3MPA《战略管理》中英文

- 格式:pptx

- 大小:311.85 KB

- 文档页数:15

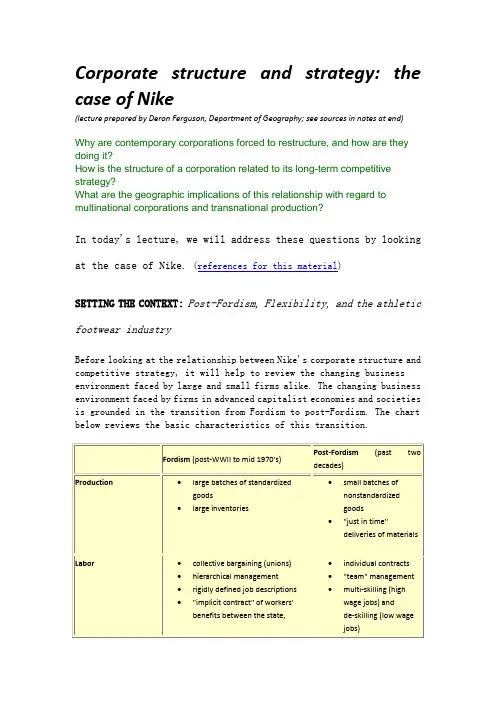

Corporate structure and strategy: the case of Nike(lecture prepared by Deron Ferguson, Department of Geography; see sources in notes at end) Why are contemporary corporations forced to restructure, and how are they doing it?How is the structure of a corporation related to its long-term competitive strategy?What are the geographic implications of this relationship with regard to multinational corporations and transnational production?In today's lecture, we will address these questions by looking at the case of Nike. (references for this material)SETTING THE CONTEXT:Post-Fordism, Flexibility, and the athletic footwear industryBefore looking at the relationship between Nike's corporate structure and competitive strategy, it will help to review the changing business environment faced by large and small firms alike. The changing business environment faced by firms in advanced capitalist economies and societies is grounded in the transition from Fordism to post-Fordism. The chart below reviews the basic characteristics of this transition.The general trend over the past two decades has been a movement from a "standardized" to a "flexible" economy (Stutz & deSouza, pp. 358-361). Many exceptions can be found to this conception of how economies are changing (e.g., the recent acquisition of McDonnell Douglas by Boeing), but elements of it can be found virtually everywhere, depending on the type of industry involved.In this example, we will look at the athletic footwear industry. In particular, we can focus on the athletic footwear market as an example of the formation of new, highly volatile, competitive markets. Changes in the footwear industry can be summarized as:∙footwear production has grown rapidly //Overhead Fig 2∙intense competition and market volatility are indicated by the explosion in the number of "styles" of athletic shoes, and competition among brands //Overhead Fig 1∙ a key to success in the industry is innovation and the rapid turn-around of design and production∙however, the production of shoes remains inherently a "Fordist," labor-intensive process ∙producers must have output and design flexibility∙producers must preserve proprietary information and technology, yet be organizationally flexibleNike has succeeded in competing in the footwear industry with the following strategy: remain flexible in a volatile market by using subcontracting relationships overseas in low labor-cost countries.NIKE'S STRUCTURE AND STRATEGY∙"Nike" began in 1964 as "Blue Ribbon Sports," a seller of Japanese-manufactured footwear∙In 1970, as the athletic footwear market grew, the Nike brand name was born∙In order to gain greater control over production and assembly, Nike opened a plant in New Hampshire in 1973 (which it closed in 1986). The bulk of its production, however,has always been overseas through subcontracting relationships of varying loyalty andintensity. //Overhead Fig 3Today, 100% of Nike's production is by subcontractors, or "production partners." Nike has three type of subcontracting relationships: //Overhead Fig 4∙Developed partners: These production partnerships were first in Japan, but are now in Taiwan and South Korea). These partners produce the "upper echelon" of shoes, orexpensive "statement" shoes, typically in smaller batches (10-25K pairs a day). They aremore likely to collaborate in innovations with Nike, many are vertically disintegratedthemselves, subcontracting "nonproprietary" shoe components and materials to otherlocal producers. Those partners which produce solely for Nike receive monthly ordersfrom Nike which don't vary more than 20% to preserve production stability.