会计英语复习题

- 格式:doc

- 大小:45.00 KB

- 文档页数:6

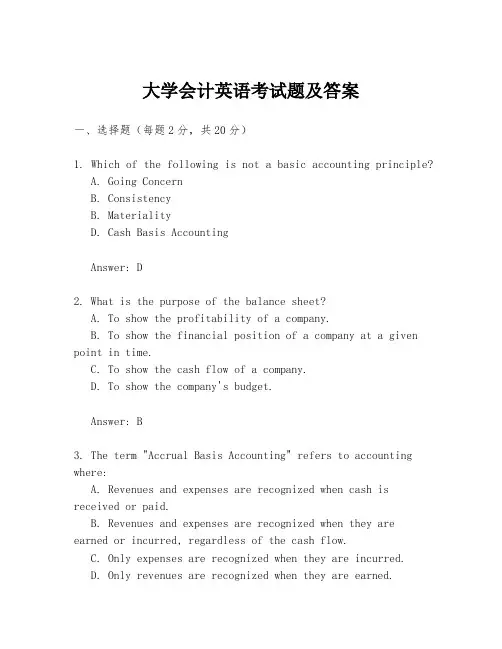

大学会计英语考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting principle?A. Going ConcernB. ConsistencyB. MaterialityD. Cash Basis AccountingAnswer: D2. What is the purpose of the balance sheet?A. To show the profitability of a company.B. To show the financial position of a company at a given point in time.C. To show the cash flow of a company.D. To show the company's budget.Answer: B3. The term "Accrual Basis Accounting" refers to accounting where:A. Revenues and expenses are recognized when cash is received or paid.B. Revenues and expenses are recognized when they are earned or incurred, regardless of the cash flow.C. Only expenses are recognized when they are incurred.D. Only revenues are recognized when they are earned.Answer: B4. What does the term "Double Entry Bookkeeping" mean?A. Every transaction is recorded in two accounts.B. Every transaction is recorded in only one account.C. Transactions are recorded on both sides of the balance sheet.D. Transactions are not recorded in the general ledger.Answer: A5. Which of the following is a non-current asset?A. InventoryB. Accounts PayableC. LandD. Wages ExpenseAnswer: C二、填空题(每空2分,共20分)6. The accounting equation is _______ = _______ + _______. Answer: Assets; Liabilities; Owner's Equity7. The term "Depreciation" refers to the systematic allocation of the cost of a(n) _______ asset over its useful life.Answer: Tangible8. In accounting, the matching principle requires thatrevenues and expenses must be recognized in the same periodin which they are _______.Answer: Earned or Incurred9. The financial statement that shows the results ofoperations over a period of time is known as the _______.Answer: Income Statement10. The process of adjusting the accounts at the end of the accounting period to match revenues and expenses is called_______.Answer: Adjusting Entries三、简答题(每题10分,共20分)11. Explain the difference between "Historical Cost" and"Fair Value" in accounting.Answer: Historical Cost refers to the original amountpaid to acquire an asset or the amount received to issue a liability. It is the amount recorded on the company's booksat the time of the transaction. Fair Value, on the other hand, is the estimated amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm's length transaction. It is the current marketvalue of the asset or liability.12. What are the main components of a Cash Flow Statement and how do they reflect the liquidity of a company?Answer: The main components of a Cash Flow Statement arethe Cash Flows from Operating Activities, Cash Flows from Investing Activities, and Cash Flows from Financing Activities. These components reflect the liquidity of a company by showing how much cash is being generated or used by the company's operations, investments, and financing activities. A positive cash flow from operations indicates that the company is generating enough cash to sustain itself, while negative cash flows may indicate financial stress.四、计算题(每题15分,共40分)13. A company has the following transactions for the year:- Sales on credit: $50,000- Cash sales: $30,000- Purchases on credit: $40,000- Cash purchases: $10,000- Wages paid in cash: $15,000- Depreciation expense: $5,000- Interest paid in cash: $2,000Calculate the net cash provided by operating activities using the indirect method.Answer:Net Income = Sales - (Cost of Goods Sold + Operating Expenses)= ($50,000 + $30,000) - ($40,000 + $10,000 + $15,000 + $5,000)= $80,000 - $70,000= $10,000Adjustments for Non-Cash Items:- Depreciation Expense: +$5,000 (since it's a non-cash expense)Increase/Decrease in Operating Assets and Liabilities: - Accounts Receivable: -$50,000 (decrease in asset, so。

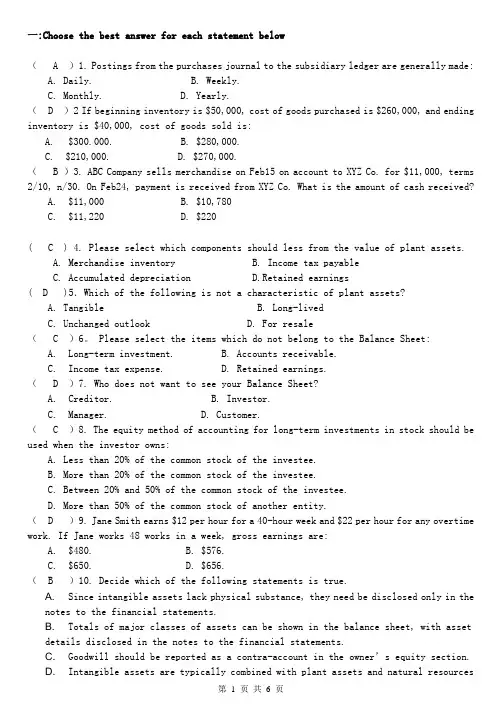

一:Choose the best answer for each statement below( A )1. Postings from the purchases journal to the subsidiary ledger are generally made:A. Daily.B. Weekly.C. Monthly.D. Yearly.( D )2 If beginning inventory is $50,000, cost of goods purchased is $260,000, and ending inventory is $40,000, cost of goods sold is:A.$300.000.B. $280,000.C. $210,000.D. $270,000.( B )3. ABC Company sells merchandise on Feb15 on account to XYZ Co. for $11,000, terms 2/10, n/30. On Feb24, payment is received from XYZ Co. What is the amount of cash received?A. $11,000B. $10,780C. $11,220D. $220( C ) 4. Please select which components should less from the value of plant assets.A. Merchandise inventoryB. Income tax payableC. Accumulated depreciationD.Retained earnings( D )5.Which of the following is not a characteristic of plant assets?A. TangibleB. Long-livedC. Unchanged outlookD. For resale( C )6。

