财务管理第七章习题

- 格式:doc

- 大小:30.95 KB

- 文档页数:10

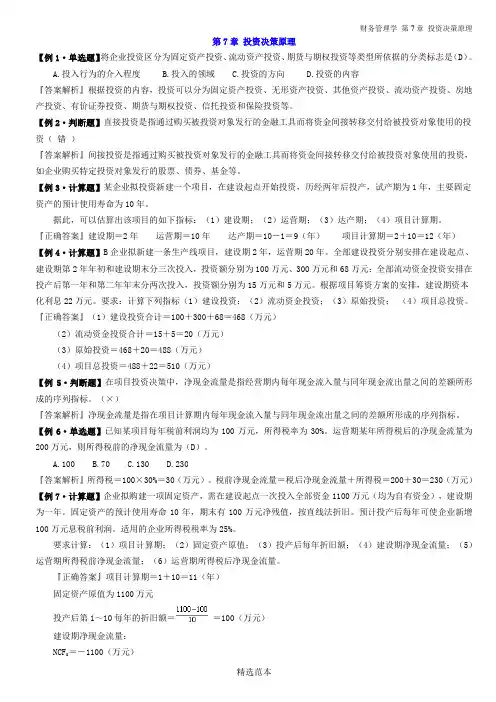

第7章投资决策原理【例1·单选题】将企业投资区分为固定资产投资、流动资产投资、期货与期权投资等类型所依据的分类标志是(D)。

A.投入行为的介入程度B.投入的领域C.投资的方向D.投资的内容『答案解析』根据投资的内容,投资可以分为固定资产投资、无形资产投资、其他资产投资、流动资产投资、房地产投资、有价证券投资、期货与期权投资、信托投资和保险投资等。

【例2·判断题】直接投资是指通过购买被投资对象发行的金融工具而将资金间接转移交付给被投资对象使用的投资(错)『答案解析』间接投资是指通过购买被投资对象发行的金融工具而将资金间接转移交付给被投资对象使用的投资,如企业购买特定投资对象发行的股票、债券、基金等。

【例3·计算题】某企业拟投资新建一个项目,在建设起点开始投资,历经两年后投产,试产期为1年,主要固定资产的预计使用寿命为10年。

据此,可以估算出该项目的如下指标:(1)建设期;(2)运营期;(3)达产期;(4)项目计算期。

『正确答案』建设期=2年运营期=10年达产期=10-1=9(年)项目计算期=2+10=12(年)【例4·计算题】B企业拟新建一条生产线项目,建设期2年,运营期20年。

全部建设投资分别安排在建设起点、建设期第2年年初和建设期末分三次投入,投资额分别为100万元、300万元和68万元;全部流动资金投资安排在投产后第一年和第二年年末分两次投入,投资额分别为15万元和5万元。

根据项目筹资方案的安排,建设期资本化利息22万元。

要求:计算下列指标(1)建设投资;(2)流动资金投资;(3)原始投资;(4)项目总投资。

『正确答案』(1)建设投资合计=100+300+68=468(万元)(2)流动资金投资合计=15+5=20(万元)(3)原始投资=468+20=488(万元)(4)项目总投资=488+22=510(万元)【例5·判断题】在项目投资决策中,净现金流量是指经营期内每年现金流入量与同年现金流出量之间的差额所形成的序列指标。

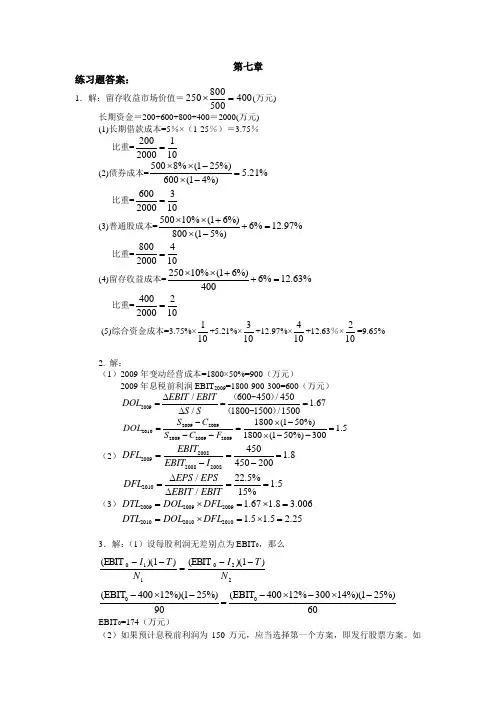

第七章练习题答案:1.解:留存收益市场价值=400500800250=⨯(万元) 长期资金=200+600+800+400=2000(万元)(1)长期借款成本=5%×(1-25%)=3.75%比重=2001200010= (2)债券成本=5008%(125%) 5.21%600(14%)⨯⨯-=⨯- 比重=6003200010= (3)普通股成本=50010%(16%)6%12.97%800(15%)⨯⨯++=⨯- 比重=8004200010= (4)留存收益成本=25010%(16%)6%12.63%400⨯⨯++= 比重=4002200010= (5)综合资金成本=3.75%×110+5.21%×310+12.97%×410+12.63%×210=9.65%2. 解:(1)2009年变动经营成本=1800×50%=900(万元)2009年息税前利润EBIT 2009=1800-900-300=600(万元)2009/600450/450 1.67/18001500/1500EBIT EBIT DOL S S ∆===∆(-)(-) 2009200920102009200920091800(150%) 1.51800(150%)300S C DOL S C F -⨯-===--⨯-- (2)2008200920082008450 1.8450200EBIT DFL EBIT I ===-- 2010/22.5% 1.5/15%EPS EPS DFL EBIT EBIT ∆===∆ (3)200920092009 1.67 1.8 3.006DTL DOL DFL =⨯=⨯=201020102010 1.5 1.5 2.25DTL DOL DFL =⨯=⨯=3.解:(1)设每股利润无差别点为EBIT 0,那么220110)1)((EBIT )1)((EBIT N T I N T I --=-- 00(EBIT 40012%)(125%)(EBIT 40012%30014%)(125%)9060-⨯--⨯-⨯-= EBIT 0=174(万元)(2)如果预计息税前利润为150万元,应当选择第一个方案,即发行股票方案。

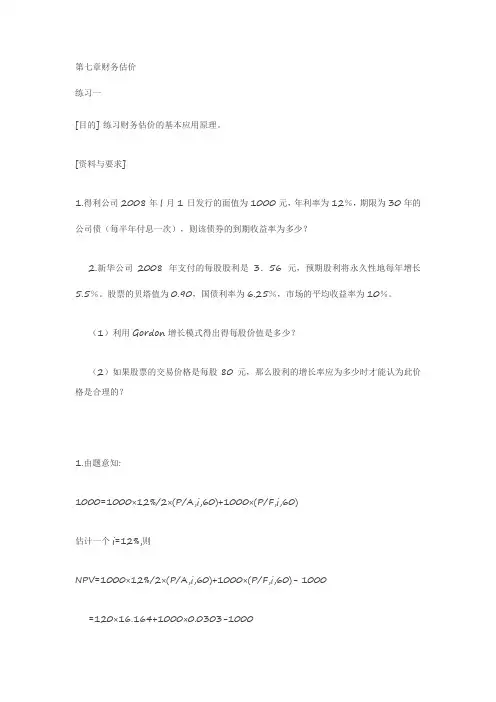

第七章财务估价练习一[目的] 练习财务估价的基本应用原理。

[资料与要求]1.得利公司2008年l 月1 日发行的面值为1000元,年利率为12%,期限为30年的公司债(每半年付息一次),则该债券的到期收益率为多少?2.新华公司2008年支付的每股股利是3.56元,预期股利将永久性地每年增长5.5%。

股票的贝塔值为0.90,国债利率为6.25%,市场的平均收益率为10%。

(1)利用Gordon增长模式得出得每股价值是多少?(2)如果股票的交易价格是每股80元,那么股利的增长率应为多少时才能认为此价格是合理的?1.由题意知:1000=1000×12%/2×(P/A,i,60)+1000×(P/F,i,60)估计一个i=12%,则NPV=1000×12%/2×(P/A,i,60)+1000×(P/F,i,60)- 1000=120×16.164+1000×0.0303-1000=1000.14-1000=0.14≈0所以,债券到期收益率等于票面利率,即年利率为12% 2.(1) K=6.25%+0.9×(10%-6.25%)=9.625% P=3.56×(1+5.5%)/(9.625%-5.5%)=91.05元(2)由题意知:P=D/(k-g)所以,80=3.56×(1+g)/(9.625%-g)g=4.95%【或者(1)K=6.25%+0.9×(10%-6.25%)=9.63% P=3.56×(1+5.5%)/(9.63%-5.5%)=90.94元(2)80=3.56×(1+g)/(9.63%-g)g=4.96%】练习二[目的] 练习公司债券价格的计算。

[资料] 远达公司于2008年3月8日以850元购买一张面值1000元,票面利率为8%,每年付息一次的债券,并于2009年3月8日以900元价格出售.[要求] 计算该债券的投资报酬率。

