level_I_mock_exam_afternoon_answers_2014

- 格式:pdf

- 大小:699.78 KB

- 文档页数:56

任务管理功能模块测试及开发答疑英语全文共6篇示例,供读者参考篇1Task Management Fun: Testing and TroubleshootingHave you ever felt like you have a million things to do and can't keep track of them all? Well, task management apps are here to help! These nifty little programs allow you to create lists of all your tasks or chores, so you'll never forget what needs to be done. But before we can use them, they need to go through a process called testing to make sure everything works properly. Let me tell you all about it!The Importance of TestingImagine if you got a new toy, but some of the pieces were missing or it didn't work quite right. That would be pretty disappointing, right? Well, the same thing can happen with apps and computer programs if they aren't tested thoroughly. That's why testing is such an important step in creating task management apps.During the testing phase, a team of people called testers will try out every single feature and function of the app. They'll check to see if tasks can be added and removed correctly, if due dates and reminders work as intended, and if the app is easy to use and understand. If they find any issues or bugs (problems with the app), they'll report it to the developers (the people who built the app) so they can fix it before the app is released to everyone.It's like having a group of kids test out a new toy before it hits the shelves – they'll make sure it's fun, safe, and works properly so that when other kids get to play with it, they'll have an awesome experience!The Testing ProcessSo, how does this testing process work? Well, it usually involves several stages:Unit TestingThis is where individual parts or "units" of the app are tested separately. It's like testing each piece of a puzzle to make sure it's cut correctly before trying to put the whole thing together.Integration TestingAfter the individual units have been tested, it's time to see how they work together. This is called integration testing. It'skind of like building a model airplane – you need to make sure all the parts fit together properly before you can take it for a test flight.System TestingNow it's time to test the entire app as a whole system. This is where the testers will try out every single feature and function, just like they would if they were regular users. It's like taking that model airplane out to the park and seeing how it flies!User Acceptance TestingFinally, the app is tested by real users to make sure it meets their needs and expectations. This is called user acceptance testing. It's like letting a group of kids play with that new toy and giving their honest feedback before it's mass-produced.Throughout this process, the testers will document any issues they find, and the developers will work to fix those bugs or make improvements based on the feedback.Q&A Time!Now that you know all about the testing process, let's address some common questions and concerns that might come up:Q: What if the testers find a lot of bugs? Does that mean the app is bad?A: Not necessarily! Finding bugs is actually a good thing because it means the testers are doing their job properly. The more bugs they find during testing, the better the app will be after they're fixed.Q: Why does testing take so long? Can't they just skip it?A: Testing is a crucial step that can't be rushed or skipped. It might seem like it takes a while, but it's better to take the time to make sure everything works perfectly than to release an app with a bunch of issues.Q: What if the app still has some bugs after it's released?A: Even after extensive testing, it's possible for some bugs to slip through unnoticed. That's why app developers often release updates and patches to fix any issues that come up after the initial release.Q: Can I be a tester too?A: Absolutely! While professional testers are trained to find and document bugs, many app developers also invite regular users to participate in beta testing (testing an app before it'sofficially released). This allows them to get feedback from their target audience.Q: What if I have an idea for a new feature?A: That's great! App developers love hearing feedback and suggestions from users. Many task management apps have forums or channels where users can submit ideas for new features or improvements. Who knows, your idea might make it into the next update!Well, there you have it – a behind-the-scenes look at the testing and development process for task management apps. It might seem like a lot of work, but it's all to ensure that these apps are as useful, functional, and bug-free as possible. So the next time you're using a task management app to keep track of your chores or homework assignments, remember all the effort that went into making it a reliable and user-friendly tool!篇2Title: Fun with Task Management and Testing!Hi everyone! Today I want to tell you all about this really cool thing called Task Management. It's a special way to keep track ofall the different things you need to do, kind of like a big to-do list but even better!You see, when you have a lot of tasks or chores or homework assignments, it can get really confusing and messy trying to remember everything. That's where Task Management comes in - it helps you organize all your tasks in one place so you don't forget anything important.There are these awesome computer programs called Task Management apps that make it super easy. You can write down all your tasks, give them names like "Clean my room" or "Do math homework", and even set reminders so the app will notify you when it's time to do that task.But here's the really cool part - before these apps get released to everyone, they have to go through something called testing. Testing is like a big check-up to make sure the app is working properly and doesn't have any bugs or problems.There are special people called testers whose job is to test out these apps and find any issues. They'll try out all the different features, like adding tasks, setting reminders, marking tasks as completed and so on. If they find something that isn't working right, they'll report it to the developers.Developers are like the engineers who build the apps. When the testers report a problem, the developers try to fix it by changing some of the code that makes the app run.Once the developers fix the issues found during testing, the app gets tested again to make sure everything is working smoothly now. This back-and-forth between testing and fixing happens many times until the app is ready for everyone to use!Sometimes, even after an app is released, people might find some problems or have questions about how to use certain features. That's when the developers open a Q&A (Questions and Answers) section.People can ask their questions there, and the developers do their best to answer and explain things clearly. If there are any problems with the app, the developers can work on fixing them based on the feedback from users.Isn't that so cool? All these smart people working together to make great apps that help us all stay organized and on top of our tasks! Testing is really important to catch any bugs before the apps go out to everyone.And having a Q&A section allows the developers to keep making the apps better and better based on what people need.Task management itself is super handy for us kids to use for keeping track of homework, chores, activities and more!Well, that's all I wanted to share about the fun world of task management, testing and development Q&A. Stay organized, test thoroughly, ask lots of questions and most importantly, have fun! Let me know if you have any other questions!篇3Task Management is Super Cool!Hi friends! Today I'm going to tell you all about Task Management and how awesome it is. Task Management helps you keep track of all the things you need to do, like homework, chores, and activities. It's like having your very own personal assistant reminding you of everything so you never forget!But first, what even is Task Management? It's a special feature or program that lets you make lists of tasks or things you need to get done. You can add new tasks, check them off when completed, and even set reminders so you don't miss anything important. Pretty neat, right?Testing the Task Management FeatureBefore any new app, website, or program can be released, it has to go through a lot of testing to make sure everything works perfectly. The developers (those are the people who build and code the programs) have to test the Task Management feature very carefully.They check if you can easily add new tasks, make sure reminders go off at the right times, and test that checking off completed tasks works smoothly. It's kind of like when your teacher checks your homework - they need to make sure you did everything right before giving you a gold star!The testers also have to check that the Task Management feature works great on different devices like phones, tablets, and computers. They try adding tasks on a tiny phone screen and a huge computer monitor to ensure it looks and functions awesomely everywhere.If any bugs or issues are found during testing, the developers have to fix them before the feature can be released. Bugs are like the program having a cold - it doesn't work properly until the bug is squashed! The testers keep testing until everything is perfect.Answering Your Task Management QuestionsEven after Task Management is released, the developers still have to answer questions from users who run into any confusion or problems. Let's go through some common questions:Q: How do I add a new task?A: Usually there is a "Add Task" button or you can type your task into a box and hit enter. Give your task a name like "Do math homework".Q: Can I set a due date or reminder?A: Yes! Most task managers let you pick a due date and set a reminder alert for when that task needs to be done. The reminder might pop up or your phone/computer could ping you.Q: How do I mark a task as completed?A: There is typically a checkbox next to each task that you can click or tap to check it off once that task is finished. Completed tasks usually get crossed out or moved to a "Done" list.Q: Can I organize my tasks into different lists or categories?A: Absolutely! You can usually create multiple lists for things like "School", "Chores", "Sports" etc. This keeps everything nicely organized.Q: What if I accidently delete a task I didn't mean to?A: Don't worry, most task managers have an Undo button or let you retrieve deleted tasks from a bin. As long as you act quickly, your task can be restored!Q: Is there a way to share my tasks with my family or friends?A: Yes, many apps let you share access to your task lists so your family can see what you need to do. This helps Mom and Dad keep track too!Those are just some of the common questions about using Task Management features. If you ever get stuck, ask a grown up for help or check the instructions for your specific app. Managing tasks takes practice but is a super useful skill!I hope this gives you a better understanding of how Task Management works and why it's so important to carefully test it before releasing any new updates or improvements. Staying organized and on top of your tasks helps you get so much more done! Let me know if you have any other questions.