Accruals Quality and Internal Control

- 格式:pdf

- 大小:278.53 KB

- 文档页数:31

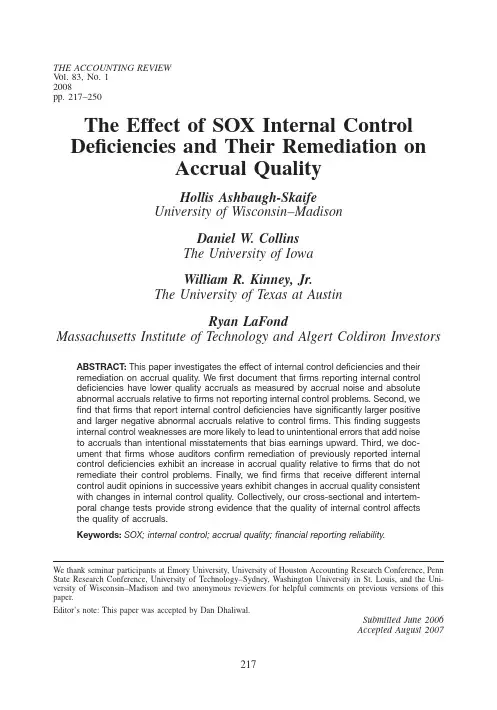

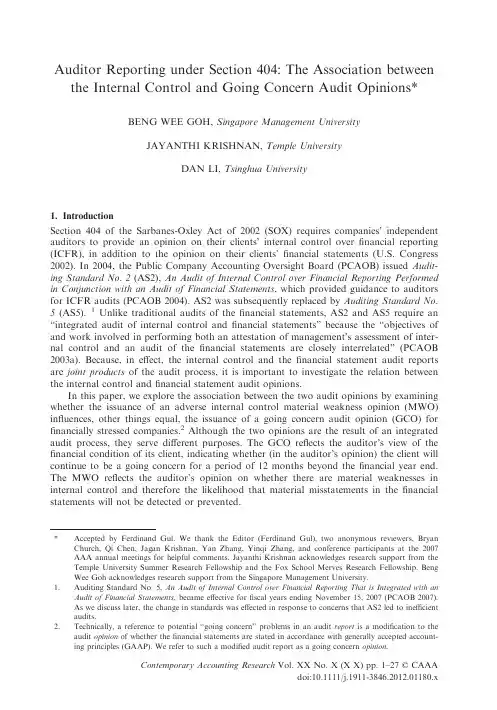

The effect of internal control de ficiencies on the usefulness of earnings in executive compensation ☆Kareen E.Brown a ,1,Jee-Hae Lim b ,⁎a School of Accounting and Finance,University of Waterloo,200University Ave W (HH 289D),Waterloo,ON,Canada N2L 3G1bSchool of Accounting and Finance,University of Waterloo,200University Ave W (HH 289G),Waterloo,ON,Canada N2L 3G1a b s t r a c ta r t i c l e i n f o Keywords:Sarbanes –Oxley ActInternal control material weaknesses (ICMW)Executive compensation EarningsSince SOX 404disclosures are informative about earnings,and due to the widespread practice of using earnings-based measures in executive compensation,this study examines whether reports of internal control material weaknesses (ICMW)under SOX 404in fluence firms'reliance on earnings in tying executive pay to ing 391(366)firm-year observations with reported ICMW and 3648(3138)firm-year obser-vations for CEOs (CFOs)reporting NOMW under SOX 404,we find a decreased strength in the association be-tween earnings and executives'(CEO and CFO)compensation when the firm reports an ICMW,and as the number of reported ICMW increases.In addition,we find this decreased weight on earnings for the more se-vere Company-Level than Account-Speci fic material weaknesses.Our study suggests that the ICMW report under SOX 404provides incremental information for executive compensation beyond that contained in reported earnings.©2012Elsevier Ltd.All rights reserved.1.IntroductionThe accounting scandals at firms such as Enron and WorldCom highlighted de ficiencies in corporate governance that were charac-terised by low financial reporting quality and disproportionate pay-for-performance.2To discipline firms and restore investor con fidence,legislative authorities enacted the Sarbanes –Oxley Act.Among the re-forms is Section 404of SOX (SOX 404)which requires both the manage-ment and the external auditor to report on the adequacy of a firm's internal control over financial reporting.Prior research shows that,relative to non-disclosing firms,firms reporting material weaknesses in internal control (ICMW)have inferior accruals and earnings quality (Ashbaugh-Skaife,Collins,Kinney,&LaFond,2008;Bedard,2006;Doyle,Ge,&McVay,2007b ),and lower earnings –returns coef ficients (Chan,Farrell,&Lee,2008).Given the fact that SOX 404disclosures are informative about earnings,and due to the widespread practice of using earnings-based measures in executive compensation,this studyexamines whether reports of ICMW under SOX404in fluence firms're-liance on earnings in tying executive pay to performance.A long line of research shows that earnings-based performance measures are commonly used to motivate and reward executives be-cause such measures correspond to manager actions (Gjesdal,1981).However,there are two drawbacks to using earnings to evaluate ex-ecutive performance.First,because executives know how their ac-tions impact earnings,they can manipulate this measure to increase their wealth.Second,earnings do not fully re flect the long-term im-plications of recent executive decisions.Based on these factors,firms place varying weights on earnings in compensating their exec-utives,and the weights are determined by how sensitive earnings are to effort and on the precision ,or lack of noise,with which it re-flects executives'actions (Banker &Datar,1989;Lambert &Larcker,1987).However,there is evidence that CEOs are shielded from certain negative events,such as firm restructuring (Dechow,Huson,&Sloan,1994),or above the line losses (Gaver &Gaver,1998).Our main focus of inquiry is signi ficant because it builds on this line of research by showing that the sensitivity of compensation –performance relations varies cross-sectionally with the quality of the system producing the earnings information.Weak internal controls potentially permit accounting errors to occur and go undetected,increasing unintentional errors in accrual estimation and/or facilitating intentional earnings management (Doyle et al.,2007b ).A report of an internal control de ficiency,there-fore,signals that the manager is unable to provide reasonable assur-ance regarding the quality of reported earnings (Ashbaugh-Skaife et al.,2008;Bedard,2006;Chan et al.,2008;Doyle et al.,2007b ).Using the sensitivity-precision framework,the errors introduced byAdvances in Accounting,incorporating Advances in International Accounting 28(2012)75–87☆Data availability:Data used in this paper are publicly available and also can be requested from the authors.⁎Corresponding author.Tel.:+15198884567x35702;fax:+15198887562.E-mail addresses:kebrown@uwaterloo.ca (K.E.Brown),jh2lim@uwaterloo.ca (J.-H.Lim).1Tel.:+15198884567x35776;fax:+15198887562.2For example Hall and Liebman (1998)report a 209%increase in CEO mean salary in large US firms from 1980to 1994,and Bebchuk and Grinstein (2005)document a 146%increase in CEO pay from 1993to 2003in S&P 500firms.Bebchuk and Fried (2004)ad-vance the theory that soaring executive pay is the result of managementpower.0882-6110/$–see front matter ©2012Elsevier Ltd.All rights reserved.doi:10.1016/j.adiac.2012.02.006Contents lists available at SciVerse ScienceDirectAdvances in Accounting,incorporating Advances inInternational Accountingj o u r na l h o me p a g e :ww w.e l s e v i e r.c o m /l oc a t e /a di a cweak internal controls are likely to result in earnings that capture ex-ecutives'effort with low precision,diminishing its use as an assess-ment tool for evaluating managers'performance.Motivated by the optimal contracting hypothesis,we posit thatfirms with ICMW report earnings with lower precision-sensitivity.The purpose of this study is to examine whetherfirms reporting ICMW place relatively less weight on earnings compared tofirms reporting no ICMW(NOMW).In other words,whether ICMW reports influence compensation contracts is an empirical issue because,al-though ICMWfirms report lower earnings–returns coefficients (Chan et al.,2008),prior research does not suggest any direct associ-ation between the valuation role of earnings and its usefulness in compensating executives(Bushman,Engel,&Smith,2006).Under the null hypothesis,the sensitivity of executive compensation to earnings is unaffected by internal control deficiency.Consistent with prior research,we also examine the weight placed on earnings forfirms reporting two different types of ICMW:Account-Specific and Company-Level weaknesses(Doyle,Ge,&McVay,2007a, b,Doyle et al.,2007b).Account-Specific(AS)material weaknesses arise from routinefirm operations and may be resolved by additional substantive auditing procedures.When AS material weaknesses are identified,executives or auditors can easily audit around them by per-forming additional substantive pany-Level(CL)mate-rial weaknesses,on the other hand,are less easily resolved by auditor involvement and result from lack of resources or inexperience in main-taining an