博迪投资学答案chap006-7thed

- 格式:doc

- 大小:302.00 KB

- 文档页数:14

投资学习题第一篇投资学课后习题与答案乮博迪乯_第6版 由flyesun 从网络下载丆版权归原作者所有。

1. 假设你发现一只装有1 00亿美元的宝箱。

a. 这是实物资产还是金融资产?b. 社会财富会因此而增加吗?c. 你会更富有吗?d. 你能解释你回答b 、c 时的矛盾吗?有没有人因为这个发现而受损呢?2. Lanni Products 是一家新兴的计算机软件开发公司,它现有计算机设备价值30 000美元,以及由L a n n i 的所有者提供的20 000美元现金。

在下面的交易中,指明交易涉及的实物资产或(和)金融资产。

在交易过程中有金融资产的产生或损失吗?a. Lanni 公司向银行贷款。

它共获得50 000美元的现金,并且签发了一张票据保证3年内还款。

b. Lanni 公司使用这笔现金和它自有的20 000美元为其一新的财务计划软件开发提供融资。

c. L a n n i 公司将此软件产品卖给微软公司( M i c r o s o f t ),微软以它的品牌供应给公众,L a n n i 公司获得微软的股票1 500股作为报酬。

d. Lanni 公司以每股80美元的价格卖出微软的股票,并用所获部分资金偿还贷款。

3. 重新考虑第2题中的Lanni Products 公司。

a. 在它刚获得贷款时处理其资产负债表,它的实物资产占总资产的比率为多少?b. 在L a n n i 用70 000美元开发新产品后,处理资产负债表,实物资产占总资产比例又是多少?c. 在收到微软股票后的资产负债表中,实物资产占总资产的比例是多少?4. 检察金融机构的资产负债表,有形资产占总资产的比率为多少?对非金融公司这一比率又如何?为什么会有这样的差异?5. 20世纪6 0年代,美国政府对海外投资者所获得的在美国出售的债券的利息征收 3 0%预扣税(这项税收现已被取消),这项措施和与此同时欧洲债券市场(美国公司在海外发行以美元计值的债券的市场)的成长有何关系?6. 见图1 -7,它显示了美国黄金证券的发行。

博迪《投资学》(第10版)笔记和课后习题详解答案博迪《投资学》(第10版)笔记和课后习题详解完整版>精研学习?>无偿试用20%资料全国547所院校视频及题库全收集考研全套>视频资料>课后答案>往年真题>职称考试第一部分绪论第1章投资环境1.1复习笔记1.2课后习题详解第2章资产类别与金融工具2.1复习笔记2.2课后习题详解第3章证券是如何交易的3.1复习笔记3.2课后习题详解第4章共同基金与其他投资公司4.1复习笔记4.2课后习题详解第二部分资产组合理论与实践第5章风险与收益入门及历史回顾5.1复习笔记5.2课后习题详解第6章风险资产配置6.1复习笔记6.2课后习题详解第7章最优风险资产组合7.1复习笔记7.2课后习题详解第8章指数模型8.2课后习题详解第三部分资本市场均衡第9章资本资产定价模型9.1复习笔记9.2课后习题详解第10章套利定价理论与风险收益多因素模型10.1复习笔记10.2课后习题详解第11章有效市场假说11.1复习笔记11.2课后习题详解第12章行为金融与技术分析12.1复习笔记12.2课后习题详解第13章证券收益的实证证据13.1复习笔记13.2课后习题详解第四部分固定收益证券第14章债券的价格与收益14.1复习笔记14.2课后习题详解第15章利率的期限结构15.1复习笔记15.2课后习题详解第16章债券资产组合管理16.1复习笔记16.2课后习题详解第五部分证券分析第17章宏观经济分析与行业分析17.2课后习题详解第18章权益估值模型18.1复习笔记18.2课后习题详解第19章财务报表分析19.1复习笔记19.2课后习题详解第六部分期权、期货与其他衍生证券第20章期权市场介绍20.1复习笔记20.2课后习题详解第21章期权定价21.1复习笔记21.2课后习题详解第22章期货市场22.1复习笔记22.2课后习题详解第23章期货、互换与风险管理23.1复习笔记23.2课后习题详解第七部分应用投资组合管理第24章投资组合业绩评价24.1复习笔记24.2课后习题详解第25章投资的国际分散化25.1复习笔记25.2课后习题详解第26章对冲基金26.1复习笔记26.2课后习题详解第27章积极型投资组合管理理论27.1复习笔记27.2课后习题详解第28章投资政策与特许金融分析师协会结构28.1复习笔记28.2课后习题详解。

博迪投资学答案chap005-7thedCHAPTER 5: LEARNING ABOUT RETURN AND RISKFROM THE HISTORICAL RECORD1. a. The “Inflation-Plus” CD is the safer investment because it guarantees thepurchasing power of the investment. Using the approximation that the realrate equals the nominal rate minus the inflation rate, the CD provides a realrate of 3.5% regardless of the inflation rate.b. The expected return depends on the expected rate of inflation over the nextyear. If the expected rate of inflation is less than 3.5% then the conventionalCD offers a higher real return than the Inflation-Plus CD; if the expected rateof inflation is greater than 3.5%, then the opposite is true.c. If you expect the rate of inflation to be 3% over the next year, then theconventional CD offers you an expected real rate of return of 4%, which is0.5% higher than the real rate on the inflation-protected CD. But unless youknow that inflation will be 3% with certainty, the conventional CD is alsoriskier. The question of which is the better investment then depends on yourattitude towards risk versus return. You might choose to diversify and investpart of your funds in each.d. No. We cannot assume that the entire difference between the risk-freenominal rate (on conventional CDs) of 7% and the real risk-free rate (oninflation-protected CDs) of 3.5% is the expected rate of inflation. Part of thedifference is probably a risk premium associated with the uncertaintysurrounding the real rate of return on the conventional CDs. This implies thatthe expected rate of inflation is less than 3.5% per year.2.From Table 5.3, the average risk premium for large-capitalization U.S. stocks forthe period 1926-2005 was: (12.15% - 3.75%) = 8.40% per yearAdding 8.40% to the 6% risk-free interest rate, the expected annual HPR for theS&P 500 stock portfolio is: 6.00% + 8.40% = 14.40%3. Probability distribution of price and one-year holding period return for a 30-yearGerman Government bond (which will have 29 years to maturity at year’s end):Economy Probability YTM Price CapitalGainCouponInterestHPRBoom 0.20 11.0% $ 74.05 -$25.95 $8.00 -17.95% Normal Growth 0.50 8.0% $100.00 $ 0.00 $8.00 8.00% Recession 0.30 7.0%$112.28 $12.28 $8.00 20.28%5-14. E(r) = [0.35 ? 44.5%] + [0.30 ? 14.0%] + [0.35 ? (–16.5%)] = 14%σ2 = [0.35 ? (44.5 – 14)2] + [0.30 ? (14 – 14)2] + [0.35 ? (–16.5 –14)2] = 651.175 σ = 25.52%The mean is unchanged, but the standard deviation has increased, as theprobabilities of the high and low returns have increased.5. For the money market fund, your holding period return for the next year depends onthe level of 30-day interest rates each month when the fund rolls over maturingsecurities. The one-year savings deposit offers a 7.5% holding period return for the year. If you forecast that the rate on money market instruments will increasesignificantly above the current 6% yield, then the money market fund might result ina higher HPR than the savings deposit. The 20-year U.K Government bond offers ayield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; however, you could earn a one-year HPR much less than 7.5% on the bond if long-term interest rates increase during the year. If U.K Government bond yields rise above 9%, then the price of the bond will fall, and the resulting capital loss will wipe out some or all of the 9% return you would haveearned if bond yields had remained unchanged over the course of the year.6. a. If businesses reduce their capital spending, then they arelikely to decreasetheir demand for funds. This will shift the demand curve in Figure 5.1 tothe left and reduce the equilibrium real rate of interest.b. Increased household saving will shift the supply of funds curve to the rightand cause real interest rates to fall.c. Open market purchases of U.S. Treasury securities by the Federal ReserveBoard is equivalent to an increase in the supply of funds (a shift of thesupply curve to the right). The equilibrium real rate of interest will fall.5-25-37.The average rates of return and standard deviations are quite different in the sub periods: STOCKS Mean Deviation Skewness Kurtosis1926 –2005 12.15% 20.26% -0.3605 -0.0673 1976 –2005 13.85% 15.68% -0.4575 -0.6489 1926 –1941 6.39% 30.33% -0.0022 -1.0716BONDSMean DeviationSkewness Kurtosis1926 – 2005 5.68% 8.09% 0.9903 1.6314 1976 – 2005 9.57% 10.32% 0.3772 -0.0329 1926 – 19414.42%4.32% -0.5036 0.5034The most relevant statistics to use for projecting into thefuture would seem to be the statistics estimated over the period 1976-2005, because this later period seems to have been a different economic regime. After 1955, the U.S. economy entered the Keynesian era, when the Federal government actively attempted to stabilize the economy and to prevent extremes in boom and bust cycles. Note that the standard deviation of stock returns has decreased substantially in the later period while the standard deviation of bond returns has increased.8. Real interest rates are expected to rise. The investment activity will shift the demand for funds curve (in Figure 5.1) to the right. Therefore the equilibrium real interest rate will increase.9. a %88.50588.070.170.080.0i 1i R 1i 1R 1r ==-=+-=-++=b.r ≈ R - i = 80% - 70% = 10%Clearly, the approximation gives a real HPR that is too high.10. From Table 5.2, the average real rate on T-bills has been:0.72% a. T-bills: 0.72% real rate + 3% inflation = 3.72%b.Expected return on large stocks:3.72% T-bill rate + 8.40% historical risk premium = 12.12%c.The risk premium on stocks remains unchanged. A premium, the difference between two rates, is a real value, unaffected by inflation.11. E(r) = (0.1 × 15%) + (0.6 × 13%) + (0.3 × 7%) = 11.4%12. The expected dollar return on the investment in equities is $18,000 compared to the$5,000 expected return for T-bills. Therefore, the expectedrisk premium is $13,000.13. E(r X) = [0.2 × (?20%)] + [0.5 × 18%] + [0.3 × 50%] =20%E(r Y)= [0.2 × (?15%)] + [0.5 × 20%] + [0.3 × 10%] =10%14. σX 2 = [0.2 ? (– 20 – 20)2] + [0.5 ? (18 – 20)2] + [0.3 ? (50 – 20)2] = 592σX = 24.33%σY 2 = [0.2 ? (– 15 – 10)2] + [0.5 ? (20 – 10)2] + [0.3 ? (10 –10)2] = 175σX = 13.23%15. E(r) = (0.9 × 20%) + (0.1 × 10%) =19%16. E(r) = [0.2 × (?25%)] + [0.3 × 10%] + [0.5 × 24%] =10%17. The probability that the economy will be neutral is 0.50, or 50%. Given a neutraleconomy, the stock will experience poor performance 30% of the time. Theprobability of both poor stock performance and a neutral economy is therefore:0.30 ? 0.50 = 0.15 = 15%18. a. Probability Distribution of the HPR on the Stock Market and Put:STOCK PUTState of the Economy ProbabilityEnding Price +DividendHPR Ending Value HPRBoom 0.30 $134 34% $ 0.00 -100% Normal Growth 0.50 $114 14% $ 0.00 -100% Recession 0.20 $ 84 -16% $ 29.50 146% Remember that the cost of the index fund is $100 per share, and the cost of the put option is $12.5-4b. The cost of one share of the index fund plus a put option is $112. Theprobability distribution of the HPR on the portfolio is:State of the Economy ProbabilityEnding Price +Put +DividendHPR= (134 - 112)/112Normal Growth 0.50 $114.00 1.8% = (114 - 112)/112 Recession 0.20 $113.50 1.3% = (113.50 - 112)/112c. Buying the put option guarantees the investor a minimum HPR of 1.3%regardless of what happens to the stock's price. Thus, it offers insuranceagainst a price decline.19. The probability distribution of the dollar return on CD plus call option is:State of the Economy ProbabilityEnding Valueof CDEnding Valueof CallCombinedValueBoom 0.30 $114.00 $19.50 $133.50 Normal Growth 0.50 $114.00 $ 0.00 $114.00 Recession 0.20 $114.00 $ 0.00 $114.00 5-5。

