会计英语课后习题参考答案

- 格式:doc

- 大小:288.50 KB

- 文档页数:23

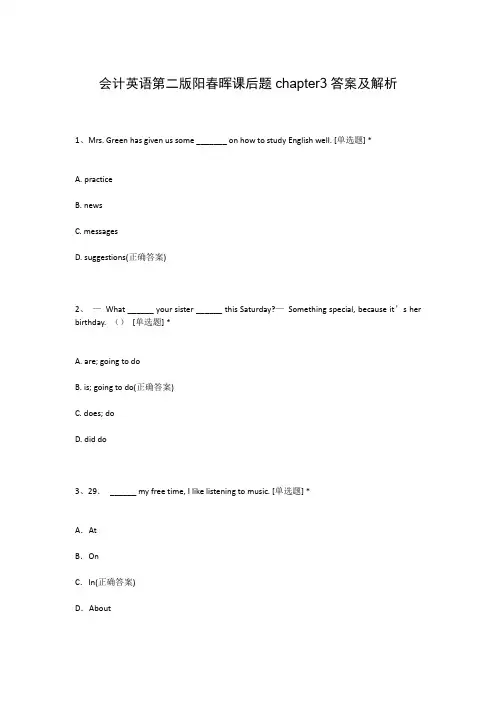

会计英语第二版阳春晖课后题chapter3答案及解析1、Mrs. Green has given us some _______ on how to study English well. [单选题] *A. practiceB. newsC. messagesD. suggestions(正确答案)2、—What ______ your sister ______ this Saturday?—Something special, because it’s her birthday. ()[单选题] *A. are; going to doB. is; going to do(正确答案)C. does; doD. did do3、29.______ my free time, I like listening to music. [单选题] *A.AtB.OnC.In(正确答案)D.About4、--Shall we have a swim?--Yes, let’s _______ it at 9:00 next Sunday. [单选题] *A. putB. meetC. setD. make(正确答案)5、I’m not sure whether we’ll go on ______ foot or by _____ bike? [单选题] *A. the; theB. /; theC. /; /(正确答案)D. the; /6、Be careful when you _______ the street. [单选题] *A. are crossingB. is crossingC. cross(正确答案)D. is cross7、Hearing that he had passed _____ health examination, he immediately made _____ call to his parents. [单选题] *A. a; /B. the; /C. the; a(正确答案)D. a; the8、They lost their way in the forest, and _____ made matters worse was night began to fall. [单选题] *A. thatB. itC. what(正确答案)D. which9、____ father is a worker. [单选题] *A.Mike's and Mary'sB. Mike and Mary's(正确答案)C. Mike's and MaryD. Mike and Marys'10、Don’t _______. He is OK. [单选题] *A. worry(正确答案)B. worried aboutC. worry aboutD. worried11、Can you tell me how the accident _______? [单选题] *A. came about(正确答案)B. came backC. came downD. came from12、Two()in our school were sent to a remote village to teach for a month. [单选题] *A. women teachers(正确答案)B. woman teachersC. women teacherD. woman teacher13、Many young people like to _______ at weekends. [单选题] *A. eat out(正确答案)B. eat upC. eat onD. eat with14、12.That is a good way ________ him ________ English. [单选题] *A.to help;forB.helps;withC.to help;with(正确答案)D.helping;in15、When we take a trip,we usually have to _______ a hotel. [单选题] *A. takeB. stayC. book(正确答案)D. bring16、The car is _______. It needs washing. [单选题] *A. cleanB. dirty(正确答案)C. oldD. new17、14.Builders have pulled down many old houses, and they will build a lot of new ________. [单选题] *A.ones (正确答案)B.oneC.the onesD.the one18、How _______ it rained yesterday! We had to cancel(取消) our football match. [单选题] *A. heavily(正确答案)B. lightC. lightlyD. heavy19、You’d ______ give up smoking. [单选题] *A. goodB. wellC. better(正确答案)D. best20、He _______ getting up early. [单选题] *A. used toB. is used to(正确答案)C. is usedD. is used for21、91.—Do you live in front of the big supermarket?—No. I live ________ the supermarket ________ the post office. [单选题] *A.across; fromB.next; toC.between; and(正确答案)D.near; to22、—______ —()[单选题] *A. How long did you stay there?B. How much did you pay for the dress?C. How many flowers did you buy?(正确答案)D. How often did you visit your grandparents?23、______ my great joy, I met an old friend I haven' t seen for years ______ my way ______ town. [单选题] *A. To, in, forB. To, on, to(正确答案)C. With, in, toD. For, in, for24、21.Design a travel guide for Shanghai! ________ the competition and be the winner! [单选题] *A.JoinB.AttendC.EnterD.Take part in (正确答案)25、Allen is looking forward to _______ his American partner at the trade fair. [单选题] *A. meetB. meeting(正确答案)C. be meetingD. having meeting26、43.How much did you ________ the man for the TV? [单选题] *A.pay(正确答案)B.takeC.spendD.buy27、79.On a ________ day you can see the city from here. [单选题] *A.warmB.busyC.shortD.clear(正确答案)28、--Whose _______ are these?? ? ? --I think they are John·s. [单选题] *A. keyB. keyesC. keys(正确答案)D. keies29、I didn't hear _____ because there was too much noise where I was sitting. [单选题] *A. what did he sayB. what he had said(正确答案)C. what he was sayingD. what to say30、40.Star wars is ______ adventure film and it is very interesting. [单选题] *A.aB.an (正确答案)C.the D./。

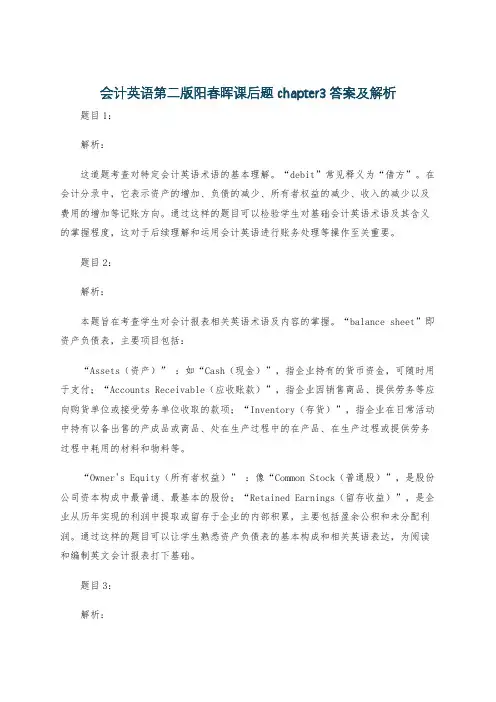

会计英语第二版阳春晖课后题chapter3答案及解析 题目1: 解析: 这道题考查对特定会计英语术语的基本理解。“debit”常见释义为“借方”。在会计分录中,它表示资产的增加、负债的减少、所有者权益的减少、收入的减少以及费用的增加等记账方向。通过这样的题目可以检验学生对基础会计英语术语及其含义的掌握程度,这对于后续理解和运用会计英语进行账务处理等操作至关重要。

题目2: 解析: 本题旨在考查学生对会计报表相关英语术语及内容的掌握。“balance sheet”即资产负债表,主要项目包括:

“Assets(资产)” :如“Cash(现金)”,指企业持有的货币资金,可随时用于支付;“Accounts Receivable(应收账款)”,指企业因销售商品、提供劳务等应向购货单位或接受劳务单位收取的款项;“Inventory(存货)”,指企业在日常活动中持有以备出售的产成品或商品、处在生产过程中的在产品、在生产过程或提供劳务过程中耗用的材料和物料等。

“Owner's Equity(所有者权益)” :像“Common Stock(普通股)”,是股份公司资本构成中最普通、最基本的股份;“Retained Earnings(留存收益)”,是企业从历年实现的利润中提取或留存于企业的内部积累,主要包括盈余公积和未分配利润。通过这样的题目可以让学生熟悉资产负债表的基本构成和相关英语表达,为阅读和编制英文会计报表打下基础。

题目3: 解析: 本题考查学生运用会计英语编制会计分录的能力。在会计中,用现金购买办公用品,会导致办公用品(属于费用类,“Office Supplies Expense” )增加,现金(“Cash”)减少。会计分录编制如下:

Debit: Office Supplies Expense 1000Credit: Cash 1000. 解析中解释了为什么借方记“Office Supplies Expense”(因为费用增加记借方),贷方记“Cash”(因为资产减少记贷方),这样可以让学生理解会计分录编制的原理和相关英语表达,提高其实际运用会计英语进行账务处理的能力。