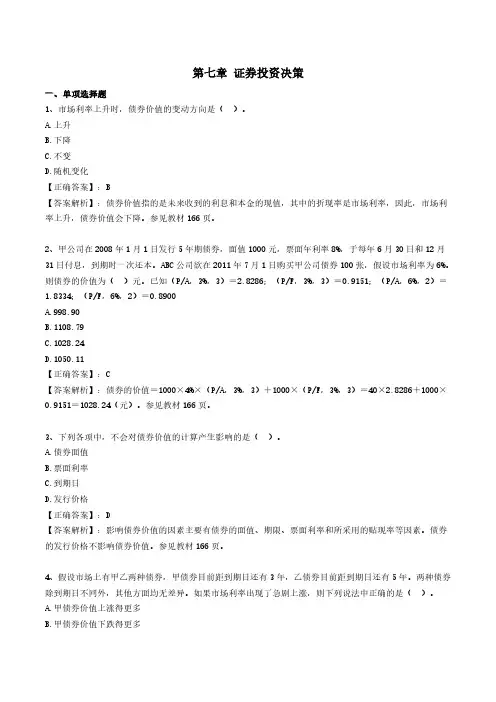

第七章证券投资决策一、单项选择题1、市场利率上升时,债券价值的变动方向是()。

A.上升B.下降C.不变D.随机变化【正确答案】:B【答案解析】:债券价值指的是未来收到的利息和本金的现值,其中的折现率是市场利率,因此,市场利率上升,债券价值会下降。

参见教材166页。

2、甲公司在2008年1月1日发行5年期债券,面值1000元,票面年利率8%,于每年6月30日和12月31日付息,到期时一次还本。

ABC公司欲在2011年7月1日购买甲公司债券100张,假设市场利率为6%。

则债券的价值为()元。

已知(P/A,3%,3)=2.8286;(P/F,3%,3)=0.9151;(P/A,6%,2)=1.8334;(P/F,6%,2)=0.8900A.998.90B.1108.79C.1028.24D.1050.11【正确答案】:C【答案解析】:债券的价值=1000×4%×(P/A,3%,3)+1000×(P/F,3%,3)=40×2.8286+1000×0.9151=1028.24(元)。

参见教材166页。

3、下列各项中,不会对债券价值的计算产生影响的是()。

A.债券面值B.票面利率C.到期日D.发行价格【正确答案】:D【答案解析】:影响债券价值的因素主要有债券的面值、期限、票面利率和所采用的贴现率等因素。

债券的发行价格不影响债券价值。

参见教材166页。

4、假设市场上有甲乙两种债券,甲债券目前距到期日还有3年,乙债券目前距到期日还有5年。

两种债券除到期日不同外,其他方面均无差异。

如果市场利率出现了急剧上涨,则下列说法中正确的是()。

A.甲债券价值上涨得更多B.甲债券价值下跌得更多C.乙债券价值上涨得更多D.乙债券价值下跌得更多【正确答案】:D【答案解析】:市场利率上涨,债券价值下降,A、C错误;距到期日越近受利率影响越小,选项B错误。

参见教材166页。

5、现有一份刚发行的面值为1000元,每年付息一次,到期归还本金,票面利率为14%,5年期的债券,若某投资者现在以1000元的价格购买该债券并持有至到期,则该债券的投资收益率应()。

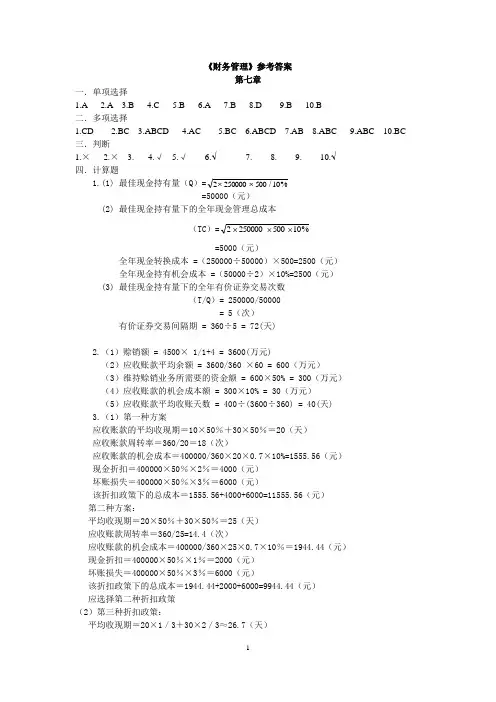

《财务管理》参考答案第七章一.单项选择1.A2.A3.B4.C5.B6.A7.B8.D9.B 10.B二.多项选择1.CD2.BC3.ABCD4.AC5.BC6.ABCD7.AB8.ABC9.ABC 10.BC 三.判断1.×2.×3.×4.√5.√6.√7.×8.×9.×10.√四.计算题1.(1) 最佳现金持有量(Q)=%2500002⨯⨯500/10=50000(元)(2) 最佳现金持有量下的全年现金管理总成本(TC)=%⨯2⨯⨯10250000500=5000(元)全年现金转换成本 =(250000÷50000)×500=2500(元)全年现金持有机会成本 =(50000÷2)×10%=2500(元)(3) 最佳现金持有量下的全年有价证券交易次数(T/Q)= 250000/50000= 5(次)有价证券交易间隔期 = 360÷5 = 72(天)2.(1)赊销额 = 4500× 1/1+4 = 3600(万元)(2)应收账款平均余额 = 3600/360 ×60 = 600(万元)(3)维持赊销业务所需要的资金额 = 600×50% = 300(万元)(4)应收账款的机会成本额 = 300×10% = 30(万元)(5)应收账款平均收账天数 = 400÷(3600÷360) = 40(天)3.(1)第一种方案应收账款的平均收现期=10×50%+30×50%=20(天)应收账款周转率=360/20=18(次)应收账款的机会成本=400000/360×20×0.7×10%=1555.56(元)现金折扣=400000×50%×2%=4000(元)坏账损失=400000×50%×3%=6000(元)该折扣政策下的总成本=1555.56+4000+6000=11555.56(元)第二种方案:平均收现期=20×50%+30×50%=25(天)应收账款周转率=360/25=14.4(次)应收账款的机会成本=400000/360×25×0.7×10%=1944.44(元)现金折扣=400000×50%×1%=2000(元)坏账损失=400000×50%×3%=6000(元)该折扣政策下的总成本=1944.44+2000+6000=9944.44(元)应选择第二种折扣政策(2)第三种折扣政策:平均收现期=20×1/3+30×2/3≈26.7(天)应收账款周转率=360/26.7=13.48(次)应收账款的机会成本=400000/360×26.7×0.7×10%=2076.67(元)现金折扣=400000×1/3×1%≈1333.33(元)坏账损失=400000×2/3×3%≈8000(元)该折扣政策下的总成本=2076.67+1333.33+8000=11410(元)所以应选择第二种折扣政策。

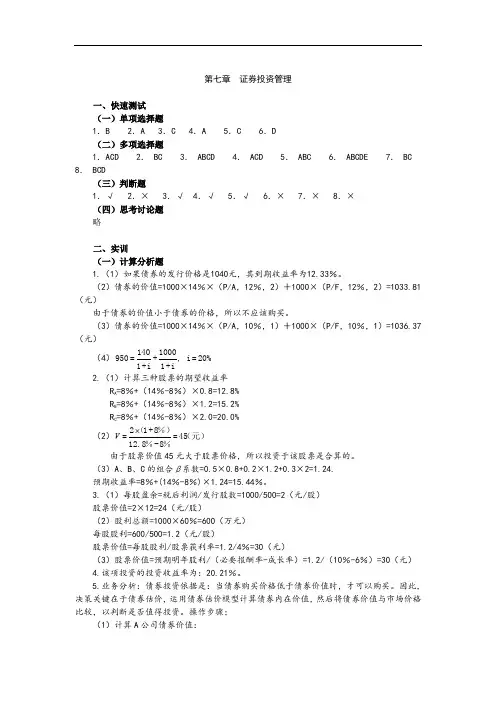

第七章证券投资管理一、快速测试(一)单项选择题1.B 2.A 3.C 4.A 5.C 6.D(二)多项选择题1.ACD 2. BC 3. ABCD 4. ACD 5. ABC 6. ABCDE 7. BC 8. BCD(三)判断题1.√ 2.× 3.√ 4.√ 5.√ 6.× 7.× 8.×(四)思考讨论题略二、实训(一)计算分析题1.(1)如果债券的发行价格是1040元,其到期收益率为12.33%。

(2)债券的价值=1000×14%×(P/A,12%,2)+1000×(P/F,12%,2)=1033.81(元)由于债券的价值小于债券的价格,所以不应该购买。

(3)债券的价值=1000×14%×(P/A,10%,1)+1000×(P/F,10%,1)=1036.37(元)(4)1401000950=+,i=20% 1+i1+i2.(1)计算三种股票的期望收益率R A=8%+(14%-8%)×0.8=12.8%R B=8%+(14%-8%)×1.2=15.2%R C=8%+(14%-8%)×2.0=20.0%(2)(%)(元)%%21+8==4512.8-8V由于股票价值45元大于股票价格,所以投资于该股票是合算的。

