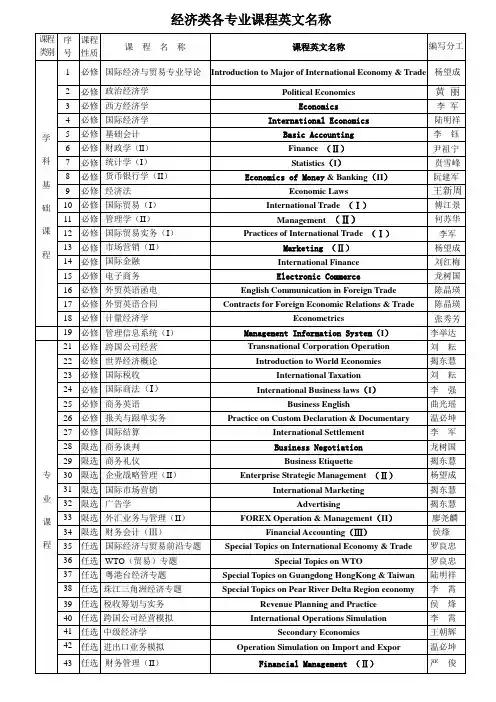

Unit 17 Money Management Business

- 格式:doc

- 大小:169.00 KB

- 文档页数:22

unit-3-商务英语综合教程2Unit 3: Business English Integrated Course 21. Vocabulary1.1. Definitions1.1.1. Management: The process of planning, organizing, controlling, and directing resources to achieve specific goals.1.1.2. Entrepreneur: A person who starts and runs a business, taking on financial risks in the hope of making a profit.1.1.3. Business plan: A written document that describes a business, its objectives, strategies, market, and financial forecasts.1.1.4. Marketing: The process of identifying, anticipating, and satisfying customer needs and wants through the creation, promotion, and distribution of products and services.1.1.5. Market research: The process of gathering and analyzing information about a market, including its size, growth potential, competition, and customer preferences.1.1.6. Sales: The act of selling a product or service, including activities such as prospecting, presenting, and closing sales.1.1.7. Advertising: The use of various media to promote a product or service, including print, broadcast, and online media.1.1.8. Public relations: The practice of managing the communication between an organization and its stakeholders, including customers, employees, investors, and the media.1.2. Examples1.2.1. The management team is responsible for setting goals, making plans, and ensuring that resources are used effectively.1.2.2. The entrepreneur invested all his savings in his new business, hoping to make a profit.1.2.3. The business plan outlines the company's objectives, strategies, and financial forecasts.1.2.4. The marketing department is responsible for identifying customer needs, creating products, and promoting them through advertising and other means.1.2.5. The market research team gathers information about competitors, customer preferences, and market trends to help the company make informed decisions.1.2.6. The sales team is responsible for finding potential customers, presenting the company's products, and closing sales.1.2.7. The advertising campaign used various media, including television, radio, and billboards, to promote the new product.1.2.8. The public relations department manages the company's communication with stakeholders, responding to inquiries from customers, investors, and the media.2. Expressions2.1. Definitions2.1.1. To break even: To earn enough money to cover all costs, without making a profit or a loss.2.1.2. To launch a product: To introduce a new product to the market.2.1.3. To conduct a survey: To gather information by asking questions to a group of people.2.1.4. To target a market: To aim marketing efforts at a specific group of customers who are likely to be interested in a product or service.2.1.5. To negotiate a deal: To discuss terms and conditions with another party in order to reach an agreement.2.1.6. To close a sale: To complete a transaction by selling a product or service to a customer.2.1.7. To handle complaints: To address customer concerns and resolve issues that arise.2.1.8. To issue a press release: To distribute a statement to the media, announcing news or events related to a company.2.2. Examples2.2.1. The company needs to sell 100,000 units of the new product in order to break even.2.2.2. The company will launch the new product next month, with a major advertising campaign.2.2.3. The company conducted a survey to find out what customers thought of the newproduct.2.2.4. The company has targeted the young adult market with its new line of clothing.2.2.5. The company is negotiating a deal with a major supplier to reduce costs.2.2.6. The salesperson was able to close the sale by offering a special discount.2.2.7. The customer service department handled the complaint by offering a refund and an apology.2.2.8. The company issued a press release announcing its new CEO and its plans for expansion.。

