计算器 HP-12C使用

- 格式:doc

- 大小:66.05 KB

- 文档页数:8

一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

当然,严格地讲,还有几个其它的重要指标需要设定:期初或期末年金(g BEG或g END),每年复利的次数(gi),和每年付款次数(g n)。

不过期初和期末在大多数情况下,是可以省略的,因为现金的流入一般默认为是在期末,而现金流出一般默认是在期初;因此只要自己把握好时间段,是可以不用设定的。

期初和期末的概念的前提,是把每一期当作当作一个时间段来看待;但时如果没有明确的提示之下,完全可以把每一期当作一个时间点来看待,这样就省却了设定期初和期末的工作。

这样做,更能够联系对现金流概念的敏感性。

下面通过一些例题,来把握货币时间价值的一些基本运算。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV, g END (后两项输入时为可选项)PV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV, g END(同上)FV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定(年)利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?析:银行向客户贷款所适用的利率均为年利率,但是如果是每月付款一次(就像大多数按揭的情形,如本题),就意味着是每月复利一次,所以需要用g n 和g i来解题。

这两个健是计算器已经设定好的,按下,就意味着年利转成月利,年数转化成月数。

当然,也可以先用年利计算出月利,然后直接按照月的期数计算,答案相同。

解答:1)20 g n, 6.39 g i, 100PV, 0 FV, g END ( 这里假设月末付款,如是月初,需按g BEG) PMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