(3)A、B、C的组合β系数=0.5×0.8+0.2×1.2+0.3×2=1.24.预期收益率=8%+(14%-8%)×1.24=15.44%。

3.(1)每股盈余=税后利润/发行股数=1000/500=2(元/股)股票价值=2×12=24(元/股)(2)股利总额=1000×60%=600(万元)每股股利=600/500=1.2(元/股)股票价值=每股股利/股票获利率=1.2/4%=30(元)(3)股票价值=预期明年股利/(必要报酬率-成长率)=1.2/(10%-6%)=30(元)4.该项投资的投资收益率为:20.21%。

《财务管理学》第七章作业及答案《财务管理学》第七章作业及答案一、名词解释1.营运资金(狭义)2.企业的资产组合3.企业的筹资组合4.经济批量二、单选题1.在下列各项中,属于应收账款机会成本的是( )。

A 坏账损失B 收账费用C 对客户信用进行调查的费用D 应收账款占用资金的应计利息2.信用条件“1/10,n/30”表示( )。

A 信用期限为10天,折扣期限为30天B 如果在开票后10天~30天内付款可享受10%的折扣C 信用期限为30天,现金折扣为10%D 如果在10天内付款,可享受1%的现金折扣,否则应在30天内全额付款3.在对存货采用ABC法进行控制时,应当重点控制的是( )。

A 数量较大的存货B 占用资金较多的存货C 品种多的存货D 价格昂贵的存货4、某公司现金收支平稳,预计全年现金需要量为250000元,现金与有价证券的转换成本为每次500元,有价证券年利率为10%。

则最佳现金持有量为:A.50000元B.5000元C.2500元D.500元三、多选题1.不同的资产组合对企业报酬和风险的影响主要有( )。

A 较多地投资于流动资产可以降低企业的风险,但会减少企业的盈利B 流动资产投资过多,而固定资产又相对不足,会使企业生产能力减少C 如果企业的固定资产增加,会造成企业的风险增加,盈利减少D 如果企业的固定资产减少,会造成企业的风险增加,盈利减少E 企业采用比较冒险的资产组合,会使企业的投资报酬率上升2.为了评价两个可选择的信用标准孰优孰劣,必须计算两个方案各自带来的利润和成本,为此应测试的项目有( )。

A 信用条件的变化情况B 销售量变化对利润销售的影响C 应收账款投资及其机会成本的变化D 坏账成本的变化E 管理成本的变化3.利息率状况对企业筹资组合的影响是( )。

A 一般来说,由于长期资金的利息率高,因此企业较少使用长期资金,较多使用短期资金B 当长期资金的利息率和短期资金的利息率相差较少时,企业一般较多地利用长期资金,较少使用流动负债C 短期资金和长期资金利息率的波动都很大,不易确定D 当长期资金利息率远远高于短期资金利息率时,会促使企业较多地利用流动负债,以降低资金成本E 利息率对企业的筹资组合没有影响4.下列关于商业信用的叙述中正确的是( )。