∙Volume partners: These are large factories producing large batches of standardized, lower-priced footwear (70-85K pairs a day). Production is routinized and serves multiple(often more than 10) companies, other than Nike (e.g., Reebok). These are "capacity"contractors--they absorb the market risk associated with cyclical demand. Thesefactories are typically more vertically integrated, owning their own leather tanneries andrubber factories. They are not where the most innovative or "state of the art" shoes areproduced, as these factories produce for multiple companies; for this reason,relationships between Nike and these companies are less loyal.∙Developing partners: These factories are located mostly in Thailand, Indonesia, and China. These locations offer Nike very low labor costs and a "hedge" against rising laborcosts in other factories or exchange rate risk. These factories are more loyal to Nike;often they are the product of a joint venture between Nike and its developed partners inTaiwan or South Korea. Often, the joint investment into these factories raises their ability to manufacture increasingly sophisticated products more rapidly than if they wereproducing unaided.Why does Nike pursue this organizational strategy?∙Shoe production is inherently labor intensive (although technology can vary). Thus, labor is an important input for footwear producers to consider, but the labor process remainslargely routine in the assembly of shoe components.∙Subcontracting relationships provide organizational flexibility, moving market risk to partners, even though production processes remain largely routine.∙Southeast Asia offers several locational advantages to Nike: i) it is a rapidly growing market; ii) low-wage, "semi-skilled" labor is plentiful; iii) governments encourageinvestment and transnational production by relaxing the enforcement of labor standards. Key points to walk away with..The business environment (that is, with respect to markets, regulation, competition, innovation) sets the context in which corporations must strategize to preserve their market share and market power. This strategy involves a careful choice of how best to flexibly structure the firm's organization and production, in which geography plays an important role. We have looked closely at this relationship--between corporate structure and strategy--by looking at Nike. By doing so, we have highlighted the fundamental relationship between geography, corporate structure and strategy, and transnational production.Concepts:corporate restructuringmultinational corporationstransnational productioncorporate strategycorporate structureflexibility (flexible production; flexible organization)Fordism, post-Fordismsubcontractingvertical disintegrationglobalizationNew International Division of Labormarket volatility企业结构与策略:耐克的情况下,(演讲准备德隆-弗格森,地理系;票据月底来源)为什么是当代公司被迫重组,以及他们是如何做的呢?相关法团结构,其长期的竞争策略是怎样的?这关系着跨国公司和跨国生产方面的地理意义是什么?在今天的讲座中,我们将看耐克的情况下解决这些问题(这种材料的引用)设置背景:后福特主义,灵活性,以及运动鞋产业在耐克的企业结构和竞争战略之间的关系,这将有助于审查大型和小型企业都面临的不断变化的业务环境。

