滋维博迪 投资学Chap008

- 格式:ppt

- 大小:1.31 MB

- 文档页数:27

兹维博迪投资学知识点总结概述及解释说明1. 引言1.1 概述本文是对兹维博迪投资学知识点的总结与解释说明,旨在帮助读者更好地理解投资学领域的重要概念和原理。

兹维博迪(Zvi Bodie)是一位知名的金融学家和教育家,他的研究和贡献在投资学领域具有重要影响力。

1.2 文章结构本文分为五个主要部分:引言、兹维博迪投资学知识点总结、解释说明、正文以及结论。

其中,引言部分主要介绍了本文的目的、概述和文章结构,为读者提供一个整体的了解。

1.3 目的本文旨在向读者展示兹维博迪投资学知识点的核心内容,并通过解释说明和具体案例分析,帮助读者深入理解这些知识点。

通过阅读本文,读者将能够掌握相关概念、原则和方法,并应用于实际投资决策中。

我们将依次介绍兹维博迪在投资学领域所关注的重要知识点,包括但不限于风险与收益、资产定价模型、投资组合理论等方面。

同时,我们还将通过解释和说明的方式,对这些知识点进行详细阐述,帮助读者消除疑惑并应用于实际。

在正文部分,我们将重点讨论兹维博迪投资学的要点,包括风险管理、期权定价和市场行为等。

通过对这些要点的深入剖析,读者将能够加深对投资学领域的理解,并能够运用相关原则和策略进行投资决策。

最后,在结论部分,我们将总结全文的主要内容,并展望未来兹维博迪投资学的发展趋势。

希望本文能够为读者提供一份有价值且实用的参考指南,使其在投资学领域取得更好的成果。

2. 兹维博迪投资学知识点总结:兹维博迪投资学是一门关于投资的学科,涵盖了广泛的知识点和概念。

在本部分中,我们将对一些重要的兹维博迪投资学知识点进行总结。

2.1 知识点一:知识点一是关于投资组合理论的内容。

兹维博迪投资学认为,通过将不同种类的资产组合在一起,可以实现风险分散和优化回报。

在这个知识点中,我们将介绍常见的投资组合理论模型,并解释不同因素对投资组合表现的影响。

2.2 知识点二:知识点二涉及价值投资和成长投资两种主要类型的股票选择策略。

兹维博迪投资学强调价值与成长之间的平衡,并提出了各自选择股票策略的方法。

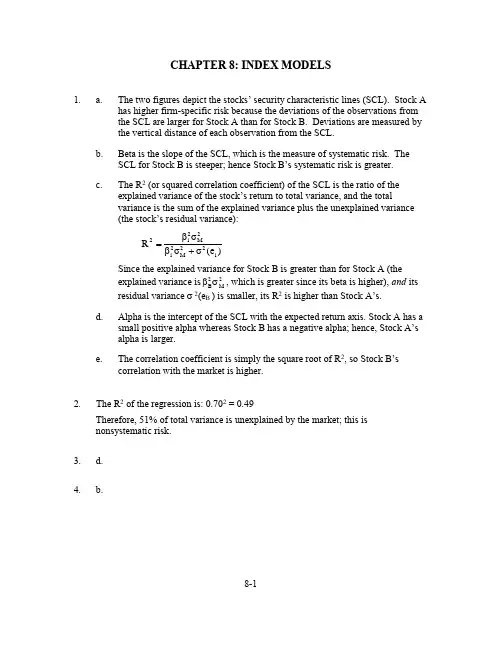

8-1CHAPTER 8: INDEX MODELS1.a.The two figures depict the stocks’ security characteristic lines (SCL). Stock A has higher firm-specific risk because the deviations of the observations from the SCL are larger for Stock A than for Stock B. Deviations are measured by the vertical distance of each observation from the SCL.b. Beta is the slope of the SCL, which is the measure of systematic risk. The SCL for Stock B is steeper; hence Stock B’s systematic risk is greater.c.The R 2 (or squared correlation coefficient) of the SCL is the ratio of the explained variance of the stock’s return to total variance, and the totalvariance is the sum of the explained variance plus the unexplained variance (the stock’s residual variance):)(e σσβσβR i 22M 2i 2M 2i 2+=Since the explained variance for Stock B is greater than for Stock A (theexplained variance is 2M 2B σβ, which is greater since its beta is higher), and its residual variance σ 2(e B ) is smaller, its R 2 is higher than Stock A’s.d.Alpha is the intercept of the SCL with the expected return axis. Stock A has a small positive alpha whereas Stock B has a negative alpha; hence, Stock A’s alpha is larger.e.The correlation coefficient is simply the square root of R 2, so Stock B’s correlation with the market is higher.2.The R 2 of the regression is: 0.702 = 0.49Therefore, 51% of total variance is unexplained by the market; this is nonsystematic risk. 3. d. 4. b.8-25. a. Firm-specific risk is measured by the residual standard deviation. Thus, stock A has more firm-specific risk: 10.3% > 9.1%b. Market risk is measured by beta, the slope coefficient of the regression. A has a larger beta coefficient: 1.2 > 0.8c. R 2 measures the fraction of total variance of return explained by the market return. A’s R 2 is larger than B’s: 0.576 > 0.436d.Rewriting the SCL equation in terms of total return (r) rather than excess return (R):r A – r f = α + β(r M – r f ) ⇒ r A = α + r f (1 - β) + βr M The intercept is now equal to:α + r f (1 - β) = 1 + r f (l – 1.2)Since r f = 6%, the intercept would be: 1 – 1.2 = –0.2%6.a. To optimize this portfolio one would need:n = 60 estimates of means n = 60 estimates of variances770,12nn 2=-estimates of covariances Therefore, in total:890,12n3n 2=+estimatesb.In a single index model: r i - r f = α i + β i (r M – r f ) + e i Equivalently, using excess returns: R i = α i + β i R M + e iThe variance of the rate of return on each stock can be decomposed into the components: (l)The variance due to the common market factor: 2M 2i σβ(2) The