亨格瑞管理会计英文第15版 答案 10-12章

- 格式:pdf

- 大小:556.89 KB

- 文档页数:21

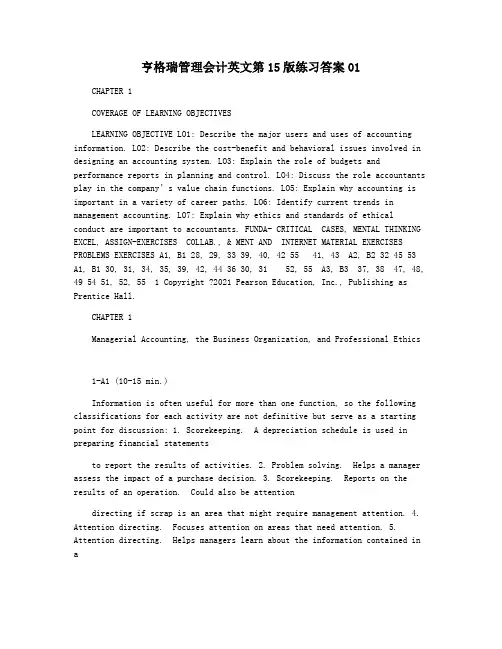

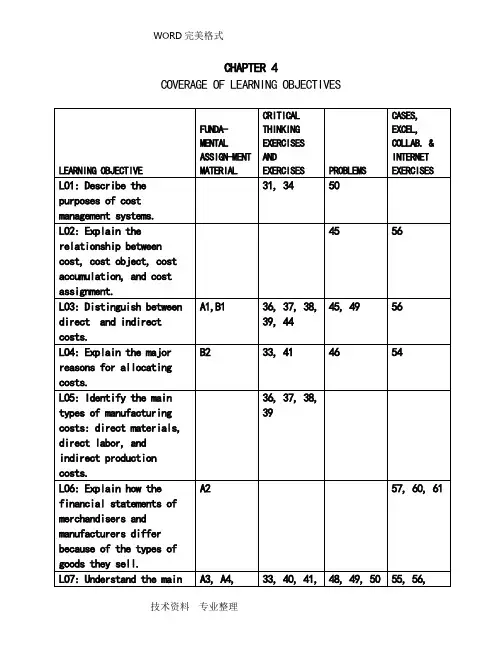

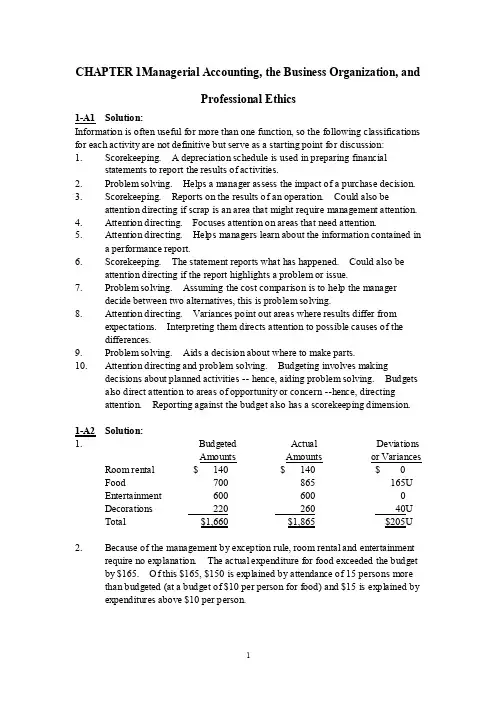

亨格瑞管理会计英文第15版练习答案01CHAPTER 1COVERAGE OF LEARNING OBJECTIVESLEARNING OBJECTIVE LO1: Describe the major users and uses of accounting information. LO2: Describe the cost-benefit and behavioral issues involved in designing an accounting system. LO3: Explain the role of budgets and performance reports in planning and control. LO4: Discuss the role accountants play in the company’s value chain functions. LO5: Explain why accounting is important in a variety of career paths. LO6: Identify current trends in management accounting. LO7: Explain why ethics and standards of ethical conduct are important to accountants. FUNDA- CRITICAL CASES, MENTAL THINKING EXCEL, ASSIGN-EXERCISES COLLAB., & MENT AND INTERNET MATERIAL EXERCISES PROBLEMS EXERCISES A1, B1 28, 29, 33 39, 40, 42 55 41, 43 A2, B2 32 45 53A1, B1 30, 31, 34, 35, 39, 42, 44 36 30, 31 52, 55 A3, B3 37, 38 47, 48, 49 54 51, 52, 55 1 Copyright ?2021 Pearson Education, Inc., Publishing as Prentice Hall.CHAPTER 1Managerial Accounting, the Business Organization, and Professional Ethics1-A1 (10-15 min.)Information is often useful for more than one function, so the following classifications for each activity are not definitive but serve as a starting point for discussion: 1. Scorekeeping. A depreciation schedule is used in preparing financial statementsto report the results of activities. 2. Problem solving. Helps a manager assess the impact of a purchase decision. 3. Scorekeeping. Reports on the results of an operation. Could also be attentiondirecting if scrap is an area that might require management attention. 4. Attention directing. Focuses attention on areas that need attention. 5. Attention directing. Helps managers learn about the information contained in aperformance report. 6. Scorekeeping. The statement reports what has happened. Could also be attentiondirecting if the report highlights a problem or issue. 7. Problem solving. Assuming the cost comparison is to help the manager decidebetween two alternatives, this is problem solving. 8. Attention directing. Variances point out areas where results differ fromexpectations. Interpreting them directs attention to possible causes of the differences. 9. Problem solving. Aids a decision about where to make parts. 10. Attention directing and problem solving. Budgeting involves making decisionsabout planned activities -- hence, aiding problem solving. Budgets also direct attention to areas of opportunity or concern --hence, directing attention. Reporting against the budget also has a scorekeeping dimension.2 Copyright ?2021 Pearson Education, Inc., Publishing as Prentice Hall.1-A2 1. 2.(15-20 min.)Room rental FoodEntertainment Decorations TotalBudgeted Amounts $ 140 700 600 220 $1,660 Actual Amounts $ 140865 600 260 $1,865 Deviations or Variances $ 0 165U 0 40U $205U Because of the management by exception rule, room rental and entertainment require no explanation. The actual expenditure for food exceeded the budgetby $165. Of this $165, $150 is explained by attendance of 15 persons morethan budgeted (at a budget of $10 per person for food) and $15 is explained by expenditures above $10 per person.Actual expenditures for decorations were $40 more than the budget. The decorations committee should be asked for an explanation of the excess expenditures.1-A3 (10 min.)All of the situations raise possibilities for violation of the integrity standard. In addition, the manager in each situation must address an additional ethical standard: 1. The General Mills manager must respect the confidentiality standard. He or sheshould not disclose any information about the new cereal. 2. Felix must address his level of competence for the assignment. If his supervisorknows his level of expertise and wants an analysis from a “layperson” point of view, he should do it. However, if the supervisor expects an expert analysis, Felix must disclose his lack of competence. 3. The credibility standard should cause Mary Sue to decline to omit the informationfrom the budget. It is relevant information, and its omission may mislead readers of the budget.3 Copyright ?2021 Pearson Education, Inc., Publishing as Prentice Hall.1-B1 (15-20 min.)Information is often useful for more than one function, so the following classifications for each activity are not definitive but serve as a starting point for discussion: 1. Problem solving. Provides information for deciding between two alternativecourses of action. 2. Scorekeeping. Recording what has happened. If amounts are compared withexpectations, this could also serve an attention-directing function. 3. Problem solving. Helps a manager decide among alternatives. 4. Attention directing. Directs attention to the use of overtime labor. Alsoscorekeeping. 5. Problem solving. Provides information to managers for deciding whether to movecorporate headquarters. 6. Attention directing. Directs attention to why nursing costs increased. 7. Attention directing. Directs attention to areas where actual results differed fromthe budget. 8. Problem solving. Helps the vice-president decide which course of action is best. 9. Problem solving. Produces information to help the marketing department make adecision about a marketing campaign. 10. Scorekeeping. Records actual overtime costs. If results are compared withexpectations, also attention directing. 11. Attention directing. Directs attention to stores with either high or low ratios ofadvertising expenses to sales. 12. Attention directing. Directs attentionto causes of returns of the drug. 13. Attention directing or problem solving, depending on the use of the schedule. If itis to identify areas of high fuel usage it is attention directing. If itis to plan for purchases of fuel, it is problem solving. 14. Scorekeeping. Records items needed for financial statements.4 Copyright ?2021 Pearson Education, Inc., Publishing as Prentice Hall.1-B2 (10-15 min.)1 & 2. Budget Actual Variance Sales $75,000 $74,600 $ 400U Costs: Fireworks $36,000 $35,500 $500F Labor 15,000 18,000 3,000U Other 8,000 7,910 90F Total cost 59,000 61,410 2,410U Profit $16,000 $13,190 $2,810U 3. The cost of fireworks was $500 ÷ $36,000 = 1.4%under budget while sales wasjust 400 ÷ $75,000 = .5% under budget. Did fireworks suppliers lowertheir prices? Were selling prices set higher than expected? There should be some explanation for the lower cost of fireworks. The labor cost was $3,000÷ $15,000 =20% over budget. Sales and other costswere close to budget in percentage terms. Why was labor cost much higherthan expected?1-B3 (15 - 20 min.) 1. A code of conduct is a document specifying theethical standards of anorganization. 2. Different companies include different elements intheir codes of conduct. Some ofthe items included in companies’ codes of condu ct include maintaining adress code, avoiding illegal drugs, following instructions of superiors, being reliable and prompt, maintaining confidentiality, not accepting personal gifts fromstakeholders as a result of company role, avoiding racial or sexual discrimination, avoiding conflict of interest, complying with laws and regulations, not using organization’s property for personal use, andreporting illegal or questionable activity. Some companies have a simple code with little detail, and others have long lists of rules and regulations regarding appropriate conduct. The key is that the code of conduct must fit with the corporate culture. 3. Simply having a code of conduct does not guarantee ethical behavior byemployees. Most important is top management’s ethical example and its support of the code of conduct. A company’s performance evaluation and reward system must be consistent with its code of conduct. If unethical actions are rewarded, they will be encouraged even if they violate the code of conduct.5 Copyright ?2021 Pearson Education, Inc., Publishing as Prentice Hall.感谢您的阅读,祝您生活愉快。

