syllabus

- 格式:doc

- 大小:50.00 KB

- 文档页数:6

Curriculum and SyllabusCurriculum is the complete set of taught material in a school system. It is prescriptive (as opposed to the …descriptive‟ syllabus, which is the outline of topics covered. If the curriculum prescribes the objectives of the system, the syllabus describes the means to achieve them).Curriculum comes from a Latin word which means the course of a chariot race. However, curriculum has come to mean much more than a prescribed one track race and calls for a search for an understanding that gives meaning to education that is both functional and ethicalCurriculum as a guiding document helps teachers in understanding standards that students need to achieve at the end of a developmental stage.The curri culum document will indicate “what” to teach, ”how” the curriculum is to be taught and help in checking “whether” the curriculum is taught as per the document.Over the years, …curriculum‟ has meant different things to different educationists. Some simply equate curriculum to the syllabus that is to be transmitted in the class. “A syllabus gives a more focused outline for particular subjects. It can‟t be equated, because a curriculum is for a course but a syllabus is for a subject,” says Dr. Yasmin Jayathri tha. The curriculum is the superset and syllabus is the subset of curriculum.The syllabus is the content, the list of topics/concepts to be taught, whereas the curriculum is a consideration of the objectives, the content, methods chosen to achieve those objectives. It could/should contain a consideration of the kind of assessment one will use to check progress.“Curriculum is developed keeping in mind the standards students should achieve from well- researched best practices. Curriculum is designed so that the teaching and testing are aligned with the standards set for each developmental stage,” adds Vimala Nandakumar. Some see it as anend-product, which is to be achieved through a prescribed plan with pre-set objectives. For others, it is the interaction between…knowledge‟,students and teachers.A curriculum can be a teacher‟s friend or an enemy depending on how the teacher plans to use it. “The curriculum can be a straight-jacket or a crutch or a spring-board. For a teacher the curriculum stops being stifling if she understands what it is meant to achieve. But most use it, often badly, as a crutch because they make no effort to engage with it or understand what it hopes to achieve. Once a teacher understands that, she can use it or work around it to achieve the same ends,” says Dr. Gurveen Kaur.。