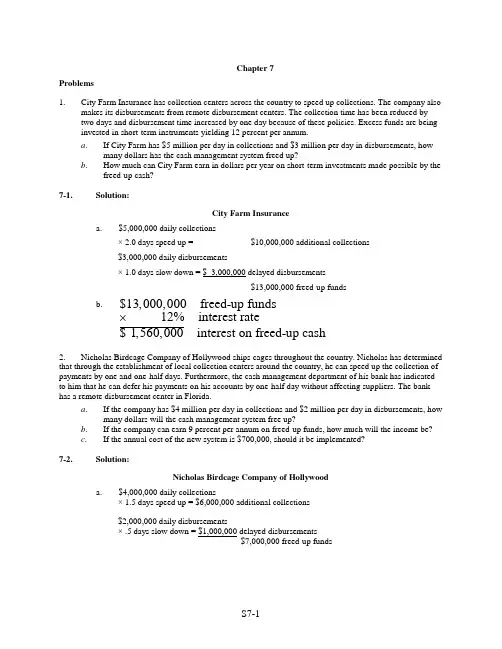

Chapter 7Problems1. City Farm Insurance has collection centers across the country to speed up collections. The company alsomakes its disbursements from remote disbursement centers. The collection time has been reduced by two days and disbursement time increased by one day because of these policies. Excess funds are being invested in short-term instruments yielding 12 percent per annum.a. If City Farm has $5 million per day in collections and $3 million per day in disbursements, howmany dollars has the cash management system freed up?b. How much can City Farm earn in dollars per year on short-term investments made possible by thefreed-up cash?7-1. Solution:City Farm Insurancea. $5,000,000 daily collections× 2.0 days speed up = $10,000,000 additional collections$3,000,000 daily disbursements× 1.0 days slow down = $ 3,000,000 delayed disbursements$13,000,000 freed-up fundsb. $13,000,000 freed-up funds12% interest rate$1,560,000 interest on freed-up cash2. Nicholas Birdcage Company of Hollywood ships cages throughout the country. Nicholas has determined that through the establishment of local collection centers around the country, he can speed up the collection of payments by one and one-half days. Furthermore, the cash management department of his bank has indicated to him that he can defer his payments on his accounts by one-half day without affecting suppliers. The bank has a remote disbursement center in Florida.a. If the company has $4 million per day in collections and $2 million per day in disbursements, howmany dollars will the cash management system free up?b. If the company can earn 9 percent per annum on freed-up funds, how much will the income be?c. If the annual cost of the new system is $700,000, should it be implemented?7-2. Solution:Nicholas Birdcage Company of Hollywooda. $4,000,000 daily collections× 1.5 days speed up = $6,000,000 additional collections$2,000,000 daily disbursements× .5 days slow down = $1,000,000 delayed disbursements$7,000,000 freed-up fundsb.$7,000,000 freed-up funds9% interest rate$630,000 interest on freed-up cash⨯ c.No. The annual income of $630,000 is $70,000 less than the annual cost of $700,000 for the new system.3. Megahurtz International Car Rentals has rent-a-car outlets throughout the world. It also keeps funds for transactions purposes in many foreign countries. Assume in 2003, it held 100,000 reals in Brazil worth 35,000 dollars. It drew 12 percent interest, but the Brazilian real declined 20 percent against the dollar. a . What is the value of its holdings, based on U.S. dollars, at year-end (Hint: multiply $35,000 times 1.12 and then multiply the resulting value by 80 percent.)b .What is the value of its holdings, based on U.S. dollars, at year-end if it drew 9 percent interest and the real went up by 10 percent against the dollar? 7-3.Solution:Megahurtz International Car Rentala.$35,000 × 1.12 = $39,200$39,200 × 80% = $31,360 dollar value of real holdings b.$35,000 × 1.09 = $38,150$38,150 × 110% = $41,965 dollar value of real holdings4. Thompson Wood Products has credit sales of $2,160,000 and accounts receivable of $288,000. Computethe value of the average collection period. 7-4.Solution:Thompson Wood ProductsAccounts ReceivableAverage collection period Average daily credit sales$288,000$2,160,000/360$288,00048days $6,000====5. Lone Star Petroleum Co. has annual credit sales of $2,880,000 and accounts receivable of $272,000. Compute the value of the average collection period. 7-5.Solution:Lone Star Petroleum Co.Accounts ReceivableAverage collection period Average daily credit sales$272,000$2,288,000/360$272,0008,00034days====6. Knight Roundtable Co. has annual credit sales of $1,080,000 and an average collection period of 32 days in 2008. Assume a 360-day year. What is the company ’s average accounts receivable balance? Accounts receivable are equal to the average daily credit sales times the average collection period. 7-6.Solution:Knight Roundtable Co.$1,080,000annual credit sales$3,000credit sales a day 360days per year=$3,000 average 32 average $96,000 average accounts daily credit sales collection period receivable balance=⨯ 7. Darla ’s Cosmetics has annual credit sales of $1,440,000 and an average collection period of 45 days in 2008. Assume a 360-day year.What is the company ’s average accounts receivable balance? Accounts receivable are equal to the average daily credit sales times the average collection period. 7-7.Solution:Darla ’s Cosmetic Company$1,440,000 annual credit sales/360 = $4,000 per day credit sales$4,000 credit sales × 45 average collection period = $180,000 average accounts receivable balance8. In Problem 7, if accounts receivable change to $200,000 in the year 2009, while credit sales are$1,800,000, should we assume the firm has a more or a less lenient credit policy? 7-8.Solution:Darla ’s Cosmetics (Continued)To determine if there is a more lenient credit policy, compute the average collection period.Accounts ReceivableAverage collection period Average daily credit sales$200,000$1,800,000/360$200,00040 days $5,000====Since the firm has a shorter average collection period, it appears that the firm does not have a more lenient credit policy.9. Hubbell Electronic Wiring Company has an average collection period of 35 days. The accounts receivable balance is $105,000. What is the value of its credit sales? 7-9.Solution:Hubbell Electronic Wiring CompanyAccounts receivable Average collection period Average daily credit sales$105,00035 days credit sales 360$105,000Credit sales/36035 daysCredit sales/360$3,000 credit sales per dayCredit sales $3,==⎛⎫ ⎪⎝⎭===000360$1,080,000⨯=10.Marv ’s Women ’s Wear has the following schedule for aging of accounts receivable.Age of Receivables, April 30, 2004(1) (2)(3) (4)Month of SalesAge of AccountAmounts Percent of AmountDue April ....................................... 0–30 $ 88,000 ____ March .....................................31–6044,000____February ................................. 61–90 33,000 ____January ................................... 91–120 55,000 ____Total receivables ................. $220,000 100%a. Fill in column (4) for each month.b. If the firm had $960,000 in credit sales over the four-month period, compute the averagecollection period. Average daily sales should be based on a 120-day period.c. If the firm likes to see its bills collected in 30 days, should it be satisfied with the averagecollection period?d. Disregarding your answer to part c and considering the aging schedule for accounts receivable,should the company be satisfied?e. What additional information does the aging schedule bring to the company that the averagecollection period may not show?7-10. Solution:Marv’s Women’s WearAge of Receivables, April 30, 2004a.(1)(2)(3)(4)Month of Sales Age of Account Amounts Percent of AmountDueApril 0-30 $ 88,000 40% March 31-60 44,000 20% February 61-90 33,000 15% January 91-120 55,000 25% Total receivables $220,000 100%b.Accounts receivable Average Collection PeriodAverage daily credit sales$220,000$960,000/120$220,000$8,00027.5 days====c. Yes, the average collection of 27.5 days is less than 30 days.d. No. The aging schedule provides additional insight that 60 percent of the accounts receivableare over 30 days old.e. It goes beyond showing how many days of credit sales accounts receivables represent, toindicate the distribution of accounts receivable between various time frames.11. Nowlin Pipe & Steel has projected sales of 72,000 pipes this year, an ordering cost of $6 per order, and carrying costs of $2.40 per pipe. a . What is the economic ordering quantity?b . How many orders will be placed during the year?c .What will the average inventory be? 7-11.Solution:Nowlin Pipe and Steel Companya.EOQ 600 units=====b. 72,000 units/600 units = 120 ordersc.EOQ/2 = 600/2 = 300 units (average inventory)12.Howe Corporation is trying to improve its inventory control system and has installed an online computer at its retail stores. Howe anticipates sales of 126,000 units per year, an ordering cost of $4 per order, and carrying costs of $1.008 per unit. a . What is the economic ordering quantity?b . How many orders will be placed during the year?c . What will the average inventory be?d .What is the total cost of inventory expected to be? 7-12.Solution:Howe Corp.a.EOQ 1,000 units ===b.126,000 units/1,000 units = 126 orders7-12. (Continued)c. EOQ/2 = 1,000/2 = 500 units (average inventory)d.126 orders × $4 ordering cost = $ 504 500 units × $1.008 carrying cost per unit = 504 Total costs= $1,00813. (See Problem 12 for basic data.) In the second year, Howe Corporation finds it can reduce ordering costs to $1 per order but that carrying costs will stay the same at $1.008 per unit. a . Recompute a, b, c , and d in Problem 12 for the second year. b .Now compare years one and two and explain what happened. 7-13.Solution:Howe Corp. (Continued)a.EOQ 500 units=====126,000 units/500 units = 252 ordersEOQ/2 = 500/2 = 250 units (average inventory) 252 orders × $1 ordering cost = $252 250 units × $1.008 carrying cost per unit = 252 Total costs = $504b.The number of units ordered declines 50%, while the number of orders doubles. The average inventory and total costs both decline by one-half. Notice that the total cost did not decline in equal percentage to the decline in ordering costs. This is because the change in EOQ and other variables (½) is proportional to the square root of the change in ordering costs (¼).14. Higgins Athletic Wear has expected sales of 22,500 units a year, carrying costs of $1.50 per unit, and an ordering cost of $3 per order. a . What is the economic order quantity?b . What will be the average inventory? The total carrying cost?c .Assume an additional 30 units of inventory will be required as safety stock. What will the new average inventory be? What will the new total carrying cost be? 7-14.Solution:Higgins Athletic Weara. EOQ==300 units ===b. EOQ/2 = 300/2 = 150 units (average inventory)150 units × $1.50 carrying cost/unit = $225 total carrying costc.EOQAverage inventory Safety Stock230030150301802=+=+=+=180 inventory × $1.50 carrying cost per year= $270 total carrying cost15. Dimaggio Sports Equipment, Inc., is considering a switch to level production. Cost efficiencies would occur under level production, and aftertax costs would decline by $35,000, but inventory would increase by $400,000. Dimaggio would have to finance the extra inventory at a cost of 10.5 percent.a. Should the company go ahead and switch to level production?b. How low would interest rates need to fall before level production would be feasible?7-15. Solution:Dimaggio Sports Equipment, Inc.a. Inventory increases by $400,000× interest expense 10.5%Increased costs $ 42,000Less: Savings 35,000Loss ($ 7,000)Don’t switch to level production. Increased ROI is less than the interest cost of moreinventory.b. If interest rates fall to 8.75% or less, the switch would be feasible.$35,000 Savings8.75%$400,000 increased inventory=16. Johnson Electronics is considering extending trade credit to some customers previously considered poorrisks. Sales will increase by $100,000 if credit is extended to these new customers. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 3 percent of sales, and production and selling costs will be 79 percent of sales. The firm is in the 40percent tax bracket.a. Compute the incremental income after taxes.b. What will Johnson’s incremental return on sales be if these new credit customers are accepted?c. If the receivable turnover ratio is 6 to 1, and no other asset buildup is needed to serve the newcustomers, what will Johnson’s incremental return on new average investment be?7-16. Solution:Johnson Electronicsa. Additional sales ............................................................................................ $100,000Accounts uncollectible (10% of new sales) .................................................. – 10,000Annual incremental revenue ......................................................................... $ 90,000Collection costs (3% of new sales) ............................................................... – 3,000Production and selling costs (79% of new sales) .......................................... – 79,000Annual income before taxes ......................................................................... $ 8,000Taxes (40%) .................................................................................................. – 3,200Incremental income after taxes ..................................................................... $ 4,800b.Incremental income Incremental return on salesIncremental sales$4,800/$100,000 4.8%===c. Receivable turnover = Sales/Receivable turnover = 6xReceivables = Sales/Receivable turnover= $100,000/6= $16,666.67Incremental return on new average investment = $4,800/$16,666.67 = 28.80%17. Collins Office Supplies is considering a more liberal credit policy to increase sales, but expects that 9 percent of the new accounts will be uncollectible. Collection costs are 5 percent of new sales, production and selling costs are 78 percent, and accounts receivable turnover is five times. Assume income taxes of 30 percent and an increase in sales of $80,000. No other asset buildup will be required to service the new accounts.a. What is the level of accounts receivable to support this sales expansion?b. What would be Collins’s incremental aftertax return on investment?c. Should Collins liberalize credit if a 15 percent aftertax return on investment is required?Assume Collins also needs to increase its level of inventory to support new sales and that inventory turnover is four times.d. What would be the total incremental investment in accounts receivable and inventory to support a$80,000 increase in sales?e. Given the income determined in part b and the investment determined in part d, should Collinsextend more liberal credit terms?7-17. Solution:Collins Office Suppliesa.