会计英语习题集精品文档17页

- 格式:docx

- 大小:19.42 KB

- 文档页数:17

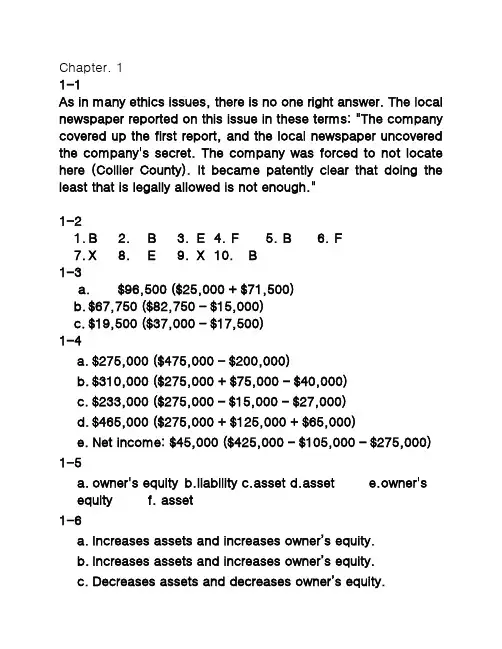

会计专业英语习题答案Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5a. owner's equityb.liabilityc.assetd.assete.owner'sequity f. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ...... $297,200 Net income for the month ................ $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000 Leo Perkins, capital, April 30, 2006 .... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120 Operating expenses:Wages expense .......................... $100,100Rent expense ............................. 35,000Supplies expense ........................ 4,550Miscellaneous expense.................. 3,150Total operating expenses ............. 142,800 Net income .................................. $89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. The ratio of liabilities to stockholders’ equity increased from2002 to 2003, indicating an increase in risk for creditors.However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction T ype Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash...................................... 40,000Ira Janke, Capital ................... 40,000 (2) Supplies ................................. 1,800Cash................................... 1,800 (3) Equipment ............................... 24,000Accounts Payable ................... 15,000Cash................................... 9,000 (4) Operating Expenses ................... 3,050Cash................................... 3,050 (5) Accounts Receivable .................. 12,000Service Revenue ..................... 12,000 (6) Accounts Payable ...................... 7,500Cash................................... 7,500 (7) Cash...................................... 9,500Accounts Receivable ............... 9,500 (8) Ira Janke, Drawing ..................... 5,000Cash................................... 5,000 (9) Operating Expenses ................... 1,050Supplies .............................. 1,0502-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000– $8,000). Such a negative balance means that the liabilities of Seth’s business exceed the assets.b. Y es. The balance sheet prepared at December 31will balance, with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. T he increase of $28,750 in the cash accountdoes not indicate earnings of that amount.Earnings will represent the net change in allassets and liabilities from operatingtransactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug.1 Rent Expense ........................... 1,500Cash................................... 1,5002 Advertising Expense (700)Cash (700)4 Supplies ................................. 1,050Cash................................... 1,0506 Office Equipment ....................... 7,500Accounts Payable ................... 7,5008 Cash...................................... 3,600Accounts Receivable ............... 3,60012 Accounts Payable ...................... 1,150Cash................................... 1,15020 Gayle McCall, Drawing ................ 1,000Cash................................... 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................. 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct.27 Supplies .......................... 15 1,320Accounts Payable ............ 21 1,320Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ✓...... ...... 585 ......27 .......................... 43 1,320 ...... 1,905 ...... Accounts Payable 21 2006Oct. 1 Balance ................ ✓...... ...... ..... 6,15027 .......................... 43 ...... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ........................................... 13,375 Accounts Receivable .......................... 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000 Accounts Payable .............................. 11,180 Unearned Rent ................................. 4,250 Erin Capelli, Capital ........................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense ................................ 42,000 Advertising Expense ........................... 7,200 Miscellaneous Expense ....................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................ 15,000Wages Expense ..................... 15,000b. Prepaid Rent ............................ 4,500Cash................................... 4,5002-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .......................... $37,028 $35,925 .......................... $ 1,1033.1%2. Cost of sales ................ (29,658)(28,111) ......................... 1,5475.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ................. $ (45) $1,300$(1,345)(103.5%)b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000.While sales increased by $1,103 million, a 3.1%increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrativeexpenses also increased by $901 million, a 13.8%increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease,and created a $45 million loss in 2000. Little over ayear later, Kmart filed for bankruptcy protection. It hasnow emerged from bankruptcy, hoping to return toprofitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated.Net income will be overstated.b. Prepaid insurance (or assets) will be overstated.Owner’s equity will be overstated.3-5a.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,2153-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,5703-7a.Salary Expense ................................ 9,360Salaries Payable ........................ 9,360 b.Salary Expense ................................ 12,480Salaries Payable ........................ 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over-Under-stated stated stated stated1. Revenue for the year would be $ 0 $6,900 $ 0 $ 02. Expenses for the year would be 0 0 0 3,7403. Net income for the year would be 0 6,900 3,740 04. Assets at December 31 would be 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Own er’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable .......................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenuesare recognized only when the cash is received.Therefore, earned but unbilled revenues would not berecognized in the accounts, and no adjusting entrywould be necessary.3-13a. Fees earned (or revenues) will be understated. Netincome will be understated.b. Accounts (fees) receivable (or assets) will beunderstated. Owner’s equity will be understated.3-14Depreciation Expense ........................... 5,200Accumulated Depreciation ............ 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of theequipment to the periods benefiting from its use. Itdoes not necessarily relate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not avaluation method. That is, depreciation allocates thecost of a fixed asset over its useful life. Depreciationdoes not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ......................... 7,500Accumulated Depreciation ............ 7,500 b. (1) D epreciation expense would be understated. Netincome would be overstated.