高盛Goldman Sachs自上而下选股框架--宏观和微观相结合120611

- 格式:pdf

- 大小:1.17 MB

- 文档页数:43

证券分析读书笔记目录一、内容综述 (3)1.1 证券分析的重要性和基础知识 (4)1.2 研究背景及研究目的 (5)1.3 研究方法和预期贡献 (6)二、财务报表分析 (7)2.1 理解财务报表的基本要素和结构 (8)2.2 财务比率分析简介 (9)2.3 现金流量分析的重要性与方法 (10)2.4 财务报表中的异常现象与分析 (12)2.5 案例分析 (13)三、公司基本面分析 (14)3.1 公司概况与行业定位 (15)3.2 公司的核心竞争力分析 (17)3.3 同业竞争分析与市场份额评估 (18)3.4 宏观经济与行业周期性影响 (19)3.5 宏观政策与行业发展前景分析 (21)四、定量分析与决策支持 (22)4.1 预测模型应用的原理与方法 (24)4.2 风险评估与管理技术 (25)4.3 金融工程在证券分析中的应用 (27)4.4 机器学习与大数据技术在证券投资中的应用 (28)4.5 投资组合理论在多资产配置中的应用 (30)五、技术分析框架与工具 (31)5.1 技术分析的基本理论框架 (32)5.2 技术分析的主要工具与图表 (33)5.3 技术指标的使用与定制 (35)5.4 交易策略设计与风险控制 (36)5.5 实证研究与技术分析的案例分析 (38)六、投资者情绪与市场心理学 (40)6.1 投资者情绪理论基础 (42)6.2 市场心理学的基本概念与方法 (43)6.3 群体行为与股票市场现象 (44)6.4 情绪指标在决策中的应用 (46)6.5 应对市场情绪波动的策略 (47)七、可持续性与社会责任投资分析 (49)八、总结与展望 (50)8.1 证券分析的综合应用与效用评估 (51)8.2 未来证券分析研究与技术的发展趋势 (52)8.3 证券分析研究对投资者与市场的影响测试 (54)一、内容综述《证券分析》一书主要围绕证券分析的理论与实践进行深入探讨,内容涵盖了证券分析的基本概念、分析方法、市场预测、风险管理以及投资心理等方面。

《大势投资:A股超额收益行业与选股策略》阅读记录目录一、内容综述 (2)1. 投资的重要性 (3)2. 股市投资的挑战与机遇 (4)3. 本书的目的和结构 (5)二、A股市场概述 (6)1. A股市场的特点 (8)2. A股市场的参与者 (9)3. A股市场的监管环境 (10)三、行业分析 (10)1. 行业分类 (12)2. 行业趋势 (13)3. 行业分析的方法 (14)4. 行业超额收益的来源 (15)四、选股策略 (17)1. 选股的重要性 (18)2. 选股策略的原则 (19)3. 常见的选股指标 (21)4. 选股策略的实施步骤 (22)五、A股超额收益的实现方式 (23)1. 宏观经济因素 (25)2. 行业因素 (26)3. 公司因素 (27)4. 技术面分析 (28)六、投资案例分析 (29)1. 股市典型案例分析 (31)2. 持续观察的投资案例 (32)3. 投资心得分享 (33)一、内容综述在阅读《大势投资:A股超额收益行业与选股策略》我对整体内容进行了综合评述。

本书首先对当前A股市场的大势进行了深入剖析,详细分析了市场走势背后的宏观经济、政策导向以及国际经济环境等多方面的因素。

通过对市场趋势的准确把握,书中提出了一些关于未来具有潜在超额收益的行业预测和趋势判断。

这不仅为我提供了一个了解市场的窗口,也为我的投资决策提供了有价值的参考。

本书特别强调了选股策略的重要性,在了解大势的基础上,如何选择具备增长潜力、能够带来超额收益的股票是每位投资者都需要面对的问题。

书中详细介绍了多种选股方法,包括基本面分析、技术分析、行业轮动策略等,并对每种策略的优势与不足进行了深入探讨。

这些内容不仅让我对选股策略有了更深入的理解,也为我在实际操作中提供了多种思路和方法。

书中还提到了风险管理的重要性,在追求超额收益的同时,如何合理控制风险是每个投资者必须考虑的问题。

书中介绍了多种风险管理方法,包括仓位管理、止损策略等,为我在实际操作中提供了宝贵的经验。

戈氏提出的金融结构指标-概述说明以及解释1.引言1.1 概述金融结构指标是金融领域中的一项重要指标,它可以用来衡量和评估一个国家或地区金融体系的稳定性、结构合理性和发展状况。