Corporate and Business Law (GLO) (F4) September 2014 to August 2015( PAPER EXAM SESSIONS IN DEC 2014 AND JUN 2015. START DATE FOR CBE NOVEMBER 19 2014.)This syllabus and study guide is designed to help with planning study and to provide detailed information on what could be assessed inany examination session.THE STRUCTURE OF THE SYLLABUS AND STUDY GUIDERelational diagram of paper with other papersThis diagram shows direct and indirect links between this paper and other papers preceding or following it. Some papers are directly underpinned by other papers such as Advanced Performance Management by Performance Management. These links are shown as solid line arrows. Other papers only have indirect relationships with each other such as links existing between the accounting and auditing papers. The links between these are shown as dotted line arrows. This diagram indicates where you are expected to have underpinning knowledge and where it would be useful to review previous learning before undertaking study.Overall aim of the syllabusThis explains briefly the overall objective of the paper and indicates in the broadest sense the capabilities to be developed within the paper.Main capabilitiesThis paper’s aim is broken down into several main capabilities which divide the syllabus and study guide into discrete sections.Relational diagram of the main capabilitiesThis diagram illustrates the flows and links between the main capabilities (sections) of the syllabus and should be used as an aid to planning teaching and learning in a structured way.Syllabus rationaleThis is a narrative explaining how the syllabus is structured and how the main capabilities are linked. The rationale also explains in further detail what the examination intends to assess and why.Detailed syllabusThis shows the breakdown of the main capabilities (sections) of the syllabus into subject areas. This is the blueprint for the detailed study guide.Approach to examining the syllabusThis section briefly explains the structure of the examination and how it is assessed.Study GuideThis is the main document that students, learning and content providers should use as the basis of their studies, instruction and materials. Examinations will be based on the detail of the study guide which comprehensively identifies what could be assessed in any examination session.The study guide is a precise reflection and breakdown of the syllabus. It is divided into sections based on the main capabilities identified in the syllabus. These sections are divided into subject areas which relate to the sub-capabilities included in the detailed syllabus. Subject areas are broken down into sub-headings which describe the detailed outcomes that could be assessed in examinations. These outcomes are described using verbs indicating what exams may require students to demonstrate, and the broad intellectual level at which these may need to be demonstrated(*see intellectual levels below).INTELLECTUAL LEVELSThe syllabus is designed to progressively broaden and deepen the knowledge, skills and professional values demonstrated by the student on their way through the qualification.The specific capabilities within the detailed syllabuses and study guides are assessed at one of three intellectual or cognitive levels:Level 1: Knowledge and comprehensionLevel 2: Application and analysisLevel 3: Synthesis and evaluationVery broadly, these intellectual levels relate to the three cognitive levels at which the Knowledge module, the Skills module and the Professional level are assessed.Each subject area in the detailed study guide included in this document is given a 1, 2, or3 superscript, denoting intellectual level, marked at the end of each relevant line. This gives an indication of the intellectual depth at which an area could be assessed within the examination. However, while level 1 broadly equates with the Knowledge module, level 2 equates to the Skills module and level 3 to the Professional level, some lower level skills can continue to be assessed as the student progresses through each module and level. This reflects that at each stage of study there will be a requirement to broaden, as well as deepen capabilities. It is also possible that occasionally some higher level capabilities may be assessed at lower levels.LEARNING HOURS AND EDUCATION RECOGNITIONThe ACCA qualification does not prescribe or recommend any particular number of learning hours for examinations because study and learning patterns and styles vary greatly between people and organisations. This also recognises the wide diversity of personal, professional and educational circumstances in which ACCA students find themselves.As a member of the International Federation of Accountants, ACCA seeks to enhance the education recognition of its qualification on both national and international education frameworks, and with educational authorities and partners globally. Indoing so, ACCA aims to ensure that its qualifications are recognized and valued by governments, regulatory authorities and employers across allsectors. To this end, ACCA qualifications are currently recognized on the education frameworks in several countries. Please refer to your nationaleducation framework regulator for further information.Each syllabus contains between 23 and 35 main subject area headings depending on the nature of the subject and how these areas have been brokendown.GUIDE TO EXAM STRUCTUREThe structure of examinations varies within and between modules and levels.The Fundamentals level examinations contain 100% compulsory questions to encouragecandidates to study across the breadth of each syllabus.The Knowledge module is assessed by equivalent two-hour paper based and computer based examinations.The Skills module examinations F5-F9 are all paper based three-hour papers containing a mix ofobjective and longer type questions. The Corporate and Business Law (F4) paper is a two- hourcomputer based objective test examination which isalso available as a paper based version from the December 2014 examination session.The Professional level papers are all three-hour paper based examinations, all containing two sections. Section A is compulsory, but there will be some choice offered in Section B.For all three hour examination papers, ACCA has introduced 15 minutes reading and planning time.This additional time is allowed at the beginning of each three-hour examination to allow candidates to read the questions and to begin planning their answers before they start writing in their answer books. This time should be used to ensure that all the information and exam requirements are properly read and understood.During reading and planning time candidates may only annotate their question paper. They may not write anything in their answer booklets until told to do so by the invigilator.The Essentials module papers all have a Section A containing a major case study question with all requirements totalling 50 marks relating to this case. Section B gives students a choice of two from three 25 mark questions.Section A of both the P4 and P5 Options papers contain one 50 mark compulsory question, and Section B will offer a choice of two from three questions each worth 25 marks each.Section A of each of the P6 and P7 Options papers contains 60 compulsory marks from two questions; question 1 attracting 35 marks, and question 2 attracting 25 marks. Section B of both these Options papers will offer a choice of two from three questions, with each question attracting 20 marks. All Professional level exams contain four professional marks.The pass mark for all ACCA Qualification examination papers is 50%. GUIDE TO EXAMINATION ASSESSMENTACCA reserves the right to examine anything contained within the study guide at any examinationsession. This includes knowledge, techniques, principles, theories, and concepts as specified.For the financial accounting, audit and assurance, law and tax papers except where indicated otherwise, ACCA will publish examinable documents once a year to indicate exactlywhat regulations and legislation could potentially be assessed within identified examination sessions.. For paper based examinations regulation issued or legislation passed on or before 31st August annually, will be examinable from 1st September of the following year to 31st August t of the year after that. Please refer to the examinable documents for the paper (where relevant) for further information.Regulation issued or legislation passed in accordance with the above dates may be examinable even if the effective date is in the future. The term issued or passed relates to when regulation or legislation has been formally approved. The term effective relates to when regulation or legislation must be applied to an entity transactions and business practices.The study guide offers more detailed guidance on the depth and level at which the examinable documents will be examined. The study guide should therefore be read in conjunction with the examinable documents list.SyllabusAIM To develop knowledge and skills in the understanding of the general legal framework within which international business takes place, and of specific legal areas relating to business, recognising the need to seek further specialist legal advice where necessary. MAIN CAPABILITIES On successful completion of this paper candidates should be able to: A Identify the essential elements of different l egal systems including the main sources of l aw, the relationship between the different b ranches of a state’s constitution, and the need f or international legal regulation, and e xplain the roles of international organisations in the promotion and regulation of international trade, and the role of international arbitration as an alternative to court adjudicationB Recognise and apply the appropriate legal rules applicable under the United Nations Convention on Contracts for the International Sale of Goods, and explain the various ways in which international business transactions can be fundedC Recognise different types of international business formsD Distinguish between the alternative forms and constitutions of b usiness organisationsE Recognise and compare types of capital and the financing of companiesF Describe and explain how companies are managed, administered and regulatedG Recognise the legal implications relating to insolvency lawH Demonstrate an understanding of corporate and fraudulent behaviourRELATIONAL DIAGRAM OF MAIN CAPABILITIES(A) Essential elements of legal systems(B) International business transactions transactions (E) Capital and the financing of companies (H) Corporate fraudulent and criminal behaviour(F) Management, administration and regulation of companies (C) Transportation and payment of international business transactions (D) The formation and constitution of business organisations(G) Insolvency law FR (F7) CR (P2) CL (F4) AA (F8)RATIONALECorporate and Business Law Global is divided into eight areas. The syllabus starts with an introduction to different legal systems, different types of law and those organisations which endeavour to promote internationally applicable laws. It also introduces arbitration as an alternative to court adjudication.It then leads into an examination of the substantive law as stated in UN Convention on Contracts for the International Sale of Goods, which relates to the formation, content and discharge of international contracts for the sale of goods.The syllabus then covers a range of specific legal areas relating to various aspects of international business of most concern to finance professionals. These are the law relating to the financing of international transactions, and the various legal forms through which international business transactions may be conducted. Particular attention is focused on the law relating to companies. Aspects examined include the formation and constitution of companies, the financing of companies and types of capital, and the day–to-day management, the administration and regulation of companies and legal aspects of insolvency law.The final section links back to all the previous areas. This section deals with corporate fraudulent and criminal behaviour.DETAILED SYLLABUSA Essential elements of legal systems1. Business, political and legal systems2.International trade, international legalregulation and conflict of laws3. Alternative dispute resolution mechanismsB International business transactions1. Introduction to the UN Convention onContracts for the International Sale of Goodsand ICC Incoterms2. Obligations of the seller and buyer, andprovisions common to bothC Transportation and payment of internationalbusiness transactions1. Transportation documents and means ofpaymentD The formation and constitution of businessorganisations1. Agency law2.Partnerships3. Corporations and legal personality4. The formation and constitution of a companyE Capital and the financing of companies1.Share capital2. Loan capital3. Capital maintenance and dividend lawF Management, administration and the regulationof companies1. Company directors2. Other company officers3. Company meetings and resolutions G Insolvency law1.Insolvency and administrationH Corporate fraudulent and criminal behaviour1. Fraudulent and criminal behaviourAPPROACH TO EXAMINING THE SYLLABUSThe syllabus is assessed by a two-hour paper-based examination, and is also offered as a computer-based examination.The examination consists of:Section A-25 x 2 mark objective test questions 50%-20 x 1 mark objective questions 20% Section B- 5 x 6 mark multi-task questions 30% 100%All questions are compulsory.NOTE ON CASE LAWCandidates should support their answers on the paper-based multi-task questions withanalysis referring to cases or examples. There is no need to detail the facts of the case. Remember, it is the point of law that the case establishes that is important, although knowing the facts of cases can be helpful as sometimes questions include scenarios based on well-known cases. Further it is not necessary to quote section numbers of Acts.Study GuideA ESSENTIAL ELEMENTS OF LEGAL SYSTEMS1. Business, political and legal systemsa)Explain the inter-relationship of economic and political and legal systems.[2]b)Explain the doctrine of the separation ofpowers and its impact on the legal system.[2] c)Explain the distinction between criminal andcivil law.[1]d)Outline the operation of the following legalsystems:[1]i) Common lawii) Civil lawiii) Sharia law.2. International trade, international legalregulation and conflict of lawsa)Explain the need for international legalregulation in the context of conflict of laws.[1] b)Explain the function of international treaties,conventions and model codes.[1]c)Explain the roles of international organisations,such as the UN, the ICC, the WTO, the OECD, UNIDROIT, UNCITRAL and courts in thepromotion and regulation of internationaltrade.[1]3. Alternative dispute resolution mechanismsa)Explain the operation, and evaluate the distinctmerits, of court-based adjudication andalternative dispute resolution mechanisms.[2] b)Explain the role of the international courts oftrade including the International Court ofArbitration .[1]c) Explain and apply the provisions of theUNCITRAL Model Law on InternationalCommercial Arbitration.[2]d) Describe the arbitral tribunal. [2]e) Explain arbitral awards. [2]B INTERNATIONAL BUSINESS TRANSACTIONS1. Introduction to the UN Convention onContracts for the International Sale of Goodsand ICC Incotermsa)Explain the sphere of application and generalprovisions of the Convention.[1]b)Explain and be able to apply the rules forcreating contractual relations under theConvention.[2]c)Explain the meaning and effect of the ICCIncoterms.[1]2. Obligations of the seller and buyer, andprovisions common to botha)Explain and be able to apply the rules relatingto the obligations of the seller under theConvention:[2]i) delivery of goods and handing overdocumentsii) conformity of the goods and third partyclaimsiii) remedies for breach of contract by theseller.b) Explain and be able to apply the rules relatingto the obligations of the buyer under theConvention:[2]i) payment of the priceii) taking deliveryiii) remedies for breach of contract by thebuyer.c) Explain and be able to apply the rules relatingto the provisions common to both the sellerand the buyer under the Convention:[2]i) anticipatory breach and instalmentcontractsii) damagesiii) interestiv) exemptionsv) effects of avoidancevi) preservation of the goods.d) Explain and be able to apply the rules relatingto the passing of risk under the Convention.[2]C TRANSPORTATION AND PAYMENT OFINTERNATIONAL BUSINESS TRANSACTIONS 1. Transportation documents and means ofpaymenta) Define and explain the operation of bills oflading.[1]b) Explain the operation of bank transfers.[1]c) Explain and be able to apply the rules ofUNCITRAL Model Law on International CreditTransfer.[2]d) Explain and be able to apply the rules of theUN Convention on International Bills OfExchange And International PromissoryNotes.[2]e) Explain the operation of letters of credit andletters of comfort.[12D FORMATION AND CONSTITUTION OFBUSINESS ORGANISATIONS1. Agency lawa)Define the role of the agent and give examplesof such relationships paying particular regardto partners and company directors.[2]b) Explain the formation of the agencyrelationship.[2]c) Define the authority of the agent.[2]d) Explain the potential liability of both principaland agent.[2]2. Partnershipsa)Demonstrate a knowledge of the legislationgoverning the partnership, both unlimited andlimited.[1]b)Discuss the formation of a partnership .[2]c)Explain the authority of partners in relation topartnership activity.[2]d)Analyse the liability of various partners forpartnership debts.[2]e)Explain the termination of a partnership, andpartners’ subsequent rights and liabilities.[2]3. Corporations and legal personalitya)Distinguish between sole traders, partnershipsand companies.[1]b)Explain the meaning and effect of limitedliability.[2]c)Analyse different types of companies,especially private and public companies.[1] d)Illustrate the effect of separate personality andthe veil of incorporation.[2]e)Recognise instances where separatepersonality will be ignored (lifting the veil ofincorporation).[2]4. The formation and constitution of a companya)Explain the role and duties of companypromoters, and the breach of those duties and remedies available to the company.[2]b)Explain the meaning of, and the rules relatingto, pre-incorporation contracts.[2]c)Describe the procedure for registeringcompanies, both public and private.[1]d)Describe the statutory books, records andreturns that companies must keep or make.[1] e) Analyse the effect of a company’sconstitutional documents.[2]f) Describe the contents of the model articles ofassociation.[1]g) Explain how the articles of association can bechanged.[2]h) Explain the control over the names thatcompanies may or may not use.[2]E CAPITAL AND THE FINANCING OFCOMPANIES1. Share capitala)Examine the different types of capital.[2]b)Illustrate the difference between variousclasses of shares, including treasury shares,the procedure for altering class rights.[2]c)Explain allotment of shares, and distinguishbetween rights issue and bonus issue ofshares.[2]d)Examine the effect of issuing shares at either adiscount, or at a premium.[2]2. Loan capitala)Define companies’ borrowing powers.[1]b)Explain the meaning of loan capital anddebenture.[2]c)Distinguish loan capital from share capital andexplain the different rights held by shareholders and debenture holders.[2]d)Explain the concept of a company charge anddistinguish between fixed and floatingcharges.[2]e)Describe the need, and the procedure for,registering company charges.[2]3. Capital maintenance and dividend lawa)Explain the doctrine of capital maintenanceand capital reduction.[2]b)Explain the rules governing the distribution ofdividends in both private and publiccompanies.[2]F MANAGEMENT, ADMINISTRATION ANDREGULATION OF COMPANIES1. Company directorsa)Explain the role of directors in the operation ofa company, and the different types of directors,such as executive/ non-executive directors orde jure and de facto directors .[2]b)Discuss the ways in which directors areappointed, can lose their office and thedisqualification of directors.[2]c)Distinguish between the powers of the board ofdirectors, the managing director/chief executive and individual directors to bind theircompany.[2]d)Explain the duties that directors owe to theircompanies.[2]2. Other company officersa)Discuss the appointment procedure relating to,and the duties and powers of, a companysecretary.[2]b)Discuss the appointment procedure relating to,and the duties and rights of, a companyauditor, and their subsequent removal orresignation.[2]3. Company meetings and resolutionsa)Distinguish between types of meetings:general meetings and annual generalmeetings.[1]b)Distinguish between types of resolutions:ordinary, special and written.[2]c)Explain the procedure for calling andconducting company meetings.[2]G INSOLVENCY LAW1 Insolvency and administrationa)Explain the meaning of, and procedureinvolved, in voluntary liquidation, includingmembers’ and creditors’ voluntaryliquidation.[2]b)Explain the meaning of, the grounds for andthe procedure involved, in compulsoryliquidation.[2]c)Explain the order in which company debts willbe paid off on liquidation .[2]d) Explain administration as an alternative toliquidation.[2]e) Explain the way in which an administrator maybe appointed, the effects of such appointment,and the powers and duties of anadministrator.[2]H CORPORATE FRAUDULENT AND CRIMINALBEHAVIOUR1 Fraudulent and criminal behavioura)Recognise the nature and legal control overinsider dealing .[2]b)Recognise the nature and legal control overmarket abuse.[2]c)Recognise the nature and legal control overmoney laundering.[2]d)Recognise the nature and legal control overbribery.[2]e)Discuss potential criminal activity in theoperation, management and liquidation ofcompanies.[2]f)Recognise the nature and legal control overfraudulent and wrongful trading.[2]11© ACCA 2014 All rights reserved.SUMMARY OF CHANGES TO F4 GLOACCA periodically reviews its qualification syllabuses so that they fully meet the needs of stakeholders such asemployers, students, regulatory and advisory bodies and learning providers.The main areas that have been deleted from the syllabus are shown in Table 1 below:Table 1 – Deletions to F4 GLOSection and subject area Syllabus contentG1d) Insolvency The rules in the 1997 UNCITRAL Model Law on Cross-Border InsolvencyG2b) Administration Comparison of administration and Chapter 11protectionH1a) Corporate governance The idea of corporate governanceH1b) Corporate governance The extra-legal codes of corporate governanceH1c) Corporate governance The legal regulation of corporate governance:12© ACCA 2014 All rights reserved.。

