hnd经济学2世界经济学

- 格式:doc

- 大小:360.00 KB

- 文档页数:24

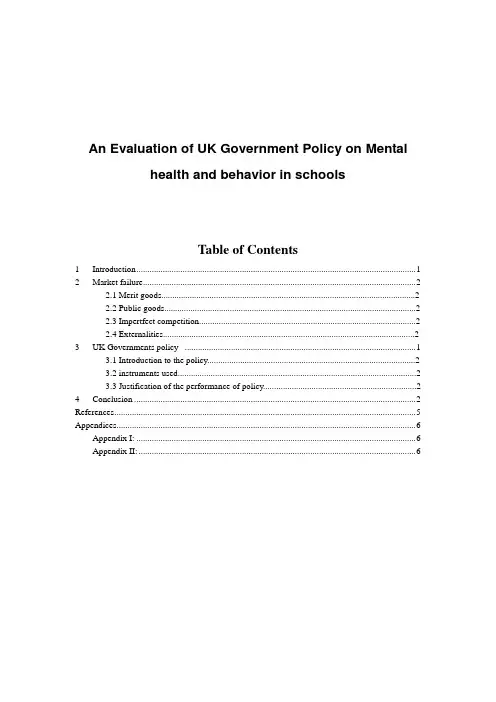

An Evaluation of UK Government Policy on Mentalhealth and behavior in schoolsTable of Contents1 Introduction (1)2 Market failure (2)2.1 Merit goods (2)2.2 Public goods (2)2.3 Impertfect competition (2)2.4 Externalities (2)3 UK Governments policy (1)3.1 Introduction to the policy (2)3.2 instruments used (2)3.3 Justification of the performance of policy (2)4 Conclusion (2)References (5)Appendices (6)Appendix I: (6)Appendix II: (6)1IntroductionThis report aims to explain the‘market failure’and the role of government in relative to merit goods, public goods, imperfect composition and externalities.The policy about mental health and behavior in school will also be introduced.Then it will describe the instruments used to achieve the policy and evaluate the policy.2Market failureMarket fail, that is, they do not provide all of the goods and services needed by the government,nor by society(SQA,2013a p184).2.1Merit goodsThe government provides services that might not be provided by the private sector in sufficient quantities or of a sufficient quantity (SQA,2013a p188).For instance,medical services,education and so on.In China,the government provides the public universities and nine year education,which support children to go to school and get a better education.2.2Public goodsThese are commodities, which would not be provided by the private sector because they would find that many people, even if they benefited from them, would refuse to pay(SQA,2013b p190), for example, grills in the park and Automatic Pet Water Fountain and so on.In many countries, the government provides the Automatic Pet Water Fountain, which is convenient for passerby to drink water whenever they want.2.3Imperfect competitionA company which control their own market , and they have no rival. A monoplist can adjust prices output in the market.for example, on February 5, 1991, pierpont Morgan bought Andrew Carnegie, Rockefeller,several iron ore and all the steel business,became the largest steel company , 65% of steel production by their control.The government could establish perfect competition through the establishment of enterprise competition policy (Peter,2013)2.4ExternalitiesAn externality is an effect of a purchase or use decision by one set of parties on others who did not have a choice and whose interests were not taken into account (SQA,2013d p188).For example, the negative externalities include car exhaust, smoking, kara OK noisy,which will do harm to the environment and people’health.As far as I am concerned, the government should have odd-and-even license plate rule and provide new energy electric vehicle.The positive externalities include new technology like purify the water and restoration of historical buildings.I think the government should support the enterprise to create more new technology.3UK Governments policy3.1 Introduction to the policy--Mental health and behavior in schoolsThe purpose of this policy is to let all pupils benefit from learning and developing in a well ordered school environment that fosters and rewards good behaviour and sanctions poor and disruptive behaviour. Their behaviour and discipline in schools advice sets out the powers and duties for school staff and approaches they can adopt to manage behaviour in their schools. It also says that schools should consider whether continuing disruptive behaviour might be a result of unmet educational or other needs. Published on16 June 2014,last updated on18 March 2016(Gov,UK,16 June 2014)3.2 Instruments usedInstruments- economic variables that governments can control directly for example, tax, public spending(SQA,2013e p194).The government take actions via government spending and relevant regulation.They found the Child and Adolescent Mental Health Services to deal with it.The specific services offered by CAMHS vary depending on the needs of the local area. The best way to influence those services overall is to get involved with the local health and wellbeing board.The government take actions to help them in referring pupils effectively to specialist CAMHS and otherwise working well with the service for the benefit of their vulnerable pupils. These include:1.The government hire some people documenting evidence of the symptoms or behaviour that are causing concern,encouraging the pupil and their parents/carers to speak to their GP2.The government spent some money working with local specialist CAMHS to make the referral process as quick and efficient as possible(Spence, S.H. 2003)3.1Justification of the performance of the policyI think the policy is successful, the mental health care benefits can make children to have a happier life.Thanks to the policy, children now have the ability to develop psychologically, emotionally, intellectually and spiritually.However,I think the policy also has some disadvantages.It has greatly increased government pressure.For example,Set up the CAMHS organization to support the school and some public organization。

经济学:

Section1:

什么是市场失灵?

解决的四个方面a.公共产品b 鼓励性产品c 内外控制d 调整

什么是垄断:对社会的影响

Section2:

选择一个政策(福利政策,竞争政策,环境政策)

.a 说明这个政策

b. 政府用什么工具达到这个政策

c. 评估这个政策

人力:

1,组织结构的类型,和主要产品

2,给一个建议说明哪种组织结构适合这个公司,可以让这个公司更好的发展,给出充分的理由

3,组织结构的决定性因素是什么,为什么布局成这样

4,分析这个公司的各种关系

5,权利的分部:

在政府,责任,代表团是怎样表现的

市场学:

1,什么是市场学,结合公司

2,宏观,微观对组织的影响

3,市场调研

4,市场细分(好处,过程,给企业带来的好处)

市场细分的目的

5,市场组合:7个“P”每个都要解释并且结合案例

6,市场营销组合随着环境的变化而变化。

一、学校简介中国人民大学是一所以人文社会科学为主的综合性研究型全国重点大学,直属于教育部,由教育部和北京市共建。

从1950年至今,国家历次确立重点大学,中国人民大学均位居其中。

目前学校是国家“985工程”和“211工程”重点建设的大学之一。

随着全球经济企业化的进程,市场经济正经历深刻的变革和转型,企业经济和管理体制正接受前所未有的巨大挑战。

在市场经济条件下,企业的健康和快速发展离不开优质的企业管理,而优质的企业管理又离不开有战略眼光和创新精神的管理者。

毫无疑问,未来在全球市场化经济环境中,懂得企业管理和市场经济运作,懂得如何以“管理出效益”的管理方式来追求企业最大效益的复合型人才将会是全球经济战场上的佼佼者。

中国人民大学国际关系学院是目前国内规模最大、层次最全的国际问题和政治经济学人才培养的科研基地之一,在国际上开设有多个国际研究中心、研究所,享有广泛盛誉。

二、专业概况中国人民大学世界经济学专业是全国高校中建立最早、培养人才层次最为齐全的教学和科研单位。

1958年中国人民大学就建立了世界经济教研室并开始招收本科生,1978年开始招收硕士研究生,1984年开始招收博士研究生,1988年建立国际经济系,2001年被评为北京市重点学科。

三、专业培养目标适应中国经济改革、开放和发展的需求,不断将理论前沿研究成果和最新实践引入教学过程,逐步实现教学的国际化、数字化、数量化、使用化,努力和国际一流大学接轨;培养出一批了解世界经济运行规律和国际经济关系特征、具备扎实的理论功底、掌握现代经济学分析工具、能够熟练进行国际交流的高素质人才,以适应国家政府部门、公司和企事业单位对于高级国际经贸战略人才的要求。

四、毕业生去向本专业毕业生的主要去向是国家政府部门、国有商业银行、外资银行和会计事务所、高等院校和大型企事业单位。

五、报名条件1、拥护《中华人民共和国宪法》,遵守法律、法规;品行端正;优秀业务骨干;身体健康,并能坚持在职学习者;2、大学本科以上学历,申请硕士学位者要求具备本科学士学位;3、不具备上述两款条件,旨在提高本人业务素质,报名条件可放宽到大专以上学历者,但此种进修生不能申请硕士学位。

世界经济学研究生课程

世界经济学研究生课程通常涵盖多个方面的内容,包括但不限于以下主题:

1. 国际经济学:研究国际贸易、国际金融和国际投资等方面的知识,涉及国际贸易理论、关税政策、汇率体系和跨国公司运作等内容。

2. 发展经济学:关注发展中国家和地区的经济增长与发展问题,探讨发展中的经济、社会和环境问题,以及如何制定和实施有效的发展政策。

3. 国际商务与跨国公司管理:介绍国际商务的基本概念和原则,涵盖国际市场营销、国际贸易法律和跨国公司管理等内容。

4. 国际金融与投资:涵盖国际金融体系、外汇市场、国际资本流动、跨国公司的融资和投资策略等内容。

5. 区域经济与全球治理:关注不同地区的经济合作、区域一体化和全球治理问题,涉及国际组织、区域合作机制和全球经济治理中的挑战和机遇。

6. 全球化与经济发展:研究全球化的影响以及不同国家和地区的经济发展经验,探讨全球化背景下的经济发展模式和策略。

7. 世界经济政策:研究世界各国的经济政策,包括货币政策、财政政策、贸易政策等,分析这些政策对全球经济的影响。

8. 世界人口与资源环境经济学:探讨全球人口增长、资源利用和环境保护等问题,研究这些问题对全球经济和社会发展的影响。

9. 文化与世界经济:分析文化因素对世界经济的影响,包括文化产业的国际贸易、文化多样性对经济发展的作用等。

10. 国际经济法:研究国际经济交易的法律规则和制度,包括国际贸易法、投资法、知识产权法等。

世界经济学研究生课程通常采用多种教学方法,如讲座、案例分析、小组讨论、研讨会等,以培养学生的批判性思维和独立研究能力。

学生通过学习这些课程,可以深入了解世界经济的变化和发展趋势,以及应对全球挑战的策略和政策。

Outcome 21.书178,179二个图Households buy commodities from firms, using the income individuals receive for their labour and capital supplied to firmsThe firms use the income received from the sale of commodities to pay for the labour and to invest in new premises,plant and equipment.2.Injections:Investments:Loan from banks, building societies, insurance companies etc. Money saved by household can be re-injected back into the inner flow as investment by business sector (firms) after they borrow the money out of financial institutions. Government Spending:Roads, hospitals, ing the fund largely collected through taxation, the government can be the biggest buyer spending money on the products and services provided by firms If government wishes to expend the flow of income in circulation, it may choose to increase the amount of its spending and probably adopt a tax-cutting.Exports:These are goods and services that are sold abroad. The payment for them will return to the firms in this country. For example, if someone buys textiles of China, then the proceeds of the sale belong to our country. This increases the circular flow and creates more economic activity in the economy for our country. Withdraws:Savings:Amount of income that consumers choose not to spend but retain for the future uses (normally deposit in financial institutions, e.g. banks and buildingsociety). Ability or desire to save out of income is measured by ‘marginalpropensity to save (MPS)’. Level of income is the biggest factor affects level of savings, i.e. the higher the income is, the greater savings (withdrawal) out ofcircular.Taxation:Through forms as personal income tax, V AT, corporate income tax, the disposable money circulated in the economy is drawn out by the government as its revenue. This can be in the form of direct tax on our income or indirect tax onpurchases, for example V AT.Imports:Part of the consumption of both households and firms are on foreign products or products contain imported components. So that portion of expenditure will eventually go into foreigners’ pockets therefore reduce the total income circulatedin domestic economy. For example if someone in Britain buys a Japanese car, then the proceeds of the sale will go back to Japan. Imports are therefore withdraws from the circular flow.3.四选二(a)1.Production: In calculating GNP, only those items which are paid for are normally included because calculations have to be made in money terms, the inclusion of other goods and services would involve imputing a value to them. For example, if a value is placed on certain jobs which a person does for himself—growing vegetables, cleaning his car, painting his house, then why not include shaving, cooking, cleaning, driving to work, etc. on the other hand, excluding what a person does for himself may distort national income figures. An imputed money value is included for certa in payments in kind which are recognized as a regular part of a person’s incoming earning, for example, goods produced and consumed by a farmer.2,Danger of Double Counting:This can arise through ‘stock appreciation’. When inflation occurs, the value of stocks of raw materials goods raises. While this adds to the profits of firms holding such stocks it represents no increase in real output. Such gains therefore, must be deducted from the Income and Output figures.3,The Black Economy: The size of the black economy can be difficult to estimate but certainly causes distortion. National Income figures for certain industries, for example, building industries have many workers who are self-employed and are paid in cash, tax revenue is lost and welfare benefits are claimed unnecessarily.(c)National Income will be in equilibrium when expenditure is equal to consumption or when injections equal total withdrawals total. And change in the level of injection or withdrawals will bring about a change in National Income. However, the change in National Income will be relatively greater than the initial change. This is known as the “Multiplier” effect.+ 书第200页的公式。

世界经济学专业课程摘要:一、世界经济学专业概述1.世界经济学专业定义2.发展历程二、世界经济学专业课程设置1.基础课程2.专业核心课程3.选修课程三、世界经济学专业实践教学1.实践教学的重要性2.实践教学的形式四、世界经济学专业就业方向1.政府部门2.金融机构3.跨国企业五、世界经济学专业的前景与挑战1.发展前景2.面临的挑战正文:世界经济学专业是一门研究全球经济体系、经济关系及其运行规律的学科。

在我国,世界经济学专业属于经济学的一个分支,旨在培养具备较高外语水平,系统掌握世界经济学基本理论和方法,能在政府部门、金融机构、跨国企业等领域从事经济分析、预测、规划和管理工作的复合型人才。

一、世界经济学专业概述世界经济学专业主要研究全球经济体系、国际经济关系、国际贸易、国际金融、国际投资等方面的内容。

随着经济全球化进程的加速,世界经济学专业在国内外的发展势头越来越好。

二、世界经济学专业课程设置为了培养学生的专业素养,世界经济学专业的课程设置分为基础课程、专业核心课程和选修课程三个部分。

基础课程包括政治经济学、微观经济学、宏观经济学等;专业核心课程包括世界经济概论、国际经济关系、国际贸易理论与政策、国际金融、国际投资等;选修课程包括国际市场营销、国际经济合作、国际税收、国际货币制度等。

三、世界经济学专业实践教学实践教学是世界经济学专业教育的重要组成部分。

通过实践教学,学生可以加深对理论知识的理解,提高实际工作能力。

实践教学的形式包括实习、社会实践、毕业论文等。

四、世界经济学专业就业方向世界经济学专业毕业生具备较强的国际视野和跨文化沟通能力,能够在政府部门、金融机构、跨国企业等领域从事经济分析、预测、规划和管理等工作。

具体就业方向包括:在政府部门从事国际经济政策的研究和制定;在金融机构从事国际金融业务、风险管理和投资咨询等工作;在跨国企业从事国际市场调研、国际营销和跨国投资等工作。

五、世界经济学专业的前景与挑战在全球经济一体化的大背景下,世界经济学专业的发展前景十分广阔。

世界经济学专业课程摘要:1.世界经济学专业课程概述2.世界经济学专业课程的主要内容3.世界经济学专业课程的学习方法与技巧4.世界经济学专业课程的就业前景正文:一、世界经济学专业课程概述世界经济学专业课程是一门涉及全球范围内经济活动的学科,旨在培养学生具备国际视野、熟悉世界经济运行规律、掌握世界经济知识体系和分析方法的能力。

通过学习世界经济学专业课程,学生可以更好地了解国际经济形势,为我国经济发展和对外经济政策制定提供有力支持。

二、世界经济学专业课程的主要内容1.微观经济学:研究单个经济单位(如家庭、企业和市场)的行为和决策,包括生产、消费、价格等方面。

2.宏观经济学:关注整个经济体系,探讨总量经济指标(如国内生产总值、通货膨胀率、失业率等)的变动及其影响因素。

3.国际经济学:分析国际贸易、国际金融、国际投资等方面的问题,涉及汇率、贸易政策、国际经济合作等议题。

4.发展经济学:研究经济发展的历程、规律和影响因素,探讨如何实现经济可持续发展。

5.区域经济学:关注特定地区的经济现象和问题,如欧洲经济、亚洲经济等。

三、世界经济学专业课程的学习方法与技巧1.注重理论联系实际:学习世界经济学需要关注国际经济形势和政策动态,将理论与实际相结合。

2.培养跨学科能力:学习世界经济学需要涉及多个学科领域,如政治、历史、文化等,提高跨学科综合能力。

3.掌握数据分析方法:学习世界经济学需要掌握一定的数据分析方法,如统计分析、计量经济学等。

4.提高英语水平:世界经济学的教材和论文多用英语撰写,因此提高英语水平对于学习世界经济学至关重要。

四、世界经济学专业课程的就业前景世界经济学专业课程的毕业生在就业市场上具有较高的竞争力。

他们可以在政府部门、金融机构、跨国公司、研究机构等领域找到合适的工作岗位。

世界经济专业介绍世界经济专业介绍1、专业背景世界经济学是在20世纪80年代初期在英国出现的一门学科,它是金融学、国际经济学、社会主义经济学和发展经济学等学科的综合,旨在从全球视野研究世界经济结构和发展。

世界经济学不但涉及国际贸易,而且还涉及国际投资、国际金融、货币政策、扩散和全球金融危机、全球能源市场、新兴市场、国际秩序和政策等重要问题。

2、专业内容1)国际贸易和投资:国际贸易理论、国际贸易实践、贸易谈判、国际投资理论、国际投资实践、投资谈判、跨国公司等;2)国际金融:国际金融理论、货币金融学、国际金融市场、比较金融体系、外汇市场、外汇交易、银行信贷、金融服务的发展、金融机构的调整等;3)流动性和区域整合:国际金融流动性理论、国际收支理论、国际经济组织、区域整合与区域经济联盟、贸易自由化、单一市场、宏观调控、民族经济理论、经济发展等;4)全球能源经济:能源经济研究、衍生品经济学、能源价格波动的分析的理论背景、全球能源市场机制、能源需求预测等。

3、专业实践1)政策分析和咨询:分析国家政策、国际合作政策、政策咨询、政治经济分析等;2)企业管理:全球经济环境分析、市场预测、市场总体框架分析、海外投资孵化器设计、科技企业管理等;3)研究和报告:市场调研、贸易研究、政策及建议报告、投资分析报告、金融解释和可行性报告;4)全球治理与民族经济:全球治理机构及潜在话语权的分析;民族经济理论、发展理论框架及实践;4、其他课程1) 外国语言学习;2) 全球政治和社会理论;3) 社会科学经济调查研究;4) 企业信息管理;5) 全球企业管理;6) 政策分析、功能模型及数值分析;7) 国际收支框架分析等。