戈氏提出的金融结构指标是指由经济学家罗伯特·戈(Robert G. King)在其相关研究中提出的一系列衡量金融结构的指标。

戈氏提出的金融结构指标主要包括金融机构的规模、金融机构的种类、金融市场的深度和金融产品的创新程度等方面。

这些指标能够反映一个国家或地区金融体系的基本组成和运行状况。

金融结构是一个国家或地区经济发展的重要组成部分,它直接关系到金融市场的有效性、金融体系的稳定性以及经济的增长潜力。

因此,研究金融结构指标对于深入了解金融体系的结构和运行机制,有效发挥金融市场的功能,提升金融体系的效率具有重要意义。

本文将以戈氏提出的金融结构指标为切入点,通过对相关研究文献的综述和分析,探讨金融结构指标在金融体系评估和监管中的应用,以及其对于金融体系发展的影响。

同时,将通过对不同国家或地区金融结构指标的比较,探讨金融体系结构在国际间的差异和相关因素。

最后,本文将总结戈氏提出的金融结构指标的优势和局限性,以及对未来研究的展望。

文章结构部分的内容如下:1.2 文章结构本文以戈氏提出的金融结构指标为主题,分为引言、正文和结论三个部分。

下面将详细介绍各个部分的内容。

引言部分概述了本文的主题,即戈氏提出的金融结构指标。

通过引言,读者可以对文章的主要内容有一个初步的了解。

接下来是正文部分,主要包括戈氏提出的金融结构指标的介绍以及对其要点的讨论。

在2.1节中,将对戈氏提出的金融结构指标进行详细的解释,包括其定义、计算方法和应用场景等内容。

在2.2和2.3节中,则将分别对戈氏提出的金融结构指标的要点1和要点2展开讨论,深入探讨其对金融行业的影响和应用价值。

最后是结论部分,总结了本文对戈氏提出的金融结构指标的研究,并提出了其研究意义。

在3.1节中,对本文的主要观点和结论进行了总结,简洁明了地概括了文章的主要内容。

根据黄金的货币性需求Dm(etf的买盘和央行的卖盘)和投机头寸??和实际利率在决定采矿中的机会成本OC,可以预测黄金价格P低Ir,支撑黄金价格在高位运行。

Ir保持不变,ETF买盘缓慢减少到去年水平,金价将温和上涨Ir降低或者ETF买盘保持跟目前一样活跃,价格有显著上行风险。

Dm在黄金价格波动中起决定作用,这包括央行在90年代末的黄金卖盘抑制金价(负需求)+ETF买盘使金价两次超过1000美金。

历史金价分析基于Dm。

本框架作为补充,长期来看,黄金价格由供应决定。

Ir决定金矿开采的主要机会成本。

货币框架:金价作为一种价值储备和外汇媒介,由潜在替代(美元等)来标价价格驱动为汇率,金融风险(由高风险政府和金融机构的信用违约互换率来衡量)商品框架:金价由边际供应成本和边际购买意愿价格决定价格驱动为Ir,CPI,对黄金需求的流动。

商品框架解释了3个程式化的共识:●长周期下地购买力稳定:P(经过CPI调整)在历史上的稳定。

用2008年美元计价的话,100年来黄金真实均价(Pr)为420美金,1盎司金购买力变化不大。

(供给)●长周期下,金价跟Ir之间的方向运动(供给)●金融危机下,金价因为Dm上升而上涨(需求)其实Pr变动挺大的(图2)黄金基本面的历史行为:●最近30年来,金矿开采量跟随Ir变动●Dm(实物黄金)的需求在金融危机中增长。

●工业需求Dn基本稳定,随金价变动供给:边际开采成本=实际开采费用(Realized exaction cost)+留待将来开采的机会成本Cof长期Pr的稳定,说明实际开采费用随着CPI增长。

金矿开采量跟随Ir变动,说明Cof随着Ir变动。

极端假设,当前Ir极度高,导致Cof极度低(早开采增加的利润极多),导致当前开采意愿极度高。

金矿开采包括探矿,开采,冶炼。

当Ir极度高的时候,人们探矿开矿冶炼的积极性最高,为什么呢?还是作者的假设里面,金矿是全部探明的?需求:Dm由观察到的金融危机程度所决定。

《驾驭周期:自上而下的投资逻辑》读书笔记目录一、内容概括 (2)二、关于《驾驭周期 (3)三、内容概览 (4)3.1 作者介绍与投资背景 (5)3.2 《驾驭周期》的核心观点 (7)3.3 书中投资逻辑分析 (8)四、自上而下投资逻辑解读 (9)4.1 自上而下的投资理念 (11)4.2 投资周期与阶段分析 (11)4.3 风险管理与策略调整 (13)五、案例分析 (15)5.1 案例背景介绍 (16)5.2 案例分析过程 (18)5.3 案例分析结论与启示 (19)六、书中亮点与个人感悟 (20)6.1 书中亮点分析 (21)6.2 个人感悟与心得体会 (22)七、实践应用与拓展思考 (23)7.1 如何将书中的投资逻辑应用到实际中 (25)7.2 拓展思考 (27)八、总结 (28)8.1 本书主要观点回顾 (29)8.2 对自己的启示与展望 (30)一、内容概括引言:介绍了市场周期的存在和投资策略的重要性。

