管理会计双语课程习题chapter_2

- 格式:doc

- 大小:107.50 KB

- 文档页数:32

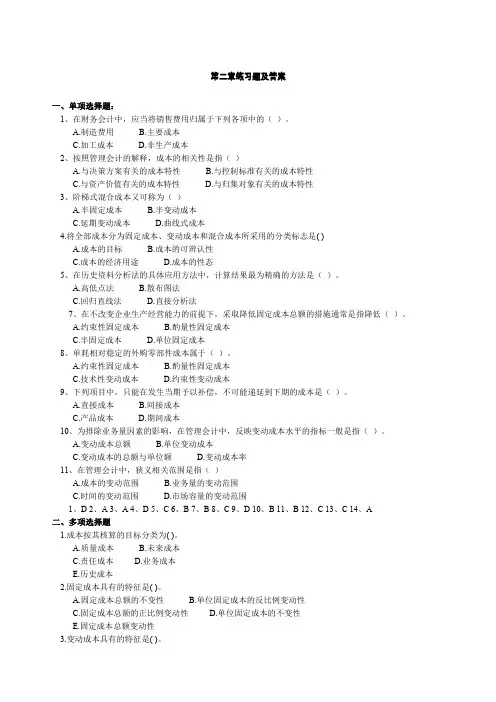

第二章练习题及答案一、单项选择题:1、在财务会计中,应当将销售费用归属于下列各项中的()。

A.制造费用B.主要成本C.加工成本D.非生产成本2、按照管理会计的解释,成本的相关性是指()A.与决策方案有关的成本特性B.与控制标准有关的成本特性C.与资产价值有关的成本特性D.与归集对象有关的成本特性3、阶梯式混合成本又可称为()A.半固定成本B.半变动成本C.延期变动成本D.曲线式成本4.将全部成本分为固定成本、变动成本和混合成本所采用的分类标志是( )A.成本的目标B.成本的可辨认性C.成本的经济用途D.成本的性态5、在历史资料分析法的具体应用方法中,计算结果最为精确的方法是()。

A.高低点法B.散布图法C.回归直线法D.直接分析法7、在不改变企业生产经营能力的前提下,采取降低固定成本总额的措施通常是指降低()。

A.约束性固定成本B.酌量性固定成本C.半固定成本D.单位固定成本8、单耗相对稳定的外购零部件成本属于()。

A.约束性固定成本B.酌量性固定成本C.技术性变动成本D.约束性变动成本9、下列项目中,只能在发生当期予以补偿,不可能递延到下期的成本是()。

A.直接成本B.间接成本C.产品成本D.期间成本10、为排除业务量因素的影响,在管理会计中,反映变动成本水平的指标一般是指()。

A.变动成本总额B.单位变动成本C.变动成本的总额与单位额D.变动成本率11、在管理会计中,狭义相关范围是指()A.成本的变动范围B.业务量的变动范围C.时间的变动范围D.市场容量的变动范围1、D2、A3、A4、D5、C6、B7、B8、C9、D 10、B 11、B 12、C 13、C 14、A二、多项选择题1.成本按其核算的目标分类为( )。

A.质量成本B.未来成本C.责任成本D.业务成本E.历史成本2.固定成本具有的特征是( )。

A.固定成本总额的不变性B.单位固定成本的反比例变动性C.固定成本总额的正比例变动性D.单位固定成本的不变性E.固定成本总额变动性3.变动成本具有的特征是( )。

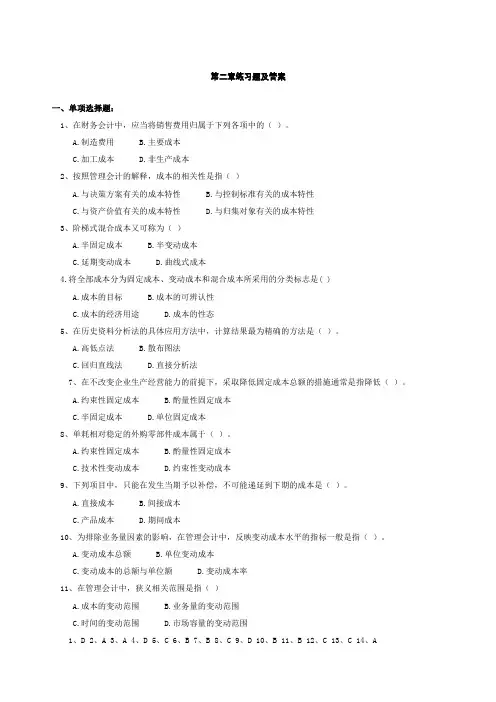

第二章练习题及答案一、单项选择题:1、在财务会计中,应当将销售费用归属于下列各项中的()。

A.制造费用B.主要成本C.加工成本D.非生产成本2、按照管理会计的解释,成本的相关性是指()A.与决策方案有关的成本特性B.与控制标准有关的成本特性C.与资产价值有关的成本特性D.与归集对象有关的成本特性3、阶梯式混合成本又可称为()A.半固定成本B.半变动成本C.延期变动成本D.曲线式成本4.将全部成本分为固定成本、变动成本和混合成本所采用的分类标志是( )A.成本的目标B.成本的可辨认性C.成本的经济用途D.成本的性态5、在历史资料分析法的具体应用方法中,计算结果最为精确的方法是()。

A.高低点法B.散布图法C.回归直线法D.直接分析法7、在不改变企业生产经营能力的前提下,采取降低固定成本总额的措施通常是指降低()。

A.约束性固定成本B.酌量性固定成本C.半固定成本D.单位固定成本8、单耗相对稳定的外购零部件成本属于()。

A.约束性固定成本B.酌量性固定成本C.技术性变动成本D.约束性变动成本9、下列项目中,只能在发生当期予以补偿,不可能递延到下期的成本是()。

A.直接成本B.间接成本C.产品成本D.期间成本10、为排除业务量因素的影响,在管理会计中,反映变动成本水平的指标一般是指()。

A.变动成本总额B.单位变动成本C.变动成本的总额与单位额D.变动成本率11、在管理会计中,狭义相关范围是指()A.成本的变动范围B.业务量的变动范围C.时间的变动范围D.市场容量的变动范围1、D2、A3、A4、D5、C6、B7、B8、C9、D 10、B 11、B 12、C 13、C 14、A二、多项选择题1.成本按其核算的目标分类为( )。

A.质量成本B.未来成本C.责任成本D.业务成本E.历史成本2.固定成本具有的特征是( )。

A.固定成本总额的不变性B.单位固定成本的反比例变动性C.固定成本总额的正比例变动性D.单位固定成本的不变性E.固定成本总额变动性3.变动成本具有的特征是( )。

