宏观经济学期末考试试卷及答案(A卷)

- 格式:pdf

- 大小:148.59 KB

- 文档页数:10

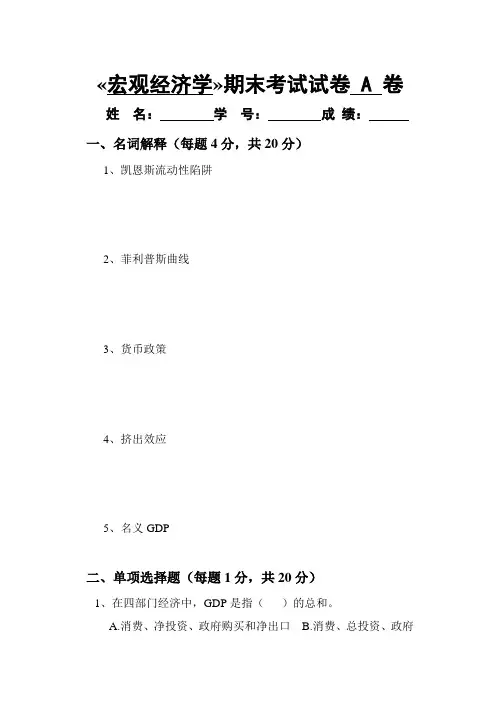

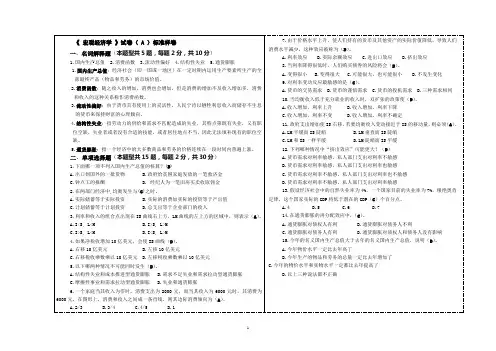

«宏观经济学»期末考试试卷 A 卷姓名:学号:成绩:一、名词解释(每题4分,共20分)1、凯恩斯流动性陷阱2、菲利普斯曲线3、货币政策4、挤出效应5、名义GDP二、单项选择题(每题1分,共20分)1、在四部门经济中,GDP是指()的总和。

A.消费、净投资、政府购买和净出口B.消费、总投资、政府购买和净出口C.消费、总投资、政府购买和总出口D.消费、净投资、政府购买和总出口2、关于投资与利率的关系,以下判断正确的是()。

A.投资是利率的增函数B.投资是利率的减函数C.投资与利率是非相关关系D.以上判断都不正确3、IS曲线与LM曲线相交时表示()。

A.产品市场处于均衡状态,而货币市场处于非均衡状态B.产品市场处于非均衡状态,而货币市场处于均衡状态C.产品市场与货币市场都处于均衡状态D.产品市场与货币市场都处于非均衡状态4、抑制需求拉上的通货膨胀,应该()。

A.降低工资B.减税C.控制货币供给量D解除托拉斯组织5、在其他条件不变的情况下,政府购买增加会使IS曲线()。

A.向左移动B.向右移动C.保持不变D.发生转动6、一国贸易盈余表示该国()。

A.消费超过产出并且净出口盈余B.消费超过产出并且净出口赤字C.消费低于产出并且净出口盈余D.消费低于产出并且净出口赤字7、在两部门经济模型中,如果边际消费倾向值为0.8,那么自发支出乘数值应该是()。

A.4B.2.5C.5D.1.68、如果中央银行采取扩张性的货币政策,可以()。

A.在公开市场买入债券,以减少商业银行的准备金,促使利率上升B.在公开市场卖出债券,以增加商业银行的准备金,促使利率下跌C.在公开市场买入债券,以增加商业银行的准备金,促使利率下跌D.在公开市场卖出债券,以减少商业银行的准备金,促使利率上升9、已知,C=3000亿元,I=800亿元,G=960亿元,X=200亿元,M=160亿元,折旧=400亿元,则()不正确。

A.净出口=40亿元B.NDP=4400亿元C. GDP=3800亿元D.GDP=4800亿元10、按百分比计算,如果名义GDP上升()价格上升的幅度,则实际GDP将()。

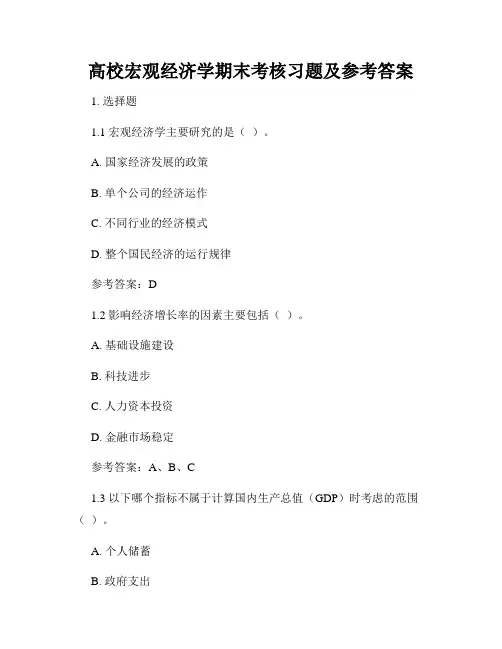

高校宏观经济学期末考核习题及参考答案1. 选择题1.1 宏观经济学主要研究的是()。

A. 国家经济发展的政策B. 单个公司的经济运作C. 不同行业的经济模式D. 整个国民经济的运行规律参考答案:D1.2 影响经济增长率的因素主要包括()。

A. 基础设施建设B. 科技进步C. 人力资本投资D. 金融市场稳定参考答案:A、B、C1.3 以下哪个指标不属于计算国内生产总值(GDP)时考虑的范围()。

A. 个人储蓄B. 政府支出C. 净出口D. 固定资本形成参考答案:A2. 简答题2.1 宏观经济学的基本概念是什么?请简要描述。

参考答案:宏观经济学是研究整个国家或地区经济体系的总体运行规律和宏观经济问题的学科。

它关注经济增长、就业、通货膨胀、货币政策等方面的问题,研究经济系统的总体运行和调控。

2.2 请简要解释什么是货币政策?参考答案:货币政策是指中央银行通过调整货币供应量和利率水平等手段来影响经济活动和价格水平的政策。

它旨在实现经济稳定和促进经济增长,通过调控货币供应和信贷规模,以及进行利率调整等策略来影响市场利率、借贷成本和金融市场活动。

3. 计算题3.1 根据以下数据,计算国家的消费水平和投资水平,并计算净出口。

消费支出:5000亿元政府支出:2000亿元投资支出:3000亿元国内生产总值(GDP):10000亿元进口:1000亿元出口:1500亿元参考答案:消费水平 = 消费支出 = 5000亿元投资水平 = 投资支出 = 3000亿元净出口 = 出口 - 进口 = 1500亿元 - 1000亿元 = 500亿元总结:本文提供了高校宏观经济学期末考核的习题及参考答案。