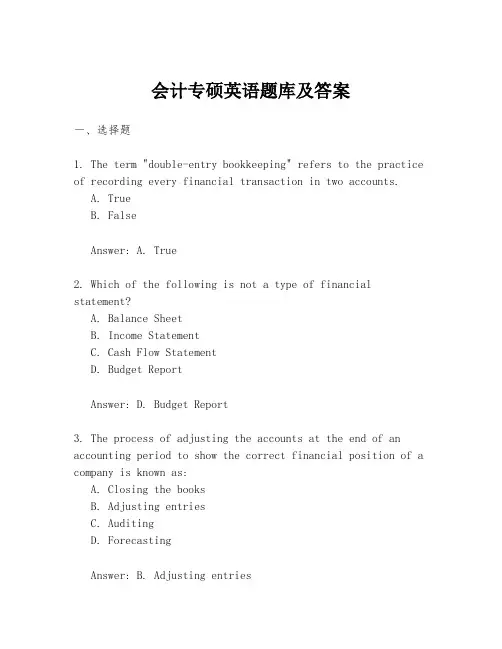

会计专硕英语题库及答案一、选择题1. The term "double-entry bookkeeping" refers to the practice of recording every financial transaction in two accounts.A. TrueB. FalseAnswer: A. True2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget ReportAnswer: D. Budget Report3. The process of adjusting the accounts at the end of an accounting period to show the correct financial position of a company is known as:A. Closing the booksB. Adjusting entriesC. AuditingD. ForecastingAnswer: B. Adjusting entries二、填空题4. The __________ is a statement that summarizes the financial performance of a company over a specific period of time.Answer: Income Statement5. The __________ is a statement that presents the financial position of a company at a specific point in time.Answer: Balance Sheet6. The __________ is the process of systematically reviewing and evaluating the financial records of a business.Answer: Auditing三、简答题7. What is the purpose of depreciation in accounting?Answer: The purpose of depreciation in accounting is to allocate the cost of a tangible asset over its useful life. It reflects the consumption of the asset's economic benefits over time and is used to match the expense with the revenue generated by the asset during its useful life.8. Explain the difference between a debit and a credit in double-entry bookkeeping.Answer: In double-entry bookkeeping, a debit is an entry that increases the value of an asset or expense account, ordecreases the value of a liability, equity, or revenue account. Conversely, a credit is an entry that increases the value of a liability, equity, or revenue account, or decreases the value of an asset or expense account. Every transaction has at least two entries, one debit and one credit, to maintain the fundamental accounting equation.四、案例分析题9. Assume you are an accountant for a company that has just purchased a piece of machinery for $100,000. The machinery is expected to have a useful life of 10 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: The annual depreciation expense using thestraight-line method is calculated by dividing the cost of the asset by its useful life. In this case, the annual depreciation expense would be $100,000 / 10 years = $10,000 per year.五、论述题10. Discuss the importance of internal controls in preventing fraud within an organization.Answer: Internal controls are crucial in preventing fraud as they provide a system of checks and balances within an organization. They ensure that transactions are authorized, recorded accurately, and processed in a timely manner. Internal controls also help to safeguard assets, promoteoperational efficiency, and ensure compliance with regulations. By establishing strong internal controls, an organization can deter potential fraudsters, detect fraud when it occurs, and correct any errors or irregularities promptly.以上是会计专硕英语题库及答案的示例内容,实际题库可能会包含更多的题目和不同的题型。

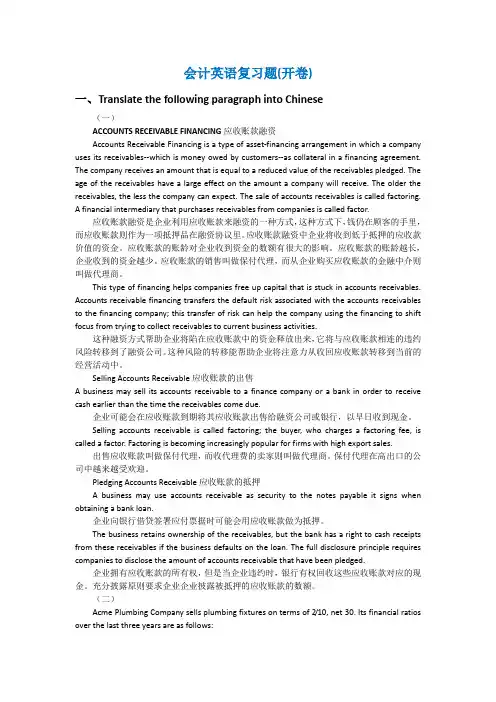

会计英语复习题(开卷)一、Translate the following paragraph into Chinese(一)ACCOUNTS RECEIVABLE FINANCING应收账款融资Accounts Receivable Financing is a type of asset-financing arrangement in which a company uses its receivables--which is money owed by customers--as collateral in a financing agreement. The company receives an amount that is equal to a reduced value of the receivables pledged. The age of the receivables have a large effect on the amount a company will receive. The older the receivables, the less the company can expect. The sale of accounts receivables is called factoring.A financial intermediary that purchases receivables from companies is called factor.应收账款融资是企业利用应收账款来融资的一种方式,这种方式下,钱仍在顾客的手里,而应收账款则作为一项抵押品在融资协议里。