effective control system.Due to the pervasiveness of CL ma-terial weaknesses,the scope of audit efforts needs to be frequently expanded to deal with these more serious concerns regarding the reli-ability offinancial statements(Moody's,2006;PCAOB2004).The extent to which auditors are able to mitigate the negative effect on earnings of these two types of weaknesses would suggest less noise/greater preci-sion in earnings from Account-Specific relative to Company-Level weaknesses.The impact of precision times sensitivity on the weight of earnings for Account-Specific pany-Level material weaknesses is therefore the second empirical question.Using391(366)firm-year observations with reported ICMW and 3648(3138)firm-year observations for CEOs(CFOs)reporting NOMW under Section404of SOX,wefind a decreased strength in the associa-tion between earnings and CEO compensation when thefirm reports an ICMW,and as the number of reported ICMW increases.Our results are also robust to controls for variousfirm characteristics that prior studies have found to influence the role of earnings in compensation contracts,including earnings quality proxies such as earnings persis-tence(Baber,Kang,&Kumar,1998)and corporate governance charac-teristics(Chhaochharia&Grinstein,2009).In addition,for CL material weaknesses,wefind evidence of a lower strength in the earnings–compensation relation for the CEOs.Wefind no such result with AS material weaknesses suggesting that only CL weaknesses affect the weight placed on earnings in compensating CEOs.This study makes two contributions.First,it contributes to existing literature by making an examination of the role of earnings as a per-formance measure in executive compensation contracts(Bushman et al.,2006;Sloan,1993;among others),and by examining how infor-mation on the quality of afirm's internal controls influences the earn-ings–compensation relation.We confirm that weak internal controls result in a diminished role for accounting measures in the CEO com-pensation relation,consistent with optimal contracting.Specifically, it is thefirms with CL weaknesses that reduce the weight on earnings in CEO cash compensation.Overall,ourfindings suggest that the in-formation in the ICMW report is incremental to,or more timely than,that provided by discretionary accruals or earnings persistence measures.Second,our study extends a growing body of literature on the rela-tion between executive compensation and ICMW in the post-SOX era. Carter,Lynch,and Zechman(2009)show that the implementation of SOX in2002led to a decrease in earnings management,and thatfirms responded by placing more weight on earnings in bonus contracts for CEOs and CFOs in the post-SOX period.Another study by Hoitash, Hoitash,and Johnstone(2009)suggests that the compensation of the CFO,who has primary responsibility for the quality of thefirm's internal controls,is penalized for reports of ICMW.Since prior evidence shows, and stresses the importance of,a performance-based compensation penalty for internal control quality as a non-financial performance mea-sure in the evaluation of executives,our study further investigates whether an ICMW impacts the weight of earnings in compensation con-tracts under the mandate of SOX404.We show thatfirms consider the strength of an earnings generation system and specifically choose to re-duce emphasis on earnings-based performance measures in determin-ing CEOs'cash compensation.The next section of this paper provides background information on the internal control disclosure practices required by the Sar-banes–Oxley Act,discusses the usefulness of earnings as a perfor-mance measure and further develops our hypotheses.The third section describes our sample and research design.The fourth section presents our descriptive statistics,results and sensitivity analyses. Thefifth section concludes the paper.2.Prior research and hypothesisSection404of SOX is one of the most visible and tangible changes tofirms'internal control systems in recent times[(Public Company Accounting Oversight Board(PCAOB)(PCAOB),2004)].3The pivotal requirement of Section404is that management assess the effective-ness of thefirm's internal controls overfinancial reporting and in-clude this information in thefirm's annualfinancial statements.This regulation increases scrutinization by thefirm's auditors because the manager assessments must then be separately attested to by the auditor.One of the benefits of the disclosures under Section404is that internal control information is now readily available and may be informative as a non-financial measure of executive performance (Hoitash et al.,2009).Numerous studies have examined the determinants and conse-quences of ICMW.Early studies document an association between ICMW andfirm characteristics,such as business complexity,organi-zational change,firm size,firm profitability and investment of re-sources in accounting controls(Ashbaugh-Skaife,Collins,&Kinney, 2007;Doyle et al.,2007a;Ge&McVay,2005).The implementation of SOX Section404has resulted in higher audit fees(Hoitash, Hoitash,&Bedard,2008;Raghunandan&Rama,2006),longer audit delays(Ettredge,Li,&Sun,2006)and improved audit committee quality(Krishnan,2005).Several studiesfind negative and significant cumulative abnormal returns(Beneish,Billings,&Hodder,2008;De Franco,Guan,&Lu,2005)and lower quality of earnings(Ashbaugh-Skaife et al.,2008;Chan et al.,2008)after SOX404disclosures.Closely related to our study is the literature that examines the as-sociation between earnings quality and ICMW.Chan et al.(2008) document a greater use of positive and absolute discretionary ac-cruals forfirms reporting ICMW than forfirms receiving a favourable report.Ashbaugh-Skaife et al.(2008)alsofind thatfirms reporting ICMW after the inception of SOX have lower quality accruals and sig-nificantly larger positive and negative abnormal accruals,relative to controlfirms.Both Ashbaugh-Skaife et al.(2008)and Bedard(2006)find evidence of improvements in earnings quality after the remedia-tion of ICMW under Section404,whereas Doyle et al.(2007b)claim lower-quality earnings under Section302,but not Section404.3SOX404sets separation implementation dates for“acceleratedfilers”(primarily largefirms),for“non-acceleratedfilers”(smallerfirms),and for foreignfirms.Specifi-cally,Section404rules required acceleratedfilers to comply beginning in2004,where-as compliance for non-acceleratedfilers and foreignfirms began in phases starting in 2006and ending in2009,at which time those two groups reach full compliance.76K.E.Brown,J.-H.Lim/Advances in Accounting,incorporating Advances in International Accounting28(2012)75–87A recent study suggests thatfirms place greater weight on earn-ings in determining incentive pay after the passage of SOX,and other concurrent reforms,because the more stringent reporting envi-ronment in the post-SOX period of2002results in less earnings man-agement(Carter et al.,2009;Hoitash et al.,2009).Carter et al.