SyllabusPaper C01FUNDAMENTALS OF MANAGEMENT ACCOUNTING C01 – A. The context of management accounting (10%)Lead Component1(a)(b)(c)(d)2(a)(b)(c)3(a)(b)C01 – B. Cost identification and beLeadComponent 1(a)(b)(c)(d)(e)(f)explain the purpose of management accounting.explain the role of the management accountant.explain the role of CIMAas a professional bodyfor managementaccountants.apply methods foridentifying cost.2(a)(b)(c)(d)C01 – C. Planning within organisatLeadComponent 1(a)(b)(c)(d)(e)(f)(g)(h)(i)2(a)(b)(c)(d)(e)(f)C01 – D. Accounting control systemLeadComponent 1(a)(b)(c)(d)2(a)prepare statements ofvariance analysis.prepare integratedaccounts in a costingenvironment.prepare financialstatements for managers.prepare budgetarycontrol statements.demonstrate costbehaviour.(b)C01 – E. Decision making (15%)LeadComponent 1(a)(b)(c)2(a)(b)(c)3(a)(b)Paper C02FUNDAMENTALS OF FINANCIAL ACCOUNTINGC02 – A. Conceptual and regulatory framework (20%)LeadComponent 1(a)(b)(c)(d)(e)(f)(g)(h)2(a)(b)(c)explain the concepts offinancial accounting.explain the regulatoryand legal framework forfinancial accounting.prepare financialstatements for managers.demonstrate the use ofbreak-even analysis inmaking short-termdecisions.apply basic approachesfor use in decision demonstrate the use of investment appraisaltechniques in makingC02 – B. Accounting systems (20%LeadComponent 1(a)(b)(c)(d)(e)(f)(g)(h)2(a)(b)C02 – C. Preparation of accounts fLeadComponent 1(a)(b)(c)(d)(e)(f)(g)(h)2(a)(b)3demonstrate the use ofbasic ratios in financialperformance.(a)C02 – D. Control of accounting sysLeadComponent 1(a)(b)(c)explain the need forexternal controls on abusiness.prepare financialstatements for a singleentity.prepare ledger accountsand supportingdocuments.explain the use of codes in accounting systems.prepare accounts fortransactions.2(a)(b)(c)3(a)(b)4(a)(b)explain internal controltechniques.demonstrate howaccounting errors arecorrected.explain the nature offraud.NAGEMENT ACCOUNTINGof management accounting (10%)Componentdefine management accounting;explain the importance of cost control and planning withinorganisations;describe how information can be used to identify performance withinan organisation;explain the differences between financial information requirementsfor companies, public bodies and society.explain the role of the management accountant and activitiesundertaken;explain the relationship between the management accountant andthe managers being served;explain the difference between placing management accountingwithin the finance function and a business partnering role within anorganisation.explain the background to the formation of CIMA;explain the role of CIMA in developing the practice of managementaccounting.nd behaviour (25%)Componentexplain the concept of a direct cost and an indirect cost;explain why the concept of ‘cost’ needs to be defined, in order to bemeaningful;distinguish between the historical cost of an asset and the economicvalue of an asset to an organisation;prepare cost statements for allocation and apportionment ofoverheads, including reciprocal service departments;calculate direct, variable and full costs of products, services andactivities using overhead absorption rates to trace indirect costs tocost units;apply cost information in pricing decisions.explain how costs behave as product, service or activity levelsincrease or decrease;distinguish between fixed, variable and semi-variable costs;explain step costs and the importance of timescales in theirtreatment as either variable or fixed;calculate the fixed and variable elements of a semi-variable cost. anisations (30%)Componentexplain why organisations set out financial plans in the form ofbudgets, typically for a financial year;prepare functional budgets and budgets for capital expenditure and depreciation;prepare a master budget based on functional budgets;explain budget statements;identify the impact of budgeted cash surpluses and shortfalls onbusiness operations;prepare a flexible budget;calculate budget variances;distinguish between fixed and flexible budgets;prepare a statement that reconciles budgeted contribution withactual contribution.explain the difference between ascertaining costs after the eventand establishing standard costs in advance;explain why planned standard costs, prices and volumes are useful in setting a benchmark;calculate standard costs for the material, labour and variableoverhead elements of the cost of a product or service;calculate variances for materials, labour, variable overhead, sales prices and sales volumes;prepare a statement that reconciles budgeted contribution withactual contribution;prepare variance statements.ystems (20%)Componentexplain the principles of manufacturing accounts and the integration of the cost accounts with the financial accounting system;prepare a set of integrated accounts, showing standard costvariances;explain job, batch, and process costing;prepare ledger accounts for job, batch and process costing systems.prepare financial statements that inform management;distinguish between managerial reports in a range of organisations,including commercial enterprises, charities and public sectorundertakings.%)Componentexplain the contribution concept and its use in cost-volume-profit(CVP) analysis;calculate the break-even point, profit target, margin of safety andprofit/volume ratio for a single product or service;prepare break-even charts and profit/volume graphs for a singleproduct or service.explain relevant costs and cash flows;explain make or buy decisions;calculate the profit maximising product sales mix using limitingfactor analysis.explain the process of valuing long-term investments;calculate the net present value, internal rate of return and paybackfor an investment.NANCIAL ACCOUNTINGand regulatory framework (20%)Componentexplain the need for accounting records;identify user groups and the characteristics of financial statements;distinguish between financial and management accounts;identify the underlying assumptions, policies and changes inaccounting estimates;explain capital and revenue, cash and profit, income andexpenditure, assets and liabilities;distinguish between tangible and intangible assets;explain the historical cost convention;identify alternative methods of valuing assets, and their impact onprofit measures and statement of financial position values.explain the influence of legislation on published accountinginformation for organisations;explain the role of accounting standards in preparing financialstatements;explain approaches to creating accounting standards.systems (20%)Componentexplain the principles of double-entry bookkeeping;prepare cash and bank accounts, and bank reconciliationstatements;prepare petty cash statements under an imprest system;prepare accounts for sales and purchases, including personalaccounts and control accounts;prepare nominal ledger accounts, journal entries and a trial balance;prepare accounts for indirect taxes;prepare accounts for payroll;prepare a non-current asset register.explain the need for accounting codes;illustrate the use of simple coding systems.unts for single entities (45%)Componentprepare accounts using accruals and prepayments;prepare accounts for bad debts and allowances for receivables;prepare accounts using different methods of calculatingdepreciation and for impairment values;prepare accounts for inventories;prepare manufacturing accounts;prepare income and expenditure accounts;prepare accounts from incomplete records;prepare accounts for the issue and redemption of shares anddebentures.prepare financial statements from trial balance;prepare a statement of cash flows.calculate basic ratios.g systems (15%)Componentidentify the requirements for external audit and the basic processesundertaken;explain the meaning of fair presentation;distinguish between external and internal audit.explain the purpose and basic procedures of internal audit; explain the need for financial controls;explain the purpose of audit checks and audit trails.explain the nature of accounting errors;prepare accounting entries for the correction of errors. explain the nature of fraud;explain the basic methods of fraud prevention and detection.。