HP12C财务计算器的使用简介HP12C财务计算器是一款被广泛应用于金融和会计领域的专业计算器。

HP12C采用逆波兰记法表示数学表达式,并且提供了多个功能键和专门设计的金融函数,方便用户进行复杂的财务计算。

本文档旨在介绍HP12C财务计算器的基本使用方法和常用功能,帮助用户快速掌握这款实用的工具。

基本操作开机与关机HP12C财务计算器使用双电源设计,可以通过太阳能或者电池供电。

当电池电量不足时,太阳能电池仍然可以提供足够的电力继续使用。

•开机:按下计算器上面的“ON”按钮,计算器即可开机;•关机:按住“ON”按钮不松手,计算器即可关机。

数字输入通过按键输入数字是HP12C财务计算器最常见的操作。

计算器的面板上共有10个数字键,分别对应0至9的数字。

•输入数字:直接按下对应的数字键即可。

逆波兰记法HP12C财务计算器采用逆波兰记法(RPN)表示数学表达式。

这种表达式形式不需要括号,通过操作符的位置来确定运算顺序。

例如,要计算2加3的结果,可以按下以下键序列:2 [ENTER]3 +计算器会依次执行加法运算,结果将会显示在屏幕上。

HP12C财务计算器支持常用四则运算,包括加法、减法、乘法和除法。

使用这些运算符时,需要注意逆波兰记法的输入顺序。

•加法:按下“+”键;•减法:按下“-”键;•乘法:按下“x”键;•除法:按下“÷”键。

存储器操作HP12C财务计算器提供了多个存储器,可以临时存储数据和结果。

存储器的编号从0到9,分别对应对应数字键上的小数字。

•存储数据:按下对应存储器的编号键(0到9),然后按下“STO”键;•读取数据:直接按下对应存储器的编号键(0到9)。

当需要清空计算器的输入或者结果时,可以使用以下方法:•清除当前数值:按下“CLX”;•清除整个栈:按下“f”和“CLx”。

常用金融函数HP12C财务计算器提供了多个专门的金融函数,方便用户进行复杂的财务计算。

下面介绍几个常用的函数。

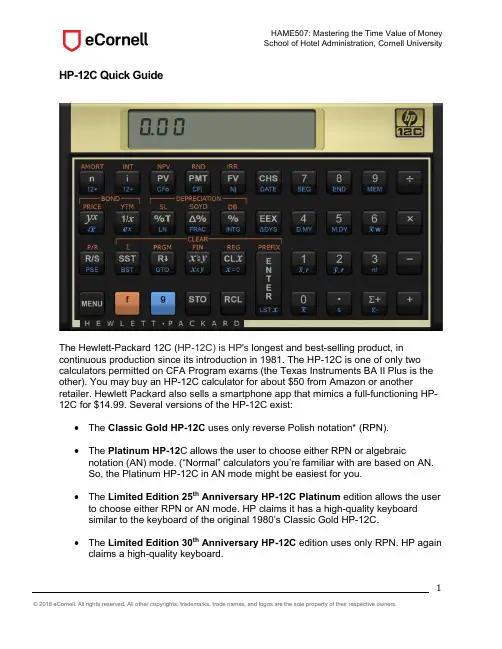

1HP-12C Quick GuideThe Hewlett-Packard 12C (HP-12C) is HP's longest and best-selling product, in continuous production since its introduction in 1981. The HP-12C is one of only two calculators permitted on CFA Program exams (the Texas Instruments BA II Plus is the other). You may buy an HP-12C calculator for about $50 from Amazon or anotherretailer. Hewlett Packard also sells a smartphone app that mimics a full-functioning HP-12C for $14.99. Several versions of the HP-12C exist:• The Classic Gold HP-12C uses only reverse Polish notation* (RPN).• The Platinum HP-12C allows the user to choose either RPN or algebraicnotation (AN) mode. (“Normal” calculators you’re familiar with are based on AN. So, the Platinum HP-12C in AN mode might be easiest for you.• The Limited Edition 25th Anniversary HP-12C Platinum edition allows the userto choose either RPN or AN mode. HP claims it has a high-quality keyboard similar to the keyboard of the original 1980’s Classic Gold HP-12C.• The Limited Edition 30th Anniversary HP-12C edition uses only RPN. HP againclaims a high-quality keyboard.2*The "Polish" in reverse Polish notation refers to the nationality of logician Jan Łukasiewicz, who invented Polish notation in the 1920s. Polish notation is parentheses-free and the inspiration for the idea of the recursive stack, a last-in, first-out computer memory store. Studies show that RPN calculators are superior to AN calculators in terms of speed and accuracy of operation. However, as noted above, you’ll likely be up and running faster with Platinum HP-12C in the familiar AN mode.What you will need to know for the purposes of this course is summarized in this quick guide. Keep it handy as a reference as you work through problems. The extensive instruction book included with your calculator is a valuable reference for the more sophisticated functions not covered in this guide. You can also find well-done tutorials on a number of financial calculators, including the HP-12C, at:/calculator_index .Basic Functions• Turning on your calculatorThe [ON] key–or [MENU] key on some HP-12C versions–in the bottom left corner turns the calculator on or off. If you do not use thecalculator for several minutes, it will turn itself off.• Changing the displayTo change the number of decimal places displayed, key [f] then the desired number of digits. For example, [f] [2] sets the display to two decimal places past the decimal point.The default values in the calculator are ‘.’ for the decimal point and ‘,’ as the separator between groups of three digits to the left, as in 30,000.00. To reverse these, turn off the calculator, then turn it back on while holding down the [.] key.• Changing signTo change the sign of the displayed value, key [CHS].Cash inflows (i.e., money going into your wallet)are entered as positive numbers. Cash outflows3(i.e., money coming out of your wallet) are entered as negative numbers.