variance due to firm specific unanticipated events: )e (i 2σ In this model: σββ=j i j i )r ,r (Cov8-3The number of parameter estimates is:n = 60 estimates of the mean E(r i )n = 60 estimates of the sensitivity coefficient βi n = 60 estimates of the firm-specific variance σ2(e i ) 1 estimate of the market mean E(r M ) 1 estimate of the market variance 2M σ Therefore, in total, 182 estimates.Thus, the single index model reduces the total number of required parameter estimates from 1,890 to 182. In general, the number of parameter estimates is reduced from:)2n 3( to 2n 3n 2+⎪⎪⎭⎫ ⎝⎛+7.a. The standard deviation of each individual stock is given by:2/1i 22M 2i i )]e ([σ+σβ=σ Since βA = 0.8, βB = 1.2, σ(e A ) = 30%, σ(e B ) = 40%, and σM = 22%, we get:σA = (0.82 ⨯ 222 + 302 )1/2 = 34.78%σB = (1.22 ⨯ 222 + 402 )1/2 = 47.93%b.The expected rate of return on a portfolio is the weighted average of the expected returns of the individual securities:E(r P ) = w A E(r A ) + w B E(r B ) + w f r fwhere w A , w B , and w f are the portfolio weights for Stock A, Stock B, and T-bills, respectively.Substituting in the formula we get:E(r P ) = (0.30 ⨯ 13) + (0.45 ⨯ 18) + (0.25 ⨯ 8) = 14%The beta of a portfolio is similarly a weighted average of the betas of the individual securities:βP = w A βA + w B βB + w f β fThe beta for T-bills (β f ) is zero. The beta for the portfolio is therefore:βP = (0.30 ⨯ 0.8) + (0.45 ⨯ 1.2) + 0 = 0.788-4The variance of this portfolio is:)e (P 22M 2P 2P σ+σβ=σwhere 2M 2P σβ is the systematic component and )e (P 2σis the nonsystematic component. Since the residuals (e i ) are uncorrelated, the non-systematic variance is:)e (w )e (w )e (w )e (f 22f B 22B A 22A P 2σ+σ+σ=σ= (0.302 ⨯ 302 ) + (0.452 ⨯ 402 ) + (0.252 ⨯ 0) = 405where σ 2(e A ) and σ 2(e B ) are the firm-specific (nonsystematic) variances of Stocks A and B, and σ 2(e f ), the nonsystematic variance of T-bills, is zero. The residual standard deviation of the portfolio is thus:σ(e P ) = (405)1/2 = 20.12% The total variance of the portfolio is then:47.699405)2278.0(222P =+⨯=σThe standard deviation is 26.45%.8.For Stock A:αA = r A - [r f + βA (r M -r f )] = 11 - [6 +0.8(12 - 6)] = 0.2% For stock B:αB = 14 - [6 + 1.5(12 -6)] = -1%Stock A would be a good addition to a well-diversified portfolio. A short position in Stock B may be desirable. 9.The standard deviation of each stock can be derived from the following equation for R 2:=σσβ=2i2M2i 2iR Explained variance Total variance Therefore:%30.3198020.0207.0R A 222A 2M2A 2A=σ=⨯=σβ=σ8-5For stock B:%28.69800,412.0202.1B 222B=σ=⨯=σ10. The systematic risk for A is:1962070.0222M 2A =⨯=σβThe firm-specific risk of A (the residual variance) is the difference between A’s total risk an d its systematic risk:980 – 196 = 784 The systematic risk for B is:5762020.1222M 2B =⨯=σβB’s firm -specific risk (residual variance) is:4800 – 576 = 422411. The covariance between the returns of A and B is (since the residuals are assumedto be uncorrelated):33640020.170.0)r ,r (Cov 2M B A B A =⨯⨯=σββ=The correlation coefficient between the returns of A and B is:155.028.6930.31336)r ,r (Cov B A B A AB =⨯=σσ=ρ12. Note that the correlation is the square root of R 2:2R =ρCov(r A ,r M ) = ρσA σM = 0.201/2 ⨯ 31.30 ⨯ 20 = 280Cov(r B ,r M ) = ρσB σM = 0.121/2 ⨯ 69.28 ⨯ 20 = 4808-613. For portfolio P we can compute:σ P = [(0.62 ⨯ 980) + (0.42 ⨯ 4800) + (2 ⨯ 0.4 ⨯ 0.6 ⨯ 336]1/2 = [1282.08]1/2 = 35.81% β P = (0.6 ⨯ 0.7) + (0.4 ⨯ 1.2) = 0.90958.08400)(0.901282.08σβσ)(e σ22M2P 