THEORIES OF COMMUNICATIONAnne HolmquestTC 264 626-7700Office hours: Daily 10:00-11:00; MW 2:00-3:00; TTh 1:30-2:00D2L mail7 absences are allowed, but upon the 8th absence you lose 200 pts. from the total pts. Print your own work; please do not merely e-mail it.Text I will use:Em Griffin, A First Look at Communication Theory, 7th th ed., (New York: McGraw-Hill, 2009).At the end: You will come up with a theory of something in communication or communication-related and you will determine the review of literature for that, with my assistance.Purpose:Our goal is not to send everyone off into the academic universe where all the talk is in theoretical, abstract language.We learn theory so that we can understand, explain, analyze and predict communication behavior that is important to us but problematic.Each good theory is an attempt to answer a problem in communication. The problem can be put in the form of a question such as, “How do people develop enduring, close friendships?” Or, “Why do communities exist online today, but not face-to-face?” You should choose theories to work with that pose the kinds of questions and give the kinds of answers that you wish to explore.Every theory also makes certain assumptions. One of the goals of the class is to get you to realize that everyone assumes some things; why do you assume the things you do? Could it be otherwise? Whenever you read a new theory, read it with a healthy dose of doubt. Shake it like a wolf shakes a rabbit. Once we apply theories to practice, what happens? Does anything about the theory need to change? Does anything about you?The ideas we learn about theory can apply equally to theories of writing, theories of psychology, theories of social behavior, or theories of whatever. We want you to create comparisons to other fields of study. There is communication to every field. Just make sure that you pick a “big” enough question so that you can explore all the elements of theory.Order of events:Consider hail. Meteorologists explain hail size from smallest to largest in this order:1. peas2. marble3. dime4. nickel5. quarter6. golf ball7. tennis ball8. baseball9. coffee cup10. softballWe will be going from smallest to largest in theory in this way with the contexts of communication:IntrapersonalInterpersonalRelationshipsGroupMass CommunicationCultureInterculturalWe will also be going from smallest to largest by the activities that we are doing with each of these contexts for theory:Summarize or paraphraseTell what question it addressesTell what assumptions it makesExplain itAnalyze itApply itUnderstand how it is similar or different from other theoriesIntegrate it with other theoriesClassify it in relation to other theories according to some higher-order criteriaBe aware of what your choice of theory says about you/your thinkingWe will cover: the evolution of theories; structure of scientific revolutionsWhere do Ideas come from? How does a theory take hold with an audience? How do theories compete? How does one theory overturn another?Graded activities:1. Journal notes on your question, working towards a theory all semester2. Exams on theories in comm. and the structure of theories3. Guest theorists will come to class, or we will model some in class, and after listening you will need to write a one-page analysis of the structure of the elements of that theory.4. Each of you will present an interesting existing theory that you found.4. Practice comparing and contrasting theories, according to some criteria.5. Review of literature for your question with readings beyond our text, comparing and contrasting theories or integrating them according to some criteria.6. Presentation of your theory orally and in writing. Models will be shown how to do so.。

Syllabus: Principles of Microeconomics Course Description:This introductory course teaches the fundamentals of microeconomics. Economics deals with the allocation of scarce resources – a task that different societies perform in different ways. In the western society, primary reliance is placed on economic markets and prices. we will discuss the criteria to evaluate our society’s allocation of resources and analyze the behavior of two of the principal actors – consumers and firms. The principles of economics will be presented in the context of various market structures.Topics include consumer theory, producer theory, the behavior of firms, market equilibrium, monopoly, and the role of the government in the economy.Lecturer: Yuanyuan Ye E-mail: yyy_dafoly@Text:“Economics Principles and Policy ” by William J. Baumol and Alan S. Blinder, Peking University Press, 11th editionReference:“Principles of Economics”by Mankiw, N. Gregory, Thomson China machine press.Grades:Your final grade will be based on the distribution listed below. This distribution is set in stone and there will be NO changes to the Final Grade Distribution. Final Grade Distribution:Group Discussion & Assignments: 20%Midterm Exam: 20%Final Exam: 60%Advice:You should ask questions in class. Class time is for interaction not just taking notes. I will send the slides to your monitor the day before the lecture. This way you can pay more attention and spend more time listening to me rather than transcribing the class. In addition, If you have any questions or you need extra help, please feel free to contact me by emails.Homeworks must be your individual work, and copying the answers of another student is definitely cheating. On the other hand, you are encouraged to get together in groups to discuss the course and even how to get started on the homeworks. And there are 6 group discussions for you to do, each group will have a random topic which I will assign to you during this semester, you will have a week to prepare for it and make a presentation during the following week.About Exams, you will only be tested on the material covered in class.Schedule:(approximate dates)Week 1:Chapters 1 and 2•Introduction•What is Economics•The Economy:Myth and RealityWeek 2: Chapters 3•The Fundamental Economic Problem: Scarcity and Choice Week 3: Chapters 4 and 5•Supply and Demand•Individual and Market Demand(part 1)Week 4: Chapter 5•Individual and Market Demand (part 2)Week 5: Chapter 6 and 7•Demand and Elasticity•Production, Inputs and Cost(part 1)Week 6: Chapters 7•Production, Inputs and Cost(part 2)Week 7: Chapters 8•Output, Price, and ProfitWeek 8: Midterm ExamPart 1 and Part 2 of the course CompleteWeek 9: Chapters 10 and 11•The firm and the Industry under Perfect Competition •Monopoly(Part 1)Week 10: Chapter 11•Monopoly(Part 2)Week 11: Chapter 12•Between Competition and MonopolyWeek 12: Chapter 14•The Price SystemWeek 13: Chapter 15 and 16•The Shortcoming of Free Markets•Innovation and Growth(Part 1)Week 14: Chapter 16•Innovation and Growth(Part 2)Week 15: Chapter 17 and 21•Externalities, the Environment, and Natural Resources •Poverty, Inequality, and Discrimination(Part 1)Week 16: Chapter 21•Poverty, Inequality, and Discrimination(Part 2)•Review of all chaptersTime Permitting: Chapter 18 T axation and Resource Allocation FINAL EXAMCourse Complete。

syllabus词根词缀解析一syllabus词根的含义和来源syllabus词根来源于古希腊语,意为“课程提纲”或“大纲”。

在现代英语中,syllabus已经成为一个专门的词汇,用来指代一份详细说明课程安排、内容和要求的文档。

二、syllabus词缀的含义和功能syllabus词缀通常用于构成与课程相关的词汇,如“syllabus”、“syllabi”等。

这些词缀具有明确的意义和功能,使得词汇的含义更加具体和准确。

例如,“-syllabi”后缀用于表示“课程提纲”或“教学大纲”的复数形式。

三、syllabus词根和词缀的组合规则和变化规律syllabus词根和词缀的组合具有一定的规则和变化规律。

一般来说,词根可以与其他前缀或后缀结合形成新的词汇。

例如,“syllabi”就是由“syllabus”加上后缀“-i”构成的。

同时,词缀的添加也会引起词性的变化,如“syllabus”是名词,而“syllabi”则是名词的复数形式。

四、syllabus词汇的语义和语用特点syllabus词汇的语义通常与课程安排、内容和要求相关。

在语用方面,Syllabus 词汇通常用于描述课程的具体安排、内容和要求,为教师和学生提供明确的指导。

同时,Syllabus词汇也具有一定的专业性和正式性,通常出现在教育领域的正式文档中。

五、syllabus词汇与其他相关词汇的辨析和区分在英语中,与syllabus相似的词汇还有许多,如“outline”、“course description”等。