应收账款融资中企业将收到低于抵押的应收款价值的资金。

应收账款的账龄对企业收到资金的数额有很大的影响。

应收账款的账龄越长,企业收到的资金越少。

应收账款的销售叫做保付代理,而从企业购买应收账款的金融中介则叫做代理商。

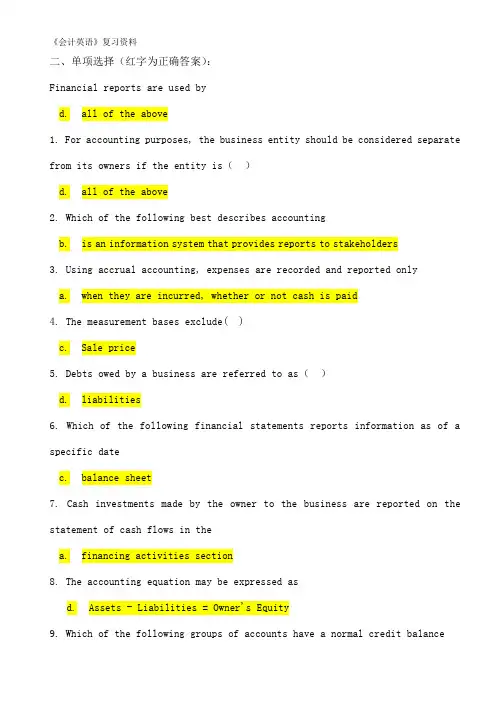

《会计英语》复习资料二、单项选择(红字为正确答案):Financial reports are used byd.all of the above1. For accounting purposes, the business entity should be considered separate from its owners if the entity is()d.all of the above2. Which of the following best describes accountingb.is an information system that provides reports to stakeholders3. Using accrual accounting, expenses are recorded and reported onlya.when they are incurred, whether or not cash is paid4. The measurement bases exclude( )c.Sale price5. Debts owed by a business are referred to as()d.liabilities6. Which of the following financial statements reports information as of a specific datec.balance sheet7. Cash investments made by the owner to the business are reported on the statement of cash flows in thea.financing activities section8. The accounting equation may be expressed asd.Assets - Liabilities = Owner's Equity9. Which of the following groups of accounts have a normal credit balancea.revenues, liabilities, capital10. Which of the following groups of accounts have a normal debit balanced.assets, expenses11. Which of the following types of accounts have a normal credit balancec.revenues and liabilities12. In the accounting cycle, the last step is()a.preparing a post-closing trial balance13. Which of the following should not be considered cash by an accountantc.postage stamps14. A bank reconciliation should be prepared periodically because ()c.any differences between the depositor's records and thebank's records should be determined, and any errors made byeither party should be discovered and corrected15. The amount of the outstanding checks is included on the bank reconciliationas a(n) ()c.deduction from the balance per bank statement16. The asset created by a business when it makes a sale on account is termedc.accounts receivable17. What is the type of account and normal balance of Allowance for Doubtful Accountsa.Contra asset, credit18. The term "inventory" indicates ()d.both A and B19. Merchandise inventory at the end of the year was understated. Which of the following statements correctly states the effect of the error income is understated20.Merchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the errorb.owner's equity is overstated21.The inventory method that assigns the most recent costs to cost of good sold isb.LIFO22.Under which method of cost flows is the inventory assumed to be composed of the most recent costsb.first-in, first-out23. When the perpetual inventory system is used, the inventory sold is debited to ( )b.cost of merchandise sold24.All of the following below are needed for the calculation of depreciation exceptd.book value25. A characteristic of a fixed asset is that it ised in the operations of a business26. Accumulated Depreciation ( )c.is a contra asset account27. The two methods of accounting for investments in stock are the cost method and the ()b.equity method28. A capital expenditure results in a debit to ()d.an asset account29. Current liabilities are()d.due and payable within one year30. The debt created by a business when it makes a purchase on account is referred to as anb.account payable31. Notes may be issued ()d.all of the above32.The cost of a product warranty should be included as an expense in thec.period of the sale of the product33. If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $100,000 will bec.Less than $100,00034. The interest rate specified in the bond indenture is called the ()b.contract rate35. When the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds ared.callable bonds36. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell atd. a discount37. One potential advantage of financing corporations through the use of bonds rather than common stock isc.the interest expense is deductible for tax purposes by thecorporation38. Characteristics of a corporation include ()d.shareholders who have limited liability39. Stockholders' equity ()c.includes retained earnings and paid-in capital40. The excess of issue price over par of common stock is termed a(n) ()d.premium41. Cash dividends are usually not paid on which of the followingc.treasury stock42. Which of the following accounts below is reported in the paid-in capital/stockholders' equity section of the corporate balance sheetd.Preferred Stock43. If preferred stock has dividends in arrears, the preferred stock must bed.convertible44. The primary purpose of a stock split is tob.reduce the market price of the stock per share45. Which statement below is not a reason for a corporation to buy back its own stock.d.to increase the shares outstanding46. The liability for a dividend is recorded on which of the following datesd.the date of declaration47. In credit terms of 2/10, n/30, the "2" represents thed.percent of the cash discount48. Revenue should be recognized when()b.the service is performed49. The ability of a business to pay its debts as they come due and to earn a reasonable amount of income is referred to as ()b.solvency and profitability50. Which of the following is not included in the computation of the quick ratioa.inventory四、问答题:3.Differentiate between financial accounting and managerial accounting.财务会计与管理会计的区别。

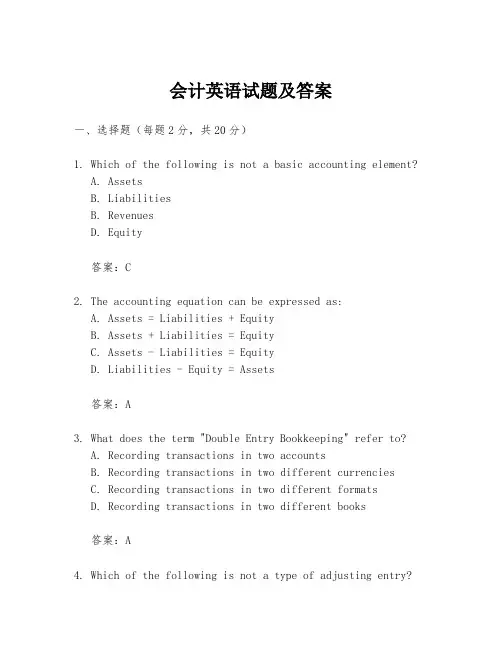

会计英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesB. RevenuesD. Equity答案:C2. The accounting equation can be expressed as:A. Assets = Liabilities + EquityB. Assets + Liabilities = EquityC. Assets - Liabilities = EquityD. Liabilities - Equity = Assets答案:A3. What does the term "Double Entry Bookkeeping" refer to?A. Recording transactions in two accountsB. Recording transactions in two different currenciesC. Recording transactions in two different formatsD. Recording transactions in two different books答案:A4. Which of the following is not a type of adjusting entry?A. AccrualB. PrepaymentC. DepreciationD. Amortization答案:B5. The purpose of closing entries is to:A. Prepare financial statementsB. Adjust for accruals and deferralsC. Record the sale of inventoryD. Record the purchase of fixed assets答案:A6. Which of the following is a measure of a company's liquidity?A. Return on Investment (ROI)B. Debt to Equity RatioC. Current RatioD. Profit Margin答案:C7. The term "Depreciation" refers to:A. The decrease in value of an asset over timeB. The increase in value of an asset over timeC. The amount of an asset that is used upD. The process of selling an asset答案:A8. What is the purpose of a trial balance?A. To calculate net incomeB. To check the accuracy of accounting recordsC. To determine the value of assetsD. To calculate the cost of goods sold答案:B9. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget答案:D10. The accounting principle that requires expenses to be recorded in the same period as the revenues they generate is known as:A. Going ConcernB. Matching PrincipleC. Historical Cost PrincipleD. Materiality答案:B二、填空题(每题2分,共20分)1. The __________ is the process of recording financial transactions in a systematic way.答案:Journalizing2. The __________ is a summary of the financial transactionsof a business during a specific period.答案:Ledger3. __________ is the accounting principle that requires all accounting information to be based on historical cost.答案:Historical Cost Principle4. The __________ is a financial statement that shows a company's financial position at a specific point in time.答案:Balance Sheet5. __________ is the process of estimating revenues and expenses for a future period.答案:Budgeting6. __________ is the accounting principle that requires all transactions to be recorded in the period in which they occur.答案:Accrual Basis Accounting7. The __________ is a financial statement that shows the results of a company's operations over a period of time.答案:Income Statement8. __________ is the process of determining the value of a company's assets and liabilities.答案:Valuation9. __________ is the accounting principle that requires alltransactions to be recorded in the order in which they occur.答案:Chronological Order10. The __________ is a financial statement that shows the sources and uses of cash during a period of time.答案:Cash Flow Statement三、简答题(每题15分,共30分)1. 描述会计信息的质量特征有哪些,并简要解释它们的含义。