习题包括选择题、简答题和计算题等。

选择题涵盖了宏观经济学的基本概念和影响经济增长率的因素等内容。

简答题要求对宏观经济学和货币政策进行简要描述和解释。

计算题要求根据给定数据计算国家的消费水平、投资水平和净出口。

通过完成这些习题,学生可以巩固对宏观经济学知识的理解和运用能力,为期末考核做好准备。

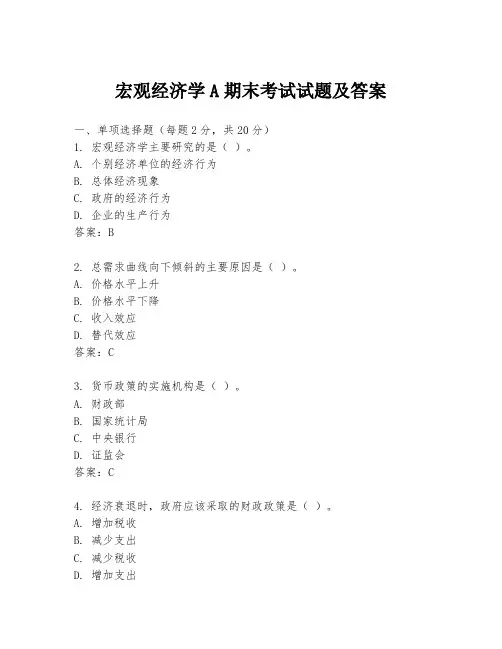

宏观经济学A期末考试试题及答案一、单项选择题(每题2分,共20分)1. 宏观经济学主要研究的是()。

A. 个别经济单位的经济行为B. 总体经济现象C. 政府的经济行为D. 企业的生产行为答案:B2. 总需求曲线向下倾斜的主要原因是()。

A. 价格水平上升B. 价格水平下降C. 收入效应D. 替代效应答案:C3. 货币政策的实施机构是()。

A. 财政部B. 国家统计局C. 中央银行D. 证监会答案:C4. 经济衰退时,政府应该采取的财政政策是()。

A. 增加税收B. 减少支出C. 减少税收D. 增加支出5. 货币供应量增加,利率下降,这表明()。

A. 货币需求减少B. 货币需求增加C. 货币供给增加D. 货币供给减少答案:C6. 通货膨胀率上升,货币的实际购买力会()。

A. 增加B. 减少C. 不变D. 不确定答案:B7. 经济中存在失业,政府应该采取的措施是()。

A. 减少公共支出B. 增加公共支出C. 增加税收D. 减少税收答案:B8. 经济增长通常与以下哪个因素有关()。

A. 资本积累B. 人口增长C. 技术进步D. 所有以上答案:D9. 长期总供给曲线是()。

B. 向上倾斜的C. 向下倾斜的D. 向右倾斜的答案:A10. 经济周期中,经济从衰退到复苏的阶段被称为()。

A. 复苏期B. 繁荣期C. 衰退期D. 萧条期答案:A二、简答题(每题10分,共40分)1. 简述凯恩斯主义经济学的主要观点。

答案:凯恩斯主义经济学认为,在短期内,总需求的变化是影响经济波动的主要因素。

政府可以通过财政政策和货币政策来调节总需求,从而实现充分就业和稳定物价。

2. 解释什么是菲利普斯曲线,并说明其在现代宏观经济学中的意义。

答案:菲利普斯曲线描述了失业率与通货膨胀率之间的负相关关系。

在短期内,较低的失业率往往伴随着较高的通货膨胀率。

然而,在长期内,这种关系可能并不稳定,因为通货膨胀预期会改变人们的行为。

3. 描述货币政策的三大工具,并简要说明它们是如何影响经济的。

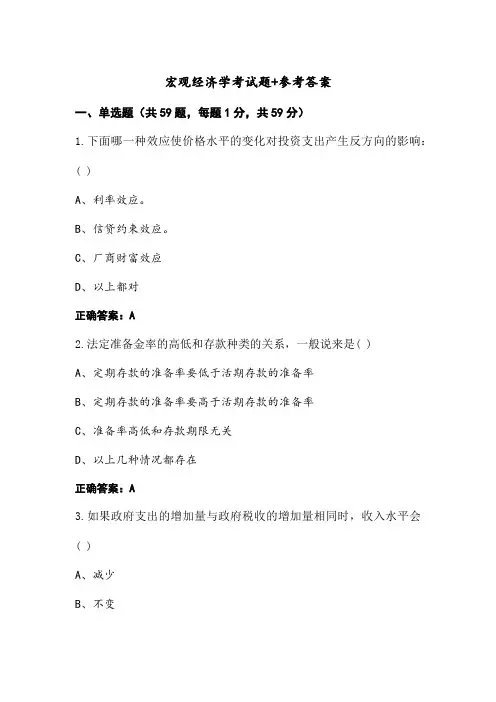

宏观经济学考试题+参考答案一、单选题(共59题,每题1分,共59分)1.下面哪一种效应使价格水平的变化对投资支出产生反方向的影响:( )A、利率效应。

B、信贷约束效应。

C、厂商财富效应D、以上都对正确答案:A2.法定准备金率的高低和存款种类的关系,一般说来是( )A、定期存款的准备率要低于活期存款的准备率B、定期存款的准备率要高于活期存款的准备率C、准备率高低和存款期限无关D、以上几种情况都存在正确答案:A3.如果政府支出的增加量与政府税收的增加量相同时,收入水平会( )A、减少B、不变C、增加D、不相关正确答案:C4.政府所追求的宏观经济目标是( )。

A、充分就业、低物价、低的经济增长、国际收支平衡。

B、物价上涨、充分就业、低的经济增长、国际收支平衡。

C、充分就业、低物价、高速稳定的经济增长、国际收支平衡和汇率的稳定。

D、以上都是错误的正确答案:D5.应计入今年的GDP的是( )。

A、存货溢价部分B、去年生产的滞销产品C、今年生产的未销售掉的产品D、只要是存货,都可以计入GDP正确答案:C6.如下哪项不正确:( )A、国际贸易账户中包括服务贸易额B、贸易余额包括所有的进口和出口C、国际收支账户表的最终余额为零D、金融账户记录的是短期资本流动项目,资本项目记录长期资本流动项目正确答案:D7.为了计算国民净福利,( )的调整不必进行。

A、休闲的价值应被加总到GNP中B、污染的成本应从GNP中扣除C、所有二手交易的价值应被加到GNP中D、那些非市场收入应被加总到GNP中正确答案:C8.GDP缩减指数等于( )。

A、名义GDP/实际GDPB、均衡的GDP/实际GDPC、实际GDP/名义GDPD、潜在GDP/实际GDP正确答案:A9.货币流通速度为V,定义为pQ/M,其中p表示价格水平,表示Q 表示产出,M表示货币供给,假设p固定,如果货币供给增加,人们可以持有货币或者花费货币,以下描述哪一个是正确的?( )A、如果人们持有所有货币,V将上升;如果人们花费掉所有货币,Q将下降。