$80,000 Investment in accounts receivable$16,0005==b. Added sales .................................................................................................. $ 80,000Accounts uncollectible (9% of new sales) .................................................... – 7,200Annual incremental revenue ......................................................................... $ 72,800Collection costs (5% of new sales) ............................................................... – 4,000Production and selling costs (78% of new sales) – 62,400Annual income before taxes ......................................................................... $ 6,400Taxes (30%) .................................................................................................. – 1,920Incremental income after taxes ..................................................................... $ 4,480Return on incremental investment = $4,480/$16,000 = 28%c. Yes! 28% exceeds the required return of 15%.7-17. (Continued)d.$80,000 Investment in inventory =$20,0004=Total incremental investmentInventory $20,000Accounts receivable 16,000Incremental investment $36,000 $4,480/$36,000 = 12.44% return on investmente. No! 12.44% is less than the required return of 15%.18. Curtis Toy Manufacturing Company is evaluating the extension of credit to a new group of customers.Although these customers will provide $240,000 in additional credit sales, 12 percent are likely to be uncollectible. The company will also incur $21,000 in additional collection expense. Production and marketing costs represent 72 percent of sales. The company is in a 30 percent tax bracket and has a receivables turnover of six times. No other asset buildup will be required to service the new customers.The firm has a 10 percent desired return on investment.a. Should Curtis extend credit to these customers?b. Should credit be extended if 14 percent of the new sales prove uncollectible?c .Should credit be extended if the receivables turnover drops to 1.5 and 12 percent of the accounts are uncollectible (as was the case in part a ). 7-18.Solution:Curtis Toy Manufacturing Companya.Added sales ...................................................................................................... $240,000 Accounts uncollectible (12% of new sales) ...................................................... 28,800 Annual incremental revenue ............................................................................. 211,200 Collection costs ................................................................................................ 21,000 Production and selling costs (72% of new sales) .............................................. 172,800 Annual income before taxes ............................................................................. 17,400 Taxes (30%) ...................................................................................................... 5,220 Incremental income after taxes .........................................................................$ 12,180$240,000Receivable turnover 6.0x6.040,000 in new receivables==$12,180Return on incremental investment 30.45%$40,000==b.Added sales .................................................................................................. $240,000 Accounts uncollectible (14% of new sales) .................................................. – 33,600 Annual incremental revenue ......................................................................... $206,400 Collection costs ............................................................................................ – 21,000 Production and selling costs (72% of new sales) .......................................... –172,800 Annual income before taxes ......................................................................... $ 12,600 Taxes (30%) .................................................................................................. – 3,780 Incremental income after taxes .....................................................................$ 8,820$8,820Return on incremental investment 22.05%$40,000==Yes, extend credit.7-18. (Continued)c.If receivable turnover drops to 1.5x, the investment in accounts receivable would equal $240,000/1.5 = $160,000. The return on incremental investment, assuming a 12% uncollectible rate, is 7.61%.$12,180==Return on incremental investment7.61%$160,000The credit should not be extended. 7.61% is less than the desired 10%.19. Reconsider problem 18. Assume the average collection period is 120 days. All other factors are the same(including 12 percent uncollectibles). Should credit be extended?7-19. Solution:Curtis Toy Manufacturing Company (Continued)First compute the new accounts receivable balance.Accounts receivable = average collection period × average daily sales240,000⨯=⨯=120 days120$667$80,040360 daysorAccounts receivable = sales/accounts receivable turnover360 days==Accounts receivable turnover3x120 days=$240,000/3$80,000Then compute return on incremental investment.$12,18015.23%=$80,000Yes, extend credit. 15.23% is greater than 10%.20. Apollo Data Systems is considering a promotional campaign that will increase annual credit sales by $600,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows:Accounts receivable (5x)Inventory (8x)Plant and equipment (2x)All $600,000 of the sales will be collectible. However, collection costs will be 3 percent of sales, and production and selling costs will be 77 percent of sales. The cost to carry inventory will be 6 percent of inventory. Depreciation expense on plant and equipment will be 7 percent of plant and equipment. The tax rate is 30 percent.a. Compute the investments in accounts receivable, inventory, and plant and equipment based on theturnover ratios. Add the three together.b. Compute the accounts receivable collection costs and production and selling costs and add thetwo figures together.c. Compute the costs of carrying inventory.d. Compute the depreciation expense on new plant and equipment.e. Add together all the costs in parts b, c, and d.f. Subtract the answer from part e from the sales figure of $600,000 to arrive at income before taxes.Subtract taxes at a rate of 30 percent to arrive at income after taxes.g. Divide the aftertax return figure in part f by the total investment figure in part a. If the firm has arequired return on investment of 12 percent, should it undertake the promotional campaigndescribed throughout this problem.7-20. Solution:Apollo Data Systemsa. Accounts receivable = sales/accounts receivable turnover=$120,000$600,000/5Inventory = sales/inventory turnover=$75,000$600,000/8Plant and equipment = sales/(plant and equipment turnover)=$600,000/2$300,000Total investment$495,0007-20. (Continued)b. Collection cost = 3% × $600,000 $ 18,000Production and selling costs = 77% × $600,000 = 462,000Total costs related to accounts receivable $480,000c. Cost of carrying inventory6% × inventory6% × $75,000 $4,500d. Depreciation expense7% × Plant and Equipment7% × $300,000 $21,000e. Total costs related to accounts receivable $480,000Cost of carrying inventory 4,500Depreciation expense 21,000Total costs $505,500f. Sales $600,000– total costs 505,500 Income before taxes 94,500 Taxes (30%) 28,350 Income after taxes $ 66,150g. Income after taxes$66,15013.36%Total investment495,000==Yes, it should undertake the campaignThe aftertax return of 13.36% exceeds the required rate of return of 12%21. In Problem 20, if inventory turnover had only been 4 times:a. What would be the new value for inventory investment?b. What would be the return on investment? You need to recompute the total investment and thetotal costs of the campaign to work toward computing income after taxes. Should the campaign beundertaken?7-21. Solution:Apollo Data Systems (Continued)a. Inventory = sales/inventory turnover$150,000 = $600,000/4b. New Total InvestmentAccounts receivable $120,000Inventory 150,000Plant and equipment 300,000$570,000Total Cost of the CampaignCost of carrying inventory6% × $150,000 = $9,000 ($4,500 more than previously)New Income After TaxesSales $600,000– total costs 510,000 ($505,500 + 4,500)Income before taxes 90,000Taxes (30%) 27,000Income after taxes $ 63,000Income after taxes$63,00011.05%Total investment570,000==No, the campaign should not be undertakenThe aftertax return of 11.05% is less than the required rate of return of 12%(Problems 22–25 are a series and should be taken in order.)22. Maddox Resources has credit sales of $180,000 yearly with credit terms of net 30 days, which is also theaverage collection period. Maddox does not offer a discount for early payment, so its customers take the full 30 days to pay.What is the average receivables balance? What is the receivables turnover?7-22. Solution:Maddox ResourcesSales/360 days = average daily sales$180,000/360 = $500Accounts receivable balance = $500 × 30 days = $15,000Receivable turnover =Sales$180,00012x Receivables$15,000==or360 days/30 = 12x23. If Maddox were to offer a 2 percent discount for payment in 10 days and every customer took advantageof the new terms, what would the new average receivables balance be? Use the full sales of $180,000 for your calculation of receivables.7-23. Solution:Maddox Resources (Continued)$500 × 10 days = $5,000 new receivable balance24. If Maddox reduces its bank loans, which cost 12 percent, by the cash generated from its reducedreceivables, what will be the net gain or loss to the firm?7-24. Solution:Maddox Resources (Continued)Old receivables – new receivables with discount = Funds freed by discount$15,000 – $5,000 .................................................................... = $10,000Savings on loan = 12% × $10,000 ............................................ = $ 1,200Discount on sales = 2% × $180,000 ......................................... = (3,600)Net change in income from discount ........................................ $(2,400) No! Don’t offer the discount since the income from reduced bank loans does not offset the loss onthe discount.25. Assume that the new trade terms of 2/10, net 30 will increase sales by 20 percent because the discountmakes the Maddox price competitive. If Maddox earns 16 percent on sales before discounts, should it offer the discount? (Consider the same variables as you did for problems 22 through 24.)7-25. Solution:Maddox Resources (Continued)New sales = $180,000 × 1.20 = $216,000 Sales per day = $216,000/360 = $600 Average receivables balance = $600 × 10 = $6,000 Savings in interest cost ($15,000 – $6,000) × 12% = 1,080Increase profit on new sales = 16% × $36,000* = $5,760Reduced profit because of discount = 2% × $216,000 = (4,320) Net change in income ................................................................................... $2,520 Yes, offer the discount because total profit increases.*New Sales $36,000 = $216,000 – $180,000COMPREHENSIVE PROBLEMBailey Distributing Company sells small appliances to hardware stores in the southern California area. Michael Bailey, the president of the company, is thinking about changing the credit policies offered by the firm to attract customers away from competitors. The current policy calls for a 1/10, net 30, and the new policy would call for a 3/10, net 50. Currently 40 percent of Bailey customers are taking the discount, and it is anticipated that this number would go up to 50 percent with the new discount policy. It is further anticipated that annual sales would increase from a level of $200,000 to $250,000 as a result of the change in the cash discount policy.The increased sales would also affect the inventory level. The average inventory carried by Bailey is based on a determination of an EOQ. Assume unit sales of small appliances will increase from 20,000 to 25,000 units. The ordering cost for each order is $100 and the carrying cost per unit is $1 (these values will not change with the discount). The average inventory is based on EOQ/2. Each unit in inventory has an average cost of $6.50.Cost of goods sold is equal to 65 percent of net sales; general and administrative expenses are 10 percentof net sales; and interest payments of 12 percent will be necessary only for the increase in the accounts receivable and inventory balances. Taxes will equal 25 percent of before-tax income.a. Compute the accounts receivable balance before and after the change in the cash discount policy.Use the net sales (Total sales – Cash discounts) to determine the average daily sales and theaccounts receivable balances.b. Determine EOQ before and after the change in the cash discount policy. Translate this intoaverage inventory (in units and dollars) before and after the change in the cash discount policy.c. Complete the income statement.Before Policy Change After Policy ChangeNet sales (Sales – Cash discounts)Cost of goods soldGross profitGeneral and administrativeexpenseOperating profitInterest on increase in accountsreceivable and inventory (12%)Income before taxesTaxesIncome after taxesd. Should the new cash discount policy be utilized? Briefly comment.CP 7-1. Solution:Bailey Distributing Companya. Accounts receivable = average collection × averageperiod daily sales Before Policy ChangeAverage collection period.40 × 10 days = 4.60 × 30 days = 1822 daysAverage daily sales。

