Joint Pricing and Inventory Decisions

- 格式:pdf

- 大小:236.85 KB

- 文档页数:28

术语翻译与回答问题(主要出自每单元的学习重点与难点)underwriter 保险业者,承诺支付者,保险商Unit 1学习重点里的词汇中英互译:词汇和词组的中英一定都是牢记。

短语搭配如play a role, be based on 不会在词汇中英互译中出现,但会在句子翻译和选择题里体现Logistics物流, warehouse仓库(warehousing仓储), inventory库存(库存成本inventory cost),procurement获得, packaging包装, inbound往内地的,归航的, outbound开往外地或外国的, handling搬运(material handling材料搬运), coordination合作协作, strategic planning战略规划, customer service 客户服务, forecasting 预测,问答题1.What is modern logistics?Logistics is that part of the supply chain process that plans, implements and controls the efficient, effective flow and storage of goods, service and related information from the point of origin to the point of consumption to meet consumer s’ requirements.2.How many sectors of economic activities are involved in logistics? What are they? 2009.10 2007.10Eight sectors of economic activities are involved in logistics. They are packaging, warehousing, material handling, inventory, transport, forecasting, strategic planning and customer service.U2Strategy策略、战略, physical身体的、物质的, availability可得性、可用性、实用性, ultimate 最后的、最终的, outlet出口、出路, patronage赞助、光顾, accessibility可到达、易接近, furnishing设备、陈设品, brand品牌, offer提供、出价, pattern式样、模式. consumer products 消费类产品, convenience product 便利型产品,shopping products 购买型产品,specialty products 特殊产品,学习产品分类。

做合同,还有清单的英语词汇Contract Formation and Inventory Management in Business Operations.In the realm of business operations, the creation of contracts and inventory lists is an integral part of ensuring smooth and efficient transactions. These documents play a pivotal role in outlining the terms and conditions of agreements, managing resources, and maintaining transparency in business dealings.Contract Formation.Contract formation is the process of negotiating and agreeing upon the terms of a contract between two or more parties. It involves several stages, including offer, acceptance, consideration, and intention to create legal relations. Each stage is crucial in ensuring that the contract is legally binding and enforceable.The first stage, the offer, is when one party proposes a deal or transaction to another party. This offer must be clear, unambiguous, and contain all the essential terms of the contract. Once the offer is made, the second party has the option to accept or reject it.Acceptance occurs when the second party agrees to the terms proposed in the offer, without any modifications. If the second party wishes to modify the terms, it must make a counter-offer, which essentially becomes a new offer. This process continues until both parties reach a mutual agreement.Consideration refers to the exchange of value between the parties. It ensures that each party receives something in return for their obligations under the contract. Consideration must be legal and sufficient to make the contract enforceable.Lastly, the intention to create legal relations is essential. Both parties must have the intention to be bound by the contract and its terms. This intention must beevident from the language and context of the contract.Once the contract is formed, it serves as a legal document that outlines the rights and obligations of the parties involved. It ensures that both parties adhere to the agreed-upon terms and conditions and serves as a recourse in case of disputes or breaches of contract.Inventory Management.Inventory management refers to the processes involved in tracking, storing, and managing a business's inventory. It ensures that the right products are available in the right quantities at the right time, meeting the demands of customers while minimizing costs and waste.Effective inventory management begins with accurate inventory counts. This involves regularly updating and verifying the quantity and status of products in stock. This information is crucial for making informed decisions about restocking, pricing, and fulfillment.Inventory tracking systems play a vital role in managing inventory. These systems allow businesses to monitor the movement of products throughout the supply chain, from procurement to sales. By tracking inventory in real-time, businesses can identify trends, predict demand, and plan accordingly.Proper storage facilities are also essential for effective inventory management. This ensures that products are protected from damage, theft, and spoilage. It also helps in maintaining the quality and integrity of products, ensuring that they are ready for sale when needed.Inventory management also involves the use of advanced techniques and tools, such as just-in-time inventory systems, lean inventory management, and inventory optimization software. These tools help businesses reduce costs, improve efficiency, and maintain a competitive edge in the market.In conclusion, contract formation and inventory management are integral components of business operations.Contracts outline the terms and conditions of agreements, ensuring legal binding and enforcement. On the other hand, inventory management ensures that businesses have the right products in the right quantities, meeting customer demands while minimizing costs and waste. By mastering these aspects of business operations, companies can achieve success and profitability.。

