A History of Scandinavian Socially Responsible Investing

- 格式:pdf

- 大小:167.61 KB

- 文档页数:16

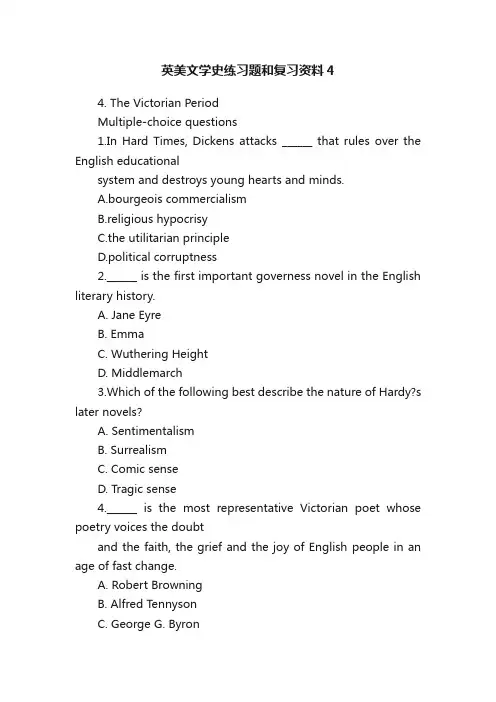

英美文学史练习题和复习资料44. The Victorian PeriodMultiple-choice questions1.In Hard Times, Dickens attacks ______ that rules over the English educationalsystem and destroys young hearts and minds.A.bourgeois commercialismB.religious hypocrisyC.the utilitarian principleD.political corruptness2.______ is the first important governess novel in the English literary history.A. Jane EyreB. EmmaC. Wuthering HeightD. Middlemarch3.Which of the following best describe the nature of Hardy?s later novels?A. SentimentalismB. SurrealismC. Comic senseD. Tragic sense4.______ is the most representative Victorian poet whose poetry voices the doubtand the faith, the grief and the joy of English people in an age of fast change.A. Robert BrowningB. Alfred TennysonC. George G. ByronD. Thomas Hardy5.Which of the following statements is not a typical feature of Charles Dickens?A.He sets out a large-scale criticism of the inhuman social institutions and thedecaying social morality.B.His works are characterized by a mingling of humor and pathos.C.The characters portrayed by Dickens are often larger than life.D.He shows a human being not at moments of crisis, but in the most trivialincidents of everyday life.6.“As for society, he was carried every other day into the hall where the boys dined,and there socially flogged as a public warning and example.”What figure of speech is used in the above sentence?A. SimileB. MetaphorC. IronyD. Overstatement7.“I will drink/ life to the lees.” In the quoted line Ulysses is saying that he ______till the end of his life.A.will keep travelling and exploringB.will go on drinking and being happyC.would like to toast to his glorious lifeD.would like t drink the cup of wine8.“She smiled, no doubt,/ Whene?er I passed her…/ … This grew; I gave commands;/ Then all smiles stopped together.” The quoted lines imply that she ______.A.obeyed his order and stopped smiling at everyday, including the duke.B.obeyed his order and stopped smiling at anybody except the duke.C.Refused to obey the order and never smiled againD.was murdered at the order of duke9. A contemporary of Alfred Tennyson, ______ is acknowledged by many as themost original and experimental poet of the time.A. Thomas CarlyleB. Thomas B. MacaulayC. Robert BrowningD. T. S. Eliot10.Most of Hardy?s novels are set in ______, the fictional primitive and crude ruralregion that is really the home place he both loves and hates.A. YorkshireB. WessexC. LondonD. Manchester11.“The floating pollen seemed to be his notes made visible, and the dampness of thegarden the weeping of the garden?s sensibility.” The quoted sentence is suggestive of ______.A.the richness of the music in the gardenB.the beauty of the scenery in the gardenC.the great power of the music in affecting the environmentD.the harmony and oneness of the music, the garden and theheroine Tess.12.In the statement “---Oh, God! Would you like to live with your soul in thegra ve?” the term “soul” apparently refers to ______.A. Heathcliff himselfB. CatherineC. one?s spiritual lifeD. one?s ghost13.“I have talked, face to face, with what I reverence; with what I delight in --- withan original, a vigorous, an expanded mind.” Here in the quoted passage, Jane isreally saying that she has talked face to face with ______.A.God who appears in her dreamsB.The reverent priestC.Mr. RochesterD.Miss Ingram14.In the clause “As Mr. Gamfield did happen to labor under the slight imputation ofhaving bruised three or four boys to death already…” , the word “slight” is used as a(n) ______.A. simileB. metaphorC. ironyD. overstatement15.Dickens takes the French Revolution as the background of the novel ______.A. Great ExpectationsB. A Tale of Two CitiesC. Bleak HouseD. Oliver Twist16.The Victorian Age was largely an age of _____, eminently represented by Dickensand Thackeray.A. poetryB. dramaC. proseD. epic prose17.The title of Alfred Tennyson?s poem “Ulysses”reminds the reader of thefollowing except ______.A. the Trojan WarB. HomerC. questD. Chirst18.The character Rochester in Jane Eyre can be well termed as a ______.A. conventional heroB. Byronic heroC. chivalrous aristocratD. Homeric hero19.Mr. Micawber in David Copperfield and Sam Well in Pickwick Pape r are perhapsthe best ______ characters created by Charles Dickens.A. comicalB. tragicC. roundD. sophisticated20.The typical feature of Robert Browning?s poetry is the ______.A. bitter satireB. larger-than-life caricatureC. Latinized dictionD. dramatic monologue21.In Tess of the D’Urbervilles, Thomas Hardy resolutely makes a seduced girl hisheroine, which clearly demonstrates the author?s ______ of the Victorian moral standards.A. blind fondnessB. total acceptanceC. deep understandingD. mounting defiance22.In Hardy?s Tess of the D’urberville s, the heroine?s tragic ending is due to ______.A. her weak characterB. her ambitionC. Angel Clare?s selfishnessD. a hostile society23.“The dehumanizing workhouse system and the dark, criminal underworld life” arethe right words to sum up the main theme of _____.A. David CopperfieldB. A Tale of Two CitiesC. Oliver TwistD. Bleak House24.“For a week after the commission of the impious and profane offence of askingfor more, Oliver remained a close prisoner in the dark and solitary room to which he had been consigned by the wisdom and mercy of the board.”In the above passage quoted from Oliver Twist, Dickens uses the words “wisdom”and “mercy” ______.A. ironicall yB. carelesslyC. nonchalantlyD. impartially25.“…and then how they met I hardly saw, but Catherine made a spring, and hecaught her, and they were locked in an embrace…” In the quoted passage, Emily Bronte tells the story in ______ point of view.A. first personB. second personC. third person limitedD. third person omniscientBlank filling1.Dickens?best-depicted characters are those innocent, virtuous, helpless_child__characters, those horrible and grotesque characters and those broadly humorous or __comical___ ones.2.Charlotte Bronte?s works are famous for the depiction of the life of themiddle-class working women, particularly __governess____.3.Wuthering Heights is the ___only___ novel written by Emily Bronte.4. A contemporary of Alfred Tennyson, __Robert Browning__ is acknowledged bymany as the most original and experimental poet of the time.5.__In Memorian____, Tennyson?s greatest work, ispresumably an elegy on thedeath of a dear friend.6.In her study of human life, George Eliot paid particular attention to therelationship between the individual personality and the social environment_. 7.Thomas Hardy is often regarded as a __transitional___ writer, in whose works wesee the influence from both the past and the present, both the traditional and the modern.8.The major novelists of the Victorian period made bitter and strong criticism_ ofthe inhuman social institutions and the decaying social morality.9.The Victorian Age in English literature was largely an age of prose, especially othe __novel____.10.The typical feature of Robert Browning?s poetry is the __dramatic monologue_.Reading comprehension(for each of the quotations listed below please give the name of the author and the title of the literary work from which it is taken and then briefly interpret it.)1.“Let it not be supposed by the enemies of …the system?, that during the period ofhis solitary incarceration, Oliver was denied the benefit of exercise, the pleasure of society, or the advantages of religious consolat ion.”Reference:The sentence is taken from Charles Dicken s? early novel, Oliver Twist. It is a typical example of irony. The word “benefit”, “pleasure”, and “advantage” actually mean theopposite. For the “benefit” of exercise, Oliver was whipped every mo rning in a stone yard; for the “pleasure” of society, he was carried every other day into the dinning hall and flogged as a public warning and example to the boys; and as for the “advantages” of religious consolation, he was kicked into the same apartment every evening at prayer time and listen to the boy?s prayer to be guarded against his sins and vices. The ironic statement is, in fact, a bitter denunciation and fierce attack at the brutal, inhuman treatment of the poor orphan by the workhouse authority.2.“Do you think, because I am poor, obscure, plain and little,I am soulless andheartless? --- You think wrong!--- I have as much soul as you--- and full as muchheart…I am not talking to you now through the medium of custom, conventionalities, or even of mortal flesh;---it is my spirit that addresses your spirit; just as if both had passed through the grave, and we stood at God?s feet, equal--- as we are!”Reference: The statement is taken from Charlotte Bronte?s masterpiece Jane Eyre. In this famous declaration, Jane proves herself a new, unconventional woman, a woman who believes in the basic human rights, in the independence and equality of people of all social classes. She is courageous enough to defy the social conventions that discriminate against the poor and the unfortunate and deprive them of their right to equality. It is not just a personal protest and declaration a governess makes to her master, but a declaration made on behalf of all the unfortunate middle-class working women, and of all the poor people in the world.3.“He flung himself into the nearest seat, and on myapproaching hurriedly toascertain if she had fainted, he gnashed at me, and foamed like a mad dog, and gathered her to him with greedy jealousy. I did not feel as if I were in the company of a cr eature of my own species…”Reference: The sentences are taken from Emily Bronte?s Wuthering Heights. It is a description of the mad, desperate love between Catherine and Heathcliff in her death scene. Heathcliff, seeing his love on the verge of death, was heart-broken. Though they two tortured each other with many a false charge, they were eager to cling to each other at this last moment. Heathcliff, in his eagerness to have her all to himself, now behaved like an animal greedily and jealously guarding his dear one or treasured prey. The terms “gnashed” and “foamed”, simple action words, vividly presents the image of a man desperate in his desire to take possession of his beloved and in his anxiety that someone would come and take her away from him.4.“Tho?/ We are not now that strength which in old days/ Moved earth and heaven;that which we are, we are;/ One equal temper of heroic hearts,/ Made weak by time and fate, but strong in will/ To strive, to speak, to find, and not to yield.”Ref erence: These lines are taken from Alfred Tennyson?s “Ulysses”. In this poem, the old Ulysses is trying to persuade his old followers into setting upon further adventurewith him again. in these lines, he argues that great strength they used to have in their past glorious days, they still have the same strong will and the same heroic spirit to go on struggling and seeking new knowledge until the end of their life. his undying heroic spirit is admirable, indeed.5.“I repeat,/ The Count your master?s known mu nificence/ Is ample warrant that nojust pretense/ Of mine for dowry will be disallowed; / Though his fair daughter?s self, as I avowed/ As starting, is my object.”Reference: These lines are taken from Robert Browning?s “My Last Duchess”. The main idea is that even though, as I said at the very beginning, my real interest in the marriage is his beautiful daughter (it should be his niece) herself, my claim of the money and property that must come with the bride can?t be refused by your master, the Count, because he is such a rich man. The statement reveals the Duke?s unashamed greediness for wealth. From his word, the reader can easily come to the conclusion that his real purpose of the second marriage is not for love, but for money. The marriage is conditioned by his demand for profit. The sacred marriage between people has been commercialized by him.。

