美国CPA考试经典例题:Audit Evidence

- 格式:pdf

- 大小:258.18 KB

- 文档页数:4

美国CPA考试《审计与鉴证》历年真题精选及详细解析1107-80Which of the following best describes the auditor's responsibility with respect to fair values?a. The auditor should obtain sufficient appropriate audit evidence to provide reasonable assurance that fair value measurements and disclosures are in conformity with GAAP.b. The auditor should determine whether management has the intent and ability to carry out courses of action that may affect fair values.c. The auditor should make fair value measurements and disclosures in accordance with GAAP and should identify and support any significant assumptions used.d. The auditor should assess the risk of material misstatement of fair value measurements.答案:AExplanationChoice "a" is correct. The auditor's overall responsibility is to obtain sufficient appropriate audit evidence to provide reasonable assurance that fair value measurements and disclosures are in conformity with GAAP.Choice "b" is incorrect. While it is true that the auditor should determine whether management has the intent and ability to carry out courses of action that may affect fair values, this is just one part of evaluating fair value measurements and not the best description of the auditor's overall responsibility.Choice "d" is incorrect. While it is true that the auditor should assess the risk of material misstatement of fair value measurements, this is done to determine the nature, timing, and extent of audit procedures. It is not the best representation of the auditor's overall responsibility.Choice "c" is incorrect. Management (and not the auditor)should make fair value measurements and disclosures in accordance with GAAP and should identify and support any significant assumptions used.。

acca p7知识点-回复ACCA P7 Knowledge Point: Audit Evidence and ProceduresAudit evidence plays a critical role in the audit process. It provides the necessary support for the auditor to form an opinion on the financial statements under review. In this article, we will explore the concept of audit evidence and the procedures involved in obtaining and documenting it.1. Understanding Audit Evidence:Audit evidence refers to the information used by the auditor to support their opinion on the financial statements. It is obtained through various procedures such as inspection, observation, inquiry, confirmation, and reperformance. The auditor assesses the relevance and reliability of the evidence to determine its suitability for their audit objectives.2. Relevance of Audit Evidence:To be relevant, audit evidence should have a logical connection and be directly related to the assertions being tested. This requires the auditor to understand the client's business and control environment and identify the areas of risk. Relevance ensures thatthe evidence obtained provides meaningful insights into the financial statements.3. Reliability of Audit Evidence:The reliability of audit evidence refers to its trustworthiness. More reliable evidence carries more weight in the auditor's assessment. Factors affecting reliability include the source and nature of evidence, the internal control environment, and the auditor's own expertise and independence.4. Obtaining Audit Evidence:Auditors use various procedures to gather audit evidence. These include:- Inspection: Examining records, documents, or tangible assets enables auditors to obtain objective evidence.- Observation: Watching a process or procedure being performed provides direct evidence of its existence and effectiveness.- Inquiry: Seeking information from management, employees, or third parties allows auditors to gather subjective evidence.- Confirmation: Obtaining written responses from external parties to corroborate information provided by the client.- Reperformance: Redoing specific procedures performed by the client to verify their accuracy and consistency.5. Evaluating Audit Evidence:Once obtained, audit evidence needs to be evaluated. This involves determining its sufficiency and appropriateness to support the audit objectives. The auditor considers factors such as the nature, timing, and quality of evidence, as well as the extent of testing performed.6. Documenting Audit Evidence:Audit evidence needs to be appropriately documented to provide a clear and transparent trail of the auditor's work. Documentation should include details of the procedures performed, the conclusions reached, and any significant findings or exceptions identified. This is crucial for reviewers and regulators to assess the adequacy of the audit work.7. Use of Analytical Procedures:Analytical procedures involve the analysis of financial andnon-financial data to identify anomalies or unusual trends. These procedures help auditors assess the reasonableness of financialinformation and highlight areas requiring further investigation.8. Audit Sampling:Due to the time and cost constraints of a complete audit, auditors often use sampling techniques to select a representative subset of items from a population. This allows them to draw conclusions about the entire population. Sampling procedures need to be carefully designed to ensure the samples selected are unbiased and representative.9. Substantive Testing vs. Test of Controls:Auditors