mpa研究生学习计划英文(中英文实用版)Master"s in Public Administration (MPA) Study PlanAs a prospective student in the Master"s in Public Administration (MPA) program, I have formulated a comprehensive study plan to ensure a successful and enriching academic experience.The following plan outlines my goals, learning strategies, and timeline for the duration of the program.1.Goals:- Acquire in-depth knowledge of public administration principles, theories, and practices.- Develop critical thinking, problem-solving, and analytical skills necessary for public sector management.- Enhance communication, leadership, and interpersonal skills to effectively lead and collaborate with diverse teams.- Gain practical experience through internships, projects, and engagement with the public sector.- Establish a strong professional network within the field of public administration.2.Learning Strategies:- Attend all lectures, seminars, and workshops to actively engage with course materials.- Allocate dedicated study hours each week to review and comprehend readings, case studies, and assignments.- Participate actively in class discussions, sharing perspectives and learning from peers.- Utilize office hours to seek clarification from professors and deepen understanding of complex concepts.- Form study groups with classmates to exchange knowledge, debate ideas, and prepare for exams collectively.3.Timeline:Year 1:- Semester 1: Focus on foundational courses in public administration, such as organizational theory, policy analysis, and public finance.- Semester 2: Continue with core courses, including strategic management, leadership, and ethics in public administration.- Summer: Engage in an internship within a government agency or non-profit organization to gain practical experience.Year 2:- Semester 1: Take elective courses that align with personal interests and career goals, such as urban planning or international development.- Semester 2: Begin working on the capstone project, applyingtheoretical knowledge to a real-world public administration challenge.- Spring: Complete any remaining elective courses and finalize the capstone project.- Summer: Prepare for graduation, including job applications, interviews, and professional networking.4.Continuous Improvement:- Regularly reflect on personal strengths, weaknesses, and areas for improvement.- Seek feedback from professors, mentors, and peers to enhance academic performance and professional development.- Stay updated with current events and trends in public administration through reading relevant literature and attending conferences or seminars.By adhering to this study plan, I aim to excel in my MPA program, develop a strong foundation in public administration, and position myself for a successful career in the public sector.公共管理硕士(MPA)学习计划作为一名即将入学的公共管理硕士(MPA)项目学生,我制定了一份全面的学习计划,以确保在项目期间获得成功且丰富的学术体验。