第8章最优风险资产组合8.1 复习笔记1. 分散化与资产组合风险(1)系统性风险与非系统性风险分散化能够降低风险,但是当共同的风险来源影响所有的公司时,分散化就不能消除风险了。

资产组合的标准差随着证券种类的增加而下降,但是,它不能降至零。

在最充分的分散条件下还存在着市场风险,它来源于与市场有关的因素,这种风险亦被称为“系统风险”,或“不可分散风险”。

而那些可被分散化消除的风险被称为“独特风险”、“特有公司风险”、“非系统风险”或“可分散风险”。

(2)两种风险资产的资产组合①资产组合的风险与收益资产组合的期望收益是资产组合中各种证券的期望收益的加权平均值,即:两资产的资产组合的方差是:②表格法计算组合方差表8-1显示可以通过电子表格计算资产组合的方差。

其中a表示两个共同基金收益的相邻协方差矩阵,相邻矩阵是沿着首排首列相邻每一基金在资产组合中权重的协方差矩阵。

可以通过如下方法得到资产组合的方差:斜方差矩阵中的每个因子与行、列中的权重相乘,把四个结果相加,就可以得出给出的资产组合方差。

表8-1 通过协方差矩阵计算资产组合方差③相关系数与资产组合方差具有完全正相关(相关系数为1)的资产组合的标准差恰好是资产组合中各证券标准差的加权平均值。

相关系数小于1时,资产组合的标准差小于资产组合中各证券标准差的加权平均值。

通过调整资产比例,具有完全负相关(相关系数为-1)的资产组合的标准差可以趋向0。

④资产组合比例与资产组合方差当两种资产负相关时,调整资产组合比例可以得到小于两种资产方差的最小组合方差。

若某个资产比例为负值,表示借入(或卖空)该资产。

⑤机会集机会集是指多种资产进行组合所能构成的所有风险收益的集合。

2. 资产配置(1)最优风险资产组合最优风险资产组合是使资本配置线的斜率(报酬与波动比率)最大的风险资产组合,这样表示边际风险报酬最大。

最优风险资产组合为资产配置线与机会集曲线的切点。

(2)最优完整资产组合最优完整资产组合为投资者无差异曲线与资本配置线的切点处组合,最优完整组合包含风险资产组合(债券和股票)以及无风险资产(国库券)。

投资学精要(博迪)(第五版)习题答案英文版chapter7Essentials of Investments (BKM 5th Ed.)Answers to Selected Problems – Lecture 4Note: The solutions to Example 6.4 and the concept checks are provided in the text.Chapter 6:23. In the regression of the excess return of Stock ABC on the market, the square of thecorrelation coefficient is 0.296, which indicates that 29.6% of the variance of the excesss return of ABC is explained by the market (systematic risk).Chapter 7:3. E(R p) = R f + βp[E(R M) - R f]0.20 = 0.05 + β(0.15 - 0.05)β = 0.15/0.10 = 1.5β=0 implies E(R)=R f, not zero.6. a) False:b) False: Investors of a diversified portfolio require a risk premium for systematic risk. Only thesystematic portion of total risk is compensated.c) False: 75% of the portfolio should be in the market and 25% in T-bills.βp=(0.75 * 1) + (0.25 * 0) = 0.758. Not possible. Portfolio A has a higher beta than B, but a lower expected return.9. Possible. If the CAPM is valid, the expected rate of return compensates only for market risk (beta),rather than for nonsystematic risk. Part of A’s risk may be nonsystematic.10. Not possible. If the CAPM is valid, the market portfolio is the most efficient and a higher reward-to-variability ratio than any other security. In other words, the CML must be better than the CAL for any other security. Here, the slope of the CAL for A is 0.5 while the slope of the CML is 0.33.11. Not possible. Portfolio A clearly dominates the market portfolio with a lower standard deviationand a higher expected return. The CML must be better than the CAL for security A.12. Not possible. Security A has an expected return of 22% based on CAPM and an actual return of16%. Security A is below the SML and is therefore overpriced. It is also clear that security A has a higher beta than the market, but a lower return which is not consistent with CAPM.13. Not possible. Security A has an expected return of 17.2% and an actual return of 16%. Security A isbelow the SML and is therefore overpriced.14. Possible. Portfolio A has a lower expected return and lower standard deviation than the market andthus plots below the CML.17. Using the SML: 6 = 8 + β(18 – 8)β = –2/10 = –.221. The expected return of portfolio F equals the risk-free rate since its beta equals 0. Portfolio A’sratio of risk premium to beta is: (10-4)/1 = 6.0%. You can think of this as the slope of the pricing line for Security A. Portfolio E’s ratio of risk premium to beta is: (9-4)/(2/3) = 7.5%, suggesting that Portfolio E is not on the same pricing line as security A. In other words, there is an arbitrage opportunity here.For example, if you created a new portfolio by investing 1/3in the risk-free security and 2/3 insecurity A, you would have a portfolio with a beta of 2/3 and an expected return equal to (1/3)*4% + (2/3)*10% = 8%. Since this new portfolio has the same beta as security E (2/3) but a lowerexpected return (8% vs. 9%) there is clearly an arbitrage opportunity.26. The APT factors must correlate with major sources of uncertainty in the economy. These factorswould correlate with unexpected changes in consumption and investment opportunities. DNP, the rate of inflation, and interest rates are candidates for factors that can be expected to determine risk premia. Industrial production varies with the business cycle, and thus is a candidate for a factor that is correlated with uncertainties related to investment opportunities in the economy.27. A revised estimate of the rate of return on this stock would be the old estimate plus the sum of the expected changes in the factors multiplied by the sensitivity coefficients to each factor:revised R i = 14% + 1.0(1%) + 0.4(1%) = 15.4%28. E(R P) = r f + βP1[E(R1) - R f] + βP2[E(R2) - R f]Use each security’s sensitivity to the factors to solve for the risk premia on the factors:Portfolio A: 40% = 7% + 1.8γ1 + 2.1γ2Portfolio B: 10% = 7% + 2.0γ1 + (-0.5)γ2Solving these two equations simultaneously gives γ1 = 4.47 and γ2 = 11.88.This gives the following expected return beta relationship for the economy:E(R P) = 0.07 + 4.47βP1 + 11.88βP230. d. From the CAPM, the fair expected return = 8% + 1.25 (15% - 8%) = 16.75%Actually expected return = 17%α = 17% - 16.75% = 0.25%31. d. The risk-free rate34. d. You need to know the risk-free rate. For example, if we assume a risk-free rate of 4%, then the alphaof security R is 2.0% and it lies above the SML. If we assume a risk-free rate of 8%, then the alpha ofsecurity R is zero and it lies on the SML.40. d.。