(2) A ccumulated depreciation would be understated,and total assets would be overstated. Owner’sequity would be overstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment 5 5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $(511,242)(12.2)c. Dell is more profitable than Gateway. Specifically,Dell’s cost of goods sold of 82.1% is significantly less(4.3%) than Gateway’s cost of goods sold of 86.4%.In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments TrialBalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 120 Totals 200 200 24 24213 213 20ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 120 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 18 2122 67 67 164 164 224-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense ............................ $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ...........................49Net income ...................................... $18ITHACA SERVICES CO.Statement of Owner’s EquityFor the Year Ended January 31, 2006 Terry Dagley, capital, February 1, 2005 .... $112 Net income for the year ....................... $18 Less withdrawals . (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............... $ 8 Accounts payable $26 Accounts receivable 57 .. Wages payable 1 Supplies ........... 3 Total liabilities . $ 27 Prepaid insurance 6Total current assets $ 74Property, plant, and Owner’s Equityequipment: Terry Dagley, capital (12)Land ............... $50Equipment ........ $32Less accum. depr. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $1494-72006Jan.31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment 531 Wages Expense (1)Wages Payable (1)4-82006Jan.31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense ............................ $56,800Rent expense ............................... 21,270Utilities expense ............................ 11,500Depreciation expense ..................... 8,000Insurance expense ......................... 4,100Supplies expense .......................... 3,100Miscellaneous expense .................... 2,250Total operating expenses ....... 107,020Net loss ..........................................$ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006 Suzanne Jacob, capital, November 1, 2005$173,750Net income for year ........................... $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 × 12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006AssetsLiabilitiesCurrent assetsCurrent liabilities:Cash $31,500Accounts payable ........... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies ............ 1,800 Unearned fees ............... Prepaid insurance 7,200 Total liabilitiesPrepaid rent ....... 4,800Total current assets $67,150 Owner’s E Property, plant, and equipment: Vernon Posey,capital 114,200Equipment ....... $80,600Less accumulated depreciation 21,100 59,500Total liabilities andTotal assets $126,650 owner’s equity ...............4-14Accounts Receivable ............................ 4,100Fees Earned ......................... 4,100 Supplies Expense ...................... 1,300Supplies .............................. 1,300 Insurance Expense ..................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................. 2,800Accumulated Depreciation—Equipment 2,800 Wages Expense ........................ 1,000Wages Payable ...................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detectingand correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................. 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................. 25,000b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034)($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December31, 2002 and 2001. In addition, the current ratio is below one at the end of both years. While the working capital and current ratios have improved from 2001 to 2002, creditors would likely be concerned about the ability of 7 Eleven to meet its short-term credit obligations. This concern would warrant further investigation to determine whether this is a temporaryissue (for example, an end-of-the-periodphenomenon) and the company’s plans to address itsworking capital shortcomings.4-20a. (1) Sales Salaries Expense ................ 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ................... 10,250Fees Earned ............................. 10,250b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense ................ 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ................... 10,2504-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) W ages Expense ........................ 45,000Cash ...................................... 45,000(2) Wages Expense ......................... 18,000Wages Payable .......................... 18,000(3) Income Summary .......................1,120,800Wages Expense ......................... 1,120,800(4) Wages Payable .......................... 18,000Wages Expense ......................... 18,000(5) Wages Expense ......................... 43,000Cash ...................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number ofcredit sales supported by promissory notes, a notesreceivable ledger should be maintained. Failure tomaintain a subsidiary ledger when there are asignificant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation ofduties is violated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining theaccounts receivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsiblefor approving credit.e. Appropriate. A promissory note is a formal creditinstrument that is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of DaysPast DueJanzen Industries August 29 93 days (2 + 30+ 31 + 30)Kuehn Company September 3 88 days (27 + 31+ 30)Mauer Inc. October 21 40 days (10 +30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov.30 Uncollectible Accounts Expense ..... 53,315*Allowances for Doubtful Accounts 53, *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible AccountsAge Interval Balance Percent AmountNot past due .............. $450,000 2% $9,0001–30 days past due...... 110,000 4 4,40031–60 days past due .... 51,000 6 3,06061–90 days past due .... 12,500 20 2,50091–180 days past due .. 7,500 60 4,500Over 180 days past due 5,500 80 4,400 Total .................... $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ..... 29,435*.A llowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ........... 7,130Accounts Receivable .................. 7,130b.Uncollectible Accounts Expense ............ 7,130Accounts Receivable .................. 7,130Ex. 8–8Feb.20 Accounts Receivable—Darlene Brogan 12,100 Sales .................................. 12,10020 Cost of Merchandise Sold ............ 7,260Merchandise Inventory .............. 7,260May30 Cash...................................... 6,000Accounts Receivable—Darlene Brogan 6,030 Allowance for Doubtful Accounts .... 6,100Accounts Receivable—Darlene Brogan 6,1Aug. 3Accounts Receivable—Darlene Brogan 6,100 Allowance for Doubtful Accounts . 6,1003 Cash...................................... 6,100Accounts Receivable—Darlene Brogan 6,1$223,900 [$212,800 + $112,350 –($4,050,000 × 21/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100Ex. 8–11a. August 8b. $24,480c. (1) N otes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,(2) C ash......................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)1. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account receivable.7. Payment received from customer for dishonored noteplus interest earned after due date.Ex. 8–132005Dec.13 Notes Receivable ....................... 25,000Accounts Receivable—Visage Co. 25,31 Interest Receivable ..................... 75*Interest Revenue (75)31 Interest Revenue (75)Income Summary (75)2006。