2P P 2=⨯-=-= Cov(r P ,r M ) = β P 2M σ=0.90 ×400=360 This same result can also be attained using the covariances of the individual stocks with the market:Cov(r P ,r M ) = Cov(0.6r A + 0.4r B , r M ) = 0.6Cov(r A , r M ) + 0.4Cov(r B ,r M )= (0.6 ⨯ 280) + (0.4 ⨯ 480) = 36014. Note that the variance of T-bills is zero, and the covariance of T-bills with any assetis zero. Therefore, for portfolio Q:[][]%55.21)3603.05.02()4003.0()08.282,15.0()r ,r (Cov w w 2w w 2/1222/1M P M P 2M 2M 2P 2P Q =⨯⨯⨯+⨯+⨯=⨯⨯⨯+σ+σ=σ75.00)13.0()90.05.0(w w M M P P Q =+⨯+⨯=β+β=β52.239)40075.0(52.464)e (22M 2Q 2Q Q 2=⨯-=σβ-σ=σ30040075.0)r ,r (Cov 2M Q M Q =⨯=σβ=15. a.Alpha (α)Expected excess returnα i = r i – [r f + βi (r M – r f ) ]E(r i ) – r f αA = 20% – [8% + 1.3(16% – 8%)] = 1.6% 20% – 8% = 12% αB = 18% – [8% + 1.8(16% – 8%)] = – 4.4% 18% – 8% = 10% αC = 17% – [8% + 0.7(16% – 8%)] = 3.4% 17% – 8% = 9% αD = 12% – [8% + 1.0(16% – 8%)] = – 4.0%12% – 8% = 4%Stocks A and C have positive alphas, whereas stocks B and D have negative alphas.The residual variances are:σ2(e A ) = 582 = 3,364σ2(e B) = 712 = 5,041σ2(e C) = 602 = 3,600σ2(e D) = 552 = 3,025b. To construct the optimal risky portfolio, we first determine the optimal activeportfolio. Using the Treynor-Black technique, we construct the active portfolio:0.000476 –0.6142Do not be concerned that the positive alpha stocks have negative weights andvice versa. We will see that the entire position in the active portfolio will benegative, returning everything to good order.With these weights, the forecast for the active portfolio is:α = [–0.6142 ⨯ 1.6] + [1.1265 ⨯ (– 4.4)] – [1.2181 ⨯ 3.4] + [1.7058 ⨯ (– 4.0)]= –16.90%β = [–0.6142 ⨯ 1.3] + [1.1265 ⨯ 1.8] – [1.2181 ⨯ 0.70] + [1.7058 ⨯ 1] = 2.08The high beta (higher than any individual beta) results from the short positionsin the relatively low beta stocks and the long positions in the relatively highbeta stocks.σ2(e) = [(–0.6142)2⨯ 3364] + [1.12652⨯ 5041] + [(–1.2181)2⨯ 3600] + [1.70582⨯ 3025] = 21,809.6σ(e) = 147.68%Here, again, the levered position in stock B [with high σ2(e)] overcomes thediversification effect, and results in a high residual standard deviation.8-78-8The optimal risky portfolio has a proportion w * in the active portfolio, computed as follows:05124.023/86.809,21/90.16/]r )r (E [)e (/w 22M f M 20-=-=σ-σα= The negative position is justified for the reason stated earlier. The adjustment for beta is:0486.0)05124.0)(08.21(105124.0w )1(1w *w 00-=--+-=β-+=Since w* is negative, the result is a positive position in stocks with positive alphas and a negative position in stocks with negative alphas. The position in the index portfolio is:1 – (–0.0486) = 1.0486c.To calculate Sharpe’s measure for the optimal risky portfolio, we compute the information ratio for the active portfolio and Sharpe’s measure for the market portfolio. The information ratio for the active portfolio is computed as follows:A = α /σ(e)= –16.90/147.68 = –0.1144 A 2 = 0.0131Hence, the square of Sharpe’s measure (S) of the optimized risky portfolio is:1341.00131.0238A S S 222M2=+⎪⎭⎫ ⎝⎛=+= S = 0.3662Compare this to the market’s Sharpe measure:S M = 8/23 = 0.3478 The difference is: 0.0184Note that the only-moderate improvement in performance results from the fact that only a small position is taken in the active portfolio A because of its large residual variance.8-9d.To calculate the exact makeup of the complete portfolio, we first compute the mean excess return of the optimal risky portfolio and its