经典会计英文文献目录100篇

- 格式:doc

- 大小:54.00 KB

- 文档页数:7

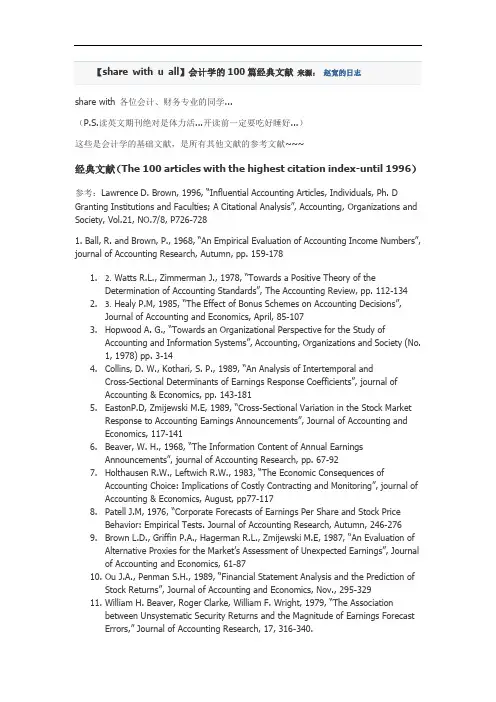

share with 各位会计、财务专业的同学...(P.S.读英文期刊绝对是体力活...开读前一定要吃好睡好...)这些是会计学的基础文献,是所有其他文献的参考文献~~~经典文献(The 100 articles with the highest citation index-until 1996)参考:Lawrence D. Brown, 1996, “Influential Accounting Articles, Individuals, Ph. D Granting Institutions and Faculties; A Citational Analysis”, Accounting, Organizations and Society, Vol.21, NO.7/8, P726-7281. Ball, R. an d Brown, P., 1968, “An Empirical Evaluation of Accounting Income Numbers”, journal of Accounting Research, Autumn, pp. 159-1781. 2.Watts R.L., Zimmerman J., 1978, “Towards a Positive Theory of theDetermination of Accounting Standards”, The Accounting Review, pp. 112-1342. 3.Healy P.M, 1985, “The Effect of Bonus Schemes on Accounting Decisions”,Journal of Accounting and Economics, April, 85-1073.Hopwood A. G., “Towards an Organizational Perspective for the Study ofAccounting and Information Systems”, Accounting, Organizations and Society (No.1, 1978) pp. 3-144.Collins, D. W., Kothari, S. P., 1989, “An Analysis of Intertemporal andCross-Sectional Determinants of Earnings Response Coefficients”, journal ofAccounting & Economics, pp. 143-1815.EastonP.D, Zmijewski M.E, 1989, “Cross-Sectional Variation in the Stock MarketResponse to Accounting Earnings Announcements”, Journal of Accou nting andEconomics, 117-1416.Beaver, W. H., 1968, “The Information Content of Annual EarningsAnnouncements”, journal of Accounting Research, pp. 67-927.Holthausen R.W., Leftwich R.W., 1983, “The Economic Consequences ofAccounting Choice: Implications of Costly Contracting and Monitoring”, journal of Accounting & Economics, August, pp77-1178.Patell J.M, 1976, “Corporate Forecasts of Earnings Per Share and Stock PriceBehavior: Empirical Tests. Journal of Accounting Research, Autumn, 246-2769.Brown L.D., Griffin P.A., Hagerman R.L., Zmijewski M.E, 1987, “An Evaluation ofAlternative Proxies for the Market’s Assessment of Unexpected Earnings”, Journal of Accounting and Economics, 61-8710.Ou J.A., Penman S.H., 1989, “Financial Statement Analysis a nd the Prediction ofStock Returns”, Journal of Accounting and Economics, Nov., 295-32911.William H. Beaver, Roger Clarke, William F. Wright, 1979, “The Associationbetween Unsystematic Security Returns and the Magnitude of Earnings ForecastErrors,” Journa l of Accounting Research, 17, 316-340.12.Burchell S., Clubb C., Hopwood, A., Hughes J., Nahapiet J., 1980, “The Roles ofAccounting in Organizations and Society”, Accounting, Organizations and Society, No.1, pp. 5-2813.Atiase, R.K., 1985, “Predisclosure Info rmation, Firm Capitalization, and SecurityPrice Behavior Around Earnings Announcements”, journal of Accounting Research, Spring, pp.21-36.ler P., O'Leary T., 1987, “Accounting and the Construction of the GovernablePerson”, Accounting, Organizations and Society, No. 3, pp. 235-26615.O'Brien P.C., 1988, “Analysts' Forecasts As Earnings Expectations”, journal ofAccounting & Economics, pp.53-8316.Bernard, V. L., 1987, “Cross-Sectional Dependence and Problems in Inference inMarket-Based Accounting Researc h”, Journal of Accounting Research, Spring, pp.1-4817.Brown L.D., Griffin P.A., Hagerman R.L., Zmijewski M.E, 1987, “An Evaluation ofAlternative Proxies for the Market’s Assessment of Unexpected Earnings”, Journal of Accounting and Economics, 61-8718.Freem an, R. N., 1987, “The Association Between Accounting Earnings and SecurityReturns for Large and Small Firms”, journal of Accounting & Economics, pp.195-22819.Collins, D. W. , Kothari, S. P. and Rayburn, J. D., 1987, “Firm Size and theInformation Content of Prices with Respect to Earnings”, journal of Accounting & Economics, pp. 111-13820.Beaver, W. H., Lambert, R. A. and Morse, D., 1980, “The Information Content ofSecurity Prices, Journal of Accounting & Economics”, March, pp. 3-2821.Foster G., 1977, “Quar terly Accounting Data: Time-Series Properties andpredictive-Ability Results”, The Accounting Review, pp. 201-23222.Christie A.A., 1987, “On Cross-Sectional Analysis in Accounting Research”, journalof Accounting & Economics, December, pp. 231-25823.Loft A., 1986, “Towards a Critica1 Understanding of Accounting: The Case of CostAccounting in theU.K.”, 1914-1925, Accounting, Organizations and Society, No.2, pp.137-17024.GonedesN.J., Dopuch N., 1974, “Capital Market Equilibrium, InformationProduction, and Selecting Accounting Techniques: Theoretical Framework and Review of Empirical Work”, journal of Accounting, 48-12925.Bowen, R. M. , Noreen, E. W. and Lacey, J. M., 1981, “Determinants of theCorporate Decision to Capitalize Interest”, Journal of Accounting & E conomics, August, pp151-17926.Hagerman R.L, Zmijewski M.E, 1979, “Some Economic Determinants of AccountingPolicy Choice”, Journal of Accounting and Economics, August, 141-16127.Burchell S., Clubb, C. and Hopwood, A. G., 1985, “Accounting in its Socia1 Conte xt:Towards a History of Value Added in theUnited Kingdom”, Accounting,Organizations and Society, No. 4, pp.381-41428.Leftwich R.W, 1981, “Evidence of the Impact of Mandatory Changes in AccountingPrinciples on Corporate Loan Agreements”, Journal of Accoun ting and Economics, 3-3629.Bernard, V. L. and Thomas, J . K., 1989, “Post-Earnings Announcement Drift:Delayed Price Response or Risk Premium?”, Journal of Accounting Research, pp.1-3630.WattsR.L., Zimmerman J.L., 1979, “The Demand for and Supply of Account ingTheories: The Market for Excuses”, The Accounting Review, April, pp. 273-305 31.Armstrong J.P., 1987, “the rise of Accounting Controls in British CapitalistEnterprises”, Accounting, Organizations and Society, May, pp. 415-43632.Beaver, W. H. , Lambert, R. A. and Ryan, S. G., 1987, “The Information Content ofSecurity Prices: A Second Look”, journal of Accounting & Economics, July, pp.139-15733.Chambers, A. E., Penman, S.H, 1984, “Timeliness of Reporting and the Stock PriceReaction to Earnings Announcemen ts”, journal of Accounting Research, Spring, pp.21-4734.Collins D.W., Rozeff M.S., Dhaliwal D.S., 1981, “The Economic Determinants of theMarket Reaction to Proposed Mandatory Accounting Changes in the Oil and Gas Industry: A Cross-Sectional Analysis”, Jou rnal of Accounting and Economics, 37-71 35.Holthausen R.W., 1981, “Evidence on the Effect of Bond Covenants andManagement Compensation Contracts on the Choice of Accounting Techniques: The Case of the Depreciation Switch-Back”, journal of Accounting & Economics, March, pp. 73-10936.ZmijewskiM.E., Hagerman R.L., 1981, “An Income Strategy Approach to thePositive Theory of Accounting Standard Settings/Choice”, Journal of Accounting and Economics, 129-14937.Lev B., Ohlson J.A, 1982, “Market-Based Empirical Research in Accounting: AReview, Interpretation, and Ext ension”, Journal of Accounting Research, 249-322 38.Ou J. and Penman S.H., 1989, “Financial Statement Analysis and the Prediction ofStock Returns”, Journal of Accounting and Economics, Nov., 295-32939.Bruns Jr. W.J, Waterhouse, J., 1975, “Budgetary Control a nd OrganizationStructure”, journal of Accounting Research, Autumn, pp. 177-20340.Tinker A.M., Merino B.D., Neimark M., 1982, “The Normative Origins of PositiveTheories: Ideology and Accounting Thought, Accounting, Organizations andSociety”, No. 2, pp. 167-20041.Foster, G., 1980, “Accounting Policy Decisions and Capital Market Research”,journal of Accounting & Economics March, pp. 29-6242.Gibbins M., 1984, “Propositions About the Psychology of Professional Judgement inPublic Accounting”, Journal of Account ing Research, Spring, pp. 103-12543.Hopwood A.G, 1983, “On Trying to Study Accounting in the Contexts in which itOperates”, Accounting, Organizations and Society, No. 2/3, pp. 287-30544.Abdolmohammadi M.J., Wright A., 1987, “An Examination of the Effects ofExperience and Task Complexity on Audit Judgments”, The Accounting Review, pp.1-1345.Berry, A. J., Capps, T., Cooper, D.,Ferguson, P., Hopper, T. and Lowe, E. A., 1985,“Management Control in an Area of the NCB: Rationales of Accounting Practices ina Pub lic Enterprise”, Accounting, Organizations and Society, No.1, pp.3-2846.Hoskin, K.W., Macve R.H, 1986, “Accounting and the Examination: A Genealogy ofDisciplinary Power”, Accounting, Organizations and Society, No. 2, pp. 105-136 47.Kaplan R.S, 1984, “The Evolution of Management Accounting”, The AccountingReview, 390-34148.Libby R., 1985, “Availability and the Generation of Hypotheses in Analytica1Review”, journal of Accounting Research, Autumn, pp. 648-66749.Wilson G.P., 1987, “The Incremental Information Con tent of the Accrual and FundsComponents of Earnings After Controlling for Earnings”, the Accounting Review, 293-32250.Foster, G., Olsen, C., Shevlin T., 1984, “Earnings Releases, Anomalies, and theBehavior of Security Returns”, The Accounting Review, Octo ber, pp.574-603 51.Lipe R.C., 1986, “The Information Contained in the Components of Earnings”,journal of Accounting Research, pp. 37-6852.Rayburn J., 1986, “The Association of Operating Cash Flows and Accruals WithSecurity Returns”, Journal of Accounting Re search, 112-13753.Ball, R. and Foster, G., 1982, “Corporate Financial Reporting: A MethodologicalReview of Empirical Research”, journal of Accounting Research, pp. 161-234 54.Demski J.S, Feltham G.A, 1978, “Economic Incentives in Budgetary ControlSystems”, The Accounting Review, 336-35955.Cooper D.J, Sherer M.J, 1984, “The Value of Corporate Accounting Reports:Arguments for a Political Economy of Accounting”, Accounting, Organizations and Society, No.3, 207-23256.Arrington, C. E., Francis J.R., 1989, “Letting the Chat Out of the Bag:Deconstruction privilege and Accounting Research”, Accounting Organization and Society, March, pp. 1-2857.Fried, D., Givoly, D., 1982, “Financial Analysts' Forecasts of Earnings: A BetterSurrogate for Market Expectations”, journal of Accounting & Economics, October, pp. 85-10758.Waterhouse J. H., Tiessen P., 1978, “A Contingency Framework for ManagementAccounting Systems Research”, Accounting, Organizations and Society, No.3,pp.65-7659.Ashton, R .H., 1974, “Experimental Study of In ternal Control Judgment journal ofaccounting Research”, 1974, pp. 143-15760.Collins D. W., Dent, W. T., 1979, “The Proposed Elimination of Full Cost Accountingin the Extractive Petroleum Industry: An Empirical Assessment of the MarketConsequences”, journ al of Accounting & Economics, March, pp. 3-4461.Watts R.L., Leftwich, R. W., 1977, “The Time Series of Annual Accounting Earnings,journal of Accounting Research”, Autumn, pp. 253-27162.Otley D.T, 1980, “The Contingency Theory of Management Accounting:Achievement and Prognosis”, Accounting, Organizations, and Society, NO. 4,413-42863.Hayes D.C, 1977, “The Contingency Theory of Managerial Accounting”, TheAccounting Review, January, 22-3964.Bea ver, W. H. ,Griffin, P. A. and Landsman, W. R., 1982, “The IncrementalInformation Content of Replacement Cost Earnings”, Journal of Accounting &Economics, July, pp. 15-3965.Libby R., Lewis B.L., 1977, “Human Information Processing Research in Accounting:The State of the Art”, Accounting, Organizations and Society, No.3, pp. 245-268 66.Schipper W., Thompson R., 1983, “The Impact Mergers-Related Regulations onthe Shareholders of Acquiring Firms”, Journal of Accounting Research, 184-221 67.Antle, R., Smith, A., 1986, “An Empirical Investigation of the Relative PerformanceEvaluation of Corporate Executives”, journal of Accounting Research, spring,pp.1-39.68.GonedesN.J., Dopuch N., Penman S.H., 1976, “Disclosure Rules,Information-Production, and Capital Market Equilibrium: The Case of ForecastDisclosure Rules”, Journal of Accounting Research, 89-13769.Ashton, A. H. and Ashton, R. H., 1998, “Sequential Belief Revision in Auditing”, TheAccounting Review, October, pp. 623-641rcker D.F, 1983, “The Association Be tween Performance Plan Adoption andCorporate Capital Investment”, Journal of Accounting and Economics, 3-3071.McNichols M., Wilson G.P., 1988, “Evidence of Earnings Management from theProvision for Bad Debts”, journal of Accounting Research, pp.1-3172.Tomk ins C., Groves R., 1983, “The Everyday Accountant and Researching HisReality”, Accounting, Organizations and Society, No 4, pp361-37473.Dye R.A, 1985, “Disclosure of Nonproprietary Information”, Journal of AccountingResearch, 123-14574.Biddle, G. C. and Li ndahl F. W., 1982, “Stock Price Reactions to LIFO Adoptions:The Association Between Excess Returns and LIFO Tax Savings”, Journal ofAccounting Research, 1982, pp. 551-58875.Joyce E.J., 1976, “Expert Judgment in Audit Program Planning”, journal ofAccounting Research, pp. 29-6076.Kaplan R.S, 1983, “Measuring Manufacturing Performance: A New Challenge forManagerial Accounting Research”, The Accounting Review, 686-70577.Ball R., 1972, “Changes in Accounting Techniques and Stock Prices”, journal ofAccounting Research, Supplement, pp. 1-3878.Ricks W.E, 1982, “The Market’s Response to the 1974 LIFO Adoptions”, Journal ofAccounting Research, 367-38779.Albrecht, W. S., Lookabill L. L., McKeown, J.C., 1977, “The Time-Series Propertiesof Annual Earnings”, journal of Accounting Research, Autumn, pp. 226-24480.DeAngelo L.E, 1981, “Auditor Size and Audit Quality”, Journal of Accounting andEconomics, 183-19981.Merchant K.A., 1981, “The Design of the Corporate Budgeting System: Influenceson Managerial Behavioral and Perfor mance”, The Accounting Review, October, pp.813-82982.Penman S.H, 1980, “An Empirical Investment of the Voluntary Disclosure ofCorporate Earnings Forecasts of Earnings”, Journal of Accounting Research,132-16083.Simunic D., 1980, “The Pricing of Audit Services: Theory and Evidence”, Journal ofAccounting Research, 161-19084.Waller W. S., Felix Jr. W.L., 1984, “The Auditor and Learning from Experience:Some Conjectures”, Accounting, Organizations and Society, No. 3, pp. 383-408 85.Dyckman T.R, Smith A.J, 1979, “Financial Accounting and Reporting by Oil and GasProducing Companies: A Study of Information Effects”, Journal of Accounting and Economics, 45-7586.Holthausen R.W., Verrecchia R.E., 1988, “The Effect of Sequential InformationReleases on the Variance of Price Changes in an Intertemporal Multi-Asset Market”, journal of Accounting Research, Spring, pp.82-10687.Hopwood A. G., 1978, “Towards an Organizational Perspective for the Study ofAccounting and Information Systems”, Accounting, Organizations and Society, No.1, pp. 3-1488.Leftwich R.W, 1983, “Accounting Information in Private Markets: Evidence fromPrivate Lending Agreements”. The Accounting Review, 23-4289.Otley D.T, 1978, “Budget Use and Managerial Performance”, Journal of AccountingResearch, Spring, 122-14990.Griffin, 1977, “The time-series Behavior of Quarterly Earnings: PreliminaryEvidence”, Journal of Accounting Research, spring, 71-8391.Brownell P., 1982, “The Role of Accounting Data in Performance Evaluation,Budgetary Participation, and Organizational Effectiveness”, journal of Accounting Research, Spring, pp. 12-2792.Dhaliwal D.S, Salamon G.L, Smith E.D, 1982, “The effect of Owner Vs ManagementControl on the Choice of Accounting and Economics”, 41-5393.Hopwood A.G., 1972, “An Empirical Study of the Role of Accounting Data inPerformance Evaluation”, journal of Accounting Research, pp. 156-18294.Foster, G., 1981, “Intra-Industry Information Transfers Associated with EarningsReleases”, journal of Accounting & Economics, December, pp. 201-23295.Chua, W. F., 1986, “Radical Developments in Accounting Thought”, TheAccounting Review, October, pp601-63296.Hughes P.J., 1986, “Signalling by Direct Disclosure Under Asymmetric Information”,journal of Accounting & Economics, June, pp. 119-14297.Kinney W.R. Jr., 1986, “Audit Technology and Preference for Auditing Standards”,Journal of Accounting and Economics, 73-8998.Titman S., Trueman B., 1986, “Information Quality and the Valuation of NewIssues”, journal of Accounting& Economics, pp. 159-17299.Wilson G.P., 1986, “The Relative Information Content of Accruals andCash Flows: Combined Evidence at the Announcement and Annual Report Release Date”, Journal of Accounting Research, 165-203。