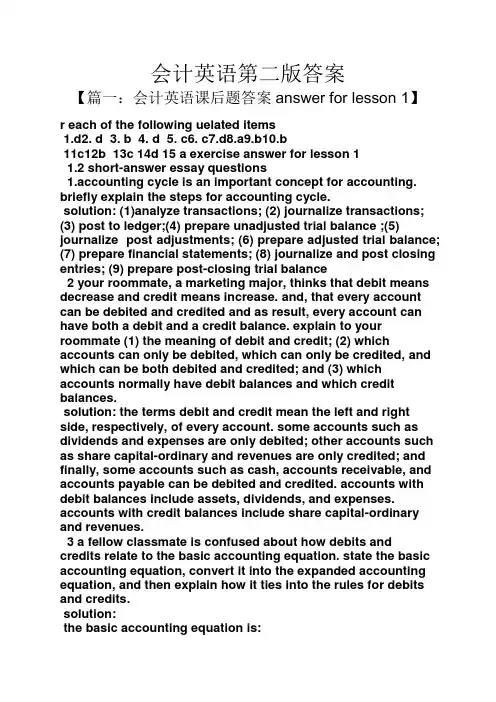

会计英语第二版答案【篇一:会计英语课后题答案answer for lesson 1】r each of the following uelated items1.d2. d3. b4. d5. c6. c7.d8.a9.b10.b11c12b 13c 14d 15 a exercise answer for lesson 11.2 short-answer essay questions1.accounting cycle is an important concept for accounting. briefly explain the steps for accounting cycle.solution: (1)analyze transactions; (2) journalize transactions; (3) post to ledger;(4) prepare unadjusted trial balance ;(5) journalize post adjustments; (6) prepare adjusted trial balance;(7) prepare financial statements; (8) journalize and post closing entries; (9) prepare post-closing trial balance2 your roommate, a marketing major, thinks that debit means decrease and credit means increase. and, that every account can be debited and credited and as result, every account can have both a debit and a credit balance. explain to your roommate (1) the meaning of debit and credit; (2) which accounts can only be debited, which can only be credited, and which can be both debited and credited; and (3) which accounts normally have debit balances and which credit balances.solution: the terms debit and credit mean the left and right side, respectively, of every account. some accounts such as dividends and expenses are only debited; other accounts such as share capital-ordinary and revenues are only credited; and finally, some accounts such as cash, accounts receivable, and accounts payable can be debited and credited. accounts with debit balances include assets, dividends, and expenses. accounts with credit balances include share capital-ordinary and revenues.3 a fellow classmate is confused about how debits andcredits relate to the basic accounting equation. state the basic accounting equation, convert it into the expanded accounting equation, and then explain how it ties into the rules for debits and credits.solution:the basic accounting equation is:assets = liabilities + equitythe expanded equation divides equity into its various parts, reflecting the shareholders investment, dividends, revenues, and expenses:assets = liabilities + share capital-ordinary + retained earnings – dividends + revenues – expensesthis expanded equation can then be re-arranged to explain why certain accounts have debit (left-hand) balances, while other accounts have credit (right-hand) balances, as follows:assets + dividends + expenses = liabilities + share capital-ordinary + retained earnings + revenuesthe accounts on the left-hand side of the equation have left-hand, or debit balances, while the accounts on theright-hand side of the equation have right-hand, or credit balances. accounts with debit balances are increased with debits and decreased with credits, while accounts with credit balances are increased with credits and decreased with debits.4 john dough, a fellow employee, wants to understand the basic steps in the recording process. identify and briefly explain the steps in the order in which they occur.solutionthe basic steps in the recording process are:1. analyze each transaction. in this step, business documents are examined to determine the effects of the transactionon the accounts.2. enter each transaction in a journal. this step is called journalizing and it results in making a chronological record of the transactions.3. transfer journal information to ledger accounts. this step is called posting. posting makes it possible to accumulatethe effects of journalized transactions on individual accounts.5 the process of transferring the information in the journal to the general ledger is called posting. explain the posting process, including the importance of the journal page number and the account numbers.solutionthe posting process begins with locating the account(s) being debited in the general ledger. then entering the date of the entry, the journal page number where the entry originated and debit portion of the entry in the date, reference and debitcolumns, respectively. once this done, the account number(s) of the account(s) being debited is (are) entered in the reference column in the journal. next, the credit portion of the journal entry is posted to the appropriate accounts in the ledger following the same steps as noted for the debit portion.the importance of the journal page number, in the reference column of each account in the general ledger accounts, is to indicate where to find the original entry. and, the generalledger account numbers, in the reference column of the journal, indicate that the entry has been posted.1.3 the effects of transactions on the accounting equationlinda champion began a professional accounting practice on may 1 and plans to prepare financial statements at the end of each month. during may, champion completed these transactions:。