perform substantive testing to obtain direct evidence about the completeness, accuracy, and validity of individual transactions. Test of controls, on the other hand, focuses on assessing the effectiveness of internal controls. The choice of procedures depends on the auditor's assessment of control risks and the desired level of assurance.10. Professional Skepticism and Judgment:Throughout the audit process, it is essential for auditors to maintain professional skepticism and exercise sound judgment. They need to be critical and independent in their assessment ofevidence, questioning assumptions and seeking corroborative evidence when necessary.In conclusion, audit evidence and procedures form the backbone of the audit process. Understanding the relevance and reliability of evidence, obtaining it through various procedures, and evaluating and documenting it are vital steps for auditors. By ensuring the quality and sufficiency of evidence, auditors can provide meaningful and reliable opinions on the financial statements.。

CCAA《审计学》测试题及解答英文版CCAA "Auditing" Test Questions and Answers1. What is the purpose of an audit?The purpose of an audit is to provide an independent assessment of an organization's financial statements to ensure they are free from material misstatement.2. What are the main types of audit evidence?The main types of audit evidence include physical examination, confirmation, documentation, observation, analytical procedures, and inquiries.3. What are the key components of the audit process?The key components of the audit process include planning, risk assessment, testing of controls, substantive procedures, and reporting.4. Explain the concept of materiality in auditing.Materiality in auditing refers to the significance of an item or an error in the financial statements that could influence the decisions of users. Auditors consider materiality when planning and performing an audit.5. What is the role of internal controls in an audit?Internal controls are processes implemented by management to provide reasonable assurance regarding the reliability of financial reporting and the effectiveness and efficiency of operations. Auditors assess the effectiveness of internal controls to determine the nature, timing, and extent of audit procedures.6. Describe the difference between a compliance audit and a financial statement audit.A compliance audit focuses on verifying whether an organization is following specific laws, regulations, or policies, while a financial statement audit examines the accuracy and completeness of an organization's financial statements.7. How do auditors assess audit risk?Auditors assess audit risk by considering inherent risk, control risk, and detection risk. The combination of these risks determines the overall risk of material misstatement in the financial statements.8. Explain the concept of independence in auditing.Independence in auditing refers to the auditor's ability to perform an audit without being influenced by relationships or conflicts of interest. It is essential for auditors to maintain independence to ensure the integrity and credibility of the audit process.9. What are the different types of audit reports?The different types of audit reports include unmodified (clean), qualified, adverse, and disclaimer of opinion. The type of report issued by auditors depends on their findings during the audit.10. How do auditors communicate audit findings to stakeholders?Auditors communicate audit findings through the audit report, which includes the auditor's opinion on the financial statements, key audit matters, and any significant issues identified during the audit.Stakeholders use this information to make informed decisions about the organization.These are some of the key concepts and topics related to auditing that are often covered in the CCAA "Auditing" test. Understanding these concepts can help prepare you for the exam and enhance your knowledge of auditing principles and practices.。

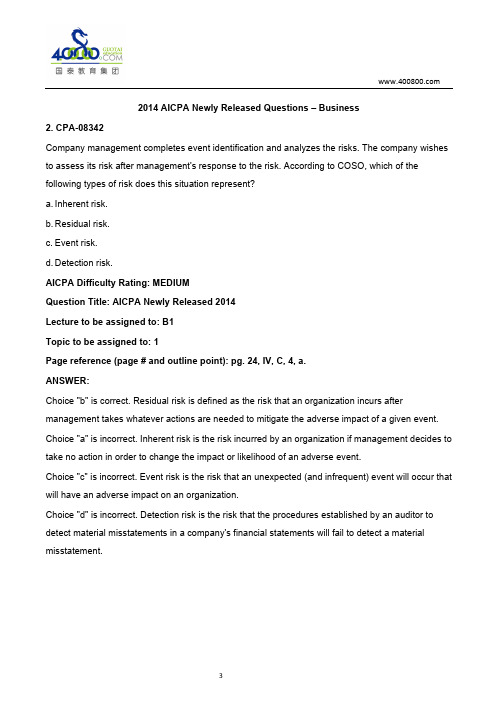

2014 AICPA Newly Released Questions – Business2. CPA-08342Company management completes event identification and analyzes the risks. The company wishes to assess its risk after management's response to the risk. According to COSO, which of the following types of risk does this situation represent?a. Inherent risk.b. Residual risk.c. Event risk.d. Detection risk.AICPA Difficulty Rating: MEDIUMQuestion Title: AICPA Newly Released 2014Lecture to be assigned to: B1Topic to be assigned to: 1Page reference (page # and outline point): pg. 24, IV, C, 4, a.ANSWER:Choice "b" is correct. Residual risk is defined as the risk that an organization incurs after management takes whatever actions are needed to mitigate the adverse impact of a given event. Choice "a" is incorrect. Inherent risk is the risk incurred by an organization if management decides to take no action in order to change the impact or likelihood of an adverse event.Choice "c" is incorrect. Event risk is the risk that an unexpected (and infrequent) event will occur that will have an adverse impact on an organization.Choice "d" is incorrect. Detection risk is the risk that the procedures established by an auditor to detect material misstatements in a company's financial statements will fail to detect a material misstatement.3。