这些词汇的含义和用法都有所不同,因此在使用时需要仔细区分。

例如,“outline”通常用于描述一个项目或计划的框架或结构,而“course description”则用于详细描述一门课程的内容和要求。

因此,在使用这些词汇时需要根据具体的语境和需求进行选择和使用。

U0702025 State of the Anglophone World: History, Geography, Cultures & PoliticsSpring 2016 SemesterLecturer: Marc-André JeanEmail: marc-andre.jean.1@ulaval.caSchedule: Classes #1 and #3Thursday, 8:20 – 9:50 a.m., Xinda 504Class #2Monday, 10:20 – 11:50 a.m., Xinda 802Classes #4 and #5Thursday, 3:40 – 5:10 p.m., Xinda 506Classes #6 and #7Friday, 8:20 – 9:50 a.m., Siqi 505N OTA B ENE:- Class #2, NO CLASS, Monday, April 4th – Qing Ming Festival- Class #2, NO CLASS, Monday, May 2nd – Labour Day Holiday- Classes #4 and #5, NO CLASS, Thursday, June 9th – Dragon Boat Festival - Classes #6 and #7, NO CLASS, Friday, June 10th – Dragon Boat Festival Students support: by email or Xinda Building, door 101Monday and Wednesday, 3:30 – 6:00 p.m. OBJECTIVES:The central objective of this survey course is to give the students a solid overview of the historical, geographical, cultural, and political evolution of the countries of the Anglophone world, also known as the major English-speaking countries, which are: the United Kingdom, the United States of America, Canada, Australia, New Zealand, and to a certain extent, India and South Africa. The lectures start with the coverage of the birth and evolution of the English language and of the Anglophone civilization as a whole. It then focuses on the major English-speaking countries previously evoked. Thus, the emphasis is first and foremost put on the European English speaking countries of the United Kingdom, which are England, the Wales, Scotland, Ireland and Northern Ireland. As the influence of England crossed the oceans from the 17th until the 20th century, this course also covers its extensions in the overseas colonies and territories. That time period of the Anglophone world is characterized by several changes and mutations in the cultural, politic, social, intellectual, artistic and scientific spheres that take place into a universe shaped by structures, behaviours and mentalities inherited from the European world and blended with native societies.At the end of this course, the students will be able to identify the main events and characters of the Anglophone world, from the 17th to the 21st century, to place them into their precise geographical context, to understand the political influences that shaped the international relations of those territories with the rest of the world, and to appreciate the very particular cultural traits of the Anglophone peoples. The characteristics of the various branches of the Anglophone civilization will be understood and the students will be able to identify, to explain and to make links between one another. Moreover, they will be able to place them in perspective with their origins and their modern and post-modern continuation.CONTENT & METHOD OF TEACHING:This survey course rests on weekly lectures supported by a visual presentation designed to give the students a combination of essential pieces of information and knowledge illustrated by selected primary sources such as fundamental texts, maps and audiovisual materials. The calendar covers essential themes of the Anglophone world including, but not limited to, its historical and geographical evolution, as well as politics, literatures, arts and sciences. The lecturer strongly recommends his students to take notes during the classes in order to gather enough information to be prepared for the assessments. They also have to do mandatory readings in the textbook entitled The Society and Culture of Major English-Speaking Countries – An Introduction(2015), and scanned book chapters covering two of the core themes (UK and Australia) that are not in the textbook. The lecturer will give more details on the first class of the semester. A personal research on the internet is also recommended, each and every time the student feels the need to deepen his/her understanding.ASSESSMENTS AND KEY READINGSThree tests are scheduled and students take them without any access to neither their personal notes nor the internet. Those assessments are made to evaluate the students’ spirit of synthesis, their analytical thought and their ability to structure their explanation of the evolution of the Anglophone world. Each test is made of four complementary sections: Section 1 is a set of multiple choice questions (a-b-c-d, choose one answer); Section2 is a set of short answer questions based on the weekly lectures and the mandatory readings; Section 3 is made of blank maps on which the students have to identify different locations, or points of interest such as cities, states, provinces or areas.ASSESSMENTS & GRADE DISTRIBUTION:1. Test #1: 33 %2. Test #2: 33 %3. Test #3: 33 %WRITEN LANGUAGE QUALITYFor the three tests, every set of 10 mistakes will lead to a -1 loss directly attributed to the grade of the assessment in question (-1 / 33). PLAGIARISMDuring any of the assessment, if the lecturer catches a student copying his/her neighbor’s answers, HE WILL FAIL THAT STUDENT.C ALENDARWeekly Class Themes1 Presentation of the courseExplanation of the assessments2 The Anglophone World: Facts and Legends. The Origins of the English Language and the Birth of the Anglophone Civilization.3 The United Kingdom – Part 1 of 34 The United Kingdom – Part 2 of 35The United Kingdom – Part 3 of 36Test #1: The Origins of the English Language AND the United Kingdom – 33% Duration: 1h307 The United States of America – Part 1 of 38 The United States of America – Part 2 of 39 The United States of America – Part 3 of 310 Canada – Part 1 of 311 Canada – Part 2 of 312Canada – Part 3 of 313Test #2: The United States of America AND Canada – 33% Duration: 1h3014Australia – Part 1 of 215Australia – Part 2 of 216New Zealand – Part 1 of 217New Zealand – Part 2 of 218 Test #3: Australia AND New Zealand – 33% Duration: 1h30Selected BibliographyThe Anglophone World – Survey studies GARNER, Steve and REDONNET, Jean-Claude. A Documented History of the Commonwealth. 1999.HICKEY, Raymond. Areal Features of the Anglophone World. 2012 HICKEY, Raymond (ed.) et al. Standards of English. Codified Varieties Around the World. 2012.OMHOVÈRE, Claire (ed.) et al. Perceiving and Representing Space in English-speaking World. 2011.The United KingdomGARNER, Steve and REDONNET, Jean-Claude. A Documented History of the Commonwealth. 1999.WELSH, Frank. The Four Nations. A History of the United Kingdom. 2003.The United States of America HEFFNER, Richard D. and HEFFNER, Alexander. A Documentary History of the United States. 2009.JENKINS, Philip. A History of the United States. 1997.REMINI, Robert V. A Short History of the United States. 2008.ZINN, Howard, EMERY, Kathy and REEVES, Ellen. A People’s History of the United States. 2003.CanadaCONRAD, Margaret and FINKEL, Alvin. Canada. A National History. 2003.GARNER, Steve and REDONNET, Jean-Claude. A Documented History of the Commonwealth. 1999.HAYES, Derek W. Canada. An Illustrated History. 2004 RIENDEAU, Roger. A Brief History of Canada. 2000.Australia and New Zealand GARNER, Steve and REDONNET, Jean-Claude. A Documented History of the Commonwealth. 1999.LYONS, Martin and RUSSELL, Penny. Australia’s History. Themes and Debates. 2005.MACINTYRE, Stuart. A Concise History of Australia. 1999.MEIN SMITH, Philippa. A Concise History of New Zealand. 2005.。

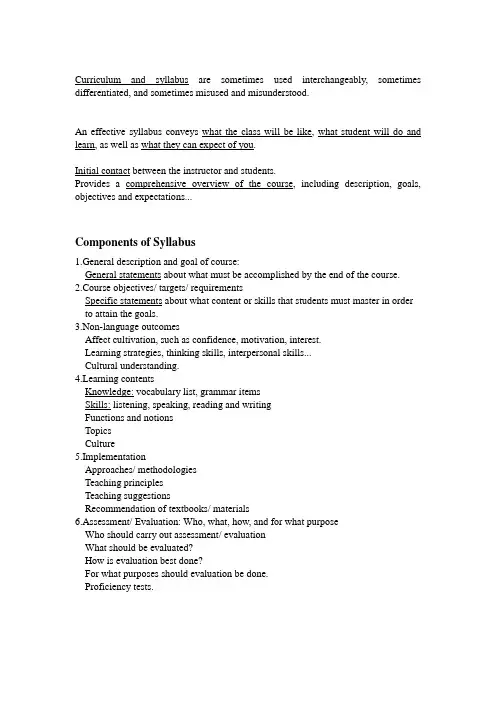

Curriculum and syllabus are sometimes used interchangeably, sometimes differentiated, and sometimes misused and misunderstood.An effective syllabus conveys what the class will be like, what student will do and learn, as well as what they can expect of you.Initial contact between the instructor and students.Provides a comprehensive overview of the course, including description, goals, objectives and expectations...Components of Syllabus1.General description and goal of course:General statements about what must be accomplished by the end of the course.2.Course objectives/ targets/ requirementsSpecific statements about what content or skills that students must master in order to attain the goals.3.Non-language outcomesAffect cultivation, such as confidence, motivation, interest.Learning strategies, thinking skills, interpersonal skills...Cultural understanding.4.Learning contentsKnowledge: vocabulary list, grammar itemsSkills: listening, speaking, reading and writingFunctions and notionsTopicsCulture5.ImplementationApproaches/ methodologiesTeaching principlesTeaching suggestionsRecommendation of textbooks/ materials6.Assessment/ Evaluation: Who, what, how, and for what purposeWho should carry out assessment/ evaluationWhat should be evaluated?How is evaluation best done?For what purposes should evaluation be done.Proficiency tests.Structural Syllabus:The major drawback of structural syllabus is that it concentrates only on the grammatical forms and the meaning of individual words, whereas the meaning of the whole sentence is thought to be self-evident.Student trained by such a syllabus often prove to be communicative incompetent.A notional/ functional syllabus(意念功能大纲)意念功能教学大纲最早被提出是根据学生要用语言表达的意思和要发挥的语言功能来安排教学内容。

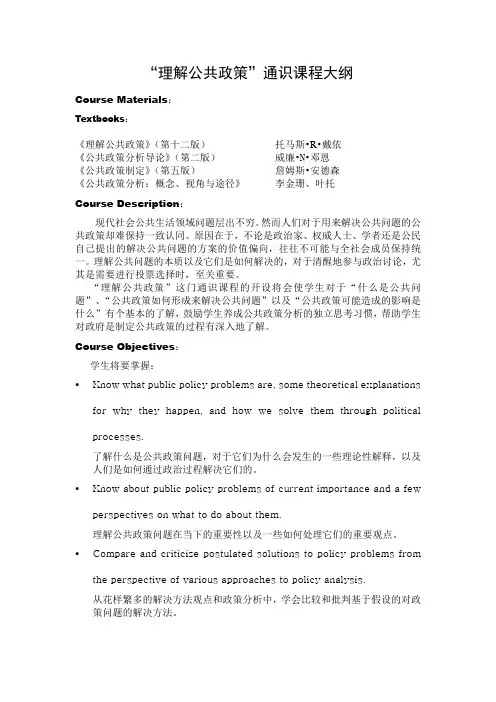

“理解公共政策”通识课程大纲Course Materials:Textbooks:《理解公共政策》(第十二版)托马斯•R•戴依《公共政策分析导论》(第二版)威廉•N•邓恩《公共政策制定》(第五版)詹姆斯•安德森《公共政策分析:概念、视角与途径》李金珊、叶托Course Description:现代社会公共生活领域问题层出不穷。

然而人们对于用来解决公共问题的公共政策却难保持一致认同。

原因在于,不论是政治家、权威人士、学者还是公民自己提出的解决公共问题的方案的价值偏向,往往不可能与全社会成员保持统一。

理解公共问题的本质以及它们是如何解决的,对于清醒地参与政治讨论,尤其是需要进行投票选择时,至关重要。

“理解公共政策”这门通识课程的开设将会使学生对于“什么是公共问题”、“公共政策如何形成来解决公共问题”以及“公共政策可能造成的影响是什么”有个基本的了解,鼓励学生养成公共政策分析的独立思考习惯,帮助学生对政府是制定公共政策的过程有深入地了解。

Course Objectives:学生将要掌握:• Know what public policy problems are, some theoretical explanations for w hy they happen, and how we solve them through political processes.了解什么是公共政策问题,对于它们为什么会发生的一些理论性解释,以及人们是如何通过政治过程解决它们的。

• Know about public policy problems of current importance and a few perspectives on what to do about them.理解公共政策问题在当下的重要性以及一些如何处理它们的重要观点。

• Compare and criticize postulated solutions to policy problems from the perspective of various approaches to policy analysis.从花样繁多的解决方法观点和政策分析中,学会比较和批判基于假设的对政策问题的解决方法。

