Key to Exercise Four

- 格式:doc

- 大小:29.00 KB

- 文档页数:4

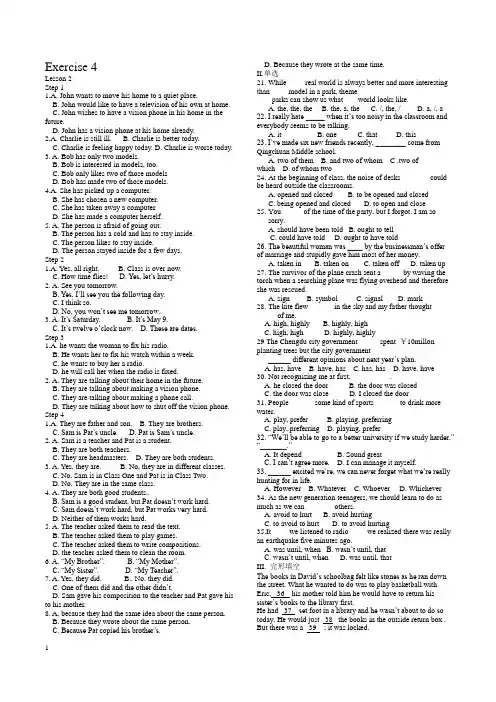

Exercise 4Lesson 2Step 11. A. John wants to move his home to a quiet place.B. John would like to have a television of his own at home.C. John wishes to have a vision phone in his home in the future.D. John has a vision phone at his home already.2. A. Charlie is still ill. B. Charlie is better today.C. Charlie is feeling happy today.D. Charlie is worse today.3. A. Bob has only two models. B. Bob is interested in models, too.C. Bob only likes two of those modelsD. Bob has made two of those models.4. A. She has picked up a computer. B. She has chosen a new computer.C. She has taken away a computer.D. She has made a computer herself.5. A. The person is afraid of going out. B. The person has a cold and has to stay inside.C. The person likes to stay inside.D. The person stayed inside for a few days.Step 21. A. Yes, all right. B. Class is over now. C. How time flies! D. Yes, let’s hurry.2. A. See you tomorrow. B. Yes, I’ll see you the following day.C. I think so.D. No, you won’t see me tomorrow..3. A. It’s Saturday. B. It’s May 9. C. It’s twelve o’clock now. D. These are dates.Step 31. A. he wants the woman to fix his radio. B. He wants her to fix his watch within a week.C. he wants to buy her a radio.D. he will call her when the radio is fixed.2. A. They are talking about their home in the future. B. They are talking about making a vision phone.C. They are talking about making a phone call.D. They are talking about how to shut off the vision phone.Step 41. A. They are father and son. B. They are brothers. C. Sam is Pat’s uncle. D. Pat is Sam’s uncle.2. A. Sam is a teacher and Pat is a student. B. They are both teachers.C. They are headmasters.D. They are both students.3. A. Yes, they are. B. No, they are in different classes.C. No, Sam is in Class One and Pat is in Class Two.D. No. They are in the same class.4. A. They are both good students.. B. Sam is a good student, but Pat doesn’t work hard.C. Sam doesn’t work hard, but Pat works very hard.D. Neither of them works hard.5. A. The teacher asked them to read the text. B. The teacher asked them to play games.C. The teacher asked them to write compositions.D. the teacher asked them to clean the room.6. A. “My Brother”. B. “My Mother”. C. “My Sister”. D. “My Teacher”.7. A. Yes, they did. B.. No, they did. C. One of them did and the other didn’t.D. Sam gave his composition to the teacher and Pat gave his to his mother.8. A. because they had the same idea about the same person. B. Because they wrote about the same person.C. Because Pat copied his brothe r’s.D. Because they wrote at the same time.第二部分英语知识运用第一节语法和词汇知识21. While ____ real world is always better and more interesting than ____ model in a park, themeparks can show us what ___ world looks like.A. the, the, theB. the, a, theC. /, the, /D. a, /, a22. I really hate _____ when it’s too noisy in the classroom and everybody seems to be talking.A. itB. oneC. thatD. this23. I’ve made six new friends recently, ________ come from Q ingchuan Middle school.A. two of themB. and two of whom C .two of which D. of whom two24. At the beginning of class, the noise of desks _______ could be heard outside the classrooms.A. opened and closedB. to be opened and closedC. being opened and closedD. to open and close25. You _____ of the time of the party, but I forgot. I am so sorry.A. should have been toldB. ought to tellC. could have toldD. ought to have told26. The beautiful woman was ____ by the businessman’s offer of marriage and stupidly gave him most of her money.A. taken inB. taken onC. taken offD. taken up27. The survivor of the plane crash sent a _____ by waving the torch when a searching plane was flying overhead and therefore she was rescued.A. signB. symbolC. signalD. mark28. The kite flew ______ in the sky and my father thought _____ of me.A. high, highlyB. highly, highC. high, highD. highly, highly29 The Chengdu city government _____ spent ¥10millon planting trees but the city government_________ different opinions about next year’s plan.A. has, haveB. have, hasC. has, hasD. have, have30. Not recognizing me at first, __________.A. he closed the doorB. the door was closedC. the door was closeD. I closed the door31. People ______ some kind of sports _________ to drink more water.A. play, preferB. playing, preferringC. play, preferringD. playing, prefer32. “We’ll be able to go to a better university if we study harder.” “_______.”A. It dependB. Sound greatC. I can’t agree more.D. I can manage it myself.33. ______ excited we’re, we can never forget what we’re really hunting for in life.A. HoweverB. WhateverC. WhoeverD. Whichever34. As the new generation teenagers, we should learn to do as much as we can _______ others.A. avoid to hurtB. avoid hurtingC. to avoid to hurtD. to avoid hurting35.It ____ we listened to radio ____ we realized there was really an earthquake five minutes ago.A. was until, whenB. wasn’t until, thatC. wasn’t until, whenD. was until, that第二节完形填空The books in David’s schoolbag felt like stones as he ran down the street. What he wanted to do was to play basketball with Eric, 36 his mother told him he would have to return his sister’s books to the library first.He had 37 set foot in a library and he wasn’t about t o do so today. He would just 38 the books in the outside return box . But there was a 39 ; it was locked.He went into the building, only a few minutes 40 closing time. He put the books into the return box. And after a brief 41 in the toilet, he would be on his way to the playground to 42 Eric.David stepped out of the toilet and stopped in 43 — the library lights were off. The place was 44 . The doors had been shut. They 45 be opened from the inside, he was trapped(被困) — in a library!He tried to 46 a telephone call, but was unable to 47 . What’s more, the pay phones were on the outside of the building. 48 the sun began to set, he searched for a light and found it.49 he could see. David wro te on a piece of paper: “ 50 ! I’m TRAPPED inside!” and stuck it to the glass door. 51 , someone passing by would see it.He was surprised to discover that this place was not so unpleasant, 52 . Rows and rows of shelves held books, videos and music. He saw a book about Michael Jordan and took it off the shelf. He settled into a chair and started to 53 .He knew he had to 54 , but now, that didn’t seem to be such a 55 thing.36. A. but B. because C. or D. since37. A. ever B. nearly C. never D. often38. A. pass B. drop C. carry D. take39. A. problem B. mistake C. case D. question40. A. during B. after C. over D. before41. A. rest B. break C. walk D. stop42. A. visit B. meet C. catch D. greet43. A. delight B. anger C. surprise D. eagerness44. A. lonely B. empty C. noisy D. crowded45. A. wouldn’t B. shouldn’t C. couldn’t D. needn’t46. A. make B. fix C. use D. pick47. A. get on B. get up C. get through D. get in48. A. If B. As C. Though D. Until49. A. On time B. Now and then C. By the way D. At last50. A. Come B. Help C. Hello D. Sorry51. A. Surely B. Thankfully C. Truly D. Gradually52. A. at most B. after all C. in short D. as usual53. A. watch B. play C. read D. write54. A. wait B. stand C. sleep D. work55. A. bad B. cool C. strange D. nice第三部分阅读理解APerhaps never before has International Children's Day been so different in China.Standing on a pile of rubble(一堆碎石) that was the Xinjian Primary School, Yi Jianguo held a photo of his daughter."She always expected to celebrate Children's Day," he said, tears filling his eyes."Although she is gone, I remember her words and must make up for her."Yi was among the 500 parents who planned to celebrate Children's Day for their lost kids.In the resettlement zone (重新安置区) in the town of Leigu, Beichuan, four