市场周期是不可避免的,投资者需要学会识别并适应这些周期,以获取长期的投资回报。

自上而下的投资逻辑:详细阐述了自上而下的投资策略,即先从宏观角度入手分析市场趋势,再逐步细化到具体行业和个股的选择。

作者强调了自上而下投资策略的重要性,并指出这是驾驭市场周期的关键。

宏观经济分析:介绍了如何进行宏观经济分析,包括经济周期、政策变化、国际形势等因素对投资的影响。

宏观经济分析是投资者做出投资决策的重要依据。

行业分析:讲解了如何根据宏观经济情况分析行业发展趋势,以及如何选择具有潜力的行业进行投资。

行业分析是连接宏观经济和个股选择的桥梁。

个股选择:在行业和宏观经济分析的基础上,介绍了如何对个股进行价值评估。

作者强调了基本面分析的重要性,并提供了实用的个股选择方法。

风险管理:讲解了如何运用风险管理策略来降低投资风险。

投资者需要根据自身的风险承受能力来制定合适的风险管理策略。

投资心态与决策过程:探讨了投资心态对投资决策的影响,以及如何培养正确的投资心态。

goldman指数名词解释

Goldman指数是指由高盛集团(Goldman Sachs)所开发和发布的一种金融指标。

这一指数通常用来衡量特定市场或行业的变化和表现。

它是通过对相关数据进行研究和分析而得出的。

Goldman指数的发布有时会引起市场的关注和投资者的反应。

与其他金融指数类似,Goldman指数可以用来追踪和比较不同市场或行业的趋势。

它可以帮助投资者更好地了解市场和行业的表现,以便做出更明智的投资决策。

Goldman指数的涵盖范围广泛,可以涉及股票市场、固定收益市场、商品市场等。

它的发布频率可以是每日、每周或每月,取决于具体的指数类型。

尽管Goldman指数在金融世界中有一定的影响力,但投资者使用该指数时仍应综合考虑其他因素,并谨慎决策。

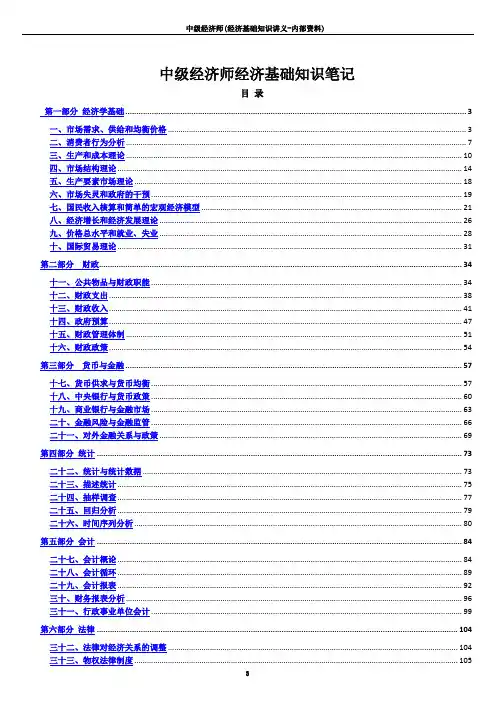

中级经济师经济基础知识笔记目录第一部分经济学基础 (3)一、市场需求、供给和均衡价格 (3)二、消费者行为分析 (7)三、生产和成本理论 (10)四、市场结构理论 (14)五、生产要素市场理论 (18)六、市场失灵和政府的干预 (19)七、国民收入核算和简单的宏观经济模型 (21)八、经济增长和经济发展理论 (26)九、价格总水平和就业、失业 (28)十、国际贸易理论 (31)第二部分财政 (34)十一、公共物品与财政职能 (34)十二、财政支出 (38)十三、财政收入 (41)十四、政府预算 (47)十五、财政管理体制 (51)十六、财政政策 (54)第三部分货币与金融 (57)十七、货币供求与货币均衡 (57)十八、中央银行与货币政策 (60)十九、商业银行与金融市场 (63)二十、金融风险与金融监管 (66)二十一、对外金融关系与政策 (69)第四部分统计 (73)二十二、统计与统计数据 (73)二十三、描述统计 (75)二十四、抽样调查 (77)二十五、回归分析 (79)二十六、时间序列分析 (80)第五部分会计 (84)二十七、会计概论 (84)二十八、会计循环 (89)二十九、会计报表 (92)三十、财务报表分析 (96)三十一、行政事业单位会计 (99)第六部分法律 (104)三十二、法律对经济关系的调整 (104)三十三、物权法律制度 (105)3三十四、合同法律制度 (110)三十五、公司法律制度 (115)三十六、其他法律制度 (119)经济基础知识笔记(重点标识版)第一部分经济学基础一、市场需求、供给和均衡价格1、需求的含义:需求是在一定时间内和一定价格条件下,消费者对某种商品或服务愿意而且能够购买的数量。

需求的构成要素有两个:一是购买欲望;二是支付能力。

2购买的数量。

市场需求是消费者需求的总和。

3、决定需求的基本因素和影响①消费者的偏好。

消费者偏好支配着他在使用价值相同或接近的替代品之间的消费选择。

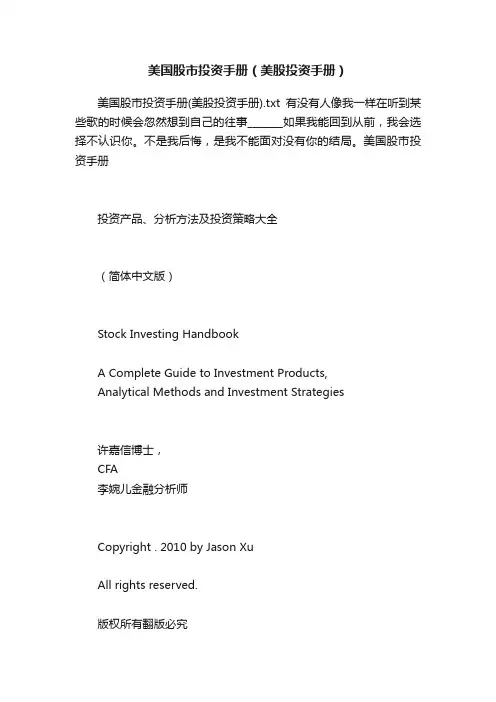

美国股市投资手册(美股投资手册)美国股市投资手册(美股投资手册).txt有没有人像我一样在听到某些歌的时候会忽然想到自己的往事_______如果我能回到从前,我会选择不认识你。

不是我后悔,是我不能面对没有你的结局。

美国股市投资手册投资产品、分析方法及投资策略大全(简体中文版)Stock Investing HandbookA Complete Guide to Investment Products,Analytical Methods and Investment Strategies许嘉信博士,CFA李婉儿金融分析师Copyright . 2010 by Jason XuAll rights reserved.版权所有翻版必究Limit of Liability/Disclaimer of Warranty: While the publisher and author have triedtheir best in preparing this book, they make no representations or warranties withrespect to the accuracy or completeness of the contents of this book and specificallydisclaim any implied warranties of merchantability or fitness for a particular purpose.No warranty may be created or extended by sales representatives. Neither thepublisher nor author shall be liable for any loss of profit or any other commercialdamages.免责声明:本书作者及出版社已尽力确保内容的准确性和完整性。

企业ESG与机构投资者持股目录一、内容概括 (2)1.1 研究背景 (3)1.2 研究意义 (3)1.3 研究方法与数据来源 (5)二、文献综述 (6)2.1 ESG投资概念及发展历程 (8)2.2 机构投资者的定义与特点 (9)2.3 ESG投资与机构投资者持股的关系 (10)2.4 文献评述与研究空间 (12)三、理论分析 (13)3.1 ESG投资理论基础 (15)3.2 机构投资者投资理念与策略 (17)3.3 ESG投资与机构投资者持股的互动机制 (18)四、研究设计 (20)4.1 研究假设 (21)4.2 模型构建 (22)4.3 变量定义与数据来源 (23)4.4 描述性统计与相关性分析 (24)五、实证分析 (25)5.1 实证模型选择 (26)5.2 实证结果 (27)5.3 结果讨论 (28)5.4 稳健性检验 (29)六、结论与建议 (30)6.1 研究结论 (31)6.2 对企业的建议 (32)6.3 对机构投资者的建议 (33)6.4 研究局限与未来展望 (34)一、内容概括本文档旨在探讨企业ESG(环境、社会和公司治理)与机构投资者持股之间的关系。

我们将介绍ESG投资的概念及其对企业价值的影响。

我们将分析机构投资者在ESG投资中的角色和行为,以及他们如何影响企业的ESG表现。

我们将讨论企业如何通过提高ESG绩效来吸引和留住机构投资者,从而实现可持续发展和长期价值创造。

ESG投资的背景和趋势:分析全球范围内ESG投资的发展趋势,以及不同国家和地区在ESG投资方面的政策和法规。

ESG投资的重要性:阐述ESG投资对企业价值、风险管理和长期竞争力的重要性,以及为什么越来越多的机构投资者开始关注ESG投资。

机构投资者的角色和行为:分析机构投资者在ESG投资中的决策过程、投资策略和评估方法,以及他们如何影响企业的ESG表现。

企业ESG绩效与机构投资者持股的关系:研究企业ESG绩效与机构投资者持股之间的关系,以及这种关系对企业价值和长期竞争力的影响。

《战胜华尔街:彼得林奇选股实录》读书记录目录一、内容概览 (2)1.1 书籍简介 (3)1.2 作者背景 (4)二、选股策略 (4)2.1 基本原则 (6)2.2 行业分析 (7)2.3 公司分析 (8)2.4 财务指标 (10)三、股票选择与投资组合管理 (11)3.1 优选股票 (12)3.2 投资组合的构建与调整 (13)3.3 风险控制 (14)四、实战案例分析 (15)4.1 案例一 (16)4.1.1 公司概况 (17)4.1.2 投资过程 (18)4.1.3 结果分析 (20)4.2 案例二 (21)4.2.1 公司概况 (22)4.2.2 投资过程 (23)4.2.3 结果分析 (24)五、总结与启示 (25)5.1 本书总结 (26)5.2 对投资者的启示 (27)一、内容概览《战胜华尔街:彼得林奇选股实录》是一本关于投资策略和股票市场的经典著作。