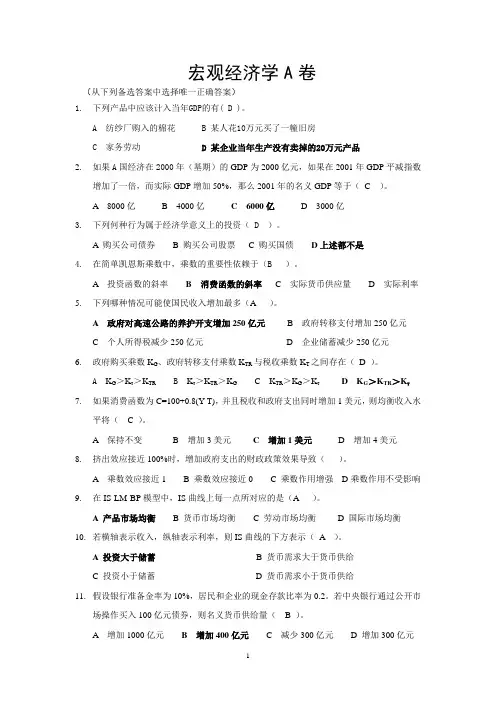

宏观经济学A卷(从下列备选答案中选择唯一正确答案)1.下列产品中应该计入当年GDP的有( D )。

A 纺纱厂购入的棉花B 某人花10万元买了一幢旧房C 家务劳动D 某企业当年生产没有卖掉的20万元产品2.如果A国经济在2000年(基期)的GDP为2000亿元,如果在2001年GDP平减指数增加了一倍,而实际GDP增加50%,那么2001年的名义GDP等于(C )。

A 8000亿B 4000亿C 6000亿D 3000亿3.下列何种行为属于经济学意义上的投资( D )。

A 购买公司债券B 购买公司股票C 购买国债D上述都不是4.在简单凯恩斯乘数中,乘数的重要性依赖于(B )。

A 投资函数的斜率B 消费函数的斜率C 实际货币供应量D 实际利率5.下列哪种情况可能使国民收入增加最多(A )。

A 政府对高速公路的养护开支增加250亿元B 政府转移支付增加250亿元C 个人所得税减少250亿元D 企业储蓄减少250亿元6.政府购买乘数K G、政府转移支付乘数K TR与税收乘数K T之间存在(D )。

A K G>K T>K TRB K T>K TR>K GC K TR>K G>K TD K G>K TR>K T7.如果消费函数为C=100+0.8(Y-T),并且税收和政府支出同时增加1美元,则均衡收入水平将( C )。

A 保持不变B 增加3美元C 增加1美元D 增加4美元8.挤出效应接近100%时,增加政府支出的财政政策效果导致()。

A 乘数效应接近1B 乘数效应接近0C 乘数作用增强D乘数作用不受影响9.在IS-LM-BP模型中,IS曲线上每一点所对应的是(A )。

A 产品市场均衡B 货币市场均衡C 劳动市场均衡D 国际市场均衡10.若横轴表示收入,纵轴表示利率,则IS曲线的下方表示(A )。

A 投资大于储蓄B 货币需求大于货币供给C 投资小于储蓄D 货币需求小于货币供给11.假设银行准备金率为10%,居民和企业的现金存款比率为0.2。

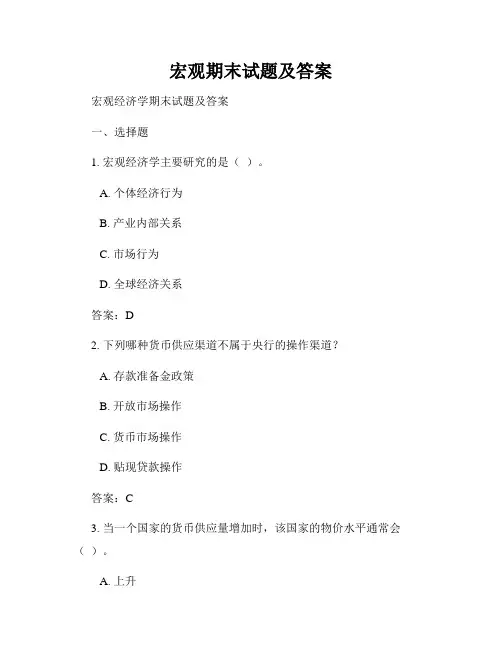

宏观期末试题及答案宏观经济学期末试题及答案一、选择题1. 宏观经济学主要研究的是()。

A. 个体经济行为B. 产业内部关系C. 市场行为D. 全球经济关系答案:D2. 下列哪种货币供应渠道不属于央行的操作渠道?A. 存款准备金政策B. 开放市场操作C. 货币市场操作D. 贴现贷款操作答案:C3. 当一个国家的货币供应量增加时,该国家的物价水平通常会()。

A. 上升B. 下降C. 保持不变D. 波动答案:A4. 经济增长率的计算公式是()。

A. (GDPt - GDPt-1)/GDPt-1 × 100%B. (GDPt-1 - GDPt)/GDPt-1 × 100%C. (GDPt - GDPt-1)/GDPt × 100%D. (GDPt-1 - GDPt)/GDPt × 100%答案:A5. 下列哪种货币政策工具可以用于调控通货膨胀?A. 货币供应量B. 货币利率C. 外汇储备D. 货币市场利率答案:B二、简答题1. 请解释货币的三个职能。