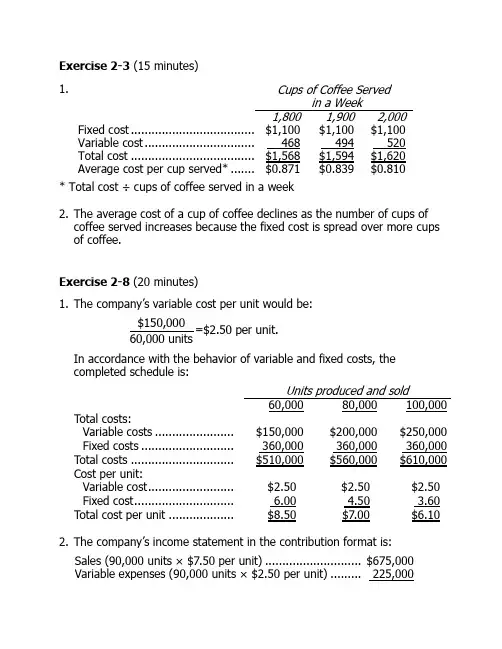

Exercise 2-3 (15 minutes)1. Cups of Coffee Servedin a Week1,800 1,900 2,000 Fixed cost ........................................$1,100 $1,100 $1,100Variable cost .................................... 468 494 520Total cost ........................................$1,568 $1,594 $1,620Average cost per cup served* ...........$0.871 $0.839 $0.810* Total cost ÷ cups of coffee served in a week2. The average cost of a cup of coffee declines as the number of cups ofcoffee served increases because the fixed cost is spread over more cups of coffee.Exercise 2-8 (20 minutes)1. The company’s variable cost per unit would be:$150,000=$2.50 per unit.60,000 unitsIn accordance with the behavior of variable and fixed costs, thecompleted schedule is:Units produced and sold60,000 80,000 100,000 Total costs:Variable costs ....................... $150,000 $200,000 $250,000 Fixed costs ........................... 360,000 360,000 360,000 Total costs .............................. $510,000 $560,000 $610,000 Cost per unit:Variable cost ......................... $2.50 $2.50 $2.50 Fixed cost ............................. 6.00 4.50 3.60 Total cost per unit ................... $8.50 $7.00 $6.102. The company’s income statement in the contribution format is:Sales (90,000 units × $7.50 per unit) ............................ $675,000Variable expenses (90,000 units × $2.50 per unit) ......... 225,000Contribution margin...................................................... 450,000Fixed expenses ............................................................ 360,000$ 90,000Problem 2-20 (30 minutes)1. Mr. Richart’s first action was to direct that discretionary expenditures bedelayed until the first of the new year. Providing that these “discretionary expenditures” can be delayed without hampering operations, this is a good business decision. By delaying expenditures, the company can keep its cash a bit longer and thereby earn a bit more interest. There is nothing unethical about such an action. The second action was to ask that the order for the parts be cancelled. Since the clerk’s order was a mistake, there is nothing unethical about this action either.The third action was to ask the accounting department to delayrecognition of the delivery until the bill is paid in January. This action is dubious. Asking the accounting department to ignore transactions strikes at the heart of the integrity of the accounting system. If the accounting system cannot be trusted, it is very difficult to run a business or obtain funds from outsiders. However, in Mr. Richart’s defense, the purchase of the raw materials really shouldn’t be recorded as an expense. He has been placed in an extremely awkward position because the company’s accounting policy is flawed.2. Th e company’s accounting policy with respect to raw materials isincorrect. Raw materials should be recorded as an asset when delivered rather than as an expense. If the correct accounting policy were followed, there would be no reason for Mr. Richart to ask the accountingdepartment to delay recognition of the delivery of the raw materials. This flawed accounting policy creates incentives for managers to delaydeliveries of raw materials until after the end of the fiscal year. This could lead to raw materials shortages and poor relations with suppliers who would like to record their sales before the end of the year.The company’s “manage-by-the-numbers” approach does not fosterethical behavior—particularly when managers are told to “do anything so long as you hit the target profits for the year.” Such “no excuses”pressure from the top too often leads to unethical behavior whenmanagers have difficulty meeting target profits.Problem 2-24 (45 minutes)1.Selling orCost Behavior Administrative Product Cost Cost Item Variable Fixed Cost Direct Indirect rect materials used (wood, glass) ..... $430,000 $430,000 dministrative office salaries ............... $110,000 $110,000actory supervision ............................ 70,000 $ 70,00 ales commissions ............................. 60,000 60,000epreciation, factory building .............. 105,000 105,00 epreciation, admin. office equipment .2,000 2,000direct materials, factory ................... 18,000 18,00 actory labor (cutting and assembly) ... 90,000 90,000 dvertising ........................................ 100,000 100,000surance, factory .............................. 6,000 6,00 dministrative office supplies .............. 4,000 4,000operty taxes, factory ....................... 20,000 20,00 tilities, factory .................................. 45,000 45,00 otal costs ......................................... $647,000 $413,000 $276,000 $520,000 $264,00Problem 2-24 (continued)2. The average product cost per bookcase will be:Direct.................................. $520,000Indirect ............................... 264,000Total ................................... $784,000$784,000 ÷ 4,000 bookcases = $196 per bookcase3. The average product cost per bookcase would increase if the productiondrops. This is because the fixed costs would be spread over fewer units,causing the average cost per unit to rise.4. a. Yes, there probably would be a disagreement. The president is likely towant a price of at least $196, which is the average cost per unit tomanufacture 4,000 bookcases. He may expect an even higher price than this to cover a portion of the administrative costs as well. The neighbor will probably be thinking of cost as including only materials used, or perhaps materials and direct labor.b. The term is opportunity cost. Since the company is operating at full capacity, the president must give up the full, regular price to sell a bookcase to the neighbor. Therefore, the president’s cost is really the full, regular price.。

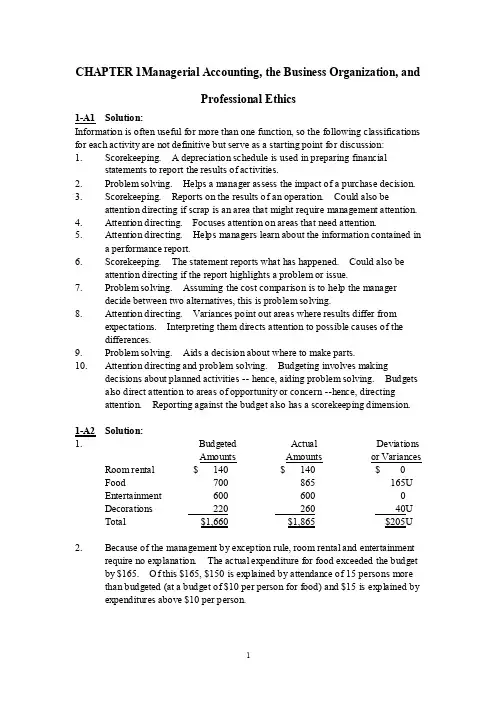

CHAPTER 1Managerial Accounting, the Business Organization, andProfessional Ethics1-A1 Solution:Information is often useful for more than one function, so the following classifications for each activity are not definitive but serve as a starting point for discussion:1. Scorekeeping. A depreciation schedule is used in preparing financialstatements to report the results of activities.2. Problem solving. Helps a manager assess the impact of a purchase decision.3. Scorekeeping. Reports on the results of an operation. Could also beattention directing if scrap is an area that might require management attention.4. Attention directing. Focuses attention on areas that need attention.5. Attention directing. Helps managers learn about the information contained ina performance report.6. Scorekeeping. The statement reports what has happened. Could also beattention directing if the report highlights a problem or issue.7. Problem solving. Assuming the cost comparison is to help the managerdecide between two alternatives, this is problem solving.8. Attention directing. Variances point out areas where results differ fromexpectations. Interpreting them directs attention to possible causes of thedifferences.9. Problem solving. Aids a decision about where to make parts.10. Attention directing and problem solving. Budgeting involves makingdecisions about planned activities -- hence, aiding problem solving. Budgets also direct attention to areas of opportunity or concern --hence, directingattention. Reporting against the budget also has a scorekeeping dimension.1-A2 Solution:1. Budgeted Actual DeviationsAmounts Amounts or Variances Room rental $ 140 $ 140 $ 0Food 700 865 165UEntertainment 600 600 0Decorations 220 260 40UTotal $1,660 $1,865 $205U 2. Because of the management by exception rule, room rental and entertainmentrequire no explanation. The actual expenditure for food exceeded the budget by $165. Of this $165, $150 is explained by attendance of 15 persons morethan budgeted (at a budget of $10 per person for food) and $15 is explained by expenditures above $10 per person.Actual expenditures for decorations were $40 more than the budget. Thedecorations committee should be asked for an explanation of the excessexpenditures.1-29 Solution:1. Controller. Financial statements are generally produced by the controller'sdepartment.2. Controller. Advising managers aids operating decisions.3. Controller. Advice on cost analysis aids managers' operating decisions.4. Treasurer. Analysts affect the company's ability to raise capital, which is theresponsibility of the treasurer.5. Treasurer. Financing the business is the responsibility of the treasurer.6. Controller. Tax returns are part of the accounting process overseen by thecontroller.7. Treasurer. Insurance, as with other risk management activities, is usually theresponsibility of the treasurer.8. Treasurer. Allowing credit is a financial decision.CHAPTER 2INTRODUCTION TO COST BEHAVIOR AND COST-VOLUME RELATIONSHIPS2-A3 Solution:The following format is only one of many ways to present a solution. This situation is reallya demonstration of "sensitivity analysis," whereby a basic solution is tested to see how much it is affected by changes in critical factors. Much discussion can ensue, particularly about the finalthree changes.The basic contribution margin per revenue mile is $1.50 - $1.30 = $.20(1) (2) (3) (4) (5)(1)×(2) (3)-(4)Revenue Cont ri buti on To talMi l es Margi n Pe r Cont ri buti on Fi xed NetSol d Revenue Mi l e Margi n Expen se s In co me 1. 800,000$.20$160,000$120,000$ 40,0002. (a) 800,000.35280,000120,000160,000(b) 880,000.20176,000120,00056,000(c) 800,000.0756,000120,000(64,000)(d) 800,000.20160,000132,00028,000(e) 840,000.17142,800120,00022,800(f) 720,000.25180,000120,00060,000(g) 840,000.20168,000132,00036,0002-B2 Solution:1. $2,300 ÷ ($30 - $10) = 115 child-days or 115 × $30 = $3,450 revenue dollars.2. 176 × ($30 - $10) - $2,300 = $3,520 - $2,300 = $1,2203. a. 198 × ($30 - $10) - $2,300 = $3,960 - $2,300 = $1,660 or (22 × $20) + $1,220 = $440 + $1,220 = $1,660 b. 176 × ($30 - $12) - $2,300 = $3,168 - $2,300 = $868 or $1,220 - ($2 × 176) = $868 c. $1,220 - $220 = $1,000d. [(9.5 × 22) × ($30 - $10)] - ($2,300 + $300) = $4,180 - $2,600 = $1,580e.[(7 × 22) × ($33 - $10)] - $2,300 = $3,542 - $2,300 = $1,2422-B 3 So lu tio n :1.$16)($20$5,000- = $4$5,000= 1,250 units2. Contribution margin ratio:($40,000)$30,000)($40,000- = 25%$8,000 ÷ 25% = $32,0003.$14)($30$7,000)($33,000-+ = $16$40,000 = 2,500 units4. ($50,000 - $20,000)(110%) = $33,000 contribution margin;$33,000 - $20,000 = $13,0005. New contribution margin:$40 - ($30 - 20% of $30)= $40 - ($30 - $6) = $16;New fixed expenses: $80,000 × 110% = $88,000;$16$20,000)($88,000+ = $16$108,000 = 6,750 units2-27 Soluti on:2-38Sol uti on:1. 100% Full 50% FullRoom revenue @ $50 $1,825,000 a$ 912,500 bVariable costs @ $10 365,000 182,500Contribution margin 1,460,000 730,000Fixed costs 1,200,000 1,200,000Net income (loss) $ 260,000 $ (470,000)a 100 × 365 = 36,500 rooms per year36,500 × $50 = $1,825,000b50% of $1,825,000 = $912,5002. Let N = number of rooms$50N -$10N - $1,200,000 = 0N = $1,200,000 ÷ $40 = 30,000 rooms Percentage occupancy = 30,000 ÷ 36,500 = 82.2%2-40 Solution:1. Let R = pints of raspberries and 2R = pints of strawberriessales - variable expenses - fixed expenses = zero net income$1.10(2R) + $1.45(R) - $.75(2R) - $.95(R) - $15,600 = 0$2.20R + $1.45R - $1.50R - $.95R -$15,600 = 0$1.2R - $15,600 = 0 R = 13,000 pints of raspberries2R = 26,000 pints of strawberries2. Let S = pints of strawberries($1.10 - $.75) × S - $15,600 = 0.35S - $15,600 = 0S = 44,571 pints of strawberries3. Let R = pints of raspberries($1.45 - $.95) × R - $15,600 = 0$.50R - $15,600 = 0R = 31,200 pints of raspberries2-42 Solution:Several variations of the following general approach are possible:Sales - Variable expenses - Fixed expenses = Target after-tax net income 1 - tax rateS - .75S - $440,000 =.3)-(1$84,000.25S = $440,000 + $120,000 3-A1 Solution:Some of these answers are controversial, and reasonable cases can be built for alternative classifications. Class discussion of these answers should lead to worthwhile disagreements about anticipated cost behavior with regard to alternative cost drivers.1. (b) Discretionary fixed cost.2. (e) Step cost.3. (a) Purely variable cost with respect to revenue.4. (a) Purely variable cost with respect to miles flown.5. (d) Mixed cost with respect to miles driven.6. (c) Committed fixed cost.7. (b) Discretionary fixed cost.8. (c) Committed fixed cost.9. (a) Purely variable cost with respect to cases of Coca-Cola.10. (b) Discretionary fixed cost.11. (b) Discretionary fixed cost.3-A2 Solution:1. Support costs based on 60% of the cost of materials:Sign A Sign B Direct materials cost $400 $200 Support cost (60% of m ater ial s c o st) $240 $120 Support costs based on $50 per power tool operation:Sign A Sign B Power tool operations 3 6 Support cost $150 $300 2. If the activity analysis is reliable, by using the current method, Evergreen Signs is predicting too much cost for signs that use few power tool operations and is predicting too little cost for signs that use many power tool operations. As a result the company could be losing jobs that require few power tool operations because its bids are too high -- it could afford to bid less on these jobs. Conversely, the company could be getting too many jobs that require many power tool operations, because its bids are too low -- given what the "true" costs will be, the company cannot afford these jobs at those prices. Either way, the sign business could be more profitable if the owner better understood and used activity analysis. Evergreen Signs would be advised to adopt the activity-analysis recommendation, but also to closely monitor costs to see if the activity-analysis predictions of support costs are accurate.3-B2 Solution:Board Z15 Board Q52Mark-up method:Material cost $40 $60Support costs (100%) $40 $60Activity analysis method:Manual operations 15 7Support costs (@$4) $60 $28The support costs are different because different cost behavior is assumed by the two methods. If the activity analyses are reliable, then boards with few manual operations are overcosted with the markup method, and boards with many manual operatio ns are undercosted with the markup method.3-B3 Solution:Variable cost per machine hour =Change in Repair Cost Change in Machine Hours= (P260,000,000 - P200,000,000) (12,000 - 8,000)= P15,000 per machine hourFixed cost per month = total cost - variable cost= P260,000,000 - P15,000 x 12,000= P260,000,000 - P180,000,000= P 80,000,000 per monthor = P200,000,000 - P15,000 x 8,000= P200,000,000 - P120,000,000= P 80,000,000 per month3-32 Solution:1. Machining labor: G, number of units completed or labor hours2. Raw material: B, units produced; could also be D if the company’s purchases do not affect the price of the raw material.3. Annual wage: C or E (depending on work levels), labor hours4. Water bill: H, gallons used5. Quantity discounts: A, amount purchased6. Depreciation: E, capacity7. Sheet steel: D, number of implements of various types8. Salaries: F, number of solicitors9. Natural gas bill: C, energy usage3-34 Solution:1. 2001 2002Sales revenues $57 $116Less: Operating income (loss) (19) 18Operating expenses $76 $ 982. Change in operating expenses ÷ Change in revenues = Variable cost percentage($98 - $76) ÷ ($116 - $57) = $22 ÷ $59 = .37 or 37%Fixed cost = Total cost – Variable cost= $76 - .37 × $57= $55or= $98 - .37 × $116= $55Cost function = $55 + .37 × Sales revenue3. Because fixed costs to not change, the entire additional total contributionmargin is added to operating income. The $57 sales revenue in 2001generated a total contribution margin of $57 × (1 - .37) = $36, which was $19 short of covering the $55 of fixed cost. But the additional $59 of salesrevenue in 2002 generated a total contribution margin of $59 × (1 - .37) = $37 that could go directly to operating income because there was no increase infixed costs. It wiped out the $19 operating loss and left $18 of operatingincome.3-35 Solution:1. Fuel costs: $.40 × 16,000 miles per month = $6,400 per month.2. Equipment rental: $5,000 × 7 × 3 = $105,000 for seven pieces of equipment for three months3. Ambulance and EMT cost: $1,200 × (2,400/200) = $1,200 × 12 = $14,4004. Purchasing: $7,500 + $5 × 4,000 = $27,500 for the month.3-36 Solution:There may be some disagreement about these classifications, but reasons for alternative classifications should be explored.Cost Discretionary Committed Advertising $22,000Depreciation $ 47,000 Company health insurance 21,000 Management salaries 85,000 Payment of long-term debt 50,000 Property tax 32,000 Grounds maintenance 9,000Office remodeling 21,000Research and development 46,000Totals $98,000 $235,000。