- disruption ,: Global convergence vs nationalSustainable-,practices and dynamic capabilities in the food industry: A critical analysis of the literature5 Mesoscopic- simulation6 Firm size and sustainable performance in food -s: Insights from Greek SMEs7 An analytical method for cost analysis in multi-stage -s: A stochastic / model approach8 A Roadmap to Green - System through Enterprise Resource Planning (ERP) Implementation9 Unidirectional transshipment policies in a dual-channel -10 Decentralized and centralized model predictive control to reduce the bullwhip effect in -,11 An agent-based distributed computational experiment framework for virtual -/ development12 Biomass-to-bioenergy and biofuel - optimization: Overview, key issues and challenges13 The benefits of - visibility: A value assessment model14 An Institutional Theory perspective on sustainable practices across the dairy -15 Two-stage stochastic programming - model for biodiesel production via wastewater treatment16 Technology scale and -s in a secure, affordable and low carbon energy transition17 Multi-period design and planning of closed-loop -s with uncertain supply and demand18 Quality control in food -,: An analytical model and case study of the adulterated milk incident in China19 - information capabilities and performance outcomes: An empirical study of Korean steel suppliers20 A game-based approach towards facilitating decision making for perishable products: An example of blood -21 - design under quality disruptions and tainted materials delivery22 A two-level replenishment frequency model for TOC - replenishment systems under capacity constraint23 - dynamics and the ―cross-border effect‖: The U.S.–Mexican border’s case24 Designing a new - for competition against an existing -25 Universal supplier selection via multi-dimensional auction mechanisms for two-way competition in oligopoly market of -26 Using TODIM to evaluate green - practices under uncertainty27 - downsizing under bankruptcy: A robust optimization approach28 Coordination mechanism for a deteriorating item in a two-level - system29 An accelerated Benders decomposition algorithm for sustainable -/ design under uncertainty: A case study of medical needle and syringe -30 Bullwhip Effect Study in a Constrained -31 Two-echelon multiple-vehicle location–routing problem with time windows for optimization of sustainable -/ of perishable food32 Research on pricing and coordination strategy of green - under hybrid production mode33 Agent-system co-development in - research: Propositions and demonstrative findings34 Tactical ,for coordinated -s35 Photovoltaic - coordination with strategic consumers in China36 Coordinating supplier׳s reorder point: A coordination mechanism for -s with long supplier lead time37 Assessment and optimization of forest biomass -s from economic, social and environmental perspectives – A review of literature38 The effects of a trust mechanism on a dynamic -/39 Economic and environmental assessment of reusable plastic containers: A food catering - case study40 Competitive pricing and ordering decisions in a multiple-channel -41 Pricing in a - for auction bidding under information asymmetry42 Dynamic analysis of feasibility in ethanol - for biofuel production in Mexico43 The impact of partial information sharing in a two-echelon -44 Choice of - governance: Self-managing or outsourcing?45 Joint production and delivery lot sizing for a make-to-order producer–buyer - with transportation cost46 Hybrid algorithm for a vendor managed inventory system in a two-echelon -47 Traceability in a food -: Safety and quality perspectives48 Transferring and sharing exchange-rate risk in a risk-averse - of a multinational firm49 Analyzing the impacts of carbon regulatory mechanisms on supplier and mode selection decisions: An application to a biofuel -50 Product quality and return policy in a - under risk aversion of a supplier51 Mining logistics data to assure the quality in a sustainable food -: A case in the red wine industry52 Biomass - optimisation for Organosolv-based biorefineries53 Exact solutions to the - equations for arbitrary, time-dependent demands54 Designing a sustainable closed-loop -/ based on triple bottom line approach: A comparison of metaheuristics hybridization techniques55 A study of the LCA based biofuel - multi-objective optimization model with multi-conversion paths in China56 A hybrid two-stock inventory control model for a reverse -57 Dynamics of judicial service -s58 Optimizing an integrated vendor-managed inventory system for a single-vendor two-buyer - with determining weighting factor for vendor׳s ordering59 Measuring - Resilience Using a Deterministic Modeling Approach60 A LCA Based Biofuel - Analysis Framework61 A neo-institutional perspective of -s and energy security: Bioenergy in the UK62 Modified penalty function method for optimal social welfare of electric power - with transmission constraints63 Optimization of blood - with shortened shelf lives and ABO compatibility64 Diversified firms on dynamical - cope with financial crisis better65 Securitization of energy -s in China66 Optimal design of the auto parts - for JIT operations: Sequential bifurcation factor screening and multi-response surface methodology67 Achieving sustainable -s through energy justice68 - agility: Securing performance for Chinese manufacturers69 Energy price risk and the sustainability of demand side -s70 Strategic and tactical mathematical programming models within the crude oil - context - A review71 An analysis of the structural complexity of -/s72 Business process re-design methodology to support - integration73 Could - technology improve food operators’ innovativeness? A developing country’s perspective74 RFID-enabled process reengineering of closed-loop -s in the healthcare industry of Singapore75 Order-Up-To policies in Information Exchange -s76 Robust design and operations of hydrocarbon biofuel - integrating with existing petroleum refineries considering unit cost objective77 Trade-offs in - transparency: the case of Nudie Jeans78 Healthcare - operations: Why are doctors reluctant to consolidate?79 Impact on the optimal design of bioethanol -s by a new European Commission proposal80 Managerial research on the pharmaceutical - – A critical review and some insights for future directions81 - performance evaluation with data envelopment analysis and balanced scorecard approach82 Integrated - design for commodity chemicals production via woody biomass fast pyrolysis and upgrading83 Governance of sustainable -s in the fast fashion industry84 Temperature ,for the quality assurance of a perishable food -85 Modeling of biomass-to-energy - operations: Applications, challenges and research directions86 Assessing Risk Factors in Collaborative - with the Analytic Hierarchy Process (AHP)87 Random / models and sensitivity algorithms for the analysis of ordering time and inventory state in multi-stage -s88 Information sharing and collaborative behaviors in enabling - performance: A social exchange perspective89 The coordinating contracts for a fuzzy - with effort and price dependent demand90 Criticality analysis and the -: Leveraging representational assurance91 Economic model predictive control for inventory ,in -s92 -,ontology from an ontology engineering perspective93 Surplus division and investment incentives in -s: A biform-game analysis94 Biofuels for road transport: Analysing evolving -s in Sweden from an energy security perspective95 -,executives in corporate upper echelons Original Research Article96 Sustainable -,in the fast fashion industry: An analysis of corporate reports97 An improved method for managing catastrophic - disruptions98 The equilibrium of closed-loop - super/ with time-dependent parameters99 A bi-objective stochastic programming model for a centralized green - with deteriorating products100 Simultaneous control of vehicle routing and inventory for dynamic inbound -101 Environmental impacts of roundwood - options in Michigan: life-cycle assessment of harvest and transport stages102 A recovery mechanism for a two echelon - system under supply disruption103 Challenges and Competitiveness Indicators for the Sustainable Development of the - in Food Industry104 Is doing more doing better? The relationship between responsible -,and corporate reputation105 Connecting product design, process and - decisions to strengthen global - capabilities106 A computational study for common / design in multi-commodity -s107 Optimal production and procurement decisions in a - with an option contract and partial backordering under uncertainties108 Methods to optimise the design and ,of biomass-for-bioenergy -s: A review109 Reverse - coordination by revenue sharing contract: A case for the personal computers industry110 SCOlog: A logic-based approach to analysing - operation dynamics111 Removing the blinders: A literature review on the potential of nanoscale technologies for the ,of -s112 Transition inertia due to competition in -s with remanufacturing and recycling: A systems dynamics mode113 Optimal design of advanced drop-in hydrocarbon biofuel - integrating with existing petroleum refineries under uncertainty114 Revenue-sharing contracts across an extended -115 An integrated revenue sharing and quantity discounts contract for coordinating a - dealing with short life-cycle products116 Total JIT (T-JIT) and its impact on - competency and organizational performance117 Logistical - design for bioeconomy applications118 A note on ―Quality investment and inspection policy in a supplier-manufacturer -‖119 Developing a Resilient -120 Cyber - risk ,: Revolutionizing the strategic control of critical IT systems121 Defining value chain architectures: Linking strategic value creation to operational - design122 Aligning the sustainable - to green marketing needs: A case study123 Decision support and intelligent systems in the textile and apparel -: An academic review of research articles124 -,capability of small and medium sized family businesses in India: A multiple case study approach125 - collaboration: Impact of success in long-term partnerships126 Collaboration capacity for sustainable -,: small and medium-sized enterprises in Mexico127 Advanced traceability system in aquaculture -128 - information systems strategy: Impacts on - performance and firm performance129 Performance of - collaboration – A simulation study130 Coordinating a three-level - with delay in payments and a discounted interest rate131 An integrated framework for agent basedinventory–production–transportation modeling and distributed simulation of -s132 Optimal - design and ,over a multi-period horizon under demand uncertainty. Part I: MINLP and MILP models133 The impact of knowledge transfer and complexity on - flexibility: A knowledge-based view134 An innovative - performance measurement system incorporating Research and Development (R&D) and marketing policy135 Robust decision making for hybrid process - systems via model predictive control136 Combined pricing and - operations under price-dependent stochastic demand137 Balancing - competitiveness and robustness through ―virtual dual sourcing‖: Lessons from the Great East Japan Earthquake138 Solving a tri-objective - problem with modified NSGA-II algorithm 139 Sustaining long-term - partnerships using price-only contracts 140 On the impact of advertising initiatives in -s141 A typology of the situations of cooperation in -s142 A structured analysis of operations and -,research in healthcare (1982–2011143 - practice and information quality: A - strategy study144 Manufacturer's pricing strategy in a two-level - with competing retailers and advertising cost dependent demand145 Closed-loop -/ design under a fuzzy environment146 Timing and eco(nomic) efficiency of climate-friendly investments in -s147 Post-seismic - risk ,: A system dynamics disruption analysis approach for inventory and logistics planning148 The relationship between legitimacy, reputation, sustainability and branding for companies and their -s149 Linking - configuration to - perfrmance: A discrete event simulation model150 An integrated multi-objective model for allocating the limited sources in a multiple multi-stage lean -151 Price and leadtime competition, and coordination for make-to-order -s152 A model of resilient -/ design: A two-stage programming with fuzzy shortest path153 Lead time variation control using reliable shipment equipment: An incentive scheme for - coordination154 Interpreting - dynamics: A quasi-chaos perspective155 A production-inventory model for a two-echelon - when demand is dependent on sales teams׳ initiatives156 Coordinating a dual-channel - with risk-averse under a two-way revenue sharing contract157 Energy supply planning and - optimization under uncertainty158 A hierarchical model of the impact of RFID practices on retail - performance159 An optimal solution to a three echelon -/ with multi-product and multi-period160 A multi-echelon - model for municipal solid waste ,system 161 A multi-objective approach to - visibility and risk162 An integrated - model with errors in quality inspection and learning in production163 A fuzzy AHP-TOPSIS framework for ranking the solutions of Knowledge ,adoption in - to overcome its barriers164 A relational study of - agility, competitiveness and business performance in the oil and gas industry165 Cyber - security practices DNA – Filling in the puzzle using a diverse set of disciplines166 A three layer - model with multiple suppliers, manufacturers and retailers for multiple items167 Innovations in low input and organic dairy -s—What is acceptable in Europe168 Risk Variables in Wind Power -169 An analysis of - strategies in the regenerative medicine industry—Implications for future development170 A note on - coordination for joint determination of order quantity and reorder point using a credit option171 Implementation of a responsive - strategy in global complexity: The case of manufacturing firms172 - scheduling at the manufacturer to minimize inventory holding and delivery costs173 GBOM-oriented ,of production disruption risk and optimization of - construction175 Alliance or no alliance—Bargaining power in competing reverse -s174 Climate change risks and adaptation options across Australian seafood -s – A preliminary assessment176 Designing contracts for a closed-loop - under information asymmetry 177 Chemical - modeling for analysis of homeland security178 Chain liability in multitier -s? Responsibility attributions for unsustainable supplier behavior179 Quantifying the efficiency of price-only contracts in push -s over demand distributions of known supports180 Closed-loop -/ design: A financial approach181 An integrated -/ design problem for bidirectional flows182 Integrating multimodal transport into cellulosic biofuel- design under feedstock seasonality with a case study based on California183 - dynamic configuration as a result of new product development184 A genetic algorithm for optimizing defective goods - costs using JIT logistics and each-cycle lengths185 A -/ design model for biomass co-firing in coal-fired power plants 186 Finance sourcing in a -187 Data quality for data science, predictive analytics, and big data in -,: An introduction to the problem and suggestions for research and applications188 Consumer returns in a decentralized -189 Cost-based pricing model with value-added tax and corporate income tax for a -/190 A hard nut to crack! Implementing - sustainability in an emerging economy191 Optimal location of spelling yards for the northern Australian beef -192 Coordination of a socially responsible - using revenue sharing contract193 Multi-criteria decision making based on trust and reputation in -194 Hydrogen - architecture for bottom-up energy systems models. Part 1: Developing pathways195 Financialization across the Pacific: Manufacturing cost ratios, -s and power196 Integrating deterioration and lifetime constraints in production and - planning: A survey197 Joint economic lot sizing problem for a three—Layer - with stochastic demand198 Mean-risk analysis of radio frequency identification technology in - with inventory misplacement: Risk-sharing and coordination199 Dynamic impact on global -s performance of disruptions propagation produced by terrorist acts。