F1-管理学术语英汉对照解释(8)Strategic Management1、strategic management : 战略管理That set of managerial decisions and actions that determines the long-run performance of an organization.战略管理是一组管理决策和行动,它决定了组织的长期绩效。

2、strategic management process: 战略管理过程An eight-step process that encompasses strategic planning, implementation, and evaluation.是一个包含8个步骤的过程,其中包括战略计划、实施和评估。

3、opportunities : 机会Positive trends in external environmental factors.机会是外部环境因素的积极趋势。

4、threats : 威胁Negative trends in external environmental factors.威胁是外部环境因素的负面趋势。

5、Core competencies: 核心能力An organization’s major value-creating skills , capabilities , and resources that determine its competitive weapons.核心能力是组织主要的价值创造技能,它决定了组织的竞争武器。

6、Strengths: 优势Any activities the organization does well or any unique resources that it has.优势是组织擅长的活动或者专有的资源。

7、Weaknesses: 劣势Activities the organization does not do well or resources it needs but does not possess.劣势是组织不擅长的活动或者非专有的资源。

richard p. rumelt加州伯克利机电工程硕士学位1972年获哈佛商学院博士学位.1976年进入加州大学执教.1995-1998年间担任strategic management society主席.dan schendel1959年俄亥俄州立大学mba1963年斯坦佛大学商业管理phd1965年加入普度大学krannert管理学院.strategic management society执行董事.david j. teece宾州大学ma1975年宾州大学经济学phd.1982年进入加州大学伯克利分校haas商学院执教1989年起任三菱银行国际商业与金融教授1994年起任加州伯克利institute of management innovation and organization (imio)主席文章简介本文是《strategic management journal》1991年的关于战略管理与经济学的特刊中的综述性文章这期特刊探讨了战略管理与经济学互相影响的发展历史和最新进展情况.最近几十年来战略管理的研究已经发生了一些变化开始吸收经济学的语言和逻辑方式.这些变化正是由于战略学家对不断扩展的经济学的使用和经济学家不断增长的能力运用新的工具和更加丰富的理论解决战略管理的中心问题.本文对大量的关于这两个领域相互影响和交流的论文和文献进行了综述让战略学家和经济学家在这种理论和运用的交流中互相认识到对方的贡献局限和机会以期望为读者在这一领域进行研究是提供新的方向.同时这篇文章还探讨了这样的问题到底是什么(或谁)会引导战略管理研究领域的理论发展——战略思考和战略学家或者经济学理论和经济学家本文主要结构:(1)简要回顾了经济学和战略管理交流的发展历史;(2)介绍了引起这种交流的主要的因素;(3)探讨了两方面在今后的可能发展状况;(4)对这期特刊中的几篇文章作了一些引导.战略管理中经济学运用的简要发展历史战略管理或简称为"战略"关注组织尤其是商业企业的发展方向.它包括目标选择产品和服务提供的选择公司在产品制造竞争中地位的设计合适的发展规模的选择和组织结构的设计管理系统的设计等方面.