外贸外文翻译---对中国外汇储备快速增长的反思

- 格式:docx

- 大小:56.21 KB

- 文档页数:15

对我国外汇储备快速增长的思考(一)摘要:进入新的世纪以来,我国的外汇储备在国际收支的双顺差和现有外汇管理体制的推动下呈现出迅猛的增长态势,在短期内由迅速逼近到超越日本。

快速的增长只是一个表面信号。

我们应该透过现象分析思考其内在原因、影向和对策。

关键词:外汇储备;国际收支;汇率制度一、我国外汇储备的发展回顾在1978年以前,我国尚未实行改革开放的经济政策,国家的对外贸易量较小,加上当时对资本进入的严格控制,外汇储备微不足道,这段时期我国的外汇储备一直由国家外汇库存和中国银行外汇结存两部分组成。

事实上,二者性质完全不同,前者是国家债权,后者是银行债务,国家不能无条件动用。

我国从1992年起起用新的外汇储备统计口径。

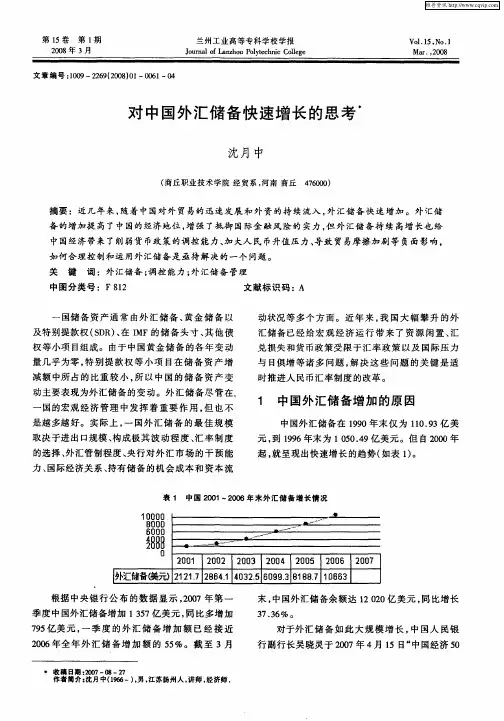

1994年,我国实行了有管理的浮动汇率制等相关改革后,外汇储备进入平稳的快速增长阶段,如表中所示,从94年到97年每年的平均增长速度为39.42%。

98年以后由于受到亚洲金融危机的影响,国际储备增长明显减弱,从98年到2000年每年的平均增长速度为5.78%。

2000年后,我国逐渐从亚洲金融危机的影响中解放出来,并于2001年12月11日加入WTO,此后,外汇储备进入高速增长阶段,以平均每年37.67%的速度增长,在2005年底时已达8,189亿美元。

二、外汇储备快速增长的原因我国外汇储备从2000年的1,655.74亿美元上升到2006年6月末的9,411亿美元再度刷新了中国外汇储备额的历史新高。

有关数据显示,日本外汇储备到2006年8月底仍在8,719亿美元以上,中国目前已经成为世界第一外汇储备国,而且与临国日本之间的数额差距还在不断扩大。

(一)对外贸易的快速增长对外贸易的快速发展为我国带来了大量的外汇资源。

改革开放20余年来,中国经济飞速发展,国民经济总量持续稳定增长。

在绝对数额大幅度增长的同时,进出口额从原来的世界第32位,跃居为现在的第3位,为我国带来了大量的外汇资源,外汇储备迅速增长。

对我国控制外汇储备增长政策的反思论文报告:对我国控制外汇储备增长政策的反思一、引言随着我国经济的快速发展,外汇储备也在快速积累。

外汇储备一直是我国经济稳定运行的重要支柱之一,但也带来了一系列问题,如外汇管制加强、投资回报率下降等。

因此,控制外汇储备增长成为了我国经济政策正常化的必然要求。

在本文中,我们将对我国外汇储备政策的反思进行探讨。

二、外汇储备政策引发的问题1. 强化外汇管制随着外汇储备不断增加,中国政府不得不加强对外汇的管制。

外汇管制限制了人民币和外币的兑换,使得跨境资本流动受到限制,这对外商投资和跨境贸易带来了一定的困难。

2. 投资回报率下降外汇储备的增加促进了投资增长,但也带来了一个问题,那就是由于大量资金长期存在储备中,导致资金的利用效率不高,从而使得资本回报率下降。

3. 外汇资产的避险成本增加外汇储备的增加也增加了外汇资产的避险成本。

为了保持外汇储备的价值,中国政府不得不购买大量美国国债等外汇资产,而这些资产的避险成本是不可避免的。

避险成本的增加也会使得我国外汇市场的利率偏高,进一步影响经济发展。

4. 增加资产泡沫风险外汇储备的增加也会导致市场流动性的增加,从而促使资产价格上涨,进一步增加资产泡沫风险。

5. 扭曲市场分配机制外汇储备的增加也会扭曲市场分配机制。

一方面,由于外汇储备的增加,各个部门之间进行投资和支出时,在预算安排上出现了一定的错位。

另一方面,储备的增加也会使得各部门之间的权力关系发生变化,而这种变化可能导致其他部门的利益受损。

三、建立合理的外汇储备政策体系1. 优化管理体系雄厚的外汇储备是保持经济稳定的重要基础,但如何管理外汇储备,需要一套完善的管理机制。

建立一个透明、规范、有效的外汇储备管理体系,可以更好地提高资源配置效率,减少浪费,为经济金融系统的改革创新打下坚实基础。

2. 降低存量外汇储备超过一定规模,随着管理成本、货币政策稳定性和国际收支预警线的提高,难以维持外汇储备的制度效果,对金融稳定和税收收入影响越来越大。

编号(学号):我国外汇储备持续增长的原因及利弊分析摘要:随着我国经济的发展和对外开放程度的提高,我国的外汇储备急速增加。

对于经济高速发展的中国来说,持续增长的巨额外汇储备无疑是一把双刃剑,对其带来的利与弊,国内已有相当多的学者以不同的角度进行研究,阐释了各自的见解。

笔者主要从我国积累巨额外汇储备的成因着手,对我国外汇储备问题进行分析研究。

关键字:外汇储备,持续增长,利弊The reasons of the China's foreign exchange reserves continuedgrowth and pros and consAbstract:With the China's economic development and a higher level of the opening up, China's foreign exchange reserves increased rapidly. For the China’s rapid economic development , the huge foreign exchange reserves continuedly growing is undoub- tedly a double-edged sword. For bringing its advantages and disadvantages, there is a number of experts who to study, to explain their own view from different aspects . I mainly from the reasons of China's huge foreign exchange reserve accumulation set out to analyze China's foreign exchange reserveswere.Keywords:Foreign exchange reserves, continued growth, pros and cons目录1 引言 (1)2 我国外汇储备的现状 (1)2.1 我国外汇储备的结构分析 (1)2.2 我国外汇储备的规模分析 (2)3 我国外汇储备规模持续增长的原因分析 (3)3.1 经济持续快速发展 (3)3.2 贸易顺差 (3)3.3 外商直接投资 (3)3.4 游资的流入 (4)4 我国外汇储备持续增长的利弊分析 (4)4.1 外汇储备持续增长的积极作用 (4)4.2 外汇储备持续增长的不良影响 (5)4.2.1 外汇储备的增加导致持有外汇机会成本的增加 (5)4.2.2 带来通货膨胀的压力 (5)4.2.3 带来贸易摩擦和推动人民币升值 (5)4.2.4 我国外汇储备结构不甚合理 (6)5 合理外汇储备的对策和建议 (6)5.1 在增加商品出口的同时,扩大进口 (6)5.2 逐步完善外资外贸政策 (6)5.3 适度放松外汇管制 (6)5.4 完善外汇市场管理体制,加强外汇市场建设 (6)5.5 改善外汇储备结构,增强外汇储备的安全性和流动性 (7)5.6 推动企业走出去战略的实施 (7)5.7 加强国际货币合作,签订区域性的多边货币交换协议 (7)参考文献 (8)致谢 (9)1 引言外汇储备是一国政府特有的可自由支配和交换的非本国货币。