货币的三个职能分别是价值尺度、流通手段和储藏手段。

首先,货币作为价值尺度,可以衡量和比较各种商品和服务的价值。

其次,货币作为流通手段,可以在市场上作为交换媒介,方便商品和服务的买卖交易。

最后,货币作为储藏手段,人们可以将其储存起来,以备将来使用。

2. 请解释通货膨胀对经济的影响。

通货膨胀对经济的影响有以下几方面:首先,通货膨胀会降低货币的购买力,导致物价上涨,减少人们的消费能力和生活水平。

其次,通货膨胀会扭曲资源配置,由于价格上涨,生产成本增加,导致企业投资意愿下降,影响经济的正常运行。

此外,通货膨胀还会引发收入分配的不平等,对固定收入者和储蓄者造成损失,而对资产持有者带来收益。

最后,通货膨胀会削弱国家货币的国际竞争力,影响国际贸易和债务偿还。

三、论述题中国经济的供给侧结构性改革供给侧结构性改革是指通过改善生产力和供给效率,推动经济结构转型升级的一种改革方式。

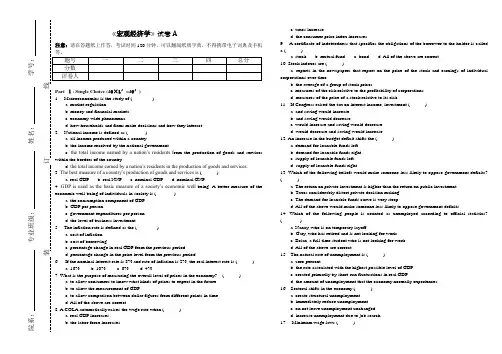

《宏观经济学》试卷A注意:请在答题纸上作答,考试时间120分钟,可以翻阅纸质字典,不得携带电子词典及手机等。

Part 1: Single Choice (40×1′=40′)1. Macroeconomics is the study of ( ) a. market regulation. b. money and financial markets. c. economy-wide phenomena. d. how households and firms make decisions and how they interact.2. National income is defined as ( ) a. all income produced within a country. b. the income received by the national government. c. the total income earned by a nation’s residents f rom the production of goods and services within the borders of the country. d. the total income earned by a nation’s residents in the production of goods and services.3. The best measure of a country’s production of goods and services is ( ) a. real GDP. b. real NNP. c. nominal GDP. d. nominal GNP.4. GDP is used as the basic measure of a society’s economic well -being. A better measure of the economic well-being of individuals in society is ( ) a. the consumption component of GDP. b. GDP per person. c. government expenditures per person. d. the level of business investment.5. The inflation rate is defined as the ( ) a. cost of inflation. b. cost of borrowing. c. percentage change in real GDP from the previous period. d. percentage change in the price level from the previous period.6. If the nominal interest rate is 8% and rate of inflation is 2%, the real interest rate is ( ) a. 16%. b. 10%. c. 6%. d. 4%.7. What is the purpose of measuring the overall level of prices in the economy? ( ) a. to allow consumers to know what kinds of prices to expect in the future b. to allow the measurement of GDP c. to allow comparison between dollar figures from different points in time d. All of the above are correct.8. A COLA automatically raises the wage rate when ( ) a. real GDP increases. b. the labor force increases.c. taxes increase.d. the consumer price index increases.9. A certificate of indebtedness that specifies the obligations of the borrower to the holder is called a ( ) a. stock. b. mutual fund. c. bond. d. All of the above are correct. 10. Stock indexes are ( ) a. reports in the newspapers that report on the price of the stock and earnings of individual corporations over time. b. the average of a group of stock prices. c. measures of the risk relative to the profitability of corporations. d. measures of the price of a stock relative to its risk.11. If Congress raised the tax on interest income, investment ( ) a. and saving would increase. b. and saving would decrease. c. would increase and saving would decrease. d. would decrease and saving would increase. 12. An increase in the budget deficit shifts the ( ) a. demand for loanable funds left. b. demand for loanable funds right. c. supply of loanable funds left. d. supply of loanable funds right.13. Which of the following beliefs would make someone less likely to oppose government deficits? ( ) a. The return on private investment is higher than the return on public investment. b. Taxes considerably distort private decision making. c. The demand for loanable funds curve is very steep. d. All of the above would make someone less likely to oppose government deficits.14. Which of the following people is counted as unemployed according to official statistics? ( ) a. Nancy, who is on temporary layoff b. Gary, who has retired and is not looking for work c. Brian, a full-time student who is not looking for work d. All of the above are correct.15. The natural rate of unemployment is ( ) a. zero percent. b. the rate associated with the highest possible level of GDP. c. created primarily by short-run fluctuations in real GDP. d. the amount of unemployment that the economy normally experiences. 16. Sectoral shifts in the economy ( ) a. create structural unemployment. b. immediately reduce unemployment. c. on net leave unemployment unchanged. d. increase unemployment due to job search. 17. Minimum wage laws ( )院系: 专业班级: 姓名: 学号:装 订 线a. probably reduce teenage employment.b. are probably the major cause of natural unemployment.c. probably most adversely affect skilled workers.d. All of the above are correct.18. Angela is the newly appointed CEO of a company that manufactures computer chips on an assembly line. Her staff has told her that given productivity numbers, they suspect some workers may be shirking. According to efficiency wage theory, what should she do? ( ) a. Pay all workers more than the equilibrium wage rate. b. Reward those who shirk with higher wages. c. Pay below the equilibrium wage rate to make up for the loss from shirking. d. Make sure that workers are getting paid exactly the equilibrium wage rate.19. Which of the following best illustrates the unit of account function of money? ( ) a. You list prices for candy sold on your Web site, , in dollars. b. You pay for tickets to a WNBA game with dollars. c. You keep $10 in your backpack for emergencies. d. None of the above is correct. 20. M1 includes ( ) a. savings deposits. b. money market deposit accounts. c. currency. d. All of the above are correct.21. The Federal Open-market Committee is made up of ( ) a. 5 of the 12 presidents of the Federal Reserve Regional banks, and the 7 members of the Board of Governors. b. the 12 presidents of the Federal Reserve Regional banks, and the Chair of the Board of Governors. c. the 12 presidents of the Federal Reserve Regional banks, and the 7 members of the Board of Governors. d. 7 of the 12 presidents of the Federal Reserve Regional banks, and the 5 members of the Board of Governors.22. If banks choose to hold more excess reserves, ( ) a. required reserves in the banking system increase. b. the money multiplier will increase. c. the discount rate will increase. d. the money supply falls.23. The Fed can influence unemployment in ( ) a. the short run, but not the long run. b. the short and long run. c. the long run, but not the short run. d. neither the short nor long run.24. When the price level rises, the number of dollars needed to buy a representative basket of goods ( ) a. decreases, so the value of money rises. b. decreases, so the value of money falls. c. increases, so the value of money rises.d. increases, so the value of money falls.25. If velocity and output were nearly constant, ( ) a. the inflation rate would be much higher than the money supply growth rate. b. the inflation rate would be much lower than the money supply growth rate. c. the inflation rate would be about the same as the money supply growth rate. d. Any of the above could be correct, more information is needed.26. If the money supply growth rate permanently increased from 10 percent to 20 percent we would expect that inflation and nominal interest rates would both increase ( ) a. by more than 10 percentage points. b. by 10 percentage points. c. but by less than 10 percentage points. d. None of the above is correct. 27. Shoeleather costs refer to ( ) a. the cost of more frequent price changes induced by higher inflation. b. resources used to maintain lower money holdings when inflation is high. c. the distortion in resource allocation created by distortions in relative prices due to inflation. d. the distortion in incentives, created by inflation, by taxes that do not adjust for inflation. 28. In order to maintain stable prices, the central bank must ( ) a. tightly control the money supply. b. keep unemployment low. c. sell indexed bonds. d. All of the above are correct. 29. Business cycles ( ) a. are explained mostly by fluctuations in corporate profits. b. no longer are very important due to government policy. c. are fluctuations in real GDP and related variables over time. d. All of the above are correct.30. Most economists believe that classical economic theory is a good description of the world in ( ) a. the long run, but not in the short run. b. the short run, but not in the long run. c. the short run and in the long run. d. neither the short nor long run.31. A decrease in U.S. interest rates leads to ( ) a. an appreciation of the dollar that leads to smaller exports. b. an appreciation of the dollar that leads to greater net exports. c. a depreciation of the dollar that leads to smaller net exports. d. a depreciation of the dollar that leads to greater net exports. 32. The long-run aggregate supply curve shifts right if ( ) a. Congress raises the minimum wage substantially. b. unemployment insurance benefits are made more generous. c. immigration from abroad increases. d. All of the above are correct.院系: 专业班级: 姓名: 学号:装 订 线33. Suppose a shift in aggregate demand creates an economic contraction. If policymakers can respond with sufficient speed and precision, they can offset the initial shift by shifting aggregate ( ) a. supply left. b. supply right. c. demand left. d. demand right.34. Which of the following has been suggested as an important cause of the Great Depression? ( ) a. a decline in the money supply b. a large decline in government expenditures c. an increase in the relative price of oil d. All of the above are correct.35. According to liquidity preference theory, which of the following shifts the money demand curve to the left? ( ) a. a decrease in the price level b. an increase in the price level c. an increase in the interest rate d. Both b and c are correct.36. If Congress cuts spending to balance the federal budget, the Fed can act to prevent unemployment and recession while maintaining the balanced budget by ( ) a. raising taxes. b. cutting expenditures. c. increasing the money supply. d. decreasing the money supply.37. Investment tax credits are designed to ( ) a. increase aggregate demand in the short run and eventually increase long-run aggregate supply. b. increase aggregate demand in the short run, but eventually decrease long-run aggregate supply. c. increase aggregate demand in the short run and have no impact on aggregate supply. d. None of the above is correct.38. According to Friedman and Phelps, the unemployment rate is above the natural rate when actual inflation ( ) a. is greater than expected inflation. b. equals expected inflation. c. is less than expected inflation. d. is high.39. The restrictive monetary policy followed by the Fed in the early 1980s ( ) a. reduced both unemployment and inflation. b. reduced inflation significantly, but at the cost of a severe recession. c. reduced unemployment significantly, but at the cost of higher inflation. d. raised both unemployment and inflation.40. A favorable supply shock will cause the short-run Phillips curve to shift ( ) a. left, and unemployment to rise. b. left, and unemployment to fall. c. right, and unemployment to rise. d. right, and unemployment to fall.Part 2: Simply answer following questions (4×5′=20′)1. How will following events influence the GDP of U.S. by expenditure method? (1)Boeing Company sold a plane to the U.S. Air Force. (2)Boeing Company sold a plane to the U.S. Air Company. (3)Boeing Company sold a plane to the Franc Air Company. (4)Boeing Company sold a plane to Mr. Cross.(5)Boeing Company produced a plane which will be sold in the next half year. 2. Who control the money supply? How does it control?3. Try to tell the relationship between short run Philips curve and long run Philips curve.4. What factors can cause unemployment? How?Part3: Calculate (2×10′=20′)1. Consider following events in certain economy:Y=5000、G=1000、T=1000、C=250+0.75(Y -T)、I=1000+50R(1)Try to calculate private saving, public saving and national saving in this economy (2) Try to find the equilibrium interest rate(3) Suppose Government purchase increase to 1250, try to calculate private saving, public saving and national saving(4) Try to find the new equilibrium2. Suppose in an economy, there are 0.76 billion adults, and 0.48 billion of them are working, 0.04 billion of them are looking for job, 0.18 billion of them are neither working nor looking for a job. Try to calculate(1) Labor force amount (2) Labor participate rate (3) Unemployment ratePart4: Analysis following questions(2×10′=20′)1. Try to tell the development path of macroeconomics. (How did it appear? How did it change?)2. Try to use the macroeconomics knowledge to analyze the current economic condition and try toafford some macroeconomic policies in China, and try to analyze their impacts to economy.院系: 专业班级: 姓名: 学号:装 订 线《国际贸易专业宏观经济学》试卷A宏观经济学(双语)A 卷参考答案Part1:1C 2D 3A 4B 5D 6C 7C 8D 9C 10B 11 B 12C 13C 14A 15D 16D 17A 18A 19A 20C 21A 22D 23A 24D 25C 26B 27B 28A 29C 30A 31A 32C 33D 34A 35A 36C 37A 38C 39B 40B Part2:1. (1) Increases government purchases and then increases GDP (2) Increases investment and then increases GDP (3) Increases net export and then increases GDP (4) Increases consumption and then increase GDP (5) Increases investment and then increase GDP2. Federal Open Market Committee conducts monetary policy by controlling the money supply. The money supply is the quantity of money available in the economy. The primary way in which the Fed changes the money supply is through open-market operations. The Fed purchases and sells U.S. government bonds. To increase the money supply, the Fed buys government bonds from the public. To decrease the money supply, the Fed sells government bonds to the public.3. The Phillips curve shows the short-run combinations of unemployment and inflation that arise as shifts in the aggregate demand curve move the economy along the short-run aggregate supply curve. The Phillips curve seems to offer policymakers a menu of possible inflation and unemployment outcomes. As a result, the long-run Phillips curve is vertical at the natural rate of unemployment. Monetary policy could be effective in the short run but not in the long run. In the long run, expected inflation adjusts to changes in actual inflation.4. Job search, this unemployment is different from the other types of unemployment. It is not caused by a wage rate higher than equilibrium. It is caused by the time spent searching for the “right” job. Minimum wage laws, although minimum wages are not the predominant reason for unemployment in our economy, they have an important effect on certain groups with particularly high unemployment rates. When the minimum wage is set above the level that balances supply and demand, it creates unemployment. Unions, a union is a worker association that bargains with employers over wages and working conditions. In the 1940s and 1950s, when unions were at their peak, about a third of the U.S. labor force was unionized. A union is a type of cartel attempting to exert its market power. Efficiency wages, Efficiency wages are above-equilibrium wages paid by firms in order to increase worker productivity. The theory of efficiency wages states that firms operate more efficiently if wages are above the equilibrium level.Part3:1. (1) Private saving=Y-T-C=5000-1000-(250+0.75*4000)=750 Public saving=T-G=1000-1000=0 National saving=750(2) I=S 1000+50R=750 R=-5 (3) Private saving=750Public saving=T-G-1000-1250=-250 National saving=500(4) 1000+50R=500 R=-10 2. (1) labor force: 0.48+0.04=0.52(2) Labor participate rate: 0.52/0.76=68% (3) Unemployment rate: 0.04/0.52=7.7%院系: 专业班级: 姓名: 学号:装 订 线。

