expected ≡ uncertain → risk

International Investment without Cover

eex

1/eex

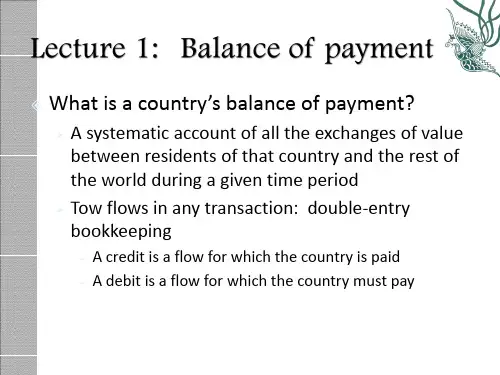

d. The formula of the expected uncovered interest differential (EUD) EUD = (1 + if)eex/e - (1 + i) where eex is the expected future spot exchange rate e. Approximated formula:

d. Illustrating CIA by Lake diagram and examples: suppose you are an American

As an American: • If CD>0, you go anticlockwise Example: Given iUK=.04, iUS=.03, e=$2/GBP1, f=$2/GBP1, CD=? • If CD<0, you go clockwise Example: Given: iUK=.04, iUS=.03, e=$2/GBP, annual forward rate=$1.96/GBP, CD = ? What is the pressure from this arbitrage: Less GBP in circulation → iUK↑ More $ in circulation → iUS↓ Buy $ spot → e ↓ sell $ forward → f ↑ Until CD = 0

EUD=0 OR [(eex – e)/e]+ if = I The expected return on foreign currency investment equals the return on domestic currency investment Approximately: At parity, The expected appreciation on the foreign currency equals interest rate difference but with opposite sign