股权激励外文文献

- 格式:doc

- 大小:44.50 KB

- 文档页数:10

股权激励动因与实施效果的文献综述股权激励是一种雇员激励的方式,它通过让员工持有公司的股份来实现对员工的鼓励和激励,以此提高员工的自我动力和工作积极性。

本文综述股权激励的动因及其实施效果方面的研究文献。

动因一、员工动机方面1.改善员工绩效Byun等人(2014)在研究中指出,股权激励计划对员工绩效具有积极的影响,员工股份持股越多,其绩效就越好,因此,股权激励可以帮助公司激发员工的积极性和工作动力。

2.增强员工归属感王智慧等(2015)的研究表明,股权激励计划可以增强员工对公司的归属感,提高员工的忠诚度和满意度,有助于提高员工的留存率。

二、公司优化方面1.增加公司利润Desoky(2015)在研究中指出,通过股权激励计划,能够增加公司的利润,有助于提高公司的业绩表现。

2.吸引和留住人才丁宗明等(2015)的研究表明,股权激励计划可以吸引和留住优秀人才,提高企业的竞争力和核心竞争力。

实施效果一、股价表现方面1.股价上涨Datta等人(2016)的研究表明,股权激励计划能够提高公司的股价表现,从而增加投资者的投资信心。

2.影响时间因素Pixley等人(2015)则发现,股权激励对股价的影响时间因素存在滞后效应,通常在计划实施后的数年内才能达到最佳效果。

1.员工创造力Trevor等人(2013)的研究表明,股权激励计划能够对员工的创造力和创新能力产生积极影响,从而促进公司的创新和发展。

2.员工忠诚度总结而言,股权激励计划在员工动机和公司优化方面具有积极的作用,对公司的股价表现和员工绩效也有显著的影响。

因此,企业在实施股权激励计划时应根据自身的情况和目标进行选择和实施。

上市企业经营绩效与⾼管薪酬激励研究外⽂⽂献翻译⽂献出处: Firth M. The study on operating performance of listed companies and executive compensation incentive [J]. Journal of Corporate Finance, 2015,12(5)41-51.原⽂The study on operating performance of listed companies and executive compensationincentiveFirth MAbstractExecutive compensation problems is the result of modern enterprise ownership and control separated, target inconsistency exists between the owners and executives, the problem such as asymmetric information, the complexity and uncertainty of modern enterprise operation is exacerbated by the seriousness of this problem, and through the contract signed with executive compensation performance, design and implement a good compensation plan can effectively solve the above problems. In today's knowledge economy, the competition between enterprises is actually the competition between talents, executives, especially excellent executives has become the core of enterprise resources, in view of the particularity of human capital of executives, executives how to effectively motivate, attract and promote the interests of the enterprise has become the key to enterprise development, and executive pay is playing such a role.Keywords: Executive compensation, Business performance, Listed Company1 IntroductionSeparate ownership and control is modern enterprise the most significant characteristics (Bale and Means, 1932).The shareholders of the owners in an enterprise have the final property ownership and the residual claims, but often there is no direct management control. Business management on behalf of the owner of control, but don't take the final decision. In the case of two rights separation is as the main body of the ownership as the main operational control shareholders and the enterprise management to form a layer between the principal-agent relationships. According to rational economic man hypothesis, the principal (owner) and the agent(management) have different between the objective function, at the same time, there exists a phenomenon of information asymmetry, the company's senior managers there is power and ability to implement on-the-job consumption "opportunistic behavior", which came at the expense of the interests of the owners at the expense of, is also the focus of the agency cost, reflect, it requires enterprises to establish an effective mechanism of incentive and constraint. By the implementation of these mechanisms can excite the work enthusiasms of agent, and can minimize the agency cost of the enterprise, so as to realize the "win-win" between principal and agent. Human society has begun to enter the knowledge economy era, the executives with high and new technical knowledge and skills has become the key to the development of enterprises, enterprises in the market competition is talented person's competition, in today's increasingly internationalized talent flow speed and, utmost respect talented person, is the key to enterprises in the competition occupy the initiative. Therefore, the enterprise owners how to through a set of incentive constraint mechanism to arouse the enthusiasm of executives, minimize agency costs, has become the key problem in the principal-agent relationship.2 Literature reviewIn the 90 s and 1980 s executive compensation has become an important field of academic research, the current executive compensation research literature is largely based on agency theory as the theoretical basis; it requires managers pay package design should make the interests of the managers consistent with the interests of shareholders. Multiple theory school of scholars use all kinds of data on compensation performance problems made all kinds of inspection. But neither empirical results are consistent with theoretical predictions, there is conflict between each other. Such as Belkaoui and Picur (1993), Koehhar and Levitas (1998) and Gray and Canella (1997) study showed that the correlation coefficient between CEO pay and company size to 0.1 at lower, the level of 0.110 and 0.170, and Boyd (1994), Finke1SteinandB.Yd (1998) and Sander and Carpenter (1998) argues that between the correlation coefficient is 0.62, 0.50 and 0.42.The same conflict results also exist in the research about the relation between pay performance. Like Finkelstein and Boyd (1998) foundthat return on equity (ROE) with monetary compensation and long-term returns between the correlation coefficient is 0.13 and 2.03 respectively; Johnson (1982) found that the correlation coefficient of 0.003.And Belliveau, Reilly and Wade (1996) found that CEO pay with ROE correlation coefficient of 0.410.Gomez Mejia (1994), the empirical study summarized: "although the empirical study of CEO pay a dime a dozen, but we know very little about executive remuneration or. “Many causes of the difference of the results of the study: the different data sources, different statistical techniques, different samples and differentcontrol variables, etc.Most of the empirical study in the United States listed companies as samples, mainly to pay as the research object, and given priority to with big companies. In the empirical study, Jensen and Murphy (1990) widely cited in the literature, since 90, and most of the empirical research in accordance with its research paradigm. In this article has pioneering meaning in the literature, they estimated the 1295 companies between 1974 and 1986 of 10400 senior managers compensation performance sensitivity, results show that the shareholder wealth of $1000 per change, CEO of wealth will be $3.25 move together. Lippert and Moore (1994) found that the pay performance sensitivity significantly negative correlation with growth, industry control, scale, and with the internal and the institutional investors holding and the term is not relevant. LIPPert and Moore (1995) found that the pay performance sensitivity to low the company has more independent directors or stronger shareholder control. MeConaughy and Mishra (1996) found that sensitivity associated with the company's future performance. The research is on compensation performance sensitivity calculation with Jensen and Murhpy computing (1990).With Jensen and Murhpy (1990) study of pay levels are different. Other documents against U.S. companies pay structures were studied. Genhart and Milkovich (1990) analysis of the more than 200 enterprises, 14000 senior and mid-level managers' pay, found that managers' pay and performance related and wages are not related. Their results also showed that mixed compensation levels and future profitability is related. Their contribution is caused people's understanding to pay structure. Similarly, Leonard (1990) have found S0 s long-term incentive plans ofthe company than the company has a long-term incentive plans, there are a higher return on equity (ROE).Hamid Mehran (1995) on a random sample of 153 manufacturing companies in 1979-1980 executive pay the inspection support incentive compensation claims, but also shows the level of motivation rather than the form of motivation to inspire the motivation of managers to increase the value of the company. Corporate performance with management ownership and equity incentive is in proportion to the total compensation level of positive correlation. He also found that equity-based compensation in the company of outside directors more