International business_Chapter_9

- 格式:doc

- 大小:62.50 KB

- 文档页数:7

International Business English国际商务英语Lesson 1 International Business第一课国际商务*International business refers to transaction between parties from different countries. Sometimes business across the borders of different customs areas of the same country is also regarded as import and export, such as business between Hong Kong and Taiwan.*International business involves more factors and thus is more complicated than domestic business. The following are some major differences between the two.1). The countries involved often have different legal systems, and one or more parties will have to adjust themselves to operate in compliance with the foreign law.2). Different counties usually use different currencies and the parties concerned will have to decide which currency to use and do everything necessary as regards conversion etc. Uncertainties and even risks are often involved in the use of a foreign currency.3).Cultural differences including language, customs, traditions, religion, value, behaviour etc. often constitute challenges and even traps for people engaged in international business.4). Countries vary in natural and economic conditions and may have different policies towards foreign trade and investment, making international business more complex than domestic business.*With the development of economic globalisation, few people or companies can completely stay away from international business. Some knowledge in this respect is necessary both for the benefit of enterprises and personal advancement.*International business first took the form of commodity trade, i.e. exporting and importing goods produced or manufactured in one country for consumption or resale in another. This form of trade is also referred to as visible trade. Later a different kind of trade in the form of transportation, communication, banking, insurance, consulting, information etc. gradually became more and more important. This type of trade is called invisible trade. Today, the contribution of service industries of the developed countries constitutes over 60% of their gross domestic products and account for an increasing proportion of world trade. *Another important form of international business is supplying capital by residents of one country to another, known as international investments. Such investments can be classified into two categories. The first kindof investments, foreign direct investments or FDI for short is made for returns through controlling the enterprises or assets invested in in a host country.*The host country is a foreign country where the investor operates, while the country where the headquarters of the investor is located is called the home country. The second kind of investment, portfolio investment, refers to purchases of foreign financial assets for a purpose other than controlling. Such financial assets may be stocks, bonds or certificates of deposit.Stocks are also called capital stocks or bonds. Bonds are papers issued by a government or a firm with promise to pay back the money lent or invested together with interest. The maturity period of a bond is at least one year, often longer, for example five, or even ten years. Certificates of deposit generally involve large amounts, say 25 thousand US dollars *Besides trade and investment, international licensing and franchising are sometimes taken as a means of entering a foreign market. In licensing, a firm leases the right to use its intellectual property to a firm in another country. Such intellectual property may be trademarks, brand names, patents, copyrights or technology. Firms choose licensing because they do not have to make cash payments to start business, and can simply receive income in the form of royaltyBesides, they can benefit from locational advantages of foreign operation without any obligations in ownership or management. The use of licensing is particularly encouraged by high customs duty and non-tariff barriers on the part of the host country. However it is not advisable to use licensing in countries with weak intellectual property protection since the licensor may have difficulty in enforcing licensing agreement.*Franchising can be regarded as a special form of licensing. Under franchising, a firm, called the franchisee, is allowed to operate in the name of another, called the franchiser who provides the former with trademarks, brand names, logos, and operating techniques for royalty. In comparison with the relation between the licenser and the licensee, the franchiser has more control over and provides more support for the franchisee.*The franchiser can develop internationally and gain access to useful information about the local market with little risk and cost, and the franchisee can easily get into a business with established products or services. Franchising is fairly popular especially in hotel and restaurant business.*Other forms for participating in international business are management contract, contract manufacturing, and turnkey project.*Under a management contract, one company offers managerial or other specialized services to another within a particular period for a flat payment or a percentage of the relevant business volume. Sometimes bonusesbased on profitability or sales growth are also specified in management contracts.Government policies often have a lot to do with management contracts. When a government forbids foreign ownership in certain industries it considers to be of strategic importance but lacks the expertise for operation, management contracts may be a practical choice enabling a foreign company to operate in the industry without owning the assets*By contract manufacturing, a firm can concentrate on their strongest part in the value chain, e.g. marketing, while contracting with foreign companies for the manufacture of their products. Such firms can reduce the amount of their resources devoted to manufacture and benefit from location advantages from production in host countries. However, loss of control over the production process may give rise to problems in respect of quality and time of delivery.*For an international turnkey project, a firm signs a contract with a foreign purchaser and undertakes all the designing, contracting and facility equipping before handing it over to the latter upon completion. Such projects are often large and complex and take a long period to complete. Payment for a turnkey project may be made at fixed total price or on a cost plus basis. The latter way of payment shifts the burden of possible additional cost over the original budget onto the purchaser *BOT is a popular variant of the turnkey project where B stands for Build, O for operate and T for transfer. For a BOT project, a firm operate a facility for a period of time after building it up before finally transferring it to a foreign company. Making profit from operating the project for a period is the major difference between BOT and the common turnkey project. Needless to say, the contractor has to bear the financial and other risks that may occur in the period of operation.*Some Words and Expressionscustoms area 关税区in compliance with 遵从,遵照conversion n.货币兑换visible trade 有形贸易resale n.转售invisible trade 无形贸易gross domestic product 国内生产总值for short 缩写为account for 占……比例headquarters n.总部trap n.陷阱,圈套portfolio investment 证券投资stocks n.股票bonds n.债券maturity n.(票据等)到期,到期日certificate of deposit 大额存单other than 而不是licensing n.许可经营franchising n.特许经营n.商标advisable adj.可行的,适当的patent n.专利royalty n.专利使用费,许可使用费,版税copyright n.版权licensor n.给予许可的人licensee n.接受许可的人franchiser n.给予特许的人franchisee n.接受特许的人logo n.标识,标记management contract 管理合同expertise n.专门知识bonus n.红利,奖金,津贴flat adj.一律的,无变动的contract manufacturing 承包生产value chain 价值链turnkey project 交钥匙工程BOT(Build, Operate, Transfer)建设,经营,移交Stand for 表示,代表variant n.变形,变体Lesson twoIncome Level and the World Market第二课收入水平和世界市场This lesson discusses the relation between the income level and the market potential, and the features of high income, middle income and low income markets.Special analyses are made on Triad, i.e. the markets of North America,European Union and Japan, as well as other markets that are closely related with China.The first two paragraphs mainly deal with GNP and GDP, two important concepts usedto indicate the total size of an economy. GDP, Gross Domestic Product, stresses the place of production while GNP, Gross National Product, on the ownership of production factors.GDP is used by most countries now where as GNP was more popular before the 1990s. The actual figures of a country’s GNP and GDP are, however, quite similar in most cases and we can use whichever figure that is available.TEXT:In assessing the potential of a market, people often look at its income level since it provides clues about the purchasing power of its residents. The concepts national income and national product have roughly the same value and can be used interchangeably if our interest is in their sum total which is measured as the market value of the total output of goods and services of an economy in a given period, usually a year. The differenceis only in their emphasis. The former stresses the income generated by turning out the products while the latter, the value of the product s themselves. Gross National Product, GNP, and Gross Domestic Product, GDP, are two important concepts used to indicate a country’s total income. GNP refers to the market value of goods and services produced by the property and labor owned by the residents of an economy. This term was used by most governments before the 1990s国民生产总值(GNP)是最重要的宏观经济指标,它是指一个国家地区的国民经济在一定时期(一般1年)内以货币表现的全部最终产品(含货物和服务)价值的总和。