物品管理的五定原则英文回答:The Five Principles of Item Management are essential guidelines for effective inventory control and organization. These principles help businesses maintain accurate records, optimize storage space, minimize costs, and ensure timely availability of items. Let's explore each principle in detail:1. Identification: The first principle is to clearly identify each item in the inventory. This can be achievedby assigning unique codes or labels to each item. The identification should be specific enough to distinguish similar items and prevent confusion. Proper identification facilitates easy tracking, reduces errors, and enables efficient stock management.2. Classification: The second principle is to classify items based on their characteristics, usage, or value. Thishelps in grouping similar items together, making it easier to locate and retrieve them when needed. Classification can be done based on various criteria such as size, weight, type, or shelf life. It enables businesses to prioritize items, allocate storage space effectively, and optimize inventory management.3. Standardization: The third principle is to establish standard procedures and protocols for item management. This includes standardized naming conventions, labeling formats, storage methods, and documentation processes. Standardization ensures consistency and uniformity in handling items, reduces confusion, and streamlines operations. It also facilitates training and enables smooth transition during employee turnover.4. Valuation: The fourth principle is to assign a value to each item in the inventory. This helps in determining the financial worth of the inventory and tracking its value over time. Valuation methods can vary based on the nature of the items, such as First-In-First-Out (FIFO) or Last-In-First-Out (LIFO) for perishable goods. Accurate valuationenables businesses to make informed decisions regarding pricing, reordering, and financial reporting.5. Control: The final principle is to establish control measures to safeguard items and prevent loss, theft, or damage. This includes implementing security measures, such as access control, surveillance systems, and inventory audits. Control measures also involve regular stock checks, reconciliation with records, and addressing discrepancies promptly. Effective control ensures the integrity of the inventory and helps in maintaining accurate records.In summary, the Five Principles of Item Management Identification, Classification, Standardization, Valuation, and Control provide a comprehensive framework for efficient and organized inventory management. By following these principles, businesses can enhance productivity, reduce costs, and improve customer satisfaction.中文回答:物品管理的五定原则是有效控制和组织库存的基本准则。

电子商务模式下易腐农产品的定价与库存联合决策作者:张名扬郭健涛于欣格来源:《预测》2021年第04期摘要:随着互联网的高速发展,电子商务平台已经成为越来越多产品的主要销售渠道。

新冠肺炎疫情发生以来,人们减少外出,生鲜电商平台订单量激增。

生鲜产品由于易腐的特性,其在销售和库存管理等方式上区别于普通产品,因此研究电商平台下易腐农产品的定价与库存联合决策十分必要。

本文通过探讨电子商务平台与线下销售的不同,抽象出电子商务平台的特点,考虑网络扩散效应以及在线评论对消费者购买意愿的影响,又结合了农产品易腐的特性,构建了两阶段的需求函数。

通过单一定价与动态定价两种策略,分别探讨了定价不受腐败程度影响以及随腐败程度变化的两种模式下零售商的最优决策。

数值模拟对比了两种定价方式的优劣,为管理者提供决策建议。

关键词:易腐农产品;电子商务平台;定价与库存管理中图分类号:F713.365文献标识码:A文章编号:1003 5192(2021)04-0032-06doi:10.11847/fj.40.4.32Abstract:With the rapid development of the Internet, e commerce platforms have become the main sales channel for more and more products. Since the outbreak of COVID 19, people have reduced going out, and the volume of fresh food e commerce platform has surged. The perishable nature of fresh products makes it different from ordinary products in terms of sales and inventory management. Therefore, it is necessary to study the pricing and inventory decisions of agricultural perishable products on e commerce platforms. By discussing the differences between e commerce platforms and offline sales to abstract characteristics of e commerce platform, a two stage demand function is constructed taking into account the perishable characteristics of agricultural products, the network diffusion effect of e commerce platforms and the influence of online reviews on consumers’ willingness to purchase. The optimal decisions of retailers under two pricing strategies, fixed pricing and dynamic pricing, are explored separately. Numerical simulation methods are used to compare the advantages and disadvantages of the two pricing strategies, so as to provide managers with recommendations for decision making.Key words:agricultural perishable products; e commerce platform; pricing and inventory management1 引言随着互联网的高速发展,电子商务平台已经成为越来越多产品的主要销售渠道。

英语作文-便利店零售行业,门槛之争加剧行业竞争The convenience store retail industry is a dynamic sector characterized by intense competition and evolving entry barriers. As convenience stores (or c-stores) have become ubiquitous in many urban and suburban areas worldwide, the landscape of this industry has undergone significant transformations. This article explores the key factors contributing to the competitive environment and the shifting thresholds for entering this market.### Market Dynamics and Competition。

Convenience stores occupy a unique niche in the retail sector by offering a combination of accessibility, extended operating hours, and a diverse range of products. These establishments cater primarily to customers seeking quick purchases, often at higher prices per item but with the convenience of immediate availability. The competitive landscape in this industry is shaped by several key elements:#### 1. Location Strategies。