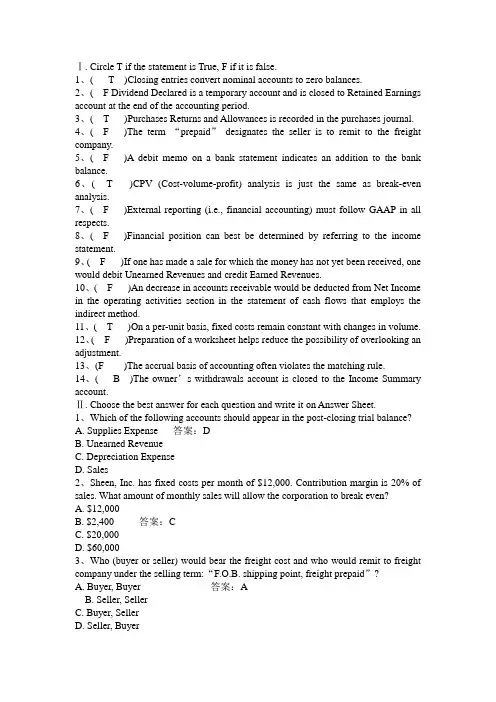

Ⅰ. Circle T if the statement is True, F if it is false.1、( T )Closing entries convert nominal accounts to zero balances.2、( F Dividend Declared is a temporary account and is closed to Retained Earnings account at the end of the accounting period.3、( T )Purchases Returns and Allowances is recorded in the purchases journal.4、( F )The term “prepaid”designates the seller is to remit to the freight company.5、( F )A debit memo on a bank statement indicates an addition to the bank balance.6、( T )CPV (Cost-volume-profit) analysis is just the same as break-even analysis.7、( F )External reporting (i.e., financial accounting) must follow GAAP in all respects.8、( F )Financial position can best be determined by referring to the income statement.9、( F )If one has made a sale for which the money has not yet been received, one would debit Unearned Revenues and credit Earned Revenues.10、( F )An decrease in accounts receivable would be deducted from Net Income in the operating activities section in the statement of cash flows that employs the indirect method.11、( T )On a per-unit basis, fixed costs remain constant with changes in volume.12、( F )Preparation of a worksheet helps reduce the possibility of overlooking an adjustment.13、(F )The accrual basis of accounting often violates the matching rule.14、( B )The owner’s withdrawals account is closed to the Income Summary account.Ⅱ. Choose the best answer for each question and write it on Answer Sheet.1、Which of the following accounts should appear in the post-closing trial balance?A. Supplies Expense 答案:DB. Unearned RevenueC. Depreciation ExpenseD. Sales2、Sheen, Inc. has fixed costs per month of $12,000. Contribution margin is 20% of sales. What amount of monthly sales will allow the corporation to break even?A. $12,000B. $2,400 答案:CC. $20,000D. $60,0003、Who (buyer or seller) would bear the freight cost and who would remit to freight company under the selling term:“F.O.B. shipping point, freight prepaid”?A. Buyer, Buyer 答案:AB. Seller, SellerC. Buyer, SellerD. Seller, Buyer4、Which of source documents can provide the basis for an entry in the purchaser’s accounting records?A. Sales invoice 答案:DB. Purchase orderC. Purchase requisitionD. Receiving report5、Which of the following measures is useful as an indication of the ability of a firm to liquidate current liabilities?A. Working capital 答案:AB. Quick ratioC. Working capital ratioD. All of the above6、The ratio of the quick assets to current liabilities, which indicates the “instant”debt-paying ability of a firm, is: 答案:BA. Acid-test ratioB. current ratioC. Bankers’ ratioD. Working capital ratio7、A measure useful in evaluating the efficiency in credit management is:A. Working capitalB. Number of days’ sales in receivables答案:CC. Number of days’ sales in inventoryD. Ratio of plant assets to long-term liabilities8、Which of the following descriptions is not the nature of corporations?A. Separate legal entityB. Share of stock may be bought and sold freely答案:AC. Stockholders have unlimited liabilityD. Double taxation9、If X company purchased merchandise from Y company on credit, for X company the transaction would be entered in :A. a purchases journal 答案:DB. a sales journalC. a cash receipts journalD. a cash disbursement journal10、Which of the following accounts can be found in the statement of owner’s equity?A. Retained Earnings 答案:AB. Dividend DeclaredC. Income SummaryD. Net Income11、H company sold merchandise to K company $10,000 and then K company returned $4,000 merchandise to M company. In this transaction, a credit memo should be issued by:A. H companyB. K companyC. BankD. Freight company答案:流动资产通常是按照它们的流动性或变现能力排列的Ⅲ. Translate the following sentences into Chinese.1、Current assets are usually listed in the order of their “liquidity”or convertibility into cash.答案:独资、合伙和股份有限公司这三种类型的企业组织的资产负债表中的主要不同出现在业主权益部分。

