国际会计第七版英文版课后答案(第六章)

- 格式:doc

- 大小:107.50 KB

- 文档页数:13

CHAPTER 6 INTERNATIONAL PARITY RELATIONSHIPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of arbitrage.Answer:Arbitrage can be defined as the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain, guaranteed profits.2. Discuss the implications of the interest rate parity for the exchange rate determination.Answer: Assuming that the forward exchange rate is roughly an unbiased predictor of the future spot rate, IRP can be written as:S = [(1 + I£)/(1 + I$)]E[S t+1 I t].The exchange rate is thus determined by the relative interest rates, and the expected future spot rate, conditional on all the available information, I t, as of the present time. One thus can say that expectation is self-fulfilling. Since the information set will be continuously updated as news hit the market, the exchange rate will exhibit a highly dynamic, random behavior.3. Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.Answer: The forward exchange rate will be an unbiased predictor of the future spot rate if (I) the risk premium is insignificant and (ii) foreign exchange markets are informationally efficient.4. Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parity?Answer: The absolute version of purchasing power parity (PPP):S = P$/P£.The relative version is:e = π$ - π£.PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket.8. Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysis?Answer: The random walk model predicts that the current exchange rate will be the best predictor of the future exchange rate. An implication of the model is that past history of the exchange rate is of no value in predicting future exchange rate. The model thus is inconsistent with the technical analysis which tries to utilize past history in predicting the future exchange rate.*9. Derive and explain the monetary approach to exchange rate determination.Answer: The monetary approach is associated with the Chicago School of Economics. It is based on two tenets: purchasing power parity and the quantity theory of money. Combing these two theories allows for stating, say, the $/£ spot exchange rate as:S($/£) = (M$/M£)(V$/V£)(y£/y$),where M denotes the money supply, V the velocity of money, and y the national aggregate output. The theory holds that what matters in exchange rate determination are:1. The relative money supply,2. The relative velocities of monies, and3. The relative national outputs.10. CFA question: 1997, Level 3.A.Explain the following three concepts of purchasing power parity (PPP):a. The law of one price.b. Absolute PPP.c. Relative PPP.B.Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:a.Short-term basis (for example, three months)b.Long-term basis (for example, six years)Answer:A. a. The law of one price (LOP) refers to the international arbitrage condition for the standardconsumption basket. LOP requires that the consumption basket should be selling for the same price ina given currency across countries.A. b. Absolute PPP holds that the price level in a country is equal to the price level in another countrytimes the exchange rate between the two countries.A. c. Relative PPP holds that the rate of exchange rate change between a pair of countries is aboutequalto the difference in inflation rates of the two countries.B. a. PPP is not useful for predicting exchange rates on the short-term basis mainly becauseinternational commodity arbitrage is a time-consuming process.B. b. PPP is useful for predicting exchange rates on the long-term basis.PROBLEMS1. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 6 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return?The market conditions are summarized as follows:I$ = 4%; i€= 3.5%; S = €1.01/$; F = €0.99/$.If $100,000,000 is invested in the U.S., the maturity value in six months will be$104,000,000 = $100,000,000 (1 + .04).Alternatively, $100,000,000 can be converted into euros and invested at the German interest rate, with the euro maturity value sold forward. In this case the dollar maturity value will be$105,590,909 = ($100,000,000 x 1.01)(1 + .035)(1/0.99)Clearly, it is better to invest $100,000,000 in Germany with exchange risk hedging.2. While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.Evaluate each payment method. Which method would you prefer? Why?Solution: The problem situation is summarized as follows:A/P = £35,000 payable in three monthsi NY = 0.35%/month, compounding monthlyi LD = 2.0% for three monthsS = $1.45/£; F = $1.40/£.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows:$49,000/(1.0035)3 = $48,489.Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755.You should definitely choose to use “option a”, and save $1,266, which is the diff erence between $49,755 and $48489.3. Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.a. Determine whether the interest rate parity is currently holding.b. If the IRP is not holding, how would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit.c. Explain how the IRP will be restored as a result of covered arbitrage activities.Solution: Let’s summarize the given data first:S = $1.5/£; F = $1.52/£; I$ = 2.0%; I£ = 1.45%Credit = $1,500,000 or £1,000,000.a. (1+I$) = 1.02(1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b. (1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%;maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c. Following the arbitrage transactions described above,The dollar interest rate will rise;The pound interest rate will fall;The spot exchange rate will rise;The forward exchange rate will fall.These adjustments will continue until IRP holds.4. Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is5.6 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.Solution:a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros tomake arbitrage profit.1.Borrow $1,000,000 and repay $1,014,000 in three months.2.Sell $1,000,000 spot for €1,060,000.3.Invest €1,060,000 at the euro interest rate of 1.35 % for three months and receive €1,074,310 atmaturity.4.Sell €1,074,310 forward for $1,053,245.Arbitrage profit = $1,053,245 - $1,014,000 = $39,245.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will bedifferent.5.Buy $1,014,000 forward for €1,034,280.Arbitrage profit = €1,074,310 - €1,034,280 = €40,0305. In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey? Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollarand the Turkish lira?Solution: A high Turkish interest rate must reflect a high expected inflation in Turkey. According to international Fisher effect (IFE), we haveE(e) = i$ - i Lira= 5.93% - 70.0% = -64.07%The Turkish lira thus is expected to depreciate against the U.S. dollar by about 64%.6. As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. How would you forecast the exchange rate to be at around November 1, 2000?Solution: Since the inflation rate is quite high in Brazil, we may use the purchasing power parity to forecast the exchange rate.E(e) = E(π$) - E(πR$)= 2.6% - 20.0%= -17.4%E(S T) = S o(1 + E(e))= (R$1.95/$) (1 + 0.174)= R$2.29/$7. (CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:Base price level 100Current U.S. price level 105Current South African price level 111Base rand spot exchange rate $0.175Current rand spot exchange rate $0.158Expected annual U.S. inflation 7%Expected annual South African inflation 5%Expected U.S. one-year interest rate 10%Expected South African one-year interest rate 8%Calculate the following exchange rates (ZAR and USD refer to the South African and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.b. Using the IFE, the expected ZAR spot rate in USD one year from now.c. Using PPP, the expected ZAR spot rate in USD four years from now.Solution:a. ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b. Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c. Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8. Suppose that the current spot exchange rate is €1.50/₤ and the one-year forward exchange rate is €1.60/₤. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., ₤666,667, at the current spot exchange rate.a.Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are aeuro-based investor. Also determine the size of the arbitrage profit.b.Discuss how the interest rate parity may be restored as a result of the abovetransactions.c.Suppose you are a pound-based investor. Show the covered arbitrage process anddetermine the pound profit amount.Solution:a. First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ₤666,667 spot for €1,000,000.3)Invest ₤666,667 at the pound interest rate of 5.2%; the maturity value will be ₤701,334.4)To hedge exchange risk, sell the maturity value ₤701,334 forward in exchange for €1,122,134.The arbitrage profit will be the difference between €1,122,134 and €1,054,000, i.e., €68,134.b. As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c. The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to hedge, he/she will bu y €1,054,000 forward in exchange for ₤658,750. The arbitrage profit will then be ₤42,584 = ₤701,334 - ₤658,750.9. Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.pute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fishereffect holds.b.What is your expected future spot dollar-pound exchange rate in three years from now?c.Can you infer the forward dollar-pound exchange rate for one-year maturity?Solution.a. Nominal ra te in US = (1+ρ) (1+E(π$)) – 1 = (1.025)(1.035) – 1 = 0.0609 or 6.09%.Nominal rate in UK= (1+ρ) (1+E(π₤)) – 1 = (1.025)(1.015) – 1 = 0.0404 or 4.04%.b. E(S T) = [(1.0609)3/(1.0404)3] (1.50) = $1.5904/₤.c. F = [1.0609/1.0404](1.50) = $1.5296/₤.Mini Case: Turkish Lira and the Purchasing Power ParityVeritas Emerging Market Fund specializes in investing in emerging stock markets of the world. Mr. Henry Mobaus, an experienced hand in international investment and your boss, is currently interested in Turkish stock markets. He thinks that Turkey will eventually be invited to negotiate its membership in the European Union. If this happens, it will boost the stock prices in Turkey. But, at the same time, he is quite concerned with the volatile exchange rates of the Turkish currency. He would like to understand what drives the Turkish exchange rates. Since the inflation rate is much higher in Turkey than in the U.S., he thinks that the purchasing power parity may be holding at least to some extent. As a research assistant for him, you were assigned to check this out. In other words, you have to study and prepare a report on the following question: Does the purchasing power parity hold for the Turkish lira-U.S. dollar exchange rate? Among other things, Mr. Mobaus would like you to do the following:Plot the past exchange rate changes against the differential inflation rates betweenTurkey and the U.S. for the last four years.Regress the rate of exchange rate changes on the inflation rate differential to estimatethe intercept and the slope coefficient, and interpret the regression results.Data source: You may download the consumer price index data for the U.S. and Turkey from the following website: , “hot file” (Excel format) . You may download the exchange rate data from the website: merce.ubc.ca/xr/data.html.Solution:a. In the current solution, we use the monthly data from January 1999 – December 2002.b. We regress exchange rate changes (e) on the inflation rate differential and estimate theintercept (α ) and slope coefficient (β):3.095) (t 1.472βˆ0.649)- (t 0.011αˆε Inf_US) -Inf_Turkey (βˆαˆ e tt ===-=++=The estimated intercept is insignificantly different from zero, whereas the slope coefficient is positive and significantly different from zero. In fact, the slope coefficient is insignificantly different from unity. [Note that t-statistics for β = 1 is 0.992 = (1.472 – 1)/0.476 where s.e. is 0.476] In other words, we cannot reject the hypothesis that the intercept is zero and the slope coefficient is one. The results are thus supportive of purchasing power parity.5. Discuss the implications of the deviations from the purchasing power parity for countries’ competitive positions in the world market.Answer: If exchange rate changes satisfy PPP, competitive positions of countries will remain unaffected following exchange rate changes. Otherwise, exchange rate changes will affect relative competitiveness of countries. If a country’s currency appreciates (depre ciates) by more than is warranted by PPP, that will hurt (strengthen) the country’s competitive position in the world market.6. Explain and derive the international Fisher effect.Answer: The international Fisher effect can be obtained by combining the Fisher effect and the relative version of PPP in its expectational form. Specifically, the Fisher effect holds thatE(π$) = I$ - ρ$,E(π£) = I£ - ρ£.Assuming that the real interest rate is the same between the two countries, i.e., ρ$ = ρ£, and substituting the above results into the PPP, i.e., E(e) = E(π$)- E(π£), we obtain the international Fisher effect: E(e) = I$ - I£.7. Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding?Answer: This implies that exchange markets are informationally efficient. Thus, unless one has private information that is not yet reflected in the current market rates, it would be difficult to beat the market.。