篇4Task Management: A Fun Adventure for Young Learners!Hey there, young explorers! Are you ready to embark on an exciting journey into the world of task management? Get ready to learn about this fascinating topic in a way that'll make you feel like you're on the coolest adventure ever!Imagine you're a brave adventurer setting out on a quest to conquer a vast and mysterious land. Just like any great explorer, you need to plan your journey carefully, organize your supplies, and keep track of all the tasks you need to complete along the way. That's where task management comes into play!Task management is like having a trusty map and asuper-cool checklist to guide you through your adventure. It helps you stay organized, focused, and on top of all the things you need to do. Without it, you might end up feeling lost and overwhelmed, kind of like wandering aimlessly through a dense jungle without any idea where you're going!Now, let's talk about testing and development – the secret weapons that help make task management tools even more awesome! Think of it like this: imagine you're an inventor creating a brand-new gadget to help you on your quest. You wouldn't want to set out with a gadget that hasn't been properly tested and fine-tuned, would you? That's where testing comes in!Testing is like putting your gadget through a series of challenges to make sure it works perfectly. It's like taking your invention on a practice run to see if it can handle all the obstacles and challenges you might face on your real adventure. By testing your task management tool, you can make sure it's reliable, user-friendly, and has all the features you need to stay on top of your tasks.But wait, there's more! Development is like having a team of brilliant inventors constantly improving and upgrading your gadget. They listen to your feedback, fix any issues you encounter, and add cool new features to make your task management tool even more powerful and convenient.Imagine having a team of experts working behind the scenes to make sure your task management tool is always up-to-date, easy to use, and packed with the latest and greatest features. It's like having a secret squad of gadget geniuses on your side, making sure you have the best tools for your adventure!Now, you might be wondering, "But how do these experts know what to improve or fix?" That's where the Q&A part comes in! Q&A stands for "Questions and Answers," and it's like having a direct line of communication with the inventors themselves.Whenever you have a question, concern, or suggestion about your task management tool, you can simply ask the experts. They'll listen carefully, answer your questions, and use your feedback to make the tool even better. It's like having a team of advisors who are always ready to help you out and make sure your adventure goes as smoothly as possible.So, what do you think, young adventurers? Are you ready to embrace the power of task management, testing, development, and Q&A? With these amazing tools and resources at your disposal, you'll be unstoppable! Just remember to stay organized, ask questions when you need help, and most importantly, have fun on your quest!篇5Sure! Here's a 1000-word article written in English, using a language suitable for a primary school student:Task Management Feature: Testing and Development Q&AHello, everyone! Today, we are going to talk about the cool new feature called "Task Management" that we have been working on. It's a helpful tool that helps us organize our tasks and get things done in a smart and fun way! In this article, we'llexplore how this feature is tested and developed. Let's get started!Testing the Task Management FeatureBefore we release a new feature, like Task Management, we have to make sure it works perfectly and doesn't have any bugs or problems. That's where testing comes in! Our team of testers carefully checks every little detail to ensure everything is just right.Functionality Testing:First, we check if the basic functions of the Task Management feature are working properly. Can we add tasks? Can we mark them as completed? Can we set deadlines? All these things are tested to make sure they work smoothly.User Interface (UI) Testing:The Task Management feature should be easy to use and understand. So, we test the buttons, icons, and menus to ensure they are clear and user-friendly. We want even the youngest users to be able to use it without any trouble!Compatibility Testing:Our team also tests the feature on different devices, like computers, tablets, and smartphones. We want to make sure it works well on all of them. So, whether you're using a big computer or a tiny phone, the Task Management feature should look great and work perfectly!Error Handling Testing:Sometimes, things can go wrong. So, we intentionally try to make mistakes while using the feature. We check if error messages appear when they should and if the feature can recover from those errors. This way, we make sure the Task Management feature is smart enough to handle any problems that may come up.Development Q&ANow, let's move on to some common questions about the development of the Task Management feature. Here are a few questions you might have:Q: How long did it take to develop the Task Management feature?A: Developing a new feature like Task Management takes time. It involves a lot of planning, designing, and coding. Ourteam of talented developers worked hard for several months to create this feature just for you!Q: Why did you decide to add a Task Management feature?A: We understand that managing tasks can sometimes be tricky, especially for students like you who have lots of things to do. So, we thought it would be great to have a feature that helps you stay organized and complete your tasks easily. We want to make your life a little bit easier and more fun!Q: Can we suggest new features for the Task Management module?A: Absolutely! We love hearing from our users, especially smart and creative students like you. If you have any ideas or suggestions for improving the Task Management feature or any other part of our app, please let us know. Your feedback is important to us!That's all for today, my young friends! We hope you enjoyed learning about the testing and development of the Task Management feature. Remember, staying organized and managing your tasks can make a big difference in your life. So, keep using the Task Management feature and make the most of it. Have a fantastic day!*Note: This article is written in a simplified language suitable for primary school students.篇6Task Management: The Fun Way to Stay Organized!Hey there, kids! Are you always forgetting to do your chores or homework? Do you struggle to keep track of all the things you need to do? Well, worry no more! Today, we're going to talk about a super cool feature called Task Management, which is like having your own personal assistant to help you stay on top of everything.Imagine you have a special notebook where you can write down all the tasks you need to complete. But wait, it gets even better! This notebook is actually a computer program that can remind you when things are due, help you prioritize your tasks, and even let you know when you've completed something. Isn't that amazing?Now, let's talk about how this Task Management feature works and how we can test it to make sure it's working properly. You see, before we can start using it, we need to make sure it doesn't have any bugs or problems. That's where testing comes in!Testing is like playing a game of "catch the mistake." We give the Task Management feature different tasks and scenarios to see how it reacts. If it does everything correctly, we give it a big thumbs up! But if it makes a mistake or behaves weirdly, we have to investigate and fix the problem.For example, we might test what happens when you add a new task to your list. Does it show up correctly? What if you have a task due today? Does the program remind you about it? We also need to check if you can mark a task as completed and if it disappears from your list once you've done it.But testing isn't just about checking for mistakes. It's also about making sure the Task Management feature is easy to use and understand. We want it to be simple enough for even the youngest kids to be able to use it without getting confused.So, we might ask some of you to try using the feature and give us feedback. If you find something confusing or difficult, we'll make changes to make it more user-friendly. After all, the whole point of Task Management is to make your life easier, not harder!Now, you might be wondering, "But what if I have a question or run into a problem while using the Task Management feature?" Well, that's where the Q&A part comes in!Whenever you have a question or need help, you can ask the developers (the people who created the Task Management feature) for assistance. They'll be happy to answer your questions and help you solve any problems you might be having.Maybe you're not sure how to add a recurring task, like "Feed the dog every morning." Or perhaps you want to know if you can set reminders for your tasks. Whatever it is, just ask, and the developers will do their best to help you out.But don't worry; you won't have to wait forever for an answer. The developers are dedicated to responding to your questions as quickly as possible. They know how important it is for you to be able to use the Task Management feature without any hiccups.So, there you have it, kids! The Task Management feature is like having a magical assistant to help you stay organized and on top of all your tasks. And with the testing and Q&A process, you can be sure that it's going to work smoothly and be easy to use.Now, go forth and conquer those to-do lists! With Task Management by your side, you'll never forget a homework assignment or chore again. Happy organizing!。