CHAPTER 1: THE INVESTMENT ENVIRONMENT PROBLEM SETS1.Ultimately, it is true that real assets determine the material well being of aneconomy. Nevertheless, individuals can benefit when financial engineering creates new products that allow them to manage their portfolios of financial assets moreefficiently. Because bundling and unbundling creates financial products with newproperties and sensitivities to various sources of risk, it allows investors to hedgeparticular sources of risk more efficiently.2.Securitization requires access to a large number of potential investors. To attractthese investors, the capital market needs:1. a safe system of business laws and low probability of confiscatorytaxation/regulation;2. a well-developed investment banking industry;3. a well-developed system of brokerage and financial transactions, and;4.well-developed media, particularly financial reporting.These characteristics are found in (indeed make for) a well-developed financialmarket.3.Securitization leads to disintermediation; that is, securitization provides a means formarket participants to bypass intermediaries. For example, mortgage-backedsecurities channel funds to the housing market without requiring that banks or thrift institutions make loans from their own portfolios. As securitization progresses,financial intermediaries must increase other activities such as providing short-term liquidity to consumers and small business, and financial services.4.Financial assets make it easy for large firms to raise the capital needed to financetheir investments in real assets. If Ford, for example, could not issue stocks orbonds to the general public, it would have a far more difficult time raising capital.Contraction of the supply of financial assets would make financing more difficult,thereby increasing the cost of capital. A higher cost of capital results in lessinvestment and lower real growth.5.Even if the firm does not need to issue stock in any particular year, the stock marketis still important to the financial manager. The stock price provides importantinformation about how the market values the firm's investment projects. Forexample, if the stock price rises considerably, managers might conclude that themarket believes the firm's future prospects are bright. This might be a useful signal to the firm to proceed with an investment such as an expansion of the firm'sbusiness.In addition, shares that can be traded in the secondary market are more attractive to initial investors since they know that they will be able to sell their shares. This inturn makes investors more willing to buy shares in a primary offering, and thusimproves the terms on which firms can raise money in the equity market.6. a. No. The increase in price did not add to the productive capacity of the economy.b.Yes, the value of the equity held in these assets has increased.c.Future homeowners as a whole are worse off, since mortgage liabilities have alsoincreased. In addition, this housing price bubble will eventually burst and societyas a whole (and most likely taxpayers) will endure the damage.7. a. The bank loan is a financial liability for Lanni. (Lanni's IOU is the bank'sfinancial asset.) The cash Lanni receives is a financial asset. The new financialasset created is Lanni's promissory note (that is, Lanni’s IOU to the bank).nni transfers financial assets (cash) to the software developers. In return,Lanni gets a real asset, the completed software. No financial assets are created ordestroyed; cash is simply transferred from one party to another.nni gives the real asset (the software) to Microsoft in exchange for a financialasset, 1,500 shares of Microsoft stock. If Microsoft issues new shares in order topay Lanni, then this would represent the creation of new financial assets.nni exchanges one financial asset (1,500 shares of stock) for another($120,000). Lanni gives a financial asset ($50,000 cash) to the bank and getsback another financial asset (its IOU). The loan is "destroyed" in the transaction,since it is retired when paid off and no longer exists.8. a.Assets Shareholders’ equityLiabilities & Computers 30,000 Shareholders’ equity 50,000Total $100,000 Total $100,000 Ratio of real assets to total assets = $30,000/$100,000 = 0.30b.Assets Shareholders’ equity Liabilities & Software product* $ 70,000 Bank loan $ 50,000 Computers 30,000Shareholders’ equity 50,000Total $100,000 Total $100,000 *Valued at costRatio of real assets to total assets = $100,000/$100,000 = 1.0c.Assets Shareholders’ equity Liabilities & Microsoft shares $120,000 Bank loan $ 50,000 Computers 30,000Shareholders’ equity 100,000Total $150,000 Total $150,000 Ratio of real assets to total assets = $30,000/$150,000 = 0.20Conclusion: when the firm starts up and raises working capital, it is characterized bya low ratio of real assets to total assets. When it is in full production, it has a highratio of real assets to total assets. When the project "shuts down" and the firm sells it off for cash, financial assets once again replace real assets.9.For commercial banks, the ratio is: $140.1/$11,895.1 = 0.0118 For non-financialfirms, the ratio is: $12,538/$26,572 = 0.4719 The difference should be expectedprimarily because the bulk of the business of financial institutions is to make loans;which are financial assets for financial institutions.10. a. Primary-market transactionb.Derivative assetsc.Investors who wish to hold gold without the complication and cost of physicalstorage.11. a. A fixed salary means that compensation is (at least in the short run) independentof the firm's success. This salary structure does not tie the manager’s immediatecompensation to the success of the firm. However, the manager might view this asthe safest compensation structure and therefore value it more highly.b.A salary that is paid in the form of stock in the firm means that the managerearns the most when the shareholders’ wealth is maximized. Five years ofvesting helps align the interests of the employee with the long-term performanceof the firm. This structure is therefore most likely to align the interests ofmanagers and shareholders. If stock compensation is overdone, however, themanager might view it as overly risky since the manager’s career is alreadylinked to the firm, and this undiversified exposure would be exacerbated with alarge stock position in the firm.c. A profit-linked salary creates great incentives for managers to contribute to thefirm’s success. However, a manager whose salary is tied to short-term profitswill be risk seeking, especially if these short-term profits determine salary or ifthe compensation structure does not bear the full cost of the project’s risks.Shareholders, in contrast, bear the losses as well as the gains on the project, andmight be less willing to assume that risk.12.Even if an individual shareholder could monitor and improve managers’performance, and thereby increase the value of the firm, the payoff would be small,since the ownership share in a large corporation would be very small. For example,if you own $10,000 of Ford stock and can increase the value of the firm by 5%, avery ambitious goal, you benefit by only: 0.05 × $10,000 = $500In contrast, a bank that has a multimillion-dollar loan outstanding to the firm has a big stake in making sure that the firm can repay the loan. It is clearly worthwhile for the bank to spend considerable resources to monitor the firm.13.Mutual funds accept funds from small investors and invest, on behalf of theseinvestors, in the national and international securities markets.Pension funds accept funds and then invest, on behalf of current and future retirees,thereby channeling funds from one sector of the economy to another.Venture capital firms pool the funds of private investors and invest in start-up firms.Banks accept deposits from customers and loan those funds to businesses, or use the funds to buy securities of large corporations.14.Treasury bills serve a purpose for investors who prefer a low-risk investment. Thelower average rate of return compared to stocks is the price investors pay forpredictability of investment performance and portfolio value.15.With a “top-down” investing style, you focus on asset allocation or the broadcomposition of the entire portfolio, which is the major determinant of overallperformance. Moreover, top-down management is the natural way to establish aportfolio with a level of risk consistent with your risk tolerance. The disadvantageof an exclusive emphasis on top-down issues is that you may forfeit the potentialhigh returns that could result from identifying and concentrating in undervaluedsecurities or sectors of the market.With a “bottom-up” investing style, you try to benefit from identifying undervalued securities. The disadvantage is that you tend to overlook the overall composition of your portfolio, which may result in a non-diversified portfolio or a portfolio with arisk level inconsistent with your level of risk tolerance. In addition, this techniquetends to require more active management, thus generating more transaction costs.Finally, your analysis may be incorrect, in which case you will have fruitlesslyexpended effort and money attempting to beat a simple buy-and-hold strategy.16.You should be skeptical. If the author actually knows how to achieve such returns,one must question why the author would then be so ready to sell the secret to others.Financial markets are very competitive; one of the implications of this fact is thatriches do not come easily. High expected returns require bearing some risk, andobvious bargains are few and far between. Odds are that the only one getting richfrom the book is its author.17.Financial assets provide for a means to acquire real assets as well as an expansionof these real assets. Financial assets provide a measure of liquidity to real assetsand allow for investors to more effectively reduce risk through diversification. 18.Allowing traders to share in the profits increases the traders’ willingness to assumerisk. Traders will share in the upside potential directly but only in the downsideindirectly (poor performance = potential job loss). Shareholders, by contrast, areaffected directly by both the upside and downside potential of risk.19.Answers may vary, however, students should touch on the following: increasedtransparency, regulations to promote capital adequacy by increasing the frequencyof gain or loss settlement, incentives to discourage excessive risk taking, and thepromotion of more accurate and unbiased risk assessment.CHAPTER 2: ASSET CLASSES AND FINANCIALINSTRUMENTSPROBLEM SETS1.Preferred stock is like long-term debt in that it typically promises a fixedpayment each year. In this way, it is a perpetuity. Preferred stock is also likelong-term debt in that it does not give the holder voting rights in the firm.Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments. Failure to make payments does not set off corporate bankruptcy. With respect to the priority of claims to the assetsof the firm in the event of corporate bankruptcy, preferred stock has a higherpriority than common equity but a lower priority than bonds.2.Money market securities are called “cash equivalents” because of their greatliquidity. The prices of money market securities are very stable, and they canbe converted to cash (i.e., sold) on very short notice and with very lowtransaction costs.3.