国际贸易对我国外汇储备的影响国际贸易一直是全球经济发展的重要驱动力,它的发展水平也可以反映一国经济的实力。

而随着我国经济的快速发展,其外贸规模也不断扩大。

然而,国际贸易的发展不仅带来外汇收入,同时也会对我国的外汇储备造成一定的影响。

本文将分析国际贸易对我国外汇储备的影响,并探讨其对我国经济的意义。

一、国际贸易对我国外汇储备的积极影响国际贸易的发展意味着我国货物和服务的出口增加,这将促使外汇储备增收。

首先,出口货物可以带来外汇收入。

随着我国结构性改革的深入推进,出口贸易成为了我国经济转型升级的重要途径。

出口增加也就意味着外汇收入增加,从而促进了外汇储备的积累。

其次,国际贸易还可以加快我国金融市场对外开放程度。

由于国际贸易需要进行跨境支付和结算,所以必须建立完善的跨境金融体系。

在这个过程中,我国的金融市场对外开放程度将得到提高,这样可以吸引更多的外汇流入。

而这些外汇资金则可以被纳入到我国的外汇储备当中。

再次,国际贸易可以促进我国增强国际竞争力。

在国际市场上,我国的产品和服务需要与其他国家的产品和服务进行竞争。

加强国际竞争力,不仅有利于我国的经济发展,也有利于外汇储备的增加。

因为优秀的商业实践可以提高出口产品的竞争力,确保我国的商品和服务能够在国际市场上占有一定的份额,这样才能为我国带来更多的外汇收入。

二、国际贸易对我国外汇储备的消极影响虽然国际贸易可以增加我国的外汇储备,但其同时也会对我国外汇储备造成一定的影响。

由于我国在国际贸易中属于出口国,因此我国的外汇储备主要来自于出口货物的结算收入。

然而,在国际贸易中也存在市场风险、结算风险等因素,这些因素会对我国的外汇储备产生消极影响。

首先,国际贸易可能会受到汇率波动的影响。

国际贸易中双方往往使用不同的货币进行交易,因此在结算时需要进行汇率转换。

汇率的波动会直接影响到结算的金额,因此可能对我国外汇储备造成损失。

其次,国际贸易中存在结算风险。

因为不同国家的监管体系和结算方式不同,可能存在一些结算问题。

中国外汇储备高速增长利弊分析前言:近几年,我国外汇储备的迅猛增加,引起国内外专家学者关注。

对于我国外汇储备是否过高,不同的专家学者有着不同的观点。

在开放经济条件下,国际收支是否保持动态平衡是衡量一国宏观经济运行平稳的主要指标之一,而一国的外汇储备水平又是衡量其国国际收支动态平衡的重要指标之一。

我国外汇储备大幅增加,一方面不仅提高了我国的对外支付能力和偿债能力,而且拉动了经济的增长;但另一方面,在现行的外汇管理制度下,外汇储备过快增长,将占用更多的基础货币,不仅在一定程度上导致宏观经济运行中的流动性过剩,人民币升值压力加剧,而且也将使贸易摩擦加剧,将会加大对宏观经济调控的难度。

一、我国外汇储备现状外汇储备(foreign exchange reserve),又称为外汇存底,指一国政府所持有的国际储备资产中的外汇部分,即一国政府保有的以外币表示的债权。

是一个国家货币当局持有并可以随时兑换外国货币的资产。

狭义而言,外汇储备是一个国家经济实力的重要组成部分,是一国用于平衡国际收支,稳定汇率,偿还对外债务的外汇积累;广义而言,外汇储备是指以外汇计价的资产,包括现钞、国外银行存款、国外有价证券等。

外汇储备是一个国家国际清偿力的重要组成部分,同时对于平衡国际收支、稳定汇率有重要的影响。

近年来,随着我国经济高速增长,我国的外汇储备也增长迅速。

从2000年的1,655.74亿美元上升到2005年的8,188.72亿美元,2006年2月我国外汇储备超过日本成为全球第一,2006年10月突破了1万亿美元,2009年6月底突破2万亿美元,2009年12月末达到23991亿美元,约占世界储备总额的三分之一。

我国2009年外汇储备增幅超过23%,连续四年居第一。

截至今年一季度末,我国外汇储备增加了479亿美元,至24471亿美元。

与去年第四季度外汇储备的增加额1265亿美元相比来看,同比增长25.25%。

二、我国外汇储备高速增长的正面影响1、充足的外汇储备使我国国际支付能力显著增强,提高了我国的综合国力。

对外贸易对我国的影响八百字英语作文The impact of foreign trade on China is significant and multifaceted. On one hand, foreign trade has contributed to the rapid economic growth of China by providing a wider market for Chinese goods and services. This has led to increased employment, improved living standards, and technological advancements. On the other hand, China's reliance on foreign trade has also made the country vulnerable to external economic shocks and fluctuations in global demand.外贸对中国的影响是巨大而多方面的。

一方面,外贸为中国的经济快速增长做出了重要贡献,为中国商品和服务提供了更广阔的市场。

这导致了就业机会增加、生活水平提高和技术进步。

另一方面,中国对外贸的依赖也使中国容易受到外部经济冲击和全球需求波动的影响。

The benefits of foreign trade for China are evident in its economic development. The influx of foreign investment and technology has facilitated the modernization of Chinese industries and infrastructure. Additionally, the export-oriented nature of China's economy has allowed the country to accumulate foreign exchange reserves, which has bolstered the stability of its currency and financial system.外贸对中国的好处在于其经济发展方面是显而易见的。

对外贸易对我国的影响八百字英语作文In the global landscape of economic interdependence, international trade stands as a paramount force shaping the destinies of nations. For China, a titan in the realm of international commerce, the ramifications of external trade are profound and multifaceted, permeating every facet ofits socio-economic fabric. Here, we delve into the nuanced impact that international trade exerts upon the Middle Kingdom, navigating through its complexities and uncovering the underlying dynamics at play.To begin with, one cannot overlook the pivotal role that external trade plays in propelling China's economic engine. As the world's largest exporter, China's manufacturing prowess is intricately entwined with its trade relations. The influx of foreign demand for Chinese goods fuels production, drives industrial growth, and bolsters employment opportunities across the nation. The sprawling network of global supply chains, with China at its nucleus, underpins the intricate dance of commerce on a global scale, fostering mutual prosperity and interconnectedness amongnations.Moreover, the influx of foreign capital facilitated by international trade serves as a catalyst for China's economic development. Foreign direct investment (FDI) inflows, spurred by the allure of China's vast market and competitive production costs, infuse capital, technology, and managerial expertise into the domestic economy. This influx not only accelerates the modernization of industries but also fosters innovation and enhances productivity, positioning China as a formidable player in the global economic arena.On the flip side, however, China's reliance on external trade renders it vulnerable to fluctuations in the global market. The specter of protectionist policies, trade disputes, and geopolitical tensions looms large, casting a shadow of uncertainty over China's export-oriented economy. Escalating tariffs, trade barriers, or diplomatic rifts with trading partners can disrupt supply chains, dampen export volumes, and impede economic growth, underscoring the inherent risks associated with overreliance on externaltrade.Furthermore, the environmental toll exacted by China's export-driven growth model cannot be overstated. The insatiable appetite for natural resources, coupled with the relentless pursuit of economic expansion, has exacted a heavy toll on China's environment. Pollution, deforestation, and ecological degradation are the grim byproducts ofChina's industrial juggernaut, underscoring the imperative for sustainable development and green initiatives tomitigate the environmental footprint of international trade.In the realm of geopolitics, China's burgeoning trade ties wield profound implications for its diplomatic relationsand strategic interests. The Belt and Road Initiative (BRI), a monumental infrastructure and investment project spanning continents, epitomizes China's ambitious foray into reshaping the global economic order. By forging strategic partnerships and fostering economic cooperation with countries along the BRI routes, China seeks to expand its sphere of influence, cultivate geopolitical alliances, and assert its status as a global superpower.In conclusion, the impact of international trade on China transcends mere economic considerations, permeating every facet of its socio-economic landscape. From driving economic growth and technological advancement to navigating geopolitical complexities and environmental challenges, the influence of external trade is omnipresent and multifaceted. As China charts its course in the ever-evolving global economy, striking a delicate balance between reaping the benefits of international trade and mitigating its inherent risks remains paramount in ensuring sustainable development and enduring prosperity.。

中国外汇储备持续增长的影响与对策摘要自1997年以来,中国外汇储备规模快速增长,成为世界最大的外汇储备国。

本文旨在探讨中国外汇储备持续增长对中国经济和全球金融市场的影响,并提出相应的对策。

本文主要从以下五个方面进行分析:(1)外汇储备持续增长的原因,(2)外汇储备增长的影响,(3)中国外汇储备增长对国际金融秩序的挑战,(4)中国领导应采取的对策,(5)中国外汇储备的未来发展趋势。