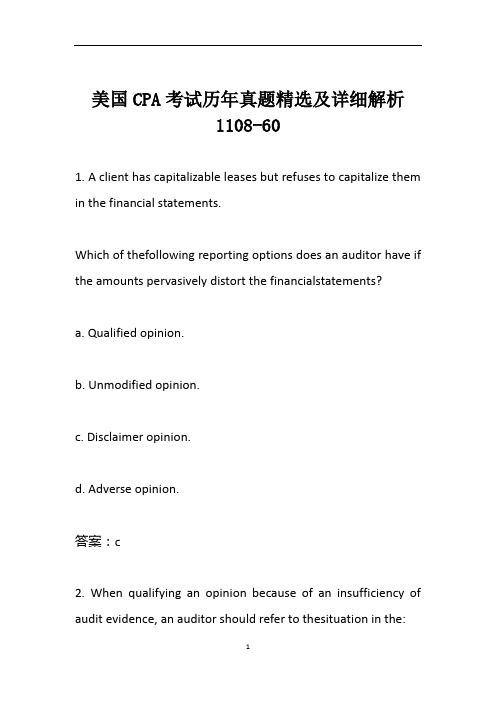

美国CPA考试经典例题:审计报告(1)Which of the following accurately depicts the auditor's responsibility with respect to Statements on Auditing Standards?a. The auditor is generally required to follow the guidance provided by the Standards, and should be able to justify any departures.b. The auditor is required to follow the guidance provided by the Standards, without exception.c. The auditor is generally required to follow the guidance provided by Standards with which he or she is familiar, but will not be held responsible for departing from provisions of which he or she was unaware.d. The auditor is generally required to follow the guidance provided by the Standards, unless following such guidance would result in an audit that is not cost-effective.ExplanationChoice "a" is correct. The auditor is generally required to follow the guidance provided by the Standards, and should be able to justify any departures.Choice "b" is incorrect. On rare occasions, the auditor may depart from the guidance provided by the SASs, but he or she must justify such departures.Choice "c" is incorrect. Lack of familiarity with a SAS is not a valid reason for departing from its guidance. The auditor is expected to have sufficient knowledge of the SASs to identify those that are applicable to a given audit engagement.Choice "d" is incorrect. The cost associated with following the guidance provided by a SAS is not an acceptable reason for departing from its guidance.美国CPA考试经典例题:审计报告(2)Which of the following provides the most authoritative guidance for the auditor of a nonissuer?a. A Journal of Accountancy article discussing implementation of a new standard.b. An AICPA audit and accounting guide that provides specific guidance with respect to the accounting practices in the client's industry.c. Specific guidance provided by an interpretation of a Statement on Auditing Standards. 其他优质百度文档推荐:d. General guidance provided by a Statement on Auditing Standards.ExplanationChoice "d" is correct. General guidance provided by a Statement on Auditing Standards is the most authoritative of level of auditing guidance for audits of nonissuers. Auditors are required to comply with SASs, and should be prepared to justify any departures therefrom.Choices "b" and "c" are incorrect. AICPA audit and accounting guides and SAS interpretations are interpretive publications that provide guidance regarding how SASs should be applied in specific situations. They are not as authoritative as SASs.Choice "a" is incorrect. Journal of Accountancy articles have no authoritative status but may be helpful to the auditor.美国CPA考试经典例题:审计报告(3)Which of the following terms identifies a requirement for audit evidence?a. Appropriate.b. Disconfirming.c. Adequate.d. Reasonable.ExplanationChoice "a" is correct. The auditor must obtain sufficient appropriate audit evidence to afford a reasonable basis for the opinion.Choice "c" is incorrect. Auditing standards do not use the word adequate in describing the requirements for audit evidence; the term is sufficient appropriate audit evidence.Choice "d" is incorrect. Auditing standards use the word reasonable to describe the type of assurance gained by the auditor as the basis for the opinion, and not to describe a specific requirement for audit evidence.Choice "b" is incorrect. Auditing standards do not use the word disconfirming in describing the requirements for audit evidence.美国CPA考试经典例题:审计报告(4)The phrase "U.S. generally accepted accounting principles" is an accounting term that:其他优质百度文档推荐:a. Is included in the audit report to indicate that the audit has been conducted in accordance with generally accepted auditing standards (GAAS).b. Provides a measure of conventions, rules, and procedures governed by the AICPA.c. Includes broad guidelines of general application but not detailed practices and procedures.d. Encompasses the conventions, rules, and procedures necessary to define U.S. accepted accounting practice at a particular time.ExplanationChoice "d" is correct. The literature pertaining to U.S. GAAP changes over time, and therefore U.S. generally accepted accounting principles can be said to encompass the conventions, rules, and procedures necessary to define accepted accounting practice at a particular time. U.S. GAAP is one of the financial reporting frameworks acceptable for preparation of financial statements. IFRS is another one.Choice "c" is incorrect. The literature pertaining to U.S. GAAP does provide detailed practices and procedures.美国CPA考试经典例题:审计报告(5)Which of the following statements is correct concerning an auditor's responsibilities regarding financial statements?a. An auditor's responsibilities for audited financial statements are confined to the expression of the auditor's opinion.b. An auditor may not draft an entity's financial statements based on information from management's accounting system.c. The adoption of sound accounting policies is an implicit part of an auditor's responsibilities.d. Making suggestions that are adopted about an entity's internal control environment impairs an auditor's independence.ExplanationChoice "a" is correct. An auditor's responsibility is to express an opinion on financial statements based on an audit.