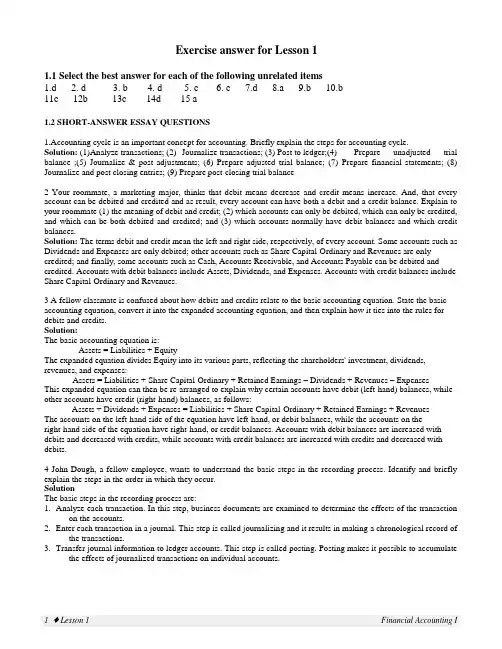

Exercise answer for Lesson 11.1 Select the best answer for each of the following unrelated items1.d2. d3. b4. d5. c6. c7.d8.a9.b 10.b11c 12b 13c 14d 15 a1.2 SHORT-ANSWER ESSAY QUESTIONS1.Accounting cycle is an important concept for accounting. Briefly explain the steps for accounting cycle.Solution: (1)Analyze transactions; (2) Journalize transactions; (3) Post to ledger;(4) Prepare unadjusted trial balance ;(5) Journalize & post adjustments; (6) Prepare adjusted trial balance; (7) Prepare financial statements; (8) Journalize and post closing entries; (9) Prepare post-closing trial balance2 Your roommate, a marketing major, thinks that debit means decrease and credit means increase. And, that every account can be debited and credited and as result, every account can have both a debit and a credit balance. Explain to your roommate (1) the meaning of debit and credit; (2) which accounts can only be debited, which can only be credited, and which can be both debited and credited; and (3) which accounts normally have debit balances and which credit balances.Solution: The terms debit and credit mean the left and right side, respectively, of every account. Some accounts such as Dividends and Expenses are only debited; other accounts such as Share Capital-Ordinary and Revenues are only credited; and finally, some accounts such as Cash, Accounts Receivable, and Accounts Payable can be debited and credited. Accounts with debit balances include Assets, Dividends, and Expenses. Accounts with credit balances include Share Capital-Ordinary and Revenues.3 A fellow classmate is confused about how debits and credits relate to the basic accounting equation. State the basic accounting equation, convert it into the expanded accounting equation, and then explain how it ties into the rules for debits and credits.Solution:The basic accounting equation is:Assets = Liabilities + EquityThe expanded equation divides Equity into its various parts, reflecting the shareholders' investment, dividends, revenues, and expenses:Assets = Liabilities + Share Capital-Ordinary + Retained Earnings – Dividends + Revenues – ExpensesThis expanded equation can then be re-arranged to explain why certain accounts have debit (left-hand) balances, while other accounts have credit (right-hand) balances, as follows:Assets + Dividends + Expenses = Liabilities + Share Capital-Ordinary + Retained Earnings + RevenuesThe accounts on the left-hand side of the equation have left-hand, or debit balances, while the accounts on theright-hand side of the equation have right-hand, or credit balances. Accounts with debit balances are increased with debits and decreased with credits, while accounts with credit balances are increased with credits and decreased with debits.4 John Dough, a fellow employee, wants to understand the basic steps in the recording process. Identify and briefly explain the steps in the order in which they occur.SolutionThe basic steps in the recording process are:1. Analyze each transaction. In this step, business documents are examined to determine the effects of the transactionon the accounts.2. Enter each transaction in a journal. This step is called journalizing and it results in making a chronological record ofthe transactions.3. Transfer journal information to ledger accounts. This step is called posting. Posting makes it possible to accumulatethe effects of journalized transactions on individual accounts.5 The process of transferring the information in the journal to the general ledger is called posting. Explain the posting process, including the importance of the journal page number and the account numbers.SolutionThe posting process begins with locating the account(s) being debited in the general ledger. Then entering the date of the entry, the journal page number where the entry originated and debit portion of the entry in the date, reference and debit columns, respectively. Once this done, the account number(s) of the account(s) being debited is (are) entered in the reference column in the journal. Next, the credit portion of the journal entry is posted to the appropriate accounts in the ledger following the same steps as noted for the debit portion.The importance of the journal page number, in the reference column of each account in the general ledger accounts, is to indicate where to find the original entry. And, the general ledger account numbers, in the reference column of the journal, indicate that the entry has been posted.1.3 The effects of transactions on the accounting equationLinda Champion began a professional accounting practice on May 1 and plans to prepare financial statements at the end of each month. During May, Champion completed these transactions:a. Invested €50,000 cash and equipment that had a€10,000 fair market (cash equivalent) value.b. Paid €1,600 rent for office space for the month.c. Purchased €12,000 of additional equipment on credit.d. Completed work for a client and immediately collected €2,000 cash.e. Completed work for a client a nd sent a bill for €7,000 to be paid within 30 days.f. Purchased €8,000 of additional equipment for cash.g. Paid an assistant €2,400 as wages for the month.h. Collected €5,000 of the amount owed by the client described in transaction (e).i. Paid for the equipment purchased in transaction (c).j. Withdrew €500 for personal use.Enquired:Using the information presented in (a) through (j) above, Linda Champion, the owner, first creates a table like the one shown below. She then uses the results to calculate net income earned during the month of May, her first month of operations.Solutions:Notice how Assets of €64,500 = Liabilities + Owner’s equity of €64,500. From this schedule you cancalculate the firm’s net income by summarizing the revenues and expenses as follows: Net income =Revenues – Expenses= (€2,000 + €7,000) –(€1,600 + €2,400)= €5,0001.4 Preparing a statement of comprehensive income and a statement of financial positionDuring June through August of 20X5, Lin Yan earned money doing computer consulting work. She went around the city and obtained several contracts for small jobs. Lin then withdrew €3,000 from her personal savings account and deposited it in a separate account for the business. At the end of the summer, Lin tried to figure out how well her business had done.Lin’s business records showed the following transactions:a. Deposited €12,500 (from customers’ payments).b. Issued cheques:−car and equipment rental, €2,000;−gas, €900;−supplies purchased and used, €100;− hir ed help, €4,800;−payroll taxes, €600;−insurance, €180;−telephone, €120.c. Transferred €2,000 cash from the business bank account to personal savings account.d. Owed €500 by customers.e. Owed €150 for gas.Required1. Show the effect of each transaction, including the initial cash deposit, on the accounting equation.2. Prepare a statement of comprehensive income for Lin’s summer business.3. Prepare a statement of financial position for Lin at the end of the summer.Solution:1. To show the effect of each transaction on the accounting equation, construct a worksheet with four columns using the following headings: item, assets, liabilities, and owner’s equity. Recall that revenues increase owner’s equity and expenses decrease owner’s equity.2. Re venues originated from two sources: customers’ payments (€12,500) and from amounts yet to be paid by customers (€500). Total expenses included car and equipment rental (€2,000), car expenses (€900 paid + €150 unpaid), supplies (€100), helpers (€4,800), payroll taxes (€600), insurance (€180), and telephone (€120). Net income is determined from the difference of total revenues and total expenses. Based on this information, the following income statement is prepared.Solutions:3. From the effect of the transactions prepared in part 1, you can generate the following statement of financialposition for the end of the summer.The cash balance can be determined as follows:The cash balance excludes two amounts: the €500 still owed to Lin by customers and €150 she owes for car gas invoices not yet paid. If she receives the money owed her and she pays her debt, then she will have an additional €350 (€500 –€150), making a total cash balance of €5,150 (€4,800 + €350) for the summer. Note that the €2,000 personal withdrawal was not included as an expense on the statement of comprehensive income. The withdrawal is considered a distribution of income (owner’s profits) rather than an expense. The owner’s equity of €5,150 on the balance sheet includes the initial investment plus net income less the withdrawal (€3,000 + €4,150 –€2,000).1.5Increases, decreases, and normal balances of accountsEnquired: Complete the following table by1. Identifying the type of account listed on each line.2. Entering debit or credit in the blank spaces to identify the kind of entry that would increase or decrease the account balance.3. Identifying the normal balance of the account.1.6 Analyzing transactions using T-accountsOpen the following T-accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Steve Moore, Capital; Steve Moore, Withdrawals; Fees Earned; and Rent Expense. Next, record these transactions of the Moore Company by recording the debit and credit entries directly in the T-accounts. Use the letters beside each transaction to identify the entries.a. Steve Moore invested €12,750 cash in the business.b. Purchased €375 of office supplies for cash.c. Purchased €7,050 of office equipment on credit.d. Received €1,500 cash as fees for services provided to a customer.e. Paid for the office equipment purchased in transaction (c).f. Billed a customer €2,700 as fees for services.g. Paid the monthly rent with €525 cash.h. Collected €1,125 of the account receivable created in transaction (f).i. Steve Moore withdrew €1,000 cash from the business.Enquired:1. Record these transactions of the Moore Company in journal.2. Open the following T-accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Steve Moore, Capital; Steve Moore, Withdrawals; Fees Earned; and Rent Expense. Next, post the entries in theT-accounts. Use the letters beside each transaction to identify the entries.Solution:a. Steve Moore invested €12,750 cash in the business:b. Purchased €375 of office supplies for cash:c. Purchased €7,050 of office equipment on credit:d. Received €1,500 cash as fees for services provided to a customer:e. Paid for the office equipment purchased in transaction (c):f. Billed a customer €2,700 as fees for services:g. Paid the monthly rent with €525 cash:h. Collected €1,125 of the account receivable created in transaction (f):i. Steve Moore withdrew €1,000 cash from the bu siness:1.7 Correct the errorBetty Wright, CPA, was asked by the controller of Gore Company to review the accounting records before financial statements are prepared. Betty reviewed the records and found three errors.1.Cash paid on accounts payable for $930 was recorded as a debit to Accounts Payable $390 and a credit to Cash $390.2.The purchase of supplies on account for $500 was debited to Equipment $500 and credited to Accounts Payable $500.3.The company paid dividends $1,200. The bookkeeper debited Accounts Receivable for $120 and credited Cash $120. Enquired:Prepare an analysis of each error showing the(a) incorrect entry.