本书由著名的投资家彼得林奇所著,书中详细阐述了林奇的投资哲学、选股方法和实战案例。

读者可以深入了解股票市场的基本原理和投资技巧,以及如何在激烈的市场竞争中取得优势。

投资哲学:介绍了彼得林奇的投资理念,包括长期投资、价值投资、成长股投资等。

成功的投资需要坚定的信念和长期的投资视野,同时要注重基本面分析和风险控制。

选股方法:详细阐述了林奇的选股策略,包括行业选择、公司分析、财务分析、市场趋势分析等方面。

林奇注重从多个角度对股票进行全面分析,以寻找具有成长潜力和价值优势的投资标的。

实战案例:通过多个实际案例,展示了林奇的投资过程和决策依据,让读者了解如何在实战中应用选股方法和投资哲学。

这些案例包括成功和失败的案例,让读者从中学到经验和教训。

市场趋势:分析了股票市场的历史演变和未来发展趋势,以及投资者如何应对市场变化。

要灵活应对市场变化,不断调整投资策略和组合配置。

本书不仅适合投资者阅读,也适合金融从业人员、经济学者等人士参考。

通过阅读本书,读者可以深入了解股票市场的运作机制和投资技巧,提高自己的投资能力和风险意识。

私募基金策略研究——全球宏观策略 2011年05月30日 16:26 新浪财经一、全球宏观对冲基金的概念全球宏观对冲基金,指利用宏观经济的基本原理来识别金融资产价格的失衡错配现象,在世界范围内,在外汇、股票、债券、期货及期权上进行杠杆性押注,以期获得高额收益的基金。

此类对冲基金投资的最佳时机往往是国际政治经济的重大事件发生,国际政治经济局势动荡的时候,此时市场价格动荡起伏,宏观对冲策略往往能够获得高额收益。

二、主要投资策略全球宏观对冲基金的管理人认为,宏观经济周期的波动具有很强的持续性,完成一个完整的经济周期往往需要数年的时间。

宏观经济周期的持续性带来市场价格波动的持续性,在较长的时间段,股票、债券及外汇市场通常跟随经济形势发生大幅度长时间的趋势性运动,这是全球宏观对冲基金盈利的理论基础。

概括地说,全球宏观对冲基金重要的投资方法就是“美林证券经济时钟理论”。

图1 美林证券经济时钟理论具体来说,全球宏观对冲基金首先会根据各项经济指标判断当前经济所处的周期以及大致持续的时间,然后根据经济周期选择相应的投资品种。

全球宏观对冲基金主要通过对大类资产的选择获取收益。

在经济复苏阶段,会选择股票进行投资,在经济过热阶段投资大宗商品,在经济滞涨阶段会持有现金,在经济衰退阶段会投资债券。

全球宏观对冲基金的另一种重要的操作手法是利用国际经济发生重大事件引起的资产价格的剧烈波动,这些事件所引起的宏观经济指标的变化在很大程度上必然导致了相关国家主权货币汇率、股票、债券价格的重估,市场波动剧烈下,押注正确的宏观对冲基金往往获取惊人回报。

三、投资范围选择全球宏观对冲基金的策略拥有所有对冲基金策略中最广阔的操作空间,能够在全球范围各个商品品种上进行投资。

这种基金的投资策略可以说是多变的。

他们可以单向多头,也可以单向空头,还会选择对冲操作。

宏观对冲基金会对宏观指标对资产价格的影响效应进行分析,选择波动最为强烈的市场进行杠杆性投资操作。

解套课堂45自上而下与自下而上的选股精华〔上〕此时股民会疑问了,前面说到了自上而下,自下而上,这两类选股方式,终究有何利弊?又有什么选股的微妙呢?应该如何应用?简单来说,“自上而下〞的选股主要通过从市场趋势、根本面、资金面的顶层因素对市场热点和行情特点进展第一步的挑选,然后选择到好的选股思路到板块,最后到个股。

而“自下而上〞的选股那么是直接从个股入手,通过对个股的价值点进展深度挖掘和调研,将其扩散,不断地叠加市场其他因素来为自己的选股增加根据。

图3-18自上而下与自下而上选股方式的优势与优势很显然,两种方式各有优势和优势,如图3-18。

“自上而下〞选股的优势在于以下三点:时效性更强,因为其是从当下的市场资金动态特点出发,找寻当下即出现牛股价值的个股;成功率更高,其是从市场趋势和相关价值点的进展个股的挖掘,各类因素的配合会让牛股的成色更高,最重要的是其挖掘的是牛股群,而不是单一的个股,这样对股民来说大大提升了选股的成功率;操作性更强,自上而下过程中,采用的都是固定的股市规律与机制,可反复利用,且有据可查,买卖都有固定的法那么,进步了操作的效率。

自上而下的优势在于:初期有门槛,即初期需要一定的根底知识和功课的累积,需要有一定量的精力消耗,需要严格地按照操作的流程进展操作,这两点看上去不算是优势,但我们要知道对很多股民来说纪律性差和惰性强是弱点,而“自上而下〞选股方式的初期,恰恰就是需要股民做一些不能马上见效的工作,需要理解整个股市运行的机制,需要搜索股市动态,需要按照步骤进展一步步的分析,做出方案,但这样的好处是随着股民使用过程中的积累,那么每次消耗的时间越来越少,很多功课做一次往往就可反复利用了。

比方说前面在第二章的投资品种篇,笔者给大家分析过很多板块内个股的股性,这些只需做一次功课就是使用很屡次,提到哪个板块马上就知道其板块内短线个股是哪些,适宜波段操作的个股是哪些,长线品种又是哪些。

