会计专业英语期末复习资料

- 格式:doc

- 大小:310.00 KB

- 文档页数:20

会计专业英语知识点作为一门重要的商科专业,会计在各行各业中都扮演着重要的角色。

对于学习会计的学生来说,掌握好会计专业的英语知识点是非常必要的。

本文将介绍一些与会计专业相关的英语知识点,以帮助学生在学习和实践中更好地应用。

一、会计基础术语1. Assets(资产):在会计中,资产指的是公司拥有的具有现金价值的资源,包括现金、存货、房地产等。

2. Liabilities(负债):负债是指公司对外的债务或应付款项,在会计中包括借款、应付账款等。

3. Equity(所有者权益):也被称为净资产或股东权益,表示公司的所有者对于其资产净值的权益。

4. Revenue(收入):收入是指公司通过销售产品或提供服务而获得的资金流入。

5. Expenses(费用):费用是指公司为经营活动而发生的支出,包括租金、工资、税金等。

6. Balance Sheet(资产负债表):资产负债表是一份会计报表,以资产、负债和所有者权益的形式显示公司的财务状况。

二、会计报表1. Income Statement(利润表):利润表显示了公司在一定期间内的收入、费用和净利润。

2. Cash Flow Statement(现金流量表):现金流量表反映了公司在一定期间内现金收入、现金支出以及现金净增加额。

3. Statement of Retained Earnings(留存收益表):留存收益表展示了公司在一定期间内的净利润和分红情况。

4. Statement of Changes in Equity(权益变动表):权益变动表展示了公司在一段时间内所有者权益的变化情况,包括净利润、股东投资等。

三、审计和税务1. Audit(审计):审计是对公司财务报表和财务记录的全面审核和检查。

2. Taxation(税务):税务是指涉及支付税款和申报纳税义务的活动,包括个人所得税、企业所得税等。

3. Tax Return(纳税申报表):纳税申报表是个人或企业向税务机关报告收入和纳税情况的文件。

国际会计期末复习资料复习资料一、名词汉译英(本大题共5道小题,每小题1分,共5分)1、融资活动2、投资活动3、公认会计原则4、证券交易委员会5、国际财务报告准则6、国际会计准则理事会7、公允反映8、法律遵循9、资产负债表10、经济合作与发展组织二、英译汉(本大题共3道小题,每小题10分,共30分)1.Accounting entails several broad processes : measurement , disclosure and auditing . Measurement is the process of identifying , categorizing , and quantifying economic activities or transactions . These measurements provide insights into the profitability of a firm's operations and the strength of its financial position . Disclosure is the process by which accounting measurements are communicated to their intended users . This area focuses on such issues as what is to be reported , when , by what means , and to whom . Auditing is the process by which specialized accounting professionals(auditors) attest to the reliability of the measurement and communication process . Whereas internal auditors are company employees who answer to management , external auditors are nonemployees who are responsible for attesting that the company's financial statements are prepared in accordance with generally accepted standards .2. Accounting in common law countries is characterized as oriented toward "fair presentation" , transparency and full disclosure and a separation between financial and tax accounting . Stock markets dominate as a source of finance , and financial reporting is aimed at the information needs of outside investors . Setting accounting standards tends to be a private sector activity , and the accounting profession plays an important role .3、Accounting in code law countries is characterized as legalistic in orientation , opaque with low disclosure , and an alignment between financial and tax accounting . Banks or governments ("insiders") dominate as a source of finance , and financial reporting is aimed at creditor protection . Setting accounting standards tends to be a public sector activity , with relatively less influence by the accounting profession .4、Accounting standards setting normally involves a combination of private- and public-sector groups . The private sector includes the accounting profession and other groups affected by the financial reporting process , such as users and preparers of financial statements and employees . The public sector includes such agencies as tax authorities , government agencies responsible for commercial law , and securities commissions . Stock exchanges may influence the process and may be in either the private or public sector , depending on the country . The roles and influence of these groups in setting accounting standard differ from country to country . These differences help explain why standards vary around the world .5.The Sarbanes-Oxley Act was passed in the wake of numerous corporate and accounting scandals, such as Enron and WorldCom. The act limits the services that audit firms can offerclients and prohibits auditors from offering certain nonaudit services to audit clients. It also requires that lead audit partners rotate off audits every five years. Section 302 of the act requires a company’s chief executive officer and chief financial officer to certify each quarterly and annual report. Section 404 requires manage ment’s assessment of internal control over financial reporting, along with a related report by the independent auditor.6、Briefly, individualism is a preference for a loosely knit social fabric over an interdependent, tightly knit fabric. Power distance is the extent to which hierarchy and an unequal distribution of power in institutions and organizations are accepted. Uncertainty avoidance is the degree to which society is uncomfortable with ambiguity and an uncertain future. Masculinity is the extent to which gender roles are differentiated and performance and visible achievement are emphasized over relationships and caring.三、简答题(本大题共3道小题,每小题15分,共45分)1、对会计体系进行分类的目的是什么?2、为什么说国家层面上的许多会计差别已经越来越模糊不清?3、简述处理会计、披露和审计准则国际差异的方法有哪些,并分别进行简要评价。

财会专业英语第一篇:财会专业英语四川大学锦城学院会计英语期末复习资料《财会专业英语》期末复习资料整理一、专业词汇1.提存(withdrawal)2.原材料(raw material)3.过账(posting)4.结账(closing entries)5.折旧(depreciation)6.凭证(voucher)7.原始凭证(original voucher/source voucher)8.分类账(ledger)9.商业票据(commercial bill)10.手续费(service charge)11.在途存款(deposit in transit)12.注销(write off)13.期票(promissory note)14.预收账款(advance from customers)15.预收收入(unearned revenue)16.应收账款(accounts receivables)17.应付账款(accounts payable)18.预付账款(accounts prepaid)19.流动性(liquidity)20.内部控制(internal control)21.营运资本(Working capital)22.备用金(petty cash)23.日记账(journal)24.复式记账(double-entry system)25.流动比率(current ratio)26.负债比率(debt ratio)27.资产周转率(asset turnover)28.应收账款周转率(accounts receivable turnover)29.存货周转率(inventory turnover)30.留存收益(retained earnings)31.或有负债(contingent liability)32.或有资产(contingent asset)33.国库券(treasury bills)34.利润表(income statement)35.资产负债表(balance sheet)36.现金流量表(cash flow statement)二、翻译1.Accounting is an information system of interpreting, recording, measuring, classifying, summarizing, reporting and describing business economic activities with monetary unit as its main criterion.The accounting information is primarily supplied to owners, managers and investors of every business, and other users to assist in the decision-making process.Therefore, accounting is also called “the language of business”.会计是一个翻译、记录、计量、认定、总结、报告和用现金作为主要标准来衡量企业经济活动的信息系统。