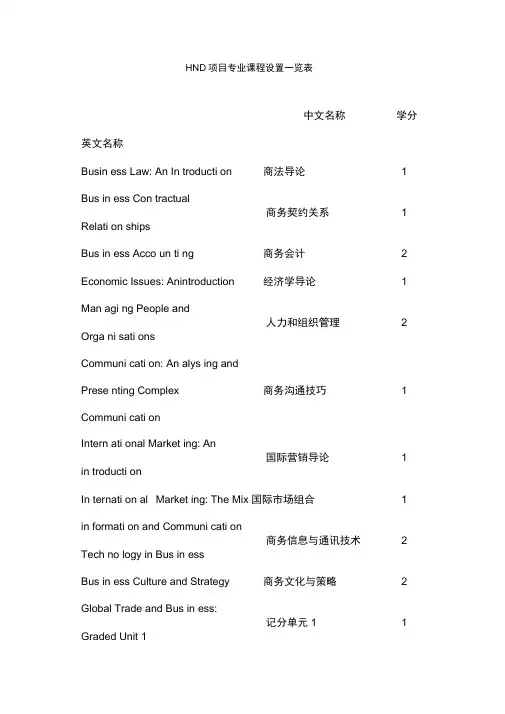

HND项目专业课程设置一览表中文名称学分英文名称Busin ess Law: An In troducti on 商法导论 1Bus in ess Con tractual商务契约关系 1 Relati on shipsBus in ess Acco un ti ng 商务会计 2Economic Issues: Anintroduction 经济学导论 1Man agi ng People and人力和组织管理 2 Orga ni sati onsCommuni cati on: An alys ing andPrese nting Complex 商务沟通技巧 1Communi cati onIntern ati onal Market ing: An国际营销导论 1 in troducti onIn ternati on al Market ing: The Mix 国际市场组合 1in formati on and Communi cati on商务信息与通讯技术 2 Tech no logy in Bus in essBus in ess Culture and Strategy 商务文化与策略 2Global Trade and Bus in ess:记分单元1 1 Graded Unit 11Econo mics 1: Micro and Macro经济学I :微观与宏观理论及其应用 经济学U :世界经济 1 财政预算 1 国际惯例 1 出口援助资源 1 出口 2 财务报表分析 2 国际物流2 国际商业组织2Theory and Applicati onEcono mics 2: The World Economy Prepari ng Finan cial Forecasts Intern ati onal In stituti ons Sources of Export Assista nee Export ingFinancial Reporting and Analysis Intern ati onal LogisticsGlobal Bus in ess Orga ni sati onsGlobal Trade and Bus in ess:记分单元2 2Graded un it 21国际理财Finan cial Services课程设置英文名称Busin ess Acco untingBusin ess Law: An In troducti onCommuni cati on: An alys ing andPrese nting Complex Communi cati onCreati ng a Culture of CustomerCareEcono mic Issues: AnIn troducti onFinan cial Sector: AnIn troducti onIn formati on Tech no logy: Applicati ons Software 1 Man agi ng People and Orga ni sati onsMarket ing: An In troducti on中文名称学分商务会计 2 商法导论 1商务沟通技巧 1 客户服务文化构建 1 经济学导论 1 金融业导论 1信息技术应用软件1 I人力和组织管理 2 市场学导论1Personal Finan cial Services 个人理财服务保险原理 1记分单元1 1经济学U :世界经1济国际贸易融资2 金融服务业规范 1所得税1信息技术应用软件1n投资学 2 养老金规划 2 个人和商业信贷 2 财政预算1记分单元2 1记分单元31Prin ciples of In sura nee Finan cial Services: Group AwardGraded Unit 1Econo mics 2: The World EconomyFinancing Intern ati onal Trade Finan cial Services Regulatory Framework In come TaxIn formati on Tech no logy: Applicati ons Software 2 In vestme nt Pension Provisi onPersonal and Commercial Lending Prepari ng Finan cial Forecasts Finan cial Services: Group Award Graded Unit 2Finan cial Services: Group AwardGraded Un it 3。

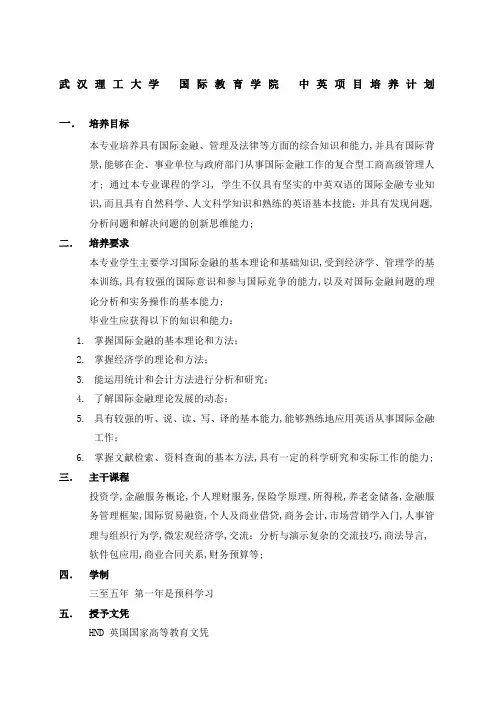

武汉理工大学国际教育学院中英项目培养计划一.培养目标本专业培养具有国际金融、管理及法律等方面的综合知识和能力,并具有国际背景,能够在企、事业单位与政府部门从事国际金融工作的复合型工商高级管理人才; 通过本专业课程的学习, 学生不仅具有坚实的中英双语的国际金融专业知识,而且具有自然科学、人文科学知识和熟练的英语基本技能;并具有发现问题,分析问题和解决问题的创新思维能力;二.培养要求本专业学生主要学习国际金融的基本理论和基础知识,受到经济学、管理学的基本训练,具有较强的国际意识和参与国际竞争的能力,以及对国际金融问题的理论分析和实务操作的基本能力;毕业生应获得以下的知识和能力:1.掌握国际金融的基本理论和方法;2.掌握经济学的理论和方法;3.能运用统计和会计方法进行分析和研究;4.了解国际金融理论发展的动态;5.具有较强的听、说、读、写、译的基本能力,能够熟练地应用英语从事国际金融工作;6.掌握文献检索、资料查询的基本方法,具有一定的科学研究和实际工作的能力;三.主干课程投资学,金融服务概论,个人理财服务,保险学原理,所得税,养老金储备,金融服务管理框架,国际贸易融资,个人及商业借贷,商务会计,市场营销学入门,人事管理与组织行为学,微宏观经济学,交流:分析与演示复杂的交流技巧,商法导言,软件包应用,商业合同关系,财务预算等;四.学制三至五年第一年是预科学习五.授予文凭HND 英国国家高等教育文凭六.学分规定课程描述投资学:本课程讲授的主要内容有:证券及证券投资工具的基本知识;证券投资的基本知识;证券市场的基本知识;证券投资分析的基本知识;证券市场监管的基本知识;开设本课程是为了培养全面了解世界证券投资及证券市场的基础知识、掌握证券投资分析的基本方法和技巧、正确进行投资决策的现代理财专家;金融服务概论:以国际货币金融关系为主要研究内容,既探讨货币和借贷资本国际运动的规律和影响的宏观问题,又研究国际金融交往的业务实践,探讨有关的国际协调;具体内容包括:国际收支、外汇与汇率、国际货币制度、国际储备和国际金融市场、国际金融机构、国际资本和流动外债管理保险学原理:学习掌握保险的基本原则及主要品种,保险合同的主要条款;了解各品种的核保及理赔,并对寿险营销制有一定认识;国际贸易融资:掌握国际收支、外汇汇率、国际金融市场和国际货币制度等方面的基本理论、基础知识和基本技能,学会如何在实际中的运用;掌握国际金融的宏观理论,学会用以说明和解决当前国际金融领域中的实际问题;掌握我国涉外金融工作中的方针、政策和做法,学会在实际工作中贯彻执行;掌握国际金融与其他经济因素的相互关系,为发展国际贸易和国际经济合作奠定理论基础,为进一步学习其他经济金融专业课打下坚实的基础;商业会计:教学基本内容是介绍借贷记账法,账户,会计凭证,会计账簿以及进行会计核算和会计信息表达方式——会计报表;该课程的基本要求是学生通过会计的学习后,能明确会计是什么,是怎样进行核算和监督的,掌握会计学的基本理论和基本操作方法,达到会计学入门应具备的理论和做帐准备;该课程的基本要求是在讲授的同时,学生应按时完成布置的作业,用以巩固所学知识,再有就是要认真做好实验,用以对所学知识不仅有理性认识,而且增加一些感性认识;个人及商业借贷:本课程是金融专业的一门基本理论与基本业务相结合的课程;包括信贷管理研究的对象和任务,信贷资产,负债管理理论、原则和方法;贷款管理的理论和操作规程;贷款风险管理的理论和方法,以及转账结算的组织管理;。

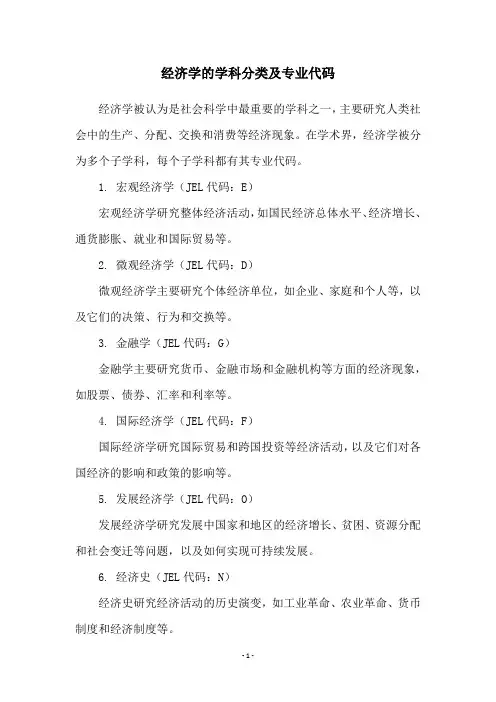

经济学的学科分类及专业代码

经济学被认为是社会科学中最重要的学科之一,主要研究人类社会中的生产、分配、交换和消费等经济现象。

在学术界,经济学被分为多个子学科,每个子学科都有其专业代码。

1. 宏观经济学(JEL代码:E)