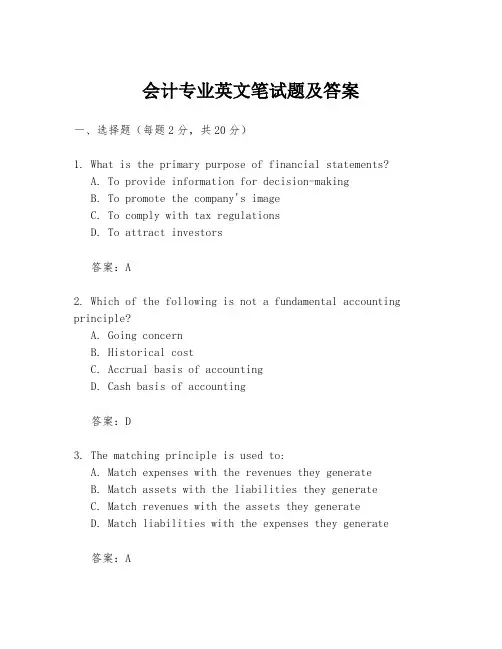

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

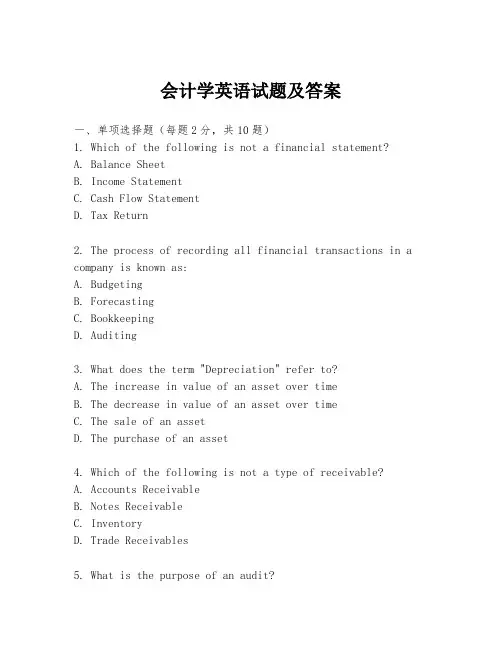

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

英语会计复习题英语会计复习题在学习会计的过程中,复习题是非常重要的一部分。

通过做题,我们可以巩固知识点,检验自己的理解程度,并且为考试做好准备。

下面是一些英语会计复习题,希望对大家的学习有所帮助。

1. What is the basic accounting equation?The basic accounting equation is Assets = Liabilities + Equity. It represents the fundamental relationship between a company's assets, liabilities, and owner's equity.2. What is the difference between accrual accounting and cash accounting? Accrual accounting records revenue and expenses when they are incurred, regardless of when the cash is received or paid. Cash accounting, on the other hand, only records revenue and expenses when the cash is actually received or paid. Accrual accounting provides a more accurate picture of a company's financial performance, while cash accounting is simpler and easier to understand.3. What is depreciation?Depreciation is the allocation of the cost of an asset over its useful life. It represents the decrease in value of an asset due to wear and tear, obsolescence, or other factors. Depreciation is recorded as an expense on the income statement and reduces the value of the asset on the balance sheet.4. What is the difference between a current asset and a fixed asset?A current asset is an asset that is expected to be converted into cash or used upwithin one year or the normal operating cycle of a business. Examples of current assets include cash, accounts receivable, and inventory. A fixed asset, on the other hand, is an asset that is used in the production of goods or services and is not expected to be converted into cash within one year. Examples of fixed assets include buildings, machinery, and vehicles.5. What is the purpose of the statement of cash flows?The statement of cash flows provides information about the cash inflows and outflows of a company during a specific period of time. It helps users of financial statements understand how a company generates and uses cash, and provides insights into its liquidity and cash flow management.6. What is the difference between gross profit and net profit?Gross profit is the difference between net sales and the cost of goods sold. It represents the profit a company makes from its core operations before deducting operating expenses. Net profit, on the other hand, is the final profit after deducting all expenses, including operating expenses, interest, and taxes. 7. What is the purpose of the balance sheet?The balance sheet provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and owner's equity, and helps stakeholders assess its solvency, liquidity, and financial stability.8. What is the difference between accounts payable and accounts receivable? Accounts payable is the amount of money a company owes to its suppliers or creditors for goods or services purchased on credit. Accounts receivable, on theother hand, is the amount of money owed to a company by its customers for goods or services sold on credit. Accounts payable represents a liability, while accounts receivable represents an asset.通过以上的复习题,我们可以回顾和巩固会计的基础知识。

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic equation of accounting?A. Assets = Liabilities + EquityB. Revenue - Expenses = ProfitC. Depreciation - Amortization = LossD. Cost of Goods Sold + Operating Expenses = Net Income答案:A2. Which of the following is NOT a type of intangible asset?A. TrademarkB. PatentC. CopyrightD. Inventory答案:D3. The process of allocating the cost of a tangible asset over its useful life is known as:A. AmortizationB. DepreciationC. AccrualD. Provision答案:B4. What is the purpose of adjusting entries at the end of anaccounting period?A. To increase the company's profitB. To ensure the financial statements are accurate and up-to-dateC. To reduce the company's tax liabilityD. To prepare for the next accounting period答案:B5. The term "Double Entry Bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording debits and credits for every transactionC. Keeping two sets of booksD. Using two different accounting software答案:B...二、简答题(每题10分,共30分)1. Explain the difference between "revenue recognition" and "matching principle".答案:Revenue recognition is the process of recognizing income in the accounting records as it is earned, regardless of when payment is received. The matching principle, on the other hand, is an accounting concept that requires expenses to be recognized in the same accounting period as the revenue they helped generate. This ensures that the financial statements reflect the actual performance of the business fora given period.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets of the entity after deducting liabilities....三、计算题(每题15分,共30分)1. Given the following information for XYZ Corp., calculate the net income for the year ended December 31, 2023:- Sales revenue: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000答案:Net Income = Sales Revenue - (Cost of Goods Sold + Operating Expenses + Depreciation Expense + Interest Expense) Net Income = $500,000 - ($300,000 + $100,000 + $20,000 + $10,000)Net Income = $500,000 - $440,000Net Income = $60,0002. If a company purchased a machine for $50,000 and expectsit to have a useful life of 5 years with no residual value, calculate the annual depreciation expense using the straight-line method.答案:Annual Depreciation Expense = (Cost of Asset - Residual Value) / Useful LifeAnnual Depreciation Expense = ($50,000 - $0) / 5Annual Depreciation Expense = $10,000...结束语:希望这份英语会计考试题目及答案对您的学习和复习有所帮助。