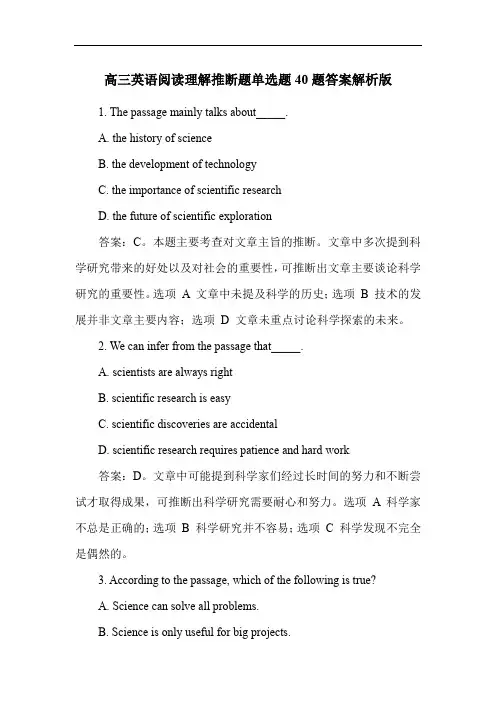

高三英语阅读理解推断题单选题40题答案解析版1. The passage mainly talks about_____.A. the history of scienceB. the development of technologyC. the importance of scientific researchD. the future of scientific exploration答案:C。

本题主要考查对文章主旨的推断。

文章中多次提到科学研究带来的好处以及对社会的重要性,可推断出文章主要谈论科学研究的重要性。

选项A 文章中未提及科学的历史;选项B 技术的发展并非文章主要内容;选项D 文章未重点讨论科学探索的未来。

2. We can infer from the passage that_____.A. scientists are always rightB. scientific research is easyC. scientific discoveries are accidentalD. scientific research requires patience and hard work答案:D。

文章中可能提到科学家们经过长时间的努力和不断尝试才取得成果,可推断出科学研究需要耐心和努力。

选项 A 科学家不总是正确的;选项B 科学研究并不容易;选项C 科学发现不完全是偶然的。

3. According to the passage, which of the following is true?A. Science can solve all problems.B. Science is only useful for big projects.C. Science has both positive and negative effects.D. Science is not important for daily life.答案:C。