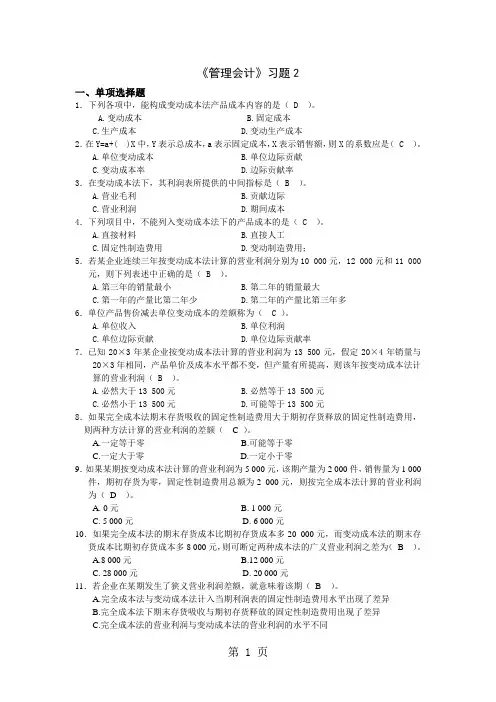

《管理会计》习题2一、单项选择题1.下列各项中,能构成变动成本法产品成本内容的是( D )。

A.变动成本B.固定成本C.生产成本D.变动生产成本2.在Y=a+( )X中,Y表示总成本,a表示固定成本,X表示销售额,则X的系数应是( C )。

A.单位变动成本B.单位边际贡献C.变动成本率D.边际贡献率3.在变动成本法下,其利润表所提供的中间指标是( B )。

A.营业毛利B.贡献边际C.营业利润D.期间成本4.下列项目中,不能列入变动成本法下的产品成本的是( C )。

A.直接材料B.直接人工C.固定性制造费用D.变动制造费用;5.若某企业连续三年按变动成本法计算的营业利润分别为10 000元,12 000元和11 000元,则下列表述中正确的是( B )。

A.第三年的销量最小B.第二年的销量最大C.第一年的产量比第二年少D.第二年的产量比第三年多6.单位产品售价减去单位变动成本的差额称为( C )。

A.单位收入B.单位利润C.单位边际贡献D.单位边际贡献率7.已知20×3年某企业按变动成本法计算的营业利润为13 500元,假定20×4年销量与20×3年相同,产品单价及成本水平都不变,但产量有所提高,则该年按变动成本法计算的营业利润( B )。

A.必然大于13 500元B.必然等于13 500元C.必然小于13 500元D.可能等于13 500元8.如果完全成本法期末存货吸收的固定性制造费用大于期初存货释放的固定性制造费用,则两种方法计算的营业利润的差额( C )。

A.一定等于零B.可能等于零C.一定大于零D.一定小于零9.如果某期按变动成本法计算的营业利润为5 000元,该期产量为2 000件,销售量为1 000件,期初存货为零,固定性制造费用总额为2 000元,则按完全成本法计算的营业利润为(D )。