CONTENTS ON NTERNATIONALCOMMERCIAL ARBITRATION LAW国际商事仲裁法(双语)教学内容一、课程说明课程性质:选修课程语言:中英双语授课对象:法学本科学时:36学分:2授课教师:中国人民大学法学院赵秀文教授二、双语教学教材1.21世纪国际法学系列教材《国际商事仲裁法》(中英双语教材),赵秀文编著,中国人民大学出版社,2004年(该教材出版后得到好评,应人大出版社的邀请,申请人于今年初又进行了修订,2008年5月底第二版即将面世);2.《国际商事仲裁案例解析》(中文),赵秀文主编,中国人民大学出版社,2005年版(书中收集的案例,都出自于双语教材各章节后的案例);3. 《国际商事仲裁法参考资料》(中英文对照),赵秀文、谢菁菁编著,中国人民大学出版社,2006年版(书中收集了《纽约公约》等国际公约、联合国贸法会的国际商事仲裁示范法、仲裁规则;中、美、法、德等各主要国家的仲裁法;以及中国国际经济法贸易仲裁委员会、国际商会国际仲裁院、伦敦国际仲裁院、美国仲裁协会等国际主要仲裁机构的仲裁规则)。

CHAP TE R 1 GE NE RAL IN TR O DU CTI O N OF IN TE R NAT IO NAL COM M E RCIALARBI T RA TI ON LAW第一章导论课时:2本章的教学目的是要求学生理解并掌握国际商事仲裁的起源与发展、国际商事仲裁法的概念、性质和法律渊源;以及我国国际仲裁法的主要内容。

Key Issues●Definition and nature of arbitration●Relations and difference between arbitration and other methods for thesettlement of dispute●Functions of the international conventions and model law in the unificationand coordination of international commercial arbitration law●Basic principles of international commercial arbitration law●Chinese international commercial arbitration law●Research method for the international commercial arbitration lawSection 1 Arbitration and Other Methods for the Settlement of DisputeOrigin and development of arbitration:Arbitration is developed with the needs of commercial business. It is the voluntary method for the settlement of dispute based on the parties agreement.Nature and characteristics of arbitration: Arbitration is contractual in nature basically as a method for the settlement of dispute. No arbitration agreement, no arbitration. This method later incorporated into the legal system of the State. The national court shall enforce the arbitration agreement as well as the arbitral awards in accordance with the local law. In this regards, it also carries out the judicial nature.Relationship between arbitration and other methods for the settlement of dispute Arbitration law governing arbitration: Arbitration incorporated advantages from both ADR and litigation. It is more flexible as ADR as to the parties autonomy. The arbitral award could be enforceable as the court judgement.Section 2 International Commercial Arbitration LawOrigin and development of international commercial arbitration law: It origins from the national law and international conventions.Parties for the international commercial arbitration law: mostly between the parties with equal legal status, that is the private parties.Subject matters of the international commercial arbitration law--relationship between the parties under the arbitration agreement--relationship between the arbitration institution, arbitration tribunal and the parties--national courts’ supervision on the international commercial arbitration law Sources of international commercial arbitration law--Domestic arbitration law--International legislation: bilateral judicial cooperation treaty, international convention, model lawSection 3 Basic Principles of International Commercial Arbitration Law Parties’ autonomy: the parties may select the arbitration institution, applied rules, arbitrators, languages, place of arbitration and so on.Independent and impartial settlement disputes by the arbitral tribunal: arbitrators are different from national judges as to the field of implem entation of law. The functions for the settlement of dispute are similar. The only objective for the arbitrator is to render awardsindependently and impartially.National courts’ supervision on the arbitration: Since the national courts implement law in public field, the arbitral awards are subject to the courts’ supervision. The court may setaside national award or may refuse national and foreign awards at the request of the partyaccording to national law.Section 4 International Commercial Arbitration Law in ChinaDomestic arbitration lawBilateral judicial cooperation treaty and international convention to which China is a party Section 5 Construction of the CourseArbitration institutionsInternational arbitration agreementArbitration tribunalArbitration proceduresThe law governing the arbitrationAward and remediesCourt supervisionCase Study: German Zueblin v. Wuxi Woco本章教学要点:1、仲裁是当事人之间通过协议约定的将他们之间的争议提交给独立的第三者裁断的解决争议的方法。