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

财务会计题库英文及答案1. Question: What is the purpose of the statement of cash flows in financial accounting?Answer: The purpose of the statement of cash flows is to provide information about the cash receipts and cash payments of an entity, showing how the changes in balance sheet accounts and income affect cash and cash equivalents, and to reveal the entity's financing and investing activities.2. Question: Explain the difference between a debit and a credit in double-entry bookkeeping.Answer: In double-entry bookkeeping, a debit is an entry on the left side of an account that either increases an asset or expense, or decreases a liability, equity, or revenue. A credit is an entry on the right side of an account that increases a liability, equity, or revenue, or decreases an asset or expense.3. Question: What is the accrual basis of accounting?Answer: The accrual basis of accounting is a method of accounting in which revenues and expenses are recognized when they are earned or incurred, not when cash is received or paid. This method provides a more accurate picture of a company's financial performance over a period of time.4. Question: How does depreciation affect a company's financial statements?Answer: Depreciation is a non-cash expense that allocates the cost of a tangible asset over its useful life. It affects the company's financial statements by reducing the asset's carrying value on the balance sheet and decreasing the net income on the income statement, which in turn can affect the retained earnings.5. Question: What is the primary goal of financial statement analysis?Answer: The primary goal of financial statement analysis is to assess the performance and financial condition of a company. It helps investors, creditors, and other stakeholders make informed decisions by evaluating the company's profitability, liquidity, solvency, and overall financial health.6. Question: What is the difference between a journal entry and a ledger entry?Answer: A journal entry records the initial transaction in the general journal, showing the date, accounts affected, and the amounts debited and credited. A ledger entry, on the other hand, is the posting of the journal entry to the appropriate accounts in the general ledger, which summarizes the transactions for each account.7. Question: Explain the matching principle in financialaccounting.Answer: The matching principle in financial accounting requires that expenses be recognized in the same period asthe revenues they helped to generate. This principle ensures that the income statement reflects the actual economic performance of the period and avoids distortions that could arise from recognizing revenues and expenses in different periods.8. Question: What is the purpose of adjusting entries?Answer: Adjusting entries are made at the end of an accounting period to ensure that the financial statements reflect the current financial position and performance of the company. They adjust for revenues and expenses that have been incurred but not yet recorded, or cash received or paid butnot yet recognized.9. Question: What is the difference between a budget and a forecast?Answer: A budget is a detailed financial plan thatoutlines expected revenues and expenses for a specific period, often used for internal management and control. A forecast,on the other hand, is a projection of future financial performance based on assumptions and trends, and is typically used for strategic planning and decision-making.10. Question: What is the role of the balance sheet infinancial accounting?Answer: The balance sheet is a financial statement that presents a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial stability. The balance sheet must always balance, with total assets equaling the sum of liabilities and equity.。

会计专业英语复习资料一、短语中英互译1、会计分录2、投资活动3、后进先出法4、客观性原则5、注册会计师6、权责发生制7、累计折旧8、资产负债表9、经营决策10、银行存款11、到期日12、历史成本13、source document14、nominal rate15、credit sale16、sum-of-years-digits method17、economic entity assumption18、financial position19、fixed assets20、public hearing21、income statement22、sales discount23、value added tax24、trade mark25、bank overdraft二、从下列选项中选出最佳答案1、Generally,revenue is recorded by a business enterprise at a pointwhen :( )A、Management decides it is appropriate to do soB、The product is available for sale to consumersC、An exchange has taken place and the earning process is virtuallycompleteD、An order for merchandise has been received2、Why are certain costs capitalized when incurred and then depreciated or amortized over subsequent accounting periods?( )A、To reduce the income tax liabilityB、To aid management in making business decisionsC、To match the costs of production with revenue as earnedD、To adhere to the accounting concept of conservatism3、What accounting principle or concept justifies the use of accruals and deferrals?( )A、Going concernB、MaterialityC、ConsistencyD、Stable monetary unit4、An accrued expense can best be described as an amount ( )A、Paid and currently matched with revenueB、Paid and not currently matched with revenueC、Not paid and not currently matched with revenueD、Not paid and currently matched with revenue5、Continuation of a business enterprise in the absence of contrary evidence is an example of the principle or concept of ( )A、Business entityB、ConsistencyC、Going concernD、Substance over form6、In preparing a bank reconciliation,the amount of checks outstanding would be:( )A、added to the bank balance according to the bank statement.B、deducted from the bank balance according to the bank statement.C、added to the cash balance according to the depositor’s records.D、deducted from the cash balance according to the depositor’s records.7、Journal entries based on the bank reconciliation are required for:( )A、additions to the cash balance according to the depositor’s records.B、deductions from the cash balance according to the depositor’srecords.C、Both A and BD、Neither A nor B8、A petty cash fund is :( )A、used to pay relatively small amounts。

英语会计试题及答案一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets + Equity = LiabilitiesD. Liabilities = Assets - Equity答案:A2. Which of the following is not an accounting principle?A. Going concernB. ConsistencyC. MaterialityD. Fair value答案:D3. What does the term "depreciation" refer to?A. The increase in the value of an asset over timeB. The allocation of the cost of a tangible asset over its useful lifeC. The decrease in the value of an asset due to obsolescenceD. The process of selling assets to pay off debts答案:B4. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Accounts payable答案:C5. What is the purpose of adjusting entries?A. To correct errors in the booksB. To update the financial statements to reflect the current financial positionC. To prepare for the next accounting periodD. To comply with tax regulations答案:B6. What is the accounting treatment for revenue recognition?A. Recognize revenue when cash is receivedB. Recognize revenue when the service is providedC. Recognize revenue when the service is earned and the amount is measurableD. Recognize revenue when the product is delivered答案:C7. Which of the following is a liability?A. Common stockB. Retained earningsC. Accounts payableD. Dividends答案:C8. What is the accounting term for the process of estimating the cost of completing a project?A. Job costingB. Activity-based costingC. Standard costingD. Variable costing答案:A9. What does the term "accrual basis accounting" mean?A. Revenues and expenses are recognized when cash is received or paidB. Revenues are recognized when earned, and expenses are recognized when incurredC. All transactions are recorded in the period in which they occurD. Only cash transactions are recorded答案:B10. Which of the following is an example of a contingent liability?A. Accounts payableB. Unearned revenueC. A lawsuit that may result in a lossD. A long-term loan答案:C二、简答题(每题5分,共30分)1. Explain the difference between a debit and a credit in accounting.答案:In accounting, a debit is an entry that increases an asset or an expense and decreases a liability or equity. Conversely, a credit is an entry that increases a liabilityor equity and decreases an asset or an expense.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns, liabilities represent what a company owes, and equity represents the ownership interest in the company.3. Describe the accounting cycle.答案:The accounting cycle is a series of stepsaccountants follow to prepare financial statements. Itincludes journalizing transactions, posting to the ledger, adjusting entries, preparing an adjusted trial balance,closing entries, and preparing financial statements.4. What is the purpose of closing entries?答案:The purpose of closing entries is to transfer the balances of temporary accounts to the appropriate permanent accounts, such as retained earnings, at the end of an accounting period. This process helps to reset the temporaryaccounts for the next accounting period.5. Explain the concept of matching principle in accounting.答案:The matching principle in accounting states that revenues should be recognized in the same period as the expenses incurred to generate those revenues. This ensures that the financial statements accurately reflect the company's performance over the period.6. What are the two main types of financial statements?答案:The two main types of financial statements are the balance sheet, which presents a company's financial position at a specific point in time, and the income statement, which shows the company's financial performance over a period of time.三、计算题(每题15分,共30分)1. A company has the following trial balance figures: Cash $10,000, Accounts Receivable $5,000, Supplies $2,000, Equipment $15,000, Accounts Payable $4,000, Common Stock $10,000, Retained Earnings $6,000, Dividends $2,000, Sales Revenue $20,000, Cost。