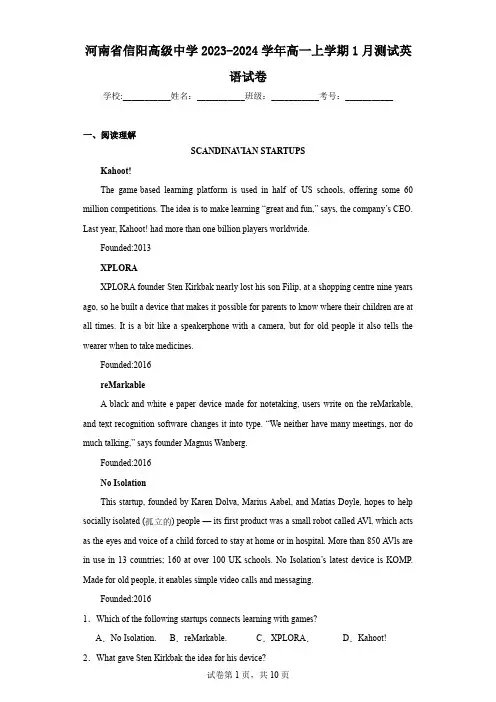

河南省信阳高级中学2023-2024学年高一上学期1月测试英语试卷学校:___________姓名:___________班级:___________考号:___________一、阅读理解SCANDINA VIAN STARTUPSKahoot!The game-based learning platform is used in half of US schools, offering some 60 million competitions. The idea is to make learning “great and fun,” says, the company’s CEO. Last year, Kahoot! had more than one billion players worldwide.Founded:2013XPLORAXPLORA founder Sten Kirkbak nearly lost his son Filip, at a shopping centre nine years ago, so he built a device that makes it possible for parents to know where their children are at all times. It is a bit like a speakerphone with a camera, but for old people it also tells the wearer when to take medicines.Founded:2016reMarkableA black-and-white e-paper device made for notetaking, users write on the reMarkable, and text recognition software changes it into type. “We neither have many meetings, nor do much talking,” says founder Magnus Wanberg.Founded:2016No IsolationThis startup, founded by Karen Dolva, Marius Aabel, and Matias Doyle, hopes to help socially isolated (孤立的) people — its first product was a small robot called A Vl, which acts as the eyes and voice of a child forced to stay at home or in hospital. More than 850 A Vls are in use in 13 countries; 160 at over 100 UK schools. No Isolation’s latest device is KOMP. Made for old people, it enables simple video calls and messaging.Founded:20161.Which of the following startups connects learning with games?A.No Isolation.B.reMarkable.C.XPLORA.D.Kahoot! 2.What gave Sten Kirkbak the idea for his device?A.The experience of nearly losing his son.B.The growing number of lonely kids.C.The need to keep the old safe.D.The special needs of the old.3.What can we know about No Isolation?A.It was founded earlier than the other three.B.It was started by more than one person.C.It provides services for teens only.D.It is mainly used in the UK.Prom(高中毕业舞会)is a day you’ll never forget. It’s one of the most important events of your senior year, one you certainly don’t want to miss.About a month before prom, I started my countdown(倒计时). It took me about a week to find my dress. I bought it secondhand, but it was the most beautiful dress I’d ever seen-not too fancy, just the look I wanted. My shoes were bought from Wal-Mart. It might not seem the best place for shoes, but they were so comfortable that I couldn’t wait to dance all night long in them. My cousin Melissa did my hair and make-up. I received so many compliments(恭维)at prom about my hair and make-up and I felt grateful to her.I had much fun with a group of friends. We danced for four hours and I felt as if my feet were going to fall off. After that came the dessert buffet(自助餐). There were four to five tables filled with sweets. I only had a piece of chocolate cheesecake and this little cup of strawberry dessert, but both were to die for.By the time the casino(老虎机)and magician arrived, everyone was super tired. I wanted to sleep, but I went out into the hall with friends and took pictures. At around 6:30 am, we headed into the breakfast hall for breakfast and goodbyes. Although it wasn’t the last time we would be seeing each other, it felt as if we were leaving behind so much.Prom is going to be one of the best times in your life. Don’t think of it as a dance. Think of it as a life-changing moment. I know it was for me.4.Paragraph 2 is mainly about the author’s_______.A.plans for the prom B.decision to attend the promC.regrets at the prom D.preparations for the prom5.At the prom, the author did all except______.A.dancing B.sleeping C.taking photos D.eating sweets 6.What does the author think of the prom?A.It is a good chance to danceB.It is an occasion to say goodbyeC.It is a life-changing event with funD.It is the most important to senior students7.What’s the best title for this text?A.Going to prom B.Senior promsC.Best time in your life D.Last moment of senior yearTurning 18 is a big deal when you are a teenager. It means you are responsible for yourself and don’t need your parents’ permission any more. However, there are lots of opinions about when one becomes an adult. Some are based on science, while others are personal opinions. While currently the age is 18, science supports 25 as a more sensible age for adulthood, and I agree.While studying the brain of teenagers, scientists have learned that when kids are around l8, their prefrontal cortex (前额皮层) is only halfway developed. The prefrontal-cortex helps people set and achieve goals by receiving signals from different regions of the brain to process information and adapting accordingly. That halfway development means that you still have things to learn and your brains still have time to develop until the age of 25.Some people think going off to college and living on your own qualify (使……具有资格) san adult, while others may believe having a steady income and being able to afford to live on your own are what make you an adult. Not everyone has a fortunate life where they have family that can provide support; there are situations where you are forced to become an “adult” whether you like it or not.In the foster care (寄养) system, once a child turns 18, he or she is considered an adult and can no longer receive state-sponsored support. These children are forced into a life where they have no family or anyone to support them other than those who were there for them in the system.Having a quality job will allow you to supply yourself with necessary things to live and help you become a more mature and responsible person. Also, going through difficult times and realizing life isn’t as easy as it seems, should qualify someone as an adult.8.What is the author’s attitude toward considering 25 as an age for adulthood?A.Cautious.B.Uncaring.C.Doubtful.D.Positive. 9.How does the prefrontal cortex work to help people set and achieve goals?A.By dealing with received signals and responding accordingly.B.By collecting information from other parts of the body.C.By sending instructions to different regions of the brainD.By transporting sensed emotions and making records10.What does the author intend to do in paragraph 3?A.Give a definition of adulthood.B.Stress the importance of family support.C.Prove not everyone lives a fortunate life.D.Show opinion on becoming an adult is divided11.What is one standard qualifying you as an adult according to the author?A.Setting up a family.B.Being responsible for your study.C.Accepting and learning from the low moments in life.D.Buying yourself quality things to live.Take your dog for a meal. At more restaurants including some of the most fashionable ones, dining with animals is now part of the evening’s menu.When locals in Key West, go out to dinner, a popular place is an open-air restaurant. On entering the restaurant, they’ll likely see a cat next to a sign that says “Pet the Cat, $1.”For the owners of the restaurant, serving human guests alongside their pets is a no-brainer. Since they opened the restaurant, they’ve had a friendly rule towards pets, the one that allows pets into the restaurant in a given week.Americans more and more depend on restaurants (they eat 4.2 meals out each week), it’s only natural that the family pet is finally getting into the act. Enter “pet-friendly restaurants” into an Internet search engine and many restaurants come out.Why do restaurants court pets? “Dogs never send their food back,” jokes one owner.The trend(趋势) doesn’t only belong to common places. Many high-rank restaurants also have followed the trend. And there are some cooks making a special effort to treat those with four legs. Lorie Ann, co-owner and cook at a restaurant named Fish Wagon in Calif., specializing in German and French food, serves a free home-made “doggie burger” and a few doggie “cookies” to non-human guests.Even as more restaurants seek to draw pet owners, they are still the exception. Mostlocal health rules make it clear that pets should be prevented from restaurants and suggest that they be kept out of open-air areas. Still, many officials don’t pay attention to the rules and allow pets to sit outside with their owners.To make pet owners convenient within the rules, some restaurants allow pets to sit with their owners only when the animals are “parked” just outside the designated (指定的) dining area .12.Why does it become part of the evening’s menu to take pets for a meal naturally in America?A.Many restaurants aim to please non-human guests.B.People have meals out more often than ever before.C.Pet owners want to give their pets better things to eat.D.More and more restaurants have friendly rules for pets.A.Try to clean.B.Try to stop.C.Try to please.D.Try to introduce. 14.What can be inferred from the last two paragraphs?A.Restaurants please owners in order to bring more dogs.B.Restaurants give more special service to pets than humans.C.Health rules don’t have any influence on dining out with pets.D.Restaurants try to balance between the rules and guests’ need.15.Which would be the best title for the passage?A.Pet Meals B.Petting Cats in RestaurantsC.Pet Owners D.Dining out with Your PetsIn the long history of about 5,000 years, numerous Chinese traditional festivals were celebrated in memory of gods or some significant days, some of which are passed down from generation to generation and people always practice special traditional activities in each festival.Qingming FestivalQingming Festival is on the 15th day after Spring Equinox, round April 4 or April 5 every year. 16 They remove the weeds growing on the ancestors’ tombs to make them clean, so this festival is also called Tomb-sweeping Festival. In some areas, people are forbidden to use fire to cook food, so they only eat cool food.Double Ninth Festival17 The Chinese character of September is the same as 9, so we get this special name. Chinese people, especially the north Chinese, climb the mountains to the peak to enjoy the wonderful scenery, and admire the beauty of chrysanthemum.Winter Solstice(冬至)Winter Solstice is on around December 22 or 23 of solar calendar each year. From Winter Solstice on, the daytime will be longer and longer. 18 In the northern region, people eat dumplings and wonton(馄饨), while in the southern region rice balls.19In China, this festival is in late January or early February, the last day of the Lunar year. People celebrate it by having a family reunion dinner, setting off fireworks and staying up late. Breaking the dishes and bowls is a thing all the people scare, but if you did it, you have to say: “sui sui ping an”. 20A.New Year’s EveB.Spring FestivalC.People will go to worship their ancestors.D.People always visit their friends and relatives.E.That day people in different regions eat different food.F.It is a pun(双关语), meaning you will be healthy every year.G.It is celebrated on Sept. 9th of the Lunar Calendar, around October.二、完形填空Considering Grandma Joy was 85, Brad knew it was impractical. In order to ask her forpark, they would have to drive 500 miles through the night and it would be the first time inThe skies 29 the next day, and they set off. When they crossed a ravine (溪谷), he would held her hand to avoid 30 on the wet path. She moved carefully with the 31 of an 85-year-old woman. They walked slowly. When some people passed her, Brad asked if she wanted to turn back.“I won’t give up even if it is 32 for me,” she told Brad. When they finally 33 the top, the hikers gave her a big round of applause. That night Brad made a campfire. He and his grandmother sat next to each other, feeling the warmth and looking at stars. Brad and Grandma Joy opened the box of their 34 . They talked about families, about loss, pain and regret and about what had happened.“Here I had the 35 to communicate with my grandson,” she said. “I thanked him.I had tears in my eyes. But they were good tears.”21.A.help B.permission C.money D.information 22.A.crazy B.elegant C.careless D.busy 23.A.ever B.always C.never D.still 24.A.camped B.walked C.cycled D.drove 25.A.helpful B.depressing C.generous D.practical 26.A.touched B.adjusted C.surprised D.forgave 27.A.roof B.shelf C.fence D.tent 28.A.successfully B.suddenly C.closely D.properly 29.A.yelled B.pointed C.cleared D.wondered 30.A.laughing B.slipping C.hesitating D.speeding 31.A.commitment B.pace C.assumption D.lesson 32.A.delightful B.difficult C.moving D.changeable 33.A.benefited from B.gave in C.got to D.suffered from 34.A.past B.duty C.joy D.disbelief 35.A.competition B.disagreement C.opportunity D.argument三、语法填空阅读下面短文,在空白处填入1个适当的单词或括号内单词的正确形式。