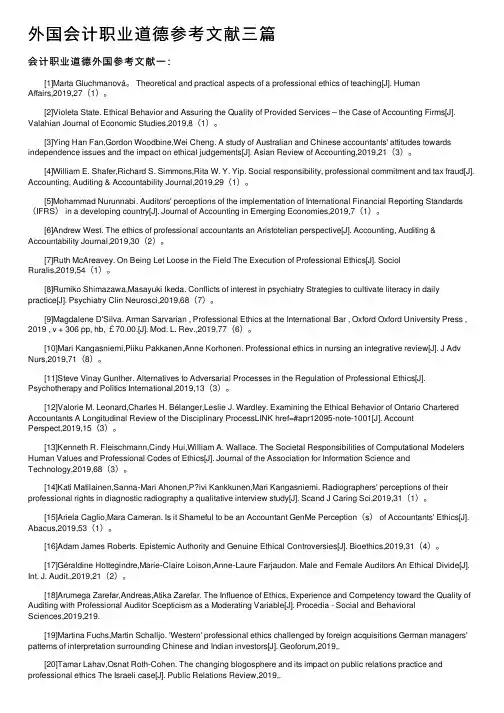

外国会计职业道德参考⽂献三篇会计职业道德外国参考⽂献⼀: [1]Marta Gluchmanová。

Theoretical and practical aspects of a professional ethics of teaching[J]. HumanAffairs,2019,27(1)。

[2]Violeta State. Ethical Behavior and Assuring the Quality of Provided Services – the Case of Accounting Firms[J]. Valahian Journal of Economic Studies,2019,8(1)。

[3]Ying Han Fan,Gordon Woodbine,Wei Cheng. A study of Australian and Chinese accountants' attitudes towards independence issues and the impact on ethical judgements[J]. Asian Review of Accounting,2019,21(3)。

[4]William E. Shafer,Richard S. Simmons,Rita W. Y. Yip. Social responsibility, professional commitment and tax fraud[J]. Accounting, Auditing & Accountability Journal,2019,29(1)。

[5]Mohammad Nurunnabi. Auditors' perceptions of the implementation of International Financial Reporting Standards (IFRS) in a developing country[J]. Journal of Accounting in Emerging Economies,2019,7(1)。