(2009) report an increase in the weight placed on earnings changes as a de-terminant of executive compensation,and a decrease in the propor-tion of compensation via salary after SOX,that is larger for CEOs and CFOs than it is for other executives.In addition,Hoitash et al. (2009)claim that changes in CFO total compensation,bonus compen-sation and equity compensation are negatively associated with dis-closures of ICMW,suggesting a performance-based compensation penalty for poor internal controls in the evaluation of CFOs.However, the empirical literature has not yet addressed whether disclosures of ICMW in the post-SOX era influence the importance of earnings in de-termining executive pay.3.The role of earnings in executive compensation contractsPrior research has identified accounting earnings and stock returns as the two implicitfirm performance indicators commonly used to determine executive compensation.Accounting earnings are useful for determining executive compensation because they shield managers from market-wide variations infirm value that are beyond executives'control(Sloan,1993).Stock returns are useful because they anticipate future cashflows and reflect the long-term economic consequences of managers'actions(Sloan,1993).As a result,stock returns capture those facets of executive effort that are missing in earnings but are associated with compensation(Clinch,1991; Lambert&Larcker,1987).The usefulness of thefirm performance measures,such as earnings or returns in executive contracts,is deter-mined by its precision and sensitivity(Banker&Datar,1989),and the optimal weight on a performance measure increases as the precision times sensitivity(or the signal-to-noise ratio)increases.Sensitivity re-fers to the responsiveness of the measure to actions taken by the manager,and precision reflects the noise or variance of the perfor-mance measure conditional on the manager's actions.Consistent with prior studies,we model executive compensation as a function of both accounting earnings and returns.Based on this model specification,the weight on earnings as a performance measure,there-fore,is a function of its precision and sensitivity,relative to stock returns,in providing information about the efforts of managers.4.The impact of ICMW on the earnings–compensation relationIn this study we argue that,for several reasons,an ICMW report indicates that reported earnings capture executives'effort with less precision and is less sensitive to managerial effort thanfirms not reporting an ICMW.First,managers are potentially more likely to use accruals to intentionally bias earnings if internal controls are weak.A more effective internal control system allows less managerial discretion in the accrual process(Ashbaugh-Skaife et al.,2008;Doyle et al.,2007b),and thus reduces the ability of the management to ma-nipulate accruals for the purpose of increasing their compensation.Second,weak internal controls potentially permit accounting er-rors to occur and go undetected(Doyle et al.,2007b).An ICMW can impair the sensitivity of the earnings measure for executive compen-sation because the earnings offirms with ICMW may reflect delayed or untimely information(Chan et al.,2008).Further,the noise regard-ing managers'performance in reported earnings due to deficient in-ternal controls are likely to be unpredictable and may not be reflected in the properties of previously reported earnings numbers. For these reasons,the precision times sensitivity of earnings with regards to the manager's actions forfirms reporting ICMW is pre-dicted to be lower than that offirms not reporting a material weak-ness.If ICMW reports provide information about the precision-sensitivity relation of earnings,then they have the potential to impact the use of earnings in designing executive compensation.It is possible that the ICMW report provides no new information to compensation committees or that the committees fully adjust for earnings characteristics in designing executive compensation con-tracts.In such case,we wouldfind no association between executive cash compensation and reported earnings.However,if effective inter-nal controls provide information on the sensitivity-precision of earn-ings,then an ICMW report has the potential to impact the strength of the relation between accounting earnings and executive compensa-tion.We predict that the relation between executive compensation and accounting earnings is lower forfirms that report ICMW.This leads to ourfirst hypothesis:H1.Firms that report ICMW have lower accounting earnings–executive compensation relation thanfirms with NOMW.5.The impact of ICMW type on theearnings–compensation relationDepending on the underlying cause of the ICMW,additional monitor-ing mechanisms or substantive testing can mitigate the negative effects of poor internal controls and impact the weight placed on earnings in exec-utive compensation contracts.Consistent with Doyle et al.(2007a,b),we categorize ICMW disclosures into two categories that may have different impacts on the earnings–compensation relation.First,Account-Specific (AS)material weaknesses arise from routinefirm operations and relate to controls over specific account balances,such as accounts receivable,in-ventory,and legal proceedings,or transaction-level processes.When AS material weaknesses are identified,executives or auditors can easily audit around them by performing additional substantive procedures.In contrast,Company-Level(CL)material weaknesses reflect is-sues beyond the direct control of the executives and relate to more macro-level controls such as the control environment,general per-sonnel training,organizational-level accountability,or the overallfi-nancial reporting processes.Due to the pervasiveness of CL material weaknesses,the scope of audit efforts needs to be frequently expand-ed to deal with these more serious concerns regarding the reliability of thefinancial statement(Moody's,2006;PCAOB,2004).We there-fore expect a more negative association between disclosures of Company-Level material weaknesses and the weights of earnings in the compensation contract relative to Account-Specific weaknesses. pany-Level ICMW have a stronger negative association with the accounting earnings–executive compensation relation than do Account-Specific ICMW.6.Sample selection and research design6.1.Sample selectionWe use several sources of data:(1)Audit Analytics,(2)Compu-stat,(3)CRSP,(4)ExecuComp,(5)firms'financial statements and (6)Lexis-Nexis Academic Universe.We start by collecting data from Section404disclosures of auditors'opinions on ICMW overfinancial reporting fromfirms'Form10-Kfilings from January2004to Decem-ber2006.4To ensure that the identified acceleratedfilers under SOX 404pertain to a material weakness in internal control,we follow up our initial search offirms that receive adverse opinions on their ICMW in the Audit Analytics database with a manual check through Lexis-Nexis.For our sample period,we identify9899observations 4According to PCAOB(Standard No.2),three types of internal control overfinancial reporting exist:(1)a control deficiency,(2)a significant deficiency,or(3)material weaknesses.Since publicfirms are only required to disclose material weaknesses in Section404,our main empirical test uses all Section404reports available on Audit An-alytics,which includes3864firm-year observations from2004to2006.77K.E.Brown,J.