Multi-factor volatility and stock returns

- 格式:pdf

- 大小:582.31 KB

- 文档页数:18

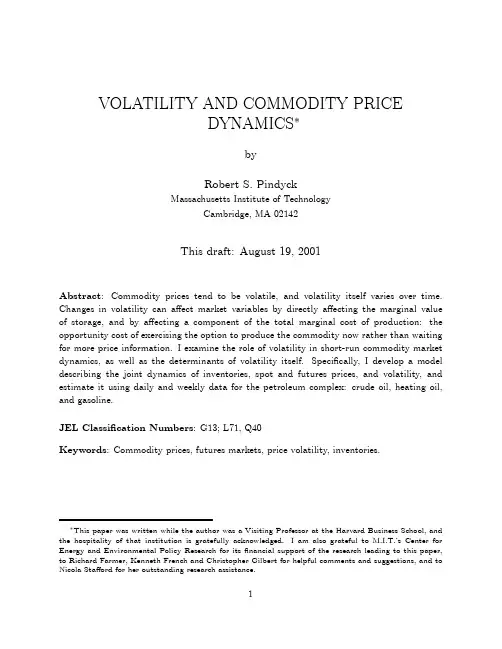

VOLATILITY AND COMMODITY PRICEDYNAMICS∗byRobert S.PindyckMassachusetts Institute of TechnologyCambridge,MA02142This draft:August19,2001Abstract:Commodity prices tend to be volatile,and volatility itself varies over time. Changes in volatility can affect market variables by directly affecting the marginal value of storage,and by affecting a component of the total marginal cost of production:the opportunity cost of exercising the option to produce the commodity now rather than waiting for more price information.I examine the role of volatility in short-run commodity market dynamics,as well as the determinants of volatility itself.Specifically,I develop a model describing the joint dynamics of inventories,spot and futures prices,and volatility,and estimate it using daily and weekly data for the petroleum complex:crude oil,heating oil, and gasoline.JEL Classification Numbers:G13;L71,Q40Keywords:Commodity prices,futures markets,price volatility,inventories.∗This paper was written while the author was a Visiting Professor at the Harvard Business School,and the hospitality of that institution is gratefully acknowledged.I am also grateful to M.I.T.’s Center for Energy and Environmental Policy Research for itsfinancial support of the research leading to this paper, to Richard Farmer,Kenneth French and Christopher Gilbert for helpful comments and suggestions,and to Nicola Stafford for her outstanding research assistance.1Introduction.Most commodity markets are characterized by periods of sharp changes in prices and inven-tory levels.In addition,the level of volatility itselffluctuates over time.This paper examines the short-run dynamics of commodity prices and inventories,with a particular focus on the role of volatility.A goal is to determine how changes in spot prices,futures prices,and inventories are affected by changes in volatility,and to elucidate the channels through which such effects occur.Another objective is to examine the behavior of volatility itself.Understanding the behavior and role of volatility is important for several reasons.First, as I show here,including volatility as a market variable can help us better understand short-run commodity market dynamics.Also,price volatility is a key determinant of the value of commodity-based contingent claims,including opportunities to invest in production facilities.Thus understanding its behavior is important for derivative valuation,hedging decisions,and decisions to invest in production facilities.Changes in volatility affect prices,production,and inventories in two main ways.First, volatility directly affects the marginal value of storage,or,as it is commonly called,marginal convenience yield,i.e.,theflow of benefits from an extra unit of inventory held by producers and/or consumers of the commodity.When prices–and hence production and demand–are more volatile,consumers and producers have a greater demand for inventories,which are needed to smooth production and deliveries,and reduce marketing costs.Thus an increase in volatility can lead to inventory build-ups and thereby raise prices in the short run.Second,volatility affects the total marginal cost of production by affecting the size of the“option premium.”Commodity producers(like producers of most goods)hold operating options,with an exercise price equal to direct marginal production and a payoffequal to the market price of the commodity.The total cost of producing a marginal unit of the commodity equals the direct marginal cost of production plus the opportunity cost of exercising thefirm’s operating option now rather than waiting for new price information.The greater is the volatility of price,the greater is the value of this option,and the greater is the opportunity cost of producing now.Thus an increase in volatility can result in a decrease in production.Using a two-period model,Litzenberger and Rabinowitz(1995)have shown that this option value leads to backwardation in futures markets.Using data for crude oil,Litzenberger and Rabinowitz(1995)showed that consistent with the theory,production is negatively correlated with price volatility,and the extent of futures market backwardation is positively correlated with price volatility.Also,Schwartz (1997)and Schwartz and Smith(2000)have shown how futures and spot prices can be used to estimate the parameters of a mean-reverting price process and derive values of contingent claims on the commodity.I go further and show how volatility and option value can be incorporated in a complete equilibrium model of a commodity market.In this paper,I develop a weekly model that relates the dynamics of inventories,spot and futures prices,and the level of volatility.I estimate the model using data for the three commodities that make up the petroleum complex:crude oil,heating oil,and gasoline.To estimate volatility,I use sample standard deviations of adjusted daily log changes in spot and futures prices.In addition to its simplicity,this approach has the advantage that it does not require a parametric model describing the evolution of volatility over time.1 As shown in this paper,at least for the petroleum complex,changes in price volatility are not predicted by market variables such as spot prices,inventory levels,or convenience yields,and can be viewed as largely exogenous.The volatility of,say,crude oil prices can be forecasted by past levels of volatility,but the marginal forecasting power of market variables is very low.However,changes in volatility directly affect market variables,by affecting the marginal value of storage,and by affecting price and production through the option premium.In addition,changes in the value of storage affect production,inventory holdings, and spot prices,so these variables are indirectly affected by changes in volatility.This paper also provides evidence on how inventory holdings affect short-run price move-ments.In a competitive commodity market,inventories can be used to reduce costs of varying production(when marginal cost is increasing),and to reduce marketing costs by facilitating production and delivery scheduling and avoiding stockouts.These latter factors 1This approach was also used by Campbell et.al.(2001)in their recent study of the behavior of stock price volatility.make it costly forfirms to reduce inventories beyond some minimal level,even if marginal production cost is constant.The extent to which price will move in the short run depends on the cost of varying production as well as the cost of drawing down inventories.Equilibrium inventory behavior is the solution to a stochastic dynamic optimization prob-lem.Early studies of manufacturing inventories(as well as Eckstein and Eichenbaum’s(1985) study of crude oil inventories)rely on a linear-quadratic specification to obtain an analyt-ical solution to this problem.This is unrealistic for commodity markets because the cost of drawing down inventory is highly convex in the stock of inventory,rising rapidly as the stock falls toward zero,and remaining very small as the stock varies across moderate to high levels.Therefore,as in my earlier study of commodity inventories,I adopt a more general specification and estimate the Euler equations that follow from intertemporal optimization.2 In addition,I use futures market data to obtain a direct measure of the marginal value of storage(i.e.,the convenience yield).This paper differs from my earlier study in several respects.First,I explicitly account for price volatility as a determinant of the marginal value of storage,and as a factor affecting the value offirms’operating options,and hence the full marginal cost of production.I can thereby estimate the extent to which changes in volatility will affect the levels of prices and inventories,and I obtain evidence on the channels through which these effects occur.In addition,I examine the determinants of price volatility itself.Finally,by earlier work was based on monthly data,but commodity marketfluctuations occur on a shorter time scale. By estimating a weekly model,I obtain a clearer picture of market dynamics.In the next section,I lay out a model of short-run commodity market dynamics that links prices,inventories,convenience yield,and volatility.The model includes a set of Euler equations(first-order conditions)and cannot be solved analytically.However,in Section3I use phase diagrams to trace through the(theoretical)effects of various shocks.In Section4, I discuss the data set,and examine the behavior of price volatility and market variables2See Pindyck(1994).This approach has also been used in studies of manufacturing inventories;see,e.g., Miron and Zeldes(1988)and Ramey(1991).Considine(1997)and Considine and Heo(2000)have estimated Euler equation models of inventory behavior for various petroleum products,focusing on the joint production characteristics of petroleum refining.for each commodity.I show that these volatilities are rapidly mean reverting,but can be viewed as largely exogenous with respect to market variables such as inventory changes and price.Section4also discusses the results of estimating the full model using General Method of Moments(GMM).In Section5,I use the model to examine the impact of shocks to volatility on price,inventories,and convenience yield.Section6concludes.2A Model of Prices,Inventories,and Volatility.In this section I lay out a structural model that describes equilibrium in two competitive markets:the cash market for spot purchase and sale of