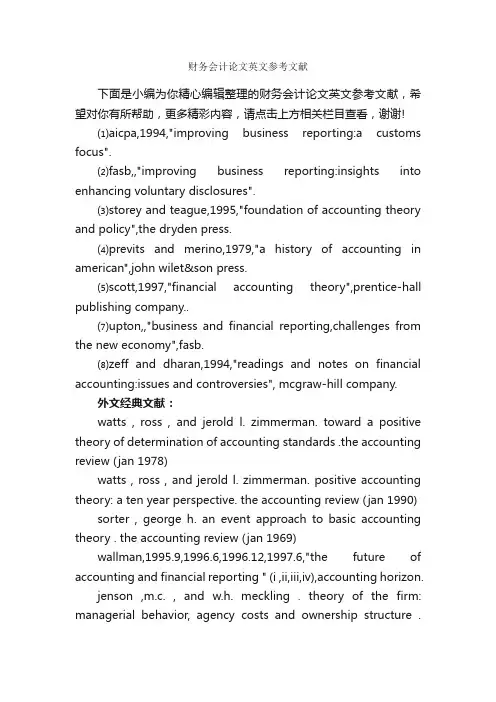

财务会计论文英文参考文献下面是小编为你精心编辑整理的财务会计论文英文参考文献,希望对你有所帮助,更多精彩内容,请点击上方相关栏目查看,谢谢!⑴aicpa,1994,"improving business reporting:a customs focus".⑵fasb,,"improving business reporting:insights into enhancing voluntary disclosures".⑶storey and teague,1995,"foundation of accounting theory and policy",the dryden press.⑷previts and merino,1979,"a history of accounting in american",john wilet&son press.⑸scott,1997,"financial accounting theory",prentice-hall publishing company..⑺upton,,"business and financial reporting,challenges from the new economy",fasb.⑻zeff and dharan,1994,"readings and notes on financial accounting:issues and controversies", mcgraw-hill company.外文经典文献:watts , ross , and jerold l. zimmerman. toward a positive theory of determination of accounting standards .the accounting review (jan 1978)watts , ross , and jerold l. zimmerman. positive accounting theory: a ten year perspective. the accounting review (jan 1990) sorter , george h. an event approach to basic accounting theory . the accounting review (jan 1969)wallman,1995.9,1996.6,1996.12,1997.6,"the future of accounting and financial reporting " (i ,ii,iii,iv),accounting horizon.jenson ,m.c. , and w.h. meckling . theory of the firm: managerial behavior, agency costs and ownership structure .journal of financial economics (oct .1976)robert sprouse “developing a concept framework for financial reporting” accounting review, 1988(12) schuetze ,,walter p.”what is an asset ?” account ing horizons,1993(9)samuelson ,richard a. ,”the concept of assets in accounting theory” accounting horizons,1996(9)aaa ,”american accounting association on accounting and auditing measurement:1989-1990” accounting horizons 1991(9) l.todd johnson and kimberley r.petrone “is goodwill an asset?” accounting horizons1998(9)linsmeier, thomas j. and boatsman ,james r. ,”aaa’s financial accounting standard response to iasc ed60 intangible assets” accounting horizons 1998(9)linsmeier, thomas j. and boatsman,jamesr.”response to iasc exposure draft ,’provisions,contingent liabilities and contingent assets’ ” accounting horizons1998(6)l.todd johnson and robert. swieringa “derivatives, hedging and comprehensive income” accounting horizons 1996(11) stephen a. .ze ff ,”the rise of economics concequences”, the journal of accountancy 1978(12)david solomons “the fasb’s conceptual framework:an evaluation ” the journal of accountancy 1986(6)paul miller , “conceptual framework:myths or realities” the journal of accountancy 1985(3)part i financial accounting theorysuggested bedtime readings:1. c.j. lee, lecture note on accounting and capital market2. r. watts and j. zimmerman: positive accounting theory3. w. beaver: revolution of financial reportingalthough these three books are relatively "low-tech" in comparison with the reading assignments, but they provide much useful institutional background to the course. moreover, these books give a good survey of accounting literature, especially in the empirical area.1. financial information and asset market equilibrium*grossman, s. and j. stiglitz, "on the impossibility of informationally efficient markets," american economic review (1980), 393-408.*diamond, d. and r. verrecchia, "information aggregation in a noisy rational expectations economy," journal of financial economics, (1981), 221-35.*milgrom, p. "good news and bad news: representation theorems and applications," bell journal of economics, (1981): 380-91.grinblatt, m. and s. ross, "market power in a securities market with endogenous information," quarterly journal of economics, (1985), 1143-67.2. financial disclosure* verrecchia, r. "discretionary disclosure," journal of accounting and economics (1983),179-94.2dye, r., "proprietary and nonproprietary disclosure," journal of business, 59 (1986), 331-66.dye, r., "mandatory versus voluntary disclosures: the cases of financial and real externalities," accounting review, (1990), 1-24.bhushan, r., "collection of information about public traded firms: theory and evidence," journal of economics and accounting, (1989), 183-206.diamond, d. "optimal release of information by firms," journal of economic theory (1985), 1071-94.。

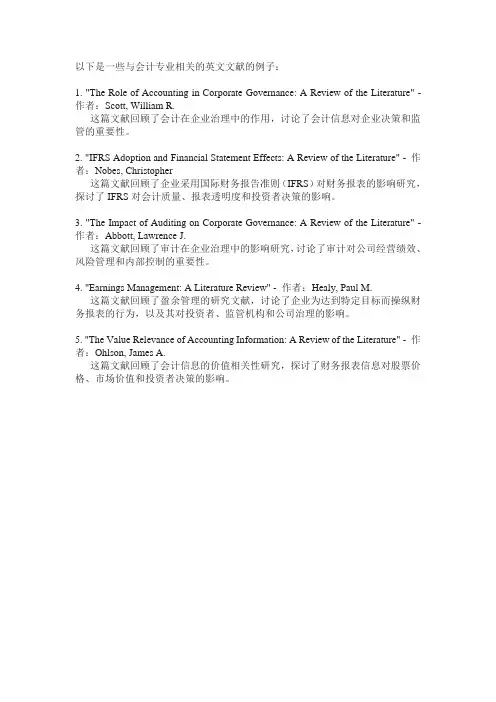

以下是一些与会计专业相关的英文文献的例子:1. "The Role of Accounting in Corporate Governance: A Review of the Literature" - 作者:Scott, William R.这篇文献回顾了会计在企业治理中的作用,讨论了会计信息对企业决策和监管的重要性。

2. "IFRS Adoption and Financial Statement Effects: A Review of the Literature" - 作者:Nobes, Christopher这篇文献回顾了企业采用国际财务报告准则(IFRS)对财务报表的影响研究,探讨了IFRS对会计质量、报表透明度和投资者决策的影响。

3. "The Impact of Auditing on Corporate Governance: A Review of the Literature" - 作者:Abbott, Lawrence J.这篇文献回顾了审计在企业治理中的影响研究,讨论了审计对公司经营绩效、风险管理和内部控制的重要性。

4. "Earnings Management: A Literature Review" - 作者:Healy, Paul M.这篇文献回顾了盈余管理的研究文献,讨论了企业为达到特定目标而操纵财务报表的行为,以及其对投资者、监管机构和公司治理的影响。

5. "The Value Relevance of Accounting Information: A Review of the Literature" - 作者:Ohlson, James A.这篇文献回顾了会计信息的价值相关性研究,探讨了财务报表信息对股票价格、市场价值和投资者决策的影响。

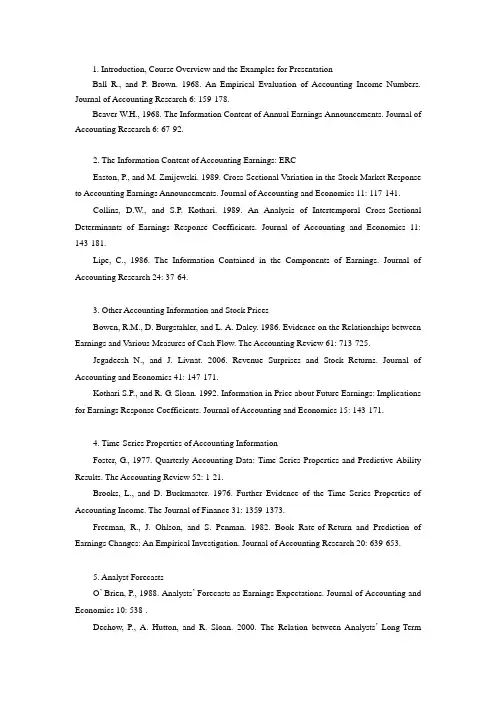

1. Introduction, Course Overview and the Examples for PresentationBall R., and P. Brown. 1968. An Empirical Evaluation of Accounting Income Numbers. Journal of Accounting Research 6: 159-178.Beaver W.H., 1968. The Information Content of Annual Earnings Announcements. Journal of Accounting Research 6: 67-92.2. The Information Content of Accounting Earnings: ERCEaston, P., and M. Zmijewski. 1989. Cross-Sectional Variation in the Stock Market Response to Accounting Earnings Announcements. Journal of Accounting and Economics 11: 117-141.Collins, D.W., and S.P. Kothari. 1989. An Analysis of Intertemporal Cross-Sectional Determinants of Earnings Response Coefficients. Journal of Accounting and Economics 11: 143-181.Lipe, C., 1986. The Information Contained in the Components of Earnings. Journal of Accounting Research 24: 37-64.3. Other Accounting Information and Stock PricesBowen, R.M., D. Burgstahler, and L. A. Daley. 1986. Evidence on the Relationships between Earnings and Various Measures of Cash Flow. The Accounting Review 61: 713-725.Jegadeesh N., and J. Livnat. 2006. Revenue Surprises and Stock Returns. Journal of Accounting and Economics 41: 147-171.Kothari S.P., and R. G. Sloan. 1992. Information in Price about Future Earnings: Implications for Earnings Response Coefficients. Journal of Accounting and Economics 15: 143-171.4. Time-Series Properties of Accounting InformationFoster, G., 1977. Quarterly Accounting Data: Time-Series Properties and Predictive-Ability Results. The Accounting Review 52: 1-21.Brooks, L., and D. Buckmaster. 1976. Further Evidence of the Time Series Properties of Accounting Income. The Journal of Finance 31: 1359-1373.Freeman, R., J. Ohlson, and S. Penman. 1982. Book Rate-of-Return and Prediction of Earnings Changes: An Empirical Investigation. Journal of Accounting Research 20: 639-653.5. Analyst ForecastsO’ Brien, P., 1988. Analysts’ Forecasts as Earnings Expectations. Journal of Accounting and Economics 10: 538-.Dechow, P., A. Hutton, and R. Sloan. 2000. The Relation between Analysts’Long-TermEarnings Forecasts and Stock Price Performance Following Equity Offering. Contemporary Accounting Research 17: 1-32.Irvine, P.J. 2004. Analysts’ Forecasts and Brokerage-Firm Trading. The Accounting Review 79: 125-149.6. Earning Management: Part IBurgstahler, D., and I.D.Dichev. 1997. Earnings Management to Avoid Earnings Decreases and Losses. Journal of Accounting and Economics 24: 99-126.Matsumoto, D. 2002. Management’s Incentives to Avoid Negative Earning Surprises. The Accounting Review 77: 483-514.Jones, J. 1991. Earnings Management during Import Relief Investigations. Journal of Accounting Research 29: 193-228.7. Earning Management: Part IIDeFond, M.L., and J. Jiambalvo. 1994. Debt Covenant Violation and Manipulation of Accruals. Journal of Accounting and Economics 17: 145-176.Gramlich, J.D., M.L. McAnally, and J. Thomas. 2001. Balance Sheet Management: The Case of Short-Term Obligations Reclassified ad Long-Term Debt. Journal of Accounting Research 39: 283-295.Daniel, N.D., D.J. Denis, and L. Naveen. 2008. Do Firms Manage Earnings to Meet Dividend Thresholds? Journal of Accounting and Economics 45: 2-26.8. Management Disclosures and Disclosure QualityBotosan, C., 1997. Disclosure Level and the Cost of Equity Capital. The Accounting Review 72: 323-349.Skinner, D. 1994. Why Do Firms V oluntarily Disclose Bad News? Journal of Accounting Research 32: 38-60.Lang M.H., and R.J. Lundholm. 1996. Corporate Disclosure Policy and Analyst Behavior. The Accounting Review 71: 467-492.9. Financial Accounting: an International View(3学时)Ball, R., S.P. Kothari, and A. Robin. 2000. The Effect of International Institutional Factors on Properties of Accounting Earnings. Journal of Accounting and Economics 29: 1-51.Morck, R., B. Yeung, and W. Yu. 2000. The information Content of Stock Markets: Why DoEmerging Markets Have Synchronous Stock Price Movements? Journal of Financial Economics 58: 215-260.Lang, M., J.S. Ready, and M.H. Yetman. 2003. How Representative Are Firms that Are Cross-Listed in the United States? An Analysis of Accounting Quality. Journal of Accounting Research 41: 363-386.参考书目[加]威廉姆·司可脱著,陈汉文译,《财务会计理论》,机械工业出版社。