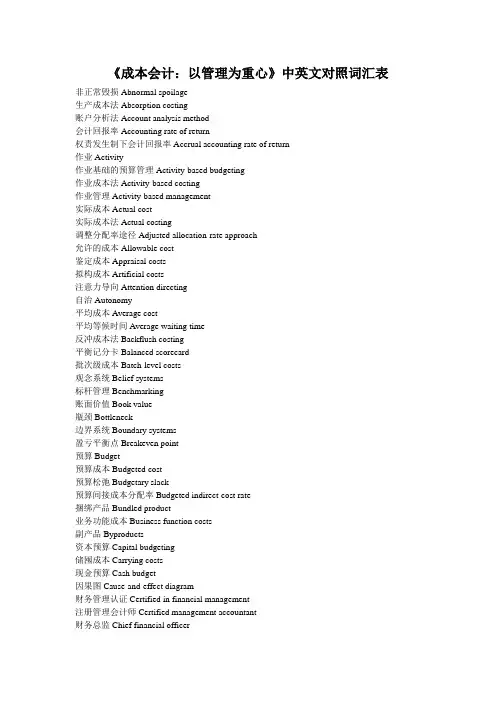

《成本会计:以管理为重心》中英文对照词汇表非正常毁损Abnormal spoilage生产成本法Absorption costing账户分析法Account analysis method会计回报率Accounting rate of return权责发生制下会计回报率Accrual accounting rate of return作业Activity作业基础的预算管理Activity-based budgeting作业成本法Activity-based costing作业管理Activity-based management实际成本Actual cost实际成本法Actual costing调整分配率途径Adjusted allocation-rate approach允许的成本Allowable cost鉴定成本Appraisal costs拟构成本Artificial costs注意力导向Attention directing自治Autonomy平均成本Average cost平均等候时间Average waiting time反冲成本法Backflush costing平衡记分卡Balanced scorecard批次级成本Batch-level costs观念系统Belief systems标杆管理Benchmarking账面价值Book value瓶颈Bottleneck边界系统Boundary systems盈亏平衡点Breakeven point预算Budget预算成本Budgeted cost预算松弛Budgetary slack预算间接成本分配率Budgeted indirect-cost rate捆绑产品Bundled product业务功能成本Business function costs副产品Byproducts资本预算Capital budgeting储囤成本Carrying costs现金预算Cash budget因果图Cause-and-effect diagram财务管理认证Certified in financial management注册管理会计师Certified management accountant财务总监Chief financial officer决定系数Coefficient of determination共谋定价Collusive pricing共同成本Common cost完整往复成本Complete reciprocated costs合成单位Composite unit商讨会法Conference method遵循质量Conformance quality常数Constant固定毛利率NRV法Constant gross-margin percentage NRV method 约束条件Constraint滚动预算Continuous budget, rolling budget贡献收益表Contribution income statement边际贡献Contribution margin单位边际贡献Contribution margin per unit边际贡献率Contribution margin percentage边际贡献比例Contribution margin ratio控制Control控制图Control chart可控性Controllability可控成本Controllable cost主计长Controller加工成本Conversion costs成本Cost成本会计Cost accounting成本会计标准委员会Cost accounting standards board成本汇集Cost accumulation成本分配Cost allocation成本分配基础Cost-allocation base成本分配基础Cost-application base成本归集Cost assignment成本-收益权衡Cost-benefit approach成本中心Cost center成本动因Cost driver成本估计Cost estimation成本函数Cost function成本层级Cost hierarchy成本流入Cost incurrence成本领先Cost leadership成本管理Cost management成本对象Cost object资本成本Cost of capital产品制造成本Cost of goods manufactured成本库Cost pool成本预测Cost predictions成本追溯Cost tracing质量成本Costs of quality, quality costs本量利分析Cost-volume-profit (CVP) analysis累计平均时间学习模型Cumulative average-time learning model当前成本Current cost客户成本层级Customer cost hierarchy客户生命周期成本Customer life-cycle costs客户盈利分析Customer-profitability analysis客户回应时间Customer-response time客户服务Customer service分权Decentralization决策模型Decision model决策表Decision table经营杠杆水平Degree of operating leverage分母水平Denominator level生产数量差异Denominator-level variance, Output-level overhead variance, Production-volume variance因变量Dependent variable产品或服务设计Design of products, services, or processes设计质量Design quality设计锁定成本Designed-in costs, locked-in costs诊断控制系统Diagnostic control systems差异成本Differential cost差异收入Differential revenue直接分配法Direct allocation method直接成本法Direct costing成本对象的直接成本Direct costs of a cost object直接生产人工成本Direct manufacturing labor costs直接材料成本Direct material costs直接材料存货Direct material inventory直接材料混合差异Direct material mix variance直接材料产量差异Direct material yield variance直接法Direct method折现率Discount rate现金流量折现法Discounted cash flow (DCF) methods酌量性成本Discretionary costs发送Distribution减少规模Downsizing向下需求旋转Downward demand spiral双重定价Dual pricing双成本分配率法Dual-rate cost-allocation method, dual-rate method倾销Dumping次优化决策制定Dysfunctional decision making, Incongruent decision making, suboptimal decision making经济订单数量Economic order quantity (EOQ)经济增加值Economic value added有效性Effectiveness效率Efficiency效率差异Efficiency variance, usage variance努力Effort技术成本Engineered costs约当产量Equivalent units事项Event预期货币价值Expected monetary value, expected value经验曲线Experience curve外部失败成本External failure cost设施支持成本Facility-sustaining costs工厂间接费用Factory overhead costs有利差异Favorable variance反馈Feedback财务主管Finance director财务会计Financial accounting财务预算Financial budget财务计划模型Financial planning models产成品存货Finished goods inventory先进先出分步法First-in, first-out (FIFO) process-costing method固定成本Fixed cost固定间接费用弹性预算差异Fixed overhead flexible-budget variance 固定间接费用耗费差异Fixed overhead spending variance弹性预算Flexible budget弹性预算差异Flexible-budget variance产品全部成本Full costs of the product目标一致性Goal congruence毛利率Gross margin percentage增长构成Growth component高低法High-low method同质的成本库Homogenous cost pool基本报酬率Hurdle rate混合成本核算系统Hybrid costing system空置时间Idle time假设成本Imputed costs增量成本Incremental cost增量成本分配法Incremental cost-allocation method增量收入Incremental revenue增量收入分配法Incremental revenue-allocation method增量单位时间学习模型Incremental unit-time learning model自变量Independent variable成本对象的间接成本Indirect costs of a cost object间接成本分配率Indirect-cost rate间接制造成本Indirect manufacturing costs工业工程法Industrial engineering method, Work-measurement method通货膨胀Inflation价格差异Input-price variance, price variance, rate variance内制Insourcing检验点Inspection point管理会计师协会Institute of Management Accountants交互式控制系统Interactive control systems截距项Intercept中间产品Intermediate product内部失败成本Internal failure costs内含报酬率法Internal rate-of-return (IRR) method产品存货成本Inventoriable costs存货管理Inventory management投资Investment投资中心Investment center批次Job分批成本记录Job-cost record, job-cost sheet分批法Job-costing system联合成本Joint costs联产品Joint products即时制生产Just-in-time (JIT) production, lean production即时制采购Just-in-time (JIT) purchasing改进法预算Kaizen budgeting人工时间记录Labor-time record学习曲线Learning curve生命周期预算Life-cycle budgeting生命周期成本法Life-cycle costing业务管理Line management线形成本函数Linear cost function线性规划Linear programming主产品Main product自产/外购决策Make-or-buy decisions管理会计Management accounting例外管理Management by exception管理控制系统Management control system制造单元Manufacturing cells生产周期时间Manufacturing cycle time, Manufacturing lead time分配的制造费用Manufacturing overhead allocated, Manufacturing overhead applied 制造类企业Manufacturing-sector companies安全边际Margin of safety市场营销Marketing市场分额差异Market-share variance市场规模差异Market-size variance全面预算Master budget全面预算生产能力利用Master-budget capacity utilization材料需求规划Materials requirements planning用料单Materials-requisition record商业类企业Merchandising-sector companies混合成本Mixed cost, semivariable cost道德风险Moral hazard动机Motivation多重共线性Multicollinearity多变量回归Multiple regression净利润Net income净现值法Net present value (NPV) method净可实现值法Net realizable value (NPV) method名义回报率Nominal rate of return非线性成本函数Nonlinear cost function非价值增加成本Nonvalue-added cost正常生产能力利用Normal capacity utilization正常成本法Normal costing正常毁损Normal spoilage目标函数Objective function准时表现On-time performance一次性特殊订单One-time-only special order经营预算Operating budget营业部门Operating department营业利润Operating income经营杠杆Operating leverage经营Operation经营成本核算系统Operation-costing system机会成本Opportunity cost资本机会成本Opportunity cost of capital采购订单成本Ordering costs组织架构Organization structure结果Outcomes产出单位成本Output unit-level costs外部采购Outsourcing分配过多的间接成本Overabsorbed indirect costs, Overapplied indirect costs, overallocated indirect costs加班奖金Overtime premium帕累托图Pareto Diagram局部生产力Partial productivity回收期法Payback method最大负荷定价Peak-load pricing完全竞争市场Perfectly competitive market期间成本Period costs实物计量法Physical measure method计划Planning现实的生产能力Practical capacity掠夺性定价Predatory pricing预防成本Prevention costs转入成本Previous department costs, transferred-in costs价格折扣Price discount区别定价Price discrimination价格恢复构成Price-recovery component主要成本Prime costs预测报表Pro forma statements概率Probability概率分布Probability distribution问题解决Problem solving分步成本核算系统Process-costing system产品Product产品成本Product cost产品成本互补Product-cost cross-subsidization产品差异化Product differentiation产品生命周期Product life cycle产品组合决策Product mix decisions成本高计的产品Product overcosting产品支持成本Product-sustaining costs成本少计的产品Product undercosting生产Production生产部门Production department生产量水平Production-denominator level生产力Productivity生产力构成Productivity component利润中心Profit center按比例分配Proration采购订单提前量Purchasing-order lead time采购成本Purchasing costsPV图PV graph定性因素Qualitative factors质量Quality定量因素Quantitative factors真实回报率Real rate of return交互分配法Reciprocal allocation method, reciprocal method 业务流程再造Reengineering精练化成本系统Refined costing system回归分析Regression analysis相关成本Relevant costs相关范围Relevant range相关收入Relevant revenues再订购点Reorder point要求的回报率Required rate of return研发Research and development剩余收益Residual income剩余项Residual term责任会计Responsibility accounting责任中心Responsibility center投资报酬率Return on investment收入分配Revenue allocation收入中心Revenue center收入动因Revenue driver收入对象Revenue object收入Revenues返工Rework合适规模Rightsizing安全库存Safety stock销售组合Sales mix销售组合差异Sales mix variance销售数量差异Sales-quantity variance分离点销售价值法Sales value at splitoff method销售数额差异Sales-volume variance业务记录Scorekeeping废料Scrap销售价格差异Selling-price variance敏感性分析Sensitivity analysis可分离成本Separable costs阶梯法Sequential allocation method, step-down allocation method, step-down method 顺序追溯Sequential tracing服务部门Service department, supporting department服务类企业Service-sector companies服务支持成本Service-sustaining costs单变量回归Simple regression单一成本分配率法single-rate cost-allocation method, single-rate method斜率系数Slope coefficient原始凭证Source document设定分析Specification analysis分离点Splitoff point毁损Spoilage人事管理Staff management单一个体成本分配法Stand-alone cost-allocation method单一个体收入分配法Stand-alone revenue-allocation method标准Standard标准成本Standard cost标准成本法Standard costing估计系数标准差Standard error of the estimation coefficient标准投入Standard input标准价格Standard price静态预算Static budget静态预算差异Static budget variance阶梯式成本函数Step cost function脱销成本Stockout costs战略成本管理Strategic cost management战略Strategy沉没成本Sunk costs超级变动成本法Super-variable costing, throughput costing供应链Supply chain单位目标成本Target cost per unit单位目标营业利润Target operating income per unit目标价格Target price目标投资回报率Target rate of return on investment理论生产能力Theoretical capacity约束理论Theory of constraints物料贡献Throughput contribution时间动因Time driver货币时间价值Time value of money全要素生产力Total factor productivity (TFP)全部间接费用差异Total-overhead variance转移价格Transfer price触发点Trigger point不确定性Uncertainty分配不足的间接成本underabsorbed indirect costs, underapplied indirect costs, underallocated indirect costs不利差异Unfavorable variance单位成本Unit cost未用生产能力Unused capacity价值增加成本Value-added cost价值链Value chain价值工程Value engineering变动成本Variable cost变动成本法Variable costing变动间接费用效率差异Variable overhead efficiency variance变动间接费用弹性预算差异Variable overhead flexible-budget variance变动间接费用耗费差异Variable overhead spending variance差异Variance加权平均的分步法Weighted-average process-costing method在产品存货Work-in-process inventory 在产品Work-in-process。