第5章国际会计协调化■教学目的与要求一、教学目的通过本章和第6章的学习,既要求学生能深刻领会国际会计协调化的含义和当前的强劲趋势,也要求学生了解各种国际性政府间机构(如联合国会计和报告国际准则政府间专家工作组、经济合作与发展组织常设会计准则工作组)、区域性国家联盟(如欧洲联盟)、官方机构国际组织(如证券委员会国际组织)以及民间国际组织(特别是会计职业界的国际组织,如国际会计师联合会和国际会计准则委员会以及区域性会计师联合会)对国际会计协调化所作的努力和成果。

本章介绍除国际会计准则委员会(将在第6章介绍)以外的各主要国际组织的作用和成果。

二、学习要求1.深刻理解国际会计协调化的含义。

2.了解推动国际会计协调化的6个主要国际组织的性质。

3.在推动国际会计协调化的其他国际组织中,关注欧洲会计师联合会和亚太会计师联合会。

4.了解有助于国际会计协调化的其他国际组织。

5.理解联合国会计和报告国际准则政府间专家工作组现今的作用只是推动国际会计协调化的权威性国际论坛。

6.着重理解欧洲联盟是推动国际会计协调化最具成效的区域性国家联盟。

7.了解经济合作与发展组织国际投资和跨国企业委员会及其常设会计准则工作组的活动。

8.了解证券交易委员会国际组织(IOSCO)作为官方机构的国际组织在国际协调中的重要作用。

9.着重理解国际会计师联合会的活动及国际审计准则。

■教学要点、重点与难点一、教学要点(一)国际会计协调化的含义较深入的阐明:1.对国际会计协调化(即会计的国际协调化),至今尚无公认的严谨的定义。

综合各家之说(参见教本),可以把国际会计协调化理解为:(1)国际会计协调化是一个限制和缩小会计差异,形成一套可接受的准则(标准)和惯例的过程;(2)其目的在于促进各国(和地区)的会计实务和财务信息的可比性;(3)国际会计协调化的意图在于归纳不同的会计制度,把多样化的实务组合成能产生共同协作结果的有序结构。

2.国际会计协调化的作用在于:(1)有助于进行国际商贸和经济合作活动;(2)促进了外国企业在国际货币市场融资(特别是在国际资本市场发行证券)时需提供的财务报表的可比性;(3)有利于跨国投资,便于跨国公司合并其分布在世界各地的子公司的财务报表。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END—OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1。

Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX)market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency, the extension of credit denominated in a foreign currency,foreign trade financing, and trading in foreign currency options and futures contracts. 2。

What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer:The market for foreign exchange can be viewed as a two—tier market。

One tier is the wholesale or interbank market and the other tier is the retail or client market。