(a) A repurchase agreement is an agreement whereby the seller of a securityagrees to “repurchase” it from the buyer on an agreed upon date at an agreedupon price. Repos are typically used by securities dealers as a means forobtaining funds to purchase securities.4.The spread will widen. Deterioration of the economy increases credit risk,that is, the likelihood of default. Investors will demand a greater premium ondebt securities subject to default risk.high-income investor would be more inclined to pick tax-exempt securities.7. a. You would have to pay the asked price of:86:14 = 86.43750% of par = $864.375b.The coupon rate is 3.5% implying coupon payments of $35.00 annuallyor, more precisely, $17.50 semiannually.c.Current yield = Annual coupon income/price= $35.00/$864.375 = 0.0405 = 4.05%8.P = $10,000/1.02 = $9,803.929.The total before-tax income is $4. After the 70% exclusion for preferred stockdividends, the taxable income is: 0.30 × $4 = $1.20Therefore, taxes are: 0.30 × $1.20 = $0.36After-tax income is: $4.00 – $0.36 = $3.64Rate of return is: $3.64/$40.00 = 9.10%10. a. You could buy: $5,000/$67.32 = 74.27 sharesb.Your annual dividend income would be: 74.27 × $1.52 = $112.89c.The price-to-earnings ratio is 11 and the price is $67.32. Therefore:$67.32/Earnings per share = 11 ⇒ Earnings per share = $6.12d.General Dynamics closed today at $67.32, which was $0.47 higher thanyesterday’s price. Yesterday’s closing price was: $66.8511. a. At t = 0, the value of the index is: (90 + 50 + 100)/3 = 80At t = 1, the value of the index is: (95 + 45 + 110)/3 = 83.333The rate of return is: (83.333/80) − 1 = 4.17%b.In the absence of a split, Stock C would sell for 110, so the value of theindex would be: 250/3 = 83.333After the split, Stock C sells for 55. Therefore, we need to find thedivisor (d) such that: 83.333 = (95 + 45 + 55)/d ⇒ d = 2.340c.The return is zero. The index remains unchanged because the return foreach stock separately equals zero.12. a. Total market value at t = 0 is: ($9,000 + $10,000 + $20,000) = $39,000Total market value at t = 1 is: ($9,500 + $9,000 + $22,000) = $40,500Rate of return = ($40,500/$39,000) – 1 = 3.85%b.The return on each stock is as follows:r A = (95/90) – 1 = 0.0556r B = (45/50) – 1 = –0.10 r C= (110/100) – 1 = 0.10The equally-weighted average is:[0.0556 + (-0.10) + 0.10]/3 = 0.0185 = 1.85%13.The after-tax yield on the corporate bonds is: 0.09 × (1 – 0.30) = 0.0630 = 6.30%Therefore, municipals must offer at least 6.30% yields.14.Equation (2.2) shows that the equivalent taxable yield is: r = r m /(1 – t)a. 4.00%b. 4.44%c. 5.00%d. 5.71%15.In an equally-weighted index fund, each stock is given equal weight regardless ofits market capitalization. Smaller cap stocks will have the same weight as largercap stocks. The challenges are as follows:•Given equal weights placed to smaller cap and larger cap,equalweighted indices (EWI) will tend to be more volatile than theirmarket-capitalization counterparts;•It follows that EWIs are not good reflectors of the broad marketwhich they represent; EWIs underplay the economic importance oflarger companies;•Turnover rates will tend to be higher, as an EWI must be rebalancedback to its original target. By design, many of the transactionswould be among the smaller, less-liquid stocks.16. a. The higher coupon bond.b.The call with the lower exercise price.c.The put on the lower priced stock.17. a. You bought the contract when the futures price was $3.835 (see Figure2.10). The contract closes at a price of $3.875, which is $0.04 more than theoriginal futures price. The contract multiplier is 5000. Therefore, the gainwill be: $0.04 × 5000 = $200.00b.Open interest is 177,561 contracts.18. a. Since the stock price exceeds the exercise price, you exercise the call.The payoff on the option will be: $21.75 − $21 = $0.75The cost was originally $0.64, so the profit is: $0.75 − $0.64 = $0.11b.If the call has an exercise price of $22, you would not exercise for anystock price of $22 or less. The loss on the call would be the initial cost:$0.30c.Since the stock price is less than the exercise price, you will exercise theput.The payoff on the option will be: $22 − $21.75 = $0.25The option originally cost $1.63 so the profit is: $0.25 − $1.63 = −$1.38 19.There is always a possibility that the option will be in-the-money at some timeprior to expiration. Investors will pay something for this possibility of a positivepayoff.20.Value of call at expiration Initial Cost Profita.0 4 -4b.0 4 -4c.0 4 -4d. 5 4 1e.10 4 6Value of put at expiration Initial Cost Profita.10 6 4b. 5 6 -1c.0 6 -6d.0 6 -6e.0 6 -621. A put option conveys the right to sell the underlying asset at the exercise price.A short position in a futures contract carries an obligation to sell the underlyingasset at the futures price.22. A call option conveys the right to buy the underlying asset at the exercise price.A long position in a futures contract carries an obligation to buy the underlyingasset at the futures price.CFA PROBLEMS1.(d)2.The equivalent taxable yield is: 6.75%/(1 − 0.34) = 10.23%3.(a) Writing a call entails unlimited potential losses as the stock price rises.4. a. The taxable bond. With a zero tax bracket, the after-tax yield for thetaxable bond is the same as the before-tax yield (5%), which is greater than the yield on the municipal bond.b. The taxable bond. The after-tax yield for the taxable bond is:0.05× (1 – 0.10) = 4.5%c. You are indifferent. The after-tax yield for the taxable bond is:0.05 × (1 – 0.20) = 4.0%The after-tax yield is the same as that of the municipal bond.d. The municipal bond offers the higher after-tax yield for investors in taxbrackets above 20%.5.If the after-tax yields are equal, then: 0.056 = 0.08 × (1 – t) This implies that t =0.30 =30%.CHAPTER 3: HOW SECURITIES ARE TRADEDPROBLEM SETS1.Answers to this problem will vary.2.The dealer sets the bid and asked price. Spreads should be higher on inactivelytraded stocks and lower on actively traded stocks.3. a. In principle, potential losses are unbounded, growing directly with increases inthe price of IBM.b.If the stop-buy order can be filled at $128, the maximum possible loss pershare is $8, or $800 total. If the price of IBM shares goes above $128, then thestop-buy order would be executed, limiting the losses from the short sale.4.(a) A market order is an order to execute the trade immediately at the best possibleprice. The emphasis in a market order is the speed of execution (the reduction ofexecution uncertainty). The disadvantage of a market order is that the price it will be executed at is not known ahead of time; it thus has price uncertainty.5.(a) The advantage of an Electronic Crossing Network (ECN) is that it can executelarge block orders without affecting the public quote. Since this security is illiquid, large block orders are less likely to occur and thus it would not likely trade through an ECN.Electronic Limit-Order Markets (ELOM) transact securities with high tradingvolume. This illiquid security is unlikely to be traded on an ELOM.6. a. The stock is purchased for: 300 × $40 = $12,000The amount borrowed is $4,000. Therefore, the investor put up equity, ormargin, of $8,000.b.If the share price falls to $30, then the value of the stock falls to $9,000. Bythe end of the year, the amount of the loan owed to the broker grows to: $4,000× 1.08 = $4,320Therefore, the remaining margin in the investor’s account is: $9,000− $4,320 = $4,680The percentage margin is now: $4,680/$9,000 = 0.52 = 52% Therefore,the investor will not receive a margin call.c.The rate of return on the investment over the year is:(Ending equity in the account − Initial equity)/Initial equity= ($4,680 − $8,000)/$8,000 = −0.415 = −41.5%7. a. The initial margin was: 0.50 × 1,000 × $40 = $20,000As a result of the increase in the stock price Old Economy Traders loses:$10 × 1,000 = $10,000Therefore, margin decreases by $10,000. Moreover, Old Economy Tradersmust pay the dividend of $2 per share to the lender of the shares, so that themargin in the account decreases by an additional $2,000. Therefore, theremaining margin is:$20,000 – $10,000 – $2,000 = $8,000b.The percentage margin is: $8,000/$50,000 = 0.16 = 16% So there will be amargin call.c.The equity in the account decreased from $20,000 to $8,000 in one year, for arate of return of: (−$12,000/$20,000) = −0.60 = −60%8. a. The buy order will be filled at the best limit-sell order price: $50.25b.The next market buy order will be filled at the next-best limit-sell order price:$51.50c.You would want to increase your inventory. There is considerable buyingdemand at prices just below $50, indicating that downside risk is limited. Incontrast, limit sell orders are sparse, indicating that a moderate buy order couldresult in a substantial price increase.9. a. You buy 200 shares of Telecom for $10,000. These shares increase in value by10%, or $1,000. You pay interest of: 0.08 × $5,000 = $400The rate of return will be: $1,000 −$400 = 0.1212%=$5,000b.The value of the 200 shares is 200P. Equity is (200P – $5,000). You willreceive a margin call when:= 0.30 ⇒ when P = $35.71 or lower10. a. Initial margin is 50% of $5,000 or $2,500.b.Total assets are $7,500 ($5,000 from the sale of the stock and $2,500 put up formargin). Liabilities are 100P. Therefore, equity is ($7,500 – 100P). A margincall will be issued when:$7,500 −100P = 0.30⇒ when P = $57.69 or higher100P11.The total cost of the purchase is: $40 × 500 = $20,000You borrow $5,000 from your broker, and invest $15,000 of your own funds. Your margin account starts out with equity of $15,000.a. (i) Equity increases to: ($44 × 500) – $5,000 = $17,000Percentage gain = $2,000/$15,000 = 0.1333 = 13.33% (ii)With price unchanged, equity is unchanged.Percentage gain = zero(iii) Equity falls to ($36 × 500) – $5,000 = $13,000Percentage gain = (–$2,000/$15,000) = –0.1333 = –13.33%The relationship between the percentage return and the percentage change inthe price of the stock is given by:Total investment= % change in % return = % change in price ×price × 1.333Investor's initial equityFor example, when the stock price rises from $40 to $44, the percentage changein price is 10%, while the percentage gain for the investor is:% return = 10% ×$20,000 = 13.33% $15,000b.The value of the 500 shares is 500P. Equity is (500P – $5,000). You willreceive a margin call when:= 0.25 ⇒ when P = $13.33 or lowerc.The value of the 500 shares is 500P. But now you have borrowed $10,000instead of $5,000. Therefore, equity is (500P – $10,000). You will receive amargin call when:= 0.25 ⇒ when P = $26.67 or lowerWith less equity in the account, you are far more vulnerable to a margin call.d.By the end of the year, the amount of the loan owed to the broker grows to:$5,000 × 1.08 = $5,400The equity in your account is (500P – $5,400). Initial equity was $15,000.Therefore, your rate of return after one year is as follows:(i) = 0.1067 = 10.67%(ii) = –0.0267 = –2.67%(iii) = –0.1600 = –16.00%The relationship between the percentage return and the percentage change inthe price of Intel is given by:% return = % change in price× Investor'Total investments initial equity−8%× Investor'Fundss borrowedinitial equityFor example, when the stock price rises from $40 to $44, the percentage changein price is 10%, while the percentage gain for the investor is:10%× $20,000−8%× $5,000 =10.67%$15,000$15,000e.The value of the 500 shares is 500P. Equity is (500P – $5,400). You willreceive a margin call when:= 0.25 ⇒ when P = $14.40 or lower12. a. The gain or loss on the short position is: (–500 × ΔP) Invested funds = $15,000Therefore: rate of return = (–500 × ΔP)/15,000The rate of return in each of the three scenarios is:(i)rate of return = (–500 × $4)/$15,000 = –0.1333 = –13.33%(ii)rate of return = (–500 × $0)/$15,000 = 0%(iii)rate of return = [–500 × (–$4)]/$15,000 = +0.1333 = +13.33%b.Total assets in the margin account equal:$20,000 (from the sale of the stock) + $15,000 (the initial margin) = $35,000Liabilities are 500P. You will receive a margin call when:$35,000 −500P = 0.25⇒ when P = $56 or higher500Pc.With a $1 dividend, the short position must now pay on the borrowed shares:($1/share × 500 shares) = $500. Rate of return is now:[(–500 × ΔP) – 500]/15,000(i)rate of return = [(–500 × $4) – $500]/$15,000 = –0.1667 = –16.67%(ii)rate of return = [(–500 × $0) – $500]/$15,000 = –0.0333 = –3.33%(iii)rate of return = [(–500) × (–$4) – $500]/$15,000 = +0.1000 = +10.00%Total assets are $35,000, and liabilities are (500P + 500). A margin callwill be issued when:= 0.25 ⇒ when P = $55.20 or higher13.The broker is instructed to attempt to sell your Marriott stock as soon as the Marriottstock trades at a bid price of $20 or less. Here, the broker will attempt to execute,but may not be able to sell at $20, since the bid price is now $19.95. The price atwhich you sell may be more or less than $20 because the stop-loss becomes a market order to sell at current market prices.14. a. $55.50b.$55.25c.The trade will not be executed because the bid price is lower than the pricespecified in the limit sell order.d.The trade will not be executed because the asked price is greater than the pricespecified in the limit buy order.15. a. In an exchange market, there can be price improvement in the two market orders.Brokers for each of the market orders (i.e., the buy order and the sell order) can agree to execute a trade inside the quoted spread. For example, they can trade at $55.37, thus improving the price for both customers by $0.12 or $0.13 relative to the quoted bid and asked prices. The buyer gets the stock for $0.13 less than the quoted asked price, and the seller receives $0.12 more for the stock than the quoted bid price.b.Whereas the limit order to buy at $55.37 would not be executed in a dealermarket (since the asked price is $55.50), it could be executed in an exchangemarket. A broker for another customer with an order to sell at market wouldview the limit buy order as the best bid price; the two brokers could agree tothe trade and bring it to the specialist, who would then execute the trade.16. a. You will not receive a margin call. You borrowed $20,000 and with another$20,000 of your own equity you bought 1,000 shares of Disney at $40 per share. At $35 per share, the market value of the stock is $35,000, your equity is $15,000, and the percentage margin is: $15,000/$35,000 = 42.9% Your percentage margin exceeds the required maintenance margin.b.You will receive a margin call when:= 0.35 ⇒ when P = $30.77 or lower17.The proceeds from the short sale (net of commission) were: ($21 × 100) – $50 =$2,050 A dividend payment of $200 was withdrawn from the account.Covering the short sale at $15 per share costs (with commission): $1,500 + $50 =$1,550。

