博迪投资学第七版答案chap003-7thed

- 格式:doc

- 大小:87.50 KB

- 文档页数:7

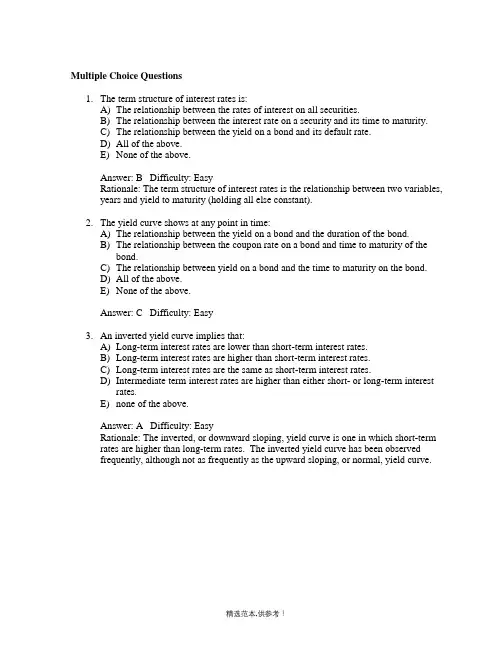

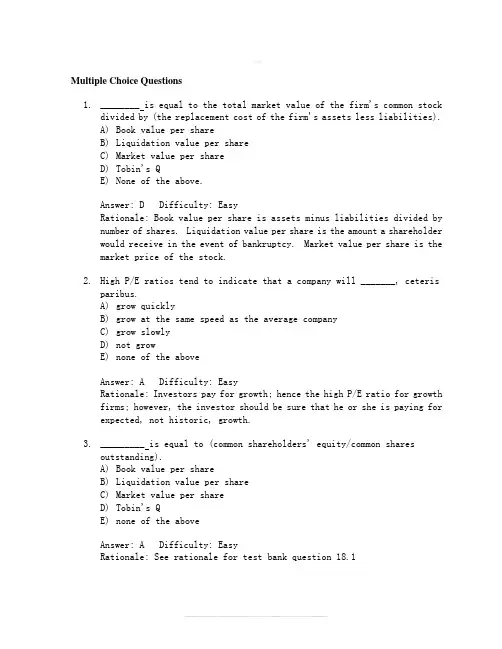

Multiple Choice Questions1. The term structure of interest rates is:A) The relationship between the rates of interest on all securities.B) The relationship between the interest rate on a security and its time to maturity.C) The relationship between the yield on a bond and its default rate.D) All of the above.E) None of the above.Answer: B Difficulty: EasyRationale: The term structure of interest rates is the relationship between two variables, years and yield to maturity (holding all else constant).2. The yield curve shows at any point in time:A) The relationship between the yield on a bond and the duration of the bond.B) The relationship between the coupon rate on a bond and time to maturity of thebond.C) The relationship between yield on a bond and the time to maturity on the bond.D) All of the above.E) None of the above.Answer: C Difficulty: Easy3. An inverted yield curve implies that:A) Long-term interest rates are lower than short-term interest rates.B) Long-term interest rates are higher than short-term interest rates.C) Long-term interest rates are the same as short-term interest rates.D) Intermediate term interest rates are higher than either short- or long-term interestrates.E) none of the above.Answer: A Difficulty: EasyRationale: The inverted, or downward sloping, yield curve is one in which short-term rates are higher than long-term rates. The inverted yield curve has been observedfrequently, although not as frequently as the upward sloping, or normal, yield curve.4. An upward sloping yield curve is a(n) _______ yield curve.A) normal.B) humped.C) inverted.D) flat.E) none of the above.Answer: A Difficulty: EasyRationale: The upward sloping yield curve is referred to as the normal yield curve, probably because, historically, the upward sloping yield curve is the shape that has been observed most frequently.5. According to the expectations hypothesis, a normal yield curve implies thatA) interest rates are expected to remain stable in the future.B) interest rates are expected to decline in the future.C) interest rates are expected to increase in the future.D) interest rates are expected to decline first, then increase.E) interest rates are expected to increase first, then decrease.Answer: C Difficulty: EasyRationale: An upward sloping yield curve is based on the expectation that short-term interest rates will increase.6. Which of the following is not proposed as an explanation for the term structure ofinterest rates?A) The expectations theory.B) The liquidity preference theory.C) The market segmentation theory.D) Modern portfolio theory.E) A, B, and C.Answer: D Difficulty: EasyRationale: A, B, and C are all theories that have been proposed to explain the term structure.7. The expectations theory of the term structure of interest rates states thatA) forward rates are determined by investors' expectations of future interest rates.B) forward rates exceed the expected future interest rates.C) yields on long- and short-maturity bonds are determined by the supply and demandfor the securities.D) all of the above.E) none of the above.Answer: A Difficulty: EasyRationale: The forward rate equals the market consensus expectation of future short interest rates.8. Which of the following theories state that the shape of the yield curve is essentiallydetermined by the supply and demands for long-and short-maturity bonds?A) Liquidity preference theory.B) Expectations theory.C) Market segmentation theory.D) All of the above.E) None of the above.Answer: C Difficulty: EasyRationale: Market segmentation theory states that the markets for different maturities are separate markets, and that interest rates at the different maturities are determined by the intersection of the respective supply and demand curves.9. According to the "liquidity preference" theory of the term structure of interest rates, theyield curve usually should be:A) inverted.B) normal.C) upward slopingD) A and B.E) B and C.Answer: E Difficulty: EasyRationale: According to the liquidity preference theory, investors would prefer to be liquid rather than illiquid. In order to accept a more illiquid investment, investors require a liquidity premium and the normal, or upward sloping, yield curve results.Use the following to answer questions 10-13:Suppose that all investors expect that interest rates for the 4 years will be as follows:10. What is the price of 3-year zero coupon bond with a par value of $1,000?A) $863.83B) $816.58C) $772.18D) $765.55E) none of the aboveAnswer: B Difficulty: ModerateRationale: $1,000 / (1.05)(1.07)(1.09) = $816.5811. If you have just purchased a 4-year zero coupon bond, what would be the expected rateof return on your investment in the first year if the implied forward rates stay the same?(Par value of the bond = $1,000)A) 5%B) 7%C) 9%D) 10%E) none of the aboveAnswer: A Difficulty: ModerateRationale: The forward interest rate given for the first year of the investment is given as 5% (see table above).12. What is the price of a 2-year maturity bond with a 10% coupon rate paid annually? (Parvalue = $1,000)A) $1,092B) $1,054C) $1,000D) $1,073E) none of the aboveAnswer: D Difficulty: ModerateRationale: [(1.05)(1.07)]1/2 - 1 = 6%; FV = 1000, n = 2, PMT = 100, i = 6, PV =$1,073.3413. What is the yield to maturity of a 3-year zero coupon bond?A) 7.00%B) 9.00%C) 6.99%D) 7.49%E) none of the aboveAnswer: C Difficulty: ModerateRationale: [(1.05)(1.07)(1.09)]1/3 - 1 = 6.99.Use the following to answer questions 14-16:The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.14. What is, according to the expectations theory, the expected forward rate in the thirdyear?A) 7.00%B) 7.33%C) 9.00%D) 11.19%E) none of the aboveAnswer: C Difficulty: ModerateRationale: 881.68 / 808.88 - 1 = 9%15. What is the yield to maturity on a 3-year zero coupon bond?A) 6.37%B) 9.00%C) 7.33%D) 10.00%E) none of the aboveAnswer: C Difficulty: ModerateRationale: (1000 / 808.81)1/3 -1 = 7.33%16. What is the price of a 4-year maturity bond with a 12% coupon rate paid annually? (Parvalue = $1,000)A) $742.09B) $1,222.09C) $1,000.00D) $1,141.92E) none of the aboveAnswer: D Difficulty: DifficultRationale: (1000 / 742.09)1/4 -1 = 7.74%; FV = 1000, PMT = 120, n = 4, i = 7.74, PV = $1,141.9217. The market segmentation theory of the term structure of interest ratesA) theoretically can explain all shapes of yield curves.B) definitely holds in the "real world".C) assumes that markets for different maturities are separate markets.D) A and B.E) A and C.Answer: E Difficulty: EasyRationale: Although this theory is quite tidy theoretically, both investors and borrows will depart from their "preferred maturity habitats" if yields on alternative maturities are attractive enough.18. An upward sloping yield curveA) may be an indication that interest rates are expected to increase.B) may incorporate a liquidity premium.C) may reflect the confounding of the liquidity premium with interest rateexpectations.D) all of the above.E) none of the above.Answer: D Difficulty: EasyRationale: One of the problems of the most commonly used explanation of termstructure, the expectations hypothesis, is that it is difficult to separate out the liquidity premium from interest rate expectations.19. The "break-even" interest rate for year n that equates the return on an n-periodzero-coupon bond to that of an n-1-period zero-coupon bond rolled over into a one-year bond in year n is defined asA) the forward rate.B) the short rate.C) the yield to maturity.D) the discount rate.E) None of the above.Answer: A Difficulty: EasyRationale: The forward rate for year n, fn, is the "break-even" interest rate for year n that equates the return on an n-period zero- coupon bond to that of an n-1-periodzero-coupon bond rolled over into a one-year bond in year n.20. When computing yield to maturity, the implicit reinvestment assumption is that theinterest payments are reinvested at the:A) Coupon rate.B) Current yield.C) Yield to maturity at the time of the investment.D) Prevailing yield to maturity at the time interest payments are received.E) The average yield to maturity throughout the investment period.Answer: C Difficulty: ModerateRationale: In order to earn the yield to maturity quoted at the time of the investment, coupons must be reinvested at that rate.21. Which one of the following statements is true?A) The expectations hypothesis indicates a flat yield curve if anticipated futureshort-term rates exceed the current short-term rate.B) The basic conclusion of the expectations hypothesis is that the long-term