children played basketball with a ball they found in the ruins."When can we return to school?" a short boy asked. "In the past we waited for a day off for Children's Day. But this time, we just wish our classes could start as normal on June 1."For 13-year-old Wang Zhen from the Mianzhu Middle School, his holiday wish was to see his mom again.The boy has become quieter since losing his mother in the earthquake."She was always nagging(唠叨) and sometimes beat me. But I know she did it because she loved me."When Zhou Lin, his psychologist, told him "you can pretend I'm your mom and give me a hug," Wang threw himself into her arms and cried.To children outside the quake zone, this was maybe their first Children's Day when rather than receiving gifts they instead gave them.In Yushan county of Jiangxi province, 11-year-old Li Jing cut her waist-long hair that had taken her five years to grow and sold it for 5 yuan."My family isn't rich, but I wanted to do something for the other children," she said.Children around the world have also been eager to help the children of Sichuan.56. Why did Yi Jianguo stand on a pile of rubble on June 1?A. He was a rescue soldier from Chengdu.B. He meant to mourn his lost daughter.B. He was planning to save his daughter. D. He was a teacher in that school.57. Why did they four boys who were playing basketball say they wanted to go to school as usualon this Children's Day?A. Because they got tired from playing basketball.B. Because they wanted one day off.C. Because they didn’t want to playD. Because they were missing their previous school life.58. Which of the following is not mentioned in this passage?A. Li Jing tried her best to help the children suffering from the terrible earthquake.B. Wang Zhen’s late mother was very strict with him in the past.C. Children out of the quake zone were excited to get various gifts for their own festival.D. A great deal of help also arrived in quake zone from abroad.59. What can be the best title for this passage?A. An Unusual Children’s DayB. Celebrating Children’s DayC. Gifts For Children’s DayD. Exciting Children’s DayBWhen computer salesman Li Guang and his girlfriend Huang Minxia saw on TV the destruction caused by the unexpected earthquake, they quickly filled their car with bottled water and instant noodles and drove more than 160 miles to lend a hand."It's a small car, but we just wanted to help," said Li, from Chongqing, a city next to hardest-hit Sichuan province. Donations(捐赠) are flooding in, more money than charities(慈善) in China collected all of last year, and so are volunteers.In the week since the quake, donations have totaled $1.3 billion — 85 percent raised within China.Many, like Li, are taking advantage of growing private car ownership and a new, expanding highway system to join the line of government and army assistance toward the epicenter.Across the disaster region, thousands of cars decorated with large handwritten signs— "Hardship comes from one direction, help comes from everywhere" and "For the people, for the Beijing Olympics" — were coming from as far as the capital, Beijing, more than 900 miles away.Private cars crowded so thickly on roads that the police set up donation drop-off points outside cities and towns to clear the way for army and government assistance. People living in tents along the roads posted handwritten signs asking for urgently needed items — water, rice, vegetables. Cars paused to hand out a box or two and then drove on.Instead of waiting for government-organized charity drives, people quickly acted on their own. Bank account(银行帐户) numbers for making earthquake donations flashed on Web logs and mobile phones. Blood donation centers were overwhelmed(淹没) with offers and began asking citizens to register(登记) in advance."People are really united this time, and they're acting on their own without waiting to be asked. It sounds corny, but we're taught in schools and from our parents about helping others," said Ge Jian, the company's general manager.60. What did Li Guang and his girlfriend Huang Minxia intended to do soon after the earthquake?A. They intended to help the victims in the quake-hit areas.B. They were on the way to a pleasant journey in Sichuan.C. They were told to do something for the disaster.D. They wanted to find their friends in the epicenter.61. What does the underlined word “corny” most probably mean?A. out of dateB. heart-brokenC. funnyD. disappointing62. According to the passage, all the following statements are true EXCEPT____?A. The good road system made it possible for more private car owners to rush to help.B. The local people in the quake zone were short of food and drinks.C. More money was collected from overseas than within China for the earthquake.D. People across China were taking active part in the rescue work.63. Why did Blood donation centers advised people to register ahead of time?A. Because they were expecting more money rather than blood.B. Because they had collected enough blood for the disaster.C. Because they were ready to go the epicenter and they were much too busy.D. Because too many people were offering to donate blood.CFor years, investors(投资者) have been trying to make money on minerals and oil found in the Sahara. But some three decades ago, scientists discovered another natural resource running below the dry dusty earth—water.In the early 1980s, Libyan President(利比亚总统) Moammar Gadhafi decided to pump this unlikely desert resource to Libya. More than 20 years later, a pipe (管道) big enough to pass a truck runs below the desert, carrying water to Libyan coastal cities.When people in Tripoli, Benghazi or Sirte turn on their faucets(水龙头), their water comes from deep under the desert and hundreds of kilometers away. This water is saved from tens of thousands of years ago when the region had a lot more rain. It sank deep into the desert and is now being pulled out by this pipe project.But with the Earth's rising temperature, the desert is now mostly unlivable. Saharan communities live in about two percent of the desert, near oases(绿洲).Children in the oasis village of Timia, Niger(几内亚), at the southern edge of the Sahara desert fill their containers(容器) every morning. The mountain village gets enough water to grow fruit year round.Brothers Aruba and Alison say their grandfather's fruit farm was the first in their village. They sell oranges and mangoes to tourists for 20 cents each. They also sell dates, raisins, and grapefruits.Theirs is the only mechanical water well(机械水井) in the village. During the hottest months, the water level goes down, but they say they still manage to water the garden. Even during the country's droughts in the early 1970s and in 2005, the garden and family survived.The brothers had not heard about the Libyan water pipe project. They hope this does not mean their garden will get less water in the coming years.Libyan water scientists say the pipe network and the Saharan underground water can last for the next 50 years.64. What used some investors to get from the Sahara desert?A. FruitsB. Underground waterC. Oil and mineralsD. Farm fields.65. What does “unlivable” in the fourth paragraph mean in this passage?A. unlikelyB. not fit for livingC. incredibleD. extremely hot66. We can learn from this passage that “dates” is ________.A. a special dayB. a placeC. some kind of fruitsD. a local farmer’s name67. This passage mainly tells us that _________.A. It’s pretty easy to grow fruit trees in the Sahara desert.B. People are doing everything possible to find and use the water in the desert.C. Water is of great importance for the people living in the coastal areas in Libya.D. The Saharan underground water can last for the next 50 years.IV. 翻译练习1.有没有什么问题你们不懂的?2.星期六在会上讲话的那个学生是我们班长。