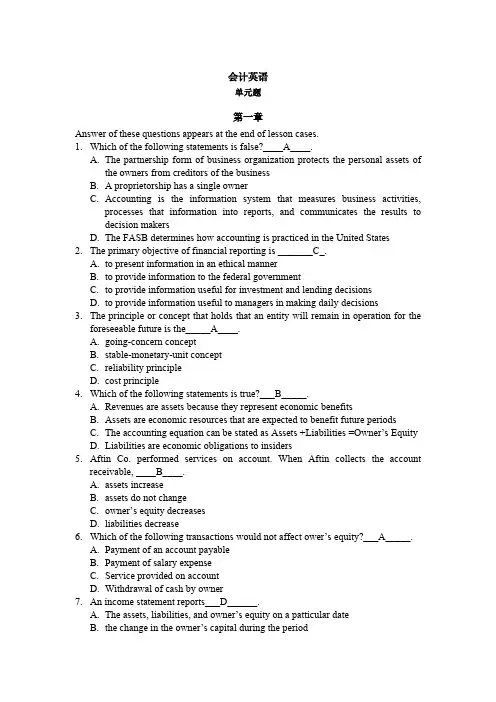

会计英语单元题第一章Answer of these questions appears at the end of lesson cases.1.Which of the following statements is false?____A____.A.The partnership form of business organization protects the personal assets ofthe owners from creditors of the businessB. A proprietorship has a single ownerC.Accounting is the information system that measures business activities,processes that information into reports, and communicates the results to decision makersD.The FASB determines how accounting is practiced in the United States2.The primary objective of financial reporting is _______C_.A.to present information in an ethical mannerB.to provide information to the federal governmentC.to provide information useful for investment and lending decisionsD.to provide information useful to managers in making daily decisions3.The principle or concept that holds that an entity will remain in operation for theforeseeable future is the_____A____.A.going-concern conceptB.stable-monetary-unit conceptC.reliability principleD.cost principle4.Which of the following statements is true?___B_____.A.Revenues are assets because they represent economic benefitsB.Assets are economic resources that are expected to benefit future periodsC.The accounting equation can be stated as Assets +Liabilities =Owner’s EquityD.Liabilities are economic obligations to insiders5.Aftin Co. performed services on account. When Aftin collects the accountreceivable, ____B____.A.assets increaseB.assets do not changeC.owner’s equity decreasesD.liabilities decrease6.Which of the following transactions would not affect ower’s equity?___A_____.A.Payment of an account payableB.Payment of salary expenseC.Service provided on accountD.Withdrawal of cash by owner7.An income statement reports___D______.A.The assets, liabilities, and owner’s equity on a patticular dateB.the change in the owner’s capital during the periodC.the cash receipts and cash payments during the periodD.the difference between revenues and expenses during the period8. If assets increase $80000 during the period and owner’s equity decreases $16000during the period, liabilities must have___B______.A. increased $64000B. increased $96000C. decreased $64000 \D. decreased $960009.The following information about the assets and liabilities at the end of 20*1 and 20*2 is given below:20*1 20*2Assets $75000 $90000Liabilities 36000 45000If net income was $15000 and there were no withdrawals, how much did the owner invest____A___.A.$ 4500B.$ 6000C.$ 45000D.$ 4350010.The amount of net income shown on the income statement also appears on the ______C__.A. statement of financial positionB. balance sheetC. statement of owner’s equityD. statement of cash flows第二章1.Which of these is (are) an example of an asset account? ___C___A.Service RevenueB.WithdrawalsC.SuppliesD.All of the above2.Traylor Company paid $ 2 850 on account. The effect of this transaction on theaccounting equation is to __D___.A.Decrease assets and decrease owner’s equityB.Increase liabilities and decrease owner’s equityC.Have no effect on total assetsD.Decrease assets and decrease liabilities3.Which of these statements is false? __A____.A.Increase in assets and increase in revenues are recorded with a debitB.Increase in liabilities and increases in owner’s equity are recorded with acreditC.Increase in both assets and withdrawals are recorded with a debitD.Decreases in liabilities and increases in expenses are recorded with a debit4.Not Payable has a normal beginning balance of $ 30 000. During the period, newborrowings total $ 63 000 and the ending balance in Notes Payable is $ 41 000.Determine the payments on loans during the period. __B___.A.$ 74 000B.$ 52 000C.$ 134 000D.Cannot be determined from the information given5.Which of these statements is not correct? __C___.A.The account is a basic summary device used in accountingB. A business transaction is recorded first in the journal and then posted to deledgerC.The ledger is a chronological listing of all transactionsD.The debit entry is recorded first in a journal entry , then the credit entry6.Which of these accounts has a normal debit balance? ___D___.A.Rent ExpenseB.WithdrawalsC.Service RevenueD.Both A and B have a normal debit balance7.The journal entry to record the collection of $ 890 from a customer on account is___B___.A. Accounts Payable 890Cash 890B. Cash 890Account Receivable 890C. Cash 890Accounts Payable 890D. Cash 890Service Revenue 8908.The ending Cash account balance is $ 57 600. During the period, cash receiptsequal $ 124 300. If the cash payments during the period total $ 135 100, then the beginning Cash amount must have __A____.A.$ 68 400B.$ 46 800C.$ 181 900D.Cannot be determined from the information givene the following selected information for the Alecia Company to calculate thecorrect credit column total for a trial balance ___C___.Accounts receivable $ 7 200Accounts payable 6 900Building 179 400Cash 15 800Capital 64 000Insurance expense 6 500Salary expense 56 100Salary payable 3 600Service revenue 190 500A.$ 201 000B.$ 137 100C.$ 265 000D.$ 74 50010.Which of the following statements is correct? ____D___.A.The chart of accounts is a list of all accounts with their balancesB.The trial balance is a list of all accounts with their balances, divided as debitor creditC.The ledger is maintained in chart-of-accounts orderD.Both B and C are correct第三章1.When should revenue be recorded under the accrual-basis and cash-basis ofaccounting? ____D___Accrual-Basis Cash-BasisA.When received When the service is performedB.When the service is performed When the customer is billedC.When the customer is billed When receivedD.When the service is performed When received2.During 20*4, Bustamante Co. incurred salary expense of $240,000.Begining andending Salary Payable was $4,000 and $ 8,000 , respectively. In 20*4,Bustamante paid salaries of ____C___A.$ 248,000B.$ 240,000C.$ 236,000D.$244,0003.During 20*4, Bustamante received $ 600,000 for service revenue. Bustamante hasnot received $ 30,000 for service already performed in 20*4, Bustamante also invested $ 20,000 into the business. Bustamante should report service revenue for 20*4 of ____D___A.