• Mathematical calculationsThe primary difference between the HP-12C’s operation in RPN mode and AN calculators is the way operations are entered. On an AN calculator, you enter the operator between two numbers:[2] [+] [3] [=]On the HP-12C, you key:[2] [ENTER] [3] [+]The first number is entered into the “stack” memory by using [ENTER]. The second number is followed by the operator desired. Another example:Desired Calculation: What you key: What you see:(12 + 13) x 5 [1] [2] [ENTER] [1] [3] [+][5] [x]12.0025.00 125.00A bit of HP-12C terminology: The displayed value showing in the window is referred to as “x ”, i.e., the number in the “x ” register. When you key [ENTER] it moves “x ” into the “y ” register. You’ll see several keys that perform operations on “x ” and “y .” For example, the [y x ] key raises “y ” to the “x ” power. The [1/x ] key takes the inverse of “x .” Here are examples that use the [y x ] and [1/x ] keys:Desired Calculation: What you key:What you see:11065(.) [1] [.] [0] [6] [ENTER] [5] [y x ] [1/x ]1.061.34 0.7512001065(.) [1] [.] [0] [6] [ENTER][5] [y x ] [1/x ][1] [2] [0] [0] [x ] 1.06 1.34 0.75 896.714 In the examples that follow in this guide, keystrokes for numbers will be consolidated for ease of reading.• Accessing alternate functions:Many of the keys on the HP-12C perform more than one function. For example, take a closer look at the [PV] key. The [NPV] function above is accessed by first keying the gold [f] key. The [CF 0] function below is accessed by first keying the blue [g] key. For example, the sequence:[25] [g] [CF 0]enters 25 as the cash flow at time 0. The use of the [NPV] and [CF 0] keys is covered in this guide’s “Irregular Cash Flows”.• Storing numbers in memoryUp to twenty numbers may be placed into memory. The first ten ‘registers’ are accessed using the number keys [0] to [9], and thesecond ten using [.0] to [.9]. The [STO] key is for storage. Example: to enter 1.125 into the first memory slot, key[1.12] [ENTER] [5] [y x ] [STO] [0]If the display is set to two decimal places, 1.76 is displayed and also stored withoutrounding in R 0, register 0, and is available for use until the memory is cleared or another number is entered into R 0.To use the stored number in R 0, key [RCL] [0]. Example: to multiply 1000 by the 1.76 already stored in register 0, key[1000] [ENTER] [RCL] [0] [x]If the display is set to two decimal places, 1,762.34 is displayed.5• Clearing registers/memoryClear just the x register (i.e., the number that appears in the display window) by keying [CL X ]. This is useful when you make an error keying in a number.Clear the financial registers by keying [f] [FIN]. This sets all financial registers, including [n], [i], [PV], [PMT], and [FV], equal to zero. This is good form before you start any time value of money calculation.Keying [f] [REG] clears all registers, including any values stored in the x register, financial registers, and memory.6Time Value of MoneyFive keys in the upper left corner are used for many of the time value of money (TVM) calculations you’ll be introduced to in this course. [n] number of payments or time periods. [i] interest rate expressed as percent, e.g., 12% entered as [12] [i], not as [.12] [i]. [PV] present value, or value at time 0[PMT] payment, a constant amount paid or received each period. [FV] future value, specifically the value at time nGiven four of the above values, the fifth can be calculated.Example: You deposit $1,000 today into an account paying 4.00% per year. Compute the amount you will be able to withdraw in 5 years.Reminder: First, clear the financial registers by keying [f] [FIN].Data: What you key: What you see: n = 5 i = 4% PV = $1000 PMT = 0* compute FV[5] [n] [4] [i][1000] [CHS] [PV] [0] [PMT] [FV]5.004.00 -1,000.000.00 1,216.65*If [f] [FIN] is keyed to start, then the payment register would already be set to zero, so no need to key [0] [PMT].The HP-12C keeps track of cash flows moving in different directions by the using opposite signs. The $1,000 we deposit today (i.e., the present value) is entered as a negative number, and the $1,216.65 we withdraw in 5 years (i.e., the future value) is shown as a positive number. A good way to visualize how the flows are signed: If you’re taking money out of your wallet and depositing, then it’s a negative sign. If you’re withdrawing money and putting it into your wallet, then it’s a