ch7战略管理

- 格式:docx

- 大小:11.68 KB

- 文档页数:3

财务管理选择题Ch1总论一、单项选择题1. 财务管理的最佳目标是()。

A.总产量最大化B.利润最大化C.收入最大化D.股东财富最大化2. 企业同其所有者之间的财务关系反映的是()。

A.经营权与所有权关系B.债权债务关系C.投资与受资关系D.债务债权关系3. 企业同其债权人之间的财务关系反映的是()。

A.经营权和所有权关系B.债权债务关系C.投资与受资关系D.债务债权关系4. 企业同其被投资单位的财务关系反映的是()。

A.经营权和所有权关系B.债权债务关系C.投资与受资关系D.债务债权关系5. 财务管理的对象是()。

A.财务关系B.货币资产C.实物资产D.资金运动6. 没有风险和通货膨胀情况下的利率是指()。

A.名义利率B.纯利率C.票面利率D.资本成本率7. 企业同其债务人的财务关系反映的是()。

A.经营权和所有权关系B.债权债务关系C.投资与受资关系D.债务债权关系8.()企业组织形式最具优势,成为企业普遍采用的组织形式。

A.普遍合伙企业B.独资企业C.公司制企业D.有限合伙企业答案:D;A;D;C;D;B;B;C二.多选选择题1. 企业的财务活动包括()。

A.企业筹资引起的财务活动B.企业投资引起的财务活动C.企业经营引起的财务活动D.企业分配引起的财务活动E.企业管理引起的财务活动2. 企业的财务关系包括()。

A.企业同其所有者之间的财务关系B.企业同其债权人之间的财务关系C.企业同被投资单位的财务关系D.企业同其债务人之间的财务关系E.企业与税务机关的财务关系3. 在不存在任何关联交易的前提下,下列各项中,无法直接由企业资金营运活动形成的财务关系包括()。

A.企业同其投资者之间的关系B.企业同受资者之间的关系C.企业同政府之间的关系D.企业同职工之间的关系E.企业与客户之间的关系4. 完善中小股东利益保护的机制主要有()。

A.完善上市公司的治理机构B.规范上市公司的信息披露制度C.约束大股东所占比例D.发展基金投资机构E.完善上市发行制度5. 在经济繁荣阶段,市场需求旺盛,企业应()。