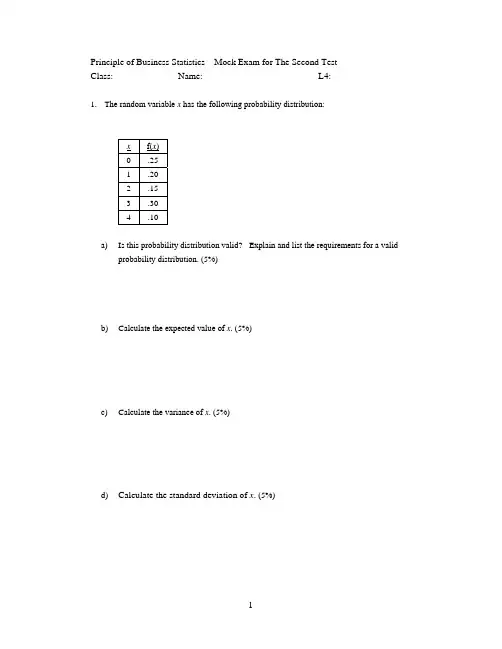

Principle of Business Statistics Mock Exam for The Second TestClass: Name: L4:1.The random variable x has the following probability distribution:x f(x)0 .251 .202 .153 .304 .10a)Is this probability distribution valid? Explain and list the requirements for a validprobability distribution. (5%)b)Calculate the expected value of x. (5%)c)Calculate the variance of x. (5%)d)Calculate the standard deviation of x. (5%)2.The length of time it takes students to complete a statistics examination isuniformly distributed and varies between 40 minutes and 1 hour 30 minutes.a)Find the mathematical expression for the probability density function. (5%)b)Compute the probability that a student will take no more than 60 minutes tocomplete the examination. (5%)c)What is the expected amount of time it takes a student to complete theexamination? (5%)d)What is the variance for the amount of time it takes a student to complete theexamination? (5%)3.The life expectancy of Timely brand watches is normally distributed with a meanof four years and a standard deviation of six months.a)What is the probability that a randomly selected watch will be in workingcondition for more than five years? (5%)b)The company has a three-year warranty period on their watches. Whatpercentage of their watches will be in operating condition after the warrantyperiod? (5%)c)What is the minimum and the maximum life expectancy of the middle 95% ofthe watches? (5%)d)Ninety-five percent of the watches will have a life expectancy of at least howmany months? (5%)4.There are 16,000 students at the University of Central Oklahoma. The average ageof all the students is 24 years with a standard deviation of 9 years. A random sample of 36 students is selected.a)Determine the standard error of the mean (the population size is much largecompared to the sample size). (5%)b)What is the probability that the sample mean will be larger than 19.5? (5%)c)What is the probability that the sample mean will be between 25.5 and 27years? (10%)5. A random sample of 25 observations was taken from a normally distributed population.The average in the sample was 84.6 with a variance of 400.a)Construct a 90% confidence interval for μ.b)Construct a 99% confidence interval for μ.c)Discuss why the 90% and 99% confidence intervals are different.d)What would you expect to happen to the confidence interval in part a if the sample sizewas increased? Be sure to explain your answer.6.Fifty students are enrolled in a statistics class. After the first examination, theinstructor wants to find out some interesting facts about her students. Sherandomly selects a sample of 5 students.a)If she knows the sample mean is 80 and population standard deviation is 8.92,provide a 95% confidence interval for the mean grade of all the students in the class. Interpret your interval estimate. (8%)b)Suppose she doesn’t know the population standard deviation. She randomlyselects a sample of 5 students. The grades were 60, 75, 80, 70, and 90. Whatassumption must be made before we can determine an interval for the meangrade of all the students in the class? Explain why. (12%)c)Continue on the question of b. Assume the assumption of Part b is met.Provide a 80% confidence interval for the mean grade of all the students in the class. (10%)d)Back to the question of a and suppose there are 1 million students in her class.what size sample should be taken so that at 95% confidence the margin oferror will be 1.748 or less? (10%)。