$ 550,000B.$570,000C.$580,000D.$630,0004.Recording an expense when it is paid instead of when incurred is a violation of____C___A.The matching principleB.The time period conceptC.The reliability conceptD.The revenue principle5.On July 31, $3,600 is paid for a one-year insurance policy. On December 31,theadjusting entry for prepaid insurance would include ____C___A.a debit to Insurance Expense, $ 3,600B.a credit to Prepaid Insurance, $ 3,600C.a debit to Insurance Expense, $ 1,500D.a credit to Prepaid Insurance, $ 1,5006. Failure to record an adjusting entry for an accrued expense , will result in the following____B___Liabilities Net IncomeA. no effect understateB. understate overstateC. overstate understateD. understate no effect7. An adjusting entry could contain all of the following except___B___A. a debit to Unearned RevenueB. a credit to CashC. a debit to Interest ReceivableD. a credit to Salary Payable8. The 20*3 income statement showed Rend Expense of $ 6,100. The related balance sheet account, Prepaid Rent, had a beginning balance of $ 1,400 and a ending balance of $ 1,200. The amount of cash paid for rent during 20*3 is (D )A. $ 6,100B. $ 1,200C. $ 6,300D. $ 5,900Exhibit 3-2Lemon Car RentalTrial BalanceDecember 31, 20x4Account Debit CreditCash $7,450Prepaid insurance1,600Equipment19,000Accumulated depreciation$4,200 Accounts payable 5,000Lemon , capital 15,600 Withdrawals6,000Rental revenue 23,400 Insurance expense7,000Salary expense4,000Repair expense3,150Total $48,200 $48,200 Adjusting entries include(1)Prepaid insurance used1,600(2)Depreciation1,3002,9009. Refer to Exhibit 3-2. The credit column of the adjusted trial balance should total ___C___A. $ 45,300B. $ 49,300C. $ 49,500D. $ 51,10010. Refer to Exhibit 3-2.Assume the net income is $ 8,000. The ending balance of Lemon, Capital should be ___A__A. $ 17,600B. $ 15,600C $ 13,600D. $ 2,000第四章1.which of the following statements best describes the purpose of internal control ? __C____A. To provide assurance that the entire business operates in accordance with management ’s plans and policiesB To prevent fraudC. To ensure that expenses and cash outlays are held to a minimumD. To provide adequate subdivision of duties within the organizationThe Data Co. has asked you to assist in the preparation of a bank reconciliation at the end of July. Answer questions 2-4 using the following code letters to indicate how the item described would be reported on the bank reconciliation.a.Add to the book balanceb.Add to the bank balancec.Deduct from the bank balanced.Deduct from the book balancee.Dose not belong to the bank reconciliation2. Note and interest collected by the bank of the company ,$500(plus $25 interest).____A__3. Deposit in transit ,$400___B___4. Check No.662 for which should have been written for $730 was incorrectly recorded by the bank as $370.____C__.5 If a bank reconciliation include an NSF check for $45, the journal entry to record this reconciliation item would include ___A___.A.credit to CashB.debit to CashC.credit to Accounts ReceivableD.no entry is required6. All of the following are controls over cash received in a store except ____C___.A. the clerk should have access to the cash register tape to make corrections when necessaryB. the customer should be able to see the amounts entered into the registerC it should be a requirement that a receipt be given to the customerD. the cash drawer should open only when the sale clerk enters an amount on the keys7. Which of the following statements related to receivables is true ? ___C___A. On the balance sheet , accounts receivable are usually reported as total accounts receivable plus the allowance for uncollectible accountsB A dishonored notes receivable should be shown as a current liabilityC. When a notes receivable is not paid at maturity, the principal plus any interest due should be charged back to the customer’s accounts receivableD When a customer overpays his accounts receivable ,the resulting balance should be properly shown among the long-term (noncurrent) assets on the balance sheet8. Cox Company began the month of July with a balance in Accounts Receivable of $51600.During July , Cox reported cash sales of $50000, credit sales on account of $228000, collections from customers on account , $201400 , and write-offs of $750.Uncollectibe-Account expense for July was estimated to be 1% of credit sales . The balance in Account Receivable on July 31 is ___A____.A. $ 77450B $ 75170C. $ 75920D $ 80550Exhibit 4-1Carrington Crop. reported the following selected data for 20*1Accounts receivable (1/1)35000 Inventory (1/1)67000Accounts receivable (12/31)28000 Inventory(12/31)68100Net sales 310250 Prepaid expenses300Cash 27500 CurrentIiabilities973009. Refer to Exhibit 4-1. Compute days’ sales in receivable ( 365 / net sales / average accounts receivable ).___D___.A. 41 daysB. 11 daysC. 33 daysD. 37 days10. Refer to Exhibit 4-1. Compute the acid-test ratio ___B____.A. 0.31B 0.57C. 0.13D. 0.27第五章1.The weighted average for the year inventory cost flow methostd is applicable towhich of the following inventory systems? ___B____.Periodic PerpertualA. Yes YesB. Yes NoC. No YesD. No No2.The LIFO inventory cost flow method may be applied to which of the following inventory systems? ___C____.Periodic PerpertualA. No NoB. No YesC. Yes YesD. Yes No3.Crow Company bagan a year and purchased merchandise as follows:Jan.1 Beginning inventory 40 units @ $ 17.00Feb.4 Purchased 80 units @ $ 16.00May.12 Purchased 80 units @ $ 16.50Aug.9 Purchased 60 units @ $ 17.50Nov.23 Purchased 100 units @ $ 18.00The company uses a periodic inventory system and the ending inventory consists of 60 units ,20 from each of the last three purchases. Determine the ending inventory assuming costs are assigned on a weighted-average basis. ___D____A.$1000.00C.$1040.00C.$1080.00D.