-H.Lim/Advances in Accounting,incorporating Advances in International Accounting28(2012)75–87with clean reports and1399observations that received adverse opin-ions on theirfinancial reporting with at least one type of internal con-trol problem as a material weakness.After controlling for duplicates or non-acceleratedfilers from2004to2006,we validate1336adverse reports and9865clean reports for a total of11,201observations.5 Our research design examines the change in executive compensa-tion in the year following the ICMW.For ICMW in the years 2004–2006,we require compensation data for2004–2007to compute the change in compensation.We eliminate513ICMW and5999 NOMW(532ICMW and6415NOMW)firm-year observations for the CEO(CFO)due to missing salary and bonus data in thefirms'proxy statements or in ExecuComp.Next,we collect stock return and account-ing information from CRSP and Compustat respectively,resulting in a loss of399ICMW and129NOMW(405ICMW and223NOMW)firm-year observations for the CEO(CFO).Finally,we excludefirm-year observations from utility andfinancialfirms because these companies operate in unique regulatory environments that are likely to influence executive compensation.Thefinal sample for this study consists of 391(366)firm-year observations with ICMW and3648(3138)firm-year observations with NOMW for the CEO(CFO).We summarize our sample selection process in panel A of Table1.Panel B of Table1summarizes the ICMW subsample by the type of weakness.Following the recommendations of the PCAOB's Standard No.2and Moody's(Doss&Jonas,2004;Doyle et al.,2007a,b),two types of material weaknesses can be classified based on different ob-jectives.Our study identifiesfirms as having either an Account-Specific(AS)or Company-Level(CL)material weakness.6Of the391 (366)firm-year observations of ICMW reported subsample,162 (140)were Company-Level and229(226)were Account-Specific weaknesses for the CEO(CFO)subsample.Panel C of Table1summarizes the industry distribution of the CEO sample of391firm-years with ICMW and the3648firm-years without some kind of material weakness based on their two-digit SIC codes.The391ICMWfirm-years cover six industry groups.Among them,the Ser-vices industry has the highest number offirms,followed by the Machin-ery,Construction and manufacturing,and the Wholesale and retail industries.The industry distribution for3648NOMWfirm-years has the highest number of observations in the Services industry followed closely by the Machinery and Construction and manufacturing industries.6.2.Research designTo test H1,that predicts a lower strength in the earnings–compensation relation when thefirm reports an ICMW under Section 404of SOX,we use the following model(1):ΔCashComp i;t¼β0þβ1ICMW i;t−1þβ2ΔROA i;tþβ3RET i;tþβ4ICMW i;t−1⁎ΔROA i;tþβ5ICMW i;t−1⁎RET i;tþβ6LOSS i;tþβ7LOSS i;t⁎ΔROA i;tþβ8LOSS i;t⁎RET i;tþβ9SIZE i;tþβ10MTB i;tþβ11CEOCHAIR i;tþβ12IndAC i;tþβ13IndBD i;tþβ14BoardMeetings i;tþβ15AcctExp i;tþYEARþINDþεtð1ÞConsistent with prior studies,we focus on cash compensation be-cause almost allfirms explicitly use accounting measures as a deter-minant of cash bonus(Murphy,2000;Core,Guay,&Larcker,2003; Huson,et al.2012).No such evidence exists for the association be-tween equity-based pay and earnings because stock option grants are offered not only to reward executives but also to introduce con-vexity in executive compensation contracts,for retention purposes and because of tax andfinancial reporting costs(Core et al.,2003).7 Similar to Hoitash et al.(2009),our dependent variable is the change in salary plus bonus pay from year t−1to year t deflated by the beginning of the year salary in year t(ΔCashComp).Our indepen-dent variables are(1)an internal controls deficiency indicator vari-able(ICMW or CL/AS)at time t−1,(2)the percentage change in return on assets(ΔROA),(3)stock returns(RET)and(4)interaction terms between the internal controls deficiency indicator and the per-centage change in both ROA and stock returns.We include annual stock returns for the year t in the model specification because a mean-ingful association between compensation andfirm performance must include returns(Murphy,1998;Sloan,1993).The parameter estimateβ4on ICMW∗ΔROA examines H1.Under the null hypothesis that the sensitivity of executive compensation to earnings is unaffected by internal control deficiency,the parameter,β4would be insignificant.However,we predict that the weight assigned to earnings will decrease with ICMW disclosures.As such, we expect the estimateβ4for the interaction ICMW∗ΔROA to be neg-ative and significant.It is possible that,with poor internal controls,5After controlling for97duplicates or non-acceleratedfilers from2004to2006,we validate1336adverse reports(relating to452firms in2004;487firms in2005;and 397firms in2006)and9865clean reports(2478firms in2004;3478firms in2005; and3909firms in2006)for a total of11,201observations.6We want to thank one of the authors(Doyle et al.,2007a,b)for the conceptual foundations of these two types of ICMW and the coding validations.Our classification of a Company-Level vs.an Account-Specific material weakness is mutually exclusive. For example,if afirm has both Company-Level weaknesses and Account-Specific ma-terial weaknesses,then we code thefirm as having a Company-Level weakness(Doyle et al.,2007a).In addition,three or more Account-Specific material weaknesses are cod-ed Company-level Weaknesses(Doyle et al.,2007b,p.1149).Table1Sample selection and descriptive statistics(January2004–December2007).Panel A:Sample selection and sample compositionCEO subsample CFO subsampleICMW NOMW10-Kfilings from Audit Analytics andsubsequent manual review2004–20061399989913999899 Less:Duplicate observations(63)(34)(63)(34) SOX404disclosure data2004–20061336986513369865 Missing compensation data2004–2007(513)(5999)(532)(6415) Missing Compustat&CRSP data2004–2007(399)(129)(405)(223) Less:Utilities&financialfirms2004–2007(33)(89)(33)(89) Testing H1&H239136483663138 Panel B:Samplefirms by types of ICMWCompany-Level(CL)Account-Specific(AS)CEO CFO CEO CFO 20046860108107 200560528886 200634283333 Panel C:Sample composition by industry(CEO sample)2-digitSICIndustry description ICMW NOMW#Obs.%#Obs.%10–13Mining11 2.8171 4.7 23–34Construction and manufacturing6516.677521.2 35–39Machinery9724.879721.8 42–49Transportation and utilities4411.349413.5 50–59Wholesale and retail4912.539210.7 72–87Services12532.0101927.97For these reasons any inferences that we draw about internal control weaknesses and the use of earnings from tests using equity based compensation would be incon-clusive.Additionally,the importance of earnings in determining executive cash based pay has increased in the post-Sox era,which is the period that we examine(Carter et al.,2009).78K.E.Brown,J.-H.Lim/Advances in Accounting,incorporating Advances in International Accounting28(2012)75–87。