applied more widely. In the end or by outside big shareholders higher insider ownership of company Ricky is in less equity compensation applications.3 Theoretical foundation of the executive compensation3.1 The principal-agent theoryIn the early days of the private enterprise, the enterprise owners or operators of the two functions, so as long as the owners are rational economic man, he will actively work for their own enterprise profit maximization, at the same time as the enterprise risk takers, he will be careful decisions, try to avoid risk. In classical enterprises, therefore, there is no power shortage and behavior distortion problem. However, with the deepening of socialized big division of labor, the production of modern enterprise system, enterprise's ownership and operation separate, its separation and led to the emergence of the principal and agent relationship, both are driven by their own interests, as the manager of the enterprise owners want as agent of the principal researchers to their own interests targeting action in accordance with the owners. And managers also is own expected utility maximization as the goal, so that both the goal of the inconsistency.3.2 The human capital theoryFrom the Angle of economics to study the compensation problem, main is to pay as senior executives in the Labor market price. In labor economics, the compensation decision mechanism on the Labor market mainly is the human capital theory. The economic activities of listed companies in the final analysis is conducted by people, the economic efficiency of listed companies in the final analysis depends on people'senthusiasm. Economic history shows that, under different institutional arrangements, the person of ability and hard work, especially the potential and creativity is the fundamental symbol of success for an enterprise system is good or bad. Therefore, economic efficiency of listed companies, the human capital property rights problems and natural economic behavior is the foundation of can't avoid. Property rights established the significance, is to make the economic behavior of the internalization of external effects, so as to produce the stimulation of strong momentum. A property rights system, therefore, the strength of the economic incentive function, mainly with the efforts of the economic subject is associated with the proximity of remuneration. Top management is the most important role in the development of modern enterprises, executive personnel is the enterprise decision makers, leaders and commanders, is the soul of the enterprise, is a leader in the development of enterprises, therefore is also an important force in China's economic and social development. Grew up in a special environment during the transition period of our country in the top management, than the business operators in the market economy country pressure is bigger, heavier burden. Especially the burden of the senior executives of state-owned enterprises with the development of the enterprise solution and two pairs of heavy burden, they want to pay more than the number of times the energy often, previously unimaginable responsibility and risk. Therefore, should recognize the importance of enterprise senior management personnel. Establish training, selection and use of enterprise management mechanism, giving them reasonable compensation.3.3 Equity theoryProblems from the Angle of psychology to study senior managers' pay mainly will be paid as a method that can meet the demand of senior executives inner and elements, to encourage executives to work enthusiasm and initiative, to improve executive performance from the individual level. In the psychology of motivation theory, the design of compensation and compensation management is based on the theory of influential Stacy Adams equity theory. Adams fair theory, the staff would first think about the ratio of their income to pay, and then will his income pay comparing with relevant income pay others. If employees feel him with others of thesame, the ratio of thought is to the state fair. If both feel not the same, the ratio of injustice are produced, namely, they may think their income is too low or too high. After this injustice, the staff will try to correct it.3.4 Strategic compensation theoriesTo think from the perspective of management, enterprises pay problem, more attention is pay management support for the enterprise strategic goals, namely how to through the compensation system to effectively help enterprises to gain a competitive advantage. About compensation management how to support the enterprise strategic target, this is the main content of the strategic compensation system design. The so-called strategic compensation, it is to point to will pay up to the enterprise strategic level, to thinking through what kind of compensation policies and compensation management system to support enterprise competitive strategy, and help enterprises to gain competitive advantage.4 The design principle of executive compensation system4.1 Principles of pay and performanceOptimal executive compensation design is the executive compensation and its operation performance, the compensation depends on the company's operating results, the design should follow the principle of the main executive compensation scheme. This principle is the principle of balance between the interests of the owner and operator. Because follow this principle, the owner and operator revenue the stand or fall of same direction as the firm's performance. Business is business risk, managers' compensation and corporate business performance has a direct relationship. Considering the operators are people too, also want to maintain family and their own survival. Considering the uncertainties of doing business at the same time, if the executive compensation and its business performance, completely will take too much risk. As a result, the executive compensation can be divided into two parts: part of the fixed income, the amount is able to maintain their personal and family life, have insurance effect. Part is risk income, completely and enterprise performance, good management can be even more greatly than the fixed income part, make its income risk, incentive role.4.2 Effective incentive principlesModern enterprise system, the organization (shareholders) and individual (senior management) is a kind of principal-agent relationship. Incentive is to strengthen and accordance of individual behavior, organizational goals, in other words, is to guide individual behavior maximize the development to achieve organizational goals. Due to corporate executives is a special company employees, has the position of privilege, enjoy "on-the-job consumption", it brought outside the regular salary incentive to executives to meet the material benefits, this need to some extent, belongs to the fair in Adams fair theory. However, in many state-owned enterprises, on-the-job consumption often goes far beyond a reasonable level, showing a high cost of self-motivation. And stands in stark contrast to the executive pay, some executive’s on-the-job consumption optional the gender is strong, too much abuse, even in a state of out of control. Has issued relevant laws and regulations, shall be forbidden.4.3 Effective restriction principleExecutives is an enterprise's decision-making and operators directly, plays an vital role in the fate of the enterprise, if in the design of enterprise organization system, lack of necessary and effective supervision and restriction mechanism, will likely agent risk. On entrepreneur behavior with some restrictions, these constraints are usually the behavior rule, violating these rules will be punished. Constraint mechanism has defined the entrepreneur behavior, the role of maintaining the order of economic activities, for the standardization of the enterprise behavior, economic and social benign operation has an indispensable positive function.译⽂上市企业经营绩效与⾼管薪酬激励研究Firth M摘要⾼管薪酬问题的产⽣源于现代企业所有权和控制权的相互分离,所有者与公司⾼管之间存在着⽬标不⼀致、信息不对称等问题,现代企业经营的复杂性和不确定性更是加剧了这⼀问题的严重性,⽽通过与⾼管签订薪酬绩效契约,设计和执⾏⼀份良好的薪酬⽅案可以有效地解决上述问题。