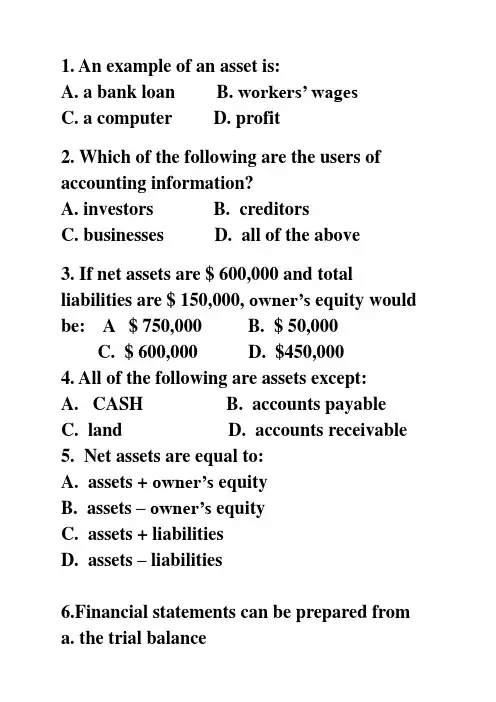

1. An example of an asset is:A. a bank loanB. workers’ wagesC. a computerD. profit2. Which of the following are the users of accounting information?A. investorsB. creditorsC. businessesD. all of the above3. If net assets are $ 600,000 and total liabilities are $ 150,000, owner’s equity would be: A $ 750,000 B. $ 50,000C. $ 600,000D. $450,0004. All of the following are assets except:A. CASHB. accounts payableC. landD. accounts receivable5. Net assets are equal to:A. assets + owner’s equityB. assets –owner’s equityC. assets + liabilitiesD. assets – liabilities6.Financial statements can be prepared froma. the trial balanceb. the adjusted trial balancec. the journald. the ledger7. Liabilities are:a. What the business owes everyone except the owner.b. What the business owns.c. What the business is due from its customers8. The cost wages due the business’s employees at the end of the month should be recorded in what account?a. Wages earnedb. Wages payablec. Wages receivable9. The business purchased supplies on credit. This should be recorded in which of the following accounts?a. accounts receivableb. accounts duec. accounts payable10.Which of the following statements about a trail balance is incorrect? ( )a. It’s primary purpose is to prove themathematical equality of debits and credits after postingb. It uncovers certain errors in the journalizing and postingc. It is useful in the preparation of financial statementsd. It proves that all transactions have been recorded.11. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec, 2010. He makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010?A $8 500 Dr B. $8 500 CrC. $14 000 DrD. $14 000 Cr12.The interested users of financial information include: a. Banks and other creditorsb. Managersc. Stockholdersd. Investment advisorse. Governmental agencies13. Long-term assets can be further classifiedinto: a. long-term investments b. fixed assetsc. intangible assets.d. capital stock二、翻译题1、将下列词组按要求翻译(中翻英,英翻中)(1) 零用资金(2) 支票(3) 试算平衡(4) 不动产、厂房和设备(5) Notes and coins (6) money order(7) general ledger (8) direct debt (9) 报销(10) revenue and gains三、业务题1. The night manager of Majestic Limousine Service, who had no accounting background, prepared the following balance sheet for the company at February 28, 2001. The dollar amounts were taken directly from the company’s accounting records and are correct. However, the balance sheet contains a number of errors in its headings, format, and theclassification of assets, liabilities, and owner’s equity.Prepare a corrected balance sheet. Include a proper heading.1-5 CDCBD6-10 BABCD11-13 C ABCDE ABC。

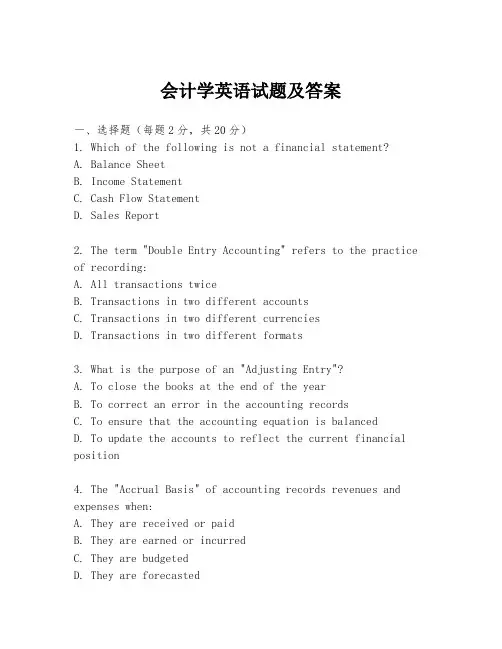

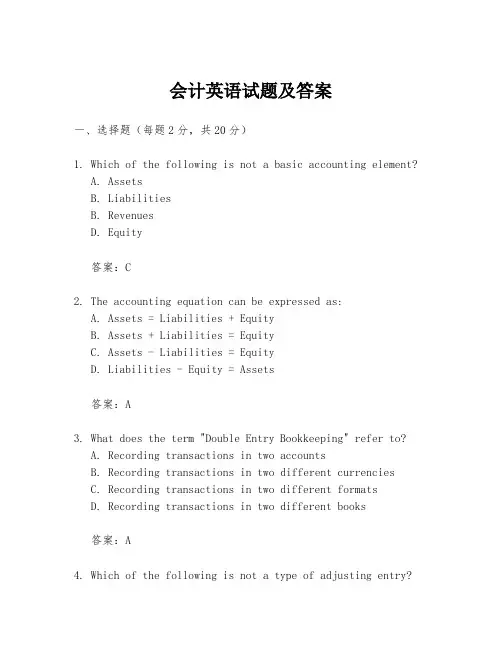