关键词:外汇储备;中国经济;金融市场;国际金融秩序;建议AbstractSince 1997, China's foreign exchange reserves have grown rapidly, making it the largest holder of foreign exchange reserves in the world. This paper aims to explore the impact of China's continuous growth in foreign exchange reserves on the Chinese economy and the global financial market, and to propose corresponding countermeasures. This paper analyzes the following five aspects: (1) the reasons for the continuous growth of foreign exchange reserves, (2) the impact of the growth in foreign exchange reserves, (3) the challenges posed by the growth of China's foreign exchange reserves to the international financial order, (4) the policy recommendations that the Chinese government should adopt, and (5) the future development trends of China's foreign exchange reserves.Keywords: foreign exchange reserves; Chinese economy; financial markets; international financial order; policy recommendations.第一部分:介绍随着中国经济的快速发展和对外贸易的日益增长,中国的外汇储备规模不断增长,已经成为世界上最大的外汇储备国。

摘要:进入新的世纪以来,我国的外汇储备在国际收支的双顺差和现有外汇管理体制的推动下呈现出迅猛的增长态势,在短期内由迅速逼近到超越日本。

快速的增长只是一个表面信号。

我们应该透过现象分析思考其内在原因、影向和对策。

关键词:外汇储备;国际收支;汇率制度一、我国外汇储备的发展回顾在1978年以前,我国尚未实行改革开放的经济政策,国家的对外贸易量较小,加上当时对资本进入的严格控制,外汇储备微不足道,这段时期我国的外汇储备一直由国家外汇库存和中国银行外汇结存两部分组成。

事实上,二者性质完全不同,前者是国家债权,后者是银行债务,国家不能无条件动用。

我国从1992年起起用新的外汇储备统计口径。

1994年,我国实行了有管理的浮动汇率制等相关改革后,外汇储备进入平稳的快速增长阶段,如表中所示,从94年到97年每年的平均增长速度为39.42%。

98年以后由于受到亚洲金融危机的影响,国际储备增长明显减弱,从98年到2000年每年的平均增长速度为5.78%。

2000年后,我国逐渐从亚洲金融危机的影响中解放出来,并于2001年12月11日加入WTO,此后,外汇储备进入高速增长阶段,以平均每年37.67%的速度增长,在2005年底时已达8,189亿美元。

二、外汇储备快速增长的原因我国外汇储备从2000年的1,655.74亿美元上升到2006年6月末的9,411亿美元再度刷新了中国外汇储备额的历史新高。

有关数据显示,日本外汇储备到2006年8月底仍在8,719亿美元以上,中国目前已经成为世界第一外汇储备国,而且与临国日本之间的数额差距还在不断扩大。

(一)对外贸易的快速增长对外贸易的快速发展为我国带来了大量的外汇资源。

改革开放20余年来,中国经济飞速发展,国民经济总量持续稳定增长。

在绝对数额大幅度增长的同时,进出口额从原来的世界第32位,跃居为现在的第3位,为我国带来了大量的外汇资源,外汇储备迅速?┰龀ぁ*?(二)资本项目顺差的快速增长与预期的作用一方面,外国直接投资增长迅猛,尤其是我国加入WTO后所作的制度变革和进一步对外开放使我国经济运行日益与国际接轨,从而吸引了众多的外资企业进入我国,这些公司的进入既推动了我国对外贸易的发展,也引起了我国资本项目的大量顺差。

本科毕业论文外文翻译外文题目:Internation Trade and its Effects on Economic Growth in China出处:IZA DP No. 5151(2010)作者:Peng Sun and Almas Heshmati原文:International Trade and its Effects on Economic Growth in ChinaABSTRACTInternational trade, as a major factor of openness, has made an increasingly significant contribution to economic growth Chinese international trade has experienced rapid expansion together with its dramatic economic growth which has made the country to target the world as its market. This research discusses the role of international trade in China’s economic growth. It starts with a review of conceptions as well as the evolution of China’s international trade regime and the policy that China has taken in favor of trade sectors. In addition, China’s international trade performance is analyzed extensively. This research then evaluates the effects of international trade on China’s economic growth through examining improvement in productivity. Both econometric and non-parametric approaches are applied based on a 6-year balanced panel data of 31 provinces of China from 2002 to 2007. For the econometric approach, a stochastic frontier production function is estimated and province specific determinants of inefficiency in trade identified. For the non-parametric approach, the Divisia index of each province/region is calculated to be used as the benchmark. The study demonstrates that increasing participation in the global trade helps China reap the static and dynamic benefits, stimulating rapid national economic growth Both international trade volume and trade structure towards high-tech exports result in positive effects on China’s regional productivity. The eastern region of China has been developing most rapidly while the central and western provinces have been lagging behind in terms of both economic growth and participation in international trade. Policy implications are drawn from the empirical results accordingly.1. IntroductionChina’s international trade has experienced rapid expansion together with its dramatic economic growth which has made the country target the world as its market. The stable political system, vast natural resources and abundant skilled labor in China have made it a modern global factory. Discussions of the role that international trade plays in promoting economic growth and productivity in particular, have been ongoing since several decades ago.A core finding from the comprehensive literature shows that internationally active countries tend to be more productive than countries which only produce for the domestic market. Due to liberalization and globalization,a country's economy has become much more closely associated with external factors such as openness. Thus, conducting a study on the effects of international trade on economic growth is of great significance in this globalized era.It helps policymakers map out appropriate policies by determining the source of productivity growth with respect to international trade.Since the initiation of economic reforms and the adoption of the open door policy, international trade and China’s economy have experienced dramatic growth. China’s integration into the global economy has largely contributed to its sustained economic growth. Some of the industries with comparative advantages began to acquire a high level of specialization, and China has achieved a high growth rate of GDP, as well as an enormous inflow of hard currency and increase in employment. Additionally, China’s participation in international trade has also contributed to improvement in productivity of domestic industries and advancement of technology. On one hand, large imports of machinery goods in the early 1990s had an immediate impact on productivity through the application of technology embodied in them. On the other hand, the level of science and technology in China increased dramatically due to the effect of “learning by doing.” Therefore, re search on how international trade contributed to China’s economic growth can serve as a distinguishing case study demonstrating how a latecomer catches up with forerunners by increasing its participation on the global stage.This research starts with literature review from the perspective of international trade effect on economic growth in part 2. In part 3, the theoretical model and estimation procedures of this research are discussed respectively. Both econometric and non-parametric approaches are applied in this research. The data and variables used in this research are explained in part 4. Thecharacteristics of a 6-year balanced panel data of 31 provinces/regions of China from 2002 to 2007 are discussed, followed by the analysis of each variable in the model. Part 5 presents empirical results according to the model constructed in this research by offering an in-depth explanation of each coefficient and comparison with the previous pieces of research. In part 6 and 7, policy implications and the main conclusion are drawn respectively.2. Literature ReviewEmpirically, there appears to be good evidence that international trade affects economic growth positively by facilitating capital accumulation, industrial structure upgrading, technological progress and institutional advancement. Specifically, increased imports of capital and intermediate products, which are not available in the domestic market, may result in the rise in productivity of manufacturing. More active participation in the international market by promoting exports leads to more intense competition and improvement in terms of productivity. Learning-by-doing may be more rapid in export industry thanks to the knowledge and technology spillover effects. In addition, the benefits of international trade are mainly generated from the external environment, appropriate trade strategy and structure of trade patterns.There are comprehensive empirical studies on the impact of trade on economic growth. Before the 1960s, research on trade effects was limited to a few specific countries. With the development of econometrics, however, many complicated methods based on a mathematical model were introduced to analyze the interactive impact between trade and economic growth. So far, the discussions in this area have been generally divided into two categories. One focuses on the causality relationship between international trade and economic growth to examine whether economic growth is propelled by international trade or vice versa. The other mainly discusses the contribution of foreign trade to economic growth.The OECD conducted a study on the impact that trade had on the average income per population. According to the result, the elasticity of international trade was 0.2, which was statistically significant.Maizels discussed the positive relationship between international trade and economic development by a rank correlation analysis among 7 developed countries. Kavoussi (1984), after studying 73 middle and low-income developing countries, found out that higher rates of economic growth was strongly correlated with higher rates of export growth. He showed that the positive correlation between exports and growth holds for both middle- andlow-income countries, but the effects tend to diminish according to the level of development.Balassa and Dollar argued that outward-oriented developing economies achieve indeed much more rapid growth than inward-oriented developing ones.Sachs and Warner constructed a policy index to analyze economic growth rate, and found that the average growth rate in the period after trade liberalization is significantly higher than that in the period before liberalization. Kraay investigated whether firms “learn” from exporting using a panel data of 2105 Chinese industrial enterprises between 1988 and 1992, and found the “learning” effects are most pronounced among established exporters. Keller discussed that international trade which involves importing intermediate goods of a high quality contributed to the diffusion of technology. Frankel and Romer constructed measures of the geographic component of countries’ trade, and used those measures to obtain instrumental variables estima tes of the effect of trade on income.The resultshowed that trade has a quantitatively large and robust positive effect on income even though it is only moderately significant statistically. Coe and Helpman studied the international R&D diffusion among 21 OECD countries and Israel over the period of 1971-1990, and found that international trade is an important channel of transferring technology.In sum, most empirical studies support the positive effects of openness on economic growth. From the comprehensive literature, both static and dynamic gains from trade could be found. The static gains from international trade refer to the improvement in output or social welfare with fixed amount of input or resource supply. They are mainly the results from the increase in foreign reserves and national welfare. Firstly, opening up to the global market offers an opportunity to trade at international prices rather than domestic prices. This opportunity provides a gain from exchange, as domestic consumers can buy cheaper imported goods and producers can export goods at higher foreign prices. Furthermore, there is a gain from specialization. The new prices established in free trade encourage industries to reallocate production from goods that the closed economy was producing at a relatively high cost to goods that it was producing at a relatively low cost .By utilizing its comparative advantage in international trade, a country could increase the total output and social welfare.Another long-term benefit of trade is the dynamic gain. This refers to the change in production structure thanks to the adoption of new technologies from abroad and an increase in the production scale. Firstly,international trade sectors based on comparative advantage alwaysenjoy the economies of scale through the expansion in production stimulated by the massive demand from the global market. This results in the decrease of production costs, a large amount of accumulation of capital and increase in employment. Secondly, international trade is one of the channels supporting technological spillovers among countries which results in a favorable impact on the productivity level (Saggi, 2000). Endogenous growth of an open economy is achieved through “learning by doing” which exhibits diffusion of technology across goods and countries.International trade, which transmits knowledge internationally, could increase the absorptive capacity of trading countries by promoting technological advancement. Increased productivity is also achieved through practice and innovation. Finally, international trade leads to robust institutional changes. International trade not only facilitates trading of goods and services, but also ideas on market mechanisms. Developing countries are learning to apply market power more efficiently with less intervention from government to increase openness. Especially in bilateral and multilateral trade, participants should fulfill their commitments to international rules and regulations to bridge the gap between developed countries.3. China’s Trade3.1 Evolution of China’s International Trade PolicySome of the unprecedented development in the Chinese trade sectors and trade policy also had various effects on the nation’s economic growt h. Targeting the global market, China has successfully converted itself from an inward-oriented country which was protected by various trade policies to an outward-oriented one with an open market. The transition from a closed economy to an open one accompanied with it various experiences. From the perspective of trade policy, China underwent a number of evolution periods, such as dependence on the Soviet Union, absolute isolation, and opening doors to the world. WTO accession,which represents a new milestone in China’s trade evolution, enabled China to participate in the world trade under the global framework by improving the multilateral trade system.Before 1978, China’s planned economic strategy and inward-oriented policy resulted in the subordinate status of international trade in the national economy. China had only minimal trade with the outside world, exporting just surplus raw materials and simple manufactured goods to cover payments for imported goods,including strategic minerals and other necessities not available in the domestic market.译文:国际贸易及其对中国经济增长的影响摘要国际贸易作为开放性的一个主要因素,对经济增长的贡献日益显著。