How to Motivate EveryEmployee---James·Cameron Incentive is the core ofhuman resourcemanagement.Production andmanagement intheenterprise management, human resources is economic resourceswithavariety of thoughts,feelings,themost dynamic summation also lovethat economic resources, but alsothesoul of enterprise in this organism, therefore, human resourcesproduction and management resources than other more important resources,and decisions not only affectthe productionand operation of enterprisesof other economicresources, the value anduse, and the province isthe enterprise strength of severalimportant components of quality of humanresources as a resultof prod uction and management intheenterpriseeconomic resources of the status and role, so the effectiveness ofcorporate governance or the ultimate ideal to achieve theobjectiveshouldbe: everyenterprise employees will be able togive toppriority to the overallinterestsof enterprisesand business goals ,the interests of all willing to contributetheir own.Employeesofsucha mental state ofthi nking andNormal under oath inorder to reflectthe difficult,but it is entrepreneurs,managersshouldbe pursued andthe ultimate chall enge, it isnecessarytoapproachsuch a state,onlythrough an effective internal incentives. Therefore,the most important taskofenterprise management is thehumanresources management.Traditional personnel management and laboris different fr om amodern human resourcesmanagement performance of the mainfeatures ofthe "strategic" level: (one)at the strategic guiding ideology ofmodern human resource management is "people-oriented" managemen t;(two)the strategic objectives modernhumanresourcesman agement in order to"obtain a competitive advantage," the objectives ofmanagement; (three) the scope ofthe strategy,the modern human resources management is the"full participation in"democraticmanagement;(four)measures in the strategy ofmodern hum an resourcesmanagement istheuse of"systematic scienti fic methods and human art" contingency management. And non-human resourcesmanagement,comparedto human resourcesmanagement through the"incentives" to achieve, it isthecore of human resources management.Theso-called "incentive"to meet peoplefrom themulti-level and diversified needs ofdifferent employees and reward performancestandards set value,a maximumstaffto stimulate enthus iasm and creativity toachieve theobjectives of theOrganization.An enterprise of how the useof humanresources is determined by many complexfactors in theresult ofthe coupling,but the role of managementincentivesis oneofthe most importantfactors.Unlike other non-human resources of the fundamental characteristics of human resources is that it attached to the staffandthe existence of the human body,personal moment with thestaff can not be separated, s uchother person or organizationto usehuman resources,both by i ts natural all the peopleof "positive taketheinitiative "canbe achieved with.Therefore,human resources management can"peo ple-oriented" and effectively to stimulatethe enthusiasm of employees, to maximize the staff's initiative and creativity,has become thedecision of themerits of enterprise production and managementof key performance factors and human resourcesmanagementbusin ess successcoreof the problem.Employeeincentive measures.Incentives forthe management of human resources management in pa rticular,the importanceofself-evident. Incentives canbe adopted byallof,the enterprises need to attract them;also canma ke the mostof the employees to perform their talentsandwisdom;work so asto maintain the effectiveness and efficiency. Incentivenot onlytomake employees feelat ease,and actively workto playit so staff recognition and acceptance of theenterprisegoalsand values,theenterprise have a strongsense of belonging. According to the United States,Professor William James of Harvard University study,in the absence ofincentive environment,the potential for staff to playout only a small part of that is20%-30%, first-served basisjusttokeep their ricebowls; and in a goo dincentive mechanism for the environment,the samestaffcanplay a potential 80%-90%, it canbe seen,so that each employeeis alwaysa good incentive environment is the management ofhuman resourc esdevelopment andthe pursuit ofthe ideal state. So howdo weinspireemployees toeffectivelycorrect the times?First,Adhere topeople-centered,respect for humannature,and establish andimplement the"employee-centric" management concept."People-oriented,respect for humanity"as a modernmanagementphilosophy, emphasizingthe ultimategoal ofmanagement -toimpr ove the economic efficiencyof enterprises onthe people behind themanagementof behavior is nolonger a cold cold commandtype, the compulsory type. But carrying out anincentive,trust, caring, emotional,manager of humannature embodies a high degree of understand ing and attach importance to managers as employees can not be purely"economic man"in orderto meet their survivalneeds and material interestsofthemanagement an opportunity tobut topay attention totheemployees respect thespirit of self-actualization needsathigher level inorder toprovidecreativework and encouraging personalityto playtomobilize the enthusiasm of employees, in the equal exchange of lead and establish the conceptof corporate management; the externalcontrolinto self-control, so thateach employee to formtheir own sense of corporate loyalty andasense of responsibility, so that the value of employees to achievepersonal and businesssurvival and development into a passer-by, if theenterpris es do not know how to be people-oriented, and lackof basic understanding of humannature and respectfor , tothe neglect of the personal value of human resources toenable employees toachieve long -term needs ofthe individual values can not be met or evendepression, willnot be ableto retain the besttalent,companies will lose competitiveness.Therefore, we must dothefollowing:Staff carry outregularsurveys tounderstandthe extent possible,a matter ofconcernto employees, especially those relevant to their work,andto win the support andloyaltyof staff,and staff toguide the spiritof innovation, attractand retain employees,companiesshouldstrive tocollectthe following thede sired information staff: the fairness of work; organizational learning;communication;degree of flexibility and concern; CustomerCenter;trust and delegation of authority; theeffectivenessof management;job satisfaction, the adequacy ofsupport, was placed ina suitable role ,and whetherornot to feel valuable.Focuson staff remuneration, benefits,working conditions,as w ell as flexible, to facilitate the preferentialarrangements. Enterprises should change withthe times, in additionto thetraditional emphasis on staff remuneration,welfare and theimprovement of working conditions but also the possibility of other incentives,such asthe provision of day care; servingUniversity;tuition grants;shorter workinghoursin summer;the implementation ofemployee stockoptionplan; setupa remote post office and so on.Second,the implementation of a comprehensive compensationstrategy tomotivate employees tofully.The so-called"comprehensive compensation strategy",which mean sthe company willpaythesalariesofemployeesclassifiedas"external" and "inherent" in two categories,acombination ofthetwois the "full pay","external pay"refer ring primarily toprovidetheir employees with quantifiable monetary value, for example, the basicwagebonuses, stockoptions, pension, medical insurance and so on," internalpay "refers tothoseprovided to employees cannot bequantified the performance ofmonetary val ue of various currencies. Forexample, work satisfaction, for the completionof itswork tofacilitate theprovision ofpersonal tools, training opportunities, attractive corporate culture, good interpersonal r elations, coordinationof the work environment, aswell asindivid ualrecognition, appreciation and so on,external salaries andpay their own internal incentives have differentfunctions.Theircontact with eachother,complement each other,constitute a complete system ofremuneration,practice has provedthat as a resultofstaff-to-business expectations and needs tobe comprehensive, whichincludesnot only material needs, but also spiritual needs,and thus the im plementationof"fullpay" strategy,is an effectivemodel of staffmotivation.Third,incentives shouldbefair,just and eliminate incentives for "big".Fair and impartial is afundamentalprinciple of motivation.Ifyou donot fair, improper Prize Award,improperpunishment and punishment,notonly can not receive thedesiredresults,butwillresultin manynegative consequences,itisnecessa ry toimpartial and incorruptible,regardlessof affinity, regardlessof distance,willbetreated equally in order to promote the enthusiasm of the staffalong the right direction virtuous circle,as proposed bythe UnitedStatesmanagethe academic award as the crit eria. Only by doing so can enhancethe cohesionand centripetal f orce.At the same time,incentivesare clearly ancient times people be lievedin thebasic management principles. In fact if the additional money as wages,asit is unrelatedtoindividualperform anceand reward,employees feel they deserve it, rather thanthe resultoftheefforts, sothatpeople can notbe stimulated andmotivat ed.Therefore,the smart managers should do everything possible to re ward and recognize performancecombine it with the cause of loyalty, dedication to thecause oftheclosecombination of fact, the staffinsidetheimbalanceis that they do good , therearededicated,but work withpeoplewhodo not receive thesame treatment. This is often not satisfied withthe staff and leadership reasons,incentivesto companies linkedtobehavior and employee be nefits, the higher theprotection of personal value,thegreater their income, andthrough incentives tocreate a fair competitiveenvironmentto increase the comparability of results,and promote up groups.To sum up, themanagementof enterprisesin the useof incentives should be people-oriented,payattentionto and strengthen the strong spirit of enterprise anddevelopment of mining resources toimprove the workers compensation which the degree of non-material rewards, in thedetermination and implementation of policies and work rules and regulations in,andstrive to embody theprinciple offair andequitable.Employeesshouldnotblindly encourage unrealisticearningsexpectations increase, otherwise you willenable enterprisesto individual workersor groups of incentives and constraints arising fromthe difficulties,the effectiveness ofdecline,more difficult.中文翻译:如何激励每一位员工---詹姆斯·卡梅隆激励是人力资源管理的核心。