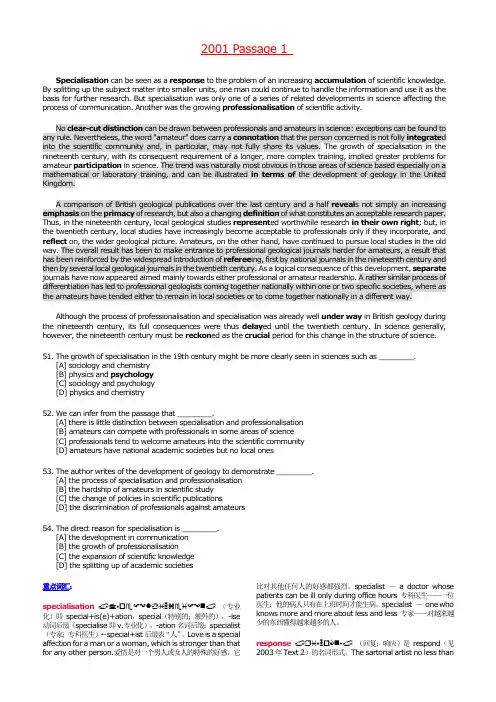

2001 Passage 1Specialisation can be seen as a response to the problem of an increasing accumulation of scientific knowledge. By splitting up the subject matter into smaller units, one man could continue to handle the information and use it as the basis for further research. But specialisation was only one of a series of related developments in science affecting the process of communication. Another was the growing professionalisation of scientific activity.No clear-cut distinction can be drawn between professionals and amateurs in science: exceptions can be found to any rule. Nevertheless, the word "amateur" does carry a connotation that the person concerned is not fully integrate d into the scientific community and, in particular, may not fully share its values. The growth of specialisation in the nineteenth century, with its consequent requirement of a longer, more complex training, implied greater problems for amateur participation in science. The trend was naturally most obvious in those areas of science based especially on a mathematical or laboratory training, and can be illustrated in terms of the development of geology in the United Kingdom.A comparison of British geological publications over the last century and a half reveal s not simply an increasing emphasis on the primacy of research, but also a changing definition of what constitutes an acceptable research paper. Thus, in the nineteenth century, local geological studies represent ed worthwhile research in their own right; but, in the twentieth century, local studies have increasingly become acceptable to professionals only if they incorporate, and reflect on, the wider geological picture. Amateurs, on the other hand, have continued to pursue local studies in the old way. The overall result has been to make entrance to professional geological journals harder for amateurs, a result that has been reinforced by the widespread introduction of referee ing, first by national journals in the nineteenth century and then by several local geological journals in the twentieth century. As a logical consequence of this development, separate journals have now appeared aimed mainly towards either professional or amateur readership. A rather similar process of differentiation has led to professional geologists coming together nationally within one or two specific societies, where as the amateurs have tended either to remain in local societies or to come together nationally in a different way.Although the process of professionalisation and specialisation was already well under way in British geology during the nineteenth century, its full consequences were thus delay ed until the twentieth century. In science generally, however, the nineteenth century must be reckon ed as the crucial period for this change in the structure of science.51. The growth of specialisation in the 19th century might be more clearly seen in sciences such as ________.[A] sociology and chemistry[B] physics and psychology[C] sociology and psychology[D] physics and chemistry52. We can infer from the passage that ________.[A] there is little distinction between specialisation and professionalisation[B] amateurs can compete with professionals in some areas of science[C] professionals tend to welcome amateurs into the scientific community[D] amateurs have national academic societies but no local ones53. The author writes of the development of geology to demonstrate ________.[A] the process of specialisation and professionalisation[B] the hardship of amateurs in scientific study[C] the change of policies in scientific publications[D] the discrimination of professionals against amateurs54. The direct reason for specialisation is ________.[A] the development in communication[B] the growth of professionalisation[C] the expansion of scientific knowledge[D] the splitting up of academic societies重点词汇:specialisation ♦☐♏☞☜●♋♓♏♓☞☜⏹(专业化)即special+is(e)+ation,special(特别的;额外的),-ise 动词后缀(specialise即v.专业化),-ation名词后缀;specialist (专家;专科医生)←special+ist后缀表“人”。