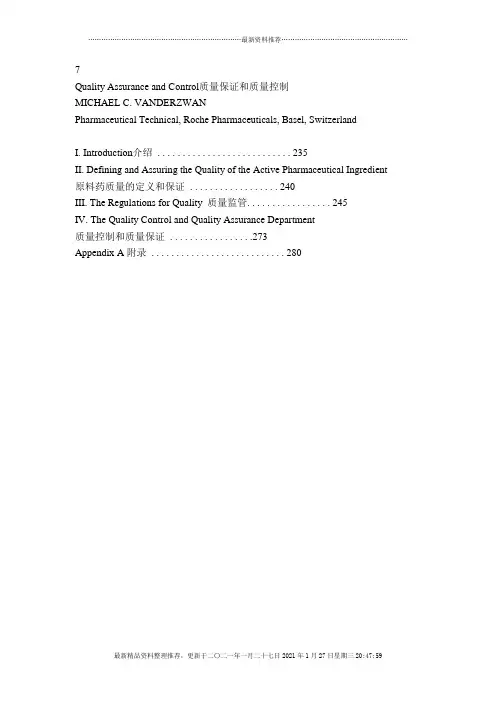

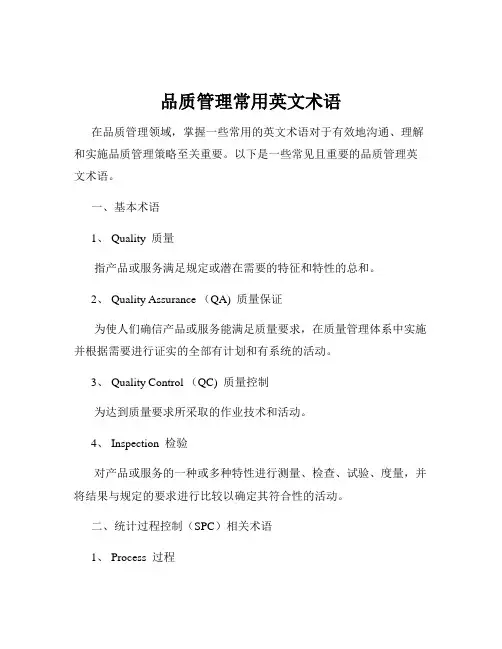

Quality Assurance and Control质量保证和质量控制MICHAEL C. VANDERZWANPharmaceutical Technical, Roche Pharmaceuticals, Basel, SwitzerlandI. Introduction介绍. . . . . . . . . . . . . . . . . . . . . . . . . . . 235II. Defining and Assuring the Quality of the Active Pharmaceutical Ingredient 原料药质量的定义和保证. . . . . . . . . . . . . . . . . . 240III. The Regulations for Quality 质量监管. . . . . . . . . . . . . . . . . 245IV. The Quality Control and Quality Assurance Department质量控制和质量保证. . . . . . . . . . . . . . . . .273Appendix A附录. . . . . . . . . . . . . . . . . . . . . . . . . . . 280目录I. INTRODUCTION介绍 (4)A. The Product产品 (4)B. The Process工艺 (5)C. The Facilities设备 (5)D. The People人员 (6)E. The Quality Management Department质量管理部门 (6)F. The Regulatory Authorities 监管机构 (7)G. The Regulations法规 (8)II. DEFINING AND ASSURING THE QUALITY OF THE ACTIVE PHARMACEUTICAL INGREDIENT 原料药质量的定义和质量保证 (9)A. Defining the API Quality 原料药质量的界定 (10)B. Testing the API for Its Defined Attributes 原料药定义的属性测试 (11)C. Designing Quality into the Process 工艺中的质量设计 (12)D. Validation of the Process 工艺验证 (13)E. Reality实际 (15)III. THE REGULATIONS FOR QUALITY质量法规 ................ 错误!未定义书签。

Title: The Importance of Internal ControlsIn the contemporary business landscape, the significance of internal controls cannot be overstated. Internal controls refer to the policies, procedures, and mechanisms implemented by an organization to safeguard its assets, ensure accurate reporting, promote compliance with regulations, and foster operational efficiency.Firstly, internal controls are essential for safeguarding the assets of an organization. Through effective financial controls, segregation of duties, and regular audits, an organization can minimize the risk of fraud, misappropriation, and waste. This ensures that the organization's resources are utilized efficiently and for the intended purposes.Secondly, internal controls are vital for ensuring accurate financial reporting. Accurate financial statements are crucial for decision-making, investor confidence, and compliance with regulatory requirements. Internal controls help to ensure that all transactions are properly recorded, accounted for, and reported in a timely and accurate manner.Moreover, internal controls promote compliance with laws, regulations, and ethical standards. By establishing clear policies and procedures, organizations can ensure that their employees understand and adhere to the applicable rules and regulations. This not only reduces the risk of legal and reputational damage but also fosters a culture of integrity and trust.Furthermore, internal controls contribute to operational efficiency. By identifying and addressing bottlenecks, waste, and inefficiencies, organizations can improve their operational performance and enhance their profitability. Effective internal controls can also reduce the cost of compliance by automating routine tasks and minimizing the need for manual intervention.In conclusion, internal controls are an indispensable aspect of any successful organization. They safeguard assets, ensure accurate reporting, promote compliance, and foster operational efficiency. By establishing and maintaining robust internal controls, organizations can create a sustainable competitive advantage in today's challenging business environment.。

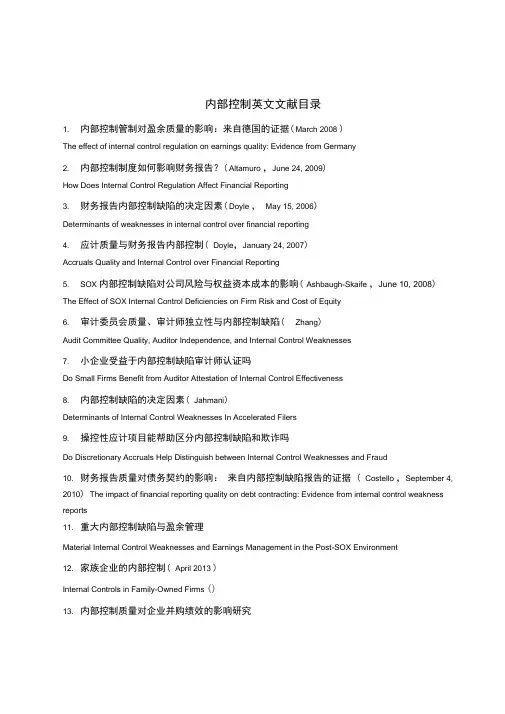

内部控制英文文献目录1. 内部控制管制对盈余质量的影响:来自德国的证据( March 2008 )The effect of internal control regulation on earnings quality: Evidence from Germany2. 内部控制制度如何影响财务报告?( Altamuro ,June 24, 2009)How Does Internal Control Regulation Affect Financial Reporting3. 财务报告内部控制缺陷的决定因素( Doyle ,May 15, 2006)Determinants of weaknesses in internal control over financial reporting4. 应计质量与财务报告内部控制( Doyle,January 24, 2007)Accruals Quality and Internal Control over Financial Reporting5. SOX 内部控制缺陷对公司风险与权益资本成本的影响( Ashbaugh-Skaife ,June 10, 2008) The Effect of SOX Internal Control Deficiencies on Firm Risk and Cost of Equity6. 审计委员会质量、审计师独立性与内部控制缺陷( Zhang)Audit Committee Quality, Auditor Independence, and Internal Control Weaknesses7. 小企业受益于内部控制缺陷审计师认证吗Do Small Firms Benefit from Auditor Attestation of Internal Control Effectiveness8. 内部控制缺陷的决定因素( Jahmani)Determinants of Internal Control Weaknesses In Accelerated Filers9. 操控性应计项目能帮助区分内部控制缺陷和欺诈吗Do Discretionary Accruals Help Distinguish between Internal Control Weaknesses and Fraud10. 财务报告质量对债务契约的影响:来自内部控制缺陷报告的证据 ( Costello ,September 4, 2010) The impact of financial reporting quality on debt contracting: Evidence from internal control weakness reports11. 重大内部控制缺陷与盈余管理Material Internal Control Weaknesses and Earnings Management in the Post-SOX Environment12. 家族企业的内部控制( April 2013 )Internal Controls in Family-Owned Firms ()13. 内部控制质量对企业并购绩效的影响研究Study on the Impact of the Quality of Internal Control on the Performance of M&A14. 内部控制质量与信用违约互换利差( January 2014)Internal Control Quality and Credit Default Swap Spreads15. 家族企业内部控制:特征和后果Internal Control in Family Firms: Characteristics and Consequences16. 内部控制报告与会计信息质量:洞察”遵守或解释的“内部控制制度Internal control reporting and accounting quality :Insight "comply-or-explain" internal control regime17. 内部控制报告与会计稳健性Internal Control Reporting and Accounting Conservatism18. 会计信息质量影响产品市场契约吗?来自政府合同授予的证据( March 2014 )Does Accounting Quality Influence Product Market Contracting? Evidence from Government Contract Awards19. 公司特征与财务报告质量:尼日利亚制造业上市公司的证据20. 内部控制情况与专家审计师选择The Association between Internal Control Situations and Specialist Auditor Choices21. 审计费用反应了控制风险的风险溢价吗( 2013-07 )Do Audit Fees Reflect Risk Premiums for Control Risk?22. 内部控制质量与审计定价Internal Control Quality and Audit Pricing under the Sarbanes-Oxley Act23. 内部控制缺陷与权益资本成本:来自萨班斯法案404 节披露的证据Internal Control Weakness and Cost of Equity: Evidence from SOX Section 404 Disclosures24. 内部控制缺陷与信息不确定性Internal Control Weaknesses and Information Uncertainty25. 重大内部控制缺陷与股票价格崩溃危险:来自404 条款披露的证据( May 2013 )Material Weaknessin Internal Control and Stock Price Crash Risk: Evidence from SOX Section 404 Disclosure 26. SOX 内部控制缺陷对公司风险与权益资本成本的影响The Effect of SOX Internal Control Deficiencies on Firm Risk and Cost of Equity27. 信用评级、债务成本与内部控制信息披露:SOX302 和SOX404 法的比较28. 萨班斯-奥克斯利法案对会计信息债务契约价值的影响The Effect of Sarbanes-Oxley on the Debt Contracting Value of Accounting Information29. 财务报告内部控制的不利意见与审计师解聘/辞职Adverse Internal Control over Financial Reporting Opinions and Auditor Dismissals/Resignations30. 新管理人员任命与随后的SOX 法案404 的意见Appointment of New Executives and Subsequent SOX 404 Opinion31. 萨班斯奥克斯利:有关萨班斯法案404 影响的证据Sarbanes-Oxley: The Evidence Regarding the Impact of Sox 40432. 内部控制有效性自愿披露的经济决定因素及后果:从首次公开发行的证据( March 2013 ) Economic Determinants and Consequences of Voluntary Disclosure of Internal Control Effectiveness: Evidence from Initial Public Offerings33. 非营利组织中内部控制问题的原因和后果The Causes and Consequences of Internal Control Problems in Nonprofit Organizations34. SOX 内部控制披露在公司控制权市场中的价值The Value of SOX Internal Control Disclosures in the Market for Corporate Control35. 