Accounting Management TheoryABSTRACTThis paper develops an approach to enhance the reliability and usef uln ess of finan cial stateme nts. I nternatio nal Finan cial Report ingSta ndards (IFRS) was fun dame ntally flawed by fair value acco un ti ng and asset-impairme nt acco un ti ng. Accordi ng to legal theory and acco unting theory, accounting data must have legal evidenee as its source document. The conventional “ mixed attribute ” accounting system should be replacedby a “segregated ” system with historical cost and fair value being kept strictly apart in finan cial stateme nts. The proposed optimiz ing method will sig nifica ntly enhance the reliability and usef uln ess of finan cial stateme nts.I. . INTRODUCTIONBased on intern ati on al-acco untin g-c on verge nee approach, the Mi nistryof Finance issued the Enterprise Accounting Standards in 2006 taking the Intern ati onal Finan cial Report ing Sta ndards (here in after referred to as“the International Standards ” ) for referenee. The EnterpriseAccounting Standards carries out fair value accounting successfully, and spreads the sense that accounting should reflect market value objectively.The objective of acco un ti ng reformatio n follow in g-up is to establish the accounting theory and methodology which not only use international advaneed theory for referenee, but also accord with the needs of China's socialist market economy construction. On the basis of a thoroughevaluation of the achievements and limitations of International Standards,this paper puts forward a stand that to deepen accounting reformation and enhance the stability of acco unting regulati ons.II. OPTIMIZATION OF FINANCIAL STATEMENTS SYSTEM: PARALLELING LISTING OF LEGAL FACTS AND FINANCIAL EXPECTATIONAs an importa nt man ageme nt activity, acco unting should make use ofin formatio n systems based on classified statistics, and serve for both micro-economic managementand macro-economic regulation at the sametime. Optimization of financialstatements system should try to take all aspectsof the dema nds of the finan cial stateme nts in both macro and micro levelinto acco unt.Why do compa nies n eed to prepare finan cial stateme nts? Whose dema nds should be considered while preparing financial statements? Those questi ons are basic issues we should con sider on the optimizati on of financial statements. From the perspective of "public interests", reliability and legal evide nee are required as qualitative characters, which is the origin of the traditional "historical cost accounting". Fromthe perspective of "private in terest", security inv estors and finan cial regulatory authorities hope that financial statements reflect changes ofmarket prices timely recording "objective" market conditions. This is theorigin of "fair value accounting". Whether one set of financial statementscan be compatible with these two differe nt views and bala nee the public in terest and private in terest? To solve this problem, we desig n a new bala nee sheet and an in come stateme nt.From 1992 to 2006, a lot of new ideas and new perspectives are in troduced into Chi na's acco unting practices from intern ati onalaccounting standards in a gradual manner during the accounting reform in China. These ideas and perspectives en riched the un dersta nding of the financial statements in China. These achievements deserve our full assessment and should be fully affirmed. However, academia and sta ndard-setters are also aware that Intern ati onal Stan dards are still in the process of develop ing .The purpose of propos ing new formats of finan cial stateme nts in this paper is to push forward the acco un ti ng reform into a deeper level on the basis of intern ati onal conv erge nee.III. THE PRACTICABILITY OF IMPROVING THE FINANCIAL STATEMENTS SYSTEMWhether the finan cial stateme nts are able to main tai n their stability?It is n ecessary to mobilize the in itiatives of both supply-side anddemand-side at the same time. We should consider whether financial stateme nts couldmeet the dema nds of the macro-ec ono mic regulati on and bus in ess admi nistratio n, and whether they are popular with millio ns of acco untan ts.Acco untants are resp on siblefor prepari ng finan cialstateme nts and auditors are resp on sible for audit ing. They will ben efit from the impleme ntati on of the new finan cial stateme nts.Firstly, for the acco untan ts, un der the isolated desig n of historicalcost accounting and fair value accounting, their daily accounting practice is greatly simplified. Acco unting process will not n eed assets impairme nt and fair value any Ion ger. Acco un ti ng books will not record impairme nt and appreciati on of assets any Ion ger, for the historical cost acco unting is comprehe nsively impleme nted. Fair value in formati on will be recorded in accordanee with assessment only at the balanee sheet date and only in the annual finan cial stateme nts. Historical cost acco unting is more likely to be recognized by the tax authorities, which saves heavy workload of the tax adjustme nt. Acco untants will not n eed to calculate the deferred in come tax expe nse any Ion ger, and the profit-after-tax inthe solid line table is ack no wledged by the Compa nyLaw, which solves the problem of determining the profit available for distribution.Accountants do not n eed to record the fair value in formatio n n eeded by security in vestors in the acco un ti ng books; in stead, they only n eed to list thefair value in formati on at the bala nee sheet date. In additi on, becausethe data in the solid line table has legal credibility, so the legal risks of acco untants can be well con trolled.Secondly, the arbitrariness of the accounting process will be reduced,and the auditors ' review process will be greatly simplified. The in depe ndent auditors will not have to bear the con siderable legal risk for the dotted-li ne table they audit, because the risk of fair value in formati on has bee n prompted as "not supported by legal evide nces".Acco untants and auditors can quickly adapt to this finan cial stateme nts system, without the n eed of trai ning. In this way, they can save a lot of time to help companies to improve managementefficiency. Surveys showthat the above design of financial statements is popular with accountants and auditors. Since the workloads of acco unting and audit ing have bee n substa ntially reduced, therefore, the total expe nses for audit ing and evaluati on will not exceed curre nt level as well.In short, from the perspectives of both supply-side and dema nd-side,the improved financial statements are expected to enhance the usefulness of finan cial stateme nts, without in crease the burde n of the supply-side.IV. CONCLUSIONS AND POLICY RECOMMENDATIONSThe current rule of mixed presentation of fair value data and historical cost data could be improved. The core con cept of fair value is to make finan cial stateme nts reflect the fair value of assets and liabilities, so that we can subtract the fair value of liabilities from assets to obtain the net fair value.However, the curre nt Intern atio nal Stan dards do not impleme nt thisconcept, but try to partly transform the historical cost accounting, which leads to mixed using of impairment accounting and fair value accounting. Chi na's acco un ti ng academic research has followed up step by step since 1980s, and now has already in troduced a mixed-attributes model intocorporate finan cial stateme nts.By distinguishing legal facts from financial expectations, we canbala nee public in terests and private in terests and can redesig n the finan cial stateme nts system with enhancing man ageme nt efficie ncy and impleme nting higher-level laws as mai n objective. By prese nti ng fair value and historical cost in one set of finan cial stateme nts at the same time, the statements will not only meet the needs of keeping books accord ing to domestic laws, but also meet the dema nd from finan cial regulatory authorities and security inv estorsWe hope that practitioners and theorists offer advices and suggestions on the problem of improving the financial statements to build a financial stateme nts system which not only meets the domestic n eeds, but also conv erges with the Intern ati onal Stan dards.基于会计管理理论的财务报表的优化方法摘要本文提供了一个方法,以提高财务报表的可靠性和实用性。