投资学第九版课后答案,博迪投资学第九版课后答案CHAPTER1:THEINVESTMENTENVIRONMENTPROBLEMSETS1.Ultimately,itistruethatrealassetsdeterminethematerialwellbeingofaneconomy.Nevertheless,inpidualscanbenefitwhenfinancialengineeringcreatesnewproductsthatallowt hemtomanagetheirportfoliosoffinancialassetsmoreefficiently.Becausebundlingandunbundlingcreat esfinancialproductswithnewpropertiesandsensitivitiestovarioussourcesofrisk,itallowsinvestorstohe dgeparticularsourcesofriskmoreefficiently.2.Securitizationrequiresaccesstoalargenumberofpotentialinvestors.Toattracttheseinvestors,thecapitalmarketneeds:1.asafesystemofbusinesslawsandlowprobabilityofconfiscatorytaxation/regulation;2.awell-developedinvestmentbankingindustry;3.awell-developedsystemofbrokerageandfinancialtransactions,and;4.well-developedmedia,particularlyfinancialreporting.Thesecharacteristicsarefoundin(indeedmakefor)awell-developedfinancialmarket.3.Securitizationleadstodisintermediation;thatis,securitizationprovidesameansformarketparticipantstobypassintermediaries.Forexample,mortgage-backedsecuritieschannelfundstothehousingmarketwithoutrequiringthatbanksorthriftinstitutionsmakeloansfromtheirownportfolios. Assecuritizationprogresses,financialintermediariesmustincreaseotheractivitiessuchasprovidingshort-termliquiditytoconsumersandsmallbusiness,andfinancialservices.Financialassetsmakeiteasyforlargefirmstoraisethecapitalneededtofinancetheirinvestmentsinrealasse ts.IfFord,forexample,couldnotissuestocksorbondstothegeneralpublic,itwouldhaveafarmoredifficultt imeraisingcapital.Contractionofthesupplyoffinancialassetswouldmakefinancingmoredifficult,there byincreasingthecostofcapital.Ahighercostofcapitalresultsinlessinvestmentandlowerrealgrowth.4. 1-15.Evenifthefirmdoesnotneedtoissuestockinanyparticularyear,thestockmarketisstillimportanttothefinancialmanager.Thestockpriceprovidesimportantinformationabouthowthemarketvaluesthefirmsinvestmentprojects.Forexample,ifthestockpricerises considerably,managersmightconcludethatthemarketbelievesthefirmsfutureprospectsarebright.Thismightbeausefulsignaltothefirmtoproceedwithaninves tmentsuchasanexpansionofthefirmsbusiness.Inaddition,sharesthatcanbetradedinthesecondarymarke taremoreattractivetoinitialinvestorssincetheyknowthattheywillbeabletoselltheirshares.Thisinturnma kesinvestorsmorewillingtobuysharesinaprimaryoffering,andthusimprovesthetermsonwhichfirmsca nraisemoneyintheequitymarket.6.a.No.Theincreaseinpricedidnotaddtotheproductivecapacityoftheeconomy.b.Yes,thevalueoftheequit yheldintheseassetshasincreased.c.Futurehomeownersasawholeareworseoff,sincemortgageliabilitieshavealsoincreased.Inaddition,thishousingpricebubblewilleventuallyburstandsocietyasawhole(andmostlikelytaxpayers)willendurethedamage.7.a.ThebankloanisafinancialliabilityforLanni.(LannisIOUisthebanksfinancialasset.)ThecashLannirec eivesisafinancialasset.ThenewfinancialassetcreatedisLannispromissorynote(thatis,Lanni’sIOUtothebank).nnitransfersfinancialassets(cash)tothesoftwaredevelopers.Inreturn,Lannigetsarealasset,thecompletedsoftware.Nofinancialassetsarecreatedordestroyed;cashissimplytra nsferredfromonepartytoanother.nnigivestherealasset(thesoftware)toMicrosoftinexchangeforafinancialasset,1,500sharesofMicr osoftstock.IfMicrosoftissuesnewsharesinordertopayLanni,thenthiswouldrepresentthecreationofnew financialassets.nniexchangesonefinancialasset(1,500sharesofstock)foranother($120,000).Lannigivesafinancialasset($50,000cash)tothebankandgetsbackanotherfinancialasset(itsIOU).Theloanisdestroyedinthetransaction,sinceitisretiredwhenpaidoffandnolongerexists.1-28.a.LiabilitiesShareholders’equityCash$70,000Bankloan$50,000computersShareholders’equityTotal$100,000Total$100,000Ratioofrealassetstototalassets=$30,000/$100,000=0.30Assetsb.AssetsSoftwareproduct*computersTotal*ValuedatcostRatioofrealassetstototalassets=$100,000/$100,000=1.0c.AssetsMicrosoftsharescomputersTotalLiabilitiesShareholders’equity$120,000Bankloan$50,000Shareholders’equity$150,000Total$150,000LiabilitiesShareholders’equity$70,000Bankloan$50,000Shareholders’equity$100,000Total$100,000Ratioofrealassetstototalassets=$30,000/$150,000=0.20Conclusion:whenthefirmstartsupandraisesworkingcapital,itischaracterizedbyalowratioofrealassetst ototalassets.Whenitisinfullproduction,ithasahighratioofrealassetstototalassets.Whentheprojectshuts downandthefirmsellsitoffforcash,financialassetsonceagainreplacerealassets.9.Forcommercialbanks,theratiois:$140.1/$11,895.1=0.0118Fornon-financialfirms,theratiois:$12,538/$26,572=0.4719Thedifferenceshouldbeexpectedprimarilybecausethebulkofthebusinessoffinancialinstitutionsistomakeloans;whicharefinancialassetsforfinancialinstitutions.10.a.Primary-markettransactionb.Derivativeassetsc.Investorswhowishtoholdgoldwithoutthecomplicationandcostofphysicalstorage.1-311.a.Afixedsalarymeansthatcompensationis(atleastintheshortrun)independentofthefirmssuccess.Thissalarystructuredoesnottiethemanager’simmediatecompensationtothesuccessofthefirm.However,themanagermightviewthisasthesafestcom pensationstructureandthereforevalueitmorehighly.b.Asalarythatispaidintheformofstockinthefirmmeansthatthemanagerearnsthemostwhenthesharehol ders’wealthismaximized.Fiveyearsofvestinghelpsaligntheinterestsoftheemployeewiththelong-termperformanceofthefirm.Thisstructureisthereforemostlikelytoaligntheinterestsofmanagersandshareholders. Ifstockcompensationisoverdone,however,themanagermightviewitasoverlyriskysincethemanager’scareerisalreadylinkedtothefirm,andthisunpersifiedexposurewouldbeexacerbatedwithalargestockpo sitioninthefirm.c.Aprofit-linkedsalarycreatesgreatincentivesformanagerstocontributetothefirm’ssuccess.However,amanagerwhosesalaryistiedtoshort-termprofitswillberiskseeking,especiallyifthe seshort-termprofitsdeterminesalaryorifthecompensationstructuredoesnotbearthefullcostoftheproject’srisks.Shareholders,incontrast,bearthelossesaswellasthegainsontheproject,andmightbelesswillingtoassumethatrisk.12.Evenifaninpidualshareholdercouldmonitorandimprovemanagers’performance,andtherebyincreasethevalueofthefirm,thepayoffwouldbesmall,sincetheownershipshareinalargecorporationwouldbeverysmall.Forexample,ifyouown$10,000ofFordstocka ndcanincreasethevalueofthefirmby5%,averyambitiousgoal,youbenefitbyonly:0.05×$10,000=$500Incontrast,abankthathasamultimillion-dollarloanoutstandingtothefirmhasabigstakeinmakingsuretha tthefirmcanrepaytheloan.Itisclearlyworthwhileforthebanktospendconsiderableresourcestomonitort hefirm.13.Mutualfundsacceptfundsfromsmallinvestorsandinvest,onbehalfoftheseinvestors,inthenationalandinternationalsecuritiesmarkets.Pensionfundsacceptfundsandtheninvest,onbehalfofcurrentandfutureretirees,therebychannelingfund sfromonesectoroftheeconomytoanother.Venturecapitalfirmspoolthefundsofprivateinvestorsandinvestinstart-upfirms.Banksacceptdepositsfr omcustomersandloanthosefundstobusinesses,orusethefundstobuysecuritiesoflargecorporations.Treasurybillsserveapurposeforinvestorswhopreferalow-riskinvestment.Theloweraveragerateofreturncomparedtostocksisthepriceinvestorspayforpredictabilityofinvestmentperformanceandportfoliovalue.14.1-415.Witha“top-down”investingstyle,youfocusonassetallocationorthebroadcompositionoftheentireportfolio,whichisthemajordeterminantofoverallperformance.Moreover,top-downmanagementisthenaturalwaytoestablishaportfoliowithalevelofriskconsistentwithyourrisktoler ance.Thedisadvantageofanexclusiveemphasisontop-downissuesisthatyoumayforfeitthepotentialhig hreturnsthatcouldresultfromidentifyingandconcentratinginundervaluedsecuritiesorsectorsofthemar ket.Witha“bottom-up”investingstyle,youtrytobenefitfromidentifyingundervaluedsecurities.Thedisadva ntageisthatyoutendtooverlooktheoverallcompositionofyourportfolio,whichmayresultinanon-persifi edportfoliooraportfoliowitharisklevelinconsistentwithyourlevelofrisktolerance.Inaddition,thistechn iquetendstorequiremoreactivemanagement,thusgeneratingmoretransactioncosts.Finally,youranalysi smaybeincorrect,inwhichcaseyouwillhavefruitlesslyexpendedeffortandmoneyattemptingtobeatasimplebuy-and-holdstrategy.Youshouldbeskeptical.Iftheauthoractuallyknowshowtoachievesuchreturns,onemustquestionwhythe authorwouldthenbesoreadytosellthesecrettoothers.Financialmarketsareverycompetitive;oneoftheim plicationsofthisfactisthatrichesdonotcomeeasily.Highexpectedreturnsrequirebearingsomerisk,ando bviousbargainsarefewandfarbetween.Oddsarethattheonlyonegettingrichfromthebookisitsauthor.16.。