variance. The risky portfolio beta is given by:βP = w M + (w A ⨯ βA ) = 1.0486 + [(–0.0486) ⨯ 2.08] = 0.95E(R P ) = α P + βP E(R M ) = [(–0.0486) ⨯ (–16.90%)] + (0.95 ⨯ 8%) = 8.42%()94.5286.809,21)0486.0()2395.0()e (22P 22M 2P 2P =⨯-+⨯=σ+σβ=σ%00.23P =σSince A = 2.8, the optimal position in this portfolio is:5685.094.5288.201.042.8y =⨯⨯=In contrast, with a passive strategy:5401.0238.201.08y 2=⨯⨯=This is a difference of: 0.0284The final positions of the complete portfolio are: Bills 1 – 0.5685 = 43.15% M 0.5685 ⨯ l.0486 = 59.61%A 0.5685 ⨯ (–0.0486) ⨯ (–0.6142) = 1.70%B 0.5685 ⨯ (–0.0486) ⨯ 1.1265 = – 3.11%C 0.5685 ⨯ (–0.0486) ⨯ (–1.2181) = 3.37%D 0.5685 ⨯ (–0.0486) ⨯ 1.7058 = – 4.71%100.00%[sum is subject to rounding error]Note that M may include positive proportions of stocks A through D.16. a.If a manager is not allowed to sell short he will not include stocks with negative alphas in his portfolio, so he will consider only A and C:8-10The forecast for the active portfolio is:α = (0.3352 ⨯ 1.6) + (0.6648 ⨯ 3.4) = 2.80% β = (0.3352 ⨯ 1.3) + (0.6648 ⨯ 0.7) = 0.90σ2(e) = (0.33522 ⨯ 3,364) + (0.66482 ⨯ 3,600) = 1,969.03 σ(e ) = 44.37%The weight in the active portfolio is:0940.023/803.969,1/80.2/)R (E )e (/w 22M M 20==σσα= Adjusting for beta:0931.0]094.0)90.01[(1094.0w )1(1w *w 00=⨯-+=β-+=The information ratio of the active portfolio is:A = α /σ(e) =2.80/44.37 = 0.0631 Hence, the square of Sharpe’s measure is:S 2 = (8/23)2 + 0.06312 = 0.1250 Therefore: S = 0.3535The market’s Sharpe measure is: S M = 0.3478When short sales are allowed (Problem 18), the manager’s Sharpe measure is higher (0.3662). The reduction in the Sharpe measure is the cost of the short sale restriction.The characteristics of the optimal risky portfolio are:βP = w M + w A ⨯ βA = (1 – 0.0931) + (0.0931 ⨯ 0.9) = 0.99 E(R P ) = αP + βP E(R M ) = (0.0931 ⨯ 2.8%) + (0.99 ⨯ 8%) = 8.18%54.535)03.969,10931.0()2399.0()e (22P 22M 2P 2P =⨯+⨯=σ+σβ=σ%14.23P =σWith A = 2.8, the optimal position in this portfolio is:5455.054.5358.201.018.8y =⨯⨯=8-11The final positions in each asset are:Bills1 – 0.5455 = 45.45% M0.5455 ⨯ (1 - 0.0931) = 49.47% A0.5455 ⨯ 0.0931 ⨯ 0.3352 = 1.70% C0.5455 ⨯ 0.0931 ⨯ 0.6648 = 3.38%100.00%b. The mean and variance of the optimized complete portfolios in theunconstrained and short-sales constrained cases, and for the passive strategy are:E(R C ) 2C σ Unconstrained0.5685 ⨯ 8.42 = 4.79 0.5685 ⨯ 528.94 = 170.95 Constrained0.5455 ⨯ 8.18 = 4.46 0.54552 ⨯ 535.54 = 159.36 Passive 0.5401 ⨯ 8.00 = 4.32 0.54012 ⨯ 529.00 = 154.31The utility levels below are computed using the formula: 2C C A 005.0)r (E σ-Unconstrained8 + 4.79 – (0.005 ⨯ 2.8 ⨯ 170.95) = 10.40 Constrained8 + 4.46 – (0.005 ⨯ 2.8 ⨯ 159.36) = 10.23 Passive 8 + 4.32 – (0.005 ⨯ 2.8 ⨯ 154.31) = 10.1617. All alphas are reduced to 0.3 times their values in the original case. Therefore, therelative weights of each security in the active portfolio are unchanged, but the alpha of the active portfolio is only 0.3 times its previous value: 0.3 ⨯ -16.90% = -5.07% The investor will take a smaller position in the active portfolio. The optimal risky portfolio has a proportion w * in the active portfolio as follows:01537.023/86.809,21/07.5/)r r (E )e (/w 22Mf M 20-=-=σ-σα= The negative position is justified for the reason given earlier. The adjustment for beta is:0151.0)]01537.0()08.21[(101537.0w )1(1w *w 00-=-⨯-+-=β-+= Since w* is negative, the result is a positive position in stocks with positive alphas and a negative position in