$1022.004.A Company uses a periodic inventory system and made an error at the end of year I that caused its year I ending inventory to be understated by $ 5000.What effect does this error have on the company’s financial statements? ___A___ income is understated;assets are understated income is understated;assets are overstated income is overstated;assets are understated income is overstated;assets are overstated5.ABC Company estimates the cost of its physical on June 30,20*2 for use in an interim financial statement.The rate of markup on cost is 25%.The following account balances are available:Inventory,March 31,20*2 $150000Purchases 86000Purchases returns 4000Sales during the second quarter of 20*2 190000The estimate of the cost of the inventory on June 30 would be ___C____.A.$80000B.$88000C.$89500D.$1845006.Which of the following factors would not be considered in the selection of LIFO as an inventory costing method? ___C____.A.Tax benbefitsB.MatchingC.Physical flowD.Improved cash flow7.Which of the following methods of inventory valuation is allowable at interim dates but not at year-eng? __B____A.Weighted averageB.Estimated gross profit ratesC.Retail methodD.Specific identication8.Dart Company’s accounting records indicated the following information: Inventory,1/ 1/20*2 $ 500000Purchases during 20*2 2500000Sales during 20*2 3200000A physical inventory taken on December 31,20*2,resulted in an ending inventory of $ 575000.Dart’s gross profit on sales has remained constant at 25% in recent years.Dart suspects some inventory may have been taken by a new employee.At December 31,20*2,what is the estimated cost of missing inventory? __A____A.$ 25000B.$ 100000C.$ 175000D.$ 2250009.Which of the following is not affected by the inventory valuation method used by a business? __C____A.Amounts owed for income taxesB.Cost of merchandise soldC.Amounts paid to acquire merchandise income of the business10.Under the retail inventory method,freight-in would be included in the calculation of the goods available for sale for which of the following? __C____Cost RetailA. No NoB. No YesC. Yes NoD. Yes Yes会计英语业务题1.The following selected transactions were completed by Castell Delivery SeeviceduringNovember :(1) Received cash from owner as additional investment , $20 000(2) Paid advertising expense , $ 520(3) Purchased supplies of gas and oil for cash $ 780(4) Received cash from cash customers , $ 1 500(5) Charged customers for delivery services on account , $ 2 100(6) Paid creditors on account , $ 470(7) Paid rent for November , $ 1 000(8) Received cash from customers on account , $ 1 810(9) Paid cash to owner for personal use , $ 900(10) Determined by taking an inventory that $ 650 of supplies of gas and oil hadbeen used during the monthIndicate the effect of each transactions on the accounting equation by listing the numbers identifying the transactions , (1) through (10) ,in a vertical column , and inserting at the right of each number the appropriate letter from the following list :(a)Increase in one asset , decrease in another asset(b)Increase in an asset , increase in a liability(c)Increase in an asset , increase in capital(d)Decrease in an asset , decrease in a liability(e)Decrease in an asset , decrease in capital2.Prepare the following columnar form . Then enter the word debit or credit in eachof the last three columns to indicate the action necessary to increase the account , to indicate the action necessary to decrease the account , and to show the normal balance of the account .Kind of Account Increase Decrease Normal Balance Asset LiabilityOwner's capitalOwner's withdrawalsRevenue Expense 3.Ora Company’s two employees each earn $ 90 per day for a four day week thatbegains on Monday and ends on Thursday . They were paid for the week ended Thursday , December 27 and both worked a full day on Monday , December 31 .January 1 of the next year was an unpaid holiday ,but the employees all worked on Wednesday and Thursday , Journalize the year-end adjusting entry to record the accrued wages and the entry to pay the employees on January 3 .4. Botello Company began operations on January 1,20×2. During the next two years , the company completed a number of transactions involving credit sales, accounts receivable collections ,and bad debts. These transactions are summarized as follows : 20×2a . Sold merchandise on credit for $54 500, terms n/60.b. Wrote off uncollectible accounts receivable in the amount of $850.c. Received cash of $45100 in payment of outstanding accounts receivable.d. In adjusting the accounts on December 31 , concluded that 2% of the outstandingaccounts receivable would become uncollectible .20×3e. Sold merchandise on credit for $ 67 800, terms n/60.f. Wrote off uncollectible accounts receivable in the amount of $1280.g. Received cash of $65 900 in payment of outstanding accounts receivable , Inadjusting the accounts on December 31 , concluded that 2% of the outstanding accounts receivable would become uncollectibleRequired:Prepare general journal entries to record the 20×2 and 20×3 summarized transactions of Botello Company and the adjusting entries to record bad debts expense at the end of each year,5. The following information is available for Carson ,Inc. for 20×2:Freight-in $20 000Purchase returns 70 000Selling expenses 200 000Ending inventory80 000The cost of goods sold is equal to 600 percent of selling expenses.:Required:Calculate the cost of goods available for sale.6.The accounting records of Classic Stores provides the following information for 20×2Beginning inventory $120 000 Purchases 790 000 Transportation-in 45 000Purchases discounts 15 000 Purchases returns and allowances 10 000 Ending inventory 130 000 Requireda.Calculate the inventory turnover ratio for 20×2 .b. If asked by management, how would you interpret the ratio that you calculated?1.posting2.revenues3.cash flow statement4.GAAPs5.chart of accounts6.debit and credit rules7. accrual accounting8. depreciation9. trial balance10.retailers11.perpetual inventory system12.liquidity1.Please state the types of accountants.2.What are the transaction recorded using debits?3.What are the steps in closing?4. Please tell us what about vouchers.5.How to account for sales using net method?6.What are the objectives of cash management?Answers1.2.3.4.5.6.In the double-entry accounting system, every transaction is recorded by equal dollar amounts of debits and credits.7.8.9.10.11.12.1. 2. 3. 4. 5. 6.。