商业企业的战略方向是现代商业社会财富创造的核心.战略这一领域不像政治学是从哲学这一古典根源发展而来也不像大部分经济学拥有吸引众多学者注意的优雅理论基础而更像医药学或工程学是一门来源于实践的学科.通过战略管理发展出的理论可以帮助解释和预测组织的成功和失败.战略管理在商学院的教学中具有丰富的传统和悠久的历史.二十世纪六十年代以前在一个广阔领域内特殊知识的被综合称为"商业政策".进入六十年代"战略"这一新的称谓取而代之不再仅仅是企业在商品市场竞争中各种功能的总和而是指导如何赢得这场竞争的关键政策.战略不是一项单独的决定或行动而是一系列相互关联相互增强的资源分配决定和执行行动.一家公司的战略建立在"独特的竞争力"之上包括了企业的扩张方式对企业的优点和弱点的平衡考虑以及运用自身的合作和竞争优势以发展新市场和新产品.在六十年代发展出的基本概念基础之上七十年代的战略管理继续发展并运用到了实践领域.专门从事战略的咨询公司的快速扩张专业战略人员的出现和战略相关刊物的出现标志着七十年代的发展.三种主要的力量推动了战略管理在七十年代的繁荣:(1)七十年代环境的不确定性和危险性让人们开始重新认识"计划"并开始寻求方法适应和利用这种不确定性;(2)第二种重要的力量是基于新的分析方法和概念的战略咨询实践的不断扩张和发展.如波士顿咨询集团的先锋性发展出的"经验曲线"和"增长-份额矩阵";(3)第三种力量是多样化投资公司的成熟并逐渐占据主导地位.最高管理者开始将公司视为不同业务单元的投资组合而他们主要的任务就是在不同业务单元间分配资本.直到七十年代理论战略研究虽然依然主要基于实际案例一些计量经济学的多元统计方法开始运用.与此同时三种不同的潮流逐渐改变了这一领域的面貌.在哈佛商学院bruce scott的学生在chandler先锋性工作(1962)的基础上开创了多样化和公司绩效的研究;在哈佛经济学院richard caves 的学生开始修正传统的mason和bain对结构和绩效的研究以包括产业中不同地位的企业从而开创了产业中"战略集团(strategy group)"的研究;而在普度大学dan schendel和他的学生开始了对组织资源选择和企业绩效间经验性的研究这一工作首次证明了产业中结构差异性的存在并首次为哈佛商学院的"战略集团"研究提供了强有力的证据.这些研究方法的转变最终使案例研究和简单的假设论证不再具有开创性七十年代的这些工作激发了八十年代的研究工作是新一代的研究工作者需要面对全新方式研究和理论需要.八十年代中变革步伐进一步加速经济学思考方式走向了战略管理研究的中心地位.这一时期中经济学最具影响的贡献无疑就是porter的竞争战略理论(1980)短时期内porter的灵活性壁垒工业分析和一般战略被广为接受并运用于教学咨询和许多项目研究之中.porter的战略方法仍建立在研究市场力量的"结构-绩效"的传统之上另一种传统观点是芝加哥大学的将产业结构视为效率产出的反应而不是市场力量的结构.在这种传统之下新的思潮开始关注独特的难于模仿的资源优势对于持续绩效的重要作用这种方法最终被称为企业战略的"基于资源的观点(resource-based view)".在这十年中战略学者大量的提高了经济学理论和他们自身经验的使用.如金融学方法交易成本观点寻租和信息不完全理论代理理论新博弈论等.这三十年的发展中在社会学的基础学科(特别是经济学)和企业管理的实际问题开始发生联系对这种复杂现象的理论解释也正是这期特刊的主要目的之一.经济学引入战略管理领域的原因作者认为主要有五个方面的原因使经济学和战略管理产生融合:(1)解释绩效数据的需要;(2)经验曲线;(3)持久利润的问题;(4)经济学不断变化的研究领域;(5)商学院中变化的研究氛围.(1)解释绩效数据的需要七十年代战略研究者开始系统的关注组织绩效(特别是投资回报)试图将它们和管理行动联系起来为这一问题寻找充分的答案是引发战略研究引入经济学思考的一个主要力量.市场份额的影响为这一问题提供了很好的解释市场份额和收益率之间联系的研究首先开始与产业组织经济学(io economics)这种关系被认为是"市场力量"存在的证据.在战略管理领域市场份额由bcg提出并由pims(profit impact of market strategy)研究大力推动他们将市场份额视为一种出于战略目的可以进行买卖的资产.1979年rumelt和wensley开始pims数据库估算获取市场份额的成本但却发现几乎不存在这样的成本市场份额和收益率的变化是正相关的.