Chapter 6The Foreign Exchange MarketExercisesⅠ. Answer the following questions in English.1. How many common methods to express a foreign exchange rate?Answer:There are two common methods to express a foreign exchange rate.2. What is usefulness of settling account?Answer:Business people will pay and recieive different currencies.Therefore, they must convert the currencies that they received into the currencies thatthey could buy commodities.3. How does stop order work?Answer: Stop orders can be used to enter the market on momentuma or to limit the potential loss of a position.4. What do you think about single currency system? Is it possible to establishsingle currency system in the world now?Answer:I think a single currency system,it means no foreign exchange market,no foreign exchange rates,no foreign exchange.It is no possible to establish single currency system in the world now. Because in our world of mainly national currencies,the foreign exchange market plays the indispensable role of providing the essential machinery for making payments across borders,transferring funds and purchasing powerfrom one currency to another,and determining that singularly important price,the exchange rate.5. What is limit order?Answer: A limit is an order to buy or sell a currency at a specified price or better.6. How to make money for many traders through foreign exchange market?Answer:(一)You should have trading currencies with a strategy.(1) Currency Trading is Only For Part of Your Investment Money(2)You Must Limit Your Losses in Currency Trading(3)Know the Trends of the Foreign Currency Market Before Trading(二)Decide What Type of Currency Trader You Will be.(1)Trade currendes in multiple lots(2)Lose the urge to trade currencies every day(3)Stick to your trading planⅡ.Fill in the each blank with an appropriate word or expression.l. The currency trader should also decide the time __frame__ that he will be using to trade in order to determine which trend will be the most important. 2. The bid is the price at which dealers are willing to __buy__ dollars (basecurrency) in terms of yen (quote currency) and users of our trading platform can __sell__ dollars in terms of yen.3. The order remains active until the end of the trading day (5:00 PM EST),unless it is __executed__ or canceled by the trader.4. A GTC order remains active until it is canceled by the currency trader or untilthe order is executed. It is the __trade’s__ responsibility to __cancel__ aGTC order.5. The Foreign Exchange Market is where the majority of buying and selling ofworld __currencies__ takes place.6. When placing a limit order, the trader also specifies the__duration__ for whichthe order is to remain active while it is not executed.Ⅲ.Translate the following sentences into English.1.外汇交易市场,也称为“Forex”或“FX”市场,是世界上最大的金融市场,平均每天超过1兆美元的资金在当中周转——相当于美国所有证券市场交易额总和的30倍。

知识改变格局 格局决定命运! 1 单元要点复习 Ⅰ.单词拼写 1.They found the body buried beneath (在……之下) a pile of leaves. 2.Snow indicates (表明;显示) the coming of winter. 3.He had intended to return today,but he postponed (推迟;延期) the trip due to the unpleasant weather. 4.This book explores the musical (音乐的) interest and needs of children in their daily lives. 5.All our dreams can come true, if we have the courage to pursue (追求) them. 6.It is lucky we booked a room, or we would have nowhere (无处) to stay now. 7.If necessary, don't hesitate (犹豫;迟疑) to give me a call. 8.Indeed (确实), the survival of society itself relies on people seeing beauty in difference and depth. 9.The workers worked long hours for two weeks before everything returned to normal (常态). 10.Maintaining (保持;维持) the right diet is the key to reducing stress. Ⅱ.单句语法填空 1.On the bus, I spotted a man stealing (steal) a wallet from a lady's shoulder bag. 2.Tom dropped his head and didn't dare to_say (say) a word,as if not knowing the answer. 3.It takes a lot of patience (patient) and hard work to be a good teacher. 4.Whatever he does, once he sets up a goal, he will start pursuing it without hesitation (hesitate). 5.We were never allowed to touch these tubes without the teacher's permission (permit). 6.Those who were willing to_shoulder (shoulder) social responsibility are especially respected and welcomed. 知识改变格局 格局决定命运! 2

