2018-2019年招商银行秋季校园招聘笔试真题及答案解析

- 格式:doc

- 大小:625.00 KB

- 文档页数:76

招商银行招聘考试笔试历年真题汇总整理招商银行校招考试内容主要为行测、综合专业知识和性格测试,题目实际上是不难的,但要有针对性的复习,多练题目是肯定的!建议报考的同学提前做好复习准备,考试资料可以到“柏蓝考”上面找找,资料确实不错,比较有针对性, 大家可以去了解一下!招商银行笔试经验分享一:笔试分两个部分,也就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后, 再发第二套试卷。

笔试不是机考,北京站今年安排在人大的就业指导中心笔试,笔试可以带计算器。

第一份试卷的测试内容即为常规行政能力测试,具体包括4个部分:1.言语理解与表达;2.数学运算;3.图形推理;4.资料分析。

时间勉强够用,一般答不完。

第二份试卷的测试内容为简答题。

今年的简答题如下:1 .从经济学角度解释“过犹不及”的含义;2.解释“劣币驱逐良币”的含义,并结合一个经济现象说明“劣币驱逐良币”的影响。

3.材料分析题(阿里上市):(1)阿里上市对中国企业的影响;(2)对比阿里和亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真的慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定他们究竟是嘛心情啊。

后面的题列出了一种现象和几个可能引起这种现象的原因,选出最合理的答案,类似“某地区骑自行车人数增多,有关自行车的事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因是啥”。

第三部分35分钟,行测题,计算和逻辑推理,时间明显不够啊。

第四部分是性格测试,如实回答就好。

好像还有一些题是关于工作中遇到某事你会怎么做,但我忘了是哪部分的题了O O O 能想起来的就这么多了,没有考察招行历史,也没有任何专业知识,不知道以后会不会也是这样。

招商银行招聘考试笔试历年真题汇总整理招商银行校招考试内容主要为行测、综合专业知识与性格测试,题目实际上就是不难得,但要有针对性得复习,多练题目就是肯定得!建议报考得同学提前做好复习准备,考试资料可以到“考佳卜资料网”上面找找,资料确实不错,都就是上届学长们根据考试情况精心整理出来得,比较有针对性,大家可以去了解一下!招商银行笔试经验分享一:笔试分两个部分,也就就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后,再发第二套试卷。

笔试不就是机考,北京站今年安排在人大得就业指导中心笔试,笔试可以带计算器。

第一份试卷得测试内容即为常规行政能力测试,具体包括4个部分:1、言语理解与表达;2、数学运算;3、图形推理;4、资料分析。

时间勉强够用,一般答不完。

第二份试卷得测试内容为简答题。

今年得简答题如下:1、从经济学角度解释“过犹不及”得含义;2、解释“劣币驱逐良币”得含义,并结合一个经济现象说明“劣币驱逐良币”得影响。

3、材料分析题(阿里上市):(1)阿里上市对中国企业得影响;(2)对比阿里与亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

泞霧薈萇頜签颏。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真得慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟就是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定她们究竟就是嘛心情啊。

后面得题列出了一种现象与几个可能引起这种现象得原因,选出最合理得答案,类似“某地区骑自行车人数增多,有关自行车得事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因就是啥”。

第三部分35分钟,行测题,计算与逻辑推理,时间明显不够啊。

招商银行招聘考试笔试历年真题汇总整理招商银行校招考试内容主要为行测、综合专业知识和性格测试,题目实际上是不难的,但要有针对性的复习,多练题目是肯定的!建议报考的同学提前做好复习准备,考试资料可以到“考佳卜资料网”上面找找,资料确实不错,都是上届学长们根据考试情况精心整理出来的,比较有针对性,大家可以去了解一下!招商银行笔试经验分享一:笔试分两个部分,也就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后,再发第二套试卷。

笔试不是机考,北京站今年安排在人大的就业指导中心笔试,笔试可以带计算器。

第一份试卷的测试内容即为常规行政能力测试,具体包括4个部分:1.言语理解与表达;2.数学运算;3.图形推理;4.资料分析。

时间勉强够用,一般答不完。

第二份试卷的测试内容为简答题。

今年的简答题如下:1.从经济学角度解释“过犹不及”的含义;2.解释“劣币驱逐良币”的含义,并结合一个经济现象说明“劣币驱逐良币”的影响。

3.材料分析题(阿里上市):(1)阿里上市对中国企业的影响;(2)对比阿里和亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真的慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定他们究竟是嘛心情啊。

后面的题列出了一种现象和几个可能引起这种现象的原因,选出最合理的答案,类似“某地区骑自行车人数增多,有关自行车的事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因是啥”。

第三部分35分钟,行测题,计算和逻辑推理,时间明显不够啊。

第四部分是性格测试,如实回答就好。

2019招商银行秋季校园招聘行测备考(事件排序题)银行招聘网为想要报考银行的同学们提供银行最新的、最权威的招考信息、笔试、面试资料。

各省市银行考试信息及时汇总,一览无遗,笔、面试资料权威详细,极大的节省同学们的时间和精力,还有更多的备考指导、考试题库在等着你!2019招商银行秋季校园招聘暂未开始,想要报考招商银行的话可以提前进行复习,以下是根据历年银行笔试题目总结的事件排序题技巧,仅供大家参考。