rate isequal to the anticipated long-term rate.C) The liquidity preference hypothesis indicates that, all other things being equal,longer maturities will have lower yields.D) The segmentation hypothesis contends that borrows and lenders are constrained toparticular segments of the yield curve.E) None of the above.Answer: D Difficulty: ModerateRationale: A flat yield curve indicates expectations of existing rates. Expectations hypothesis states that the forward rate equals the market consensus of expectations of future short interest rates. The reverse of C is true.22. The concepts of spot and forward rates are most closely associated with which one ofthe following explanations of the term structure of interest rates.A) Segmented Market theoryB) Expectations HypothesisC) Preferred Habitat HypothesisD) Liquidity Premium theoryE) None of the aboveAnswer: B Difficulty: ModerateRationale: Only the expectations hypothesis is based on spot and forward rates. A andC assume separate markets for different maturities; liquidity premium assumes higheryields for longer maturities.Use the following to answer question 23:23. Given the bond described above, if interest were paid semi-annually (rather thanannually), and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be:A) Less than 12%B) More than 12%C) 12%D) Cannot be determinedE) None of the aboveAnswer: B Difficulty: ModerateRationale: FV = 1000, PV = -850, PMT = 50, n = 40, i = 5.9964 (semi-annual);(1.059964)2 - 1 = 12.35%.24. Interest rates might declineA) because real interest rates are expected to decline.B) because the inflation rate is expected to decline.C) because nominal interest rates are expected to increase.D) A and B.E) B and C.Answer: D Difficulty: EasyRationale: The nominal rate is comprised of the real interest rate plus the expectedinflation rate.25. Forward rates ____________ future short rates because ____________.A) are equal to; they are both extracted from yields to maturity.B) are equal to; they are perfect forecasts.C) differ from; they are imperfect forecasts.D) differ from; forward rates are estimated from dealer quotes while future short ratesare extracted from yields to maturity.E) are equal to; although they are estimated from different sources they both are usedby traders to make purchase decisions.Answer: C Difficulty: EasyRationale: Forward rates are the estimates of future short rates extracted from yields to maturity but they are not perfect forecasts because the future cannot be predicted with certainty; therefore they will usually differ.26. The pure yield curve can be estimatedA) by using zero-coupon bonds.B) by using coupon bonds if each coupon is treated as a separate "zero."C) by using corporate bonds with different risk ratings.D) by estimating liquidity premiums for different maturities.E) A and B.Answer: E Difficulty: ModerateRationale: The pure yield curve is calculated using zero coupon bonds, but coupon bonds may be used if each coupon is treated as a separate "zero."27. The on the run yield curve isA) a plot of yield as a function of maturity for zero-coupon bonds.B) a plot of yield as a function of maturity for recently issued coupon bonds trading ator near par.C) a plot of yield as a function of maturity for corporate bonds with different riskratings.D) a plot of liquidity premiums for different maturities.E) A and B.Answer: B Difficulty: Moderate28. The market segmentation and preferred habitat theories of term structureA) are identical.B) vary in that market segmentation is rarely accepted today.C) vary in that market segmentation maintains that borrowers and lenders will notdepart from their preferred maturities and preferred habitat maintains that marketparticipants will depart from preferred maturities if yields on other maturities areattractive enough.D) A and B.E) B and C.Answer: E Difficulty: ModerateRationale: Borrowers and lenders will depart from their preferred maturity habitats if yields are attractive enough; thus, the market segmentation hypothesis is no longerreadily accepted.29. The yield curveA) is a graphical depiction of term structure of interest rates.B) is usually depicted for U. S. Treasuries in order to hold risk constant acrossmaturities and yields.C) is usually depicted for corporate bonds of different ratings.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: The yield curve (yields vs. maturities, all else equal) is depicted for U. S.Treasuries more frequently than for corporate bonds, as the risk is constant acrossmaturities for Treasuries.Use the following to answer questions 30-32:30. What should the purchase price of a 2-year zero coupon bond be if it is purchased at thebeginning of year 2 and has face value of $1,000?A) $877.54B) $888.33C) $883.32D) $893.36E) $871.80Answer: A Difficulty: DifficultRationale: $1,000 / [(1.064)(1.071)] = $877.5431. What would the yield to maturity be on a four-year zero coupon bond purchased today?A) 5.80%B) 7.30%C) 6.65%D) 7.25%E) none of the above.Answer: C Difficulty: ModerateRationale: [(1.058) (1.064) (1.071) (1.073)]1/4 - 1 = 6.65%32. Calculate the price at the beginning of year 1 of a 10% annual coupon bond with facevalue $1,000 and 5 years to maturity.A) $1,105B) $1,132C) $1,179D) $1,150E) $1,119Answer: B Difficulty: DifficultRationale: i = [(1.058) (1.064) (1.071) (1.073) (1.074)]1/5 - 1 = 6.8%; FV = 1000, PMT = 100, n = 5, i = 6.8, PV = $1,131.9133. Given the yield on a 3 year zero-coupon bond is 7.2% and forward rates of 6.1% in year1 and 6.9% in year 2, what must be the forward rate in year 3?A) 8.4%B) 8.6%C) 8.1%D) 8.9%E) none of the above.Answer: B Difficulty: ModerateRationale: f3 = (1.072)3 / [(1.061) (1.069)] - 1 = 8.6%34. An inverted yield curve is oneA) with a hump in the middle.B) constructed by using convertible bonds.C) that is relatively flat.D) that plots the inverse relationship between bond prices and bond yields.E) that slopes downward.Answer: E Difficulty: EasyRationale: An inverted yield curve occurs when short-term rates are higher thanlong-term rates.35. Investors can use publicly available financial date to determine which of the following?I)the shape of the yield curveII)future short-term ratesIII)the direction the Dow indexes are headingIV)the actions to be taken by the Federal ReserveA) I and IIB) I and IIIC) I, II, and IIID) I, III, and IVE) I, II, III, and IVAnswer: A Difficulty: ModerateRationale: Only the shape of the yield curve and future inferred rates can be determined.The movement of the Dow Indexes and Federal Reserve policy are influenced by term structure but are determined by many other variables also.36. Which of the following combinations will result in a sharply increasing yield curve?A) increasing expected short rates and increasing liquidity premiumsB) decreasing expected short rates and increasing liquidity premiumsC) increasing expected short rates and decreasing liquidity premiumsD) increasing expected short rates and constant liquidity premiumsE) constant expected short rates and increasing liquidity premiumsAnswer: A Difficulty: ModerateRationale: Both of the forces will act to increase the slope of the yield curve.37. The yield curve is a component ofA) the Dow Jones Industrial Average.B) the consumer price index.C) the index of leading economic indicators.D) the producer price index.E) the inflation index.Answer: C Difficulty: EasyRationale: Since the yield curve is often used to forecast the business cycle, it is used as one of the leading economic indicators.38. The most recently issued Treasury securities are calledA) on the run.B) off the run.C) on the market.D) off the market.E) none of the above.Answer: A Difficulty: EasyUse the following to answer questions 39-42:Suppose that all investors expect that interest rates for the 4 years will be as follows:39. What is the price of 3-year zero coupon bond with a par value of $1,000?A) $889.08B) $816.58C) $772.18D) $765.55E) none of the aboveAnswer: A Difficulty: ModerateRationale: $1,000 / (1.03)(1.04)(1.05) = $889.0840. If you have just purchased a 4-year zero coupon bond, what would be the expected rateof return on your investment in the first year if the implied forward rates stay the same?