外文原文The impact of RMB appreciationAs the comprehensive strength of the national economy grows, the Chinese currency, the Renminbi (RMB) began to appreciate. Effects of the RMB's appreciation since July have been felt both domestically and abroad, and will become even more significant with time. China should embrace the new opportunities that appreciation has opened-up and allow more room for the national economy to grow in the process of globalization.People need to be aware that the appreciation of the RMB may have some less desirable effects on economic growth in the short term. Currently, China's export market still relies heavily on cheap labor to compete in the international market. As its added value is low, the appreciation of the RMB will affect China's export and consequently the overall growth rate of the national economy. However, there are also many positive aspects to the appreciation of the RMB. In the long run, RMB appreciation will generate more development opportunities. People will feel richer, it will improve China's status and influence in the world economy and it will change the commodity structure and the flow of investment. It will also have a significant influence on the structure of domestic production resources.First of all, it will accelerate industrial upgrading. In a market economy, the fluctuation of the foreign exchange rate involves the international balance of incomes and expenses and is an important price indicator. The appreciation of the RMB means that the price of various domestic resources, especially land and labor, will go up in relative terms and this will speed up necessary adjustments to the commodity mix and domestic industry. RMB appreciation will gradually change the value of the international and domestic markets. Domestic enterprises will rely more on sales to the domestic market so that national economic growth is less dependent on export demand and a more reasonable industrial structure will form.Secondly, it will promote technical innovation. In many countries, technical innovation relies primarily on a market mechanism which makes good use of price as a lever. China's production process is enormously costly in terms of resources and energy, and labor is too cheap. The appreciation of the RMB will cause an increase in the domestic prices of such things as land and labor as well stimulate the demand for innovation. Products for export must rely on technological innovation to be morecompetitive internationally. In the domestic market, enterprises are also forced to compete through technological innovation. Simply speaking, the appreciation of the RMB will cause the formation of a market environment that is conducive to speeding up technological innovation.Thirdly, the appreciation of the RMB will benefit the people. On the one hand, it will make imported products relatively cheaper. It will also be cheaper for Chinese to travel abroad. This will increase consumption. On the other hand, it will push up the market price of domestic financial assets, changing the financial market structure. If other conditions don't change, Chinese people will feel richer as the value of their money grows and further stimulates domestic demand. Of greater strategic significance is the fact that the appreciation of the RMB will make the price Chinese labor price higher.RMB appreciation reflects the success of Chinese economic development after reform and opening up. It is also an important turning point in China's social and economic situation. The downsides to RMB appreciation shouldn't be overemphasized. The fluctuation of the RMB is the result of changes to the current economic structure and will have an important impact on the economic structure of the future. Maintaining the status quo is short-sighted and will harm the long-term interests of China. The best choice is to speed up the transformation of the economic growth mode and adapt to the appreciation of RMB to make the most from the process.With the announcement of reforming the RMB exchange rate regime on July 21, 2005, great attention has been paid to the impacts of RMB’s appreciation on China’s trade. Since China being in the transition from pegging to a managed floating regime, no existing approximate model and method can be utilized to investigate this question directly. In this paper, scenario analysis technique is used to give a study on this issue, coupled with the introduction of the substituted valuables: Japanese yen and Euro exchange rate. Our results show that RMB’s appreciation would not bring se vere effects on China’s trade in 2005; however, the possible sustained reduction of export growth in 2006 should be paid more attention. It is also necessary and urgent to press forward with the reform of RMB exchange rate regime, and put up the related supporting policies to avoid such sudden fluctuation as the Japanese situation after “Plaza Accord”.The RMB exchange rate became a hot topic after the announcement of exchangerate regime reform on July 21, 2005. The new regime, a managed floating exchange rate regime based on market supply and demand with reference to a basket of currencies, allows RMB to rise by 2%, with a daily 0.3% trading band based on the price of the previous day. With its rapid development, China’s economy has become an increasingly important element in the global economic development and integration. Against this backdrop, the impacts of RMB’s appreciation on China’s trade attract great attention.Before this reform of RMB, there has emerged a vast theoretical literature concentrated on the impacts of RMB’s revaluation. However, relatively little research has been undertaken on the empirical analysis of this issue. Cyn-Young Park (2005), an economist in Asian Development Bank, analyzed macroeconomic impact of a “one-off ” appreciation of the RMB against the dollar using the Oxford Economic Forecasting model. This work may shed light on the dynamics between global imbalances and revaluation. The OEF model framework allows simulation analyses based on the global econometric structure, which will provide some quantitative results for the impacts of a revaluation on the concerned economies, such as the PRC, Japan, US, and other Asian countries. The stability of equilibrium state may be damaged when the regime shifts, which, however, cannot be studied in this model. Zhang, a researcher in Chinese Academy of these results suggested that the impact of a revaluation on China’s economy might change in the proportion of an appreciation’s scale. In fact, in the short term, the reasonableness of this proportionate result should be doubted.The main body of existing literature, however, has so far mostly centered on quantitative discussion describing the relation between trade and exchange rate. There has been surprisingly little empirical work that focus on the exchange rate regime shift, especially from pegging to the US dollar to a managed floating regime, No existing appropriate model or method can be found to support this kind of research directly. Therefore, some indirect methods should be experimented for studying this issue with the substitute variables introduced.In this paper, scenario analysis technique is used to give a sensitivity analysis of China’s trade to the appreciation of RMB. The first type of scenarios is a hypothetic scenario being related with the current appreciation of RMB by 2%; while the second one that belongs to the historical scenario is based on the historical event---the Japanese yen’s variability after subscribing “Plaza Accord”.The remaining part of thispaper is organized as follows. The theory and method of scenario analyses are introduced in Section 2. Models and their evaluation are outlined in Section 3. Forecasting results from scenarios analyses are presented in Section 4.Scenario analysis (Committee on the Global Financial System, 2000) is a kind of stress testing which serves to estimate potential extreme losses of a portfolio value and give helpful suggestions to the decision makers in risk management of a company or a financial institution. Generally, scenario is a means to explore the future economic situation, and identify what might happen and how an organization can act or react upon future developments.The RMB’s appreciation should undoubtedly generate extensive and far-reaching implication for China’s economy, especially for exports. This research should be based on establishing and testing econometric models. We establish the evaluatd models for export and trading forms respectively. In the following empirical work, these models are used in the scenari o analysis of China’s trade. The sample data are collected over the period from Jan. 2005. Data on export and import are taken from China’s Customs Statistics. The exchange rate data are obtained from the University of British Columbia’s website.In this p aper, the scenario analysis is used to analyze the effects of RMB’s appreciation on China’s trade in 2005 and 2006. Our evidence shows that China’s exports would continue to keep a strong increasing trend in the hypothetical scenario being a one-off appreciation of 2%. Seen from the current situation about RMB, the similar favorable results may be expected to occur if RMB exchange rate regime would mark a sound operation. Therefore, we conclude that China’s eaports would not be affected much by the current appreciation of RMB, and would keep an increasing trend in 2005. On the other hand, despite the rapid development of China’s exports which not only benefit from China’s strong economic development, but also from the strong international competitiveness of export goods, there still exist the risk due to the obvious sustained drop of growth in 2006, which may impede the rapid growth of exports. Domestic demand should also be promoted to counteract the risk from the fluctuation of international market.By People's Daily Online; The author, Chen Feixiang, is the Director of the Economic and Financial Deparment of Tongji University.JEL Classification: C53, F17, F31Key words: RMB’s appreciation, China’s trade, Scenario analysis中文译文人民币升值的影响随着国民经济的综合实力的增长,中国的货币,人民币开始升值。