更多有关银行校园招聘网申、笔试、面试技巧事件排序题行测考试中主要考查考生在未掌握全部必要事实的条件下解决问题的能力。

题中给出的五个事件表述虽然简单,但它表示一个现象,或者一件事演变过程中的几个关键环节。

具体解题思路呈现如下:第一,找逻辑关系,避免盲目排序。

第二,找首尾项,快速选出正确答案。

第三,巧用排除法,逐个排除错误选项。

例1:风调雨顺 (2)棉花丰收 (3)外汇储备增加(4)国力增强 (5)大量出口A.1-2-5-3-4B.2-1-5-3-4C.3-4-1-2-5D.1-4-3-5-4答案:A。

中公解析:按照事件之间的因果关系进行排序。

风调雨顺后棉花丰收,进而可以大量出口棉花使外汇储备增加,从而增强了国力。

例2:(1)百年老树枝繁叶茂 (2)勘测施工线路(3)将老树平行移动300米 (4)研究制定移动方案(5)老树萌发新芽A.5-2-3-4-1B.1-2-4-3-5C.1-2-3-4-5D.2-1-4-3-5答案:D。

解析:本题描述的是因施工迁移百年老树的事件。

"研究制定移动方案"后才能移动古树,即4在3之前,排除A、C。

比较B、D选项,(在)勘测施工线路(时)——(发现)百年老树枝繁叶茂——(经过)研究制定移动方案(后)——将老树平行移动300米——老树(重新)萌发新枝,D选项更符合事件逻辑顺序。

故本题选择D。

例3:(1)影响原油开采 (2)断流时间增加(3)入海口海水倒灌 (4)河水浪费严重(5)油田被迫减产A.3-1-5-4-2B.2-4-3-5-1C.5-3-1-4-2D.4-2-3-1-5答案:D。

招商银行招聘考试笔试历年真题汇总整理招商银行笔试经验分享一:笔试分两个部分,也就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后,再发第二套试卷。

笔试不是机考,北京站今年安排在人大的就业指导中心笔试,笔试可以带计算器。

第一份试卷的测试内容即为常规行政能力测试,具体包括4个部分:1.言语理解与表达;2.数学运算;3.图形推理;4.资料分析。

时间勉强够用,一般答不完。

第二份试卷的测试内容为简答题。

今年的简答题如下:1.从经济学角度解释“过犹不及”的含义;2.解释“劣币驱逐良币”的含义,并结合一个经济现象说明“劣币驱逐良币”的影响。

3.材料分析题(阿里上市):(1)阿里上市对中国企业的影响;(2)对比阿里和亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真的慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定他们究竟是嘛心情啊。

后面的题列出了一种现象和几个可能引起这种现象的原因,选出最合理的答案,类似“某地区骑自行车人数增多,有关自行车的事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因是啥”。

第三部分35分钟,行测题,计算和逻辑推理,时间明显不够啊。

第四部分是性格测试,如实回答就好。

好像还有一些题是关于工作中遇到某事你会怎么做,但我忘了是哪部分的题了。

能想起来的就这么多了,没有考察招行历史,也没有任何专业知识,不知道以后会不会也是这样。

招商银行笔试经验分享三:考试历时100分钟。

120道客观题。

这次没有考主观题。

行测包括言语理解、数字推理、数量关系、图形推理、逻辑、资料分析言语题主要考了词语填空、成语、病句、意在说明类题二十题;数字推理五个;数量关系十几题。

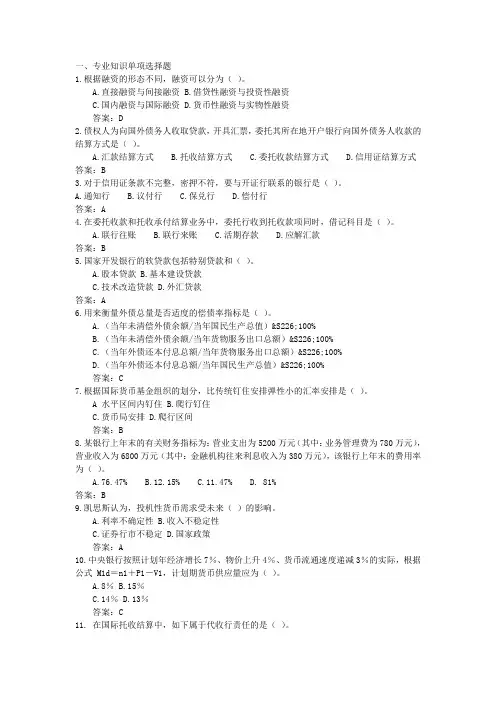

一、专业知识单项选择题1.根据融资的形态不同,融资可以分为()。

A.直接融资与间接融资B.借贷性融资与投资性融资C.国内融资与国际融资D.货币性融资与实物性融资答案:D2.债权人为向国外债务人收取贷款,开具汇票,委托其所在地开户银行向国外债务人收款的结算方式是()。