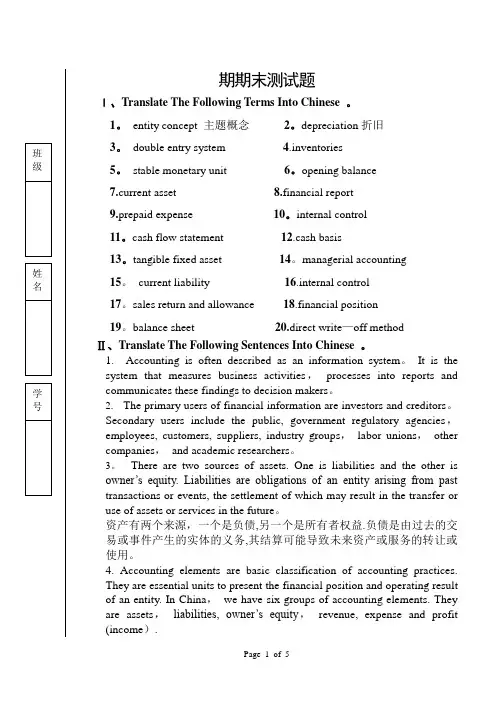

期期末测试题Ⅰ、Translate The Following Terms Into Chinese 。

1。

entity concept 主题概念2。

depreciation折旧3。

double entry system 4.inventories5。

stable monetary unit6。

opening balance7.current asset 8.financial report9.prepaid expense 10。

internal control11。

cash flow statement 12.cash basis13。

tangible fixed asset 14。

managerial accounting15。

current liability 16.internal control17。

sales return and allowance 18.financial position19。

balance sheet 20.direct write—off methodⅡ、Translate The Following Sentences Into Chinese 。

1. Accounting is often described as an information system。

It is the system that measures business activities,processes into reports and communicates these findings to decision makers。

2. The primary users of financial information are investors and creditors。

Secondary users include the public, government regulatory agencies,employees, customers, suppliers, industry groups,labor unions,other companies,and academic researchers。

2012春本科英语1复习资料第一部分交际用语1.—-- Hello, may I talk to the headmaster now?__C__A. Sorry, you can’t B。

No, you can’tC。

sorry, he is busy at the moment2。

-—- What kind of TV program do you like best?__A__A。

It’s hard to say, actuallyB. I only watch them at weekendC. I’m too busy to say3.-—— Oh, sorry to bother you.__C__A。

Oh, I don’t know B。

No, you can’t C. That’s okay4.-—- Can you turn down the radio, please?__A__A. I’m sorry, I didn’t realize it was that loudB. Please forgive me C。

I’ll keep it down next time 5。

—-— Would you mind if I open the window for a better view?__C__A。

That’s fine, thank youB。

Yes, please C. Of course not6.-—- Hello, could I speak to Don please?__B__A。

Who are you B。

Who's speaking C。

Are you Jane 7.——- May I know your address?__A__A。

Sure. Here you are B。

I have no ideaC。

It’s far from here8.—-— How's the movie? Interesting? BA. I was seated far away in the cornerB. Far from。

精品文档期期末测试题Ⅰ、Translate The Following Terms Into Chinese .1. entity concept 主题概念2.depreciation折旧3. double entry system4.inventories5. stable monetary unit6.opening balance7.current asset 8.financial report9.prepaid expense 10.internal control11.cash flow statement 12.cash basis13.tangible fixed asset 14.managerial accounting15. current liability 16.internal control17.sales return and allowance 18.financial position19.balance sheet 20.direct write-off methodⅡ、Translate The Following Sentences Into Chinese .1. Accounting is often described as an information system. It is the systemthat measures business activities, processes into reports and communicatesthese findings to decision makers.The primary users of financial information are investors and creditors. 2. Secondary users include the public, government regulatory agencies,employees, customers, suppliers, industry groups, labor unions, othercompanies, and academic researchers.There are two sources of assets. One is liabilities and the other is 3.owner's equity. Liabilities are obligations of an entity arising from pasttransactions or events, the settlement of which may result in the transfer oruse of assets or services in the future.资产有两个来源,一个是负债,另一个是所有者权益。