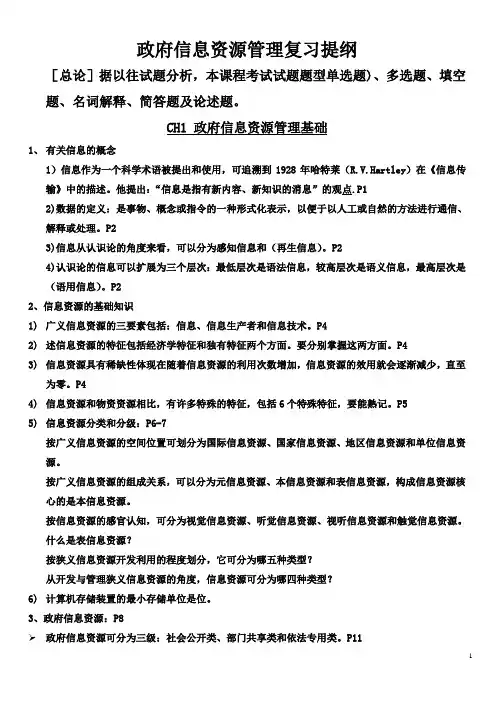

政府信息资源管理复习提纲[总论]据以往试题分析,本课程考试试题题型单选题)、多选题、填空题、名词解释、简答题及论述题。

CH1 政府信息资源管理基础1、有关信息的概念1)信息作为一个科学术语被提出和使用,可追溯到1928年哈特莱(R.V.Hartley)在《信息传输》中的描述。

他提出:“信息是指有新内容、新知识的消息”的观点.P12)数据的定义:是事物、概念或指令的一种形式化表示,以便于以人工或自然的方法进行通信、解释或处理。

P23)信息从认识论的角度来看,可以分为感知信息和(再生信息)。

P24)认识论的信息可以扩展为三个层次:最低层次是语法信息,较高层次是语义信息,最高层次是(语用信息)。

P22、信息资源的基础知识1)广义信息资源的三要素包括:信息、信息生产者和信息技术。

P42)述信息资源的特征包括经济学特征和独有特征两个方面。

要分别掌握这两方面。

P43)信息资源具有稀缺性体现在随着信息资源的利用次数增加,信息资源的效用就会逐渐减少,直至为零。

P44)信息资源和物资资源相比,有许多特殊的特征,包括6个特殊特征,要能熟记。

P55)信息资源分类和分级:P6-7按广义信息资源的空间位置可划分为国际信息资源、国家信息资源、地区信息资源和单位信息资源。

按广义信息资源的组成关系,可以分为元信息资源、本信息资源和表信息资源,构成信息资源核心的是本信息资源。

按信息资源的感官认知,可分为视觉信息资源、听觉信息资源、视听信息资源和触觉信息资源。

什么是表信息资源?按狭义信息资源开发利用的程度划分,它可分为哪五种类型?从开发与管理狭义信息资源的角度,信息资源可分为哪四种类型?6)计算机存储装置的最小存储单位是位。

3、政府信息资源:P8政府信息资源可分为三级:社会公开类、部门共享类和依法专用类。

P11根据政府信息的组织机构来源,主要有上级信息、平行信息、内部信息和(历史信息)等。

P12 政府信息资源的特点有哪些?P134、资源管理基础知识:关于信息资源管理的定义有很多,概括起来有管理哲学说、(系统方法说)、管理过程说和管理活动说等几种基本思想学说。

Management 经管空间战略管理的本质问题天津社会科学院徐全军摘要:战略管理的本质问题是如何保持企业能力与环境机会的动态匹配。

在整个战略管理理论的发展史中,每一位具有划时代影响力的学者都对该问题做出了解释,到目前,PEST和五力模型是分析市场机会的主要工具,能力树和价值链是分析能力的主要工具。

但是,传统理论和模型对该问题并没有给出完整的答案,还需要学者和企业家不断地探索和创新。

关键词:战略管理企业能力市场机会中图分类号:F270文献标识码:A 文章编号:1005-5800(2013)07(b)-040-021 战略管理的本质问题战略管理的本质问题是保持企业能力与环境机会的动态匹配。

所有企业经营的成功与失败,无不与这个问题相关。

20世纪90年代,巨人集团面临着有利的市场机会,但错误地估计了自己的能力,陷入了经营危机,而同期的同行——联想公司,利用已有的能力培育了渠道营销能力,抓住市场机会,迅速壮大;三株公司虽然抓住了市场机会,但忽视了能力与机会的匹配,结果在一场官司下就如“蝴蝶效应”般地倒下了;海尔用了七年的时间专心打造品牌,在培育了战略性资源后,逐步扩展市场,获得了巨大的成功,相反,三九集团不顾自己的能力,过度地进入多个行业,并没有取得很好的成就;顺驰房地产公司抓住了市场的机会,却在超常规发展中发生危机,万科房地产公司却以成熟的管理模式驾驭着不断变化的市场机会。

企业发展的途径无非就是两种形式:一是抓住机会,进入市场,打造与市场匹配的能力;二是使用已有的能力开拓一个市场。

但是在实业界中,企业往往存在两个毛病:一是看不到机会,使机会擦肩而过;二是不知自己有多大的能耐,经不住市场的诱惑,盲目进行战略投资。

如何评价自己的能力?如何识别市场机会?如何保持能力与机会的匹配?这是企业经营者必须时刻思考的问题,是战略咨询公司必须为客户进行精确界定的问题,是战略管理理论必须做出回答的问题。