其他优质百度文档推荐:Choice "b" is incorrect. An auditor may draft an entity's financial statements based on information from management's financial system. This would be referred to as a compilation engagement.Choice "c" is incorrect. The adoption of sound accounting policies is an implicit part of management's responsibilities, not the auditor's responsibilities.Choice "d" is incorrect. An auditor often makes suggestions that are adopted about an entity's internal control environment.Choice "b" is incorrect. The phrase "U.S. generally accepted accounting principles" does not provide a measure of conventions, rules, and procedures governed by the AICPA. The AICPA provides Statements on Auditing Standards, which relate to proper performance of a financial statement audit, not to accounting principles.Choice "a" is incorrect. Inclusion of the phrase "U.S. generally accepted accounting principles" in the audit report indicates whether the financial statements are presented in accordance with the conventions, rules, and procedures that define accepted accounting practice in the United States. Inclusion of this phrase does not indicate whether the audit has been conducted in accordance with generally accepted auditing standards (GAAS).其他优质百度文档推荐:。

Chapter 1 Multiple-Choice Questions1. easy Recording, classifying, and summarizing economic events in a logical manner for the purpose of providing financial information for decision making is commonly called:c a. finance.b. auditing.c. accounting.d. economics.2. easy In the audit of historical financial statements, which of the following accounting bases is the most common?c a. Regulatory accounting principles.b. Cash basis of accounting.c. Generally accepted accounting principles.d. Liquidation basis of accounting.3. easy Any service that requires a CPA firm to issue a report about the reliability of an assertion that is made by another party is a(n):b a. accounting and bookkeeping service.b. attestation service.c. assurance service.d. tax service.4. Three common types of attestation services are:easy a. audits, reviews, and “other” attestation services.a b. audits, verifications, and “other” attestation services.c. reviews, verifications, and “other” attestation services.d. audits, reviews, and verifications.5. (SOX) easy The organization that is responsible for providing oversight for auditors of public companies is called the ________.d a. Auditing Standards Board.b. American Institute of Certified Public Accountants.c. Public Oversight Board.d. Public Company Accounting Oversight Board.6. (SOX) The Sarbanes-Oxley Act applies to which of the following companies?easy a. All companies.c b. Privately held companies.c. Public companies.d. All public companies and privately held companies with assets greater than $500 million.7. medium Providing quantitative information that management and others can use to make decisions is the function of:d a. management information systems.b. auditing.c. finance.d. accounting.8. An audit of historical financial statements most commonly includes the:medium a. balance sheet, the income statement, and the statement of cash flows.d b. income statement, the statement of cash flows, and the statement of net working capital.c. statement of cash flows, the balance sheet, and the retained earnings statement.d. balance sheet, the income statement, and the statement of cash flows.9. medium The ___________ rate may be defined as approximately the rate a bank could earn by investing in U.S. treasury notes for the same length as the length of a business loan.c a. nominalb. statedc. risk-freed. prevailing10. The use of the Certified Public Accountant title is regulated by:medium a. the federal government.b b. state law through a licensing department or agency of each state.c. the American Institute of Certified Public Accountants through the licensing departmentsof the tax and auditing committees.d. the Securities and Exchange Commission.11. An operational audit has as one of its objectives to:medium a. determine whether the financial statements fairly present the entity’s operations.c b. evaluate the feasibility of attaining the entity’s operational objectives.c. make recommendations for improving performance.d. report on the entity’s relative success in attaining profit maximization.12. An audit of historical financial statements is most often performed to determine whether the: medium a. organization is operating efficiently and effectively.d b. entity is following specific procedures or rules set down by some higher authority.c. management team is fulfilling its fiduciary responsibilities to shareholders.d. none of these choices.13. medium An examination of part of an organization’s procedures and methods for the purpose of evaluating efficiency and effectiveness is what type of audit?a a. Operational audit.b. Compliance audit.c. Financial statement audit.d. Production audit.14. medium An audit to determine whether an entity is following specific procedures or rules set down by some higher authority is classified as a(n):b a. audit of financial statements.b. compliance audit.c. operational audit.d. production audit.15. Which of the following is a type of audit evidence?medium