2024年黑龙江学位英语考试真题全文共6篇示例,供读者参考篇1The 2024 Heilongjiang Postgraduate English ExamHi everyone! My name is Xiaoming and I'm a 5th grader. My big sister took the Heilongjiang Postgraduate English Exam this year and I wanted to tell you all about it!First of all, the exam was super hard! My sister had to study for months and months. She took classes, did practice tests, and read lots of big, thick books. Sometimes I would peep over her shoulder when she was studying and all the words looked like gibberish to me. Things like "rhetorical devices" and "syntactical analysis" - what does that even mean?? I'm just a kid but that stuff looked crazy difficult.The exam had different sections testing different skills. There was reading comprehension where you had to read some long passages and answer questions about them. My sister said some of the passages were from super old books written hundreds of years ago with weird outdated language. Yuck! Who wants to read that boring stuff?There was also a listening section where they played audio recordings and you had to answer questions. My sister said the recordings had people speaking in all these different English accents - American, British, Australian. And some of the speakers talked super fast too which made it really hard to understand. If I had to take that section I would have been lost!But I think the worst part for my sister was the writing section. She had to write a huge essay in perfect English about some complicated topic. And she only had like an hour to do it! Can you imagine? I can barely write a one page essay for school in an entire week. How is anyone supposed to write a graduate level essay in an hour? That's insane!Oh and there was also a translation section where you had to translate passages back and forth between Chinese and English. My sister said some of the translations required really advanced vocabulary that you basically had to have memorized special lists of words for. Geez, talk about specific!Anyway, after months of hardcore studying and feeling super stressed out, my sister finally took the exam on a Saturday morning in June. The exam was at some big university downtown and there were tons of other students there looking nervous. My sister said the exam room was completely silent except for thesounds of clicking pens and shuffling paper. For four whole hours she had to sit there and do nothing but this brutally difficult English exam. Doesn't that sound awful??When it was all over, my poor sister looked exhausted. She had to go straight home and take a long nap afterwards! A few weeks later she got her score in the mail and...drumroll please...she passed! Wow, I was so proud of her. She worked incredibly hard and it paid off. Studying that intensely for such a high stakes exam must have been so stressful.After seeing what my sister went through, I've decided I definitely do NOT want to go to graduate school haha! Too much pressure. I'll just be satisfied with the simple life - reading comic books, playing video games, and avoiding high level English exams at all costs!Well, that's my incredibly technical and intellectual overview of the 2024 Heilongjiang Postgraduate English Exam! Hopefully it has educated you on what a monumentally difficult challenge that test is. Us kids are better off just sticking to finger painting, am I right? Let me know if you have any other questions!篇2The Big, Bad Postgrad English ExamI'm Xiao Ming, and I'm 10 years old. My big sister Jing Jing is 22, and she just took the really hard Heilongjiang Postgraduate Entrance English Exam a few weeks ago. She studied sooooo much for it! I saw her hunched over her books every night after dinner for like a year. She said the exam was super important because she needs to pass it with a high score to get into a good graduate program at university.Jing Jing looked pretty nervous in the days leading up to the exam. She kept mumbling English words under her breath and shaking her head. "How am I supposed to remember all these words?" she would say. I felt bad for her.The morning of the exam, our parents made Jing Jing's favorite dumplings for breakfast to give her energy. We all cheered her on as she headed out the door. "You've got this, sis!"I yelled.When she came home after the exam, Jing Jing looked really tired. Her eyes were all squinty and she plopped down on the couch right away. "That was brutal!" she told us. "The reading passages were sooooo long and had all these big fancy words I'd never seen before. And the listening section was really hard too with all the different accents."She said one part asked her to write an essay comparing two theories from different books, but she couldn't remember all the details about the theories. "I just tried my best to analyze them using examples and evidence," she said with a sigh. Another section tested her grammar knowledge with all these tricky questions about verb tenses, conditionals, and parallel structure. "My brain is fried!" Jing Jing exclaimed, holding her head.But the worst part according to Jing Jing was the translation section where she had to translate passages back and forth between English and Chinese. "Those translators have to know so many specialized terms for science, law, business, you name it! How does anyone memorize all that vocabulary?" She threw her arms up in the air dramatically.After staying up late studying every night for so long, Jing Jing was definitely glad it was over. But she still has to wait over a month to get her results back. Our whole family has our fingers crossed that she did well enough to get into her dream graduate program! If not, she may have to take the test again next year. Just thinking about that makes me tired.I don't know how college students like Jing Jing manage such difficult English exams. Remembering grammar rules, understanding long readings, writing analytic essays, andtranslating all seem incredibly hard to me. I'll just be over here practicing my ABCs and simple vocabulary words for now. The big postgrad English exam can wait!篇3The 2024 Heilongjiang Postgraduate English ExamLast month, I had to take a big important test called the Heilongjiang Postgraduate English Exam. It was a super hard test to get into graduate school. I was really nervous!A few weeks before the test, my teacher Ms. Wang had our whole class practice some sample questions. The reading part had all these long, boring passages about history and science. We had to read them and answer comprehension questions. Yuck!"Why do we have to learn about photosynthesis and the Industrial Revolution?" I whined. "That stuff is so booorrring!""You'll appreciate learning it when you're older," Ms. Wang said in this really patient voice. Teachers always say that.The listening part was hard too. We had to listen to conversations and lectures, then answer questions about the main ideas and details. One conversation was about two friendsdeciding what movie to see. How am I supposed to know what they were talking about?"Jason clearly wanted to see the comic book movie, but Samantha convinced him to see the tragic historical drama instead," Ms. Wang explained after playing the audio.I just shook my head. "I don't know how you understood any of that, Ms. Wang."We also had to practice writing essays for the test. The sample prompts were all dull topics like "The Importance of Reading Literature" or "How Teamwork Leads to Success."I much preferred the creative writing we did in class, like the time we wrote stories about going on adventures with our favorite superheroes. My Green Lantern story was way more fun than an essay about literature!Despite all the practice, I was still really nervous for the actual test day. The night before, I could barely sleep thinking about how hard it would be. What if I failed and didn't get into graduate school?The morning of the test, my mom made my favorite breakfast - pancakes with whipped cream and sprinkles on top."Eat up, this will help keep your energy and brain power up for the big test!" she said cheerfully.I just groaned. "I'm too nervous to be hungry."At the exam site, there were students of all ages - teenagers, university students, adults, even some old grandpa types. The room was dead silent except for the sound of pencils frantically bubbling in answers.The reading section was just as boring as I expected, with passages about economic policies in developing nations and experiments on gene mutation. My brain started wandering, thinking about how my friends were probably outside playing baseball or watching TV this beautiful Saturday morning.Then the listening section started and I struggled to pay attention as a biologist droned on and on about the lifecycle of the armadillo lizard. Was that even a real thing? I'm pretty sure Ms. Wang made that one up to practice with.The essay prompt was about whether general education requirements were valuable for university students. Ugh, that topic put me right to sleep. So instead I wrote a secret essay about how Spiderman could have defeated that gooey monsterVenom using only a supersoaker full of soap and water. It was way more exciting than general ed classes, that's for sure!After what felt like dozers, the exam was finally over. I plopped down on a bench outside, drenched in sweat from concentrating so hard."How'd it go?" my dad asked, giving me a high five."Piece of cake!" I said with a wink, then we went to the mall to celebrate being done with that horrible test.A few weeks later, I found out I somehow managed to get a good enough score to get into the graduate program I wanted. I must have spent all my brainpower on that Spiderman essay!So that was my crazy experience with the 2024 Heilongjiang Postgraduate English Exam. Hopefully by the time I'm old enough for graduate school, they'll make the test a little more fun. Maybe they can throw in some questions about superhero movies or video games!