道德规范与职业行为准则(二)(总分40,考试时间90分钟)单项选择题1. Fern Baldwin, CFA, as a representative for Fernholz Investment Management, is compensated by a base salary plus a percentage of fees generated. In addition, she receives a quarterly performance bonus on a particular client's fee if the client's account increases in value by more than 2 points over a benchmark index. Baldwin had a meeting with a prospect in which she described the firm's investment approach but did not disclose her base salary, percentage fee, or bonus. Baldwin has :A. violated the Standards by not disclosing her salary, fee percentage, and performance bonus. B. violated the Standards by not disclosing her performance bonus. C. not violated the Standards because **pensation arrangements are confidential and should not be disclosed to clients.2. A client calls his money manager and asks the manager to liquidate a large portion of his assets under management for an emergency. The manager warns the client of the risk of selling many assets quickly but says that he will try to get the client the best possible price. This is a violation of:A. Standard Ⅲ(C) , Suitability. B. Standard ⅤB. , Communication with Clients and Prospective Clients. C. none of the Standards listed here.3. An analyst working at an investment firm has a client that rents limousines. The client tells the analyst that as long as he is the client's analyst, he can have free use of a limousine several times a year. The analyst needs to:A. inform his supervisor in writing of the offer if the analyst intends to accept the offer. B. explicitly refuse such an offer. C. do nothing since the offer is not linked to the performance of the client's portfolio.4. With respect to reporting investment results, Global Investment Performance Standards (GIPS) require a minimum of:A. three years of historical performance. B. ten years of historical performance. C. five years of historical performance.5. Which of the following was NOT a motivation for creating the Global Investment Performance Standards (GIPS) ?A. Increase the role of government agencies in the investment industry. B. Achieve greater uniformity **parability among presentations of performance. C. Improve the service offered to investment management clients.6. Jan Hirsh, CFA, is employed as manager of a college endowment fund. The college's board of directors has recently voted to consider divesting **panies located in a country that has a poorcivil rights record. Hirsh has personal investments in several firms in the country. Hirsh needs to :A. disclose her ownership in the stocks to her supervisor only. B. disclose her ownership in the stocks to the board of directors only. C. do nothing since the board has not made a decision yet.7. Which of the following does NOT violate Standard Ⅰ ( D), Misconduct? Roland Lawson, a CFA charterholder and a financial analyst:A. is arrested for participating in a nonviolent protest. B. committed perjury in connection with a lawsuit against his firm. C. drinks excessively during business meetings with clients and returns to work under the influence of alcohol.8. Which one of the following constitutes the illegal use of material nonpublic information?A. Trading based on your analytical review of the firm's future prospects. B. Trading immediately after attending the firm's annual shareholders' meeting. C. Trading on information your sister, the firm's attorney, told you over dinner.9. Tony Calaveccio, CFA, is the manager of the TrustCo Small Cap Venture Fund in Toronto. He places trades for the fund with Worldwide Brokerage. Worldwide is holding a conference in Amsterdam and has offered to pay for Calaveccio's airfare, meals, and accommodations associated with his attendance of the conference. The conference concerns European small cap securities and the EASDAQ. He decides that he will accept their offer and attend the conference. In order to comply with the Code and Standards, he may:A. attend, but he must disclose the arrangement to his employer as a gift. B. simply attend. Since the conference is directly related to his professional responsibilities, no further notification or permission is required. C. attend, but he must disclose the arrangement as **pensation to his employer in writing.10. In 1995, the CFA Institute sponsored and funded the Global Investment Performance Standards (GIPS) in response to :A. an increase in insider trading. B. new regulation passed by the SEC. C. a need to address issues, such as portability of investment results.11. Which of the following is a component of the Code of Ethics? CFA Institute members shall:A. use particular care in determining applicable fiduciary duty. B. not knowingly participate or assist in any violation of laws, rules, or regulations. C. use reasonable care and exercise independent professional judgment.12. A money manager, who is a member of CFA Institute, suggests during