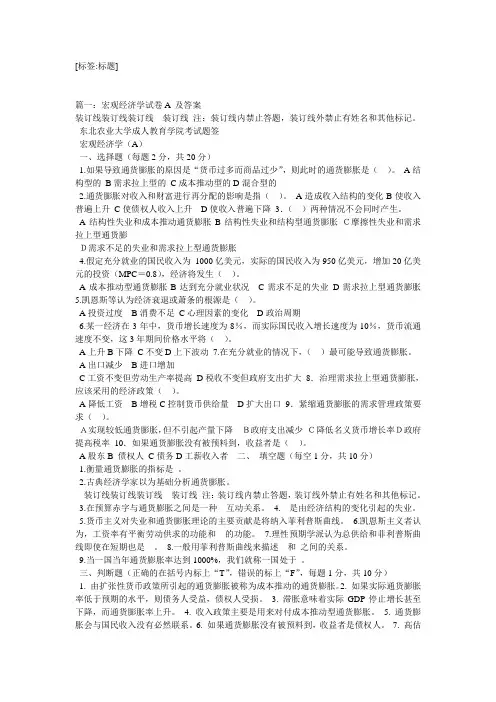

[标签:标题]篇一:宏观经济学试卷A 及答案装订线装订线装订线装订线注:装订线内禁止答题,装订线外禁止有姓名和其他标记。

东北农业大学成人教育学院考试题签宏观经济学(A)一、选择题(每题2分,共20分)1.如果导致通货膨胀的原因是“货币过多而商品过少”,则此时的通货膨胀是()。

A结构型的B需求拉上型的C成本推动型的D混合型的2.通货膨胀对收入和财富进行再分配的影响是指()。

A造成收入结构的变化B使收入普遍上升C使债权人收入上升D使收入普遍下降3.()两种情况不会同时产生。

A结构性失业和成本推动通货膨胀B结构性失业和结构型通货膨胀C摩擦性失业和需求拉上型通货膨D需求不足的失业和需求拉上型通货膨胀4.假定充分就业的国民收入为1000亿美元,实际的国民收入为950亿美元,增加20亿美元的投资(MPC=0.8),经济将发生()。

A成本推动型通货膨胀B达到充分就业状况C需求不足的失业D需求拉上型通货膨胀5.凯恩斯等认为经济衰退或萧条的根源是()。

A投资过度B消费不足C心理因素的变化D政治周期6.某一经济在3年中,货币增长速度为8%,而实际国民收入增长速度为10%,货币流通速度不变,这3年期间价格水平将()。