宏观经济学研究整体经济活动,如国民经济总体水平、经济增长、通货膨胀、就业和国际贸易等。

2. 微观经济学(JEL代码:D)

微观经济学主要研究个体经济单位,如企业、家庭和个人等,以及它们的决策、行为和交换等。

3. 金融学(JEL代码:G)

金融学主要研究货币、金融市场和金融机构等方面的经济现象,如股票、债券、汇率和利率等。

4. 国际经济学(JEL代码:F)

国际经济学研究国际贸易和跨国投资等经济活动,以及它们对各国经济的影响和政策的影响等。

5. 发展经济学(JEL代码:O)

发展经济学研究发展中国家和地区的经济增长、贫困、资源分配和社会变迁等问题,以及如何实现可持续发展。

6. 经济史(JEL代码:N)

经济史研究经济活动的历史演变,如工业革命、农业革命、货币制度和经济制度等。

7. 实证经济学(JEL代码:C)

实证经济学主要关注经济数据的收集、分析和解释,以及经济政策和经济理论的检验和评估等。

以上是经济学的主要学科分类及其专业代码。

每个专业代码包含多个子领域和研究方向,为经济学家们提供了更多的研究选择和发展机会。

新疆农业大学中外合作办学情况简介国际教育学院新疆农业大学国际教育学院成立于2010年3月,主要职能是负责留学生汉语预科、学历教育以及短期游学和各类语言培训项目,中外合作办学项目的的招生、教学以及学生管理。

一、留学生教育近年来,每年在校的留学生200多人,来自19个国家和地区,其中学习专业的学生约占30%,语言生主要是汉语预科生,有少量学习新疆少数民族语言的学生。

二、中外合作办学项目1、SQA-HND项目。

通过引进英国高等教育体系中的阶段性文凭课程,在充分吸收国外先进教学理念,引进教材、管理模式的基础上结合我校同类专业的课程开展教学,为我区学生提供了在国内接受国外优质教育资源的机会。

本项目于2003年9月在我校首次招生,至今我学院获批准开设的专业包括商科类六个专业。

2013年,经自治区教育厅批准,我校首次开办开设国际经济与贸易、人力资源管理两个专业本科国际教育班,2014年招生人数达96人。

目前,该项目在校学生包括一个专科班,5个本科班,共152人。

2、新疆农业大学与俄罗斯太平洋国立大学合作举办交通运输(物流工程方向)专业合作办学项目。

该项目经教育部批准,采取“3+2”培养模式,由两校共同制定和实施教学计划。

计划学制是在我校学习三年(含一年预科语言学习阶段),到国外合作高校继续专业学习二年,毕业可同时获取两所院校本科学位。

目前,该项目已招生70名学生,这是新疆第一个由教育部批准的本科以上层次中外合作办学项目。

专业简介:国际经济与贸易主要课程:经济学导论(Economic Issues: An Introduction)、经济学1:微观和宏观的理论和应用(Economics 1: Micro and Macro Theory and Application )、商务会计(Business Accounting)、经济学2:世界经济(Economics 2: The World Economy)、国际贸易概论、国际贸易实务、国际结算、商法导论(Business Law :an introduction)、记分单元2(国际贸易与商务:大综合2)(Global Trade and Business :Grade unit 2 )、国际金融、国际商务组织(Global Business Organisations)、计量经济学、国际物流(International Logistics)信息与沟通技术在商务中的应用(Information and Communications Technology in Business) 、财务预算(Preparing Financial Forecasts)、商务文化与策略(Business Culture and Strategy)、商务行为技巧(Behavioral Skills for Business)、现代企业管理、国际经济合作、当代世界经济与政治。

1、SQA HND是什么?答:SQA HND是由英国苏格兰学历管理委员会(又称苏格兰资格监管局,简称SQA)颁发的英国国家高等教育文凭(Higher National Diploma,简称HND)。

该文凭由英国文化委员会推荐,中英两国政府合作引进,经中国驻英国大使馆教育处认证,SQA HND文凭等同于我国大专文凭。

2、SQA是什么性质的机构?答:SQA(Scottish Qualifications Authority)苏格兰学历管理委员会,又称苏格兰资格监管局,受苏格兰首相的直接领导,隶属苏格兰教育部。

是负责除学位和部分专业资格以外其它学历资格的开发、评估、颁证和资质鉴定的法定政府机构。

SQA是唯一得到中国驻英使馆认证的英国颁证机构。

SQA学历资格在世界上得到认可。

SQA的主要职能包括:设计与推广优质的国家资格证书、国家高等资格证书、职业资格证书;资格鉴定及授权发证;审批开设SQA证书项目的教育和培训机构;安排评估、评审及考试;体现质量保证职能;颁发学历资格证书。

3、国内学生完成SQA HND课程后可获得什么结果?答:学生在国内完成三年的学习后,成绩合格修满学分者可获得SQA颁发的HND 文凭,同时获得中国劳动和社会保障部职业技能鉴定中心核发的国家三级职业资格证书。

获得SQA HND文凭的学生可以继续到英国、澳大利亚、新西兰、荷兰、美国、马来西亚等国家续本,获得本科学位后成绩优异者可继续攻读硕士学位。

4、什么是“五年学业规划”?答:即前三年在国内完成HND课程,后两年到国外完成本科和硕士课程,整个过程为五年。

学生可根据自身情况选择分段学习。

第一年国内预科、第二、三年国内专业课程;获HND文凭并雅思成绩达到国外大学要求者第四年可国外续本,获得学士学位后,第五年可继续攻读硕士课程,实现“五年分段学习,国内外专本硕连读”。

5、SQA HND在国内的教学模式?答:国内课程教学模式有两种,分别为全英班和中文班,两者的特点有:6、SQA HND课程招生对象是谁?答:应、往届高中毕业生(或同等学历者)。

Assessment task 2Assessment task instructions The UK economy is made up of millions of people and billions of economic activities. Within these activities, goods and services are created and exchanged. It can be complicated at times but a simple model explaining in general terms how an economy is organised and how those involved interact is a good start.Question 1 Draw a diagram showing the participants of the Circular Flow of Income and explain how it operates. The simple model is sufficient for a beginning, but an economy is more complex and involves external influences, which can raise or lower economic activity.Question 2 Identify three injections and three withdrawals from the Circular Flow of Income; give examples of each, and how they affect levels of economic activity. In the following table, there are examples of the growth rate of various countries over nine years Country United Kingdom United States Bulgaria Switzerland 1994 4.7 4.0 1.8 0.3 1995 2.9 2.7 2.1 0.6 1996 2.63.6 -9.4 0.3 1997 3.44.4 -5.6 1.7 1998 3.0 4.3 4.0 2.4 1999 2.14.1 2.3 1.6 2000 3.1 3.85.4 3.0 2001 1.9 0.3 4.0 1.3 2002 1.6 2.4 3.5 0.6Question 3 Choose any two of the following questions: (a)Explain at least three difficulties encountered in measuring the National Income of a country. (b) Explain (using at least three reasons) why it is difficult to compare the growth rates of the countries in the table above. (c) Explain how the multiplier effect could substantially raise the level of National Income. (d) Explain the difference between real and nominal growth using the table above.Assessment task 2 Outcome(s) covered 2 Suggested solution and making an assessment decisionQuestion 1 A circular flow diagram clearly identifying the following in their correct places: Firms: Households: Markets for factors of production: Land, labour, capital and wages, rent, profit and income. revenue spending Goods and services sold Goods and services bought Firms Households Production inputs Land, labour, capital Wages, rent, profit income (PPT 书P74)Question 2Injections: Investment Withdrawals: Savings Government spending Taxation Exports Imports Appropriate examples: Investments: New factory being built 【built a new private enterprise (grow)】Government spending: New hospital being built (not PFI or PPP)【built public schools (grow)】Exports: Firm wins order to supply new computers to foreign firm 【In cooperation with foreign sales (grow)】Savings: High interest rates result in more savings【a country saves too much of its income (decline)】Taxation: Imports: Government raise level of income tax 【government raise income tax (decline)】Record numbers of holidaymakers go on overseas holidays 【spending on foreign goods by more national】(PPT书P73)Question 3(a) Any three from the following: Errors/omissions from the data gathered,Black economy,Non-recorded items,eg DIY, housework, barter,Transfer income,Double counting.(b) Methods may change over time. Accuracy of figures,Inflation adjustments,Social conditions,Work conditions,Unequal distribution of income. Spending patterns eg defence.(c) Explanation of multiplier either in words or through use of algebra(书P199.200). Explanation should show that an initial injection to National Income results in a larger level of NI than the original injection. Propensity to save and consume.(d) An explanation of the difference between real and nominal growth, identifying that in real terms inflation is taken into account. In 1998 the growth rate is shown as 3%. If this figure is the nominal rate and inflation is measured at 3.1%, then there is no real growth in the economy. Any similar example will suffice.【GDP=Consumption +Capital investment spending +GeneralGovernment spending +Exports +Imports of Goods(Services) GNP=GDP+NPIA(Net property income from abroad) National Income=GNP-Capital Consumption Real Growth Rate=Nominal Growth Rate-Inflation Rate (Real Growth is the grow adjusted for inflation, Nominal Growth is the grow in the current value of money, Inflation Rate is measure of rate of change in price index)2000: 3.1-3.2=-0.1 no real growth 】附加工作总结一篇,不需要的朋友下载后可以编辑删除,谢谢安全生产监管执法工作方案5篇第一篇一、指导思想2014年,全区安全生产监管执法工作要以科学发展观为指导,全面贯彻落实《国务院关于进一步加强企业安全生产工作的通知》和《省政府关于进一步加强企业安全生产工作的意见》文件精神,进一步规范安全生产监管执法行为,落实行政执法责任制,提高依法行政水平,严厉打击安全生产领域的非法违法行为,及时消除事故隐患,促进全区安全生产形势进一步稳定好转。