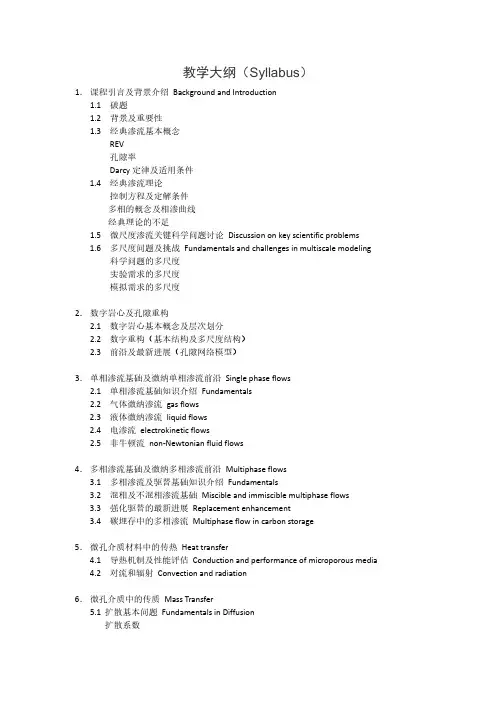

教学大纲(Syllabus)1.课程引言及背景介绍Background and Introduction1.1破题1.2背景及重要性1.3经典渗流基本概念REV孔隙率Darcy定律及适用条件1.4经典渗流理论控制方程及定解条件多相的概念及相渗曲线经典理论的不足1.5微尺度渗流关键科学问题讨论Discussion on key scientific problems1.6多尺度问题及挑战Fundamentals and challenges in multiscale modeling科学问题的多尺度实验需求的多尺度模拟需求的多尺度2.数字岩心及孔隙重构2.1 数字岩心基本概念及层次划分2.2 数字重构(基本结构及多尺度结构)2.3 前沿及最新进展(孔隙网络模型)3.单相渗流基础及微纳单相渗流前沿Single phase flows2.1 单相渗流基础知识介绍Fundamentals2.2 气体微纳渗流gas flows2.3 液体微纳渗流liquid flows2.4 电渗流electrokinetic flows2.5 非牛顿流non-Newtonian fluid flows4.多相渗流基础及微纳多相渗流前沿Multiphase flows3.1 多相渗流及驱替基础知识介绍Fundamentals3.2 混相及不混相渗流基础Miscible and immiscible multiphase flows3.3 强化驱替的最新进展Replacement enhancement3.4 碳埋存中的多相渗流Multiphase flow in carbon storage5.微孔介质材料中的传热Heat transfer4.1 导热机制及性能评估Conduction and performance of microporous media4.2 对流和辐射Convection and radiation6.微孔介质中的传质Mass Transfer5.1扩散基本问题Fundamentals in Diffusion扩散系数气体扩散问题离子扩散问题5.2复杂扩散问题:耦合对流及吸附解吸附等Complex diffusion 7.流固耦合问题(变形、断裂、运动)8.多尺度模拟前沿及总结Multiscale modeling: frontier and summary8.1 多尺度模拟的方法论Methodology8.2 多尺度模拟的未来Perspective。

syllabus的名词解释课程大纲(syllabus)是指在教育领域中用于规定和描述课程内容的文件或纲要。

这一概念在各种教学环境中被广泛使用,从中小学到大学,以及职业培训等不同层次的教育中都可以找到相关的课程大纲。

一、课程大纲的重要性课程大纲对于教师和学生来说具有重要意义。

首先,它概述了课程的学习目标和目标,为学生提供了一个清晰的学习方向。

同时,它也为教师提供了一个教学计划的框架,帮助他们组织教学内容和安排教学活动。

此外,课程大纲还可以作为学校和教育机构之间沟通的工具,确保不同教师在相同课程中传授的内容和标准一致。

二、课程大纲的内容课程大纲的具体内容可以因教育层次和学科而异,但通常包括以下几个方面:1.课程概述:课程大纲的开场白通常会简要介绍该课程的主题、背景和重要性,为学生提供一个整体认识。