A上升B下降C不变D上下波动7.在充分就业的情况下,()最可能导致通货膨胀。

A出口减少B进口增加C工资不变但劳动生产率提高D税收不变但政府支出扩大8.治理需求拉上型通货膨胀,应该采用的经济政策()。

A降低工资B增税C控制货币供给量D扩大出口9.紧缩通货膨胀的需求管理政策要求()。

A实现较低通货膨胀,但不引起产量下降B政府支出减少C降低名义货币增长率D政府提高税率10.如果通货膨胀没有被预料到,收益者是()。

A股东B 债权人C债务D工薪收入者二、填空题(每空1分,共10分)1.衡量通货膨胀的指标是。

2.古典经济学家以为基础分析通货膨胀。

装订线装订线装订线装订线注:装订线内禁止答题,装订线外禁止有姓名和其他标记。

《宏观经济学》试卷( A )标准样卷一、名词解释题(本题型共5题,每题2分,共10分)1.国内生产总值2.消费函数3.流动性偏好4.结构性失业5.通货膨胀1.国内生产总值:经济社会(即一国或一地区)在一定时期内运用生产要素所生产的全部最终产品(物品和劳务)的市场价值。

2.消费函数:随之收入的增加,消费也会增加,但是消费的增加不及收入增加多,消费和收入的这种关系称作消费函数。

3.流动性偏好:由于货币具有使用上的灵活性,人民宁肯以牺牲利息收入而储存不生息的货币来保持财富的心理倾向。

4.结构性失业:指劳动力的供给和需求不匹配造成的失业,其特点第既有失业,又有职位空缺,失业者或者没有合适的技能,或者居住地点不当,因此无法填补现有的职位空缺。

5.通货膨胀:指一个经济中的大多数商品和劳务的价格连续在一段时间内普遍上涨。

二、单项选择题(本题型共15题,每题2分,共30分)1.下面哪一项不列入国内生产总值的核算?(B)A.出口到国外的一批货物B.政府给贫困家庭发放的一笔救济金C.钟点工的报酬D. 经纪人为一笔旧房买卖收取佣金2.在两部门经济中,均衡发生与(C)之时。

A.实际储蓄等于实际投资B.实际的消费加实际的投资等于产出值C.计划储蓄等于计划投资D.总支出等于企业部门的收入3.利率和收入的组合点出现在IS曲线右上方,LM曲线的左上方的区域中,则表示(A)。

A.I<S, L<MB.I>S, L>MC.I>S, L<MD.I<S, L>M4.如果净税收增加10亿美元,会使IS曲线(D)。

A.右移10亿美元B.左移10亿美元C.右移税收乘数乘以10亿美元D.左移税收乘数乘以10亿美元5.以下哪两种情况不可能同时发生(B)。

A.结构性失业和成本推进型通货膨胀B.需求不足失业和需求拉动型通货膨胀C.摩擦性事业和需求拉动型通货膨胀D.失业和通货膨胀6.一个家庭当其收入为零时,消费支出为2000元,而当其收入为6000元时,其消费为6000元,在图形上,消费和收入之间成一条直线,则其边际消费倾向为(A)。

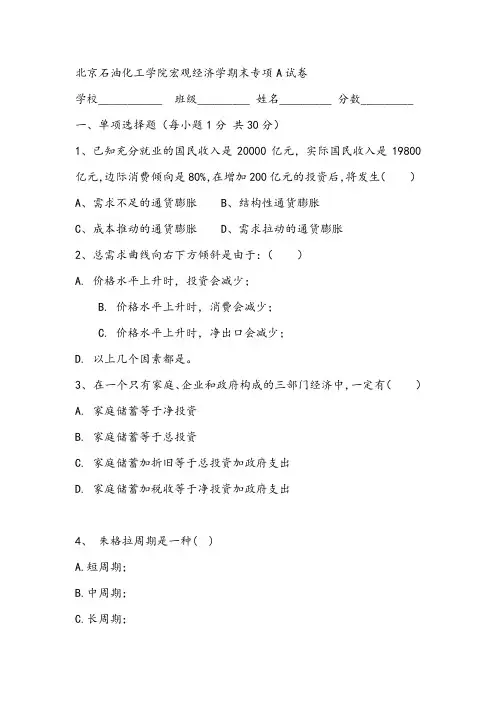

北京石油化工学院宏观经济学期末专项A试卷学校___________ 班级_________ 姓名_________ 分数_________一、单项选择题(每小题1分共30分)1、已知充分就业的国民收入是20000亿元,实际国民收入是19800亿元,边际消费倾向是80%,在增加200亿元的投资后,将发生()A、需求不足的通货膨胀B、结构性通货膨胀C、成本推动的通货膨胀D、需求拉动的通货膨胀2、总需求曲线向右下方倾斜是由于:()A. 价格水平上升时,投资会减少;B. 价格水平上升时,消费会减少;C. 价格水平上升时,净出口会减少;D. 以上几个因素都是。

3、在一个只有家庭、企业和政府构成的三部门经济中,一定有()A. 家庭储蓄等于净投资B. 家庭储蓄等于总投资C. 家庭储蓄加折旧等于总投资加政府支出D. 家庭储蓄加税收等于净投资加政府支出4、朱格拉周期是一种( )A.短周期;B.中周期;C.长周期;D.不能确定。

5、为提高经济增长率,可采取的措施是:()A、加强政府的宏观调控;B、刺激消费水平;C、减少工作时间;D、推广基础科学工作及应用科学的研究成果。

6、6 C.边际储蓄倾向为7、宏观经济学研究的问题是: ( )A. 资源配置B. 资源利用C. 资源配置和资源利用D. 经济增长8、总需求曲线向右下方倾斜是因为()A. 价格水平上升时,投资会减少B. 价格水平上升时,消费会减少C. 价格水平上升时,所得税会增加D. 以上几个因素都是9、经济增长总是以实际GDP的数值来衡量的,这是因为[ ]A.产出逐年变化B.收入法与支出法得出的数字并不相等C.逐年的名义GDP差别太大D.价格水平逐年变化10、财政政策的主要内容包括()。

A.筹集资金;B.政府支出;C.政府税收;D.政府支出与税收11、在LM曲线不变的情况下,IS曲线斜率的绝对值大,则()。

A、货币政策的效果好B、财政政策的效果好C、财政政策和货币政策的效果好同样好D、无法确定12、哈罗德中性假设的含义是()a. 资本产量比不变b. 无技术进步c. 人均资本拥有量不变d. 三个说法都正确这个可以在我的讲稿中直接找到吧?13、货币数量的减少使总需求曲线(),所以实际GDP( ),价格水平()。

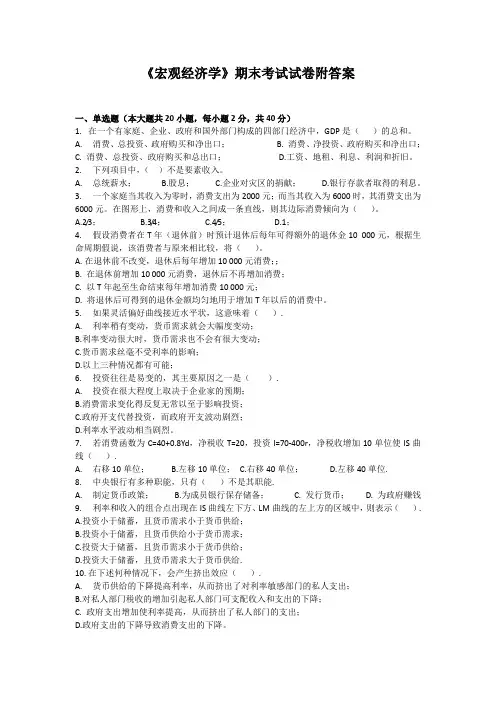

《宏观经济学》期末考试试卷附答案一、单选题(本大题共20小题,每小题2分,共40分)1.在一个有家庭、企业、政府和国外部门构成的四部门经济中,GDP是()的总和。