A. 0元B. 1 000元C. 5 000元D. 6 000元10.如果完全成本法的期末存货成本比期初存货成本多20 000元,而变动成本法的期末存货成本比期初存货成本多8 000元,则可断定两种成本法的广义营业利润之差为(B )。

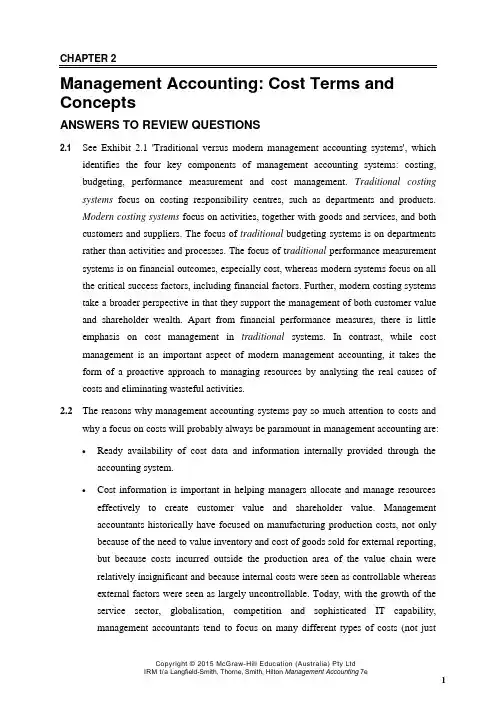

CHAPTER 2Management Accounting: Cost Termsand ConceptsANSWERS TO REVIEW QUESTIONS2.1See Exhibit 2.1'Traditional versus modern management accounting systems', whichidentifies the four key components of management accounting systems: costing, budgeting, performance measurement and cost management. Traditional costing systems focus on costing responsibility centres, such as departments and products.Modern costing systems focus on activities, together with goods and services, and both customers and suppliers. The focus of traditional budgeting systems is on departments rather than activities and processes. The focus of t raditional performance measurement systems is on financial outcomes, especially cost, whereas modern systems focus on all the critical success factors, including financial factors. Further, modern costing systems take a broader perspective in that they support the management of both customer value and shareholder wealth. Apart from financial performance measures, there is little emphasis on cost management in traditional systems. In contrast, while cost management is an important aspect of modern management accounting, it takes the form of a proactive approach to managing resources by analysing the real causes of costs and eliminating wasteful activities.2.2 The reasons why management accounting systems pay so much attention to costs andwhy a focus on costs will probably always be paramount in management accounting are:∙Ready availability of cost data and information internally provided through the accounting system.∙Cost information is important in helping managers allocate and manage resources effectively to create customer value and shareholder value. Managementaccountants historically have focused on manufacturing production costs,not onlybecause of the need to value inventory and cost of goods sold for external reporting,but because costs incurred outside the production area of the value chain wererelatively insignificant and because internal costs were seen as controllable whereasexternal factors were seen as largely uncontrollable. Today,with the growth of theservice sector, globalisation, competition and sophisticated ITcapability,management accountants tend to focus on many different types of costs(not just manufacturing product costs) and the causes of those costs along the value chain.The monitoring of external factors relating to customer satisfaction and product differentiation and so on is now seen as an important aspect of management accounting.The ‘Real life’ examples in the chapter illustrate how viability can depend on managing, controlling and reducing costs and why management accounting systems pay so much attention to costs.IAG, to keep insurance premiums as low as possible for its customers and to meet its obligations to shareholders, needs to manage costs in every part of its business. It needs to minimise administration costs, look for savings in its supply chain, use technology to increase efficiency and find synergies within its operations, including achieving cost savings through reducing carbon emissions and managing the environment.The Australian hotel industry,to determine the trade-off between room rates and occupancy (as the room rate goes down, the occupancy level goes up),uses cost classification to help set room prices and manage the yield on providing accommodation.In setting room rates the hotel manager must consider cost behaviour: which costsare variable costs of providing accommodation, such as roomcleaning costs, and which are committedcosts, such as council rates, premises costs and insurance costs. Room rates must be set so that theycover at least the variable cost per room per day. The system identifies the variable costs of the two major products of the hotel: rooms and food and beverages. The variable costs per room tend to be low, whereas the variable costs forfood and beverage service tend to be high. This means that the extra profit that can be earned from each extra night of accommodation sold is high. The key to improving profitability is, therefore, maximising room sales. The appropriate classification of costs helps the hotel industry to understand and manage its costs and profitability.The Japanese experience, where it wantedto retain its competitive advantage in high technology manufacturing but was faced with competing against low labour costs in other Asian countries, has been that some companies have found it cost effective to return their manufacturing operations to Japan.Kenwood returnedto Japan because of a lower foreign exchangerate, higher skills and productivity of Japanese labour, and a reduced need for re-exporting. These factors resulted in costsavings across the value chain of 10 per cent,reduced lead times from two weeks to one or two days and reducedinventory levels from 18 to three days. In Japan a cell production method of small production teams working on a range of tasks is used rather than an assembly line approach.This resultsin labour savings and the flexibility of small production lots to meet customer demand more effectively and quickly. Canon returned to Japan because it identified that costs across the value chain from development through to production and distribution can be managed more efficiently and effectively in Japan by using automation to offset Japan’s relatively higher labour costs.Film makers also need to analyse and manage their costs effectively. In seeking finance, film producers provide detailed budgets of estimated production costs. They need to manage actual costs carefully once production begins. Careful costing becomes even more important in an environment of rising costs and, according tothe Australian Film Commission, the costs of making Australian feature films have increased significantly over time. The Film Finance Corporation Australia (FFC) compared the costs in 1993 and 2001 of shooting the same feature film. Location costs, including council fees, security fees, facilities and cleaning up,rose by more than 380 per cent; equipment, including cameras, grips, lighting and sound, increased by an average of 177 per cent;rentals and storage, including for the art department and office, construction, toilets, cleaning, and editing facilities, increased by 81 per cent; and fringe costs, including cast and crew overtime, night and other loadings, rose by more than 150 per cent.The cost of gold production in Australia has continued to rise and the price of gold is subject to world market supply and demand. Assigning costs to cost objects is important in assessing the future of the gold industry.A key figure for gold miners and their investors is the estimated production cost per ounce for gold. When the gold price in June 1997 fell to $450 per ounce, only nine of the top 25 mines were comfortably covering costs. Recent record prices have more than offset the increase in gold production costs; but gold mining is capital intensive, involving large scale power generation and mining equipment. By the end of 2006 average global mine cash costs had risen to approximately $400 per ounce, and the total production costs including depreciation and other capital expenses had risen to $508 per ounce. There are high energy costs in extracting the ore from the ground and refining it; these processes may need particular attention to reduce environmental costs in a carbon-constrained future.2.3 We often classify information as qualitative or quantitative. We can then furthercategorise quantitative information as financial or non-financial (i.e. representing monetary amounts or numerically representing other measures). However, this question asks the student to first distinguish between financial and non-financial information. The non-financial information can therefore bepresented in the subcategories of qualitative and quantitative information.Many answers are possible.A quick check on the internet will reveal to students that the Australian Open run by Tennis Australia encourages applications for a wide range of jobs, both paid and voluntary. Data is therefore required about the staffing requirements of the Open. Weather information assists with decisions relating to having the roof of centre court open or closed at the start of a match, as only extreme weather eventswill lead to it being closed after the start of the match. The timing of an Australia Day fireworks display in the areaalso affects matches, as they pause matches while the display is on. Weather forecasts can also affect the amount and nature of drinks that are ordered; more cold drinks and ice creams are probably sold during hot spells, whereas colder sessions can create higher demand for hot food and drink. Hotter weather puts a strain on medical services, whereas wet and cold weather can change demand at the tournament clothing outlets. The timing of cricket matches at the neighbouring MCG has an impact on parking and should be known in advance. The number of presold tickets can affect both the number of tickets sold on the day and the number of quick entry lanes for presold tickets (when they have them) needed.Instructor: a useful discussion can focus on which information is quantitative and which is qualitative.2.4Managers in the head office of Qantas could use cost information in planning when theydevelop a budget for their operations during the following year. Included in that budget would be projected costs associated with:existing planes, buildings and equipment (rent, depreciation, maintenance etc.);staff salaries, recruitment and training;food for on-board meals in the different classes of seat (a few years ago there was publicity about how much Qantas saved by cutting one olive from each First Class meal);advertising contracts; and so on. At the end of the year, or each month, this budget would be used for cost control, by comparing the actual costs incurred with projected costs in the budget and analysing variances.2.5Costs can be classified and reported in many different ways, depending on the purposefor which managers will use the information. Students should be careful how they interpret this phrase. It is not really different costs but the same bundle of costs with different cost classifications for different purposes. Cost data that are classified and reported in a particular way for one purpose may be inappropriate for another use.2.6Fixed costs remain constant in total across changes in activity levels, whereas variablecosts change inproportion to the level of activity. Examples are:Fixed costs Variable costsSalaries of permanent staff Casual staff salaries will vary with forecastdemand and the need to cover permanent staffleave arrangementsDepreciation of buildings and equipment Paper and postage costs, while declining, varywith the number of customers who have notadopted the online communication methodsSecurity services:if they are outsourced they are often subject to long-term contracts which would also make them fixed Telephone banking costs and across the counter retail banking may decline as internet banking increasesOther long-term contracts may includethose for cleaningStudents should note that it is important to recognise what a variable cost ‘varies with’.The answer to Question 2.7 is directly relevant here. In the context of a bank it is interesting to discuss the measures of output, the activities and the measures of input;cost is one measure of the inputs (resources consumed) that support the activities that produce the outputs. Costs in the table above can be extended to include those relating to investment activity and community engagement.2.7 When analysing cost behaviour the ‘level of activity’refers to the level of workperformed in the organisation. The activity causes the cost and, for this reason, the level of activity is often referred to as the level of cost driver. Activity can be expressed in many different ways, including units produced, number of machine hours, number of direct labour hours, number of transactions, kilometres driven, kilowatts used, pages printed, number of set-ups, number of engineering hours and so on. In a university, academic teaching activity is variously related to the number of courses/units/subjects prepared and taught, the number of hours of class contact, the number of students taught, marking load and various online teaching tasks.2.8 Cost objects are items for which managers need separate measures of cost. Examplesare:Cost object ‘Real l ife’ examples Reason for management interestcustomer IAG policy holders, hotelindustry guests, bar patrons,restaurant patrons to find out if particular customers are profitableproduct IAG policies, hotel industryaccommodation, food andbeverage;high technology TVs,cameras, printers and so on;afilm; an ounce of goldto find out if a product is profitableactivities IAG claims handling; hotelroom cleaning; assembling TVs;film editing;drilling for gold to obtain activity cost / per unit of activity for estimating the costs of other cost objects such as products, as well as for benchmarkingdepartment IAG policy and claimsdepartments;hotelaccommodation and food andbeverage departments; hightechnology research anddevelopment and administrativedepartments; film locationlogistics; gold refining to evaluate performance against a budget2.9 A direct cost can be traced to a cost object in an economic manner. An indirect costcannot be traced in an economic manner. Many costs could be traced if the organisation was willing to spend resources on tracing the