International banks provide the core of the FX market。

国际财务管理(英⽂版)课后习题答案6CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency, the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts.2. What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange? Answer: The market for foreign exchange can be viewed as a two-tier market. One tier is the wholesale or interbank market and the other tier is the retail or client market. International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, corporations or individuals, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Retail transactions account for only about 14 percent of FX trades. The other 86 percent is interbank trades between international banks, or non-bank dealers large enough to transact in the interbank market.3. Who are the market participants in the foreign exchange market?Answer: The market participants that comprise the FX market can be categorized into five groups: international banks, bank customers, non-bank dealers, FX brokers, and central banks. International banks provide the core of the FX market. Approximately 100 to 200 banks worldwide make a market in foreign exchange, i.e., they stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, the bank customers, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Non-bank dealers are large non-bank financial institutions, such as investment banks, mutual funds, pension funds, and hedge funds, whose size and frequency of trades make it cost- effective to establish their own dealing rooms to trade directly in the interbank market for their foreign exchange needs.Most interbank trades are speculative or arbitrage transactions where market participants attempt to correctly judge the future direction of price movements in one currency versus another or attempt to profit from temporary price discrepancies in currencies between competing dealers.FX brokers match dealer orders to buy and sell currencies for a fee, but do not take a position themselves. Interbank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.Central banks sometimes intervene in the foreign exchange market in an attempt to influence the price of its currency against that of a major trading partner, or a country that it “fixes” or “pegs” its currency against. Intervention is the process of using foreign currency reser ves to buy one’s own currency in order to decrease its supply and thus increase its value in the foreign exchange market, or alternatively, selling one’s own currency for foreign currency in order to increase its supply and lower its price.4. How are foreign exchange transactions between international banks settled?Answer: The interbank market is a network of correspondent banking relationships, with large commercial banks maintaining demand deposit accounts with one another, called correspondent bank accounts. The correspondent bank account network allows for the efficient functioning of the foreign exchange market. As an example of how the network of correspondent bank accounts facilities international foreign exchange transactions, consider a U.S. importer desiring to purchase merchandise invoiced in guilders from a Dutch exporter. The U.S. importer will contact his bank and inquire about the exchange rate. If the U.S. importer accepts the offered exchange rate, the bank will debit the U.S. importer’s account for the purchase of the Dutch guilders. The bank will instruct its correspondent bank in the Netherlands to debit its correspondent bank account the appropriate amount of guilders and to credit the Dutch exporter’s bank account. The importer’s bank will then debit its books to offset the debit of U.S. importer’s account, reflecting the decrease in its correspondent bank account balan ce.5. What is meant by a currency trading at a discount or at a premium in the forward market?Answer: The forward market involves contracting today for the future purchase or sale of foreign exchange. The forward price may be the same as the spot price, but usually it is higher (at a premium) or lower (at a discount) than the spot price.6. Why does most interbank currency trading worldwide involve the U.S. dollar?Answer: Trading in currencies worldwide is against a common currency that has international appeal. That currency has been the U.S. dollar since the end of World War II. However, the euro and Japanese yen have started to be used much more as international currencies in recent years. More importantly, trading would be exceedingly cumbersome and difficult to manage if each trader made a market against all other currencies.7. Banks find it necessary to accommodate their clients’ needs to buy or sell FX forward, in many instances for hedging purposes. How can the bank eliminate the currency exposure it has created for itself by accommodating a client’s forward transaction?Answer: Swap transactions provide a means for the bank to mitigate the currency exposure in a forward trade. A swap transaction is the simultaneous sale (or purchase) of spot foreign exchange against a forward purchase (or sale) of an approximately equal amount of the foreign currency. To illustrate, suppose a bank customer wants to buy dollars three months forward against British pound sterling. The bank can handle this trade for its customer and simultaneously neutralize the exchange rate risk in the trade by selling (borrowed) British pound sterling spot against dollars. The bank will lend the dollars for three months until they are needed to deliver against the dollars it has sold forward. The British pounds received will be used to liquidate the sterling loan.8. A CD/$ bank trader is currently quoting a small figure bid-ask of 35-40, when the rest of the market is trading at CD1.3436-CD1.3441. What is implied about the trader’s beliefs by his prices?Answer: The trader must think the Canadian dollar is going to appreciate against the U.S. dollar and therefore he is trying to increase his inventory of Canadian dollars by discouraging purchases of U.S. dollars by standing willing to buy $ at onlyCD1.3435/$1.00 and offering to sell from inventory at the slightly lower than market price of CD1.3440/$1.00.9. What is triangular arbitrage? What is a condition that will give rise to a triangular arbitrage opportunity?Answer: Triangular arbitrage is the process of trading out of the U.S. dollar into a second currency, then trading it for a third currency, which is in turn traded for U.S. dollars. The purpose is to earn anarbitrage profit via trading from the second to the third currency when the direct exchange between the two is not in alignment with the cross exchange rate.Most, but not all, currency transactions go through the dollar. Certain banks specialize in making a direct market between non-dollar currencies, pricing at a narrower bid-ask spread than the cross-rate spread. Nevertheless, the implied cross-rate bid-ask quotations impose a discipline on the non-dollar market makers. If their direct quotes are not consistent with the cross exchange rates, a triangular arbitrage profit is possible.PROBLEMS1. Using Exhibit 5.4, calculate a cross-rate matrix for the euro, Swiss franc, Japanese yen, and the British pound. Use the most current American term quotes to calculate the cross-rates so that the triangular matrix resulting is similar to the portion above the diagonal in Exhibit 5.6.Solution: The cross-rate formula we want to use is:S(j/k) = S($/k)/S($/j).The triangular matrix will contain 4 x (4 + 1)/2 = 10 elements.¥SF £$Euro 138.05 1.5481 .6873 1.3112 Japan (100) 1.1214 .4979 .9498 Switzerland .4440 .8470U.K 1.90772. Using Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Canadian dollar and the Swiss franc using the most current quotations. State the forward cross-rates in “Canadian” terms.Solution: The formulas we want to use are:F N(CD/SF) = F N($/SF)/F N($/CD)orF N(CD/SF) = F N(CD/$)/F N(SF/$).We will use the top formula that uses American term forward exchange rates.F1(CD/SF) = .8485/.8037 = 1.0557F3(CD/SF)= .8517/.8043 = 1.0589F6(CD/SF)= .8573/.8057 = 1.06403. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points.Spot 1.3431-1.3436One-Month 1.3432-1.3442Three-Month 1.3448-1.3463Six-Month 1.3488-1.3508Solution:One-Month 01-06Three-Month 17-27Six-Month 57-724. Using the spot and outright forward quotes in problem 3, determine the corresponding bid-ask spreads in points. Solution:Spot 5One-Month 10Three-Month 15Six-Month 205. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,CD= [(F N($/CD) - S($/CD/$)/S($/CD)] x 360/Nf1,CD= [(.8037 - .8037)/.8037] x 360/30 = .0000f3,CD= [(.8043 - .8037)/.8037] x 360/90 = .0030f6,CD= [(.8057 - .8037)/.8037] x 360/180 = .0050The pattern of forward premiums indicates that the Canadian dollar is trading at an increasing premium versus the U.S. dollar. That is, it becomes more expensive (in both absolute and percentage terms) to buy a Canadian dollar forward for U.S. dollars the further into the future one contracts.6. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,$= [(F N (£/$) - S(£/$))/S(£/$)] x 360/Nf1,$= [(.5251 - .5242)/.5242] x 360/30 = -.0023f3,$= [(.5268 - .5242)/.5242] x 360/90 = -.0198f6,$= [(.5290 - .5242)/.5242] x 360/180 = -.0183The pattern of forward premiums indicates that the British pound is trading at a discount versus the U.S. dollar. That is, it becomes more expensive to buy a U.S. dollar forward for British pounds (in absolute but not percentage terms) the further into the future one contracts.7. Given the following information, what are the NZD/SGD currency against currency bid-ask quotations?American Terms European TermsBank Quotations Bid Ask Bid AskNew Zealand dollar .7265 .7272 1.3751 1.3765Singapore dollar .6135 .6140 1.6287 1.6300Solution: Equation 5.12 from the text implies S b(NZD/SGD) = S b($/SGD) x S b(NZD/$) = .6135 x 1.3765 = .8445. The reciprocal, 1/S b(NZD/SGD)= S a(SGD/NZD)= 1.1841. Analogously, it is implied that S a(NZD/SGD) = S a($/SGD) x Sa(NZD/$) = .6140 x 1.3765 = .8452. The reciprocal, 1/S a(NZD/SGD) = S b(SGD/NZD)= 1.1832. Thus, the NZD/SGD bid-ask spread is NZD0.8445-NZD0.8452 and the SGD/NZD spread is SGD1.1832-SGD1.1841.8. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting €0.7627/$1.00 and Credit Suisse is offering SF1.1806/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current €/SF quote of .6395. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What €/SF price will eliminate triangular arbitrage?Solution: To make a triangular arbitrage profit the Deutsche Bank trader would sell $5,000,000 to Dresdner Bank at€0.7627/$1.00. This trade would yield €3,813,500= $5,000,000 x .7627. The Deutsche Bank trader would then sell the euros for Swiss francs to Union Bank of Switzerland at a price of €0.6395/SF1.00, yielding SF5,963,253 = €3,813,500/.6395. The Deutsche Bank trader will resell the Swiss francs to Credit Suisse for $5,051,036 = SF5,963,253/1.1806, yielding a triangular arbitrage profit of $51,036.If the Deutsche Bank trader initially sold $5,000,000 for Swiss francs, instead of euros, the trade would yield SF5,903,000 = $5,000,000 x 1.1806. The Swiss francs would in turn be traded for euros to UBS for €3,774,969= SF5,903,000 x .6395. The euros would be resold to Dresdner Bank for $4,949,481 = €3,774,969/.7627, or a loss of $50,519. Thus, it is necessary to conduct the triangular arbitrage in the correct order.The S(€/SF)cross exchange rate should be .7627/1.1806 = .6460. This is an equilibrium rate at which a triangular arbitrage profit will not exist. (The student can determine this for himself.) A profit results from the triangular arbitrage when dollars are first sold for euros because Swiss francs are purchased for euros at too low a rate in comparison to the equilibrium cross-rate, i.e., Swiss francs are purchased for only €0.6395/SF1.00 instead of the no-arbitrage rate of €0.6460/SF1.00. Similarly, when dollars are first sold for Swiss francs, an arbitrage loss results because Swiss francs are sold for euros at too low a rate, resulting in too few euros. That is, each Swiss franc is sold for €0.6395/SF1.00 instead of the higher no-arbitrage rate of€0.6460/SF1.00.9. The current spot exchange rate is $1.95/£ and the three-month forward rate is $1.90/£. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.92/£ in three months. Assume that you would like to buy or sell £1,000,000.a. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation?b. What would be your speculative profit in dollar terms if the spot exchange rate actually turns out to be $1.86/£. Solution:a. If you believe the spot exchange rate will be $1.92/£ in three months, you should buy £1,000,000 forward for $1.90/£. Your expected profit will be:$20,000 = £1,000,000 x ($1.92 -$1.90).b. If the spot exchange rate actually turns out to be $1.86/£ in three months, your loss from the long position will be:-$40,000 = £1,000,000 x ($1.86 -$1.90).10. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss Francs (CHF) and purchase an equivalent amount of equities denominated in South African Rands (ZAR).Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD).Currency Exchange Ratesa.Describe the currency transaction that Omni should undertake to eliminate currency riskover the 30-day period.b.Calculate the following:The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equityportfolio.The current value of Omni’s Swiss equity portfolio in ZAR.The annualized forward premium or discount at which the ZAR is trading versus theCHF.CFA Guideline Answer:a.To eliminate the currency risk arising from the possibility that ZAR will appreciateagainst the CHF over the next 30-day period, Omni should sell 30-day forward CHFagainst 30-day forward ZAR delivery (sell 30-day forward CHF against USD and buy30-day forward ZAR against USD).b.The calculations are as follows:Using the currency cross rates of two forward foreign currencies and three currencies (CHF, ZAR, USD), the exchange would be as follows:--30 day forward CHF are sold for USD. Dollars are bought at the forward sellingprice of CHF1.5285 = $1 (done at ask side because going from currency into dollars)--30 day forward ZAR are purchased for USD. Dollars are simultaneously sold to purchase ZAR at the rate of 6.2538 = $1 (done at the bid side because going fromdollars into currency)--For every 1.5285 CHF held, 6.2538 ZAR are received; thus the cross currency rate is1.5285 CHF/6.2538 ZAR = 0.244411398.At the time of execution of the forward contracts, the v alue of the 3 million CHF equity portfolio would be 3,000,000 CHF/0.244411398 = 12,274,386.65 ZAR.To calculate the annualized premium or discount of the ZAR against the CHF requires comparison of the spot selling exchange rate to the forward selling price of CHF for ZAR.Spot rate = 1.5343 CHF/6.2681 ZAR = 0.24477912030 day forward ask rate 1.5285 CHF/6.2538 ZAR = 0.244411398The premium/discount formula is:[(forward rate – spot rate) / spot rate] x (360 / # day contract) =[(0.244411398 – 0.24477912) / 0.24477912] x (360 / 30) =-1.8027126 % = -1.80% discount ZAR to CHFMINI CASE: SHREWSBURY HERBAL PRODUCTS, LTD.Shrewsbury Herbal Products, located in central England close to the Welsh border, is an old-line producer of herbal teas, seasonings, and medicines. Its products are marketed all over the United Kingdom and in many parts of continental Europe as well.Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for £320,000 of its products, conditional upon delivery being made in three months’ time and the order invoiced in euros. Shrewsbury’s controller, Elton Peters, is concerned with whether the pound will appreciate versus the euro over the next three months, thus eliminating all or most of the profit when the euro receivable is paid. He thinks this is an unlikely possibility, but he decides to contact the firm’s banker for suggestions about hedging the exchange rate exposure.Mr. Peters learns from the banker that the current spot e xchange rate is €/£ is €1.4537, thus the invoice amount should be €465,184. Mr. Peters also learns that the three-month forward rates for the pound and the euro versus the U.S. dollar are $1.8990/£1.00 and $1.3154/€1.00, respectively. The banker offers to set up a forward hedge for selling the euro receivable for pound sterling based on the €/£ forward cross-exchange rate implicit in the forward rates against the dollar.What would you do if you were Mr. Peters?Suggested Solution to Shrewsbury Herbal Products, Ltd.Note to Instructor: This elementary case provides an intuitive look at hedging exchange rate exposure. Students should not have difficulty with it even though hedging will not be formally discussed until Chapter 8. The case is consistent with the discussion that accompanies Exhibit 5.9 of the text. Professor of Finance, Banikanta Mishra, of Xavier Institute of Management – Bhubaneswar, India contributed to this solution.Suppose Shrewsbury sells at a twenty percent markup. Thus the cost to the firm of the £320,000 order is £256,000. Thus, the pound could appreciate to €465,184/£256,000 = €1.8171/1.00 before all profit was eliminated. This seems rather unlikely. Nevertheless, a ten percent appreciation of the pound (€1.4537 x 1.10) to €1.5991/£1.00 would only yield a profit of £34,904 (= €465,184/1.5991 - £256,000). Shrewsbury can hedge the exposure by selling the euros forward for British pounds at F3(€/£) = F3($/£) ÷ F3($/€) = 1.8990 ÷ 1.3154 = 1.4437. At this forward exchange rate, Shrewsbury can “lock-in”a price of £322,217 (= €465,184/1.4437) for the sale. The forward exchange rate indicates that the euro is trading at a premium to the British pound in the forward market. Thus, the forward hedge allows Shrewsbury to lock-in a greater amount (£2,217) than if the euro receivable was converted into pounds at the current spotIf the euro was trading at a forward discount, Shrewsbury would end up locking-in an amount less than £320,000. Whether that would lead to a loss for the company would depend upon the extent of the discount and the amount of profit built into the price of £320,000. Only if the forward exchange rate is even with the spot rate will Shrewsbury receive exactly £320,000. Obviously, Shrewsbury could ensure that it receives exactly £320,000 at the end of three-month accounts receivable period if it could invoice in £. That, however, is not acceptable to the French wholesaler. When invoicing in euros, Shrewsbury could establish the euro invoice amount by use of the forward exchange rate instead of the current spot rate. The invoice amount in that case would be €461,984 = £320,000 x 1.4437. Shrewsbury can now lock-in a receipt of £320,000 if it simultaneously hedges its euro exposure by selling €461,984 at the forward rate of 1.4437. That is, £320,000 =€461,984/1.4437.。