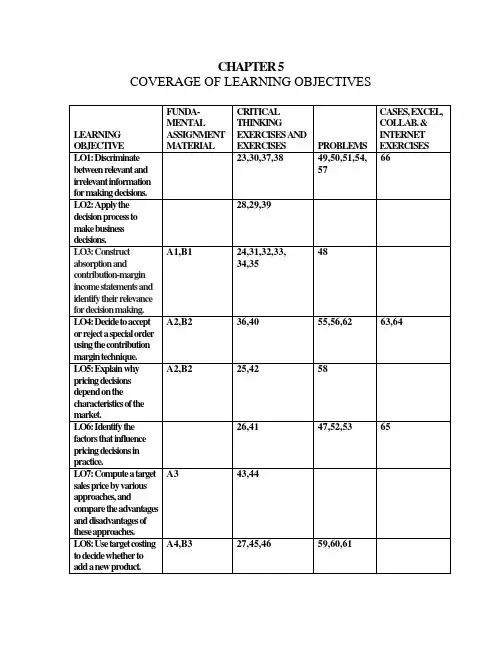

CHAPTER 5 COVERAGE OF LEARNING OBJECTIVESCHAPTER 5Relevant Information for Decision Making with a Focus on Pricing Decisions5-A1 (40-50 min.)1. INDEPENDENCE COMPANYContribution Income StatementFor the Year Ended December 31, 2009(in thousands of dollars)Sales $2,200 Less variable expensesDirect material $400Direct labor 330Variable manufacturing overhead (Schedule 1) 150 Total variable manufacturing cost ofgoods sold $880 Variable selling expenses 80Variable administrative expenses 25Total variable expenses 985 Contribution margin $ 1,215 Less fixed expenses:Fixed manufacturing overhead (Schedule 2) $345Selling expenses 220Administrative expenses 119 Total fixed expenses 684 Operating income $ 531INDEPENDENCE COMPANYAbsorption Income StatementFor the Year Ended December 31, 2009(in thousands of dollars)Sales $2,200 Less manufacturing cost of goods sold:Direct material $400Direct labor 330Manufacturing overhead (Schedules 1 and 2) 495 Total manufacturing cost of goods sold 1,225 Gross margin $ 975 Less:Selling expenses $300Administrative expenses 144 444 Operating income $ 531INDEPENDENCE COMPANYSchedules of Manufacturing OverheadFor the Year Ended December 31, 2009(in thousands of dollars)Schedule 1: Variable CostsSupplies $ 20Utilities, variable portion 40Indirect labor, variable portion 90 $150 Schedule 2: Fixed CostsUtilities, fixed portion $ 15Indirect labor, fixed portion 50Depreciation 200Property taxes 20Supervisory salaries 60 345 Total manufacturing overhead $495 2. Change in revenue $200,000Change in total contribution margin:Contribution margin ratio in part 1is $1,215 ÷ $2,200 = .552Ratio times decrease in revenue is .552 × $200,000 $ 110,400 Operating income before change 531,000 New operating income $420,600 This analysis is readily done by using data from the contribution income statement.In contrast, the data in the absorption income statement must be analyzed and split into variable and fixed categories before the effect on operating income can beestimated.5-A2 (25-30 min.)1. A contribution format, which is similar to Exhibit 5-6, clarifies the analysis.Without WithSpecial Effect of SpecialOrder Special Order Order Units 2,000,000 150,000 2,150,000Total Per UnitSales $11,000,000 $660,000 $4.40 1$11,660,000 Less variable expenses:Manufacturing $ 3,500,000 $322,500 $2.15 2$ 3,822,500 Selling & administrative 800,000 35,250 .2353 835,250 Total variable expenses $ 4,300,000 $357,750 $2.385 $ 4,647,250 Contribution margin $ 6,700,000 $302,250 $2.015 $ 7,002,250 Less fixed expenses:Manufacturing $ 3,000,000 0 0.00 $ 3,000,000 Selling & administrative 2,200,000 0 0.00 2,200,000 Total fixed expenses $ 5,200,000 0 0.00 $ 5,200,000 Operating income $ 1,500,000 $302,250 $2.015 $ 1,802,250 1$660,000 ÷ 150,000 = $4.402Regular unit cost = $3,500,000 ÷ 2,000,000 = $1.75 Logo .40Variable manufacturing costs $2.153Regular unit cost = $800,000 ÷ 2,000,000 = $ .40 Less sales commissions not paid (3% of $5.50) (.165)Regular unit cost, excluding sales commission $ .2352. Operating income from selling 7.5% more units would increase by $302,250 ÷$1,500,000 = 20.15%. Note also that the average selling price on regularbusiness was $5.50. The full cost, including selling and administrative expenses, was $4.75. The $4.75, plus the 40¢ per logo, less savings in commissionsof .165¢ came to $4.985. The president apparently wanted $4.985 + .08($4.985)= $4.985 + .3988 = $5.3838 per pen.Most students will probably criticize the president for being too stubborn. Thecost to the company was the forgoing of $302,250 of income in order to protectthe company's image and general market position. Whether $302,250 was a wise investment in the future is a judgment that managers are paid for rendering.5-A3 (15-20 min.)The purpose of this problem is to underscore the idea that any of a number of general formulas might be used that, properly employed, would achieve the same target selling prices. Desired sales = $7,500,000 + $1,500,000 = $9,000,000.The target markup percentage would be:1. 100% of direct materials and direct labor costs of $4,500,000.Computation is: ($9,000,000 - $4,500,000) ÷ $4,500,000 = 100%2. 50% of the full cost of jobs of $6,000,000.Computation is: ($9,000,000 - $6,000,000) ÷ $6,000,000 = 50%3. [$9,000,000 – ($3,500,000 + $1,000,000 + $700,000)] ÷ $5,200,000 = 73.08%4. ($9,000,000 - $7,500,000) ÷ $7,500,000 = 20%5. [$9,000,000 – ($3,500,000 + $1,000,000 + $700,000 + $500,000)] ÷ $5,700,000= $3,300,000 ÷ $5,700,000 = 57.9%If the contractor is unable to maintain these profit percentages consistently, the desired operating income of $1,500,000 cannot be obtained.1. Revenue ($360 × 70,000) $25,200,000Total cost over product life 16,000,000 Estimated contribution to profit $ 9,200,000 Desired (target) contribution to profit40% × $25,200,000 10,080,000 Deficiency in profit $ 880,000The product should not be released to production.2. Previous total estimated cost $16,000,000Cost savings from suppliers.20 × .70 × $8,000,000 1,120,000 Revised total estimated cost $14,880,000 Revised total contribution to profit:$25,200,000 - $14,880,000 $10,320,000 Desired (target) contribution to profit 10,080,000 Excess contribution to profit $ 240,000The product should be released to production.3. Previous revised total estimated cost fromrequirement 2. $14,880,000 Process improvement savings:.25 × .30 × $8,000,000 $600,000Less cost of new technology 220,000 380,000 Revised total estimated cost 14,500,000 Revised total contribution to profit:$25,200,000 - $14,500,000 $10,700,000 Desired (target) contribution to profit 10,080,000 Excess contribution to profit $ 620,000 The product should be released to production.1. KINGLAND MANUFACTURINGContribution Income StatementFor the Year Ended December 31, 2009(In thousands of dollars)Sales $13,000 Less variable expenses:Direct material $4,000Direct labor 2,000Variable indirect manufacturingcosts (Schedule 1) 960Total variable manufacturing cost of goods sold $6,960Variable selling expenses:Sales commissions $500Shipping expenses 300 800Variable clerical salaries 400Total variable expenses 8,160 Contribution margin $ 4,840 Less fixed expenses:Manufacturing (Schedule 2) $ 702Selling (advertising) 400 Administrative-executive salaries 100Total fixed expenses 1,202 Operating income $ 3,638KINGLAND MANUFACTURINGAbsorption Income StatementFor the Year Ended December 31, 2009(In thousands of dollars)Sales $13,000 Less manufacturing cost of goods sold:Direct material $4,000Direct labor 2,000Indirect manufacturing costs(Schedules 1 and 2) 1,662Gross profit 5,338 Selling expenses:Sales commissions $500Advertising 400Shipping expenses 300 $1,200 Administrative expenses:Executive salaries $100Clerical salaries 400 500 1,700 Operating income $ 3,638KINGLAND MANUFACTURINGSchedules 1 and 2Indirect Manufacturing CostsFor the Year Ended December 31, 2009(In thousands of dollars)Schedule 1: Variable CostsCutting bits $ 60Abrasives for machining 100Indirect labor 800 $ 960Schedule 2: Fixed CostsFactory supervisors' salaries $100Factory methods research 40Long-term rent, factory 100Fire insurance on equipment 2Property taxes on equipment 30Depreciation on equipment 400Factory superintendent's salary 30 702Total indirect manufacturing costs $1,6622. Operating income would decrease from $3,638,000 to $3,268,000:Decrease in revenue $1,000,000Decrease in total contribution margin*:Ratio times revenue is .37 × $1,000,000 $ 370,000Decrease in fixed expenses 0Operating income before increase 3,638,000New operating income $3,268,000*Contribution margin ratio in contribution income statement is $4,840 ÷$13,000 = .37 (rounded).The above analysis is readily calculated by using data from the contribution income statement. In contrast, the data in the absorption income statement must be analyzed and divided into variable and fixed categories before the effect on operating income can be estimated.5-B2 (30-40 min.)1. DANUBE COMPANYIncome StatementFor the Year Ended December 31, 20X0Total Per Unit Sales $40,000,000 $20.00Less variable expenses:Manufacturing $18,000,000Selling & administrative 9,000,000 27,000,000 13.50Contribution margin $13,000,000 $ 6.50Less fixed expenses:Manufacturing $ 4,000,000Selling & administrative 6,000,000 10,000,000 5.00Operating income $ 3,000,000 $ 1.50 2. Additional details are either in the statement of the problem or in the solution torequirement 1:Total Per Unit Full manufacturing cost $22,000,000 $11.00 Variable cost:Manufacturing $18,000,000 $ 9.00 Selling and administrative 9,000,000 4.50 Total variable cost $27,000,000 $13.50 Full cost = fully allocated cost*Full manufacturing cost $22,000,000 $11.00 Selling and administrative expenses 15,000,000 7.50 Full cost $37,000,000 $18.50 Gross margin ($40,000,000 - $22,000,000) $18,000,000 $ 9.00 Contrib. margin ($40,000,000 - $27,000,000) $13,000,000 $ 6.50 * Students should be alerted to the loose use of these words. Their meaning maynot be exactly the same from company to company. Thus, "fully allocatedcost" in some companies may be used to refer to manufacturing costs only.3. Ricardo’s analysis is incorrect. He was on the right track, but he did notdistinguish sufficiently between variable and fixed costs. For example, whenmultiplying the additional quantity ordered by the $11 full manufacturing cost, hefailed to recognize that $2.00 of the $11 full manufacturing cost was a "unitized"fixed cost allocation. The first fallacy is in regarding the total fixed cost asthough it fluctuated like a variable cost. A unit fixed cost can be misleading if itis used as a basis for predicting how total costs will behave.A second false assumption is that no selling and administrative expenses will beaffected except commissions. Shipping expenses and advertising allowances willbe affected also -- unless arrangements with Costco on these items differ fromthe regular arrangements.The following summary, which is similar to Exhibit 5-6 in the textbook, is acorrect analysis. The middle columns are all that are really necessary.Without WithSpecial Effect of SpecialOrder Special Order Order Units 2,000,000 100,000 2,100,000Total Per UnitSales $40,000,000 $1,600,000 $16.00 $41,600,000 Less variable expenses:Manufacturing $18,000,000 $ 900,000 $ 9.00 $18,900,000 Selling and administrative 9,000,000 330,000 3.30* 9,330,000 Total variable expenses $27,000,000 $1,230,000 $12.30 $28,230,000 Contribution margin $13,000,000 $ 370,000 $ 3.70 $13,370,000 Less fixed expenses:Manufacturing $ 4,000,000 0 0.00 $ 4,000,000 Selling and administrative 6,000,000 20,000 0.20** 6,020,000 Total fixed expenses $10,000,000 20,000 0.20 $10,020,000 Operating income $ 3,000,000 $ 350,000 $ 3.50 $ 3,350,000 * Regular variable selling and administrative expenses,$9,000,000 ÷ 2,000,000 = $ 4.50 Less: Average sales commission at 6% of $20 = (1.20) Regular variable sell. and admin. expenses, less commission $ 3.30**Fixed selling and administrative expenses, specialcommission, $20,000 ÷ 100,000 .20Some students may wish to enter the $20,000 as an extra variable cost, makingthe unit variable selling and administrative cost $3.50 and thus adding no fixedcost. The final result would be the same; in any event, the cost is relevantbecause it would not exist without the special order.Some instructors may wish to point out that a 5% increase in volume wouldcause an 11.7% increase in operating income, which seems like a highinvestment by Danube to maintain a rigid pricing policy.4. Ricardo is incorrect. Operating income would have declined from $3,000,000 to$2,850,000, a decline of $150,000. Ricardo’s faulty analysis follows:Old fixed manufacturing cost per unit,$4,000,000 ÷ 2,000,000 = $2.00 New fixed manufacturing cost per unit,$4,000,000 ÷ 2,500,000 = 1.60 "Savings" $ .40Loss on variable manufacturing costs per unit,$8.70 - $9.00 (.30) Net savings per unit in manufacturing costs $ .10The analytical pitfalls of unit-cost analysis can be avoided by using thecontribution approach and concentrating on the totals:Without Effect of WithSpecial Special SpecialOrder Order Order Sales $40,000,000 $4,350,000a$44,350,000Variable manufacturingcosts $18,000,000 $4,500,000b$22,500,000 Other variable costs 9,000,000 0 9,000,000 Total variable costs $27,000,000 $4,500,000 $31,500,000 Contribution margin $13,000,000 $ (150,000)c$12,850,000a500,000 × $8.70 selling price of special orderb 500,000 × $9.00 variable manufacturing cost per unit of special orderc 500,000 × $.30 negative contribution margin per unit of special orderNo matter how fixed manufacturing costs are unitized, or spread over the unitsproduced, their total of $4,000,000 remains unchanged by the special order.5-B3 (10-15 min.)1. Cost-plus pricing is adding a specified markup to cost to cover those components of the value chain not included in the cost plus a desired profit. In this case the markup is 30% of production cost.Price charged for piston pin = 1.30 × $50.00 = $65.00. If the estimated selling price is only $46 and this price cannot be influenced by Caterpillar, a manager would be unlikely to favor releasing this product for production.2. Target costing assumes the market price cannot be influenced by companies except by changing the value of the product to consumers. The price charged would then be the $46 estimated by market research.The highest acceptable manufactured cost or target cost, T, isDollarsTarget Price $ 46.00Target Cost TTarget Gross Margin $ .30T46 – T = .30T1.30T = 46T = 46 ÷ 1.30 = $35.383. The required cost reduction over the product’s life isExisting manufacturing cost $50.00Target manufacturing cost 35.38Required cost reduction $14.62Steps that Caterpillar managers can take to meet the required cost reduction include value engineering during the design phase, Kaizen costing during the production phase, and activity-based management throughout the product’s life.5-1 Precision is a measure of the accuracy of certain data. It is a quantifiable term. Relevance is an indication of the pertinence of certain facts for the problem at hand. Ideally, data should be both precise and relevant, but relevance generally takes priority.5-2 Decisions may have both quantitative and qualitative aspects corresponding to the nature of the facts being considered before deciding. Quantitative implications of alternative choices can be expressed in monetary or numerical terms, such as variable costs, initial investment, etc. Other relevant features may not be quantifiable, such as the quality of life in a choice between locating in San Francisco or New York. The advantage of quantitative information is that it is more objective and often easier to compare alternatives than with qualitative judgments.5-3 The accountant's role in decision-making is primarily that of a technical expert on relevant information analysis, especially relevant costs. The accountant is usually an information provider, not the decision maker, although the accountant may be part of a management team charged with making decisions.5-4 No. Only future costs that are different under different alternatives are relevant to a decision.5-5 Past data are unchangeable regardless of present or future action and thus would not differ under different alternatives.5-6 Past costs may be bases for formulating predictions. However, past costs are not inputs to the decision model itself because past costs cannot be changed by the decision.5-7 The contribution approach has several advantages over the absorption approach, including a better analysis of cost-volume-profit relationships, clearer presentation of all variable costs, and more relevant arrangement of data for such decisions as make-or-buy or product expansion.5-8 The terms that describe an income statement that emphasizes the differences between variable or fixed costs are contribution approach, variable costing, or direct costing.5-9 The commonalty of approach is the focus on the differences between future costs and revenues of different available alternatives.5-10 No, fixed costs are not always irrelevant. Often they are not relevant. However, they can be relevant if they are affected by the decision being considered.5-11 Customers are one of the factors influencing pricing decisions because they can buy or do without the product, they can make the product themselves, or they can usually purchase a similar product from another supplier.5-12 Target cost per unit is the average total unit cost over the product’s life cycle that will yield the desired profit margin.5-13 Value engineering is a cost-reduction technique, used primarily during the design function in the value chain, that uses information about all value chain functions to satisfy customer needs while reducing costs.5-14 Kaizen costing is the Japanese term for continuous improvement during manufacturing.5-15 In target costing, managers start with a market price. Then they try to design a product with costs low enough to be profitable at that price. Thus, prices essentially determine costs.5-16 Customer demands and requirements are important in the product development process. Many companies seek customer input on the design of product features. They seek to reduce non-value-added costs without affecting product features that are valuable to customers. Suppliers are also important. Companies purchase many of the materials used in products. They have to work with suppliers to get the lowest cost for these materials.5-17 Not necessarily. There are other important factors that management