2022年考研考博-考博英语-中国社会科学院考试全真模拟易错、难点剖析AB卷(带答案)一.综合题(共15题)1.翻译题Translate the underlined sentences into good Chinese.The American tradition has found this view of human history repugnant and false.(1)This tradition sees the world as many, not as one. These empirical instincts, the preference for fact over logic, for deed over dogma, have found their most brilliant expression in the writings of William James and in the approach to philosophical problems which James called “radical empiricism”. Against the belief in the all-encompassing power of a single explanation, against the commitment to the absolutism of ideology, against the notion that all answers to political and social problems can be found in the back of some sacred book, against the deterministic interpretation of history, against the closed universe,(2)James stood for what he called the unfinished universe ― a universe marked by growth, variety, ambiguity, mystery, and contingency ― a universe where free men may find partial truths, but where no mortal man will ever get an absolute grip on Absolute Truth, a universe where social progress depends not on capitulation to a single, all-consuming body of doctrine, but on the unforced intercourse of unconstrained minds.Thus ideology and pragmatism differ radically in their views of history. They differ just as radically in their approach to issues of public policy. The ideologist, by mistaking models for reality, always misleads as to the possibilities and consequences of public decision. The history of the twentieth century is a record of the manifold ways in which humanity has been betrayed by ideology.Let us take an example from contemporary history.(3)It is evident now, for example, that the choice between private and public means, that choice which has obsessed so much recent political and economic discussion in underdeveloped countries, is not a matter of religious principle. It is not a moral issue to be decided on absolutist grounds, either by those on the right who regard the use of public means as wicked and sinful, or by those on the left who regard the use of private means wicked and sinful. It is simply a practical question as to which means can best achieve the desired end. It is a problem to be answered not by theology but by experience and experiment. Indeed, I would suggest that we might well banish some overloaded words from intellectual discourse. They belong to the vocabulary of demagoguery, not to the vocabulary of analysis.So, with the invention of the mixed society, pragmatism has triumphed over absolutism. As a consequence, the world is coming to understand that the mixed economy offered the instrumentalities through which one can unite social control with individual freedom. But ideology is a drug; no matter how much it is exposed by experience, the craving for it still persists. That craving will, no doubt, always persist, so long as there is human hunger for an all-embracing, all-explanatory system, so long indeed as political philosophy is shaped by the compulsion to return to the womb.The oldest philosophical problem, we have noted, is the relationship between the one and the one and the many. Surely the basic conflict of our times is precisely the conflict between those who would reduce the world to one and those who see the world as many—between those who believe that the world is evolving in a single direction, along a single predestined line, toward a single predestined conclusion, and those who think that humanity in the future, as in the past, will continue to evolve in diverse directions, toward diverse conclusions, according to the diverse traditions, values, and purposes of diverse peoples. It is a choice, in short, between dogmatism and pragmatism, between the theological society and the experimental society.Ideologists are afraid of the free flow of ideas, even of deviant ideas within their own ideology. They are convinced they have a monopoly on the Truth. Therefore they always feel that they are only saving the world when they slaughter the heretics.(4)Their objective remains that of making the world over in the image of their dogmatic ideology. The goal is a monolithic world, organized on die principle of infallibility — but the only certainty in an absolute system is the certainty of absolute abuse.The goal of free men is quite different. Free men know many truths, but they doubt whether any mortal man knows the Truth. Their religious and their intellectual heritage join in leading them to suspect fellow men who lay claim to infallibility. They believe that there is no greater delusion than for man to mistake himself for God.(5)They accept the limitations of the human intellect and the infirmity of the human spirit. The distinctive human triumph, in their judgment, lies in the capacity to understand the frailty of human striving but to strive nonetheless.【答案】1.这种传统将世界看成“多”,而不是“一”。

第三部分阅读理解试题解析第一篇一、文章结构总体分析这是一篇论述科学发展的专业化和职业化的文章。

全文客观地描述这一过程,并且以英国地质学的发展为例说明专业化发展导致专业人员和业余人员之间的分化越来越明显。

第一段:科学知识的积累导致知识的进一步分类和分化,即专业化发展。

与专业化发展同时并存的另一现象是科学活动的日益职业化。

第二段:专业化的发展给业余研究者的进入带来了困难,这种趋势在某些科学领域尤为突出。

第三、四段指出:以英国地质学研究为例,说明专业人员和业余人员之间分化越来越明显。

而这种专业化和职业化的分化过程早在19世纪英国的地质学领域就已经开始形成。

二、试题具体解析21. The growth of specialisation in the 21. 19世纪专业化的发展在____科19th century might be more clearly seen 学领域更为显见。

in sciences such as ____.[A] sociology and chemistry [A] 社会学、化学[B] physics and psychology [B] 物理学、心理学[C] sociology and psychology [C] 社会学、心理学[D] physics and chemistry [D] 物理学、化学[答案]D[解析]本题考核的知识点是:事实细节题+ 常识。