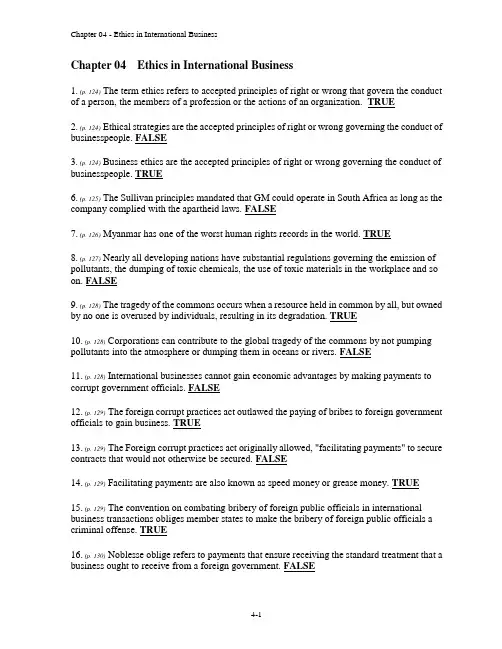

Chapter 04 Ethics in International Business1. (p. 124) The term ethics refers to accepted principles of right or wrong that govern the conduct of a person, the members of a profession or the actions of an organization. TRUE2. (p. 124) Ethical strategies are the accepted principles of right or wrong governing the conduct of businesspeople. FALSE3. (p. 124) Business ethics are the accepted principles of right or wrong governing the conduct of businesspeople. TRUE6. (p. 125) The Sullivan principles mandated that GM could operate in South Africa as long as the company complied with the apartheid laws. FALSE7. (p. 126) Myanmar has one of the worst human rights records in the world. TRUE8. (p. 127) Nearly all developing nations have substantial regulations governing the emission of pollutants, the dumping of toxic chemicals, the use of toxic materials in the workplace and so on. FALSE9. (p. 128) The tragedy of the commons occurs when a resource held in common by all, but owned by no one is overused by individuals, resulting in its degradation. TRUE10. (p. 128) Corporations can contribute to the global tragedy of the commons by not pumping pollutants into the atmosphere or dumping them in oceans or rivers. FALSE11. (p. 128) International businesses cannot gain economic advantages by making payments to corrupt government officials. FALSE12. (p. 129) The foreign corrupt practices act outlawed the paying of bribes to foreign government officials to gain business. TRUE13. (p. 129) The Foreign corrupt practices act originally allowed, "facilitating payments" to secure contracts that would not otherwise be secured. FALSE14. (p. 129) Facilitating payments are also known as speed money or grease money. TRUE15. (p. 129) The convention on combating bribery of foreign public officials in international business transactions obliges member states to make the bribery of foreign public officials a criminal offense. TRUE16. (p. 130) Noblesse oblige refers to payments that ensure receiving the standard treatment that a business ought to receive from a foreign government. FALSE17. (p. 130) Social responsibility refers to the idea that businesspeople should consider the social consequences of economic actions when making business decisions and that there should be a presumption in favor of decisions that have both good economic and social consequences. TRUE19. (p. 131) The ethical obligations of a multinational corporation toward employment conditions, human rights, environmental pollution and the use of power are always clear cut. FALSE21. (p. 132-133) An individual with a strong sense of personal ethics is less likely to behave in an unethical manner in a business setting. TRUE22. (p. 133) Expatriate managers may experience more than the usual degree of pressure to violate their personal ethics. TRUE23. (p. 134) A firm's organizational culture refers to the values and norms that are shared among employees of an organization. TRUE24. (p. 135) The Enron debacle indicates that an organizational culture can legitimize behavior that a society would judge as unethical. TRUE25. (p. 136) According to the Friedman doctrine, the only social responsibility of business is to increase profits, so long as the company stays within the rules of law. TRUE26. The Friedman doctrine is the belief that ethics are nothing more than a reflection of culture and therefore, a firm should adopt the ethics of the culture in which it is operating. F27.Cultural relativism is the belief that ethics are nothing more than a reflection of culture and therefore, a firm should adopt the ethics of the culture in which it is operating. TRUE28.According to the righteous moralist if a manager of a multinational sees that firms from other nations are not following ethical norms in a host nation, that manager should not either. F 29. (p. 138) The naive immoralist claims that a multinational's home country standards of ethics are the appropriate ones for companies to follow in foreign countries. FALSE30. (p. 138) Most moral philosophers see value in utilitarian and Kantian approaches to business ethics. TRUE31. (p. 138) The utilitarian approaches to ethics hold that the moral worth of actions or practices is determined by their consequences. TRUE32.It, typically is fairly easy to measure the benefits, costs and risks of a course of action. F33. An advantage of utilitarianism is that the philosophy allows for the consideration of justice. FALSE34. (p. 139) Rights theories recognize that human beings have fundamental rights and privileges that transcend national boundaries and cultures. TRUE35. (p. 140) A just distribution is one that is considered fair and equitable. TRUE36. (p. 141) According to Rawls, inequalities can be just if the system that produces inequalities is to the advantage of everyone. TRUE37. (p. 142) Talking with prior employers regarding someone's reputation is a good way to discerna potential employee's ethical predisposition. TRUE38. (p. 143) Building an organization culture that places a high value on ethical behavior requires incentive and reward systems. TRUE39. (p. 144) A firm's stakeholders are individuals or groups that have an interest, claim or stake in the company, what it does and how well it performs. T40. (p. 145-146) Companies can strengthen the moral courage of employees by committing themselves to retaliate against employees who exercise moral courage, say no to superiors or otherwise complain about unethical actions. FALSE41. (p. 124) The accepted principles of right or wrong governing the conduct of businesspeople are best known as A. Business measures B. Business ethics42. (p. 124) Identify the incorrect statement regarding ethical issues in international business.A. They are often rooted in the fact that political systems, law, economic development and culture of nations vary significantlyB. Human rights and environmental regulations are some of the common ethical issuesC. Ethical practices of all nations are similar in natureD. Managers in multinational firms need to be particularly sensitive to differences in business practices because they work across national borders43. (p. 125) To guard against abuse of employment practices in other nations, multinationals should do all of the following exceptA. Establish minimal acceptable standards that safeguard the basic rights and dignity of employeesB. Adhere to working conditions of the host country if they are clearly inferior to those in a multinational's home nationC. Audit foreign subsidiaries and subcontractors on a regular basis to make sure established standards are metD. Take action to correct unacceptable behavior46. (p. 126) Identify the incorrect statement pertaining to foreign multinationals doing business in countries with repressive regimes.A. Inward investment by multinationals can be a force for economic, political and social progress that ultimately improves the rights of people in repressive regimesB. No multinational does business with nations that lack the democratic structures and human rights records of developed nationsC. Multinational investment cannot be justified on ethical grounds in some regimes due to their extreme human rights violationsD. Multinationals adopting an ethical stance can, at times, improve human rights in repressive regimes47. (p. 127) Identify the incorrect statement about environmental regulations.A. Environmental regulations are often lacking in developing nationsB. Environmental regulations are similar across developed and developing nationsC. Developed nations have substantial regulations governing the emission of pollutants, the dumping of toxic chemicals, etcD. Inferior environmental regulations in host nations, as compared to home nation, can lead to ethical issues48. (p. 128) Everyone benefits from the atmosphere and oceans but no one is specifically responsible for them. In this sense, the atmosphere and oceans can be referred to as a(n)B. Global commonsC. Joint assetD. Global reserve49. (p. 128) The _____ occurs when a resource is shared by all, but owned by no one is overused by individuals, resulting in its degradation.A. Tragedy of the commonsB. Noblesse obligeC. Ethical dilemmaD. Friedman system50. (p. 129) Which of the following observations is true of the Foreign Corrupt Practices Act?A. The act outlawed the paying of bribes to foreign government officials to gain businessB. There is enough evidence that it put U.S. firms at a competitive disadvantageC. The act originally allowed for "facilitating payments."D. The Nike case was the impetus for the 1977 passage of this act51. (p. 129) The Convention on Combating Bribery of Foreign Public Officials in International Business Transactions excludesA. Speed payments to secure contracts that would otherwise not be securedB. Grease payments to gain exclusive preferential treatmentC. Facilitating payments made to expedite routine government actionD. Payments to government officials for special privileges52. (p. 129) Grease paymentsA. Are not the same as facilitating payments or speed moneyB. are facilitating payments made to expedite routine government actionC. Are payments to gain exclusive preferential treatmentsD. Can be used to secure contracts that would otherwise not be secured53. (p. 129) Facilitating payments areA. Permitted under the amended Foreign Corrupt Practices ActB. A direct violation of the Foreign Corrupt Practices ActC. Permitted so long as they designed only to gain exclusive preferential treatmentD. Used to secure contracts that would otherwise not be secured54. (p. 130) The idea that businesspeople should consider the social consequences of economic actions when making business decisions and that there should be a presumption in favor of decisions that have both good economic and social consequences is known asA. Business ethicsB. Noblesse obligeC. Ethical dilemmaD. Social responsibility55. (p. 130) Which of the following, in a business setting is taken to mean benevolent behavior that is the responsibility of successful enterprises.A. Sullivan's principlesB. Ethical dilemmaC. Tragedy of the commonsD. Noblesse oblige57. (p. 132) _____ are generally accepted principles of right and wrong governing the conduct of individuals.A. Ethical dilemmasB. Noblesse obligesC. Personal ethicsD. Business measures58. (p. 132) Ethical dilemmas exist because of all of the following reasons exceptA. Many real-world decisions are complex and difficult to frameB. Decisions may involve first, second and third-order consequences that are hard to quantifyC. Doing the right thing or knowing what the right thing might be is often far too easyD. They are situations in which none of the available alternatives seem ethically acceptable59. (p. 132) Which of the following is not likely to lead to unethical behavior?A. An organizational culture that de-emphasizes business ethicsB. A process that does not incorporate ethical considerations into business decision-makingC. A strong personal ethical code governing the conduct of an individualD. Pressure from the parent company to meet unrealistic performance goals60. (p. 133) Ethical behavior is likely to be determined by all of the following, except A. Decision making processes B. Organization culture C. Leadership D. Realistic performance goals61. (p. 133) Expatriate managers may experience more than the usual degree of pressure to violate their personal ethics because of all of the following reasons exceptA. They are away from their ordinary social context and supporting cultureB. They are psychologically and geographically closer to the parent companyC. They may be based in a culture that does not place the same value on ethical norms important in the manager's home countryD. They may be surrounded by local employees who have less rigorous ethical standards62. (p.63. (p. 136) All of the following approaches to business ethics are discussed by scholars primarilyto demonstrate that they offer inappropriate guidelines for ethical decision making in a multinational enterprise exceptA. Friedman doctrineB. Cultural relativismC. Kantian ethicsD. Naive moralist64. (p. 136) According to _____ the social responsibility of business is to increase profits, so longas the company stays within the rules of law. A. The naive immoralistB. The righteous moralistC. Cultural relativismD. The Friedman doctrine65. (p. 136) The Friedman doctrine suggests thatA. Ethics