the commodity,and the market for storage,in which an equilibrium level of inventories is held at a“price”equal to marginal value,i.e.,marginal convenience yield.Together,these markets determine the spot price, the inventory level,and the convenience yield(and hence,implicitly,the futures price).The model accounts for the role of volatility in both of these markets.2.1Cash Markets and Storage Markets.In a competitive commodity market subject to stochasticfluctuations in production and/or consumption,producers(and to a lesser extent,consumers and third parties)will hold in-ventories.Producers hold them to reduce costs of adjusting production over time,and also to reduce marketing costs by facilitating production and delivery scheduling and avoiding stockouts.If marginal production costs are increasing with the rate of output and if de-mand isfluctuating,producers can reduce costs over time by selling out of inventory during high-demand periods,and replenishing inventories during low-demand periods.Inventories also serve as a“lubricant”to facilitate scheduling and reduce marketing costs.Industrial consumers of a commodity also hold inventories,to facilitate their own production processes.To the extent that inventories can reduce production and marketing costs in the face of changing demand conditions,they will reduce the magnitude of short-run pricefluctuations. Also,because it is costly forfirms to reduce inventory holdings beyond some minimal level, price volatility tends to be greater during periods when inventories are low.When inventory holdings can change,the market-clearing price is determined not only by current production and consumption,but also by inventories.Thus,we must account for equilibrium in both the cash and storage markets.In the cash market,purchases and sales of the commodity for immediate delivery occur at a price that I will refer to as the“spot price.”Equilibrium in this market defines a relationship between the spot price and net demand,i.e.,the difference between production and consumption.To see this,write consumption demand as Q=Q(P,z1),where P is the spot price and z1is a vector of demand-shifting variables.Likewise,write the supply function as x=x(P,z2),where z2is a vector of supply-shifting variables.Letting N t denote the inventory level,the change in inventories at time t is:∆N t=x(P,z2)−Q(P,z1).This just says that the cash market is in equilibrium when net demand(the demand for production in excess of consumption)equals net supply.We can rewrite this in terms of the following inverse net demand function:P t=f(∆N t;z1,z2).(1)Market clearing in the cash market therefore implies a relationship between the spot price and the change in inventories.Now consider the market for storage.At any instant of time,the supply of storage is the total quantity of inventories,N t.In equilibrium,this must equal the quantity demanded, which is a function of price.The price of storage is the“payment”by inventory holders for the privilege of holding a unit of inventory,and has three components:the cost of physical storage(e.g.,tanks to hold heating oil);the opportunity cost of forgone interest;and any expected depreciation or appreciation in the spot price.The price of storage will equal the value of theflow of services from the marginal unit of inventory,and is usually referred to as marginal convenience yield.Denoting the price of storage byψt,the demand for storage function can be written as N(ψt,z3),where z3is a vector of demand-shifting variables,such as temperature.One important component of z3is the volatility of price,which is a goodproxy for market volatility in general.3Writing this as an inverse demand function,we have:ψt=g(N,z3).(2)Thus market clearing in the storage market implies a relationship between marginal conve-nience yield(the price of storage)and the demand for storage.Market equilibrium is determined from eqns.(1)and(2),and an additional equation (to be derived shortly)describing the dynamic tradeoffbetween producing and selling out of inventory.Given values for the exogenous variables z1,z2,and z3,these three equations determine the values at each point in time of the three endogenous variables P t,N t,andψt.2.2Operating Options and Convenience Yield.Consider the incremental production decision for afirm that produces a commodity from a fixed quantity of reserves or other raw material,has a constant marginal production cost c, and faces a market price thatfluctuates stochastically.Thefirm has an option to produce a unit now(and receive incremental net revenue P−c),or wait and possibly produce the unit in the future.At any point in the future,the net payofffrom exercising this option is V=max[0,P t−c].The greater the volatility of price,the greater is the expected value ofthis future payoff,and thus the greater is the opportunity cost of exercising the option now rather than waiting.Thus price will exceed marginal cost by a premium,which I denote by ωt.(See Dixit and Pindyck(1994)for a detailed discussion.)I discuss the determination ofωt later;here,simply note thatωt is an increasing function of volatility.Hence an increase in volatility increases the opportunity cost of producing today,and raises full marginal cost.Next,consider the net(of storage costs)marginal convenience yield that we can measure by comparing spot and futures prices:ψt−k=(1+r)P t−F1t,(3)3The marginal value of storage is small when the total stock of inventories is large(because one more unit of inventory is of little extra benefit),but can rise sharply when the stock becomes small.Thus the demand for storage function should be downward sloping and convex,i.e.,∂N/∂ψ<0and∂2N/∂ψ2>0.where F1t is the futures price at time t for a contract maturing at time t+1,r is the one-period interest rate,and k is the one-period cost of storage.4As discussed above,ψt is the value of theflow of production-and delivery-facilitating services from the marginal unit of inventory,a value that should be greater the greater is the volatility of price.However,ψt also includes operating options,such as the value of keeping oil in the ground rather than producing it now.To see this,suppose that inventories yield no other services,and k=0. We would still needψt>0for oil production to take place at all.Ifψt were equal to zero, producers would have no incentive to exercise their options to produce(just as a call option on a non-dividend paying stock is optimally exercised only at expiration).Put differently, oil in the ground provides a price-protection service,the value of which is positive and is included inψt.Thus even if inventory levels are large,we should observe at least weak backwardation in the futures market.5This simply reflects the fact that there is some value to delaying production and waiting for more information about prices,even if the expected future spot price is less than the current spot price.Furthermore,this value will be greater the greater is the volatility of price.In summary,volatility should affect convenience yield in two ways,and in both cases positively.First,it should affect the value of theflow of production-and delivery-facilitating services that inventories provide.Second,it should affect the price-protection service that is part of convenience yield.As an empirical matter,it will not be possible to measure these effects separately.Instead,we can only measure the combined effect,and test whether convenience yield depends positively on volatility.4To see why eqn.(3)must hold,note that the(stochastic)return from holding a unit of the commodity for one period isψt+(P t+1−P t)−k.Suppose that one also shorts a futures contract.The return on this futures contract is F1t−F1,t+1=F1t−P t+1,so one would receive a total return equal toψt+(F1t−P t)−k. No outlay is required for the futures contract,and this total return is non-stochastic,so it must equal the risk-free rate times the cash outlay for the commodity,i.e.,rP t,from which eqn.(3)follows.Because futures contracts are marked to market,strictly speaking,F1t should be a forward price.For most commodities, however,the difference between the futures and forward prices is negligible.5For a detailed discussion of this point and derivation ofψt in the context of a two-period model,see Litzenberger and Rabinowitz(1995).McDonald and Shimko(1998)also address this point,and measureψt and its components for the gold market.2.3Costs.I now turn to the specification of the model that will be estimated.The total economic cost of commodity production,marketing,and storage is given by:TC=C(x)+Ω(x;σ,r)+Φ(N,P,σ)+kN,(4)and has four components:•C(x)is direct production cost,which I assume is quadratic in the production level x.•Ω(x;σ,r)is the opportunity cost of producing x now,rather than waiting.As explained below,it depends on the level of price volatility,σ,and the risk-free interest rate r.•Φ(N,P,σ)is total marketing cost,i.e.,the cost of production and delivery scheduling and avoidance of stockouts,and is decreasing in the level of inventories N.