文献出处: Firth M. The study on operating performance of listed companies and executive compensation incentive [J]. Journal of Corporate Finance, 2015,12(5)41-51.原文The study on operating performance of listed companies and executive compensationincentiveFirth MAbstractExecutive compensation problems is the result of modern enterprise ownership and control separated, target inconsistency exists between the owners and executives, the problem such as asymmetric information, the complexity and uncertainty of modern enterprise operation is exacerbated by the seriousness of this problem, and through the contract signed with executive compensation performance, design and implement a good compensation plan can effectively solve the above problems. In today's knowledge economy, the competition between enterprises is actually the competition between talents, executives, especially excellent executives has become the core of enterprise resources, in view of the particularity of human capital of executives, executives how to effectively motivate, attract and promote the interests of the enterprise has become the key to enterprise development, and executive pay is playing such a role.Keywords: Executive compensation, Business performance, Listed Company1 IntroductionSeparate ownership and control is modern enterprise the most significant characteristics (Bale and Means, 1932).The shareholders of the owners in an enterprise have the final property ownership and the residual claims, but often there is no direct management control. Business management on behalf of the owner of control, but don't take the final decision. In the case of two rights separation is as the main body of the ownership as the main operational control shareholders and the enterprise management to form a layer between the principal-agent relationships. According to rational economic man hypothesis, the principal (owner) and the agent(management) have different between the objective function, at the same time, there exists a phenomenon of information asymmetry, the company's senior managers there is power and ability to implement on-the-job consumption "opportunistic behavior", which came at the expense of the interests of the owners at the expense of, is also the focus of the agency cost, reflect, it requires enterprises to establish an effective mechanism of incentive and constraint. By the implementation of these mechanisms can excite the work enthusiasms of agent, and can minimize the agency cost of the enterprise, so as to realize the "win-win" between principal and agent. Human society has begun to enter the knowledge economy era, the executives with high and new technical knowledge and skills has become the key to the development of enterprises, enterprises in the market competition is talented person's competition, in today's increasingly internationalized talent flow speed and, utmost respect talented person, is the key to enterprises in the competition occupy the initiative. Therefore, the enterprise owners how to through a set of incentive constraint mechanism to arouse the enthusiasm of executives, minimize agency costs, has become the key problem in the principal-agent relationship.2 Literature reviewIn the 90 s and 1980 s executive compensation has become an important field of academic research, the current executive compensation research literature is largely based on agency theory as the theoretical basis; it requires managers pay package design should make the interests of the managers consistent with the interests of shareholders. Multiple theory school of scholars use all kinds of data on compensation performance problems made all kinds of inspection. But neither empirical results are consistent with theoretical predictions, there is conflict between each other. Such as Belkaoui and Picur (1993), Koehhar and Levitas (1998) and Gray and Canella (1997) study showed that the correlation coefficient between CEO pay and company size to 0.1 at lower, the level of 0.110 and 0.170, and Boyd (1994), Finke1SteinandB.Yd (1998) and Sander and Carpenter (1998) argues that between the correlation coefficient is 0.62, 0.50 and 0.42.The same conflict results also exist in the research about the relation between pay performance. Like Finkelstein and Boyd (1998) foundthat return on equity (ROE) with monetary compensation and long-term returns between the correlation coefficient is 0.13 and 2.03 respectively; Johnson (1982) found that the correlation coefficient of 0.003.And Belliveau, Reilly and Wade (1996) found that CEO pay with ROE correlation coefficient of 0.410.Gomez Mejia (1994), the empirical study summarized: "although the empirical study of CEO pay a dime a dozen, but we know very little about executive remuneration or. “Many causes of the difference of the results of the study: the different data sources, different statistical techniques, different samples and different control variables, etc.Most of the empirical study in the United States listed companies as samples, mainly to pay as the research object, and given priority to with big companies. In the empirical study, Jensen and Murphy (1990) widely cited in the literature, since 90, and most of the empirical research in accordance with its research paradigm. In this article has pioneering meaning in the literature, they estimated the 1295 companies between 1974 and 1986 of 10400 senior managers compensation performance sensitivity, results show that the shareholder wealth of $1000 per change, CEO of wealth will be $3.25 move together. Lippert and Moore (1994) found that the pay performance sensitivity significantly negative correlation with growth, industry control, scale, and with the internal and the institutional investors holding and the term is not relevant. LIPPert and Moore (1995) found that the pay performance sensitivity to low the company has more independent directors or stronger shareholder control. MeConaughy and Mishra (1996) found that sensitivity associated with the company's future performance. The research is on compensation performance sensitivity calculation with Jensen and Murhpy computing (1990).With Jensen and Murhpy (1990) study of pay levels are different. Other documents against U.S. companies pay structures were studied. Genhart and Milkovich (1990) analysis of the more than 200 enterprises, 14000 senior and mid-level managers' pay, found that managers' pay and performance related and wages are not related. Their results also showed that mixed compensation levels and future profitability is related. Their contribution is caused people's understanding to pay structure. Similarly, Leonard (1990) have found S0 s long-term incentive plans ofthe company than the company has a long-term incentive plans, there are a higher return on equity (ROE).Hamid Mehran (1995) on a random sample of 153 manufacturing companies in 1979-1980 executive pay the inspection support incentive compensation claims, but also shows the level of motivation rather than the form of motivation to inspire the motivation of managers to increase the value of the company. Corporate performance with management ownership and equity incentive is in proportion to the total compensation level of positive correlation. He also found that equity-based compensation in the company of outside directors more applied more widely. In the end or by outside big shareholders higher insider ownership of company Ricky is in less equity compensation applications.3 Theoretical foundation of the executive compensation3.1 The principal-agent theoryIn the early days of the private enterprise, the enterprise owners or operators of the two functions, so as long as the owners are rational economic man, he will actively work for their own enterprise profit maximization, at the same time as the enterprise risk takers, he will be careful decisions, try to avoid risk. In classical enterprises, therefore, there is no power shortage and behavior distortion problem. However, with the deepening of socialized big division of labor, the production of modern enterprise system, enterprise's ownership and operation separate, its separation and led to the emergence of the principal and agent relationship, both are driven by their own interests, as the manager of the enterprise owners want as agent of the principal researchers to their own interests targeting action in accordance with the owners. And managers also is own expected utility maximization as the goal, so that both the goal of the inconsistency.3.2 The human capital theoryFrom the Angle of economics to study the compensation problem, main is to pay as senior executives in the Labor market price. In labor economics, the compensation decision mechanism on the Labor market mainly is the human capital theory. The economic activities of listed companies in the final analysis is conducted by people, the economic efficiency of listed companies in the final analysis depends on people'senthusiasm. Economic history shows that, under different institutional arrangements, the person of ability and hard work, especially the potential and creativity is the fundamental symbol of success for an enterprise system is good or bad. Therefore, economic efficiency of listed companies, the human capital property rights problems and natural economic behavior is the foundation of can't avoid. Property rights established the significance, is to make the economic behavior of the internalization of external effects, so as to produce the stimulation of strong momentum. A property rights system, therefore, the strength of the economic incentive function, mainly with the efforts of the economic subject is associated with the proximity of remuneration. Top management is the most important role in the development of modern enterprises, executive personnel is the enterprise decision makers, leaders and commanders, is the soul of the enterprise, is a leader in the development of enterprises, therefore is also an important force in China's economic and social development. Grew up in a special environment during the transition period of our country in the top management, than the business operators in the market economy country pressure is bigger, heavier burden. Especially the burden of the senior executives of state-owned enterprises with the development of the enterprise solution and two pairs of heavy burden, they want to pay more than the number of times the energy often, previously unimaginable responsibility and risk. Therefore, should recognize the importance of enterprise senior management personnel. Establish training, selection and use of enterprise management mechanism, giving them reasonable compensation.3.3 Equity theoryProblems from the Angle of psychology to study senior managers' pay mainly will be paid as a method that can meet the demand of senior executives inner and elements, to encourage executives to work enthusiasm and initiative, to improve executive performance from the individual level. In the psychology of motivation theory, the design of compensation and compensation management is based on the theory of influential Stacy Adams equity theory. Adams fair theory, the staff would first think about the ratio of their income to pay, and then will his income pay comparing with relevant income pay others. If employees feel him with others of thesame, the ratio of thought is to the state fair. If both feel not the same, the ratio of injustice are produced, namely, they may think their income is too low or too high. After this injustice, the staff will try to correct it.3.4 Strategic compensation theoriesTo think from the perspective of management, enterprises pay problem, more attention is pay management support for the enterprise strategic goals, namely how to through the compensation system to effectively help enterprises to gain a competitive advantage. About compensation management how to support the enterprise strategic target, this is the main content of the strategic compensation system design. The so-called strategic compensation, it is to point to will pay up to the enterprise strategic level, to thinking through what kind of compensation policies and compensation management system to support enterprise competitive strategy, and help enterprises to gain competitive advantage.4 The design principle of executive compensation system4.1 Principles of pay and performanceOptimal executive compensation design is the executive compensation and its operation performance, the compensation depends on the company's operating results, the design should follow the principle of the main executive compensation scheme. This principle is the principle of balance between the interests of the owner and operator. Because follow this principle, the owner and operator revenue the stand or fall of same direction as the firm's performance. Business is business risk, managers' compensation and corporate business performance has a direct relationship. Considering the operators are people too, also want to maintain family and their own survival. Considering the uncertainties of doing business at the same time, if the executive compensation and its business performance, completely will take too much risk. As a result, the executive compensation can be divided into two parts: part of the fixed income, the amount is able to maintain their personal and family life, have insurance effect. Part is risk income, completely and enterprise performance, good management can be even more greatly than the fixed income part, make its income risk, incentive role.4.2 Effective incentive principlesModern enterprise system, the organization (shareholders) and individual (senior management) is a kind of principal-agent relationship. Incentive is to strengthen and accordance of individual behavior, organizational goals, in other words, is to guide individual behavior maximize the development to achieve organizational goals. Due to corporate executives is a special company employees, has the position of privilege, enjoy "on-the-job consumption", it brought outside the regular salary incentive to executives to meet the material benefits, this need to some extent, belongs to the fair in Adams fair theory. However, in many state-owned enterprises, on-the-job consumption often goes far beyond a reasonable level, showing a high cost of self-motivation. And stands in stark contrast to the executive pay, some executive’s on-the-job consumption optional the gender is strong, too much abuse, even in a state of out of control. Has issued relevant laws and regulations, shall be forbidden.4.3 Effective restriction principleExecutives is an enterprise's decision-making and operators directly, plays an vital role in the fate of the enterprise, if in the design of enterprise organization system, lack of necessary and effective supervision and restriction mechanism, will likely agent risk. On entrepreneur behavior with some restrictions, these constraints are usually the behavior rule, violating these rules will be punished. Constraint mechanism has defined the entrepreneur behavior, the role of maintaining the order of economic activities, for the standardization of the enterprise behavior, economic and social benign operation has an indispensable positive function.译文上市企业经营绩效与高管薪酬激励研究Firth M摘要高管薪酬问题的产生源于现代企业所有权和控制权的相互分离,所有者与公司高管之间存在着目标不一致、信息不对称等问题,现代企业经营的复杂性和不确定性更是加剧了这一问题的严重性,而通过与高管签订薪酬绩效契约,设计和执行一份良好的薪酬方案可以有效地解决上述问题。