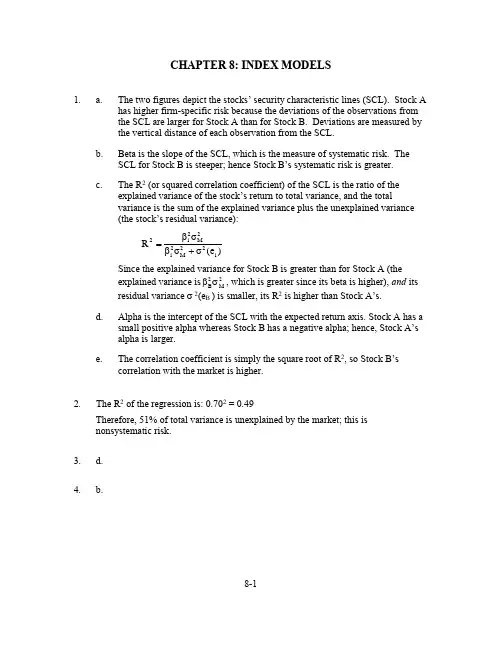

8-1CHAPTER 8: INDEX MODELS1.a.The two figures depict the stocks’ security characteristic lines (SCL). Stock A has higher firm-specific risk because the deviations of the observations from the SCL are larger for Stock A than for Stock B. Deviations are measured by the vertical distance of each observation from the SCL.b. Beta is the slope of the SCL, which is the measure of systematic risk. The SCL for Stock B is steeper; hence Stock B’s systematic risk is greater.c.The R 2 (or squared correlation coefficient) of the SCL is the ratio of the explained variance of the stock’s return to total variance, and the totalvariance is the sum of the explained variance plus the unexplained variance (the stock’s residual variance):)(e σσβσβR i 22M 2i 2M 2i 2+=Since the explained variance for Stock B is greater than for Stock A (theexplained variance is 2M 2B σβ, which is greater since its beta is higher), and its residual variance σ 2(e B ) is smaller, its R 2 is higher than Stock A’s.d.Alpha is the intercept of the SCL with the expected return axis. Stock A has a small positive alpha whereas Stock B has a negative alpha; hence, Stock A’s alpha is larger.e.The correlation coefficient is simply the square root of R 2, so Stock B’s correlation with the market is higher.2.The R 2 of the regression is: 0.702 = 0.49Therefore, 51% of total variance is unexplained by the market; this is nonsystematic risk. 3. d. 4. b.8-25. a. Firm-specific risk is measured by the residual standard deviation. Thus, stock A has more firm-specific risk: 10.3% > 9.1%b. Market risk is measured by beta, the slope coefficient of the regression. A has a larger beta coefficient: 1.2 > 0.8c. R 2 measures the fraction of total variance of return explained by the market return. A’s R 2 is larger than B’s: 0.576 > 0.436d.Rewriting the SCL equation in terms of total return (r) rather than excess return (R):r A – r f = α + β(r M – r f ) ⇒ r A = α + r f (1 - β) + βr M The intercept is now equal to:α + r f (1 - β) = 1 + r f (l – 1.2)Since r f = 6%, the intercept would be: 1 – 1.2 = –0.2%6.a. To optimize this portfolio one would need:n = 60 estimates of means n = 60 estimates of variances770,12nn 2=-estimates of covariances Therefore, in total:890,12n3n 2=+estimatesb.In a single index model: r i - r f = α i + β i (r M – r f ) + e i Equivalently, using excess returns: R i = α i + β i R M + e iThe variance of the rate of return on each stock can be decomposed into the components: (l)The variance due to the common market factor: 2M 2i σβ(2) The variance due to firm specific unanticipated events: )e (i 2σ In this model: σββ=j i j i )r ,r (Cov8-3The number of parameter estimates is:n = 60 estimates of the mean E(r i )n = 60 estimates of the sensitivity coefficient βi n = 60 estimates of the firm-specific variance σ2(e i ) 1 estimate of the market mean E(r M ) 1 estimate of the market variance 2M σ Therefore, in total, 182 estimates.Thus, the single index model reduces the total number of required parameter estimates from 1,890 to 182. In general, the number of parameter estimates is reduced from:)2n 3( to 2n 3n 2+⎪⎪⎭⎫ ⎝⎛+7.a. The standard deviation of each individual stock is given by:2/1i 22M 2i i )]e ([σ+σβ=σ Since βA = 0.8, βB = 1.2, σ(e A ) = 30%, σ(e B ) = 40%, and σM = 22%, we get:σA = (0.82 ⨯ 222 + 302 )1/2 = 34.78%σB = (1.22 ⨯ 222 + 402 )1/2 = 47.93%b.The expected rate of return on a portfolio is the weighted average of the expected returns of the individual securities:E(r P ) = w A E(r A ) + w B E(r B ) + w f r fwhere w A , w B , and w f are the portfolio weights for Stock A, Stock B, and T-bills, respectively.Substituting in the formula we get:E(r P ) = (0.30 ⨯ 13) + (0.45 ⨯ 18) + (0.25 ⨯ 8) = 14%The beta of a portfolio is similarly a weighted average of the betas of the individual securities:βP = w A βA + w B βB + w f β fThe beta for T-bills (β f ) is zero. The beta for the portfolio is therefore:βP = (0.30 ⨯ 0.8) + (0.45 ⨯ 1.2) + 0 = 0.788-4The variance of this portfolio is:)e (P 22M 2P 2P σ+σβ=σwhere 2M 2P σβ is the systematic component and )e (P 2σis the nonsystematic component. Since the residuals (e i ) are uncorrelated, the non-systematic variance is:)e (w )e (w )e (w )e (f 22f B 22B A 22A P 2σ+σ+σ=σ= (0.302 ⨯ 302 ) + (0.452 ⨯ 402 ) + (0.252 ⨯ 0) = 405where σ 2(e A ) and σ 2(e B ) are the firm-specific (nonsystematic) variances of Stocks A and B, and σ 2(e f ), the nonsystematic variance of T-bills, is zero. The residual standard deviation of the portfolio is thus:σ(e P ) = (405)1/2 = 20.12% The total variance of the portfolio is then:47.699405)2278.0(222P =+⨯=σThe standard deviation is 26.45%.8.For Stock A:αA = r A - [r f + βA (r M -r f )] = 11 - [6 +0.8(12 - 6)] = 0.2% For stock B:αB = 14 - [6 + 1.5(12 -6)] = -1%Stock A would be a good addition to a well-diversified portfolio. A short position in Stock B may be desirable. 9.The standard deviation of each stock can be derived from the following equation for R 2:=σσβ=2i2M2i 2iR Explained variance Total variance Therefore:%30.3198020.0207.0R A 222A 2M2A 2A=σ=⨯=σβ=σ8-5For stock B:%28.69800,412.0202.1B 222B=σ=⨯=σ10. The systematic risk for A is:1962070.0222M 2A =⨯=σβThe firm-specific risk of A (the residual variance) is the difference between A’s total risk an d its systematic risk:980 – 196 = 784 The systematic risk for B is:5762020.1222M 2B =⨯=σβB’s firm -specific risk (residual variance) is:4800 – 576 = 422411. The covariance between the returns of A and B is (since the residuals are assumedto be uncorrelated):33640020.170.0)r ,r (Cov 2M B A B A =⨯⨯=σββ=The correlation coefficient between the returns of A and B is:155.028.6930.31336)r ,r (Cov B A B A AB =⨯=σσ=ρ12. Note that the correlation is the square root of R 2:2R =ρCov(r A ,r M ) = ρσA σM = 0.201/2 ⨯ 31.30 ⨯ 20 = 280Cov(r B ,r M ) = ρσB σM = 0.121/2 ⨯ 69.28 ⨯ 20 = 4808-613. For portfolio P we can compute:σ P = [(0.62 ⨯ 980) + (0.42 ⨯ 4800) + (2 ⨯ 0.4 ⨯ 0.6 ⨯ 336]1/2 = [1282.08]1/2 = 35.81% β P = (0.6 ⨯ 0.7) + (0.4 ⨯ 1.2) = 0.90958.08400)(0.901282.08σβσ)(e σ22M2P 2P P 2=⨯-=-= Cov(r P ,r M ) = β P 2M σ=0.90 ×400=360 This same result can also be attained using the covariances of the individual stocks with the market:Cov(r P ,r M ) = Cov(0.6r A + 0.4r B , r M ) = 0.6Cov(r A , r M ) + 0.4Cov(r B ,r M )= (0.6 ⨯ 280) + (0.4 ⨯ 480) = 36014. Note that the variance of T-bills is zero, and the covariance of T-bills with any assetis zero. Therefore, for portfolio Q:[][]%55.21)3603.05.02()4003.0()08.282,15.0()r ,r (Cov w w 2w w 2/1222/1M P M P 2M 2M 2P 2P Q =⨯⨯⨯+⨯+⨯=⨯⨯⨯+σ+σ=σ75.00)13.0()90.05.0(w w M M P P Q =+⨯+⨯=β+β=β52.239)40075.0(52.464)e (22M 2Q 2Q Q 2=⨯-=σβ-σ=σ30040075.0)r ,r (Cov 2M Q M Q =⨯=σβ=15. a.Alpha (α)Expected excess returnα i = r i – [r f + βi (r M – r f ) ]E(r i ) – r f αA = 20% – [8% + 1.3(16% – 8%)] = 1.6% 20% – 8% = 12% αB = 18% – [8% + 1.8(16% – 8%)] = – 4.4% 18% – 8% = 10% αC = 17% – [8% + 0.7(16% – 8%)] = 3.4% 17% – 8% = 9% αD = 12% – [8% + 1.0(16% – 8%)] = – 4.0%12% – 8% = 4%Stocks A and C have positive alphas, whereas stocks B and D have negative alphas.The residual variances are:σ2(e A ) = 582 = 3,364σ2(e B) = 712 = 5,041σ2(e C) = 602 = 3,600σ2(e D) = 552 = 3,025b. To construct the optimal risky portfolio, we first determine the optimal activeportfolio. Using the Treynor-Black technique, we construct the active portfolio:0.000476 –0.6142Do not be concerned that the positive alpha stocks have negative weights andvice versa. We will see that the entire position in the active portfolio will benegative, returning everything to good order.With these weights, the forecast for the active portfolio is:α = [–0.6142 ⨯ 1.6] + [1.1265 ⨯ (– 4.4)] – [1.2181 ⨯ 3.4] + [1.7058 ⨯ (– 4.0)]= –16.90%β = [–0.6142 ⨯ 1.3] + [1.1265 ⨯ 1.8] – [1.2181 ⨯ 0.70] + [1.7058 ⨯ 1] = 2.08The high beta (higher than any individual beta) results from the short positionsin the relatively low beta stocks and the long positions in the relatively highbeta stocks.