A.汇款结算方式B.托收结算方式C.委托收款结算方式D.信用证结算方式答案:B3.对于信用证条款不完整,密押不符,要与开证行联系的银行是()。

A.通知行B.议付行C.保兑行D.偿付行答案:A4.在委托收款和托收承付结算业务中,委托行收到托收款项同时,借记科目是()。

A.联行往账B.联行来账C.活期存款D.应解汇款答案:B5.国家开发银行的软贷款包括特别贷款和()。

A.股本贷款B.基本建设贷款C.技术改造贷款D.外汇贷款答案:A6.用来衡量外债总量是否适度的偿债率指标是()。

A.(当年未清偿外债余额/当年国民生产总值)&S226;100%B.(当年未清偿外债余额/当年货物服务出口总额)&S226;100%C.(当年外债还本付息总额/当年货物服务出口总额)&S226;100%D.(当年外债还本付息总额/当年国民生产总值)&S226;100%答案:C7.根据国际货币基金组织的划分,比传统钉住安排弹性小的汇率安排是()。

A 水平区间内钉住 B.爬行钉住C.货币局安排D.爬行区间答案:B8.某银行上年末的有关财务指标为:营业支出为5200万元(其中:业务管理费为780万元),营业收入为6800万元(其中:金融机构往来利息收入为380万元),该银行上年末的费用率为()。

A.76.47%B.12.15%C.11.47%D. 81%答案:B9.凯思斯认为,投机性货币需求受未来()的影响。

A.利率不确定性B.收入不稳定性C.证券行市不稳定D.国家政策答案:A10.中央银行按照计划年经济增长7%、物价上升4%、货币流通速度递减3%的实际,根据公式 M1d=n1+P1-V1,计划期货币供应量应为()。

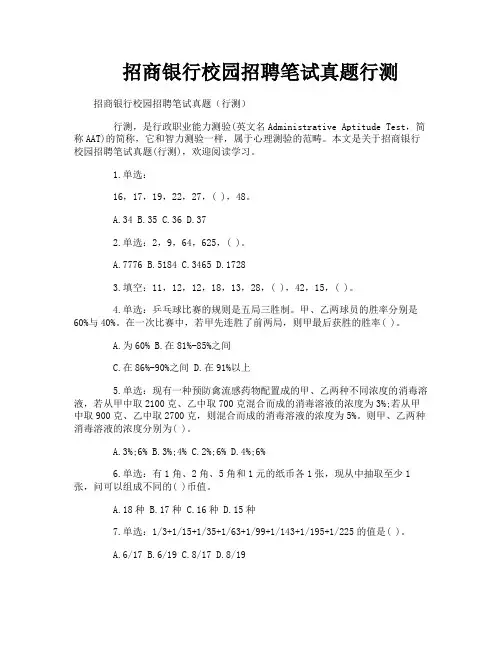

招商银行校园招聘笔试真题行测招商银行校园招聘笔试真题(行测)行测,是行政职业能力测验(英文名Administrative Aptitude Test,简称AAT)的简称,它和智力测验一样,属于心理测验的范畴。

本文是关于招商银行校园招聘笔试真题(行测),欢迎阅读学习。

1.单选:16,17,19,22,27,( ),48。

A.34B.35C.36D.372.单选:2,9,64,625,( )。

A.7776B.5184C.3465D.17283.填空:11,12,12,18,13,28,( ),42,15,( )。

4.单选:乒乓球比赛的规则是五局三胜制。

甲、乙两球员的胜率分别是60%与40%。

在一次比赛中,若甲先连胜了前两局,则甲最后获胜的胜率( )。

A.为60%B.在81%-85%之间C.在86%-90%之间D.在91%以上5.单选:现有一种预防禽流感药物配置成的甲、乙两种不同浓度的消毒溶液,若从甲中取2100克、乙中取700克混合而成的消毒溶液的浓度为3%;若从甲中取900克、乙中取2700克,则混合而成的消毒溶液的浓度为5%。

则甲、乙两种消毒溶液的浓度分别为( )。

A.3%;6%B.3%;4%C.2%;6%D.4%;6%6.单选:有1角、2角、5角和1元的纸币各1张,现从中抽取至少1张,问可以组成不同的( )币值。

A.18种B.17种C.16种D.15种7.单选:1/3+1/15+1/35+1/63+1/99+1/143+1/195+1/225的值是( )。

A.6/17B.6/19C.8/17D.8/198.单选:将一根绳子连续对折三次,然后每隔一定长度剪一刀,共剪6刀。

问这样操作后,原来的绳子被剪成了( )段。

A.18B.49C.42D.529.单选:唉声:叹气:憋闷( )。

A.爱财:如命:吝啬B.跋山:涉水:勤劳C.万水:千山:遥远D.手舞:足蹈:兴奋10.单选:小红说:如果中山大道只允许通行轿车和不超过10吨的货车,大部分货车将绕开中山大道。