《会计专业英语》模拟试题及答案一、单选题(每题1分,共 20分)1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2)In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4)To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32.Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010?A.$8 500 DrB.$8 500 CrC.$14 000 DrD.$14 000 Cr3.Should dividends paid appear on the face of a company’s cash flow statement?A. YesB. NoC. Not sureD. Either4.Which of the following inventory valuation methods is likely to lead to the highestfigure for closing inventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-current assets in a company’s the statement of financial position?(1) plant, equipment, and property(2) company car(3) €4000 cash(4) €1000 chequeA. (1), (3)B. (1), (2)C. (2), (3)D. (2), (4)6. Whi ch of the following items may appear as current liabilities in a company’s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree?1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expenses account $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until 30 June 2010. It was increased from that date to $96,000 per year. What rent expense and end of year prepayment should be included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Plant and equipment: $860,000Depreciation for plant and equipment: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 was sold for $49,000. The plant had originally cost $80,000. Plant purchased during the year cost $180,000. It is the company.s policy to charge a full year depreciation in the year of acquisition of an asset and none in the year of sale, using a rate of 10% on the straight line basis. What net amount should appear in Lambda.s balance sheet at 30 September 2010 for plant and equipment?A $563,000B $467,000C $510,000D $606,00010. A company’s plant and machinery ledger account for the year ended 30 September 2010 was as follows:The company’s policy is to charge depreciation at 20% per year on the straight line basis, with proportionate depreciation in years of purchase and disposal. What is the depreciation charge for the year ended 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of financial information.(1) True(2) Prudence(3) Completeness(4) CorrectWhich of these characteristics contribute to reliability?A (1), (3) and (4) onlyB (1), (2) and (4) onlyC (1), (2) and (3) onlyD (2), (3) and (4) only12. The plant and machinery cost account of a company is shown below. The company’s policy is to charge depreciation at 20% on the straight line basis, with proportionate depreciation in years of acquisition and disposal.A. $67,000B. $64,200C. $70,000D. $68,60013. In preparing its financial statements for the current year, a company’s closi ng inventory was understated by $300,000. What will be the effect of this error if it remains uncorrected?A The current year’s profit will be overstated and next year’s profit will be understatedB The current year’s profit will be understated but there will be no effect on next year’s profitC The curr ent year’s profit will be understated and next year’s profit will be overstatedD The current year’s profit will be overstated but there will be no effect on next year’s profit.14. In preparing a company’s cash flow statement, which, if any, of the following items could form part of the calculation of cash flow from financing activities?(1) Proceeds of sale of premises(2) Dividends received(3) Issue of sharesA 1 onlyB 2 onlyC 3 onlyD None of them.15. At 31 March 2009 a company had oil in hand to be used for heating costing $8,200 and an unpaid heating oil bill for $3,600. At 31 March 2010 the heating oil in hand was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil during the year ended 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the company’s income statement for heating oil for the year?A $23,900B $36,100C $45,300D $33,10016. In times of inflation In times of rising prices, what effect does the use of the historical cost concept have on a company’s asset values and profit?A. Asset values and profit both undervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimated residual value of the plant in 10 years time is estimated to be $6,000. Beta’s policy is to charge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta’s accou nting period of 18 months to 30/09/2010 ?A. $5400B. $900C. $1350D. $67518. A company’s income statement for the year ended 31 December 2005 showed a n et profit of $83,600. It was later found that $18,000 paid for the purchase of a motor van had been debited to the motor expenses account. It is the company’s policy to depreciate motor vans at 25 per cent per year on the straight line basis, with a full y ear’s cha rge in the year of acquisition. What would the net profit be after adjusting for this error?A.$97,100B.$70,100C.$106,100D.$101,60019. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect of a transaction must always be shown in the financial statements even if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only20. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it’s paid or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only二、翻译题(共30分)1、将下列分录翻译成英文(每个2分,共10分)1.借:固定资产清理 30 000累计折旧 10 000贷:固定资产 40 0002.借:银行存款 10 500贷:交易性金融资产 10 000投资收益 5003.借:应付职工薪酬 1 000贷:库存现金 1 0004.借:银行存款 4 095贷:其他业务收入 3 500应交税费–应交增值税(销项税额) 5955.借:应付票据 40 000贷:银行存款 40 0002、将下列报表翻译成中文(每空1分,共20分)1.ABC group the statement of financial position as at 31/Dec/2010€2.Non-current assets3.Intangible assets4.Property, plant and equipment5.Investment in associates6.Held-for-maturity investment7.Deferred income tax assets8.Current Assets9.Trade and other receivables10.Derivative financial instruments11.Cash and cash equivalents12.Assets of discontinued operation13.Assets in total14.Current Liabilities15.Accrued payroll16.Accrued dividend17.Accrued accounts18.Non-current Liabilities19.Liabilities in total Assets三、阅读题(共30分)Research and development (R&D)Accounting treatment of R&DUnder International Accounting Standards the accounting for R&D is dealt with under IAS 38, Intangible Assets. IAS 38 states that an intangible asset is to be recognised if, and onlyif, the following criteria are met: it is probable that future economic benefits from the asset will flow to the entity, the cost of the asset can be reliably measured.The above recognition criteria look straightforward enough, but in reality it can prove to be very difficult to assess whether or not these have been met. In order to make this recognition of intangibles more clear, IAS 38 separates an R&D project into a research phase and a development phase.Research phaseIt is impossible to demonstrate whether or not a product or service at the research stage will generate any probable future economic benefit. As a result, IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.Development phaseUnder IAS 38, an intangible asset arising from development must be capitalised if an entity can demonstrate all of the following criteria: the technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset; existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably. If any of the recognition criteria are not met then the expenditure must be charged to the income statement as incurred. Note that if the recognition criteria have been met, capitalisation must take place. Once development costs have been capitalised, the asset should be amortised in accordance with the accruals concept over its finite life. Amortisation must only begin when commercial production has commenced.Questions:1)Outline the criterias of recognition of intangible assets (5分)2)Criterias to recognised as development (5分)3)Identify the accounting treatment of research phase (10分)4)Identify the accounting treatment of development phase (10分)四、业务题(按要求用英文编制分录,每题2分,共20分)Johnny set up a business and in the first a few days of trading the following transactions occurred (ignore all the tax):1)He invests $80 000 of his money in his business bank account2)He then buys goods from Isabel, a supplier for $4 000 and pays by cheque, the goods isdelivered right after the payment3) A sale is made for $3 000 –the customer pays by cheque4)Johnny makes another sale for $2 000 and the customer promises to pay in the future5)He then buys goods from another supplier, Kamen, for $2 000 on credit, goods isdelivered on time6)He pays a telephone bill of $800 by cheque7)The credit customer pays the balance on his account8)He returened some faulty goods to his supplier Kamen, which worth $400.9)Bank interest of $70 is received10)A cheque customer returned $400 goods to him for a refund参考答案1、单选题1-5 CCACB 6-10 DCDCD 11-15 ABCDD 16-20 CBABA2、翻译题1)中翻英1.Dr disposal of fixed assetDepreciationCr fixed asset2. Dr BankCr Tradable financial assetInvestment income3.Dr accrued payrollCr cash4.Dr bankCr other operating revenueAccrued tax-V AT (output)5.Dr accrued notesCr bank2) 英翻中1.编制单位:ABC 资产负债表时间:2010年12月31日单位:欧元2.非流动资产3.无形资产4.固定资产5.长期股权投资6.持有至到期投资7.递延所得税资产8.流动资产9.应收账款及其他应收款10.货币资金11.非持续性经营资产12.资产总计13.负债14.流动负债15.应付职工薪酬16.应付股利17.应付账款18.非流动负债19.负债总计20.净资产3、阅读题1)Outline the criterias of recognition of intangible assets (5分)IAS 38 states that an intangible asset is to be recognised if, and only if, the following criteria are met: it is probable that future economic benefits from the asset will flow to the entity, the cost of the asset can be reliably measured.2)Criterias to recognised as developmentthe technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset;existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably.3)Identify the accounting treatment of research phase (10分)IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.4)Identify the accounting treatment of development phase (10分)intangible asset arising from development must be capitalised Once development costs have been capitalised, the asset should be amortised in accordance with the accruals concept over its finite life. Amortisation must only begin when commercial production has commenced.4、业务题1)Dr bankCr capital2)Dr finished goodsCr bank3)Dr bankCr sales revenue4)Dr accounts receivableCr sales revenue5)Dr finished goodsCr accrued accounts6)Dr administrativeCr bank7)Dr bankCr accounts receivable8)Dr bankCr finished goods9)Dr bankCr financial expense10)Dr sales revenueCr bank。