篇4Title: The Super Difficult English Test for Big KidsWow, you guys won't believe what happened to me last week! I had to take the craziest, most difficult test ever. It wascalled the 2024 Heilongjiang Postgraduate English Exam. I know, I know, it sounds like a really big kid test, but my parents said I had to take it if I wanted to go to a good middle school someday.The test was held at this huge school with lots of buildings and labs and stuff. When we got there, there were so many big kids around! I felt like a tiny little ant. My mom tried to make me feel better by saying all the big kids were probably really nervous too, but I didn't believe her. They all looked so calm and confident.Once we were allowed inside, we had to go through a million security checks. The teachers looked very serious and kept reminding us that cheating was not allowed AT ALL. I would never cheat of course, but their warnings still made me super nervous. What if I accidentally did something wrong?Finally, we made it to the test room and the proctor passed out the test booklets. I couldn't believe how thick the booklet was! It had to be at least 50 pages long. The first section was listening, which is usually my best section. But these listening passages were no joke. They used all these crazy big vocabulary words that I had never heard before. Words like "ubiquitous" and "juxtaposed." What does that even mean?!After listening, we moved on to reading. This part was THE WORST. The passages were all about things like nuclear physics, global economics, and postmodern literary theory. Umm....hello? I'm only 11 years old! How am I supposed to know anything about that stuff? Skimming and scanning didn't help at all because I couldn't understand most of the words.By the time we got to the writing section, my hand was already cramping from bubbling in so many answers. And you'll never guess what the essay prompt was - "Discuss the implications ofEntralbank monetary policy on developing economies." Say whattttt? I just stared at that prompt for a good 15 minutes before finally deciding to just write a paragraph about my dog Rufus. Hey, at least it was a paragraph!Speaking was the last section, and thank goodness because I was already exhausted. Although it wasn't that much easier than the other sections. The example question was "Using situationally appropriate register and body language, explain the philosophical underpinnings of Kantian deontological ethics to a group of academics." Again...WHAT? If anyone from the test is reading this, here's my best attempt at an answer: "Ethics are good. People should be nice. The end."When the exam was finally over, I was the first one to run out of that room! I didn't even care about the test scores anymore. I just wanted to go home, put on my PJs, and watch a nice silly movie to clear my head.On the car ride home, I asked my mom if all big kid tests are that hard. She said yes, but that I would get used to it over time. Used to it?! I'm not sure I want to get used to feeling stressed and confused for hours on end! I think I might just skip middle school and go straight into the workforce after elementary school. Any places hiring? I'd make a great lemonade stand entrepreneur!篇5The Big Test DayToday was a very important day - the Heilongjiang Postgraduate English Test! I wasn't taking the test myself since I'm only in 4th grade. But my older brother Haoran was taking it because he wants to go to a really good university after high school.Haoran has been studying sooooo hard for this test. He takes it super seriously. Every night for months, he has been reading, writing practice essays, doing practice tests, andlistening to English audio lessons. Sometimes I try to distract him by making funny faces when he's studying, but he just ignores me. He's really focused when it comes to his English studies.This morning, Haoran woke up at 6am which is soooo early! He had to leave by 7:15 to get to the test center on time. The test was being held at a big high school across town. While he was getting ready, I could hear him muttering English words under his breath for practice. "Conscientious, gregarious, superfluous..." I don't even know what those words mean!Mom made Haoran a huge breakfast to help his brain. She made his favorite - jianbing from the street vendor down the road. It's like a crispy crepe stuffed with eggs, vegetables, sauces and crackers. He stuffed it all in his face so fast! I thought he was going to choke. Then he gulped down three glasses of milk too. I don't think I've ever seen anyone eat that much for breakfast before. "Brain food," Mom said with a wink.Finally it was time for Haoran to leave. Dad drove him to the test center. Before he left, I gave Haoran a big hug for good luck. "Knock 'em dead, bro!" I said, giving him a nuggie on the head. He just rolled his eyes at me. Typical older brother stuff. But I could tell he was nervous under that cool demeanor.The test was scheduled to last almost 5 hours total with just a short break halfway through. It had every section you could imagine - reading comprehension, listening, writing essays, filling in sentences, speaking, and even some math word problems! They really tested absolutely every English skill in the book. No wonder Haoran had studied so hard - this test seemed crazy difficult.While Haoran was suffering through the marathon test session, the rest of us tried to have a pretty normal Saturday at home. But it seemed weird without Haoran there. We're so used to him being around muttering English phrases and vocabulary words all day long.For lunch, Mom made Haoran's favorite dumplings filled with egg, shrimp and pork. She saved a huge helping for him, covering the plate in plastic wrap so they'd stay hot and fresh for when he got home later. Yum!Around 3pm, Dad went to pick up Haoran from the test center. I could hear the car pull into the driveway. I ran outside to watch Haoran getting out of the car. He looked exhausted, like a weight had been lifted off his shoulders. His hair was all ruffled and messed up. I gave him a big hug and asked "How'd it goooooo?"Haoran shrugged casually like it was no big deal. But then a small smile crept across his face and he finally admitted, "It was hard...but I think I did pretty well!"Yes! All that hard work had paid off. I already knew my big brother was wicked smart. But seeing his confidence after conquering that massive test made me look up to him even more.I have a feeling Haoran is going to get into the best university ever. Then he'll keep on slaying it and become wildly successful at whatever he decides to do. Probably something amazing that requires amazing English skills.After his stressful day, Haoran deserved a break. We all gathered around the table to feast on Mom's delicious dumplings. Haoran told us all about the different sections as he inhaled dumpling after dumpling. There were some hard reading passages about environmental science. An easy children's song for the listening portion (child's play for Haoran!). He had to write a persuasive essay about net migration trends.The whole family listened raptly as Haoran regaled us with tales from his test day. Well, Mom, Dad and I listened. Our little brother Junjie was too busy shoveling dumplings into his mouth to pay any attention, as usual. I'm just glad the hard part is overfor Haoran. No more stuffy study sessions or practice tests for a while. We can finally get our fun, goofy brother back!Tonight I'm going to make a special celebration for Haoran before bed: grilled sticky rice cakes from the street vendor, his favorite! He'll need a delicious dessert to fully recharge after today's mental marathon. I'm so proud of him for conquering this test. It's one of his biggest accomplishments so far, but I know there are many more amazing things to come.Bring it on, Haoran! The world better get ready.篇6The Big English TestWow, what a day yesterday was! I had to take the super important Heilongjiang Postgraduate Entrance English Exam. My mom and dad have been helping me get ready for months. They said this test is really hard and I need to do my best if I want to get into a good university later on.I was pretty nervous leading up to the test day. In the weeks before, we did a ton of practice questions from old exams. The reading passages were so long and had all these big vocabulary words I'd never seen before. The grammar questions were trickytoo, with all the rules about verb tenses, conditionals, and modals. My parents made me memorize tons of vocab words and grammar rules. It was like drinking from a firehose!The listening section stressed me out too. You have to listen really carefully to conversations and lectures, then answer questions about the details. The speakers talk so fast and use difficult academic words. We practiced listening exercises over and over, but I still found it really hard to catch everything.By far the worst section for me was the writing. We had to write essays on complex abstract topics like "The Impact of Technology on Modern Society" or "Balancing Economic Growth and Environmental Protection." How is a 10-year-old supposed to know anything about that stuff? My mom is an English teacher, so she coached me on how to structure an essay, use transition words, and write sophisticated sentences. But coming up with enough relevant content to fill two whole essays was pure misery.So with my brain overflowing from all that prep work, test day finally arrived. We had to get to the exam site super early in the morning. As my dad drove me there, my mind was racing –what if I blank out? What if I can't understand the listening audio?What if my essay is garbage? I tried my best not to have a panic attack on the way there.When we arrived, the test site was chaos. Long lines of stressed out students checking in, proctors barking orders, nervous parents saying last minute words of encouragement. It was overwhelming! Finally, they let us into the auditorium to start the testing.The first sections were the dreaded listening and reading. Just。