positive sign.7Example: You invest $5,000 today and $1,000 at the end of each of the next 10 years. Compute the amount you will have after 10 years if the investment earns 8% per year.Data: What you key: What you see: n = 10 i = 8 PV = $5000 PMT = $1000 calculate FV[10] [n] [8] [i][5000] [CHS] [PV] [1000] [CHS] [PMT] [FV]10.008.00 -5,000.00 -1,000.00 25,281.19• Monthly cash flowsCar loans, home mortgages, student loans, and other loans typically have monthly payments. To input the number of monthly payments when you know the number ofyears, key [g] [n]. For example, the number of payments for a 30-year mortgage can be entered as [30] [g] [n]. 360 is displayed and entered into the n register.To input the monthly interest rate when you know the annual percentage rate (APR), key [g] [i]. For example, the monthly interest rate for a mortgage with 6.00% APR, compounded monthly, can be entered as [6] [g] [i]. 0.50 is displayed and entered into the i register.Example: Compute the monthly payment on a 30-year $200,000 mortgage with a 7.5% APR, compounded monthly?Data: What you key: What you see: n = 30 x 12 i = 7.5% ÷ 12PV = $200,000FV = 0* calculate PMT[30] [g] [12x] [7.5] [g] [12÷] [200000] [PV] [0] [FV] [PMT]360.000.63200,000.000.00 -1,398.43*If [f] [FIN] is keyed to start, then the payment register would already be set to zero, so no need to key [0] [FV].8• Payments at the end of the period versus the beginning of the periodFor payments that occur at the beginning of the period, key [g] [BEG]. To confirm that the HP-12C will now make calculations presuming payments occur at the beginning of each period, “BEGIN” appears at the bottom of the display.Most of the time, though, such as when we are dealing with car loans, home mortgages, or student loans, payments occur at the end of the period. To return to the HP-12C’s default mode of presuming payments occur at the end of the period, key [g] [END]. “BEGIN” will no longer appear at the bottom of the display.• Irregular cash flowsFor calculations that involve cash flows occurring at regular intervals but with differing amounts, we enter values using [g] functions [CF 0], [CFj], and [Nj]. We can thencalculate the net present value or internal rate of return by using [f] functions [NPV] and [IRR].Enter the cash flow at time 0 by keying the value followed by [g] [CF 0]. If there is no time 0 cash flow, key [0] [g] [CF 0]. For example, if the first cash flow is -1000, key [1000] [CHS] [g] [CF 0].Enter subsequent cash flows in order using [g] [CFj]. If subsequent cash flows are different, each must be entered separately. For example, if the next two cash flows are 400 and then 500, key [400] [g] [CFj] then [500] [g] [CFj].9If equal cash flows repeat, then the number of equal cash flows can be keyed using [g] [Nj]. For example, if the next five cash flows equal 300 each, key [300] [g] [CFj] [5] [g] [Nj].Up to 20 cash flows can be stored in CF 0 to CF 19. Note that these cash flow registers are shared with the 20 memory registers. If you key [1000] [CHS] [g] [CF 0], -1000 is entered into CF 0 and will overwrite the value in the R 0 register. If you then key [400] [g] [CFj], 400 is entered into CF 1 will overwrite the value in the R 1 register.Example: Following an initial investment of $1,000, you expect cash flows of $400 in one year, $500 in two years, and $600 in three years.Data: What you key: What you see: clear all registers enter CF 0 enter CF 1 enter CF 2 enter CF 3[f] [REG] [1000] [CHS] [g] [CF 0] [400] [g] [CFj] [500] [g] [CFj] [600] [g[ [CFj]0.00-1,000.00 400.00 500.00 600.00You can now perform NPV and IRR calculations using these stored values.To calculate the NPV of the investment, you first need to enter an interest rate using the [i] key. Then key [f] [NPV].Calculation of internal rate of return requires no additional information. Key [f] [IRR].10Example: Continuing the example from above, if the cost of capital is 14.5% per year, what is the NPV and IRR?Data: What you key: What you see:enter interest rate calculate NPV calculate IRR [14.5] [i] [f] [NPV] [f] [IRR] 14.50 130.43 21.65。