costs. This is why we use the term ‘in an economic manner’. For indirect costs, the benefits of tracing the cost to the cost object are less than the cost of doing so.In an IT department in a law firm, for example, direct costs would include the depreciation of computer hardware, the cost of software and the salary costs of the IT staff. Other direct costs to the department include heating and lighting and depreciation on their office furniture. Costs that are indirect to the department include a share of accounting costs, the use of cleaning staff, and security costs.2.10 Costs that are direct to a plant but indirect to the products they produce include the costof secretarial staff at the plant, the salaries of the manager, telephone and IT costs, the depreciation of buildings, cleaning costs, car park and landscaping costs. Even costs more closely related to the manufacturing process can be direct to the plant but indirect to items produced. Hence, three other costs that could be classified as direct costs of a chemicals production plant but indirect costs of the chemicals produced are rent of factory, factory machine maintenance and factory supervision.2.11Controllable by CEO of the AFL Uncontrollable by CEO of the AFLWages of staff hired by and under the direction of AFL staff Items controlled by others such as the football club managers,e.g. the maintenance of playing arenasCosts for cleaning and security directly managed by AFL staff Items affected by outside influences such as the weather, legislation, and suppliers, e.g. refreshment costsContract items at the time of making the contract. These can include outsourced security, cleaning and so on. Note that lease costs are included here Contract/lease costs during the life of the contractsNote that ‘control’ relates to the manager's degree of influence. There is a broadspectrum between absolute, total control and no influence at all.Absolute and totalcontrol is rare. When we refer to ‘controllable’ we usually mean ‘significant influence’.2.12 The value chain is a set of linked processes or activities that begins with resources andends with providing (and supporting) products (i.e. goods and services) which customers value. Each of these segments can be examined from the viewpoint of providing managers with useful cost information.Research and development costs include building and running laboratories or research facilities, developing and testing new products and obtaining market data to ascertain demand for the product. As competition escalates, managers need to know where their competitive advantage might lie in keeping ahead of the market in introducing new (or modified) products or services.Design costs involve translating the research and development information into productsthat will satisfy customers’ needs. This includes all costs associated with the design of the product and the processes by which it will be produced. It may also require further R & D to be undertaken if the product or process design reaches a point where the firm cannot proceed until additional information is attained. It is important for managers to know the extent of design costs, since these must be recovered over the life of the product. Changing the design of the product can also bring changes in the costs of production, supply and distribution.Supply costs relate to the procurement and receipt of all incoming materials, parts or components related to the production of the product. Included also should be the costs of dealing with various suppliers so that the firm can evaluate its most suitable and cost-effective supplier profile. Managers who have (and fully understand) supply costs will make more effective supplier relationship decisions.Production costs include the costs associated with the collection and assembly of the resources to produce a product or service. Manufacturing costs (as opposed to costs in service environments) are the most common example of production costs and are regarded as those costs which are incurred within the factory area. Managers can use production costs to determine the cost per unit produced, whether this varies with batch size or volume produced, what additional costs are incurred with variations to the product, and so on. Apart from knowing these costs for planning, control and decisionmaking, production costs are required for financial reporting purposes. Marketing costs include costs associated with linking product features with customer needs and wants, together with promoting and selling the product. Managers need these costs to manage a vital part of the value chain, which is often misunderstood—and the total costs of which are often difficult to determine.Distribution costs are any costs associated with getting the finished product into the hands of the customer, and include transport and storage, distribution channel costs and so on. Managers need these costs to determine the most cost-effective way to distribute the product – something which may change over time and with different markets served by the firm.Customerservice (or support)costs comprise all costs incurred in serving or supporting the customer: answering inquiries, providing information about product features, installation, after-sales service, warranties and repairs, and so on. Managers who understand these costs will be better placed to accurately determine customer profitability compared to managers who do not.2.13 Value chain for a computer manufacturer:Value chain segment Examples of costsResearch and development Evaluating the suitability of using new material to manufacture the computersStudy of overseas trends to determine appropriate styles for local marketDesign Developing a new look computerDesigning new functionality into the computers Supply Cost of materialsCustoms duties on imported materialsManufacturing or production Direct materials and direct labour Factory overheadMarketing Media advertising to promote the productSales force costs associated with calling on prospective retailcustomersDistribution Warehousing and storageDelivery to customersCustomer service Warranty claims relating to defective workmanshipAnswering customer queries relating to installation of softwareand so onOnly manufacturing costs are included in the inventory value (shown on the balance sheet) for financial reporting purposes.2.14 The three main components of product cost are direct material, direct labour andmanufacturing overhead. Direct material is the cost of materials consumed in the process of manufacturing the product that can be directly traced to each product. Direct labour is the cost of personnel who work directly on the manufactured product, including salary, wages and labour on-costs. Manufacturing overhead covers all other costs of manufacturing the product that are not direct material or direct labour, including indirect materials, indirect labour and costs of depreciation, insurance, utilities and costs of manufacturing support departments. For example, if we consider Calvin Klein jeans,the cost of the denim used to make the jeans would be classified as direct material, the wages of the workers who cut and sew the jeans would constitute a direct labour cost and the heating and lighting of the assembly area would be part of the manufacturing overhead cost.A useful discussion can cover the classification of stitching thread as indirect material although it could technically be traced to the jeans.However, when fancy stitching is a design feature of the jeans, how should that thread be classified?2.15 Inventoriable cost is another term for product cost.It relates to the costs normallypermitted to be included as product cost for external reporting purposes (i.e. as inventory cost in the list of assets and for the determination of cost of goods sold in the calculation of profit). The term is derived from the storage of the goods as inventory until the goods are sold.2.16 Product costs are costs that are associated with manufactured goods and once they aresold the product costs become expenses. Period costs are those costs that are expensed during the time period in which they are incurred.Examples of each follow:Product costs Period costsDirect labour Upstream costs such as research anddevelopmentDirect material Support service costs such asaccountants’ salaries, depreciation ofoffice equipmentManufacturing overhead such as wages of factory manager and supervisors, machine maintenance, depreciation of factory building and equipment Downstream costs of selling and marketing such as sales personnel salaries, advertising, distribution2.17 In most service firms there is no inventory as the product is consumed as it is produced.All costs are thustreated as period costs.2.18 The four major steps in the flow of costs through a manufacturing company are outlinedin Exhibit 2.6 and described as follows:1 When raw material for manufacturing production is purchased, its cost is added toraw materials inventory.2 As it is consumed in the production, its cost is removed from raw material inventoryand added to work in process inventory account, which records the cost of productson which manufacture has begun but has only partially been completed at balancedate. Work in process inventory also accumulates the costs of direct labour andmanufacturing overhead incurred in the production.3 When products are finished, their costs are transferred from work in processinventory to finished goods inventory, which refers to manufactured goods that arecomplete and ready for sale.4 Finally, when products are sold their costs are transferred from finished goodsinventory to cost of goods sold account, which is an expense during the period whenthe sale is made.2.19 Product cost in a manufacturing context is the cost assigned to goods that aremanufactured. Product cost is classified as an asset and appears on the balance sheet when it moves through the raw material, work in process and finished goods inventories.When the goods are sold, their cost is transferred from finished goods inventory account to cost of goods sold, an expense account, and is deducted from sales revenue to estimate the gross profit appearing on the income statement. As costs are resources given up to obtain future benefits, if the benefits extend beyond the current accounting period, the costs are recorded as assets (e.g. raw material or finished goods inventories accounts). When the benefits from a cost are confined to the current period, the costs are recorded as an expense that is used up in the generation of revenue (e.g. cost of goods sold expense).2.20 Cost of goods manufactured is the total cost of goods that are completed during theperiod and moved to finished goods inventory, and cost of goods sold is the total cost of goods that are sold during the period and removed from finished goods inventory.Cost of goods manufactured can also be distinguished from manufacturing costs. The manufacturing costs are the total cost of resources consumed in production within a particular period. These can include resources still in the production stage at the end of the period.The cost of goods manufactured is the cost of goods finished in the period, even if they were started in a previous period.SOLUTIONS TO EXERCISESEXERCISE 2.21 (10 minutes) Classifying costs of support department; direct, indirect, controllable and uncontrollable costsEXERCISE 2.22 (20 minutes) Classifying product and period costs, variable and fixed costs, manufacturing costs1 Advertising costs: period cost, fixed non-manufacturing cost2 Straight-line depreciation: product cost, fixed manufacturing overhead3 Wages of assembly line workers: product cost, variable, direct labour4 Delivery costs on customer shipments: period cost, variable non-manufacturing cost5 Newsprint consumed: product cost, variable, manufacturing cost (direct material)6 Plant insurance: product cost, fixed, manufacturing cost (manufacturing overhead)7 Glass costs: product cost, variable, direct material8 Tyre costs: product cost, variable, manufacturing cost (direct material)9 Sales commissions: period cost, variable non-manufacturing cost10 Wood glue: product cost, variable, manufacturing cost (either direct material ormanufacturing overhead (i.e., indirect material) depending on how significant the cost is) 11 Wages of security guards: product cost, variable, (manufacturing cost) manufacturingoverhead12 Salary of financial vice president: period cost, fixed non-manufacturing cost EXERCISE 2.23 (20 minutes) Classifying product and period costs, variable and fixed costs, manufacturing costs1 Handbrake pads: product cost, variable, manufacturing cost (direct material)2 Inward shipping costs: product cost, variable, manufacturing cost (direct material)3 Oil consumed by sewing machines: product cost, variable, manufacturing cost(manufacturing overhead)4 Hourly wages of cleaners: period cost, variable, non-manufacturing cost5 Salary of financial controller: period cost, fixed, non-manufacturing cost6 Advertising: period cost, fixed, non-manufacturing cost7 Straight-line depreciation on factory machinery: product cost, fixed, manufacturing cost(manufacturing overhead)8 Wages of assembly workers: product cost, variable, manufacturing cost (direct labour)9 Delivery costs on customer shipments: period cost, variable, non-manufacturing cost10 Printed circuit boards: product cost, variable, manufacturing cost (direct material)11 Plant insurance: product cost, fixed, manufacturing cost (manufacturing overhead)12 Grain costs: product cost, variable, manufacturing cost (direct material)EXERCISE 2.24 (10 minutes) Classifying costs; value chain: manufacturer1 (d)。