2 对战略管理本质问题的理论解释在整个战略管理理论的发展史中,每一位具有划时代影响力的学者,如安德鲁斯、安索夫、波特、普拉哈拉德等,都围绕着战略管理本质问题做出了理论阐述。

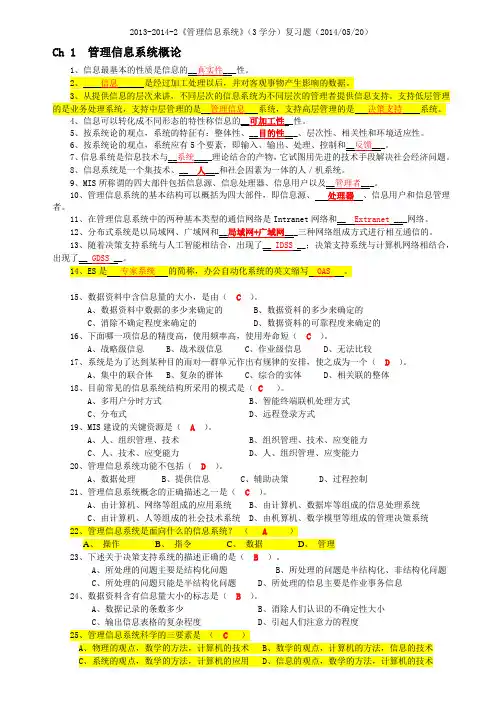

2013-2014-2《管理信息系统》(3学分)复习题(2014/05/20)Ch 1 管理信息系统概论、信息可以转化成不同形态的特性称信息的__可加工性__5、按系统论的观点,系统的特征有:整体性、__目的性___、层次性、相关性和环境适应性。

6、按系统论的观点,系统应有5个要素,即输入、输出、处理、控制和__反馈___。

7、信息系统是信息技术与__系统____理论结合的产物,它试图用先进的技术手段解决社会经济问题。

8、信息系统是一个集技术、__ 人___和社会因素为一体的人/机系统。

9、MIS所称谓的四大部件包括信息源、信息处理器、信息用户以及__管理者___。

10、管理信息系统的基本结构可以概括为四大部件,即信息源、处理器、信息用户和信息管理者。

11、在管理信息系统中的两种基本类型的通信网络是Intranet网络和__ Extranet ___网络。

12、分布式系统是以局域网、广域网和__局域网+广域网___三种网络组成方式进行相互通信的。

13、随着决策支持系统与人工智能相结合,出现了__ IDSS __;决策支持系统与计算机网络相结合,15、数据资料中含信息量的大小,是由(C)。

A、数据资料中数据的多少来确定的B、数据资料的多少来确定的C、消除不确定程度来确定的D、数据资料的可靠程度来确定的16、下面哪一项信息的精度高,使用频率高,使用寿命短(C)。