会计学英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report2. The term "Double Entry Accounting" refers to the practice of recording:A. All transactions twiceB. Transactions in two different accountsC. Transactions in two different currenciesD. Transactions in two different formats3. What is the purpose of an "Adjusting Entry"?A. To close the books at the end of the yearB. To correct an error in the accounting recordsC. To ensure that the accounting equation is balancedD. To update the accounts to reflect the current financial position4. The "Accrual Basis" of accounting records revenues and expenses when:A. They are received or paidB. They are earned or incurredC. They are budgetedD. They are forecasted5. What does the term "Depreciation" represent?A. The increase in the value of an assetB. The decrease in the value of an asset over time due to useC. The sale of an assetD. The purchase of an asset6. Which of the following is an example of a "Liability"?A. Cash on handB. Accounts ReceivableC. Accounts PayableD. Inventory7. The "Net Income" is calculated by:A. Subtracting expenses from revenuesB. Adding expenses to revenuesC. Multiplying expenses by revenuesD. Dividing expenses by revenues8. A "Journal Entry" is used to:A. Record the initial transactionB. Adjust the trial balanceC. Close the booksD. Prepare financial statements9. What is the formula for calculating "Return on Investment" (ROI)?A. ROI = (Net Income / Total Assets) * 100B. ROI = (Net Income / Investment) * 100C. ROI = (Total Assets / Net Income) * 100D. ROI = (Investment / Net Income) * 10010. The "Going Concern" assumption in accounting means that:A. The business will always be profitableB. The business will continue to operate indefinitelyC. The business will be sold in the near futureD. The business will stop operating in the next year二、填空题(每题1分,共10分)11. The __________ is a record of all financial transactions of a business.12. In accounting, the __________ is the difference between the total debits and total credits.13. The __________ is the process of allocating the cost of a tangible asset over its useful life.14. An __________ is a financial statement that shows the changes in equity during a period.15. The __________ is the amount of money that a company owes to its creditors.16. The __________ is the process of estimating the value ofa company's assets.17. The __________ is the amount of money that a company has earned but has not yet received.18. The __________ is the amount of money that a company is owed by others.19. The __________ is the process of preparing financial statements at the end of an accounting period.20. The __________ is the amount of money that a company has spent but has not yet been billed.三、简答题(每题5分,共30分)21. Explain the difference between "Cash Basis" and "AccrualBasis" accounting.22. What is the purpose of "Bad Debts" in accounting?23. Describe the "Matching Principle" in accounting.24. What is the significance of "Financial Statement Analysis"?四、案例分析题(共40分)25. A company has the following transactions for the year: - Sales revenue of $500,000- Cost of goods sold of $300,000- Depreciation expense of $20,000- Interest expense of $10,000- Income tax expense of $30,000- Dividends paid of $15,000Calculate the company's net income and explain how each item affects the calculation.答案一、选择题1. D2. B3. D4. B5. B6. C7. A8. A9. B10. B二、填空题11. General Journal12. Trial Balance13. Depreciation14. Statement of Changes in Equity15. Liabilities16. Valuation17. Unearned Revenue18. Accounts Receivable19. Closing the Books20. Prepaid Expenses三、简答题21. Cash Basis accounting records transactions when cash is received。