第七章:投资决策原理一、名词解释1、企业投资2、间接投资3、短期投资4、长期投资5、对内投资6、对外投资7、初创投资8、独立项目9、互斥项目 10、相关项目11、常规项目 12、现金流量 13、净现值 14、内含报酬率15、获利指数 16、投资回收期 1 7、平均报酬率二、判断题1、对现金、应收账款、存货、短期有价证劵的投资都属于短期投资。

()2、长期证劵投资因需要可转为短期投资。

()3、对内投资都是直接投资,对外投资都是间接投资。

()4、原有固定资产的变价收入是指固定资产更新时变卖原有固定资产所得的现金收入,不用考虑净残值的影响。

()5、在互斥选择决策中,净现值法有时会做出错误的决策,而内含报酬率法则始终能得出正确的答案。

()6、进行长期投资决策时,如果某一备选方案净现值比较小,那么该方案的内含报酬率也相对较低。

()7、由于获利指数是用相对指数来表示,所以获利指数法优于净现值法。

()8、固定资产投资方案的内含报酬率并不一定只有一个。

()9、某些自然资源的储量不多,由于不断开采,价格将随储量的下降而上升‘因此对这些自然资源越晚开发越好。

()三、单项选择题1、有关企业投资的意义,下列叙述中不正确的是()A.企业投资是实现财务管理目标的基本前提。

B.企业投资是发展生产的必要手段C.企业投资是有利于提高职工的生活水平D.企业投资是降低风险的重要方法2、某企业欲购进一套新设备,要支付400万元,该设备的使用寿命为4年,无残值,采用直线法并计提折旧。

预计每年可生产税前净利140万元,如果所得税税率为40%,则回收期为()年。

A、4.5B、2.9C、2.2 D3.23、当贴现率与内含报酬率相等时()A、净现值小于零B、净现值等于零C、净现值大于零D、净现值不一定4、某企业准备新建一条生产线,预计各项支出如下:投资前费用2000元,设备购置费用8000元,设备安装费用1000元,建筑工程费用6000元,投产时需垫支营运资金3000元,不可预见费按总支出的5%计算,则该生产线的投资总额为()元。

财务管理第7章试题第7章1. 项目投资是I. 对企业内部生产经营所需要的各种资产的投资;II. 保证生产经营过程的连续和生产经营规模的扩大;III. 十分重要不仅数额大、但投资面广,不利企业发展;VI. 对企业的稳定与发展、未来盈利能力和长期偿债能力的增强都有着重大影响。

A.I、II、III和VI 都对;B.I、II、III和VI 都不对;C.只有I、II、III对;D.只有I、II、VI对2. 项目投资包括:I. 独立项目;II. 排他性项;III. 替代性项目VI. 合作项目E.I、II、III和VI 都对;F.I、II、III和VI 都不对;G.只有I、II、III对;H.只有I、II、VI对3. 现金流相互不相关或接受一个项目意味着并不排除对其他项目做进一步的考虑被称之为:A. 合作项目B. 独立项目C. 排他性项目D. 替代性项目(1)A ;(2)B;(3)C;(4)D。

4. 那些具有相同功能并由此相互竞争的项目,项目组中的一个就排除了考虑该组中的其他项目。

A. 竞争性项目;B. 排他性项目;C. 独立性项目;D. 排他性项目(1)A ;(2)B;(3)C;(4)D。

5. 用一个项目取代另一个项目。

如果被取代,则意味着接受新项目;如果不能被取代,则意味着继续使用旧项目。

A. 替代性项目;B. 独立性项目C. 竞争性项目;D. 排他性项目。

(1)A ;(2)B;(3)C;(4)D。

6. 用于资本预算的资金仅有固定的数额,并且许多项目将为这些有限的资金而相互竞争。

A. 现金流模型;B. 有限资金;C. 边际成本;D. 资本限额。

(1)A ;(2)B;(3)C;(4)D。

7. 展示非年金的任何模型的现金流就是A. 相关现金流;B. 年金;C. 混合现金流;D. 传统现金流。

(1)A ;(2)B;(3)C;(4)D。

8. 任何具有传统现金流模型的项目的现金流都包括三个基本要素I. 初始投资II. 营运现金流III. 终结现金流VI. 无论是扩张、重置、更新或者其他项目都具有前初始投资和营运现金流。

第七章营运资金管理一、单项选择题1. C2.A3.B4.BA5.A6.A7.D8.A9.C10.B11.A12.B13.C14.B15.C16.D17.B18.B 19.D20. C二、多项选择题1.BD2.ABC3.ABCD4.ABC5.ABC6.ACD7.CD8.ABCD9.ABCD10.BC11.ACD12.BD13.ABCD14.AC15.ABCD16.ACD17.BCD18.BC19.AB20.AC三、判断题1.X2.X3.X4.√5.X6.X7.×8.√9.×10.×11.×12.×13.×14.√15.×16.×17.√18.×19.√20.√四、业务分析题实训题(一)(参考答案(1)最佳现金持有量=[(2×250000×500)/10%]½=50000(元)(2)最佳现金管理总成本=(2×250000×500×10%)½=5000(元)转换成本=250000/50000×500=2500(元)持有机会成本=50000/2×10%=2500(元)(3)有价证券交易次数=250000/50000=5(次)有价证券交易间隔期=360/5=72(天)实训题(二)参考答案各方案现金持有量及其总成本由于,丙方案的现金持有总成本最低,因此,丙方案是最佳现金持有量方案。

实训题(三)参考答案(1)现销与赊销比例为1:4,所以现销额=赊销额/4,即赊销额+赊销额/4=4500,所以赊销额=3600(万元)(2)应收账款的平均余额=日赊销额×平均收账天数=3600/360×60=600(万元)(3)维持赊销业务所需要的资金额=应收账款的平均余额×变动成本率=600×50%=300(万元)(4)应收账款的机会成本=维持赊销业务所需要的资金×资金成本率=300×10%=30(万元)(5)应收账款的平均余额=日赊销额×平均收账天数=3600/360×平均收账天数=400,所以平均收账天数=40(天)。

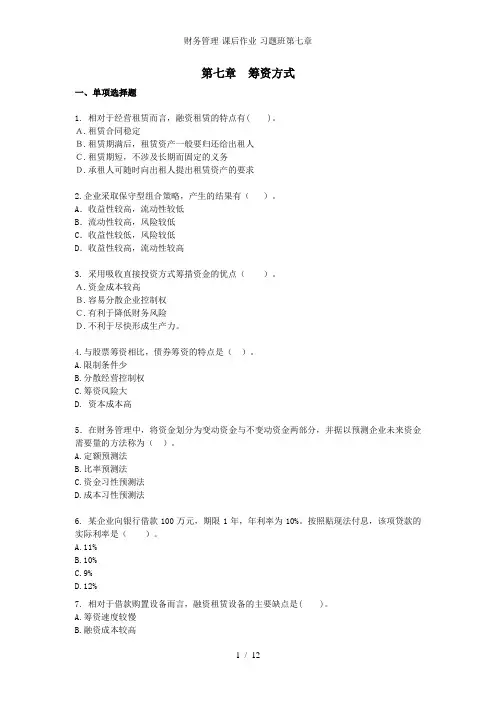

财务管理第七章习题与答案筹资方式一、单项选择题1.某企业按“2/10,n/50”的条件购进一批商品。

若企业放弃现金折扣,在信用期内付款,则其放弃现金折扣的机会成本为()。

A.16.18% B.20% C.14% D.18.37%2.下列关于企业筹资的基本原则的说法,不正确的是()A.规模适当 B.筹措的资金充足 C.来源合理 D.方式经济3.公司增发的普通股的发行价为20元/股,筹资费用为发行价的5%,最近刚发放的股利为每股2元,已知该股票的资金成本为12%,则该股票的股利年增长率为()。

A.2% B.1.33% C.4% D.5%4.关于留存收益的成本,下列说法不正确的是()A.留存收益是企业资金的一种重要来源B.它实际上是股东对企业进行追加投资,股东对这部分投资也要求有一定的报酬C.由于是自有资金,所以没有成本D.在没有筹资费用的情况下,留存收益的成本计算与普通股是一样的5.某企业用贴现的方式按年利率12%从银行借入款项1000万元,银行要求企业按贷款额的8%保留补偿性余额,该借款的实际年利率为()。

A.15% B.10% C.12% D.12.5%6.在财务管理中,依据财务比率与资金需求量之间的关系预测资金需求量的方法称为()。

A.定性预测法 B.比率预测法 C.基本分析法 D.资金习性预测法7.留存收益的来源渠道()。

A.只有盈余公积 B.只有未分配利润 C.包括盈余公积和未分配利润 D.指的是分配的股利二、多项选择题1.某企业拥有流动资产100万元(其中永久性流动资产为30万元),负债和权益资本共计400万元(其中权益资本150万元,长期负债100万元,自发性流动负债60万元),则以下说法正确的有()。

A.该企业采取的是激进型组合策略B.该企业采取的是平稳型组合策略C.该企业的临时性流动负债为90万元D.该企业目前没有处于经营性低谷2.按有无特定的财产担保,可将债券分为()。

A.信用债券B.有担保债券C.抵押债券D.无担保债券3.甲公司用贴现法以10%的年利率从银行贷款1000万元,期限为1年,则以下说法正确的有()A.甲公司应付利息是90万元B.甲公司实际可用的资金为900万元C.甲公司的实际利率要比10%高D.甲公司的应付利息是100万元4.在短期借款的利息计算和偿还方法中,企业实际负担利率高于名义利率的有()。