招商银行招聘考试笔试历年真题汇总整理招商银行校招考试内容主要为行测、综合专业知识和性格测试,题目实际上是不难的,但要有针对性的复习,多练题目是肯定的!建议报考的同学提前做好复习准备,考试资料可以到柏蓝考上面找找,资料确实不错,都是上届学长们根据考试情况精心整理出来的,比较有针对性,大家可以去了解一下!招商银行笔试经验分享一:笔试分两个部分,也就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后,再发第二套试卷。

笔试不是机考,北京站今年安排在人大的就业指导中心笔试,笔试可以带计算器。

第一份试卷的测试内容即为常规行政能力测试,具体包括4个部分:1.言语理解与表达;2.数学运算;3.图形推理;4.资料分析。

时间勉强够用,一般答不完。

第二份试卷的测试内容为简答题。

今年的简答题如下:1.从经济学角度解释“过犹不及”的含义;2.解释“劣币驱逐良币”的含义,并结合一个经济现象说明“劣币驱逐良币”的影响。

3.材料分析题(阿里上市):(1)阿里上市对中国企业的影响;(2)对比阿里和亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真的慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定他们究竟是嘛心情啊。

后面的题列出了一种现象和几个可能引起这种现象的原因,选出最合理的答案,类似“某地区骑自行车人数增多,有关自行车的事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因是啥”。

第三部分35分钟,行测题,计算和逻辑推理,时间明显不够啊。

第四部分是性格测试,如实回答就好。

2019招商银行秋季校园招聘笔试考情_难度分析银行招聘网为想要报考银行的同学们提供银行最新的、最权威的招考信息、笔试、面试资料。

各省市银行考试信息及时汇总,一览无遗,笔、面试资料权威详细,极大的节省同学们的时间和精力,还有更多的备考指导、考试题库在等着你!2019招商银行秋季校园招聘暂未开始,想要报考招商银行的话可以提前进行复习,以下是根据历年招商银行笔试题目总结的笔试考情及难度分析,仅供考生参考。

更多有关银行校园招聘网申、笔试、面试技巧行测从题目上来看,2018招商银行校园招聘考试题型题量与往年差别不大,行测部分主要包括数量运算(25题)、判断推理(10题)、言语理解(20题),共55题,这需要考生课下练就有较快的做题速度与准确率,不然考试现场紧张+陌生,原先会的题可能也忘了!2018招商银行校园招聘笔试数量关系考查了数字推理、数学运算和思维策略,部分题目为省考和国考题目改编,难度中等;判断推理题型上,考查了逻辑推理和图形推理,难度上图形推理难度为易,逻辑推理总体中等偏易,一道偏难;言语理解考试中选词填空、片段阅读、语句排序和病句辨析可看做必考题型。

英语看完了行测,我们再来看一下英语的考试题型题量及难度的变化,招商银行英语考试单选考查的有托业中典型的词性辨析、词义辨析以及状语从句连词,但是个别题目的题干较长,需要真正理解题干语义才能选出正确答案。

可以看出今年单选考查的主要还是词汇量以及语义理解能力。

阅读理解以托业和短篇阅读为主,一共5篇,每个短篇阅读下有3道题目,话题涉及商务、文化、健康等,整体难度不大。

总之,今年招行英语考试还是比较偏重考查考生的基础知识储备。

考生备考时还是要注重基础词汇的积累。

考试结束之后,不管考的怎样大家都应该去了解一下银行校园招聘面试的历年考情及考题,因为笔试结束2周左右就会陆续进行面试。

因为现在处在考试的高峰期,大家一边准备笔试、一边准备面试,时间肯定不充足。

所以中公金融人小编建议大家合理安排时间,制定好适合自己的备考计划。

招商银行招聘考试笔试历年真题汇总整理招商银行校招考试内容主要为行测、综合专业知识和性格测试,题目实际上是不难的,但要有针对性的复习,多练题目是肯定的!建议报考的同学提前做好复习准备,考试资料可以到“壹银考”上面找找,资料确实不错,都是上届学长们根据考试情况精心整理出来的,比较有针对性,大家可以去了解一下!招商银行笔试经验分享一:笔试分两个部分,也就是两套试卷,每试卷1个小时。

完成第一套试卷收上去后,再发第二套试卷。

笔试不是机考,北京站今年安排在人大的就业指导中心笔试,笔试可以带计算器。

第一份试卷的测试内容即为常规行政能力测试,具体包括4个部分:1.言语理解与表达;2.数学运算;3.图形推理;4.资料分析。

时间勉强够用,一般答不完。

第二份试卷的测试内容为简答题。

今年的简答题如下:1.从经济学角度解释“过犹不及”的含义;2.解释“劣币驱逐良币”的含义,并结合一个经济现象说明“劣币驱逐良币”的影响。

3.材料分析题(阿里上市):(1)阿里上市对中国企业的影响;(2)对比阿里和亚马逊,从商家管理、支付平台以及支付风险等角度对比分析。

招商银行笔试经验分享二:今天晚上按照规定时间登陆测评网站,发现IE版本太高,不兼容测评网页,又找不到win8兼容性设置,当时真的慌了,不会就这么错过测评了吧?好在还有度娘,设置好后进入测评网页。