2.学习目标:这部分会列举学生在该课程中应该学会的基本知识、技能和态度。

学习目标的设定需要考虑课程的内容和学生的能力水平,以确保目标达成性和挑战性。

3.教学内容:在这一部分,教师会详细列出课程中要涵盖的具体主题和内容。

例如,如果是一门历史课程,教学内容可以包括各个历史时期、重大事件等。

对于每个主题,教师可以列出相关的核心概念、重要事件或人物,并说明学生将通过何种方式了解这些内容,如阅读材料、小组讨论或实地考察等。

4.教学方法和评估方式:这一部分介绍了教学过程中所采用的方法和学生被评估和测验的方式。

例如,教学方法可以是讲课、讨论、实验或项目研究,而评估方式则可以有考试、论文、小组作业等。

5.教材和参考资料:这一部分列出了与课程相关的教材和其他参考资料。

教材通常是主要的学习资源,而其他参考资料则可能有助于深入理解和研究课程的内容。

三、课程大纲的制定和调整课程大纲的制定是一个复杂的过程,需要教师和教育专家的共同努力。

在初步制定大纲时,教师需要考虑课程的目标、内容和教学方法,同时也应该与其他教师进行讨论和意见交流,以确保大纲的准确性和连贯性。

一、名词解释在语言学领域,syllabus(音译:“西拉巴斯”)是一个常见的名词,它指的是在一门课程中涉及的所有教材、教学安排和学习目标等内容的总称。

在学术上,syllabus一般由教师或教育机构根据学科要求和教学需要进行设计,并在课程开始前向学生提供。

二、语言学中的syllabus1. 定义和作用在语言学中,syllabus主要指的是用于教授语言课程的教学大纲。

它包含了课程内容的整体安排、学习目标的设定、教学方式和评估方法等信息,是教师和学生在进行语言学习时的重要参考依据。

通过syllabus,教师可以清晰地将课程的目标和内容传达给学生,帮助学生了解课程的整体架构和学习重点,从而更好地进行学习和备考。

2. 课程内容和安排在语言学中,syllabus通常会包含课程的各个学习模块或单元的主题、教学内容和学习时间安排等信息。

在英语课程的syllabus中,可能会包括词汇、语法、听说读写等技能的学习模块、每个模块所涉及的具体内容和教学方法、以及每周课程的安排和作业要求等。

3. 学习目标和评估方式另外,在语言学的syllabus中,通常也会明确列出每个学习模块或单元的学习目标,以及学生的评估方式和标准。

这有助于教师和学生清晰地了解在课程学习过程中要达到的目标和要求,以及如何进行学习效果的评估和监控。

这种明确的学习目标和评估方式有助于提高教学的针对性和学生的学习动力,从而更好地促进语言学习的效果。

4. 教学方式和教学资源在语言学中的syllabus中通常也会包括教学方式和所需的教学资源等信息。

课程中可能采用的教学方法、学生需要使用的教材和参考书目、以及教师提供的学习资源和支持等。

这有助于学生和教师了解在课程学习过程中所需的教学资源和协助,并为教学和学习提供了更好的保障。

三、结语syllabus在语言学中被广泛应用,它不仅是教师进行课程设计和教学安排的重要工具,也是学生进行学习和备考的重要参考资料。

通过syllabus的制定和使用,可以更好地促进语言学习的有效进行,提高教学和学习的效果。

SyllabusChina in Global EconomySpring, 2010Instructor: Dr. Li JingClassroom: Hist.209Class time: Thursday, 1:30pm—4:20pmCourse Description and ObjectiveCourse DescriptionThis course offers an opportunity for international students to begin studying the Chinese economy in the era of globalization and the interaction between China and the rest of world. It aims to develop the learners’ understanding of the process of China’s economic reforms and opening-up policy, how China was involved into the global economic circulation, it will be conducive to improving the learners’ sense of awareness in economics. The contents of this course is issues-oriented, it covers issues emerged in the last 30 years, and the analysis on issues are also based on the related theory.There are three parts in the course.The first part covers a number of issues areas that together provide an answer to the questions of enterprises reform, financial system reform, three rural problems, resource, environment and sustainable development of China. It will help the learners to get a general structure of the structural reforms and its outcomes.The Second part covers the interactions between China and world economy from the foreign trade, foreign investment and economic adjustment under the WTO frame work, the relations between China and its top trade partners.The third part covers China’s macroeconomic policy since 1990, fiscal policy, monetary policy, exchange rate policy and China’s response in times of crisis. It will address and compare China’s stimulus package and its outcomes during Asian Crisis (1997-1998) and global financial crisis (2008- ).The design of the course does not assume prior systematic knowledge about China or the Chinese economy. The students can expect to build a solid knowledge basis for learning, more systematically, about China and China’s ties with the rest of the world.Learning OutcomesBy the end of the course, students shoulda) Well understand China’s roadmap in economic reform and opening- up policy, especially the logic behind it.b) Well understand the Chinese economic features in the era of globalization and tasks ahead for China.c) Build the capability of studying the Chinese economy with economics knowledge. Prerequisite: principles of economics or permission of department.Course RequirementsStudents are expected to read through the articles selected for each week before the class convenes. In order to better comprehend the course readings and in-class discussions, however, students are strongly encouraged to refer to the following surveys of the Chinese economy:1.Angus Maddison, Chinese Economic Performance in the Long Term (OECD Development Center Studies, 1998).2.Wu Jinglian, Understanding and Interpreting Chinese Economic Reform(Thomson/South-Western, 2005).3.Barry Naughton, The Chinese Economy: transitions and growth, (MIT Press, 2007).4.Barry Eichengreen, ed., China, Asia, and the New World Economy (Oxford University Press, 2008).(The above books on reserve in the American University Program office)5.Wang Mengkui, China’s Economic Transformation Over 20 Years( Foreign LanguagesPress , Beijing), 20006.Li Jingwen, The Chinese Economy into the 21st Century, ( Foreign Languages Press , Beijing),2000Each student will be asked to make a presentation and lead a discussion based on a topic assigned for the week. The discussion shall be based on but not limited to the weekly readings assigned.The students will be grouped, and each group will participate in the in-class discussion; each group is required to make a presentation at the last class. The topic shall be based on the topics of each week but not limited to the weekly readings.In the fifth week, each student must present a one-page ‘writing plan’ for the term paper, which is due the last day of the course. Use the Chicago Manual of Styles for formatting the paper and observe the usual rules of academic integrity.Required Work and Grading PolicyYour final grade will be determined by the following:1.Attendance 15%2.In- Class group discussion and presentation 10%3.Term Report Presentation ( in group, in the last class) 10 %4.Individual presentation 15%5.Term paper 50%(should be personal)Grades are on a 100 points scale:90-10080-89 70-79 60-69 59- AB C D ECLASS SCHEDULEWeek Topics Lecture (hours)Otheractivities01 Chapter1 An Review on the Chinese EconomyThe roadmap of China’s Reforms and Opening-up302 Chapter 2 Reform of Enterprises (SOEs and SMEs)2In –classdiscussion03 Chapter 3 China’s Financial System and Supervision 304 Chapter 4 Three Rural Problems 305 Chapter5 Resource, Environment and Sustainabledevelopment2In –classdiscussion06 Chapter 6 Foreign Trade Development 307 Chapter 7 China’s Inward & Outward FDI and Other Investments308 Chapter 8 China’s WTO Entry: A Long March toGeneva2In –classdiscussion09 Chapter 9 Bilateral Ties between China and Its Top 3Trade Partners2In –classdiscussion10 Chapter10 China’s Macroeconomic Policy Since 1990311 Chapter11 China’s stimulus package in Time of Crisis 312 Chapter12 An Conclusion and Tasks Ahead for China 1 Term report Presentation Feedbacks Hand in the term paperWork SchedulePart I Basic Reforms and OutcomesWeek one Chapter 1 An Review on the Chinese EconomyThe roadmap of China’s Reforms and Opening-upWang Mengkui, China’s Economic Transformation Over 20 Years( Foreign Languages Press , Beijing), 2000, Chapter 4,5Li Kui-wai, The two decades of Chinese economic reform compared, China & World Economy, No. 2., 2001Liu Guoguang, Economic Reform and Development in China,China and World Economy No.1, 1998Conference News 30 Years of Economic Reforms in China:Retrospect and Outlook (81) , China & World Economy, No.1,2008Hu Angang, China’s Economic Growth and Poverty Reduction(1978-2002), edited by Wanda Tseng and David Cowen, India’s and China’s Recent Experience with Reform and Growth, IMF, 2005 . Chapter 3Week Two Chapter 2 Reform of Enterprises (SOEs and SMEs)Wang Mengkui, China’s Economic Transformation Over 20 Years( Foreign Languages Press , Beijing), 2000,Jiang Xiaojuan ,The Globalization of China's Economy and the Formation and Development of En terprise Groups ,China & World Economy, No. 1 ,2000Shiyong Zhao, Government Policies and Private Enterprise Development in China: 2003-2006, China & World Econom y, No.4.2009Wang Zhongyu, State-owned Enterprise Reform in a Major Stage ,China & World Economy, No. 2,1997Zhang Chunlin, Revisiting China’s SOE Reform Strategy, China & World Economy, No.2, 2002Week Three Chapter 3 China’s Financial System and SupervisionBarry Naughton, China's Financial Reform: Achievements and Challenges, BRIE Working Paper 112.1998, BRIEChen Yuan, Financial System Reform and Economic Development in China, edited by Wanda Tseng and David Cowen, India’s and China’s Recent Experience with Reform and Growth, IMF, 2005Xie Ping, Financial Reform in China: Review and Future Challenges, China & World Economy, No. 5, 1999Xia Bin China Ready for Adopting a Universal Banking System? , China & World Economy, No. 2, 2001Week Four Chapter 4 Three rural problemsWang Mengkui, China’s Economic Transformation over 20 Years (Foreign Languages Press, Beijing), 2000, Chapter 3 Reform of Economic Structure in China’s Rural AreaZhu Ling, Gender Inequality in the Land Tenure System of Rural China, China & World Economy, No. 2, 2001Zhigang Xu RanTao, Urbanization, Rural Land System and Social Security in China, China & World Economy,No.6, 2004LiZhou, Public Goods, Environmental Protection,and the Development Paradigm in Rural China , China & World Economy , No.6,2004Tao Ran Liu Mingxing, Rural Taxation and Government Regulations in China, China & World Economy, No.2, 2003Yang Yao, Village Elections, Accountability and Income Distribution in Rural China, China & World Economy, No.6, 2006Fang Cai Meiyan Wang, A Counterfactual Analysis on Unlimited Surplus Labor in Rural China , China & World Economy, No.1, 2008Week Five Chapter 5 Resource, Environment and Sustainable developmentLi Jingwen, The Chinese Economy into the 21st Century, (Foreign Languages Press , Beijing), 2000, Chapter 17 The EnvironmentWarwick J. McKibbin, Global Energy and Environmental Impacts of an Expanding China, China & World Economy, No.4, 2006Pan Jiahua, Du Yaping, Environmental Degradation as a Threat to China's Food Security, China & World Economy, No. 1, 1998Shi Min, Environmental Protection in China: Existent Problems and Improvement Measures, China & World Economy, No. 4, 1998Chunsheng Tian, Sino-Russian Energy Cooperation and Geo-Strategic Issues, China & World Economy, No.3, 2005Dan Shi Energy Industry in China:Marketization and National Energy Security, China & World Economy, No.4, 2005Jason Zunsheng Yin David Forre, Elasticity of Energy Demand and Challenges for China’s Energy Industry, China & World Economy, No.4,2006Part II The Interaction between China and World EconomyWeek Six Foreign Trade DevelopmentNicholas R. Lardy, Trade Liberalization and its role in Chinese Economic Growth, edited by Wanda Tseng and David Cowen, India’s and China’s Recent Experience with Reform and Growth, IMF, 2005 .Chapter 7Hung-gay Fung, China’s Foreign Trade and Investment:An Overview and Analysis , China & World Economy, No.3, 2005Pingyao Lai ,China’s Foreign Trade:Achievements, Determinants and Future Policy Challenges, China & World Economy, No.6, 2004Fung Hung-gay, Are China’s Trade Policies Effective?China & World Economy, No.1, 2003 Week Seven China’s Inward & Outward FDI and Other Investments Xiaojuan Jiang, Prospects and Analysis of FDI in China, China & World Economy, No.4, 2005Judith M. Dean, “Are foreign investors attracted to weak environmental regulations? Evaluatingthe evidence from China,” Journal of Development Economics, November 2008 (on-line).Furong Jin Keun Lee Yee-Kyoung, Changing Engines of Growth in China:From Exports, FDI and Marketization to Innovation and Exports, China & World Economy,No.2,2008Laijun Luo Louis Brennan Chan , Factors Influencing FDI Location Choice in China's Inland Areas, China & World Economy, No.2, 2008Zhang Honglin,Why Does China Receive So Much Foreign Direct Investment?China & World Economy,No.3, 2002Jiang Xiaojuan, New Regional Patterns of FDI Inflow:Policy Orientation and Expected Performance, China & World Economy, No.2, 2002Foreign Capital Utilization in China: Prospects and Future Strateg y, World Bank,《中国利用外资的前景和战略》,世界银行主编,中信出版社,2007(This book is written in both Chinese and English)Week Eight China’s WTO Entry: A Long March to GenevaSong Hong,The Impact of China's WTO Accession on Industrial Development, China & World Economy, No. 1 , 2000Liping He, Xiaohang Fan, Foreign,China & World Economy, No.5, 2004Li Yuefen, Economic Implications of China's Accession to the WTO,China&World Economy,No.2, 2003Guo Kesha,Comprehensive Impacts of China's WTO Entry on Its Industrial Sector,China & World Economy,No.2,2003Zhang Xiaopu , Chinese policy options on international capital flow after WTO accession, China &World Economy,No.3, 2003Changhong Pei Lei Peng, Responsibilities of China after Accession to the WTO,China & World Economy, No4, 2007Wang Yu,some important issues concerning China’s macroeconomic management after WTO entry –interview with prof. Lawrence lau, China &World Economy,No.5, 2003Kanamori Toshiki, China's Economy and Financial Market after the WTO Entry, China &World Economy,No 6, 2001Week Nine Bilateral Ties between China and Its Top 3 Trade Partners Changhong Pei, Analysis of the Changes in the Growth of Japan's Direct Investment in and Trade with China , China & World Economy,No.6, 2005Willem F. Duisenberg, China and the Euro Area in a Global Perspective, China & WorldEconomy, No.3, 2002Zhao Longyue and Wang Yan, “Trade Remedies and Non-Market Economies: Economic Implications Of The First US Countervailing Duty Case On China”,World Bank Research Working papers, December 2008, pp. 1-50.David Scott, “China-EU convergence 1957–2003: towards a ‘strategic partnership’”, Asia Europe Journal, Volume 5, Number 2, June 2007, pp. 217-233.Wing Thye Woo, “Dealing sensibly with the threat of disruption in trade with China: the analytics of increased economic interdependence and accelerated technological innovation,” Economic Change and Restructuring, Volume 40, Numbers 1-2, June 2007,pp. 1-26.Bibo Liang , Political Economy of US Trade Policy towards China, China & World Economy, No.5, 2007He Li Ping, Sino-Japanese economic relational: a Chinese perspective,China & World Economy, 2003.5Part III China’s Macroeconomic PolicyWeek Ten China’s Macroeconomic Policy Since 1990Olivier Blanchard Francesco Gi, Rebalancing Growth in China:A Three-Handed Approach, China & World Economy, No.4, 2006Stephen S. Roach, On Next Asia: Opportunities and Challenges for a New Globalization, Chapter 3 , Chinese Rebalancing, John Wiley & Sons, Inc, 2009Yu Yong-ding, A Review of China's Macroeconomic Development and Policies in the 1990s China & World Economy, No. 6 ,2001Week Eleven China’s stimulus package in Time of CrisisYu Yongding, China's Macroeconomic Situation and Future Prospect, China & World Economy, No.1, 1999Yu Yongding, China 1999-2000: The Macroeconomic Situation and Financial Reforms, China & World Economy, No. 1, 2000Xin Wang, China as a Net Creditor:An Indication of Strength or Weaknesses?China & World Economy, No.6, 2007Hung-Gay Fung Qingfeng, China’s Outward Direct and Portfolio Investments Wilson, China & World Economy, No.6, 2007Week Twelve A Conclusion and Tasks Ahead for ChinaGuiyang Zhuang, How Will China Move towards Becoming a Low Carbon Economy?China & World Economy No.3, 2008Shi Dan, Energy Restructuring in China:Retrospects and Prospects, China & World Economy No.4, 2008Xin Wang, China as a Net Creditor:An Indication of Strength or Weaknesses?China & World Economy, No.6, 2007Jonathan Anderson,Capital Account Controls and Liberalization:Lessons for India and China, edited by Wanda Tseng and David Cowen, India’s and China’s Recent Experience with Reform and Growth, IMF, 2005 Chapter 3。