phone calls to his clients that, "I hope you will relay to your friends the great returns I earned for you this past year. " The manager had generated above average returns in the past year. Is this a violation of Standard Ⅲ(D) , Performance Presentation?A. Yes, because the Standard forbids members asking their clients to say anything about how well the member has done. B. No, because the request was made orally and not in writing. C. Yes, because the intended message fails the test of completeness as required under the standard.13. When GIPS and local laws conflict, in order to be in compliance with GIPS, the investmentfirm must :A. follow GIPS and need not reference the local law. B. follow local law, and no additional disclosure is required. C. follow local law but disclose the conflict with GIPS.14. Roger Halpert, CFA, prepares a company research report in which he recommends a strong "buy". He has been careful to ensure that his **plies with the CFA Institute Standard on research reports. According to CFA Institute Standards of Professional Conduct, which of the following statements about how Halpert **municate the report is most correct?A. Halpert can make his report in person, by telephone, or by computer on the Internet. B. Halpert can transmit his report by computer on the Internet. C. Halpert can make his report by telephone.15. An analyst likes to trade options in her own account. She does not deem any of her client accounts suitable for option trading. When she finds a favorable options position, in accordance to Standard Ⅵ (B) , Priority of Transactions, she should :A. first tell her clients about it before acting herself. B. act on it immediately on behalf of her clients then act on her behalf. C. act on it on her own behalf as she sees fit.16. Which of the following is NOT part of the CFA Institute Code of Ethics?A. Integrity. B. Independent judgment. C. Contractual provisions.17. While it would be customary to report both five - year and ten - year performance data, Seminole Equity Partners has been in existence for only eight years. Because of this, Kurt Dambach does not report ten - year data but reports for both five years and since the inception of the fund. This he notes in a footnote at the bottom of the information sheet. This action is:A. in accordance with the Code and Standards since he has indicated the basis in a footnote. B. a violation of the Standard concerning prohibition against misrepresentation. C. a violation of the Standard concerning performance presentation.18. Advisors, Inc. , is in the process of adopting the Global Investment Performance Standards (GIPS). The managers of the firm **bining the results of fee - paying discretionary portfolios **posites for reporting purposes. For purpose of comparison, each fee - paying discretionary portfolio must be included in at least:A. **posites. B. **posite. C. **posites.19. The El Rey Investment Company, located in Barcelona, Spain, is in the process of adopting the Global Investment Performance Standards (GIPS) for the current fiscal year. One of the GIPS standards is in direct conflict with Spanish investment reporting regulations. In order to be in **pliance with GIPS, El Rey must:A. comply with the GIPS standard and make full disclosure of the conflict. B. comply with the local regulation and make full disclosure of the conflict. C. comply with both the GIPS standard and the local regulation **parison purposes.20. John Hill, CFA, has been working for Advisors, Inc. , for eight years. Hill is about to start his own money management business and has given his two - week notice of his resignation from Advisors. A few days before his resignation takes effect, on his lunch hour, he takes out a loan from a bank on behalf of his new business and uses the money to buy some office equipment for his new business. Since he engaged in these transactions while still an employee of Advisors, Hillviolated Standard Ⅳ(A), Loyalty to Employer, by:A. engaging in a financial transaction, like taking out a loan, only. B. none of these actions. C. purchasing office equipment, only.21. Brian Bellow, a CFA Institute member, is a portfolio manager for Progressive Trust Company. Several friends asked Bellow to review their investment portfolios. On his own time, Bellow examined their portfolios and made several recommendations. He received no **pensation from his friends for his investment advice and provided no future investment counsel to them. According to CFA Institute Standards of Professional Conduct, did Bellow violate his duty to Progressive Trust?A. No, because Bellow provided no ongoing investment advice. B. No, because Bellow provided investment advice to his friends. C. Yes, because he undertook an independent practice that could result in compensation or other benefit to him.22. In order to comply with the CFA Institute Standards, an analyst