LZ从六点五十做到七点四十几,差不多一小时,分为4个部分,时间分配为5+25+35+25,前5分钟是例题,熟悉题型,第二部分25分钟,一开始有几个人脸图片,通过表情猜心情,如沮丧、快乐、歇斯底里,LZ完全不确定他们究竟是嘛心情啊。

后面的题列出了一种现象和几个可能引起这种现象的原因,选出最合理的答案,类似“某地区骑自行车人数增多,有关自行车的事故却减少了,问原因;旅游公司推出网络订票,但近期电话订票并未减少,原因是啥”。

第三部分35分钟,行测题,计算和逻辑推理,时间明显不够啊。

第四部分是性格测试,如实回答就好。

2023银行校园招聘考试历年真题汇编·EPI理科数量关系(40) (1)数字推理(25) (12)思维策略(15) (18)资料分析(20) (22)数量关系(40)基本技巧与方法(15)1.(2017年交通银行秋招)汽车配件厂加工了一批零件,数量小于1000个,现在这批零件如果每4个装在一个小盒里,剩3个;如果每5个装在一个中盒里,剩2个;如果每6个装在一个大盒里,剩1个。

那么,这批零件最多有()个。

A.953B.970C.967D.999【答案】C【解析】本题考查代入排除法。

所求为最多,先从最大的值999带入,不符合每5个一盒剩2这个条件,排除。

再代入970,不满足每4个装在一个小盒里,剩3个,排除。

再代入967,满足所有条件。

故选C项。

2.(2018年邮储银行秋招)一个三位数除以53后,得到一个正整数商,且余数是商的一半。

那么这个三位数最大是()。

A.928B.890C.963D.990【答案】C【解析】本题考查代入排除法。

代入后只有C项,963÷53=18…9,满足余数是商的一半。

故选C项。

3.(2020年工行总部秋招)有四个数字,最大数字与最小数字之差为4,并且它们组成的最大数与组成的最小数之差为4176,四个数乘积为504。

则这四个数字是()。

A.4、2、5、6B.3、6、7、4C.8、6、4、7D.1、4、3、5【答案】B【解析】本题考查代入排除法。

只有B项4个数的乘积是504,其他均不符合题意。

验证B项中最大数与最小数差为7-3=4,符合题意。

组成的最大数与最小数差为7643-3467=4176,符合题意。

故选B项。

4.(2020年工行总部秋招)学校购进一批文具用品(铅笔和圆珠笔)和体育器材(篮球和排球)。

其中,铅笔和圆珠笔之比为5:3,篮球和排球之比为3:7,则这批文具用品和体育器材之和可能为()。

A.71B.83C.92D.101【答案】C【解析】铅笔和圆珠笔之比为5:3,则铅笔和圆珠笔之和为8的倍数。

招商银行笔试题库及参考答案一、选择题1. 招商银行成立于哪一年?A. 1987年B. 1990年C. 1993年D. 1995年参考答案:A. 1987年2. 招商银行的总部位于哪个城市?A. 北京B. 上海C. 广州D. 深圳参考答案:D. 深圳3. 以下哪个业务不属于招商银行的主营业务?A. 存款业务B. 贷款业务C. 保险业务D. 证券业务参考答案:C. 保险业务4. 招商银行的企业文化理念是?A. 以人为本B. 诚信立业C. 创新发展D. 共赢共享参考答案:B. 诚信立业5. 招商银行推出的“一卡通”业务,以下哪项描述是正确的?A. 只能用于存款业务B. 只能用于消费业务C. 存款、消费、理财等功能齐全D. 只能用于贷款业务参考答案:C. 存款、消费、理财等功能齐全二、填空题1. 招商银行的股票代码是______。

参考答案:6000362. 招商银行的核心价值观是______、______、______。

参考答案:诚信、专业、创新3. 招商银行成立于______年,是我国第一家完全由企业法人持股的股份制商业银行。

参考答案:1987年4. 招商银行的经营理念是______、______、______。

参考答案:客户至上、风险控制、持续发展三、判断题1. 招商银行是我国四大国有商业银行之一。

(对/错)参考答案:错2. 招商银行的个人业务主要包括:存款、贷款、理财、信用卡等。

(对/错)参考答案:对3. 招商银行的企业业务主要包括:公司贷款、企业存款、国际贸易融资等。

(对/错)参考答案:对4. 招商银行在境内外设有众多分支机构,为全球客户提供金融服务。

(对/错)参考答案:对四、简答题1. 简述招商银行的业务范围。

参考答案:招商银行的业务范围主要包括个人业务、企业业务、金融市场业务、资产管理业务等。

个人业务包括存款、贷款、理财、信用卡等;企业业务包括公司贷款、企业存款、国际贸易融资等;金融市场业务包括货币市场、债券市场、外汇市场、黄金市场等;资产管理业务包括基金管理、保险资产管理等。