外文资料译文论文题目人民币汇率升值对我国外贸的影响分析专业国际经济与贸易班级姓名学号指导教师职称2012 年 1 月 3 日The impact of RMB exchange rate appreciation to our economy and the foreign tradeThis paper analyzes the causes of RMB exchange rate appreciation, expounds the beneficial effects, adverse effects on our coun-try's economic and foreign trade, and puts for-ward the countermeasures to the effects.Present situation of Chinese foreign trade surplus continues to expand, which is caused by a variety of reasons. The appreciation of RMB exchange rate on China's economy, foreign trade import and export volume and structure have a series of effects, only to take positive and effective measures to make the economy of our country and export enterprises to obtain the sustainable and stable development.1. reasons for the appreciation of the RMB exchange rate1.1 Chinese and foreign interest rate differenceInterest rate policy is an important tool of monetary policy. The rate of relative height will affect the capital flow direction is one of the important ways, high interest rates will stimulate the international capital inflow, and reduce its outflow of funds. Thus affecting the scale of international trade, make the difference of interest rate on exchange rate influence the trend of continuous improvement.1.2 Money supply situationRMB exchange rate and China's money supply substantiallypositive correlation, due to the deepening of reform and opening up, foreign investors can not only make use of cheap Chinese labour, more optimistic about China's huge domestic market. Therefore, foreign investment increased substantially. Due to tightening of monetary policy, the RMB fund is quite nervous, the entry of foreign capital and foreign exchange, so appeared apparent oversupply, resulting in the trend of Renminbi rmb.1.3 International balance of payments and foreign exchange reserveThe formation of foreign exchange market and the international trade and investment is not divided, international balance of payment is a country's foreign economic activities of the various payment sum. Under floating exchange rates, the market supply and demand to determine the exchange rate changes, therefore international payments deficit will lead to the devaluation of the currency, the foreign currency appreciation, namely the exchange rate rise. Conversely, international payments surplus caused a decline in foreign exchange rates.1.4 Economic growthA country's economic take-off stage, due to the low level of productivity, economic development performance for the extensive mode of operation, and thus their own currency exchange rate decreased, i.e.. A country's economy is relatively mature stage, consumer demand as income and growth, but the growth that consumes demand to catch the output supply growth, so in the period of rapid economic growth, supply relative consumption demand, so asto have a downward pressure on prices.2. The exchange rate of RMB appreciation on China's economy and foreign trade favourable effects2.1 Be helpful for Chinese enterprises to "go out"The appreciation of the renminbi means that Chinese enterprises to invest abroad cost relatively drops than before, which makes them to lower the cost of the establishment of multinational companies. So it is beneficial to the Chinese enterprises to "go out", to create a truly international competitiveness of Chinese transnational corporation. 2.2 Will help improve trade conditionsThe appreciation of the renminbi, export prices higher, you can use less export products in return for their own needs a variety of products. Export profit increases ceaselessly, can improve our terms of trade.2.3 Conducive to reduce external debt debt service pressureThe rise in the renminbi exchange rate, outstanding debt servicing required the amount of local currency is correspondingly reduced, to a certain extent so as to reduce the burden of external debt.2.4 Conducive to promoting the transformation of foreign trade growth modeThe appreciation of the renminbi has contributed to China's foreign trade growth mode from extensive original shift quality and cost-effective intensive, this will bring the improvement of export structure, encourage technological innovation, sustainable development.2.5 Conducive to lower import costsAfter revaluation, the price of imported goods will have the same magnitude of decline, reducing our cost of imports and import fees paid. The appreciation of the renminbi will make large transaction costs of imports, so as to improve the profit situation of related industries, to economy construction is very favorable.2.6 Be helpful for improving the environment of attracting foreign investmentThe appreciation of the RMB exchange rate, can make have foreign-funded enterprises in China increased profits, so as to enhance the confidence of investors, to further increase investment or investment; the appreciation of the RMB exchange rate will attract a lot of foreign capital into China 's capital market, indirect investment proportion will be increased further.3. The exchange rate of RMB appreciation on China's economy and foreign trade adverse effects3.1 The influence of Chinese enterprise and many integrated competition ability of the industryThe appreciation of the renminbi will lead to certain technical content and added value is low, poor management, high cost and low efficiency of export enterprises lose in the price in the international market competitive advantage, eventually had to be eliminated.3.2 Increasing employment pressureRMB appreciation will restrain or hit exports, will ultimatelyaffect the employment. In the current China's employment situation is extremely grim situation, the appreciation of the RMB exchange rate will be worse employment situation.3.3 The agriculture of our country will face greater challengesThe appreciation of the renminbi will block trade of China's agricultural products export growth, import will increase apparently, production of our country agriculture will cause impact, influence farmer to add close. Import and export trade of agricultural products could be reversed, with surplus to deficit.3.4 The impact of the financial market stabilityChina financial market development lags behind relatively, the appreciation of the renminbi will be a large number of short-term capital flows into the capital market through various channels, the profit-seeking behavior, easily lead to monetary and financial crisis, the Chinese economy will be sustained and healthy development causes adverse effect.3.5 Weaken China's export growthThe appreciation of the renminbi, China's manufacturing industry in the global competition will gradually disappear, easy manufacturing overseas. The value of the renminbi, export enterprises to maintain a certain profit, the export unit of foreign currency prices will increase, not conducive to exports continued to expand and in the international market share increase.3.6 Export growth is restricted to the export enterprises, bring a lossThe appreciation of the renminbi, if China's export commoditiesdenominated in foreign currency prices unchanged, requires the export commodities denominated in Renminbi price decline, in this way, China's exports will not be affected, but our country enterprise 's profit fell by.3.7 Not conducive to attracting foreign investment in ChinaThe appreciation of the renminbi to processing trade of foreign enterprises export cost increase, so that the processing trade of the foreign investment decline. This will affect foreign investment enterprises,Profit to investment scale and industry localization process, is not conducive to China 's processing trade industry sustainable development, upgrade.4. In view of the appreciation of the RMB exchange rate on China's economy and foreign trade 's influence, proposed countermeasures 4.1 Develop an international market energetically?In order to future export trade, long-term development? In addition to continue to consolidate and further develop the traditional American, Japanese, European market?, enterprises should also actively looking for and open up new target markets, such as Africa, ASEAN and other potential huge market, promote the diversification of the market, enterprises to expand exports, to the export enterprises to bring new profit source.4.2 To alleviate the pressure of RMB appreciationWe can adjust the foreign trade structure to reduce the reliance onthe American market. In view of capital inflow pressures, continue to encourage the inflow of foreign capital in the. According to the rapid growth of foreign exchange reserves has brought the pressure, we can take measures to appropriate control of its growth rate, as the gradual adjustment of the RMB exchange rate level and lay the foundation for.4.3 Improve product quality, create their own brandIn order to improve the export products in the international market competition, China's export enterprises to deal with the RMB appreciation is another key measures to realize the upgrading of products, to build their own brands, from to the price advantage competition to quality and brand and price advantage to participate in international competition.4.4 Change the mode of growth of export tradeThe new technology, new energy, new materials and other high-tech penetration into traditional industries to them, so that our export products by labor concentrated model, resource intensive to high technology content, the degree of processing depth, high value-added new products. And to the development of high-tech industry.4.5 Timely adjustment of exchange rate and exchange rate systemWe should realize the adjustment of the RMB exchange rate policy, successfully, for the future of the stability of macro economy, trade and Industry Department trade departments the balance between development and sustainable economic growth in China have a profound and positive significance. And this, to be on the governmentto take decisive measures, eliminate the appreciation expectation.4.6 Reduce production and transaction costThe export enterprises may through strengthen management, straighten out the internal process, reduce the management cost; using the appreciation of the renminbi, increase the import raw materials from abroad, to reduce the material cost; direct contact with foreign or make full use of the Internet to the development of electronic commerce, export less intermediate links, improving the trading efficiency, reduce transaction costs.Authors: Aaron Johnson, 《The impact of RMB exchange rate appreciation to our economy and the foreign trade》2009.08浅谈人民币汇率升值对我国经济及外贸的影响本文分析了人民币汇率升值的原因,阐述了人民币汇率升值对我国经济及外贸的有利影响、不利影响,并针对人民币汇率升值对我国经济及外贸的影响,提出了对策。