利率转换菜单部分所谓利率转换,是指将名义利率转换成有效利率,或者将有效利率转换成名义利率。

这里主要涉及名义利率,有效利率,和复利次数三个变量。

HP12—C不提供专门的利率转化菜单,但是,可以使用货币时间价值菜单,通过计算不同复利情况下的终值,来间接解决此类问题。

例题6如名义年利率为12%,那么,当每年复利次数分别为1, 2和12时,有效年利率各是多少?解答:1)m=1时1 n, 12 i, 100 CHS PV, 0 PMTFV= 112, 100 –, 12 (12/100 等于12%, 下同),因此,有效年利率为12%。

2)m=2时2 n, 12/2 i (按键操作为:12 ENTER 2,÷,i,下同) , 100 CHS PV, 0 PMT,FV=112.3600, 100 –, 12.3600因此,有效年利率为12.36%。

3)m=12时12 n, 12/12 i, 100 CHS PV, 0 PMT,FV=112.6825, 100 –, 12.6825因此,有效年利率为12.6825%。

摊销菜单部分此菜单是在本利均摊的还款方式下,计算各期贷款中的利息、本金,或一段时间之后的本金余额。

共涉及利息,本金和余额三个变量。

对于HP-12C,通过f AMORT调用摊销功能。

例题7王先生向银行申请20年期的住房按揭货款100万元,贷款合同规定的利率为6.39%。

如果王先生选择本利均摊的还款方式,每个月月末支付本利,那么,第11个月当期支付的利息和本金额分别是多少?在在支付第11个月本利后,剩下的贷款余额(即本金余额)是多少?在第12-23个月期间,在王先生支付给银行的款项中,利息和本金分别是多少?在第23个月偿还本利后,剩余的贷款额是多少?解答:1)先计算第11个月的利息,本金和月末余额:第一步,计算每月还款额:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391 (每月支付的本利和为7391元)第二步,设定初始状态(直接按CLX键,下同)0 n,100 PV第三步,计算:10 f AMORT1 f AMORT-0.5212 (第11月支付的利息为5212元)x > < y, -0.2179 (第11个月支付的本金为2179元)RCL PV,97.6659 (第11个月月末的本金余额为976,659元)2)再计算12-23个月的利息总额、本金总额和第23个月月末的本金余额:第一步,计算每月还款额:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391第二步,设定初始状态:0 n, 100 PV (可选项-该步可省略)第三步,计算:11 f AMORT12 f AMORT-6.1626 (第12-23个月支付的利息总额为61,626元)x > < y, -2.7066 (第12-23个月支付的本金总额为27,066元)RCL PV 94.9593 (第23个月月末的本金余额为949,593元)。

一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

另外,还有几个其它的重要指标需要设定:期初或期末年金(g BEG 或g END),每年复利的次数(g i),和每年付款次数(g n)。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV, g ENDPV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV, g ENDFV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?解答:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

例题3如果第1年年初你投资100万元,以后每年年末追加投资8.76万元,希望在第30年年末得到2,000万元。

那么,投资的收益率(必要回报率)必须是多少?解答:30n, 100 CHS PV, 8.76 CHS PMT, 2000 FV, g END,i= 8.0030故必要回报率为8.0030%(严格地讲,应该是>=8.0030%)。

例题4第1年年初投资10万元,以后每年年末追加投资5万元,如果年收益率为6%,那么,在第几年年末,可以得到100万元?解答:6 i, 10 CHS PV, 5 CHS PMT, 100 FV, g END,n= 12故在第12年年末,可得到100万元。

例题5小王出租了一套房屋,每年租金收入2万元,年初收取。

金融计算器_H P-12C使用例题一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

另外,还有几个其它的重要指标需要设定:期初或期末年金(g BEG或g END),每年复利的次数(g i),和每年付款次数(g n)。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV,PV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV,FV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?解答:20 g n, 6.39 g i, 100 PV, 0 FV,PMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

例题3如果第1年年初你投资100万元,以后每年年末追加投资8.76万元,希望在第30年年末得到2,000万元。

那么,投资的收益率(必要回报率)必须是多少?解答:30n, 100 CHS PV, 8.76 CHS PMT, 2000 FV,i= 8.0030故必要回报率为8.0030%(严格地讲,应该是>=8.0030%)。

例题4第1年年初投资10万元,以后每年年末追加投资5万元,如果年收益率为6%,那么,在第几年年末,可以得到100万元?解答:6 i, 10 CHS PV, 5 CHS PMT, 100 FV,n= 12故在第12年年末,可得到100万元。

例题5小王出租了一套房屋,每年租金收入2万元,年初收取。

一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

另外,还有几个其它的重要指标需要设定:期初或期末年金(g BEG 或g END),每年复利的次数(g i),和每年付款次数(g n)。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV, g ENDPV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV, g ENDFV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?解答:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

例题3如果第1年年初你投资100万元,以后每年年末追加投资8.76万元,希望在第30年年末得到2,000万元。

那么,投资的收益率(必要回报率)必须是多少?解答:30n, 100 CHS PV, 8.76 CHS PMT, 2000 FV, g END,i= 8.0030故必要回报率为8.0030%(严格地讲,应该是>=8.0030%)。

例题4第1年年初投资10万元,以后每年年末追加投资5万元,如果年收益率为6%,那么,在第几年年末,可以得到100万元?解答:6 i, 10 CHS PV, 5 CHS PMT, 100 FV, g END,n= 12故在第12年年末,可得到100万元。