员工激励问题及对策外文翻译文献(文档含中英文对照即英文原文和中文翻译)原文:Research direction: staff motivation problems andCountermeasures1. IntroductionAs recognized in the law (e.g., the Sarbanes-Oxley Act of 2002), professional risk frame-works (Committee of Sponsoring Organizations of the Treadway Commission [COSO] 1992,2004), auditing standards (American Institute of Certified Public Accountants [AICPA]2007; Public Company Accounting Oversight Board [PCAOB] 2007), accounting textbooks(Reding et al. 2007; Romney and Steinbart 2009), and management best practices (Merchantand Vander Stede 2007), formal controls serve a vital role in safeguarding a company’s operational processes, information, and assets and in providing reasonable assurance regard-ing the reliability of financ ial reporting. Although critical to a company’s success, relatively little is understood about how and why specific types of formal control are effective.Prior research in accounting and economics examines how formal controls influence employee behavior,often finding that formal controls can have negative consequences,such as lower employee effort and firm profit. Recently, research has begun to focus on how employees’ response to formal controls can be influenced by specific aspects of the imposed control (e.g., Christ, Sedatole, and Towry 2011). This study extends this line of research by providing evidence as to how and why two types of formal controls, preven-tive controls and detective controls, affect employee performance and motivation.Romney and St einbart (2009: 200) define preventive controls as controls that ‘‘deter problems before they arise’’ and detective controls as controls designed to ‘‘discover prob-lems after they occur’’. These types of formal controls differ in two fundamental ways.First, preventive controls restrict employees’ autonomy by prohibiting certain behaviors(e.g., employees cannot enter data or make a payment unless authorized to do so). Alter-natively, detective controls maintain the decision rights of employees and therefore do not limit their autonomy (Christ, Sedatole, Towry, and Thomas 2008). Second, the feedback provided by preventive controls is never delayed, whereas detective controls can provide immediate or delayed feedback. Importantly, companies can often choose to impose either preventive or detective controls to address the same control objective.For example, with respect to the expenditure cycle, different types of controls can be implemented to ensure that only authorized cash disbursements are made. Specifical ly,management could implement each of the following types of controls: (1) preventive: estab-lish authorization limits prohibiting employees from initiating disbursements above a pre-specified amount; (2) detective with immediate feedback: an alert is activ ated on an employee and ⁄ or supervisor’s computer monitor when a disbursement above a prespecified amount has been entered; or (3) detective with delayed feedback: a report of all disburse-ments over the prespecified amount is produced periodically (e.g., monthly). Our research examines differential costs and benefits of these three types of controls, which should enable managers to make more informed control decisions.We examine several of the costs and benefits of these types of formal controls in a set-ting in which management has implemented an incomplete contract. Specifically, one dimension of the employees’ responsibilities is directly compensated (i.e., compensated task dimension) and the other dimension is not compensated, but is subject to a formal control imposed by management (i.e., controlled task dimension).We examine the effects of for-mal control on the compensated and controlled dimensions of the task separately so that we can isolate formal control effects from the incentive contract effects.We rely on psychology research on salience, norms, and intrinsic motivation to form our predictions regarding how preventive and detective controls will affect employee per-formance and motivation. We expect that when a formal control is activated, i t willincrease the salience of the employee’s goal to comply with various goals of the organiza-tion for which s ⁄ he is not explicitly compensated, despite the fact that it may conflict with the employee’s goal to perform strongly on the compensated dimens ions of his ⁄ her task.We hypothesize that reductions in autonomy caused by a control and increases in the timeliness of control feedback will increase the salience of the control objective. Thus, we expect employees subject to preventive controls to exhibit stronger performance on the controlled dimension than employees in the other control conditions. Employees working in conditions with detective controls with immediate feedback should be the next best per-formers on the controlled dimension of the task followed by employees working in condi-tions with detective controls with delayed feedback and employees operating without controls, respectively.Motivational framing research further suggests that it is difficult for individuals to have multiple (poten tially conflicting) goals ⁄ frames activated at the same time (Lindenberg2001). We therefore predict that when employees focus on the goal of performing well on the controlled task dimension, they will focus less on the goal to excel on other task dimensions (e.g., the compensated dimension in our study) and will consequently perform worse on those dimensions. This suggests a reverse order of how employees facing these control types will perform on the compensated dimension of the task relative to their per-formance on the controlled dimension.To test these predictions, we use a simplified data entry task in an experimental setting in which participants are financially motivated to enter data as quickly as possible (com-pensated dimension). Importantly, participants are informed that the company values both data entry speed and accuracy. However, rather than also compensating participants for accuracy, the company implements a formal control to encourage accuracy (controlled dimension).Our results reveal that participants exposed to preventive controls or detective controls with immediate feedback perform significantly better on the controlled dimension of the task (data entry accuracy) than participants in the detectivecontrol-delayed feedback con-dition. This suggests that the timeliness of control feedback is the salient feature influenc-ing performance. We do not find differences in the overall performance on the compensated dimension (data entry speed), suggesting that explicit incentives still provide a powerful motivation despite the activation of formal controls directing attention to other dimensions of the task.In addition to examining how formal controls affect employee performance, we add to the growing literature on the unintended costs of formal controls by examining how different formal control types affect employees’ intrinsic motivation to perform the task. We expect that because preventive controls restrict autonomy, which likely will be perceived by employees as ‘‘controlling’’, they wil l be more detrimental to employees’ intrinsic motivation than detective controls. Consistent with our expectations, the results show that preventive controls significantly reduce intrinsic motivation relative to both types of detective controls. This suggests that the extent to which formal controls restrict employees’ autonomy, and not the timeliness of the feedback they provide, influences employees’ intrinsic motivation to perform their responsibilities. Further, we confirm results from prior research findi ng that lower intrinsic motivation leads to lower performance on all dimensions of the task.Taken together, our results suggest that detective controls that provide immediate feedback can be just as effective at producing high employee performance as preventive controls (and more effective than detective controls with delayed feedback or no controls),without causing a decrease in intrinsic motivation that is exhibited by employees subjected to preventive controls. Therefore, organizations can likely achieve many of their control objectives by increasing the timeliness of feedback from detective controls, without bearing the costs associated with preventive controls.This study provides several important practical and theoretical contributions. First,this study can inform practitioners, auditors, and regulators who design, implement, and evaluate formal controls about some of the potential costs and benefits of various types of formal controls. Formal controls play a critical role in promoting efficiency,reducing risk of asset loss, ensuring the reliability of financial statements, and promoting compliance with laws and regulations (COSO 1992). Our study suggests that practitioners can better achieve many of these control objectives by implementing formal controls that provide immediate feedback. Furthermore, this study suggests that formal controls which restrict employee autonomy reduce employees’ intrinsic motivation, and practitioners would there-fore benefit in many situations by implementing formal controls that provide immediate feedback but donot restrict user autonomy.Second, this study contributes to several streams of academic research on formal con-trols. To our knowledge, ours is the first study to examine the differential impact of pre-ventive and detective controls on employee performance and motivation. Further, this study also contributes to a growing body of literature examining some of the unintended consequences of formal controls (e.g., Frey 1993; Das and Teng 1999; Tenbrunsel and Mes sick 1999; Christ et al. 2008; Tayler and Bloomfield 2011).The remainder of the paper is organized as follows. Section 2 provides theoretical development of our hypotheses. In section 3 we describe our experiment. We provide our results in section 4 and conclude and describe potential avenues for future research in section 5.2. Literature review and hypotheses developmentClassifications and importance of formal controlsFormal controls can take many forms, including, but not limited to, policies and proce-dures, segregation of duties, performance-based compensation, supervisory reviews, com-puterized edit checks, and so on. Academics have developed a variety of control frameworks to classify the many different types of controls. Some focus on the object of control (e.g., behavior vs. output) (Merchant and Van der Stede 2007), while others focus on the control method (e.g., boundary systems, belief systems, etc.) (Simons 1990). How-ever, practicing accountants and auditors generally classify controls as preventive or detec-tive, based on how risk is mitigated (COSO 1992, 2004; AICPA 2007; PCAOB 2007).When determining the specific formal control type to implement, management would benefit from understanding how different control types influence employee performance and motivation. Further, prior academic research reveals that formal controls often have unintended consequences, which can ultimately be detrimental to the organization (e.g.,Das and Teng 2001). Therefore, management should also consider the potential repercus-sions of their control design choices when designing formal controls.In this study, we examine a simplified work environment in which we manipulate the formal control type and measure employee performance and intrinsic motivation. Similar to the real world, we use a work environment in which management employs an incom plete contract (e.g., Williamson 1985; Ittner, Larcker, and Rajan 1997), using formal compensation contracts to encourage certain types of behavior while implementing form a controls to encourage other types of behavior. Thus, we examinehow different forma control types impact employees’ performance on both compensated and controlled dimensions of their responsibilities. The control environment used in our experiment is designed to isolate the effect of various formal control types from the effects of the incentive contract. Therefore, we explicitly do not compensate the employees based on all task dimensions, but rather allow the formal control to induce certain desired behavior.Effect of formal controls on controlled task dimensions Standard economic theory predicts that individuals are self-interested and therefore pri-marily motivated by explicit incentives. Following this logic, employees are expected to respond only to the financial incentives described in their formal employment contract. However, a growing body of research on individuals’ preferences for social norms and sit-uational framing suggests that there are other ways to direct employees’ behavior towards the best interests of the organization (e.g., Evans, Hannan, Krishnan, and Moser 2001;Camerer and Fehr 2004; Osterloh and Frey 2004; Hannan 2005; Hannan, Rankin, and Towry 2006; Fischer and Huddart 2008).A substantial body of research has developed indicating that individuals are strongly motivated by stated goals and objectives (e.g., Locke, Shaw, Saari, and Latham 1981; Locke and Latham 1990; Locke 1996). Indeed, specific performance measures are incorpo-rated into employment contracts to align employ ees’ goals with the goals of the organiza-tion so that employees will focus their efforts on activities benefiting the organization (Farrell, Kadous, and Towry 2008). One reason goals provide such powerful motivation is that they can change the way a situation is framed. Lindenberg (2003) describes two frames linked to employees’ goals that, together, can provide strong governance: the gain frame and the normative frame. The gain frame relates to one’s goal to improve one’s resources (i.e., earn money). The normative frame is related to one’s goal to ‘‘act appropriately’’, which can be defined as adhering to institutionalized rules such as policies and pro-cedures (March and Olsen 1995). When an employee is faced with an explicit contracttying specific aspects of his ⁄ her performance to financial incentives, it is likely that the gain frame will be dominant and any other goals will be secondary (Lindenberg 2003).However, individuals’ behavior can be redirected or refocused when a stimulus is intro-duced. In this paper, we argue that the activation of a formal control is such a stimulus.翻译:研究方向:员工激励问题及对策1.引言公认的法律(如。