are nothing more than the reflection of cultureB. A multinational's home-country standards of ethics are inappropriate to follow in foreign countriesC. Businesses should not undertake social expenditures beyond those mandated by the law and required for the efficient running of a businessD. If a manager of a multinational sees that firms from other nations are not following ethical norms in a host nation, that manager should not either66. (p. 136) Identify the incorrect statement pertaining to the Friedman doctrine.A. It states that the only social responsibility of business is to increase profits, so long as the company stays within the rules of lawB. It argues that businesses should undertake social expenditures beyond those mandated by the lawC. It believes that maximizing profits is the way to maximize the returns that accrue to firms stockholdersD. Managers of the firm should not make decisions regarding social investments on behalf ofthe stockholders67. (p. 137) Cultural relativism suggests thatA. Ethics are nothing more than the reflection of culture and that a firm should adopt the ethicsof the culture in which it is operatingB. The only social responsibility of business is to increase profitsC. Managers of a firm should not make decisions regarding social investmentsD. A multinational's home-country standards of ethics are always appropriate to follow in foreign countries68. (p. 137) Identify the incorrect statement pertaining to cultural relativism.A. It argues that a firm should adopt the ethics of the culture in which it is operatingB. At its extreme, it suggests that if a culture supports slavery, it is OK to use slave labor in a countryC. It embraces the idea that universal notions of morality transcend different culturesD. It believes that ethics are nothing more than the reflection of a culture69. (p. 137) Child labor is permitted and widely employed in Country X. A multinational company entering Country X decides to employ minors in its subsidiary, even though it is against the multinational's home country ethics. Which of the following approaches to business ethics would justify the actions of the multinational company?A. Righteous moralistB. Cultural relativismC. The justice theoryD. The rights theory70. (p. 137) The idea that universal notions of morality transcend different cultures is implicitly rejected by A. The righteous moralist B. The naive immoralist C. The Friedman doctrineD. Cultural relativism71. (p. 137) The righteous moralist suggests thatA. Ethics are nothing more than the reflection of cultureB. A multinational's home-country standards of ethics are the appropriate ones for companies to follow in foreign countriesC. The social responsibility of business is to increase profits, so long as the company stays within the rules of lawD. If a manager of a multinational sees that firms from other nations are not following ethical norms in a host nation, that manager should not either72. (p. 137) Which of the following statement about the righteous moralist approach is not true?A. It claims that a multinational's home-country standards of ethics are the appropriate ones for companies to follow in foreign countriesB. It is typically associated with managers from developing nationsC. Its proponents often go too far in advocating that the appropriate thing to do is adopt home-country standardsD. It can create practical problems73. (p. 137) The righteous moralist approach to business ethics is typically associated with managers from A. Third world nations B. Underdeveloped nations C. Developing nationsD. Developed nations74. (p. 138) The _____ approach asserts that if a manager of a multinational sees that firms from other nations are not following ethical norms in a host nation, that manager should not either.A. Cultural relativismB. Friedman doctrineC. Righteous moralistD. Naive immoralist75. (p. 138) The naive immoralist suggests thatA. Ethics are nothing more than the reflection of cultureB. A multinational's home-country standards of ethics are the appropriate ones for companies to follow in foreign countriesC. The social responsibility of business is to increase profits, so long as the company stays within the rules of lawD. If firms in a host nation do not follow ethical norms then the manager of a multinational should also not follow ethical norms there76. (p. 138) According to the _____ approach to business ethics, the moral worth of actions or practices is determined by their consequences.A. UtilitarianB. Cultural relativismC. Friedman doctrineD. Naive immoralist77. (p. 138) The utilitarian approach to business ethics suggests thatA. People should be treated as ends and never purely as means to the ends of othersB. The moral worth of actions or practices is determined by their consequencesC. People have dignity and need to be treated as suchD. Human beings have fundamental rights and privileges that transcend national cultures78. (p. 138) Which of the following approaches is committed to the maximization of good and the minimization of harm?A. The righteous moralistB. Cultural relativismC. Friedman doctrineD. Utilitarianism79. (p. 139) Tools to assess actions such as cost-benefit analysis and risk assessment are rooted in the _____ philosophy.A. Utilitarian approachB. Kantian approachC. Friedman doctrineD. Naive immoralist80. (p. 139) According to the _____ approach, the best decisions are those that produce the greatest good for the greatest number of people.A. Naive immoralistB. Friedman doctrineC. UtilitarianD. Kantian81. (p. 139) The Kantian approach to ethics suggests thatA. Human beings have fundamental rights and privileges that transcend national boundariesB. The moral worth of actions or practices is determined by their consequencesC. People should be treated as ends and never purely as means to the ends of othersD. Ethics are nothing more than the reflection of culture82. (p. 139) The utilitarian approach to business ethics has been criticized because of all of the following reasons, exceptA. The measurement of benefits, costs and risks is often not possible due to limited knowledgeB. The philosophy omits the consideration of justiceC. The philosophy advocates the greatest good for the greatest number of people, but such actions may result in the unjustified treatment of a minorityD. It holds that the moral worth of actions or practices is determined by their consequences83. (p. 139) Rights theories suggest thatA. Human beings have fundamental rights and privileges that transcend national boundariesB. The moral worth of actions or practices is determined by their consequencesC. People should be treated as ends never purely as means to the ends of othersD. Minimum levels of morally acceptable behavior should be established84. (p. 140) Identify the approach that most moral philosophers favor and that forms the basis for current models of ethical behavior in international businesses.A. Friedman doctrineB. Cultural relativismC. The righteous moralistD. Rights theory85. (p. 140) The Universal Declaration of Human Rights, related to employment, upholds all of the following, exceptA. Just and favorable work conditionsB. Equal pay for equal workC. Prohibition of trade unionsD. Protection against unemployment86. (p. 140) Article 1 of the United Nations' Universal Declaration of Human Rights states: "All human beings are born free and equal in dignity and rights." This best echoesA. Cultural relativismB. Friedman doctrineC. The righteous moralist approachD. Kantian ethics87. (p. 140) A(n) _____ is any person or institution that is capable of moral action such as a government or corporation.A. Moral agentB. UtilitarianC. Righteous moralistD. Naive immoralist88. (p. 140) Justice theories of business ethics focus onA. The moral worth of actions or practicesB. Minimum levels of morally acceptable behaviorC. Fundamental rights and privileges that transcend national boundariesD. The attainment of a just distribution of economic goods and services89. (p. 141) The notion that all economic goods and services should be distributed equally except when an unequal distribution would work to everyone's advantage was developed byA. David HumeB. John RawlsC. Jeremy BenthamD. John Stuart Mill90. (p. 141) Under the veil of ignorance, everyone is imagined to be ignorant ofA. All of his or her particular characteristicsB. Fundamental rights and privilegesC. The moral worth of actions or practicesD. The minimum levels of morally acceptable behavior91. (p. 141) According to John Rawls,A. Each person be permitted the maximum amount of basic liberty compatible with a similar liberty for othersB. Freedom of speech and assembly is the single most important component in a justice systemC. Equal basic liberty is only possible in a pure market economyD. Inequalities in a justice system are not to be tolerated under any circumstance92. (p. 141) Rawls' philosophy that inequalities are justified if they benefit the position of the least-advantaged person is known as theA. Inequality principleB. Equity principleC. Difference principleD. Indifference principle93. (p. 142) Managers of international business can do all of the following to make sure ethical issues are considered in business decisions, exceptA. Favor hiring and promoting people with a well-grounded sense of personal ethicsB. Build an organizational culture that places a high value on ethical behaviorC. Make sure that leaders within the business do not articulate the rhetoric of ethical behaviorD. Develop moral courage95. (p. 143) To build an organization culture that values ethical behavior, a company should do all of the following, exceptA. Not sanction people who do not engage in ethical behaviorB. Articulate values that emphasize ethical valuesC. Make sure that key business decisions not only make good economic sense, but are also ethicalD. Place a high value on ethical behavior by providing incentives and reward systems96. (p. 144) External stakeholdersA. Are individuals or groups who own the businessB. Include all employees, the board of directors and stockholdersC. Typically, comprises customers, suppliers, lenders, etcD. Are individuals or groups who work for the business97. (p. 144) Internal stakeholdersA. Are individuals or groups who work for or own the businessB. Do not have any claim on a firm or its activitiesC. Typically comprises customers, suppliers, lenders, governments, unions, etcD. Are individuals, except employees, board of directors and stockholders that have some claim on the firm98. (p. 144) _____ means standing in the shoes of a stakeholder and asking how a proposed decision might impact that stakeholder.A. Veil of ignoranceB. Difference principleC. Moral imaginationD. Noblesse oblige99. (p. 145) Establishing _____ involves a business' resolve to place moral concerns ahead of other concerns in cases where either the fundamental rights of stakeholders or key moral principles have been violated.A. A veil of ignoranceB. A difference principleC. Moral imaginationD. Moral intent 100. (p. 145) _____ enables managers to walk away from a decision that is profitable, but unethical.A. Noblesse obligeB. Moral courageC. Difference principleD. Friedman doctrine101. (p. 124) What are business ethics? What is the relationship between business ethics and an ethical strategy?Business ethics are the accepted principles of right or wrong governing the conduct of businesspeople. An ethical strategy is a strategy or course of action that does not violate those accepted principles.102. (p. 124-13) What is considered normal practice in one country may be considered unethical in others. Discuss.Chapter 04 - Ethics in International BusinessMany of the ethical issues and dilemmas in international business are rooted in the fact that political systems, law, economic development and culture vary significantly from nation to nation. Therefore, what might be considered a normal business practice in one country may constitute unethical behavior in another country. Managers in a multinational company need to be sensitive to these differences and choose the ethical action in those circumstances where variation across societies creates the potential for ethical problems. In the international business setting, the most common ethical issues involve employment practices, human rights, environmental regulations, corruption and the moral obligation of multinational corporations.4-11。