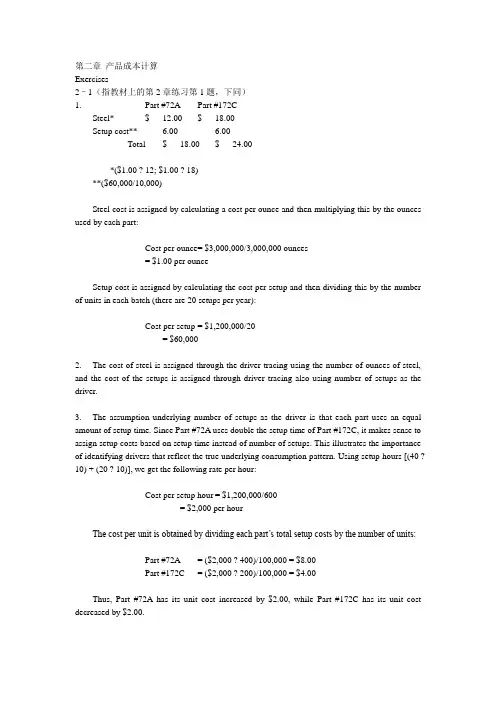

第二章产品成本计算Exercises2–1(指教材上的第2章练习第1题,下同)1. Part #72A Part #172CSteel* $ 12.00 $ 18.00Setup cost** 6.00 6.00Total $ 18.00 $ 24.00*($1.00 ? 12; $1.00 ? 18)**($60,000/10,000)Steel cost is assigned by calculating a cost per ounce and then multiplying this by the ounces used by each part:Cost per ounce= $3,000,000/3,000,000 ounces= $1.00 per ounceSetup cost is assigned by calculating the cost per setup and then dividing this by the number of units in each batch (there are 20 setups per year):Cost per setup = $1,200,000/20= $60,0002. The cost of steel is assigned through the driver tracing using the number of ounces of steel, and the cost of the setups is assigned through driver tracing also using number of setups as the driver.3. The assumption underlying number of setups as the driver is that each part uses an equal amount of setup time. Since Part #72A uses double the setup time of Part #172C, it makes sense to assign setup costs based on setup time instead of number of setups. This illustrates the importance of identifying drivers that reflect the true underlying consumption pattern. Using setup hours [(40 ?10) + (20 ? 10)], we get the following rate per hour:Cost per setup hour = $1,200,000/600= $2,000 per hourThe cost per unit is obtained by dividing each part’s total setup costs by the number of units:Part #72A = ($2,000 ? 400)/100,000 = $8.00Part #172C = ($2,000 ? 200)/100,000 = $4.00Thus, Part #72A has its unit cost increased by $2.00, while Part #172C has its unit cost decreased by $2.00.problems2–51. Nursing hours required per year: 4 ? 24 hours ? 364 days* = 34,944*Note: 364 days = 7 days ? 52 weeksNumber of nurses = 34,944 hrs./2,000 hrs. per nurse = 17.472Annual nursing cost = (17 ? $45,000) + $22,500= $787,500Cost per patient day = $787,500/10,000 days= $78.75 per day (for either type of patient)2. Nursing hours act as the driver. If intensive care uses half of the hours and normal care the other half, then 50 percent of the cost is assigned to each patient category. Thus, the cost per patient day by patient category is as follows:Intensive care = $393,750*/2,000 days= $196.88 per dayNormal care = $393,750/8,000 days= $49.22 per day*$525,000/2 = $262,500The cost assignment reflects the actual usage of the nursing resource and, thus, should be more accurate. Patient days would be accurate only if intensive care patients used the same nursing hours per day as normal care patients.3. The salary of the nurse assigned only to intensive care is a directly traceable cost. To assign the other nursing costs, the hours of additional usage would need to be measured. Thus, both direct tracing and driver tracing would be used to assign nursing costs for this new setting.2–61. Bella Obra CompanyStatement of Cost of Services SoldFor the Year Ended June 30, 2006Direct materials:Beginning inventory $ 300,000Add: Purchases 600,000Materials available $ 900,000Less: Ending inventory 450,000*Direct materials used $ 450,000Direct labor 12,000,000Overhead 1,500,000Total service costs added $ 13,950,000Add: Beginning work in process 900,000Total production costs $ 14,850,000Less: Ending work in process 1,500,000Cost of services sold $ 13,350,000*Materials available less materials used2. The dominant cost is direct labor (presumably the salaries of the 100 professionals). Although labor is the major cost of providing many services, it is not always the case. For example, the dominant cost for some medical services may be overhead (e.g., CAT scans). In some services, the dominant cost may be materials (e.g., funeral services).3. Bella Obra CompanyIncome StatementFor the Year Ended June 30, 2006Sales $ 21,000,000Cost of services sold 13,350,000Gross margin $ 7,650,000Less operating expenses:Selling expenses $ 900,000Administrative expenses 750,000 1,650,000Income before income taxes $ 6,000,0004. Services have four attributes that are not possessed by tangible products: (1) intangibility, (2) perishability, (3) inseparability, and (4) heterogeneity. Intangibility means that the buyers of services cannot see, feel, hear, or taste a service before it is bought. Perishability means that services cannot be stored. This property affects the computation in Requirement 1. Inability to store services means that there will never be any finished goods inventories, thus making the cost of services produced equivalent to cost of services sold. Inseparability simply means that providers and buyers of services must be in direct contact for an exchange to take place. Heterogeneity refers to the greater chance for variation in the performance of services than in the production of tangible products.2–71. Direct materials:Magazine (5,000 ? $0.40) $ 2,000Brochure (10,000 ? $0.08) 800 $ 2,800Direct labor:Magazine [(5,000/20) ? $10] $ 2,500Brochure [(10,000/100) ? $10] 1,000 3,500Manufacturing overhead:Rent $ 1,400Depreciation [($40,000/20,000) ? 350*] 700Setups 600Insurance 140Power 350 3,190Cost of goods manufactured $ 9,490*Production is 20 units per printing hour for magazines and 100 units per printing hour for brochures, yielding monthly machine hours of 350 [(5,000/20) + (10,000/100)]. This is also monthly labor hours, as machine labor only operates the presses.2. Direct materials $ 2,800Direct labor 3,500Total prime costs $ 6,300Magazine:Direct materials $ 2,000Direct labor 2,500Total prime costs $ 4,500Brochure:Direct materials $ 800Direct labor 1,000Total prime costs $ 1,800Direct tracing was used to assign prime costs to the two products.3. Total monthly conversion cost:Direct labor $ 3,500Overhead 3,190Total $ 6,690Magazine:Direct labor $ 2,500Overhead:Power ($1 ? 250) $ 250Depreciation ($2 ? 250) 500Setups (2/3 ? $600) 400Rent and insurance ($4.40 ? 250 DLH)* 1,100 2,250Total $ 4,750Brochure:Direct labor $ 1,000Overhead:Power ($1 ? 100) $ 100Depreciation ($2 ? 100) 200Setups (1/3 ? $600) 200Rent and insurance ($4.40 ? 100 DLH)* 440 940Total $ 1,940*Rent and insurance cannot be traced to each product so the costs are assigned using direct labor hours: $1,540/350 DLH = $4.40 per direct labor hour. The other overhead costs are traced according to their usage. Depreciation and power are assigned by using machine hours (250 for magazines and 100 for brochures): $350/350 = $1.00 per machine hour for power and $40,000/20,000 = $2.00 per machine hour for depreciation. Setups are assigned according to the time required. Since magazines use twice as much time, they receive twice the cost: Letting X = the pro?portion of setup time used for brochures, 2X + X = 1 implies a cost assignment ratio of 2/3 for magazines and 1/3 for brochures.Exercises3–11. Resource Total Cost Unit CostPlastic1 $ 10,800 $0.027Direct labor andvariable overhead2 8,000 0.020Mold sets3 20,000 0.050Other facility costs4 10,000 0.025Total $ 48,800 $0.12210.90 ? $0.03 ? 400,000 = $10,800; $10,800/400,000 = $0.0272$0.02 ? 400,000 = $8,000; $8,000/400,000 = $0.023$5,000 ? 4 quarters = $20,000; $20,000/400,000 = $0.054$10,000; $10,000/400,000 = $0.0252. Plastic, direct labor, and variable overhead are flexible resources; molds and other facility costs are committed resources. The cost of plastic, direct labor, and variable overhead are strictly variable. The cost of the molds is fixed for the particular action figure being produced; it is a step cost for the production of action figures in general. Other facility costs are strictly fixed.3–3High (1,400, $7,950); Low (700, $5,150)V = ($7,950 – $5,150)/(1,400 – 700)= $2,800/700 = $4 per oil changeF = $5,150 – $4(700)= $5,150 – $2,800 = $2,350Cost = $2,350 + $4 (oil changes)Predicted cost for January = $2,350 + $4(1,000) = $6,350problems3–61. High (1,700, $21,000); Low (700, $15,000)V = (Y2 – Y1)/(X2 – X1)= ($21,000 – $15,000)/(1,700 – 700) = $6 per receiving orderF = Y2 – VX2= $21,000 – ($6)(1,700) = $10,800Y = $10,800 + $6X2. Output of spreadsheet regression routine with number of receiving orders as the independent variable:Constant 4512.98701298698Std. Err. of Y Est. 3456.24317476605R Squared 0.633710482694768No. of Observations 10Degrees of Freedom 8X Coefficient(s) 13.3766233766234Std. Err. of Coef. 3.59557461331427V = $13.38 per receiving order (rounded)F = $4,513 (rounded)Y = $4,513 + $13.38XR2 = 0.634, or 63.4%Receiving orders explain about 63.4 percent of the variability in receiving cost, providing evidence that Tracy’s choice o f a cost driver is reasonable. However, other drivers may need to be considered because 63.4 percent may not be strong enough to justify the use of only receiving orders.3. Regression with pounds of material as the independent variable:Constant 5632.28109733183Std. Err. of Y Est. 2390.10628259277R Squared 0.824833789433823No. of Observations 10Degrees of Freedom 8X Coefficient(s) 0.0449642991356633Std. Err. of Coef. 0.0073259640055344V = $0.045 per pound of material delivered (rounded)F = $5,632 (rounded)Y = $5,632 + $0.045XR2 = 0.825, or 82.5%Pounds of material delivered explains about 82.5 percent of the variability in receiving cost. This is a better result than that of the receiving orders and should convince Tracy to try multiple regression.4. Regression routine with pounds of material and number of receiving orders as the independent variables:Constant 752.104072925631Std. Err. of Y Est. 1350.46286973443R Squared 0.951068418023306No. of Observations 10Degrees of Freedom 7X Coefficient(s) 0.0333883151096915 7.14702865269395Std. Err. of Coef. 0.00495524841198368 1.68182916088492V1 = $0.033 per pound of material delivered (rounded)V2 = $7.147 per receiving order (rounded)F = $752 (rounded)Y = $752 + $0.033a + $7.147bR2 = 0.95, or 95%Multiple regression with both variables explains 95 percent of the variability in receiving cost. This is the best result.5–21. Job #57 Job #58 Job #59Balance, 7/1 $ 22,450 $ 0 $ 0Direct materials 12,900 9,900 35,350Direct labor 20,000 6,500 13,000Applied overhead:Power 750 600 3,600Material handling 1,500 300 6,000Purchasing 250 1,000 250Total cost $ 57,850 $ 18,300 $ 58,2002. Ending balance in Work in Process = Job #58 = $18,3003. Ending balance in Finished Goods = Job #59 = $58,2004. Cost of Goods Sold = Job #57 = $57,850problems5–31. Overhead rate = $180/$900 = 0.20 or 20% of direct labor dollars.(This rate was calculated using information from the Ladan job; however, the Myron and Coe jobs would give the same answer.)2. Ladan Myron Coe Walker WillisBeginning WIP $ 1,730 $1,180 $2,500 $ 0 $ 0Direct materials 400 150 260 800 760Direct labor 800 900 650 350 900Applied overhead 160 180 130 70 180Total $ 3,090 $2,410 $3,540 $ 1,220 $ 1,840Note: This is just one way of setting up the job-order cost sheets. You might prefer to keep the detail on the materials, labor, and overhead in beginning inventory costs.3. Since the Ladan and Myron jobs were completed, the others must still be in process. Therefore, the ending balance in Work in Process is the sum of the costs of the Coe, Walker, and Willis jobs.Coe $3,540Walker 1,220Willis 1,840Ending Work in Process $6,600Cost of Goods Sold = Ladan job + Myron job = $3,090 + $2,410 = $5,5004. Naman CompanyIncome StatementFor the Month Ended June 30, 20XXSales (1.5 ? $5,500) $8,250Cost of goods sold 5,500Gross margin $2,750Marketing and administrative expenses 1,200Operating income $1,5505–201. Overhead rate = $470,000/50,000 = $9.40 per MHr2. Department A: $250,000/40,000 = $6.25 per MHrDepartment B: $220,000/10,000 = $22.00 per MHr3. Job #73 Job #74Plantwide:70 ? $9.40 = $658 70 ? $9.40 = $658Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $22 1,100.00 20 ? $22 440.00$ 1,225.00 $ 752.50Department B appears to be more overhead intensive, so jobs spending more time in Department B ought to receive more overhead. Thus, departmental rates provide more accuracy.4. Plantwide rate: $250,000/40,000 = $6.25Department B: $62,500/10,000 = $6.25Job #73 Job #74Plantwide:70 ? $6.25 = $437.50 70 ? $6.25 = $437.50Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $6.25 312.50 20 ? $6.25 125.00$ 437.50 $ 437.50Assuming that machine hours is a good cost driver, the departmental rates reveal that overhead consumption is the same in each department. In this case, there is no need for departmental rates, and a plantwide rate is sufficient.5–41. Overhead rate = $470,000/50,000 = $9.40 per MHr2. Department A: $250,000/40,000 = $6.25 per MHrDepartment B: $220,000/10,000 = $22.00 per MHr3. Job #73 Job #74Plantwide:70 ? $9.40 = $658 70 ? $9.40 = $658Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $22 1,100.00 20 ? $22 440.00$ 1,225.00 $ 752.50Department B appears to be more overhead intensive, so jobs spending more time in Department B ought to receive more overhead. Thus, departmental rates provide more accuracy.4. Plantwide rate: $250,000/40,000 = $6.25Department B: $62,500/10,000 = $6.25Job #73 Job #74Plantwide:70 ? $6.25 = $437.50 70 ? $6.25 = $437.50Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $6.25 312.50 20 ? $6.25 125.00$ 437.50 $ 437.50Assuming that machine hours is a good cost driver, the departmental rates reveal that overhead consumption is the same in each department. In this case, there is no need for departmental rates, and a plantwide rate is sufficient.5–51. Last year’s unit-based overhead rate = $50,000/10,000 = $5This year’s unit-based overhead rate = $100,000/10,000 = $10Last Year This YearBike cost:2 ? $20 $ 40 $ 403 ? $12 36 36Overhead:5 ? $5 255 ? $10 50Total $101 $126Price last year = $101 ? 