stocks with negative alphas. The position in the index portfolio is:1 – (–0.0151) = 1.0151To calculate Sharpe’s measure for the optimal risky portfolio we compute theinformation ratio for the active portfolio and Sharpe’s measure for the marketportfolio. The information ratio of the active portfolio is 0.3 times its previousvalue:A = α /σ(e)= –5.07/147.68 = –0.0343 and A2 =0.00118Hence, the square of Sharpe’s measure of the optimized risky portfolio is: S2 = S2M + A2 = (8/23)2 + 0.00118 = 0.1222S = 0.3495Compare this to the market’s Sharpe measure: S M = 8/23 = 0.3478The difference is: 0.0017Note that the reduction of the forecast alphas by a factor of 0.3 reduced the squared information ratio and the improvement in the squared Sharpe ratio by a factor of:0.32 = 0.0918. The regression results provide quantitative measures of return and risk based onmonthly returns over the five-year period.βfor ABC was 0.60, considerably less than the average stock’s β of 1.0. Thisindicates that, when the S&P 500 rose or fell by 1 percentage point, ABC’s return on average rose or fell by only 0.60 percentage point. Therefore, ABC’s systematic risk (or market risk) was low relative to the typical value for stocks. ABC’s alpha (the intercept of the regression) was –3.2%, indicating that when the market return was 0%, the average return on ABC was –3.2%. ABC’s unsystematic risk (orresidual risk), as measured by σ(e), was 13.02%. For ABC, R2 was 0.35, indicating closeness of fit to the linear regression greater than the value for a typical stock.β for XYZ was s omewhat higher, at 0.97, indicating XYZ’s return pattern was very similar to the β for the market index. Therefore, XYZ stock had average systematic risk for the period examined. Alpha for XYZ was positive and quite large,indicating a return of almost 7.3%, on average, for XYZ independent of marketreturn. Residual risk was 21.45%, half again as much as ABC’s, indicating a wider scatter of observations around the regression line for XYZ. Correspondingly, the fit of the regression model was considerably less than that of ABC, consistent with an R2 of only 0.17.8-12The effects of including one or the other of these stocks in a diversified portfoliomay be quite different. If it can be assumed that both stocks’ betas will remainstable over time, then there is a large difference in systematic risk level. The betas obtained from the two brokerage houses may help the analyst draw inferences forthe future. The three estimates of ABC’s β are similar, regardless of the sampleperiod of the underlying data. The range of these estimates is 0.60 to 0.71, wellbelow the market average βof 1.0. The three estimates of XYZ’s β varysignificantly among the three sources, ranging as high as 1.45 for the weekly dataover the most recent two years. One could infer tha t XYZ’s β for the future mightbe well above 1.0, meaning it might have somewhat greater systematic risk thanwas implied by the monthly regression for the five-year period.These stocks appear to have significantly different systematic risk characteristics. If these stocks are added to a diversified portfolio, XYZ will add more to total volatility.19. 9 = 3 + β (11 - 3) ⇒β = 0.7520. a. Merrill Lynch adjusts beta by taking the sample estimate of beta and averagingit with 1.0, using the weights of 2/3 and 1/3, as follows:adjusted beta = [(2/3) ⨯ 1.24] + [(1/3) ⨯ 1.0] = 1.16b.If you use your current estimate of beta to be βt–1 = 1.24, thenβt = 0.3 + (0.7 ⨯ 1.24) = 1.1688-13。