2012春本科英语1复习资料第一部分交际用语1.--- Hello, may I talk to the headmaster now?__C__A. Sorry, you can’tB. No, you can’tC. sorry, he is busy at the moment2.--- What kind of TV program do you like best?__A__A. It’s hard to say, actuallyB. I only watch them at weekendC. I’m too busy to say3.--- Oh, sorry to bother you.__C__A. Oh, I don’t knowB. No, you can’tC. That’s okay4.--- Can you turn down the radio, please?__A__A. I’m sorry, I didn’t realize it was that loudB. Please forgive meC. I’ll keep it down next time5.--- Would you mind if I open the window for a better view? __C__A. That’s fine, thank youB. Yes, pleaseC. Of course not6.--- Hello, could I speak to Don please?__B__A. Who are youB. Who’s speakingC. Are you Jane7.--- May I know your address?__A__A. Sure. Here you areB. I have no ideaC. It’s far from here8.--- How’s the movie? Interesting? BA. I was seated far away in the cornerB. Far from. I should have stayed home watching TVC. It was shown late until midnight9.--- What if my computer doesn’t work? BA. I’m not good at computerB. Ask Anne for helpC. I’ve called the repair shop10.--- Let’s take a walk.__C__A. Yes, pleaseB. Oh, thanksC. Yes, let’s11.--- What’s the problem, Harry?__A__A. I can’t remember where I left my glassesB. No problem at allC. Thank you for asking me about it12.--- Is this the motel you mentioned? AA. Yes, it’s as quiet as we expectedB. It looks comfortableC. No, the price’s reasonable13.--- Would you like to have dinner with us this evening? __B__A. I don’t knowB. Sorry, but this evening I have to go to the airport to meet my parentsC. No, I can’t14.--- Well, Mary, how are you?__C__A. I’m goodB. I’m pleasedC. I’m fine15.--- Would you like to see the menu? AA. No, thanks. I already know what to orderB. Your menu is very clearC. I hear the food here is tasty16.--- I think the Internet is very helpful.__A__A. Yes, so do IB. That’s a very good ideaC. Neither do I第二部分词汇与结构1. The definition leaves ___B___ for disagreement.A. a small roomB. much roomC. great deal room2.I prefer classic music __B__pop music.A. thanB. toC. with3.Ancient Greece is the__B__of western civilization.A. sourcesB. sourceC. origin4.It is very convenient __A__here.A. livingB. to liveC. live5.All the team members tried their best. We lost the game, _C_.A. asB. thereforeC. however6.The sun heats the earth, _C_is very important to living things.A. thatB. whatC. which7.When we were having a meeting, the director __B__the bad news by telephone.A. was tellingB. was toldC. could tell8.More and more people in China now __A__to work regularly.A. driveB. drivesC. have driven9.Let me __B__ the case carefully before I draw a conclusion.A. look outB. look intoC. look after10.The patient acted on the doctor’s __C__ and finally recovered.A. advicesB. adviseC. advice11.Silk __A__by Chinese for thousands of years now.A. has been usedB. was usedC. is used12.You __B__to lock the door at night.A. shallB. oughtC. must13.You must explain _C_how they succeeded ____the experiment.A. of us, forB. at us, atC. to us, in14.Before I got to the cinema, the film __A__.A. had begunB. has begunC. is begun15.I have lived here __B__ 1997.A. forB. sinceC. from16. A lecture hall is __B__ where students attend lectures.A. thatB. oneC. which17.I’m tired. I __B__ working very hard.A. haveB. have beenC. had18.He keeps _____B____ at himself in the mirror.A. to lookB. lookingC. look19.The bedroom needs __C__.A. decorateB. to decorateC. decorating20.Before she left on the trip, she __A__ hard.A. had trainedB. has trainedC. would trained21.He is the man __C__ dog bit me.A. thatB. whichC. whose22.Mary forgot __B__a letter to her mother, so she wrote to her just now.A. writingB. to writeC. to have written23.--- What’s happened to Tom? __A__ to hospital.A. He’s been takenB. He’ll be takenC. He’s taken24.He was __C__about his new job.A. above the moonB. on the moonC. over the moon25.Everything __B__ if Albert hadn’t called the fire brigade.A. will be destroyedB. would have been destroyedC. would be destroyed26.On his first sea __B__, he was still quite young but showed great courage to face the storm.A. tripB.voyageC. tour27.I broke my leg when I __A__skiing in America.A. wasB. isC. would be28.She was convicted __C__ murder.A. toB. inC. of29.He, as well as I, __A__ a student.A. isB. amC. are30.Mother was busy. Although she was not watching the basketball on TV, she __A__ it on the radio.A. was listening toB. was hearingC. was listening31.Hardly __A__ home when it began to rain.A. had I gotB. I had gotC. had I arrived in32.It happen __C__ a winter night.A. atB. inC. on第三部分完型填空Passage 1There are advantages and disadvantages to 1 Asian and Western educational methods. For example, one advantage 2 the education in Japan is that students there learn much more math and science 3 American students. They also study more hours each day than Americans 4 . The study is difficult, but it 5 students for a society that values discipline and self-control. There is, however, a disadvantage. Memorization is an important learning method in Japanese schools, 6 many students say that after an exam, they forget much of the information that they have memorized.The advantage to the education in North America, 7 the other hand, is that studentslearn to think by themselves. The system prepares them for a society that values 8 ideas. There is, however, a disadvantage. When students graduate from high school, they haven’t memorized 9 many basic rules and facts as students in other countries 10 .1. A. only B. both C. all2. A. for B. as C. to3. A. to B. for C. than4. A. do B. have C. does5. A. provides B. gets C. prepares6. A. and B. yet C. just7. A. at B. on C. under8. A. old B. poor C. new9. A. more B. less C. as10. A. have B. does C. haven’t1-5 BCCAC 6-10 BBCCAPassage 2A study has shown that fitness is the key __1 _ long life, irrespective of body shape __2__ even smoking habits. Researchers discovered that people who exercise live longer than __3__, even if they are overweight and smoke.The study found that __4__ fit of the 6,000 middle-aged men in the study were five times more likely to die within six years of the start of the research than the fittest. This was true __5__ the men had heart problems, smoked or were overweight. Scientists concluded that it was better __6__ and active than skinny and sedentary. Dr Ken cooper, a fitness expert, said, “You are better off smoking a packet of cigarettes a day and exercising regularly than __7__ a non –smoker and sedentary.”Although he adds, “But don’t misunderstand me. I am not endorsing __8 , I am trying to tell you how dangerous it is to be sedentary.”The British Government is putting pressure __9 manufacturers to reduce high levels of sugar in food and to restrict the hard-sell of junk food to children in order to improve the nation’s health. But the new study suggests the Government should encourage more people __10 _.1. A. for B. of C. to2. A. or B. and C. but3. A. these that do notB. these who do notC. those who do not4. A. the little B. less C. the least5. A. if or not B. whether or not C. when6. A. to be fat B. being fat to C. doing7. A. being B. be C. to be8. A. smoked B. to smoke C. smoking9. A.for B. on C. to10. A. exercised B. exercising C. to exercise1-5 CACCB 6-10 AACBC短文理解1短文理解5Benjamin Disraeli, the famous nineteenth century prime minister, said, “London is not a city, --- it is a nation.”Today this is an understatement; London, with its vast range of different ethnic groups, is a world.Certainly, London is the most culturally diverse city in the world. The city was founded by the Romans and since then new arrivals have constantly added to its character and prosperity.Within 10 years 40% of Londoners will be from ethnic minority groups, including the growing number of Londoners of mixed ethnic origin, but most of them will have been born in Britain.Children of Caribbean-Chinese marriages will go to school with children of Russian-Irish couples. None of them will be English but all of them will be Londoners.Most of Britain's ethnic minority residents live in the capital, speaking over 300 languages.Nearly all of the African population and many of the Caribbean population of Britain live in London (83% and 58% respectively); 39% of the Chinese population of Britain and 36% of the Asian population of Britain live in London.The largest migrant community is from the Irish Republic with 256,000 people, 3.8% of the total population of London.There are an estimated 330,000 refugees and asylum seekers living in London, with most recent arrivals coming from Eastern Europe, North Africa and Kurdistan.Young people, in particular, are skilled at dealing with a large number of different and hybrid cultures.They themselves often have several different ethnic identities since their parents and grandparents may come from several different backgrounds and their friends and partners do also. They are “skilled cross-cultural travellers” without leaving their home-town.1. Why does the writer think that Benjamin Disraeli’s statement is an understatement?Because he thinks London is _________.A. a miniature world thanks to its great cultural diversityB. even larger than some countries in the worldC. not a nation at all2.London is regarded as the most culturally diverse city in the world due to the following facts EXCEPT that _________.A. within 10 years 40% Londoners will be from ethnic minority groupsB. many young people are immigrants from different backgroundsC. London accommodates about 330,000 refugees and asylum seekers from many other countries3.Ethnic minority groups will make up _________ of the London population in the future.A. 36%B. 40%C. 39%4.The last paragraph mainly tells us in London _________.A. young people feel at ease with a large number of diversified culturesB. young people are raised in a multicultural environmentC. young people find it hard to adapt themselves to hybrid cultures5.The passage mainly deals with _________.A. the advantage of hybrid cultures in LondonB. the composition of the population in LondonC. the cultural diversity in London1-5 ABBAC短文理解6Who will stage the games?Preparing for the Olympics Games is a huge undertaking. Just like the athletes, the host city spends years getting ready for the event. Before deciding which city will host the Olympic Games, the International Olympic Committee (IOC) has to examine bids from all over the world. Bidding for the games begins about ten years in advance. Without preparing a very strong bid1, a city will not win the competition to host the games. Beijing was chosen for the 2008 games from five bidders — Osaka, Paris, Toronto and Istanbul.Why does it take so long to prepare?Building the infrastructure costs huge amounts of money. Holding the World Cup in 2002 in Japan and South Korea, for example, meant that ten new stadiums had to be built, as well as many hotels and an improved transport system. In Beijing, after winning the bid the government began major construction projects — the extension of the underground, the improvement of the airport and the building of new motorways3. Each hostcity must also build an Olympic village for the athletes. By planting trees and creating parks, the city becomes more attractive for tourists.Why do countries want to host the Olympic Games?Hosting the games has a major effect on the economy and brings international prestige to the country. Thousands and thousands of visitors come to the games and the host cities are permanently improved.1.Bidding for the Olympic Games usually starts ______ before the games are really held.A. two yearsB. eight yearsC. ten years2.Beijing was one of the _______ bidders for the 2008games.A. fiveB. fourC. three3.The World Cup 2002 was held in _______.A. JapanB. South KoreaC. A and B4. What construction projects did Beijing start after winning the bid?A. The extension of the underground.B. The improvement of the airport.C. The building of new motorwaysD. All of the above5. Why do countries want to host the Olympic Games?A. Because it has a major effect on the economy.B. Because it brings international prestige to the country.C. Because the host cities are permanently improved.D. All of the above.1-5 CACDD短文理解7阅读下列短文,并根据短文内容判断其后的句子是否正确(T)、错误(F),还是文字中没有涉及相关信息(NG)。