(Par value of the bond = $1,000)A) 5%B) 3%C) 9%D) 10%E) none of the aboveAnswer: B Difficulty: ModerateRationale: The forward interest rate given for the first year of the investment is given as 3% (see table above).41. What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Parvalue = $1,000)A) $1,092.97B) $1,054.24C) $1,028.51D) $1,073.34E) none of the aboveAnswer: C Difficulty: ModerateRationale: [(1.03)(1.04)]1/2 - 1 = 3.5%; FV = 1000, n = 2, PMT = 50, i = 3.5, PV =$1,028.5142. What is the yield to maturity of a 3-year zero coupon bond?A) 7.00%B) 9.00%C) 6.99%D) 4%E) none of the aboveAnswer: D Difficulty: ModerateRationale: [(1.03)(1.04)(1.05)]1/3 - 1 = 4%.Use the following to answer questions 43-46:The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.43. What is, according to the expectations theory, the expected forward rate in the thirdyear?A) 7.23B) 9.37%C) 9.00%D) 10.9%E) none of the aboveAnswer: B Difficulty: ModerateRationale: 862.57 / 788.66 - 1 = 9.37%44. What is the yield to maturity on a 3-year zero coupon bond?A) 6.37%B) 9.00%C) 7.33%D) 8.24%E) none of the aboveAnswer: D Difficulty: ModerateRationale: (1000 / 788.66)1/3 -1 = 8.24%45. What is the price of a 4-year maturity bond with a 10% coupon rate paid annually? (Parvalue = $1,000)A) $742.09B) $1,222.09C) $1,035.66D) $1,141.84E) none of the aboveAnswer: C Difficulty: DifficultRationale: (1000 / 711.00)1/4 -1 = 8.9%; FV = 1000, PMT = 100, n = 4, i = 8.9, PV =$1,035.6646. You have purchased a 4-year maturity bond with a 9% coupon rate paid annually. Thebond has a par value of $1,000. What would the price of the bond be one year from now if the implied forward rates stay the same?A) $995.63B) $1,108.88C) $1,000.00D) $1,042.78E) none of the aboveAnswer: A Difficulty: DifficultRationale: (925.16 / 711.00)]1/3 - 1.0 = 9.17%; FV = 1000, PMT = 90, n = 3, i = 9.17, PV = $995.63Use the following to answer question 47:47. Given the bond described above, if interest were paid semi-annually (rather thanannually), and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be:A) Less than 10%B) More than 10%C) 10%D) Cannot be determinedE) None of the aboveAnswer: B Difficulty: ModerateRationale: FV = 1000, PV = -917.99, PMT = 45, n = 36, i = 4.995325 (semi-annual);(1.4995325)2 - 1 = 10.24%.Use the following to answer questions 48-50:48. What should the purchase price of a 2-year zero coupon bond be if it is purchased at thebeginning of year 2 and has face value of $1,000?A) $877.54B) $888.33C) $883.32D) $894.21E) $871.80Answer: D Difficulty: DifficultRationale: $1,000 / [(1.055)(1.06)] = $894.2149. What would the yield to maturity be on a four-year zero coupon bond purchased today?A) 5.75%B) 6.30%C) 5.65%D) 5.25%E) none of the above.Answer: A Difficulty: ModerateRationale: [(1.05) (1.055) (1.06) (1.065)]1/4 - 1 = 5.75%50. Calculate the price at the beginning of year 1 of an 8% annual coupon bond with facevalue $1,000 and 5 years to maturity.A) $1,105.47B) $1,131.91C) $1,084.25D) $1,150.01E) $719.75Answer: C Difficulty: DifficultRationale: i = [(1.05) (1.055) (1.06) (1.065) (1.07)]1/5 - 1 = 6%; FV = 1000, PMT = 80, n = 5, i = 6, PV = $1084.2551. Given the yield on a 3 year zero-coupon bond is 7% and forward rates of 6% in year 1and 6.5% in year 2, what must be the forward rate in year 3?A) 7.2%B) 8.6%C) 8.5%D) 6.9%E) none of the above.Answer: C Difficulty: ModerateRationale: f3 = (1.07)3 / [(1.06) (1.065)] - 1 = 8.5%Use the following to answer questions 52-61:52. What should the purchase price of a 1-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $966.37B) $912.87C) $950.21D) $956.02E) $945.51Answer: D Difficulty: DifficultRationale: $1,000 / (1.046) = $956.0253. What should the purchase price of a 2-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $966.87B) $911.37C) $950.21D) $956.02E) $945.51Answer: B Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)] = $911.3754. What should the purchase price of a 3-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $887.42B) $871.12C) $879.54D) $856.02E) $866.32Answer: E Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)] = $866.3255. What should the purchase price of a 4-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $887.42B) $821.15C) $879.54D) $856.02E) $866.32Answer: B Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)(1.055)] = $821.1556. What should the purchase price of a 5-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $776.14B) $721.15C) $779.54D) $756.02E) $766.32Answer: A Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)(1.055)(1.058)] = $776.1457. What is the yield to maturity of a 1-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: A Difficulty: ModerateRationale: 4.6% (given in table)58. What is the yield to maturity of a 5-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: C Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)(1.055)(1.058)]1/5 -1 = 5.2%59. What is the yield to maturity of a 4-year bond?A) 4.69%B) 4.95%C) 5.02%D) 5.05%E) 5.08%Answer: C Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)(1.055)]1/4 -1 = 5.05%60. What is the yield to maturity of a 3-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: B Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)]1/3 -1 = 4.9%61. What is the yield to maturity of a 2-year bond?A) 4.6%B) 4.9%C) 5.2%D) 4.7%E) 5.8%Answer: D Difficulty: ModerateRationale: [(1.046)(1.049)]1/2 -1 = 4.7%Essay Questions62. Discuss the three theories of the term structure of interest rates. Include in yourdiscussion the differences in the theories, and the advantages/disadvantages of each.Difficulty: ModerateAnswer:The expectations hypothesis is the most commonly accepted theory of term structure.The theory states that the forward rate equals the market consensus expectation of future short-term rates. Thus, yield to maturity is determined solely by current and expected future one-period interest rates. An upward sloping, or normal, yield curve wouldindicate that investors anticipate an increase in interest rates. An inverted, or downward sloping, yield curve would indicate an expectation of decreased interest rates. Ahorizontal yield curve would indicate an expectation of no interest rate changes.The liquidity preference theory of term structure maintains that short-term investorsdominate the market; thus, in general, the forward rate exceeds the expected short-term rate. In other words, investors prefer to be liquid to illiquid, all else equal, and willdemand a liquidity premium in order to go long term. Thus, liquidity preference readily explains the upward sloping, or normal, yield curve. However, liquidity preferencedoes not readily explain other yield curve shapes.Market segmentation and preferred habitat theories indicate that the markets fordifferent maturity debt instruments are segmented. Market segmentation maintains that the rates for the different maturities are determined by the intersection of the supply and demand curves for the different maturity instruments. Market segmentation readilyexplains all shapes of yield curves. However, market segmentation is not observed in the real world. Investors and issuers will leave their preferred maturity habitats if yields are attractive enough on other maturities.The purpose of this question is to ascertain that students understand the variousexplanations (and deficiencies of these explanations) of term structure.63. Term structure of interest rates is the relationship between what variables? What isassumed about other variables? How is term structure of interest rates depictedgraphically?Difficulty: ModerateAnswer:Term structure of interest rates is the relationship between yield to maturity and term to maturity, all else equal. The "all else equal" refers to risk class. Term structure ofinterest rates is depicted graphically by the yield curve, which is usually a graph of U.S.governments of different yields and different terms to maturity. The use of U.S.governments allows one to examine the relationship between yield and maturity,holding risk constant. The yield curve depicts this relationship at one point in time only.This question is designed to ascertain that students understand the relationshipsinvolved in term structure, the restrictions on the relationships, and how therelationships are depicted graphically.64. Although the expectations of increases in future interest rates can result in an upwardsloping yield curve; an upward sloping yield curve does not in and of itself imply the expectations of higher future interest rates. Explain.Difficulty: ModerateAnswer:The effects of possible liquidity premiums confound any simple attempt to extractexpectation from the term structure. That is, the upward sloping yield curve may be due to expectations of interest rate increases, or due to the requirement of a liquiditypremium, or both. The liquidity premium could more than offset expectations ofdecreased interest rates, and an upward sloping yield would result.The purpose of this question is to assure that the student understands the confounding of the liquidity premium with the expectations hypothesis, and that the interpretations of term structure are not clear-cut.。