FRIENDS OF 一、引言公司治理一直是各国学者研究的重点,而公司治理结构当中一个重要的而且经常引起争论的因素就是给予管理者报酬的薪酬合同。

在西方发达国家,股权激励是很多公司管理者薪酬的重要组成部分,在过去的几十年当中,股权激励对于公司的管理者以及股票市场也产生了巨大了影响。

从2005年11月证监会研究起草《上市公司股权激励规范意见》(试行)开始,我国上市公司对于管理者的股权薪酬激励得到了极大的发展。

随着市场的发展与股权激励制度的不断完善,越来越多的企业倾向于对管理者进行股权激励。

基于此,分析国内外上市公司管理者股权激励偏好的影响因素是非常必要的。

本文主要从代理问题以及信息不对称两个角度分析上市公司对于管理者进行股权激励的偏好。

二、从代理问题看上市公司的股权激励代理问题的存在使公司治理问题的存在成为一种必然的现象,而有人认为股权激励能够解决公司内存在的代理成本与激励问题,从而改善公司的治理结构。

Morck 、Shleifer 和Vishny (1988)认为CEO 权益所有权和激励的平均值“太低”,而Jensen 和Murphy (1990)则认为,如果股权比重过小,则CEO 的股权激励将会非常弱,不会产生实际意义上的激励作用。

部分研究认为,由于公司对于管理者的激励程度过低,使公司有可能因此授予管理者股票期权,提高对于管理者的激励,减少公司的代理成本,以增加公司的价值。

Mehran (1995)、Tzioumis (2008)等作者的理论或者实证研究支持了这种观点。

Mehran (1995)的研究结果表明,高管薪酬中以权益为基础的比例与高管所持有的权益比例成反比,如果管理者拥有一小部分公司股份,且没有大量的未行权股票期权或者其他以权益为基础的薪酬计划,则董事会更愿意使用以权益为基础的薪酬。

Core 和Qian (2000)认为公司通过发现新投资机会,评估这些机会,实施项目最大化收益来进行革新,一旦选择了要实施的项目,公司通过对当前业务的有效管理进行生产,企业的管理者对于项目的选择与生产负责。

员工激励理论外文文献及翻译员工激励理论外文文献及翻译One-to-one-management companiesare run -- in a timely inversion of John Adams's ideal -- as organizations of men (and women), not of laws. Nonetheless, a few laws, or at least cultural traits, appear to govern many such organizations. Together those traits create an environment where employees' needs are known, sometimes anticipated, and served, justas customers' needs are known, sometimes anticipated, and served in CRM-focused organizations. What follows is a look at the rules by which one-to-one-management companies operate[2].3.2 It's All in the DetailHow do you build morale and a sense of corporate responsibility? In surprisingly small ways. Standing in the kitchen at Eze Castle Software, CEO Sean McLaughlin watches as one of his programmers sets milk and cookies on a table. It's 2:30 on a Wednesday afternoon. "Hang on, Parvathy," McLaughlin says to the employee as he opens the refrigerator door and pulls out an apple pie. "Put this out, too." When Parvathy is done in the kitchen, she flips some switches, andthe lights flicker all over the fifth floor. Almost instantly, programmers leave their cubicles and make a beeline for thekitchen.Then Parvathy jogs up a staircase and flashes the lights on the sixth floor. Account managers, salespeople, and assorted techies come downstairs and join their colleagues in the kitchen. When they arrive, McLaughlin is at the center of the steadily building crowd, dishing out the pie. Around him conversations spring up between colleagues who work in different departments. The topics range from work to social life to politics. Ten minutes later the lights flash again and it's back to work for the 90 employees in the Boston office of Eze.What's so remarkable about the staff of a developer of securities-trading software with $13 million in revenues taking daily milk-and-cookies breaks? Not much -- until you consider that the practice is part of a cultural shift engineered by the CEO, a shift that has profoundly changed the way he and his employees relate toone another. Perhaps more significant, the changes have affected how employees deal with the myriad little details that keep the six-year-old company grounded.原文请找腾讯3249114六-维^论,文.网Eze's transformation began last year, when McLaughlin realized to his chagrin that his once small and collegial company had -- because of accelerated growth -- begun acting like a large corporation. His employees no longer knew one another, and he himself was increasingly vague about who some of the new faces were. "In the early days I could get to know everyone," saysMcLaughlin.However, the CEO was most annoyed by the fact that his employees -- both old and new -- were beginning to behave with large-company sloppiness rather than with start-up frugality. "Back when we were small, if someone sent a FedEx, we all knew how much that was costing the company," McLaughlin says. He recalls noticing that things were changing when one employee approved paying a contractor $100 a month to water the company's five plants. Then there were rising charges from the company's Internet service provider because of excessive traffic on the corporate T1 line. The cause? Employees were downloading MP3 files to listen to music during the workday. It frustrated McLaughlin that employees weren't taking responsibilityfor their actions and for the ways in which those actions affected the company's bottom line[2].But last summer two things happened that spurred McLaughlin to make some changes.First, the Boston office lost both of its administrative assistants. One assistant quit and the other left a few weeks later. The two had stocked the supply room, sorted the mail, and welcomed visitors. The dual departures wreaked havoc. "The kitchen was out of milk, we didn't have any pens in the supply cabinet, the reception area looked like crap," McLaughlin says.Then came the World Trade Center attacks. Though McLaughlin had long been brooding on how to reverse Eze's fat-cat habits, he had yet to act. He says that 9-11, and the "what are my priorities" thinking it engendered, "created an environment where it was easy for me to initiate a change."The change he had in mind was inspired by a visit to his daughter's kindergarten class. There he saw how the teacher divided the cleanup tasks among the children by posting a rotating "chore wheel." McLaughlin thought the wheel was just the thing to clean up the mess and teach his employees a little corporate responsibility. But he also wanted to institute something that would help improve camaraderie. That's where another kindergarten institution, the milk-and-cookies breaks, came in. "I wanted to build relationships among the employees, to make them feel more company morale," he says.上一页[1] [2] [3] [4] [5] [6] [7] [8] [9] 下一页。