2012春本科英语1复习资料第一部分交际用语1.—-- Hello, may I talk to the headmaster now?__C__A。

Sorry, you can’t B. No, you can'tC. sorry, he is busy at the moment2.—-— What kind of TV program do you like best?__A__A。

It’s hard to say, actuallyB. I only watch them at weekendC. I’m too busy to say3.—-— Oh, sorry to bother you.__C__A。

Oh, I don't know B。

No, you can’t C. That's okay 4。

--- Can you turn down the radio, please?__A__A。

I'm sorry, I didn’t realize it was that loudB。

Please forgive me C. I’ll keep it down next time 5.--— Would you mind if I open the window for a better view? __C__A。

That’s fine, thank youB。

Yes, please C. Of course not6。

——— Hello, could I speak to Don please?__B__A. Who are youB. Who’s speaking C。

Are you Jane 7。

--- May I know your address?__A__A. Sure. Here you areB. I have no ideaC. It's far from here8.—-— How’s the movie? Interesting? BA. I was seated far away in the cornerB。

会计专业英语期末考试试卷和答案1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: DA.A debit to the cash receivable account of $2100.B.A credit to the accounts receivable account of $2100.C.A debit to the cash account of $1400.D.A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法method during a period of rising prices? BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9. What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10. Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司二、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用三、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bank on December 1.(2)Prepare the adjusting journal entry to record accrual of the interest payable on the loan on December 31.Answer:(1)Debit: cash $250000Credit: current liabilities $250000(2)Debit: Accrual Expense $5000 不确定Credit: Interest Payable $50003. Please prepare the related entries according to the following accounting events.1)Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales will be uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2)On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3)On July 1, Nick Company paid the $500 amount that had been written off on March 1.Answer:(1)Debit: Uncollectible Accounts Expense坏账损失$12000Credit: Allowance for Doubtful Accounts坏账准备$12000(2)Debit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)Debit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what weconsider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

会计英语词汇资料最新必看对于英语,我们需要把陌生的单词片语和句型语法不断的熟悉和熟练,使之成为我们的一种习惯,把它变成我们的第二天性。

因此,重复重复再重复,熟练熟练再熟练,是学会英语的不二法门。

下面是小编给大家整理的一些会计英语词汇的学习资料,希望对大家有所帮助。

会计英语词汇declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总额折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 应付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。