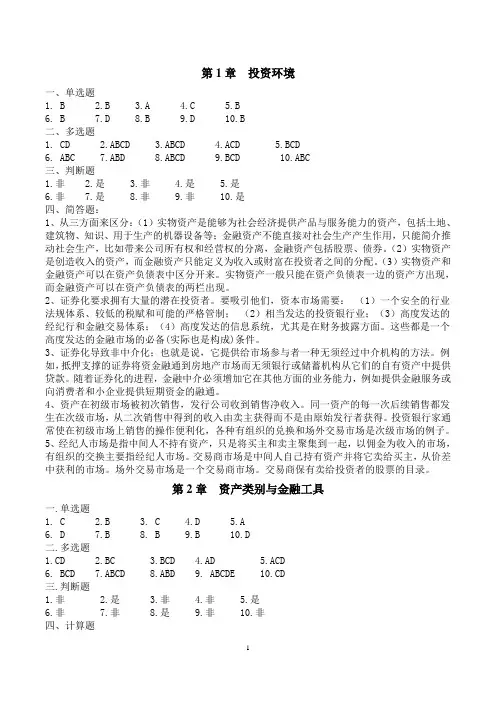

第1章投资环境一、单选题1. B2.B3.A4.C5.B6. B7.D8.B9.D 10.B二、多选题1. CD2.ABCD3.ABCD4.ACD5.BCD6. ABC7.ABD8.ABCD9.BCD 10.ABC三、判断题1.非2.是3.非4.是5.是6.非7.是8.非9.非 10.是四、简答题:1、从三方面来区分:(1)实物资产是能够为社会经济提供产品与服务能力的资产,包括土地、建筑物、知识、用于生产的机器设备等;金融资产不能直接对社会生产产生作用,只能简介推动社会生产,比如带来公司所有权和经营权的分离,金融资产包括股票、债券。

(2)实物资产是创造收入的资产,而金融资产只能定义为收入或财富在投资者之间的分配。

(3)实物资产和金融资产可以在资产负债表中区分开来。

实物资产一般只能在资产负债表一边的资产方出现,而金融资产可以在资产负债表的两栏出现。

2、证券化要求拥有大量的潜在投资者。

要吸引他们,资本市场需要:(1)一个安全的行业法规体系、较低的税赋和可能的严格管制;(2)相当发达的投资银行业;(3)高度发达的经纪行和金融交易体系;(4)高度发达的信息系统,尤其是在财务披露方面。