a. Oral responses to the auditor from employees of the company under audit.d b. Written communications from company employees or outsiders.c. Observations made by an auditor.d. Evidence may take any of the above forms.16. Which of the following services provides the lowest level of assurance on a financial statement? medium a. A review.a b. An audit.c. Neither service provides assurance on financial statements.d. Each service provides the same level of assurance on financial statements.17. The three requirements for becoming a CPA include all but which of the following?medium a. Uniform CPA examination requirement.c b. Educational requirements.c. Character requirements.d. Experience requirement.18. In “auditing” financial accounting data, the primary concern is with:medium a a. determining whether recorded information properly reflects the economic events thatoccurred during the accounting period.b. determining if fraud has occurred.c. determining if taxable income has been calculated correctly.d. analyzing the financial information to be sure that it complies with governmentrequirements.19. medium Financial statement users often receive unreliable financial information from companies. Which of the following is not a common reason for this?d a. Complex business transactions.b. Large amounts of data.c. Lack of firsthand knowledge about the business.d. Each of these choices is a common reason for unreliable financial information.20. Which of the following is not a Trust Services principle as defined by the AICPA or CICA? challenging a. Online privacy.d b. Availability.c. Processing integrity.d. Operational integrity.21. Which one of the following is more difficult to evaluate objectively?challenging c a. Presentation of financial statements in accordance with generally accepted accountingprinciples.b. Compliance with government regulations.c. Efficiency and effectiveness of operations.d. All three of the above are equally difficult.22. (SOX) challenging The Sarbanes-Oxley Act prohibits a CPA firm that audits a public company from providing which of the following types of services to that company?c a. Reviews of quarterly financial statements.b. Preparation of corporate tax returns.c. Most consulting services.d. Tax services.23. Which of the following audits can be regarded as generally being a compliance audit? challenging a. IRS agents’ examinations of taxpayer returns.a b. GAO auditor’s evaluation of the computer operations of governmental units.c. An internal auditor’s review of a company’s payroll authorization procedures.d. A C PA firm’s audit of the local school district.24. Which of the following can be significantly affected by an audit?challenging a. Business risk.b b. Information risk.c. The risk-free interest rate.d. Inherent risk.25. The trait that distinguishes auditors from accountants is the:challenging a. auditor’s ability to interpret accounting principles generally accepted in the United States.d b. auditor’s education beyond the Bachelor’s degree.c. auditor’s ability to interpret FASB State ments.d. auditor’s accumulation and interpretation of evidence related to a company’s financialstatements.26. challenging Attestation services on information technology include WebTrust services and SysTrust services. Which of the following statements most accurately describes SysTrust services?b a. SysTrust services provide assurance on business processes, transaction integrity andinformation processes.b. SysTrust services provide assurance on system reliability in critical areas such as securityand data integrity.c. ysTrust services provide assurance on internal control over financial reporting.d. SysTrust services provide assurance as to whether accounting personnel are followingprocedures prescribed by the company controller.Essay Questions27.easyDiscuss the three primary requirements for becoming a CPA.Answer:The three primary requirements for becoming a CPA are:•Educational requirement. An undergraduate degree with a major in accounting isrequired. Most states now require 150 semester hours for licensure and some statesrequire 150 semester hours before taking the CPA exam.•Uniform CPA examination requirement. This is a four-part exam with components onauditing and attestation, financial accounting and reporting, regulation, and businessenvironment and concepts.•Experience requirement. The experience requirement varies from state to state withsome states requiring no experience, while other states require up to two years of auditexperience.28. easy Two types of attestation services provided by CPA firms are audits and reviews. Discuss the similarities and differences between these two types of attestation services. Which type provides the least assurance?Answer:Two primary types of attestation services are: audits of historical financial statements and reviews of historical financial statements. While both services involve the accumulation and evaluation of evidence regarding assertions made by management in the company’s financial statements, a review involves a less extensive examination and provides a lower level of assurance about the client’s financial statements than an audit.29. medium Discuss the differences and similarities between the roles of accountants