酒店市场营销国外研究综述文献1. "Hotel Marketing: A Review of the Literature" by M. Kozak and N. Rimmington (2000)This article provides a comprehensive review of the literature on hotel marketing, covering topics such as segmentation, targeting, positioning, branding, pricing, distribution, and promotion. The authors highlight the importance of understanding customer needs and preferences, as well as the competitive environment, in developing effective marketing strategies. They also discuss the role of technology and the internet in hotel marketing, and the challenges and opportunities they present.2. "The Impact of Social Media on Hotel Marketing" by A. Sigala (2012)This paper examines the impact of social media on hotel marketing, focusing on the use of platforms such as Facebook, Twitter, and TripAdvisor. The author argues that social media can enhance customer engagement, loyalty, and advocacy, as well as provide valuable feedback and insights for hotels. However,she also notes the risks and challenges associated with social media, such as negative reviews and privacy concerns.3. "Green Marketing in the Hotel Industry: A Review of the Literature" by M. Kozak and N. Rimmington (2010)This article reviews the literature on green marketing in the hotel industry, discussing the motivations, benefits, and challenges of adopting environmentally sustainable practices. The authors argue that green marketing can enhance a hotel's reputation, attract environmentally conscious customers, and reduce costs and environmental impact. However, they also note the need for clear communication, education, and certification to ensure credibility and avoid greenwashing.4. "Luxury Hotel Marketing: A Review of the Literature" by J. Kim and J. Kim (2017)This paper provides a review of the literature on luxury hotel marketing, focusing on the unique characteristics and challenges of this segment. The authors discuss the importance of creating a distinctive brand image, providing personalizedservices, and leveraging digital technologies to enhance customer experience and engagement. They also highlight the role of partnerships, events, and social responsibility in luxury hotel marketing.5. "Revenue Management in the Hotel Industry: A Review of the Literature" by A. Kimes (2013)This article reviews the literature on revenue management in the hotel industry, discussing the principles, techniques, and challenges of optimizing pricing and inventory decisions. The author argues that revenue management can enhance profitability, customer satisfaction, and market share, but also requires a sophisticated understanding of demand patterns, competition, and customer behavior. She also discusses the role of technology and data analytics in revenue management.。

商人的工作英语作文初中英文:As a merchant, my job is to buy and sell goods in order to make a profit. This involves a lot of negotiation, salesmanship, and strategic planning. I have to keep a close eye on market trends and constantly be on the lookout for new opportunities to expand my business.One of the most important aspects of being a successful merchant is the ability to build relationships with both suppliers and customers. For example, I often have to negotiate with suppliers to get the best prices for the goods I want to sell. This requires good communicationskills and the ability to find common ground in order to reach a mutually beneficial agreement.Another example is when I have to deal with customers.I have to be able to understand their needs and preferences in order to provide them with the right products. Buildingtrust and rapport with customers is crucial for repeat business and positive word-of-mouth referrals.In addition to the interpersonal skills required for the job, I also have to be savvy when it comes to financial management. I need to carefully track my expenses, manage inventory, and make strategic decisions about pricing and promotions in order to maximize profits.Overall, being a merchant is a challenging yet rewarding job. It requires a combination of people skills, business acumen, and a strong work ethic in order to succeed in this competitive industry.中文:作为一个商人,我的工作是买卖商品以赚取利润。

2012注会综合英语词汇总结本词汇总结集合2012东奥张淑丽综合讲义和北注协职业能力综合测试英语附录摘选,适合英语基础差的人,多背几个单词,到时候即使不会做也多打几个单词进去,说不定就是60分了!加油Introductionprehensive stage 综合阶段2.auditing 审计3.accounting 会计4.corporate strategy and risk management 公司战略与风险管理5.financial management and cost management 财务成本管理6.economic laws 经济法7.taxtion laws 税法中国注册会计师协会新的职业道德规范12.the partner rotation 合伙人轮换13.Listed companies 上市公司14. public interest entity 公众利益实体Unit one EthicsIntegrity 诚信Independence 独立objectivity客观和公正professional competence and due care专业胜任能力和应有的关注confidentiality保密professional behavior 良好职业行为Self-interest threat 自身利益的不利影响Self-review threat自我评价的不利影响Advocacy threat 过度推介的不利影响Familiarity threat密切关系的不利影响Intimidation threat 外在压力的不利影响Client acceptance 接受客户关系Engagement acceptance 承接业务Changes in a professional appointment客户变更委托Conflicts of interest 利益冲突Second opinions 第二次意见Fees 收费Marketing professional services 专业服务营销Gifts and hospitality 礼品和招待Custody of client assets 保管客户资产Requirements for objectivity 对客观和公正原则的要求Audit and review engagements审计和审阅业务Assurance engagements 鉴证业务Networks and network firms 网络和网络事务所Public interest entities公共利益实体Related entities关联实体Corporate governance(公司)治理层Documentation工作记录Engagement period业务期间Mergers and acquisitions合并和收购Financial interests经济利益Loans and guarantees贷款和担保Employment雇佣Long association with an audit client 与审计客户长期存在业务关系Preparing accounting records and financial statements编制会计记录和财务报表Recruiting services招聘服务Overdue fees逾期收费Contingent fees或有收费Unit two AccountingNotes receivable 应收票据Provision for decline in the value of inventories 存货跌价准备Investment property 投资性房地产Accounts payable 应付账款Long-term loans payable 长期借款Paid-in capital 实收资本Capital surplus 资本溢价=capital premiumsSurplus reserves 资本公积Undistributed profits 未分配利润Owner’s equity 所有者权益Comprehensive income 综合收益Research and development expense 研发费用Income tax expense 所得税费用Finished goods 产成品Work in progress 在产品Constructions in progress 在建工程Funds 基金Intangible asses 无形资产Trademarks 商标Patens 专利权Liabilities 负债Current liabilities 流动负债Accounts payable应付账款Dividend payable 应付股利Sales revenue 销售收入Sales allowances 销售折让Purchase expense 进货费用Employ welfare 员工福利Investment income 投资收益Donation income 捐赠收入Foreign exchange loss 汇兑损失Business combination企业合并Goodwill商誉Financial instrument 金融工具Provision 预计负债Registered capital注册资本Impairment loss 资产减值损失Share-based payment股份支付Earnings Per Share (EPS)每股收益Share option 期权Initial measurement 初始计量Subsequent measurement 后续计量consideration 对价capital reserve 资本公积retained earning 留存收益merger and acquisition 并购(兼并和收购)Business combination under the same control 同一控制下的企业合并Combining party 合并方Combined party 被合并方Combining