这些都是一个高度发达的金融市场的必备(实际也是构成)条件。

3、证券化导致非中介化;也就是说,它提供给市场参与者一种无须经过中介机构的方法。

例如,抵押支撑的证券将资金融通到房地产市场而无须银行或储蓄机构从它们的自有资产中提供贷款。

随着证券化的进程,金融中介必须增加它在其他方面的业务能力,例如提供金融服务或向消费者和小企业提供短期资金的融通。

4、资产在初级市场被初次销售,发行公司收到销售净收入。

同一资产的每一次后续销售都发生在次级市场,从二次销售中得到的收入由卖主获得而不是由原始发行者获得。

投资银行家通常使在初级市场上销售的操作便利化,各种有组织的兑换和场外交易市场是次级市场的例子。

5、经纪人市场是指中间人不持有资产,只是将买主和卖主聚集到一起,以佣金为收入的市场,有组织的交换主要指经纪人市场。

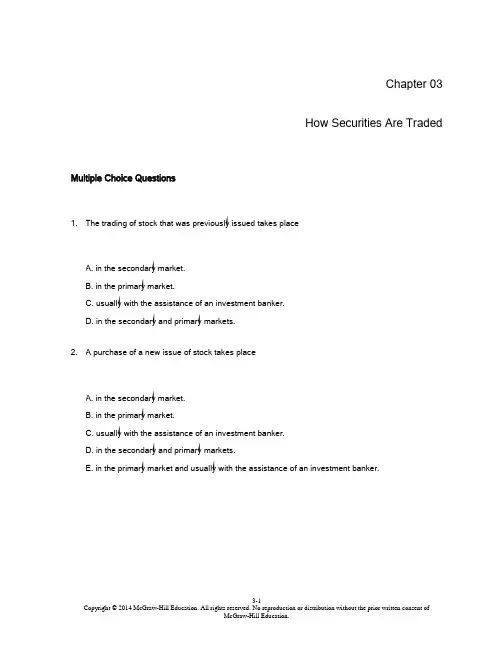

Chapter 03How Securities Are Traded Multiple Choice Questions1.The trading of stock that was previously issued takes placeA. i n the secondary market.B. i n the primary market.C. u sually with the assistance of an investment banker.D. i n the secondary and primary markets.2. A purchase of a new issue of stock takes placeA. i n the secondary market.B. i n the primary market.C. u sually with the assistance of an investment banker.D. i n the secondary and primary markets.E. i n the primary market and usually with the assistance of an investment banker.3.Firms raise capital by issuing stockA. i n the secondary market.B. i n the primary market.C. t o unwary investors.D. o nly on days when the market is up.4.Which of the following statements regarding the specialist are true?A. S pecialists maintain a book listing outstanding unexecuted limit orders.B. S pecialists earn income from commissions and spreads in stock prices.C. S pecialists stand ready to trade at quoted bid and ask prices.D. S pecialists cannot trade in their own accounts.E. S pecialists maintain a book listing outstanding unexecuted limit orders, earn income fromcommissions and spreads in stock prices, and stand ready to trade at quoted bid and askprices.5.Investment bankersA. a ct as intermediaries between issuers of stocks and investors.B. a ct as advisors to companies in helping them analyze their financial needs and find buyers fornewly issued securities.C. a ccept deposits from savers and lend them out to companies.D. a ct as intermediaries between issuers of stocks and investors and act as advisors tocompanies in helping them analyze their financial needs and find buyers for newly issuedsecurities.6.In a "firm commitment," the investment bankerA. b uys the stock from the company and resells the issue to the public.B. a grees to help the firm sell the stock at a favorable price.C. f inds the best marketing arrangement for the investment banking firm.D. a grees to help the firm sell the stock at a favorable price and finds the best marketingarrangement for the investment banking firm.7.The secondary market consists ofA. t ransactions on the AMEX.B. t ransactions in the OTC market.C. t ransactions through the investment banker.D. t ransactions on the AMEX and in the OTC market.E. t ransactions on the AMEX, through the investment banker, and in the OTC market.8.Initial margin requirements are determined byA. t he Securities and Exchange Commission.B. t he Federal Reserve System.C. t he New York Stock Exchange.D. t he Federal Reserve System and the New York Stock Exchange.9.You purchased JNJ stock at $50 per share. The stock is currently selling at $65. Your gains maybe protected by placing aA. s top-buy order.B. l imit-buy order.C. m arket order.D. l imit-sell order.E. N one of the options10.You sold JCP stock short at $80 per share. Your losses could be minimized by placing aA. l imit-sell order.B. l imit-buy order.C. s top-buy order.D. d ay-order.E. N one of the options11.Which one of the following statements regarding orders is false?A. A market order is simply an order to buy or sell a stock immediately at the prevailing marketprice.B. A limit-sell order is where investors specify prices at which they are willing to sell a security.C. I f stock ABC is selling at $50, a limit-buy order may instruct the broker to buy the stock if andwhen the share price falls below $45.D. A market order is an order to buy or sell a stock on a specific exchange (market).12.Restrictions on trading involving insider information apply to the following exceptA. c orporate officers.B. c orporate directors.C. m ajor stockholders.D. A ll of the options are subject to insider trading restrictions.E. N one of the options is subject to insider trading restrictions.13.The cost of buying and selling a stock consists ofA. b roker's commissions.B. d ealer's bid-asked spread.C. a price concession an investor may be forced to make.D. b roker's commissions and dealer's bid-asked spread.E. b roker's commissions, dealer's bid-asked spread, and a price concession an investor may beforced to make.14.Assume you purchased 200 shares of GE common stock on margin at $70 per share from yourbroker. If the initial margin is 55%, how much did you borrow from the broker?A. $6,000B. $4,000C. $7,700D. $7,000E. $6,30015.You sold short 200 shares of common stock at $60 per share. The initial margin is 60%. Yourinitial investment wasA. $4,800.B. $12,000.C. $5,600.D. $7,200.16.You purchased 100 shares of IBM common stock on margin at $70 per share. Assume the initialmargin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin.A. $21B. $50C. $49D. $8017.You purchased 100 shares of common stock on margin at $45 per share. Assume the initialmargin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $30? Ignore interest on margin.A. 0.33B. 0.55C. 0.43D. 0.23E. 0.2518.You purchased 300 shares of common stock on margin for $60 per share. The initial margin is60% and the stock pays no dividend. What would your rate of return be if you sell the stock at $45 per share? Ignore interest on margin.A. 25.00%B. -33.33%C. 44.31%D. -41.67%E. -54.22%19.Assume you sell short 100 shares of common stock at $45 per share, with initial margin at 50%.What would be your rate of return if you repurchase the stock at $40 per share? The stock paid no dividends during the period, and you did not remove any money from the account before making the offsetting transaction.A. 20.03%B. 25.67%C. 22.22%D. 77.46%20.You sold short 300 shares of common stock at $55 per share. The initial margin is 60%. At whatstock price would you receive a margin call if the maintenance margin is 35%?A. $51.00B. $65.18C. $35.22D. $40.3621.Assume you sold short 100 shares of common stock at $50 per share. The initial margin is 60%.What would be the maintenance margin if a margin call is made at a stock price of $60?A. 40%B. 33%C. 35%D. 25%22.Specialists on stock exchanges perform which of the following functions?A. A ct as dealers in their own accounts.B. A nalyze the securities in which they specialize.C. P rovide liquidity to the market.D. A ct as dealers in their own accounts and analyze the securities in which they specialize.E. A ct as dealers in their own accounts and provide liquidity to the market.23.Shares for short transactionsA. a re usually borrowed from other brokers.B. a re typically shares held by the short seller's broker in street name.C. a re borrowed from commercial banks.D. a re typically shares held by the short seller's broker in street name and are borrowed fromcommercial banks.24.Which of the following orders is most useful to short sellers who want to limit their potentiallosses?A. L imit orderB. D iscretionary orderC. L imit-loss orderD. S top-buy order25.Which of the following orders instructs the broker to buy at the current market price?A. L imit orderB. D iscretionary orderC. L imit-loss orderD. S top-buy orderE. M arket order26.Which of the following orders instructs the broker to buy at or below a specified price?A. L imit-loss orderB. D iscretionary orderC. L imit-buy orderD. S top-buy orderE. M arket order27.Which of the following orders instructs the broker to sell at or below a specified price?A. L imit-sell orderB. S top-lossC. L imit-buy orderD. S top-buy orderE. M arket order28.Which of the following orders instructs the broker to sell at or above a specified price?A. L imit-buy orderB. D iscretionary orderC. L imit-sell orderD. S top-buy orderE. M arket order29.Which of the following orders instructs the broker to buy at or above a specified price?A. L imit-buy orderB. D iscretionary orderC. L imit-sell orderD. S top-buy orderE. M arket order30.Shelf registrationA. i s a way of placing issues in the primary market.B. a llows firms to register securities for sale over a two-year period.C. i ncreases transaction costs to the issuing firm.D. i s a way of placing issues in the primary market and allows firms to register securities for saleover a two-year period.E. i s a way of placing issues in the primary market and increases transaction costs to the issuingfirm.31.Block transactions are transactions for more than _______ shares and they account for about_____ percent