A、战略级信息B、战术级信息C、作业级信息D、无法比较17、系统是为了达到某种目的而对—群单元作出有规律的安排,使之成为一个(D)。

A、集中的联合体B、复杂的群体C、综合的实体D、相关联的整体18、目前常见的信息系统结构所采用的模式是(C)。

A、多用户分时方式B、智能终端联机处理方式C、分布式D、远程登录方式19、MIS建设的关键资源是(A)。

A、人、组织管理、技术B、组织管理、技术、应变能力C、人、技术、应变能力D、人、组织管理、应变能力20、管理信息系统功能不包括(D)。

历年真题及解析中英合作商务管理专业与金融管理专业管理段课程考试战略管理与伦理试题(课程代码11745)第一部分 必答题(本部分包括一、二、三题,共60分。

)一、 单选题。

本题包括第1—10小题,每小题1分,共10分。

1. 反映人的自由全面和谐发展,人与人、人与世界万物和谐相处与共同繁荣这一内在客观规律的关系是( )A.社会关系B.企业关系C.家庭关系D.伦理关系(知识点定位——CH1-2 伦理、道德和法律)2. 在企业战略制定过程中,着眼于企业目前经营业务和客户需求问题的是( )A.企业愿景B.企业使命C.企业伦理D.企业追求(知识点定位——CH2 企业愿景、使命与伦理追求)3.企业的主体道德包含两部分,通常我们所说的职业道德属于企业的( )A.公德B.道德认识C.私德D.道德意志(知识点定位——CH1-2 道德)4.企业具有保持其持续竞争优势的资源是( )A.雄厚的资金B.先进的技术C.优良的设备D.良好的信誉历年真题及解析(知识点定位——CH4-1 企业资源)5.股东治理模式又称为英美模式,其公司目标的特点是( )A.仅为股东利益服务B.为公司员工服务C.为高层管理者服务D.为所有利益相关者服务(知识点定位——CH5-1 股东治理模式)6.最准确地描述波士顿矩阵中“现金牛”产品概念的选项是( )A.市场占有率高、市场增长率高的产品B.市场占有率高、市场增长率低的产品C.市场占有率低、市场增长率高的产品D.市场占有率低、市场增长率低的产品(知识点定位——CH6-2 波⼠士顿矩阵分析)7.企业为顾客提供的产品具有独特价值,该企业采用的战略是( )A.重点集中战略B.成本领先战略C.差别化战略D.单一化战略(知识点定位——CH7-1 ⼀一般竞争战略)8.某罐头食品厂为解决生产所需原料,投资建设农副产品生产基地的战略属于( )A.不相关多元化B.后向一体化C.前向一体化D.相关多元化(知识点定位——CH7-1 ⼀一般竞争战略)9.公司为了适应东道国当地市场需求而强调产品和服务差别化的战略是( )A.多国本土化战略B.全球战略C.跨国经营战略D.国际化战略(知识点定位——CH9-2 国际化战略的类型)历年真题及解析10. 将公司战略落实到具体业务部门的过程称为( )A.战略分析阶段B.战略制定阶段C.战略实施阶段D.战略控制阶段(知识点定位——CH10-1 企业战略实施)二、 简答题本题包括第11-12小题,每小题5分,共10分。

107[战略管理]本科课程教学大纲(文学、外语、经济、管理、艺术类)主审:一、课程描述1.简要描述课程性质。

不是对必修/选修的描述,而是对学科专业性质的描述。

战略管理/策略管理在古代战场上是「将军的学问」,在商业上则是「总经理的学问」,它不对各个职能部门的局部运营战术做微观的细部探讨,而是从整个公司的宏观层次,为公司擘划下一个长期的道路,以免「见树不见林」,汲汲营营于个别职能效率的优化却将公司往错误且致命的方向带去(俗称作死)。

本门课盼望给学生一种思维高度、站在全公司/集团的角度,通盘考虑外界行业情势变化、和周遭企业的互动关系、对手的行动动态、与自身实力后,去运筹帷幄公司集体下一步的走向与布局,以及这样的行动设计需要搭配内部怎样的资源调度与结构变革。

学生毕业后理想的对接职位如:经营分析部门、商业情报部门、战略规划部门、总经理特助幕僚、企业谘询顾问…等,皆非常需要具备战略高度的策略思维,这种训练是商学院学生在大学课堂中必须走过的最后一里,也是本课程的价值之所在。

2.简要描述课程主要内容,学生将从课程获得什么,教师的教学方式是什么等。

本课程的讲授内容包括:经典的外部环境分析、价值链、五力分析;内部能力与资源分析;事业层次的竞争优势来源(含波特的知名分类与后续学者的补充)、竞争策略、策略群组分析、攻击与防御、如何阻绝对手的动作;公司层次战略则包括:商业模式、成长扩张、多元化、垂直整合、水平整合、外包、联盟、合资、商业生态系统、并购/重组、内部创业等;以及国际化(全球化)战略、国际企业进入模式;最后是策略的实施与执行、组织结构的匹配、公司治理… 等。