•k is the per-unit cost of physical storage,which I assume is constant.Two other variables must be defined.First,ψ=−∂Φ/∂N is the marginal value of storage,i.e.,marginal convenience yield:ψt=(1+r)P t−F1t+k.Second,ω=∂Ω/∂x is the marginal option premium,i.e.,the opportunity cost of exercising the option to produce an incremental unit of the commodity,given a total production level x.These components of cost are modelled as follows.I assume that the direct cost of production is quadratic.For crude oil,direct cost is:C(x)=(c0+ηt)x t+1c1x2t,(5)2whereηt is a random shock.Note that there are no input cost variables(such as wage rates)in(5);such variables cannot be measured–and are unlikely to vary much–on a weekly basis.For heating oil and gasoline,however,the cost of the crude oil input is a large component of direct production cost,and must be accounted for:c1x2t+c2P C,t x t,(6)C(x)=(c0+ηt)x t+12where P C,t is the price of crude oil.Marketing cost should be roughly proportional to the price of the commodity.It should also be increasing in the level of price volatility,which I use as a proxy for market volatility in general.6Higher volatility makes scheduling and stockout avoidance more difficult,and thus should increase the demand for storage.Ideally,the total marketing cost functionΦshould be derived from a dynamic optimizing model that accounts for stockout costs and costs of scheduling and managing production and shipments,but that is beyond the scope of this work.Instead,I assume that this function is isoelastic in price,the variance of log price changes,and the total inventory level:Φ(N,P,σ)=1α3−1exp(b0+11X j=1b j DUM jt)Pα1t(σ2t)α2N1−α3t,(7)where DUM jt are monthly time dummies andα3>1.This implies that the marginal value of storage(marginal convenience yield),−∂Φ/∂N,can be written as:logψt=b0+11X j=1b j DUM jt+α1log P t+α2logσ2t−α3log N t.(8)To model the marginal opportunity costωt=∂Ωt/∂x t,we need an expression for the value of the option to produce a marginal unit of the commodity,and the optimal price P∗at which that option should be exercised.The difference between P∗and the direct marginal cost C0(x)is the opportunity cost of exercising the option to produce the marginal unit. Valuing this option requires assumptions about the stochastic dynamics of price.To account for the fact that prices tend to be strongly mean-reverting,I assume that the price process can be written in continuous time as:dP/P=λ(µ−P)dt+σdz,(9)or equivalently:d log P=λ(µ−12σ2−P)dt+σdz.(10) Here,µis the“normal”price to which P t tends to revert andλis the speed of reversion.I treatσas a constant because allowing for stochastic volatility precludes a closed-form6Price volatility is highly correlated with the volatility of consumption and production.Also,price fluctuations themselves(whether caused byfluctuations in net demand,or something else,such as speculative buying and selling)cause consumption and production tofluctuate.solution for the option value.Furthermore,it should not affect the way in which the option value depends on volatility,although it will affect its magnitude(overstating it).To account for this,I include a scaling coefficient that is estimated as part of the model.7 In the Appendix,I show that if the price process follows eqn.(10)and direct marginal cost is non-stochastic,a series solution can be found for the value of the option to produce. For estimation purposes,I use a quadratic approximation to this solution.As shown in the Appendix,letting r denote the risk-free interest rate andρthe risk-adjusted expected return on the commodity,the opportunity costωt can be written as:ωt=1√γ1γ2−µ,(11)whereγ1=λθλµ+θσ2,γ2=λ(θ+1)2λµ+(2θ+1)σ2,(12)andθ=12+(ρ−r−λµ)σ2+v u u t"(r−ρ+λµ)σ2−12#2+2rσ2.(13)I include a scaling coefficient,so that c2ωt is the marginal opportunity cost.Note that the estimated value of c2should be close to1.2.4Euler Equations.With expressions for the components of cost,we can solve the intertemporal profit max-imization problem,making use of the fact that in the U.S.markets for crude oil and oil products are reasonably competitive,so that producers can be treated as price takers.Of course much of the crude oil and some of the gasoline consumed in the U.S.is imported, but the presence of imports will simply make the domestic net demand function(which I estimate)more elastic than it would be otherwise.(If the supply of imports is highly elastic, the spot price will have little or no dependence on the change in domestic inventories.) 7The numerical analyses of Hull and White(1987)suggest that treatingσas non-stochastic makes little quantitative difference in any case.See,also,Franks and Schwartz(1991).Taking prices as given,firms choose production and inventory levels to maximize the present value of the expectedflow of profits:max E t∞Xτ=0Rτ,t(P t+τQ t+τ−TC t+τ),(14) where Rτ,t is theτ-period discount factor,Q is sales,TC is given by eqn.(4),and the maximization is subject to the accounting identity∆N t=x t−Q t.(15) (The maximization is subject to the additional constraint that N t+τ≥0for allτ,but because Φ→∞as N→0,this constraint will never be binding.)To obtainfirst-order conditions,first maximize with respect to x t,holding N tfixed so that∆x t=∆Q t:P t=c00+c1x t+c2P C,t+c3ωt+ηt.(16) (I have included the term for the crude oil input price,c2P C,t,so this equation would apply to heating oil and gasoline;for crude oil this term is dropped.)It will be convenient to eliminate production and write the model in terms of prices and inventories.In the short run(a period of one week),consumption should be very inelastic with respect to price,so I model it as:Q t=Q+11X j=1d j DUM jt+c4HDD t+c5CDD t+c6T t+²t,(17)where the DUM jt are monthly dummies,HDD and CDD are,respectively,heating and cool-ing degree days,and T is a time trend.Thus I assume that consumptionfluctuates seasonally and in response to changes in temperature,is subject to(possibly serially correlated)random shocks(²t),but is insensitive to price.Substituting for Q t in eqn.(15)and rearranging:x t=∆N t+Q+11X j=1d j DUM jt+c4HDD t+c5CDD t+c6T t+²t(18)Thus eqn.(16)can be rewritten as:P t=c0+c1∆N t+c2P C,t+c3ωt+c4HDD t+c5CDD t+c6T t+11X j=1d j DUM jt+c1²t+ηt,(19)where c0=c00+c1Q.Eqn.(19)describes market clearing in the cash market.8 Next,maximize eqn.(14)with respect to N t,holding Q t and N t+1fixed:0=E t[c0(1−R1t)+ψt−k+ηt−R1tηt+1+c1(x t−R1t x t+1)+c2(P C,t−R1t P C,t+1)+c3(ωt−R1tωt+1)].(20) Over a one-week time period,R1t≈1.Making this substitution and also substituting eqn.(18)for x t,yields the secondfirst-order condition:0=E t[c1∆2N t+1+ψt−k+c2∆P C,t+1+c3∆ωt+1+11X j=1d j∆DUM j,t+1+c4∆HDD t+1+c5∆CDD t+1+c6+∆ηt+1+∆²t+1],(21)where∆2N t+1≡∆N t+1−∆N t.Eqn.(19)simply equates price with full marginal cost,where the latter includes the opportunity cost of exercising the marginal operating option.It contains error terms repre-senting the unexplained part of marginal cost(ηt)and unanticipated shocks to demand(²t). Eqn.(21)describes the tradeoffbetween selling out of inventory versus producing.To see this,rearrange the equation so thatψt−k is on the left-hand side.The equation then says that net marginal convenience yield(the savings in marketing costs over the coming period from having another unit of inventory,net of storage costs)should equal the expected change in production cost(the increase this period minus the decrease next period)from producing a unit now rather than selling it from inventory and then replenishing inventory by producing it next period.The expected change in production cost can come from expected changes in input prices,expected changes in opportunity costs,and expected increases in cost due to convexity of the cost function.To estimate the model,I substitute eqn.(8)forψt in eqn.(21).Also,because estimation is by GMM,I drop the expectation operator and use actual values of variables dated at t+1:0=c1∆2N t+1+exp(b0+11X j=1b j DUM jt)Pα1t(σ2t)α2N−α3t−k+c2∆P C,t+1+c3∆ωt+1+8Eqn.(19)is an expanded version of a model that has been used by a number of other authors.See,for example,Williams and Wright(1991),Routledge,Seppi,and Spatt(2000),and Schwartz and Smith(2000).11X j=1d j∆DUM j,t+1+c4∆HDD t+1+c5∆CDD t+1+c6+∆ηt+1+∆²t+1.(22) The model is closed by including eqn.(8)for the marginal convenience yield.Together, eqns.(19),(22),and(8)describe the evolution of the state variables P t,N t,andψt.As I show later,it is reasonable to treat the fourth state variable,the volatilityσt,as exogenous. 3Market Dynamics.Before discussing the estimation of this model,it is useful to examine its theoretical impli-cations for market dynamics and the effects of volatility and other shocks.Although the model contains a complete empirical description of the market,I have not actually solved thefirm’s stochastic dynamic optimization problem(beyond deriving first-order conditions).Thus I cannot calculate optimal trajectories for market variables that correspond to particular stochastic processes for demand,cost,and volatility shocks. However,I can analyze deterministically optimal trajectories for market variables,consistent withfirms choosing output and inventory levels that are solutions to the corresponding deterministic optimization problem.I examine such trajectories qualitatively as a way of characterizing the market behavior implied by the ter I use this approach to quantitatively estimate the response of prices and inventories to various shocks.First,consider the(deterministic)steady-state equilibrium in which there are no seasonal variations in cost or demand,σis constant,and there are no other shocks so that∆N=∆2N=∆P=0.Replacing expectations with actual values in eqn.(21),treating HDD and CDD as constants and setting the time dummies and time trend parameter c6to zero,and using overbars to denote equilibrium values,we then haveψ=k.Also,P=c0+c3ω,9andN=bPα1/α3σ2α2/α3k−1/α3,where b=e b0/α3.We can now draw a phase diagram for the two state variables N and∆N.When esti-mating the model,Ifind that for both crude oil and heating oil,the parametersα1andα3 9This applies to crude oil.For heating oil or gasoline,P=c0+c2P C+c3ω.。