should:A. use only his own research in making investment recommendations, because anything else would violate Standard Ⅰ(B), Independence and Objectivity. B. use only **pany's research when making investment recommendations and use outside research for reports and analysis on stocks. C. use outside research only after verifying its accuracy.23. The Global Investment Performance Standards (GIPS) were designed to be applied with the goal of full disclosure and fair representation of investment performance in all instances EXCEPT:A. when applicable local laws or regulations conflict with the GIPS, in which case, firms **ply with local laws and fully disclose the conflict. B. when a firm or composite has been in existence for less than five years, in which case, less stringent standards apply. C. in the case of private equity and real estate investments, which do not fall within the scope of the GIPS.24. Chris Babcock, CFA, a portfolio manager for a large Texas investment firm, has been **pensation in addition to what her firm pays her. The offer is from one of her clients and the **pensation will be based on her yearly performance in excess of the market index. Babcock should :A. turn down the offer because it represents a clear conflict between this client and Babcock's other clients. B. make written disclosure to all parties involved before she accepts this offer. C. make written disclosure to her other clients before she accepts this offer.25. In accordance with Standard Ⅲ(A) Loyalty, Prudence and Care, which of the following statements is least accurate? Members and Candidates should:A. submit to clients, at least quarterly, itemized statements detailing all of the period's transactions. B. make investment decisions in the context of the total portfolio. C. vote all proxies on behalf of clients in a responsible manner.26. Michael Malone, CFA, is an investment analyst for a large brokerage firm in New York who covers the airlines industry. Alter hours in his personal time, Malone maintains an online blog on which he expresses his personal opinions about various investment opportunities, including, but not limited to, the airlines industry. On his blog, he posts a very negative investment opinion about WestAir stock. Malone knows that WestAir's stock will be downgraded to a "sell" by his firm next week. Malone has:A. violated Standard Ⅵ(B) Priority of Transactions by releasing materialinformation to the public before releasing to the firm's clients. B. violated Standard Ⅱ(A) Material Nonpublic Information by releasing material that could negatively impact the price of the security. C. violated Standard Ⅳ(A) Loyalty by divulging confidential information that is the intellectual property of his employer.27. CFA Institute does not impose fines. All of the other choices are possible sanctions. CFA Institute may suspend a candidate from further participation in the CFA program. With respect to **plaints concerning the professional conduct of a CFA Institute member, which of the following is TRUE?A. Anyone can write the Standards and Policy Committee staff with a complaint concerning the conduct of any member. B. Anyone can write the Professional Conduct Program staff with a complaint concerning the conduct of any member. C. Only other members can write the Professional Conduct Program staff with a complaint concerning the conduct of another member.28. To comply with Standard Ⅳ(B) , Additional Compensation Arrangements, members should do all of the following EXCEPT:A. immediately make a written report to their employer specifying **pensation benefits they receive. B. immediately make a written report of any services they expect to receive. C. reject any **pensation immediately because it is not appropriate to accept **pensation in a business setting.29. Assume that on January 1,2005, a firm with no Global Investment Performance Standards (GIPS) compliant history since its inception four years ago wishes to **pliance with GIPS. Which of the following accurately reflects the appropriate action for the firm to take?A. Comply with GIPS for the year beginning January 1,2002, and report its performance prior to this date with a disclosure of why the earlier years are not **pliant. B. Comply with GIPS for the year beginning January 1,2002, and report only performance results since this date. C. Comply with GIPS for all four periods since the firm's inception.30. Which of the following is a CORRECT statement of a member's duty under the Code and Standards?A. A member is required to comply only with applicable local laws, rules, regulations, or customs even though the CFA Institute Code and Standards may impose a higher degree of responsibility or a higher duty on the member. B. A member who trades securities in a foreign securities market where no applicable local laws or stock exchange rules regulate the use of material nonpublic information