小王出租了一套房屋,每年租金收入2万元,年初收取。

如果从第1年年初开始出租,共出租10年,利率为8%。

那么,这10年的租金的现值是多少?在第10年年末的终值又是多少?解答:1)现值:10n, 8i, 2 PMT, 0 FV, g BEG,PV= -14.4938故现值为14.4938万元。

2)终值:10n, 8i, 0 PV, 2 PMT, g BEGFV= -31.2910故终值为31.2910万元。

二、利率转换菜单部分所谓利率转换,是指将名义利率转换成有效利率,或者将有效利率转换成名义利率。

这里主要涉及名义利率,有效利率,和复利次数三个变量。

HP12—C不提供专门的利率转化菜单,但是,可以使用货币时间价值菜单,通过计算不同复利情况下的终值,来间接解决此类问题。

例题6如名义年利率为12%,那么,当每年复利次数分别为1, 2和12时,有效年利率各是多少?解答:1)m=1时1 n, 12 i, 100 CHS PV, 0 PMTFV= 112, 100 –, 12 (12/100 等于12%, 下同),因此,有效年利率为12%。

2)m=2时2 n, 12/2 i (按键操作为:12 ENTER 2,÷, i,下同) , 100 CHS PV, 0 PMT,FV=112.3600,100 –, 12.3600因此,有效年利率为12.36%。

3)m=12时12 n, 12/12 i, 100 CHS PV, 0 PMT,FV=112.6825 100 –, 12.6825因此,有效年利率为12.6825%。

三、摊销菜单部分此菜单是在本利均摊的还款方式下,计算各期贷款中的利息、本金,或一段时间之后的本金余额。

共涉及利息,本金和余额三个变量。

对于HP-12C,通过f AMORT调用摊销功能。

王先生向银行申请20年期的住房按揭货款100万元,贷款合同规定的利率为6.39%。

如果王先生选择本利均摊的还款方式,每个月月末支付本利,那么,第11个月当期支付的利息和本金额分别是多少?在在支付第11个月本利后,剩下的贷款余额(即本金余额)是多少?在第12-23个月期间,在王先生支付给银行的款项中,利息和本金分别是多少?在第23个月偿还本利后,剩余的贷款额是多少?解答:1)先计算第11个月的利息,本金和月末余额:第一步,计算每月还款额:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391 (每月支付的本利和为7391元)第二步,设定初始状态(直接按CLX键,下同)0 n,100 PV第三步,计算:10 f AMORT1 f AMORT-0.5212 (第11月支付的利息为5212元)x > < y, -0.2179 (第11个月支付的本金为2179元)RCL PV,97.6659 (第11个月月末的本金余额为976,659元)2)再计算12-23个月的利息总额、本金总额和第23个月月末的本金余额:第一步,计算每月还款额:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391第二步,设定初始状态:0 n, 100 PV第三步,计算:11 f AMORT12 f AMORT-6.1626 (第12-23个月支付的利息总额为61,626元)x > < y, -2.7066 (第12-23个月支付的本金总额为27,066元)RCL PV 94.9593 (第23个月月末的本金余额为949,593元)四、现金流菜单操作现金流菜单主要解决不规则现金流的净现值和内部回报率。

例题8李小姐在某项目上的初始投资为20万元。

在5年当中,第1年年末追加投资2万元,第2年盈利3万元,第3年盈利8万元,第4年亏损1万元,第5年盈利6万余,并在第5年年末出售该项目,获得24万元。

如果贴现率为10%,请问李小姐投资该项目是否赚钱了?第一步, 输入数据:20 CHS g CFO (即白色的PV键,下同)2 CHS g CFj(即白色的PMT键,下同)3 g CFj8 g CFj1 CHS g CFj30 g CFj第二步,计算:10 if NPV = 4.6163 (净现值大于0,所以赚钱)例题9何先生在某项目上的初始投资为200万元。