(b) correct entry.(c) correcting entry.Solution:1. (a) Incorrect EntryAccounts Payable (390)Cash (390)(b) Correct EntryAccounts Payable (930)Cash (930)(c) Correcting EntryAccounts Payable (540)Cash (540)2. (a) Incorrect EntryEquipment (500)Accounts Payable (500)(b) Correct EntrySupplies (500)Accounts Payable (500)(c) Correcting EntrySupplies (500)Equipment (500)3. (a) Incorrect EntryAccounts Receivable (120)Cash (120)(b) Correct EntryDividends ......................................................................................... 1,200Cash ....................................................................................... 1,200(c) Correcting EntryDividends ......................................................................................... 1,200Accounts Receivable (120)Cash ....................................................................................... 1,0801.8 Ben Cartwright Pest Control has the following balances in selected accounts on December 31, 2011.Accounts Receivable € 0Accumulated Depreciation – Equipment 0Spraying Equipment 6,650Interest Payable 0Notes Payable 20,000Prepaid Insurance 2,400Salaries Payable 0Supplies 2,940Unearned Spraying Revenues 36,000All of the accounts have normal balances. The information below has been gathered at December 31, 2011.1. Depreciation on the equipment for 2011 is €1,250.2. Ben Cartwright Pest Control borrowed €20,000 by signing a 10%, one-year note on July 1, 2011.3. Ben Cartwright Pest Control paid €2,400 for 12 months of insurance coverage on October 1, 2011.4. Ben Cartwright Pest Control pays its employees total salaries of €10,000 every Monday for the preceding 5-day week (Monday-Friday). On Monday, December 27, 2011, employees were paid for the week ending December 24, 2011. All employees worked the five days ending December 31, 2011.5. Ben Cartwright Pest Control performed disinfecting services for a client in December 2011. The client will be billed €3,000.6. On December 1, 2011, Ben Cartwright Pest Control collected €36,000 for disinfecting processes to be performed from December 1, 2011, through May 31, 2011.7. A count of supplies on December 31, 2011, indicates that supplies of €950 are on hand.Enquired:Prepare in journal form with explanations, the adjusting entries for the seven items listed for Ben Cartwright Pest Control.Solutions:(1) Depreciation Expense - Equipment ............................................................... 1,250Accumulated Depreciation - Equipment................................................. 1,250 (To record depreciation for the period)(2) Interest Expense ............................................................................................ 1,000Interest Payable....................................................................................... 1,000 (To record accrued interest on note payable)[€20,000 * 10% * (6/12) = €1,000](3) Insurance Expense (600)Prepaid Insurance (600)(To recognize period insurance expense)[(€2,400 / 12) * 3 = €600](4) Wages Expense .............................................................................................. 10,000Wages Payable ........................................................................................ 10,000 (To record wages for the week)(5) Accounts Receivable ..................................................................................... 3,000Spraying Revenues ................................................................................. 3,000 (To record revenue earned but not yet received)(6) Unearned Spraying Revenues ........................................................................ 6,000Spraying Revenues ................................................................................. 6,000 (To record revenue earned with prior payment)(7) Supplies Expense ........................................................................................... 1,990Supplies .................................................................................................. 1,990 (To record supplies expense)[€2,940 - €950 = €1,990]1.9 Complete the worksheet for adjusted trial balanceThe worksheet for Boone Mailing Center appears below.BOONE MAILING CENTERWorksheetFor the Month Ended August 31, 2011Using the adjustment data below, complete the worksheet. Add any accounts that are necessary. Adjustment data:(a) Prepaid rent expired during August, $2.(b) Depreciation expense on equipment for the month of August, $8.(c) Supplies on hand on August 31 amounted to $6.(d) Salaries expense incurred at August 31 but not yet paid amounted to $10SolutionBOONE MAILING CENTERWorksheetFor the Month Ended August 31, 20111.10Preparing and posting closing entriesUse the information provided in the T-accounts below to prepare closing journal entries at December 31, 20X5.Rent ExpenseSolution:20X5(1) Dec 31 Services Revenue................................................ 73,000Income Summary ......................................... 73,000To close the revenue account and open Income Summary.(2) 31 Income Summary....................................................... 48,100Rent Expense ............................................... 8,600Salaries Expense .......................................... 20,000Insurance Expense ....................................... 3,500Depreciation Expense .................................. 16,000To close the expense accounts.(3) 31 Income Summary....................................................... 24,900Marcy Jones, Capital ................................... 24,900To close Income Summary.(4) 31 Marcy Jones, Capital ................................................ 24,000Marcy Jones, Withdrawals........................... 24,000To close the withdrawals account.Post the closing entries prepared in part (a) above to the T-accounts.1.11 Prepare closing entries and a post-closing trial balanceLatitudes Company had the following adjusted trial balance.LATITUDES COMPANYAdjusted Trial BalanceFor the month ended June 30, 20X1Enquired:(a) Prepare closing entries at June 30, 20X1.(b) Prepare a post-closing trial balance.Solution:(a)Service Revenue ...................................................................................................... 4,100Income Summary ....................................................................................... 4,100 Income Summary ..................................................................................................... 3,900Supplies Expense ....................................................................................... 2,300Miscellaneous Expense .............................................................................. 300 Salaries Expense ................................................................................................................... 1,300Income Summary (200)Retained Earnings (200)Retained Earnings (300)Dividends (300)(b)LATITUDES COMPANYPost-closing Trial BalanceFor the month ended June 30, 20X1Account titles Debits CreditsCash $ 3,700Accounts Receivable 3,900Supplies 500Accounts Payable $ 1,800Unearned Revenue 200Share Capital-Ordinary 5,000Retained Earnings 700DividendsService RevenueSalaries ExpenseMiscellaneous ExpenseSupplies ExpenseSalary Payable 400$8,100 $8,1001.12 Preparation of a classified statement of financial positionThe adjusted trial balance for Alpine Climbing Adventures has been alphabetized as follows:ALPINE CLIMBING ADVENTURESAdjusted trial BalanceMarch 31, 20X7Accounts payable..................................................................... € 2,400Accounts receivable................................................................. € 6,000Accumulated depreciation, equipment..................................... 14,000Amy Rooniak, capital .............................................................. 36,700Amy Rooniak, withdrawals ..................................................... 47,000Cash ......................................................................................... 15,000Depreciation expense, equipment ............................................ 1,400 Equipment................................................................................ 41,000Insurance expense.................................................................... 3,900Interest expense (660)Long-term notes payable ......................................................... 11,000Rent expense............................................................................ 15,000 Revenues.................................................................................. 122,000Supplies (540)Supplies expense...................................................................... 3,600Telephone expense................................................................... 4,200Unearned revenues................................................................... 22,000Utilities expense....................................................................... 1,800Wages expense......................................................................... 68,000 _______Totals ....................................................................................... €208,100 €208,100Required1. Journalize the closing entries.2. Prepare a statement of comprehensive income and a statement of change in owner’s equity for the year ended March 31, 20X7, and a classified statement of financial position at March 31, 20X7. The owner made an additional investment during the year of €5,000. A €6,000 payment on the long-term notes payable will be made during the year ended March 31, 20X7.Solution:20X7 Closing entries:March 31 Revenues............................................................... 122,000Income Summary ........................................... 122,000To close the revenue account.31 Income Summary .................................................. 98,560Depreciation Expense, Equipment ................. 1,400Insurance Expense.......................................... 3,900Interest Expense (660)Rent Expense.................................................. 15,000Supplies Expense ........................................... 3,600Telephone Expense ........................................ 4,200Utilities Expense ............................................ 1,800Wages Expense .............................................. 68,000To close expense accounts.31 Income Summary ................................................. 23,440Amy Rooniak, Capital................................... 23,440To close the income summary to capital.31 Amy Rooniak, Capital.......................................... 47,000Amy Rooniak, Withdrawals.......................... 47,000To close withdrawals to capital.。