第七章营运资金管理思考练习一、单项选择题1.C2.B3.D4.C5.B6.B7.C8.C9.B 10.B 11.A 12.D 13.C 14.D 15.C二、多项选择题1.ACD 2.AB 3.BCD 4.ABC 5.ABCD 6.BC 7.AB 8.AC9.AB 10.BC 11.AC 12.ABCD 13.BC 14.BD 15.BD三、判断题1-5.×√×√× 6-10.√×××× 11-15 √×√×√四、计算题1.(1)最佳现金持有量=(2×400000×400/20%)1/2=40000元(2)转换成本=400000/40000×400=4000元机会成本=40000/2×20%=4000元(3)有价证券交易间隔期=360/(400000÷40000)=36天2.(1)收益增加=800×5%×20%=8(万元)(2)信用政策调整后的平均收现期=20×30%+30×40%+40×30%=30(天)收入增加使资金平均占用变动=800×(1+5%)×80%/360×30-800×80%/360×25=11.56(万元)(3)应计利息变动=11.56×10%=1.156(万元)(4)增加的收账费用=800×5%×1%=0.4(万元)(5)增加坏账损失=800×(1+5%)×1.2%-800×1%=2.08(万元)(6)增加的现金折扣=800×(1+5%)×30%×2%+800×(1+5%)×40%×1%=8.4(万元)(7)增加的各项费用合计=1.156+0.4+2.08+8.4=12.036(万元)(8)改变信用期的净损益=8-12.036=-4.036(万元),小于0。

1、股票股利与股票分割影响的区别在于(C)。

A.股东的持股比例是否变化B.所有者权益总额是否变化C.所有者权益结构是否变化D.股东所持股票的市场价值总额是否变化2、下列销售预测方法中,不属于定性分析法的是( C )。

A.德尔菲法B.推销员判断法C.因果预测分析法D.产品寿命周期分析法3、关于公司净利润的分配,以下说法正确的是( C )。

A.公司从税后利润中提取法定公积金后,经董事会批准,还可以从税后利润中提取任意公积金B.公司向投资者分配股利(利润)时,股份有限公司股东按照实缴出资比例分红C.法定公积金可用于弥补亏损或转增资本D.税后利润弥补亏损必须用当年实现的净利润4、上市公司发放现金股利的原因不包括(D)。

A.投资者偏好B.减少代理成本C.传递公司的未来信息D.减少公司所得税负担5、某公司现有发行在外的普通股200万股,每股面值1元,资本公积300万元,未分配利润800万元,股票市价10元,若按10%的比例发放股票股利并按市价折算,公司报表中资本公积的数额将会增加(A)万元。

A.180B.280C.480D.300你的答案:发放股票股利之后增加的资本公积=200×10%×10-200×10%×1=180(万元)6、(A)认为用留存收益再投资带给投资者的收益具有很大的不确定性,并且投资风险随着时间的推移将进一步增大,所以投资者更喜欢现金股利。

A.在手之鸟理论B.信号传递理论C.代理理论D.股利无关论7、(A)的依据是股利无关论。

A.剩余股利政策B.固定股利政策C.固定股利支付率政策D.低正常股利加额外股利政策8、某公司近年来经营业务不断拓展,目前处于成长阶段,预计现有的生产经营能力能够满足未来10年稳定增长的需要,公司希望其股利与公司盈余紧密配合。

基于以上条件,最为适宜该公司的股利政策是( C )。

A.剩余股利政策B.固定股利政策C.固定股利支付率政策D.低正常股利加额外股利政策9、下列因素中,有可能导致公司采取较紧的利润分配政策的是( C )。

思考题1.答题要点:如果通过事后审计将赔偿责任引入投资项目的预测阶段,从积极的方面来说,由于赔偿责任的约束,一方面进行投资预测的工作人员会不断地改进预测方法,总结经验教训,更加认真踏实地做好本职工作,从而提高投资项目预测的准确度,从而持续提高投资管理的效率。

另一方面,进行投资预测的工作人员在进行项目预测时会更加谨慎,从而降低企业的投资风险。

从消极的方面来说,由于赔偿责任的存在,进行预测的工作人员为了规避这种风险,可能故意低估一些风险比较大的项目的决策指标,从而使公司丧失投资效率最高的项目。

另外,某一项目的实际值和预测值的偏差可能是多种原因导致的,其中可能有环境变化方面的原因,可能有投资实施阶段的原因,如果责任划分不清,会使投资项目预测的工作人员感到不公平,降低他们的工作满意度,从而影响他们的工作积极性,主动性和创造性,最终对投资项目造成不利影响。

2.答题要点:按照现金流量的发生时间,投资活动的现金流量可以被分为初始现金流量、营业现金流量和终结现金流量。

初始现金流量一般包括如下的几个部分:(1)投资前费用;(2)设备购置费用;(3)设备安装费用;(4)建筑工程费;(5)营运资金的垫支;(6)原有固定资产的变价收入扣除相关税金后的净收益;(7)不可预见费。

营业现金流量一般以年为单位进行计算。

营业现金流入一般是指营业现金收入,营业现金流出是指营业现金支出和交纳的税金。

终结现金流量主要包括:(1)固定资产的残值收入或变价收入(指扣除了所需要上缴的税金等支出后的净收入);(2)原有垫支在各种流动资产上的资金的收回;(3)停止使用的土地的变价收入等。

投资决策采用折现现金流量指标更合理的的原因是:(1)非折现指标把不同时间点上的现金收入和支出当作毫无差别的资金进行对比,忽略了资金的时间价值因素,这是不科学的。

而折现指标则把不同时间点收入或支出的现金按照统一的折现率折算到同一时间点上,使不同时期的现金具有可比性,这样才能做出正确的投资决策。

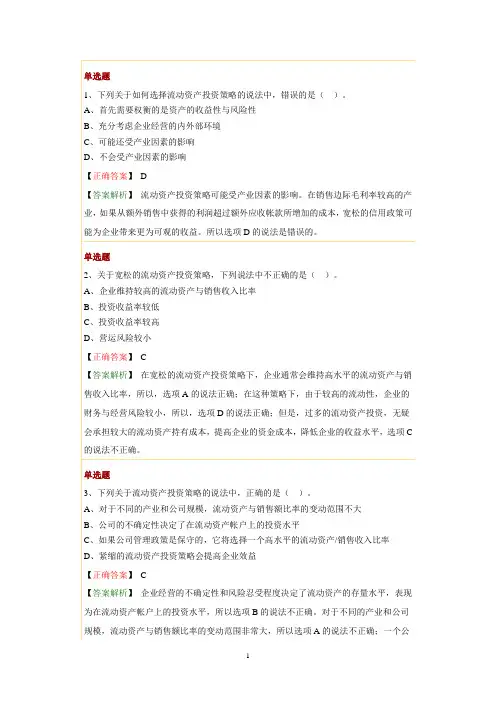

单选、下列关于如何选择流动资产投资策略的说法中,错误的是)、首先需要权衡的是资产的收益性与风险、充分考虑企业经营的内外部环、可能还受产业因素的影、不会受产业因素的影正确答D答案解流动资产投资策略可能受产业因素的影响。

在销售边际毛利率较高的业如果从额外销售中获得的利润超过额外应收帐款所增加的成本宽松的信用政策能为企业带来更为可观的收益。

所以选的说法是错误的单选、关于宽松的流动资产投资策略,下列说法中不正确的是)、企业维持较高的流动资产与销售收入比、投资收益率较、投资收益率较、营运风险较正确答C答案解在宽松的流动资产投资策略下,企业通常会维持高水平的流动资产与售收入比率,所以,选的说法正确;在这种策略下,由于较高的流动性,企业财务与经营风险较小,所以,选的说法正确;但是,过多的流动资产投资,无会承担较大的流动资产持有成本提高企业的资金成本降低企业的收益水平选的说法不正确单选、下列关于流动资产投资策略的说法中,正确的是)、对于不同的产业和公司规模,流动资产与销售额比率的变动范围不、公司的不确定性决定了在流动资产帐户上的投资水、如果公司管理政策是保守的,它将选择一个高水平的流动资销售收入比、紧缩的流动资产投资策略会提高企业效正确答C答案解企业经营的不确定性和风险忍受程度决定了流动资产的存量水平,表为在流动资产帐户上的投资水平,所以选的说法不正确。

对于不同的产业和公的说法不正确;一个规模,流动资产与销售额比率的变动范围非常大,所以选项司必须选择与其业务需要和管理风格相符合的流动资产投资策略如果公司管理政策保守的它将选择一个高水平的流动资销售收入比率保证更高的流动(安全性所以选的说法正确;在不可预见的事件没有损坏企业的流动性而导致严重问题生的情况下,紧缩的流动资产投资策略会提高企业效益,选的说法缺乏前提,以不正确单选、目标现金余额的确定,有三种模型,下列说法中不正确的是)、在成本模型中,考虑的成本包括机会成本、管理成本和交易成、在三种模型中,都考虑了机会成、在存货模型中,在最佳现金持有量下,机会成本=交易成、在随机模型中,考虑了机会成本和交易成本2正确答A答案解在成本模型中,考虑的成本包括机会成本、管理成本和短缺成本,三成本之和最小时的现金持有量为最佳持有量。