2014LevelⅠMock Exam:Afternoon Session1.Linda Chin,CFA,is a member of a political group advocating less governmental regulation in all aspects of life.She works in a country where local securities laws are minimal and insider trading isnot prohibited.Chin's politics are reflected in her investment strategy,where she follows hercountry's mandatory legal and regulatory requirements.Which of the following actions by Chin wouldbe most consistent with the CFA Institute Standards of Professional Conduct?A.Continuing her current investment strategyB.Following the CFA Institute Standards of Professional ConductC.Disclosing her political advocacy to clients【答案】B【解析】“Guidance for Standards I-VII,”CFA InstituteStandard I(A):Knowledge of the Law,Standard II(A):Material Nonpublic InformationStandard I(A):Knowledge of the Law requires members and candidates to comply with the morestrict law,rules,or regulations and follow the highest requirement,which in this case would be the CFA Institute Standards of Professional Conduct.Standard II(A):Material Nonpublic Information would also apply because members and candidates who possess material nonpublic information that could affect the value of an investment must not act or cause others to act on theinformation.Disclosure that she meets local mandatory legal requirements--versus the more strict law,rules,or regulations mandate of the Standards of Professional Conduct--would not excuse the member from following the Standards of Professional Conduct.2.Colleen O'Neil,CFA,manages a private investment fund with a balanced global investmentmandate.Her clients insist that her personal investment portfolio replicate the investments withintheir portfolios to assure them she is willing to put her own money at risk.By undertaking which ofthe following simultaneous investment actions for her own portfolio would O'Neil most likely be inviolation of Standard VI(B):Priority of Transactions?A.Sale of a listed US blue chip value stockB.Purchase of a UK government bond in the primary marketC.Participation in a popular frontier market IPO【答案】C【解析】“Guidance for Standards I-VII,”CFA InstituteStandard VI(B):Priority of TransactionsStandard VI(B):Priority of Transactions dictates members and candidates give their clients and employer priority when making personal investment transactions. Even when clients allow orinsist the manager invest alongside them,the manager's transactions must never adversely affect the interests of the clients.A popular or“hot”IPO in a frontier market is likely to beoversub cribed.In such cases,Standard VI(B)dictates that the manager should not participate in this event to better ensure clients will have a higher probability of getting their full subscription allotment, even though clients have allowed or dictated that she participate alongside them.licent Plain has just finished taking Level II of the CFA examination.Upon leaving the examinationsite,she meets with four Level III candidates who also just sat for their exams.Curious about their examination experience,Plain asks the candidates how difficult the Level III exam was and how theydid on it.The candidates say the essay portion of the examination was much harder than they had expected and that they were not able to complete all questions as a result.The candidates go on totell Plain about broad topic areas that were tested and complain about specific formulas they hadmemorized that did not appear on the exam.The Level III candidates least likely violated the CFAInstitute Standards of Professional Conduct by discussing:A.specific formulas.B.the examination essays.C.broad topic areas.【答案】B【解析】“Guidance for Standards I-VII,”CFA InstituteStandard VII(A):Conduct as Members and Candidates in the CFA ProgramDiscussing the level of difficulty of the essay portion of the examination did not violate Standard VII(A):Conduct as Members and Candidates in the CFA Program. Standard VII(A)and the Candidate Pledge were violated by candidates when they revealed broad topic areas and formulas tested or not tested on the exam.4.Heidi Halvorson,CFA,is the chief investment officer for Tukwila Investors,an asset managementfirm specializing in fixed-income investments.Tukwila is in danger of losing one of its largest clients,Quinault Jewelers,which accounts for nearly one-third of its revenues.Quinault recently told Halverson that Tukwila would be fired unless the performance of Quinault's portfolio improvessignificantly. Shortly after this conversation,Halvorson purchases two corporate bonds she believesare suitable for any of her clients based on third-party research from a reliable and diligent source.Immediately after the purchase,one bond increases significantly in price while the other bonddeclines significantly.At the end of the day,Halvorson allocates the profitable bond trade to Quinaultand the other bond to two of her largest institutional accounts.Halvorson most likely violated the CFA Institute Standards of Professional Conduct in regard to:A.client suitability.B.third-party research.C.trade allocations.【答案】C【解析】Guidance for Standards I-VII,”CFA InstituteStandard Ill(B):Fair Dealing,Standard Ill(C):Suitability,Standard V(A):Diligence and Reasonable BasisThe investment officer failed to deal fairly by allocating profitable trades to a favored client at the expense of others,a violation of Standard Ill(B):Fair Dealing. The standard requires members and candidates to treat all clients fairly when taking investment action.Tukwila should have a systematic approach to allocating trades,such as pro rata,before or at the time of tradeexecution,or as soon as possible after trades are executed.The analyst believes the bonds are suitable for any of her clients,so she has not violated Standard Ill(C):Suitability.5.Jack Steyn,CFA,recently became the head of the trading desk at a large investment managementfirm that specializes in domestic equities.While reviewing the firm's trading operations,he notices clients give discretion to the manager to select brokers on the basis of their overall services to themanagement firm.Despite the client directive,Steyn would most likely violate Standard Ill(A):Loyalty, Prudence,and Care if he pays soft commissions for which of the following services from thebrokers?A.Database services for offshore investmentsB.Equity research reportsC.Investment conference attendance【答案】A【解析】“Guidance for Standards I-VII,”CFA Institute Standard Ill(A):Loyalty,Prudence, and CareStandard Ill(A):Loyalty,Prudence,and Care stipulates that the client owns the brokerage.Therefore,members and candidates are required to use client brokerage only to the benefit of the clients(soft commissions policy).Because the firm specializes in domestic equities,an offshore investment database service would not benefit the clients.6.Based on his superior return history,Vijay Gupta,CFA,is interviewed by the First Faithful Church tomanage the church's voluntary retirement plan's equity portfolio.Each church staff member chooseswhether to opt in or out of the retirement plan according to his or her own investment objectives.Theplan trustees tell Gupta that stocks of companies involved in the sale of alcohol,tobacco, gambling,or firearms are not acceptable investments given the objectives and constraints of the portfolio.Gupta tells the trustees he cannot reasonably execute his strategy with these restrictions and that allhis other accounts hold shares of companies involved in these businesses because he believes theyhave the highest alphA.By agreeing to manage the account according to the trustees'wishes, doesGupta violate the CFA Institute Standards of Professional Conduct?A.Yes,because the restrictions provided by the trustees are not in the best。