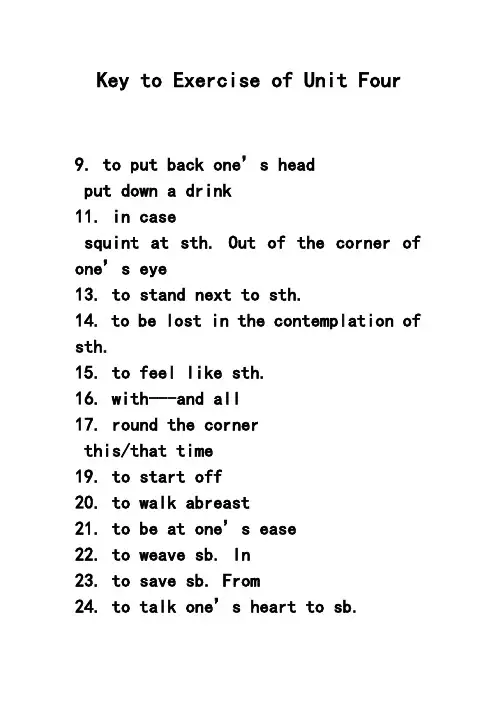

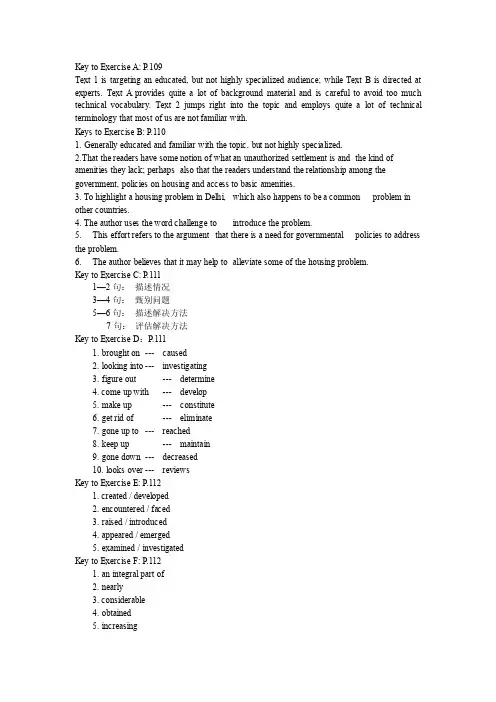

Key to Exercise of Unit Four9. to put back one’s headput down a drink11. in casesquint at sth. Out of the corner of one’s eye13. to stand next to sth.14. to be lost in the contemplation of sth.15. to feel like sth.16. with---and all17. round the cornerthis/that time19. to start off20. to walk abreast21. to be at one’s ease22. to weave sb. In23. to save sb. From24. to talk one’s heart to sb.25. not for all the money in the world knock sb. Down27. to say sth. In a strained voiceget beyond sb.29. for God’s sake30. to do sth. By accidentMarch the words or expressions in the two columns that have similar meanings.A. 1=B. 4 A. 2=B. 6A. 3=B. 8 A. 4 =B. 10 A.A. 5=B. 12 A. 6=B. 11=B. 15 A. 8==B. 16 =B. 1= B. 3 =B. 7=B. 18 =B. 20=B. 5 A. 16=B. 14.=B. 9 =B. 2=B. 13 =B. 196. Give the equivalent of the following in British English.1. lift 3. lorry 4. autumn6. term7. film8. cinema9. motorbike 10. sweet 11. cock 12. toilet13. pavement 14. clever 15. cheque 16. boot17. railway 18. undergroundMore Work on the Test1.T ranslate1.)Into Chinese1.难以解决的问题2.一本难以看懂的书3.一个爱交际的女人4.黑市5.黑色幽默6.害群之马7.黑人权利8.缺少表达能力的人9.全国性运动10.赞扬或恭维的话11.调皮的男孩12.某些大人物们13.种族隔离的学校14.他的无可争议的权威15.一个地位很高的人士16.公海17.上流社会18.机密消息19.冷淡而缺少人情味的门20.冷淡的公文式的信21.真诚的羡慕22.不自然的,紧张的说话的声音2) Into English1. to celebrate the Golden Jubilee2. to excite admiration3. to touch the conscience4. to win the prize5. to receive the reprimand6. to omit the words7. to renounce the prizes8. to avert a crisis9. to attend the ceremony10. to exhibit a works of art11. to indulge the pleasures12. to guard a child13. to feel up to it14. to bring sth. to a close15. to weave sb. in16. to save sb. from a situation17. to talk out one’s heart to sb.18. to knock sb. down19. to pour sb. a drink20. to raise (lift ) one’s glass二.Translate1.Import of the country’s beef wassuspended because of the mad cowscare.2.During the war, they had to suspendthe construction of the railway.2. it was a serious offence to take drugs, Robert was suspended from school for two weeks.3. She was reading in a hammock suspended from two tree branches.4.The sales suspension has brought us heavy losses.5.This is perhaps the longestsuspension bridge in Asia.6.The author is very good at creating suspense.7.He used to watch wit great envy children of wealthy people go to school.8. I rather envy their school for its beautiful campus.9.She averted her face so that people would not see her blush.10.He has always had an aversion to publicity.11.The government’s policy succeeded in averting a serious economic recession.12.Michael Jordan is the envy of many black kids.13.Every summer, hundreds of thousands of people are sent to guard the riverbanks against floods.14.it was not easy to get the golden apple, for it was guarded by a furiousgiant.15.Xicheng was practically unguarded so Zhuge Liang narrowly escaped being captured.16.The prisoners of war killed the guards and escaped into the woods. 17.He is probably the greatest guard in the history of basketball.18.They took Americans off guard by launching a sudden attack on a Sunday.19.There were two armed soldiers standing guard at the bridge.20.Napoleon exhibited his military talent early in life.21.These exhibits are all insured and carefully guarded.22.When the exhibition is over, the exhibit will be given to the host country as gifts.23.She is going to exhibit some of her most recent sculptures at the National Art Gallery.四.Put the most appropriate words in the blanks.1. C2. A3. B4. A5. D6. B7. C 8. D 9. A五. Study the difference between the following pairs or groups of words1. 1) renounce 2) announce3) renounce 4)denounce2. 1) avoid , prevent 2) prevent3. 1) divided 2) segregated3)divided 4)separated4. 1) personage 2) person3) personality 4)person5. 1)complementary 2) complimentary 3) complimentary 4) compliment6. 1) secret 2) confidential3) secret 4) confidential, secret七. Choose the best word or phrase for each blank from the four supplied inbrackets.2. larger3. Unfortunately4. original5. receipt6. rejoin7. viciously8. demanded9. marched 10. assumed 11. cases 12. get away 13. protest 14. had spoken to15. couldn’t really have comfortedMore Work on the Text二.Complete the following sentences with the right form ofthe verb in the brackets.1.is2. are3. was4. frightens5. are6. is7. were all8. was9. knows 10. are 11. are, am 12. is13. was 14. has 15. is, is三.Rewrite the sentences using the patternshown in the example.1.It is now believed that foreignlanguage are most easily learnt by children under 14.2.It is reported that the negotiationsbetween the two countries had made headway.3.It has been confirmed that a majorbreakthrough has been achieved in cancer research.4.It is strongly recommended thatfishing in the lake be strictly forbidden during the spring season.5.It is agreed among the rival companiesthat joint efforts should be made to prevent the price of color TV from going through the floor.6.It shouldn’t be assumed that all ourproblems will be resolved overnight.7.It is generally assumed thatdepression affects a person’s health in many ways.8.It was announced yesterday that a newtax law would be imposed beginning next year.9.In ancient times, it was believed thatthe heart , not the brain, was the center of thought.10.It is predicted (in a medical report)the number of AIDS victims in Asia will increase sharply in the next decade.四.Translate the sentences into English1.I t’s widely rumored that Linda’sbeing promoted.2.I t is estimated that the projectwill cost RMB three billion.3.I t is assumed that the Labor Partywill remain in power.4.I t was proposed a few years ago thatthe president be elected for oneterm only.5.I t was announced that anotherbridge across the Yangtze would be built next year.6.i t was believed even then that theabnormal state of affairs wouldn’t last long.二.Paying special attention to subject –verb agreement.1. The jury is having trouble reachinga verdict.2. Whenever either of us is in a tight corner, we always come to each other’s help.3. Statistics are facts obtained from analyzing information given in numbers.4. Statistics is a branch of mathematics concerned with the study of information expressed in numbers.5. Neither his friends and nor his father was admitted by Tsinghai University.6. Xiao Li is one of the best foot players at our university who have ever participated in intercollegiate championships.五.Put in appropriate connectives. 1.a s, where, that/which, if/whether ,but. if2.W hen, if, Then, that/which, than六.Complete each of the following sentences with the most likelyanswer.1. B2. A3. A4. D5. C6. A7. D 11. B 13. A 14. D 16 C。