基于多因子模型的量化投资研究基于多因子模型的量化投资研究1. 引言量化投资是近年来发展迅速的一种投资策略,其核心思想是利用数学模型和计算机技术对市场进行分析和预测,以期获得超越市场的收益。

而多因子模型作为一种有效的量化投资方法,通过考量多个因子对股票价格的影响,量化地评估股票的价值和风险。

2. 多因子模型概述多因子模型是一种基于统计分析的投资模型,通过将股票的收益率与多个因子进行回归分析,来解释股票收益率的波动。

多因子模型通常包括市场因子、规模因子、价值因子、动量因子等。

市场因子衡量股票相对市场的表现,规模因子衡量股票的市值大小,价值因子衡量股票的估值水平,动量因子衡量股票的价格趋势。

通过综合考虑多个因子,可以更全面地评估股票的投资价值。

3. 多因子模型的构建在构建多因子模型时,首先需要选择适合的因子。

这需要根据市场的特点和投资者的偏好进行选择。

随后,需要进行因子的数据处理和归一化处理,以消除不同因子之间的量纲差异。

然后,通过回归分析对股票收益率与因子之间的关系进行建模。

最后,通过模型的参数估计,可以量化地评估股票的价值和风险,并进行投资决策。

4. 多因子模型的优势与传统的单因子模型相比,多因子模型具有以下优势:(1)全面性:多因子模型综合考虑了多个因子对股票收益率的影响,可以更全面地评估股票的价值和风险。

(2)稳定性:多因子模型通过考虑多个因子,可以降低单个因子的不确定性对投资组合的影响,提高投资策略的稳定性。

(3)有效性:多因子模型通过统计分析和回归分析,可以对不同因子的权重进行优化调整,从而提高投资组合的收益率。

5. 多因子模型的应用多因子模型在量化投资中有广泛的应用。

一方面,多因子模型可以用于股票的选择和投资组合的构建。

通过量化评估股票的价值和风险,可以选择具有良好投资价值的股票,并构建具有较高收益率和较低风险的投资组合。

另一方面,多因子模型还可以用于市场的预测和交易信号的生成。

通过对多个因子的综合分析,可以预测市场的走势,并基于此生成交易信号。

资产定价异常的多因子解释ABSTRACT前人的研究工作表明,普通股的平均收益与公司的一些特征有关系,比如公司的大小(Small、Big)、每股收益与股票价格之比(Earings/Price),每股现金流与股票价格(Cash flow/Price)之比,股票账面价值与市值比(Book value of equity/Market value of equity),过去销售额增长(past sales growth),长期过去收益(Long-term past return),短期过去收益(Short-term past return)。

这些因素不能够被CAPM所解释,所以它们被叫做异常现象。

本文认发现除了短期收益的连续性这一点以外,其他的异常现象都能被三因子模型解释。

本文首先主要是通过实证分析证明三因子模型解释了大部分CAPM所不能解释的关于股票平均收益的异常现象。

之后针对一些人提出的关于三因子模型的质疑进行解释,并总结本文的出的结论。

I、Tests on the 25 FF Size-BE/ME Portfolios表1中的样本数据来自于纽约证券交易所、美国证券交易所和纳斯达克证券交易所。

首先由表一可以看出小公司的股票平均收益大于大公司,同时高的账面市值比的公司的收益大于低的账面市值比的公司。

同时表1也反映了三因子模型时间序列回归(也就是(2))的拟合程度,如果三因子模型得出的结果是期望收益的话,那么回归方程的截距应该是接近于0。

我们看到,小公司和账面市值比比较低的组合截距为负,大公司和账面市值比较高的组合截距为正。

其他情况的话是接近于0的。

F值(表中没有给出)拒绝了原假设,同时这25个组合的R方的均值为0.93,也就是拟合效果比较的好,所以那个截距是显著不为零的。

尽管这个模型确实反映了组合平均收益的大部分风险,但是它的截距的绝对值的均值是0.093,也就是说有些截距它是显著不为0的。

II、LSV Deciles与前面的分组不同,LSV是根据BE/ME,E/P,C/P和五年的销售排名来分成10组。

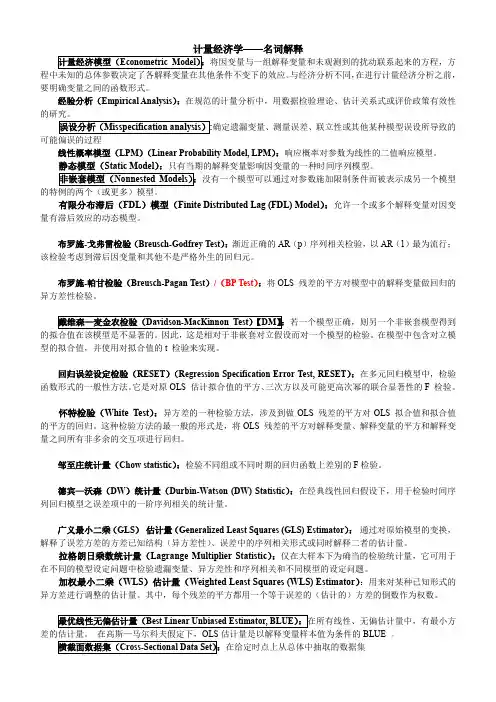

——名词解释将因变量与一组解释变量和未观测到的扰动联系起来的方程,方程中未知的总体参数决定了各解释变量在其他条件不变下的效应。

与经济分析不同,在进行计量经济分析之前,要明确变量之间的函数形式。

经验分析(Empirical Analysis):在规范的计量分析中,用数据检验理论、估计关系式或评价政策有效性的研究。

确定遗漏变量、测量误差、联立性或其他某种模型误设所导致的可能偏误的过程线性概率模型(LPM)(Linear Probability Model, LPM):响应概率对参数为线性的二值响应模型。

没有一个模型可以通过对参数施加限制条件而被表示成另一个模型的特例的两个(或更多)模型。

有限分布滞后(FDL)模型(Finite Distributed Lag (FDL) Model):允许一个或多个解释变量对因变量有滞后效应的动态模型。

布罗施-戈弗雷检验(Breusch-Godfrey Test):渐近正确的AR(p)序列相关检验,以AR(1)最为流行;该检验考虑到滞后因变量和其他不是严格外生的回归元。