因此可以说自上而下的选股是一个纯熟工种,其不会产生太大的瓶颈,一旦度过了初期的门槛就会非常顺畅,由于其成功率在于股民自身知识的储藏,你积累的经历越多,你将来获得财富也就越多,因为一切都是来源于股民自身才能,其可靠度很强。

自上而下选股技巧

自上而下选股是指从全局宏观经济形势出发,结合行业分析、公司基本面及技术面等

诸多因素,以看清市场走势、挖掘优质板块和个股的选股方式。

首先,投资者需要把握宏观经济形势,了解市场走势和政策走向。

经济面对于整个市

场的影响是至关重要的,大范围的宏观经济形势往往能预示市场的未来趋势。

例如,经济

发展的潜力较大,政策较为支持的行业将更容易受到市场的青睐和重视。

其次,选择行业是整个自上而下选股策略的核心。

市场中的行业是长时间大涨和大跌

的主体,不同行业的繁荣与萧条周期也不同,所以行业的选择至关重要。

例如,近年来的

互联网行业就是一个极好的例子,这个行业的快速发展,成为整个市场的领头羊。

最后,考虑公司的基本面和技术面。

基本面是公司估值的关键指标,而技术面则代表

短期市场情绪。

投资者在选择股票时应注重公司的基本面,例如增长性、竞争优势、管理

层的能力等等,以此来找到优质的公司。

而技术面则需要分析股票的短期走势和市场情绪,选择相应的止盈和止损策略。

总之,自上而下选股是一个综合的选股方法,需要考虑到镜头最大化,从大的全局经

济角度开始考虑,逐步深入到行业和个股层面。

经过长期稳定的策略,投资者可以朝自己

所预想的方向推进,从而实现良好的回报。

2012611证券研究报告将宏观观点转化为选股建议的工具 我们推出了一套基于宏观因素描绘、微观层面比较以及对商业周期各阶段投资分析的自上而下选股框架,从而将宏观观点与微观投资建议相关联。

宏观和微观因素对于回报都非常重要 对于亚洲市场上市值占比60%左右的股票而言,宏观因素(如全球经济增速、本地经济增速和金融状况)都是重要的回报推动因素。

此外,估值、每股盈利市场共识预测调整以及技术性指标等微观因素也与随后3个月的回报高度相关。

宏观 + 微观 = 超额收益 对于全球领先指标(GLI)中定义的四阶段商业周期,我们基于各阶段的宏观和微观特征对股票进行筛选。

回溯测试显示,采用这种方法获得的回报有望超过传统买入/持有策略带来的回报。

经济衰退阶段的选股:降低贝塔值和对增长的敏感性;买入受益于政策放松的股票 我们的GLI 指标显示,自4月份以来我们已进入经济衰退阶段。

在此背景下,我们特别关注于受宏观面影响和微观面支撑的程度处于适当水平的股票:NAB 、Orica 、恒安国际、中石油、腾讯控股、长江实业、恒生银行、HDFC 、ITC 、BRI 、LS Corp 、Shinhan 、CIMB 、SM Inv.、JCC 、Delta 、TSMC 和BK Bank 。

我们将定期更新这些股票建议。

对部分市场的部分板块采用自上而下的选股框架 资料来源:FactSet 、MSCI 、CEIC 、高盛全球经济商品和策略研究 刘劲津, CFA+852-2978-1224 u@高盛(亚洲)有限责任公司慕天辉, CFA+852-2978-1328 timothy.moe@高盛(亚洲)有限责任公司Caesar Maasry+852-2978-7213 caesar.maasry@高盛(亚洲)有限责任公司鄧啟志+852-2978-0722 richard.tang@ 高盛(亚洲)有限责任公司Sunil Koul+852-2978-0924 sunil.koul@高盛(亚洲)有限责任公司高盛与其研究报告所分析的企业存在业务关系,并且继续寻求发展这些关系。