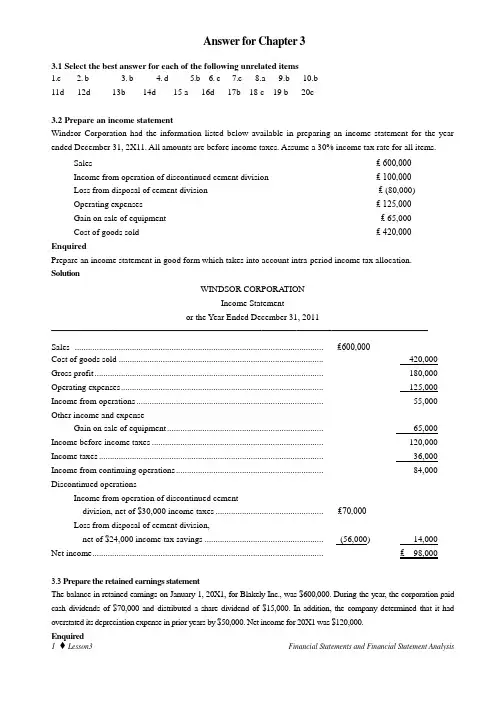

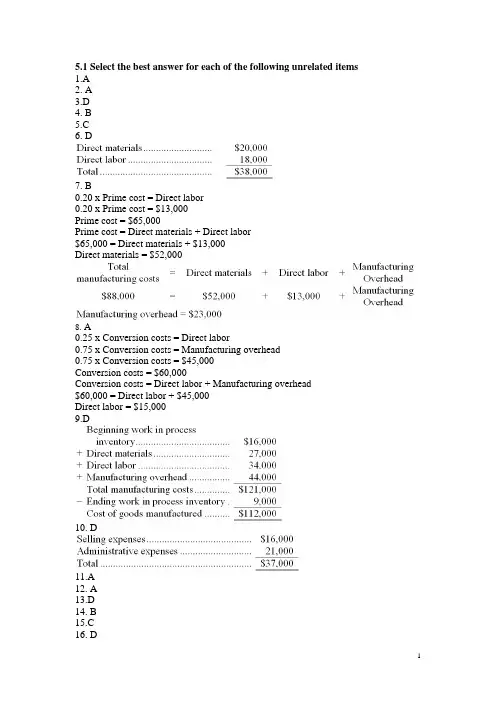

Answer for Chapter 33.1 Select the best answer for each of the following unrelated items1.c2. b3. b4. d5.b6. c7.c8.a9.b 10.b11d 12d 13b 14d 15 a 16d 17b 18 c 19 b 20c3.2Prepare an income statementWindsor Corporation had the information listed below available in preparing an income statement for the year ended December 31, 2X11. All amounts are before income taxes. Assume a 30% income tax rate for all items.Sales ₤ 600,000Income from operation of discontinued cement division ₤ 100,000Loss from disposal of cement division ₤ (80,000)Operating expenses ₤ 125,000Gain on sale of equipment ₤ 65,000Cost of goods sold ₤ 420,000EnquiredPrepare an income statement in good form which takes into account intra-period income tax allocation.SolutionWINDSOR CORPORA TIONIncome Statementor the Year Ended December 31, 2011 ———————————————————————————————————————————Sales ................................................................................................................. ₤600,000Cost of goods sold ............................................................................................. 420,000 Gross profit ........................................................................................................ 180,000 Operating expenses ............................................................................................ 125,000 Income from operations ..................................................................................... 55,000 Other income and expenseGain on sale of equipment ....................................................................... 65,000 Income before income taxes .............................................................................. 120,000 Income taxes ...................................................................................................... 36,000 Income from continuing operations ................................................................... 84,000 Discontinued operationsIncome from operation of discontinued cementdivision, net of $30,000 income taxes ................................................. ₤70,000Loss from disposal of cement division,net of $24,000 income tax savings ...................................................... (56,000) 14,000 Net income ......................................................................................................... ₤98,0003.3 Prepare the retained earnings statementThe balance in retained earnings on January 1, 20X1, for Blakely Inc., was $600,000. During the year, the corporation paid cash dividends of $70,000 and distributed a share dividend of $15,000. In addition, the company determined that it had overstated its depreciation expense in prior years by $50,000. Net income for 20X1 was $120,000.EnquiredPrepare the retained earnings statement for 20X1.SolutionBLAKEL Y INC.Retained Earnings StatementFor the Y ear Ended December 31, 20X1Balance, January 1 as reported $600,000 Correction for understatement of net incomein prior period (depreciation expense error) 50,000 Balance, January 1, as adjusted 650,000 Add: Net income 120,000770,000 Less: Cash dividends $70,000Share dividend 15,000 85,000 Balance, December 31 $685,0003.4 Prepare fiancial statementsThese financial statement items (in thousands) are for Chen Company at year-end, July 31, 2X11.Salaries payable ¥4,580 Note payable (long-term) ¥3,300Salaries expense 45,700 Cash 22,200Utilities expense 19,100 Accounts receivable 9,780Equipment 22,000 Accumulated depreciation 6,000Accounts payable 4,100 Dividends 4,000 Commission revenue 56,100 Depreciation expense 4,000Rent revenue 6,500 Retained earnings (1/1/2X11) 30,000Share capital-ordinary 16,200Enquired(a) Prepare an income statement and a retained earnings statement for the year.(b) Prepare a classified statement of financial position at July 31, 2X11.Solution(a) CHEN COMPANYIncome StatementFor the Year Ended July 31, 2X11 ———————————————————————————————————————————RevenuesCommission revenue .................................................................................... ¥56,100Rent revenue ................................................................................................. 6,500 Total revenues ...................................................................................... ¥62,600 ExpensesSalaries expense ............................................................................................ 45,700Utilities expense ........................................................................................... 19,100Depreciation expense .................................................................................... 4,000Total expense........................................................................................ 68,800 Net loss ................................................................................................................... ¥ (6,200)CHEN COMPANYRetained Earnings StatementFor the Year Ended July 31, 2X11 ———————————————————————————————————————————Retained Earnings, August 1, 2X10 ............................................................................. ¥30,000 Less: Net loss ..................................................................................................... ¥6,200 Dividends ...................................................................................................... 4,000 10,200 Retained Earnings , July 31, 2X11 .......................................................................... ¥18,800(b) CHEN COMPANYStatement of Financial PositionJuly 31, 2X11 ———————————————————————————————————————————AssetsProperty, plant, and equipmentEquipment..................................................................................................... ¥22,000Less: Accumulated depreciation ................................................................... 6,000 ¥16,000 Current assetsAccounts receivable ...................................................................................... 9,780Cash ............................................................................................................ 22,20031,980 Total assets ............................................................................................ ¥47,980Equity and LiabilitiesEquityShare capital-ordinary………………………………………………… ¥16,200Retained earnings ......................................................................................... 18,800 ¥35,000 Long-term liabilitiesNote payable ................................................................................................. 3,300 Current liabilitiesAccounts payable .......................................................................................... ¥4,100Salaries payable ............................................................................................ 4,580 8,680 Total equity and liabilities ....................................................................................... ¥47,9803.5 Prepare a statement of cash flowsA comparative statement of financial position for Mann Company appears below:MANN COMPANYComparative Statement of Financial PositionDec. 31, 2Y11 Dec. 31, 2Y10AssetsEquipment €60,000 €32,000Accumulated depreciation—equipment (20,000) (14,000) Long-term investments -0- 18,000 Prepaid expenses 6,000 9,000 Inventory 25,000 18,000 Accounts receivable 18,000 14,000 Cash 27,000 10,000 Total assets €116,000€87,000Equity and LiabilitiesShare capital-ordinary € 40,000€23,000 Retained earning 22,000 10,000 Bonds payable 37,000 47,000 Accounts payable 17,000 7,000 Total equity and liabilities €116,000€87,000 Additional information:1. Net income for the year ending December 31, 2Y11 was €27,000.2. Cash dividends of €15,000 were declared and paid during the year.3. Long-term investments that had a cost of €18,000 were sold for €14,000.4. Sales for 2Y11 were €120,000.EnquiredPrepare a statement of cash flows for the year ended December 31, 2Y11, using the indirect method.SolutionMANN COMPANYStatement of Cash FlowsFor the Year Ended December 31, 2Y11Cash flows from operating activitiesNet income .................................................................................................. €27,000Adjustments to reconcile net income to net cash provided byoperating activities:Depreciation expense ....................................................................... € 6,000Loss on sale of long-term investments ............................................... 4,000Increase in accounts receivable ........................................................ (4,000)Decrease in prepaid expenses ........................................................... 3,000Increase in inventories ...................................................................... (7,000)Increase in accounts payable ............................................................ 10,000 12,000Net cash provided by operating activities ........................................ 