最后他们认为市场份额的变化是有价值的但是由许多随机因素(如运气良好的管理)对份额和收益的关系产生影响.市场份额方面的研究激发了对有关份额和收益联系的竞争均衡的更多研究工作.竞争均衡假设排除了各企业间财富的不同是由于各自自由战略选择的结果而将之归因于不可控制和预测的现象的影响这种假设经常不考虑革新变化和差异性的存在.新古典经济学的均衡意味着利润是处处为零的.而纳什均衡的基本思想是参与者因各自面对的不确定性不对称信息和不均等资源而各自采取行动这就产生了广阔的利润空间.(2)经验曲线七十年代bcg发展了长期以来被忽视的经验曲线.经验曲线的观点认为累计产量而非生产规模是生产成本的重要推动力量.这一思想推动着众多管理者以当前利润的代价换取市场优势和增长.经验曲线首次出现在战略过程和竞争行动及市场产出之间考量范围之内在传统的企业受环境影响的观点下经验曲线将注意力集中于竞争对手的行动.这种以经验为基础的竞争逻辑方式不是来自于经济学领域而是在战略管理领域发展起来后再推向经济学.(3)持久利润的问题在标准新古典经济学中竞争会侵蚀成功公司的额外利润使每一家企业只能维持成本.而实践研究显示今天能做得很好良好的效益是可以持续的.为寻找企业持久的成功的理论解释自然会考虑到经济学理论中寻求.最显见的理论就是产业组织经济学中各种有关非正常回报的理论.传统进入壁垒理论产生出规模经济和沉没成本的概念;灵活性壁垒理论强调了在产业中专业化投资的学习和首先进入优势的重要形.芝加哥学派的观点支持高额利润是特殊高质量资源的回报的观点.创新经济学关注schumpeterian竞争知识产权和技术转移成本等.战略管理中出现了大量的工作试图将这些观点综合到一个一致的框架之内最显著的成果无疑来自于porter.他在mason和bain的"结构-绩效"观点的基础上将视角从产业层面移向企业层面分析了企业如何通过竞争战略在行业内获得持续竞争优势.第二种努力是战略的资源观点.这种观点将注意力从制造市场壁垒转向竞争从要素市场障碍转向资源流动将非正常的回报定义为与独特资源结合产生的租金而不是市场的力量.战略管理的内容包括识别资源的存在和质量并建立市场位置和契约安排以最有效的利用维持和扩展这些资源.ghemawat提出了一种围绕"委托"的新的解释认为战略和绩效的持续都来源于长期的与行动相联系的机制安排.(4)经济学不断变化的研究领域企业的新古典经济学模型如一架在没有秘密没有摩擦和不确定性的世界中平稳运行的机器而近三十年(特别是近二十年)来至少有五种力量在破坏这种平稳他们是不确定性信息不对称有限理性机会主义和资产专用性.这些现象不同方式的结合促生了经济学一些新的内容.①交易成本经济学交易成本经济学结合了有限理性资产专用性和机会主义这一经济学分支对战略管理具有最大的吸引力.这一领域建立在科斯关于企业边界和内部组织的探讨之上以williamson为主的经济学家建立了分析作为指导市场活动的制度安排的市场和商业企业边界的框架.这一框架比较了市场和企业的相对效率让经济学家可以比较不同组织形式的有效性(之前都只关注于寻找对于复杂商业组织的垄断解释).除了这一比较它还开始考察促使特别决定和行动产生的内部结构和规则.在战略管理之中交易成本是经济学思考战略与组织理论的交界点.因其关注制度细节而非精确计算而比其他产业经济学分支引起更多非经济学家的关注.八十年代有大量的研究工作运用交易成本经济学考察组织结构.②代理理论代理理论综合了机会主义和信息不对称的思考关注激励协议和决定权的分配.它与交易成本理论的不同之处在于后者表明没有统一的合约能涵盖所有的可能性代理理论不做出假设而是寻求每一种组织形式最佳的合约形式.代理理论发展出两个分支委托-代理理论主要关注委托人和其雇员或代理间最优激励和约的设计问题;公司控制理论则较少技术性更多关注于整③博弈论和新产业组织经济学博弈论产生后很少进行实际方面的发展直到七十年代后期spence的工作激发了现代经济学家的兴趣.现代的博弈论对于理性行为的本质提出了深刻的质疑.在许多信息不对称的非合作博弈情况下那些在信息均衡情况下追求效用最大的个人是无法达到均衡的.目前现代博弈论还不能直接对战略管理产生影响但对于未来的有关理性行为的经济学却会有很大的影响.博弈论运用于产业组织经济学产生两个引起战略管理关注的主题即委托代理战略和声誉问题.