在连续的会计期间周而复始的循环进行Accounting equation 会计等式:资产 = 负债 + 业主权益Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额 / 应收帐款平均余额Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。

凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。

Accrued dividend 应计股利Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratioAcquisition cost 购置成本Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。

会计专业英语知识点汇总会计专业是现代商业领域中非常重要的一门专业。

在学习会计专业时,除了掌握会计理论和实践技巧外,掌握一定的英语知识也是非常重要的。

本文将为大家汇总一些会计专业的英语知识点,希望能够帮助到学习会计专业的同学们。

1.会计基础知识 (Accounting Basics)–Assets:资产–Liabilities:负债–Equity:所有者权益–Revenue:收入–Expenses:费用–Balance Sheet:资产负债表–Income Statement:损益表–Cash Flow Statement:现金流量表2.会计准则和规范 (Accounting Standards and Regulations)–Generally Accepted Accounting Principles (GAAP):通用会计准则–International Financial Reporting Standards (IFRS):国际财务报告准则–Financial Accounting Standards Board (FASB):美国财务会计准则委员会–International Accounting Standards Board (IASB):国际会计准则委员会3.资产负债表相关术语 (Balance Sheet Terminology)–Current Assets:流动资产–Non-current Assets:非流动资产–Current Liabilities:流动负债–Non-current Liabilities:非流动负债–Shareholders’ Equity:股东权益–Goodwill:商誉–Depreciation:折旧–Amortization:摊销4.损益表相关术语 (Income Statement Terminology)–Gross Profit:毛利润–Operating Income:营业收入–Operating Expenses:营业费用–Net Income:净收入–Earnings per Share (EPS):每股收益5.现金流量表相关术语 (Cash Flow Statement Terminology)–Cash Inflows:现金流入–Cash Outflows:现金流出–Operating Activities:经营活动–Investing Activities:投资活动–Financing Activities:筹资活动–Net Cash Flow:净现金流量6.会计报表分析 (Financial Statement Analysis)–Ratio Analysis:比率分析–Liquidity Ratios:流动性比率–Solvency Ratios:偿债能力比率–Profitability Ratios:盈利能力比率–Efficiency Ratios:效率比率7.审计和内部控制 (Auditing and Internal Control)–Audit:审计–Internal Control:内部控制–Segregation of Duties:职责分离–Internal Audit:内部审计–External Audit:外部审计8.税务会计 (Tax Accounting)–Taxable Income:应税收入–Tax Deductions:税收减免–Tax Credits:税收抵免–Tax Liability:税务负债–Tax Planning:税务规划这些是会计专业中一些重要的英语知识点,希望能够帮助到学习会计专业的同学们。

Unit 1Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。

Unit 2Each proprietorship, partnership, and corporation is a separate entity.每一独资企业、合伙企业和股份公司都是一个单独的主体。

In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements.在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。

《会计英语》复习资料 二、单项选择(红字为正确答案):

Financial reports are used by d. all of the above

1. For accounting purposes, the business entity should be considered separate from its owners if the entity is( ) d. all of the above

2. Which of the following best describes accounting? b. is an information system that provides reports to stakeholders

3. Using accrual accounting, expenses are recorded and reported only a. when they are incurred, whether or not cash is paid

4. The measurement bases exclude( ) c. Sale price

5. Debts owed by a business are referred to as( ) d. liabilities

6. Which of the following financial statements reports information as of a specific date? c. balance sheet

7. Cash investments made by the owner to the business are reported on the statement of cash flows in the a. financing activities section

8. The accounting equation may be expressed as d. Assets - Liabilities = Owner's Equity

9. Which of the following groups of accounts have a normal credit balance? a. revenues, liabilities, capital

10. Which of the following groups of accounts have a normal debit balance? d. assets, expenses

11. Which of the following types of accounts have a normal credit balance? c. revenues and liabilities

12. In the accounting cycle, the last step is( ) a. preparing a post-closing trial balance

13. Which of the following should not be considered cash by an accountant? c. postage stamps

14. A bank reconciliation should be prepared periodically because ( ) 2 / 20

c. any differences between the depositor's records and the bank's records should be determined, and any errors made by either party should be discovered and corrected

15. The amount of the outstanding checks is included on the bank reconciliation as a(n) ( ) c. deduction from the balance per bank statement

16. The asset created by a business when it makes a sale on account is termed c. accounts receivable

17. What is the type of account and normal balance of Allowance for Doubtful Accounts? a. Contra asset, credit

18. The term "inventory" indicates ( ) d. both A and B 19. Merchandise inventory at the end of the year was understated. Which of the following statements correctly states the effect of the error? a. net income is understated 20.Merchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the error? b. owner's equity is overstated 21.The inventory method that assigns the most recent costs to cost of good sold is b. LIFO 22.Under which method of cost flows is the inventory assumed to be composed of the most recent costs? b. first-in, first-out 23. When the perpetual inventory system is used, the inventory sold is debited to ( ) b. cost of merchandise sold 24.All of the following below are needed for the calculation of depreciation except d. book value

25. A characteristic of a fixed asset is that it is b. used in the operations of a business 26. Accumulated Depreciation ( ) c. is a contra asset account 27. The two methods of accounting for investments in stock are the cost method and the ( ) b. equity method

28. A capital expenditure results in a debit to ( ) d. an asset account 29. Current liabilities are( ) d. due and payable within one year 30. The debt created by a business when it makes a purchase on account is referred to as an b. account payable 31. Notes may be issued ( ) d. all of the above

32.The cost of a product warranty should be included as an expense in the 3 / 20

c. period of the sale of the product 33. If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $100,000 will be c. Less than $100,000 34. The interest rate specified in the bond indenture is called the ( ) b. contract rate 35. When the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds are d. callable bonds 36. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at d. a discount

37. One potential advantage of financing corporations through the use of bonds rather than common stock is c. the interest expense is deductible for tax purposes by the corporation

38. Characteristics of a corporation include ( ) d. shareholders who have limited liability

39. Stockholders' equity ( ) c. includes retained earnings and paid-in capital 40. The excess of issue price over par of common stock is termed a(n) ( ) d. premium 41. Cash dividends are usually not paid on which of the following? c. treasury stock