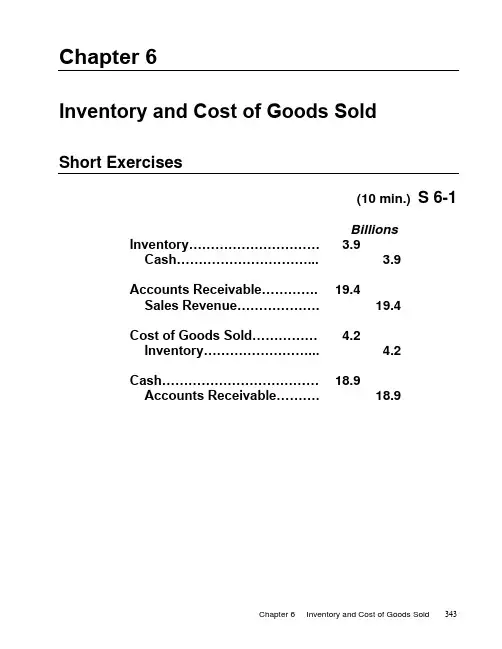

西方财务会计第六章答案chapter 6 Accounting for merchandising businessesClass Discussion Questions1. Mercha ndising businesses acquire merchandise for resale to customers. It is the selling ofmerchandise, instead of a service, that makes the activities of a merchandising business dif-ferent from the activities of a service business.2. Yes. Gross profit is the excess of (net) sales over cost of merchandise sold. A net loss ariseswhen operating expenses exceed gross profit. Therefore, a business can earn a gross profit but incur operating expenses in excess of this gross profit and end up with a net loss.3. a. Incr ease c. Decreaseb. Increase d. Decrease4. U nder the periodic method, the inventory records do not show the amount available for saleor the amount sold during the period. In contrast, under the perpetual method of accounting for merchandise inventory, each purchase and sale of merchandise is recorded in the invento-ry and the cost of merchandise sold accounts. As a result, the amount of merchandise availa-ble for sale and the amount sold are continuously (perpetually) disclosed in the inventory records.5. The multiple-step form of income statement contains conventional groupings for revenuesand expenses, with intermediate balances, before concluding with the net income balance. In the single-step form, the total of all expenses is deducted from the total of all revenues, with-out intermediate balances.6. The major advantages of the single-step form of income statement are its simplicity and itsemphasis on total revenues and total expenses as the determinants of net income. The major objection to the form is that such relationships as gross profit to sales and income from opera-tions to sales are not as readily determinable as when the multiple-step form is used.7. a. 2% discount allowed if paid within ten days of date of invoice; entire amount of invoicedue within 60 days of date of invoice.b. Payment due within 30 days of date of invoice.c. Payment due by the end of the month in which the sale was made.8. a. A credit memorandum issued by the seller of merchandise indicates the amount for whichthe buyer's account is to be credited (credit to Accounts Receivable) and the reason for the sales return or allowance.b. A debit memorandum issued by the buyer of merchandise indicates the amount for whichthe seller's account is to be debited (debit to Accounts Payable) and the reason for the purchases return or allowance.9. a. The buyerb. The seller10. E xamples of such accounts include the following: Sales, Sales Discounts, Sales Returns andAllowances, Cost of Merchandise Sold, Merchandise Inventory.Ex. 6–1a. $490,000 ($250,000 + $975,000 – $735,000)b.40% ($490,000 ÷ $1,225,000)c. No. If operating expenses are less than gross profit, there will be a net income. On the otherhand, if operating expenses exceed gross profit, there will be a net loss.Ex. 6–2 : $15,710 million ( $20,946 million – $5,236 million ) Ex. 6–3a. Purchases discounts, purchases returns and allowancesb. Transportation in;c. Merchandise available for saled. Merchandise inventory (ending)Ex. 6–41. The schedule should begin with the January 1, not the December 31, merchandise inventory.2. Purchases returns and allowances and purchases discounts should be deducted from (notadded to) purchases.3. The result of subtracting purchases returns and allowances and purchases discounts frompur chases should be labeled ―net purchases.‖4. Transportation in should be added to net purchases to yield cost of merchandise purchased.5. The merchandise inventory at December 31 should be deducted from merchandise availablefor sale to yield cost of merchandise sold.A correct cost of merchandise sold section is as follows:Cost of merchandise sold:Merchandise inventory, January 1, 2006 ........ $132,000 Purchases ........................................................... $600,000Less: Purchases returns and allowances$14,000Purchases discounts .............................. 6,000 20,000 Netpurchases ..................................................... $580,000Add transportation in ....................................... 7,500Cost of merchandise purchased ................. 587,500 Merchandise available for sale ......................... $719,500 Less merchandise inventory,December 31, 2006....................................... 120,000 Cost of merchandise sold .................................. $599,500 Ex. 6–5 Net sales: $3,010,000 ( $3,570,000 – $320,000 – $240,000 ) Gross profit: $868,000 ( $3,010,000 – $2,142,000 )Ex. 6–6THE MERIDEN COMPANYIncome StatementFor the Year Ended June 30, 2006Revenues:Net sales ................................................................................. $5,400,000Rent revenue ......................................................................... 30,000Total revenues................................................................... $5,430,000 Expenses:Cost of merchandise sold ..................................................... $3,240,000Selling expenses .................................................................... 480,000 Administrative expenses ...................................................... 300,000 Interest expense .................................................................... 47,500 Total expenses ................................................................... 4,067,500 Net income ..................................................................................... $1,362,500Ex. 6–71. Sales returns and allowances and sales discounts should be deducted from (not added to)sales.2. Sales returns and allowances and sales discounts should be deducted from sales to yield "netsales" (not gross sales).3. Deducting the cost of merchandise sold from net sales yields gross profit.4. Deducting the total operating expenses from gross profit would yield income from operations(or operating income).5. Interest revenue should be reported under the caption ―Other income‖ and should be addedto Income from operations to arrive at Net income.6. The final amount on the income statement should be labeled Net income, not Gross profit.A correct income statement would be as follows:THE PLAUTUS COMPANYIncome StatementFor the Year Ended October 31, 2006Revenue from sales:Sales .................................................................... $4,200,000Less: Sales returns and allowances ............... $81,200Sales discounts ....................................... 20,300 101,500Net sales ........................................................ $4,098,500 Cost of merchandise sold ........................................ 2,093,000 Gross profit .............................................................. $2,005,500 Operating expenses:Selling expenses ................................................. $ 203,000Transportation out ............................................ 7,500Administrative expenses ................................... 122,000Total operating expenses ............................ 332,500 Incomefrom operations .......................................... $1,673,000 Other income: Interest revenue ................................................. 66,500Net income ................................................................ $1,739,500 Ex. 6–8a. $25,000 c. $477,000 e. $40,000 g. $757,500b. $210,000 d. $192,000 f. $520,000 h. $690,000Ex. 6–9a. Cash ......................................................................................... 6,900Sales ................................................................................... 6,900 Cost of Merchandise Sold ...................................................... 4,830 Merchandise Inventory .................................................... 4,830b. Accounts Receivable ............................................................... 7,500Sales ................................................................................... 7,500 Cost of Merchandise Sold ...................................................... 5,625 Merchandise Inventory .................................................... 5,625c. Cash ......................................................................................... 10,200Sales ................................................................................... 10,200 Cost of Merchandise Sold ...................................................... 6,630 Merchandise Inventory .................................................... 6,630d. Accounts Receivable—American Express ........................... 7,200Sales ................................................................................... 7,200 Cost of Merchandise Sold ...................................................... 5,040 Merchandise Inventory .................................................... 5,040e. Credit Card Expense (675)Cash (675)f. Cash ......................................................................................... 6,875Credit Card Expense (325)Accounts Receivable—American Express ..................... 