Exercise 4Lesson 2Step 11.A. John wants to move his home to a quiet place.B. John would like to have a television of his own at home.C. John wishes to have a vision phone in his home in the future.D. John has a vision phone at his home already.2.A. Charlie is still ill. B. Charlie is better today.C. Charlie is feeling happy today.D. Charlie is worse today.3. A. Bob has only two models.B. Bob is interested in models, too.C. Bob only likes two of those modelsD. Bob has made two of those models.4.A. She has picked up a computer.B. She has chosen a new computer.C. She has taken away a computer.D. She has made a computer herself.5. A. The person is afraid of going out.B. The person has a cold and has to stay inside.C. The person likes to stay inside.D. The person stayed inside for a few days.Step 21.A. Yes, all right. B. Class is over now.C. How time flies!D. Yes, let’s hurry.2. A. See you tomorrow.B. Yes, I’ll see you the following day.C. I think so.D. No, you won’t see me tomorrow..3. A. It’s Saturday. B. It’s May 9.C. It’s twelve o’clock now.D. These are dates.Step 31.A. he wants the woman to fix his radio.B. He wants her to fix his watch within a week.C. he wants to buy her a radio.D. he will call her when the radio is fixed.2. A. They are talking about their home in the future.B. They are talking about making a vision phone.C. They are talking about making a phone call.D. They are talking about how to shut off the vision phone. Step 41.A. They are father and son. B. They are brothers.C. Sam is Pat’s uncle.D. Pat is Sam’s uncle.2. A. Sam is a teacher and Pat is a student.B. They are both teachers.C. They are headmasters.D. They are both students.3. A. Yes, they are. B. No, they are in different classes.C. No, Sam is in Class One and Pat is in Class Two.D. No. They are in the same class.4. A. They are both good students..B. Sam is a good student, but Pat doesn’t work hard.C. Sam doesn’t work hard, but Pat works very hard.D. Neither of them works hard.5. A. The teacher asked them to read the text.B. The teacher asked them to play games.C. The teacher asked them to write compositions.D. the teacher asked them to clean the room.6. A. “My Brother”. B. “My Mother”.C. “My Sister”.D. “My Teacher”.7. A. Yes, they did. B.. No, they did.C. One of them did and the other didn’t.D. Sam gave his composition to the teacher and Pat gave his to his mother.8. A. because they had the same idea about the same person.B. Because they wrote about the same person.C. Because Pat copied his brother’s.D. Because they wrote at the same time.II.单选21. While ____ real world is always better and more interesting than ____ model in a park, themeparks can show us what ___ world looks like.A. the, the, theB. the, a, theC. /, the, /D. a, /, a22. I really hate _____ when it’s too noisy in the classroom and everybody seems to be talking.A. itB. oneC. thatD. this23. I’ve made six new friends recently, ________ come from Qingchuan Middle school.A. two of themB. and two of whom C .two ofwhich D. of whom two24. At the beginning of class, the noise of desks _______ could be heard outside the classrooms.A. opened and closedB. to be opened and closedC. being opened and closedD. to open and close25. You _____ of the time of the party, but I forgot. I am sosorry.A. should have been toldB. ought to tellC. could have toldD. ought to have told26. The beautiful woman was ____ by the businessman’s offerof marriage and stupidly gave him most of her money.A. taken inB. taken onC. taken offD. taken up27. The survivor of the plane crash sent a _____ by waving the torch when a searching plane was flying overhead and therefore she was rescued.A. signB. symbolC. signalD. mark28. The kite flew ______ in the sky and my father thought_____ of me.A. high, highlyB. highly, highC. high, highD. highly, highly29 The Chengdu city government _____ spent ¥10millon planting trees but the city government_______ different opinions about next year’s plan.A. has, haveB. have, hasC. has, hasD. have, have30. Not recognizing me at first, __________.A. he closed the doorB. the door was closedC. the door was closeD. I closed the door31. People ______ some kind of sports ______ to drink more water.A. play, preferB. playing, preferringC. play, preferringD. playing, prefer32. “We’ll be able to go to a better university if we study harder.” “_______.”A. It dependB. Sound greatC. I can’t agree more.D. I can manage it myself.33. ______ excited we’re, we can never forget what we’re really hunting for in life.A. HoweverB. WhateverC. WhoeverD. Whichever34. As the new generation teenagers, we should learn to do as much as we can _______ others.A. avoid to hurtB. avoid hurtingC. to avoid to hurtD. to avoid hurting35.It ____ we listened to radio ____ we realized there was really an earthquake five minutes ago.A. was until, whenB. wasn’t until, thatC. wasn’t until, whenD. was until, thatIII. 完形填空The books in David’s schoolbag felt like stones as he ran down the street. What he wanted to do was to play basketball with Eric, 36 his mother told him he would have to return his sister’s books to the library first.He had 37 set foot in a library and he wasn’t about to do so today. He would just 38 the books in the outside return box . But there was a 39 ; it was locked.1He went into the building, only a few minutes 40 closing time. He put the books into the return box. And after abrief 41 in the toilet, he would be on his way to the playground to 42 Eric.David stepped out of the toilet and stopped in 43 — the library lights were off. The place was 44 . The doors had been shut. They 45 be opened from the inside, he was trapped(被困) — in a library!He tried to 46 a telephone call, but was unable to 47 . What’s more, the pay phones were on the outside of the building. 48 the sun began to set, he searched for a light and found it.49 he could see. David wrote on a piece of paper:“ 50 ! I’m TRAPPED inside!” and stuck it to the glass door. 51 , someone passing by would see it.He was surprised to discover that this place was not so unpleasant, 52 . Rows and rows of shelves held books, videos and music. He saw a book about Michael Jordan and took it off the shelf. He settled into a chair and startedto 53 .He knew he had to 54 , but now, that didn’t seem to be such a 55 thing.36. A. but B. because C. or D. since37. A. ever B. nearly C. never D. often38. A. pass B. drop C. carry D. take39. A. problem B. mistake C. case D. question40. A. during B. after C. over D. before41. A. rest B. break C. walk D. stop42. A. visit B. meet C. catch D. greet43. A. delight B. anger C. surprise D. eagerness44. A. lonely B. empty C. noisy D. crowded45. A. wouldn’t B. shouldn’t C. couldn’t D. needn’t46. A. make B. fix C. use D. pick47. A. get on B. get up C. get through D. get in48. A. If B. As C. Though D. Until49. A. On time B. Now and then C. By the way D. At last50. A. Come B. Help C. Hello D. Sorry51. A. Surely B. Thankfully C. Truly D. Gradually52. A. at most B. after all C. in short D. as usual53. A. watch B. play C. read D. write54. A. wait B. stand C. sleep D. work55. A. bad B. cool C. strange D. nice第三部分阅读理解APerhaps never before has International Children's Day been so different in China.Standing on a pile of rubble(一堆碎石) that was the Xinjian Primary School, Yi Jianguo held a photo of his daughter."She always expected to celebrate Children's Day," he said, tears filling his eyes."Although she is gone, I remember her words and must make up for her."Yi was among the 500 parents who planned to celebrate Children's Day for their lost kids.In the resettlement zone (重新安置区) in the town of Leigu, Beichuan, four children played basketball with a ball they found in the ruins."When can we return to school?" a short boy asked. "In the past we waited for a day off for Children's Day. But this time, we just wish our classes could start as normal on June 1."For 13-year-old Wang Zhen from the Mianzhu Middle School, his holiday wish was to see his mom again.The boy has become quieter since losing his mother in the earthquake."She was always nagging(唠叨) and sometimes beat me. But I know she did it because she loved me." When Zhou Lin, his psychologist, told him "you can pretend I'm your mom and give me a hug," Wang threw himself into her arms and cried.To children outside the quake zone, this was maybe their first Children's Day when rather than receiving gifts they instead gave them.In Yushan county of Jiangxi province, 11-year-old Li Jing cut her waist-long hair that had taken her five years to grow and sold it for 5 yuan."My family isn't rich, but I wanted to do something for the other children," she said.Children around the world have also been eager to help the children of Sichuan.56. Why did Yi Jianguo stand on a pile of rubble on June 1?A. He was a rescue soldier from Chengdu.B. He meant to mourn his lost daughter.B. He was planning to save his daughter. D. He was a teacher in that school.57. Why did they four boys who were playing basketball say they wanted to go to school as usualon this Children's Day?A. Because they got tired from playing basketball.B. Because they wanted one day off.C. Because they didn’t want to playD. Because they were missing their previous school life.58. Which of the following is not mentioned in this passage?A. Li Jing tried her best to help the children suffering from the terrible earthquake.B. Wang Zhen’s late mother was very strict with him in the past.C. Children out of the quake zone were excited to get various gifts for their own festival.D. A great deal of help also arrived in quake zone from abroad.59. What can be the best title for this passage?A. An Unusual Children’s DayB. Celebrating Children’s DayC. Gifts For Children’s DayD. Exciting Children’s DayBWhen computer salesman Li Guang and his girlfriend Huang Minxia saw on TV the destruction caused by the unexpected earthquake, they quickly filled their car with bottled water and instant noodles and drove more than 160 miles to lend a hand. "It's a small car, but we just wanted to help," said Li, from Chongqing, a city next to hardest-hit Sichuan province. Donations(捐赠) are flooding in, more money than charities(慈善) in China collected all of last year, and so are volunteers.In the week since the quake, donations have totaled $1.3 billion — 85 percent raised within China.Many, like Li, are taking advantage of growing private car ownership and a new, expanding highway system to join the line of government and army assistance toward the epicenter. Across the disaster region, thousands of cars decorated with large handwritten signs— "Hardship comes from one direction, help comes from everywhere" and "For the people, for the Beijing Olympics" — were coming from as far as the capital, Beijing, more than 900 miles away.Private cars crowded so thickly on roads that the police set up donation drop-off points outside cities and towns to clear the way for army and government assistance. People living in tents along the roads posted handwritten signs asking for urgently needed items — water, rice, vegetables. Cars paused to hand out a box or two and then drove on.Instead of waiting for government-organized charity drives, people quickly acted on their own. Bank account(银行帐户) numbers for making earthquake donations flashed on Web logs2and mobile phones. Blood donation centers were overwhelmed(淹没) with offers and began asking citizens to register(登记) in advance."People are really united this time, and they're acting on their own without waiting to be asked. It sounds corny, but we're taught in schools and from our parents about helping others," said Ge Jian, the company's general manager.60. What did Li Guang and his girlfriend Huang Minxia intended to do soon after the earthquake?A. They intended to help the victims in the quake-hit areas.B. They were on the way to a pleasant journey in Sichuan.C. They were told to do something for the disaster.D. They wanted to find their friends in the epicenter.61. What does the underlined word “corny” most probably mean?A. out of dateB. heart-brokenC. funnyD. disappointing62. According to the passage, all the following statements are true EXCEPT____?A. The good road system made it possible for more private car owners to rush to help.B. The local people in the quake zone were short of food and drinks.C. More money was collected from overseas than within China for the earthquake.D. People across China were taking active part in the rescue work.63. Why did Blood donation centers advised people to register ahead of time?A. Because they were expecting more money rather than blood.B. Because they had collected enough blood for the disaster.C. Because they were ready to go the epicenter and they were much too busy.D. Because too many people were offering to donate blood.CFor years, investors(投资者) have been trying to make money on minerals and oil found in the Sahara. But some three decades ago, scientists discovered another natural resource running below the dry dusty earth—water.In the early 1980s, Libyan President(利比亚总统) Moammar Gadhafi decided to pump this unlikely desert resource to Libya. More than 20 years later, a pipe (管道) big enough to pass a truck runs below the desert, carrying water to Libyan coastal cities.When people in Tripoli, Benghazi or Sirte turn on their faucets(水龙头), their water comes from deep under the desert and hundreds of kilometers away. This water is saved from tens of thousands of years ago when the region had a lot more rain. It sank deep into the desert and is now being pulled out by this pipe project.But with the Earth's rising temperature, the desert is now mostly unlivable. Saharan communities live in about two percent of the desert, near oases(绿洲).Children in the oasis village of Timia, Niger(几内亚), at the southern edge of the Sahara desert fill their containers(容器) every morning. The mountain village gets enough water to grow fruit year round.Brothers Aruba and Alison say their grandfather's fruit farm was the first in their village. They sell oranges and mangoes to tourists for 20 cents each. They also sell dates, raisins, and grapefruits.Theirs is the only mechanical water well(机械水井) in the village. During the hottest months, the water level goes down, but they say they still manage to water the garden. Even during the country's droughts in the early 1970s and in 2005, the garden and family survived.The brothers had not heard about the Libyan water pipe project. They hope this does not mean their garden will get less water in the coming years.Libyan water scientists say the pipe network and the Saharan underground water can last for the next 50 years.64. What used some investors to get from the Sahara desert?A. FruitsB. Underground waterC. Oil andminerals D. Farm fields.65. What does “unlivable” in the fourth paragraph mean in this passage?A. unlikelyB. not fit for livingC. incredibleD. extremely hot66. We can learn from this passage that “dates” is ________.A. a special dayB. a placeC. some kind of fruitsD. a local farmer’s name67. This passage mainly tells us that _________.A. It’s pretty easy to grow fruit trees in the Sahara desert.B. People are doing everything possible to find and use the water in the desert.C. Water is of great importance for the people living in the coastal areas in Libya.D. The Saharan underground water can last for the next 50 years.IV. 翻译练习1.有没有什么问题你们不懂的?2.星期六在会上讲话的那个学生是我们班长。