布罗施-帕甘检验(Breusch-Pagan Test)/(BP Test):将OLS 残差的平方对模型中的解释变量做回归的异方差性检验。

若一个模型正确,则另一个非嵌套模型得到的拟合值在该模型是不显著的。

因此,这是相对于非嵌套对立假设而对一个模型的检验。

在模型中包含对立模型的拟合值,并使用对拟合值的t 检验来实现。

回归误差设定检验(RESET)(Regression Specification Error Test, RESET):在多元回归模型中,检验函数形式的一般性方法。

它是对原OLS 估计拟合值的平方、三次方以及可能更高次幂的联合显著性的F 检验。

怀特检验(White Test):异方差的一种检验方法,涉及到做OLS 残差的平方对OLS 拟合值和拟合值的平方的回归。

这种检验方法的最一般的形式是,将OLS 残差的平方对解释变量、解释变量的平方和解释变量之间所有非多余的交互项进行回归。

第6章 多因子定价模型黄万阳(根据肖俊喜译稿整理)在第5章结束部分,我们总结了CAPM 贝塔不能完全解释资产期望收益截面部分的经验证据。

该证据意味着可能需要1或多个其它因子刻画期望收益行为,自然考虑多因子定价模型。

理论争论也表明:由于仅在强假设下CAPM 才被逐期应用,需要多因子定价模型。

有两个主要的理论方法:罗斯(Ross,1976)提出的以套利为基础的套利定价理论(APT )。

默顿(Merton,1973a )提出的以均衡为基础的跨期资本资产定价模型。

在这一章,我们考虑多因子模型计量经济分析。

这章安排如下。

第6.1节简短地讨论多因子方法理论背景。

在第6.2节中我们考虑已知因子模型的估计与检验。

而在第6.3节中我们给出风险溢价(PREMIA )与期望收益的估计量。

既然因子不总是由理论提供,那么在第6.4节我们讨论构造因子的方法。

第6.5节给出了实证结论。

由于缺乏模型设定,离差总能被其余因子解释。

因此,这就产生了解释违背模型问题。

在第6.6节我们将讨论这个问题。

6.1 理论背景作为资本资产定价模型可供选择的模型,罗斯(Ross,1976)引入了套利定价理论。

APT 比CAPM 更一般,由于它考虑多个风险因子。

不像CAPM ,APT 也不要求识别市场投资组合。

然而,这种一般性不是无成本的。

在其一般形式中,APT 给出了资产期望收益与个数不确定的未识别因子之间近似关系。

在这种情况下,否定该理论是不可能的(除非套利机会存在)。

因此,模型可检验性依赖于额外假设的引入1。

套利定价理论假设市场是竞争的、无摩擦的;所考虑的资产收益生成过程为i i i i a R ε+'+=f b (6.1.1)0][=f i E ε (6.1.2)∞<≤=222][σσεi i E (6.1.3)其中i R 是资产i 的收益,i a 是因子模型截距,i b 是资产i 因子敏感度)1(⨯K 向量,f 是共同因子实现(realization ))1(⨯K 向量,i ε是扰动项。