会计英语的考试题目及答案会计英语考试题目及答案一、选择题(每题2分,共20分)1. What is the term used to describe the process of recording financial transactions in a company's books?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report答案:D3. The process of ensuring that the financial records are accurate and complete is known as:A. BookkeepingB. AccountingC. AuditingD. Reporting答案:C4. What is the primary purpose of an income statement?A. To show the financial position of a company at a specific point in time.B. To show the changes in equity of a company over a period of time.C. To show the profitability of a company over a period of time.D. To show the cash inflows and outflows of a company over a period of time.答案:C5. Which of the following is not a principle of accounting?A. Accrual BasisB. ConsistencyC. MaterialityD. Fair Value答案:D6. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twice in different accounts.B. Recording transactions in two different ways.C. Recording debits and credits for every transaction.D. Recording transactions in two different books.答案:C7. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Liabilities - Equity = AssetsD. Equity - Assets = Liabilities答案:A8. What is the purpose of depreciation in accounting?A. To increase the value of an asset.B. To allocate the cost of a tangible asset over its useful life.C. To sell an asset.D. To calculate the profit of a company.答案:B9. Which of the following is a non-current liability?A. Accounts PayableB. Wages PayableC. Long-term DebtD. Taxes Payable答案:C10. The term "revenue recognition" refers to the process of:A. Recognizing expenses when they are paid.B. Recognizing revenues when they are earned.C. Recognizing assets when they are acquired.D. Recognizing liabilities when they are incurred.答案:B二、简答题(每题5分,共20分)1. Explain the difference between "cash basis" and "accrual basis" accounting.答案:Cash basis accounting records transactions when cash is received or paid, whereas accrual basis accounting records transactions when they are earned or incurred, regardless of the cash flow.2. What is the purpose of a balance sheet?答案:The purpose of a balance sheet is to present thefinancial position of a company at a specific point in time, showing what the company owns (assets), what it owes (liabilities), and the net worth of the company's owners (equity).3. Define "depreciation" in the context of accounting.答案:Depreciation is the systematic allocation of the costof a tangible asset over its useful life, reflecting the consumption of the asset's economic benefits over time.4. What is the importance of an audit in the financial reporting process?答案:An audit provides an independent assessment of the accuracy and completeness of a company's financial statements, enhancing their credibility and reliability for stakeholders.三、案例分析题(每题15分,共30分)1. Assume you are an accountant for a company that has just sold a product for $10,000 on credit. Prepare the journalentry for this transaction under both cash basis and accrual basis accounting.答案:Under cash basis, no journal entry is made until cashis received. Under accrual basis, the journal entry would be: Dr. Accounts Receivable $10,000Cr. Revenue $10,0002. A company has the following transactions in January: purchased office supplies for $500 in cash, received $2,000for services provided in December, and accrued $1,500 in wages for January. Prepare the adjusting entries for these transactions at the end of January.答案:The adjusting entries would be:Dr. Office Supplies Expense $500Cr. Office Supplies $500 (for cash purchase)Dr. Accounts Receivable $2,000Cr. Revenue $2,000 (for services provided in December)Dr. Wages Payable $1,500Cr. Wages Expense $1,500 (for accrued wages)四、论述题(每题15分,共30分)1. Discuss the role of ethics in accounting and provide examples of ethical dilemmas that an accountant might face. 答案。

一:Choose the best answer for each statement below( A )1. Postings from the purchases journal to the subsidiary ledger are generally made:A. Daily.B. Weekly.C. Monthly.D. Yearly.( D )2 If beginning inventory is $50,000, cost of goods purchased is $260,000, and ending inventory is $40,000, cost of goods sold is:A.$300.000.B. $280,000.C. $210,000.D. $270,000.( B )3. ABC Company sells merchandise on Feb15 on account to XYZ Co. for $11,000, terms 2/10, n/30. On Feb24, payment is received from XYZ Co. What is the amount of cash received?A. $11,000B. $10,780C. $11,220D. $220( C ) 4. Please select which components should less from the value of plant assets.A. Merchandise inventoryB. Income tax payableC. Accumulated depreciationD.Retained earnings( D )5.Which of the following is not a characteristic of plant assets?A. TangibleB. Long-livedC. Unchanged outlookD. For resale( C )6。