and auditors. What additional expertise must an auditor possess beyond that of an accountant?Answer:The role of accountants is to record, classify, and summarize economic events in a logical manner for the purpose of providing financial information for decision making. To do this, accountants must have a sound understanding of the principles and rules that provide the basis for preparing the financial information. In addition, accountants are responsible for developing systems to ensure that the entity’s economic events are properly recorded on a timely basis and at a reasonable cost.The role of auditors is to determine whether the financial information prepared by accountants properly reflects the economic events that occurred. To do this, the auditor must not only understand the principles and rules that provide the basis for preparing financial information, but must also possess expertise in the accumulation and evaluation of audit evidence. It is this latter expertise that distinguishes auditors from accountants.30. medium Discuss the similarities and differences between financial statement audits, operational audits, and compliance audits. Give an example of each type.Answer:Financial statement audits, operational audits, and compliance audits are similar in that each type of audit involves accumulating and evaluating evidence about information to ascertain and report on the degree of correspondence between the information and established criteria. The differences between each type of audit are the information being examined and the criteria used to evaluate the information. An example of a financial statement audit would be the annual audit of IBM Corporation, in which the external auditors examine IBM’s financial statements to determine the degree of correspondence between those financial statements and generally accepted accounting principles. An example of an operational audit would be an internal auditor’s evaluation of whether the company’s computerized payroll-processing system is operating efficiently and effectivel y. An example of a compliance audit would be an IRS auditor’s examination of an entity’s federal tax return to determine the degree of compliance with the Internal Revenue Code.31. medium Discuss the similarities and differences between the roles of independent auditors, GAO auditors, internal revenue agents, and internal auditors.Answer:The roles of all four types of auditors are similar in that they involve the accumulation and evaluation of evidence about information to ascertain and report on the degree of correspondence between the information and established criteria. The differences in their roles center around the information audited and the criteria used to evaluate that information. Independent auditors primarily audit companies’ financial statements. GAO auditors’ primary responsibility is to perform the audit function for Congress. IRS auditors are responsible for the enforcement of federal tax laws. Internal auditors primarily perform operational and compliance audits for their employing company.32. (SOX)mediumWhat is an engagement to attest on internal control over financial reporting?Answer:Section 404 of the Sarbanes-Oxley Act requires public companies to report management’sassessment of the effectiveness of internal control over financial reporting. The Act furtherrequires auditors to attest to the effectiveness of internal control over financial reporting.This evaluation, which is integrated with the audit of financial statements, providesforward-looking information, because effective internal controls reduce the likelihood offuture misstatements in the financial statements.33. challenging To do an audit, it is necessary for information to be in a verifiable form and some criteria by which the auditor can evaluate the information. (A) What information and criteria would an independent CPA firm use when auditing a company’s historical financial statements? (B) What information and criteria would an Internal Revenue Service auditor use when auditing that same compan y’s tax return? (C) What information and criteria would an internal auditor use when performing an operational audit to evaluate whether the company’s computerized payroll processing system is operating efficiently and effectively?Answer:(A) The information used by a CPA firm in a financial statement audit is the financialinformation in the company’s financial statements. The most commonly used criteria are accounting principles generally accepted in the United States.(B) The information used by an IRS auditor is the financial information in the company’sfederal tax return. The criteria are the internal revenue code and interpretations.