经济学考研之世界经济学专业简介凯程考研晶晶老师了解到很多同学在报考经济学专业的时候其实对于各个细分专业的具体情况不是很了解,有些连本专业的学生听了都犯迷糊的专业,就更不用说跨专业考经济学研究生的小伙伴们了。

今天凯程晶晶老师就为大家介绍一个招生院校较多的细分专业——世界经济学。

一、学科简介世界经济学属于经济学一级学科理论经济学下的二级学科,一般来说,在考研属于学术性硕士。

世界经济是世界各国的经济相互联系和相互依存而构成的世界范围的经济整体。

它是在国际分工和世界市场的基础上,把世界范围内的各国经济通过商品流通、劳务交换、资本流动、技术转让、国际经济一体化等多种形式和渠道,把各国的生产、生活和其他经济方面有机地联系在一起二、研究方向世界经济学的研究方向主要有以下几个方面:01世界经济理论02国别地区经济03国际经济关系04国际金融与贸易学05专业英语06全球化与世界经济07欧盟经济三、专业就业方向本学科要求掌握较坚实的现代经济学基础理论,具有较系统的世界经济和国际关系的专门知识;较为熟练的掌握一门外语,并能阅读本专业的外文资料;掌握计算机技术和其他现代经济分析技术;具有独立的研究和工作能力。

学位获得者能从事世界经济和国际关系领域内的研究和教学工作,或在实际业务部门从事涉外经济的管理和研究等工作。

四、考研参考书:《政治经济学教程》宋涛中国人民大学出版社2006年版《政治经济学》逢锦聚等高等教育出版社2007年版《西方经济学》高鸿业中国人民大学出版社《微观经济理论基本原理与扩展》尼克尔森中国人民大学出版社《宏观经济学》曼昆中国人民大学出版社《微观经济学十八讲》平新乔《微观经济学:现代观点》范里安《宏观经济学》巴罗五、专业院校排名。