may take investment action based on this information. C. In the absence of specific applicable law or other regulatory requirements, the Code and Standards govern the member's actions.31. When an analyst makes an investment recommendation, which of the following statements must be disclosed to clients?A. The firm is a market maker in the stock of the **pany. B. An employee of the firm holds a directorship with the **pany. C. All of these statements must be disclosed to clients.32. In order to comply with Standard Ⅲ (A), Loyalty, Prudence, and Care, an analyst needs to:A. comply with applicable fiduciary duty. B. perform all of the actions listed here. C. liquidate hisholdings of all stocks that his client owns.33. Standard Ⅵ (C) , Referral Fees, is applicable to :A. only cash consideration received for the recommendation of products or services. B. only cash consideration paid for the recommendation of products or services. C. all consideration received or paid for the recommendation of products or services.34. Kenneth, CFA, is a portfolio manager at A & B limited, if he suspects a colleague at **pany of engaging in ongoing illegal activities, as according to the CFA Institute Standards of Professional Conduct, he is required to take all of the following actions EXCEPT:A. determine whether the conduct is, in fact, illegal. B. disassociate himself from any illegal activity. C. report the illegal violations to the appropriate governmental or regulatory organizations.35. Michael Bellow, CFA, CAIA, is an investment banker who is involved with an initial public offering (IPO) of NewCo. Because this is Bellow's first involvement in an IPO, he reports to an experienced supervisor. While reviewing past financial statements provided by NewCo, Bellow suspects that NewCo deliberately overstated its earnings for the past several quarters. Bellow seeks the advice of his firm's **petent general counsel and follows the advice given without deviation. Based on the general counsel's advice, Bellow consults his immediate supervisor about the suspected overstatement of earnings. After reviewing the situation, Bellow's supervisor explains why NewCo's calculations of its earnings are correct. Bellow realizes that his inexperience and exuberance initially led him to an incorrect conclusion about NewCo's earnings. Which of the following statements about Bellow's actions involving Standard Ⅰ(A), Knowledge of the law, and Standard Ⅰ(C) , Misrepresentation, is TRUE? Bellow:A. violated both Standard Ⅰ(A) and Standard Ⅰ(C).B. violated Standard ⅠA. but did not violate Standard Ⅰ(C).C. did not violate either Standard Ⅰ (A) or Standard ⅠC..36. According to the Code of Ethics, a member reflects credit on the profession when a member:A. consults with other members on a regular basis. B. practices in a professional and ethical manner. C. places the clients first.37. Within the Global Investment Performance Standards (GIPS) are supplemental provisions which must be applied to which of the following asset classes?A. Emerging markets and private equity. B. Private equity and real estate. C. Hedge funds and derivatives.38. Which of the following is NOT a form of plagiarism?A. Citing quotations said to be attributable to "leading analysts" or "investment experts" without specific reference. B. Presenting statistical forecasts by others with the sources identified but without the qualifying statements that may have been used by the originator. C. Using factual information published by a recognized financial statistics reporting service without acknowledgment.39. In January 2003, the Medusco Investment firm has decided to present its performance history in compliance with the Global Investment Performance Standards (GILES). Medusco was formedon January 1, 1992, and has never before presented its performance results in compliance with the GIPS standards. Which of the following actions must Medusco take in order to claim **pliance?A. Present GIPS - compliant performance results for the 5 - year period from January 1, 1998, through December 31, 2002, and report five additional years of non - GIPS - compliant performance with a disclosure explaining why the performance in the earlier years is not GIPS - compliant. B. **ply with GIPS for periods after January 1 , 2000, and report non - GIPS - compliant performance results for the periods January 1, 1993, through December 31, 1999, with a disclosure explaining why these earlier years are not GIPS -compliant. C. Present GIPS- compliant performance results for the 5 -year period from January 1, 1998, through December 31, 2002.40. Which of the following is least accurate regarding reasons for imposing a summary suspension upon covered persons?A. Failure to return the annual professional conduct statement. B. Misdemeanor charge for the possession of illegal narcotic substances. C. Disbarment under securities laws.。