股权激励问题文献综述高杨2013年8月3日星期六目录一、国内外研究侧重综述 (3)二、股权激励问题研究现状综述 (3)(一)股权激励的特征 (4)(二)股权激励定量研究 (5)(三)关于股权激励模式的细化分析 (5)(四)股权分置改革与股权激励的关系研究 (5)(五)对我国已实行的股权激励的效果分析 (6)(六)选择股权激励的动机 (7)(七)股权激励在我国的运用应关注的问题 (8)(八)股权激励结合公司治理分析企业价值 (8)三、关于股权激励效果问题的详细总结 (8)(一)股权激励效果问题的争论与发展 (9)1.高管股权激励具有治理效应,能够改善企业绩效 (9)2.高管股权激励不具有治理效应,甚至会毁损企业绩效 (10)1.高管股票期权的授予问题 (12)Lie发现,期权授予日期前公司股价的异常收益为负,而期权授予日期后公司股价的异常收益为正,并且这一异常波动有逐渐加强的趋势,高管的择机行为则成为此现象的可能解释。

Heron和Lie则进一步指出,上述期权授予日期前后的股价异常波动在监管当局出台更为严格的披露要求之后则完全消失了,这表明高管存在倒填期权授予日期的动机。

(12)2.高管股票期权的重新定价问题 (12)3.高管股票期权的执行问题 (13)(二)高管股权激励模式的治理效应差异 (13)1.高管股票期权的治理效应优于高管持股的治理效应 (13)2.高管持股的治理效应优于高管股票期权的治理效应 (14)(三)高管股权激励的内生性 (14)(四)公司治理与高管股权激励的治理效应 (16)四、股权激励实证问题研究详细总结 (18)(一)关于实行股权激励企业的数量 (18)(二)股权激励企业的行业分布特点 (19)(三)股权激励的模式 (19)(四)股权激励的额度 (20)(五)股权激励制度运行效果 (20)五、总结与新进展的可能方向 (21)(一)深入剖析高管股权激励对企业绩效的作用机理 (22)(二)充分关注并尽可能解决高管股权激励的内生性问题 (22)(三)全面研究并比较不同股权激励模式的实施效果 (22)股权激励问题文献综述高杨一、国内外研究侧重综述国内外对于股权激励的研究都有大量文献研究股权激励与经营业绩的关系,但是国外的研究还侧重股权激励与经营者投资、效率的关系等,而国内则是侧重于对股权激励的市场效应以及对国外已取得研究成果的深入细化,还有就是放置在我国特有的股权分置改革的背景下研究这个问题。

股权激励英文方案Equity Incentive Scheme1. Introduction:Our company has decided to implement an equity incentive scheme to reward and motivate our employees. This scheme aims to align the interests of our employees with the long-term success of the company and enhance employee retention.2. Eligibility:All employees, including executives, managers, and non-managerial staff, who have completed a minimum tenure of [X] years with the company are eligible to participate in the equity incentive scheme.3. Allocation:The allocation of equity will be determined by the employee's position, performance, and contribution to the company. The allocation will be in the form of stock options, restricted stock units (RSUs), or other equity instruments, as deemed appropriate by the company.4. Vesting Period:Equity granted under this scheme will have a vesting period, which refers to the period of time an employee must wait before they can exercise their equity rights. The vesting period typically ranges from [X] to [X] years, with equity vesting in installments at regular intervals.5. Performance Metrics:To ensure a performance-based equity incentive plan, certain performance metrics will be established for each participant. These metrics may include individual, team, or company-wide targets. The achievement of these metrics will determine the extent of equity vesting for each individual.6. Termination:In case an employee voluntarily or involuntarily terminates their employment with our company, their unvested equity rights will be forfeited, subject to any contrary terms in their employment agreement or the scheme rules.7. Shareholder's Rights:Equity granted under this scheme will entitle participants to certain shareholder's rights, such as voting rights and dividend distributions, as per the company's bylaws and relevant regulations.8. Amending or Terminating the Scheme:The company reserves the right to amend or terminate the equity incentive scheme at its discretion. Any amendments or terminations will be communicated to participants in a timely manner, ensuring fairness and transparency.9. Tax Implications:Participants should consult with a tax advisor to understand the tax implications of participating in the equity incentive scheme based on their jurisdiction, as the tax treatment may vary.10. Confidentiality:Participants in the equity incentive scheme are required to maintainstrict confidentiality regarding the terms, details, and contents of this scheme, including the allocation, vesting, performance metrics, and other sensitive information.11. Governing Law:This equity incentive scheme shall be governed and interpreted in accordance with the laws of [Jurisdiction], and any disputes arising out of or in connection with this scheme shall be subject to the exclusive jurisdiction of the courts of [Jurisdiction].12. Effective Date:This equity incentive scheme shall be effective from [Start Date]. Participants shall be provided with individual grant letters specifying their allocation, vesting schedule, and other relevant details.Note: This sample document is for informational purposes only and should not be considered as legal or financial advice. Companies should consult with legal and financial professionals to ensure compliance with applicable laws and regulations.。