文章第二段最后两句话指出,“19世纪专业化的发展要求时间更长、内容更复杂的培训,这使得非专业研究人员面临越来越大的困难。

这个趋势在以数学训练或实验室训练为基础的科学领域显得更为突出。

”四个选项中涉及社会学、化学、物理学、心理学四个学科。

根据常识,物理学、化学与地质学都是以数学和实验室培训为基础的科学,而社会学和心理学则不是。

比较四个选项只有D选项“物理和化学”是正确答案。

22. We can infer from the passage that ____. 22.从文中,我们可以推断出_____。

PART 1History of Sociolinguistics11.1 INTRODUCTIONTo introduce this handbook, the editors map out the gestation of sociolinguistics by focusing on six of the ‘founding fathers’: William Labov, who pioneered a school devoted to showing the rele-vance of social determinants of variation for linguistic theory; Basil Bernstein, the British sociologist whose work on class-related ‘codes’ led to a brief flirtation with American sociolin-guists; Dell Hymes, whose adaptation of Roman Jakobson’s theory of communication (Jakobson, 1960) shaped the ethnography of communication and educational linguistics and who molded soci-olinguistics by editing several pioneering volumes and the flagship journal Language in Society; John Gumperz, founder of interactional sociolin-guistics; and Charles Ferguson and Joshua Fishman. All except Bernstein (although he was invited) attended the Linguistic Institute in Bloomington in the summer of 1964, the land-mark event that launched the field. All (except Bernstein again) served on the Committee on Sociolinguistics of the Social Sciences Research Council, established in 1963 to plan the 1964 seminar and that operated until the early 1970s. All participated in the many conferences and publications which fashioned sociolinguistics in those years, and each continued to publish for the next 30 years, expanding their own interpre-tations of the field. My task in this chapter is to describe and assess the specific contribution of Ferguson and Fishman to the ‘study of language in its social context’, and to explore the nature of the discipline that emerged, trying to explain why it is sometimes called ‘sociolinguistics’ and sometimes ‘the sociology of language’, terms occasionally used interchangeably (Paulston and Tucker, 1997)1 though elsewhere (Bright, 1992; Gumperz, 1971) clearly distinguished.I shall also mention founders omitted from the selected six, such as William Bright, Allen Grimshaw, Einar Haugen, Uriel Weinreich and Sue Ervin-Tripp2 who were also pioneers. Haugen was, by 1963, a senior scholar: after 30 years as chair of Scandinavian Studies at the University of Wisconsin, he was about to take up a chair in Scandinavian and Linguistics at Harvard. He had taught a course on bilingualism at the 1948 Linguistic Institute, and his book on the Norwegian language in America (Haugen, 1953) established him as the leading authority on bilingualism and language shift. He was the first linguist to write about the ecology of language, the title of his 1972 collected papers (Haugen, 1972). His study of Norwegian language planning (Haugen, 1966) was a groundbreaking work.A second major publication in 1953 was that of Uriel Weinreich (1953a), a seminal work that is still regularly cited as the basis for understanding language contact. Fishman (1997c), a friend of his3 from Yiddish youth movement days, summa-rizes his work in sociolinguistics, starting with an undergraduate paper in Yiddish on Welsh lan-guage revival (U. Weinreich, 1944), his doctoral dissertation on Swiss bilingualism, a study ofFerguson and Fishman: Sociolinguistics and the Sociology of LanguageB e r n a r d S p o l s kyTHE SAGE HANDBOOK OF SOCIOLINGUISTICS 4the Russian treatment of minority languages (U. Weinreich, 1953b), and the beginning of the language and culture atlas of Ashkenazic Jewry published a quarter of a century after his prema-ture death. Fishman recalls a paper that the two of them did not write in 1954 on the societal nature of language; Weinreich’s draft was too linguistic and Fishman’s too sociological to negotiate a common version. Weinreich visited the 1964 Linguistic Institute, delivering four lectures on semantic theory (U. Weinreich, 1966). His theory of semantics, Fishman suggested, was ‘profoundly cultural and socio-situational’, and so a comfort-ing antidote to the anti-sociolinguistic theory that Chomsky was establishing.4 Weinreich had a strong influence on many of the founders, not least on his student William Labov. Labov (1997: 147) stresses the contribution to his own development made by a teacher not much older than him and especially the importance of Weinreich’s part in writing a paper which explained the relevance of sociolinguistics to the understanding of language change (U. Weinreich, Labov and Herzog, 1968).A third founder was Susan Ervin-Tripp who joined the Committee on Psycholinguistics as a graduate assistant. Her distinction between com-pound and coordinate bilingualism (Osgood, 1954) led to much research and controversy. Based at Berkeley after 1958, her interest in child language acquisition cross-culturally brought her naturally into sociolinguistics (Ervin-Tripp, 1973). She also joined the Committee on Sociolinguistics in 1966 (Ervin-Tripp, 1997).The task I have been set in this chapter is made more complex by the need to distinguish individ-ual contributions from joint work and both from the working of the Zeitgeist,5 the difficult to docu-ment formation of a consensus on next steps in a scientific field. All of the scholars I have named were already actively engaged in what is now describable as sociolinguistic research and publi-cation before 1964. Shuy (1997) notes that Fishman first taught a course called ‘Sociology of Language’ at the University of Pennsylvania in 1956 and continued to teach it at Yeshiva University. Huebner (1996) that the term ‘socio-linguistics’ was first used by Currie (1952) and picked up by Weinreich (U. Weinreich 1953a: 99) and in articles in Word which Weinreich edited.6 The classic paper on diglossia (Ferguson, 1959) appeared there. At the 1962 LSA Linguistic Institute, Ferguson taught a course with the simple title ‘Sociolinguistics’ and repeated it the follow-ing summer and in the 1965 academic year at Georgetown University. In 1964, Fishman had just completed his pioneering study of language loyalty in the USA (Fishman, 1966).7 Labov had published his Martha’s Vineyard study (Labov, 1962) and was completing the New York dissertation (Labov, 1966) that continues to encourage study of socially-explainable language variation. Gumperz and Hymes were editing the papers from the 1963 American Association of Anthropology meeting (Gumperz and Hymes, 1972), which remains a foundation text. Even without the seminar, research and publication in the field were by then well underway. Bloomington 1964 was a milestone rather than a starting point, buta significant one.1.2 FISHMAN MEETS FERGUSONIn his introduction to the festschrift for Ferguson’s 65th birthday (Fishman, Tabouret-Keller, Clyne, Krishnamurti and Abdulaziz 1986: v), Fishman8 recalls his first contact with Ferguson: ‘It took almost a month for Charles Ferguson and me to realize that we were living next door to each other during the Summer Linguistic Institute of 1964 at Indiana University.’ They had communicated briefly before that; during the summer, both in the seminar that Ferguson chaired ‘primus inter pares’, and with Fishman taking Ferguson’s course (101 Introduction to Linguistics), they became ‘neighbors, colleagues, students (each acknowledging the other as teacher) and close friends, roles we have enacted, either repeatedly or continuously …’In May 1963, Fishman was not on the original list of scholars to be invited to Bloomington, which included Gumperz, Haugen, Immanuel Wallerstein9 or Paul Friedrich, Steven E. Deutsch10 and Dell Hymes. In December, William Labov and William Stewart,11 both about to finish their degrees, were added; a month later, Fishman was also invited (as were Heinz Kloss12 and Basil Bernstein, all three considered sociologists rather than linguists) (Committee on Sociolinguistics 1963–). Fishman had not been sure that he would be included – his only relevant publication was an article on the Whorfian hypothesis (Fishman, 1960), although he had earlier published articles on Yiddish bilingualism, pluralism and minorities, and was just finishing his first major opus (Fishman, 1966) which was to set the path for the host of studies of minority language maintenance and loss that now dominate the sociolinguistic research field. He later (Fishman, 1997a) recalled that he was at Stanford rewriting Fishman (1966) when he first heard about the 1964 seminar and was encouraged to apply by Einar Haugen, also a fellow at the Center for Advanced Studies in the Behavioral Sciences. He phoned Ferguson whose article on diglossia he knew; Ferguson ‘seemed a little cool on the phone’ but accepted the appli-cation. Ferguson quickly came to appreciateFISHMAN, FERGUSON: THE SOCIOLOGY OF LANGUAGE5Fishman’s potential contribution: in a letter written in 1965 trying unsuccessfully to persuade Fishman to stay on the Committee of Sociolinguistics, he wrote, ‘Of all the members, you are most probably the only one whose primary interest is in the field of sociolinguistics, and your publications in the field have been the most extensive. You are con-cerned with both “macro” and “micro” and with relating the two’ (Committee on Sociolinguistics 1963–) (letter from Ferguson in Ethiopia dated 25 November 1965).Fishman did not know what the seminar was going to be like, but he was willing to put up with a hot uncomfortable summer in Bloomington in order to be with ‘a community of like-minded scholars’. When the seminar began, Fishman found the sociologists – including himself, ‘a refurbished social psychologist’ as he noted (Fishman, 1997a: 88) – to be in a weak position because they did not know each other and did not have strong interests in common. Only Fishman, Kloss and Lieberson had published or were ready to publish about language. The anthropologists and linguists had met before, most recently at the 1963 AAA meeting and at the May UCLA meeting. There was a major gap between the two groups and, partly because of that, Fishman returned to his earlier preference for calling the field the sociology of language.13 He com-plained that social problems were not emphasized in Bloomington, and that only annoyance greeted his reference to ‘the fact that people were willing to kill and be killed for their beloved language was being completely overlooked’ (Fishman, 1997a: 93).14At Bloomington and after, a close personal and academic relationship quickly developed between Ferguson and Fishman. Fishman’s state-ment about their friendship has been cited: Ferguson (1997: 80) respected not just Fishman’s extensive empirical studies but his potential for theory-building:I tend to be pessimistic about formulating a basic theory of sociolinguistics; possibly I am unduly pes-simistic. I would think that if Fishman put his mind to it, he could probably come up with a kind of theory. Of course, it would tend to focus on mac-rosociolinguistics (sociology of language), like the books he has written on ethnicity and nationalism and so forth …For Fishman, Ferguson remained his main teacher of linguistics.15 While their research paths diverged, with Ferguson firmly on the linguistic and Fishman firmly on the sociological side, their early conversations and continuing association had a major influence on the growth and shape of the field.1.3 ORGANIZING A NEW FIELDLeft to work alone, there is little doubt that the founders of sociolinguistics would have continued their individual scholarly paths investigating the complex relations between language and society, and the structure and interplay of the two systems evolved to deal with the evolutionary inadequacies of human physiology, rejecting the ideology estab-lished in mainstream linguistics by Chomsky’s lack of interest in meaning and his focus on the competence of an ‘idealized monolingual’. Each of them had come with a different goal and was attracted by a different inspiration. William Bright, for instance, had been trained in American Indian linguistics by M. B. Emeneau and Mary Haas, both of whom continued the interest of Edward Sapir in language in culture; he was thus open to influence in writing his first published paper on lexical innovation in Karuk by a lecture on bilin-gualism from Einar Haugen in 1949 (Bright, 1997: 53). In India on a two-year post-doctoral Rockefeller fellowship, in the course of conversa-tions with Ferguson and John Gumperz, he ‘became aware that a field of sociolinguistics might be developed’ (Bright, 1997: 54). In her obituary of Bright in Language,Jane Hill (2007) cites Murray (1998) as believing that Bright, Gumperz and Ferguson were all influenced by the multilingual patterns they discovered in India when visiting Deccan College in Pune in the mid-1950s.John Gumperz (1997) had been trained in dialectology, wrote a dissertation on the Swabian dialects of Michigan, and then spent two years studying village dialects in a Northern Indian community. There, he worked with many Indian linguists and an interdisciplinary team. He taught at the Indian summer Linguistic Institutes in Pune in 1955 and 1956 alongside American structural linguists and South Asia scholars, some trained by J. R. Firth of the School of Oriental and African Studies (Gumperz, 1997). This combina-tion of fieldwork in complex multilingual com-munities and the opportunity to discuss his work with a diverse group of scholars was, he believes, critical.16There were further discussions at the Foreign Service Institute of the US Department of State where both Ferguson and Bright worked in the 1950s. But it was in the early 1960s that formal activity began. In the late 1950s, the Association of Asian Studies formed a Committee on South Asian Languages, which brought together at various meetings Ferguson, Bright, Gumperz and Uriel Weinreich and produced a 1960 special issue of the International Journal of American Linguistics on linguistic diversity in South Asia (Ferguson and Gumperz, 1960). In 1959, Ferguson became a full-time organizer17when he wasTHE SAGE HANDBOOK OF SOCIOLINGUISTICS 6appointed director of the new Center for Applied Linguistics, a position he held for seven years. With support from several foundations, the Ford Foundation leading (Fox, 2007; Fox and Harris, 1964), the Center made major contributions to the development of the International Association of Teachers of English to Speakers of Other Languages (Alatis and LeClair, 1993), the Test of English as a Foreign Language (Spolsky, 1995), and American Indian education. It also organized several linguistic surveys (Ohannessian, Ferguson and Polomé, 1975), including the Ethiopian study (Bender, Bowen, Cooper and Ferguson, 1976) which Ferguson directed, spending two periods of four months each in the field in 1968–69.Impressed by the successful model of the SSRC Committee on Psycholinguistics (Osgood, 1954), Ferguson proposed in early 1963 holding a seminar on sociolinguistics at the summer Linguistic Institute planned for Indiana University. Through the SSRC, he obtained a grant of $54,800 from the National Science Foundation to help pay the salaries of senior and junior participants. The summer seminar, building on an earlier May 1964 UCLA meeting to which Bright had invited ‘ “the usual suspects”: Haugen, Ferguson, Gumperz, Hymes, Labov