Economics 2: The WorldEconomyReworkContentIntroduction----------------------------------------------------------------3 Section 1: International TradeThree gains from trading internationally---------------------------------------3 Free Trade--------------------------------------------------------------------------3 Absolute and Comparative Advantage-----------------------------------------3 Protectionism----------------------------------------------------------------------4 Barriers to trade-------------------------------------------------------------------4 WTO and EU----------------------------------------------------------------------5 Section 2: International FinanceBalance of Payments and General trends in UK Trade----------------------6 Relationship between the exchange rate and the balance of payments—14 Single Currency------------------------------------------------------------------15 Effects on individuals and business of the Euro-----------------------------15 Section 3: Less Developed Countries (LDCs)Characteristics of a LDC--------------------------------------------------------16 Current issues that face LDCs--------------------------------------------------16 The impacts of multinationals on LDCs and NICs--------------------------16 Conclusion-----------------------------------------------------------------16 References------------------------------------------------------------------17Introduction:As a member of the government of nation on the periphery of Europe, it is my obligation to illustrate the benefits of joining the EU to the Premier. In this report, I will analyze 15elements in next three parts to make a clear explanation of benefits of joining the EU.Section 1: International TradeThree gains from trading internationally:To begin with, the international trade could increase world out-put. The tendency of globalization brings the firms more opportunities to gain the labor, resources, contracts and new technology. The supply and demand will be improved with the improvement of company’s productivity.Once the supply has been improved, the goods and services were produced at lower cost and there are more and more competitions, the price of the product might fall which means consumers could get more choices and cheaper goods.In addition, the most important gaining of international trade is it can generate economic growth. Free trade could increase sales, profit margins, and market shares and the both demand and supply level has updated. Meanwhile, the producer needs more resources, labor and capital to produce more to satisfy the global market. It direct result in improving the material market, finance market, and may decline the unemployment rate.Free tradeFree trade is a concept that there is no barrier to goods and services exchanged between countries. Since different countries have different terrain, weather, resources and technology, the international trade would bring the goods which are more valuable than the local people produce it by themselves.A good example for free trade is in Nov.18, 2004, Chinese President and Chilean President declared the start of the FTA negotiations. According to the agreement, the two countries would start tariff reduction of goods trade from July 1, 2006. Tariff of products accounting for 97% of the total of the two countries would be zero in ten years. China and Chile would carry out free trade in education, science & technology, environment protection, labor, social security, IPR, investment and promotion, mineral and industry. This agreement has promoted the free trade between China and Chile successfully.Absolute and comparative advantageAbsolute advantage refers to the ability of a particular person or a country to produce a particular good with fewer resources than another person or country. Absolute advantage is said to occur when one country can produce a good or service topre-determined quality more cheaply than anther country. It stands contrasted with the concept of comparative advantage which refers to the ability to produce a particular good at a lower opportunity cost. Opportunity cost is defined as the cost of choosing a good or service measured in terms of the next best alternative given up. A country has a comparative advantage in producing a good if the opportunity cost of producing that good in term of other goods is lower in that country than it is in other countries. Example: Korea and Japan have following production possibilities for two commodities, mobile phones and computers; assume that all the resources owned bythe advantage it has is much greater for mobiles. Using the same resources as Korea it can make twice as many mobile phones.For Japan the ‘cost’ of 1 Mobile phone is 10 bales of Computers, i.e. 20000/2000For Korea it is 15, i.e. 15000/1000But if we look at the case of computers we will find that here for Japan the cost of a bale of computers is one-tenth of a Mobile phone while for Korea it is one fifteenth. In terms of the output of Mobile phone foregone (opportunity cost), computer is cheaper in Korea than Japan. Korea has a Comparative advantage in computer while Japan has comparative advantage in mobile phone.ProtectionismProtectionism is the economic policy of restraining trade between nations, through methods such as high tariffs on imported goods, restrictive quotas, a variety of restrictive government regulations designed to discourage imports and anti-dumping laws in an attempt to protect domestic industries in a particular nation from foreign take-over or competition.Here are two examples of protectionism:1: Britain imports bananas from its ex-colonies in South America while USA owns huge banana plantations in South America. In 1999 Britain refused to import bananas from South America, so the US government slapped tariffs on some British-made goods. The most serious one was a punitive tariff of 100% on Scottish wool products in order to limit the import from Britain.2: Another example of protectionism is in January, 2009, American government settled a policy that only the American steel can be used in America. The American government tended to use this policy to reduce the loss in financial crisis and it helps the steel workers to keep their jobs. In this example, protectionism protects the domestic lower-skilled labor and domestic industries.Barriers to tradeTo protect a country’s own industries, the country which in adverse side need to find some ways to be barriers to limit the import products, usually, the two methodsare—tariff and non tariffs.Tariff is taxes or customs duties placed on foreign products to artificially raise their prices and this hopefully, suppresses domestic demand for them. This tax may be ad value, that is, a percentage of the price of the goods or specific, that is, a tax per unit of weight or physical quantity.For example, in January 12, 2009 the Russian government raised the expropriation tariff (up to 30 percent) for the cars import in the next nine months. The import car’s price will be increased to be WP (price for the whole world) adds the tariff, since the price is increasing, the sales of the import cars must fall down. The customers might choose the Russian car instead of import cars since it is cheaper.Non-tariff barriers traditionally have been actions such Quotas, embargoes, exchange control and import deposits. Probably the best known of these is the quota. This is a physical limitation on the quantity of import. Quota is a physical limitation on the quantity of imports which had been acknowledged by local laws. Usually the importers need to apply to pay for a license to sell goods.For instance, Russia uses another method to limit foreign car import since 2008—to limit the quantity of import; only a few companies which have the import license could import cars and have a selling upper limit. Russia uses these methods to restrict the import quantity, and during the government limited foreign goods import, it can promote the domestic industries.WTO and EUIn 1948, the General Agreement on Tariffs and Trade (GATT) was established by the developed countries. In 1 Jan 1995, the GATT was supplanted by a new institution, the World Trade Organization (WTO) and aims to improve trade and investment flows around the world. It is an international body seeking to promote free trade by opening markets through the elimination of import tariffs. The organization administers trade agreements, monitors international trade policy and acts as a forum for trade negotiations. The four main goals of WTO are: freeing global trade through universally lowered tariffs, imposing the same rules on all members in order to homogenize the trade process, spurring competition through lowered subsidies, and ensuring the same trade concessions for all member nations. The WTO also provides technical assistance and training for developing countries. WTO aims for equal representation among members by granting each member country "most-favored nation" status; when a member country bestows a trade privilege on another nation, the privilege must be extended to all other member countries. Another tenet is "national treatment," which behooves countries to treat foreign imports equally with those produced domestically.The best example for joining the WTO is the join of China in 2007, after that, China achieves lots of benefits from the decrease of tariff, limitations and the simplification of trading procedures.EU stands for European Union and is an economic union, which aims to abolish tariffs and quotas among members, common tariff and quota system, restrictions onfactor movements and harmonization and unification of economic policies and institutions. It draws out regulations, monitors member states, solves disputes and problems among member states and negotiates with other countries or international organizations on the behalf of EU members. The European Union aims to promote and smooth free trade among internal European Union and initiatives for simplifying national and community rules include simpler legislation for the internal market (SLIM) and European Business Test Panel. For example, in Oct 16, 2009, EU and Korean government signed a free trade agreement of 100 billion US dollars after two years’ negotiation and EU will cancel the tariffs on imports of textile and cars from Korea in the next three years. This will promote the free trade of EU and have positive impact on the economy.Section 2: International FinanceBalance of Payments and General trends in UK TradeBalance of payment is the name given to the record of transactions between the residents of the country and the rest of the world over a period of time. It is a key economic statistics and UK’s Balance of Payments is comprises by the current account, the capital account, the financial account which deals with flow of direct portfolio and investments and reserve assets and the International Investment Position which shows the Stock of External Financial Assets and Liabilities. The chart below shows the composition if Balance of Payments in 2008:a) The current account can be divided into four categories: trade in goods, trade in service, income and current transfers. Positive net income from abroad corresponds to a current account surplus; negative net income from abroad corresponds to a current account deficit.Here are the trade figures of recent years:Here are the Current Account Balance Chart and the Chart of trade in Goods and services of UK in last 20 years.The current balance has usually been in deficit over the last 30 years.The UK has recorded a current account deficit in every year since 1984. Prior to 1984, the current account recorded a surplus in 1980 to 1983. From 1984 to 1989, the current account deficit increased steadily to reach a high of 25.5 billion pounds in 1989, equivalent to -4.9 per cent of Gross Domestic Product (GDP). From 1990 until 1997, the current account deficit declined to a low of 1.0 billion pounds in 1997. Between 1998 and 2006, the current account deficit widened sharply, peaking at 43.8 billion pounds in 2006. This was the highest recorded in cash terms but only equated to -3.3 per cent of GDP. In the past two years, there has been a reduction in the current account deficit –in 2008 it currently stands at 25.1 billion, equivalent to -1.7 per cent of GDP.It is obvious that UK had a large deficit in trade of goods in the last 30 years and the deficit becomes lager and increases greatly from 1998 to 2008 while the surplus of trade in service grows smoothly but not as markedly as the goods deficit. The trade in goods account recorded net surpluses in the years 1980 to 1982, largely as a result of growth in exports of North Sea oil. Since then however, the trade in goods account has remained in deficit. The deficit grew significantly in the late 1980s to reach a peak of 24.7 billion in 1989, before narrowing in the 1990s to levels of around 10 billion to 14 billion. In 1998 the deficit jumped by over 9 billion, and it has continued to rise since, reaching a cash record of 92.9 billion in 2008.There are two different of Income—Direct Investment Income and Portfolio Investment Income. The Direct Investment Income means the profits earned by UK companies from overseas branches and associated company. And the Portfolio Investment Income is the interest on bonds and dividends, held abroad by UK companies and residents.Here are charts of income over the 10 years:The income section has shown positive growth from 2006 to 2008 and is very much in surplus recently.As for the current transfer, it also has two different parts:The taxes, payments and receipts to the EU, Social Security Payments abroad, and military expenditure abroad is the Central Government Transfer. And for Other Sector Transfers, it includes receipts from the EU Social Fund, taxes on income and wealth paid by UK workers and businesses to foreign governments, insurance premiums and claims.There is the Chart of Current transfer in last 10 yearsThe transfers account has shown a deficit in every year since 1960. The deficit increased steadily to reach 4.8 billion in 1990. In 1991, the deficit reduced to 1.0 billion, reflecting 2.1 billion receipts from other countries towards the UK’s cost of the first Gulf conflict. The deficit has since increased, to reach a record 13.6 billion in 2008.b) Compared with Current Accounts, the composition of the Capital and Financial Account is more complicate.Capital Account has two categories:Capital transfer: It is investment grants by the government and debts which the government has agreed with the creditor do not need to be met.Acquisition and disposal of non produced/nonfinancial assets: Purchase or sales of property by foreign embassy or patents, copyrights, trademarks, franchises and leases.The capital account has shown strong steady surplus growth especially from the year of 2006 to 2008.The financial account has four categories and here are the charts of the four categories over the last ten years:According to these graphs, investment increased dramatically from the mid-1990s, reflecting the increased globalization of the world economy. Between 2000 and 2007, other investment dominated cross-border investment, primarily banking activity. In 2008 however, other investment, has recorded net disinvestment as the global financial crisis deepened leading to a reduction in loans internationally and a repatriation of deposits. In recent years, including the latest, the UK has needed to borrow from abroad to finance a continuing current account deficit, which has resulted in inward investment (UK liabilities) exceeding outward investment (UK assets).c) The international investment position is the balance sheet of the stock of external assets and liabilities. Between 1966 and 1994 the UK’s assets tended to exceed itsliabilities, by up to a record 86.4 billion pounds in 1986. But from 1995 to 2007, the UK recorded a net liability position in every year, reaching a record 352.6 billion pounds in 2006. In 2008, the UK returned to a net asset position of 92.9 billion pounds mainly due to exchange rate effects.The chart below indicates UK’s international investment position:Relationship between the exchange rate and the balance of paymentsThe exchange rate is the price of a currency in terms of other currencies. Its effect on balance of payments will depend upon its relationship with other currencies and how its value will change. As the currency weakens (devalues) the exports will become cheaper abroad but the country has to pay more for imports but the goods and services would become internationally cheaper and lead to more goods a services being purchased. If demand remains the same then the value of goods and services to the country will reduce and the current account balance may deteriorate. If the exchange rate rises then the country’s goods and services might suffer and demand from abroad could fall. If the demand remains the same however then the value of exports will rise and the current account balance should improve.For instance, when the UK market needs to import American goods (such as corns) the exchange market in UK would be the demand of U.S dollars is larger than the supply of UK pounds. If the American markets needs import more British goods, they need to exchange more pounds in the currency market, so the both of demand of US Dollar and supply of UK Pounds is increasing, meanwhile, the exchange rate of £/$is increasing. UK pound is more valuable means the goods of UK are usually more expensive and American people need to spend more US dollars compared to thesame amount of pounds. That is why the currency exchange rate is so important for the balance of payments. For example, if the exchange rate of £/$is increasing, the American business man might not choose UK goods, because of the high price. Single CurrencyEuropean single currency Euro came to exist since 1999. There are 12 member states of EU who use Euro while UK is still not one of the members since there are both advantages and disadvantages to join it.Advantages:At firstly, the single currency reduces the exchange rate uncertainty because people don't have to convert money from one currency to another when purchase goods. Meanwhile, using the single currency will increase foreign investment such as direct inward investment since the reduction of uncertainty. Then it may produce a great transparency. Whether people buy or sell goods, consumers can compare price in a single currency. It will help to decrease the scope for price discriminations and create pressure to lower the price. Moreover, it could maintain interest rate lower and the commitment to low inflation should allow economies to operate with lower cost. Disadvantages:A country may lose the independent monetary policy if it joins the single currency. The single currency forces a country to forgo an independent monetary policy. After the single currency has been used, the country's monetary policy will determined by the supranational central bank and not by the domestic central bank. This is why the theory of optimal currency areas emphasizes the importance of flexible prices, labor mobility and fiscal transfers. Flexible prices and labor mobility become more important when a currency union exists; governments have an incentive to make markets work more efficiently.Besides, there are also political costs to the country. If the government loses control over monetary policy to the supranational central bank, politicians are limited to using fiscal policy to influence economy.Effects on individuals and business of the EuroAs for the individuals,they can get lower prices and higher quality goods and services when they have more choices due to increased competition among companies through the Euro zones; they can measure the good price through Europe and choose the best one. In addition, single currency reduces the transaction costs of traveling in Europe. Individuals could travel more frequently than past since it is more convenient and cheaper. People do not need to concern the exchange rate and commission fee when visiting the other countries in Europe.As for the business, people could avoid the exchange rate risk and traders do not need to waste time and cost on purchasing foreign currencies. Moreover, the business market could be expanded there are more opportunities.Section 3: Less Developed Countries (LDCs) Characteristics of a LDCLess Developed Countries (LDCs) mainly exist in Asia and Africa. Most LDCs’subsistence is agriculture. The land of LDCs is very ineffectively used and is very low in productivity, there are normally no modern techniques or equipment available, and the land is always threatened by floods or droughts. The birth rates in LDCs are very high but there is very heavy infant mortality since the health care system is poor.A good example for LDC is Angola. A 2007 survey concluded that low and deficient niacin status was common in Angola. Many regions in this country have high incidence rates of tuberculosis and high HIV prevalence rates. Angola has one of the highest infant mortality rates in the world and one of the world's lowest life expectancies.Current issues that face LDCsThe World Bank offers aid programs to Angola to support the health care system of Angola to reduce the infections of HIV but the aid programs they get from the World Bank of IMF carry conditions which they feel are difficult to comply with, and are expensive.Besides, the indebtedness of Angola keeps increasing year on year. This makes Angola almost impossible to borrow more.They borrow a huge amount of money to develop their economy, purchase foreign goods and service. However, the high interest or other factors make debts become a great stress on LDCs. They are in the trip of debts, which prevent the development of their economy.The impacts of multinationals on LDCs and NICsNow days, there are more and more multi-national firms which have branches in various countries since it can reduce the labor, material, transport cost. Companies from newly industrialized countries tend to be MNCs. A good example for multinationals on NICs and LDCs is Great Wall Computer Corporation from China. This company invests 120 million dollars to build a new factory in Algeria to expand its market and increase 34 percent of its foreign sale income. The company offers more jobs to the people in Algeria thus increase the employment and income of Algerian. The company also brings new technology to this less developed country. However, the company transfers most of profits back to China and uses their financial strength to impose their will in host counties either.ConclusionAfter analyzing these 15 elements, you may have a clear acknowledge of the international trade, finance and LDCs and as for the economic environment of the whole area, it can be benefit to join the EU. It will enhance our country’s economic growth by attracting more free capital, using single currency and enlarge the market.References:Web research:/downloads/theme_economy/PB09.pdfRelated Web sites /wiki/Protectionism/eurocash.asp/Book resource:The Economics 2: The World Economy: Higher National Diploma. Scottish Qualifications AuthorityUnited Kingdom Balance of Payments the Pink Book 2009: Office for National Statistics。