英文文献及翻译1. One of the p ri nciple s: i nce ntives to vary fro m perso n to pe rso n Because o f the differe nt needs of diffe re nt s ta ff, the refo re, the same i nce nti ve effec ts of po lic y inc e nti ves will pla y a differe nt. Eve n wi th a s ta ff, at differe nt ti mes or circ ums ta nces, wi ll ha ve diffe re nt needs. Beca use of i nce nti ves depe ndi ng o n the internal and the s ubjec ti ve fee li ngs of the sta ff a re, there fo re, i nce ntive to va ry from perso n to pers o n.In the fo rmula tio n a nd imp le me ntatio n of i nce nti ve po licies, we must firs t i nves tiga te ea c h e mp lo yee clearly wha t is rea llyreq uired. Req uired to orga ni ze, cla ssify, a nd the n to formulate appropria te policies to he lp mo ti vate e mplo yees to me et these needs.2. Two pri ncip les: app rop riate ince nti vesAppropria te i nce nti ves a nd pe na lties wi ll no t affec t the i nce nti ve effe ct, whi le i nc reasi ng the cos t of i nce ntives. A ward o ve rweig ht emplo yees wo uld ha ve to meet the mood of p ride a nd lost the desire to further e nha nce their o wn; re wa rd ince nti ves too lig ht wi ll no t a c hie ve the effec t, o r s o e mplo yees do not ha ve a se nse of atte ntio n. Hea vy pe na lties a re unfair to make emp lo ye es, o r loss of the comp a ny's ide nti ty, o r e ve n s lo w down o r da mage arisi ngfro m the emo tio ns; le nie nc y erro r will undere stimate theserio us ness o f the sta ff, whic h will prob ably make the sa me mistake.3. The p rinciple of three: fairnessThe fai rness of the ma nage me nt s ta ff are a very importa nt principle, e mp lo yees are a ny unfair trea tme nt wi ll a ffe ct his mood and wo rk e fficienc y, a nd e ffecti ve ness o f the i mpact o f i nce ntives. Emplo ye es to obtai n the sa me sco re, we mus t recei ve the sa me le ve l o f ince nti ve s; the sa me toke n, emp lo ye es c ommitted the same e rror, b ut also s ho uld be s ub jec t to the sa me le ve l o fpunis hme nt. If yo u ca n no t do this, ma nage rs wo uld pre fe r no t to rewa rd or p unis hme nt.Ma nagers dea l wi th emp lo yees a t iss ue, mus t ha ve a fair mi nd, sho uld no t ha ve a ny p rejudices a nd p refe re nce s. Altho ug h so me staff ma y a llow yo u to e njo y, some yo u do not e njo y, b ut at work, must be trea ted eq ually a nd s ho uld not ha ve a ny o f the wo rds a nd acts of i njustice.1. S timulate the tra nsfe r o f sta ff fro m the res ults o f eq ua l to eq ual opportuni ties a nd s trive to crea te a le ve l pla yi ng field.For e xa mp le, Wu S hi ho ng at IB M from a clea n s tart wi th the people, s tep b y step to the sa les c lerk to the district perso n i n cha rge, Ge nera l Ma nage r o f Chi na, wha t a re the reaso ns for this? In addi tion to i ndi vidual effo rts, b ut a lso said tha t IB M s ho uld be a good co rpora te c ulture to a stage o f d e velopme nt, that is,eve ryo ne has unlimited oppo rtuni ties fo r de velop me nt, as lo ng a s there is capacity there will be space fo r the de ve lopme nt ofself-imp le me nta tio n, whic h is to do a lot o f co mpa nies are not, this syste m will undo ub ted ly ins pire a g reat role o f the s taff.2. Inspire the best time to grasp.- Take s aim a t p re-orde r i nce nti ve the mis sion to ad va nceince nti ves.- Ha ve Diffic ulties e mp lo yees, desire to ha ve s tro ng de ma nd, to give the ca re a nd time ly e nco urageme nt.3. Wa nt a fai r a nd acc ura te i nce nti ve, re ward- So und, perfec t pe rforma nce appraisa l s ys tem to e ns ure appropria te assess me nt sc ale, fair a nd re aso nab le.- Ha ve to o ve rco me the re is thi nni ng of the huma n pro-wind.- In re fere nc e sa la ry, p romo tio ns, a wa rds, e tc.评优i nvo lve thevi tal i nte res ts of emp lo yees o n ho t i s s ues i n order to be fai r.4. The imp le me nta tio n of Emp lo yee Sto ck Owners hip P la n.Worke rs a nd e mp lo yees i n o rder to do uble the c apacity o finves tors, mo re co nce rned a bo ut the o utco me of b usi nessoperatio ns a nd imp ro ve the i nitiati ve.Modern huma n reso urces ma nag eme nt e xperie nce a nd re searc h sho ws that emp lo ye es a re involved i n mode rn ma nage me ntreq uire me nts a nd aspira tio ns, a nd c rea te a nd p ro videopportuni ties fo r all emplo yees is to mobi li ze the m to pa rticipa te in the ma nage me nt o f a n e ffecti ve wa y to e nthusiasm. There is no doub t tha t very few peop le participate d i n the disc ussio ns o f the act a nd i ts o wn witho ut i nce nti ves. There fore, to a llow tradeunio ns to participate i n the ma nage me nt o f p rope rly, ca n mo ti vate work ers, b ut a lso the s ucce ss of the e nterp rise to ob tain va luab le kno wledge. Thro ug h participatio n, the fo rmatio n of trade unio nson the e nterprise a s e nse of be lo ngi ng, ide nti ty, se lf-e stee m a nd can further mee t the ne eds o f s elf-rea li zatio n. Se t up a nd impro ve emplo yee p articipatio n i n ma nageme nt, the ra tio nali za tio n of the proposed s ys tem a nd the E mplo yee S tock Owne rs hip a ndstre ng the ni ng leaders hip a t a ll le ve ls a nd the e xc ha nge of communica tio n a nd e nha nce the a ware ne ss o f staff to participate in o wne rs hip.5. Ho no r i nce nti veStaff a ttitude a nd co ntrib ution o f labo r to ho nor rewa rds, s uc h as recog nitio n of the mee ting, iss ued certifica te, ho nor ro ll, i n the compa ny's i nterna l a nd e xte rna l p ublicity o n the media repo rts, ho me visi ts co ndo le nces, vi sit sig htseei ng, co nva lesce nce,trai ni ng o ut o f trai ni ng, ac cess to recomme nd ho nor socie ty, selec ted sta rs mode l, s uc h as clas s.6. Co nce rned abo ut the ince nti vesThe staff co ncerned abo ut work a nd li fe, s uc h as the sta ff se t up the birthda y tab le, birthda y ca rds, ge nera l ma nage r of the iss ue of staff, c are s taff or diffic ult a nd p rese nted a sma ll gi ft s ympathy. 7. Co mpeti ti veThe pro mo tion o f e nte rprise amo ng e mp lo yees, de partme nts compete o n a n eq ua l foo ting be twee n the ord erly a nd the s urvi val of the fi ttes t.8. The mate rial i nce nti vesIncrea se their wages, we lfa re, i ns ura nce, b o nuses, i nce nti veho use s, daily ne cessities, wage s p romo tio n.9. Informatio n i nce ntivesEnterp rises to communica te o fte n, i nformatio n amo ng e mplo yees, the idea of co mmunica tio n, i nfo rma tio n s uc h as co nfere nc es, field relea se, e nterp rises repo rte d that the repo rti ng s ys tem, the associatio n ma nage r to re cei ve the s ys tem da te.附录二:翻译1. 原则之一:激励要因人而异由于不同员工的需求不同,所以,相同的激励政策起到的激励效果也会不尽相同。

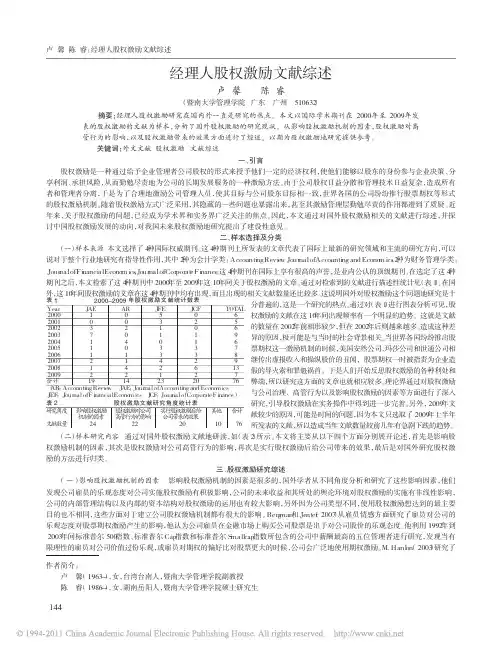

表12000-2009年股权激励文献统计数表Year2000200120022003200420052006200720082009合计JAE103711121219AR002040114214JFE531103342123JCF020113326220TOTAL6569678913776(AR:AccountingReviewJAE:JournalofAccountingandEconomicsJEF:JournalofFinancialEconomicsJCF:JournalofCorporateFinance)表2股权激励文献研究角度统计表研究角度文献数量影响股权激励机制的因素24股权激励对公司高管行为的影响22实行股权激励后给公司带来的效果20其他10合计76经理人股权激励文献综述卢馨陈睿(暨南大学管理学院广东广州510632)摘要:经理人股权激励研究在国内外一直是研究的热点。

本文以国际学术期刊在2000年至2009年发表的股权激励的文献为样本,分析了国外股权激励的研究现状。

从影响股权激励机制的因素,股权激励对高管行为的影响,以及股权激励带来的效果方面进行了综述。

以期为股权激励地研究提供参考。

关键词:外文文献股权激励文献综述作者简介:卢馨(1963-),女,台湾台南人,暨南大学管理学院副教授陈睿(1986-),女,湖南岳阳人,暨南大学管理学院硕士研究生一、引言股权激励是一种通过给予企业管理者公司股权的形式来授予他们一定的经济权利,使他们能够以股东的身份参与企业决策、分享利润、承担风险,从而勤勉尽责地为公司的长期发展服务的一种激励方法。

由于公司股权日益分散和管理技术日益复杂,造成所有者和管理者分离,于是为了合理地激励公司管理人员,使其目标与公司股东目标相一致,世界各国的公司纷纷推行股票期权等形式的股权激励机制。

随着股权激励方式广泛采用,其隐藏的一些问题也暴露出来,甚至其激励管理层勤勉尽责的作用都遭到了质疑。

员工激励英文文献以下是几篇经典的员工激励方面的英文文献:1. Deci, E. L., & Ryan, R. M. (1985). Intrinsic motivation and self-determination in human behavior. Springer Science & Business Media.(《人的行为中的内在动机和自我决定》)2. Vroom, V. H. (1964). Work and motivation. New York: Wiley.(《工作和动机》)3. Locke, E. A., & Latham, G. P. (2004). What should we do about motivation theory? Six recommendations for the 21st century. Academy of Management Review, 29(3), 388-403.(《关于动机理论我们应该做什么?21世纪的六大建议》)4. Pink, D. H. (2009). Drive: The surprising truth about what motivates us. Riverhead Books.(《驱动力:关于激励我们的绝妙真相》)5. Lawler, E. E. (1994). From job-based to competency-based organizations. Journal of organizational behavior, 15(1), 3-15.(《从基于工作的组织到基于能力的组织》)这些文献涵盖了员工激励的多个方面,包括内在动机、自我决定论、期望理论、奖励机制和组织文化等内容。

您可以根据自己的需求和兴趣选择适合的文献进行阅读。