1.40 = $141.40/dayPrice this year = $126 ? 1.40 = $176.40/dayThis is a $35 increase over last year, nearly a 25 percent increase. No doubt the Carsons arenot pleased and would consider looking around for other recreational possibilities.2. Purchasing rate = $30,000/10,000 = $3 per purchase orderPower rate = $20,000/50,000 = $0.40 per kilowatt hourMaintenance rate = $6,000/600 = $10 per maintenance hourOther rate = $44,000/22,000 = $2 per DLHBike Rental Picnic CateringPurchasing$3 ? 7,000 $21,000$3 ? 3,000 $ 9,000Power$0.40 ? 5,000 2,000$0.40 ? 45,000 18,000Maintenance$10 ? 500 5,000$10 ? 100 1,000Other$2 ? 11,000 22,000 22,000Total overhead $50,000 $50,0003. This year’s bike rental overhead rate = $50,000/10,000 = $5Carson rental cost = (2 ? $20) + (3 ? $12) + (5 ? $5) = $101Price = 1.4 ? $101 = $141.40/day4. Catering rate = $50,000/11,000 = $4.55* per DLHCost of Estes job:Bike rental rate (2 ? $7.50) $15.00Bike conversion cost (2 ? $5.00) 10.00Catering materials 12.00Catering conversion (1 ? $4.55) 4.55Total cost $41.55*Rounded5. The use of ABC gives Mountain View Rentals a better idea of the types and costs of activities that are used in their business. Adding Level 4 bikes will increase the use of the most expensive activities, meaning that the rental rate will no longer be an average of $5 per rental day. Mountain View Rentals might need to set a Level 4 price based on the increased cost of both the bike and conversion cost.分步成本法6–11. Cutting Sewing PackagingDepartment Department DepartmentDirect materials $5,400 $ 900 $ 225Direct labor 150 1,800 900Applied overhead 750 3,600 900Transferred-in cost:From cutting 6,300From sewing 12,600Total manufacturing cost $6,300 $12,600 $14,6252. a. Work in Process—Sewing 6,300Work in Process—Cutting 6,300b. Work in Process—Packaging 12,600Work in Process—Sewing 12,600c. Finished Goods 14,625Work in Process—Packaging 14,625 3. Unit cost = $14,625/600 = $24.38* per pair6–21. Units transferred out: 27,000 + 33,000 – 16,200 = 43,8002. Units started and completed: 43,800 – 27,000 = 16,8003. Physical flow schedule:Units in beginning work in process 27,000Units started during the period 33,000Total units to account for 60,000Units started and completed 16,800Units completed from beginning work in process 27,000Units in ending work in process 16,200Total units accounted for 60,0004. Equivalent units of production:Materials ConversionUnits completed 43,800 43,800Add: Units in ending work in process:(16,200 ? 100%) 16,200(16,200 ? 25%) 4,050 Equivalent units of output 60,000 47,8506–31. Physical flow schedule:Units to account for:Units in beginning work in process 80,000Units started during the period 160,000Total units to account for 240,000Units accounted for:Units completed and transferred out:Started and completed 120,000From beginning work in process 80,000 200,000 Units in ending work in process 40,000Total units accounted for 240,0002. Units completed 200,000Add: Units in ending WIP ? Fraction complete(40,000 ? 20%) 8,000Equivalent units of output 208,0003. Unit cost = ($374,400 + $1,258,400)/208,000 = $7.854. Cost transferred out = 200,000 ? $7.85 = $1,570,000Cost of ending WIP = 8,000 ? $7.85 = $62,8005. Costs to account for:Beginning work in process $ 374,400Incurred during June 1,258,400Total costs to account for $ 1,632,800Costs accounted for:Goods transferred out $ 1,570,000Goods in ending work in process 62,800Total costs accounted for $ 1,632,8006–31、Units t0 account for:Units in beginning work in process(25% completed) 10000Units started during the period 70000 Total units to account for 80000 Units accounted forUnits completed and transferred outStarted and completed 50000From beginning work in process 10000 60000 Units in ending work in process(60% completed) 20000 Total units accounted for 80000 2、60000+20000×60%=72000(units)3、Unit cost for materials:($/unit)Unit cost for convension:($/unit)Total unit cost:5+1.13=6.13($/unit)4、The cost of units of transferred out:60000×6.13=367800($)The cost of units of ending work in process:20000×5+20000×20%×1.13=113560($)作业成本法4–21. Predetermined rates:Drilling Department: Rate = $600,000/280,000 = $2.14* per MHrAssembly Department: Rate = $392,000/200,000= $1.96 per DLH*Rounded2. Applied overhead:Drilling Department: $2.14 ? 288,000 = $616,320Assembly Department: $1.96 ? 196,000 = $384,160Overhead variances:Drilling Assembly TotalActual overhead $602,000 $ 412,000 $ 1,014,000Applied overhead 616,320 384,160 1,000,480Overhead variance $ (14,320) over $ 27,840 under $ 13,5203. Unit overhead cost = [($2.14 ? 4,000) + ($1.96 ? 1,600)]/8,000= $11,696/8,000= $1.46**Rounded4–31. Yes. Since direct materials and direct labor are directly traceable to each product, their cost assignment should be accurate.2. Elegant: (1.75 ? $9,000)/3,000 = $5.25 per briefcaseFina: (1.75 ? $3,000)/3,000 = $1.75 per briefcaseNote: Overhead rate = $21,000/$12,000 = $1.75 per direct labor dollar (or 175 percent of direct labor cost).There are more machine and setup costs assigned to Elegant than Fina. This is clearly a distortion because the production of Fina is automated and uses the machine resources much more than the handcrafted Elegant. In fact, the consumption ratio for machining is 0.10 and 0.90 (using machine hours as the measure of usage). Thus, Fina uses nine times the machining resources as Elegant. Setup costs are similarly distorted. The products use an equal number of setups hours. Yet, if direct labor dollars are used, then the Elegant briefcase receives three times more machining costs than the Fina briefcase.3. Overhead rate = $21,000/5,000= $4.20 per MHrElegant: ($4.20 ? 500)/3,000 = $0.70 per briefcaseFina: ($4.20 ? 4,500)/3,000 = $6.30 per briefcaseThis cost assignment appears more reasonable given the relative demands each product places on machine resources. However, once a firm moves to a multiproduct setting, using only one activity driver to assign costs will likely produce product cost distortions. Products tend to make different demands on overhead activities, and this should be reflected in overhead cost assignments. Usually, this means the use of both unit- and nonunit-level activity drivers. In this example, there is a unit-level activity (machining) and a nonunit-level activity (setting up equipment). The consumption ratios for each (using machine hours and setup hours as the activity drivers) are as follows:Elegant FinaMachining 0.10 0.90 (500/5,000 and 4,500/5,000)Setups 0.50 0.50 (100/200 and 100/200)Setup costs are not assigned accurately. Two activity rates are needed—one based on machine hours and the other on setup hours:Machine rate: $18,000/5,000 = $3.60 per MHrSetup rate: $3,000/200 = $15 per setup hourCosts assigned to each product:Machining: Elegant Fina$3.60 ? 500 $ 1,800$3.60 ? 4,500 $ 16,200Setups:$15 ? 100 1,500 1,500Total $ 3,300 $ 17,700Units ÷3,000 ÷3,000Unit overhead cost $ 1.10 $ 5.904:Elegant Unit overhead cost:[9000+3000+18000*500/5000+3000/2]/3000=$5.1 Fina Unit overhead cost:[3000+3000+18000*4500/5000+3000/2]/3000=$7.94–51. Deluxe Percent Regular PercentPrice $900 100% $750 100%Cost 576 64 600 80Unit gross profit $324 36% $150 20%Total gross profit:($324 ? 100,000) $32,400,000($150 ? 800,000) $120,000,0002. Calculation of unit overhead costs:Deluxe gularUnit-level:Machining:$200 ? 100,000 $20,000,000$200 ? 300,000 $60,000,000Batch-level:Setups:$3,000 ? 300 900,000$3,000 ? 200 600,000Packing:$20 ? 100,000 2,000,000$20 ? 400,000 8,000,000Product-level:Engineering:$40 ? 50,000 2,000,000$40 ? 100,000 4,000,000Facility-level:Providing space:$1 ? 200,000 200,000$1 ? 800,000 800,000Total overhead $25,100,000 $73,400,000Units ÷100,000 ÷800,000Overhead per unit $251 $91.75Deluxe Percent Regular PercentPrice $900 100% $750.00 100%Cost 780* 87*** 574.50** 77***Unit gross profit $120 13%*** $175.50 23%***Total gross profit:($120 ? 100,000) $12,000,000($175.50 ? 800,000) $140,400,000*$529 + $251**$482.75 + $91.753. Using activity-based costing, a much different picture of the deluxe and regular products emerges. The regular model appears to be more profitable. Perhaps it should be emphasized.4–61. JIT Non-JITSalesa $12,500,000 $12,500,000Allocationb 750,000 750,000a$125 ? 100,000, where $125 = $100 + ($100 ? 0.25), and 100,000 is the average order size times the number of ordersb0.50 ? $1,500,0002. Activity rates:Ordering rate = $880,000/220 = $4,000 per sales orderSelling rate = $320,000/40 = $8,000 per sales callService rate = $300,000/150 = $2,000 per service callJIT Non-JITOrdering costs:$4,000 ? 200 $ 800,000$4,000 ? 20 $ 80,000Selling costs:$8,000 ? 20 160,000$8,000 ? 20 160,000Service costs:$2,000 ? 100 200,000$2,000 ? 50 100,000Total $1,160,000 $340,0 0For the non-JIT customers, the customer costs amount to $750,000/20 = $37,500 per order under the original allocation. Using activity assign?ments, this drops to $340,000/20 = $17,000 per order, a difference of $20,500 per order. For an order of 5,000 units, the order price can be decreased by $4.10 per unit without affecting customer profitability. Overall profitability will decrease, however, unless the price for orders is increased to JIT customers.3. It sounds like the JIT buyers are switching their inventory carrying costs to Emery without any significant benefit to Emery. Emery needs to increase prices to reflect the additional demands on customer-support activities. Furthermore, additional price increases may be needed to reflectthe increased number of setups, purchases, and so on, that are likely occurring inside the plant. Emery should also immediately initiate discussions with its JIT customers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities.4–71. Supplier cost:First, calculate the activity rates for assigning costs to suppliers:Inspecting components: $240,000/2,000 = $120 per sampling hourReworking products: $760,500/1,500 = $507 per rework hourWarranty work: $4,800/8,000 = $600 per warranty hourNext, calculate the cost per component by supplier:Supplier cost:Vance FoyPurchase cost:$23.50 ? 400,000 $ 9,400,000$21.50 ? 1,600,000 $ 34,400,000Inspecting components:$120 ? 40 4,800$120 ? 1,960 235,200Reworking products:$507 ? 90 45,630$507 ? 1,410 714,870Warranty work:$600 ? 400 240,000$600 ? 7,600 4,560,000Total supplier cost $ 9,690,430 $ 39,910,070Units supplied ÷400,000 ÷1,600,000Unit cost $ 24.23* $ 24.94**RoundedThe difference is in favor of Vance; however, when the price concession is considered, the cost of Vance is $23.23, which is less than Foy’s component. Lumus should accept the contractual offer made by Vance.4–7 Concluded2. Warranty hours would act as the best driver of the three choices. Using this driver, the rate is $1,000,000/8,000 = $125 per warranty hour. The cost assigned to each component would be:Vance FoyLost sales:$125 ? 400 $ 50,000$125 ? 7,600 $ 950,000$ 50,000 $ 950,000Units supplied ÷400,000 ÷1,600,000Increase in unit cost $ 0.13* $ 0.59**Rounded$0.075 per unitCategory II: $45/1,000 = $0.045 per unitCategory III: $45/1,500 = $0.03 per unitCategory I, which has the smallest batches, is the most undercosted of the three categories. Furthermore, the unit ordering cost is quite high relative to Category I’s selling price (9 to 15 percent of the selling price). This suggests that something should be done to reduce the order-filling costs.3. With the pricing incentive feature, the average order size has been increased to 2,000 units for all three product families. The number of orders now processed can be calculated as follows:Orders = [(600 ? 50,000) + (1,000 ? 30,000) + (1,500 ? 20,000)]/2,000= 45,000Reduction in orders = 100,000 – 45,000 = 55,000Steps that can be reduced = 55,000/2,000 = 27 (rounding down to nearest whole number)There were initially 50 steps: 100,000/2,000Reduction in resource spending:Step-fixed costs: $50,000 ? 27 = $1,350,000Variable activity costs: $20 ? 55,000 = 1,100,000$2,450,000预算9-4Norton, Inc.Sales Budget For the Coming YearModel Units Price Total SalesLB-1 50,400 $29.00 $1,461,600LB-2 19,800 15.00 297,000WE-6 25,200 10.40 262,080 WE-7 17,820 10.00 178,200 WE-8 9,600 22.00 211,200 WE-9 4,000 26.00 104,000 Total $2,514,080二、1. Raylene’s Flowers and GiftsProduction Budget for Gift BasketsFor September, October, November, and DecemberSept. Oct. Nov. D ec.Sales 200 150 180 250Desired ending inventory 15 18 25 10Total needs 215 168 205 260Less: Beginning inventory 20 15 18 25 Units produced 195 153 187 2352. Raylene’s Flowers and GiftsDirect Materials Purchases BudgetFor September, October, and NovemberFruit: Sept. Oct. Nov.Production 195 153 187? Amount/basket (lbs.) ? 1 ? 1 ?1Needed for production 195 153 187Desired ending inventory 8 9 12Needed 203 162 200Less: Beginning inventory 10 8 9Purchases193 154 190Small gifts: Sept. Oct. Nov.Production 195 153 187 ? Amount/basket (items) ? 5 ? 5 ? 5Needed for production 975 765 935Desired ending inventory 383 468 588Needed 1,358 1,233 1,523Less: Beginning inventory 488 383 468Purchases 870 850 1,055Cellophane: Sept. Oct. Nov.Production 195 153 187。