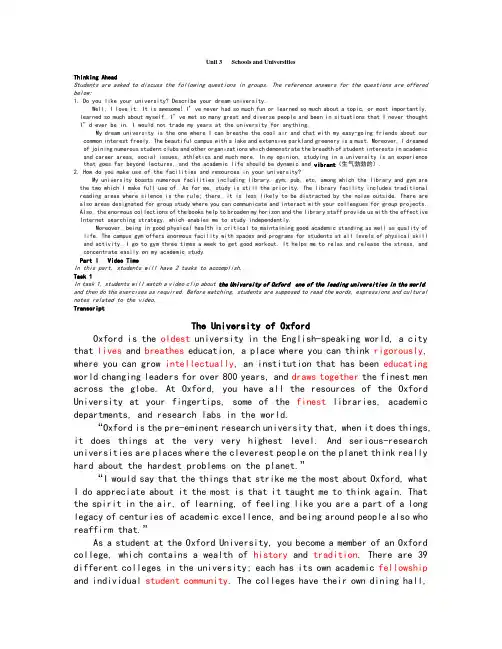

Unit 3 Schools and UniversitiesThinking AheadStudents are asked to discuss the following questions in groups. The reference answers for the questions are offered below:1. Do you like your university? Describe your dream university.Well, I love it. It is awesome! I’ve never had so much fun or learned so much about a topic, or most importantly, learned so much about myself. I’ve met so many great and diverse people and been in situations that I never thought I’d ever be in. I would not trade my years at the university for anything.My dream university is the one where I can breathe the cool air and chat with my easy-going friends about our common interest freely. The beautiful campus with a lake and extensive parkland greenery is a must. Moreover, I dreamed of joining numerous student clubs and other organizations which demonstrate the breadth of student interests in academic and career areas, social issues, athletics and much more. In my opinion, studying in a university is an experience that goes far beyond lectures, and the academic life should be dynamic and vibrant(生气勃勃的).2. How do you make use of the facilities and resources in your university?My university boasts numerous facilities including library, gym, pub, etc, among which the library and gym are the two which I make full use of. As for me, study is still the priority. The library facility includes traditional reading areas where silence is the rule; there, it is less likely to be distracted by the noise outside. There are also areas designated for group study where you can communicate and interact with your colleagues for group projects. Also, the enormous collections of the books help to broaden my horizon and the library staff provide us with the effective Internet searching strategy, which enables me to study independently.Moreover, being in good physical health is critical to maintaining good academic standing as well as quality of life. The campus gym offers enormous facility with spaces and programs for students at all levels of physical skill and activity. I go to gym three times a week to get good workout. It helps me to relax and release the stress, and concentrate easily on my academic study.Part I Video TimeIn this part, students will have 2 tasks to accomplish.Task 1In task 1, students will watch a video clip about the University of Oxford, one of the leading universities in the world, and then do the exercises as required. Before watching, students are supposed to read the words, expressions and cultural notes related to the video.TranscriptThe University of OxfordOxford is the oldest university in the English-speaking world, a city that lives and breathes education, a place where you can think rigorously, where you can grow intellectually, an institution that has been educating world changing leaders for over 800 years, and draws together the finest men across the globe. At Oxford, you have all the resources of the Oxford University at your fingertips, some of the finest libraries, academic departments, and research labs in the world.“Oxford is the pre-eminent research university that, when it does things, it does things at the very very highest level. And serious-research universities are places where the cleverest people on the planet think really hard about the hardest problems on the planet.”“I would say that the things that strike me the most about Oxford, what I do appreciate about it the most is that it taught me to think again. That the spirit in the air, of learning, of feeling like you are a part of a long legacy of centuries of academic excellence, and being around people also who reaffirm that.”As a student at the Oxford University, you become a member of an Oxford college, which contains a wealth of history and tradition. There are 39 different colleges in the university; each has its own academic fellowship and individual student community. The colleges have their own dining hall,library, cultural groups and sports teams. Your college will give you opportunity to meet other brilliant students from all areas of academic study, from astrophysicist to archeologist, from scientists to engineers. Oxford is an ancient and beautiful city; at the same time, it is modern and vibrant. Whenever things enclose proximity, you can cycle from pubs to parks and from museums to galleries. Oxford has excellent transport connections, and it is one hour from London and Heathrow Airport.Key to ExercisesExercise 1 Watching for DetailsStudents are asked to watch the video clip and fill in the blanks with the missing information.1) Oxford is the oldest university in the English-speaking world, a city that lives and breathes education, a place where you can think rigorously, where you can grow intellectually, an institution that has been educating world changing leaders for over 800 years, and draws together the finest men across the globe. At Oxford, you have all the resourcesof Oxford University at your fingertips, some of the finest libraries, academic departments, and research labs in the world.2) As a student at the Oxford University, you become a member of an Oxford College, which contains a wealth of history and tradition, the colleges have their own academic fellowship and individual student community. The College has its own dining hall, library, cultural groups and sports teams.3) Oxford has excellent transportation connections and it is one hour from London and Heathrow Airport.Exercise 2 Essay WritingTask 2In task 2, students are asked to watch a video clip about the hall of residence in the University of Derby in the UK and then do the exercises as required. Before watching, students are supposed to read the words, expressions and cultural notes related to the video.TranscriptThe Hall of Residence in the University of DerbyLiving in halls is a great opportunity to socialize with hundreds of people from all over the country, and quite likely all over the world. At the University of Derby, every first year who wants a place can have a place in halls, you can apply online once you got an unconditional offer, and we guarantee a place to all first years who apply before the 31st August. The university has five city center halls in Derby, and all the halls are a short walk from the university sites. It is really easy to get around city and university buses link all the halls. The buses run regularly, and you are living in halls, you get vouchers for a number of free trips. Alternatively, if you want to bring your car or a bike, all the halls have car parks and bike sheds. Derby is a great city, with something on most nights: fantastic shopping at the New West Field Center, and a friendly and vibrant atmosphere. It is also close to places like the Peak National Park for walking, biking or climbing.Your room will most likely be one of four or six in a flat, you can choose from a standard room where you share a shower and toilet with your flat mates, and an En-suite room, or a premium en-suite room, with its own mini-fridge and the use of TV lounge for all the people in the flat. If you have specific health or medical issue, we can also provide you with the room specially-adapted for your needs. Each room has Internet access, and connection to the university network. A phone which comes with free internalcalls and a TV aerial point. Your booking fee also covers contents insurance for your room.Hall staff is on hand 24 hours a day, and resident safety is our priority. There is CCTV on all sites and intercom systems in every flat to keep you safe and secure. Our staff has years of experience in dealing with all manner of welfare issues. So you can be sure that you are in safe hands. Living in halls is very good value for money, and compares favorably with private accommodation. Heating, lighting and hot water are all included; once you’ve paid your whole fees, all you have to budget for is food and going out. Cleaners come to your flat once a week, and cover the kitchen, shower, toilet and other shared areas. But your room is down to you. Each hall has a coin-operated laundry, containing large washers and dryers, so there is no excuse to take washing home at the weekends.Every hall also has its own common room, where you can relax and socialize away from your room. These contain wide-screen TVs and DVD players, pool tables and other entertainment. As well as studying, living in halls is also about community, and having time to socialize. The halls run all sorts of activities, and helps you get to know your neighbors better, and make new friends. There are events, such as pool competitions, barbecues and quizzes; and on the first weekend, a welcome-to- halls party. Your time in hall should be a great experience and one that you will never forget. We are here to support you along the way.Key to ExercisesExercise 1 Making a Sound JudgmentStudents are asked to watch the short video and decide whether the following statements are true (T) or false (F).F 1) Every student who applies for the university can be guaranteed a place in the hall of residence.T 2) The buses that link the halls are free of charge.T 3) Specially-adapted rooms are provided to the students with health or medical issue.T 4) Each room in the hall of residence has Internet access to the university network.F 5) You can relax and enjoy yourself in your room which contains a lot of recreational facilities, such as wide-screenTV and DVD players.Exercise 2 Watching for DetailsStudents are asked to watch the short video again and choose the best answers to the questions.1) B2) C3) BPart II Listening ActivitiesIn this part, students will have 3 listening tasks to accomplish.Task 1In task 1, students will listen to an introduction about Freshers’ Week at university and then do the exercises as required. Before listening, students are supposed to read the words and expressions related to the talk.TranscriptFreshers’ WeekFreshers’ Week at universities can be a nerve-wracking experience.The UK has a well-respected higher education system and some of the top universities and research institutions in the world. But to those who are new to it all, it can be overwhelming and sometimes confusing.October is usually the busiest month in the academic calendar.Universities have something called Freshers’ Week for their newcomers. It’s a great opportunity to make new friends, join lots of clubs and settle into university life.However, having just left the comfort of home and all your friends behind, the prospect of meeting lots of strangers in big halls can be nerve-wracking. Where do you start? Who should you make friends with? Which clubs should you join?Luckily, there will be thousands of others in the same boat as you worrying about starting their university social life on the right foot. So just take it all in slowly. Don’t rush into anything that you’ll regret for the next three years.Here are some top tips from past students on how to survive Freshers’Week:Blend in. Make sure you are aware of British social etiquette. Havea few wine glasses and snacks handy for your housemates and friends.Be hospitable. Sometimes cups of tea or even slices of toast can give you a head start in making friends.Be sociable. The more acti ve you are, the more likely you’ll be to meet new people than if you’re someone who never leaves their room.Bring a doorstop. Ke ep your door open when you’re in and that sends positive messages to your neighbors that you’re friendly.So with a bit of clever planning and motivation, Freshers’Week can give you a great start to yo ur university life and soon you’ll be passing on your wisdom to next year’s new recruits.