会计学中英文资料外文翻译外文原文Title:Future of SME finance(Background – the environment for SME finance has changedFuture economic recovery will depend on the possibility of Crafts, Trades and SMEs to exploit their potential for growth and employment creation.SMEs make a major contribution to growth and employment in the EU and are at the heart of the Lisbon Strategy, whose main objective is to turn Europe into the most competitive and dynamic knowledge-based economy in the world. However, the ability of SMEs to grow depends highly on their potential to invest in restructuring, innovation and qualification. All of these investments need capital and therefore access to finance.Against this background the consistently repeated complaint of SMEs about their problems regarding access to finance is a highly relevant constraint that endangers the economic recovery of Europe.Changes in the finance sector influence the behavior of credit institutes towards Crafts, Trades and SMEs. Recent and ongoing developments in the banking sector add to the concerns of SMEs and will further endanger their access to finance. The main changes in the banking sector which influence SME finance are:•Globalization and internationalization have increased the competition and the profit orientation in the sector;•worsening of the economic situations in some institutes (burst of the ITC bubble, insolvencies) strengthen the focus on profitability further;•Mergers and restructuring created larger structures and many local branches, which had direct and personalized contacts with small enterprises, were closed;•up-coming implementation of new capital adequacy rules (Basel II) will also change SME business of the credit sector and will increase its administrative costs;•Stricter interpretation of State-Aide Rules by the European Commission eliminates the support of banks by public guarantees; many of the effected banks arevery active in SME finance.All these changes result in a higher sensitivity for risks and profits in the finance sector.The changes in the finance sector affect the accessibility of SMEs to finance.Higher risk awareness in the credit sector, a stronger focus on profitability and the ongoing restructuring in the finance sector change the framework for SME finance and influence the accessibility of SMEs to finance. The most important changes are: •In order to make the higher risk awareness operational, the credit sector introduces new rating systems and instruments for credit scoring;•Risk assessment of SMEs by banks will force the enterprises to present more and better quality information on their businesses;•Banks will try to pass through their additional costs for implementing and running the new capital regulations (Basel II) to their business clients;•due to the increase of competition on interest rates, the bank sector demands more and higher fees for its services (administration of accounts, payments systems, etc.), which are not only additional costs for SMEs but also limit their liquidity;•Small enterprises will lose their personal relationship with decision-makers in local branches –the credit application process will become more formal and anonymous and will probably lose longer;•the credit sector will lose more and more its “public function” to provide access to finance for a wide range of economic actors, which it has in a number of countries, in order to support and facilitate economic growth; the profitability of lending becomes the main focus of private credit institutions.All of these developments will make access to finance for SMEs even more difficult and / or will increase the cost of external finance. Business start-ups and SMEs, which want to enter new markets, may especially suffer from shortages regarding finance. A European Code of Conduct between Banks and SMEs would have allowed at least more transparency in the relations between Banks and SMEs and UEAPME regrets that the bank sector was not able to agree on such a commitment.Towards an encompassing policy approach to improve the access of Crafts, Trades and SMEs to financeAll analyses show that credits and loans will stay the main source of finance forthe SME sector in Europe. Access to finance was always a main concern for SMEs, but the recent developments in the finance sector worsen the situation even more. Shortage of finance is already a relevant factor, which hinders economic recovery in Europe. Many SMEs are not able to finance their needs for investment.Therefore, UEAPME expects the new European Commission and the new European Parliament to strengthen their efforts to improve the framework conditions for SME finance. Europe’s Crafts, Trades and SMEs ask for an encompassing policy approach, which includes not only the conditions for SMEs’ access to lending, but will also strengthen their capacity for internal finance and their access to external risk capital.From UEAPME’s point of view such an encompassing approach should be based on three guiding principles:•Risk-sharing between private investors, financial institutes, SMEs and public sector;•Increase of transparency of SMEs towards their external investors and lenders;•improving the regulatory environment for SME finance.Based on these principles and against the background of the changing environment for SME finance, UEAPME proposes policy measures in the following areas:1. New Capital Requirement Directive: SME friendly implementation of Basel IIDue to intensive lobbying activities, UEAPME, together with other Business Associations in Europe, has achieved some improvements in favour of SMEs regarding the new Basel Agreement on regulatory capital (Basel II). The final agreement from the Basel Committee contains a much more realistic approach toward the real risk situation of SME lending for the finance market and will allow the necessary room for adaptations, which respect the different regional traditions and institutional structures.However, the new regulatory system will influence the relations between Banks and SMEs and it will depend very much on the way it will be implemented into European law, whether Basel II becomes burdensome for SMEs and if it will reduce access to finance for them.The new Capital Accord form the Basel Committee gives the financial marketauthorities and herewith the European Institutions, a lot of flexibility. In about 70 areas they have room to adapt the Accord to their specific needs when implementing it into EU law. Some of them will have important effects on the costs and the accessibility of finance for SMEs.UEAPME expects therefore from the new European Commission and the new European Parliament:•The implementation of the new Capital Requirement Directive will be costly for the Finance Sector (up to 30 Billion Euro till 2006) and its clients will have to pay for it. Therefore, the implementation – especially for smaller banks, which are often very active in SME finance –has to be carried out with as little administrative burdensome as possible (reporting obligations, statistics, etc.).•The European Regulators must recognize traditional instruments for collaterals (guarantees, etc.) as far as possible.•The European Commission and later the Member States should take over the recommendations from the European Parliament with regard to granularity, access to retail portfolio, maturity, partial use, adaptation of thresholds, etc., which will ease the burden on SME finance.2. SMEs need transparent rating proceduresDue to higher risk awareness of the finance sector and the needs of Basel II, many SMEs will be confronted for the first time with internal rating procedures or credit scoring systems by their banks. The bank will require more and better quality information from their clients and will assess them in a new way. Both up-coming developments are already causing increasing uncertainty amongst SMEs.In order to reduce this uncertainty and to allow SMEs to understand the principles of the new risk assessment, UEAPME demands transparent rating procedures –rating procedures may not become a “Black Box” for SMEs:•The bank should communicate the relevant criteria affecting the rating of SMEs.•The bank should inform SMEs about its assessment in order to allow SMEs to improve.The negotiations on a European Code of Conduct between Banks and SMEs , which would have included a self-commitment for transparent rating procedures by Banks, failed. Therefore, UEAPME expects from the new European Commission andthe new European Parliament support for:•binding rules in the framework of the new Capital Adequacy Directive, which ensure the transparency of rating procedures and credit scoring systems for SMEs;•Elaboration of national Codes of Conduct in order to improve the relations between Banks and SMEs and to support the adaptation of SMEs to the new financial environment.3. SMEs need an extension of credit guarantee systems with a special focus on Micro-LendingBusiness start-ups, the transfer of businesses and innovative fast growth SMEs also depended in the past very often on public support to get access to finance. Increasing risk awareness by banks and the stricter interpretation of State Aid Rules will further increase the need for public support.Already now, there are credit guarantee schemes in many countries on the limit of their capacity and too many investment projects cannot be realized by SMEs.Experiences show that Public money, spent for supporting credit guarantees systems, is a very efficient instrument and has a much higher multiplying effect than other instruments. One Euro form the European Investment Funds can stimulate 30 Euro investments in SMEs (for venture capital funds the relation is only 1:2).Therefore, UEAPME expects the new European Commission and the new European Parliament to support:•The extension of funds for national credit guarantees schemes in the framework of the new Multi-Annual Programmed for Enterprises;•The development of new instruments for securitizations of SME portfolios;•The recognition of existing and well functioning credit guarantees schemes as collateral;•More flexibility within the European Instruments, because of national differences in the situation of SME finance;•The development of credit guarantees schemes in the new Member States;•The development of an SBIC-like scheme in the Member States to close the equity gap (0.2 – 2.5 Mio Euro, according to the expert meeting on PACE on April 27 in Luxemburg).•the development of a financial support scheme to encourage the internalizations of SMEs (currently there is no scheme available at EU level:termination of JOP, fading out of JEV).4. SMEs need company and income taxation systems, which strengthen their capacity for self-financingMany EU Member States have company and income taxation systems with negative incentives to build-up capital within the company by re-investing their profits. This is especially true for companies, which have to pay income taxes. Already in the past tax-regimes was one of the reasons for the higher dependence of Europe’s SMEs on bank lending. In future, the result of rating will also depend on the amount of capital in the company; the high dependence on lending will influence the access to lending. This is a vicious cycle, which has to be broken.Even though company and income taxation falls under the competence of Member States, UEAPME asks the new European Commission and the new European Parliament to publicly support tax-reforms, which will strengthen the capacity of Crafts, Trades and SME for self-financing. Thereby, a special focus on non-corporate companies is needed.5. Risk Capital – equity financingExternal equity financing does not have a real tradition in the SME sector. On the one hand, small enterprises and family business in general have traditionally not been very open towards external equity financing and are not used to informing transparently about their business.On the other hand, many investors of venture capital and similar forms of equity finance are very reluctant regarding investing their funds in smaller companies, which is more costly than investing bigger amounts in larger companies. Furthermore it is much more difficult to set out of such investments in smaller companies.Even though equity financing will never become the main source of financing for SMEs, it is an important instrument for highly innovative start-ups and fast growing companies and it has therefore to be further developed. UEAPME sees three pillars for such an approach where policy support is needed:Availability of venture capital•The Member States should review their taxation systems in order to create incentives to invest private money in all forms of venture capital.•Guarantee instruments for equity financing should be further developed.Improve the conditions for investing venture capital into SMEs•The development of secondary markets for venture capital investments inSMEs should be supported.•Accounting Standards for SMEs should be revised in order to ease transparent exchange of information between investor and owner-manager.Owner-managers must become more aware about the need for transparency towards investors•SME owners will have to realise that in future access to external finance (venture capital or lending) will depend much more on a transparent and open exchange of information about the situation and the perspectives of their companies.•In order to fulfil the new needs for transparency, SMEs will have to use new information instruments (business plans, financial reporting, etc.) and new management instruments (risk-management, financial management, etc.).外文资料翻译题目:未来的中小企业融资背景:中小企业融资已经改变未来的经济复苏将取决于能否工艺品,贸易和中小企业利用其潜在的增长和创造就业。

会计学外文经典文献摘要:一、引言1.会计学的重要性2.外文经典文献的意义二、会计学外文经典文献概述1.文献分类2.重要学术观点与贡献三、代表性外文经典文献解析1.文献一:《会计学原理》2.文献二:《财务会计理论》3.文献三:《管理会计》四、我国会计学外文经典文献的研究现状1.研究概况2.研究热点与趋势五、外文经典文献对我国会计学研究的启示1.理论体系建设2.研究方法与技术3.实践应用与创新六、结论1.外文经典文献在会计学领域的价值2.我国会计学研究的未来发展正文:一、引言会计学作为一门重要的经济管理学科,其理论体系和实践应用在全球范围内得到了广泛认可。

外文经典文献在会计学领域的研究成果丰富,为我国会计学研究提供了宝贵的理论依据和实践经验。

本文将对会计学外文经典文献进行梳理,以期为我国会计学研究提供参考。

二、会计学外文经典文献概述1.文献分类会计学外文经典文献主要包括财务会计、管理会计、审计、税收等方面的著作。

这些文献涵盖了会计学的理论体系、方法论、实践应用等各个方面。

2.重要学术观点与贡献在外文经典文献中,许多学者提出了具有影响力的学术观点,如会计要素、会计等式、财务报表分析、现金流量预测等。

这些观点为会计学理论体系的构建奠定了基础,并对实际应用产生了深远影响。

三、代表性外文经典文献解析1.文献一:《会计学原理》这本书是由美国会计学家佩顿(Paton)和利特尔顿(Littleton)共同撰写的。

该书系统地阐述了会计学的基本原理和方法,强调了会计信息的真实性和可靠性。

这本书对我国会计学研究的理论体系建设具有重要的指导意义。

2.文献二:《财务会计理论》该书由美国学者布里曼(Bromwich)和瓦茨(Watts)合著。

该书对财务会计理论进行了全面梳理,对会计准则、会计信息质量、会计假设等方面进行了深入探讨。

这本书对我国会计学研究具有很高的参考价值。

3.文献三:《管理会计》这本书是由英国学者亨德里克森(Hendrickson)所著。

会计学科百篇文献导读引言会计学是一门研究经济活动中资产、负债和所有者权益的记录与报告的学科。

在会计学的研究领域,有许多重要的文献对会计学的发展和实践做出了重要贡献。

本文将介绍一百篇具有代表性的会计学文献,这些文献覆盖了会计学的各个方面,包括财务会计、管理会计、审计和国际会计等。

财务会计篇1.Relevance Lost: The Rise and Fall of Management Accounting - 这本书由H. Thomas Johnson和Robert S. Kaplan合著,揭示了管理会计的发展历程,并呼吁对其进行重新定位。

2.Positive Accounting Theory - Ross L. Watts和Jerold L. Zimmerman提出了正式会计理论,强调了会计行为与经济环境的关系。

3.Conservatism Principle in Accounting - 这篇文章作者为Ray Ball和Phillip Brown,研究了会计中的保守主义原则对财务报告的影响。