bec商务英语高级用书In the realm of business English, mastering advanced communication skills is crucial for professionals looking to excel in the global marketplace. "BEC Higher Level: Business English" is a comprehensive resource designed to equiplearners with the necessary language proficiency to navigate the complexities of international business.The book is structured around various business contexts, ensuring that learners are exposed to a wide range ofscenarios they may encounter in their careers. Each chapter focuses on a specific aspect of business, such as marketing, finance, or human resources, providing targeted languageskills and industry-specific vocabulary.Chapter 1: The Art of NegotiationThis chapter delves into the nuances of business negotiations. Learners are introduced to advanced vocabulary and strategies for effective communication, including how to make persuasive arguments, handle objections, and close deals.Chapter 2: Presentation SkillsMastering the art of public speaking is essential in business. This section teaches learners how to construct compelling presentations, use visual aids effectively, and engage with their audience.Chapter 3: Writing Professional Emails and ReportsClear and concise written communication is key. Learners are guided through the process of writing professional emails, reports, and business correspondence, with a focus on tone, structure, and clarity.Chapter 4: Understanding and Analyzing Business DataData literacy is a must in today's data-driven business world. This chapter covers how to interpret financial statements, market research, and statistical data, enabling learners to make informed decisions.Chapter 5: Cultural Awareness in International BusinessCultural competence is vital for success in global business. Learners explore the importance of cultural awareness, learn about different business etiquettes, and how to avoid common cross-cultural communication pitfalls.Chapter 6: Leadership and TeamworkEffective leadership and collaboration are the cornerstones of a successful business. This section discusses leadership qualities, team dynamics, and how to give and receive feedback constructively.Chapter 7: Dealing with Challenges and ConflictResolutionEvery business faces challenges. Learners are taught how to handle difficult situations, negotiate solutions, and resolve conflicts professionally.Chapter 8: Advanced Grammar and Vocabulary for BusinessA solid grasp of grammar and an extensive vocabulary are essential. This chapter provides a review of complex grammatical structures and introduces advanced business terminology.Chapter 9: Networking and Socializing in a Business ContextNetworking is a critical skill for career advancement. Learners are shown how to build professional relationships, attend business social events, and use social media for professional networking.Chapter 10: Preparing for the BEC Higher Level ExamThe book concludes with a comprehensive guide to preparing for the BEC Higher Level exam, including tips for each section of the test, sample questions, and strategiesfor effective exam preparation."BEC Higher Level: Business English" is more than just a textbook; it's a passport to success in the competitive world of international business. With its practical approach andengaging content, it empowers learners to communicate with confidence and competence.。