因此,投资者应当考虑到本公司可能存在可能影响本报告客观性的利益冲突,不应视本报告为作出投资决策的唯一因素。

有关分析师的申明和其他重要信息,见信息披露附录,或参阅/research/hedge.html 。

由非美国附属公司聘用的分析师不是美国FINRA 的注册/合格研究分析师。

本报告仅供分发给高盛机构客户。

Introducing GS top-down stock picking frameworkIn this report, we introduce a framework to help connect the macro environment tosingle stock selection.Specifically, we believe this framework would be helpful to:∙Formalize our existing top-down stock picking logic and approach in adisciplined and statistically-tested manner that is also intuitivelyappealing∙Better comprehend how macro factors influence individual stock returnsand help connect macro trends to actionable stock ideas∙Expand our implementation focus to include more single stock ideas aswell as theme baskets and derivative overlays∙Complement our sector analysts’ views and our bottom-up stockselection processes such as Asia-Pacific Conviction Lists and GS Sustain, whichfocus principally on operating returns and industry position∙Provide a tool which can add further perspective to investors’ own stockselection processesThe exhibit below summarizes the key building blocks and logic flow in this report.The key building blocks and approach of our stock-selection frameworkSource: FactSet, I/B/E/S, Goldman Sachs Global ECS Research estimates.Executive summaryTop-down and bottom-up are the two prevalent approaches to securities analysis. However,neither is perfect— macro-focused investors may overlook micro factors and industry dynamicswhile stock pickers may sometimes miss the big picture.With an objective of combining the two approaches and translating macro views into actionablestock ideas (and, hopefully, good returns), we introduce a top-down stock selection frameworkwhich builds upon macro factor profiling, micro specific comparisons, and business-cycle-based investing.Key conclusions and investment implications in this report are:1.Macro analysis is important, even to stock pickers. Our regression model showsselect macroeconomic factors are statistically significant return drivers (R²>40%) foraround 250 stocks in Asia, representing 58% of MXAPJ market cap. Thisunderscores the importance of macro analysis even to bottom-up-oriented investors. Macro analysis is particularly effective in Hong Kong, China,Singapore, and sectors including energy, financials, and materials.2. Some macro variables are more important than others. Investors can beoverwhelmed by macro data, but many macroeconomic variables are highly correlated.Stock pickers can simplify the process of macro monitoring by focusing on six factors,namely, market risk, local growth, policy/liquidity, CPI, oil prices, and globalgrowth.3.Micro specifics have linked well with ensuing returns. Empirically, microconsiderations such as valuation, consensus EPS and target price changes, andtechnical entry levels have shown very strong relationships with ensuing 3-monthreturns. These micro considerations complement the macro perspective and addressthe extent to which fundamentals are discounted in share prices.4.Our two-tier stock selection strategy may help performance. We haveestablished a trading algorithm based on our global leading indicator and its derivedbusiness cycle— expansion, slowdown, contraction, and recovery— toimplement our macro and micro analysis. Backtests of our two-tier strategysuggest performance can be enhanced to a meaningful extent byconsidering these macro and micro factors.5. Useful tool. This framework is flexible and can complement the investment process fordifferent types of investors.Caveats: A tool, not a cure-allWe believe this approach adds value, but we also recognize its limitations.Regression models are static and assume mean-reversion, and need to beupdated and refined to adapt to changing fundamentals.Stock ideas: Investing in a contraction phaseThe latest GLI reading suggests the global economy has entered a contraction phase. Againstthis backdrop, we would:a. Reduce market risk “beta”;b. Buy stocks with low sensitivity to local growth;c. Accumulate policy easing beneficiaries;d. Own stocks that may outperform in a disinflationary environment;e. Buy stocks that may benefit from lower oil prices;f. Overweight stocks that are less sensitive to global growth momentum.Stocks which have these macro characteristics and have shown favorable micro readings areshown in Exhibit 1. Exhibit 1: We like these stocks because of their favorable macro exposure and compelling micro profile relative to their regional peersStock recommendations for June 2012 (Priced as of June 5)Note (1): These stocks are rated Buy or Neutral by Goldman Sachs Research except SM Investments which is NC. We use consensus estimates for SM Investments. Note (2): * denotes the stock is on our regional Conviction List. “Tick” indicates stock that ranks top-30 percentile within each factor relative to its market peers and they perform well in our specified macro environment. Revisions and sentiment are based on forward 12-month consensus EPS.Source: Factset, I/B/E/S, Goldman Sachs Global ECS Research estimates.Key exhibits for chart loversWe highlight the important exhibits (takeaways) as follows:∙ Exhibit 7: Where top-down analysis may be more applicable in terms of markets andsectors.∙ Exhibit 8: Stocks that are the most and least sensitive to different macro factors acrossmarkets.∙ Exhibit 17: The empirical relationships between micro parameters and ensuing returns.∙ Exhibits 28 to 38: Market summary pages which detail the factor loading for each stockunder our study universe.Part 1: Mapping stock returns to macro exposureDefining our study universeTo ensure the practicability of the regression results, we choose to focus on MXAPJ constituentswith at least US$1bn of index market cap, over US$5mn of average daily value traded (ADVT) inthe past 6 months, and at least 5 years of listing history. There are 412 stocks in MXAPJwhich fit these requirements (as of April 30, 2012) and they represent 86% ofMXAPJ index market cap . These stocks are mostly located in Australia, China, Koreaand India , with a sector concentration in financials, IT and telecoms (Exhibits 2 and 3). Exhibit 2: Liquid, large-cap stocks are mostly found in Australia, China, Korea and India Free-float market cap distribution by marketsExhibit 3: ...and they are concentrated in sectors including financials, IT, and telecoms Free-float market cap distribution by sectorsSource: FactSet, MSCI, Goldman Sachs Global ECS Research. Source: FactSet, MSCI, Goldman Sachs Global ECS Research.Defining the dependent variables (returns)We choose 3-month price returns as the dependent variable in our regression model as weattempt to strike a balance between high frequency trading and the “buy-and-hold” approach.Returns are quoted in local currency , on our assumption that foreign investors should treatthe currency decisions separately from the stock selection decisions and the impact of FXchanges could be partly reflected/captured in the underlying macro trends (e.g. exports in CAIand FCI).Choosing and testing independent variables (macro factors)While there are a large number of macro variables that equity investors could focus on, we electto limit our independent variables to 14 macro factors which theoretically should drive stock prices.In other words, this is not an exhaustive list of macro variables which might influence stockreturns but what we have found to be generally influential at a market level. See Asia Pacific:Portfolio Strategy: What macro indicators matter for Asian markets?, May 7, for details.We also test the statistical significance of2nd derivatives and lead/lags for each of the factorsin our multi-factor regression model to ensure statistically important relationships will beaccounted for.Given many of these variables are inter-correlated and are essentially linked to similar sets offundamental drivers, we run a correlation matrix to eliminate those with strong directionalrelationships to improve the ensuing regression results (Appendix 1). In cases where macrofactors are strongly correlated among each other within a category (e.g. growth), we prefer ourAustralia 20%China 23%Hong Kong 8%India 11%Indonesia2%Korea 16%Malaysia 2%Philippines 0%Singapore 5%Taiwan 9%Thailand 4%Banks23%InformationTechnology 14%Telecom11%Materials10%Energy9%Industrials7%Cons Disc7%Cons Stap6%Property6%Insurance and other financial services 4%Utilities 2%Health Care1%proprietary indexes such as Current Activity Index (CAI), Financial Conditions Index (FCI),and Global Leading Indicator (GLI) given their broader representation and statistically-testedrobustness (see Exhibit 4).Following the above steps, we conclude that a significant part of an individual stock’s returnvariations can be reasonably explained by 6 broad macro measurements: Market risk (MXAPJ),domestic growth (CAI), domestic liquidity/policy (FCI), domestic inflation (CPI), oilprices (WTI), and global growth (GLI).The final step is to establish linkages between returns and these macro factors by usingregression techniques, namely simple linear and multiple factor regression models .Recognizing the advantages and deficiencies of these modeling techniques, we choose to baseour stock selection analysis on the former and the market analysis on the latter.