and others’ (Bright, 1997: 55) and whose papers were later published (Bright, 1966), pinpointed according to Shuy18 (1997: 30) ‘the creation of modern sociolinguistics’.Thom Huebner (1996)19 summarizes the major activities of the Committee after 1964. In 1966, there was a conference on the language problems of developing nations which established language policy and management as a major component of sociolinguistics (Fishman, Ferguson and Das Gupta, 1968). In the opening paper, Fishman starts with a discussion of ‘sociolinguistics’: ‘Interest in the sociology of language can be traced back quite far … ’. Modern sociolinguistics was not the direct heir, but ‘a byproduct of very recent and still ongoing developments in its two parent disciplines, linguistics and sociology’ (Fishman, 1968b: 3). The stronger interest had come from linguistics. Fishman’s own approach becomes clear in the concluding essay (Fishman, 1968a) in which he explored the relationship between such issues as selection of a national language, adoption of a language of wider com-munication, language planning concerns, and goals for bilingualism and biculturalism. In his own contribution, Ferguson recognized that many of the topics discussed could be dealt with ‘by the conceptual frameworks used in the study of social organization, political systems, or economic pro-cesses’ (Ferguson, 1968: 27), but they depended on understanding of language, such as the ques-tionable belief that a language is backward or needs purifying or modernizing.In 1966, the Committee supported a workshop on teaching sociolinguistics and a project on the acquisition of communicative competence. The manual for cross-cultural study of child language (Slobin, 1967) that resulted has guided much international research (Ervin-Tripp, 1997: 73). In 1968, Dell Hymes organized a conference on pidginization and later published a collection of papers on pidgins and creoles (Hymes, 1971). The following year, Grimshaw (1969) arranged a meeting to look at language as sociological data as an obstacle in cross-cultural sociological research. Continuing work on child language, in 1974 the Committee sponsored a conference on language input and acquisition (Snow and Ferguson, 1977) which led to extensive and continuing research on language socialization (Ervin-Tripp, 1997: 74).The Committee and Ferguson also supported the foundation of the journal Language in Society edited by Dell Hymes in 1972; he was succeeded as editor by William Bright. Ferguson (1997: 86) confessed that he had opposed Fishman’s plan to start his own journal, but admitted he was wrong, as Language in Society and The International Journal of the Sociology of Language have both been productive but different. Ferguson did not found a new organization for sociolinguists,20 and the two major annual conferences NW A V21 and the Sociolinguistics Symposium22 came later; but his organizational work in the 1960s played a major role in forming, consolidating and publiciz-ing what is clearly one of the more fruitful fields for the study of language.Fishman too was an organizer, but one who did not like meetings: his main managerial activities were the planning, direction and interpretation of major research projects, and the encouragement of an impressive body of publication by scholars throughout the world. I have already mentioned the language loyalty study whose publication par-alleled the burst of research in the early 1960s. Shortly after, he started work (with funding from the US Office of Education) on the equally influ-ential study of bilingualism in a New Jersey barrio completed in 1968 and published three years later (Fishman, Cooper and Ma, 1971); among his col-leagues were Robert L. Cooper and for a year John Gumperz. In the 1970s, while he was in Jerusalem, he conducted a study of bilingual edu-cation for the US Office of Education (Fishman, 1976). Also while he was in Israel, with a Ford grant and the help of Robert Cooper and others, he prepared his pioneering study of the spread of English (Fishman, Cooper and Conrad, 1977). During this time, in cooperation with Charles Ferguson and a number of international scholars, he was working on what is still the only majorempirical study of the effectiveness of languageFISHMAN, FERGUSON: THE SOCIOLOGY OF LANGUAGE7planning processes (Rubin, Jernudd, Das Gupta, Fishman and Ferguson, 1977).Apart from significant funded research proj-ects, Fishman’s most important organizational activity has been as an editor. The first venture was a collection of readings on the sociology of language (Fishman, 1968c) which marked out his claim to be the prime exponent and arbiter of the field. Noting the success of this volume, a leading European linguistics publishing house, Mouton of The Hague (now Mouton de Gruyter of Berlin), invited him to start a journal and an associated book series. The International Journal of the Sociology of Language(IJSL) first appeared in 1973, celebrated its centenary issue 20 years later, and has reached 194 issues in 2009. While about one out of six are ‘singles’ issues, the main feature of the journal is the breadth of its internationally edited thematic issues, ranging from the sociology of language in Israel (the first issue celebrating Fishman’s time in Jerusalem) to the latest, a double issue on the sociolinguistics of Spanish. IJSL has served as a powerful instrument for encouraging international study of sociolinguistic issues, and constitutes an unmatched library of descriptions of sociolinguistic situations all around the world. There have been innovative approaches, including the ‘focus’ issues in which a scholar is invited to present a long paper on a controversial topic, such as bilingualism and schooling in the USA or the origin of Yiddish, and a number of other scholars are invited to write comments.23 The journal, like all the other journals in the field is publisher-sponsored and susceptible to market-ing pressure: Fishman (1997b: 239) interprets the absence of organizational support as evidence of the ‘professional marginalization and tentative-ness of the field’ although one may hope that as a result of technological developments, producing the ‘long tail’ that Anderson (2004, 2006) described, if publishers were to drop the journals, there would be web-based alternatives to fill the gaps. Paralleling the enormous contribution of IJSL to sociolinguistics has been the related book series edited by Fishman: some 96 volumes pub-lished by Mouton now carry the ‘Contributions to the Sociology of Language’ imprimatur.In addition to these two major projects, Fishman has planned and edited a distinguished body of edited collections. Macnamara (1997: 175) testifies that the special issue of The Journal of Social Issues that he edited on ‘Problems of Bilingualism’ in 1967 was largely the work of Fishman, who asked him to be editor ‘mainly to give a beginner a leg up’. There are many other volumes giving evidence of Fishman’s work as organizer and developer: two follow-up volumes to the Readings (Fishman, 1968c, 1971) and its companion Fishman (1972b); one on language planning (Fishman, 1974); another on writing systems (Fishman, 1978a); one on soci-etal multilingualism (Fishman, 1978b); a bilingual volume on Yiddish (Fishman, 1981); a second on language planning (again shared with a more junior colleague) (Cobarrubias and Fishman, 1983); an innovative collection of papers on the first con-gresses of language revival movements (Fishman, 1993b); a significant collection dealing with post-imperial English (Fishman, Rubal-Lopez and Conrad, 1996); and, most recently, a collection on the sociology of language and religion24 (Omoniyi and Fishman, 2006).While their contributions to the field were different, it is easy to see how impoverished socio-linguistics would have been without the organiza-tional work of Charles Ferguson and Joshua Fishman. If each of them had been willing to sit quietly in his office, conduct and publish his indi-vidual research, and ignore the challenges and efforts of providing leadership and encourage-ment to others, their individual scholarship would still have had a considerable effect, but their extensive work as organizers of meetings and publishers of other people’s research played a major role in shaping the field as we know it.1.4 S EEKING A COMMUNITY OFLIKE-MINDED SCHOLARSThe terms sociolinguistics and sociology of language both suggest a bidisciplinary approach, a blending of sociologists and linguists in a com-bined effort to see how language and society are related. In spite of his early failure to write a joint paper with Uriel Weinreich, Fishman still believed in the ‘community of like-minded schol-ars’ (Fishman, 1997a: 88) that he hoped to find in Bloomington who could rescue him from the iso-lation he had felt working between the disciplines. He was soon disappointed. He knew only two participants from before, Einar Haugen and Leonard Savitz, a sociologist he had known at the University of Pennsylvania. He knew of Kloss (whose address he was able to give to Ferguson), Gumperz (whom he had met and read), Labov (whose papers Uriel Weinreich had given him), and Stewart (he had read his paper on multilingual typology – a 1962 paper he reprinted as Stewart (1968)). The sociologists were not just outnum-bered (eight to five), but, except for Kloss, had not yet published anything that could be considered sociolinguistics, hardly knew each other, and did not have strong interests in common; the anthro-pologists25 and the linguists had interacted before and were more at home in a seminar conducted as part of a major linguistics event. All knew linguis-tic theory, while none of the sociologists did.THE SAGE HANDBOOK OF SOCIOLINGUISTICS 8The two groups thus formed ‘two cultures’; Fishman (1997a: 91) refers specifically to meth-odological gaps, as when he was asked for his corpus (and quipped in return that you don’t need phonology to explain the causes of World War II), and Gumperz, presenting his pioneering paper on code switching (Blom and Gumperz, 1972) in Hemnesberget that highlighted a conversation he had heard at a party, was asked why he had not carried out statistical tests.Of the sociologists, Lieberson, who was about to publish a paper on a bilingual city (Lieberson, 1965, 1997), edited an early journal issue with important papers on sociolinguistics (Lieberson, 1966) and continued to carry out research and publish in sociolinguistics for some years (Lieberson, 1981). He writes (Lieberson, 1997: 164) that he was particularly influenced by Ferguson, who had ‘a passionate commitment to the field … labels were irrelevant’. He believes that ‘few could match Ferguson in the breath of this overview’. Eventually, he ‘drifted away’ from sociolinguistics which he felt unlikely to be of much interest to sociology. He suspected that the work of Joshua Fishman was having less influence on American sociologists than on sociologists overseas or on other disciplines.Leonard Savitz had been a fellow-student of Allen Grimshaw at the University of Pennsylvania, and Fishman (1997a) reports he met him there and suggested to him that they produce a set of ‘socio-logical readings’ concerned with language. His field was criminology and the sociology of crime, so that the suggestion was not taken up.26 Chester L. Hunt was a sociologist who had carried out research in the Philippines and who wrote a paper at the seminar (Hunt, 1966). Neither continued to work in sociolinguistics.Heinz Kloss considered himself not as a socio-linguist but rather an ‘authority on ethnic law’ (Mackey and McConnell, 1997: 301). Fishman, who found his interest in language, nationality and minorities very appealing, included a chapter (Kloss, 1966) in his book, and was a member of the board that recommended appointing him to the staff of the International Center for Research on Bilingualism at the University of Laval. Many of his proposals, such as the distinction between status and corpus planning, have become key con-cepts in sociolinguistics.There was another sociologist who must have provided Fishman with more support. He refers to Allen Grimshaw as ‘in a special category by him-self’, not a member of the seminar but attending it regularly. Grimshaw (1997) says that his initia-tion to language science was through Savitz. Grimshaw had become interested in language and social contexts during a visit to India in 1961. He writes: ‘I was an informal participant in many of the activities of the seminar and gave a talk to the group about ways in which knowledge about lan-guage might eliminate sociological questions; it was not long before I became more closely involved’ (1997: 101). This involvement included membership and later chairmanship of the Committee on Sociolinguistics, organization of a conference (Grimshaw, 1969), and publication of a number of papers that were later collected by Dill (Grimshaw, 1981).Ferguson (1997: 78) acknowledges that the sociologists made important contributions to the Bloomington seminar but on the whole left it to anthropologists and linguists to develop the field. The participants each had different points of view: Labov wanted to make linguistics more relevant while Fishman wanted to improve sociology. For Ferguson himself, ‘sociolinguistics was just a loose label for phenomena relating language to society’. Over the years, most did not change their opinions.Looking back, one can speculate that it was not just lack of knowledge of each other’s methodolo-gies that kept the fields apart, but a fundamental gap between the issues that concerned them.I recall that in the 1960s, Noam Chomsky would regularly dismiss an argument as ‘not interesting’. With rare exceptions, the topics that interested the linguists did not interest the sociologists, and vice versa. One solution was to train ‘real’ sociolinguists. In his analysis of the interdisciplinary problem, Shuy (1997: 18) notes the problem of training new scholars in two fields: ‘Social scientists did not want to give up anything to get linguistics. Nor did linguists want to give up anything to get social science’. Appended to two of Fishman’s edited volumes (Fishman, 1978a; 1978b), there is a description of ‘A graduate program in the sociol-ogy of language’, with equal number of courses and credit in linguistics, sociology of language, and sociology. It describes the kind of programme he hoped to build at Yeshiva University and pro-posed at the Hebrew University, combining the new field with a solid basis in the two parent dis-ciplines. It just didn’t happen – at Yeshiva, the Language Behavior Program chaired by Vera John-Steiner lasted 10 years, and at the Hebrew University it never started – and in a later paper, Fishman (1991b)27 once again makes a convincing case for the need for sociolinguists to know sociol-ogy and sociologists to respect the significance of language. He puts it strikingly: ‘Sociology, too, although far less messianic in its promise, is chained and waiting, somewhere in its own disci-plinary provincialism, waiting to come to sociolin-guistics, to broaden and deepen it somewhat and to enable it to live up to its name’ (1991b: 67).One sociologist who did appreciate Fishman’swork was Kjolseth (1997: 145) who reports that。