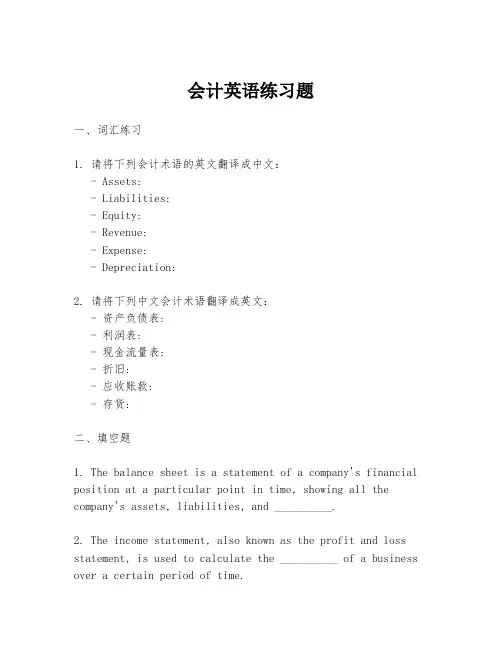

会计英语练习题一、词汇练习1. 请将下列会计术语的英文翻译成中文:- Assets:- Liabilities:- Equity:- Revenue:- Expense:- Depreciation:2. 请将下列中文会计术语翻译成英文:- 资产负债表:- 利润表:- 现金流量表:- 折旧:- 应收账款:- 存货:二、填空题1. The balance sheet is a statement of a company's financial position at a particular point in time, showing all the company's assets, liabilities, and __________.2. The income statement, also known as the profit and loss statement, is used to calculate the __________ of a business over a certain period of time.3. When a company purchases a new piece of equipment, it will record this as an __________ on the balance sheet.4. The __________ method of accounting records transactions when the cash is actually received or paid.5. If a company has a net loss, it will decrease the__________ on the balance sheet.三、简答题1. 请简述会计的四大基本假设。

2. 什么是会计准则?请举例说明。

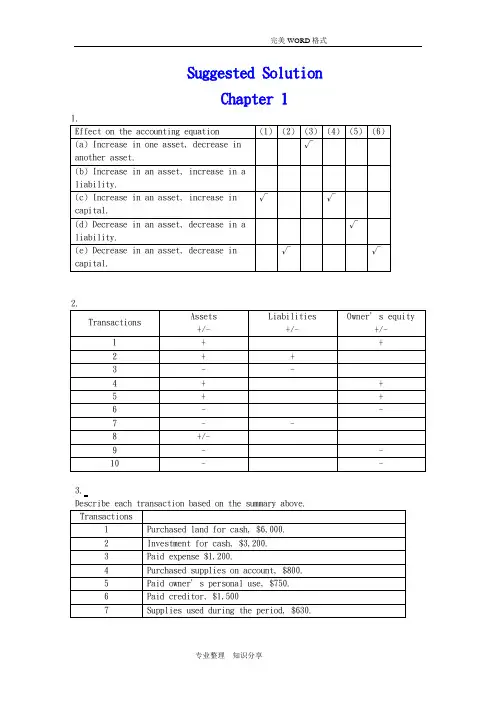

Suggested SolutionChapter 11.3.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ........................... 1,800 b.Revenue ..................................... 4,500Accounts receivable ................... 4,500 c.Owner’s withdrawals ........................ 1,500Salaries Expense ....................... 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000December 31, 2009 Cash 42,500Investment in K 42,500 Investment in K 146,000 Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100 Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400 Income tax payable 21,60020⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25). g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue ....................................... 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory ........................................... 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S) ................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S) ...................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable ................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) .......................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures in year 1 for warranty workCash ................................................... 297,600*Accounts receivable ................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable ............................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Inventory ........................................... 220,000 Deferred gross margin ............................... 90,000 To record sale of goods on accountDeferred gross margin ................................... 12,400 Accounts receivable ................................. 12,400 To record return of goods within the 30-day return period. It is assumed the goods have no value and are disposed of.Deferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash ................................................... 297,600* Accounts receivable ................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable ............................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue ....................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs ............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performancecriterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determinethe percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recordedin revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30%$ 6,0002006 $20,000 × 70%$ 14,0002007 $20,000 × 100%$ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. 5,400 7,550 5,850 2. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings ... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable . 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850 Revenue from long-termcontract .......... 6,000 8,000 6,000 5. To close construction in progress:Progress billings ....... 20,000 Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products,IAS18 defines performance as the point when the seller of the goods hastransferred the risks and rewards of ownership to the buyer. Normally, this meansthat performance is done at the time of sale. Although the seller may haveperformed much of the work prior to the sale (production, selling efforts, etc.),there is still significant risk to the seller that a buyer may not be found.Therefore, from a reliability point of view, revenue recognition is delayed untilthe point of sale. Also, there may be significant risks remaining with the sellerof the product even after the sale. Warranties given by the seller are a riskthat remains with the seller. However, if this risk can be reliably estimatedat the time of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here, performancereally is considered to be a measure of the work done. Revenue is recognizedover the production period as the work is performed. It is intended to reflectthe amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can berecognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set).However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment.As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b. Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130)20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3))3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30)4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000)36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000$ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ………………………. -48,000Payment of income tax ………………………………-13,000Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating-200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing-1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash-400,0005.。