内部控制缺陷与销售、一般的及行政费用的非对称性行为Internal Control Weakness and the Asymmetrical Behavior of Selling, General, and Administrative Costs36. 内部控制缺陷及补救措施披露对投资者感知的盈余质量的影响The Impact of Disclosures of Internal Control Weaknesses and Remediation on Investor-Perceived Earnings Quality37. 内部控制缺陷与美国上市的中国公司与美国公司的审计师SOX Internal Control Deficiencies and Auditors of U.S.-Listed Chinese versus U.S. Firms38. 内部控制信息披露与代理成本—来自瑞士的非金融类上市公司的证据( January 2013) Internal Control Disclosure and Agency Costs Evidence from Swiss listed non-financial Companies39. 萨班斯奥克斯利法案与公司投资:来自自然实验的新证据The Sarbanes-Oxley Act and Corporate Investment: New Evidence from a Natural Experiment40. 国内投资者保护、所有权结构与交叉上市公司遵守SOX 要求披露内部控制缺陷Home Country Investor Protection, Ownership Structure and Cross-Listed Firms 'Compliance with SOX-Mandated Internal Control Deficiency Disclosure41. 审计师对披露重大缺陷相关风险的看法Auditors ' Percenpsti o f the Risks Associated with Disclosing Material Weaknesses42. 交叉上市公司提供与美国公司相同质量的披露?来自萨班斯-奥克斯利法案302 条款下的内部控制缺陷信息披露的证据Do cross-listed firms provide the same quality disclosure as U.S. firms? Evidence from the internal control deficiency disclosure under Section 302 of the Sarbanes-Oxley Act43. 内部控制缺陷与并购绩效Internal Control Weaknesses and Acquisition Performance44. 萨班斯-奥克斯利法案302 条款下的内部控制缺陷对审计费用的影响The Effect of Internal Control Weakness under Section 404 of the Sarbanes-Oxley Act on Audit Fees45. 审计师对财务报告内部控制的评价对审计费用、债务成本及净遵从收益The Effect of Auditors ' Assessment of Internal Control of over Financial Reporting on Audit Fees, Cost of Debt and Net Compliance Benefit46. 上市公司披露的信息含量与萨班斯-奥克斯利法案Information Content of Public Firm Disclosures and the Sarbanes-Oxley Act47. 财务错报与股票市场的契约:从增发的证据Financial Misstatements and Contracting in the Equity Market: Evidence from Seasoned Equity Offerings48. 公司治理质量与SOX 302 条款下内部控制报告Corporate Governance Quality and Internal Control Reporting Under Sox Section 30249. 审计委员会质量、审计师独立性与内部控制缺陷Audit Committee Quality, Auditor Independence, and Internal Control Weaknesses50. SOX404 条款的影响:成本,盈余质量与股票价格The Effect of SOX Section 404: Costs, Earnings Quality, and Stock Prices51. 内部控制缺陷与银行贷款契约:来自SOX404 条款披露的证据Internal Control Weakness and Bank Loan Contracting: Evidence from SOX Section 404 Disclosures52. 审计师对财务报告内部控制的决策:分析、综合和研究方向Auditors I'nternal Control Over Financial Reporting Decisions: Analysis, Synthesis, and Research Directions 53. 应计质量与财务报告内部控制( Doyle ,The Accounting Review, forthcoming )Accruals Quality and Internal Control over Financial Reporting54. 业绩基础CEO 和CFO 薪酬对内部控制质量的影响The impact of performance-based CEO and CFO compensation on internal control quality55. 内部控制重大缺陷与CFO 薪酬Internal Control Material Weaknesses and CFO Compensation56. 财务报告内部控制缺陷的决定因素Determinants of weaknesses in internal control over financial reporting57. 内部控制与管理指南Internal Control and Management Guidance58. 2002 萨班斯-奥克斯利法案302 条款下内部控制缺陷的市场反应以及这些缺陷的特征Market Reactions to the Disclosure of Internal Control Weaknesses and to the Characteristics of thoseWeaknesses under Section 302 of the Sarbanes Oxley Act of 200259. 自愿报告内部风险管理和控制系统的经济激励Economic Incentives for Voluntary Reporting on Internal Risk Management and Control Systems60. 后萨班斯法案时代审计意见的信息含量The information content of audit opinions in the post-sox era61. 上市公司披露的信息含量与萨班斯-奥克斯利法案( April, 2010 )Information Content of Public Firm Disclosures and the Sarbanes-Oxley Act62. 信息摩擦如何影响公司资产流动性的选择?萨班斯法案404 条款的影响How do Informational Frictions Affect the Firm s Choice of A'sset Liquidity? The Effect of SOX Section 404 63. 已审计的信息披露给资本市场参与者带来利益是什么( December 19, 2013)What are the benefits of audited disclosures to equity market participants64. 诉讼风险与审计定价:公众股权的作用( January 7, 2013)Litigation Risk and Audit Pricing: The Role of Public Equity65. 萨班斯-奥克斯利法案对IPO 和高收益债券发行人的影响The Impact of Sarbanes-Oxley on IPOs and High Yield Debt Issuers66. 来自金融危机的公司治理的经验教训The Corporate Governance Lessons from the Financial Crisis67. 谁对企业欺诈吹口哨Who Blows the Whistle on Corporate Fraud68. 内部控制缺陷与现金持有价值Internal Control Weakness and Value of Cash Holdings69. 民族文化和制度环境对内部控制信息披露的影响The impact of national culture and institutional Environment on internal control disclosures70. 财务报告质量与权益资本成本之间联系的讨论:一些个人的意见( June 6, 2013)Some Personal Observations on the Debate on the Link between Financial Reporting Quality and the Cost of Equity Capital71. 使用盈利预测同时估计企业层面的权益资本成本和长期增长Using Earnings Forecasts to Simultaneously Estimate Firm-Specific Cost of Equity and Long-Term Growth72. 高管薪酬差距与权益资本成本Executive Pay Disparity and the Cost of Equity Capital73. 财务报告质量与公司债券市场(博士论文,Mingzhi Liu, 2011 )Financial Reporting Quality and Corporate Bond MarketsReferencesAboody, D., J. Hughes, and J. Liu. (2005) Earnings quality, insider trading, and cost of capital. Journalof Acco un ti ng Research 43: 651 -673.Akins, B., J. Ng and R. Verdi (2012) Investor competition over information and the pricing of information asymmetry. The Accounting Review 87(1): 35-58.Ali, A., A. Klein and J. Rosenfeld. (1992) Analysts ' use of information abouttrpaenrsmitaonryent andearnings components in forecasting annual EPS. The Accounting Review 67: 183-198.Amihud, Y., and H. Mendelson. (1986) Asset pricing and the bid-ask spread. Journal of Financial Econo mics 17: 223 —49.Artiach, T. and P. Clarkson. (2011) Disclosure, conservatism and the cost of equity capital: A review of the foundation literature. Accounting and Finance 51(1): 2-49.Ashbaugh-Skaiffe, H., D. Collins, W. Kinney, Jr., and R. LaFond (2009) The effect of SOX internal control deficiencies on firm risk and cost of equity. Journal of Accounting Research 47(1): 1-43.Armstrong, C., J. Core, D. Taylor and R. Verrecchia (2011) When does information asymmetry affect the cost of capital? Journal of Accounting Research 49(1): 1-40.Balakrishnan, K., R. Vashishtha and R. Verrecchia (2012) Aggregate competition, information asymmetry and cost of capital: Evidence from equity market liberalization. Working paper, University of Pennsylvania.Barron, O., O. Kim, S. Lim and D. Stevens (1998) Using analysts forecasts to measure properties on analysts ' information environmeTnth.e Accounting Review 73: 421-433.Barry, C., and S. Brown. (1985) Differential information and security market equilibrium. Journal of Financial and Quantitative Analysis 20: 407 T22.Barth, M., W. Beaver, and W. Landsman (2001) The relevance of value-relevance literature for financial accounting standard setting: Another view, Journal of A”ccounting and Economics (Sept): 77-104.Barth, M., Y. Konchitchki and W. Landsman (2013) Cost of capital and earnings transparency. Journal of Accounting and Economics , forthcoming.Beyer A., D. Cohen, T. Lys and B. Walther (2010) The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics 50: 296-343.Bhattacharya, N., F. Ecker, P. Olsson, and K. Schipper (2012) Direct and mediated association among earnings quality, information asymmetry, and the cost of capital, The Accounting Review 87(2): 449-482. Botosan, C. (1997) Disclosure level and the cost of equity capital. The Accounting Review 72: 323 -350. Botosan, C., and M. Plumlee. (2002) A re-examination of disclosure level and