of all trading on the NYSE.A. 1,000; 5B. 500; 10C. 100,000; 50D. 10,000; 30E. 5,000; 2332.A program trade isA. a trade of 10,000 (or more) shares of a stock.B. a trade of many shares of one stock for one other stock.C. a trade of analytic programs between financial analysts.D. a coordinated purchase or sale of an entire portfolio of stocks.E. n ot feasible with current technology but is expected to be popular in the near future.33.When stocks are held in street nameA. t he investor receives a stock certificate with the owner's street address.B. t he investor receives a stock certificate without the owner's street address.C. t he investor does not receive a stock certificate.D. t he broker holds the stock in the brokerage firm's name on behalf of the client.E. t he investor does not receive a stock certificate and the broker holds the stock in the brokeragefirm's name on behalf of the client.34.NASDAQ subscriber levelsA. p ermit those with the highest level, 3, to "make a market" in the security.B. p ermit those with a level 2 subscription to receive all bid and ask quotes, but not to enter theirown quotes.C. p ermit level 1 subscribers to receive general information about prices.D. i nclude all OTC stocks.E. p ermit those with the highest level, 3, to "make a market" in the security; permit those with alevel 2 subscription to receive all bid and ask quotes, but not to enter their own quotes; andpermit level 1 subscribers to receive general information about prices.35.You want to buy 100 shares of Hotstock Inc. at the best possible price as quickly as possible. Youwould most likely place aA. s top-loss order.B. s top-buy order.C. m arket order.D. l imit-sell order.E. l imit-buy order.36.You want to purchase XON stock at $60 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $3,000 to invest, how many shares can you buy?A. 100 sharesB. 200 sharesC. 50 sharesD. 500 sharesE. 25 shares37.A sale by IBM of new stock to the public would be a(n)A. s hort sale.B. s easoned equity offering.C. p rivate placement.D. s econdary market transaction.E. i nitial public offering.38.The finalized registration statement for new securities approved by the SEC is calledA. a red herring.B. t he preliminary statement.C. t he prospectus.D. a best-efforts agreement.E. a firm commitment.39.One outcome from the SEC investigation of the "Flash Crash of 2010" wasA. a prohibition of short selling.B. h igher margin requirements.C. a pproval of new circuit breakers.D. e stablishment of electronic communications networks (ECNs).E. p assage of the Sarbanes-Oxley Act.40.All of the following are considered new trading strategies exceptA. h igh frequency trading.B. a lgorithmic trading.C. d ark pools.D. s hort selling.41.You sell short 100 shares of Loser Co. at a market price of $45 per share. Your maximum possibleloss isA. $4,500.B. u nlimited.C. z ero.D. $9,000.E. C annot tell from the information given42.You buy 300 shares of Qualitycorp for $30 per share and deposit initial margin of 50%. The nextday, Qualitycorp's price drops to $25 per share. What is your actual margin?A. 50%B. 40%C. 33%D. 60%E. 25%43.When a firm markets new securities, a preliminary registration statement must be filed withA. t he exchange on which the security will be listed.B. t he Securities and Exchange Commission.C. t he Federal Reserve.D. a ll other companies in the same line of business.E. t he Federal Deposit Insurance Corporation.44.In a typical underwriting arrangement the investment banking firmI) sells shares to the public via an underwriting syndicate.II) purchases the securities from the issuing company.III) assumes the full risk that the shares may not be sold at the offering price.IV) agrees to help the firm sell the issue to the public, but does not actually purchase the securities.A. I, II, and IIIB. I, III, and IVC. I and IVD. I I and IIIE. I and II45.Which of the following is true regarding private placements of primary security offerings?A. E xtensive and costly registration statements are required by the SEC.B. F or very large issues, they are better suited than public offerings.C. T hey trade in secondary markets.D. T he shares are sold directly to a small group of institutional or wealthy investors.E. T hey have greater liquidity than public offerings.46.A specialist on the AMEX Stock Exchange is offering to buy a security for $37.50. A broker inOklahoma City wants to sell the security for his client. The Intermarket Trading System shows a bid price of $37.375 on the NYSE. What should the broker do?A. R oute the order to the AMEX Stock Exchange.B. R oute the order to the NYSE.C. C all the client to see if she has a preference.D. R oute half of the order to AMEX and the other half to the NYSE.E. I t doesn't matter—he should flip a coin and go with it.47.You sold short 100 shares of common stock at $45 per share. The initial margin is 50%. Yourinitial investment wasA. $4,800.B. $12,000.C. $2,250.D. $7,200.48.You sold short 150 shares of common stock at $27 per share. The initial margin is 45%. Yourinitial investment wasA. $4,800.60.B. $12,000.25.C. $2,250.75.D. $1,822.50.49.You purchased 100 shares of XON common stock on margin at $60 per share. Assume the initialmargin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin.A. $42.86B. $50.75C. $49.67D. $80.3450.You purchased 1000 shares of CSCO common stock on margin at $19 per share. Assume theinitial margin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin.A. $12.86B. $15.75C. $19.67D. $13.5751.You purchased 100 shares of common stock on margin at $40 per share. Assume the initialmargin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $25? Ignore interest on margin.A. 0.33B. 0.55C. 0.20D. 0.23E. 0.25margin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $24? Ignore interest on margin.A. 0.33B. 0.375C. 0.20D. 0.23E. 0.2553.You purchased 100 shares of common stock on margin for $50 per share. The initial margin is50% and the stock pays no dividend. What would your rate of return be if you sell the stock at $56 per share? Ignore interest on margin.A. 28%B. 33%C. 14%D. 42%E. 24%50% and the stock pays no dividend. What would your rate of return be if you sell the stock at $42 per share? Ignore interest on margin.A. 28%B. 33%C. 14%D. 40%E. 24%55.Assume you sell short 1,000 shares of common stock at $35 per share, with initial margin at 50%.What would be your rate of return if you repurchase the stock at $25 per share? The stock paid no dividends during the period, and you did not remove any money from the account before making the offsetting transaction.A. 20.47%B. 25.63%C. 57.14%D. 77.23%What would be your rate of return if you repurchase the stock at $35 per share? The stock paid no dividends during the period, and you did not remove any money from the account before making the offsetting transaction.A. -33.33%B. -25.63%C. -57.14%D. -77.23%57.You want to purchase GM stock at $40 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $4,000 to invest, how many shares can you buy?A. 100 sharesB. 200 sharesC. 50 sharesD. 500 sharesE. 25 shares58.You want to purchase IBM stock at $80 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $2,000 to invest, how many shares can you buy?A. 100 sharesB. 200 sharesC. 50 sharesD. 500 sharesE. 25 sharesWhat would be the maintenance margin if a margin call is made at a stock price of $50?A. 40%B. 20%C. 35%D. 25%60.Assume you sold short 100 shares of common stock at $70 per share. The initial margin is 50%.What would be the maintenance margin if a margin call is made at a stock price of $85?A. 40.5%B. 20.5%C. 35.5%D. 23.5%61.You sold short 100 shares of common stock at $45 per share. The initial margin is 50%. At whatstock price would you receive a margin call if the maintenance margin is 35%?A. $50B. $65C. $35D. $40stock price would you receive a margin call if the maintenance margin is 30%?A. $90.23B. $88.52C. $86.54D. $87.1263.The preliminary prospectus is referred to as aA. r ed herring.B. i ndenture.C. g reenmail.D. t ombstone.E. h eadstone.64.The securities act of 1933I) requires full disclosure of relevant information relating to the issue of new securities.II) requires registration of new securities.III) requires issuance of a prospectus detailing financial prospects of the firm.IV) established the SEC.V) requires periodic disclosure of relevant financial information.VI) empowers SEC to regulate exchanges, OTC trading, brokers, and dealers.A. I, II, and IIIB. I, II, III, IV, V, and VIC. I, II, and VD. I, II, and IVE. I V only65.The Securities Act of 1934I) requires full disclosure of relevant information