④经济学生物学的竞争和经济学的竞争是有类似之处的在nelson和winter建立的理论框架中企业主要通过改进和变革的努力进行竞争.他们的主要观点是企业的能力基于那些无法明确理解的惯例但却可以通过重复和实践来发展和优化.(5)商学院中变化的研究氛围在过去三十年中商学院的角色发生了深远的变化从收集和传播最新的实践知识发展为对与复杂商业企业管理活动相联系的现象的理论理解的发展和交流.这种转变的发生有许多原因:福特基金和卡奈基基金的推动;大学教育运用和推动的实践教学;顾问公司的兴起以及和经济学系关系的亲近.没有这些原因这一领域今日的面目会十分不同战略管理中涉及的经济学也会少了很多.五十年代末产生了许多对当时商学院的批评认为商学院应该溶入更多的数学经济学社会学和心理学这样的基础学科商学院出现了越来越强的以基础科学为主的发展趋势.随着mba教育的发展出现的大量如营销财务金融等特殊领域的教师需求.越来越多的大公司开始自创管理发展程序以填补日增的mba理论教育和实践的空缺.在许多领域咨询公司代替了商学院行使管理实践智囊的地位.令最初那些对商学院批评者没有想到的是对于经验主义的关注越来越少对理论结构的内部逻辑的关注使经济学受到高度重视而描绘真实的制度却受到忽视.这种局面到八十年代才被打破很大程度是归功于porter战略方法的成功.形成了两种流派以经济学为基础的战略管理和关注行为的战略管理究竟那种更好能占据统治地位还不明确.在作者看来这两者间应该取得一种平衡太偏向于理论会破坏研究教学和管理实践间的平衡太偏向于管理过程则会失去理论架构.在作者看来需要一种理论与实用之间的平衡.未来经济学与战略管理之间的联系毫无疑问是经济学中的平衡假设和针对竞争对手的相应策略而不是无形的环境令战略管理中产生了如此多的新框架新观点.这种经济学的广泛运用也正是正统经济学衰弱的结果而这种正统经济学的衰弱也部分是由于对于战略管理的研究的结果.经济学主要关注对资源分配和协调的市场表现与之相对战略管理是关注企业内部的这种分配和协调.战略管理正大量运用经济学观点和模型如果这种趋势继续下去竞争战略会有一个独立的未来或者仅仅成为应用经济学的一个分支.作者认为竞争战略仍然会是战略管理的一个部分而它与经济学的联系会使它在未来不断发展出新的形式.原因主要有以下几个方面:(1)战略并不是应用微观经济学发展和贯彻公司战略并不是"应用"经济学或其他任何学科.不可否认经济分析对战略的作用但人口统计学法学社会学和对政治趋势的理解同样发挥重要的作用.部分的竞争战略可以通过已知的有关竞争行为的经济理论和模型加以验证但是大多数的企业战略同样包含建立在关于顾客供应商雇员和竞争者的理解感觉和信念基础之上的判断的关于组织行为政治表现技术因素和发展趋势的假设.竞争战略是综合性的不仅仅是因为它综合了各种商业功能而且是因为这种战略的创造和升值需要建立在一个广泛知识基础之上的观察和判断.(2)经济学家无法了解商业运作经济学有一种强烈抵制无序性的趋势而战略管理受其本性限制是注重实效的.主流经济学已经变成一种精确的科学无法学习足够的商业运作和管理知识以挑战战略管理的地位.因此也许向一个多面手传授经济学知识比向经济学家传授商业知识容易得多.(3)微观经济学是抽象的拼贴新的微观经济学的局限在于它是解释而不是预测它结合一系列模型每种模型捕捉和阐释一种特定的现象最终新的微观经济学仅仅成为一种解释别处获得的知识的正式语言camerer称之为"拼贴问题".微观经济学依旧在发展将融合更多的现存框架但仍需面对很多的问题如判断和决策制定之间的持续的偏离管理者间的差异不仅由于信息渠道的差别还在于他们的信念和对于其面对机制理解的差别企业没有绝对完全的选择而是在建立在对其自身能力和面对机会的有限理解之上.(4)战略随时间的变化这些变化部分来源于技术法律社会和政治变迁以及来自于知识的教育和研究而微观经济学很少或没有考虑到这种变化.昨日的商业战略也许就是今日战略管理研究的主题而经济学只是对半个世纪前的现象进行理论化研究.(5)竞争优势是内在的理论和经验研究都显示出优势来源于组织能力而不是市场地位或战术这正显示出了当今经济学研究的最薄弱的地方——企业内部.随着交易成本经济学和代理理论逐渐发展成为"组织科学"我们可以期待这一领域的新的和重要的研究成果的出现对于组织经济学视角也许会发挥持续的作用但仍是整体一部分.。