7,200Ex. 6–10It was acceptable to debit Sales for the $235,750. However, using Sales Returns and Allow-ances assists management in monitoring the amount of returns so that quick action can be taken if returns become excessive.Accounts Receivable should also have been credited for $235,750. In addition, Cost of Mer-chandise Sold should only have been credited for the cost of the merchandise sold, not the selling price. Merchandise Inventory should also have been debited for the cost of the merchandise re-turned. The entries to correctly record the returns would have been as follows: Sales (or Sales Returns and Allowances) ............................. 235,750 Accounts Receivable ......................................................... 235,750 Merchandise Inventory .......................................................... 141,450 Cost of Merchandise Sold ................................................ 141,450 Ex. 6–11a. $7,350 [$7,500 –$150 ($7,500 × 2%)]b. Sales Returns and Allowances .............................................. 7,500Sales Discounts (150)Cash ................................................................................... 7,350Merchandise Inventory .......................................................... 4,500 Cost of Merchandise Sold ................................................ 4,500Ex. 6–12(1) Sold merchandise on account, $12,000.(2) Recorded the cost of the merchandise sold and reduced the merchandise inventory account,$7,800.(3) Accepted a return of merchandise and granted an allowance, $2,500.(4) Updated the merchandise inventory account for the cost of the merchandise returned,$1,625.(5) Received the balance due within the discount period, $9,405. [Sale of $12,000, less return of$2,500, l ess discount of $95 (1% × $9,500).]Ex. 6–13a. $18,000b. $18,375c. $540 (3% × $18,000)d. $17,835Ex. 6–14a. $7,546 [Purchase of $8,500, less return of $800, less discount of $154 ($7,700 × 2%)]b. Merchandise InventoryEx. 6–15Offer A is lower than offer B. Details are as follows:A BList price ............................................................................... $40,000 $40,300Less discount ......................................................................... 800 403 $39,200 $39,897 Transportation (625)$39,825 $39,897Ex. 6–16(1) Purchased merchandise on account at a net cost of $8,000.(2) Paid transportation costs, $175.(3) An allowance or return of merchandise was granted by the creditor, $1,000.(4) Paid the balance due within the discount period: debited Accounts Payable, $7,000, and cre-dited Merchandise Inventory for the amount of the discount, $140, and Cash, $6,860.Ex. 6–17a. Merchandise Inventory .......................................................... 7,500Accounts Payable ............................................................. 7,500b. Accounts Payable ................................................................... 1,200Merchandise Inventory .................................................... 1,200c. Accounts Payable ................................................................... 6,300Cash ................................................................................... 6,174Merchandise Inventory (126)a. Merchandise Inventory .......................................................... 12,000Accounts Payable—Loew Co. ......................................... 12,000b. Accounts Payable—Loew Co. ............................................... 12,000Cash ................................................................................... 11,760Merchandise Inventory (240)c. Accounts Payable*—Loew Co. ............................................. 2,940Merchandise Inventory .................................................... 2,940d. Merchandise Inventory .......................................................... 2,000Accounts Payable—Loew Co. ......................................... 2,000e. Cash (940)Accounts Payable—Loew Co. (940)*Note: The debit of $2,940 to Accounts Payable in entry (c) is the amount of cash refund due from Loew Co. It is computed as the amount that was paid for the returned merchandise, $3,000, less the purchase discount of $60 ($3,000 × 2%). The credit toAccounts Payable of $2,000 in en-try (d) reduces the debit balance in the account to $940, which is the amount of the cash refund in entry (e). The alternative entries below yield the same final results.c. Accounts Receivable—Loew Co. .......................................... 2,940Merchandise Inventory .................................................... 2,940d. Merchandise Inventory .......................................................... 2,000Accounts Payable—Loew Co. ......................................... 2,000e. Cash (940)Accounts Payable—Loew Co. ............................................... 2,000 Accounts Receivable—Loew Co. .................................... 2,940Ex. 6–19a. $10,500b. $4,160 [($4,500 – $500) ? 0.99] + $200c. $4,900d. $3,960e. $834 [($1,500 – $700) ? 0.98] + $50Ex. 6–20a. At the time of sale c. $4,280b. $4,000 d. Sales Tax PayableEx. 6–21a. Accounts Receivable ............................................................... 9,720Sales ................................................................................... 9,000Sales Tax Payable (720)Cost of Merchandise Sold ...................................................... 6,300 Merchandise Inventory .................................................... 6,300b. Sales Tax Payable ................................................................... 9,175Cash ................................................................................... 9,175a. Accounts Receivable—Beta Co. ........................................... 11,500Sales ................................................................................... 11,500 Cost of Merchandise Sold ...................................................... 6,900 Merchandise Inventory .................................................... 6,900b. Sales Returns and Allowances (900)Accounts Receivable—Beta Co. (900)Merchandise Inventory (540)Cost of Merchandise Sold (540)c. Cash ......................................................................................... 10,388Sales Discounts (212)Accounts Receivable—Beta Co. ...................................... 10,600 Ex. 6–23a. Merchandise Inventory .......................................................... 11,500Accounts Payable—Superior Co. ................................... 11,500b. Accounts Payable—Superior Co. (900)Merchandise Inventory (900)c. Accounts Payable—Superior Co. ......................................... 10,600Cash ................................................................................... 10,388Merchandise Inventory (212)Ex. 6–24a. debit c. credit e. debitb. debit d. debit f. debitEx. 6–25(b) Cost of Merchandise Sold (d) Sales (e)Sales Discounts(f) Sales Returns and Allowances (g) Salaries Expense (j) Supplies ExpenseEx. 6–26a. 2003: 2.07 [$58,247,000,000 ÷ ($30,011,000,000 + $26,394,000,000)/2]2002: 2.24 [$53,553,000,000 ÷ ($26,394,000,000 + $21,385,000,000)/2]b.These analyses indicate a decrease in the effectiveness in the use of the assets to generateprofits. This decrease is probably due to the slowdown in the U.S. economy during 2002–2003. However, a comparison with similar companies or industry averages would be helpful in making a more definitive statement on the effectiveness of the use of the assets.Ex. 6–27a. 4.13 [$12,334,353,000 ÷ ($2,937,578,000 + $3,041,670,000)/2]b. Although Winn-Dixie and Zales are both retail stores, Zales sells jewelry at a much slowervelocity than Winn-Dixie sells groceries. Thus, Winn-Dixie is able to generate $4.13 of sales for every dollar of assets. Zales, however, is only able to generate $1.53 in sales per dollar of assets. This makes sense when one considers the sales rate for jewelry and the relative cost of holding jewelry inventory, relative to groceries. Fortunately, Zales is able to counter its slow sales velocity, relative to groceries, with higher gross profits, relative to groceries. Appendix 1—Ex. 6–28a. and c.SALES JOURNALCost of MerchandiseSold Dr.Invoice Post.Accts. Rec. Dr. MerchandiseDate No. Account Debited Ref.Sales Cr. Inventory Cr.2006Aug. 3 80 Adrienne Richt ................... ?12,000 4,0008 81 K. Smith .............................. ?10,000 5,50019 82 L. Lao .................................. ?9,000 4,00026 83 Cheryl Pugh ........................ ?14,000 6,50045,000 20,000b. andc.PURCHASES JOURNALAccounts Merchandise OtherPost Payable Inventory Accounts Post.Date Account Credited Ref.Cr. Dr. Dr. Ref. Amount2006Aug. 10 Draco Rug Importers ................. ?8,000 8,00012 Draco Rug Importers ................. ?3,500 3,50021 Draco Rug Importers ................. ?19,500 19,50031,000 31,000d.Merchandise inventory, August 1 ............................................... $ 19,000Plus: August purchases ................................................................ 31,000Less: Cost of merchandise sold ................................................... (20,000)Merchandise inventory, August 31 ............................................. $ 30,000ORQuantity Rug Style Cost2 10 by 6 Chinese* $ 7,5001 8 by 10 Persian 5,5001 8 by 10 Indian 4,0002 10 by 12 Persian 13,000 $ 30,000*($4,000 + $3,500)。