国际贸易实务双语教程课后题答案解析KeyChapter1I. Answer my questions1. International trade is business whose activities involve the crossing of national borders. It includes not only international trade and foreign manufacturing but also encompasses the growing services industry in areas such as transportation, tourism, banking, advertising, construction, retailing, wholesaling, and mass communications. It includes all business transactions that involve two or more countries. Such business relationship may be private or governmental.2. Sales expansion, resource acquisition and diversification of sales and supplies.3. To gain profit.4. To seej out foreign markets and procurement.5. There are four major forms which are the following:Merchandise exports and Imports, Service Exports and Imports, Investment and Multinational Enterprise.6. It is the account which is a summary statement of the flow of all international economic and financial transactions between one nation (eg.the United States ) and the rest of the world over some period of time, usually one year.7. Merchandise Exporting and Importing.8. Yes. There are great differences between them.1) direct investment takes place when control follows the investment. It usually means high commitment of capital, personnel, and technology abroad. It aims at gaining of foreign resources and foreign markets. Direct investment may often get higher foreign sales than exporting. And sometimes it involves two or more parties. 2) While portfolio investments are not under control. And they are used primarilyfor financial purposes. Treasures of companies, for example, routinely more funds from one country to another to get a higher yield on short term investments.9. MNE is the abbreviation of the multinational enterprise. Its synonymsare NNC(the multinational corporation) and TNC (transnational corporation).10. Examples are travel, transport, fee, royalties, dividends and interest.11. The choice of forms is influenced by the objective being pursued and the environments in which the company must operate.12. It is limited by the number of people interested in a firm’s products andservices and by customers’ capacity to make purchase.13. This is because at an early stage of international involvement these operationsusually take the least commitme nt and least risk of a firm’s resources.14. Royalties means the payment for use of assets from abroad, such as fortrademarks patens, copyrights, or other expertise under contract known as licencingagreements.Royalties are also paid franchising.15. It is a way of doing business in which one party (the franchiser) the use of atrademark that is an essential asset for the franchisers’ business.II Match each one on the left with its correct meaning on the right 1. J 2.A 3.E 4.B 5.C 6.D 7.I 8.G 9.F 10.H III Translate the following terms and phrases into Chinese1 购买⼒ 11 经济复苏;恢复2 潜在销售量 12 经济衰退3 加价,涨价 13 间接投资4 国内市场 14 有形货物5 制成品 15 有形进出⼝6 边际利润 16 收⼊及⽀出;岁⼊及岁出7 市场占有率 17 超额能⼒8 贸易歧视 18 贸易中间⼈(商);经纪⼈9 时机选择 19 全部包建的⼯程承包⽅式10 经销周期 20 许可证协定IV Translate the following into English1. Trade is often the ‘engine’ of growt h. However oversimplified this metaphormay be, it does serve to underline the importance of foreign trade in the process ofgrowth. A healthy expansion of exports may not always be sufficient condition forrapid and sustained growth, but a strong positive association between the two isclearly undeniable. Trade expansion contributes to economic growth inmany ways.Among them are the benefits of specialization; the favorable effects of internationalcompetition on domestic economic efficiency; the increased capacity to pay for theimports required in development and more generally the stimulus to investment.2. International trade is the exchange of goods and services produced in onecountry for goods and services produced in another country. In addition to visibletrade, which involves the import and export of goods and merchandise, there is alsoinvisible trade, which involves the exchange of services between nations. Nationssuch as Greece and Norway have large maritime fleets and provide transportationservice. This is a kind of invisible trade. Invisible trade can be as important to somenations as the export of raw materials or commodities is to others. In both cases, thenations earn the money to buy necessities.3. There exist different ways of conducting international business. Exclusive salemeans the seller gives the overseas client the exclusive right of selling a particularproduct in a designated area within a specified period of time. In this kind of businesstransaction, the product is bought by the exclusive seller and therefore he should sellthe product by himself, assuming sole responsibilities for his profit and loss.Exclusive sale is different from agency where only commission is involved. Anddifference exists between general contract and exclusive sales because the exclusiveseller enjoys exclusive right in a particular area.4. There is no country in the world that can produce all the products it needs.Thus countries join in international division of labor for effective production andreproduction. Sometimes a country can buy goods and services from abroad on abarter basis. Barter means doing business by exchanging goods of one sortfor goodsof another sort without using money. Barter trade itself is not enough to meat acountry’s imp ort needs. But as a form of international trade, it is still attractive indeveloping countries where foreign exchange is in short supply and inflow of foreignfunds is far from sufficient to meet their obligations in external trade.Chapter2I. Answer the following questions(Omited)II. Filling the blanks with the suitable words in the text:1.meeting/satisfying;2.agent, foreign/overseas;/doc/72314187.htmlmission;4.own;5.setting;6.patent;7.profits;8.outlets;9.joint, venture; 10.subsidiaryIII.Translate the followings into English1). Economic activity began with the cavemen, who was economically self-sufficient. He did his own hunting, found his ownshelter, and provided for hisown needs. As primitive populations grew and developed, the principle of division oflabor evolved. One person was more able to perform some activity than another, andtherefore each person concentrated on what he did best. While one hunted, anotherfished. The hunter then traded his surplus to the fisherman, and each benefited fromthe variety of diet.In today’s complex economic world, neither individuals nor nations are self-sufficient nations are self-sufficient. Nations have utilized different economicresources; people have developed different skills. This is the foundation ofinternational trade and economic activities.Foreign trade, the exchange of goods between nations, takes place for many reasons. The first, as mentioned above, is that no nation has all of the commoditiesthan it needs. Raw materials are scattered around the world. Large deposits of copperare mined in Peru and Zaire, diamonds are mined in South Africa, and petroleum isrecovered in Middle East. Countries that do not have these resources within their ownboundaries must buy from countries that export them.Foreign trade also occurs because a country often does not have enough of aparticular item to meet its needs. Although the United States is a major producer ofsugar, it consumes more than it can produce internally and thus must import sugar.Third, one nation can sell some items at a lower cost than other countries. Japanhas been able to export large quantities of radios and television sets because it canproduce them more efficiently than other countries. It is cheaper for the United Statesto buy these from Japan than to produce them domestically.Finally, foreign trade takes place because of innovation or style. Even though theUnited States produces more automobiles than any other country, it still imports largequantities of autos from Germany, Japan and Sweden, primarily because there is amarket for them in the United States.2). The different kinds of trade nations engaged in are varied and complex, amixture of visible and invisible trade. Most nations are more dependent on exportsthan on any other activity. The earnings from exports pay for the imports that theyneed and want. A nation’s balance of payment is a record of these complex transactions. By reflecting all of these transactions in monetary terms , a nation is ableto combine the income it receives, for example, from exports, tourists expenditures,and immigrant remittances. This combined incomes is then spent on such items asmanufactured goods from other countries, travel for its citizens to other countries, andthe hiring of construction engineers.Chapter3I. Translate the followings from Chinese into English:1 terms of payment2 written form of contract3 execution of the contract4 sales contract5 purchase confirmation6 terms of transaction7 trading partners 8 the setting up of a contract9 trade agreement 10 consignment contract11 the contract proper 12 extension of the contract13 the contracting parties 14 special clause15 general terms and conditionsII. Answer the following questions in English:1 A contract is an agreement which sets forth bind obligations of the relevant parties. And any part that fails to fulfill his contractual obligations may be sued and forced to make compensation.2 There are two parties of business contract negotiations: oral and written. The former refers to direct discussions abroad; written negotiations often begin with enquiries made by the buyers.3 A written contract is generally prepared and signed as the proof of the agreement and as the basis for its execution. A sales or purchase confirmation is less detailed than a contract, covering only the essential terms of the transaction. It is usually used for smaller deals or between familiar trade partners.4 The setting up of a contract is similar to that of a trade agreement or any other type of formal agreements. It generally contains: 1) the title. The type of the contract is indicated in the title; 2) the contract proper. It is the main part of a contract; 3) the signature of the contracting parties indicating their status as the seller or the buyer; 4) the stipulations on the back of the contract and are equally binding upon the contracting parties.5 It generally contains the time of shipment, the mode of payment described in addition to an exact description of the goods including the quantity, quality, specifications, packing methods, insurance, commodity inspection, claims, arbitration and force majeure, etc.III. Translate the following into Chinese:合同是在双⽅达成协议的基础上制定的,⽽协议⼜是双⽅进⾏商务谈判的结果。