relating to the issue of new securities.II) requires registration of new securities.III) requires issuance of a prospectus detailing financial prospects of the firm.IV) established the SEC.V) requires periodic disclosure of relevant financial information.VI) empowers SEC to regulate exchanges, OTC trading, brokers, and dealers.A. I, II, and IIIB. I, II, III, IV, V, and VIC. I, II, and VD. I, II, and IVE. I V, V, and VI66.Which of the following is not required under the CFA Institute Standards of Professional Conduct?A. K nowledge of all applicable laws, rules and regulationsB. D isclosure of all personal investments, whether or not they may conflict with a client'sinvestmentsC. D isclosure of all conflicts to clients and prospectsD. R easonable inquiry into a client's financial situationE. A ll of the options are required under the CFA Institute standards.67.According to the CFA Institute Standards of Professional Conduct, CFA Institute members haveresponsibilities to all of the following exceptA. t he government.B. t he profession.C. t he public.D. t he employer.E. c lients and prospective clients.Short Answer Questions68.Discuss margin buying of common stocks. Include in your discussion the advantages anddisadvantages, the types of margin requirements, how these requirements are met, and who determines these requirements.69.List three factors that are listing requirements for the New York Stock Exchange. Why does theexchange have such requirements?Chapter 03 How Securities Are Traded KeyMultiple Choice Questions1.The trading of stock that was previously issued takes placeA.in the secondary market.B.in the primary market.ually with the assistance of an investment banker.D.in the secondary and primary markets.Secondary market transactions consist of trades between investors.AACSB: AnalyticBlooms: ApplyDifficulty: Basic2. A purchase of a new issue of stock takes placeA.in the secondary market.B.in the primary market.ually with the assistance of an investment banker.D.in the secondary and primary markets.E.in the primary market and usually with the assistance of an investment banker.Funds from the sale of new issues flow to the issuing corporation, making this a primary market transaction. Investment bankers usually assist by pricing the issue and finding buyers.AACSB: AnalyticBlooms: ApplyDifficulty: Basic3.Firms raise capital by issuing stockA.in the secondary market.B.in the primary market.C.to unwary investors.D.only on days when the market is up.Funds from the sale of new issues flow to the issuing corporation, making this a primary market transaction.AACSB: AnalyticBlooms: ApplyDifficulty: Basic4.Which of the following statements regarding the specialist are true?A.Specialists maintain a book listing outstanding unexecuted limit orders.B.Specialists earn income from commissions and spreads in stock prices.C.Specialists stand ready to trade at quoted bid and ask prices.D.Specialists cannot trade in their own accounts.E.Specialists maintain a book listing outstanding unexecuted limit orders, earn income fromcommissions and spreads in stock prices, and stand ready to trade at quoted bid and askprices.The specialists' functions are all of the items listed. In addition, specialists trade in their ownaccounts.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate5.Investment bankersA.act as intermediaries between issuers of stocks and investors.B.act as advisors to companies in helping them analyze their financial needs and find buyersfor newly issued securities.C.accept deposits from savers and lend them out to companies.D.act as intermediaries between issuers of stocks and investors and act as advisors tocompanies in helping them analyze their financial needs and find buyers for newly issuedsecurities.The role of the investment banker is to assist the firm in issuing new securities, both in advisory and marketing capacities. The investment banker does not have a role comparable to acommercial bank, as indicated in accept deposits from savers and lend them out to companies.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate6.In a "firm commitment," the investment bankerA.buys the stock from the company and resells the issue to the public.B.agrees to help the firm sell the stock at a favorable price.C.finds the best marketing arrangement for the investment banking firm.D.agrees to help the firm sell the stock at a favorable price and finds the best marketingarrangement for the investment banking firm.In a "firm commitment," the investment banker buys the stock from the company and resells the issue to the public.AACSB: AnalyticDifficulty: Intermediate7.The secondary market consists ofA.transactions on the AMEX.B.transactions in the OTC market.C.transactions through the investment banker.D.transactions on the AMEX and in the OTC market.E.transactions on the AMEX, through the investment banker, and in the OTC market.The secondary market consists of transactions on the organized exchanges and in the OTCmarket. The investment banker is involved in the placement of new issues in the primarymarket.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate8.Initial margin requirements are determined byA.the Securities and Exchange Commission.B.the Federal Reserve System.C.the New York Stock Exchange.D.the Federal Reserve System and the New York Stock Exchange.The Board of Governors of the Federal Reserve System determines initial marginrequirements.AACSB: AnalyticDifficulty: Intermediate9.You purchased JNJ stock at $50 per share. The stock is currently selling at $65. Your gainsmay be protected by placing aA.stop-buy order.B.limit-buy order.C.market order.D.limit-sell order.E.None of the optionsWith a limit-sell order, your stock will be sold only at a specified price, or better. Thus, such an order would protect your gains. None of the other orders are applicable to this situation.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate10.You sold JCP stock short at $80 per share. Your losses could be minimized by placing aA.limit-sell order.B.limit-buy order.C.stop-buy order.D.day-order.E.None of the optionsWith a stop-buy order, the stock would be purchased if the price increased to a specified level, thus limiting your loss.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate11.Which one of the following statements regarding orders is false?A. A market order is simply an order to buy or sell a stock immediately at the prevailing marketprice.B. A limit-sell order is where investors specify prices at which they are willing to sell a security.C.If stock ABC is selling at $50, a limit-buy order may instruct the broker to buy the stock ifand when the share price falls below $45.D. A market order is an order to buy or sell a stock on a specific exchange (market).All of the order descriptions above are correct except a market order is an order to buy or sell a stock on a specific exchange (market).AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate12.Restrictions on trading involving insider information apply to the following exceptA.corporate officers.B.corporate directors.C.major stockholders.D.All of the options are subject to insider trading restrictions.E.None of the options is subject to insider trading restrictions.Corporate officers, corporate directors, and major stockholders are corporate insiders and are subject to restrictions on trading on inside information. Further, the Supreme Court held thattraders may not trade on nonpublic information even if they are not insiders.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate13.The cost of buying and selling a stock consists ofA.broker's commissions.B.dealer's bid-asked spread.C. a price concession an investor may be forced to make.D.broker's commissions and dealer's bid-asked spread.E.broker's commissions, dealer's bid-asked spread, and a price concession an investor maybe forced to make.All of the options are possible costs of buying and selling a stock.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate14.Assume you purchased 200 shares of GE common stock on margin at $70 per share from yourbroker. If the initial margin is 55%, how much did you borrow from the broker?A.$6,000B.$4,000C.$7,700D.$7,000E.$6,300200 shares × $70/share × (1 - 0.55) = $14,000 × (0.45) = $6,300.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate15.You sold short 200 shares of common stock at $60 per share. The initial margin is 60%. Yourinitial investment wasA.$4,800.B.$12,000.C.$5,600.D.$7,200.200 shares × $60/share × 0.60 = $12,000 × 0.60 = $7,200.AACSB: AnalyticBlooms: ApplyDifficulty: Intermediate。