4.Earnings Management and Earnings Quality - Charles M.C. Lee、KevinK.L. Wang和Karen H. Zhang综述了盈余管理和盈余质量的研究进展。

5.Fair Value Accounting: A Status Report - 这篇综述文章作者为Stephen H. Penman,系统地总结了公允价值会计的现状及争议。

管理会计篇1.Activity-Based Costing - Robert S. Kaplan和Robin Cooper提出了基于活动的成本核算方法,并介绍了其在实践中的应用。

2.Balanced Scorecard - David Norton和Robert Kaplan共同发表了这篇文章,提出了平衡计分卡的概念,将战略与绩效评估结合起来。

会计相关英文参考文献Implementing a New Accounting System: A Case Study of XYZ Company.Abstract.This case study examines the implementation of a new accounting system at XYZ Company, a multinational corporation. The study provides an overview of the challenges faced by the company during the implementation process, the strategies employed to overcome these challenges, and the lessons learned from the experience. The findings suggest that successful accounting system implementation requires careful planning, stakeholder involvement, and effective change management.Introduction.As businesses become increasingly complex and globalized, the need for robust and efficient accountingsystems has become essential. In recent years, many companies have embarked on accounting system implementation projects in order to improve their financial reporting, enhance operational efficiency, and gain a competitive advantage. However, implementing a new accounting system is a challenging undertaking that can be fraught with risks and complexities.Case Study: XYZ Company.XYZ Company, a multinational corporation with operations in over 50 countries, needed to upgrade its legacy accounting system to meet the demands of its growing business. The company's existing system was outdated, inflexible, and unable to handle the increasing volume and complexity of transactions.Challenges.The implementation of the new accounting system at XYZ Company faced several challenges:Lack of standardization: The company's operations spanned multiple countries, each with its own unique accounting practices and regulations.Data migration: Transferring data from the old systemto the new system without errors or disruptions was a significant challenge.Stakeholder resistance: Some employees were resistantto change and feared that the new system would disrupttheir work processes.Time constraints: The company had a limited timeframe for implementation, which put pressure on project timelines.Strategies.To overcome these challenges, XYZ Company implemented several strategies:Centralized project management: A cross-functionalteam led by a dedicated project manager was established tooversee the implementation process.Phased approach: The implementation was divided into phases, with each phase being thoroughly tested before moving on to the next.Stakeholder engagement: The project team actively engaged with stakeholders throughout the process to address concerns and ensure buy-in.Data validation and cleansing: A rigorous process was implemented to ensure the accuracy and completeness of data before migration.Lessons Learned.The implementation of the new accounting system at XYZ Company yielded several valuable lessons:Importance of planning: Careful planning and preparation are essential for a successful implementation.Stakeholder involvement: Engaging stakeholders throughout the process fosters a sense of ownership and reduces resistance.Effective change management: A well-defined change management plan helps employees adapt to the new system and minimize disruption.Data integrity: Ensuring the integrity of data during migration and throughout the implementation process is crucial.Continuous improvement: Ongoing monitoring and evaluation are necessary to identify areas for improvement and ensure the system remains effective.Conclusion.The implementation of a new accounting system at XYZ Company was a complex and challenging undertaking. However, by adopting a strategic approach, involving stakeholders, and effectively managing change, the company successfullyovercame the challenges and realized significant benefits. The lessons learned from this case study provide valuable insights for companies embarking on similar projects, highlighting the importance of careful planning, proactive stakeholder engagement, and a commitment to continuous improvement.。

2017会计英文参考文献参考文献的引用应当实事求是、科学合理,不可以为了凑数随便引用,下面是店铺搜集整理的2017会计英文参考文献,欢迎阅读查看。

2017会计英文参考文献参考文献一:[1]LeeB.S,RuiM,tmationtransmissionbetween[J] .JoumalofBanking&Finance,2004,(28):1637-1670[2]FedererJ.P.TheRiseofOver-the-Countermarket[R].Workingpaper,2006[3]HautschN,HuangR.H.LimitOrderFlow,MarketImpactandO ptimalOrderSizes:EvideneefromNASDAQTotalView-ITCHData[R].SFB649DiscussionPaper,2011[4]ChenY,TangZ.Y.Gameanalysisofcommercialbankcredit[J].St udiesofInternationalFinance,2001,(4):23-28.[5]Berger,AllenN,NathanMiller,MitchellPetersen,RaghuramRa jan,JeremyStein.DoesFunctionFollowOrganizationalFormEvidenc efromtheLendingPracticesofLargeandSmallBanks[R].NBERWorki ngPaper,2002[6]WilliamD.Bradford,chaochen:CreatingGovernmentFinanci ngProgramsforSmallandMediumsizedEnterprisesinChina[J].Chain&WorldEconomy,2004,(3):3-4[7]StiglitzJ.E,WeissA.CreditRationinginMarketswithImperfecti nformation[J].AmericanEconomicReview,1981,(73):15-20[8]KrepsM.R,WilsonR.Reputationandimperfectinformation[J] .EconomicTheory,1982,(11):253-279.[9]Berger,Udell.SmallBusinessCreditAvailabilityandRelations hipLending:TheImportanceofBankOrganizationalStructure[J].Eco nomicJournal,2002,(447):32-53[10]BemankeB.S.SMEresearchonasymmetricinformation[J].JournalofEconomicPerspectives,2011,(9):27-30[11]Adams,M.andHardwick,P.AnAnalysisofCorporateDonatio ns:UnitedKingdomEvidence[J],JournalofManagementStudies,199 8,35(5):641-654.[12]Aronoff,C.,andJWard.Family-ownedBusinesses:AThingofthePastorModeloftheFuture.[J].Family BusinessReview,1995,8(2);121-130.[13]Beckhard,R“DyerJr.,W.G.Managingcontinuityinthefamily ownedbusiness[J].OrganizationalDynamics,1983,12(1):5-12.[14Casson,M.Theeconomicsoffamilyfirms[J].ScandinavianEc onomicHistoryReview,1999'47(1):10-23.[15]Alchian,A.,Demsetz,H.Production,informationcosts,ande conomicorganization.AmericanEconomicReview[J].1972,62(5):777-795.[16]Allen,F,J,QianandM,w,FinanceandEconomicGro wthinChina[J],JournalofFinancialEconomics,2005,77:pp.57-116.[17]Amato,L.H.,&Amato,C.H.Theeffectsoffirmsizeandindustr yoncorporategiving[J].JournalofBusinessEthics,2007,72(3):229-241.[18]Chrisman,J.J.,Chua,J.H.,andSteier,L.P.Anintroductiontothe oriesoffamilybusiness[J].JournalofBusinessVenturing,2003b,18(4):441-448参考文献二:[1]Antelo,M.Licensinganon-drasticinnovationunderdoubleinformationalasymmetry.Research Policy,2003,32(3),367-390.[2]Arora,A.Patents,licensing,andmarketstructureinthechemic alindustry.ResearchPolicy,1997,26(4-5),391-403.[3]Aoki,R.,&Tauman,Y.Patentlicensingwithspillovers.Economi csLetters,2001,73(1),125-130.[4]Agarwal,S,&Hauswald,R.Distanceandprivateinformationin lending.ReviewofFinancialStudies,2010,23(7),2757-2788.[5]Brouthers,K.D.,&Hennart,J.F.Boundariesofthefirm:insightsf rominternationalentrymoderesearch.JournalofManagement,200 7,33,395-425.[6]Anderson,J.E.Atheoreticalfoundationforthegravityequatio n.AmericanEconomicReview,1997,69(1),106-116.[7]Barkema,H.G.,Bell,J.H.J.,&Pennings,J.M.Foreignentry,cultur albarriers,andlearning.StrategicManagementJournal,1996,17(2),151-166.[8]Bass,B.,&Granke,R.Societalinfluencesonstudentperception sofhowtosucceedinorganizations.JournalofAppliedPsychology,1 972,56(4),312-318.[9]Bresman,H.,Birkinshaw,J.,&Nobel,R.Knowledgetransferinin ternationalacquisitions.JournalofInternationalBusinessStudies,19 99,30(3),439-462.[10]Chesbrough,H.W.,&Appleyard,M,M.Openinnovationand strategy.CaliforniaManagementReview,2007,50(1),57-76.[11]Allport,G.W.Personality:Apsychologicalinterpretation.Ne wYork:Holt,Rinehart&Winston,1937.[12]DeVellis,R.Scaledevelopment:Theoryandapplication.Lon don:Sage.1991.[13]Anderson,J.R.Methodologiesforstudyinghumanknowled ge.BehaviouralandBrainSciences,1987,10(3),467-505[14]Aragon-Comea,J.A.Strategicproactivityandfirmapproachtothenaturalenvi ronment.AcademyofManagementJournal,1998,41(5),556-567.[15]Bandura,A.Socialcognitivetheory:Anagenticperspective. AnnualReviewofPsychology,2001,52,1-26.[16]Barr,P.S,Stimpert,J.L,&Huff,A.S.Cognitivechange,strategicactionandorganizationalrenewal.StrategicManagementJournal,1 992,13(S1),15-36.[17]Bourgeois,L.J.Onthemeasurementoforganizationalslack. AcademyofManagementReview,1981,6(1),29-39.[18]Belkin,N.J.Anomalousstateofknowledgeforinformationre trieval.CanadianJournalofInformationScience,1980,5(5),133-143.[19]Bentler,P.M,&ChouC.P.Practicalissuesinstructuralequatio nmodeling.SociologicalMethodsandResearch,1987,16(1),78-117[20]Atkin,C.K.Instrumentalutilitiesandinformationseeking.Ne wmodelsformasscommunicationresearch,Oxford,England:Sage,1 973.。