international business law 陈建平邹日强主编《国际商法》简介:陈建平等编著的《国际商法》教材旨在使读者在英语语境中较为系统地学习国际商务法律知识,熟悉和掌握英文商务法律术语、基本概念及基础理论,在此基础上深刻领会法律英语在语义、语用、语篇等方面的特殊性及其变化规律,提高专业英语技能。

本书分9个部分,共23个单元,重点介绍国际货物买卖法、合同法、商事组织法、代理法、产品责任法、国际投资法、知识产权法、国际商务中的争端解决等内容。

作者简介暂缺《国际商法》作者简介目录《国际商法》目录:Chapter 1 Introduction to International Business Law Chapter 2 NCOTERMSChapter 3 The Law of International Marine Cargo Transport Chapter 4 The Law of Insurance in InternationalCargoTransportChapter 5 The Law of International Settlement of Payment Chapter 6 Antidumping LawChapter 7 Contract LawChapter 8 United Nations Convention on Contracts far theInternational Sale of GoodsChapter 9 Contract Law in ChinaChapter 10 Corporate LawChapter 11 The Law of PartnershipsChapter 12 The Law of AgencyChapter 13 Product Liability LawChapter 14 Legal Forms of Foreign Direct Investment in China Chapter 15 Trade Related Investment Measures Agreement Chapter 16 Multilateral Investment Guarantee Agency Chapter 17 Paris Convention for the Protection of IndustrialPropertyChapter 18 Patent Law in ChinaChapter 19 Trademark Law in ChinaChapter 20 Copyright Law in ChinaChapter 21 International Commercial ArbitrationChapter 22 The Dispute Settlement System of WTOChapter 23 International Center for Settlement of InvestmentDisputes。