must consider before discontinuing a product. The product may be necessary to round out a product line. The product may be the company’s attempt to break into a new market area or new product class.5-18 The variable costs of a job can be misused as a guide to pricing. However, the adjusted markup percentages based on variable costs can have the same price result as those based on total costs, plus they have the advantage of indicating the minimum price at which any sale may be considered profitable even in the short run.5-19 Three examples of pricing decisions are (1) pricing new products, (2) pricing products sold under private labels, and (3) responding to new prices of a competitor's products.5-20 Three popular markup formulas are (1) as a percentage of variable manufacturing costs, (2) as a percentage of total variable costs, and (3) as a percentage of full costs.5-21 Two long-run effects that inhibit price cutting are (a) the effects on longer-run price structures and (b) the effects on longer-run relations with customers.5-22 Full costs are more popular than variable costs for pricing because price stability is encouraged and in the long run all costs must be recovered to stay in business.5-23 No. There is a confusion between total fixed costs and unit fixed costs. Increasing sales volume will decrease unit fixed costs, but not total fixed costs. This assumes that the volume increase results in operating levels that are still within the relevant range.5-24 Managers generally find contribution margin income statements more useful, especially if they are concerned with short-term results. The contribution margin statement provides information on the immediate profit impact of increases or decreases in sales.5-25 Marginal cost is the additional cost resulting from producing and selling one additional unit. It changes as production volume changes. With a given fixed capacity, marginal cost generally decreases up to a point and then increases. Variable cost is the accountant's approximation to marginal cost. It remains constant over the relevant range of volume. Because the difference between these two costs often is not material (within the relevant range), in such cases we can use the variable-cost estimate of marginal cost for decision-making purposes.5-26 Pricing decisions must be made within legal constraints. These laws help protect companies from predatory and discriminatory pricing. Predatory pricing involves setting prices so low that they drive competitors out of the market. Discriminatory pricing is charging different prices to different customers for the same product or service.5-27 Managers are directly involved in the research and development and the design functions. During the initial product research phase, managers often are involved in surveys, focus groups (with major airlines), and other market research activities to explore the potential for a new airplane. During process and product design, managers help with such tasks as negotiations with suppliers and cost analyses. Production managers provide input regarding cost reduction ideas. Marketing managers provide input regarding customer needs (a super large plane with more than 500 seats versus more medium-sized planes that can serve more markets). Distribution managers provide input regarding the costs of various channels of distribution. Finally, managers involved with customer relations provide input regarding the likely cost-to-serve profile for expected customers for a new product.5-28 (5 min.)All the data given are historical costs. Most students will identify the $5 and $7 prices as relevant. They will also declare that the $3 price of popcorn is irrelevant. Press them to see that the relevant admission prices are expected future costs that will differ between the alternatives. The past prices are being used as a basis for predicting the future prices.Similarly, the past prices of popcorn were not different. Hence, they are regarded as irrelevant under the assumption that the future prices will not differ.5-29 (20 min.) Some students may forget to apply the 10% wage rate increase to both alternatives.(1) Historical direct materials were $5.00per unit; direct labor was $6.00 per unit. (2) (2) Direct material costs are expected tofall by 10%, or 50¢ per unit. Directlabor costs are affected by a 10% rateincrease and a 5% increase in labortime if the new material is used.(3) (3) Cost comparisons per unit:Old NewMaterial MaterialDirect material $ 5.00 $ 4.50Direct labor$6.00 × 110% 6.60$6.00×110%×105% 6.93Expected futurecost $11.60 $11.43(4) The chosen action is implemented,and the evaluation of performance be-comes a principal source of feedback.This historical information aids thedecision process (prediction, decision,and implementation) of future decisions.5-30 (10 min.)Relevant costs are the future costs that differ between alternatives. Among the irrelevant costs are the cost of tickets to the symphony, automobile costs, and baby-sitting cost for the first four hours. The relevant costs are:Symphony Game Difference Tickets, 2 @ $20 each $0 $40 $40Parking 0 6 6Baby-sitting, 1 extrahour @ $7 0 7 7Total $0 $53 $53 The baseball game is $53 more costly to the Petrocelis than is the symphony.5-31 (10 min.) This is a basic exercise. Answers are in thousands of dollars.1. 200 + 200 + 170 = 5702. 800 - 570 = 2303. 230 - 150 = 804. 570 – 200 = 370; or 200 + 170 = 3705-32 (10-15 min.) This is a basic exercise.Sales ¥950Variable expenses:Direct materials ¥290Direct labor 160Variable factory overhead 60(a) Variable manufacturing cost ofgoods sold ¥510Variable selling and admin. expenses 100Total variable expenses 610(b) Contribution margin ¥340Fixed expenses:Fixed factory overhead ¥120Fixed selling and administrativeexpenses 45 165(c) Operating income ¥ 1755-33 (15-20 min.)This is a straightforward exercise in basic terms and relationships. To fill all theblanks, both absorption and contribution income statements must be prepared. Data arein millions of dollars. Required answers are in italics.Absorption ContributionApproach Approach Sales $920 $920 Direct materials used $350 $350Direct labor 210 210Variable indirectmanufacturing costs 100 100f. Variable manufacturing cost ofgoods sold 660 Variable selling and administrativeexpenses 90 Total variable expenses 750 k. Contribution margin 170 Fixed factory overhead 50 50g. Manufacturing cost of goods sold 710j. Gross profit 210Fixed selling and administrativeexpenses 80 80 130 Variable selling and administrativeexpenses 90 170Operating income $ 40 $ 405-34 (10-20 min.) Answers are in thousands of rands (ZAR).Prime costs = Direct material + Direct labor600 = 370 + DLDL = 230The body of a model income statement follows. The computations are explainedfor each item that was originally blank. Numbers given in the problem are in bold.Sales, 780 + 120 ZAR900Direct materials ZAR370Direct labor, 600 - 370 230Factory overhead, 780 - (370 + 230) 180Manufacturing cost of goods sold 780Gross margin ZAR120Selling and administrative expenses* 100Operating income ZAR 20*120 - 205-35 (15-20 min.) The data are placed in the format of the income statement, and the unknowns are computed as shown:Sales $890 Variable expensesDirect materials $150Direct labor 170Variable indirect manufacturing 110Variable manufacturing cost of goods sold 430 1 Variable selling and administrative expenses 260 2Total variable expenses (890 - 200) 690Contribution margin 200 Fixed expensesFixed indirect manufacturing $ 90 3Fixed selling and administrative expenses 100 190 Operating income $ 10 1150 + 170 + 110 = 4302890 - 200 = 690; 690 - 430 = 2603Total fixed expenses = 200 - 10 = 190Fixed indirect manufacturing = 190 - 100 = 905-36 (10-15 min.)1. Operating income would increase by $300 if the order is accepted.Without Effect of WithSpecial Special SpecialOrder Order Order Units 2,000 100 2,100 Sales $36,000 $1,500 $37,500 Purchase cost 20,000 1,000 21,000 Variable printing cost 4,000 200 4,200 Total variable cost 24,000 1,200 25,200 Contribution margin 12,000 300 12,300 Fixed cost 8,000 0 8,000 Operating income $ 4,000 $ 300 $ 4,300 2. If maximizing operating income in the short run were the only goal, the ordershould be accepted. However, if qualitative considerations favoring rejection are worth more than the $300 increase in operating income, the manager wouldreject the offer. For example, accepting the offer from F. C. Kitsap may generate similar offers from other clubs who now willingly pay the $18 normal price.Lost profits on such business might more than offset the $300 gain on this sale.On the other hand, this might be a way of gaining F. C. Kitsap as a regularcustomer who will then buy other items that generate a profit well in excess ofthe $300.。