ECONOMICS 502: MACROECONOMICS IISpring 2007Instructor: Costas Azariadis (azariadi@) McM 256A, x55639 Office Hours: MW 10-11 and by appointmentLectures: MW 1-2:30, Eliot 103T.A.: Daniel Sanches (dsanche@) McM 331Office Hours: TBAWeekly Review: F 11-12:30, Eliot 103Exams: In-class mid-terms, Feb.19 and April 2. Pre-final review, May 2. (Final TBA)Final Grade: Problem sets (20%), mid-terms (40%), final (40%)Goals: Starting where Economics 502 left off, we will examine key issues in growth, asset prices, business cycles, income distribution and macroeconomic policy from the unified viewpoint of dynamic general equilibrium (DGE) with both perfect and imperfect financial markets. We will learn to describe the core behavioral relations in macroeconomics as laws of motion, that is, as solutions to certain types of low-dimensional deterministic and stochastic dynamical systems. As we go along, we’ll dig deeper into the two workhorse paradigms of dynamic macroeconomics, overlapping generations and infinitely-lived households. We’ll assess how good these models, and their refinements, are at explaining basic empirical regularities in modern economies. Accomplishing these objectives will require your active engagement in class and much work on the problem sets. General References: No existing textbook is well matched with the topics covered in this course, and none is required. We’ll make intensive use of journal articles, and limited use of the following texts, handbooks and lecture notes:Costas Azariadis, Intertemporal Macroeconomics, Blackwell 1993 (IM) John Cochrane, Asset Pricing, Rev. ed., Princeton 2005 (AP)David Romer, Advanced Macroeconomics, 3rd ed, McGraw-Hill 2006 (AM) Benjamin Friedman and Frank Hahn, Handbook of Monetary Economics, Elsevier 1990 (HME)John Stachurski, Lecture Notes on Stochastic Economic Dynamics, Dec. 2006 (SED)Students who wish to go deeper into dynamical systems in continuous or discrete time may start with two introductory books:Morris Hirsch and Stephen Smale, Differential Equations, Dynamical Systems,and Linear Algebra, Academic Press 1974Robert Devaney, An Introduction to Chaotic Dynamical Systems, 2nd ed., Addison-Wesley 1989TOPICS1. INTRODUCTION: DGE AND DYNAMICAL SYSTEMS (6 lectures)a) Course overview. Macroeconomic facts from growth, asset prices, business cycles, and the distribution of income and wealth.b) The dynamical systems approach to DGE. Linear and non-linear deterministic systems in continuous and discrete time. Steady states and cycles. Hyperbolicity, stability and determinacy of equilibria.c) Stochastic dynamical systems and Markov chains. Stationarity and ergodicity.2. ASSET PRICES, FLUCTUATIONS AND GROWTH (8 lectures)a) Arrow securities. Asset prices in exchange economies with and without complete markets. Asset return anomalies.b) Money as a store of value. The golden rule and intertemporal efficiency. Multiperiod lifecycle models.c) Accumulating physical capital, human capital and knowledge. Poverty traps and other growth anomalies. Fiscal policy and economic growth.d) Fluctuations, the Solow residual, and the real business cycle model.3. IMPERFECT ASSET MARKETS (6 lectures)a) The macroeconomic consequences of private information and limited enforcement of property rights. Collateral and endogenous debt constraints as limitations on capital mobility. Dynamic complementarities and indeterminacy.b) Basic welfare theorems. Implications for consumption, asset returns and the distribution of wealth.c) The Solow residual, fluctuations, and growth.4. MONETARY POLICY (6 lectures)a)The optimum quantity of money. Friedman’s rule with perfect and imperfect markets. Inflationary finance.b) Targets and instruments of monetary policy. Efficiency, determinacy and equilibrium selection.c) Inflation targeting and Taylor’s rule.READINGS (consult class website)PART 1a) A zariadis, C. (2005), “The theory of povert y traps: What have we learned?”, ch.2 in Poverty Traps, ed. by S.Bowles, S.Durlauf and K.Hoff, Princeton.Blanchard, O., and J. Simon (2001), “The long and large decline in U.S. output volatility”, Brookings Papers on Economic Activity,1, 135-164. Campbell, J. (2003), “Consumption-based asset pricing”, in Handbook of the Economics of Finance, ed. by G. Constantinides, M. Harris and R. Stulz, Elsevier.Diaz-Jimenez, V. Quadrini, S. Rodriguez and V. Rios-Rul l (2002), “Updated facts on the U.S. distribution of earnings, income and wealth”, Quarterly Review of the Federal Reserve Bank of Minneapolis, 26.Stock, J., and M. Watson (1990), “ Business cycle fluctuations in U.S. macroeconomic time series”, ch. 1 in HME.b) IM, chs. 1-4, 6 and 7. AM, pp. 48-62 and 76-87. SED, chs 1 and 5. Nishimura, K., and J. Stachurski (2004), “Discrete time models in economic theory”, CUBO, 6, 187-207.c) SED, chs. 6, 7.1 and 8; 7.2 and 13.PART 2a) AP, chs. 1-3.Lucas, R. (1978) “Asset prices in an exchange economy”, Econometrica, 46, 1429-1445.Mehra, R., and E. Prescott (1985), “The equity premium: a puzzle”, Journal of Monetary Economics, 15, 145-161.Mankiw, G., and S. Zeldes (1991), “The consumption of stockholders and non-stockholders”, Journal of Financial Economics, 29, 97-112.b) IM, chs 11.1, 24.1, 24.3, 12 and 15.1.Gottardi, P. (1996), “Stationary monetary equilibria in overlapping generations models with incomplete markets”, Journal of Economic Theory, 71, 75-89.Blanchard, O. (1985), “Debts, deficits and finite horizons”, Journal of Political Economy, 93, 223-247.Azariadis, C., J. Bullard and L. Ohanian (2004), “Trend-reverting fluctuations in the life-cycle model”, Journal of Economic Theory, 119, 334-356.c) AM, chs.2 (except 2.11), and 3.1-3.6. IM, ch. 13.1, 13.2, 13.4 and 19.1. Lucas, R. (1988), “On the mechanics of economic development”, Journal of Monetary Economics, 22, 3-42.Aghion. P., and P. Howitt (1992), “A model of growth through creative destruc tion”, Econometrica, 60, 323-351.Romer, P. (1990), “Endogenous tech nological change”, Journal of Political Economy, 98, S71-S102.Azariadis, C. (1996), “The economics of poverty traps”, Journal of Economic Growth, 1, 449-486.Acemoglu, D. (2002). “Directed technical change”, Review of Economic Studies, 69, 781-810.d) AM, ch.4Cogley, T., and J. Nason (1995), “Output dynamics in real business cycle models”, American Economic Review, 85,492-511.Prescott, E. (1998), “Needed: a theory of total factor productivity”, International Economic Review, 39, 525-552.Hsieh, C-T., and P. Klenow (2006), “Misallocation and manufacturing TFP in China and India”, Stanford W.P.PART 3a) B ewley, T. (1986), “Dynamic implications of the form of the budget constraint”, in Models of Dynamic Economies, ed. by H. Sonnenschein, Springer Verlag.Kiyotaki, N. (1998), “Credit and business cycles”, Japanese Economic Review, 18-35.Kehoe, T., and D. Levine (1993), “Debt-constrained asset markets”, Review of Economic Studies, 60, 865-888.Azariadis, C., and L. Kaas (2006), “Is dynamic general equilibrium a theory of everything?”, sec. 1-3. Forthcoming in Economic Theory.b) Kocherlakota, N. (1996), “Implications of efficient risk sharing without commitment”, Review of Economic Studies, 63, 595-609.Alvarez, F., and U. Jermann (2000), “Efficiency, equilibrium and asset pricing with risk of default”, Econometrica, 68, 775-797.c) Azariadis and Kaas (2006), sec. 4-8.PART 4a) IM, chs. 25 and 26.Lucas, R. (2000), “Inflation and welfare”, Econometrica, 68, 247-274. Edmond, C. (2002), “Self-insurance, social insurance, and the optimum quantity of money”, American Economic ReviewPapers and Proceedings, 92, 141-147.Sargent, T., and N. Wallace (1981), “Some unpleasant monetarist arithmetic”, Quarterly Review of the federal reserve Bank of Minneapolis, Fall, 1-17.b) Bh attacharya,J., and R.Singh (2005), “Optimal monetary rules in an overlapping generations economy with limited communication, Iowa State U W.P.Woodford, M. (2005), “Central ba nk communication and policy effectiveness”, Columbia W.P.c) Antinolfi, G., C.Azariadis, and J. Bullard (2006), “Monetary policy as equili9brium selection”, Washington U. W.P.。