(FromKey to ExercisesExercise 1 Making a Sound JudgmentStudents are asked to listen to the task and decide whether the following statements are true (T) or false (F).T 1) Although UK has the excellent education system and some top universities, the newcomers still feel confused sometimes.F 2) The newcomers tend to feel very excited and happy in Freshers’ Week.T 3) It is a great opportunity to make new friends to join many clubs in Freshers’ Week.F 4) Every freshman feels very comfortable in making new friends and joining clubs.Exercise 2 Listening for DetailsStudents are asked to listen to the talk again and fill in the blanks with the missing information.Tips on How to Survive Freshers’ WeekBlend in. Make sure you are aware of British etiquette. Have a few wine and snacks handy for your housemates and friends.Be _hospitable. Sometimes cups of tea or even slices of toast can give you a head start in making friends.Be sociable. The more active you are, the more likely you’ll be to meet new people.Bring a doorstop. Keep your door open when you are in and that sends positive messages to your neighbors that you’re friendly.Task 2Students will listen to a conversation between a teacher and a student, and then do the exercises as required. Before listening, students are supposed to read the words and expressions related to the dialogue.TranscriptA Dialogue between a Teacher and a StudentDr Richardson: Enter, please.David Simons: Good afternoon, Dr Richardson.Dr Richardson: Good afternoon. You’re David Simons, is that right?David Simons:Yes. I’ve an appointment to talk about the course requirements with you.Dr Richardson: Fine. Now why don’t you take a seat over there and I’ll just get some details from you. First, can I have your home address and your student number?David Simons: That’s 15 Market Avenue, Hornsby and my student number is C97H85.Dr Richardson: OK. Now I see here that you’ve already completed 18 credit points, but that you haven’t done the Screen Studies course which is normally a prerequisite for this course. Why is that, David?David Simons:Oh, the course coordinator gave me an exemption because I’ve worked for a couple of years in the movie and television business and they considered my practical experience fulfilled the same requirements. Dr Richardson: Fine. Shall we go over the course requirements first, and then you can bring up any queries or problems you might have. It might be most useful to start with a few dates. The final examination will be in the last week of June, that’s the week of the 23rd. but the final date hasn’t been set. It should be the 25th or the 20th, but you don’t have to worry about that yet. Before that, as you can see in your study guide, there are three essay assignments and some set exercises. I’ll deal with these first. These set exercises are concerned with defining concepts and key terms. They do have fixed answers not in the wording but in the content. To that extent they are quite mechanical, and provide an opportunity for you to do very well as long as your answers are veryspecific and clear.David Simons: Yes, I see there are about twenty terms here. How long should the answers be?Dr Richarson: You shouldn’t exceed 250 words for each term.David Simons:Right. That looks easy enough. And the third assignment seems fairly straightforward too. Just a journalistic type review of a recent development in television. It’s not so different from what I’ve done in my work.Dr Richarson:Yes, it should be fairly easy for you, but don’t exceed 1,000 words on that one. Essays 1 and 2 are the long ones. The first essay should be about 2,000 words and the second 2,500 to 3,000, and the approach for both should be analytical. In the first one, your focus should be on TV and the audience, and you should primarily consider the theoretical issues, particularly in relation to trying to understand audience studies. In the second, I’ll want you to focus on analyzing television programs.David Simons: Should I concentrate on one particular type of program for that?Dr Richarson: Not necessarily. But you must be careful not to overextend yourself here. A comparison between two programs or even between two channels is fine, or a focus on one type of program, such as a particular series, works well here.David Simons:So if I wanted to look at television news programs, that would be OK?Dr Richarson:Yes, there would be no problem with that. In fact it’s quitea popular choice, and most students handle it very well.David Simons: Good. I’ll probably do that, because it’s the area I want to work in later.(黄若妤,2008) Key to ExercisesExercise 1 Listening for Global UnderstandingStudents are asked to listen to the conversation and choose the best answers to the questions.1) D2) B3) DExercise 2 Listening for DetailsStudents are asked to listen to the conversation again and draw lines to match the assignments with their descriptions.Assignmentset exercise assignment1 assignment2 assignment3Descriptionmechanical theoretical analytical journalisticAdditional ListeningIn this section, students will listen to a lecture given by a counselor about the campus facilities and then do the exercises as required. Before listening, students are supposed to read the words and expressions related to the lecture. TranscriptCampus FacilitiesHi, I am your counselor for this year. Today we will visit the facilities available to you on our campus. As students, you should take advantage of everything you have available to you.How many of you like sports? Well, I hope most of you do, because our school has great sports facilities. We have an indoor gym with state of the art equipment. First I want to tell you about our basketball facilities. There are 2 basketball courts, both are full court and open for student use. We offer basketball leagues that all students are invited to join, just sign up with a team. Usually there are games on the courts, but during the league time, only the teams are allowed to use the courts. The basketball courts are open 24 hours a day. If you want a job, you can be a referee at the games.Next, I want to tell you about the tennis facilities. We have 5 tennis courts available for student use. The tennis courts are open everyday 8 am until 10 in the evening. You should call ahead to reserve a court, because they are very popular and can often be booked weeks in advance. There are rackets and balls available for rent at the front desk of the courts.There is an Olympic size swimming pool that is open for students and the general public. There are also showers and locker rooms available. The swimming pool is open everyday 9 am until 7 in the evening. There are openings for the position of lifeguards, so if you are looking for a job in the sun, this might be good for you.There are also 2 weight rooms and a gymnastics room. The weight rooms have all the standard equipment available. Please check with the gym to see the open hours, because they vary from time to time. The gymnastics room is usually not open for individual users because there are almost always classes held in the room. However, if you are interested, you may sign up for gymnastics classes. Plus if you like martial arts and boxing, we offer classes for everyone, from beginners to advanced students. Please check the schedule for availability. There is everything available from Chinese Wushu to Brazilian wrestling.I will talk for a brief moment about our library system. Our campus has3 libraries available to undergraduate students, one additional graduate library, and one faculty library. The libraries are open daily until midnight, except for during testing periods, when the libraries will be open 24 hours.Please look on a map to see where the libraries are located. All students with a valid ID can check out books, with a maximum of 10 books at a time. Books can be checked out for a 2 weeks period, and then renewed for a one month maximum. After that, there is a 1$ fine per week that the book is overdue.I will repeat that…There is a hefty one dollar fine per week! So it is a good idea to return books on time. If you lose a book, then you will have to repay the library for it, plus a fine. If you damage a book, most likely you will have to repay the value of the book. So please, enjoy the library facilities, but take care of the school’s belongings. The library is also equipped with 200 computers for student use. They are all internet ready and available for use. You must sign up at the library for 1 hour timeslots. You may sign up for up to 3 consecutive slots at a time. No one can use the computers without first signing in at the library.That is it for now. Thank you for your attention.(胡敏, 2008) ExercisesExercise 1 Listening for DetailsStudents are asked to listen to the talk and answer the following questions.1) How many hours are the basketball courts open each day?The basketball counters are open 24 hours a day.2) What kind of job do the basketball courts offer?The basketball counts offer the position of referrees at games.3) How many tennis courts are available for students?There are five tennis courts available for students.4) What kind of job does the swimming pool offer?The swimming pool offers the position of lifeguards.5) What should you do if you are interested in gymnastics?You may sign up for gymnastics classes.Exercise 2 Listening for Specific InformationStudents are asked to listen to the talk again and fill in the blanks with the missing information.Part III Oral PracticeIn this part, students will have 3 tasks to accomplish.Task 1 Casual TalkStudents are supposed to choose one of the topics to discuss their definition in detail with the help of the words in the following Information Box. They may do it either in pairs or in groups.My definition of a good…Reference AnswerIn my opinion, a good university should create a most beautiful academic setting where the historic architecture and the inviting green spaces are integrated together. Students can be able to really breathe in the atmosphere. A good university should be dedicated to helping students think smart as they build their academic, personal and career success.I think the key ingredients of a good education include a capable faculty, and strong academic programs. A good university should balance its educational program and close attention to student needs with a progressive look to the future to meet the needs of changing society. In addition to the beautiful campus and the prestigious academic strength, students should enjoy excellent accommodations that help define the university experience. Moreover, a good university should boast attractive and abundant resources and facilities, which support students to enjoy and experience the high-quality academic program, and colorful social life at the same time.Additional Information:Facultylecturer 讲师tutor 助教,导师assistant professor 助理教授associate professor 副教授coordinator 课程协调老师liaison officer 校联络departmental head/chairperson 系主任dean (大学学院)院长chancellor/university president(大学)校长headmaster (中小学)校长school counselor/adviser 指导老师Degreesdiploma 文凭,毕业证书degree 学位Bachelor 学士学位Master 硕士学位Doctorate 博士头衔./Bachelor of Arts 文学学士学位./Bachelor of Science 理学学士学位./Master of Arts 文学硕士学位./Master of Science 理学硕士学位./Doctor of Medicine 医学博士./Doctor of Philosophy 博士Postdoctoral 博士后(研究人员)honorary degree 荣誉学位Coursesbasic course 基础课specialized course 专业课compulsory/required course 必修课optional/selective course 选修课literature 文学philosophy 哲学history 历史art 艺术sociology 社会学linguistic 语言学psychology 心理学engineering 工程学architecture 建筑学business 商务law 法学economics 经济学finance 金融学accounting 会计学banking 银行学biochemistry 生物化学Facilitiesdivision/departments 系campus 校园common room 公共休息室canteen 食堂dining hall 食堂cafeteria 自助餐厅accommodation 住宿parking lot 停车场shopping mall 购物中心teaching building 教学楼lecture theatre 阶梯教室administration/admin office 管理/行政办公室laboratory/lab 实验室student union 学生会auditorium 会堂,礼堂gymnasium/gym 体育馆playground 操场locker room 更衣室library 图书馆recreation room 娱乐室Task 2 Group WorkStudents are asked to redesign and redecorate the apartment they have just rented. Teaching StrategyStep 1Divide the class into pairs and ask them to share the two-bedroom apartment.Step 2Ask the students to think of the things they want to put in the apartment and where they’d like to put themStep 3Let the students begin the discussion and reach an agreement.Step 4Ask the students to draw the layout of their apartment and present it to the class.Task 3 Problem SolvingFresher’s Week at universities can be a nerve-wracking experience. Students are asked to identify the problems they might encounter at university and come up with solutions to them.Teaching StrategyStep 1List the categories of problems that students may encounter at university on the board. Such as, study, financial problem, relations with others, etc.Step 2Divide the class into groups of four. Assign each group a specific category for discussion. Each group, with the help of the related words and phrases, is required to list in detail the problems relevant to the category given to them and tries hard to offer advice or solutions to these problems.Step 3Draw the chart on the board. 10-15 minutes later, ask each group to report what they have discussed.Reference AnswerFar from reflecting on the many new opportunities before me, I was wondering if I will ever feel settled when I first stepped into the college. I was even experiencing doubts about my decision to go to university in the first place. It seems that most new students go through a negative period in which our thoughts may be dominated by feelings of loneliness, anxiety, homesickness or combination of these.It is important to believe that you are not the only one feeling like this; even those around you appear to be happy and coping well. If you are feeling homesick, phone home and talk it through with your family and friends. However, try not to give up too quickly and rush home at the first available opportunity as this will not help in the long term. It will mean that you are not around at times when other freshers are making a big effort to initiate friendship and may mean you miss important social events. Instead, you might suggest that your friends from home visit you at university. This is particularly important if you are hoping to combine a long-distance relationship with life at university.Time for FunWord Games1) Who is closer to you, your mom or your dad?Mom is closer, because dad is farther. ( father 父亲,音似 farther)2) What clothing is always sad?Blue jeans. ( blue 蓝色的,伤感的)3) I have a tree in my hand. What kind of tree is it?It’s a palm. ( palm 棕榈树,手掌)4) What fruit is never found singly?A pear. ( pear 梨,音似 pair).。