第二单元测评第一部分听力(共两节,满分30分)第一节(共5小题;每小题1.5分,满分7.5分)听下面5段对话。

每段对话后有一个小题,从题中所给的A、B、C三个选项中选出最佳选项。

听完每段对话后,你都有10秒钟的时间来回答有关小题和阅读下一小题。

每段对话仅读一遍。

1.What can we learn from the conversation?A.Frank was still alive after a car accident.B.Frank’s car was lost.C.Frank fell out of a car.2.Where does the conversation take place?A.In a hospital.B.In a school.C.In a shop.3.What are the two speakers talking about?A.The future plan.B.The weather.C.The TV program.4.Where does the conversation probably take place?A.In the office.B.In the supermarket.C.On the phone.5.Why does the woman want to borrow a car?A.To see a film.B.To meet her parents.C.To go to a party.第二节(共15小题;每小题1.5分,满分22.5分)听下面5段对话或独白。

每段对话或独白后有几个小题,从题中所给的A、B、C三个选项中选出最佳选项。

听每段对话或独白前,你将有时间阅读各个小题,每小题5秒钟;听完后,各小题将给出5秒钟的作答时间。

每段对话或独白读两遍。

听第6段材料,回答第6至8题。

6.Why does Linda ask her daddy to give her something?A.Because it will be cold soon.B.Because it is Linda’s birthday tomorrow.C.Because he has a lot of money.7.What does Linda’s father want to buy for her at first?A.A new coat.B.A new dictionary.C.A mobile phone.8.What will the two speakers do this afternoon?A.Have dinner together.B.Buy a birthday cake.C.Go to the supermarket.听第7段材料,回答第9、10题。