招商银行招聘笔试真题一、招商银行笔试题型结构一、基础知识部份(70题左右)(1)时事政治。

简单地说确实是今年度发生的国内、国外重要或典型事件。

(2)专业知识。

涉及宏观经济学,会计学,证券投资学,法律,人力资源治理,运算机技术等综合知识。

(3)招行知识。

招行的广告语,招行核心资本充沛率,招行黄金产品名称,招行校园招聘宣传口号等内容。

二、行政能力测试(70题左右)(1)语言题。

形式是选词填空和段落排序。

(2)逻辑判定。

(3)资料分析。

一样有三道大题。

3、英语阅读(20题左右)(1)2021年招行英语考试与工行、中行不同。

招行给了四篇阅读,每篇阅读有5问,共20题,三十分钟必需做完。

(2)这四篇英语阅读讨论的问题别离是:商店男女小偷比例及缘故、中国援助非洲问题,英国对对欧元区债务危机的矛盾的地方,英国部份图书馆被取消引发的抗议。

(3)文章难度一样,问题超级简单,一样都能够在原文迅速找到答案。

4、性格测试二、招商银行笔试100练习题一、商业银行贷款发放和利用应当符合国家法律、行政法规和中国人民银行发布的行政规章,应当遵循的原那么有( D )A:平安性、打算性、效益性B:打算性、择优性、归还性C:平安性、打算性、择优性D:平安性、流动性、效益性二、按贷款期限划分短时间贷款是指( C )A:六个月之内(含六个月) B、六个月之内C:一年之内(含一年) D、一年之内3、按贷款方式划分,贷款分哪些种类( B )A:保证贷款、抵押贷款、质押贷款B:信誉贷款、担保贷款、单据贴现C:信誉贷款、保证贷款、单据贴D:担保贷款、抵押贷款、质押贷款4、贷款五级分类的标准是( A )A:正常、关注、次级、可疑、损失B:正常、可疑、超期、呆滞、呆帐C:正常、次级、关注、可疑、损失、D:关注、超期、可疑、呆滞、呆帐五、自营贷款的期限一样最长不超过( C )A:五年B:八年C:十年D: 十五年六、依照我国商业银行存贷款比例指标,各项贷款与各项存款之比( A ) A:不超过75% B:不超过120%C:不超过100% D:不超过70%7、商业银行年末存贷比例不得高于( C )A:70% B:75% C:80% D:65%八、一年期以上中长期贷款余额与一年期以上存款余额的比例不得高于( B ) A:100% B:120% C:70% D:80%九、商业银行资产欠债比例治理指标中资产利润率为( D )A:利润总额与全数资产的比例不抵于10%B:利润总额与全数资产的比例不抵于5%C:利润总额与全数资产的比例不抵于0.1%D:利润总额与全数资产的比例不低于0.5%10、短时间贷款展期期限累计不得超过( C )A:一年B:半年C:原借款期限D:原借款期限的一半1一、商业银行资产欠债比例治理指标中一样要求企业的流动比率应高于( D ) A100% B50% C资产欠债率D200%1二、在以下哪一种情形下,合同债务人可不承担违约责任( A )A:不可抗力B意外事故C标的物灭失D超期履行13、以下那个担保形式不属于物权担保( D )A抵押B质押C留置D保证14、对担保合同说法正确的选项是( A )A:被担保合同与担保合同属于主从合同关系B:担保合同为主合同C:被担保合同为主合同D:担保合同本身能够独立存在1五、商业银行再贴现业务是指( C )A:商业银行持未到期的贴现单据向其他商业银行请求贴现B:商业银行持未到期的贴现单据向非银行融资机构请求贴现C:商业银行持未到期的贴现单据向中央银行请求贴现D:商业银行持未到期的贴现单据向企业请求贴现1六、动产抵押质权人最要紧的权利是( C )A:留置质物的权利B:救济质物的权利C:优先受偿权D:代位权17、商业银行发放贷款的种类要紧为( B )A:商业贷款B:自营贷款C:委托贷款D:农业贷款1八、商业银行核销呆帐贷款的程序是( D )A:先金额小后金额大B:呆帐形成三年以后核销C:上级要求核销D: 先认定后核销1九、对最大一家客户贷款余额不得超过( A )A:本行资本总额的10%B:本行资本总额的30%C:本行资本总额的20%D:本行资本总额的40%20、贷款利息收回率指标表达正确的选项是( D )A:贷款实收利息占贷款利息收入的比例不抵于75%B:贷款实收利息占贷款利息收入的比例不低于80%C:贷款实收利息占贷款利息收入的比例不低于85%D:贷款实收利息占贷款利息收入的比例不低于90%2一、抵押人不履行合同时,抵押权人有权( A )A:变现抵押物优先受偿B:占有并利用抵押物C:没收抵押物D:退还抵押物2二、有关保证的以下说法中,错误的选项是( A )A:主合同被确认失效后,保证人再也不承担任何责任B:保证方式有一样保证和连带责任保证之分C:不管保证人承担的是履行责任仍是补偿责任,保证人都可能承担补偿责任。