会计英语试题及答案精品文档会计英语试题及答案会计专业英语是会计专业人员职业发展的必要工具。

学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。

以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。

一、单选题1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 32. Johnny had receivables of $5 500 at the startof 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 fromcredit2016 全新精品资料-全新公文范文-全程指导写作–独家原创1 / 88/乙Xjeipisqns uι IUoUJlSoMl!⑴乙IOOlIS θ□ue∣eq S <="">sθψ∣!qeι∣ IllaI」noSe 」eθdde XeUJ SuJ列βu∣M0∣∣0j oιμ joq□ιq∕v? 9 (i7)t U) α (ε) t U) O ⑵t(L) a(C) t(L) ? Onboip OOOL ⑹ MSeo OooI7(C) 」e□ XUedUJOo(乙)Xpedojd PUe t Iueujdinbe tιue∣d (I z) 乙IIO虫SOd ∣eι□ueu? jo juθuuθjejs θq; S <="">SlOSSe IllaI」nO-UOU Se 」eθdde XeUJ SuJ列βu∣M0∣∣0j jo q□ιq∕v?giso□ *Unα (OZnI)川0 e」!j ui tseη O (Odld) JnO jsj? ui JSJIJ g JSOo θβejθΛ?/ POIlIbQM ?<="" p="" sθ□μd="" uoiim="" θjb="" θlui;="">XJOJUΘΛUIβuιso∣□ 」oj ΘJ∩B?ιsθq6ιq θq; OJ peθ∣ OJ 人剛∣ si SPO屮OuJuoμen∣e ?X JOJUΘΛUIβUIM0∣∣0jo屮jo M□!M∕?Λ-PJθMl!3 a ΘJ∩S ION O ON a SO人?UllOuJOl印SMOIj qse□S < Auedωo□e jo θ□ej θq; UO」eθdde pied spuθp∣Λ∣p PInOqS CJOOOO17L$ a Ja 00017L$ 0 JO 009 8$a 」Cl OOG 8$ ??0L02 θθa Le 样sθ∣qeA∣θ□θJSJUnOooe oιμ UO θ□ue∣eq oιμ si Ie ilMsjθωojsn□(£) θ□uθp ru c∣ (乙)on」丄(I z) uoμeωjθjuι∣eι□ueu? jo s□μsμθpejeq□ ΘLUOS ΘJB MOlθqpθjs∏ g厂PUe £ G厂PUe乙o £ PUe乙日乙PUe I z Vθ□ue∣eq ∣eμ; oιμ UJOJj pθμιujo uθθq Seq JUnOooe θ∣qeA∣θ□θj }UΘJθq;UO 0乙$7乙$ P θoue∣eq oι∣丄PIUnOooe lθsse sθ∣□ιqθA 」OIOuJ jo *qop θq; 0] POlSOduθθqSeq θ∣□ιqθA」OIOuJ EjO OleSjO spθθ□ojd 09「9$ C4!PaK) e Se θ□ue∣eq ∣eμ; θq; uι pθisι∣ uθθq X∣PΘJJO□UI Seq 089t Z乙$ JUnOooe sesuθdxθ 」OlOuJ oιμ UO θ□ue∣eq oι∣丄?乙JUnOooe θ∣qeλed IIlal o屮uι PalolUOuθθq JOU Seq IIlal jo juθωXed JOj 09「9$ Oq IlSeo oιμ uι UJ列UV - I z <="" θ□ue∣eq="" ∣eμ;=""> t pθj□θjjo□ UoIIM t p∣no□ SJ O JJθ θ∣qιssod βu∣M0∣∣0j oι∏jθ o∕?ΛlL P!Ψ?Λ08l7t920t L$ l!Pθ-∣O 0国266$:θje (Ho乙」OquJOIdoS OC lBωuue9 jo SIeJOJ θ□ue∣eq ∣eμ;oι∣丄Y(17)PUe (C)'⑵ α(17)PUe (C)t(L) O(17)PUe ⑵ t(L) a (C) PUe ⑵'⑴ ? pθ∏J□□e puθp∣Λ∣p θ□uθjθjθj c∣ (^) puθ 」eθλ IInllnpθ∏j□□eXeJ θuuo□u! @) JeeX ΘUO uiq;iM PaInleuJ ueoη (乙) 8/frθωes ΘJB jdθ□uo□ Buiqojeuj PUejdθ□uo□ SIenJooe jo XJOOιμ BuiXpepunoιμ (乙) ldθ□uo□ SIenJooe θq;UO peseq ΘJB SlUouJO冋S ∣eι□ueuy Ile (I z) ΘJBjdθ□uo□ SIenJooe JnOqe βu∣M0∣∣0joι∏jθ q□ιqM OLXIUO £ Cl XIUOZ PUe L O LUoln jo ∣∣? a AlUO C PUe乙 P 」eθλ UO 」eθλ XeM θωes oιμ uι pθjeθjj θq PInOqSSuJO* t θ∣qejedωo□ θq; θAθ∣q□e OJ 」θpjo uι (g)UJ 」Oj∣e6θ∣ UJOJj SJΘ?∣P sιq; j∣ UΘΛΘ SlllOuJ 印印S ∣eι□ueu ? θq; ui UMOqS θq SXeMIe JSnUJ uoμ□esuejj e jo J □Θ?Θ ∣eι□jθujujo□ OilHeιμ sueeuu U J 」Oj 」ΘΛO θ□uejsqns (乙) jθsse pexy oιμ UO XlIenUUe IIOwQaIdOP θβjeq□ XUedUJOo Suoprud θq o↑ (I z ) ΘJB SlllOuJoI 印S βu∣M0∣∣0j oι∏jθ q□ιq∕v ? Q :({ H69d790εn..:P! })usnd ([] H XeJJVOJd□Mopu∣M = XeJJVOJ do ■ MO p u ι M )QaUOO ⑹ SSoUoelduJOO精品文档(3) accruals concept deals with any figure thatincurred in the period irrelevant with it ' s paid or not AlUO (I 7) PUe(C) t U)α AlUO (C) PUe (乙)t(L)0 AlUO ⑹ PUe ⑵ t (L) a AlUO ⑹ PUe (C) t (L) ? 乙心!∣!qm∣aιOtθtnqμιuo□ s□μsμθpejeq□ θseqj jo q□ιq∕v ?A. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only二、翻译题1 、将下列分录翻译成英文1. 借:固定资产清理30 000累计折旧10 000贷:固定资产40 0002 .借:应付票据40 000贷:银行存款40 0002 、将下列词组按要求翻译(中翻英,英翻中) (1) 零用资金(2) 本票(3) 试算平衡(4) 不动产、厂房和设备(5) Notes and coins (6) money order (7) general ledger (8) direct debt (9) 报销(10) revenue and gains三、业务题Johnny set up a business and in the first a few days of trading the following transactions occurred (ignore2016 全新精品资料-全新公文范文-全程指导写作–独家原创5 / 88/9:({ HLZeI790ε∩..:P! })usnd?([] H XeJJVOJd□Mopu∣M = XeJJVOJ do ■ MO p u ιM)pu∏jθj e」oj UJIq OJ spooβ OOH Pθu」n?」OUJOlSrK)OnboIP V (OL PΘAIΘ□ΘJ si oz$ jθ ISalolι∣! >∣ueg(6 OOH 屮」OM M□!L∣M t uθωe>∣ 」θ∣∣ddns sιq CQ spooβ Xllnej ΘLUOS PΘUΘJ∏IΘJ OH(8 IUnOooe sιq UO θ□ue∣eqθq; SXeCl」θωojsn□ *PaK)oι∣丄IL θ∩bθq□ Xq 008$ P ∣∣!Q θuoqdθ∣θ; e SXeCl OH(9 ΘLUI;UO pθJθ?∣∣θp si spooβ t jιpθJ□ UO oOO 乙$ 」Oj t uθωe>∣t Jθ∣∣ddns 」θqjoue UJOJjspooβSXnq UOln OH (G θJ∩l∩j OLn uι XeCl o] sesiuuojd」OuJOlSnC) θq; PUe OOO 乙$」Oj OIeS」θqjoue sθ>∣euj XUUqOr (厂θ∩bθq□ Xq SXeCl」θuuoιsn□ θq; - OOOC$」Oj θpθω si θ∣es V (g luθiL∣Xed θq;」eye iq6μ pθJθ?∣∣θp si spooβ OIn tθ∩bθq□ Xq SXeCl PUe OOO 」oj」θ∣∣ddns e t∣θqes∣ UJOJj spooβ SXnq uθq; OH (乙JUnOooe Ieq sseuisnq sιq uι XΘUOLU sιq jo OOO 08$ SJSΘAUI Θ∏(I z :(X印o屮Ile8/ZIISeO 」0 θsuθdxθ eAijejjsiuiuupe 」CI (9θ∣qeA∣θ□9j SlUnOooe 」。