在前3年,每年盈利15万元;第4年至第8年,每年盈利30万元;第9年至第10年,每年盈利20万元,并在第10年末出售该项目,获得150万元。

请计算该项目的内部回报率。

并且如果何先生的融资成本是10%,问投资该项目是否赚钱了?解答:第一步, 输入数据:200 CHS g CFO15 g CFj, 3(前三年)g Nj (即白色的FV键,下同)30 g CFj, 5(4至8年)g Nj20 g CFj (第9年现金流)170 g CFj (第10年现金流)第二步,计算:fIRR= 9.7298 (小于融资成本,故赔钱)五、统计菜单操作统计菜单主要用于计算预期收益率、收益率标准差估计值、估计相关系数、阿尔法和贝塔系数等。

例题10表1种列明了某股票2001-2006年的收益率。

请估计该股票的预期收益率。

表1年份收益率年份收益率2001 20% 2004 5%2002 15% 2005 20%2003 -6% 2006 -10%解答:f CLEAR∑20∑+,15∑+, 6 CHS ∑+, 5∑+, 20∑+, 10 CHS ∑+g X = 7.3333根据表2中的数据,预测该股票的预期收益率表2经济状态收益率概率复苏10% .3繁荣20% .2衰退8% .4萧条-4% .1解答:f CLEAR∑10 ENTER .3∑+,20 ENTER .2 ∑+, 8 ENTER .4∑+, 4 CHS ENTER .1∑+g Xw = 9.8例题12根据表3中的历史样本数据,估计该资产预期收益率的标准差。

表3年份收益率年份收益率2001 20% 2004 5%2002 15% 2005 20%2003 -6% 2006 -10%解答:f CLEAR∑20∑+,15∑+, 6 CHS ∑+, 5∑+, 20∑+, 10 CHS∑+g s = 13.1403 (标准差为13.1403%)例题13根据表5种数据,估计两项资产的协方差表4经济状态A-收益率B-收益率1 10% -20%2 20% 30%3 -5% 5%4 30% 17%5 -10% -18% 解答:f CLEAR∑10 ENTER 20 CHS ∑+, 20 ENTER 30 ∑+, …… 10 CHS ENTER 18 CHS ∑+g s =21.7876 (资产B的标准差为21.7876%)x > < y, 16.7332 (资产A的标准差为16.7332%)0 g ý, r, x> < y, 0.6439(资产A和资产B的相关系数)例题14根据表4,估计A和B两项资产的协方差。

表5经济状态 A B 概率1 7% -11% 20%2 18% 20% 20%3 23% -30% 20%4 -10% 60% 20%5 6% -5% 20% 注:HP-12C 不能计算不等概率情况下的标准差。

故如果出现,只能用标准差公式计算。

解答:f CLEAR ∑7 ENTER 11CHS ∑+,18 ENGER 20 ∑+,…… 6 ENTER 5 CHS ∑+,g X ∑+ (将平均值输入,并增加一组数据,因为HP-12C默认的分母是N-1)g s =31.0316 (资产B的标准差为31.0316%)x > < y, 11.4088 (资产A的标准差为11.4088%)0 g ý, r, x> < y, -0.7548(资产A和资产B的相关系数)例题15根据表6,估计资产A的β系数。

表6年份RA RM1 20% 12%2 -7% 8%3 29% 11%4 -10% -8%5 15% 6%解答:f CLEAR∑20 ENTER 12 ∑+, 7 CHS ENTER 12 ∑+, …… 15 ENTER 6 ∑+0 g ý, r, 0.4954 (常数值—以市场收益作为横轴、资产收益作为纵轴时,α的估计值不准确)1 g ý,r, 2.0307 (常数值与β估计值之和)β=2.0307-0.4954=1.5353例题16根据表7中的数据,估计资产A的α和β系数。

表7年份某资产的风险溢价市场的风险溢价1 17% 9%2 -10% 8%3 26% 11%4 -13% -11%5 12% 3%解答:f CLEAR∑17 ENTER 9 ∑+, 10 CHS ENTER 8 ∑+, …… 12 ENTER 3 ∑+0 g ý, r, 1.2101 (α值为1.2101%,以市场风险溢价作为横轴、资产风险溢价作为纵轴时,所描述的就是证券市场线SCL,故α的估计值和β的估计值均有效)1 g ý, r,2.5076 (α值与和β值之和)β=2.5076-1.2101=1.2975六、日期菜单操作该菜单主要用来计算两个日期之间的时间间隔(天数)。