∙ Simple linear regression by a single factor (e.g. six separate regressionmodels) allows us to estimate the factor loadings for the independentvariables without running into multicollinearity issues. This approachmay work better in capturing the maximum total exposure to a singlefactor. That said, it doesn't account for the impact of other significantvariables and therefore is not robust to changes in the relationshipbetween macro factors over time. Even if we run a number of singlefactor regressions, the resulting individual R²s from this are not additiveand we cannot statistically prove the explanatory power of each factorfor returns.∙ Multiple factor regression with stepwise elimination helps form a quantifiablerelationship (equation) as to what factors are important and to what extent they, when alltreated as independent variables, have historically affected stock returns (when onefactor changes and others are held constant). The drawback is that the (high) correlationamong macro variables lowers the precision of the regression estimates, which is likelyto lead to estimates being very inaccurate for some stocks when the regressions arecarried out across a large universe of single stocks. If we subsequently use the analysisto pick stocks with the highest/lowest sensitivities there is a risk that we will also end upmaximizing exposure to estimation errors. Exhibit 4: The independent variables in our regression model are representative of the principal macro categories that tend to influence stock returnsMacro variables and the inputs to our regression modelNote: We use the next 3 month yoy growth for CAI (local/US/EU) as they show significantly higher correlations with returns, which provides better indicative power on returns and fits our purpose of mapping returns to macro exposure better. See Appendix 1 for details.Source: FactSet, I/B/E/S, Goldman Sachs Global ECS Research estimates.Input specificationsChosen variablesreturns Log P(t)‐Log P(t ‐3)returns Log P(t)‐Log P(t ‐3) index returns Log P(t)‐Log P(t ‐3)Log (Avg. of last 3 monthly yoy growth)growth Log (Avg. of last 3 monthly yoy growth)Log (Avg. of last 3 monthly yoy growth)Log (Avg. of next 3 monthly yoy growth)Log (Avg. of latest 3 mom growth)Local CPI Log (Avg. of last 3 monthly yoy growth)Local CPI Local FCI Log (Avg. of last 3 monthly yoy growth)Local FCILog WTI(t)‐Log WTI(t ‐3)Log (Avg. of next 3 monthly yoy growth)Log (Avg. of next 3 monthly yoy growth)Log (Avg. of last 3 monthly yoy growth)Log (latest 3 mom changes)MXAPJ returnsLocal CAIWTIGLII nd e p en den tv a ria b le sDomestic liquidity/policyExhibit 5: Our model shows that stock returns can be reasonably explained by 6market/macro factorsComponents our multi-factor regression modelIntercept other factors Source: Goldman Sachs Global ECS Research.Regression results (1): Understanding where macro analysis may applyTop-down approach works for some stocks, but not all. Our model has yielded reasonably high R² (over 40%) for 247 stocks out of the total 412 sample universe (58%of market cap). It also means the remaining 165 stocks could be more sensitive to microfactors as opposed to macro forces if one takes R² of 40% as the threshold1.From a market standpoint, the top-down approach seems to work better for Hong Kong, China and Singapore, while the bottom-up study appears more suitable for Australia and the ASEAN-4 markets. We think these results reflect the following:a. Hong Kong, China (HK-listed) and Singapore have open economies andfree capital markets, meaning that the local stock markets are more sensitiveto global macro forces and capital flows relative to the region.b. The dynamics between domestic and externally-driven demand for Australiacan differ—currently, the domestic economy is hampered by the (until recently)strong currency, weak property market and issues in the banking system whilecommodity exports remain resilient due to demand from global EMs. Thisdichotomy makes a static top-down analysis less effective.c. The domestic demand component and generally low foreign investorsparticipation in the ASEAN-4 have resulted in lower returns volatility for thesesmaller markets. As such, the top-down framework has to be adjusted bylocal factors to make it more applicable and effective to explain returns.By sector, the average R² is generally low for defensives including telcos, utilities and healthcare stocks, suggesting: a) their share prices are not sensitive to macrochanges, relative to the aggregate market; b), their price sensitivity to the market riskfactor is low as reflected by the regression results; and, c) a micro-focused approach isrequired to generate alpha in these sectors.At the other end of the spectrum, a top-down approach could be effective for energy,financials, and materials given the high R², which conceptually makes sense as these sectors are closely linked with global dynamics via real demand and financial channels.1 Note that these R²s are derived from our regression models and the macro factors may not represent the true macro profile for our study universe.Exhibit 6: Macro factors appear important return drivers (R² more than 40%) for 60% of thestocks and 58% of market cap in MXAPJ Accumulated distribution of R ² based on our study universeSource: Goldman Sachs Global ECS Research estimates.Exhibit 7: Top-down analysis works for select economic groups but not allAverage R² based on our multi-factor regressionSource: FactSet, I/B/E/S, Goldman Sachs Global ECS Research estimates.Regression results (2): Making sense of itWe ran macro-factor regressions for more than 400 stocks in Asia and the results are organizedby their factor loadings in each market in Exhibit 8 (we show the top-3 stocks under each marketfactor only; regression results for the full universe are shown in the country summary pages).0%10%20%30%40%50%60%70%80%90%100%0%10%20%30%40%50%60%70%80%90%100%Top ‐down approach may workbetterMacro factors explain >40% of return variations%of market capR2Bottom ‐up approach may workbetterMacro factors explain<40% of return variationsBottom 25 percentile Top 25 percentileExhibit 8: We group stocks under different macro buckets based on their factor loadingsStocks with highest/lowest factor loadings by marketNote (*): Highest (positive) coefficients for FCI means stocks have historically performed better relative to their benchmark when financial conditions tighten. Note (1): We rank stocks by their factor loadings based on the output from our simple linear regression model. Multiple factor regression models using specific independent variables are required to estimate the relative significance of variables and their explanatory power on returns.Note (2): We only show stocks which rank in the top-80 percentile in terms of R² ranking for that particular factor.Note (3): We exclude Philippines because only 4 stocks satisfy our liquidity requirements.Source: Goldman Sachs Global ECS Research estimates.To better interpret and make sense of the regression output, we think it is useful to look at a fewexamples below.Example 1: Samsung Electronics (005930 KR)The regression R² is low for Samsung Electronics (33%), suggesting the stock’s returnscould be more sensitive to specific micro factors than the high-level macro variables thatwe test.∙While Samsung is perceived by investors as a DM growth proxy, its share does notappear to be well linked with global growth momentum (GLI is eliminated in the stepwiseregression). This coincides with the stock’s substantial outperformance in the past fewyears due to its improved competiveness and strong product cycle (e.g. Galaxysmartphones).