Multiple Choice Questions1。

Market risk is also referred to asA)systematic risk, diversifiable risk.B)systematic risk, nondiversifiable risk.C) unique risk, nondiversifiable risk.D) unique risk, diversifiable risk.E) none of the above.Answer: B Difficulty: EasyRationale: Market, systematic, and nondiversifiable risk are synonyms referring to the risk that cannot be eliminated from the portfolio。

Diversifiable, unique, nonsystematic, and firm-specific risks are synonyms referring to the risk that can be eliminated from the portfolio by diversification.2. The risk that can be diversified away isA)firm specific risk。

B) beta。

C) systematic risk.D)market risk.E) none of the above。

Answer: A Difficulty: EasyRationale: See explanations for 1 and 2 above.3. The variance of a portfolio of risky securitiesA)is a weighted sum of the securities’ variances。

博迪投资学答案chap005-7thedCHAPTER 5: LEARNING ABOUT RETURN AND RISKFROM THE HISTORICAL RECORD1. a. The “Inflation-Plus” CD is the safer investment because it guarantees thepurchasing power of the investment. Using the approximation that the realrate equals the nominal rate minus the inflation rate, the CD provides a realrate of 3.5% regardless of the inflation rate.b. The expected return depends on the expected rate of inflation over the nextyear. If the expected rate of inflation is less than 3.5% then the conventionalCD offers a higher real return than the Inflation-Plus CD; if the expected rateof inflation is greater than 3.5%, then the opposite is true.c. If you expect the rate of inflation to be 3% over the next year, then theconventional CD offers you an expected real rate of return of 4%, which is0.5% higher than the real rate on the inflation-protected CD. But unless youknow that inflation will be 3% with certainty, the conventional CD is alsoriskier. The question of which is the better investment then depends on yourattitude towards risk versus return. You might choose to diversify and investpart of your funds in each.d. No. We cannot assume that the entire difference between the risk-freenominal rate (on conventional CDs) of 7% and the real risk-free rate (oninflation-protected CDs) of 3.5% is the expected rate of inflation. Part of thedifference is probably a risk premium associated with the uncertaintysurrounding the real rate of return on the conventional CDs. This implies thatthe expected rate of inflation is less than 3.5% per year.2.From Table 5.3, the average risk premium for large-capitalization U.S. stocks forthe period 1926-2005 was: (12.15% - 3.75%) = 8.40% per yearAdding 8.40% to the 6% risk-free interest rate, the expected annual HPR for theS&P 500 stock portfolio is: 6.00% + 8.40% = 14.40%3. Probability distribution of price and one-year holding period return for a 30-yearGerman Government bond (which will have 29 years to maturity at year’s end):Economy Probability YTM Price CapitalGainCouponInterestHPRBoom 0.20 11.0% $ 74.05 -$25.95 $8.00 -17.95% Normal Growth 0.50 8.0% $100.00 $ 0.00 $8.00 8.00% Recession 0.30 7.0%$112.28 $12.28 $8.00 20.28%5-14. E(r) = [0.35 ? 44.5%] + [0.30 ? 14.0%] + [0.35 ? (–16.5%)] = 14%σ2 = [0.35 ? (44.5 – 14)2] + [0.30 ? (14 – 14)2] + [0.35 ? (–16.5 –14)2] = 651.175 σ = 25.52%The mean is unchanged, but the standard deviation has increased, as theprobabilities of the high and low returns have increased.5. For the money market fund, your holding period return for the next year depends onthe level of 30-day interest rates each month when the fund rolls over maturingsecurities. The one-year savings deposit offers a 7.5% holding period return for the year. If you forecast that the rate on money market instruments will increasesignificantly above the current 6% yield, then the money market fund might result ina higher HPR than the savings deposit. The 20-year U.K Government bond offers ayield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; however, you could earn a one-year HPR much less than 7.5% on the bond if long-term interest rates increase during the year. If U.K Government bond yields rise above 9%, then the price of the bond will fall, and the resulting capital loss will wipe out some or all of the 9% return you would haveearned if bond yields had remained unchanged over the course of the year.6. a. If businesses reduce their capital spending, then they arelikely to decreasetheir demand for funds. This will shift the demand curve in Figure 5.1 tothe left and reduce the equilibrium real rate of interest.b. Increased household saving will shift the supply of funds curve to the rightand cause real interest rates to fall.c. Open market purchases of U.S. Treasury securities by the Federal ReserveBoard is equivalent to an increase in the supply of funds (a shift of thesupply curve to the right). The equilibrium real rate of interest will fall.5-25-37.The average rates of return and standard deviations are quite different in the sub periods: STOCKS Mean Deviation Skewness Kurtosis1926 –2005 12.15% 20.26% -0.3605 -0.0673 1976 –2005 13.85% 15.68% -0.4575 -0.6489 1926 –1941 6.39% 30.33% -0.0022 -1.0716BONDSMean DeviationSkewness Kurtosis1926 – 2005 5.68% 8.09% 0.9903 1.6314 1976 – 2005 9.57% 10.32% 0.3772 -0.0329 1926 – 19414.42%4.32% -0.5036 0.5034The most relevant statistics to use for projecting into thefuture would seem to be the statistics estimated over the period 1976-2005, because this later period seems to have been a different economic regime. After 1955, the U.S. economy entered the Keynesian era, when the Federal government actively attempted to stabilize the economy and to prevent extremes in boom and bust cycles. Note that the standard deviation of stock returns has decreased substantially in the later period while the standard deviation of bond returns has increased.8. Real interest rates are expected to rise. The investment activity will shift the demand for funds curve (in Figure 5.1) to the right. Therefore the equilibrium real interest rate will increase.9. a %88.50588.070.170.080.0i 1i R 1i 1R 1r ==-=+-=-++=b.r ≈ R - i = 80% - 70% = 10%Clearly, the approximation gives a real HPR that is too high.10. From Table 5.2, the average real rate on T-bills has been:0.72% a. T-bills: 0.72% real rate + 3% inflation = 3.72%b.Expected return on large stocks:3.72% T-bill rate + 8.40% historical risk premium = 12.12%c.The risk premium on stocks remains unchanged. A premium, the difference between two rates, is a real value, unaffected by inflation.11. E(r) = (0.1 × 15%) + (0.6 × 13%) + (0.3 × 7%) = 11.4%12. The expected dollar return on the investment in equities is $18,000 compared to the$5,000 expected return for T-bills. Therefore, the expectedrisk premium is $13,000.13. E(r X) = [0.2 × (?20%)] + [0.5 × 18%] + [0.3 × 50%] =20%E(r Y)= [0.2 × (?15%)] + [0.5 × 20%] + [0.3 × 10%] =10%14. σX 2 = [0.2 ? (– 20 – 20)2] + [0.5 ? (18 – 20)2] + [0.3 ? (50 – 20)2] = 592σX = 24.33%σY 2 = [0.2 ? (– 15 – 10)2] + [0.5 ? (20 – 10)2] + [0.3 ? (10 –10)2] = 175σX = 13.23%15. E(r) = (0.9 × 20%) + (0.1 × 10%) =19%16. E(r) = [0.2 × (?25%)] + [0.3 × 10%] + [0.5 × 24%] =10%17. The probability that the economy will be neutral is 0.50, or 50%. Given a neutraleconomy, the stock will experience poor performance 30% of the time. Theprobability of both poor stock performance and a neutral economy is therefore:0.30 ? 0.50 = 0.15 = 15%18. a. Probability Distribution of the HPR on the Stock Market and Put:STOCK PUTState of the Economy ProbabilityEnding Price +DividendHPR Ending Value HPRBoom 0.30 $134 34% $ 0.00 -100% Normal Growth 0.50 $114 14% $ 0.00 -100% Recession 0.20 $ 84 -16% $ 29.50 146% Remember that the cost of the index fund is $100 per share, and the cost of the put option is $12.5-4b. The cost of one share of the index fund plus a put option is $112. Theprobability distribution of the HPR on the portfolio is:State of the Economy ProbabilityEnding Price +Put +DividendHPR= (134 - 112)/112Normal Growth 0.50 $114.00 1.8% = (114 - 112)/112 Recession 0.20 $113.50 1.3% = (113.50 - 112)/112c. Buying the put option guarantees the investor a minimum HPR of 1.3%regardless of what happens to the stock's price. Thus, it offers insuranceagainst a price decline.19. The probability distribution of the dollar return on CD plus call option is:State of the Economy ProbabilityEnding Valueof CDEnding Valueof CallCombinedValueBoom 0.30 $114.00 $19.50 $133.50 Normal Growth 0.50 $114.00 $ 0.00 $114.00 Recession 0.20 $114.00 $ 0.00 $114.00 5-5。