σ2(e) = [(–0.6142)2⨯ 3364] + [1.12652⨯ 5041] + [(–1.2181)2⨯ 3600] + [1.70582⨯ 3025] = 21,809.6σ(e) = 147.68%Here, again, the levered position in stock B [with high σ2(e)] overcomes thediversification effect, and results in a high residual standard deviation.8-78-8The optimal risky portfolio has a proportion w * in the active portfolio, computed as follows:05124.023/86.809,21/90.16/]r )r (E [)e (/w 22M f M 20-=-=σ-σα= The negative position is justified for the reason stated earlier. The adjustment for beta is:0486.0)05124.0)(08.21(105124.0w )1(1w *w 00-=--+-=β-+=Since w* is negative, the result is a positive position in stocks with positive alphas and a negative position in stocks with negative alphas. The position in the index portfolio is:1 – (–0.0486) = 1.0486c.To calculate Sharpe’s measure for the optimal risky portfolio, we compute the information ratio for the active portfolio and Sharpe’s measure for the market portfolio. The information ratio for the active portfolio is computed as follows:A = α /σ(e)= –16.90/147.68 = –0.1144 A 2 = 0.0131Hence, the square of Sharpe’s measure (S) of the optimized risky portfolio is:1341.00131.0238A S S 222M2=+⎪⎭⎫ ⎝⎛=+= S = 0.3662Compare this to the market’s Sharpe measure:S M = 8/23 = 0.3478 The difference is: 0.0184Note that the only-moderate improvement in performance results from the fact that only a small position is taken in the active portfolio A because of its large residual variance.8-9d.To calculate the exact makeup of the complete portfolio, we first compute the mean excess return of the optimal risky portfolio and its variance. The risky portfolio beta is given by:βP = w M + (w A ⨯ βA ) = 1.0486 + [(–0.0486) ⨯ 2.08] = 0.95E(R P ) = α P + βP E(R M ) = [(–0.0486) ⨯ (–16.90%)] + (0.95 ⨯ 8%) = 8.42%()94.5286.809,21)0486.0()2395.0()e (22P 22M 2P 2P =⨯-+⨯=σ+σβ=σ%00.23P =σSince A = 2.8, the optimal position in this portfolio is:5685.094.5288.201.042.8y =⨯⨯=In contrast, with a passive strategy:5401.0238.201.08y 2=⨯⨯=This is a difference of: 0.0284The final positions of the complete portfolio are: Bills 1 – 0.5685 = 43.15% M 0.5685 ⨯ l.0486 = 59.61%A 0.5685 ⨯ (–0.0486) ⨯ (–0.6142) = 1.70%B 0.5685 ⨯ (–0.0486) ⨯ 1.1265 = – 3.11%C 0.5685 ⨯ (–0.0486) ⨯ (–1.2181) = 3.37%D 0.5685 ⨯ (–0.0486) ⨯ 1.7058 = – 4.71%100.00%[sum is subject to rounding error]Note that M may include positive proportions of stocks A through D.16. a.If a manager is not allowed to sell short he will not include stocks with negative alphas in his portfolio, so he will consider only A and C:8-10The forecast for the active portfolio is:α = (0.3352 ⨯ 1.6) + (0.6648 ⨯ 3.4) = 2.80% β = (0.3352 ⨯ 1.3) + (0.6648 ⨯ 0.7) = 0.90σ2(e) = (0.33522 ⨯ 3,364) + (0.66482 ⨯ 3,600) = 1,969.03 σ(e ) = 44.37%The weight in the active portfolio is:0940.023/803.969,1/80.2/)R (E )e (/w 22M M 20==σσα= Adjusting for beta:0931.0]094.0)90.01[(1094.0w )1(1w *w 00=⨯-+=β-+=The information ratio of the active portfolio is:A = α /σ(e) =2.80/44.37 = 0.0631 Hence, the square of Sharpe’s measure is:S 2 = (8/23)2 + 0.06312 = 0.1250 Therefore: S = 0.3535The market’s Sharpe measure is: S M = 0.3478When short sales are allowed (Problem 18), the manager’s Sharpe measure is higher (0.3662). The reduction in the Sharpe measure is the cost of the short sale restriction.The characteristics of the optimal risky portfolio are:βP = w M + w A ⨯ βA = (1 – 0.0931) + (0.0931 ⨯ 0.9) = 0.99 E(R P ) = αP + βP E(R M ) = (0.0931 ⨯ 2.8%) + (0.99 ⨯ 8%) = 8.18%54.535)03.969,10931.0()2399.0()e (22P 22M 2P 2P =⨯+⨯=σ+σβ=σ%14.23P =σWith A = 2.8, the optimal position in this portfolio is:5455.054.5358.201.018.8y =⨯⨯=8-11The final positions in each asset are:Bills1 – 0.5455 = 45.45% M0.5455 ⨯ (1 - 0.0931) = 49.47% A0.5455 ⨯ 0.0931 ⨯ 0.3352 = 1.70% C0.5455 ⨯ 0.0931 ⨯ 0.6648 = 3.38%100.00%b. The mean and variance of the optimized complete portfolios in theunconstrained and short-sales constrained cases, and for the passive strategy are:E(R C ) 2C σ Unconstrained0.5685 ⨯ 8.42 = 4.79 0.5685 ⨯ 528.94 = 170.95 Constrained0.5455 ⨯ 8.18 = 4.46 0.54552 ⨯ 535.54 = 159.36 Passive 0.5401 ⨯ 8.00 = 4.32 0.54012 ⨯ 529.00 = 154.31The utility levels below are computed using the formula: 2C C A 005.0)r (E σ-Unconstrained8 + 4.79 – (0.005 ⨯ 2.8 ⨯ 170.95) = 10.40 Constrained8 + 4.46 – (0.005 ⨯ 2.8 ⨯ 159.36) = 10.23 Passive 8 + 4.32 – (0.005 ⨯ 2.8 ⨯ 154.31) = 10.1617. All alphas are reduced to 0.3 times their values in the original case. Therefore, therelative weights of each security in the active portfolio are unchanged, but the alpha of the active portfolio is only 0.3 times its previous value: 0.3 ⨯ -16.90% = -5.07% The investor will take a smaller position in the active portfolio. The optimal risky portfolio has a proportion w * in the active portfolio as follows:01537.023/86.809,21/07.5/)r r (E )e (/w 22Mf M 20-=-=σ-σα= The negative position is justified for the reason given earlier. The adjustment for beta is:0151.0)]01537.0()08.21[(101537.0w )1(1w *w 00-=-⨯-+-=β-+= Since w* is negative, the result is a positive position in stocks with positive alphas and a negative position in stocks with negative alphas. The position in the index portfolio is:1 – (–0.0151) = 1.0151To calculate Sharpe’s measure for the optimal risky portfolio we compute theinformation ratio for the active portfolio and Sharpe’s measure for the marketportfolio. The information ratio of the active portfolio is 0.3 times its previousvalue:A = α /σ(e)= –5.07/147.68 = –0.0343 and A2 =0.00118Hence, the square of Sharpe’s measure of the optimized risky portfolio is: S2 = S2M + A2 = (8/23)2 + 0.00118 = 0.1222S = 0.3495Compare this to the market’s Sharpe measure: S M = 8/23 = 0.3478The difference is: 0.0017Note that the reduction of the forecast alphas by a factor of 0.3 reduced the squared information ratio and the improvement in the squared Sharpe ratio by a factor of:0.32 = 0.0918. The regression results provide quantitative measures of return and risk based onmonthly returns over the five-year period.βfor ABC was 0.60, considerably less than the average stock’s β of 1.0. Thisindicates that, when the S&P 500 rose or fell by 1 percentage point, ABC’s return on average rose or fell by only 0.60 percentage point. Therefore, ABC’s systematic risk (or market risk) was low relative to the typical value for stocks. ABC’s alpha (the intercept of the regression) was –3.2%, indicating that when the market return was 0%, the average return on ABC was –3.2%. ABC’s unsystematic risk (orresidual risk), as measured by σ(e), was 13.02%. For ABC, R2 was 0.35, indicating closeness of fit to the linear regression greater than the value for a typical stock.β for XYZ was s omewhat higher, at 0.97, indicating XYZ’s return pattern was very similar to the β for the market index. Therefore, XYZ stock had average systematic risk for the period examined. Alpha for XYZ was positive and quite large,indicating a return of almost 7.3%, on average, for XYZ independent of marketreturn. Residual risk was 21.45%, half again as much as ABC’s, indicating a wider scatter of observations around the regression line for XYZ. Correspondingly, the fit of the regression model was considerably less than that of ABC, consistent with an R2 of only 0.17.8-12The effects of including one or the other of these stocks in a diversified portfoliomay be quite different. If it can be assumed that both stocks’ betas will remainstable over time, then there is a large difference in systematic risk level. The betas obtained from the two brokerage houses may help the analyst draw inferences forthe future. The three estimates of ABC’s β are similar, regardless of the sampleperiod of the underlying data. The range of these estimates is 0.60 to 0.71, wellbelow the market average βof 1.0. The three estimates of XYZ’s β varysignificantly among the three sources, ranging as high as 1.45 for the weekly dataover the most recent two years. One could infer tha t XYZ’s β for the future mightbe well above 1.0, meaning it might have somewhat greater systematic risk thanwas implied by the monthly regression for the five-year period.These stocks appear to have significantly different systematic risk characteristics. If these stocks are added to a diversified portfolio, XYZ will add more to total volatility.19. 9 = 3 + β (11 - 3) ⇒β = 0.7520. a. Merrill Lynch adjusts beta by taking the sample estimate of beta and averagingit with 1.0, using the weights of 2/3 and 1/3, as follows:adjusted beta = [(2/3) ⨯ 1.24] + [(1/3) ⨯ 1.0] = 1.16b.If you use your current estimate of beta to be βt–1 = 1.24, thenβt = 0.3 + (0.7 ⨯ 1.24) = 1.1688-13。