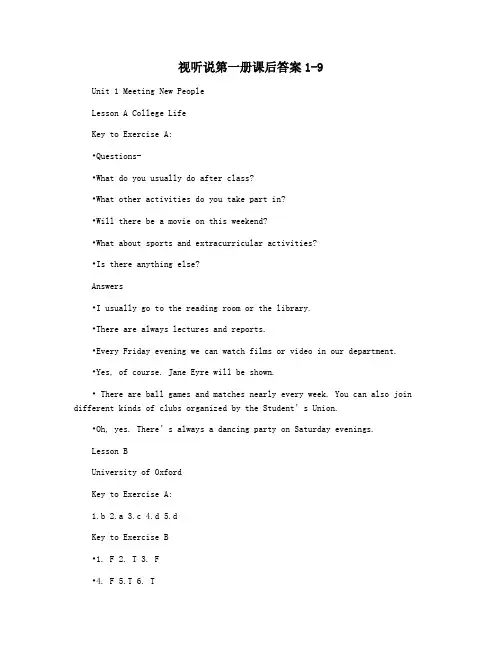

视听说第一册课后答案1-9Unit 1 Meeting New PeopleLesson A College LifeKey to Exercise A:•Questions-•What do you usually do after class?•What other activities do you take part in?•Will there be a movie on this weekend?•What about sports and extracurricular activities?•Is there anything else?Answers•I usually go to the reading room or the library.•There are always lectures and reports.•Every Friday evening we can watch films or video in our d epartment.•Yes, of course. Jane Eyre will be shown.• There are ball games and matches nearly every week. You can also join different kinds of clubs organized by the Student’s Union.•Oh, yes. There’s always a dancing party on Saturday evening s.Lesson BUniversity of OxfordKey to Exercise A:1.b2.a3.c4.d5.dKey to Exercise B•1. F 2. T 3. F•4. F 5.T 6. TKey to Exercise C•1. undergraduates•••••••••Unit 2 SportsLesson A The Olympic Spirit●Key to Exercise B ●1. It is mutual understanding, friendship, unity and fair play.●2. At the present, there has not been a wording for professionalathletes in China.3. No. Two of them have rather negative opinions on the present athletic sport.4. Sports management is beneficial to the promotion of the athletic sports level.5. The Sydney Olympics is a watershed. Since its beginning, anti-doping has risen from traditional battle to the battle of biologic engineering.Lesson BThe history of the Olympics ●Answers to Mind-mapping activities B.●Group A ●1 Cities.●2 The French educator Baron Pierre de Coubertin. ●3 On July 15, 2001.●4 Unity between Africa, the Americas, Asia , Australia , and Europe.●5 Zeus.●Group B●1 Olympia,Greece.●2 International Olympic Committee.●3 “Faster, Higher ,Stronger”.●4 Green Olympic, High-tech Olympics and People’s Olympics.●5 Tokyo, Japan in 1964.II. While-listening Activities●A.●1.F 2.F 3.F 4.T 5. TB. summary●The purpose of the first modern Olympics, which were held in Athens in 1896 was to help athletes and through competition and provide a way for athletes of all nations to ●During the sports competitions in Baron de Coubertin designed the Olympic rings in 1913, whichof the world-Europe, Asia, Africa, Australia and the two American continents, represented by one ring. Stronger".●Olympia, Greece to every new Olympics. In this way, the Olympic flame links the old and new gamesLesson C The Flame●●●●●(chorus)●●●And we're together again●My friends, will you show us the way●●●●●And looks to you and me●(chorus)●●●●Key to Ba. We travel on, guided by the flame●b. The fire within makes you reach out to the goal●c. Since ancient times we've come together in the light of the flame●d. look to your heart you will find the flameUnit 3EducationLesson A Pre-school education in the U.S.AKey to ExercisesB.•forty; five; three or four; two-thirds• eighty-thousand; ten percent.C.1. Young children in pre-school programs learn colors and numbers. They identify common objects and letters of the alphabet to prepare for reading. They sing and play games that use numbers and maps. They learn to cooperate with teachers and other children. Many pre-school programs include activities to help young children learn about the world around them. For example, children visit places like zoos, museums and fire and police stations.2. He may not be ready for kindergarten since many American kindergartens now require skills taught in early education programs.Lesson B Developing Children’s CreativityKey to exercises in part II.•4-3-2-1B.1. C2. b3. a4. aLesson C. Hillary’s view on EducationKey to ExercisesA.The first speaker:The policy will possibly libel(slander or hurt) 25% of the teachers in America as ineffective. It has not done what it needs to do to help children.The second speaker:The policy has unfortunately not been either founded or implemented effectively or appropriately. It does a disservice(damage or obstacle) to the educational process. It penalizes schools and teachers.B.1. T2. F3. T4. T5.FUnit 4 Man and NatureLesson AThe Effect of Global Warming⏹Effects :⏹Increasing global temperature will cause s ea level to rise, and is expected to increase the intensity of extreme weather events and to change the amount and pattern of precipitation. Other effects of global warming include changes in agricultural yields, glacier retreat, species extinctions and increases in the ranges of disease vectors.Key to exercises in Part II⏹A.⏹ Africa and Asia; Latin America; Industrial countries; small island nations.⏹B.⏹F F F T F T⏹C. Global warming⏹⏹⏹ ⏹ ⏹ ⏹ Lesson BGlobal warming and the melting soil⏹Key to Exercises:⏹A.⏹F T T F T⏹B.⏹1. top authorities; 300 scientists; eight nations; impact⏹2. sea levels; feet high; 100 years.Top 10 things we can do to reduce global warming⏹1. reduce, reuse, and recycle.⏹2. use less heat and air conditioning.⏹3. change a light bulb.⏹4. drive less and drive smart.⏹5. buy energy-efficient products.⏹6. use less hot water.⏹7. use the off switch.⏹8. plant a tree.⏹9. get a report card from your utility company.⏹10. encourage others to conserve.⏹D. A gigantic tornadoUnit 5News ILesson A : The lead of News⏹Key to Exercise B: ⏹1. rescued a newborn baby⏹2.might help counter the effects of global warming.⏹3. a responsible withdrawal of U.S.forces⏹4. will be remembered; Bolt’s sprints⏹5. the Oscar ceremony; the 80 years academy awards⏹6. a financial rescue package; the global financ ial crisis.⏹7. Al-Qaeda remains the single greatest threat to the U.S.⏹8. five million; have been taking part in the biggest earthquake drill⏹9. The two main opposition parties in Pakistan; have a clear majority. Lesson BFinancial News⏹Key to Exercise B:⏹Lead: President Barrack Obama is facing an early decision on trade policy⏹Further details: travel to Canada; are warning of disastrous consequences; embraces protectionism. ⏹Background information:⏹1. the U.S. Hou se of Representatives passed an economic recovery plan; works hand-in-hand; Congress⏹2. the House and Senate; American-made steed; public-works projects.Lesson CA report on Bird Flu⏹Key to Exercise:⏹A.⏹1. a 19-year-old man⏹2. The cause of his sickness has now been confirmed as the deadlyH5N1strain of bird flu. ⏹3. Cambodia⏹4. He is known to have eaten poultry.⏹5.He has been kept isolated and is in a stable condition.⏹B.⏹1 F 2 T 3 F4 F 5 T⏹C.⏹1. confirmed; fortunate; spreading; Cambodia; here; around the world⏹2. resurfaced ; a dozen;⏹3. fear; mutating; transmitted.Unit 6 societyLesson AGetting Rich Quickly?⏹Key to Exercise B:⏹Speaker A : You are gullible. You shouldn’t believe everything you read, especially on the Internet. ⏹Speaker B: All I have to do is first send some money to the person who sent me the letter, After that he will tell me how to earn much more money.⏹C.⏹The person at the top: asks the people below him for money, and thentells them to go and ask other people for money while sending some of it backto him. ⏹The people at the bottom: give their money to the people above them, and they get nothing. They end up losing.Lesson BViolent Crime Increase in U.SKey to Exercise C:⏹1. But the largest increase was in the West. Violent crime in that partof the country rose almost five percent.⏹2. Northeastern states had the smallest i ncrease. It was three percent over the same period last year. ⏹3. The report shows that violent crime rose nationwide, especially in cities with populations between half a million and a million.Lesson CA School Shooting in Finland⏹Key to Exe rcise B: 6-3-2-5-1-4⏹Key to Exercise C:⏹1. the police line; midday; dinner ladies⏹2. the school’s public address system; should remain in their classrooms; five boys and two girls ⏹3. assumes; to be confirmed by⏹4. arrived in the school yard; contact with; gave command to ; responded; was hurt.Unit 7 Culture and History(I)Lesson A What is culture?Key to Exercises in Lesson A ⏹A.⏹Definition A: People’s knowledge about art, music, and literature.⏹Definition B: All the ways in which a group of people act, dress, think, and feel.⏹B.⏹1. long sloping forehead⏹2. scars into or tattoos on body⏹3. Use rouge, lipstick, eye shadow, perfume, and hair spray to increase attractiveness.⏹C:⏹1.Why do many people cut scars into their bodies or tattoo themselves?⏹ d⏹2. Which of the following would expose the dead body on platforms for birds to eat?⏹ a⏹3. Which of the following is not true?⏹ d⏹4. Why does the speaker mention the Flathead Indians?⏹ cLesson B Culture shockKey to Exercises ⏹A:⏹1. Much of what he has learned about interpreting the actions of people around him is suddenly irrelevant.⏹2. Serious impact of the individual’s feelings of self-worth.⏹3. Fatigue, irritability and impatience.Unit 8 Culture and history (II)Lesson ASuch a historic City!Key to Exercise C ⏹Nelson’s Column:⏹It was built⏹Westminster Abbey:⏹Tower of London: It is a famous Madame Tussauds: There you can see Sometimes, it’s hard toLesson BPubs in Britain ⏹Key to C:⏹1. all ages and social classes mix to talk, do business, just spend a couple of quiet hours.⏹2. pay for your round; t hat you buy a drink for everyone in your group.Lesson C Columbus Discover America?Key to AF T F F T FKEY TO B1. He was born in Italy.2. Sept 9, 14923. Oct 12, 1492; They arrived on a small island in the Bahamas.5. He died a disappointed man.Key to Exercise C ⏹1. He set out to solve a major problem. Europeans wanted spices from India and China, but it was costly to import them overland or sail them all the way around Africa. Columbus decided to find a new sea-route from Europe to Asia. ⏹2. A month and 3 days.⏹3. Columbus believed he was near the coast of Asia and the islands of the East Indies. So he called the people who greeted him Indians.⏹4. While Columbus’s voyage opened up a whole new world for Europeans to explore, it ultimately spelled a disaster for the Native Americans. Columbus made 1492 one of the pivotal years in world history. And for both good and bad, the New World and the old were changed forever.Unit 9 Holidays and FestivalsLesson A Thanksgiving DayKey to Exercise A⏹The passage talks mainly about the origin of Thanksgiving Day and the significance of celebrating this festival.Key to Exercise B⏹1. Thanksgiving originated in 1620.⏹2. They sailed to America on the Mayflower, seeking a place where they could have freedom of worship.⏹3. Pilgrims waited for the harvests all summer long with great anxiety, knowing that their lives and the future existence of the colony depended onthe coming harvest. Finally the fields produced a yieldrich beyond expectations. Therefore it was decided that a day of thanksgiving to the Lord be fixed. Key to Exercise C⏹C.⏹ thanks; friends; holiday; success; prospect; appreciative; r elationship; interaction; gratitude; equally; value; Additionally; pursuit; granted.Lesson B Spring FestivalKey to A1. D2. B 3 . D. 4. DKey to Exercise B⏹1. People born in the year of Snake:⏹It’s a good year for unmarried sna kes to get married.⏹2.People born in the year of Pig:⏹Pigs will enjoy good luck in their careers, probably getting that hard-earned promotion.⏹3.People born in the year of Rabbit:⏹Unmarried rabbit people will likely hook up with someone from their past, though the relationship might not last very long.⏹4. People born in the year of Ox and Goat:⏹Ox and Goat people will be the target of vicious gossip, and will be prone to digestive problems.⏹5. People born in the years of DragonDragons born in the spring and summer will experience changes for theworse in their careers and in love.6. To ward off gossip, people should :Place a sheet of pink paper in the centre of their home or office.7.Through Fengshui, people can increase their luch with money, people can:⏹Place a glass of water to the north.8. To improve health, people can:Place a music box or a plate of wet sand in the northeast or southwest.9.The start of the Lunar New Year is traditionally a time for Hong Kongers to:Get their fortunes told, though sometimes it’s better not to know.Key to C1. F2. T.3. T.4. F.5. FKey to D1. a2. b.3. c.4. c.Lesson C ChristmasKey to A•1 a 2e 3 d 4 b 5cKey to B•1. At the Amari Atrium Hotel in Bangkok, Thailand. •2. A 6-meter-high Christmas tree, made entirely of chocolates. •3. 50 kilograms•4. 6•5. 90%。