Economics2: The World EconomyF86E 35Candidate Name: REN LUGrade and Class: 2013 BA1Introduction (3)1. Free trade (4)2. Absolute advantages and comparative advantages (4)3. The benefits of free trade (5)4. The purpose of carrying out trade protectionism (7)5.One Mechanism of the World Trade Organization (8)6. One measure of European Union promotes economic integration (9)7. Balance of payments (10)8. The general trends in UK trade over the last 30 year (13)9. The balance of payments affected by exchange rates (14)10. Advantages and disadvantages of fixed rate and floating rate (16)11. Effects of fixed rate and floating rate on individuals and company (18)12. The characteristics of the newly industrialized countries and the developing countries (19)13. The issues of the newly industrialized countries and the developing countries (20)14. The influences Multi-National Corporations bring to newly industrialized countries. (21)Conclusion (23)Reference (24)IntroductionThis report has introduced the world economics simply. The content includes: International trade, free trade, Protectionism, the role of WTO and under-developed nation, UK absolute and comparative advantage, the protectionism and two recent examples about demonstrate arguments which government may put forward for its use, two barriers of trade, a EU initiative about the role of the EU in promoting trade, the composition of the balance of payments, the general trends in UK trade over the last 30 years, the way which the balance of payments affected by exchange rates, an analysis of two current issues that face LDCs, and the aid of recent examples about two impacts of multinationals on NICs and LDCs.I. Free trade(1). Free trade is a type of trade policy that allows traders to act and transact without interference from government. Thus, the policy permits trading partners mutual gains from trade, with goods and services produced according to the theory of comparative advantage.China-ASEAN free trade area was formally established in January 1, 2010, covering a population of 1900000000. China-ASEAN free trade area’s GDP amounted to $6 and trade amounted to $4.5. It is the largest free trade zone among developing countries. After the establishment of CAFTA, more than 90% products are carried out for zero tariffs on both sides. Average tariffs from Chinese to ASEAN decrease from 9.8% to 0.1%, Average tariffs from ASEAN’s six old members to Chinese decrease from 12.8% to 0.6%. Tariffs’ huge reduction promoted the rapid growth of bilateral trade. China and ASEAN countries’ trade investment grows, economic integration deepens, companies and people are widely benefit, realizing goals of mutual benefit and win-win cooperation and common development. China and ASEAN’s total quantity of bilateral trade grows rapidly. From January to October this year, the bilateral trade volume has reached to $295900000000, a year-on-year growth of 25.7%.(2). Absolute advantages and comparative advantagesAbsolute advantages is said to occur when one country can produce a good or service to pre-determined quality with less resources or more cheaply than another country.Even when a country has an absolute advantage over another country in terms of commodities they wish to trade it will still be to their mutual advantage to tradeproviding each country has the comparative advantages.UK is a major importer of manufacturing goods such clothes, shoes, toys, electronic produces etc. as these labor oriented consumer goods will cost more in UK before 1980s. UK has the With the development of service, the advantage of trade is service trade.The goods that courtry import and export change over time as the goods in which they have a comparative advantage change over time. Before 1970s, manufacturing industry is its absolute advantage. After 1970s, service industry is more competitive for international trade such as computer software, business service and pharmaceuticals. These industry are seen to bring the possibility of long term growth, while the industries based on heavy capital investment or requiring relatively cheap labor will not be competitive with developing countries.2. The benefits of free trade(1). Goods and services produced at lower cost. Free trade can promote the cooperation of different countries in the world. It can decrease the cost of producing goods.(2). Greater range of commodities for consumers, more choice. Any countries cannot produce all products, they all have products which are unable to produce. Trade allow us to buy all of them. Greater range of commodities provide customers with more choice.(3). Increased world-wide output. Each country producing according to theirrespective advantages has high efficiency. Under the same resources, it has high yield. Therefore, international trade increased world-wide output.3.Barriers to International TradeTrade barriers are government-induced restrictions on international trade. The barriers can take many forms, including the following tariffs and non tariffs.Non Tarriff Barriers-exchange controlsIn a real world, there is and should be a certain degree of government intervention on foreign exchange. Imports need foreign currencies to buy gooods and services from abroad.Importers must apply to the cenytal bank for the currency they need to purchase goods in that country, The Central bank can erxert control over the variety and volume of both imports and exports by controlling the quantity of foreign cuurency it will issue to exporters and importers.Non Tarriff Barriers-Import DepoitsGovernment requires importers to lodge a non-interest bearing deposit in advance with its Central Bank before they can buy goods and services from abroad. Besides, the deposit is usually in an amount equal to all or part of the cost of imported goods. This is time consuming and obviously expensive since it reduces the liquidity of the importing firms, which tend to hinder their importing activities. Before 1984, the Nigerian advanced import deposit ranged from 50% to 200% of the value of a list of import items.Give a example about tariffs, 35% tariffs on Chinese tyres imposed on the United States on 11th September in 2009. It make Chinese tyres firms have to increase price if sales in America.For example, t non tariffs in Russia to Ukraine for embargoes which suspension of Ukraine imports of juice on 29th July in 2014. It make Ukraine’s juice not allow sale in Russia.4. The purpose of raising barriers to International Trade(1) The purpose is to protect employment.Footwear manufactureers associations of Italy, Spain ad Portugal are reported to have field applications to the EU to curb footwear imports from China. Local shoemarkers in Elche, the capital of Spain’s once flourishing footwear industry, argue that “made in China”is taking away their jobs by that Chinese shoes have been booming in Spain just because of good quality and reasonable prices.(2) The purpose is to anti-dumping. In July 2012, SolarWorld AG, a Germangiant, led a consortium of around 25 EU solar panel producers to file a complaint to the EU Commission to investigate whether there has been distortion of competition by Chinese counterparts due to dumping. Soon Germany against China low price.5.The Role of WTOThe World Trade Organization (WTO) is an organization that intends to supervise and liberalize international trade. The organization officially commenced on 1 January 1995 under the Marrakech Agreement, signed by 123 nations on 15 April 1994, replacing the General Agreement on Tariffs and Trade(GATT), which commenced in 1948. The organization deals with regulation of trade between participating countries by providing a framework for negotiating and formalizing trade agreements and a dispute resolution process aimed at enforcing participants' adherence to WTO agreements, which are signed by representatives of member governments and ratified by their parliaments.The WTO dispute settlement mechanism is measures of dealing with trade disputes between members.It is the effective way for countries especially the developing countries to resolve the economic friction and safeguard their legitimate rights and interests.It is very unfavorable for the developing countries to resolve trade disputes especially trade disputes with the developed countries through bilateral channels. The bilateral approach pursues strength doctrine. Involved in trade disputes among developing countries, the WTO dispute settlement mechanism ruling is comparatively fair and reasonable. As either the complainant or respondent, the legitimate interests of the developing countries have been effectively protected. It is because the WTO dispute adjudication has very strong fairness, developing countries generally have a high enthusiasm to use the WTO dispute settlement mechanism. Some larger economic scale developing countries is more active in the use of WTO dispute settlement mechanism.It helps to reduce the economic friction between countries, and promote friendly relations among nations.The Uruguay Round was the 8th round of multilateral trade negotiations (MTN) conducted within the framework of the General Agreement on Tariffs andTrade(GATT), spanning from 1986 to 1994 and embracing 123 countries as "contracting parties". The Round led to the creation of the World Trade Organization, withGATT remaining as an integral part of the WTO agreements. The broad mandate of the Round had been to extend GATT trade rules to areas previously exempted as too difficult to liberalize (agriculture, textiles) and increasingly important new areas previously not included (trade in services, intellectual property,investment policy trade distortions)Here are some others areas the WTO has dealt with in attempts to establish itself as the policing body promoting free trade. The Banana Dispute. The WTO ruled that the European Union discriminated unfairly against the US with its banana import rules. The WTO allowed the US to slap a $191 million sanction on the EU. Was it paid? We do not know but probably not so.6. One measure of European Union promotes economic integrationThe European Union (EU) is a politico-economic union of 28 member states that are located primarily in Europe. The EU operates through a system of supranational institutions and intergovernmental negotiated decisions by the member states. The institutions are: the European Commission, the Council of the European Union, the European Council, the Court of Justice of the European Union, the European Central Bank, the Court of Auditors, and the European Parliament. The European Parliament is elected every five years by EU citizens(1)EU can eliminate customers duties and quotas on imports and exports of goodsbetween member states and eliminate tariffs between EU members. Though the institutions, members can establish common policies for agriculture and transport for free trade.(2)It can accelerate the investment from a wide range of contries. With the risingstatus of the euro and d evelopment of European capital market, members’ cost of capital will decline, which is conducive to investment and economic growth. The European Central Bank (ECB) develop and implement a unified monetary policy, each country’s interest rates, prices and i nvestment returns will gradually narrow the differences or reach to unanimous, leading to an overall decline of price and the level of interest rates.7. Balance of payments()The balance of payments (BOP) of a country is the record of all economic transactions between the residents of a country and the rest of the world in a particular period (over a quarter of a year or more commonly over a year). These transactions are made by individuals, firms and government bodies. Thus the balance of payments includes all external visible and non-visible transactions of a country during a given period, usually a year. It represents a summation of country's current demand and supply of the claims on foreign currencies and of foreign claims on its currencyThis table illustrates current account, capital account and financial account in UK during the 20 years from 1980 to 2010. In terms of current account, there just four years the figure is positive when between 1980 and 1983. And then the figure almost negative from 1984 to 2010. And the figure achieves the lowest number about -55190 million in 2008. This situation illustrate that the economy of UK develop not very well.As for capital account, the data shows that this account experience a fluctuate trend. First, the figure was -4 million in 1980 and then the figure decrease to -79 million in 1981. After that the figure was 6 million in 1982 increase to 159 million in 1987. What is funny thing is the figure fall again to -39 million in 1988. After that the figure experience a fluctuate and what is no table is the figure gain a lowest number -1527 million in 2006.In terms of financial account, the figure see an positive trend from 2157 million in 1980 to 122 million in 1986. And then the figure experience a negative trend between-9690 million in 1987 and -23296 million in 1993. And from -20261 million in 1999 to -30276 million in 2010 this account experience negative trend again, and get the lowest number in 2008 because of the financial