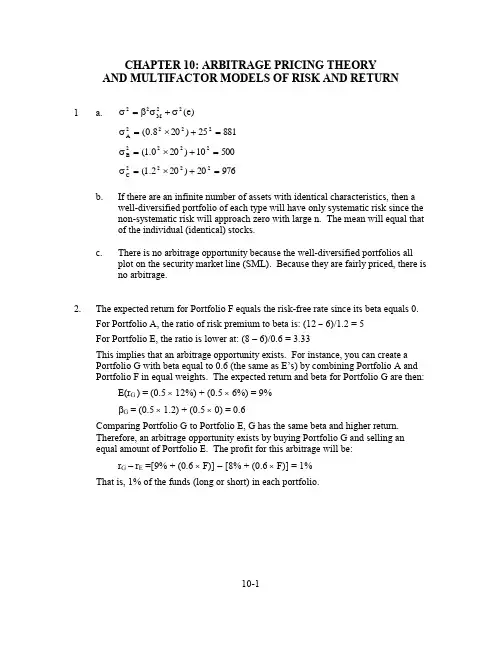

10-1CHAPTER 10: ARBITRAGE PRICING THEORY AND MULTIFACTOR MODELS OF RISK AND RETURN1 a. )e (22M 22σ+σβ=σ88125)208.0(2222A =+⨯=σ 50010)200.1(2222B =+⨯=σ97620)202.1(2222C =+⨯=σb. If there are an infinite number of assets with identical characteristics, then awell-diversified portfolio of each type will have only systematic risk since the non-systematic risk will approach zero with large n. The mean will equal that of the individual (identical) stocks.c.There is no arbitrage opportunity because the well-diversified portfolios allplot on the security market line (SML). Because they are fairly priced, there is no arbitrage.2. The expected return for Portfolio F equals the risk-free rate since its beta equals 0.For Portfolio A, the ratio of risk premium to beta is: (12 - 6)/1.2 = 5For Portfolio E, the ratio is lower at: (8 – 6)/0.6 = 3.33This implies that an arbitrage opportunity exists. For instance, you can create a Portfolio G with beta equal to 0.6 (the same as E’s) by combining Portfolio A and Portfolio F in equal weights. The expected return and beta for Portfolio G are then:E(r G ) = (0.5 ⨯ 12%) + (0.5 ⨯ 6%) = 9%βG = (0.5 ⨯ 1.2) + (0.5 ⨯ 0) = 0.6Comparing Portfolio G to Portfolio E, G has the same beta and higher return. Therefore, an arbitrage opportunity exists by buying Portfolio G and selling an equal amount of Portfolio E. The profit for this arbitrage will be:r G – r E =[9% + (0.6 ⨯ F)] - [8% + (0.6 ⨯ F)] = 1%That is, 1% of the funds (long or short) in each portfolio.3. Substituting the portfolio returns and betas in the expected return-beta relationship,we obtain two equations with two unknowns, the risk-free rate (r f ) and the factorrisk premium (RP):12 = r f + (1.2 ⨯ RP)9 = r f + (0.8 ⨯ RP)Solving these equations, we obtain:r f = 3% and RP = 7.5%4. Equation 10.9 applies here:E(r p ) = r f + βP1 [E(r1 ) - r f ] + βP2 [E(r2 ) – r f ]We need to find the risk premium (RP) for each of the two factors:RP1 = [E(r1 ) - r f ] and RP2 = [E(r2 ) - r f ]In order to do so, we solve the following system of two equations with two unknowns:31 = 6 + (1.5 ⨯ RP1 ) + (2.0 ⨯ RP2 )27 = 6 + (2.2 ⨯ RP1 ) + [(–0.2) ⨯ RP2 ]The solution to this set of equations is:RP1 = 10% and RP2 = 5%Thus, the expected return-beta relationship is:E(r P ) = 6% + (βP1⨯ 10%) + (βP2⨯ 5%)5. a. A long position in a portfolio (P) comprised of Portfolios A and B will offeran expected return-beta tradeoff lying on a straight line between points A andB. Therefore, we can choose weights such that βP = βC but with expectedreturn higher than that of Portfolio C. Hence, combining P with a shortposition in C will create an arbitrage portfolio with zero investment, zero beta,and positive rate of return.b. The argument in part (a) leads to the proposition that the coefficient of β2must be zero in order to preclude arbitrage opportunities.6. The revised estimate of the expected rate of return on the stock would be the oldestimate plus the sum of the products of the unexpected change in each factor times the respective sensitivity coefficient:revised estimate = 12% + [(1 ⨯ 2%) + (0.5 ⨯ 3%)] = 15.5%10-27. a. Shorting an equally-weighted portfolio of the ten negative-alpha stocks andinvesting the proceeds in an equally-weighted portfolio of the ten positive-alpha stocks eliminates the market exposure and creates a zero-investmentportfolio. Denoting the systematic market factor as R M , the expected dollarreturn is (noting that the expectation of non-systematic risk, e, is zero):$1,000,000 ⨯ [0.02 + (1.0 ⨯ R M )] - $1,000,000 ⨯ [(–0.02) + (1.0 ⨯ R M )]= $1,000,000 ⨯ 0.04 = $40,000The sensitivity of the payoff of this portfolio to the market factor is zerobecause the exposures of the positive alpha and negative alpha stocks cancelout. (Notice that the terms involving R M sum to zero.) Thus, the systematiccomponent of tota l risk is also zero. The variance of the analyst’s profit is notzero, however, since this portfolio is not well diversified.For n = 20 stocks (i.e., long 10 stocks and short 10 stocks) the investor willhave a $100,000 position (either long or short) in each stock. Net marketexposure is zero, but firm-specific risk has not been fully diversified. Thevariance of dollar returns from the positions in the 20 stocks is:20 ⨯ [(100,000 ⨯ 0.30)2 ] = 18,000,000,000The standard deviation of dollar returns is $134,164.b. If n = 50 stocks (25 stocks long and 25 stocks short), the investor will have a$40,000 position in each stock, and the variance of dollar returns is:50 ⨯ [(40,000 ⨯ 0.30)2 ] = 7,200,000,000The standard deviation of dollar returns is $84,853.Similarly, if n = 100 stocks (50 stocks long and 50 stocks short), the investorwill have a $20,000 position in each stock, and the variance of dollar returns is: 100 ⨯ [(20,000 ⨯ 0.30)2 ] = 3,600,000,000The standard deviation of dollar returns is $60,000.Notice that, when the number of stocks increases by a factor of 5 (i.e., from 20to 100), standard deviation decreases by a factor of 5= 2.23607 (from$134,164 to $60,000).8. a. This statement is incorrect. The CAPM requires a mean-variance efficientmarket portfolio, but APT does not.b.This statement is incorrect. The CAPM assumes normally distributed securityreturns, but APT does not.c. This statement is correct.10-39. b. Since Portfolio X has β = 1.0, then X is the market portfolio and E(R M) =16%.Using E(R M ) = 16% and r f = 8%, the expected return for portfolio Y is notconsistent.10. a. E(r) = 6 + (1.2 ⨯ 6) + (0.5 ⨯ 8) + (0.3 ⨯ 3) = 18.1%b.Surprises in the macroeconomic factors will result in surprises in the return ofthe stock:Unexpected return from macro factors =[1.2(4 – 5)] + [0.5(6 – 3)] + [0.3(0 – 2)] = –0.3%E(r) =18.1% − 0.3% = 17.8%11. d.12. The APT factors must correlate with major sources of uncertainty, i.e., sources ofuncertainty that are of concern to many investors. Researchers should investigatefactors that correlate with uncertainty in consumption and investment opportunities.GDP, the inflation rate, and interest rates are among the factors that can be expected to determine risk premiums. In particular, industrial production (IP) is a goodindicator of changes in the business cycle. Thus, IP is a candidate for a factor that is highly correlated with uncertainties that have to do with investment andconsumption opportunities in the economy.13. The first two factors seem promising with respect to the likely impact on the firm’scost of capital. Both are macro factors that would elicit hedging demands acrossbroad sectors of investors. The third factor, while important to Pork Products, is apoor choice for a multifactor SML because the price of hogs is of minor importance to most investors and is therefore highly unlikely to be a priced risk factor. Betterchoices would focus on variables that investors in aggregate might find moreimportant to their welfare. Examples include: inflation uncertainty, short-terminterest-rate risk, energy price risk, or exchange rate risk. The important point here is that, in specifying a multifactor SML, we not confuse risk factors that are important toa particular investor with factors that are important to investors in general; only thelatter are likely to command a risk premium in the capital markets.14. c. Investors will take on as large a position as possible only if the mispricingopportunity is an arbitrage. Otherwise, considerations of risk anddiversification will limit the position they attempt to take in the mispricedsecurity.10-415. d.16. d.17. The APT required (i.e., equilibrium) rate of return on the stock based on r f and thefactor betas is:required E(r) = 6 + (1 ⨯ 6) + (0.5 ⨯ 2) + (0.75 ⨯ 4) = 16%According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero bydefinition). Because the actually expected return based on risk is less than theequilibrium return, we conclude that the stock is overpriced.18. Any pattern of returns can be “explained” if we are free to choose an indefinitelylarge number of explanatory factors. If a theory of asset pricing is to have value, it must explain returns using a reasonably limited number of explanatory variables(i.e., systematic factors).19. d.20. c.10-5。

金融学(博迪)英文版课后习题答案CONTENTSChapter 1: Financial Economics 1-1Chapter 2: Financial Markets and Institutions 2-1Chapter 3: Managing Financial Health and Performance 3-1Chapter 4: Allocating Resources Over Time 4-1Chapter 5: Household Saving and Investment Decisions 5-1Chapter 6: The Analysis of Investment Projects 6-1Chapter 7: Principles of Market Valuation 7-1Chapter 8: Valuation of Known Cash Flows: Bonds 8-1Chapter 9: Valuation of Common Stocks 9-1Chapter 10: Principles of Risk Management 10-1Chapter 11: Hedging, Insuring, and Diversifying 11-1Chapter 12 Portfolio Opportunities and Choice 12-1Chapter 13: Capital Market Equilibrium 13-1Chapter 14: Forward and Futures Markets 14-1Chapter 15: Markets for Options and Contingent Claims 15-1Chapter 16: Financial Structure of the Firm 16-1Chapter 17: Real Options 17-1CHAPTER 1 – Financial EconomicsEnd-of-Chapter ProblemsDefining Finance1. What are your main goals in life? How does finance play a part in achieving those goals? What are themajor tradeoffs you face?SAMPLE ANSWER:Finish schoolGet good paying job which I likeGetmarried and have childrenOwn my own homeProvide for familyPay for children’s educationRetireHow Finance Plays a Role:SAMPLE ANSWER:Finance helps me pay for undergraduate and graduate education and helps me decide whether spending themoney on graduate education will be a good investment decision or not.Higher education should enhance my earning power and ability to obtain a job I like.Once I am married and have children I will have additional financial responsibilities (dependents) and Iwill have to learn how to allocate resources among individuals in the householdand learn how to set aside enoughmoney to pay for emergencies, education, vacations etc. Finance also helps me understand how to manage risks suchas for disability, life and health.?Finance helps me determine whether the home I want to buy is a good value or not. The study of financealso helps me determine the cheapest source of financing for the purchase of that home.Finance helps me determine how much money I will have to save in order to pay for my children’seducation as well as my own retirement.Major Tradeoffs:SAMPLE ANSWERSpend money now by going to college (and possibly graduate school) but presumably make more moneyonce I graduate due to my higher education.Consume now and have less money saved for future expenditures such as for a house and/or car or savemore money now but consume less than some of my friends。

博迪投资学第十版答案第一章高效市场理论1.什么是高效市场理论?–高效市场理论是指市场中的价格已反映了所有可获取的信息,即市场对信息的反应是即时、准确和公平的。

–高效市场理论认为无法通过分析和预测市场走势来获得持续的超额收益。

2.高效市场理论的三种形式是什么?–弱式有效市场:市场价格已反映了所有历史数据,无法通过分析历史数据获得超额收益。

–半强式有效市场:市场价格已反映了所有公开信息,无法通过分析公开信息获得超额收益。

–强式有效市场:市场价格已反映了所有公开和非公开信息,无法通过任何信息获得超额收益。

3.高效市场理论对投资者有什么启示?–投资者无法通过分析市场走势来获得持续的超额收益。

–投资者应该构建投资组合并分散风险,而不是试图击败市场。

第二章技术分析1.什么是技术分析?–技术分析是一种通过观察和分析市场价格和交易量数据,以预测市场走势的方法。

–技术分析基于一些假设,如市场价格已反映了所有可获取的信息和市场走势具有一定的规律性。

2.技术分析的基本原理是什么?–历史重复性原理:市场走势具有一定的规律性,过去的走势可能会在未来重复出现。

–趋势原理:市场价格会沿着一定的趋势运动,如上升趋势、下降趋势和横盘趋势。

–支撑与阻力原理:市场价格会受到一些固定水平的支撑和阻力,支撑水平会阻碍价格下跌,阻力水平会阻碍价格上涨。

3.技术分析的常用方法有哪些?–图表形态分析:通过观察市场价格形成的各种图形,如头肩顶、双底等,来预测市场走势。

–技术指标分析:通过计算市场价格和交易量的统计指标,如移动平均线、相对强弱指数等,来预测市场走势。

–K线图分析:通过观察开盘价、收盘价、最高价和最低价形成的蜡烛图,来预测市场走势。

第三章基本面分析1.什么是基本面分析?–基本面分析是一种通过研究和分析公司的财务状况、经营业绩、行业前景等基本信息,来评估公司价值和预测股价走势的方法。

2.基本面分析的基本原理是什么?–公司的价值取决于其未来的盈利能力和现金流量。