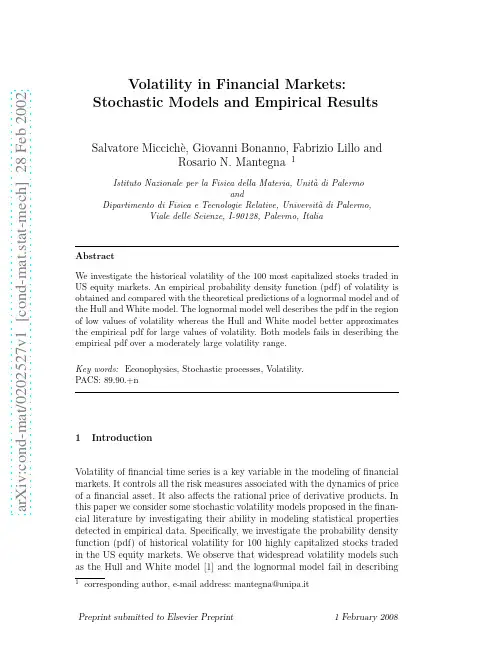

THE JOURNAL OF FINANCE•VOL.LXI,NO.1•FEBRUARY2006The Cross-Section of Volatilityand Expected ReturnsANDREW ANG,ROBERT J.HODRICK,YUHANG XING,and XIAOYAN ZHANG∗ABSTRACTWe examine the pricing of aggregate volatility risk in the cross-section of stock returns.Consistent with theory,we find that stocks with high sensitivities to innovations inaggregate volatility have low average returns.Stocks with high idiosyncratic volatilityrelative to the Fama and French(1993,Journal of Financial Economics25,2349)model have abysmally low average returns.This phenomenon cannot be explained byexposure to aggregate volatility risk.Size,book-to-market,momentum,and liquidityeffects cannot account for either the low average returns earned by stocks with highexposure to systematic volatility risk or for the low average returns of stocks withhigh idiosyncratic volatility.I T IS WELL KNOWN THAT THE VOLATILITY OF STOCK RETURNS varies over time.While con-siderable research has examined the time-series relation between the volatility of the market and the expected return on the market(see,among others,Camp-bell and Hentschel(1992)and Glosten,Jagannathan,and Runkle(1993)),the question of how aggregate volatility affects the cross-section of expected stock returns has received less attention.Time-varying market volatility induces changes in the investment opportunity set by changing the expectation of fu-ture market returns,or by changing the risk-return trade-off.If the volatility of the market return is a systematic risk factor,the arbitrage pricing theory or a factor model predicts that aggregate volatility should also be priced in the cross-section of stocks.Hence,stocks with different sensitivities to innovations in aggregate volatility should have different expected returns.The first goal of this paper is to provide a systematic investigation of how the stochastic volatility of the market is priced in the cross-section of expected stock returns.We want to both determine whether the volatility of the market ∗Ang is with Columbia University and NBER.Hodrick is with Columbia University and NBER. Yuhang Xing is at Rice University.Xiaoyan Zhang is at Cornell University.We thank Joe Chen,Mike Chernov,Miguel Ferreira,Jeff Fleming,Chris Lamoureux,Jun Liu,Laurie Hodrick,Paul Hribar, Jun Pan,Matt Rhodes-Kropf,Steve Ross,David Weinbaum,and Lu Zhang for helpful discussions. We also received valuable comments from seminar participants at an NBER Asset Pricing meeting, Campbell and Company,Columbia University,Cornell University,Hong Kong University,Rice University,UCLA,and the University of Rochester.We thank Tim Bollerslev,Joe Chen,Miguel Ferreira,Kenneth French,Anna Scherbina,and Tyler Shumway for kindly providing data.We especially thank an anonymous referee and Rob Stambaugh,the editor,for helpful suggestions that greatly improved the paper.Andrew Ang and Bob Hodrick both acknowledge support from the National Science Foundation.259260The Journal of Financeis a priced risk factor and estimate the price of aggregate volatility risk.Many option studies have estimated a negative price of risk for market volatility using options on an aggregate market index or options on individual stocks.1Using the cross-section of stock returns,rather than options on the market,allows us to create portfolios of stocks that have different sensitivities to innovations in market volatility.If the price of aggregate volatility risk is negative,stocks with large,positive sensitivities to volatility risk should have low average returns. Using the cross-section of stock returns also allows us to easily control for a battery of cross-sectional effects,such as the size and value factors of Fama and French(1993),the momentum effect of Jegadeesh and Titman(1993),and the effect of liquidity risk documented by P´astor and Stambaugh(2003).Option pricing studies do not control for these cross-sectional risk factors.We find that innovations in aggregate volatility carry a statistically signif-icant negative price of risk of approximately−1%per annum.Economic the-ory provides several reasons why the price of risk of innovations in market volatility should be negative.For example,Campbell(1993,1996)and Chen (2002)show that investors want to hedge against changes in market volatility, because increasing volatility represents a deterioration in investment opportu-nities.Risk-averse agents demand stocks that hedge against this risk.Periods of high volatility also tend to coincide with downward market movements(see French,Schwert,and Stambaugh(1987)and Campbell and Hentschel(1992)). As Bakshi and Kapadia(2003)comment,assets with high sensitivities to mar-ket volatility risk provide hedges against market downside risk.The higher demand for assets with high systematic volatility loadings increases their price and lowers their average return.Finally,stocks that do badly when volatility increases tend to have negatively skewed returns over intermediate horizons, while stocks that do well when volatility rises tend to have positively skewed re-turns.If investors have preferences over coskewness(see Harvey and Siddique (2000)),stocks that have high sensitivities to innovations in market volatility are attractive and have low returns.2The second goal of the paper is to examine the cross-sectional relationship be-tween idiosyncratic volatility and expected returns,where idiosyncratic volatil-ity is defined relative to the standard Fama and French(1993)model.3If the Fama–French model is correct,forming portfolios by sorting on idiosyncratic volatility will obviously provide no difference in average returns.Nevertheless, if the Fama–French model is false,sorting in this way potentially provides a set 1See,among others,Jackwerth and Rubinstein(1996),Bakshi,Cao and Chen(2000),Chernov and Ghysels(2000),Burashi and Jackwerth(2001),Coval and Shumway(2001),Benzoni(2002), Pan(2002),Bakshi and Kapadia(2003),Eraker,Johannes and Polson(2003),Jones(2003),and Carr and Wu(2003).2Bates(2001)and Vayanos(2004)provide recent structural models whose reduced form factor structures have a negative risk premium for volatility risk.3Recent studies examining total or idiosyncratic volatility focus on the average level of firm-level volatility.For example,Campbell et al.(2001)and Xu and Malkiel(2003)document that idiosyncratic volatility has increased over time.Brown and Ferreira(2003)and Goyal and Santa-Clara(2003)argue that idiosyncratic volatility has positive predictive power for excess market returns,but this is disputed by Bali et al.(2004).Cross-Section of Volatility and Expected Returns261 of assets that may have different exposures to aggregate volatility and hence different average returns.Our logic is the following.If aggregate volatility is a risk factor that is orthogonal to existing risk factors,the sensitivity of stocks to aggregate volatility times the movement in aggregate volatility will show up in the residuals of the Fama–French model.Firms with greater sensitivities to aggregate volatility should therefore have larger idiosyncratic volatilities rela-tive to the Fama–French model,everything else being equal.Differences in the volatilities of firms’true idiosyncratic errors,which are not priced,will make this relation noisy.We should be able to average out this noise by constructing portfolios of stocks to reveal that larger idiosyncratic volatilities relative to the Fama–French model correspond to greater sensitivities to movements in aggre-gate volatility and thus different average returns,if aggregate volatility risk is priced.While high exposure to aggregate volatility risk tends to produce low ex-pected returns,some economic theories suggest that idiosyncratic volatility should be positively related to expected returns.If investors demand compen-sation for not being able to diversify risk(see Malkiel and Xu(2002)and Jones and Rhodes-Kropf(2003)),then agents will demand a premium for holding stocks with high idiosyncratic volatility.Merton(1987)suggests that in an information-segmented market,firms with larger firm-specific variances re-quire higher average returns to compensate investors for holding imperfectly diversified portfolios.Some behavioral models,like Barberis and Huang(2001), also predict that higher idiosyncratic volatility stocks should earn higher ex-pected returns.Our results are directly opposite to these theories.We find that stocks with high idiosyncratic volatility have low average returns.There is a strongly significant difference of−1.06%per month between the average re-turns of the quintile portfolio with the highest idiosyncratic volatility stocks and the quintile portfolio with the lowest idiosyncratic volatility stocks.In contrast to our results,earlier researchers either find a significantly pos-itive relation between idiosyncratic volatility and average returns,or they fail to find any statistically significant relation between idiosyncratic volatility and average returns.For example,Lintner(1965)shows that idiosyncratic volatil-ity carries a positive coefficient in cross-sectional regressions.Lehmann(1990) also finds a statistically significant,positive coefficient on idiosyncratic volatil-ity over his full sample period.Similarly,Tinic and West(1986)and Malkiel and Xu(2002)unambiguously find that portfolios with higher idiosyncratic volatility have higher average returns,but they do not report any significance levels for their idiosyncratic volatility premiums.On the other hand,Longstaff (1989)finds that a cross-sectional regression coefficient on total variance for size-sorted portfolios carries an insignificant negative sign.The difference between our results and the results of past studies is that the past literature either does not examine idiosyncratic volatility at the firm level, or does not directly sort stocks into portfolios ranked on this measure of inter-est.For example,Tinic and West(1986)work only with20portfolios sorted on market beta,while Malkiel and Xu(2002)work only with100portfolios sorted on market beta and size.Malkiel and Xu(2002)only use the idiosyncratic262The Journal of Financevolatility of one of the100beta/size portfolios to which a stock belongs to proxy for that stock’s idiosyncratic risk and,thus,do not examine firm-level idiosyn-cratic volatility.Hence,by not