Key to Exercise TwoSection 1. Compound DictationMartha Leathe’s belief is derived from(come from)her experience with children, not so much the one she is taught but her own, the task of raising children is often a test of belief as parents come to realize that their actions provide the lessons that children (1) assimilate同化to be similar . Here is Martha Leathe with her essay for this I believe.Several weeks ago, I got a call from a good friend whose husband had just been diagnosed with (被诊断为)prostate cancer(前列腺癌). “Do we tell the kids?” she asked.“Absolutely,” I answered.“Do we use the C-word (cancer委婉语)?”“Yes, I think you do,” I said. “The boys deserve to know the truth, however heartbreaking it is.”Adults always insist that children be honest, but how many of us are honest with our kids, particularly about the tough stuff: death, sex, (2) corruption(腐败), our own failings?I believe in telling children the truth. I believe this is vital for their understanding of the world, their (3) confidence and the development of their morals and values.This does not mean kids need to be unnecessarily (4) frightened, or told more than they can handle. When our son was 6, he tagged along紧跟,尾随while his older sister got her nose-ring changed. In the shop, he sifted through (check and sort carefully)a big bin of brightly (5) packaged condoms. “What are these?” he said.“Condoms,” I replied.“What are they for,” he asked. Briefly, I explained what condoms are, (6) precisely where you put them and how they work.“Oh,”he said, clearly (7) disappointed, I think, that they weren’t candy. It wasn’t a lot of information, but it was the truth.Many people think they are protecting children when they spare them the truth. I disagree. I believe children (8) possess an enviable (to be envied) ability to cope with and make sense of what even adults find confounding困惑的.When we are honest with children, we also validate their intuition. If we can admit that, yes, people can be mean, grandma does have a drinking problem, divorce is painful, we allow children to trust their gut. (9) They can begin to recognize and rely on their own inner voice, which will speak to them throughout their lives.Kids also have an uncanny (surpassing the normal异乎寻常) sense of when something is up: They realize when we’re uneasy, they can tell when we’re lying.One night, I was in the car with our two oldest daughters. (10) It was dark and cozy — the perfect time for a heart-to-heart conversation.Out of the blue, one of our kids said, “So, Mom, have you ever smoked pot(大麻)?” I stalled a little, but the girls persisted. They had me, and they knew it. So I told them the truth, albeit(虽然)somewhat abridged(缩略). What ensued was a frank discussion about the lures and perils of drugs. I believe my honesty was much more effective than warnings or platitudes(陈词滥调).These same daughters are in college now; we have two other kids still at home. (11) And while I have made plenty of mistakes as a parent, I do have clear and open relationships with each of our kids. I believe that my being truthful with our children has paid off, because I’m pretty sure that now they are honest with me.上述是一篇叙述型的文章,不是考试类型,就练习一下dictation题型及熟悉语音语调和速度。

第一单元什么成就全球性语言?Key to ExercisesT ext AII .Vocabulary Expansion1. dominance2. subjugate3. intrinsic4.supremacy5.on account of6.be weighed against7.neuter8.inflectional9.cosmopolitan udIII. Cloze1.dominant2.fieldsmon4.bad5.publishingmercially7.reaching8.achieving9.outcome 10.imaginativeT ext BSection A语言涉及到身份,正如我们所穿的衣服。

我们总是尽量使自己的英语与别人的不一样。

英语作为一门外语在教授时我们总是追求其易懂和得体。

但如果每个民族创造他们自己独特的英语,英语作为一门语言有没有解体的危险。

“我认为媒体的融合过程将使不同种类的英语越来越被人们所理解。

但如果每个地区有不同的英语而每个地区与世隔绝,谁知道又会发生什么情况呢?远离南卡罗莱纳州海岸的海岛是世界上最迷人的地方之一,如果你来到这儿,你会看到三百年前作为奴隶用船运来的黑人。

他们说一种被成为嘎勒英语的语言。

这种语言以英语为基础,又带有许多非洲词汇;作为一种英语变体我们是无法理解的。

这就是可能发生的一种情况。