A.消费、总投资、政府购买和净出口;B. 消费、净投资、政府购买和净出口;C. 消费、总投资、政府购买和总出口;D.工资、地租、利息、利润和折旧。

2.下列项目中,()不是要素收入。

A.总统薪水;B.股息;C.企业对灾区的捐献;D.银行存款者取得的利息。

3.一个家庭当其收入为零时,消费支出为2000元;而当其收入为6000时,其消费支出为6000元。

在图形上,消费和收入之间成一条直线,则其边际消费倾向为()。

A.2/3;B.3/4;C.4/5;D.1;4.假设消费者在T年(退休前)时预计退休后每年可得额外的退休金10 000元,根据生命周期假说,该消费者与原来相比较,将()。

A.在退休前不改变,退休后每年增加10 000元消费;;B. 在退休前增加10 000元消费,退休后不再增加消费;C. 以T年起至生命结束每年增加消费10 000元;D. 将退休后可得到的退休金额均匀地用于增加T年以后的消费中。

5.如果灵活偏好曲线接近水平状,这意味着().A.利率稍有变动,货币需求就会大幅度变动;B.利率变动很大时,货币需求也不会有很大变动;C.货币需求丝毫不受利率的影响;D.以上三种情况都有可能;6.投资往往是易变的,其主要原因之一是().A.投资在很大程度上取决于企业家的预期;B.消费需求变化得反复无常以至于影响投资;C.政府开支代替投资,而政府开支波动剧烈;D.利率水平波动相当剧烈。

7.若消费函数为C=40+0.8Yd,净税收T=20,投资I=70-400r,净税收增加10单位使IS曲线().A.右移10单位;B.左移10单位;C.右移40单位;D.左移40单位.8.中央银行有多种职能,只有()不是其职能.A.制定货币政策;B.为成员银行保存储备;C. 发行货币;D. 为政府赚钱9.利率和收入的组合点出现在IS曲线左下方、LM曲线的左上方的区域中,则表示().A.投资小于储蓄,且货币需求小于货币供给;B.投资小于储蓄,且货币供给小于货币需求;C.投资大于储蓄,且货币需求小于货币供给;D.投资大于储蓄,且货币需求大于货币供给.10.在下述何种情况下,会产生挤出效应().A.货币供给的下降提高利率,从而挤出了对利率敏感部门的私人支出;B.对私人部门税收的增加引起私人部门可支配收入和支出的下降;C. 政府支出增加使利率提高,从而挤出了私人部门的支出;D.政府支出的下降导致消费支出的下降。

7、财政政策(A)Array A.涉及政策支出和税收水平 B.包括创造工作岗位计划C.包括最低工资安排,所有的工人至少可以得到一个公平的工资D.包括失业保险计划8、如果存在通货膨胀缺口,应采取的财政政策是(A)。

A.增加税收; B.减少税收;C.增加政府支付; D.增加转移支付。

9、利率变动反映最敏感的是(C)。

A.货币的交易需求; B.货币谨慎需求;C.货币的投机需求; D.三种需求反应相同10、当法定准备金为20%,商业银行最初所吸收的存款为3000货币单位时,银行所能创造的货币总量为(C)。

A.20000货币单位; B.80000货币单位;C.15000货币单位; D.60000货币单位。

11、公开市场业务是指(D)A.商业银行的信贷活动B.商业银行在公开市场上买进或卖出政府债券C.中央银行增加或减少对商业银行的贷款D.中央银行在金融市场上买进或卖出政府债券12、IS曲线上的每一点都表示使(A)A.投资等于储蓄的收入和利率的组合 B.投资等于储蓄的均衡的货币量C.货币需求等于货币供给的均衡货币量 D.产品市场和货币市场同时均衡的收入13、一般地说,位于LM曲线左方的收入和利率组合,都是( A )。

A.货币需求大于货币供给的非均衡组合; B.货币需求等于货币供给的均衡组合;C.货币需求小于货币供给的非均衡组合; D.产品需求等于产品攻击的非均衡组合。

14、扩张性货币政策的效应是( C )。

A.价格水平提高; B.总需求增加;C.同一价格水平上的总需求增加; D.价格水平下降,总需求增加。

15、乘数原理和加速原理的联系在于( A)A.前者说明投资的变化对国民收入的影响,后者说明国民收入的变化对投资产生影响B.两者都说明投资是怎样产生的C.前者解释了经济如何走向繁荣,后者说明经济怎样陷入萧条D.前者解释了经济如何走向萧条,后者说明经济怎样走向繁荣16、按照哈罗德的看法,要想使资本主义经济在充分就业的情况下稳定地增长下去,其条件是(A)A.Ga = Gw = Gn B.Ga = GwC.Ga = Gn D.Ga > Gn17、已知充分就业的收入为10000亿元,实际的收入为9000亿元,在边际消费倾向为75%的条件下,增加100亿元的投资,则(B)A.将导致需求拉动型通货膨胀,且通货膨胀缺口为5亿元B.仍未能使经济消除需求不足的失业C.将导致成本推动型通货膨胀D.将使经济达到充分就业的状态18、引起周期性失业的原因是( B )。

【注意:答案按序号写在答题纸上,答毕后试题与答题纸一并上交】一、单项选择(每题1分,共20分)1.下列哪种情况下货币供给增加_________。

A. 政府购买增加B. 联储从公众手中购买国库债券C. 一个普通民众购买通用汽车的债券D. IBM向公众发售股票,并将收益用于建设新工厂2. 假设你以200000美元购买了一栋新房子并入住,在计算GDP的时候,消费支出__________。

A. 增加了200000美元B. 增加了200000美元除以你预期将在这栋房子里居住的年数C. 增加了这栋房子的估算租金,它等于如果将这栋房子出租可以获得的市场租金D. 不变3. 如果名义货币供给增长10%,实际产出增长3%,货币流通速度不变,实际利率为5%,那么名义利率为__________。

A. 18% % C. 12% D. 8%4. 在未预期到的通货膨胀时期,债权人受害,而债务人受益,因为__________。

A.事后实际利率超过事前实际利率B.事后实际利率低于事前实际利率C.实际利率下降D.名义利率下降5. 对于柯布道格拉斯生产函数,产出中分配给劳动的份额________________。

A.随着劳动数量的增加而减少B.随着劳动数量的增加而增加C.随着资本数量的增加而增加D.不随劳动数量的变化而变化6. 总供给方程表明当价格水平_________时产出超过自然产出水平。

A.较低B.较高C.低于预期价格水平D.高于预期价格水平7. 工资刚性_________。

A.使得劳动需求等于劳动供给B.是由部门转移引起的C.阻止劳动需求和劳动供给到达均衡水平D.提高找到工作的概率8.假定一台可比的电脑在美国的售价为500美元,在德国的售价为2000欧元,如果名义汇率是1美元兑2欧元,那么美元的实际汇率(即一台美国电脑能够换到的德国电脑的数量)为_________。