Mock函数中的特定函数1. 定义在软件开发中,Mock函数是一种用于模拟测试中依赖项的行为的技术。

Mock函数可以用来替换调用实际的依赖项,以模拟对该依赖项的调用并返回预先定义的结果。

Mock函数可以帮助我们在测试中隔离被测系统的各个组件,在没有真实依赖项的情况下测试系统的各个部分。

Mock函数的定义及用法可以根据具体的开发语言和测试框架的不同而略有差异,本文主要以Python中的unittest.mock库为例进行解释。

2. 用途Mock函数的主要用途是在单元测试中模拟依赖项的行为。

在传统的单元测试中,为了测试一个函数或方法,我们通常需要在测试代码中实例化和配置一些依赖项。

这种方式可能会导致以下几个问题:•依赖项的创建和配置可能很麻烦,需要编写大量的测试代码;•依赖项的行为可能不可预知或不稳定,导致测试结果不确定;•依赖项的调用可能涉及到一些非功能性的操作,比如网络请求、文件读写等,会使测试变得缓慢、不可靠、难以重复。

Mock函数可以帮助我们解决这些问题。

通过使用Mock函数,我们可以轻松地创建、配置和使用一个模拟的依赖项,以便更有效地进行单元测试。

具体来说,Mock函数可以用于以下几种情况:模拟函数的返回值Mock函数可以用来替代某个函数的调用,并返回我们预先定义的结果。

这在我们需要测试一个函数对不同情况的处理能力时非常有用。

例如,我们可以使用Mock函数模拟一个网络请求的返回结果,以确保被测函数能正确地处理各种网络请求的响应。

模拟函数的调用Mock函数可以被配置为记录自己的调用信息,包括传入的参数和调用的次数。

这对于需要验证某个函数是否被正确调用、被调用的次数是否正确等情况非常有用。

例如,我们可以使用Mock函数来模拟一个文件写入函数的调用,并验证被测函数是否正确地调用了该函数。

模拟异常的抛出Mock函数还可以被配置为在被调用时抛出一个指定的异常。

这对于测试被测函数在异常情况下的处理能力非常有用。

mock的使用方法-回复mock是一种在软件开发中常用的测试工具和技术。

它可以帮助开发者模拟测试环境中的各种情况和数据,以验证代码的功能和性能。

本文将详细介绍mock的使用方法,以及如何实现一步一步的回答。

第一步:了解mock的基本概念和作用mock是一个全面的测试框架,它可以创建虚拟对象,并模拟实际环境中的各种情况和数据。

通过使用mock,开发人员可以轻松地测试和验证代码的行为,而无需依赖于实际的数据库、网络连接或其他外部资源。

mock的使用可以提高代码测试的可靠性和效率,同时也能够帮助开发者更早地发现和解决潜在的问题。

第二步:选择适合的mock库在使用mock之前,我们需要选择适合自己项目的mock库。

目前比较流行的mock库有Pytest-mock、unittest.mock和Mockito等。

不同的mock库对于不同的编程语言和应用场景都有各自的优势和适应性。

因此,在选择mock库之前,我们需要仔细研究各个mock库的文档和示例,以便找到最适合自己的工具。

第三步:安装和配置mock库安装和配置mock库是使用mock的第一步。

根据所选择的mock库,我们需要按照相应的指南和说明来安装mock库,并确保其正常工作。

通常情况下,mock库可以通过软件包管理器直接安装,也可以通过源代码进行手动安装。

第四步:创建mock对象mock对象是测试中最基本的单位,它可以模拟实际对象的行为和属性。

在创建mock对象时,我们需要注意其类型和用途。

有些mock库提供了专用的函数和语法来创建不同类型的mock对象,如函数mock、类mock和属性mock等。

在创建mock对象时,我们可以根据需要指定其返回值和行为,以实现精确的模拟效果。

第五步:配置mock对象的行为配置mock对象的行为是使用mock的核心步骤之一。

通过配置mock 对象的行为,我们可以模拟各种特定的情况和数据,并验证代码的行为是否符合预期。

MockExamLevelI2003finalwanswers(2)The Association for Investment Management and Research (AIMR sm) does not endorse, promote, review, or warrant the accuracy of the products or services offered by organizations sponsoring or providing CFA? exam preparation materials or programs, nor does AIMR verify pass rates or exam results claimed by such organizations.D O NOT OPEN THIS EXAM COVER SHEET UNTIL INSTRUCTED TO DO SO BYEXAMINATION SUPERVISOR2003 CFA? Level I Mock ExamSASF Practice Exam 2003Saturday, May 3, 2003Instructors:Patrick Collins, Ph.D., CFAEd Cordisco, CPADon Davis, CFAJustin Johnson, CFAJivendra Kale, Ph.D.Jim Keene, CFAJohn Stratton, CFA, CFPMatt Tucker, CFAProf. John M. Veitch, Ph.D., CFALoren Walden, CFAThe Security Analysts of San FranciscoSASF CFA? Level I 2003 Practice ExamSaturday, May 3, 2003Questions Topics # of Questions Instructor1 – 16 Ethical Conduct and PPS 16 questions Loren Walden17 – 34 Quantitative Analysis 18 questions J Veitch/J Kale35 – 49 Economics 15 questions John Veitch50 – 64 Financial Statement Analysis I 15 questions J. Johnson65 –79 Financial Statement Analysis II 15 questions Ed Cordisco80 – 93 Equity Valuation 14 questions J Keene/J Stratton94 – 107 Fixed Income 14 questions M Tucker108 –117 Derivatives/Alt. Investments 10 questions D Davis/J. Keene 118 –122 Portfolio Management 5 questions Patrick Collins122 questionsPlease note that the distribution of questions on the SASF CFA Level I Practice exam broadly reflects the weights placed on each subject area by the CFA Level I study guide. There is no guarantee that the questions on the actual CFA exam will reflect these relative weights.The Association for Investment Management and Research (AIMR sm) does not endorse,promote, review, or warrant the accuracy of the products or services offered by organizationssponsoring or providing CFA? exam preparation materials or programs, nor does AIMR verify pass rates or exam results claimed by such organizations.Study Session #1 – Ethics2003 Loren W. Walden, CFA. All rights reserved. Reproduction in any form, in whole or in part, is prohibited without permission.1. Which of the following is an element when defining a beneficial owner in regard to priority of transactions?A.Direct or indirect (family) monetary interest in the security;B.Voting influence on the securities;C.Power to dispose or direct the disposition of the security;D.All of the above2. Which of the following items are required in regard to managing a client portfolio when making a recommendation or action on behalf of the client?A.Update your knowledge of the client circumstances bi-annually.B.Do not represent opinions as facts.C.Tell your clients how the investment process works.D.B and C only3. Which of the following items are not allowed even if they are disclosed to the employer and to the client in writing prior to the potential conflict?A.Gifts greater than $1000 in value.B.Gifts from a client to the portfolio manager of any value.C.Neither of these are allowedD.Both of these are allowedFanky Quattro, CFA and portfolio manager of You Can Trust Us (YCTU) mutual fund and individual portfolio management services recently received a call from one of the brokers covering his account. The broker had 25,000 shares of an initial public offering that was priced at $13 dollars a share and opened for trading at $30. The broker said to Fanky “I’m glad to get these to you, but we expect you to buy more shares in the aftermarket to support the stock. And we also strongly suggest that you take a hard look at our other investment banking deals if you want to continue getting allocations like this.”Based on the information above, Fanky decides to put the entire allocation into his largest three clients so that each one gets a 1% position. He decided to allocate the shares this waybecause the position would be too small to impact the mutual fund.4. Which of the following is true?A.Fanky should not take the shares because of the implied quid pro quo;B.Fanky is in direct violation with the higher standards of AIMR by accepting shares thatare not “blue skied.”C.Fanky violated AIMR rules by not dealing fairly with all of his clients.D.Fanky has not made any violations at this point given the information above.5. The Designated Officer (D.O.), when reviewing a violation of AIMR’s code of ethics, can perform which of the following duties?A.Institute a private censure for minor infractions to which the covered person can acceptby not responding or can reject in writing within 30 days of receipt of the private censure notification;B.Request material and notify the covered person of the right to be represented by counsel;C.Terminate the investigation;D.All of the above.6. Which of the following is not one of the parties the GIPS standards were created for?A.Prospective clients but not existing clientsB.International investment management firmsC.Prospective clients and existing clientsD.Domestic investment management firms7. Which of the following is not a key characteristic of GIPS?A.If local law conflicts with GIPS the firm is required to comply with the local law andmust disclose the conflict.B.If local law conflicts with GIPS the firm is required to comply with GIPS because itis the higher standard.C.GIPS are the minimum world wide standard where local laws may not exist.D.Applies to the presentation of investment performance on behalf of a third party.8. Under GIPS, historical performance MUST be presented for at least five years or since inception if the firm is new. After five years has been accumulated in compliance with GIPS standards the firm MUST add subsequent years until ten years is recorded. From that point forward the firm can drop one year each year going forward and keep reporting just ten years worth of data.A.TrueB.FalseC.Neither true nor false because it depends on the country of origin.D.Neither true nor false because the performance is retroactive for the full 10 years ofoperation rolling each year successively into the existing AIMR PPS until the prior tennon-GIPS is in place.9. The scope and purpose of GIPS third party verification is to increase the level of confidence that a firm claiming GIPS compliance did adhere to the standards and GIPS verification is for the firm not the composite.A.TrueB.False10. Which of the following is not a requirement of the disclosures under GIPS?A.If managed against a specific benchmark, the percentage not invested in countriesincluded in the benchmark;B.If local law overrides GIPS law and how this impacts presentation;C.If cash allocations are not allowed;D.If a carve out, how cash is accounted for.Questions 11 though 13 are to be answered from the case below:Thomas Whitman, CFA, is the senior portfolio manager for Red Tree Capital, a large independent investment advisor that has $2 billion under management comprised ofcorporate pension accounts and family trusts. The firm has adopted AIMR’s Code andStandards and all newly hired employees are given a copy of the code and asked to sign a document stating that they have read the code. Thomas is responsible for all junior portfolio managers and the trading staff as part of his duties.One of his traders recently received a block trade order given to him by portfolio manager Jeff Johnston, CFA. The following quote is Jeff speaking to the trader: “I just got off the phone with our biotech analyst, Frederica Fortune. She said that Genetime is ripe to be bought by a large pharmaceutical company and that it is a bargain at any price below $12! She also said that even though she has only been covering the stock a short period, her meeting with management yesterday was upbeat and she is confident that management is going places.The fact that it is a single product company in early trial phase did not temper her views because she believes the product has the potential to be ablockbuster. The stock is at $11, go ahead and buy $10 million dollars worth- up to a price of $12. I am putting it in all of my accounts and will get the account numbers to you as the orders fill.”The trade takes several days to complete and then Jeff de cides which portfolios will get each day’s order fills at the end of the trading session. Since the large pension accounts require more shares, he has directed the majority of the first trades to these pension accounts to fill the appropriate allocation.。