(C) The information used by an internal auditor when performing an operational audit ofthe payroll system could include various items such as the number of errors made, costs incurred by the payroll department, and number of payroll records processed each month.The criteria would consist of company standards for departmental efficiency and effectiveness.34.challengingExplain what is meant by information risk, and discuss the four causes of this risk.Answer:Information risk is the possibility that information upon which a business decision is madeis inaccurate. Four causes of information risk are:•remoteness of information,•biases and motives of the provider,•voluminous data, and•complex exchange transactions.35. Attestation services fall into five categories. What are these categories?challenging Answer:The five categories of attestation services include:•audits of historical financial statements,•attestation on internal control over financial reporting,•reviews of historical financial statements,•attestation services on information technology, and•other attestation services that may be applied to a broad range of subject matter.36. challenging Discuss four factors that are likely to significantly reduce information risk in the next five to ten years.Answer:Four factors that are likely to significantly reduce information risk in the next five to ten years are:•technological advances,•more companies will go on-line, reducing the risk of investors obtaining outdated information,•new accounting and auditing standards, and•auditors will find more efficient and effective audit techniques.Other Objective Answer Format Questions37. easy a The criteria by which an auditor evaluates the information under audit may vary with the information being audited.a. Trueb. False38. easy b The criteria used by an external auditor to evaluate published financial statements are known as generally accepted auditing standards.a. Trueb. False39. (SOX) easyb The Sarbanes-Oxley Act establishes standards related to the audits of privately held companies.a. Trueb. False40. (SOX) easya The Sarbanes-Oxley Act is widely viewed as having ushered in sweeping changes to auditing and financial reporting.a. Trueb. False41. easy b Only companies that file annual statements with the Securities and Exchange Commission are required to have an annual external audit.a. Trueb. False42. easy b The financial statements most commonly audited by external auditors are the balance sheet, the income statement, and the statement of changes in retained earnings.a. Trueb. False43. medium b The primary purpose of a compliance audit is to determine whether the financial statements are prepared in compliance with generally accepted accounting principles.a. Trueb. False44. medium a Results of compliance audits are typically reported to someone within the organizational unit being audited rather than to a broad spectrum of outside users.a. Trueb. False45. medium b The primary role of the United States General Accounting Office is the enforcement of the federal tax laws as defined by Congress and interpreted by the courts.a. Trueb. False46. medium b CPA firms are never allowed to provide bookkeeping services for audit clients.a. Trueb. False47. (SOX) medium a Section 404 of the Sarbanes-Oxley Act requires public companies to have an external auditor attest to their internal control over financial reporting.a. Trueb. False48. (SOX) challenging b The Sarbanes-Oxley Act requires a company’s chairman of the board of directors, CEO, and CFO to certify the company’s financial statements.a. Trueb. False49. (SOX) challenging b The criterion that is most likely to be used as a framework in evaluating a company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act is the Enterprise Risk Management framework.a. Trueb. False50. challenging a Most public companies’ audited financial statements are available on the SEC’s EDGAR database.a. Trueb. False。

美国CPA考试经典例题:Audit Evidence(1)In auditing intangible assets, an auditor most likely would review or recompute amortization and determine whether the amortization period is reasonable in support of management's financial statement assertion of:a. Valuation and allocation.b. Existence.c. Rights and obligations.d. Completeness.ExplanationChoice "a" is correct. Assertions about valuation and allocation deal with whether assets, liabilities, and equity interests have been included in the financial statements at appropriate amounts. Recalculation of the amortization and review of the amortization period would test the valuation and allocation assertion.Choice "b" is incorrect. Assertions about existence deal with whether assets, liabilities, and equity interests exist at a given date. Evaluating amortization does not relate to this assertion.Choice "d" is incorrect. Assertions about completeness deal with whether all assets, liabilities, and equity interests that should be presented in the financial statements are so included. Evaluating amortization does not relate to this assertion.Choice "c" is incorrect. Assertions about rights and obligations deal with whether assets are the rights of the entity and liabilities are the obligations of the entity at a given date. Evaluating amortization does not relate to this assertion.美国CPA考试经典例题:Audit Evidence(2)An auditor's analytical procedures most likely would be facilitated if the entity:a. Corrects material weaknesses in internal control before the beginning of the audit.b. Uses a standard cost system that produces variance reports.c. Segregates obsolete inventory before the physical inventory count.d. Develops its data from sources solely within the entity.