中国网络大学CHINESE NETWORK UNIVERSITY 毕业设计(论文)院系名称:百度网络学院专业:百度学生姓名:百度学号:123456789指导老师:百度中国网络大学教务处制2019年3月1日对我国外汇储备激增问题的思考摘要:近年来,我国外汇储备增长过快,外汇储备规模已经位居世界第一。

庞大的外汇储备在体现我国经济实力的同时,也给我国经济发展带来了诸多负面影响。

外汇储备激增的负面影响已成为我国在对外经济发展中亟待解决的问题。

本文首先阐述了外汇储备持续过快增长的基本情况;通过对我国外汇储备激增的原因进行分析;并对我国外汇储备持续过快增长的负面影响进行研究;最后从外汇储备的总量调控和结构优化两个方面,提出了关于抑制外汇储备激增负面影响的策略建议。

关键词:外汇储备;规模管理;结构管理;负面影响;对策目录1引言(或绪论) (1)1.1 研究背景与意义……………………………………………………………………1.2 国内外研究现状…………………………………………………………………………Y 1.3研究思路与方法…………………………………………………………………………Y 2我国外汇储备现状分析…………………………………………………………………Y2.1外汇储备规模…………………………………………………………………………Y 2.2外汇储备结构…………………………………………………………………………Y 3我国外汇储备激增的原因………………………………………………………………Y3.1积极的外贸政策…………………………………………………………………………Y 3.2 人民币升值的助推………………………………………………………………………Y 3.3强制性结售汇制…………………………………………………………………………Y 4我国外汇储备激增的负面影响……………………………………………………………Y4.1通货膨胀压力增大…………………………………………………………………Y 4.2高额的机会成本………………………………………………………………Y 4.3资产管理的难度和风险…………………………………………………………………Y 4.4损害了经济增长的潜力……………………………………………………………Y 5缓解外汇储备激增的对策措施……………………………………………………………Y5.1 总量调控的主要措施……………………………………………………………………Y 5.2 结构优化的主要策略……………………………………………………………………Y 结论……………………………………………………………………………………Y 致谢……………………………………………………………………………………Y 参考文献………………………………………………………………………………Y1引言1.1研究背景与意义外汇储备是一个综合性的因变量,是一国国际经济往来的最终结果。

对中国外汇储备快速增长的思考

沈月中

【期刊名称】《兰州工业学院学报》

【年(卷),期】2008(015)001

【摘要】近几年来,随着中国对外贸易的迅速发展和外资的持续流入,外汇储备快速增加.外汇储备的增加提高了中国的经济地位,增强了抵御国际金融风险的实力,但外汇储备持续高增长也给中国经济带来了削弱货币政策的调控能力、加大人民币升值压力、导致贸易摩擦加剧等负面影响,如何合理控制和运用外汇储备是亟待解决的一个问题.

【总页数】4页(P61-64)

【作者】沈月中

【作者单位】商丘职业技术学院,经贸系,河南,商丘,476000

【正文语种】中文

【中图分类】F812

【相关文献】

1.中国外汇储备快速增长:原因、风险及前景预测 [J], 彭菲娅;刘兵权

2.浅析中国外汇储备结构及快速增长的原因 [J], 王臻

3.中国外汇储备快速增长与商业银行的新机遇 [J], 李贵义

4.重新认识中国外汇储备快速增长的原因 [J], 田秋生;李虹檠

5.中国外汇储备快速增长的原因探析——基于人口结构的视角 [J], 朱庆

因版权原因,仅展示原文概要,查看原文内容请购买。

外贸外文翻译---对中国就业率快速增长的反思引言近年来,中国的就业率快速增长,吸引了国内外的广泛关注。

中国政府通过一系列政策措施,成功地创造了大量的就业机会,促进了社会经济的快速发展。

然而,这种快速增长的就业率是否能够持续下去,是否存在某些潜在的问题,需要我们认真思考和探讨。

中国就业率的快速增长现状根据国家统计局发布的数据,2019年12月全国城镇就业人员为4.32亿人,同比增长4.2%。

其中,新就业人员为1342万人,其中高技能人才新增31.6万人。

这一数据显示出,中国的就业市场保持着强劲的增长态势,就业结构也在不断优化。

对中国就业率快速增长的反思尽管中国的就业率呈现出快速增长的趋势,但也存在一些问题和挑战,需要我们思考和解决。

第一个问题是劳动力市场的结构性矛盾。

虽然就业机会增多,但同时也存在一些行业和职业的就业难题。

例如,大量的高校毕业生进入市场后,发现招聘要求过高,找不到稳定和优质的工作;外来务工人员的就业问题也十分突出。

第二个问题是劳动力素质的不足。

随着中国经济的快速发展,许多行业对人才的要求也越来越高,但一些劳动者并未进行相关的专业培训和技能提升,导致了人才供需的失衡。

第三个问题是人口老龄化对就业市场的影响。

中国的人口老龄化问题越来越突出,这不仅对社会经济带来了挑战,也使得就业市场的供需结构出现了一些变化。

结论中国的就业市场保持着快速增长的态势,但也存在一些问题和挑战,需要我们认真思考和探讨。

政府应当出台更多有针对性的政策,解决结构性矛盾和人口老龄化问题,并且加大对人才培训和技能提升的投入,推动就业市场的持续稳定和健康发展。

对我国外汇储备过快增长的思考

孙健

【期刊名称】《珠江经济》

【年(卷),期】2005(000)010

【摘要】截至2005年6月底,我国外汇储备余额已高达7109、73亿美元,外

汇储备增长速度再创新高。

外汇储备是用来稳定国际收支,稳定金融体制的:但是,外汇储备的过快增长,将对一国经济发展带来较大的负面影响:本文通过对我国外汇储备现状的分析,探讨我国在外汇储备方面存在的问题,针对我国外汇储备过度增长所带来的负面影响提出相应对策。

【总页数】6页(P76-81)