![亨格瑞成本与管理会计(中英第15版)中文PPT (12)[38页]](https://uimg.taocdn.com/83c244d3a6c30c2258019eb7.webp)

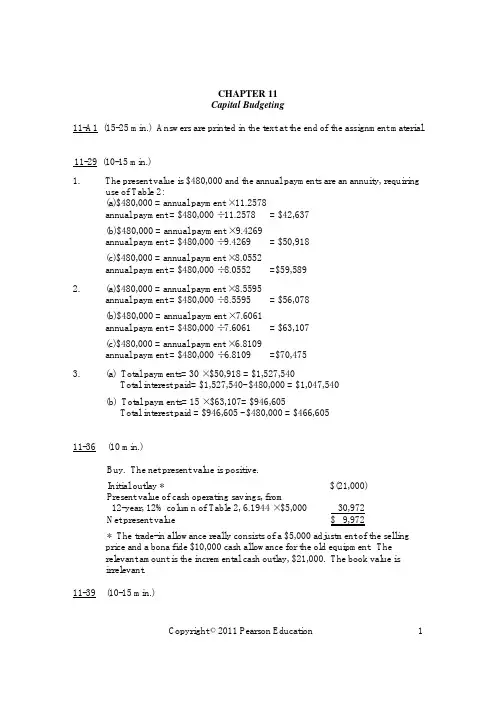

CHAPTER 11Capital Budgeting11-A1 (15-25 min.) Answers are printed in the text at the end of the assignment material.11-29 (10-15 min.)1. The present value is $480,000 and the annual payments are an annuity, requiringuse of Table 2:(a)$480,000 = annual payment × 11.2578annual payment = $480,000 ÷ 11.2578 = $42,637(b)$480,000 = annual payment × 9.4269annual payment = $480,000 ÷ 9.4269 = $50,918(c)$480,000 = annual payment × 8.0552annual payment = $480,000 ÷ 8.0552 =$59,5892. (a)$480,000 = annual payment × 8.5595annual payment = $480,000 ÷ 8.5595 = $56,078(b)$480,000 = annual payment × 7.6061annual payment = $480,000 ÷ 7.6061 = $63,107(c)$480,000 = annual payment × 6.8109annual payment = $480,000 ÷ 6.8109 =$70,4753. (a) Total payments= 30 × $50,918 = $1,527,540Total interest paid= $1,527,540- $480,000 = $1,047,540(b) Total payments= 15 × $63,107= $946,605Total interest paid = $946,605 - $480,000 = $466,60511-36 (10 min.)Buy. The net present value is positive.Initial outlay * $(21,000)Present value of cash operating savings, from12-year, 12% column of Table 2, 6.1944 × $5,000 30,972Net present value $ 9,972* The trade-in allowance really consists of a $5,000 adjustment of the sellingprice and a bona fide $10,000 cash allowance for the old equipment. Therelevant amount is the incremental cash outlay, $21,000. The book value isirrelevant.11-39 (10-15 min.)Copyright ©2011 Pearson Education 1Copyright ©2011 Pearson Education21. NPV @ 10% = 10,000 × 3.7908 = $37,908 - $36,048 = $1,860 NPV @ 12% = 10,000 × 3.6048 = $36,048 - $36,048 = $0NPV @ 14% = 10,000 × 3.4331 = $34,331 - $36,048 = $(1,717)2.The IRR is the interest rate at which NPV = $0; therefore, from requirement 1 we know that IRR = 12%.3.The NPV at the company’s cost of capital, 10%, is positive, so the project should be accepted.4.The IRR (12%) is greater than the company’s cost of capital (10%), so the project should be accepted. Note that the IRR and NPV models give the same decision.11-46 (10-15 min.)Annual addition to profit = 40% × $25,000 = $10,000.1.Payback period is $36,000 ÷ $10,000 = 3.6 years. It is not a good measure of profitability because it ignores returns beyond the payback period and it does not account for the time value of money.2. NPV = $5,114. Accept the proposal because NPV is positive. Computation: NPV = ($10,000 × 4.1114) - $36,000= $41,114 - $36,000 = $ 5,1143. ARR = (Increase in average cash flow – Increase in depreciation) ÷ Initialinvestment= ($10,000 - $6,000) ÷ $36,000 = 11.1%11-51 (30-35 min.)1.Annual Operating Cash FlowsXeroxCannon Difference Salaries $49,920(a) $41,600(b) $ 8,320 Overtime 1,728(c) -- 1,728 Repairs and maintenance 1,800 1,050 750Toner, supplies, etc. 3,6003,300 300 Total annual cash outflows $57,048 $45,950 $11,098(a) ($ 8 × 40 hrs.) × 52 weeks × 3 employees = $320 × 52 × 3 = $49,920 (b) ($10 × 40 hrs.) × 52 weeks × 2 employees = $400 × 52 × 2 = $41,600 (c) ($12 × 4 hrs.) × 12 months × 3 machines = $ 48 × 12 × 3 = $ 1,728Initial Cash FlowsXeroxCannon Difference Purchase of Cannon machines $ -- $50,000 $50,000Sale of Xerox machines -- -3,000 -3,000 Training and remodeling -- 4,000 4,000 Total $ -- $51,000 $51,000Copyright ©2011 Pearson Education 3EXHIBIT 11-50All numbers are expressed in Mexican pesos.2. 18% Total Sketch of Relevant Cash Flows(inthousands)PresentPVFactor Value 0 1 2 3 4 5Cash operating savings:* .8475 83,902 99,000108,90078,212.718272,904119,790.608667,966 131,769 .5158.4371 63,356 144,946Total366,340Income tax savings fromdepreciation not changedby inflation, see 1 3.1272 105,074 33,600 33,600 33,600 33,600 33,600471,414TotalRequired outlay at time zero 1.0000 (420,000) (420,000)Net present value 51,414*Amounts are computed by multiplying (150,000 × .6) = 90,000 by 1.10, 1.10 2, 1.10 3, etc.Copyright ©2011 Pearson Education 461PV PresentofValue$1.00ofCashFlows Annual Cash FlowsDiscountedat 12% 0 1 2 3 4 5T OTAL P ROJECT A PPROACH:Cannon:Init. cash outflow 1.0000 $ (51,000)Oper. cash flows 3.6048 (165,641) (45,950) (45,950) (45,950) (45,950) (45,950)Total $(216,641)Xerox:Oper. cash flows 3.6048 $(205,647) (57,048) (57,048) (57,048) (57,048) (57,048)Difference in favor ofretaining Xerox $ (10,994)I NCREMENTAL A PPROACH:Initial investment 1.0000 $(51,000)Annual operatingcash savings 3.6048 40,006 11,098 11,098 11,098 11,098 11,098Net present valueof purchase $(10,994)2. The Xerox machines should not be replaced by the Cannon equipment.Net savings = (Present value of expenditures to retain Xerox machines) less (Present value of expenditures toconvert to Cannon machines)= $205,647 - $216,641 = $(10,994)3. a. How flexible is the new machinery? Will it be useful only for the presently intended functions, or can it be easilyadapted for other tasks that may arise over the next 5 years?b. What psychological effects will it have on various interested parties?Copyright ©2011 Pearson Education 46211-71 (60-90 min.)This is a complex problem because it requires comparing three alternatives. It reviews Chapter 6 as well as covering several of the topics of Chapter 11. The following answer uses the total project approach. The total net future cash outflows are shown for each alternative.1. Alternative A: Continue to manufacture the parts with the current tools.Annual cash outlaysVariable cost, $92 × 8,000 $(736,000)Fixed cost, 1/3 × $45 × 8,000 × .6 (72,000)Tax savings, .4 × ($736,000 + $72,000) 323,200After-tax annual cost $(484,800)Present value, 3.6048 × $484,800 $(1,747,607)PV of remaining tax savings on MACRS:11.52% × $2,000,000 × .4 × .8929 82,2905.76% × $2,000,000 × .4 × .7972 36,735Total present value of costs, Alternative A $(1,628,582)Alternative B: Purchase from outside supplierAnnual cash outlaysPurchase cost, $110 × 8,000 $(880,000)Tax savings, $880,000 × .4 352,000After-tax annual cost $(528,000)Copyright ©2011 Pearson Education 463Present value, $528,000 × 3.6048 $(1,903,334)Sale of old equipment:Sales price $ 400,000Book value [(11.52% + 5.76%) × $2,000,000] 345,600Gain $ 54,400Taxes @ 40% (21,760)Total after-tax effect ($400,000 - $21,760) 378,240Total present value of costs, Alternative B $(1,525,094)Copyright ©2011 Pearson Education 464Alternative C: Purchase new toolsInvestment $(1,800,000) Annual cash outlaysVariable cost, $73 × 8,000 $(584,000)Fixed cost (same as A) (72,000)Tax savings, .4 × ($584,000 + $72,000) 262,400After-tax annual cost $(393,600)Present value, $393,600 × 3.6048 (1,418,849)Tax savings on new equipment* 579,217Effect of disposal of new equipmentSales price $ 500,000Book value 0Gain $500,000Taxes @ 40% 200,000Total after-tax effect $ 300,000Present value, $300,000 × .5674 170,220Effect of disposal of old equipment (see Alternative B) 378,240Total present value of costs, Alternative C $(2,091,172)* Using the MACRS schedule for tax depreciation, the depreciation rate for each year of a 3-year asset's life is shown inExhibit 11-6:Depreciation Tax PV PresentYear Rate Savings Factor Value1 33.33% .3333 × $1,800,000 × .40 = $239,976 .8929 $214,2752 44.45% .4445 × 1,800,000 × .40 = 320,040 .7972 255,1363 14.81% .1481 × 1,800,000 × .40 = 106,632 .7118 75,9014 7.41% .0741 × 1,800,000 × .40 = 53,352 .6355 33,905Total present value of tax savings $579,217Using Exhibit 11-7, we get .8044 × $1,800,000 × .4 = $579,168, which differs from $579,217 by a $49 rounding error.The alternative with the lowest present value of cost is Alternative B, purchasing from the outside supplier.Copyright ©2011 Pearson Education 4652. Among the major factors are (1) the range of expected volume (both large increases and decreases in volume make thepurchase of the parts relatively less desirable), (2) the reliability of the outside supplier, (3) possible changes inmaterial, labor, and overhead prices, (4) the possibility that the outside supplier can raise prices before the end of five years, (5) obsolescence of the products and equipment, and (6) alternate uses of available capacity (alternative uses make Alternative B relatively more desirable).Copyright ©2011 Pearson Education 466Copyright ©2011 Pearson Education467CHAPTER 12 Cost Allocation12-30 (10-15 min.) 1. Rate = [$2,500 + ($.05 × 100,000)] ÷ 100,000 = $.075 per copy Cost allocated to City Planning in August = $.075 × 42,000 = $3,150. 2. Fixed cost pool allocated as a lump sum depending on predicted usage:To City Planning: (36,000 ÷ 100,000) × $2,500 = $900 per monthVariable cost pool allocated on the basis of actual usage: $.05 × number of copies Cost allocated to City Planning in August: $900 + ($.05 × 42,000) = $3,000. 