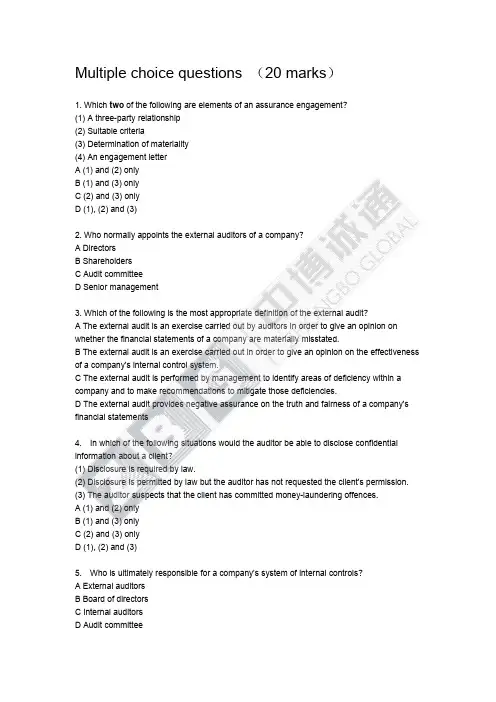

Multiple choice questions(20marks)1.Which two of the following are elements of an assurance engagement?(1)A three-party relationship(2)Suitable criteria(3)Determination of materiality(4)An engagement letterA(1)and(2)onlyB(1)and(3)onlyC(2)and(3)onlyD(1),(2)and(3)2.Who normally appoints the external auditors of a company?A DirectorsB ShareholdersC Audit committeeD Senior management3.Which of the following is the most appropriate definition of the external audit?A The external audit is an exercise carried out by auditors in order to give an opinion on whether the financial statements of a company are materially misstated.B The external audit is an exercise carried out in order to give an opinion on the effectiveness of a company's internal control system.C The external audit is performed by management to identify areas of deficiency within a company and to make recommendations to mitigate those deficiencies.D The external audit provides negative assurance on the truth and fairness of a company's financial statements4.In which of the following situations would the auditor be able to disclose confidential information about a client?(1)Disclosure is required by law.(2)Disclosure is permitted by law but the auditor has not requested the client's permission.(3)The auditor suspects that the client has committed money-laundering offences.A(1)and(2)onlyB(1)and(3)onlyC(2)and(3)onlyD(1),(2)and(3)5.Who is ultimately responsible for a company's system of internal controls?A External auditorsB Board of directorsC Internal auditorsD Audit committee6.Which of the following statements about materiality are correct?(1)Information is material if its omission or misstatement could influence the economic decisions of users of the financial statements.(2)Materiality is based on the auditor's experience and judgement.(3)Materiality is always based on revenue.(4)Materiality should only be calculated at the planning stage of the audit.A(1),(2)and(3)B(1),(3)and(4)C(1)and(2)D(2)and(4)7.What are the two elements of the risk of material misstatement at the assertion level?A Inherent risk and detection riskB Audit risk and detection riskC Inherent risk and control riskD Detection risk and control risk8.'Audit risk'represents the risk that the auditor will give an inappropriate opinion on the financial statements when the financial statements are materially misstated.Which of the following categories of risk can be controlled by the auditor?Category of risk:(1)Control risk(2)Detection risk(3)Sampling riskA(1)and(2)B(2)onlyC(1)and(3)D(2)and(3)9.Which of the following statements are correct with regard to the relationship between the audit plan and the audit strategy for an external audit engagement?(1)The audit plan should be developed before the audit strategy is established.(2)The audit plan and the audit strategy should be established and developed at the same time.(3)The overall audit strategy should be more detailed than the audit plan.(4)The audit strategy should be established before the audit plan is developed.A(1)and(3)B(2)onlyC(3)and(4)D(4)only10.Who is responsible for the prevention and detection of fraud?A Internal auditorsB External auditorsC Those charged with governance and managementD The audit committeeCase Study(80marks)2010.Dec.2aExplain the concept of TRUE and FAIR presentation.2011.Jun.5aYou are the audit manager of Daffy&Co and you are briefing your team on the approach to adopt in undertaking the review and finalisation stage of the audit.In particular,your audit senior is unsure about the steps to take in relation to uncorrected misstatements.During the audit of Minnie Co the following uncorrected misstatement has been noted.The property balance was revalued during the year by an independent expert valuer and an error was made in relation to the assumptions provided to the valuer.Required:(a)Explain the term‘misstatement’and describe the auditor’s responsibility in relation to misstatements.2008.Dec.2bAuditors have various duties to perform in their role as auditors,for example,to assess the truth and fairness of the financial statements.Required:Explain THREE rights that enable auditors to carry out their duties.2013.J.1bIntroductionFox Industries Co(Fox)manufactures engineering parts.It has one operating site and a customer base spread across Europe.The company’s year end was30April2013.Below is a description of the purchasing and payments system.Purchasing systemWhenever production materials are required,the relevant department sends a requisition form to the ordering department.An order clerk raises a purchase order and contacts a number of suppliers to see which can despatch the goods first.This supplier is then chosen.The order clerk sends out the purchase order.This is not sequentially numbered and only orders above$5,000require authorisation. Purchase invoices are input daily by the purchase ledger clerk,who has been in the role for many years and,as an experienced team member,he does not apply any application controls over the input process.Every week the purchase day book automatically updates the purchase ledger,the purchase ledger is then posted manually to the general ledger by the purchase ledger clerk.Payments systemFox maintains a current account and a number of saving(deposit)accounts.The current account is reconciled weekly but the saving(deposit)accounts are only reconciled every two months.In order to maximise their cash and bank balance,Fox has a policy of delaying payments to all suppliers for as long as possible.Suppliers are paid by a bank transfer.The finance director is given the total amount of the payments list,which he authorises and then processes the bank payments.Required:(b)As the external auditors of Fox Industries Co,write a report to management in respect of the purchasing andpayments system described above which:(i)Identifies and explains FOUR deficiencies in the system;and(ii)Explains the possible implication of each deficiency;and(iii)Provides a recommendation to address each deficiency.A covering letter IS required.Note:Up to two marks will be awarded within this requirement for presentation and the remaining marks will be split equally between each part.2013.Dec.1d2Minty Cola Co(Minty)manufactures fizzy drinks such as cola and lemonade as well as other soft drinks and its year end is31December2013.You are the audit manager of Parsley&Co and are currently planning the audit of Minty.You attended the planning meeting with the engagement partner and finance director last week and recorded the minutes from the meeting shown below.You are reviewing these as part of the process of preparing the audit strategy.Minutes of planning meeting for MintyMinty’s trading results have been strong this year and the company is forecasting revenue of$85million, which is an increase from the previous year.The company has invested significantly in the cola and fizzy drinks production process at the factory.This resulted in expenditure of$5million on updating, repairing and replacing a significant amount of the machinery used in the production process.As the level of production has increased,the company has expanded the number of warehouses it uses to store inventory.It now utilises15warehouses;some are owned by Minty and some are rented from third parties.There will be inventory counts taking place at all15of these sites at the year end.A new accounting general ledger has been introduced at the beginning of the year,with the old and new systems being run in parallel for a period of two months.As a result of the increase in revenue,Minty has recently recruited a new credit controller to chase outstanding receivables.The finance director thinks it is not necessary to continue to maintain an allowance for receivables and so has released the opening allowance of$1·5million.In addition,Minty has incurred expenditure of$4·5million on developing a new brand of fizzy soft drinks. The company started this process in January2013and is close to launching their new product into the market place.The finance director stated that there was a problem in November in the mixing of raw materials within the production process which resulted in a large batch of cola products tasting different.A number of these products were sold;however,due to complaints by customers about the flavour,no further sales of these goods have been made.No adjustment has been made to the valuation of the damaged inventory,which will still be held at cost of$1million at the year end.As in previous years,the management of Minty is due to be paid a significant annual bonus based on the value of year-end total assets.Required:(d)Describe substantive procedures the audit team should perform to obtain sufficient and appropriate audit evidence in relation to the following three matters:(ii)The release of the$1·5million allowance for receivables;and2013.Jun.5bPanda Co manufactures chemicals and has a factory and four offsite storage locations for finished goods.Panda Co’s year end was30April2013.The final audit is almost complete and the financial statements and audit report are due to be signed next week.Revenue for the year is$55million and profit before taxation is$5·6million.The following two events have occurred subsequent to the year end.No amendments or disclosures have been made in the financial statements.Event1–Defective chemicalsPanda Co undertakes extensive quality control checks prior to despatch of any chemicals.Testing on3 May2013found that a batch of chemicals produced in April was defective.The cost of this batch was $0·85million.In its current condition it can be sold at a scrap value of$0·1million.The costs of correcting the defect are too significant for Panda Co’s management to consider this an alternative option.Event2–ExplosionAn explosion occurred at the smallest of the four offsite storage locations on20May2013.This resulted in some damage to inventory and property,plant and equipment.Panda Co’s management have investigated the cause of the explosion and believe that they are unlikely to be able to claim on their insurance.Management of Panda Co has estimated that the value of damaged inventory and property, plant and equipment was$0·9million and it now has no scrap value.Required:For each of the two events above:(i)Explain whether the financial statements require amendment;and(ii)Describe audit procedures that should be performed in order to form a conclusion on any required amendment.Answers to multiple choice questions:1.A2.B3.D4.B5.B6.C7.C8.D9.D10.C。

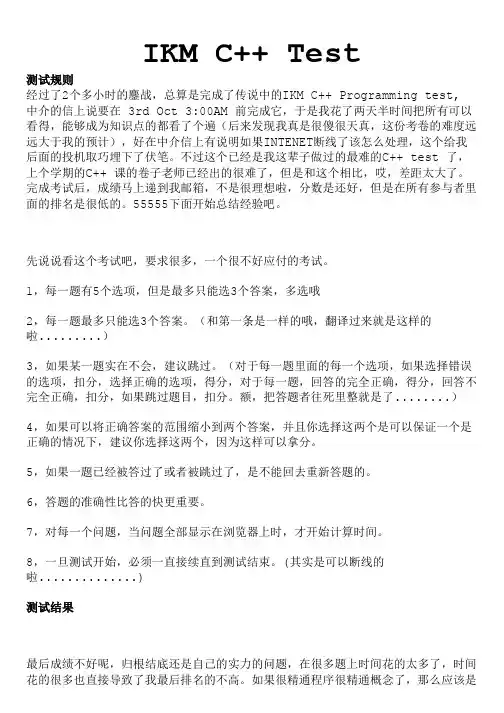

IKM C++ Test测试规则经过了2个多小时的鏖战,总算是完成了传说中的IKM C++ Programming test, 中介的信上说要在 3rd Oct 3:00AM 前完成它,于是我花了两天半时间把所有可以看得,能够成为知识点的都看了个遍(后来发现我真是很傻很天真,这份考卷的难度远远大于我的预计),好在中介信上有说明如果INTENET断线了该怎么处理,这个给我后面的投机取巧埋下了伏笔。

不过这个已经是我这辈子做过的最难的C++ test 了,上个学期的C++ 课的卷子老师已经出的很难了,但是和这个相比,哎,差距太大了。

完成考试后,成绩马上递到我邮箱,不是很理想啦,分数是还好,但是在所有参与者里面的排名是很低的。

55555下面开始总结经验吧。

先说说看这个考试吧,要求很多,一个很不好应付的考试。

1,每一题有5个选项,但是最多只能选3个答案,多选哦2,每一题最多只能选3个答案。

(和第一条是一样的哦,翻译过来就是这样的啦.........)3,如果某一题实在不会,建议跳过。

(对于每一题里面的每一个选项,如果选择错误的选项,扣分,选择正确的选项,得分,对于每一题,回答的完全正确,得分,回答不完全正确,扣分,如果跳过题目,扣分。

额,把答题者往死里整就是了........)4,如果可以将正确答案的范围缩小到两个答案,并且你选择这两个是可以保证一个是正确的情况下,建议你选择这两个,因为这样可以拿分。

5,如果一题已经被答过了或者被跳过了,是不能回去重新答题的。

6,答题的准确性比答的快更重要。

7,对每一个问题,当问题全部显示在浏览器上时,才开始计算时间。

8,一旦测试开始,必须一直接续直到测试结束。

(其实是可以断线的啦..............)测试结果最后成绩不好呢,归根结底还是自己的实力的问题,在很多题上时间花的太多了,时间花的很多也直接导致了我最后排名的不高。

如果很精通程序很精通概念了,那么应该是可以很快做完的。