文是:Free on Board.装运港船上交货价是国际贸易中常用的价格术语之一。

[转载]主要船公司及租箱公司箱号前缀原⽂地址:主要船公司及租箱公司箱号前缀作者:绿野之仙境MAERSK——MSKU、MRKU、MAEU、MRSU、APMU、MVIU、MNBU、MMAU、MWCU、MWSU、MWMU、MSWU、MSFU、MCRU、MCAUP&O NEDLLOYD——PONU、POCU、KNLUMSC——MSCU、MEDUCMA CGM——CMAU、ECMU、CGMU、AMCUHAPAG-LLOYD——HLXU、HLBUOOCL——OOLUAPL——APZU、APHU、APRUZIM——ZIMU、ZCSUEVERGREEN——EISU、EITU、EGSU、EGHU、EMCU、HMCUITALIA——ITAU、IMTULLOYD TRIESTINO——LTIUYANGMING——YMLU、YMMUWAN HAI——WHLU、WHSUCOSCO——CBHUCSCL——CCLU、CSLUSITC——SITUNYK——NYKUMOL——MOAU、MOEU、MOFU、MOSU、MOTU、MORU“K”LINE——KKFU、KKTU、KLFU、AKLUHAMBURG SUD——HASU、SUDUHANJIN——HJCU、HJSUHUENG-A——HALU、HARU(STX) PAN OCEAN——STXU、POLUKMTC——KMTUHYUNDAI——HDMU、HMMUSINOTRANS——SNBU、SNHU、SNCUSINOKOR——SKLU、SKHU、SKRU、SKOUT.S.LINES——TSLU、TSTUPIL——PCIUUASC——UACU、UASU、UAEUIRISL——IRSU、SBAU、HDXUFLORENS——FCIU、FSCU、FBLUTEX——TGHU、TEMU、TEXUSEACO(GESEACO)——GESU、SEGU AMFICON——AMFU、AMZUBEACON——BMOU、BEAUCRONOS——CRSU、CXDU、CRXU、CXRU、CXSU、CRTU、CXTU TRITON——TTNU、TRIU、TRHU、TCNU、TCKUTOUAX(GOLD)——GLDU、TGCUCAI——CAIU、CAXUTAL——TCLU、TRLU、TLLUCAPITAL——CLHUINTERPOOL——INKU、INBU、IPXUWATER FRONT——WFHUGATEWAY——GATU、GAEUBLUE SKY——BSIUSEACUBE(SEACASTLE)——DRYU、SZLU CARLISLE——CRLUBRIDGE HEAD——BHCUXINES——XINUCARU——CARUUES——UESU、UETUGVC——GVCU、GVDUDONGFANG——DFSU、DFOUWEIDONG——WDFUTRANS CONTAINER——TKRU、RZDUMCC——MIEUCRCT——TBJUNAMSUNG——NSSU、NSDU、NSRUEXSIF——EXFUFESCO——FESUDELMAS——DVRUEMIRATES——ESPUCNC——CNCUSINOCHEM——SIMUUCS——UXXUUNIGLORY——UGMUKAMBARA——KMBUCK LINE——CKLUBULK HAUL——BLKUFLEX-BOX——FBXURAFFLES——RFCU、RLTUSAFMARINE AND CMBT LINES(SCL)——SCMU、CMBU REGIONAL CONTAINER LINES(RCL)——REGU GENSTAR——GSTUMIN SHENG——MSLUSENATOR——SENUDAL——DAYUUNITAS——UNIUMAGELLAN——MAGUCSAV——CSVUFARRELL LINES——FRLUSPINNAKER LEASING——SLSU COMANAV——CMNU。