3. The second method, the one that allocated fixed- and variable-cost pools separately, is preferable. It better recognizesthe causes of the costs. The fixed cost depends on the size of the photocopy machine, which is based on predicted usage and is independent of actual usage. Variable costs, in contrast are caused by actual usage.Exhibit 12-34Customer Type 1Customer Type 2 Customer Type 3 Sales Gross price profit per margin Gross Gross Gross Product unit per unit Units Revenue profit Units Revenue profit Units Revenue profitA $11.031$ 4.14 200 $ 2,206 $ 828 2,200 $ 24,266 $ 9,108 500 $ 5,515 $ 2,070 B 20.47 4.09 100 2,047 409 1,200 24,564 4,908 3,000 61,410 12,270 C 51.38 10.28 50 2,569 514 400 20,552 4,112 5,000 256,900 51,400D 90.00 39.38 400 36,000 15,752 800 72,000 31,504 400 36,000 15,752Total 750 $42,822 17,5034,600 $141,382 49,632 8,900 $359,825 81,492 Cost to serve 7,36845,193 87,439 Operating income $10,135 $4,439 ($5,947) Customer gross margin percentage 40.9% 35.1% 22.6% Cost to serve percentage 17.2% 32.0% 24.3%Customer operating income percentage 23.7%3.1% (1.7%)1$32,000 ÷ 2,900 units; etc. The rounded numbers from the first two columns are used in subsequent calculations.5. The chart below shows customer profitability for the three customer types and suggested strategies for profit improvement.Grow business with this customer type byfocused sales efforts and quantity discounts.Work with customers to lowerthe cost to serve. Seek internalprocess improvements to lowerthose elements of the cost toserve controllable by thecompany.Copyright ©2011 Pearson Education 46912-35 (15-20 min.)of1. AllocationCostsGallons Weighting Joint$300,000 $180,000×A 9,000 9/15SolventSolvent B 6,000 6/15 × $300,000 120,00015,000 $300,0002. Relative Sales Allocation ofCostsValue at Split-off* Weighting JointSolvent A $270,000 27/54 × $300,000 $150,000Solvent B 270,000 27/54 × $300,000 150,000$540,000 $300,000 * $30 × 9,000 and $45 × 6,00012-42 (25-30 min.)There a several ways to organize an analysis that provides product costs. We like to focus first on determining total activity-cost pools and activity cost per driver unit. Then, an analysis similar to the one shown in Exhibit 12-8 can be used.Schedule a: Activity center cost poolsResources Supporting the Allocated Setup/Maintenance Activity Center Allocation Calculation Cost Assembly supervisors $90,000 × 2% $ 1,800 Assembly machines $247,000 × (400 ÷ 1,900) 52,000 Facilities management $95,000 × (400 ÷ 1,900) 20,000 Power $54,000 × (10 ÷ 90) 6,000Total assigned cost $79,800Cost per driver unit (setup) $79,800 ÷ 40 $ 1,995 Resources Supporting the Allocated Setup/Maintenance Activity Center Allocation Calculation Cost Assembly supervisors $90,000 × 98% $ 88,200 Assembly machines $247,000 × (1,500 ÷ 1,900) 195,000 Facilities management $95,000 × (1,500 ÷ 1,900) 75,000 Power $54,000 × (80 ÷ 90) 48,000Total assigned cost $406,200Cost per driver unit (machine hour) $406,200 ÷ 1,500 $ 270.80Copyright ©2011 Pearson Education 470Exhibit 12-42 Contribution to cover other value-chain costs by productStandardDeluxe Custom Cost per Driver unit Driver Driver Driver Activity/Resource (Schedule a) Units Cost Units Cost Units Cost Setup/Maintenance $1,995 20 $ 39,900 12 $ 23,940 8 $ 15,960 Assembly $270.80 1,000 270,800 400 108,320 100 27,080 Parts 1,003,800 115,080 15,980Direct labor 298,00072,000 68,000 Total $1,612,500$319,340 $127,020 Units 100,000 10,000 1,000 Cost per display $16.125 $31.934 $127.02Selling price 20.00050.000 250.00 Unit gross profit $ 3.875$18.066 $122.98 Total gross profit $387,500$180,660 $122,980The total contribution of these products is $387,500 + $180,660 + $122,980 = $691,140.12-43 (25-30 min.) See solution to problem 12-42.12-55 (100 – 200 min.)1. Exhibits 12-55A and 12-55B show the calculation of customer gross margin percentage and customer cost-to-serve percentage for the 4 customer types. Exhibit 12-55C shows a plot of customer gross margin percentage versus customer cost-to-serve percentage for the 4 customer types.2. Suggested strategies for profit improvement for the 4 customer types follow.•Customer type 1 - Mega stores. These stores have the lowest cost-to-serve.Profitability can be improved by focusing on a better product mix. A quarter ofthe sales (cases) to these stores are from bulk and singles products – both ofwhich have a negative gross margin. A shift in mix towards more regular andfragile product types would improve profitability.•Customer type 2 – Local small stores. These stores have a product mix that contains a substantial amount (32%) of the negative gross margin products. Thesame change in sales focus that applies to mega stores can be applied to localsmall stores.But unlike mega stores, small stores are very costly to serve. From Exhibit 12-55 B, the largest single cost to serve local small stores is truck deliveries. Theaverage number of cases per order (the same as per truck delivery) is 6,000,000 ÷ 80,000 = 75. Compare this to mega stores that average 7,680,000 ÷ 32,000 = 240 cases per order (delivery). This is a significant factor causing the high cost-to-serve.For example, suppose that the average order size could be increased from 75,000 to 150,000 cases. If the total annual cases sold is unchanged (6,000,000), a totalof 40 orders, a 50% reduction, would be made. An estimate of the cost savingsand the impact on the cost-to-serve percentage can be made as follows:Cost per Driver Unit Reduction in Driver Cost Savings(Exhibit 12-55B) Units of 50% (000) Truck delivery $167.55 34,000 $5,696.70 Order processing 27.49 40,000 1,099.60 Regular scheduling 5.83 36,000 209.88 Expedited scheduling 19.44 4,000 77.76 Total cost savings (000) $7,083.94 Cost savings as a percent of revenue 24.9%New cost-to-serve as a percent of revenue 60.1%In addition to the above savings, other activities would also be impacted by thereduction in orders such as customer service. So while the total impact ofCopyright ©2011 Pearson Education 472focusing on increasing order size can only be estimated, it is reasonable to expect dramatic cost savings from the current 85% of revenue.Other factors that should be investigated include the high level of corporatesupport and customer service.•Customer type 3 – Local large stores. Local large stores generate $68,400 ÷ $136,230 = 50% of DSI’s total revenue and with a net margin of 58% - 47% = 11%. The key to local large store profitability is sales of a large percentage (80%) of regular product. The cost-to-serve percentage is 47%. This could be reduced as for customer type 2 by increasing the order size from the current level of14,400,000 ÷ 120,000 = 120 cases per order. But a dramatic improvementshould not be expected. In general, local large stores are sustaining DSI’sbusiness and their loyalty should be cultivated.•Customer type 4 – Specialty stores. Specialty stores have a low gross margin of 22% coupled with a very large cost-to-serve percent of 106%! Although thesestores do not account for a significant portion of DSI’s revenue the companyshould rationalize their business. Several actions could be suggested. One is to charge a premium for all high-security products. The vast majority of theseproducts are sold to specialty stores with only marginal sales to mega and local small stores. Another action is to adopt a customer loyalty program based onvolume of sales. The list price of $7.25 per case would apply to customers with sales volumes less than a specified level. Most of DSI’s customers would qualify for discounts (similar to those currently existing) so prices would not besignificantly different. For specialty stores, prices would increase dramatically.This may result in losing specialty-store business so DSI needs to decide is this isa direction they wish to consider.Copyright ©2011 Pearson Education 473Exhibit 12-55A (Units and dollars are in thousands.)C u s t o m e r T y p eProductRegular Short Fragile Bulk HighSecurity Singles Total Gross Profit PercentageProduct mix percentage 60% 5% 5% 20% 5% 5% 100% Cases sold 4,608 384 384 1,536 384 3847,680Total Revenue$ 21,888 $ 1,824$ 1,824$7,296$ 1,824 $ 1,824 $36,480Gross Profit per Case $ 3.28 $ 1.58 $ 2.74 $(1.44)$ 0.54 $ (5.30)1Total Gross Profit$ 15,114 $ 607 $ 1,052 $(2,212)$ 207 $(2,035)$12,733 35%Product mix percentage 50% 5% 5% 30% 8% 2% 100% Cases sold3,000 300 300 1,800 480 120 6,000 Total Revenue @ 4.75/case $ 14,250 $ 1,425 $ 1,425 $ 8,550 $ 2,280 $ 570 $28,500 Gross Profit per Case $ 3.28 $ 1.58 $ 2.74 $ (1.44) $ 0.54 $ (5.30)2Total Gross Profit$ 9,840 $ 474 $ 822 $(2,592) $ 259 $ (636)$ 8,167 29%Product mix percentage 80% 0% 10% 10% 0% 0% 100%Cases sold 11,520 -1,4401,440--14,400Total Revenue @ 4.75/case $ 54,720 $ - $ 6,840 $ 6,840 $ - $ - $68,400Gross Profit per Case $ 3.28 $ 1.58 $ 2.74 $ (1.44) $ 0.54 $ (5.30)3Total Gross Profit$ 37,786 $ - $ 3,946 $(2,074) $ - $ - $39,658 58%Product mix percentage 10% 20% 0% 0% 70% 0% 100% Cases sold 60 120 - - 420-600Total Revenue @ 4.75/case $ 285 $ 570 $ - $ - $ 1,995 $ - $ 2,850 Gross Profit per Case $ 3.28 $ 1.58 $ 2.74 $ (1.44)$ 0.54 $ (5.30)4Total Gross Profit $ 197$ 190$ -$ -$ 227$ - $ 61322%Exhibit 12-55B (Units and dollars are in thousands.)ActivityO r d e r P r o c e s s i n gC u s t o m e r S e r v i c eO r d e r C h a n g e sC o r p o r a t e S u p p o r tR e g u l a r S c h e d u l i n gE x p e d i t e d S c h e d u l i n gS h i p p i n gT r u c k D e l i v e r yP a r c e l D e l i v e r y Cost DriverO r d e r sL a b o r H o u r sN u m b e r o f C h a n g e sL a b o r H o u r sO r d e r sO r d e r sP a l l e t sD e l i v e r i e sD e l i v e r i e sC u s t o m e r T y p eCost/DriverUnit $27.49 $43.34$32.63$51.66$5.83 $19.44 $6.60 $167.55 $23.89Total Driver Units3218.73.2 - 29 3 41625.6 1.6 Cost to Serve $879.68 $810.46$104.42-$169.07$58.32$2,745.6$4,289.28$38.22$9,095.05Revenue (See Exhibit 12-55A) $36,480.001 Cost-to-Serve Percentage24.9%Driver Units 80 100 8 20 72 8 640 68 8Cost to Serve $2,199.2 $4,334$261.04$1,033.2 $419.76$155.52$4,224$11,393.4$191.12$24,211.24Revenue (See Exhibit 12-55A) $28,500.02Cost-to-Serve Percentage85.0%Exhibit 12-55B (continued)ActivityO r d e r P r o c e s s i n gC u s t o m e r S e r v i c eO r d e r C h a n g e sC o r p o r a t e S u p p o r tR e g u l a r S c h e d u l i n gE x p e d i t e d S c h e d u l i n gS h i p p i n gT r u c k D e l i v e r y P a r c e l D e l i v e r y Cost DriverO r d e r sL a b o r H o u r sN u m b e r o f C h a n g e sL a b o r H o u r sO r d e r sO r d e r sP a l l e t sD e l i v e r i e sD e l i v e r i e sC u s t o m e r T y p eCost/DriverUnit $27.49 $43.34$32.63$51.66$5.83 $19.44 $6.60 $167.55 $23.89TotalDriver Units 120 70 2.4 80 108 12 840 90 6Cost to Serve$3,298.8 $3,033.8 $78.31$4,132.8 $629.64 $233.28 $5,544$15,079.5$143.34$32,173.47Revenue (See Exhibit 12-55A) $68,400.03 Cost-to-Serve Percentage47.0%Driver Units 12 30 1.2 0 10 2 60 4.8 2.4Cost to Serve $329.88$1,300.2 $39.16- $58.3 $38.88 $396 $804.24 $57.34$3,023.99Revenue (See Exhibit 12-55A) $2,850.004 Cost-to-Serve Percentage106.1%CUSTOMER PROFITABILITYCT3, 47%, 58%0%10%20%30%40%50%60%70%80%90%100%0%10%20%30%40%50%60%70%80%90%100%110%120%COST-TO-SERVE PERCENTAGEG R O S S P R O F I T P E R C E N T A G EExhibit 12-55CCopyright ©2011 Pearson Education 478。