【作者】孙健

【作者单位】中南财经政法大学投资系

【正文语种】中文

【中图分类】F832.63

【相关文献】

1.我国外汇储备增长过快原因及对策分析 [J], 孙妍

2.我国外汇储备增长过快研究 [J], 王永锋

3.浅析我国外汇储备增长过快的原因及其优化措施 [J], 李钊

4.浅析我国外汇储备增长过快的原因及其优化措施 [J], 李钊

5.我国外汇储备增长过快的深层次原因及其优化路径分析 [J], 张亮

因版权原因,仅展示原文概要,查看原文内容请购买。

附录Rethinking Fast Growth in China’s Foreign Exchange ReservesI.IntroductionSince2000, China’s foreign exchange reserves have been growing fast. By the end of2001, China’s foreign exchange reserves had exceeded US$200bn and by the end of 2002 hadreached US$286.4bn. By the end of2003, it had reached US$403.3bn and in 2004 it reachedUS$609.9bn. In l 999, China’s foreign exchange reserves accounted for l 5.6 percent of itsGDP. The ratio has been growing continually and Was 36.88 percent of GDP by 2004, making China the second largest foreign exchange reserve holder in the worldafter Japan. Statistics released by Japan’s Ministry ofFinance on 7 July 2005 show that by the end of June the same year, Japan’foreign exchange reserve were valued at US$43.5bn.China has reserves ofUS$771 bn by the end ofJune 2005. However, China has a larger ratioofforeign exchange reserve to GDP than Japan. In 2005, China’s ratio offoreign exchangereserve to GDP was 37 percent, whereas that of Japan was 18 percent. By the end ofDecember 2005, China’s foreign exchange reserves had expanded further to reach US$818.87bn.II.Cause of China’s Sustained High Growthof Foreign Exchange ReservesThe main re ason for China’s sustained fast-expanding foreign exchange reserves in recentyears, is continual surpluses in the current and capital accounts of China’s balance ofpayments. In terms of sources, foreign exchange reserves can be divided into creditor’s rights-based reserve and debt-based reserve. The former is reserve from current accounts, whereas the latter is from the capital accounts.Foreign exchange reserves of developingcountries are mainly composed ofdebt-based reserve. Since the latter halfofthe 1990s, thestructure of China’s foreign exchange reserve sources has undergone significant change. From 1994 to 1996, China’s foreign exchange reserves were mainly composed of debt-based reserve. The increased foreign exchangereserves mainly came from capital accountsurplus, which mainly resulted from the increase in foreign direct investment(FDI).Since 1997, the creditor’s rights segment ofChina’s foreign exchange reserves has gradually becomemore increased. However, during 2003-2004 the debt-based reserve rebounded dramatically. In that period,the capital account surplus soared from US$52.726bn in 2003 to US$110.66bnin2004, andChina’s foreignexchangereservesincreasedbyUS$206.681bnin2004. Thiswasclosely related to the continually growing expectations toward renminbi revaluation and theinflux ofinternational“hot money”in pursuit of speculative gain s.It is noteworthy that since 2004, the expectation for renminbi appreciation has beengrowing continually and a large amount of speculative capitalhas swarmed in. The Central Bank has adopted a compulsory foreign exchange settlement policy to maintainthe relative stability of the renminbi exchange rate, which is an important factor behindexpanding foreign exchange reserves. Seen from the current situation and the developmenttrend in the near future, the factors that have caused expansion ofChina’s foreign exchangereserves will continue.Admittedly, the sustained surpluses in the current and capital accounts of China’s balance of payments in recent yearsare the main reason for its continually fast-expanding foreign exchange reserves. However, two fundamental factors are worthconsidering:(i)flaws in the formation of the renminbi exchange rate regime are theinstitutional root cause of sustained high growth offoreign exchange reservesand(ii)thevarious theoretical misconceptions about China’s foreign exchange reserves have swayedpolicies and contributed to the sustained fast growth in China’s foreign exchange reserves.In terms ofinstitutional causes, the eruption ofthe 1997 Asian financial crisis held back the process of the China’s reform of the renminbi exchange rate regime.The renminbi came under great pressure to depreciate. To maintain the stability of the renminbi exchange rate, there was a forceddeparturefromtheorigi nal“managedfloating exchange rate regime.”Inthewakeofthe crisis, the Chinese economy was afected by the global economic recession and worseningdeflation, whichhas graduallymadetherenminbiexchangerateregime shifttoafactor“US-dollar-pegged fixed exchange rate regime.”Apart from the external impacts, the errors inChina’s macroeconomic policies an d strategies, such as those concerning foreign trade, foreign capital, foreign exchange reserve and industrial policies, have led to a distortion in theformation ofthe renminbi exchange rate regime.An obvious feature ofthat distortion is thecompulsory settlement and sales of foreign exchange in the banks, and the closed inter-bankforeign exchange market. In such an institutional framework, the implementation of thecompulsory foreign exchange settlement and sales, the convertibility ofthe current accountsandtheCentralBank’s controlontheforeign exchangepositionofthebanksdesignatedforforeign exchange operations have meant that banks, enterprises andresidents unable to holdforeign exchangeattheirownwil1. The CentralBank,meanwhile, holdsaconsiderableamountofforeign exchangeintheform ofstateforeign exchangereserves. Suchan arrangementwilldefinitely lead to the sustained an d accelerated expansion of foreign exchange reserves.In terms of policy orientation, there have long been many theoretical misconceptions regardingthebasicfunctionsandrolesofforeign exchange reserves:forexample, that foreignexchange reserves equal economic strength, exaggeration ofthe function offoreign exchangereserves, and accumulating reserves without definite andjustifiable reasons. All these factorshave strongly pushed the sustained high growth of China’s foreign exchange reserves.III.Analysis of the Theoretical Misconceptions onChina's Foreign Exchange Reserves1.Regarding the Opinion that Foreign ExchangeReserves Equal Economic StrengthSince the 1990s, there has been a popular opinion that the more foreign exchange reservesChina has, the better it is, and that the growth offoreign exchange reserves reflects China’s economic strength and improvement of its international status. The rapid growth in foreignexchange reserves is seen as a sign of sound economic operation. In reality, this is a biasedviewpoint that fails to apprec iate China’s actual economic condition.Foreign exchange reserve is a balancing item for international payments, which isclosely related to various aspects of the economy and to changes in the worldeconomy. Inconsidering the rational scale of foreign exchange reserves, one must take into accountvarious factors in the economy,including the scale and development pace of the nationaleconomy, the level ofeconomic opening up and foreign dependency, the level and structureofforeign trade development, the level ofutilization offoreign investment and the capacityoffinancinginternationally, theefficiencyofeconomic adjustmentand regulation, andtheforeign exchange management system. From an international perspective,developedcountries are morepowerful in terms of overall national strength, and have bettermacroeconomic regulation frameworks. Their home currencies are convertible and can beused for international payments. Therefore, theirdemand for foreign exchange reserves isrelatively weak. In contrast, developing countries are fettered by a low development level, with an imperfect macroeconomic regulation system. They are short of foreign exchangeresources and their home currencies are often not suitable for international use. Therefore, they are highly dependent on the international market and have a stronger demand forforeign exchange reserves.Indeterminingarational scaleofforeign exchangereserves, Chinaneedsto beawareoftheinternationallyacceptedempirical standards, andtoconsideritsownactualeconomic conditions, thatis, theimperfectmacroeconomicregulation system, unstable macroeconomy, imperfectmarketeconomic system,relativelyfragilefinancialsystemandforeign exchangeregime, andinconvertibilityoftherenminbi. In addition, Chinaisundergoingeconomictransitionandfacesmany uncertainties. Therefore, it needs to hold reserves to cope with possible contingencies. However, thisdoesnotmean thatthemore reserves are,thebetteroftheeconomywillbe . There areseveral reasons,as follows:(1)EverythingNeeds to be “within Limits,”and so does the Scale of Foreign Exchange Reserves(2)The Scale ofForeign Exchange Reserves does not Necessarily Represent the OverallEconomic Strength ofa Country(3)InGeneral,GrowthofForeignExchangeReservesdoesnotNecessarilyhaveaPositiveCo rrelation with Economic Operation2.Exaggeration of the Function of Foreign Exchange ReservesWith the rapid development offinancial globalization, the basic functions offoreign exchangereserve have also undergone changes. The demand for foreign exchange reserves is notonly for transactions and risk prevention, but there isalso“development-oriented demand'’. Especially in the case of emerging-marketcountries, increasing attention is often paid toforeign exchange reserves as a way to boost public morale, strengthen internationalcredibility, to improve financing capacity in the international market and to reduce reform risks. Such demand for foreign exchange reserves is called development-oriented demand. There has been development in the understanding of the function of the foreignexchangereserve. In the past, the use of foreign exchange reserves was confined to coping withinternational payment deficits and maintaining exchan ge rate stability ofhome currencies. Now it is used as a means to safeguard the international reputation of a country and toenhance its competitive edge in the international market. However, a one-sidedunderstanding of the role change has led to the specious view that change in the quantityofforeign exchange reserves is an important criterion or confidence index for measuring thesoundness of the macroeconomy. In this view, the main function of the foreign exchangereserve does not lie in its utility, but in its role as an index. For that reason, it has graduallybecome a mainstream opinion that the more foreign exchange reserves a country has, theberet it will be. The function of foreign exchange reserve has been deified and its role ofadjustment of international payments has been exaggerated. In reality, the role of foreignexchange reserve in adjusting international payments and preventing financial crisis islimited and has two main functions, which are outlined in the following two sections.