date 合并日Business combination under the different control 非同一控制下的企业合并Acquirer 购买方Acquiree 被购买方Acquisition date 购买日cost method 成本法equity method 权益法acquisition method 购买法control 控制joint control 共同控制significant influence 重大影响subsidiary 子公司associate 联营企业joint venture 合资(合营)企业step acquisition 多次收购达到控制non-controlling interest 少数股东权益goodwill 商誉negative goodwill 负商誉adjusting entries 调整分录eliminate inter-company items 抵消公司间往来项目Equity settled share based payment 以权益结算的股份支付Cash settled share based payment以现金结算的股份支付Option 股票期权Grant date 授予日Vesting period 等待行权期Exercise date 行权日Stock appreciation right 股票增值权service condition 服务期限条件performance condition 业绩条件Equity instrument 权益工具Debt instrument 债务工具Redeemable preference shares 可赎回优先股Compound instrument 复合工具convertible loan stock可转换债券Held-to-maturity investments持有至到期投资Loans and receivables贷款和应收账款Available-for-sale financial assets可供出售金融资产Financial asset at fair value through profit or loss 以公允价值计量变动计入当期损益的金融资产Financial assets held for trading 交易性金融资产Derivative 衍生金融工具Hedge 套期保值Effective interest rate 实际利率Amortized cost 摊余成本Unit three AuditingAcceptable difference可接受差异High levels of assurance高水平保证Expert专家Subsequent events日后事项Material misstatement 重大错报Walkthrough test穿行测试Flow chart流程图Assertion 认定Existent存在Occurrence 发生Completeness 完整性Valuable and allocation 计价和分摊Cutoff截止Accuracy准确性Inquiry询问Observation 观察Inspection检查Recalculation重新计算Gross margin毛利External audit外部审计Reasonable assurance合理保证Risk-oriented audit approach 风险导向审计方法Audit risk = material misstatement risk × detection risk=inherent risk × control risk × detection risk审计风险=重大错报风险×检查风险=固有风险×控制风险×检查风险Assessing the risk of material misstatement 评估重大错报的风险Fraud舞弊;欺诈Error 错误Professional skepticism职业怀疑Reasonable assurance合理保证T est of control控制测试Substantive procedure 实质性程序Audit evidence审计证据Assertion认定Assessment 评估Internal Control System内部控制制度Omission漏报Misstatement 错报Materiality 重要性Materiality level 重要性水平T olerable misstatement level可容忍错报的水平Walkthrough tests 穿行测试T ests of detail 细节测试Analytical procedures 分析程序Transaction cycle交易循环Sales and trade receivables 销售和收款Purchase and trade payables 采购和付款Inventory and store存货和仓储Financing and investment筹资和投资Analytical review分析性复核Provision for doubtful debts坏账准备Letter of Confirmation函证Positive/negative confirmation积极/消极函证Authorization 授权Physical control 实物控制Segregation of duties 职责分离Letter of Engagement审计业务约定书Assurance engagement and external audit鉴证业务和外部审计Audit approach审计方法Staffing人员安排Deadline截止日期Group Audit集团审计Going concern永(持)续经营T olerable Error可容忍错误True and fair presentation真实公允反映Types of opinion: unqualified opinion, qualified opinion, adverse opinion, disclaimer of opinion审计意见类型:无保留意见,保留意见,否定意见,无法表示意见Audit documentation: working paper审计记录:工作底稿Rely on the work of experts依靠专家工作Internal audit内部审计Audit evidence审计证据Population(样本选取的)总体Counting盘点Subsequent events随后事项(期后事项)Quality control质量控制Management representation管理层声明(书面声明)Emphasis of matter’ paragraph强调事项段Corporate governance公司治理Unit Four Financial and Cost managementPerpetuity 永续年金Advanced annuities 预付年金Delayed annuities 递延年金Mean 均值Variance 方差Standard deviation 标准差Normal Distribution 正态分布Portfolio of securities 证券组合Face value/par value面值Yield to maturity 到期收益率Interest rate利率Nominal/stated interest rate票面利率Maturity到期日Expiry date到期日Required rate of return要求的报酬率CAPM: capital asset pricing model资本资产定价模型Covariance and correlation 协方差和相关性Diversifiable and non-diversifiable risks 可分散和不可分散风险Risk free rate of return无风险报酬率Risk premium风险溢价WACC加权平均资本成本Cost of debt债券资本成本Cost of equity权益资本成本Ordinary share普通股Convertible debt可转换债券Equity beta: βequity权益贝塔系数Redeem赎回At par面值DOL:经营杠杆系数degree of operating leverageDFL::财务杠杆系数degree of financing leverageDTL:总杠杆系数degree of total leverageFinancial distress 财务困境Dividend policy股利政策Cash dividend 现金股利Stock (scrip )dividend 股票股利Stock split 股票分割Stock repurchase 股票回购Dividends grow at the long-term growth rate in earnings股利按长期增长率增长Payout ratio股利支付率Residual dividend policy with all distribution in the form of dividend所有剩余均以股利形式发放的剩余股利政策Regular-dividend-plus-extras policy正常股利加额股利外支付政策Leasing 租赁Convertibles 可转换债券Warrants 认股权证Preference shares 优先股Re-order再订购,重新订购Lead-time订货至交货的时间Stock out库存中断;脱销EOQ (economic order quantity)经济订货量Order cost订货成本Hold cost持有成本Large order discount大宗订货折扣Marginal costing变动成本法(边际成本法)Cost-volume-profit (CVP)本量利分析Marginal contribution边际贡献Margin of safety安全边际Variable cost变动成本Fixed cost固定成本Discretionary Fixed Cost 酌量性固定成本Committed Fixed Cost 约束性固定成本Initial public offering(IPO)首次公开发行股票Stock market 股票市场Debt ratio 资产负债率Return on assets (ROA) 资产净利率Return on equity (ROE) 权益净利率Internal growth rate内涵增长率Sustainable growth rate 可持续增长率Overall budget 全面预算Capital asset pricing model (CAMP) 资本资产定价模型Net present value (NPV) 净现值Internal rate of return (IRR) 内含报酬率Cash dividend现金股利Stock dividend股票股利Liability dividend 债务股利Performance evaluation 业绩评价Cost centre 成本中心Profit centre 利润中心Investment centre投资中心Unit Five Corporate strategy and risk management Macro-environment: 宏观经济环境Product life cycle: 产品生命周期Porter’s five forces: 波特的五力模型Threat of New Entrants行业新进入者的威胁Threat of Substitute Products替代品的威胁Bargaining Power of customers购买商的议价能力Bargaining Power of Suppliers供应商的议价能力Competition/rivalry同业竞争Strategic group: 战略组群Segmentation: 细分Porter’s diamond: 波特的钻石模型Convergence:集中,趋同Resource audit 资源审计SWOT: SWOT模型Opportunity: 机会Threat: 威胁Strength: 优势Weakness: 劣势Resources资源Capability能力Core competence 核心竞争力Functional structure 职能结构Divisional structure (product division,geographical division)事业部结构(产品事业部、地区事业部)SBU (strategic business unit)战略业务单元零基预算(Zero-based budgeting)Political risk 政治风险Country risk 国家风险Project risk 项目风险Legal/compliance risk 法律/合规风险Operational risk 操作风险Commodity risk 产品风险Foreign exchange risk汇率风险Floating rate 浮动利率Fixed rate 固定利率Liquidity risk 流动性风险Credit risk 信用风险Strategic risk 战略风险Reputation risk 声誉风险Risk appetite 风险偏好Risk acceptance 风险接受Risk avoidance 风险规避Risk mitigation 风险缓释Risk transfer 风险转移Risk attitude 风险态度Financial instrument 金融工具Derivatives 衍生品Hedging 对冲/套期Forward contract 远期合约Swap 掉期/互换Options 期权Call options 看涨期权Put options 看跌期权Futures 期货Exercise price 行权价格Elapse 失效、逾期Spot rate 即期汇率Forward rate 远期汇率Premium/discount 升水/贴水Unit Six Economic law公司法律制度Company Law of the People's Republic of China证券法律制度Securities Law of the People's Republic of China破产法律制度Enterprise Bankruptcy Law of the People's Republic of China合同法律制度Contract Law of the People's Republic of China竞争法律制度Law of the People's Republic of China for Countering Unfair Competition.Partnership 合伙Partner 合伙人Company 公司Security 证券Limited liability Company 有限责任公司Company limited by shares 股份有限公司Listed company 上市公司Chief executive officer (CEO) 首席执行官Common stock 普通股Preferred stock 优先股Unit seven Tax law Value added tax (VAT)增值税法Business tax营业税法Enterprise income tax企业所得税法Individual income tax个人所得税法T ax Planning 税务筹划。