博迪投资学答案chap009-7thed9-2CHAPTER 9: THE CAPITAL ASSET PRICING MODEL1. c.2. d. From CAPM, the fair expected return = 8 + 1.25(15 - 8) = 16.75%Actually expected return = 17%α = 17 - 16.75 = 0.25%3. Since the stock’s beta is equal to 1.2, its expected rate of return is:6 + [1.2 ⨯ (16 – 6)] = 18%011P P P D )r (E -+= 53$P 5050P 618.011=⇒+=-4. The series of $1,000 payments is a perpetuity. If beta is 0.5, the cash flowshould be discounted at the rate:6 + [0.5 ⨯ (16 – 6)] = 11%PV = $1,000/0.11 = $9,090.91If, however, beta is equal to 1, then the investment should yield 16%, and the price paid for the firm should be:PV = $1,000/0.16 = $6,250The difference, $2,840.91, is the amount you will overpay if you erroneouslyassume that beta is 0.5 rather than 1.5. Using the SML: 4 = 6 + β(16 – 6) ⇒ β = –2/10 = –0.26. a.7.E(r P ) = r f + β P [E(r M ) – r f ]18 = 6 + β P (14 – 6) ⇒ β P = 12/8 = 1.59-38.a. False. β = 0 implies E(r) = r f , not zero.b. False. Investors require a risk premium only for bearing systematic(undiversifiable or market) risk. Total volatility includes diversifiablerisk.c. False. Your portfolio should be invested 75% in the market portfolioand 25% in T-bills. Then:βP = (0.75 ⨯ 1) + (0.25 ⨯ 0) = 0.759. Not possible. Portfolio A has a higher beta than Portfolio B, but the expectedreturn for Portfolio A is lower than the expected return for Portfolio B. Thus, these two portfolios cannot exist in equilibrium.10. Possible. If the CAPM is valid, the expected rate of return compensates onlyfor systematic (market) risk, represented by beta, rather than for the standard deviation, which includes nonsystematic risk. Thus, Portfolio A’s lower rate of return can be paired with a higher standard deviation, as long as A’s bet a is less than B’s.11. Not possible. The reward-to-variability ratio for Portfolio A is better than thatof the market. This scenario is impossible according to the CAPM because the CAPM predicts that the market is the most efficient portfolio. Using the numbers supplied:5.0121016S A =-= 33.0241018S M =-= Portfolio A provides a better risk-reward tradeoff than the market portfolio.12. Not possible. Portfolio A clearly dominates the market portfolio. Portfolio Ahas both a lower standard deviation and a higher expected return.13. Not possible. The SML for this scenario is: E(r) = 10 + β(18 – 10)Portfolios with beta equal to 1.5 have an expected return equal to:E(r) = 10 + [1.5 ⨯ (18 – 10)] = 22%The expected return for Portfolio A is 16%; that is, Portfolio A plots belowthe SML ( A = –6%), and hence, is an overpriced portfolio. This is inconsistent with the CAPM.9-414. Not possible. The SML is the same as in Problem 13. Here, Portfolio A’srequired return is: 10 + (0.9 ⨯8) = 17.2%This is greater than 16%. Portfolio A is overpriced with a negative alpha:α A = –1.2%15. Possible. The CML is the same as in Problem 11. Portfolio A plots below theCML, as any asset is expected to. This scenario is not inconsistent with theCAPM.16. If the security’s correlation coefficient with the market portfolio doubles (withall other variables such as variances unchanged), then beta, and therefore the risk premium, will also double. The current risk premium is: 14 – 6 = 8%The new risk premium would be 16%, and the new discount rate for thesecurity would be: 16 + 6 = 22%If the stock pays a constant perpetual dividend, then we know from the original data that the dividend (D) must satisfy the equation for the present value of a perpetuity:Price = Dividend/Discount rate50 = D/0.14 ⇒ D = 50 ⨯ 0.14 = $7.00At the new discount rate of 22%, the stock would be worth: $7/0.22 = $31.82 The increase in stock risk has lowered its value by 36.36%.17. d.18. a. Since the market portfolio, by definition, has a beta of 1, its expected rateof return is 12%.b.β = 0 means no systematic risk. Hence, the stock’s expected rate of return inmarket equilibrium is the risk-free rate, 5%.ing the SML, the fair expected rate of return for a stock with β = –0.5 is:E(r) = 5 + [(–0.5)(12 – 5)] = 1.5%The actually expected rate of return, using the expected price and dividendfor next year is:E(r) = [($41 + $1)/40] – 1 = 0.10 = 10%Because the actually expected return exceeds the fair return, the stock isunderpriced.9-519. a. E(r P) = r f + β P [E(r M ) – r f ] = 5% + 0.8 (15% − 5%) = 13%α = 14% - 13% = 1%You should invest in this fund because alpha is positive.b. The passive portfolio with the same beta as the fund should be invested80% in the market-index portfolio and 20% in the money market account.For this portfolio:E(r P) = (0.8 × 15%) + (0.2 × 5%) = 13%14% − 13% = 1% = α20. d. [You need to know the risk-free rate]21. d. [You need to know the risk-free rate]22. a.Expected Return AlphaStock X 5% + 0.8(14% - 5%) =12.2% 14.0% - 12.2% = 1.8%Stock Y 5% + 1.5(14% - 5%) =18.5%17.0% - 18.5% = -1.5%b.i. Kay should recommend Stock X because of its positive alpha, compared toStock Y, which has a negative alpha. In graphical terms, the expectedreturn/risk profile for Stock X plots above the security market line (SML), while the profile for Stock Y plots below the SML. Also, depending onthe individual risk preferences of Kay’s clients, the lower beta for Stock X may have a beneficial effect on overall portfolio risk.ii. Kay should recommend Stock Y because it has higher forecasted return and lower standard deviation than Stock X. The respective Sharpe ratios for Stocks X and Y and the market index are:Stock X: (14% - 5%)/36% = 0.25Stock Y: (17% - 5%)/25% = 0.48Market index: (14% - 5%)/15% = 0.60The market index has an even more attractive Sharpe ratio than either of the individual stocks, but, given the choice between Stock X and Stock Y, Stock Y is the superior alternative.When a stock is held as a single stock portfolio, standard deviation is therelevant risk measure. For such a portfolio, beta as a risk measure isirrelevant. Although holding a single asset is not a typically recommended investment strategy, some investors may hold what is essentially asingle-asset portfolio when they hold the stock of their employer company.For such investors, the relevance of standard deviation versus beta is an9-6important issue.9-79-823. The appropriate discount rate for the project is:r f + β[E(r M ) – r f ] = 8 + [1.8 ⨯ (16 – 8)] = 22.4% Using this discount rate:∑=+-=101t t 1.224150400NPV = −400 pesos + [150 pesos × Annuity factor (22.4%, 10 years) = 180.92 pesos The internal rate of return (IRR) for the project is 35.73%. Recall from your introductory finance class that NPV is positive if IRR > discount rate (or,equivalently, hurdle rate). The highest value that beta can take before the hurdle rate exceeds