招商银行招聘笔试真题一、招商银行笔试题型结构1、基础知识部分(70题左右)(1)时事政治.简单地说就是本年度发生的国内、国外重要或者典型事件。

(2)专业知识。

涉及宏观经济学,会计学,证券投资学,法律,人力资源管理,计算机技术等综合知识。

(3)招行知识.招行的广告语,招行核心资本充足率,招行黄金产品名称,招行校园招聘宣传口号等内容。

2、行政能力测试(70题左右)(1)语言题。

形式是选词填空和段落排序。

(2)逻辑判断。

(3)资料分析。

一般有三道大题.3、英语阅读(20题左右)(1)2015年招行英语考试与工行、中行不同。

招行给了四篇阅读,每篇阅读有5问,共20题,三十分钟必须做完。

(2)这四篇英语阅读讨论的问题分别是:商店男女扒手比例及原因、中国援助非洲问题,英国对对欧元区债务危机的矛盾之处,英国部分图书馆被取消引起的抗议。

(3)文章难度一般,问题非常简单,一般都可以在原文迅速找到答案。

4、性格测试二、招商银行笔试100练习题1、商业银行贷款发放和使用应当符合国家法律、行政法规和中国人民银行发布的行政规章,应当遵循的原则有( D )A:安全性、计划性、效益性B:计划性、择优性、偿还性C:安全性、计划性、择优性D:安全性、流动性、效益性2、按贷款期限划分短期贷款是指(C )A:六个月以内(含六个月)B、六个月以内C:一年以内(含一年)D、一年以内3、按贷款方式划分,贷款分哪些种类( B )A:保证贷款、抵押贷款、质押贷款B:信用贷款、担保贷款、票据贴现C:信用贷款、保证贷款、票据贴D:担保贷款、抵押贷款、质押贷款4、贷款五级分类的标准是( A )A:正常、关注、次级、可疑、损失B:正常、可疑、逾期、呆滞、呆帐C:正常、次级、关注、可疑、损失、D:关注、逾期、可疑、呆滞、呆帐5、自营贷款的期限一般最长不超过( C )A:五年B:八年C:十年D: 十五年6、根据我国商业银行存贷款比例指标,各项贷款与各项存款之比(A )A:不超过75% B:不超过120%C:不超过100% D:不超过70%7、商业银行年末存贷比例不得高于( C )A:70% B:75%C:80%D:65%8、一年期以上中长期贷款余额与一年期以上存款余额的比例不得高于( B ) A:100% B:120% C:70%D:80%9、商业银行资产负债比例管理指标中资产利润率为( D )A:利润总额与全部资产的比例不抵于10%B:利润总额与全部资产的比例不抵于5%C:利润总额与全部资产的比例不抵于0.1%D:利润总额与全部资产的比例不低于0.5%10、短期贷款展期期限累计不得超过(C )A:一年B:半年C:原借款期限D:原借款期限的一半11、商业银行资产负债比例管理指标中一般要求企业的流动比率应高于( D ) A100% B50%C资产负债率D200%12、在下列哪种情况下,合同债务人可不承担违约责任(A )A:不可抗力B意外事故C标的物灭失D逾期履行13、下列那个担保形式不属于物权担保(D )A抵押B质押C留置D保证14、对担保合同说法正确的是(A )A:被担保合同与担保合同属于主从合同关系B:担保合同为主合同C:被担保合同为主合同D:担保合同本身能够独立存在15、商业银行再贴现业务是指( C )A:商业银行持未到期的贴现票据向其他商业银行请求贴现B:商业银行持未到期的贴现票据向非银行融资机构请求贴现C:商业银行持未到期的贴现票据向中央银行请求贴现D:商业银行持未到期的贴现票据向企业请求贴现16、动产抵押质权人最主要的权利是(C )A:留置质物的权利B:救济质物的权利C:优先受偿权D:代位权17、商业银行发放贷款的种类主要为( B )A:商业贷款B:自营贷款C:委托贷款D:农业贷款18、商业银行核销呆帐贷款的程序是(D )A:先金额小后金额大B:呆帐形成三年以后核销C:上级要求核销D: 先认定后核销19、对最大一家客户贷款余额不得超过(A )A:本行资本总额的10%B:本行资本总额的30%C:本行资本总额的20%D:本行资本总额的40%20、贷款利息收回率指标叙述正确的是(D )A:贷款实收利息占贷款利息收入的比例不抵于75%B:贷款实收利息占贷款利息收入的比例不低于80% C:贷款实收利息占贷款利息收入的比例不低于85%D:贷款实收利息占贷款利息收入的比例不低于90%21、抵押人不履行合同时,抵押权人有权( A )A:变现抵押物优先受偿B:占有并使用抵押物C:没收抵押物D:退还抵押物22、有关保证的下列说法中,错误的是( A )A:主合同被确认失效后,保证人不再承担任何责任B:保证方式有一般保证和连带责任保证之分C:不管保证人承担的是履行责任还是赔偿责任,保证人都可能承担赔偿责任。