the expected cost of equity capital. Journal of Accounting Research 40: 21 ZO.Botosan, C., M. Plumlee and Y. Xie (2004) The role of information precision in determining the cost of equity capital. Review of Accounting Studies 9 (2-3): 233-259.Botosan, C., and M. Plumlee. (2005) Assessing alternative proxies for the expected risk premium. The Accounting Review 80: 21-53.Botosan, C., M. Plumlee and H. Wen. (2011) The relation between expected returns, realized returns, and firm risk characteristics. Contemporary Accounting Research 28(4): 1085-1122.Brown, P. and T. Walter (2012) The CAPM: Theoretical validity, empirical intractability and practical applications. Abacus 1-7.Callahan, C., R. Smith and A. Spencer (2012) An examination of the cost of capital implications of FIN 46. The Accounting Review 87(4): 1105-1134.Chava, S., and A. Purnanandam (2010) Is default risk negatively related to stock returns? Review of Financial Studies 23: 2523-2559.Chen, S., B. Miao and T. Shevlin (2013) A new measure of disclosure quality: The level of disaggregation of accounting data in annual reports. Working paper, The University of Texas at Austin. Christensen, P., L. de la Rosa and G. Feltham (2010) Information and the cost of capital: An ex ante perspective. The Accounting Review 85(3): 817-848.Clarkson, P., J. Guedes and R. Thompson (1996) On the diversifiability, observability, and measurement of estimation risk. Journal of Financial and Quantitative Analysis 31: 69084.Claus, J., and J. Thomas (2001) Equity premia as low as three percent? Evidence from analysts earnings forecasts for domestic and international stock markets. The Journal of Finance 56(5): 1629-1666.Clinch G., and B. Lombardi (2011) Information and the cost of capital: the Easley- O' Hara(2004) modelwith endogeneous information acquisition. Australian Journal of Management 36(5): 5-14.Coles, J., U. Loewenstein, and J. Suay. (1995) On equilibrium pricing under parameter uncertainty. The Journal of Financial and Quantitative Analysis 30: 347 -374.Core, J., (2001) A review of the empirical disclosure literature: Discussion. Journal of Accounting and Economics 31: 441-456.Core, J., W. Guay and R. Verdi, (2008) Is accruals quality a priced risk factor? Journal of Accountingand Economics 46: 2-22.Daniel, K. and S. Titman, 1997, Evidence on the characteristics of cross-sectional variation in common stock returns. Journal of Finance 52, 1-33.Daske, H., L Hail, C. Leuz and R. Verdi (2008) Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research 46: 1085-1142.Daske, H., L Hail, C. Leuz and R. Verdi, (2013) Adopting a label: Heterogeneity in the economic consequences around IAS/IFRS adoptions. Journal of Accounting Research 51(3):495-548.Dechow, P. and I. Dichev. (2002) The quality of accruals and earnings: the role of accrual estimation errors. The Accounting Review 77 (Supplement): 35-59.Dechow, P., W. Ge and C. Schrand (2010) Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50: 344-401.Dhaliwal, D., L. Krull and W. Moser (2005) Dividend taxes and implied cost of equity capital. Journal of Accounting Research 43(5): 675-708.Dhaliwal, D., L. Krull and O. Li (2007) Did the 2003 Tax Act reduce the cost of equity capital? Journal of Accounting and Economics 43(1): 121-150.Diamond, D., and R. Verrecchia. (1991) Disclosure, liquidity, and cost of capital. Journal of Finance 46: 1325 -59. Dye, R., (2001) An evaluation of “ essayson disclosure a”nd the disclosure literature in accounting. Journal of Accounting and Economics 32: 181-235.Easley, D., S. Hvidkjaer and M. O'Hara.(2002) Is information risk a determinant of asset returns. Journal of Finance 57: 2185-2221.Easley, D., and M. O' Hara. (2004) Information and the cost of capital. Journal of Fi nance 59: 1553-1583. Easton, P. (2004) PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. The Accounting Review 79(1): 73-96.Easton, P., and S. Monahan. (2005) An evaluation of accounting based measures of expected returns. The Accounting Review 80: 501 -538.Easton, P., and S. Monahan. (2010) Evaluating accounting-based measures of expected returns: Easton and Monahan and Botosan and Plumlee redux. Working paper, University of Notre Dame.Ecker, F., J. Francis, I. Kim, P. Olsson, and K. Schipper (2006). A returns-based representation of earnings quality. The Accounting Review 81: 749 -780.Fama, E., and J. MacBeth. 1973. Risk, return, and equilibrium: Empirical tests. Journal of Political Economy 81: 607-636.Fama, E., and K. French. (1992) The cross-section of expected stock returns. Journal of Finance 47(2): 427-465. Fama, E., and K. French. (1993) Common risk factors in the returns on bonds and stocks. Journal of Financial Economics 33: 3-56.Francis, J., LaFond, R., Olsson, P., and K. Schipper. (2004) Costs of equity and earnings attributes. The Accounting Review 79: 967-1010.Francis, J., LaFond, R., Olsson, P., and K. Schipper. (2005) The market pricing of accruals quality. Journal of Accounting & Economics 39: 295-327.Francis, J., Nanda, D., and P. Olsson. (2008) Voluntary disclosure, information quality, and costs of capital. Journal of Accounting Research 46 (1): 53-99.Gebhardt,W., C. Lee and B. Swaminathan (2001) Towards an ex ante cost of capital. Journal of Accounting Research 39(1): 135-176.Goh, B-W., J. Lee, C-Y. Lim and T. Shevlin (2013) The effect of corporate tax avoidance on the cost of equity. Working paper, Singapore Management University.Gow, I., G. Ormazabal and D. Taylor (2010) Correcting for cross-sectional and time-series dependence in accounting research The Accounting Review 85(2): 483-512.Gray, P., P. Koh and Y. Tong (2009) Accruals quality, information risk and cost of capital: Evidence from Australia. Journal of Business Finance and Accounting 36(1-2): 51-72.Guay, W., S.P. Kothari and S. Shu (2011) Properties of implied cost of capital using analysts forecasts. Australian Journal of Management 36(2): 125-149.Hail, L. (2002) The impact of voluntary corporate disclosure on the ex-ante cost of capital for Swiss firms European Accounting Review 11: 741-773.Hail, L., and C. Leuz. (2006) International differences in the cost of equity capital: Do legal institutions and securities regulation matter? Journal of Accounting Research 44(3): 485-531.Healy, P., and K. Palepu (2001) Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405-440. Hirshleifer, D., K. Hou, and S.H. Teoh (2012) The accrual anomaly: Risk or mispricing? ManagementScienee (58-2); 320 -335.Holthausen, R., and R. Watts (2001) The relevance of value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics (Sept): 3-75.Hribar, P. and T, Jenkins. (2004) The effect of accounting restatements on earnings revisions and the estimated cost of capital. Review of Accounting Studies 9(2-3): 337-356.Hughes, J. S., J. Liu, and J. Liu. (2007) Information asymmetry, diversification, and cost of capital. The Accounting Review 82: 705-729.Hughes, J. S., J. Liu, and J. Liu. (2009) On the association between expected returns and implied cost of capital R”eview of Accounting Studies 14: 