the IRR is determined by:35.73 = 8 + β(16 – 8) ⇒ β = 27.73/8 = 3.4724. a. McKay should borrow funds and invest those funds proportionately inMurray’s existing portfolio (i.e., buy more risky assets on margin). Inaddition to increased expected return, the alternative portfolio on thecapital market line will also have increased risk, which is caused by thehigher proportion of risky assets in the total portfolio.b. McKay should substitute low beta stocks for high beta stocks in order toreduce the overall beta of York’s portfolio. By reducing the overallportfolio beta, McKay will reduce the systematic risk of the portfolio, andtherefore reduce its volatility relative to the market. The security marketline (SML) suggests such action (i.e., moving down the SML), even thoughreducing beta may result in a slight loss of portfolio efficiency unless fulldiversification is maintained. York’s primary objective, however, is notto maintain efficiency, but to reduce risk exposure; reducing portfolio betameets that objective. Because York does not want to engage in borrowingor lending, McKay cannot reduce risk by selling equities and using theproceeds to buy risk-free assets (i.e., lending part of the portfolio). 25. d.26. r 1 = 19%; r 2 = 16%; β1 = 1.5; β2 = 1a. To determine which investor was a better selector of individual stocks welook at abnormal return, which is the ex-post alpha; that is, the abnormalreturn is the difference between the actual return and that predicted bythe SML. Without information about the parameters of this equation(risk-free rate and market rate of return) we cannot determine whichinvestor was more accurate.9-9b. If r f = 6% and r M = 14%, then (using the notation alpha for the abnormalreturn):α 1 = 19 – [6 + 1.5(14 – 6)] = 19 – 18 = 1%α 2 = 16 – [6 + 1(14 – 6)] =16 – 14 = 2%Here, the second investor has the larger abnormal return and thusappears to be the superior stock selector. By making better predictions,the second investor appears to have tilted his portfolio towardunderpriced stocks.c. If r f = 3% and r M = 15%, then:α 1 =19 – [3 + 1.5(15 – 3)] = 19 – 21 = –2%α 2 = 16 – [3+ 1(15 – 3)] = 16 – 15 = 1%Here, not only does the second investor appear to be the superior stockselector, but the first investor’s predictions appear valueless (or worse).27. In the zero-beta CAPM the zero-beta portfolio replaces the risk-free rate, andthus:E(r) = 8 + 0.6(17 – 8) = 13.4%28. a. Call the aggressive stock A and the defensive stock D. Beta is thesensitivity of the stock’s return to the market return, i.e., the change in thestock return per unit change in the market return. Therefore, wecompute each stock’s beta by calculating the difference in its return across the two scenarios divided by the difference in the market return:00.2255382A =---=β 30.0255126D =--=βb. With the two scenarios equally likely, the expected return is an average ofthe two possible outcomes:E(r A ) = 0.5 ⨯ (–2 + 38) = 18%E(r D ) = 0.5 ⨯ (6 + 12) = 9%c. The SML is determined by the market expected return of [0.5(25 + 5)] =15%, with a beta of 1, and the T-bill return of 6% with a beta of zero. Seethe following graph.The equation for the security market line is:E(r) = 6 + β(15 – 6)d.Based on its risk, the aggressive stock has a required expected return of:E(r A ) = 6 + 2.0(15 – 6) = 24%The analyst’s forecast of expected return is only 18%. Thus the stock’s alpha is:α A = actually expected return – required return (given risk)= 18% – 24% = –6%Similarly, the required return for the defensive stock is:E(r D) = 6 + 0.3(15 – 6) = 8.7%The analyst’s forecast of expected return for D is 9%, and hence, the stock has a positive alpha:α D = actually expected return – required return (given risk)= 9 – 8.7 = +0.3%The points for each stock plot on the graph as indicated above.e. The hurd le rate is determined by the project beta (0.3), not the firm’s beta.The correct discount rate is 8.7%, the fair rate of return for stock D.9-1029. a. Agree; Regan’s conclusion is correct. By definition, the market portfolio lieson the capital market line (CML). Under the assumptions of capital markettheory, all portfolios on the CML dominate, in a risk-return sense, portfoliosthat lie on the Markowitz efficient frontier because, given that leverage isallowed, the CML creates a portfolio possibility line that is higher than allpoints on the efficient frontier except for the market portfolio, which isRainbow’s portfolio. Because Eagle’s portfolio lies on the Markowitzefficient frontier at a point other than the market portfolio, Rainbow’sportfoli o dominates Eagle’s portfolio.b. Unsystematic risk is the unique risk of individual stocks in a portfolio that isdiversified away by holding a well-diversified portfolio. Total risk iscomposed of systematic (market) risk and unsystematic (firm-specific) risk.Disagree; Wilson’s remark is incorrect. Because both portfolios lie on theMarkowitz efficient frontier, neither Eagle nor Rainbow has any unsystematicrisk. Therefore, unsystematic risk does not explain the different expectedreturns. The determining factor is that Rainbow lies on the (straight) line(the CML) connecting the risk-free asset and the market portfolio (Rainbow),at the point of tangency to the Markowitz efficient frontier having the highestreturn per unit of risk. Wilson’s remar k is also countered by the fact that,since unsystematic risk can be eliminated by diversification, the expectedreturn for bearing unsystematic is zero. This is a result of the fact thatwell-diversified investors bid up the price of every asset to the point whereonly systematic risk earns a positive return (unsystematic risk earns noreturn).30. E(r) = r f+ β × [E(r M) − r f]Fuhrman Labs: E(r) = 5 + 1.5 × [11.5 − 5.0] = 14.75%Garten Testing: E(r) = 5 + 0.8 × [11.5 − 5.0] = 10.20%If the forecast rate of return is less than (greater than) the required rate ofreturn, then the security is overvalued (undervalued).Fuhrman Labs: Forecast return –Required return = 13.25% − 14.75% =−1.50%Garten Testing: Forecast return –Required return = 11.25% − 10.20% =1.05%Therefore, Fuhrman Labs is overvalued and Garten Testing is undervalued.31. Under the CAPM, the only risk that investors are compensated for bearing isthe risk that cannot be diversified away (systematic risk). Because systematicrisk (measured by beta) is equal to 1.0 for both portfolios, an investor wouldexpect the same rate of return from both portfolios A and B. Moreover, sinceboth portfolios are well diversified, it doesn’t matter if the specific risk of the individual securities is high or low. The firm-specific risk has been diversified away for both portfolios.。