3.简要描述课程成绩构成。

包括考核方式、成绩占比及评分标准等。

出勤10%、随堂小测10%、读书报告20%、企业战略分析论文30%、期末考30%。

并视学生表现加个人分(详见本文件末第六项)。

按课程章节分别列出每章教学目标,采何种方式,培养学生何能力。

(一)教科书•战略管理:思维与要径(第3版),黄旭主编。

管理学ch1.管理概述1.管理的概念:管理者在一定环境下,对组织资源进行的计划、组织、领导、控制,以有效率和有效果地实现组织目标的过程。

(1)五要素:管理的目标、主体、客体、方法、环境(2)管理者构成管理活动的主体,要提高组织管理水平,关键在于提高组织中管理者的素质。

(3)资源中人最重要2.管理的性质:(一)二重性(1)自然属性:生产力、社会化大生产相联系,组织劳动表现社会属性:生产关系、社会制度相联系,指挥、监督劳动表现(2)科学性:客观规律、科学管理知识(3)艺术性:因地制宜、因人而异,创造性(二)目标性(三)组织性:组织在管理中起到关键枢纽作用,组织是管理的核心要素。

(四)创新性:环境,生产力发展和社会进步3.管理的职能:计划:管理的前提(确定目标、制定战略)组织:管理的载体(组织设计、人员配备、组织运行)领导:指挥、指导、激励、沟通有效的领导工作是组织任务完成的关键因素控制:限制偏差的积累,以保证计划目标的实现;环境变,做调整4.管理理论发展的历史演变:(1)18世纪中叶,产业革命亚当斯密,《国富论》劳动分工思想罗伯特.欧文人际关系思想,工人是“有生机器”(2)古典管理理论1. 泰勒科学管理理论泰勒是“科学管理之父”他认为“管理就是确切地知道你要别人干些什么,并注意用最好的、最经济的方法去干”把人当“经济人”对待2. 法约尔一般管理理论法约尔是“经营管理理论之父”第一次明确区分“经营”和“管理”强调管理活动处于核心地位3. 马克斯.韦伯行政组织理论韦伯“组织理论之父”提出了“理想的行政组织体系”(三人:个人、企业、社会)(3)人际管理理论和社会系统理论1.人际管理理论创始人:梅奥(1.进行霍桑实验 2.创立了人际关系学说)人际关系学说观点:1.工人是“社会人”2.正式组织中存在非正式组织3.工人的满足度是决定劳动生产率的首位因素2.社会系统理论创始人:巴纳德(组织)1.独创性地提出了组织的概念,并分其为正式组织和非正式组织2.最早使用“系统”观念研究组织3.共同目标是组织存在和发展的灵魂4.管理者的权威不是来自上级的授予,而是来自由下而上的认可5.现代管理理论(1)管理过程学派(经营管理学派)法约尔:过程、职能(2)管理实践学派(经验管理学派)德鲁克“现代管理之父”。