246-259.Hutchens, M. and S. Rego (2013) Tax risk and the cost of equity capital. Working paper, Indiana University. Hwang, L-S., W-J. Lee, S-Y. Lim and K-H. Park, (2013) Does information risk affect the implied cost of equity capital? An analysis of PIN and adjusted PIN. Journal of Accounting and Economics 55(2-3): 148-167.Kim, D., and Y. Qi (2010) Accruals quality, stock returns, and macroeconomic conditions. The Accounting Review 85(3): 937-978.Klein, R., and V. Bawa. (1977) The effect of estimation risk on optimal portfolio choice. Journal of Financial Economics 3: 215-231.Kothari, S.P., X. Li and J. Short. (2009) The effect of disclosures by management, analysts, and financial press oncost of capital, return volatility, and analyst forecasts: A study using content analysis. The Accounting Review82(5): 1255-1297.Kravet, T. and T. Shevlin. (2010) Accounting restatements and information risk. Review of Accounting Studies 15: 264-294.Kyle, A. (1985) Continuous auctions and insider trade. Econometrica 53(6): 1315-1335.Lambert, R., C. Leuz, and R. Verrecchia. (2007) Accounting information, disclosure, and the cost of capital. Journal of Accounting Research 45(2): 385-420.Lambert, R., C. Leuz, and R. Verrecchia. (2012) Information asymmetry, information precision, and the cost of capital. Review of Finance 16: 1-29.Lambert, R., (2009) Discussion of “onthe association between expected returns and implied cost of capital R”eview of Accounting Studies 14: 260-268.Leuz, C., and R. Verrecchia (2004) Firms ' capital allocatio n choices, in formati on qhuaCys tandcapital. Work ing paper, Uni versity of Penn sylva nia.Li, V., T. Shevli n and D. Shores (2013) Revisit ing the AQ measure of accrual quality. Work ing paper, Uni versityof Wash ington.Lys, T., and S. Sohn. (1990) The associati on betwee n revisi ons of finan cial an alyst forecastsearning and security price cha nges. Jour nal of Acco un ti ng and Econo mics 13: 341-363.Mashruwala, C. and S. Mashruwala (2011) The pric ing of accrual quality: January versus the rest of the year. TheAccou nting Review 86(4): 1349-1381.McInnis, J. (2010) Earnings smoothness, average returns and implied cost of equity capital. The Accou ntingReview 85(1): 315-341.Mohanram, P., and D. Gode (2013) Removing predictable analyst forecast errors to improve implied cost of equity estimates. Review of Acco un ti ng Studies 18: 443-478.Ogneva, M., K.R. Subramanyam, and K. Raghunandan (2007) Internal control weakness and cost of equity: Evidenee from SOX Section 404 disclosures. The Accou nti ng Review 82(5) :1255-1297.Ogneva, M., (2012) Accrual quality, realized returns, and expected returns: The importanee of con trolli ng forcash flow shocks, The Accou nting Review 87(4): 1415-1444.Peterse n, M., (2009) Estimati ng sta ndard errors in finance data pan els: Compari ng approaches. Reviewof Financial Studies 22(1): 435-480.Petkova, R. (2006) Do the Fama-Fre nch factors proxy for inno vati on in predictive variables? Journal of Finance61: 581-612.Reidl, E., and G. Serafeim (2011) In formati on risk and fair values: An exam in ati on of equity betas. Journal ofAccounting Research 49(4): 1083-1122.Strobl, G., (2013) Earnings manipulation and the cost of capital. Journal of Accounting Research, forthco ming. Verrecchia, R. (2001) Essays on disclosure. Journal of Accounting and Economics 32: 97-180.Vuolteenaho, T. (2002) What drives firm-level stock returns? The Journal of Finance 57: 233 -264.How Do Various Forms of Auditor Rotation Affect Audit Quality? Evidence from China内部控制质量、企业风险与权益资本成本一一理论分析与实证检验1. Accruals Quality and In ternal Con trol over Finan cial Report in g.Acco un ti ng Review, Oct2007, V ol.82 Issue52. Audit Committee Quality and Internal Control An Empirical Analysis.FullAccounting Review, Apr2005, Vol.80 Issue 23. Bala ncing the Dual Resp on sibilities of Busin ess Un it Con trollers Field and Survey Evide nee. Accounting Review, Jul2009, Vol. 84 Issue44. Corporate Governance and Internal Control over Financial Reporting A Comparison ofRegulatory Regimes Accou nting Review, May2009, Vol. 84 Issue 35. Ear nings Man ageme nt of Firms Report ing Material In ternal Con trol Weak nesses un der Sect ion 404of the Sarbanes-Oxley Act. Auditing, Nov2008, Vol. 27 Issue 26. Economic Incentives for V oluntary Reporting on Internal Risk Management and Control Systems.Auditing, May2008, V ol. 27 Issue 67. Firm Characteristics and Volu ntary Man ageme nt Reports on In ternal Con trol. Audit ing, Nov2006,Vol. 25 Issue28. Former Audit Partners on the Audit Committee and Internal Control Deficiencies. Accounting Review,Mar2009, Vol. 849.Internal Control Quality and Audit Pricing under the Sarbanes-Oxley Act . Auditing, May2008, Vol.2710.Internal Control Weakness and Cost of Equity Evidenee from SOX Section 404 Disclosures Accou nti ngReview, Oct2007, Vol. 8211.I nternal Control Weak nesses and In formatio n Un certai nty. Accou nting Review, May2008, Vol. 8312.lnternal Controls and the Detection of Management Fraud. Journal of Accounting Research, Sprin g99,Vol. 3713.Reduci ng Man ageme nt's In flue nee on Auditors Judgme nts An Experime ntal In vestigati on of SOX404 Assessme nts Acco un ti ng Review, Nov2008, V)l. 8314.SOX Section 404 Material WeaknessDisclosures and Audit Fees.Full Auditing, May2006, Vol. 2515.The Effect of SOX Internal Control Deficiencies and Their Remediation on Accrual Quality. AccountingReview, Jan2008, Vol. 8316.The Impact of SOX Section 404 Internal Control Quality Assessment on Audit Delay in the SOX Era.Auditing, Nov2006, Vol. 25Ashbaugh-Skaife, H., Collins, D. W., & Kinney Jr., W. R. (2007). The discovery and reporting of internal con trol deficie ncies prior to SOX-ma ndated audits. Jour nal of Acco unting and Economics, 44(1 —2), 166 -92.Ashbaugh-Skaife, H., Collins, D. W., Kinney Jr, W. R., & Lafond, R. (2009). The Effect of SOX Internal Control Deficiencies on Firm Risk and Cost of Equity. Journal of Accounting Research, 47(1),1 -43.Bahramian, A. (2011), Evaluation of the effectiveness of internal controls in an Investment Company, Master Thesis in Imam Hossein University, Iran.Daraby, M, (2006), analyzing the effect of strengthening internal controls, audit reports of companies listed on the Stock Audit, Master Thesis in Azan Islamic university.Doyle, J., Ge, W., & McVay, S. (2007). Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics, 44(1 -2), 193 -223.Feng, M., Li, C., & McVay, S. (2009). Internal control and management guidance. Journal of Accounting and Economics, 48(2 -3), 190 -209.Maham K., Poriya Nasab, A. (2000), Internal control) Integrated Framework( , Report of the Committee of the Commission Tardy, azman Hesabresy, Pages 118, 135.Ogneva, M., Subramanyam, K. R., & Raghunandan, K. (2007). Internal control weakness and cost of equity: evidence from SOX Section 404 disclosures. The Accounting Review, 82(5), 1255-1297.Rezaie Jahangoshaee, H, (1996). A analytical study of the degree of reliance of independent auditors on firms internal controls, Master Thesis, shahid Beheshti University, Iran.。