其他优质百度文档推荐:ExplanationChoice "b" is correct. An auditor's analytical procedures are facilitated when an entity uses a standard cost system with variance reports because the comparison of actual to budget will already have been performed. In addition, it is likely that management will already be aware of significant variations from budget and will be better able to address any questions the auditor may have.Choice "c" is incorrect. Segregation of obsolete inventory would not be an important factor in determining whether analytical procedures would be effective.Choice "a" is incorrect. Correction of internal control weaknesses prior to the beginning of the audit would not affect analytical procedures.Choice "d" is incorrect. Analytical procedures using data developed solely within the entity are not as reliable as analytical procedures using data developed externally.美国CPA考试经典例题:Audit Evidence(3)An auditor may achieve audit objectives related to particular assertions by:a. Adhering to a system of quality control.b. Increasing the level of detection risk.c. Performing analytical procedures.d. Preparing audit documentation.ExplanationChoice "c" is correct. The auditor relies on substantive tests to achieve audit objectives related to particular assertions. Analytical procedures are one type of substantive procedure.Choice "a" is incorrect. CPA firms performing audits are required to adhere to a system of quality control, but adhering to such a system does not directly help the firm achieve specific audit objectives.Choice "d" is incorrect. Audit documentation is used to record the results of audit procedures that have been performed to achieve audit objectives. Mere preparation of audit documentation does not achieve audit objectives.Choice "b" is incorrect. Increasing the level of detection risk does not enable the auditor to achieve audit objectives related to a particular assertion.其他优质百度文档推荐:美国CPA考试经典例题:Audit Evidence(4)Which of the following comparisons would an auditor most likely make in evaluating an entity's costs and expenses?a. The budgeted current year's warranty expense with the current year's contingent liabilities.b. The current year's accounts receivable with the prior year's accounts receivable.c. The budgeted current year's sales with the prior year's sales.d. The current year's payroll expense with the prior year's payroll expense.ExplanationChoice "d" is correct. The most likely analytical review procedure involving costs and expenses would be to compare the current year's payroll expense (average amount per employee) to the prior year, taking into consideration an average increase in wage rates. This is a very effective technique in auditing payroll expense.Choice "b" is incorrect. Comparing the current year's accounts receivable balance with the prior year provides little evidence because accounts receivable may fluctuate based on timing of cash payments, which is unpredictable.Choice "c" is incorrect. Comparing the budgeted current year's sales with the prior year's sales provides evidence regarding the reasonableness of the current year sales budget, but does not provide evidence about costs and expenses.Choice "a" is incorrect. The current year's budgeted warranty expense would likely be compared to the current year's actual warranty expense, not to all of the contingent liabilities for the year.美国CPA考试经典例题:Audit Evidence(5)Which of the following is a true statement regarding documentation requirements for analytical procedures?a. When an analytical procedure is used during the overall review stage of the audit, the auditor is required to document the auditor's expectation and any additional procedures performed to investigate significant unexplained differences.b. When an analytical procedure is used as the principal substantive test of a significant financial statement assertion, the auditor is required to document both the auditor's其他优质百度文档推荐:expectation and the factors considered in developing that expectation.c. When an analytical procedure is used as the principal substantive test of a significant financial statement assertion, the auditor is required to document the reasons analytical procedures were performed instead of tests of details.d. When an analytical procedure is used as the principal substantive test of a significant financial statement assertion, the auditor is required to document his or her expectation and management's concurrence with that expectation.ExplanationChoice "b" is correct. When an analytical procedure is used as the principal substantive test of a significant financial statement assertion, the auditor is required to document both the auditor's expectation and the factors considered in developing that expectation.Choice "c" is incorrect. There is no requirement that the auditor document the reasons analytical procedures were performed instead of tests of details.Choice "d" is incorrect. There is no requirement that the auditor document management's concurrence with the expectation.Choice "a" is incorrect. When an analytical procedure is performed during the overall review stage, there are no specific documentation requirements. The requirement that the auditor document the expectation and any additional procedures performed to investigate significant unexplained differences relates to analytical procedures performed as principal substantive tests.其他优质百度文档推荐:。