39,000 Cash flows from investing activitiesSale of long-term investments .................................................................... 14,000Purchase of equipment ................................................................................ (28,000)Net cash used by investing activities ................................................ (14,000) Cash flows from financing activitiesIssuance of ordinary shares ......................................................................... 17,000Retirement of bonds payable ...................................................................... (10,000)Payment of cash dividends ......................................................................... (15,000)Net cash used by financing activities ............................................... (8,000) Net increase in cash .............................................................................................. 17,000 Cash at beginning of period .................................................................................. 10,000 Cash at end of period ............................................................................................€27,0003.6 Perform vertical analysisDecember 31, 2X12December 31, 2X11Inventory€ 780,000 € 600,000 Accounts receivable 510,000 400,000 Total assets 3,000,0002,500,000EnquiredUsing these data from the comparative statement of financial position of Luca Company perform vertical analysis. Solution Dec. 31, 2012Dec. 31, 2011Amount Percentage*Amount Percentage**Inventory€ 780,000 26% € 600,000 24% Accounts receivable 510,000 17% 400,000 16% Total assets 3,000,000100.0%2,500,000100.0%€€780,000.263,000,000=€€600,000.242,500,000=€€510,000.173,000,000=€€400,000.162,500,000=3.7 Perform horizontal analysisComparative information taken from the Wells Company financial statements is shown below: 2X12 2X11 (a) Notes receivable $ 20,000 $ -0-(b) Accounts receivable 175,000 140,000 (c) Retained earnings 30,000 (40,000) (d) Income taxes payable 45,000 20,000 (e) Sales900,000 750,000 (f)Operating expenses170,000200,000EnquiredUsing horizontal analysis, show the percentage change from 2X11 to 2X12 with 2X11 as the base year. Solution (a) Base year is zero. Not possible to compute. (b) $35,000 ÷ $140,000 = 25% increase(c) Base year is negative. Not possible to compute. (d) $25,000 ÷ $20,000 = 125% increase (e)$150,000 ÷ $750,000 = 20% increase***(f) $30,000 ÷ $200,000 = 15% decrease3.8 Perform horizontal analysisThe following items were taken from the financial statements of Ritz, Inc., over a four-year period:Item 2Y12 2Y11 2Y10 2Y09Net Sales €800,000€650,000€600,000€500,000Cost of Goods Sold 580,000 460,000 420,000 400,000Gross Profit €220,000€190,000€180,000€100,000EnquiredUsing horizontal analysis and 2Y09 as the base year, compute the trend percentages for net sales, cost of goods sold, and gross profit. Explain whether the trends are favorable or unfavorable for each item.SolutionItem 2Y12 2Y11 2Y10 2Y09Net Sales 160% 130% 120% 100%Cost of Goods Sold 145% 115% 105% 100%Gross Profit 220% 190% 180% 100%The trend in net sales is increasing and favorable. The cost of goods sold trend is increasing which could be unfavorable, but the sales are increasing each year at a faster pace than cost of goods sold. This is apparent by examining the gross profit percentages, which show a favorable, increasing trend.3.9 Analysis the liquidity of the Howell CompanyHowell Company has the following selected accounts after posting adjusting entries:Accounts Payable € 55,000Notes Payable, 3-month 80,000Accumulated Depreciation—Equipment 14,000Salary Payable 27,000Notes Payable, 5-year, 8% 30,000Estimated Warranty Liability 34,000Salary Expense 6,000Interest Payable 3,000Mortgage Payable 200,000Sales Tax Payable 21,000Enquired(a) Prepare the current liability section of Howell Company's statement of financial position, assuming $25,000of the mortgage is payable next year. List liabilities in magnitude order, with largest first.(b) Comment on Howell 's liquidity, assuming total current assets are €450,000.Solution(a) HOWELL COMPANYCurrent LiabilitiesNotes payable, 3-month € 80,000Accounts payable 55,000Estimated warranty liability 34,000Salary payable 27,000Long-term debt due within one year 25,000Sales tax payable 21,000Interest payable 3,000Total Current Liabilities €245,000(b) The liquidity position looks favorable. If all current liabilities are paid out of current assets, there would stillbe €205,000 of current assets. The current assets are almost twice the current liabilities and it appears as though Howell Company has sufficient current resources to meet current obligations when due.3.10 Calculate the debt to total assets and times interest earned ratiosFranco Corporation reports the following selected financial statement information at December 31, 2X11: Total Assets $110,000Total Liabilities 65,000Net Income 18,000Interest Income 1,600Interest Expense 900Tax Expense 300EnquiredCalculate the debt to total assets and times interest earned ratios.SolutionDebt to total assets: $65,000 ÷ $110,000 = 59%Times interest earned: ($18,000 + $900 + $300) ÷ $900 = 21.33 times3.11 Compute the receivables turnover and the average collection periodBerman Company reported the following financial information:12/31/2X11 12/31/2X10Accounts receivable $ 320,000 $ 360,000Net credit sales 2,550,000 2,420,000EnquiredCompute (a) the receivables turnover and (b) the average collection period for 2X11.Solution(a) Receivables turnover = $2,550,000 ÷ $340,000 = 7.5 times(b) Average collection period = 365 ÷ 7.5 = 49 days3.12 Calculate the net income and EPSBanks Company is considering two alternatives to finance its purchase of a new $4,000,000 office building.(a) Issue 400,000 ordinary shares at $10 per share.(b) Issue 8%, 10-year bonds at par ($4,000,000).Income before interest and taxes is expected to be $3,000,000. The company has a 30% tax rate and has 600,000 ordinary shares outstanding prior to the new financing.EnquiredCalculate each of the following for each alternative:(1) Net income.(2) Earnings per share.Solution(a) Issue Shares (b) Issue BondsIncome before interest and taxes $3,000,000 $3,000,000Interest (8% × $4,000,000) —320,000Income before income taxes 3,000,000 2,680,000Income tax expense 900,000 804,000(1) Net income $2,100,000 $1,876,000Shares outstanding 1,000,000 600,000(2) Earnings per share $2.10 $3.133.13 Compute the return on ordinary shareholders’ equity ratioThe following information is available for Ritter Corporation:2Y11 2Y10 Average ordinary shareholders’ equity$1,500,000 $1,000,000Average total shareholders’ equity 2,000,000 1,500,000Ordinary dividends declared and paid 72,000 50,000Preference dividends declared and paid 30,000 30,000Net income 330,000 270,000EnquiredCompute the return on ordinary shareholders’ equity ratio for both years. Briefly commen t on your findings.Solution2Y10 2Y11Return on ordinaryshareholders’ equity ratio:$270,000 – $30,000 $330,000 – $30,000————————— = 24% ————————— = 20%$1,000,000 $1,500,000Ritter’s return on common stockholders’ equity ratio decreased approximately 17% during 2011. Ritter’s earnings increased during 2011 by 22%, but its average ordinary shareholders’ equity increased by 50%, causing the return on ordinary shareholders’ equity to declin e by 17%.3.14 Calculate book value per shareBellingham Corporation has the following equity balances at December 31, 2X11.Share Capital–Ordinary, $1 par $ 3,500Share Premium–Ordinary 24,500Retained Earnings 62,500Total $90,500EnquiredCalculate book value per share.SolutionNumber of shares outstanding: $3,500/$1 = 3,500Book value per share: $90,500/3,500 = $25.863.15 Calculate financial ratiosSelected information from the comparative financial statements of Fryman Company for the year ended December 31 appears below:2X11 2X10Inventory $ 140,000 $160,000Accounts receivable (net) 180,000 200,000Total assets 1,200,000 800,000Long-term debt 400,000 300,000Current liabilities 140,000 110,000Net credit sales 1,330,000 700,000Cost of goods sold 900,000 530,000Interest expense 50,000 25,000Income tax expense 60,000 29,000Net income 150,000 85,000EnquiredAnswer the following questions relating to the year ended December 31, 2X11. Show computations.1. Inventory turnover for 2X11 is __________.2. Times interest earned in 2X11 is __________.3. The debt to total assets ratio for 2X11 is __________.4. Receivables turnover for 2X11 is __________.5. Return on assets for 2X11 is __________.Solution$900,0001. Inventory turnover for 2011 is 6 times. ———————————— = 6 times.($140,000 + $160,000) ÷ 2$150,000 + $60,000 + $50,0002. Times interest earned in 2011 is 5.2 times. —————————————— = 5.2 times.$50,000$140,000 + $400,0003. The debt to total assets ratio for 2011 is 45%. —————————— = 45%.$1,200,000$1,330,0004. Receivables turnover for 2011 is 7 times. ———————————— = 7 times.($180,000 + $200,000) ÷ 2$150,0005. Return on assets for 2011 is 15%. ————————————— = 15%.($1,200,000 + $800,000) ÷ 2。