《管理会计(双语)》课程教学大纲课程编码:12120203k206课程性质:专业必修课学分:3课时:48开课学期:第五学期适用专业:会计学一、课程简介《管理会计(双语》是会计学专业(本科)的一门必修课程。

是以现代企业所处的社会经济环境为背景,明确阐明以企业为主体,密切联系现代会计的预测、决策、规划、控制、考核评价等职能,系统地介绍了现代管理会计的基本理论、基本方法和实用操作技术。

课程分为三部分,第一部分主要交代了管理会计的基本原理和传统管理会计的基本方法;第二部分主要分别讨论管理会计各项职能在实践中的应用程序与具体操作方法。

第三部分集中介绍管理会计发展的新领域。

管理会计是一门理论性较强、计算内容较多的课程。

通过该门课程的学习,使学生领会管理会计的精髓,掌握管理会计的基本理论和基本方法,学会各种分析方法的应用技能和技巧,不断提高学生分析问题和解决问题的能力。

二、教学目标课程总体目标:通过本课程教学,掌握管理会计的基本理论和基本分析方法,结合相应的实践教学,培养学生能独立开展各项管理会计工作的能力。

具体入下:1.了解管理会计的产生与发展,明确管理会计的特点、职能、内容和任务;2.掌握成本习性与变动成本法、本量利分析等管理会计基础分析方法,并了解方法的一般原理;3.掌握短期经营决策分析、长期投资决策分析、全面预算、标准成本控制、责任会计等内容的基本理论与方法。