What is logistics Management? 什么是物流管理1.The Definition of logistics物流管理的定义After completing a commercial transaction, logistics will execute the t ransfer of goodsfrom the supplier(seller)to the customer(buyer) in the most cost-effective manner. This is the definition of logistics. During the transfer process, hardware such as logistics facilities and equipme nt (logistics carriers) are needed, as well as information control and standardization. In addition, supports from the government and logistic s association should be in place.完成商业交易后物流将以最有效的成本方式以最有效的成本方式实行从供应商(卖方)到客户(买方)货物转运。

这就是物流的定义。

在转运过程中,像物流设施和设备(物流运输工具)之类的硬件是必要的,也需要信息控制和标准化管理。

另外,来自政府和物流协会的支持应该到位。

Three major functions of logistics.物流的三个主要功能(1) Creating time value: same goods can be valued different at diff erent times. Goods often stop during the transfer process, which is p rofessionally called the storage of logistics. It creates the time value for goods.创造时间价值:同样的货物在不同的时间有不同的价值。

国际市场营销学培训讲义(英文版) International Marketing Training HandbookSession 1: Introduction to International Marketing1.1 Definition of International Marketing- Explanation of international marketing and its importance in today's globalized world.- Overview of key concepts, such as globalization, market segmentation, and cultural diversity.1.2 Benefits and Challenges of International Marketing- Discussion on the advantages of expanding into international markets, such as increased sales and new business opportunities. - Identification of common challenges, such as cultural differences, legal and regulatory complexities, and competitive pressures.1.3 International Marketing Strategies- Introduction to different strategies for entering international markets, including exporting, licensing, joint ventures, and direct investment.- Examination of factors influencing strategy selection, such as market potential, risk assessment, and resource allocation. Session 2: Market Research and Analysis2.1 Understanding Global Consumers- Analysis of cultural differences and their impact on consumer behavior.- Identification of global consumer segments and trends to targeteffectively.2.2 Market Research Methods- Overview of primary and secondary research methods for gathering market intelligence.- Explanation of techniques for analyzing market data, such as surveys, focus groups, and data mining.2.3 Assessing Market Potential- Examination of key factors to consider when evaluating market potential, including market size, growth rate, and competition.- Introduction to tools and frameworks for assessing market attractiveness and competitiveness.Session 3: Market Entry Strategies3.1 Exporting and Importing- Discussion on the advantages and disadvantages of exporting and importing.- Explanation of export and import processes, including logistics, documentation, and international trade regulations.3.2 Licensing and Franchising- Overview of licensing and franchising as market entry strategies. - Examination of the benefits, risks, and considerations involved in entering into licensing and franchising agreements.3.3 Joint Ventures and Strategic Alliances- Introduction to joint ventures and strategic alliances as collaborative market entry strategies.- Analysis of the advantages, challenges, and factors for successful partnerships.Session 4: Product and Brand Management4.1 Adaptation vs. Standardization- Examination of product and brand adaptation strategies to suit local market preferences.- Discussion on the benefits and risks of standardizing products and brands across international markets.4.2 Product Development and Innovation- Overview of product development processes for international markets.- Introduction to strategies for fostering innovation and staying competitive in global markets.4.3 Branding and Positioning- Explanation of brand building and positioning strategies for global brands.- Examination of the role of culture, communication, and customer perception in successful international branding.Session 5: Communication and Promotion5.1 Integrated Marketing Communications- Introduction to integrated marketing communications (IMC) and its role in international marketing.- Explanation of different promotional tools and channels, such as advertising, public relations, and digital marketing.5.2 Cultural Sensitivity in Communication- Discussion on the importance of cultural sensitivity and adaptation in international communication.- Analysis of successful cross-cultural marketing campaigns and the lessons learned.5.3 Digital Marketing in International Markets- Overview of digital marketing strategies and tactics for reaching global audiences.- Examination of the challenges and opportunities in leveraging digital platforms for international marketing.Note: This training handbook provides an overview of key topicsin international marketing and can be customized to suit specific training objectives and participant needs.Session 6: Pricing and Distribution6.1 Pricing Strategies in International Markets- Explanation of factors affecting pricing decisions in international markets, such as currency fluctuations, local market conditions, and competition.- Introduction to pricing strategies, such as cost-based pricing, market-based pricing, and value-based pricing.6.2 Distribution Channels and Logistics- Overview of distribution channel options in international markets, including direct sales, distributors, agents, and e-commerce.- Examination of logistics considerations, such as transportation, warehousing, and customs regulations.6.3 Channel Management and Relationship Building- Discussion on the importance of effective channel management and relationship building with international partners.- Introduction to strategies for selecting, managing, and incentivizing channel partners.Session 7: Legal and Ethical Considerations7.1 International Legal Framework- Overview of international trade laws and regulations, such as tariff and non-tariff barriers, intellectual property protection, and contract laws.- Explanation of the role of international organizations, such as the World Trade Organization (WTO), in promoting fair trade practices.7.2 Ethical Issues in International Marketing- Analysis of ethical dilemmas and challenges in international marketing, such as cultural sensitivity, advertising standards, and environmental sustainability.- Discussion on the importance of corporate social responsibility (CSR) in international business practices.7.3 Risk Management and Compliance- Introduction to risk management strategies for mitigating legal and ethical risks in international marketing.- Explanation of compliance standards, such as anti-corruption laws and data privacy regulations, that businesses need to adhere to in global markets.Session 8: Market Expansion and Growth8.1 Emerging Markets and Opportunities- Analysis of emerging markets and their potential for business expansion and growth.- Discussion on strategies for entering and succeeding in emerging markets, such as adaptation to local conditions and collaboration with local partners.8.2 International Business Development- Overview of strategies and considerations for expanding and growing international business operations.- Discussion on factors such as market diversification, innovation, and strategic partnerships.8.3 Sustainable International Marketing- Examination of sustainability and responsible business practices in international marketing.- Introduction to concepts such as green marketing, social entrepreneurship, and inclusive business models.Session 9: Cross-Cultural Communication and Negotiation9.1 The Importance of Cross-Cultural Communication- Explanation of the challenges and opportunities presented by cross-cultural communication in international business.- Analysis of cultural dimensions and their impact on communication styles and business practices.9.2 Cross-Cultural Negotiation- Overview of negotiation strategies and techniques in cross-cultural settings.- Examination of cultural norms and practices that influence negotiation processes and outcomes.9.3 Managing Cultural Differences- Discussion on strategies for managing and leveraging cultural differences in international business.- Introduction to intercultural competence skills, such as empathy, adaptability, and cultural intelligence.Session 10: International Marketing Plan10.1 Developing an International Marketing Plan- Step-by-step guide to developing an international marketing plan. - Explanation of key components, such as market analysis, target market selection, marketing objectives, and implementation strategies.10.2 Evaluating and Monitoring International Marketing Performance- Introduction to metrics and tools for evaluating the performance of international marketing activities.- Discussion on the importance of monitoring and adjusting strategies based on market feedback and changing conditions. 10.3 Case Studies and Best Practices in International Marketing- Analysis of real-world case studies and best practices in international marketing.- Examination of successful international marketing campaigns and their underlying strategies and tactics.Note: This training handbook provides an overview of key topics in international marketing and can be customized to suit specific training objectives and participant needs. The content can be expanded upon by incorporating additional case studies, interactive exercises, and group discussions to enhance participant engagement and learning.。

定价与组合的销售策略英文When it comes to pricing and sales strategies, there are several key factors to consider in order to effectively market and sell a product or service. Pricing is a crucial element that can greatly influence consumer behavior and ultimately impact sales. It is important to carefully consider the cost of production, competitor pricing, and the perceived value of the product when determining the price point.In addition to pricing, the combination of products or services offered can also play a significant role indriving sales. By bundling complementary items together, businesses can create added value for the consumer and potentially increase the overall purchase amount. This can be particularly effective in encouraging upsells and cross-sells.One common pricing strategy is known as "value-based pricing," which involves setting prices based on the perceived value to the customer rather than the cost of production. This approach requires a deep understanding of the target market and their willingness to pay for theproduct or service. By effectively communicating the value proposition, businesses can justify higher prices and potentially increase profitability.Another approach is "penetration pricing," whichinvolves setting a low initial price in order to quickly gain market share. This can be effective for new productsor services entering a competitive market, as it can help generate buzz and attract an initial customer base. However, it is important to have a clear plan for increasing prices over time in order to maintain profitability.In terms of sales strategies, the use of discounts, promotions, and incentives can be powerful tools fordriving sales. Limited-time offers and exclusive deals can create a sense of urgency and drive impulse purchases. Additionally, loyalty programs and rewards can helpcultivate long-term customer relationships and encourage repeat business.It is also essential to consider the impact of pricing and sales strategies on overall brand positioning and perception. Overly aggressive discounting or pricing can potentially devalue the brand and erode profit margins.Finding the right balance between competitive pricing and maintaining brand integrity is crucial for long-term success.In conclusion, pricing and sales strategies are critical components of any business's marketing efforts. Bycarefully considering pricing models, product combinations, and sales tactics, businesses can effectively drive sales and maximize profitability.在制定定价和销售策略时,有几个关键因素需要考虑,以便有效地营销和销售产品或服务。

法雷奥中国技术研发中心MAIN ACTIVITIES项目采购Technical activities:1) Helps the project team define the Valeo requirement: QCD objectives, expression in functional specifications, schedules. Based on his/her knowledge of family purchasing strategies, he/she challenges make or buy choices, ensures that technological choices will not “lock in” the choice of suppliers, challenges the breakdown of the final product into different components/functions, and ensures that component standards are complied with.帮助项目部门制定项目需求,QCD目标、在功能规范,计划安排。

根据其采购战略知识。

确认自制或购买,确保技术选择不会被供应商锁定。

成品成本分析,确保零部件标准合格。

2) Ensures that the right conditions exist so that the best suppliers are able to propose the best QCD solutions.· Conducts consultations with the supplier base (including Panel 300 suppliers) and any other potential suppliers.· Participates in the selection of suppliers, in close collaboration with the family buyers (note: the latter have the right to veto choices).· Uses functional specifications as a basis of consultation and makes sure that suppliers’ ideas are taken into account.· Integrates suppliers very early (phase 0 or 1) and gives them access to the project platform.· Initiates, when necessary, value analyses to meet target costs.· Facilitates communication between suppliers and the various project team members.确保在适当的条件下供应商可以可以根据QCD提出解决方案;与供应商进行磋商,与公司采购密切合作参与供应商选择。