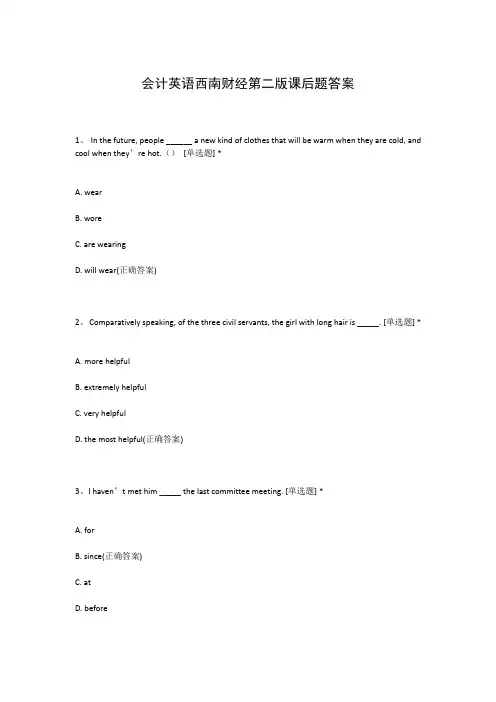

会计英语西南财经第二版课后题答案1、In the future, people ______ a new kind of clothes that will be warm when they are cold, and cool when they’re hot.()[单选题] *A. wearB. woreC. are wearingD. will wear(正确答案)2、Comparatively speaking, of the three civil servants, the girl with long hair is _____. [单选题] *A. more helpfulB. extremely helpfulC. very helpfulD. the most helpful(正确答案)3、I haven’t met him _____ the last committee meeting. [单选题] *A. forB. since(正确答案)C. atD. before4、He studied harder to _______ his reading skills. [单选题] *A. improve(正确答案)B. rememberC. memorizeD. forget5、The relationship between employers and employees has been studied(). [单选题] *A. originallyB. extremelyC. violentlyD. intensively(正确答案)6、Modern plastics can()very high and very low temperatures. [单选题] *A. stand(正确答案)B. sustainC. carryD. support7、His picture is on show in London this month. [单选题] *A. 给...看B. 展出(正确答案)C. 出示D. 上演8、- I haven't been to Guilin yet.- I haven t been there, ______. [单选题] *A. tooB. alsoC. either(正确答案)D. neither9、78.According to a report on Daily Mail, it’s on Wednesday()people start feeling really unhappy. [单选题] *A. whenB. whichC. whatD. that(正确答案)10、This is not our house. lt belongs to _____. [单选题] *A. the Turners'B. the Turners(正确答案)C. Turner'sD. Turners11、It ______ me half an hour to return to school.()[单选题] *A. takes(正确答案)B. spendsC. costsD. brings12、People cut down many trees ______ elephants are losing their homes. ()[单选题] *A. ifB. butC. so(正确答案)D. or13、Alice is fond of playing ____ piano while Henry is interested in listening to ___ music. [单选题] *A. the, /(正确答案)B. the, theC. the, aD. /, the14、He used to get up at six in the morning,()? [单选题] *A. used heB. did heC. didnt he (正确答案)D. should he15、_____from far away, the 600-meter tower is stretching into the sky. [单选题] *A. SeeB. SeeingC. To seeD. Seen(正确答案)16、Tom is very _______. He never cleans his room. [单选题] *A. lazy(正确答案)B. activeC. shyD. healthy17、96.Let's cross the street from school. There is a park ______ the school. [单选题] * A.far fromB.next toC.atD.opposite(正确答案)18、John will go home as soon as he _______ his work. [单选题] *A. finishB. will finishC. finishedD. finishes(正确答案)19、56.Sam is in a hurry. Maybe he has got ________ important to do. [单选题] * A.everythingB.nothingC.anythingD.something(正确答案)20、—John, How is it going? —______.()[单选题] *A. It’s sunnyB. Thank youC. Well doneD. Not bad(正确答案)21、—______ is the concert ticket?—It’s only 160 yuan.()[单选题] *A. How manyB How much(正确答案)C. How oftenD. How long22、54.—________?—Yes, please. I'd like some beef. [单选题] * A.What do you wantB.May I try it onC.Can I help you(正确答案)D.What else do you want23、19.Students will have computers on their desks ________ . [单选题] * A.in the future(正确答案)B.on the futureC.at the momentD.in the past24、She is a girl, _______ name is Lily. [单选题] *A. whose(正确答案)B. whoC. whichD. that25、--What are the young people doing there?--They are discussing how to _______?the pollution in the river. [单选题] *A. come up withB. talk withC. deal with(正确答案)D. get on with26、My father and I often go ______ on weekends so I can ______ very well. ()[单选题] *A. swim; swimmingB. swims; swimC. swimming; swimmingD. swimming; swim(正确答案)27、3.Shanghai is my hometown. It’s ________ China. [单选题] *A.nearB.far away fromC.to the east ofD.in the east of(正确答案)28、74.No person ()carry a mobile phone into the examination room during the national college Entrance Examinations.[单选题] *A.shall(正确答案)B.mustC.canD.need29、--I can’t watch TV after school.--I can’t, _______. [单选题] *A. alsoB. tooC. either(正确答案)D. so30、Study hard, ______ you won’t pass the exam. [单选题] *A. or(正确答案)B. andC. butD. if。

会计英语叶建芳第四版课后题摘要:一、引言1.会计英语的重要性2.叶建芳第四版教材的特点二、课后题概述1.题型分类2.难度分析3.解题技巧与策略三、重点题型详解1.选择题a.解题步骤b.常见错误分析c.答题技巧2.填空题a.解题方法b.易错点提示c.解题策略3.判断题a.判断标准b.解题技巧c.错误判断分析四、课后题练习与解答1.练习题一:会计基本概念2.练习题二:财务报表与分析3.练习题三:会计分录与账户4.练习题四:计量、估计与披露5.练习题五:财务决策与控制五、总结与展望1.课后题学习成果总结2.提高会计英语能力的建议3.叶建芳第四版教材在教学中的应用与评价正文:一、引言随着全球化进程的不断推进,会计英语在国际贸易、企业交流等领域发挥着越来越重要的作用。