directly computing differences in average returns between stocks with low and high idiosyncratic volatilities,previous studies miss the strong negative relation between idiosyncratic volatility and average returns that we find.The low average returns to stocks with high idiosyncratic volatilities could arise because stocks with high idiosyncratic volatilities may have high exposure to aggregate volatility risk,which lowers their average returns.We investigate this conjecture and find that this is not a complete explanation.Our idiosyn-cratic volatility results are also robust to controlling for value,size,liquidity, volume,dispersion of analysts’forecasts,and momentum effects.We find the effect robust to different formation periods for computing idiosyncratic volatil-ity and for different holding periods.The effect also persists in bull and bear markets,recessions and expansions,and volatile and stable periods.Hence,our results on idiosyncratic volatility represent a substantive puzzle.The rest of this paper is organized as follows.In Section I,we examine how aggregate volatility is priced in the cross-section of stock returns.Section II documents that firms with high idiosyncratic volatility have very low average returns.Finally,Section III concludes.I.Pricing Systematic Volatility in the Cross-SectionA.Theoretical MotivationWhen investment opportunities vary over time,the multifactor models of Merton(1973)and Ross(1976)show that risk premia are associated with the conditional covariances between asset returns and innovations in state vari-ables that describe the time-variation of the investment opportunities.Camp-bell’s(1993,1996)version of the Intertemporal Capital Asset Pricing Model (I-CAPM)shows that investors care about risks both from the market return and from changes in forecasts of future market returns.When the represen-tative agent is more risk averse than log utility,assets that covary positively with good news about future expected returns on the market have higher av-erage returns.These assets command a risk premium because they reduce a consumer’s ability to hedge against a deterioration in investment opportuni-ties.The intuition from Campbell’s model is that risk-averse investors want to hedge against changes in aggregate volatility because volatility positively affects future expected market returns,as in Merton(1973).However,in Campbell’s setup,there is no direct role for fluctuations in mar-ket volatility to affect the expected returns of assets because Campbell’s model is premised on homoskedasticity.Chen(2002)extends Campbell’s model to a heteroskedastic environment which allows for both time-varying covariances and stochastic market volatility.Chen shows that risk-averse investors also want to directly hedge against changes in future market volatility.In Chen’s model,an asset’s expected return depends on risk from the market return,Cross-Section of Volatility and Expected Returns263 changes in forecasts of future market returns,and changes in forecasts of fu-ture market volatilities.For an investor more risk averse than log utility,Chen shows that an asset that has a positive covariance between its return and a variable that positively forecasts future market volatilities causes that asset to have a lower expected return.This effect arises because risk-averse investors reduce current consumption to increase precautionary savings in the presence of increased uncertainty about market returns.Motivated by these multifactor models,we study how exposure to market volatility risk is priced in the cross-section of stock returns.A true conditional multifactor representation of expected returns in the cross-section would take the following form:r i t+1=a i t+βi m,tr mt+1−γm,t+βi v,t(v t+1−γv,t)+Kk=1βi k,t(f k,t+1−γk,t),(1)where r it+1is the excess return on stock i,βi m,t is the loading on the excess mar-ket return,βi v,t is the asset’s sensitivity to volatility risk,and theβik,t coefficientsfor k=1,...,K represent loadings on other risk factors.In the full conditional setting in equation(1),factor loadings,conditional means of factors,and fac-tor premiums potentially vary over time.The model in equation(1)is writtenin terms of factor innovations,so r mt+1−γm,t represents the innovation in themarket return,v t+1−γv,t represents the innovation in the factor reflecting ag-gregate volatility risk,and innovations to the other factors are represented by f k,t+1−γk,t.The conditional mean of the market and aggregate volatility are denoted byγm,t andγv,t,respectively,while the conditional means of the other factors are denoted byγk,t.In equilibrium,the conditional mean of stock i is given bya i t=E tr it+1=βi m,tλm,t+βi v,tλv,t+Kk=1βi k,tλk,t,(2)whereλm,t is the price of risk of the market factor,λv,t is the price of aggre-gate volatility risk,and theλk,t are the prices of risk of the other factors.Note that only if a factor is traded is the conditional mean of a factor equal to its conditional price of risk.The main prediction from the factor model setting of equation(1)that we examine is that stocks with different loadings on aggregate volatility risk have different average returns.4However,the true model in equation(1)is infeasible 4While an I-CAPM implies joint time-series as well as cross-sectional predictability,we do not examine time-series predictability of asset returns by systematic volatility.Time-varying volatility risk generates intertemporal hedging demands in partial equilibrium asset allocation problems.In a partial equilibrium setting,Liu(2001)and Chacko and Viceira(2003)examine how volatility risk affects the portfolio allocation of stocks and risk-free assets,while Liu and Pan(2003)show how investors can optimally exploit the variation in volatility with options.Guo and Whitelaw(2003) examine the intertemporal components of time-varying systematic volatility in a Campbell(1993, 1996)equilibrium I-CAPM.264The Journal of Financeto examine because the true set of factors is unknown and the true conditionalfactor loadings are unobservable.Hence,we do not attempt to directly use equa-tion(1)in our empirical work.Instead,we simplify the full model of equation(1),which we now detail.B.The Empirical FrameworkTo investigate how aggregate volatility risk is priced in the cross-section ofequity returns we make the following simplifying assumptions to the full spec-ification in equation(1).First,we use observable proxies for the market factorand the factor representing aggregate volatility risk.We use the CRSP value-weighted market index to proxy for the market factor.To proxy innovationsin aggregate volatility,(v t+1−γv,t),we use changes in the VIX index from the Chicago Board Options Exchange(CBOE).5Second,we reduce the number offactors in equation(1)to just the market factor and the proxy for aggregatevolatility risk.Finally,to capture the conditional nature of the true model,weuse short intervals—1month of daily data—to take into account possible timevariation of the factor loadings.We discuss each of these simplifications in turn.B.1.Innovations in the VIX IndexThe VIX index is constructed so that it represents the implied volatility of asynthetic at-the-money option contract on the S&P100index that has a matu-rity of1month.It is constructed from eight S&P100index puts and calls andtakes into account the American features of the option contracts,discrete cashdividends,and microstructure frictions such as bid–ask spreads(see Whaley(2000)for further details).6Figure1plots the VIX index from January1986to December2000.The mean level of the daily VIX series is20.5%,and itsstandard deviation is7.85%.Because the VIX index is highly serially correlated with a first-order au-tocorrelation of0.94,we measure daily innovations in aggregate volatility byusing daily changes in VIX,which we denote as VIX.Daily first differences inVIX have an effective mean of zero(less than0.0001),a standard deviation of5In previous versions of this paper,we also consider:Sample volatility,following French et al.(1987);a range-based estimate,following Alizadeh,Brandt,and Diebold(2002);and a high-frequency estimator of volatility from Andersen,Bollerslev,and Diebold(2003).Using these mea-sures to proxy for innovations in aggregate volatility produces little spread in cross-sectional av-erage returns.These tables are available upon request.6On September22,2003,the CBOE implemented a new formula and methodology to constructits volatility index.The new index is based on the S&P500(rather than the S&P100)and takes into account a broader range of strike prices rather than using only at-the-money option contracts. The CBOE now uses VIX to refer to this new index.We use the old index(denoted by the ticker VXO).We do not use the new index because it has been constructed by backfilling only to1990, whereas the VXO is available in real time from1986.The CBOE continues to make both volatility indices available.The correlation between the new and the old CBOE volatility series is98%from 1990to2000,but the series that we use has a slightly broader range than the new CBOE volatility series.Cross-Section of Volatility and Expected Returns26519861988199019921994199619982000 Figure1.Plot of VIX.The figure shows the VIX index plotted at a daily frequency.The sample period is January1986to December2000.2.65%,and negligible serial correlation(the first-order autocorrelation of VIX is−0.0001).As part of our robustness checks in Section I.C,we also measure innovations in VIX by specifying a stationary time-series model for the con-ditional mean of VIX and find our results to be similar to those using simple first differences.While VIX appears to be an ideal proxy for innovations in volatility risk because the VIX index is representative of traded option secu-rities whose prices directly reflect volatility risk,there are two main caveats with respect to using VIX to represent observable market volatility.The first concern is that the VIX index is the implied volatility from the Black–Scholes(1973)model,and we know that the Black–Scholes model is an approximation.If the true stochastic environment is characterized by stochas-tic volatility and jumps, VIX will reflect total quadratic variation in both diffusion and jump components(see,for example,Pan(2002)).Although Bates (2000)argues that implied volatilities