Unit17 Money Management BusinessMoney ManagementBanking, stock broking, and fund management are converging. For investment banking houses, money management business is not a question of whether to enter, but rather to "buy" or to "build". In 1970, only 7 of top 15 underwriters had affiliations with units that ran money. By 2003, nearly all major investment banks had drifted into fund management. Several factors have contributed to the growing importance of money management operations within investment banking business umbrella.Money management business资金管理行业Banking, stock broking, and fund management are converging.银行业、证券经纪业和资金管理业正逐渐趋同。

Converge: to come from different directions and meet at the same point to become one thing[≠diverge]:For investment banking houses, money management business is not a question of whether to enter, but rather to "buy" or to "build. ".对投资银行来说,资金管理行业不是什么是否进入的问题,而是要去“买”还是去“新建”的问题。

In 1970, only 7 of top 15 underwriters had affiliations with units that ran money 1970年,顶级的15家承销商中只有7家拥有运营资金的附属机构。

By 2003, nearly all major investment banks had drifted into fund management. 2003年,几乎所有顶级的投资银行都介入了资金管理业务。

Drift: to move slowlyDrift into sth: to move, change, or do something without realizing it. 不知不觉的开始做某个事情She was just drifting into sleep when her boss is coming in. 当她迷迷糊糊刚要睡着的时候,经理近来了。

(在这个句子中,nearly all major investment banks had drifted into fund management. 表达的意思是:几乎所有的顶级的投资银行都在不知不觉中介入了资金管理业务。

)Several factors have contributed to the growing importance of money management operations within investment banking business umbrella.A Contribute toB : A 导致 B 的发生,A是B的原因Several factors have contributed to the growing importance of money management operations有几个因素导致了资金管理业务的重要性,或者说有几个因素是资金管理变的越来越重要的原因。

(好,我们再来看一下这句话中umbrella的意思,umbrella 本意是伞,在这里把investment banking比做一个大伞,在这个大伞下经营着很多的业务,money management就是其中之一.译文:资金管理业务作为投资银行业务的一个分支,其重要性正日益增强。

导致这一现象的原因有以下几点:First, it is to keep up with competition by providing a one-stop financial store. Running affiliated funds expands the range of products and services investment banks offer to clients. Second, it helps balance out banks' volatile income streams with a relatively stable .source of income. Affiliated funds provide support for Wall Street parents' underwriting business as well. Investment banks take in revenues to underwrite securities is sues and fee income with the help of fund management operations. It is one of the most attractive segments of the financial services industry. The total industry net assets have grown from $135 billion in 1980 to ,$4.49 trillion by December 1997. By the end of 2003, the assets of the U. S. ' s mutual funds grew to nearly $7 trillion.First, it is to keep up with competition by providing a one-stop financial store. 首先是出于通过提供一步到位式金融服务(one- stop financial store,或称全方位金融服务) 从而保持自己竞争力的需要。

Running affiliated funds expands the range of products and services investment banks offer to clients.运营附属基金可以扩大投资银行向客户提供的产品和服务的范围;Second, it helps balance out banks’volatile income streams with a relatively stable source of income.Volatile: 动荡不定的Balance out: if two or more things balance out, the final result is that they are equal in amount, importance, or effect:译文:其二,资金管理可以带来相对稳定的收入流,从而有助于抵消银行收入流的不稳定;Affiliated funds provide support for Wall Street parents' underwriting business as well.附属基金也为其华尔街上的母公司的承销业务提供了支持,Investment banks take in revenues to underwrite securities issues and fee income with the help of fund management operations.投资银行可以从承销证券发行得到收益,并通过经营资金管理业务获取费用型收入。

It is one of the most attractive segments of the financial services industry.资金管理是金融服务行业中最具吸引力的业务之一,The total industry net assets have grown from $135 billion in 1980 to ,$4.49 trillion by December 1997.其行业的总净资产已经从1980年的1 350亿美元增加到了I 1997年12月的44 900亿美元。

By the end of 2003, the assets of the U. S. ' s mutual funds grew to nearly $7 trillion.到2003年年底,美国全国的共同基金资产已达到近7万亿美元。

Investment management business itself is undergoing radical reshaping. According to a widely read report from Goldman Sachs published in 1997, consolidation is the wave of the future. Within the next few years, the industry will emerge as a handful of dominant companies and some smaller niche players. To establish and secure a position in the marketplace quickly, Wall Street firms favor buying over the build-it-yourself approach.Investment management business itself is undergoing radical reshaping.投资管理行业本身正在进行彻底的洗牌。