我国著名会计学家叶建芳教授所著的《会计英语》教材,历经多次修订,已成为会计专业学生的必备书籍。

本篇文章将针对叶建芳第四版《会计英语》教材的课后题进行详细解析,以帮助读者提高会计英语水平。

二、课后题概述1.题型分类叶建芳第四版《会计英语》的课后题主要包括选择题、填空题、判断题等。

这些题型涵盖了会计英语的基本概念、财务报表、会计分录、计量、估计与披露、财务决策等方面,全面检测读者对会计英语知识的掌握程度。

2.难度分析总体来说,课后题的难度适中,既适合初学者巩固基础知识,又能锻炼有一定基础的读者提高解题能力。

其中,部分题目具有一定的挑战性,需要读者对相关知识点有较深入的理解。

3.解题技巧与策略为提高解题效率,读者需要掌握一定的解题技巧。

以下为针对不同题型的解题策略:(1)选择题:仔细阅读题干,分析选项差异,运用排除法缩小答案范围,最后根据知识点选择正确答案。

注意审题,避免粗心大意。

(2)填空题:根据题干信息,填入合适的知识点。

注意检查答案是否符合题意和语法规范。

(3)判断题:明确判断标准,分析题干中的关键信息,避免盲目判断。

对于存疑的题目,可以借助教材或其他资料进行查证。

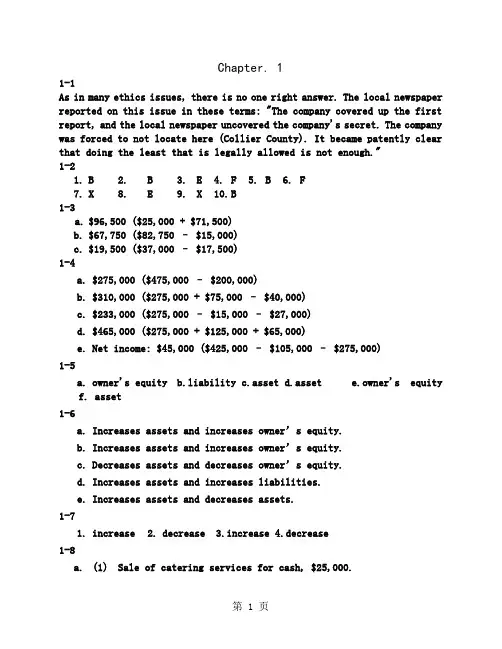

Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000)1-5a. owner's equityb.liabilityc.assetd.assete.owner's equityf. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4.decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ........ $297,200Net income for the month ................... $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000Leo Perkins, capital, April 30, 2006 ....... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120Operating expenses:Wages expense ............................ $100,100Rent expense ............................. 35,000Supplies expense ......................... 4,550Miscellaneous expense .................... 3,150Total operating expenses ............... 142,800 Net income ................................. $ 89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. T he ratio of liabilities to stockholders’ equity increased from 2002to 2003, indicating an increase in risk for creditors. However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction Type Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash ................................... 40,000Ira Janke, Capital .................. 40,000(2) Supplies ............................... 1,800Cash ................................ 1,800(3) Equipment .............................. 24,000Accounts Payable .................... 15,000Cash ................................ 9,000(4) Operating Expenses ..................... 3,050Cash ................................ 3,050(5) Accounts Receivable .................... 12,000Service Revenue ..................... 12,000(6) Accounts Payable ....................... 7,500Cash ................................ 7,500(7) Cash ................................... 9,500Accounts Receivable ................. 9,500(8) Ira Janke, Drawing ..................... 5,000Cash ................................ 5,000(9) Operating Expenses ..................... 1,050Supplies ............................ 1,050 2-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 –$4,000 –$8,000).Such a nega tive balance means that the liabilities of Seth’s business exceed the assets.b. Yes. The balance sheet prepared at December 31 will balance,with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. The increase of $28,750 in the cash account does not indicateearnings of that amount. Earnings will represent the net change in all assets and liabilities from operating transactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug. 1 Rent Expense ........................... 1,500Cash ................................ 1,5002 Advertising Expense (700)Cash (700)4 Supplies ............................... 1,050Cash ................................ 1,0506 Office Equipment ....................... 7,500Accounts Payable .................... 7,5008 Cash ................................... 3,600Accounts Receivable ................. 3,60012 Accounts Payable ....................... 1,150Cash ................................ 1,15020 Gayle McCall, Drawing .................. 1,000Cash ................................ 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................... 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct. 27 Supplies ........................ 15 1,320Accounts Payable .............. 21 1,320 Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ..... ..... 585 .....27 ....................... 43 1,320 ..... 1,905 ..... Accounts Payable 21 2006Oct. 1 Balance ................ ..... ..... ..... 6,15027 ....................... 43 ..... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ................................. 13,375Accounts Receivable ............................ 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000Accounts Payable ............................... 11,180 Unearned Rent .................................. 4,250 Erin Capelli, Capital .......................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense .................................. 42,000 Advertising Expense ............................ 7,200 Miscellaneous Expense .......................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................... 15,000Wages Expense ....................... 15,000b. Prepaid Rent ........................... 4,500Cash ................................ 4,500 2-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales ........................ $37,028 $35,925 $ 1,103 3.1%2. Cost of sales................. (29,658) (28,111) 1,547 5.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes.................. $ (45) $ 1,300 $(1,345) (103.5%) b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000. While salesincreased by $1,103 million, a 3.1% increase, cost of salesincreased by $1,547 million, a 5.5% increase. Selling, general,and administrative expenses also increased by $901 million, a13.8% increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease, and createda $45 million loss in 2000. Little over a year later, Kmart filedfor bankruptcy protection. It has now emerged from bankruptcy,hoping to return to profitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated. Net incomewill be overstated.b. Prepaid insurance (or assets) will be overstated. Owner’sequity will be overstated.3-5a.Insurance Expense ............................. 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................. 1,215Prepaid Insurance ...................... 1,215 3-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,570 3-7a.Salary Expense ................................ 9,360Salaries Payable ....................... 9,360 b.Salary Expense ................................ 12,480Salaries Payable ....................... 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over- Under-stated stated stated stated1. Revenue for the year would be .... $ 0 $6,900 $ 0 $ 02. Expenses for the year would be ... 0 0 0 3,7403. Net income for the year would be . 0 6,900 3,740 04. Assets at December 31 would be ... 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Owner’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable ........................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenues arerecognized only when the cash is received. Therefore, earned butunbilled revenues would not be recognized in the accounts, andno adjusting entry would be necessary.3-13a. Fees earned (or revenues) will be understated. Net income willbe understated.b. Accounts (fees) receivable (or assets) will be understated.Owner’s equity will be unde rstated.3-14Depreciation Expense ............................ 5,200Accumulated Depreciation ............... 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of the equipmentto the periods benefiting from its use. It does not necessarilyrelate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not a valuationmethod. That is, depreciation allocates the cost of a fixed assetover its useful life. Depreciation does not attempt to measuremarket values, which may vary significantly from year to year.3-17a.Depreciation Expense .......................... 7,500Accumulated Depreciation ............... 7,500b. (1) Depreciation expense would be understated. Net income wouldbe overstated.(2) Accumulated depreciation would be understated, and totalassets would be overstated. Owner’s equity would beoverstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment (5)5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $ 2,844,000 8.0 b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0 Cost of goods sold (3,605,120) 86.4 Operating expenses (1,077,447) 25.8 Operating income (loss) $ (511,242) (12.2) c. Dell is more profitable than Gateway. Specifically, Dell’s costof goods sold of 82.1% is significantly less (4.3%) than Gateway’s cost of goods sold of 86.4%. In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments Trial BalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable 50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing 8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense 0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 1920 Totals 200 200 24 24 213 213 20 ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable 57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing 8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense 5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 1920 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 182122 67 67 164 164 22 4-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense .............................. $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ............................49Net income ..................................... $18ITHACA SERVICES CO.Statemen t of Owner’s EquityFor the Year Ended January 31, 2006Terry Dagley, capital, February 1, 2005 ........ $112Net income for the year ........................ $18Less withdrawals (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ........ $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities: Cash ............... $ 8 Accounts payable ... $26Accounts receivable 57 Wages payable (1)Supplies ........... 3 Total liabilities $ 27 Prepaid insurance .. 6Total current assets $ 74Property, plant, and Owner’s E quity equipment: Terry Dagley, capital 122 Land ............... $50Equipment .......... $32Less accum. depr. .. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $149 4-72006Jan. 31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment .. 531 Wages Expense (1)Wages Payable (1)4-82006Jan. 31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense .............................. $56,800Rent expense ............................... 21,270Utilities expense .......................... 11,500Depreciation expense ....................... 8,000Insurance expense .......................... 4,100Supplies expense ........................... 3,100Miscellaneous expense ...................... 2,250Total operating expenses ............ 107,020 Net loss ....................................... $ (3,170) 4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006Suzanne Jacob, capital, November 1, 2005 ....... $173,750 Net income for year ............................ $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 ....... $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000($13,750 × 12 months) would be reported as a current liability onthe balance sheet. The remainder of $335,000 ($500,000 –$165,000)would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006Assets LiabilitiesCurrent assets Current liabilities:Cash $31,500 Accountspayable ...................... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies .............. 1,800 Unearned fees .................Prepaid insurance ..... 7,200 Total liabilities Prepaid rent .......... 4,800Total current assets $67,150Owner’s EquityProperty, plant, and equipment: Vernon Posey, capital .............Equipment ........... $80,600Less accumulated depreciation 21,100 59,500 Totalliabilities andTotal assets $126,650 owner’s equity......... $126 4-14Accounts Receivable ............................. 4,100Fees Earned ......................... 4,100 Supplies Expense ....................... 1,300Supplies ............................ 1,300 Insurance Expense ...................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................... 2,800Accumulated Depreciation—Equipment .. 2,800 Wages Expense .......................... 1,000Wages Payable ....................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detecting and correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ................................ 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................... 25,000 b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034) ($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December 31, 2002and 2001. In addition, the current ratio is below one at the endof both years. While the working capital and current ratios haveimproved from 2001 to 2002, creditors would likely be concernedabout the ability of 7 Eleven to meet its short-term creditobligations. This concern would warrant further investigationto determine whether this is a temporary issue (for example, anend-of-the-period phenomenon) and the company’s plans toaddress its working capital shortcomings.4-20a. (1) Sales Salaries Expense .................. 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ..................... 10,250Fees Earned ............................. 10,250 b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense .................. 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ..................... 10,250 4-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) Wages Expense .......................... 45,000Cash .................................... 45,000(2) Wages Expense ........................... 18,000Wages Payable ........................... 18,000(3) Income Summary .......................... 1,120,800Wages Expense ........................... 1,120,800(4) Wages Payable ........................... 18,000Wages Expense ........................... 18,000(5) Wages Expense ........................... 43,000Cash .................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number of credit salessupported by promissory notes, a notes receivable ledger shouldbe maintained. Failure to maintain a subsidiary ledger whenthere are a significant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation of duties isviolated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining the accountsreceivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsible forapproving credit.e. Appropriate. A promissory note is a formal credit instrumentthat is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of Days PastDueJanzen Industries August 29 93 days (2 + 30 + 31+ 30)Kuehn Company September 3 88 days (27 + 31 + 30)Mauer Inc. October 21 40 days (10 + 30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov. 30 Uncollectible Accounts Expense ......... 53,315*Allowances for Doubtful Accounts..... 53,315 *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible Accounts Age Interval Balance Percent AmountNot past due .............. $450,000 2% $ 9,0001–30 days past due ....... 110,000 4 4,40031–60 days past due ...... 51,000 6 3,06061–90 days past due ...... 12,500 20 2,50091–180 days past due ..... 7,500 60 4,500Over 180 days past due .... 5,500 80 4,400 Total .................. $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ......... 29,435*..... Allowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ............... 7,130Accounts Receivable .................... 7,130b.Uncollectible Accounts Expense ................ 7,130Accounts Receivable .................... 7,130Ex. 8–8Feb. 20 Accounts Receivable—Darlene Brogan .... 12,100Sales ............................... 12,10020 Cost of Merchandise Sold ............... 7,260Merchandise Inventory ............... 7,260 May 30 Cash ................................... 6,000Accounts Receivable—Darlene Brogan .. 6,00030 Allowance for Doubtful Accounts ........ 6,100Accounts Receivable—Darlene Brogan .. 6,100 Aug. 3 Accounts Receivable—Darlene Brogan .... 6,100Allowance for Doubtful Accounts ..... 6,1003 Cash ................................... 6,100Accounts Receivable—Darlene Brogan .. 6,100 Ex. 8–9$223,900 [$212,800 + $112,350 –($4,050,000 × 2 1/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100a. August 8b. $24,480c. (1) Notes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,0(2) Cash ...................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)Ex. 8–121. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account recei vable.7. Payment received from customer for dishonored note plus interestearned after due date.。