(1)Foreign Exchange Reserves can Only Adjust Temporary Imbalance of InternationalPaymentsIt is only a temporary measure to use foreign exchange reserves to balance internationalpayments. It is implemented only for saving time in domestic economic restructuring. Whena country encounters a large amount of deficit in international payments over a relativelylong period of time, although foreign exchange reserves can be used to intervene in theprocess, its role will be limited no matter how large the scale of the reserve is. If foreignexchange reserves were to diminish rapidly, public confidence might collapse, which mighthave a disastrous impact on domestic economic development.(2)Large-scale Foreign Exchange Reserves are not the Decisive Factor in thePreventionofFinancial CrisisThe Asian financial crisis that broke out in the 1990s is a typical case for the study ofmodern financiaI crisis. Some Asian economies became severely affected as a result ofinterest rate changes in international markets, increases in foreign debt, abnormal changesin international capital flow and the speculative attack by international hot money. Althoughthose countries were all holding high level of foreign exchange reserves before the crisisburst out, they still could not manage to survive the attack of large quantities of speculativecapita1. The main reason is that the causes of the crisis were complicated. They includewrong government policies, aworsening economic foundation, abrupt changes in investorconfidence and in their market anticipationfragile financial systems and errors in financialmanagement. The root cause is that against the backdrop of a re-shaped internationaleconomic landscape, and accelerated financial globalization and liberalization, structuralproblems, coupled with policy blunders, had intensified in those crisis-afflicted transitionalcountries. As a result, even their high-level foreign exchange reserves could not save them.China successfully survived the Asian financial crisis. A rather popular view is that itwas because of China’s high-level foreign exchange reserves. Such a view deservesdiscussion. Admittedly,China was able to make use of high-level foreign exchange reservesfor the demand oftransactions, crisis prevention and development. In particular, it did playan active role in bolstering confidence in the economic development. However,those werenotthekeyfactors. Infact, duringtheAsian financial crisis, Chinaonlyhadforeignexchangereserves of US$150bn. Compared with the huge amounts of international speculative hotmoney, this was but a drop in the bucket. Its role in warding ofthe financial crisis was verylimited. A very important reason for China’s success in surviving the crisis was that Chinahad not opened up its capital market, and had imposed strict control on its capital account. Thanks to this“firewall,”the large-scale flow of speculative capital was prevented.With C hina’s relatively stringent foreign exchange management,it is worth discussingthe necessity to maintain a large pool of foreign exchange reserves as an anti-withdrawalemergency fund. For example, consider whether high-level foreign exchange reserve canreally help to improve the confidence of foreign investors. By the end of 2004, Japan hadforeign exchange reserves ofUS$844.5bn, ranking first in the world. Chinese Taiwan,inthe same period, owned US$240bn foreign exchange reserves and had a high foreignexchange reserve--GDP ratio. But so far, no statistics indicate that either Japan or ChineseTaiwan have much attraction for foreign investors. In contrast, foreign exchange reservesoftheUSAcan only sustainimportsforlessthan amonth, whichare farbelowthetheoreticalwarning limit. Despite this, no country or individual has any doubt about theUS capacity to make international payments. As proof,the USA has long maintained itsedge in attracting foreign investors. When the 1997 Asian financial crisis erupted, theaffected Asian countries were all holding a large pool of foreign exchange reserves, butnone of them escaped the crisis.3. Making Reserve “For the Reserve’s Sake”Regarding China’s foreign exchange reserves, there is a theoreticalmisconception thatleads to advocating reserve for reserve’s sake. This view is derived from the idea thatforeign exchange reserves equal economic strength, and the view that deifies the functionof foreign exchange reserve. This view is manifested in two ways.(1)Passive Holding ofForeign Exchange ReservesUnder the influence of the view that foreign exchange reserves equal economic strength, and the more reserves the better, some take a one-sided view thatprecautionary holding offoreign exchange reserves will avert peril, and reserves should not be used until the criticalmoment. As a result, foreign exchange reserves have in reality not been effectively utilizedalthough there has been a large pool of them. Reflecting such a view, in the management offoreign exchange reserves, such factors as the economic benefit, social benefit, risk control, efficiency of operation, structure of currencies of reserves and their asset structure havebeen ignored. This has made the management of reserves rigid and inflexible.(2)Taking the Increasing ofForeign Exchange Reserves as a Policy ObjectiveForeign exchange reserves are the important part of a country’s monetary policy. Changein reserves is an item for balancing international payments, and it is usually a result ofintervention in the foreign exchange market by the central banks of various countries. Change in the reserve aims to stabilize the exchange rate. Therefore, change in the foreignexchange reserve in itself is not a policy objective, but, rather, keeps the exchange ratestable to protect the export competitiveness of domesticenterprises. This is closely relatedto measures to boost economic growth and to ensure full employment, both of which arekey internal factors in maintaining the balance ofdevelopment. Obviously, change in foreignexchange reserves is not the only target of monetary policy. In China there has been atendency to take increasing foreign exchange reserves as the policy objective.No doubt, the various theoretical misconceptions regarding the scale ofChina’s foreignexchange reserves are important factors in the country’s sustained rapid expansion ofreserves, amaterthatbrews risk.IV.Adjustment of Foreign Exchange Reserve Policies China’s foreign exchange reserves have maintained a high growth rate. Although large-scale foreign exchange reserves have strengthened financial security, the security of theforeign exchangereserveassetitselfisworrisome. Chinahas paidahighpriceand shoulderedhigh risks for its large pool of foreign exchange reserves.There are further high risks, suchas loss of interest and the shrinking of the real value of its foreign exchange reserves. Thelarge scale of foreign exchange reserves have had a series of adverse impacts on China’s economic development, and has created risk. The current condition of China’s foreignexchange reserves has become a critical hidden danger threatening financial safety. Therefore, there is an urgent need to adjust China’S foreign exchange reserve policies.1. Control the Scale of Foreign Exchange ReservesFirst, China’s foreign exchange reserves should be maintained at a reasonable leve1. Froman international perspective, it is generally accepted that the minimum foreign exchangereserves shouldbeableto sustainimportsforatleast 3months, aperiodthatisconsideredthe warning threshold. Based on intemational experience, the warning limit for the ratio offoreign exchange reserve to foreign debt balance is 30 percent. From China’s point ofview, its imports over 3 months in 2004 would have needed approximately US$140bn offoreignexchange, whereas another US$70bn would have been needed to satisfy the warning limitfor the ratio offoreign exchange reserve to foreign debt balance. Ifthe needs for satisfyingforeign investors’transfer of their profits to their home countries, financial reform andother contingencies are taken into consideration, the scale of China’S foreign exchangereserves should be largely maintained at a rational level ofUS$300-400bn.Second, China needs to choose the appropriate time to adjust relevant macroeconomicpolicies and strategies that have led to the sustained surplus in its balance of internationalpayments, including foreign trade, foreign investment and industrial policies. Regardingtrade policy, for instance, China has long implemented the traditional trade strategy that isbased on the basic principle of creating foreign exchange through exports. This has led tosustained trade surplus and rapid expansion of foreign exchange reserves, which not onlyexacerbates the pressure for renminbi appreciation, but also carries great risk. Moreover, improving the determination of the basis of the renminbi exchange rate, and rectifying itsdistorted formation mechanism, will improve the foreign exchange market, increase theflexibility ofexchange rate and improve the exchange rate form ation mechanism.This Can holdbacktherapidgrowthinforeign exchangereserves. Nodoubt, adjustingthe relevant macroeconomic policies, including foreign trade policy and strategies, is whatis needed for ens uring China’s security of foreign exchange reserves.2. Strengthen Management of Foreign Exchange ReservesIn the current situation, apart from controlling the scale of foreign exchange reserves, it ismore importan t for China to implement sound man agement and use of reserves. First, itshould be well man aged so as to produce the maximum economic and social benefits. Inmanaging foreign exchange reserves, besides reducing its adverse impacts on themacroeconomy, the most urgent task is to bring out the positive role of the large pool ofrenminbi deposits and foreign exchange reserves in boosting economic growth, and toestablish a new mechanism to transform reserves and deposit fund into investment andcapita1. Second, risk management of foreign exchange reserves should be strengthenedand a risk management framework should be established and improved. Third, the efficiencyof foreign exchange reserve operation should be improved. Finally, the currency and assetstructures of foreign exchange reserves should be considered in a rational way.对中国外汇储备快速增长的反思I.序言从2000年起,中国的外汇储备一直快速增长。