所以,选的说法不正确。

三种模的共同点是都考虑了机会成本在存货模型中考虑的是机会成本和交易成(交易本与现金和有价证券之间的转换次数成正比相当于存货的变动订货成本与订货次数关系这有助于理解为什么在现金的存货模型中考虑了交易成本在最佳现金持有量下,机会成本=交易成本;在随机模型中,回归线R的计算公式中的i表示的是以日为基础计算的现金机会成本,由此可知,考虑了机会成本。

b表示的是每次有价证券的固定转换成本,由此可知,考虑了交易成本。

由于H=3R-2L,所以,H-R=2×(R-L)。

单选题2、下列成本中,属于确定目标现金余额的成本模型和随机模型都需要考虑的是()。

A、机会成本B、管理成本C、短缺成本D、转换成本【正确答案】 A【答案解析】在成本模型下,需要考虑的成本包括机会成本、管理成本和短缺成本;所随机模型需要考虑的成本包括转换成本和机会成本。

根据随机模型的计算公式可知以本题的答案为选单选、某公司持有有价证券的年利率%,公司的最低现金持有量400元,现金回线1000元如果公司现有现2200元根据现金持有量的随机模型此时应投于有价证券的金额是)元14001200010000正确答C答案解323100024002200(元),公司现有现2200达到了现金持有量的上限所以需要进行现金与有价证券的转换投资于有价证券的额220010001200(元)单选、下列各项关于现金周转期的表述中,正确的是)、加速支付应付帐款可以减少应收帐款周转、产品生产周期的延长会缩短现金周转、现金周转期一般长于存货周转期与应收帐款周转期之、现金周转期是介于公司支付现金与收到现金之间的时间正确答D答案解如果要减少现金周转期,可以从以下方面着手:加快制造与销售产成来减少存货周转期加速应收帐款的回收来减少应收帐款周转期减缓支付应付帐款延长应付帐款周转期。

故选的说法不正确。

产品生产周期的延长会延长存货周期,从而延长现金周转期,故选不正确。

现金周转期,是指介于公司支付现金收到现金之间的时间段,它等于经营周期减去应付帐款周转期。

由此可知,选说法不正确,选的说法正确单选、在营运资金管理中,企业从取得存货开始到销售存货并收回现金为止的时为)、现金周转、存货周转B、经营周、应收帐款周转正确答C答案解企业的经营周期是指从取得存货开始到销售存货并收回现金为止的时期其中,从收到原材料,加工原材料,形成产成品,到将产成品卖出的这一时期,称为货周转期产品卖出后到收到顾客支付的货款的这一时期称为应收帐款周转期现周转期是指介于企业支付现金与收到现金之间的时间段它等于经营周期减去应付款周转期单选、在其他条件相同的情况下,下列各项中,可以加速现金周转的是)、减少存货、减少应付帐、放宽赊销信用、利用供应商提供的现金折正确答A答案解现金周转期=存货周转期+应收帐款周转期-应付帐款周转期,减少货量会减少存货周转期其他条件不变时存货周转期减少会减少现金周转期即加现金周转,因是答案。

减少应付帐款会减小应付帐款周转期,放宽赊销信用期增加应收帐款周转期,利用供应商提供的现金折扣会减小应付帐款周转期,所以都不是答案单选、某企业年赊销收入36万元,信用条件“2/1n/30时,预计2%的客户择现金折扣优惠,其余客户在信用期付款,变动成本率6%,资金成本率1%则应收帐款占用资金的应计利息为)元。

年36天计算20800145681248015600正确答D答案解应收帐款平均收帐期102%308%2(天(元1560%16263600000/360应收帐款占用资金的应计利息单选、假设某企业预测的年销售额200万元,应收帐款平均收帐天数4天,变动本率60,资金成本率8,一年36天计算,则应收帐款占用资金应计利息)万元2502001512正确答D答案解应收帐款占用资金应计利息=日销售平均收现变动成本资成本2000/3604560%81(万元单选、关于应收帐款的成本,下列说法中不正确的是)、因投放于应收帐款而放弃其他投资所带来的收益,即为应收帐款的机会成、应收帐款的机会成本=应收帐款平均余资本成、应收帐款的管理成本主要是指在进行应收帐款管理时,所增加的费、应收帐款的坏帐成本是指无法收回应收帐款而发生的损失,此项成本一般与应收款发生的数量成正正确答B答案解应收帐款的机会成本=应收帐款占用资资本成本=应收帐款平均变动成本资本成本,所以,选的说法不正确、企业在进行商业信用定量分析时,应当重点关注的指标是)、发展创新评价指、企业社会责任指、流动性和债务管理指、战略计划分析指正确答C答案解商业信用定量分析就是是否对一个客户提供信用,是否提供信用涉及应收帐款能否收回企业的应收帐款相当于对方的流动负债需要分析对方的偿债能力即需要重点关注的指标是流动性和债务管理指标。

多选、如果企业把信用标准定得过高,则会)、降低违约风、降低收帐费、降低销售规、降低企业市场竞争能正确答ABCD答案解如果企业把信用标准定得过高,将使许多客户因信用品质达不到所设标准而被企业拒之门外其结果是有利于降低违约风险及收帐费用但不利于企业市竞争能力的提高和销售收入的扩大判断、5评价系统中能是指如果企业或个人在当前的现金流不足以还债,他在短期和长期内可供使用的财务资源。

正确答答案解5评价系统中资是指如果企业或个人在当前的现金流不足还债,他们在短期和长期内可供使用的财务资源能是指经营能力,通常通过分申请者的生产经营能力及获利情况管理制度是否健全管理手段是否先进产品生销售是否正常,在市场上有无竞争力,经营规模和经营实力是否逐年增长等来评估单选、在应收帐款管理中,下列说法中不正确的是)、应收帐款的主要功能是增加销售和减少存、应收帐款的成本主要包括机会成本、管理成本和坏帐成、监管逾期帐款和催收坏帐的成本会影响公司的利、信用期的确定,主要是分析改变现行信用期对成本的影正确答D答案解信用期的确定,主要是分析改变现行信用期对收入和成本的影响。

所选的表述不正确单选)、以下不属于信用条件组成要素的是2、信用期、折扣期、现金折、收帐政正确答D答案解信用条件是销货企业要求赊购客户支付货款的条件,由信用期间、折期限和现金折扣三个要素组成、放弃现金折扣的信用成本率受折扣百分比、折扣期和付款期的影响。

下列各项中可以使放弃现金折扣信用成本率提高的有)、付款期、折扣期不变,折扣百分比提、折扣期、折扣百分比不变,付款期延、折扣百分比不变,付款期和折扣期等量延、折扣百分比、付款期不变,折扣期延正确答AD答案解放弃现金折扣的信用成本率现金折扣-现金折扣率][360款期-折扣期,付款期延长,公式的分母增大,公式的计算结果减小,所以选的说法不正确付款期和折扣期等量延长,公式的分母不变公式的计算结果不变以选的说法不正确单选、在应收帐款保理的各种类型中,由保理商承担全部收款风险的是)、明保、暗保、有追索权保、无追索权保正确答D答案解无追索权保理是指保理商将销售合同完全买断并承担全部的收款风险单选、下列关于应收帐款日常管理的表述中,错误的是)、应收帐款的日常管理工作包括对客户的信用调查和分析评价、应收帐款的催收工、企业对顾客进行信用调查的主要方法是直接调查法和间接调查B、应收帐款的保理可以分为有追索权保理、无追索权保理、明保理和暗保、到期保理是指保理商并不提供预付帐款融资,而是在赊销到期时才支付,届时不货款是否收到,保理商都必须向销售商支付货正确答C答案解应收帐款的保理可以分为有追索权保理、无追索权保理、明保理和暗理以及折扣保理和到期保理,所以选的表述不正确单选、应收帐款保理具有多种方式,其中在销售合同到期前,保理商将剩余未收款部分预付给销售商,一般不超过全部合同额7090,这种保理方式为)、无追索权保、有追索权保、融资保、明保正确答C答案解应收帐款保理具有多种方式,其中在销售合同到期前,保理商将剩余收款部分先预付给销售商一般不超过全部合同额7090这种保理方式是折保理,又称为融资保理单选、下列各项中,不属于存缺货成的是)、材料供应中断造成的停工损、产成品缺货造成的拖欠发货损、丧失销售机会的损、存货资金的应计利正确答D答案解缺货成本,是指由于存货供应中断而造成的损失,包括材料供应中断成的停工损失产成品库存缺货造成的拖欠发货损失和丧失销售机会的损失及造成的誉损失等。

存货资金的应计利息属于储存成本单选、下列与持有存货成本有关的各成本计算中,不正确的是)、取得成本=购置成、储备存货的总成本=取得成本+储存成本+缺货成、订货成本=固定订货成本+变动订货成C、存储成本=固定储存成本+变动储存成正确答A答案解取得成本=订货成本+购置成本,因此选的表述不正确单选、下列各项储存成本中,与存货的数量无关的是)、存货资金的应计利、仓库租、存货破损和变质损、存货的保险费正确答B答案解变动储存成本与存货的数量有关,如存货资金的应计利息、存货的破和变质损失、存货的保险费用等。