第23章期货、互换与风险管理本章重点1.讨论外汇期货2.研究股指期货3.利率期货市场4.外汇与固定收益证券的互换市场23.1 外汇期货23.1.1 利率平价外汇市场上存在即期汇率与期货价格之间的平价关系。

违背了利率平价关系(interest rate parity relationship),套利者就能够在市场上以零净投资获得无风险利润。

利率平价关系也被称为抛补利息套利关系(covered interest arbitrage relationship)。

用两种货币,美元与英镑来说明这种利率平价关系。

E0——当前两种货币的汇率F0——远期价格美国和英国两国的无风险利率分别为r US和r UK根据利率平价理论E0与F0之间的关系为(23-1)例如,如果每年的r US=0.04,r UK=0.05,而E0=2美元/英镑那么1年期远期合约的理论期货价格应该为分析:如果r US<r UK,即把资金投在美国比投在英国增值慢,那么为什么不是所有的投资者都决定把他们的资金投在英国呢?一个重要的原因就是美元相对于英镑会升值,所以尽管在美国的美元投资比在英国的英镑投资增值慢,但是随着时间的推移,每美元能换得的英镑数目会越来越多,这正好抵消了英国的高利率所带来的好处。

结论:当r US<r UK时,F0肯定小于E0。

由F0比E0得到的美元升值程度恰好可以与两国利率之间的差额相抵消。

当然,如果情况相反,结论正好颠倒过来:当r US大于r UK时,F0肯定大于E0。

例23-1:抛补利息套利例如,假定期货价格是1.97美元/英镑而不是1.981美元/英镑,那么采取以下策略你就可以获得套利利润。

用E0表示1年后的汇率(美元/英镑),当然它应该是一个随投机者现在的期望而改变的随机变量。

第一步,你把从英国借入的1英镑按即期汇率兑换成2美元,一年以后你必须还本付息。

因为贷款是在英国按英国利率借入的,所以你需要偿还1.05英镑,而它相当于E1(1.05)美元。