B. 4 D.9. 在有人口增长但没有技术进步的情况下,索洛增长模型不能解释生活水平的持续增长,其原因在于:A. 总产出没有增长B. 折旧的增长快于产出C. 在稳态,产出、资本和人口的增长率相同D. 资本和人口增长,但产出无法跟上10. 如果目前的稳态人均资本量低于资本的黄金率水平,并且政府实施了提高储蓄率的政策,人均消费__________:A .开始下降到初始水平以下,但是最后上升将到初始水平之上B .一直上升到初始水平之上C .开始上升到初始水平之上,然后逐渐回落到初始水平D .一直下降到初始水平之下11.经济处于流动性陷阱时,__________曲线水平,__________政策无效。

宏观经济学测试题(附答案)一、单选题(共59题,每题1分,共59分)1.能计入GDP帐户中的是( )。

A、农民生产自己消费的那部分农产品B、家庭主妇的家务劳动C、家政公司提供的家务劳动D、二手车的售价正确答案:C2.当采用扩张的财政政策和扩张的货币政策时可能会发生:( )A、实际利率水平降低B、汇率贬值C、经常账户赤字增加D、以上全对正确答案:D3.哈罗德的分析之所以是一种长期分析,是因为他( )。

A、从连续的各个时期来分析经济增长B、根据投资和储蓄之间的关系来分析经济增长C、根据有效需求来分析经济增长D、在技术、人口、资本均可变化的时期内分析经济增长正确答案:D4.财政政策的内在稳定器作用体现在( )。

A、延缓经济衰退B、刺激经济增长C、减缓经济波动D、促使经济达到均衡正确答案:C5.下列各项中,( )项不属于生产要素供给的增长A、就业人口的增加B、人才的合理流动C、投资的增加D、发展教育事业正确答案:B6.当经济过热时,中央银行可以在金融市场上( )。

A、买进政府债券,降低再贴现率B、卖出政府债券,降低再贴现率C、买进政府债券,提高再贴现率D、卖出政府债券,提高再贴现率正确答案:D7.因为最近股票市场爆发了一轮大行情,王五将其全部存款都购买了股票。

以下哪种说法是正确的?( )A、因为货币资产的名义利率提高而增加了其货币需求B、因为非货币资产的利率变化而改变了其货币需求C、因为非货币资产的预期收益升高而减少了其货币需求D、以上都不对正确答案:C8.经济增长的最佳定义是( )。

A、投资和资本量的增加B、因要素供给增加或生产率提高使潜在的国民收入有所提高C、实际国民收入在现有水平上有所提高D、人均货币收入的增加正确答案:B9.社会保障支付属于( )。

A、税收B、消费C、转移支付D、政府支出正确答案:C10.如果一国经济处于萧条和衰退时期,政府应采取( )。

A、财政预算赤字B、财政预算盈余或赤字C、财政预算盈余D、财政预算平衡正确答案:A11.下列哪种情况会引起沿着货币需求曲线向下移动?( )A、国民收入减少B、利率下降C、国民收入增加D、利率上升正确答案:B12.实际国民生产总值反映了( )的变化。

宏观经济学期末考试试卷及答案( A 卷)一、名词解释题(本题型共5题。

每题2分,共10分,将答案写在答题纸上)1.国民生产总值2. 消费函数3. 充分就业4 经济周期5. 菲利普斯曲线二、单项选择题(本题型共30题。

每题正确答案只有一个,从每题的备选答案中选出正确的答案,将其英文字母编号填入答题纸上相应的空格.....内。

每题1分,共30分)1、今年的名义国内生产总值大于去年的名义国内生产总值,说明:( )A.、今年物价水平一定比去年高了;B、今年生产的物品和劳务的总量一定比去年增加了;C、今年的物价水平和实物产量水平一定都比去年提高了;D、以上三种说法都不一定正确。

2、一国的国内生产总值小于国民生产总值,说明该国公民从外国取得的收入( )外国公民从该国取得的收入( )A.、大于;B、小于;C、等于;D、可能大于也可能小于。

3、两部门的均衡是:()A: I=S;B: I+G=S+T;C: I+G+X=S+T+M;D: AD=AS。

4、一般地说,通货膨胀会使()。

A.债权人受损,债务人受益;B.债权人受益,债务人受损;C.债权人和债务人都受益;D.债权人和债务人都受损。

5、在货币总量不变条件下,当物价上升,货币投机需求减少,利率上升,从而抑制投资需求和居民信贷消费需求,导致产出的下降,这种效应被称为()A. 净出口效应;B. 利率效应;C.实际余额效应;D.财富效应。

6、总需求曲线向下倾斜的原因之一是( ):A. 随着价格水平下降,家庭的实际财富下降,他们将增加消费;B. 随着价格水平上升,家庭的实际财富下降,他们将减少消费;C. 随着价格水平下降,家庭的实际财富上升,他们将减少消费;D. 随着价格水平上升,家庭的实际财富上升,他们将增加消费。

7、在LM曲线即定时,扩张性的财政政策使IS曲线向()。

A: 上移; B: 下移;C: 不变; D: 无联系。

8、假设银行利率为6%,在下列几项投资中,投资者应该选择():A.类投资的平均资本收益率最高的是2%;B.类投资的平均资本收益率最高的是5%;C.类投资的平均资本收益率最高的是8%;D.无法确定。

宏观经济学期末考试试卷及答案宏观经济学期末考试试卷及答案 A 卷一、名词解释题本题型共5题。

每题2分共10分将答案写在答题纸上1国民生产总值 2. 消费函数 3. 充分就业 4 经济周期 5. 菲利普斯曲线二、单项选择题本题型共30题。

每题正确答案只有一个从每题的备选答案中选出正确的答案将其英文字母编号填入答题纸上相应的空格内。

每题1分共30分1、今年的名义国内生产总值大于去年的名义国内生产总值说明 A.、今年物价水平一定比去年高了B、今年生产的物品和劳务的总量一定比去年增加了C、今年的物价水平和实物产量水平一定都比去年提高了D、以上三种说法都不一定正确。

2、一国的国内生产总值小于国民生产总值说明该国公民从外国取得的收入外国公民从该国取得的收入 A.、大于B、小于C、等于D、可能大于也可能小于。

3、两部门的均衡是A: IS B: IGST C: IGXSTM D: ADAS。

4、一般地说通货膨胀会使。

A债权人受损债务人受益B债权人受益债务人受损C债权人和债务人都受益D债权人和债务人都受损。

5、在货币总量不变条件下当物价上升货币投机需求减少利率上升从而抑制投资需求和居民信贷消费需求导致产出的下降这种效应被称为 A. 净出口效应 B. 利率效应 C.实际余额效应 D.财富效应。

6、总需求曲线向下倾斜的原因之一是 A. 随着价格水平下降家庭的实际财富下降他们将增加消费 2 B. 随着价格水平上升家庭的实际财富下降他们将减少消费 C.随着价格水平下降家庭的实际财富上升他们将减少消费 D. 随着价格水平上升家庭的实际财富上升他们将增加消费。

7、在LM曲线即定时扩张性的财政政策使IS曲线向。

A: 上移B: 下移C: 不变D: 无联系。

8、假设银行利率为6在下列几项投资中投资者应该选择 A.类投资的平均资本收益率最高的是 2 B.类投资的平均资本收益率最高的是 5 C.类投资的平均资本收益率最高的是8 D.无法确定。