computed taking into account jump risk are very close to original Black–Scholes implied volatilities,jump risk may be priced differently from volatility risk.Our analysis does not separate jump risk from diffusion risk,so our aggregate volatility risk may include jump risk components.266The Journal of FinanceA more serious reservation about the VIX index is that VIX combines both stochastic volatility and the stochastic volatility risk premium.Only if the risk premium is zero or constant would VIX be a pure proxy for the innovation in aggregate volatility.Decomposing VIX into the true innovation in volatility and the volatility risk premium can only be done by writing down a formal model.The form of the risk premium depends on the parameterization of the price of volatility risk,the number of factors,and the evolution of those factors. Each different model specification implies a different risk premium.For exam-ple,many stochastic volatility option pricing models assume that the volatility risk premium can be parameterized as a linear function of volatility(see,for example,Chernov and Ghysels(2000),Benzoni(2002),and Jones(2003)).This may or may not be a good approximation to the true price of risk.Rather than imposing a structural form,we use an unadulterated VIX series.An advan-tage of this approach is that our analysis is simple to replicate.B.2.The Pre-Formation RegressionOur goal is to test whether stocks with different sensitivities to aggregate volatility innovations(proxied by VIX)have different average returns.To measure the sensitivity to aggregate volatility innovations,we reduce the num-ber of factors in the full specification in equation(1)to two,namely,the mar-ket factor and VIX.A two-factor pricing kernel with the market return and stochastic volatility as factors is also the standard setup commonly assumed by many stochastic option pricing studies(see,for example,Heston(1993)).Hence, the empirical model that we examine isr i t=β0+βi MKT MKT t+βi VIX VIX t+εi t,(3) where MKT is the market excess return, VIX is the instrument we use forinnovations in the aggregate volatility factor,andβiMKT andβi VIX are loadingson market risk and aggregate volatility risk,respectively.Previous empirical studies suggest that there are other cross-sectional factors that have explanatory power for the cross-section of returns,such as the size and value factors of the Fama and French(1993)three-factor model(hereafter FF-3).We do not directly model these effects in equation(3),because controlling for other factors in constructing portfolios based on equation(3)may add a lot of noise.Although we keep the number of regressors in our pre-formation portfolio regressions to a minimum,we are careful to ensure that we control for the FF-3factors and other cross-sectional factors in assessing how volatility risk is priced using post-formation regression tests.We construct a set of assets that are sufficiently disperse in exposure to aggregate volatility innovations by sorting firms on VIX loadings over the past month using the regression(3)with daily data.We run the regression for all stocks on AMEX,NASDAQ,and the NYSE,with more than17daily observations.In a setting in which coefficients potentially vary over time,a 1-month window with daily data is a natural compromise between estimatingCross-Section of Volatility and Expected Returns267 coefficients with a reasonable degree of precision and pinning down conditionalcoefficients in an environment with time-varying factor loadings.P´astor andStambaugh(2003),among others,also use daily data with a1-month window insimilar settings.At the end of each month,we sort stocks into quintiles,basedon the value of the realizedβ VIX coefficients over the past month.Firms inquintile1have the lowest coefficients,while firms in quintile5have the highest β VIX loadings.Within each quintile portfolio,we value weight the stocks.We link the returns across time to form one series of post-ranking returns for eachquintile portfolio.Table I reports various summary statistics for quintile portfolios sorted bypastβ VIX over the previous month using equation(3).The first two columnsreport the mean and standard deviation of monthly total,not excess,simplereturns.In the first column under the heading“Factor Loadings,”we report thepre-formationβ VIX coefficients,which are computed at the beginning of eachmonth for each portfolio and are value weighted.The column reports the time-series average of the pre-formationβ VIX loadings across the whole sample.By construction,since the portfolios are formed by ranking on pastβ VIX,thepre-formationβ VIX loadings monotonically increase from−2.09for portfolio1to2.18for portfolio5.The columns labeled“CAPM Alpha”and“FF-3Alpha”report the time-seriesalphas of these portfolios relative to the CAPM and to the FF-3model,respec-tively.Consistent with the negative price of systematic volatility risk found bythe option pricing studies,we see lower average raw returns,CAPM alphas,and FF-3alphas with higher past loadings ofβ VIX.All the differences be-tween quintile portfolios5and1are significant at the1%level,and a jointtest for the alphas equal to zero rejects at the5%level for both the CAPM andthe FF-3model.In particular,the5-1spread in average returns between thequintile portfolios with the highest and lowestβ VIX coefficients is−1.04%permonth.Controlling for the MKT factor exacerbates the5-1spread to−1.15%per month,while controlling for the FF-3model decreases the5-1spread to −0.83%per month.B.3.Requirements for a Factor Risk ExplanationWhile the differences in average returns and alphas corresponding to dif-ferentβ VIX loadings are very impressive,we cannot yet claim that these dif-ferences are due to systematic volatility risk.We examine the premium for aggregate volatility within the framework of an unconditional factor model. There are two requirements that must hold in order to make a case for a fac-tor risk-based explanation.First,a factor model implies that there should be contemporaneous patterns between factor loadings and average returns.For example,in a standard CAPM,stocks that covary strongly with the market factor should,on average,earn high returns over the same period.To test a fac-tor model,Black,Jensen,and Scholes(1972),Fama and French(1992,1993), Jagannathan and Wang(1996),and P´astor and Stambaugh(2003),among others,all form portfolios using various pre-formation criteria,but examine268The Journal of FinanceT a b l e IP o r t f o l i o s S o r t e d b y E x p o s u r e t o A g g r e g a t e V o l a t i l i t y S h o c k sW e f o r m v a l u e -w e i g h t e d q u i n t i l e p o r t f o l i o s e v e r y m o n t h b y r e g r e s s i n g e x c e s s i n d i v i d u a l s t o c k r e t u r n s o n V I X ,c o n t r o l l i n g f o r t h e M K T f a c t o r a s i n e q u a t i o n (3),u s i n g d a i l y d a t a o v e r t h e p r e v i o u s m o n t h .S t o c k s a r e s o r t e d i n t o q u i n t i l e s b a s e d o n t h e c o e f f i c i e n t β V I X f r o m l o w e s t (q u i n t i l e 1)t o h i g h e s t (q u i n t i l e 5).T h e s t a t i s t i c s i n t h e c o l u m n s l a b e l e d M e a n a n d S t d .D e v .a r e m e a s u r e d i n m o n t h l y p e r c e n t a g e t e r m s a n d a p p l y t o t o t a l ,n o t e x c e s s ,s i m p l e r e t u r n s .S i z e r e p o r t s t h e a v e r a g e l o g m a r k e t c a p i t a l i z a t i o n f o r f i r m s w i t h i n t h e p o r t f o l i o a n d B /M r e p o r t s t h e a v e r a g e b o o k -t o -m a r k e t r a t i o .T h e r o w “5-1”r e f e r s t o t h e d i f f e r e n c e i n m o n t h l y r e t u r n s b e t w e e n p o r t f o l i o 5a n d p o r t f o l i o 1.T h e A l p h a c o l u m n s r e p o r t J e n s e n ’s a l p h a w i t h r e s p e c t t o t h e C A P M o r t h e F a m a –F r e n c h (1993)t h r e e -f a c t o r m o d e l .T h e p r e -f o r m a t i o n b e t a s r e f e r t o t h e v a l u e -w e i g h t e d β V I X o r βF V I X w i t h i n e a c h q u i n t i l e p o r t f o l i o a t t h e s t a r t o f t h e m o n t h .W e r e p o r t t h e p r e -f o r m a t i o n β V I X a n d βF V I X a v e r a g e d a c r o s s t h e w h o l e s a m p l e .T h e s e c o n d t o l a s t c o l u m n r e p o r t s t h e β V I X l o a d i n g c o m p u t e d o v e r t h e n e x t m o n t h w i t h d a i l y d a t a .T h e c o l u m n r e p o r t s t h e n e x t m o n t h β V I X l o a d i n g s a v e r a g e d a c r o s s m o n t h s .T h e l a s t c o l u m n r e p o r t s e x p o s t βF V I X f a c t o r l o a d i n g s o v e r t h e w h o l e s a m p l e ,w h e r e F V I X i s t h e f a c t o r m i m i c k i n g a g g r e g a t e v o l a t i l i t y r i s k .T o c o r r e s p o n d w i t h t h e F a m a –F r e n c h a l p h a s ,w e c o m p u t e t h e e x p o s t b e t a s b y r u n n i n g a f o u r -f a c t o r r e g r e s s i o n w i t h t h e t h r e e F a m a –F r e n c h f a c t o r s t o g e t h e r w i t h t h e F V I X f a c t o r t h a t m i m i c s a g g r e g a t e v o l a t i l i t y r i s k ,f o l l o w i n g t h e r e g r e s s i o n i n e q u a t i o n (6).T h e r o w l a b e l e d “J o i n t t e s t p -v a l u e ”r e p o r t s a G i b b o n s ,R o s s a n d S h a n k e n (1989)t e s t f o r t h e a l p h a s e q u a l t o z e r o ,a n d a r o b u s t j o i n t t e s t t h a t t h e f a c t o r l o a d i n g s a r e e q u a l t o z e r o .R o b u s t N e w e y –W e s t (1987)t -s t a t i s t i c s a r e r e p o r t e d i n s q u a r e b r a c k e t s .T h e s a m p l e p e r i o d i s f r o m J a n u a r y 1986t o D e c e m b e r 2000.F a c t o r L o a d i n g sN e x t M o n t h F u l l S a m p l e S t d .%M k t C A P M F F -3P r e -F o r m a t i o n P r e -F o r m a t i o n P o s t -F o r m a t i o n P o s t -F o r m a t i o n R a n kM e a nD e v .S h a r e S i z e B /M A l p h a A l p h aβ V I X βF V I Xβ V I XβF V I X11.645.539.4%3.700.890.270.30−2.09−2.00−0.033−5.06[1.66][1.77][−4.06]21.394.4328.7%4.770.730.180.09−0.46−0.42−0.014−2.72[1.82][1.18][−2.64]31.364.4030.4%4.770.760.130.080.030.080.005−1.55[1.32][1.00][−2.86]41.214.7924.0%4.760.73−0.08−0.060.540.620.0153.62[−0.87][−0.65][4.53]50.606.557.4%3.730.89−0.88−0.532.182.310.0188.07[−3.42][−2.88][5.32]5-1−1.04−1.15−0.83[−3.90][−3.54][−2.93]J o i n t t e s t p -v a l u e0.010.030.00。