2018年招商银行秋季校园招聘笔试真题及答案解析 第一部分英语(1-15) 一、阅读理解 Text 1 It would be all too easy to say that Facebook’s market meltdown is coming to an end. After all, Mark Zuckerberg’s social network burned as much as $ 50 billion of shareholders’ wealth in just a couple months. To put that in context, since its debut(初次登台)on NASDAQ in May, Facebook has lost value nearly equal to Yahoo, AOL, Zynga, Yelp, Pandora, Open Table, Groupon, LinkedIn, and Angie’s List combined, plus that of the bulk of the publicly traded newspaper industry. As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world, it’s no surprise to anyone who read the initial public offering (IPO) prospectus(首次公开募股说明书). Worse still, all the crises that emerged when the company debuted — overpriced shares, poor corporate governance, huge challenges to the core business, and a damaged brand — remain today. Facebook looks like a prime example of what Wall Street calls a falling knife — that is, one that can cost investors their fingers if they try to catch it. Start with the valuation(估值). To justify a stock price close to the lower end of the projected range in the IPO, say $ 28 a share, Facebook’s future growth would have needed to match that of Google seven years earlier. That would have required increasing revenue by some 80 percent annually and maintaining high profit margins all the while. That’s not happening. In the first half of 2012, Facebook reported revenue of $ 2.24 billion, up 38 percent from the same period in 2011. At the same time, the company’s costs surged to $ 2.6 billion in the six-month period. This so-so performance reflects the Achilles’ heel of Facebook’s business model, which the company clearly stated in a list of risk factors associated with its IPO: it hasn’t yet figured out how to advertise effectively on mobile devices, the number of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter, or more than half its customer base. Numbers are only part of the problem. The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways. Indeed, the more Facebook’s disappointment in the market is catalogued, the worse Facebook’s image becomes. Not only does that threaten to rub off on users, it’s bad for recruitment and retention of talented hackers, who are the life blood of Zuckerberg’s creation. Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he holds. This arrangement also was fully disclosed at the time of the offering. It’s a pity so few investors apparently bothered to do their homework.

1. What can be inferred about Facebook from the first paragraph? A. Its market meltdown has been easily halted. B. It has increased trade with the newspaper industry. C. It has encountered utter failure since its stock debut. D. Its shareholders have invested $ 50 billion in a social network.

2. The crises Facebook is facing _______________. A. have been disclosed in the IPO prospectus B. are the universal risks Wall Street confronts C. disappoint its faithful users D. have existed for a long time

3. To make its stock price reasonable, Facebook has to _______________. A. narrow the IPO price range B. cooperate with Google C. keep enormously profitable D. invest additional $ 2.6 billion

4. It can be inferred from the context that the “Achilles’ heel” (Line 1, Para. 5) refers to ______________. A. deadly weakness B. problem unsolved C. indisputable fact D. potential risk

5. What effect will Facebook’s failure in the market have? A. Its users’ benefits will be threatened. B. Talented hackers will take down the website. C. The CEO will hold the super-voting stock. D. The company’s innovation strength will be damaged.

Text 2 I’ll admit I’ve never quite understood the obsession(难以破除的成见)surrounding genetically modified (GM) crops. To environmentalist opponents, GM foods are simply evil, an understudied, possibly harmful tool used by big agricultural businesses to control global seed markets and crush local farmers. They argue that GM foods have never delivered on their supposed promise, that money spent on GM crops would be better channeled to organic farming and that consumers should be protected with warning labels on any products that contain genetically modified ingredients. To supporters, GM crops are a key part of the effort to sustainably provide food to meet a growing global population. But more than that, supporters see the GM opposition of many environmentalists as fundamentally anti-science, no different than those who question the basics of man-made climate change. For both sides, GM foods seem to act as a symbol: you’re pro-agricultural business or anti-science. But science is exactly what we need more of when it comes to GM foods, which is why I was happy to see Nature devote a special series of articles to the GM food controversy. The conclusion: while GM crops haven’t yet realized their initial promise and have been dominated by agricultural businesses, there is reason to continue to use and develop them to help meet the enormous challenge of sustainably feeding a growing planet. That doesn’t mean GM crops are perfect, or a one-size-fits-all solution to global agriculture problems. But anything that can increase farming efficiency — the amount of crops we can produce per acre of land — will be extremely useful. GM crops can and almost certainly will be part of that suite of tools’ but so will traditional plant breeding, improved soil and crop management and perhaps most important of all, better storage and transport infrastructure(基础设施), especially in the developing world. (It doesn’t do much good for farmers in places like sub-Saharan Africa to produce more food if they can’t get it to hungry consumers.) I’d like to see more non-industry research done on GM crops — not just because we’d worry less about bias, but also because seed companies like Monsanto and Pioneer shouldn’t be the only entities working to harness genetic modification. I’d like to see GM research on less commercial crops, like corn. I don’t think it’s vital to label GM ingredients