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency, the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts.2. What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer: The market for foreign exchange can be viewed as a two-tier market. One tier is the wholesale or interbank market and the other tier is the retail or client market. International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, corporations or individuals, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Retail transactions account for only about 14 percent of FX trades. The other 86 percent is interbank trades between international banks, or non-bank dealers large enough to transact in the interbank market.3. Who are the market participants in the foreign exchange market?Answer: The market participants that comprise the FX market can be categorized into five groups: international banks, bank customers, non-bank dealers, FX brokers, and central banks. International banks provide the core of the FX market. Approximately 100 to 200 banks worldwide make a market in foreign exchange, i.e., they stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, the bank customers, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Non-bank dealers are large non-bank financial institutions, such as investment banks, mutual funds, pension funds, and hedge funds, whose size and frequency of trades make it cost- effective to establish their own dealing rooms to trade directly in the interbank market for their foreign exchange needs.Most interbank trades are speculative or arbitrage transactions where market participants attempt to correctly judge the future direction of price movements in one currency versus another or attempt to profit from temporary price discrepancies in currencies between competing dealers.FX brokers match dealer orders to buy and sell currencies for a fee, but do not take a position themselves. Interbank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.Central banks sometimes intervene in the foreign exchange market in an attempt to influence the price of its currency against that of a major trading partner, or a country that it “fixes” or “pegs” its currency against. Intervention is the process of using foreign currency reser ves to buy one’s own currency in order to decrease its supply and thus increase its value in the foreign exchange market, or alternatively, selling one’s own currency for foreign currency in order to increase its supply and lower its price.4. How are foreign exchange transactions between international banks settled?Answer: The interbank market is a network of correspondent banking relationships, with large commercial banks maintaining demand deposit accounts with one another, called correspondent bank accounts. The correspondent bank account network allows for the efficient functioning of the foreign exchange market. As an example of how the network of correspondent bank accounts facilities international foreign exchange transactions, consider a U.S. importer desiring to purchase merchandise invoiced in guilders from a Dutch exporter. The U.S. importer will contact his bank and inquire about the exchange rate. If the U.S. importer accepts the offered exchange rate, the bank will debit the U.S. importer’s account for the purchase of the Dutch guilders. The bank will instruct its correspondent bank in the Netherlands to debit its correspondent bank account the appropriate amount of guilders and to credit the Dutch exporter’s bank account. The importer’s bank will then debit its books to offset the debit of U.S. importer’s account, reflecting the decrease in its correspondent bank account balan ce.5. What is meant by a currency trading at a discount or at a premium in the forward market?Answer: The forward market involves contracting today for the future purchase or sale of foreign exchange. The forward price may be the same as the spot price, but usually it is higher (at a premium) or lower (at a discount) than the spot price.6. Why does most interbank currency trading worldwide involve the U.S. dollar?Answer: Trading in currencies worldwide is against a common currency that has international appeal. That currency has been the U.S. dollar since the end of World War II. However, the euro and Japanese yen have started to be used much more as international currencies in recent years. More importantly, trading would be exceedingly cumbersome and difficult to manage if each trader made a market against all other currencies.7. Banks find it necessary to accommodate their clients’ needs to buy or sell FX forward, in many instances for hedging purposes. How can the bank eliminate the currency exposure it has created for itself by accommodating a client’s forward transaction?Answer: Swap transactions provide a means for the bank to mitigate the currency exposure in a forward trade. A swap transaction is the simultaneous sale (or purchase) of spot foreign exchange against a forward purchase (or sale) of an approximately equal amount of the foreign currency. To illustrate, suppose a bank customer wants to buy dollars three months forward against British pound sterling. The bank can handle this trade for its customer and simultaneously neutralize the exchange rate risk in the trade by selling (borrowed) British pound sterling spot against dollars. The bank will lend the dollars for three months until they are needed to deliver against the dollars it has sold forward. The British pounds received will be used to liquidate the sterling loan.8. A CD/$ bank trader is currently quoting a small figure bid-ask of 35-40, when the rest of the market is trading at CD1.3436-CD1.3441. What is implied about the trader’s beliefs by his prices?Answer: The trader must think the Canadian dollar is going to appreciate against the U.S. dollar and therefore he is trying to increase his inventory of Canadian dollars by discouraging purchases of U.S. dollars by standing willing to buy $ at only CD1.3435/$1.00 and offering to sell from inventory at the slightly lower than market price of CD1.3440/$1.00.9. What is triangular arbitrage? What is a condition that will give rise to a triangular arbitrage opportunity?Answer: Triangular arbitrage is the process of trading out of the U.S. dollar into a second currency, then trading it for a third currency, which is in turn traded for U.S. dollars. The purpose is to earn anarbitrage profit via trading from the second to the third currency when the direct exchange between the two is not in alignment with the cross exchange rate.Most, but not all, currency transactions go through the dollar. Certain banks specialize in making a direct market between non-dollar currencies, pricing at a narrower bid-ask spread than the cross-rate spread. Nevertheless, the implied cross-rate bid-ask quotations impose a discipline on the non-dollar market makers. If their direct quotes are not consistent with the cross exchange rates, a triangular arbitrage profit is possible.PROBLEMS1. Using Exhibit 5.4, calculate a cross-rate matrix for the euro, Swiss franc, Japanese yen, and the British pound. Use the most current American term quotes to calculate the cross-rates so that the triangular matrix resulting is similar to the portion above the diagonal in Exhibit 5.6.Solution: The cross-rate formula we want to use is:S(j/k) = S($/k)/S($/j).The triangular matrix will contain 4 x (4 + 1)/2 = 10 elements.¥SF £$Euro 138.05 1.5481 .6873 1.3112 Japan (100) 1.1214 .4979 .9498 Switzerland .4440 .8470U.K 1.90772. Using Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Canadian dollar and the Swiss franc using the most current quotations. State the forward cross-rates in “Canadian” terms.Solution: The formulas we want to use are:F N(CD/SF) = F N($/SF)/F N($/CD)orF N(CD/SF) = F N(CD/$)/F N(SF/$).We will use the top formula that uses American term forward exchange rates.F1(CD/SF) = .8485/.8037 = 1.0557F3(CD/SF)= .8517/.8043 = 1.0589F6(CD/SF)= .8573/.8057 = 1.06403. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points.Spot 1.3431-1.3436One-Month 1.3432-1.3442Three-Month 1.3448-1.3463Six-Month 1.3488-1.3508Solution:One-Month 01-06Three-Month 17-27Six-Month 57-724. Using the spot and outright forward quotes in problem 3, determine the corresponding bid-ask spreads in points.Solution:Spot 5One-Month 10Three-Month 15Six-Month 205. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,CD= [(F N($/CD) - S($/CD/$)/S($/CD)] x 360/Nf1,CD= [(.8037 - .8037)/.8037] x 360/30 = .0000f3,CD= [(.8043 - .8037)/.8037] x 360/90 = .0030f6,CD= [(.8057 - .8037)/.8037] x 360/180 = .0050The pattern of forward premiums indicates that the Canadian dollar is trading at an increasing premium versus the U.S. dollar. That is, it becomes more expensive (in both absolute and percentage terms) to buy a Canadian dollar forward for U.S. dollars the further into the future one contracts.6. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,$= [(F N (£/$) - S(£/$))/S(£/$)] x 360/Nf1,$= [(.5251 - .5242)/.5242] x 360/30 = -.0023f3,$= [(.5268 - .5242)/.5242] x 360/90 = -.0198f6,$= [(.5290 - .5242)/.5242] x 360/180 = -.0183The pattern of forward premiums indicates that the British pound is trading at a discount versus the U.S. dollar. That is, it becomes more expensive to buy a U.S. dollar forward for British pounds (in absolute but not percentage terms) the further into the future one contracts.7. Given the following information, what are the NZD/SGD currency against currency bid-ask quotations?American Terms European TermsBank Quotations Bid Ask Bid AskNew Zealand dollar .7265 .7272 1.3751 1.3765Singapore dollar .6135 .6140 1.6287 1.6300Solution: Equation 5.12 from the text implies S b(NZD/SGD) = S b($/SGD) x S b(NZD/$) = .6135 x 1.3765 = .8445. The reciprocal, 1/S b(NZD/SGD)= S a(SGD/NZD)= 1.1841. Analogously, it is implied that S a(NZD/SGD) = S a($/SGD) x S a(NZD/$) = .6140 x 1.3765 = .8452. The reciprocal, 1/S a(NZD/SGD) = S b(SGD/NZD)= 1.1832. Thus, the NZD/SGD bid-ask spread is NZD0.8445-NZD0.8452 and the SGD/NZD spread is SGD1.1832-SGD1.1841.8. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting €0.7627/$1.00 and Credit Suisse is offering SF1.1806/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current €/SF quote of .6395. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What €/SF price will eliminate triangular arbitrage?Solution: To make a triangular arbitrage profit the Deutsche Bank trader would sell $5,000,000 to Dresdner Bank at €0.7627/$1.00. This trade would yield €3,813,500= $5,000,000 x .7627. The Deutsche Bank trader would then sell the euros for Swiss francs to Union Bank of Switzerland at a price of €0.6395/SF1.00, yielding SF5,963,253 = €3,813,500/.6395. The Deutsche Bank trader will resell the Swiss francs to Credit Suisse for $5,051,036 = SF5,963,253/1.1806, yielding a triangular arbitrage profit of $51,036.If the Deutsche Bank trader initially sold $5,000,000 for Swiss francs, instead of euros, the trade would yield SF5,903,000 = $5,000,000 x 1.1806. The Swiss francs would in turn be traded for euros to UBS for €3,774,969= SF5,903,000 x .6395. The euros would be resold to Dresdner Bank for $4,949,481 = €3,774,969/.7627, or a loss of $50,519. Thus, it is necessary to conduct the triangular arbitrage in the correct order.The S(€/SF)cross exchange rate should be .7627/1.1806 = .6460. This is an equilibrium rate at which a triangular arbitrage profit will not exist. (The student can determine this for himself.) A profit results from the triangular arbitrage when dollars are first sold for euros because Swiss francs are purchased for euros at too low a rate in comparison to the equilibrium cross-rate, i.e., Swiss francs are purchased for only €0.6395/SF1.00 instead of the no-arbitrage rate of €0.6460/SF1.00. Similarly, when dollars are first sold for Swiss francs, an arbitrage loss results because Swiss francs are sold for euros at too low a rate, resulting in too few euros. That is, each Swiss franc is sold for €0.6395/SF1.00 instead of the higher no-arbitrage rate of €0.6460/SF1.00.9. The current spot exchange rate is $1.95/£ and the three-month forward rate is $1.90/£. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.92/£ in three months. Assume that you would like to buy or sell £1,000,000.a. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation?b. What would be your speculative profit in dollar terms if the spot exchange rate actually turns out to be $1.86/£.Solution:a. If you believe the spot exchange rate will be $1.92/£ in three months, you should buy £1,000,000 forward for $1.90/£. Your expected profit will be:$20,000 = £1,000,000 x ($1.92 -$1.90).b. If the spot exchange rate actually turns out to be $1.86/£ in three months, your loss from the long position will be:-$40,000 = £1,000,000 x ($1.86 -$1.90).10. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss Francs (CHF) and purchase an equivalent amount of equities denominated in South African Rands (ZAR).Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD).Currency Exchange Ratesa.Describe the currency transaction that Omni should undertake to eliminate currency riskover the 30-day period.b.Calculate the following:• The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equityportfolio.•The current value of Omni’s Swiss equity portfolio in ZAR.• The annualized forward premium or discount at which the ZAR is trading versus theCHF.CFA Guideline Answer:a.To eliminate the currency risk arising from the possibility that ZAR will appreciateagainst the CHF over the next 30-day period, Omni should sell 30-day forward CHFagainst 30-day forward ZAR delivery (sell 30-day forward CHF against USD and buy30-day forward ZAR against USD).b.The calculations are as follows:•Using the currency cross rates of two forward foreign currencies and three currencies (CHF, ZAR, USD), the exchange would be as follows:--30 day forward CHF are sold for USD. Dollars are bought at the forward sellingprice of CHF1.5285 = $1 (done at ask side because going from currency into dollars)--30 day forward ZAR are purchased for USD. Dollars are simultaneously sold to purchase ZAR at the rate of 6.2538 = $1 (done at the bid side because going fromdollars into currency)--For every 1.5285 CHF held, 6.2538 ZAR are received; thus the cross currency rate is1.5285 CHF/6.2538 ZAR = 0.244411398.• At the time of execution of the forward contracts, the v alue of the 3 million CHF equity portfolio would be 3,000,000 CHF/0.244411398 = 12,274,386.65 ZAR.• To calculate the annualized premium or discount of the ZAR against the CHF requires comparison of the spot selling exchange rate to the forward selling price of CHF for ZAR.Spot rate = 1.5343 CHF/6.2681 ZAR = 0.24477912030 day forward ask rate 1.5285 CHF/6.2538 ZAR = 0.244411398The premium/discount formula is:[(forward rate – spot rate) / spot rate] x (360 / # day contract) =[(0.244411398 – 0.24477912) / 0.24477912] x (360 / 30) =-1.8027126 % = -1.80% discount ZAR to CHFMINI CASE: SHREWSBURY HERBAL PRODUCTS, LTD.Shrewsbury Herbal Products, located in central England close to the Welsh border, is an old-line producer of herbal teas, seasonings, and medicines. Its products are marketed all over the United Kingdom and in many parts of continental Europe as well.Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for £320,000 of its products, conditional upon delivery being made in three months’ time and the order invoiced in euros.Shrewsbury’s controller, Elton Peters, is concerned with whether the pound will appreciate versus the euro over the next three months, thus eliminating all or most of the profit when the euro receivable is paid. He thinks this is an unlikely possibility, but he decides to contact the firm’s banker for suggestions about hedging the exchange rate exposure.Mr. Peters learns from the banker that the current spot e xchange rate is €/£ is €1.4537, thus the invoice amount should be €465,184. Mr. Peters also learns that the three-month forward rates for the pound and the euro versus the U.S. dollar are $1.8990/£1.00 and $1.3154/€1.00, respectively. The banker offers to set up a forward hedge for selling the euro receivable for pound sterling based on the €/£ forward cross-exchange rate implicit in the forward rates against the dollar.What would you do if you were Mr. Peters?Suggested Solution to Shrewsbury Herbal Products, Ltd.Note to Instructor: This elementary case provides an intuitive look at hedging exchange rate exposure. Students should not have difficulty with it even though hedging will not be formally discussed until Chapter 8. The case is consistent with the discussion that accompanies Exhibit 5.9 of the text. Professor of Finance, Banikanta Mishra, of Xavier Institute of Management – Bhubaneswar, India contributed to this solution.Suppose Shrewsbury sells at a twenty percent markup. Thus the cost to the firm of the £320,000 order is £256,000. Thus, the pound could appreciate to €465,184/£256,000 = €1.8171/1.00 before all profit was eliminated. This seems rather unlikely. Nevertheless, a ten percent appreciation of the pound (€1.4537 x 1.10) to €1.5991/£1.00 would only yield a profit of £34,904 (= €465,184/1.5991 - £256,000). Shrewsbury can hedge the exposure by selling the euros forward for British pounds at F3(€/£) = F3($/£) ÷ F3($/€) = 1.8990 ÷ 1.3154 = 1.4437. At this forward exchange rate, Shrewsbury can “lock-in” a price of £322,217 (= €465,184/1.4437) for the sale. The forward exchange rate indicates that the euro is trading at a premium to the British pound in the forward market. Thus, the forward hedge allows Shrewsbury to lock-in a greater amount (£2,217) than if the euro receivable was converted into pounds at the current spotIf the euro was trading at a forward discount, Shrewsbury would end up locking-in an amount less than £320,000. Whether that would lead to a loss for the company would depend upon the extent of the discount and the amount of profit built into the price of £320,000. Only if the forward exchange rate is even with the spot rate will Shrewsbury receive exactly £320,000.Obviously, Shrewsbury could ensure that it receives exactly £320,000 at the end of three-month accounts receivable period if it could invoice in £. That, however, is not acceptable to the French wholesaler. When invoicing in euros, Shrewsbury could establish the euro invoice amount by use of the forward exchange rate instead of the current spot rate. The invoice amount in that case would be €461,984 = £320,000 x 1.4437. Shrewsbury can now lock-in a receipt of £320,000 if it simultaneously hedges its euro exposure by selling €461,984 at the forward rate of 1.4437. That is, £320,000 = €461,984/1.4437.。