Chapter 7 — Acquisiti on and Restructuri ng StrategiesTRUE/FALSE1. A merger is defi ned as a tra nsact ionin which one firm purchases con troll ingin terest in ano ther firm. ANS: FPTS: 1DIF: MediumREF: 1842. Most acquisitions that are designed to achieve greater market power entail buying acompetitor, a supplier, a distributor, or a bus in ess in a highly related in dustry. ANS: TPTS: 1DIF: Medium REF: 184-1853. An acquisition of a firm in a highly related industry is referred to as a horiz on tal acquisition. ANS: FPTS: 1DIF: Medium REF: 1864. In most nations, regulations limiting acquisition activity has been stre ngthe ned.5. The reasons why a firm would overpay for a company that it acquires include in adequatedue dilige nee. ANS: TPTS: 1DIF: EasyREF: 192-1936. Synergy is created by the efficiencies derived from economies of scale and econo miesof scope and by shari ng resources across the bus in esses in the merged firm. ANS: T PTS: 1DIF: Easy7. Acquisitions can becomea substitute for innovation future rounds of acquisiti ons.ANS: TPTS: 1DIF: Medium8. Restructuring refers to changes in the composition of a firm' s set ofbus in esses or its finan cial structure.MULTIPLE CHOICE1. Cross-border acquisitions involvea. acquisiti ons by firms from develop ing coun tries of firms in developed coun tries.b. acquisiti ons by firms from developed coun tries of firms in develop ing coun tries.c. acquisitionsmade by firms both within and between developed and developingcoun tries. d. none of the above. ANS: C PTS: 1DIF: Medium REF: 181-1822. In a mergera. two firms agree to integrate their operations on a relatively coequal basis.b. one firm buys controlling interest in another firm.c. two firms combine to create a third separate entity.d. one firm breaks into two firms. ANS: A PTS: 1 DIF: Easy REF: 1843. A(an) ___ occurs when one firm buys a controlling, or 100% interest, inanother firm. a. mergerANS: F PTS: 1 DIF: Hard REF: 187-188REF: 194in somefirms and trigger REF: 195-196ANS: T PTS: 1 DIF: Medium REF: 198b. acquisitionc. spin-offd. restructuring ANS: B PTS: 1 DIF: Medium REF: 1844. When the target firm ' s managers oppose an acquisition, it is referred to as a(an)a. stealth raid.b. adversarial acquisition.c. leveraged buyout.d. hostile takeover.ANS: D PTS: 1 DIF: Easy REF: 1845. When a firm acquires its supplier, it is engaging in a(an)a. merger.b. unrelated acquisition.c. vertical acquisition.d. hostile takeover.ANS: C PTS: 1 DIF: Medium REF: 185-1866. Cross-border acquisitions are typically made toa. incr ease a firm ' s market power.b. reduce the cost of new product development.c. take advantage of higher education levels of labor in developed countries.d. circumvent barriers to entry in another country.ANS: D PTS: 1 DIF: Medium REF: 187 | 181-1827. Entering new markets through acquisitions of companies with new products is not risk-free,especially if acquisition becomes a substitute fora. innovation.b. market discipline.c. risk analysis.d. international diversification.ANS: A PTS: 1 DIF: Medium REF: 1898. Without effective due diligence thea. acquiring firm is likely to overpay for an acquisition.b. firm may miss its opportunity to buy a well-matched company.c. acquisition may deteriorate into a hostile takeover, reducing the value creating potential ofthe action.d. firm may be unable to act quickly and decisively in purchasing the target firm.9. Due diligence includes all of the following activities EXCEPT assessing a. differences in firm cultures.b. the level of private synergy between the two firms.c. tax consequences of the acquisition.d. the appropriate purchase price. ANS: C PTS: 1 DIF: Medium REF: 192-19310. The use of high levels of debt in acquisitions has contributed to a. the increase in above-average returns earned by acquiring firms. b. an increased risk of bankruptcy for acquiring firms.c. the confidence of the stock market in firms issuing junk bonds.d. an increase in investments that have long-term payoffs. ANS: B PTS: 1 DIF: Hard REF: 19311. One problem with becoming too large is that large firmsa. become excessively diverse and have difficulty focusing on strategicb. usually increase bureaucratic controls.c. become attractive takeover targets.d. tend to have inadequate financial controls. ANS: B PTS: 1 DIF: Medium REF: 196 12. A friendly acquisitiona. facilitates the integration of the acquired and acquiring firms.b. enhances the complementarity of the two firms ' assets.c. raises the price that has to be paid for a firm.d. allows joint ventures to be developed. ANS: A PTS: 1 DIF: Medium REF: 197ANS: A PTS: 1 DIF: Medium REF: 192-193 goals.。