Please select the items which do not belong to the Balance Sheet:A. Long-term investment.B. Accounts receivable.C. Income tax expense.D. Retained earnings.( D )7. Who does not want to see your Balance Sheet?A. Creditor.B. Investor.C. Manager.D. Customer.( C )8. The equity method of accounting for long-term investments in stock should be used when the investor owns:A. Less than 20% of the common stock of the investee.B. More than 20% of the common stock of the investee.C. Between 20% and 50% of the common stock of the investee.D. More than 50% of the common stock of another entity.( D )9. Jane Smith earns $12 per hour for a 40-hour week and $22 per hour for any overtime work. If Jane works 48 works in a week, gross earnings are:A. $480.B. $576.C. $650.D. $656.( B )10. Decide which of the following statements is true.A. Since intangible assets lack physical substance, they need be disclosed only in thenotes to the financial statements.B. Totals of major classes of assets can be shown in the balance sheet, with assetdetails disclosed in the notes to the financial statements.C. Goodwill should be reported as a contra-account in the owner’s equity section.D. Intangible assets are typically combined with plant assets and natural resourcesand shown in the property, plant, and equipment section.( C ) 11. Please select which components should less from the value of plant assets.A. Merchandise inventoryB. Income tax payableC. Accumulated depreciationD.Retained earnings( D )12.Which of the following is not a characteristic of plant assets?A.TangibleB.Long-livedC.Unchanged outlookD. For resale( A )13. In accounting, which of the following factors is not an estimate to determine the depreciation of a plant asset?A.Costeful lifeC.Salvage valueD.Total units of output( C )14. Please select an item for not belong to the Balance Sheet.A. Long-term investmentB. Accounts receivableC. Income tax expenseD. Retained earnings( A )15. In general, which is the basis of preparing a Balance Sheet?A. Assets=Liabilities + Owners’ equityB. Assets - Liabilities = Owners’ equityC. Profits = Revenues - ExpensesD. Revenues =Profits + Expenses( A ) 16. In accounting, which of the following factors is not an estimate to determine the depreciation of a plant asset?E.Cost B. Useful lifeC. Salvage valueD. Total units of output( C )17. Please select an item for not belong to the Balance Sheet.A. Long-term investmentB. Accounts receivableC. Income tax expenseD. Retained earnings( A )18. In general, which is the basis of preparing a Balance Sheet?A. Assets=Liabilities + Owners’ equityB. Assets - Liabilities = Owners’ equityC. Profits = Revenues - ExpensesD. Revenues =Profits + Expenses( C )19. The major elements of the income statement are:A. Revenue, cost of goods sold, selling expenses, and general expenseB. Operating section, cooperating section, discontinued operations, extraordinary items, and cumulative effectC. Revenues, expenses, gains and lossesD. All of these( D )20. Information in the income statement helps users to:A. Evaluate the past performance of the enterpriseB. Provide a basis for predicting future performanceC. Help assess the risk or uncertainty of achieving future cash flowsD. All of these( D )21. Jane Smith earns $12 per hour for a 40-hour week and $22 per hour for any overtime work. If Jane works 48 works in a week, gross earnings are:A. $480.B. $576.C. $650.D. $656.( B )22. Decide which of the following statements is true.E. Since intangible assets lack physical substance, they need be disclosed only in thenotes to the financial statements.F. Totals of major classes of assets can be shown in the balance sheet, with assetdetails disclosed in the notes to the financial statements.G. Goodwill should be reported as a contra-account in the owner’s equity section.H. Intangible assets are typically combined with plant assets and natural resourcesand shown in the property, plant, and equipment section.( A )23. Postings from the purchases journal to the subsidiary ledger are generally made:A.Daily.B. Weekly.C. Monthly.D. Yearly.( D ) 24. If beginning inventory is $50,000, cost of goods purchased is $260,000, and ending inventory is $40,000, cost of goods sold is:B.$300.000. B. $280,000.C. $210,000.D. $270,000.( B )25. ABC Company sells merchandise on Feb15 on account to XYZ Co. for $11,000, terms 2/10, n/30. On Feb24, payment is received from XYZ Co. What is the amount of cash received?A. $11,000B. $10,780C. $11,220D. $220参考答案:1-5 A D B C D,6-10 ; C D C D B11-15 C D A C A,16-20, A C A C D 21-25 D B A D B二、Translate the following Chinese into English1、原始凭证2、现金折扣3、资产负债表4、现金流量表5、明细分类帐6、流动负债7、借方和贷方8、复式记帐法8、会计假设10、债券投资参考答案:1、 original vouchers2、 cash discount3、 balance sheet4、 statement of cashflow5、 subsidiary ledgers6、 current liabilities7、 debit and credit8、 double entry9、 accounting assumptions10、 bonds investment三、Decide whether the statements are true or false. Write “T ” for “True ” and “F ”for “False ”( T )1.Revenues increase owner ’s equity.( F )2. Most companies have fewer balance of assets accounts than balance of liability account.( T )3. Debit means left ,credit means right.( F )4. Debit means increase ,credit means decrease.( T )5. The accounting reporting period agrees to the calendar year.( F )6. If revenues exceed expenses for the same accounting period ,the entity is deemedto suffer a loss.( T )7. Expenses decrease owner ’s equity.( T )8. The statement of cash flow is concerned only with cash and cash equivalents.( F )9. Accounting provides financial information that is only useful to a businessmanagement.( F )10. Accounting is another word for bookkeeping.( F ) 11. Accounting is another word for bookkeeping.( F ) 12. Accounting provides financial information that is only useful to a businessmanagement.( T )1 3. The statement of cash flow is concerned only with cash and cash equivalents. ( T ) 14. Expenses decrease owner ’s equity.( F )1 5. If revenues exceed expenses for the same accounting period ,the entity is deemedto suffer a loss.( T )1 6. The accounting reporting period agrees to the calendar year.( F )17. Debit means increase ,credit means decrease.( T ) 18. Debit means left ,credit means right.( F )1 9. Most companies have fewer balance of assets accounts than balance of liabilityaccount.( T )20.Revenues increase owner ’s equity.参考答案: 1-5 T F T F T , 6-10 F T T F F , 11-15F F T T F ,16-20 T F T F T ;四、Intangible Assets 无形资产Patents 专利Copyrights 商标Goodwill 商誉Current Assets流动资产Accounts Receivables 应收账款Notes Receivables 应收票据Inventories 存货Plant Assets 固定资产Vehicles 车辆Furniture and Fixtures 家具Equipments 机器设备Buildings 建筑物Accumulated Depreciation 累计折旧Land 土地五、Analyze the below transactions of FJ company and write down the accounting entry. 1. John Whith and his family invested $6,000 in FJ Company and received 600 shares of stock.2. FJ Company sold the products to DEF Company for $2,000, DEF Company agrees to pay ABC within 20 days.3.FJ Company paid its telephone bill for $100 cash.参考答案1、Debit: Cash in Bank $6,000Credit: Capital Stock $6,0002、Debit: Accounts Receivable $2,000Credit: Prime Operating Revenue $2,0003、Debit: Administrative Expenses $100Credit: Cash $100六、Sentences translation1.With a properly prepared balance sheet, you can look at a balance sheet at the end of each accounting period and know if your business has more or less value, if your debts are higher or lower, and if your working capital is higher or lower. 1、如果有了正确编制的资产负债表,你就能知道你公司的每一个会计期末的价值是更多了还是更少了,你的债务是更高了还是更低了,你的实收资本是更高了还是更低了。