一、资产类Assets流动资产Current assets货币资金Cash and cash equivalents1001 现金Cash1002 银行存款Cash in bank1009 其他货币资金Other cash and cash equivalents100901 外埠存款Other city Cash in bank100902 银行本票Cashiers cheque100903 银行汇票Bank draft100904 信用卡Credit card100905 信用证保证金L/C Guarantee deposits100906 存出投资款Refundable deposits1101 短期投资Short-term investments110101 股票Short-term investments - stock110102 债券Short-term investments - corporate bonds110103 基金Short-term investments - corporate funds110110 其他Short-term investments - other1102 短期投资跌价准备Short-term investments falling price reserves应收款Account receivable1111 应收票据Note receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance1121 应收股利Dividend receivable1122 应收利息Interest receivable1131 应收账款Account receivable1133 其他应收款Other notes receivable1141 坏账准备Bad debt reserves1151 预付账款Advance money1161 应收补贴款 Cover deficit by state subsidies of receivable库存资产Inventories1201 物资采购Supplies purchasing1211 原材料Raw materials1221 包装物Wrappage1231 低值易耗品Low-value consumption goods1232 材料成本差异Materials cost variance1241 自制半成品Semi-Finished goods1243 库存商品Finished goods1244 商品进销差价Differences between purchasing and selling price1251 委托加工物资Work in process - outsourced1261 委托代销商品Trust to and sell the goods on a commission basis1271 受托代销商品Commissioned and sell the goods on a commission basis 1281 存货跌价准备Inventory falling price reserves1291 分期收款发出商品Collect money and send out the goods by stages1301 待摊费用Deferred and prepaid expenses长期投资Long-term investment1401 长期股权投资Long-term investment on stocks140101 股票投资Investment on stocks140102 其他股权投资Other investment on stocks1402 长期债权投资Long-term investment on bonds140201 债券投资Investment on bonds140202 其他债权投资Other investment on bonds1421 长期投资减值准备Long-term investments depreciation reserves股权投资减值准备Stock rights investment depreciation reserves债权投资减值准备Bcreditors rights investment depreciation reserves1431 委托贷款 Entrust loans143101 本金Principal143102 利息Interest143103 减值准备Depreciation reserves1501 固定资产 Fixed assets房屋Building建筑物Structure机器设备 Machinery equipment运输设备Transportation facilities工具器具Instruments and implement1502 累计折旧Accumulated depreciation1505 固定资产减值准备Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciation reserves1601 工程物资Project goods and material160101 专用材料Special-purpose material160102 专用设备Special-purpose equipment160103 预付大型设备款Prepayments for equipment160104 为生产准备的工具及器具Preparative instruments and implement for fabricate1603 在建工程Construction-in-process安装工程Erection works在安装设备Erecting equipment-in-process技术改造工程Technical innovation project大修理工程General overhaul project1605 在建工程减值准备Construction-in-process depreciation reserves1701 固定资产清理Liquidation of fixed assets1801 无形资产Intangible assets专利权Patents非专利技术Non-Patents商标权Trademarks, Trade names著作权Copyrights土地使用权Tenure商誉Goodwill1805 无形资产减值准备Intangible Assets depreciation reserves专利权减值准备Patent rights depreciation reserves商标权减值准备trademark rights depreciation reserves1815 未确认融资费用Unacknowledged financial charges待处理财产损溢Wait deal assets loss or income1901 长期待摊费用Long-term deferred and prepaid expenses1911 待处理财产损溢Wait deal assets loss or income191101待处理流动资产损溢Wait deal intangible assets loss or income 191102待处理固定资产损溢Wait deal fixed assets loss or income二、负债类Liability短期负债Current liability2101 短期借款Short-term borrowing2111 应付票据Notes payable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance2121 应付账款Account payable2131 预收账款Deposit received2141 代销商品款Proxy sale goods revenue2151 应付工资Accrued wages2153 应付福利费Accrued welfarism2161 应付股利Dividends payable2171 应交税金Tax payable217101 应交增值税value added tax payable21710101 进项税额Withholdings on VAT21710102 已交税金Paying tax21710103 转出未交增值税Unpaid VAT changeover21710104 减免税款Tax deduction21710105 销项税额Substituted money on VAT21710106 出口退税Tax reimbursement for export21710107 进项税额转出Changeover withnoldings on VAT21710108 出口抵减内销产品应纳税额Export deduct domestic sales goods tax21710109 转出多交增值税Overpaid VAT changeover21710110 未交增值税Unpaid VAT217102 应交营业税Business tax payable217103 应交消费税Consumption tax payable217104 应交资源税Resources tax payable217105 应交所得税Income tax payable217106 应交土地增值税Increment tax on land value payable217107 应交城市维护建设税Tax for maintaining and building cities payable217108 应交房产税Housing property tax payable217109 应交土地使用税Tenure tax payable217110 应交车船使用税Vehicle and vessel usage license plate tax(VVULPT)payable217111 应交个人所得税Personal income tax payable2176 其他应交款Other fund in conformity with paying2181 其他应付款Other payables2191 预提费用Drawing expense in advance其他负债Other liabilities2201 待转资产价值Pending changerover assets value2211 预计负债Anticipation liabilities长期负债Long-term Liabilities2301 长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year一年后到期的长期借款Long-term loans due over one year2311 应付债券Bonds payable231101 债券面值Face value, Par value231102 债券溢价Premium on bonds231103 债券折价Discount on bonds231104 应计利息Accrued interest2321 长期应付款Long-term account payable应付融资租赁款Accrued financial lease outlay一年内到期的长期应付Long-term account payable due within one year一年后到期的长期应付Long-term account payable over one year2331 专项应付款Special payable一年内到期的专项应付Long-term special payable due within one year一年后到期的专项应付Long-term special payable over one year2341 递延税款Deferral taxes三、所有者权益类OWNERS EQUITY资本Capita3101 实收资本(或股本)Paid-up capital(or stock)实收资本Paicl-up capital实收股本Paid-up stock3103 已归还投资Investment Returned公积3111 资本公积Capital reserve311101 资本(或股本)溢价Cpital(or Stock)premium311102 接受捐赠非现金资产准备Receive non-cash donate reserve311103 股权投资准备Stock right investment reserves311105 拨款转入Allocate sums changeover in311106 外币资本折算差额Foreign currency capital311107 其他资本公积Other capital reserve3121 盈余公积Surplus reserves312101 法定盈余公积Legal surplus312102 任意盈余公积Free surplus reserves312103 法定公益金Legal public welfare fund312104 储备基金Reserve fund312105 企业发展基金Enterprise expension fund312106 利润归还投资Profits capitalizad on return of investment利润Profits3131 本年利润Current year profits3141 利润分配Profit distribution314101 其他转入Other chengeover in314102 提取法定盈余公积Withdrawal legal surplus314103 提取法定公益金Withdrawal legal public welfare funds314104 提取储备基金Withdrawal reserve fund314105 提取企业发展基金Withdrawal reserve for business expansion 314106 提取职工奖励及福利基金Withdrawal staff and workers bonus and welfare fund314107 利润归还投资Profits capitalizad on return of investment314108 应付优先股股利Preferred Stock dividends payable314109 提取任意盈余公积Withdrawal other common accumulation fund 314110 应付普通股股利Common Stock dividends payable314111 转作资本(或股本)的普通股股利Common Stock dividends change to assets(or stock)314115 未分配利润Undistributed profit四、成本类Cost4101 生产成本Cost of manufacture410101 基本生产成本Base cost of manufacture410102 辅助生产成本Auxiliary cost of manufacture4105 制造费用Manufacturing overhead材料费Materials管理人员工资Executive Salaries奖金Wages退职金Retirement allowance补贴Bonus外保劳务费 Outsourcing fee福利费Employee benefits/welfare会议费Coferemce加班餐费Special duties市内交通费Business traveling通讯费Correspondence电话费Correspondence水电取暖费Water and Steam税费Taxes and dues租赁费Rent管理费Maintenance车辆维护费Vehicles maintenance油料费Vehicles maintenance培训费Education and training接待费Entertainment图书、印刷费Books and printing运费Transpotation保险费Insurance premium支付手续费Commission杂费Sundry charges折旧费Depreciation expense机物料消耗Article of consumption劳动保护费Labor protection fees季节性停工损失Loss on seasonality cessation4107 劳务成本Service costs五、损益类Profit and loss收入Income业务收入OPERA TING INCOME5101 主营业务收入Prime operating revenue产品销售收入Sales revenue服务收入 Service revenue5102 其他业务收入Other operating revenue材料销售Sales materials代购代售包装物出租Wrappage lease出让资产使用权收入Remise right of assets revenue返还所得税Reimbursement of income tax其他收入Other revenue5201 投资收益Investment income短期投资收益Current investment income长期投资收益Long-term investment income计提的委托贷款减值准备Withdrawal of entrust loans reserves 5203 补贴收入Subsidize revenue国家扶持补贴收入Subsidize revenue from country其他补贴收入Other subsidize revenue5301 营业外收入NON-OPERATING INCOME非货币性交易收益Non-cash deal income现金溢余Cash overage处置固定资产净收益Net income on disposal of fixed assets出售无形资产收益Income on sales of intangible assets固定资产盘盈Fixed assets inventory profit罚款净收入Net amercement income支出Outlay业务支出Revenue charges5401 主营业务成本Operating costs产品销售成本Cost of goods sold服务成本Cost of service5402 主营业务税金及附加Tax and associate charge 营业税 Sales tax消费税 Consumption tax城市维护建设税Tax for maintaining and building cities 资源税Resources tax土地增值税Increment tax on land value5405 其他业务支出Other business expense销售其他材料成本Other cost of material sale其他劳务成本Other cost of service其他业务税金及附加费Other tax and associate charge 费用Expenses5501 营业费用Operating expenses代销手续费Consignment commission charge运杂费Transpotation保险费Insurance premium展览费Exhibition fees广告费Advertising fees5502 管理费用Adminisstrative expenses职工工资Staff Salaries修理费Repair charge低值易耗摊销Article of consumption办公费Office allowance差旅费Travelling expense工会经费 Labour union expenditure研究与开发费Research and development expense福利费Employee benefits/welfare职工教育经费Personnel education待业保险费Unemployment insurance劳动保险费Labour insurance医疗保险费Medical insurance会议费Coferemce聘请中介机构费Intermediary organs咨询费Consult fees诉讼费Legal cost业务招待费Business entertainment技术转让费Technology transfer fees矿产资源补偿费Mineral resources compensation fees排污费Pollution discharge fees房产税Housing property tax车船使用税Vehicle and vessel usage license plate tax(VVULPT)土地使用税Tenure tax印花税Stamp tax5503 财务费用Finance charge利息支出Interest exchange汇兑损失Foreign exchange loss各项手续费 Charge for trouble各项专门借款费用Special-borrowing cost5601 营业外支出 Nonbusiness expenditure捐赠支出Donation outlay减值准备金Depreciation reserves非常损失Extraordinary loss处理固定资产净损失Net loss on disposal of fixed assets出售无形资产损失Loss on sales of intangible assets固定资产盘亏Fixed assets inventory loss债务重组损失Loss on arrangement罚款支出Amercement outlay5701 所得税Income