∙It is positively correlated with domestic growth and liquidity conditions, which seemsnormal, although their statistical significance is lower than the market risk factor.Exhibit 9: The low R² for Samsung suggests that micro factors could be more important in driving the stock price Stepwise regression results (Samsung Electronics)Source: FactSet, CEIC, MSCI, Goldman Sachs Global ECS Research estimates.Example 2: ICBC (1398 HK)∙Our model shows 74% of ICBC’s share price variations can be explained by the fourfactors in the stepwise regression model.∙ICBC’s sensitivity to the market risk factor is high (high beta), partly reflecting therelatively high growth and policy volatility (or market concerns) in China.∙It is positively correlated with inflation and policy easing as the bank may benefit fromloan pricing and higher loan quota when these macro conditions move in its favor.∙The share prices tend to outperform (underperform) the aggregate market when globalgrowth decelerates (accelerates), as the stock is not as sensitive as the MXAPJaggregate to global growth momentum.Exhibit 10: Policy easing should bode well for ICBC but its GDP growth exposure may not be as high as many have perceivedStepwise regression results (ICBC)Source: FactSet, CEIC, MSCI, Goldman Sachs Global ECS Research estimates.Example 3: WesFarmers (WES AU)∙ The regression R² is high compared with other Australian stocks in our study sample,meaning that top-down approach may make more sense for WES relative to otherAustralian stocks.∙ The stock has showed low sensitivity to MXAPJ returns in local currency terms.∙ Higher CPI tends to bode well for stock returns, as high inflation may allow the companyto raise prices more easily.∙ While the local exposure of its business operations may suggest high sensitivity todomestic growth activities, domestic CAI is omitted from the regression. This may reflectthe hybrid structure of the Australian economy as discussed on page 7. Exhibit 11: The market risk sensitivity is generally low for AU stocks due possibly to the omission of FX beta; domestic activities link well with export growth cycles, adding complications when interpreting regression resultsStepwise regression results (WesFarmers)Source: FactSet, CEIC, MSCI, Goldman Sachs Global ECS Research estimates.# of obs.60R²74%# of obs.142R² 50%Example 4: TATA Consultancy Services (TCS IN)∙ It has one of the highest R² (74%) among the Indian stocks in the MXAPJ universe(average 46%).∙ The stock can be classified as a low-beta stock given its low return coefficient withMXAPJ (c.0.67).∙ The stock has tended to move very closely with GLI momentum (1% of GLI momentumchange has historically led to 15% of share price movement), consistent with TCS’sbusiness concentration in global developed markets. Exhibit 12: TATA consultancy’s share prices seem very sensitive to global growth given the company’s geographic exposureStepwise regression results (TATA Consultancy Services)Source: FactSet, CEIC, MSCI, Goldman Sachs Global ECS Research estimates.# of obs.86R² 74%Part 2: Adding micro overlays—valuation, micro fundamentals and technical indicators—to enhance returnsPart 1 aims to match individual equities’ returns to select macro factors. However, the returnattribution exercise is insufficient to build a sensible trading strategy on its own, because:a. No market or stock in our sample universe has close to a 100% fit (R²) in our regressionmodel, suggesting some unobserved or uncaptured variables, which we believe aremostly micro-related, are also significant performance drivers;b. Stock returns are essentially a joint function of earnings growth and valuation changes.Our analysis helps partly explain returns variations using macro factors but does nottake into account the returns that macro drivers have on risk premia and therefore thewillingness of investors to pay for equities for a given level of earnings.c. In some cases, share prices may have already reflected stock-specific themes/exposure;and pricing signals (especially shorter-term ones) are difficult to capture in macro-factorregression models.As such, we incorporate valuation parameters, micro fundamental variables, and varioustechnical indicators into our broader framework. We believe these additional considerationscould help us form an objective view on stocks’ micro profile and help answer the questions of“how much is priced in” and “entry level”, which have shown strong relationships with pricereturns (more on this later).Valuation parametersWe focus on the stock’s current valuations to gauge how the stock’s fundamentals are beingpriced by the market and to avoid buying/selling at full/depressed valuation levels.Specifically, taking the conclusions from our recent work: Asia Pacific: Portfolio Strategy: GlobalStrategy Paper: No. 3: AsiaPac Valuation: What works, and when, March 12, 2012, we havechosen forward P/E, trailing D/Y, and trailing P/B, which are proven to be significant returnsindicators (higher significance to medium-term returns) according to our analysis, as the keymetrics.While we have also proved that P/CF has strong predictive power on forward returns at a marketlevel, we deliberately exclude this in our analysis given its short and unstable time series at anindividual stock level.Micro fundamentalsWhile we have established relationships between macro factors and stock returns in Part 1,stocks react to macro forces because they tend to impact earnings or earnings expectations,which can be quantified and captured by the changes of consensus EPS and expected returns(target price). In this vein, we look at following indicators to assess stock’s micro dynamics usingconsensus data:∙Earnings revision (magnitude)—percentage of month-on-month forward 12-monthEPS changes;∙Earnings sentiment (breadth)—percentage of net earnings upgrades/downgradesversus the total number of consensus estimates (mom);∙Consensus target price—percentage changes (mom).Technical indicatorsBroadly speaking, technical indicators can be grouped into four categories—momentum,volatility, trend and volume . Given the numerous forms of technical indicators, we focus onthose that are most commonly used and are comparable from a time series standpoint. The keyobjective here is to form a view on short-term entry levels.1. RSI (momentum): We use 14-day RSI to gauge the near-term price momentum ofparticular stocks. We prefer 14-day over longer-dated RSIs given its higher volatilityrelative to longer-dated RSIs, which better fits our objective of evaluating entry point forshorter-term investing.2. Bollinger bands (volatility): For computational purpose, we look at %b , as opposedto the actual moving averages and the two bands (upper and lower) to quantify wherethe current price is relative to its recent range in standard deviation terms. Low %bindicates current prices are closer to the lower Bollinger band and vice versa.3. Moving Average Convergence/Divergence (MACD) (trend): We take thedifferentials between MACD line (12 day-26 day exponential moving average (EMA))and MACD signal line (9-day EMA), which is the histogram on a typical MACD chart, togauge the short-term trend and price momentum of the stock. High positive valuesreflect strong price momentum in recent trading periods and vice versa.4. Volume: Most volume-based indicators require a time-series perspective to form tradingsignals; hence, an absolute number often does not tell us much. Volume signals canvary so decision-making is not stable. As such, we exclude volume-relatedindicators in our micro score calculation .Exhibit 13: We use these micro parameters to form a view on the stocks’ fundamentals, aiming to enhance therisk/reward of our top-down stock recommendationsA summary of micro parametersSource: FactSet, I/B/E/S, Goldman Sachs Global ECS Research estimates.The effectiveness of micro overlays—an empirical studyWhile these micro parameters are commonly regarded as important elements to potential returns,their actual implications and contribution to returns are unclear to us up to this point.As such, we test the conditions and formats under which these micro factors matter most topotential returns, and design our trading strategies accordingly. Input specifications P(t)/fEPS(t)P(t)/tBPS(t)P(t)/tDPS(t)fEPS(t)/fEPS(t ‐1)‐1{#up rev(t)‐#down rev(t)}/#estimate(t) price TP(t)/TP(t ‐1)‐1Momentum 14‐day RSIVolatility Bollinger Bands (%b)Trend MACD line ‐ MACD signal line Composite micro scoreM ic ro par am et e r s Technical indicators。