Lesson 1 International Business(国际商务)★International business refers to transaction between parties(当事人、参与者)from different countries.Sometimes business across the borders of different customs areas (关税区)of the same country is also regarded as import and export, such as business between Hong Kong and Taiwan.International business involves more factors and thus is more complicated than domestic business. The followings(下列各项) are some major differences between the two:★ 1. The countries involved often have different legal systems(不同的法律体系), and one or more parties will have to adjust themselves to operate in compliance with(遵照、遵从) the foreign law.2. Different countries usually use different currencies(不同的货币) and the parties will have to decide which currency to use and do everything necessary as regards(关于) conversion (兑换) etc. Uncertainties and even risks are often involved in the use of a foreign currency.3.including language, customs,traditions, religion, value, behavior etc. often constitute challenges and even traps for people engaged in international business. 4. Countries vary in natural and economic conditions and may have different policies towards foreign trade and investment, making international business more complex than domestic business.With the development ofeconomic globalization(经济全球化),few people or companies can completely stay away from(置身于外)international business. Some knowledge in this respect(方面) is necessary both for the benefit of enterprises and personal advancement(个人进步).International business first took the form of commodity trade(商品贸易),.(即)exporting andimporting goods produced or manufactured in one country for consumption or resale(消费或转售) in another. This form of trade is also referred to as(被称为)visible trade(有形贸易). Later a different kind of trade in the form of transportation, communication, banking, insurance, consulting(咨询), information(信息业) etc. gradually became more andmore important. This type of trade is called invisible trade(无形贸易). Today, the contribution of service industries(服务业) of the developed countries constitutes over 60% of their gross domestic products(国内生产总值)and account for(占…) an increasing proportion of world trade. ★Another important form of international business is supplying capital byresidents of one country to another, known ascan be classified into two categories. The first kind of investments, foreign direct investments(外国直接投资)or FDI for short is made for returns(回报)through controlling the enterprises or assets invested in in a host country(东道国).The host country is a foreigncountry where the investor operates, while the country where the headquarters of investor is located is called the home country(投资国). The second kind of investment, portfolio investment(证券投资), refers to purchases of foreign financial assets(金融资产) for a purpose other than controlling.Such financial assets may be stocks(股票), bonds(债券)or certificate of deposit(大额存单). Stocks are also called capital stocks or bonds(股本或股份).★Bonds are papers issued by a government or a firm with promise to pay back the money lent or invested together with interest. The maturity period(到期时间)of a bond is at least one year, often longer, for example five, or even ten years. Certificates of deposit generally involve large amounts, say 25thousand US dollars.★Besides trade and investment, international licensing(国际许可)and franchising(特许经营) are sometimes taken as a means of entering a foreign market. In licensing, a firm leases(出租)the right to use its intellectual property(知识产权) to a firm in another country. Such intellectual property may be trademarks (商标), brand names(品牌),patents(专利), copyrights (版权) or technology(技术). Firms choose licensing is because they don’t have to make cash payment to start business, and can simply receive income in the form of royalty(知识产权/专利使用费). Besides, they can benefit from locational advantages of foreign operation(当地经营优势) without any obligation in ownership or management. Theuse of licensing is particularly encouraged by high customs duty(关税) and non-tariff barriers(非关税壁垒) on the part of the host country. However it is not advisable to use licensing agreement in countries with weak intellectual property protection(知识产权保护)since the licensor(许可方)may have difficulty in enforcing licensing agreement(执行许可协议).Franchising can be regarded as a special form of licensing. Under franchising, a firm, called the franchisee (特许使用方), is allowed to operate in the name of another, called the franchiser(特许授予方) who provides the former with trademarks, brand names, logos(公司标志), and operating techniques(经营技巧) for royalty(特许使用费). In comparison with therelation between the licenser(许可授予方) and the licensee(许可使用方), the franchiser has more control over and provides more support for the franchisee.★The franchiser can develop internationally and gain access to useful information about the local market with little risk and cost, and the franchisee can easily get into a businesswith established(已获认可的)products or services. Franchising is fairly popular especially in hotel and restaurant business. Other forms for participating in international business are management contract(管理合同), contract manufacturing (生产合同), and turnkey project(“交钥匙”工程). Under a management contract, one company offersmanagerial or other specialized services to another within a particular period for a flat payment(固定费用) or a percentage of the relevant business volume(相关业务总价值). ★Sometimes bonuses(分红)based on profitability or sales growth are also specialized (注明) in management contracts. When a government forbids foreign ownership in certainindustries it considers to be of strategic importance but lacks the expertise for operation, management contracts may be a practical (切实可行的)choices enabling a foreign company to operate in the industry without owning the assets. By contract manufacturing, a firm can concentrate on their strongest part in the value chain(价值链), e. g. marketing, while contractingwith foreign companies for the manufacture of their products. Such firms can reduce the amount of their resources devoted to manufacture and benefit from location advantages(当地优势) from production in host counties. ★However, loss of control over the producing process may give rise to(产生) problems in respect of quality and time of delivery (交货期).For an international turnkey project, a firm signs a contract with a foreign purchaser and undertakes all the designing, contracting and facility equipping before handing it over to the latter upon completion.Such projects are often large and complex and take a long period to complete. Payment for a turnkey project may be made at a fixed total price or on a cost plus basis(在实际成本之外收取一定费用). The latter way of payment shifts the burden of possible additional cost over the original budget onto the purchaser.★BOT(建设、经营、移交)is a popular variant of the turnkey project where B stands for build, O for operate and T for transfer. For a BOT project, a firm operates a facility for a period of time after buildingit up before finally transferring it to a foreign company. Making profit from operating the project for a period is the major difference between BOT and the common turnkey project. Needless to say, the contractor has to bear the financial and other risks that may occur in the period of operation.。