管理会计第15版英文版答案021、He _______ getting up early. [单选题] *A. used toB. is used to(正确答案)C. is usedD. is used for2、85.You’d better? ? ? ? ? a taxi, or you’ll be late. [单选题] *A.take(正确答案)B.takingC.tookD.to take3、John is quite _______. He likes to attend activities in?his spare time. [单选题] *A. active(正确答案)B. quietC. lazyD. honest4、--Henry treats his secretary badly.--Yes. He seems to think that she is the _______ important person in the office. [单选题] *A. littleB. least(正确答案)C. lessD. most5、The flowers _______ sweet. [单选题] *A. tasteB. smell(正确答案)C. soundD. feel6、The market economy is quickly changing people’s idea on_____is accepted. [单选题] *A.what(正确答案)B.whichC.howD.that7、Jeanne's necklace was _____ 500 francs at most. [单选题] *A. worthyB. costC. worth(正确答案)D. valuable8、Just use this room for the time being ,and we’ll offer you a larger one _______it becomes available [单选题] *A. as soon as(正确答案)B unless .C as far asD until9、78.According to a report on Daily Mail, it’s on Wednesday()people start feeling really unhappy. [单选题] *A. whenB. whichC. whatD. that(正确答案)10、I’d like to know the _______ of the club. [单选题] *A. schedule(正确答案)B. schoolC. menuD. subject11、( ) What _____ fine weather we have these days! [单选题] *A. aB. theC. /(正确答案)D. an12、The scenery is so beautiful. Let’s _______. [单选题] *A. take photos(正确答案)B. take mapsC. take busD. take exams13、He can’t meet his friends tonight because he _______ do homework. [单选题] *A. has to(正确答案)B. needC. have toD. don’t have to14、While my mother _______ the supper, my father came back. [单选题] *A. cooksB. is cookingC. was cooking(正确答案)D. has cooked15、46.The pants look cool.You can ________. [单选题] *A.try it onB.try on itC.try them on(正确答案)D.try on them16、Its’time to go to bed. _______ your computer, please. [单选题] *A. Turn onB. Turn inC. Turn off(正确答案)D. Turn down17、He prefers to use the word “strange”to describe the way()she walks. [单选题] *A. in which(正确答案)B. by whichC. in thatD. by that18、He is a student of _______. [单选题] *A. Class SecondB. the Class TwoC. Class Two(正确答案)D. Second Two19、( ) It ___ the Chinese people 8 years to build the Dam. [单选题] *A. took(正确答案)B. costsC. paidD. spends20、My father and I often go ______ on weekends so I can ______ very well. ()[单选题] *A. swim; swimmingB. swims; swimC. swimming; swimmingD. swimming; swim(正确答案)21、75.As a student in Senior Three, I must work hard.(), I should take exercise to strengthen my body.[单选题] *A.OtherwiseB.Meanwhile(正确答案)C.ThereforeD.Thus22、The huntsman caught only a()of the deer before it ran into the woods. [单选题] *A. gazeB. glareC. glimpse(正确答案)D. stare23、--Don’t _______ too late, or you will feel tired in class.--I won’t, Mum. [单选题] *A. call upB. wake upC. stay up(正确答案)D. get up24、5 He wants to answer the ________ because it is an interesting one. [单选题] * A.problemB.question(正确答案)C.doorD.plan25、A brown bear escaped from the zoo, which was a()to everyone in the town. [单选题] *A. HarmB. violenceC. hurtD. threat(正确答案)26、He went to America last Friday. Alice came to the airport to _______ him _______. [单选题] *A. take; offB. see; off(正确答案)C. send; upD. put; away27、This kind of work _______ skills and speed. [单选题] *A. looks forB. waits forC. calls for(正确答案)D. cares for28、A survey of the opinions of students()that they admit several hours of sitting in front of the computer harmful to health. [单选题] *A. show;areB. shows ;is(正确答案)C.show;isD.shows ;are29、My English teacher has given us some _______ on how to study English well. [单选题] *A. storiesB. suggestions(正确答案)C. messagesD. practice30、I used to take ____ long way to take the bus that went by ____ tunnel under the water. [单选题] *A. a, aB. a. theC. a, /(正确答案)D. the, a。