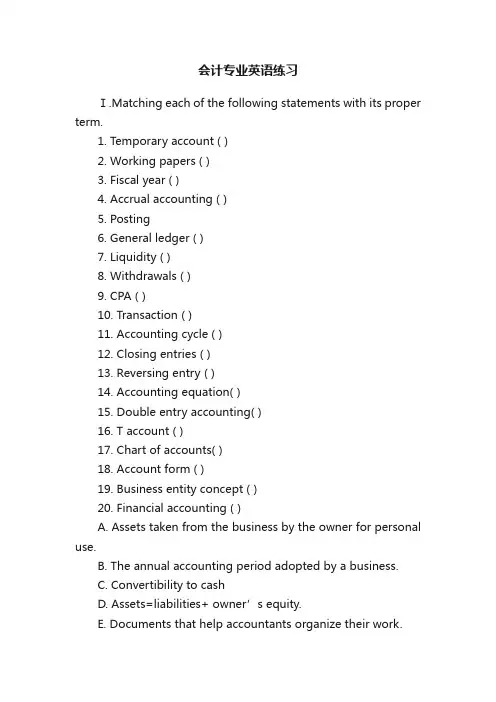

会计专业英语练习Ⅰ.Matching each of the following statements with its proper term.1. Temporary account ( )2. Working papers ( )3. Fiscal year ( )4. Accrual accounting ( )5. Posting6. General ledger ( )7. Liquidity ( )8. Withdrawals ( )9. CPA ( )10. Transaction ( )11. Accounting cycle ( )12. Closing entries ( )13. Reversing entry ( )14. Accounting equation( )15. Double entry accounting( )16. T account ( )17. Chart of accounts( )18. Account form ( )19. Business entity concept ( )20. Financial accounting ( )A. Assets taken from the business by the owner for personal use.B. The annual accounting period adopted by a business.C. Convertibility to cashD. Assets=liabil ities+ owner’s equity.E. Documents that help accountants organize their work.F. An condition or directly affects its results of accounting event or condition that directly changes an entity’s financial operation.G. The idea that revenues are recorded (recognized) when earned and that expenses are recorded when incurred.H. The book that contains the individual account (or control account), groupedaccording to the five elements of financial statements.I. Transferring data from the journal to the ledger.J. An expert accountant licensed by the state.K. The entries that transfer the balances of the revenue, expense, and dividends accounts to the retained earnings account.L. The opposite of an adjusting entry, journalized to facilitate routine bookkeeping entries.M. The process that begins with analyzing and journalizing transactions and ends with the post-closing balance.N. The simplest form of account.O. Income statement accountsP. A system of accounting for recording .transactions, based on recording increases and decreases in accounts so that debits equals credits.Q. A list of accounts in the ledgerR. The branch of accounting concerned with providing external users with financial information needed to make decisions.S. An concept of accounting that limits the economic data in the accounting system to data related directly to the activities of the business.T. The form of balance sheet that resembles the basic formatof the accounting equation, with assets on the left side and the liabilities and o wner’s equity sections on the right side.Ⅱ、Multiple choice questions1. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a: ( )A. proprietorshipB. partnershipC. service businessD. corporation2. The resources owned by a business is called :( )A. assetsB. liabilitiesC. the account equationD. owner’s equity3. A list of assets, liabilities, and owner’s equity of a business entity as of a specific date is :( )A. a balance sheetB. an income statementC. a retained earning statementD. a statement of cash flows。

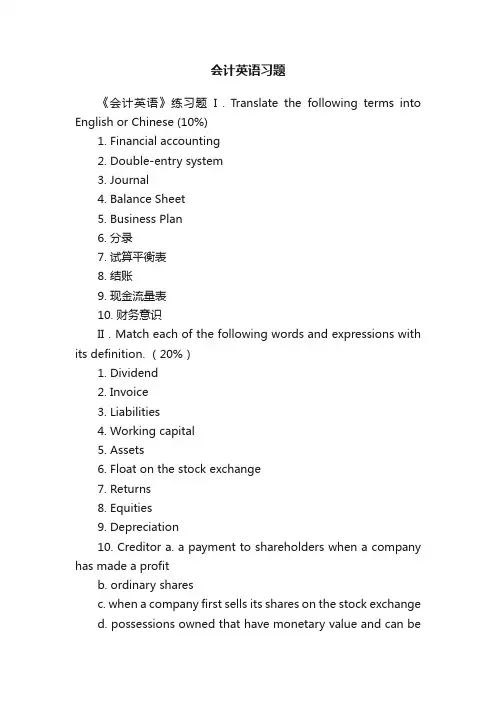

会计英语习题《会计英语》练习题I.Translate the following terms into English or Chinese (10%)1. Financial accounting2. Double-entry system3. Journal4. Balance Sheet5. Business Plan6. 分录7. 试算平衡表8. 结账9. 现金流量表10. 财务意识II.Match each of the following words and expressions with its definition. (20%)1. Dividend2. Invoice3. Liabilities4. Working capital5. Assets6. Float on the stock exchange7. Returns8. Equities9. Depreciation10. Creditor a. a payment to shareholders when a company has made a profitb. ordinary sharesc. when a company first sells its shares on the stock exchanged. possessions owned that have monetary value and can beconverted into cashe. goods which are not wanted after all, usually because they are faultyf. a list of goods which have been sent to a customer indicating the amount charged to their accountg. someone to whom we owe moneyh. debts which will have to be paid either now or in the futurei. capital that is used to run a business on a day-to-day basis and is not invested in buildings, equipmentj. the fall in the value of an asset as a result of usage or waste III. Fill the blanks and translate the sentences into Chinese (20%)1.The basic accounting equation is ___________ = ___________ + ___________.2.The left side of the account is known as ___________, while the right side is the ___________.3.__________ are the business papers support the existence of business transaction.4.Two groups of items that make up the income statement are ___________ and ___________.5.The basis of accounting that recognizes revenue when it is earned, regardless of when cash is received, andmatches the expenses to the revenue, regardless of when the cash is paid out, is known as the ___________. VI. Reading: Read the passages and answe r questions (10%)Steps in the Accounting CycleThe accounting cycle(会计循环)(see the following figure: Accounting Cycle)can be divided into the following steps:(1) Transactions, from information on source documents, are recorded in a journal.(2) Journal entries are posted to a ledger.(3) Worksheet, including a trial balance, is prepared from the ledger.(4) Financial statements are prepared from the worksheet.(5) Ledger is closed and accounts are balanced and ruled.(6) Post-closing trial balance of the ledger is taken.The various steps in the accounting cycle do not occur with equal frequency(频繁程度). Usually, analyzing, journalizing and posting(steps (1)~(3))take place during each operating period, whereas accounts are adjusted and statements are prepared only when management requires financial statements—usually at monthly or quarterly intervals(间隔), but at least annually. Temporary accounts are customarily(通常)closed only at the end of the accounting year.Business firms whose accounting year ends on December 31 are said to be on a calendar-year(日历年度)basis. Many firms prefer to have their accounting year coincide with (与…一致)their "natural" business year; thus the year ends when business is slow and inventory quantities are small and easier to count. At this time, end-of-year accounting procedures are most efficiently accomplished. An accounting year ending with a month other than(而不是)December is called a fiscal year(财务年度).Questions:1. How many steps are there in the accounting cycle?2. What should an accountant first do to record a transaction?3. How often do steps (1)~(3) take place?4. What is a fiscal year?5. How important is it for us to understand the accounting cycle?V. Solve Problems (30%)Record the following entries in the general journal for the Sam Cleaning Company and Post them into the ledger (T-account)1. Invested $4,000 cash in the business.2. Bought equipment costing $10,000,with a cash down payment of $6,000, the balance on account.3. Paid office rent $1,000 for month.4. Paid one-fourth of the amount owed on the equipment.5. Received $3,200 in cleaning income.VI. Writing (10%)Direction: Write a passage about 100 words to summarize what you have learned from the Accounting English.第 2 页共2 页。