crisis the figure was -39301 million.8. The general trends in UK trade over the last 30 yearOverall, the evolution of trade in goods show an upward trend. With the quick development , UK need to keep up with the times, the country must through trade in good to increase country’s income so with the passage of time, there are more and more trade in UK.The table shows the evolution of trade in goods and services in UK between 1980 and 2008. The trade in goods account stand 20 billion in 1980. The trade in goods accounthas remained in deficit. The deficit grew remarkable in the late 1980s to reach a peak of about 24 billion in 1989. And then decreased back to 20 billion in early 1990s and keep a stable at 10 billion from 1991 to 1998. In 1998 the deficit jumped by over 9 billion, and it has continued to rise since, reaching a cash record of 92.9 billion in 2008.The chart shows that the total goods exports are less than imports, which leads to deficit.However, the total service exports are more than total service imports, which results in surplus.It shows United Kingdom is in a large fiscal deficit in the last 30 years. The highest surplus is in 1981, however the current balance deficit from 1984 to 1990. From 1984 to 1989, the current balance deficit and in 1987, the deficit increase quickly. The current balance deficit fell sharply from 1990 to 1991. From 1992 to 1997, the current balance slightly fluctuates. Then from 2000 to 2006, the deficit increased substantially, although from 2002 to 2004, there is a slight decline. From 2007 to 2008 deficit has a steep decline. Main reason may be in goods trade balance deficits, while the surplus on trade in services, especially in the last 30 years growth.In the past 30 years Britain's merchandise trade decreased, because of the high cost of HR, the UK is few to doing the manufacture, most goods is depend on imported, no exported. But the financial services, renting and business, is totally increased, so in the past 30 years, the UK financial has been steadily increasing.9. The balance of payments affected by exchange rates(1) The effects of exchange rates for tradea. Imported goods will be dearer, therefore the Trade in Goods is likely to move into deficit. Consumers may turn to consume more imported goods; Inflation may be lower because domestic firms may reduce prices. The price of imported raw materials may go down again affecting the Trade aspect. Consumers may find it easier to buy imported goods.b. Domestic goods and services will be cheaper both in foreign and domestic markets. A country which has reduced the value of its currency would certainly be looking to sell more abroad. This should mean an improvement in Trade in Goods.Cheaper currency helps boost the exportSee an example: A UK firm manufactures hard discs for a computer firm in the USA. Selling price: 100 pounds.Exchange rate: 1 pounds = $1.5Cost to the American: $150.Exchange rate: 1 pounds = $2Cost to the American: $200The American firm may consider this to be too expensive and look elsewhere for a cheaper alternative.If:Exchange rate: 1 pounds =$1Cost to the American: $100The American firm may consider this to be cheaper, and buy more.(2)The effects of exchange rates for capital accountsa. Manufacturing firms might for example build up stocks at te cheaper price andforeign investment may increase because profits sent back will be worth more intheir domestic currency.b.It could encourage firms and individuals to invest abroad in that the forigncurrency earned will be worth more when sent back to the domestic market. 10. Advantages and disadvantages of fixed rate and floating rateFloating exchange rate or fluctuating exchange rate is a type of exchange-rate regime in which a currency's value is allowed to fluctuate in response to market mechanisms of the foreign-exchange market. A currency that uses a floating exchange rate is known as a floating currency. A floating currency is contrasted with a fixed currency.Advantages.Large reserves will not be necessary to protect the currency against changes or speculation. A country has no obligation to maintain exchange rate stability, and therefore it does not need foreign exchange reserve as much as in the fixed exchange rates, which can save foreign exchange funds.The exchange rate will not become a target because whichever way it moves, the mechanism should start to operate quickly to restore equilibrium. The imbalance of a country's international balance of payments can be eliminated by free fluctuation of exchange rate.Governments do not have to introduce measures to keep the value at a fixed rate, which might be harmful to other sections of the economy. Because the balance of payments of each country can adjust by themselves, which ensures the stability of foreign exchange market in a certain extent.Disadvantages.The futures market is designed to prevent this. By buying forward for commodities a price is agreed which does not change when the commodity is delivered. It causes all countries' instability of ability of international settlement and commodity price .Demand may be unstable because external prices of domestic goods will be subject to change. Planning production may be difficult. The instability of exchange rate increases the risk of international tradeIf there is inflation a floating exchange rate will not always deal with it effectively because the depreciation of the currency in the foreign exchange markets will make imports dearer and assist possible cost push inflation.Fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime where a currency's value is fixed against either the value of another single currency, to a basket of other currencies, or to another measure of valueAdvantages.They reduce uncertainty, this makes trade and investments between the two countries easier and more external and more predictable and is especially useful for small economies in which external trade forms a large part of their GDP.Long term granting of credits, long-term contracts and investment overseas are seen to carry less risk. It makes the capacity of the international settlement and the price of import and export goods be stable.The fixed rate played a crucial role in achieving this growth in FDI. The stability of the exchange rate suppressed the speculation of foreign exchange market to a certain extent.Disadvantages.If deficits persist then reserves of foreign currency may be used up quite quickly. It leads to reduction of exports, the deficit of international balance of payments and more unstablethe currency.Countries which have a persistent deficit or surplus will have to take some action which may have severe impacts upon exports and imports or both.If inflation occurs the underlying cause will need to be tackled. Countries cannot rely on devaluing the currency to get rid of the problem. It weakened the autonomy of domestic monetary policy.11. Effects of fixed rate and floating rate on individuals and company Floating ExchangeCompany.Floating exchange rate system put forward higher requirements for company's macro-economic management capacity and development of financial market.It increases company’s management and operation cost.The company directly produces exchange loss.Individuals.In the floating exchange rate system, exchange rate tend to fluctuate significantly, which is not conducive to individuals investment With floating exchange rates, individuals might speculate in financial markets Individuals are beginning to realize the challenge of price advantage recession and the necessity of improving non price competitiveness.The individuals began to realize the importance of monetary settlement timing.The individuals began to realize the importance of monetary currency selection.Fixed ExchangeC ompany. Rigid exchange rate arrangements may be considered implicit exchange rate guarantee, so as to encourage capital inflows in the short term and no hedging of foreign debt, damaging the company’s health of the financial system. Fixed rate makes the company’s adjustment of rela tive price be easier and smoother.It is beneficial to a long-term stable development of company’s economic.It is directly generate the exchange rate lossesI ndividuals. It Is conducive for individuals to make cost and profit accounting, which avoids the risk of exchange rate fluctuations.It easily leads to currency overvaluation and weaken the competitiveness of local exports, causing personal imbalances of long-term current-account.It helps individuals to eliminate the risk of exchange rate and reduce the transaction cost of international trade and investment.12. The characteristics of the newly industrialized countries and the developing countriesNewly industrialized countries’economic structure especially industrial and agricultural structure changes significantly, and the proportion of industry is larger than agriculture. In total exports, the proportion of manufactured goods increased, getting rid of the situation of a half of the developing countries depending on primary products. Many intermediate products and machinery and equipment required for production is still in the hands of the developed countries. In some production ofmanufactured goods, Brazil is only developed countries’ assembly processing factory. Due to the introduction of a large number of foreign capital, Brazil has large foreign debts, and the amount of principal and interest is huge. From 2011 to 2014, the economy of Brazil is not optimistic the situation of the period for these four years, the average economic was only 1.4%.The developing countries rely heavily on agricultural production. From the production structure of agriculture, low-income countries’ share of agriculture in the GDP is much higher than that of developed countries; from the employment structure, the proportion of agricultural labor in India up to 50% ~ 70%; from the urbanization level, the proportion of urban population in total population of low and middle income is much lower than those of high income countries. Underdeveloped market economy is the nat ure of India’s economy. Due to the long suffering bound colonial plunder and feudal relations of production, as well as government’s improper intervention after independence, the market of India failed to operate and was distorted severely, unable to function as the basic means of resource allocation.13. The issues of the newly industrialized countries and the developing countriesNewly industrializing country:While Brazil introducing large-scale foreign capital and borrowing from the international financial capital, Brazil can not solve the problem of excessive dependence on international capital in the economy and can not solve the problem of establishing independent economic system in the international division of labor. Brazil's wealth gap is 21 times that of France, in Brazil's 1.6 billion of the national population, "marginalized people" with no fixed income was highly up to 50%. Brazil is not only the country with the most capital in the third world, but also the countrywith the largest foreign debt. Larger and larger foreign debt of principle and interest makes economic development be on the brink of collapse.Less Developed Country:China faces the debt crisis and fund backflow. The agricultural infrastructure deteriorates and per capita output of grain decreased continuously. Because population growth exceeded the growth of social material production, the society has overburdened. Labor roductivity of developing country is only 1/23 of that in developed countries. Political instability and frequent wars aggravated the existing difficulties, making residents become destitute and homeless.14. The influences Multi-National Corporations bring to newly industrialized countries.Overall, General Electric Corporation plays a positive role for the economic development of these countries. General Electric’s foreign investment has brought the capital required for Singapore’s economic development, technology and advanced management idea, driving the development of the national industry, which helps these countries to realize rapid economic growth and quick increase in national power objectively. General Electric Corporation provides a large number of employment opportunities, which solves the serious unemployment issue, maintaining the stability of society.However, it also has negative effects on the state power. Generally speaking, General Electric Corporation has some negative effects on the independence of Singapore’seconomic and social development. Some key sectors and departments of national economy has risk of being controlled by the General Electric Corporation, or have even been controlled. Some implementation of national industrial policy, anti-unfair competition policy, labor and environmental policy are weakened because of the existence of General Electric Corporation.ConclusionForm this report, We have know so many useful knowledge about international trad and we can know much about the advantages of trade and the functions of different organizations plays in trade. And we also know a lot of Balance of Payment of UK and the characteristics and problems of less developed countries.Reference (1)(2)(3)(4)(5)(6)。