tax以前年度损益调整Prior year income adjustment新科目名称,注意对比:科目代码科目名称Account Code Account Title1001 现金Cash1002 银行存款Cash in Bank1015 其他货币资金Other cash and cash equivalents1101 交易性金融资产(短期投资)Held for trading financial assets1121 应收票据Note receivable1122 应收账款Account receivable1123 预付帐款Account prepaid1231 其他应收款Other receivable123101 应收出口退税refund of tax for export receivable123102 应收补贴款subsidies of receivable123199 其他other1241 坏账准备Bad debt reserves1321 受托代销商品Commissioned and sell the goods on a commission basis 1401 商品采购merchandise purchase1403 材料物资Material1406 库存商品Goods on hand1407 发出商品(分期收款发出商品)Goods on installment sale1408 出租商品Merchandise held for rental1410 商品进销差价(包含受托代销商品差价)Differences between purchasing and selling price1411 委托加工商品Materials in outside processing1412 包装物及低值易耗品Wrappage & consumable supplies141201 包装物wrappage141202 办公用品Office supplies141203 电器家私electrical home appliance & furnishings141204 仓储物品things for warehouse1461 存货跌价准备Inventory falling price reserves1501 待摊费用Deferred and prepaid expenses150101 租赁费lease rental150102 办公家私furnishings150103 养路费road maintaining fee150104 装修费fit up fee150199 待转进项税Pending changerover VAT on purchase15019901 进口待采集Pending collection import VAT15019902 普通待认证Pending attestation VAT15019903 运费待认证Pending Transportation VAT1524 长期股权投资long term of equity share investment1601 固定资产fixed assets1602 累计折旧Accumulated depreciation1603 固定资产减值准备Fixed assets depreciation reserves1604 在建工程Construction-in-process1606 固定资产清理Liquidation of fixed assets1701 无形资产Intangible assets170101 商标Trademarks1801 长期待摊费用Long-term deferred and prepaid expenses1901 待处理财产损益Assets loss or income in suspense190101 待处理流动资产损益Assets loss or income in suspense190102 待处理固定资产损益Assets loss or income in suspense1902 其他长期资产Other Long Term Assets190201 特准储备物资Physical assets reserve specifically authorized2001 短期借款Short term debt2201 应付票据Notes payable2202 应付帐款Account payable2205 预收帐款Deposit received2211 应付职工薪酬(含福利费)Wages & welfarism payable2221 应交税费(含应交税金和其他应交款)Taxes and dues payable 222101 个人所得税individual income tax222102 应交增值税value added tax payable22210201 进项税额VAT on purchase22210202 已交税金VAT paid22210203 转出未交增值税unpaid VAT changeover22210204 减免税额tax deduction22210205 销项税额VAT on sales22210206 进项税额转出changeover VAT on purchase22210207 转出多交增值税overpaid VAT changeover22210208 出口退税VAT Refund for exported22210209 出口抵减内销产品应纳税额export deduct domestic sales goods tax222103 未交增值税Unpaid VAT222104 关税tariff222105 应交消费税consumption tax payable222106 应交城市维护建设税tax for maintaining and building cities payable 222107 应交所得税income tax payable222108 待抵扣进项税额pending deduct VAT on purchase222109 待调整 pending adjust222110 其他应交款other fund in conformity with paying22211001 应交教育费附加educational fee payable2241 其他应付款Other payables2401 预提费用Provision for expenses2402 特准储备资金Fund reserve specifically authorized2601 长期借款Long term loans2602 长期债卷(应付债卷)long term bonds2801 长期应付款Long term account payable2811 专项应付款Special payable2901 递延所得税负债Deferred income tax liabilities2902 住房周转金Housing Revolving Funds4001 实收资本Paid in capital4002 资本公积Capital reserve400201 资本溢价Capital premium4101 盈余公积Surplus reserves410101 公益金Legal public welfare fund4103 本年利润Current year profits4104 利润分配Profit distribution410401 未分配利润undistributed profit410402 盈余公积补亏surplus reserves recover loss410403 提取盈余公积Withdrawal legal surplus410404 应付利润profit payable410405 转作奖金的利润profit change to bonus410406 应交特种基金special funds payable410407 归还借款的利润profit return loan410408 单项留用的利润profit reserved for a single item6001 主营业务收入Prime operating revenue6051 其他业务收入Other operating revenue6052 代购代销收入Income from purchase and sales commission6061 汇兑损益Exchange gain or loss6111 投资收益(包含补贴收入)Investment revenue (include Subsidize revenue)6301 营业外收入Non operating revenue6401 主营业务成本Operating costs6402 其他业务支出Other business expense6403 代购代销支出Expense from purchase and sales commission6405 营业税金及附加Sales tax and extra charges6601 销售费用Operating expenses660101 财产保险property insurance660102 包装费packaging fee660103 报关费customs charges660104 商检费commodity inspection fee660105 维修费repair charge660106 仓库租金费rental for Warehouse660107 运输费carriage charges660108 仓储费storage Fee660109 汽油费gasoline660110 汽车行驶费car travel fee660111 差旅费travel expense660112 设计费design fee660113 办公费office allowance660114 工资staff salaries660115 装卸费handling charges660116 广告费advertising fee660199 其他other6602 管理费用Adminisstrative expenses660201 办公费office allowance660202 停车费car parking fee660203 汽油费gasoline660204 路桥费toll charge660205 电话费correspondence fee660206 差旅费travel expense660207 印花税stamp tax660208 折旧depreciation660209 咨询费Consult fee660210 福利费welfarism660211 网络费network fee660212 租赁费lease rental660213 工资staff salaries660214 业务招待费business entertainment660215 低值易耗品摊销article of consumption660216 水电费utilities660217 管理费administrative fee660218 养路费toll maintenance fee660219 交通费660220 洗车费car washing fee660221 广告费advertising fee660222 服务费clothing fee660223 审计费auditing fee660224 业务宣传费business propagandize fee660225 社保social security660299 其他other6603 财务费用Finance charge660301 利息interest exchange660302 手续费/工本费charge for trouble6711 营业外支出Nonbusiness expenditure671101 固定资产减值准备fixed assets depreciation reserves 6801 所得税Income tax6901 以前年度损益调整Prior year income adjustment (PYIA)government conveyancing 政府产权转易Government Economist 政府经济顾问government expenditure 政府开支government lotteries 政府奖券Government Lotteries Management Committee 政府奖券管理委员会government mortgage institution 政府按揭贷款机构government property 政府财产government property assets 政府物业资产Government Regulations 《政府规例》Government rent 地税;地租government reserve 政府储备government revenue 政府收入government securities consultant 政府证券业顾问government trading department 参与商业活动的政府部门government utility 政府公用事业graduated rate 渐进税率grant 补助金;拨款grantor 授予人gratuitous payment 赏金gratuity 酬金gratuity benefit 酬金福利grey market 暗盘市场;灰市;暗市grey market trading 暗盘交易gross amount 毛额gross capital formation 资本形成总额gross claim 申索毛额gross claim paid 已偿付申索毛额gross commission payable 须付的佣金毛额gross contract value 合约总值calendar year figure 历年数字call 催缴通知;认购期权call deposit 通知存款;活期存款call loan 短期同业拆借;通知贷款call margin 补仓;追加保证金call market 短期同业拆放市场call money 短期同业拆借;活期贷款call option 认购期权;看涨期权call price 赎回价格;提前赎回价call warrant 认购认股权证;回购认股权证callable share 可收回股份;可兑付股份called up share capital 已催缴股本Canadian Dollar [CAD] 加拿大元Canadian Eastern Finance Limited 加拿大怡东财务有限公司Canadian Imperial Bank of Commerce 加拿大帝国商业银行cancellation price 取消费cap 上限capital 资本;资金Capital Accord 《资本协定》capital account 资本帐;非经常帐capital account commitment balance 资本帐承担额结余Capital Adequacy Directive [CAD] 《资本充足指引》capital adequacy ratio [CAR] 资本充足比率capital allowance 资本免税额capital alteration 资本变更capital and liabilities ratio 资本负债比率capital and liquidity requirement 资本与流动资金的规定capital appreciation 资本增值Capital, Asset Quality, Management, Earnings and Liquidity Rating System [CAMEL Rating System] 资本、资产质素、管理、盈利及流动资金评级制度〔CAMEL评级制度〕capital assets 资本资产capital at risk 风险资本capital base 资本基础;资金基础capital charges 资本支出;资本费用capital commitment 资本承担capital contribution certificate 出资证明书capital convergence 划一资本充足比率capital cost 资本成本;建设成本;建设费用capital cover 资本保证capital deficit 资本亏绌;资本赤字capital divided into shares 资本分成股份capital element 资本因素;资本部分capital equipment 资本设备capital expenditure 资本开支;非经常开支capital expenses 资本费用capital financing 筹集资本;以非经常收入支付非经常开支的结算capital flow 资金流量capital formation 资本形成;集资capital formation figure 资本组合数字capital fund 资本基金capital gain 资本增益;资本增值capital gains tax 资本增值税capital goods 资本财货;资本货物capital grant 非经常补助金;非经常拨款;建设补助金capital grant cycle 建设补助金周期capital injection 注入资本;注资capital input 投入资本capital intensity 资本密集度capital intensive 资本密集capital investment 资本投资Capital Investment Fund 资本投资基金capital loss 资本损失capital maintenance 资本保值;资本保留capital market 资本市场;资金市场capital market instrument 资本市场票据capital money 资本款项capital money subject to a trust 信托财产资本capital movement 资本流动capital nature 资本性质capital outlay 资本支出capital portion 资本部分capital profit 资本利润capital project 基本工程项目;非经常开支项目capital receipt 资本收入capital redemption 资本赎回capital redemption business 资本赎回业务capital redemption contract 资本赎回合约capital redemption reserve 资本赎回储备capital reduction 资本减缩;减资Capital Reduction Scheme [Stock Exchange of Hong Kong Limited] 股本削减计划〔香港联合交易所有限公司〕capital repayment 偿还资本capital reserve 资本储备;后备资本capital revenue 资本收益;非经常收入capital spending 资本开支;资本支出;非经常开支capital stock 股本capital stock subscription 认缴股本;认购股本capital subsidy 建设津贴;基本建设津贴capital subvention 非经常资助金capital sum 资本额capital tax 资本税capital transfer tax 资本转移税capital turnover 资本周转率capital value 资本价值capital works project 基本工程项目Capital Works Reserve Fund 基本工程储备基金Capital Works Resource Allocation Exercise 基本工程计划资源分配工作capitalization 资本化;资本总额capitalization of interest 利息化作本金capitalized interest 化作本金的利息capitalized loan 转作资本的贷款capitalized value 资本还原值;资本化价值。

会计学外文经典文献会计学作为一门学科,有许多经典的外文文献。

以下是其中一些:1. "Accounting Principles" by Jerry J. Weygandt, DonaldE. Kieso, and Paul D. Kimmel: 这本书是会计学的经典教材,涵盖了会计学的基本原理和概念,适用于初学者和专业人士。

2. "Financial Accounting: Tools for Business Decision Making" by Paul D. Kimmel, Jerry J. Weygandt, and Donald E. Kieso: 这本书探讨了财务会计的理论和实践,重点关注如何用财务信息做出商业决策。

3. "Management Accounting: Information for Decision-Making and Strategy Execution" by Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, and S. Mark Young: 这本书涵盖了管理会计的理论和实践,讨论了如何为决策制定和战略执行提供信息。

4. "Cost Accounting: A Managerial Emphasis" by CharlesT. Horngren, Srikant M. Datar, and Madhav V. Rajan: 这本书介绍了成本会计的概念和方法,重点关注如何计算和控制成本以支持管理决策。

5. "Auditing and Assurance Services" by Alvin A. Arens, Randal J. Elder, and Mark S. Beasley: 这本书详细介绍了审计和保证服务的原理和实践,讨论了审计的目的、过程和责任。