3种液体黏度测量方法的不确定度评定第22卷第3期V01.22No.3重庆工学院(自然科学) JoumalofChongqingInstituteofTechnology(NaturalScience)2008年3月Mar.20o83种液体黏度测量方法的不确定度评定倪燕茹(泉州师范学院理工学院,福建泉州362000) UncertaintyEvaluationofThreeMeasurementMethods ofLiquidViscosityNIY an—ru(SchoolofScienceandTechnology,QuanzhouNormalUniversity,Q~anzho u362000,China)Abstract:InthelightofGuideofMeasurementUncertaintypromulgatedbyBI PM,thispaperdeducesex—pressionsofevaluatingcombinedstandarduncertaintyofmeasurementofme asuringliquidviscosityutihzing thethreekindsofliquidviscositymeasuringmethods:capillaryandfallingballmethodandrotatorycylin—dermethod,sothatevaluatingmeasurementerrorofliquidviscositycanbemo reobjectiveandall-sided, reflectingmeasuringeffectsstillbetter.Keywords:liquidviscosity;measurementmethod;combinedstandarduncer taintyofmeasurementEvaluatingCo液体黏度是反映液体物理性质的重要指标之一.液体黏度的测量在石油,化工,轻工,食品,交通,国防,航天等许多工业部门和研究领域都有着重要的应用ll』.在基础研究领域中,液体黏度的测量也占有着重要的地位.就像其他被测量一样,在实际测量时,由于实验方法和计量器具的不完善,测量环境的不理想,不稳定,实验者在操作上和读取数值时不十分准确等原因,使液体黏度的测量值偏离其真值,即存在着测量误差.因此,在给出液体黏度的测量结果的报道时,还需要给出液体黏度测量值可靠性的报道,即测量结果残存误差的评定,也就是液体黏度的测量合成不确定度.测量不确定度是反映测量水平的主要指标,是评定测量结果质量高低的一个重要依据.测量不确定度越小,测量结果的可靠性就越高,使用价值也就越大.有关液体黏度的测量方法比较多,典型的传统测量方法主要有毛细管法,落球法,收稿Et期:2O07—12—11基金项目:泉州师范学院校自选科研课题(2(D4KJ1105).作者简介:倪燕茹(1965一),女,黑龙江哈尔滨人,讲师,主要从事基础物理理论及实验教学研究倪燕茹:3种液体黏度测量方法的不确定度评定115旋转柱体法等,由于它们依据的原理各不相同,计算公式各不相同,因而测量合成不确定度的评定公式也就各不相同.为此,本研究将根据国际计量局(B)等7个国际组织颁布的”测量不确定度表示指南”(即GUM),推导出以上3种传统液体黏度测量方法的合成不确定度的计算公式,并进行分析比较与讨论.1毛细管法毛细管法测定液体黏度的理论基础是哈根一白肃叶定律(Hagen-Poiseuflle),考虑到流体在圆管中作层流流动时的动能损失,修正后的液体黏度计算式[2]为:=78tr4p2(,一)g一瓦q(1)其中:为液体黏度;r为毛细管半径;L为毛细管长度;ID为液体的密度;h.一h2为液柱高度差;g为重力加速度;Q为单位时间流出液体的质量.根据间接测量量的合成标准不确定度计算式[]:√耋(塞)2u)(2)可知毛细管法测定液体黏度的合成标准不确定度uc(叩)为:uc(r1)=其中Or,,,磊,,由式(1)求得.=(~,=r4~tp2t0g4LQ(g~ar一,”…一,”“=r4~tpQz(hi-h2)g+,=一r4~p2(,hi-h2)g一11=.r4npg,Oh2=一.r4npg8tOg8tOa一‟一将以匕各式代人式(3),并考虑到R<<L,0<<L,略去高阶量,得:(3)√()2+()2+(半)2+()2+(2揣)2(4)从式(4)可以看出,用毛细管法测定液体黏度的合成不确定度计算公式,不仅涉及到r,』D,L,h1,h2,Q6个直接测量量的最佳估计值及它们各自的合成不确定度,还涉及到液体黏度这个间接测量量的最佳估计值,运算后才能给出液体黏度的测量合成不确定度,从而给出液体黏度的测量结果报道.由于液体黏度测量合成不确定度uc()与时间t的合成不确定度无关,而且uc(r),uc(ID),uc(),uc(Q),uc(hi)和uc(h2)6个合成不确定度在主观上误差较小,即标准不确定度的A 类评定较小,因此用毛细管法测量液体黏度精度较高.2落球法落球法是常温下测定液体黏度常用的方法,其液体黏度的计算公式.为:l16重庆工学院(=2g褥j[】‟其中:】7为液体黏度;r为小球半径;1为围绕圆筒刻画的两道水平标记N1和N2之间的距离;t为小球通过N1N2的时间;lDo为液体密度;R为盛有液体的圆筒的内半径;h为筒中液体的深度.根据间接测量量的合成标准不确定度的计算公式(2)可得,落球法测定液体黏度公式的合成标准不确定度uc(叩)为:uc(r1)=(6)其中,,,,,Oh由式(5)求得:耄=[i:—:】=,=[—+—】毫=[一】_,隅=[-r/,=[南南】立.√++告+㈩从式(7)可以看出,采用落球法测定液体黏度的合成不确定度计算公式不仅涉及到t,r,1和lDo4个直出,由于液体黏度测量合成不确定度uc(】7)与时间t这个直接测量量的合成不确定度uc(£)有关,而t是3旋转柱体法旋转柱体法是适用范围最广的液体黏度测量方法,其液体黏度的计算公式[为:倪燕茹:3种液体黏度测量方法的不确定度评定117.D(1一2)(;一i),n,(8)其中:叩为液体黏度;D为金属丝的扭转模量;z为浸人液体的深度;cc,1为外圆筒的转速;01为与转速cc,1对应的圆柱的扭转角度;cc,2为外圆筒的转速;02为与转速cc,2对应的圆柱的扭转角度;R2为内圆筒半径;飓为外圆筒半径.根据间接测量量的合成标准不确定度的计算公式(2)可得,旋转柱体法测定液体黏度公式的合成标准不确定度c(刁)为:其中,,,,由式(8)求得:a(01—02)(R;一;)翌a翌D(;一;)OD一4丁【;;(CO1—092)一D‟a1—47【;;(CO1—092)一(01—02) 一二!堡二堡2一=鱼一!二1172-3一2—4nlRZR2(c£,1—092)一(01—02)‟3—2nl(CO1—092)1I3一R3(R;一)鱼一二!二2Rz-3一一二!二21二!aR2—2nl(CO1—092)11.2一R2(R;一;)‟az一4nlRZR2(c£,1一c£,2) 勘一D(01—02)(;一;)一丑勘D(01—02)(R;一;)0col一4nlRZR2(c£,1一c£,2)一(CO1—092)‟2—4nlRZR2(c£,1一c£,2)一(CO1—092)将以匕各个偏导式代入式(9).可得:(9)之(D)之(01)之(02)(2R2)之(R3)2R2):R一-+(乏(2)之(z)之(cc,1)乏(cc,2)丽+丁++从式(10)可以看出,旋转柱体法测定液体黏度的合成不确定度计算公式不仅涉及到D,z,cc,1,01,cc,2,2,2和38个直接测量量的最佳估计值和它们各自的合成不确定度,还涉及到液体黏度这个间接测量量的最佳估计值,运算后才能给出液体黏度的测量合成不确定度,从而给出液体黏度的测量结果报道.而且从式(10)可以看出,由于液体黏度测量合成不确定度c(刁)与时间t 的合成不确定度无关,这就可以提高测量精度.另外,旋转柱体法不妨碍生产正常进行,不需要将待测液体从生产过程中取出,只需要由驱动装置改变外圆管的转速,即可测出相应的扭转角,使用比较方便.所以说旋转柱体法适合用于在线检测液体的黏度.4结束语本研究借助”测量不确定度表示指南”(GuM)中的间接测量量的合成不确定度的评定公式,根据3种传统液体黏度测量方法的计算公式,较详细地推导给出了3种传统液体黏度测量方法的合成不确定度评定的计算公式,并根据液体黏度的合成不确定度计算公式针对这3种液体黏度测量方法的适用范围进行了讨论.另外,本研究不仅对其他液体黏度的测量方法的合成标准不确定度评定即误差(下转第127页)莫降涛,等:允许取消预订的生产一销售库存模型127问题,建立了生产一销售利润模型,讨论了解的存在性并给出了求解算法,最后用数值例子进行了验证.本研究所讨论的模型对于实际库存管理中产品的生产和价格决策有重要的参考价值,下一步可以考虑生产期为变量,取消预定和变质率分别为时间的一般函数的情形.参考文献:LeeKhaiSheag,NGIreneCL.Advancedsaleofservicecapacities:atheoretic alanalysisoftheimpactofpricesensitivi~onpric- ingandcapacityallocations[J].JournalofBusinessResearch,2001,54:219—255.Y ouPengSheng.Orderingand~cingofS~Tviceproductsinalladvancesaless ystemwithprice-dependentdemand[J].EuropeanJournalofOperationalResearch.20069170:57—71.Y ouPengSheng,WuMonTong.疝I】alorderingandpricingpokeyforaninventorysystemwithordercancellations[J ].ORSpec-tnlm,2OO7,29(4):661—679.AbadPL.疵II1alpricingandlot-峨underconditionsofperishability,finiteproductionandpamalbackorderingand lostsale[J].EuropeanJournalofOperationalResearch,2OO3,144:677—685. TengJinnTsair,ChangChunTao,SureshKumarGoya1.Optim~pricingando rderingpo~cyunderpermissibledelayinpayments[J].InternationaljoILrl~ofproductioneconomics,2005,97:121—129. Mukhopadhyays,MukherjeeRN,ChaudhuriKS.Jointpricingandorderingp ohcyforadeterioratinginventory[putersand IndustrialEngineering,2OO4,47:339—349.ChungKunJen,HouKuoLung.Anoptimalproductionruntimewithimperfec tproductionprocessesandallowableshortages[J].Computers&OperationsResearch,2OO3,30:483—490. TengJinnTaair,OuyangLiangY uh,ChangChunTao.Deterministiceconomi cproductionquantitymodelswithtime-varyingdemandandcost[J].AppliedMalhematicalModelling,2(D5,29:987—1003.(责任编辑刘舸)(上接第117页)评定具有一定的参考意义,而且对其他被测量的合成不确定度的计算公式的推导也具有一定的参考价值.参考文献:昊江涛,毕胜山,刘志刚.一种适用于低沸点液体黏度测量的金属毛细管黏度计[J].工程热物理,20O4,25(6):921.杨述武.物理实验:力学及热学部分[M].3版.北京:高等教育出版社,2OOO.林抒,龚镇雄.普通物理实验[M].北京:人民教育出版社,1981.高桂丽,李大勇,石德全.液体黏度测定方法及装置的研究现状和发展趋势[J].现代涂料与涂装,2006(2):39—42.范虹,沈文梅,王树平.不确定度在大学物理实验中的应用[J].河北建筑工程学院,20o6(4):120—122.(责任编辑陈松)1J1J1J1J1J1J1J1Jn1j1J‟!J。