![亨格瑞成本与管理会计(中英第15版)中文PPT (11)[39页]](https://uimg.taocdn.com/6577b6349b89680202d825c7.webp)

亨格瑞管理会计英文第15版答案11CHAPTERllCapitalBudgetin ; 1. ; Thepresentvalueis$480,00(a)$480,000=annualpaymen ; annualpayment=$480,0004- 1 annualpaymcnt=$480,000 4- 9 ; annualpayment=$480,000 4- 8 armualpaymcnt 二$480, 0004-8; anCHAPTER 11 Capital Budgeting1.The present value is $480, 000 and the annual payments are an annuity, requiring use of Table 2:(a)$480,000 = annual payment X 11.2578 annual payment 二 $480, 000 4- 11. 2578 二 $42, 637 (b) $480, 000 二 annual payment X 9.4269annual payment = $480, 000payment X 8.0552 annual payment二 $480,000payment X 8.5595 annual payment= $480, 000 payment X 7.6061 annual payment = $480, 000payment X 6.8109 annual payment= $480, 000 4- 6.8109 =$70,475 (a) Total payments=30 X $50,918 = $1,527,540Total interest paid= $1, 527, 540- $480, 000 = $1, 047, 540 2.3.(b) Total payments 二 15 X $63, 107= $946, 605 Total interest paid 二$946, 605 一 $480, 000 = $466, 6059. 4269 = $50,918 (c) $480, 000 = annual8. 0552 二$59, 589 (a)$480, 000 = annual 8. 5595 二 $56, 078 (b) $480, 000 = annual 7. 6061 = $63, 107 (c) $480, 000 二 annualmin.) Buy. The net present value is positive.Initial outlay *Present value of cash operating savings, from12-year, 12% column of Table 2, 6. 1944 X $5, 000 Net present value$ (21,000) * The trade-in allowance really consists of a $5,000 adjustme nt of the sei ling price and a bona fide $10,000 cash al Iowa neo for the old equipment ・ The relevant amo unt is the incremental cash outlay, $21,000. The book value is irrelevant・ min.)Copyright ?2011 Pearson Education11.NPV @ 10% = 10, 000 X 3. 7908 = $37, 908 - $36, 048 = $1, 860 NPV @ 12% =10, 000 X 3. 6048 = $36, 048 - $36, 048 = $0NPV @ 14% = 10, 000 X 3.4331 = $34, 331 - $36, 048 = $(1,717)The IRR is the interest rate at which NPV 二$0; therefore, from requirement 1 we know that IRR 二12%・The NPV at the company? s cost of capital, 10%, is positive, so the project should be accepted・The TRR (12%) is greater than the company' s cost of capital (10%), so the project should be accepted・ Note that the IRR and NPV models give the same decision.2.3.4.min.)Payback period is $36, 000 $10, 000 = 3.6 years・ It is not a good measure of profitabi1ity because it ignores returns beyond the payback period and it does not account for the time value of money.NPV = $5, 114. Accept the proposal because NPV is positive・ Computation: NPV 二($10, 000 X 4. 1114) - $36,000 =$41, 114 一$36, 000 = $ 5, 114 2.3. ARR 二(Increase in average cash f 1 ow - Increase in depreciation)4- Initial investmenl二($10, 000 - $6, 000) 一$36, 000 二11. 1%min.)Salaries $49, 920 (a) $41, 600(b) $ 8,320 Overtime 1, 728(c) — 1,728 Repairs and maintenanee 1,800 1,050 750Toner, supplies, etc. Total annual cash outflows(a) ($ 8 X 40 hrs.) X 52 weeks X 3 employees 二$320 X 52 X 3 =$49,920 (b) ($10 X 40 hrs.) X 52 weeks X 2 employees = $400 X 52 X 2 二$41, 600 (c) ($12 X 4 hrs.) X 12 months X 3 machines =$ 48 X 12 X 3 = $ 1,728Purchase of Cannon machines $ -- $50,000 $50,000Copyright ?2011 Pearson Education2 1.Sale of Xerox machines Training and remodeling Total 一一-3,000-3,000 Copyright ?2011 Pearson Education 3All numbers are expressed in Mexican pesos・ 2. 18% Total Sketch ofRelevant Cash Flows (in thousands) Cash operating savings:* ・847583,902 99,000 10& 900 119, 790 131,769 .4371 144,946 Income tax savings fromdepreciation not changed by inflation, see 1 3.1272 33,600 33, 600 33, 60033,600 33,600 Required outlay at time zero 1.0000 Net present value^Amounts are computed by multiplying (150,000 X .6) = 90, 000 by 1. 10, 1. 102, 1. 10 3, etc.Copyright ?2011 Pearson Education 461PV Present of $1.00 Value ofTOTAL PROJECT APPROACH: Cannon:Init. cash outflow 1.0000 $ (51,000) Oper. cash flows (45,950) (45, 950) (45,950) (45, 950) (45, 950) Total $(216, 641)Xerox:Oper. cash flows 3. 6048 (57, 048) (57, 048) (57, 048) (57, 048) (57, 048)Differenee in favor of retaining XeroxINCREMENTAL APPROACH: Initial investment 1.0000 $(51,000) Annual operatingcash savings 3. 6048 11, 098 11, 098 11, 098 11, 098 11, 098 Net present valueof purchase 2. The Xerox machines should not be replaced by the Cannonequipment. Net savings = (Present value of expenditures to retain Xeroxmachines) 1 ess (Present value of expenditures toconvert to Cannon machines)二$205, 647 - $216,641 二$ (10, 994) 3. a. How flexible is the new machinery? Will it be useful only for the presently intended functions, or can it beeasilyadapted for other tasks that may arise over the next 5 years?b. What psychological effects will it have on various interested parties? Copyright ?2011 Pearson Education。