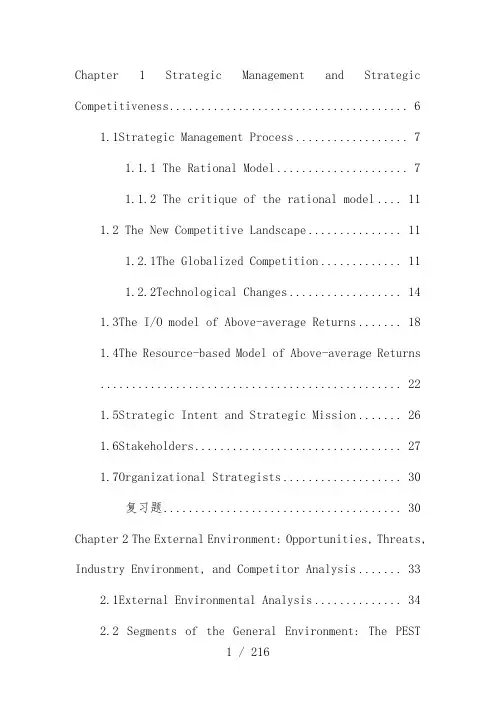

Chapter 1 Strategic Management and Strategic Competitiveness (6)1.1Strategic Management Process (7)1.1.1 The Rational Model (7)1.1.2 The critique of the rational model (11)1.2 The New Competitive Landscape (11)1.2.1The Globalized Competition (11)1.2.2Technological Changes (14)1.3The I/O model of Above-average Returns (18)1.4The Resource-based Model of Above-average Returns (22)1.5Strategic Intent and Strategic Mission (26)1.6Stakeholders (27)1.7Organizational Strategists (30)复习题 (30)Chapter 2 The External Environment: Opportunities, Threats, Industry Environment, and Competitor Analysis (33)2.1External Environmental Analysis (34)2.2 Segments of the General Environment: The PESTAnalysis (37)2.3 Industry Environment Analysis: The Five ForcesModel (39)2.4 Strategic Group Analysis (50)2.5 Competitor Analysis (51)复习题 (52)Chapter 3 The Internal Environment: Resources, Capabilities, and Core Competencies (55)3.1 The importance of Internal Analysis (56)3.2 Resources, Capabilities, and Core Competencies (59)3.2.1 Resources (59)3.2.2 Capabilities (62)3.2.3 Core Competencies (64)3.3 Steps in a Resource-based Strategic Analysis 663.4 Value Chain Analysis (75)复习题 (77)Chapter 4 Business-Level Strategy (78)4.1 Customers: Who, What, and How (79)4.1.1 Who: Determining the customers to serve 804.1.2 What: Determining the customer needs tosatisfy (81)4.1.3 How: Determining core competenciesnecessary to satisfy customers’ needs (82)4.2 Types of Business-level Strategy (82)4.3 Cost Leadership Strategy (84)4.4 Differentiation Strategy (89)4.5 Focus Strategies (94)4.6 Integrated Low-Cost/Differentiation Strategy 96复习题 (100)Chapter 5 Corporate-Level Strategy (103)5.1 Corporate-level Strategy and Levels ofDiversification (104)5.2 Reasons for Diversification (107)5.3 Techniques for Analyzing Diversified Companies’Portfolios (108)复习题 (111)Chapter 6 Acquisition and Restructuring Strategies . 1136.1 Reasons for Acquisitions and Problems in AchievingSuccess (113)6.2 Attributes of Successful Acquisitions (115)6.3 Restructuring (116)复习题 (117)Chapter 7 International Strategy (121)7.1 Opportunities and Outcomes of InternationalStrategy (122)7.2 International Business-level Strategy (127)复习题 (130)Chapter 8 Cooperative Strategy (133)8.1Types of and Reasons for Cooperative Strategies (134)8.2Business-level and Corporate-level CooperativeStrategies (137)8.2.1 Business-Level Cooperative Strategies 1378.2.2 Corporate-Level Cooperative Strategies 1398.3Network Strategies (141)8.4Competitive Risks with Cooperative Strategies 143Chapter 9 Corporate Governance (149)9.1 Corporate Governance Mechanisms (150)9.2 Separation of Ownership and Managerial Control (154)9.3 Five Governance Mechanisms (160)9.3.1 Ownership Concentration (160)9.3.2 Board of Directors (162)9.3.3 Executive Compensation (164)9.3.4 The Multidivisional Structure (167)9.3.5 Market for Corporate Control (168)复习题 (169)Chapter 10 Organizational Structure and Controls (172)10.1 Evolutionary Patterns of Strategy andOrganizational Structure (172)10.1.1 Simple Structure (175)10.1.2 Functional Structure (177)10.1.3 Multidivisional Structure (183)10.2 Implementing International Strategies:Organizational Structure and Control (195)10.2.1 Using the Worldwide Geographic AreaStructure to Implement the Multi-domesticStrategy (195)10.2.2 Using the Worldwide Product DivisionalStructure to Implement the Global Strategy . 198复习题 (202)Chapter 11 Corporate Entrepreneurship and Innovation 20211.1 Innovation and Corporate Entrepreneurship . 20311.2Internal Corporate Venturing (208)复习题 (216)Chapter 1 Strategic Management and Strategic CompetitivenessLearning ObjectivesAfter reading this chapter, you should be able to ·Defining strategic competitiveness, competitive advantage, and above-average returns.·Discuss the challenge of strategic management.·Describe the new competitive landscape and how it is beingshaped by global and technological changes.·Use the industrial organization(I/O) model to explain how firms can earn above-average returns.·Use the resource-based model to explain how firms can earn above-average returns.·Describe strategic intent and strategic mission and discuss their value to the strategic management process.·Define stakeholders and describe the three primary stakeholder groups’ ability to influence organizations.·Describe the work of strategists.·Explain the strategic management process.1.1Strategic Management Process1.1.1 The Rational ModelStrategic competitiveness(战略竞争力) is achieved when a firm successfully formulates and implements a value-creating strategy. When a firm implements a value-creating strategy of which other companies are unable to duplicate the benefits or find it too costly to imitate, this firm has a sustained or sustainablecompetitive advantage(持续的或可持续的竞争优势). The speed with which competitors are able to acquire the skills needed to duplicate the benefits of a firm’s value-creating strategy determines how long a competitive advantage will last. Understanding how to exploit its competitive advantage is necessary for a firm to earn above-average returns. Above-average returns(高于平均的或超额回报) are returns in excess of what an investor expects to earn from other investment with a similar amount of risk.Risk(风险) is an investor’s uncertainty about the economic gains or losses that will result from a particular investment. Firms that are without a competitive advantage or that are not competing in an attractive industry earn, at best, only average returns. Average returns(平均回报)are returns equal to those an investor expects to earn from other investments with a similar amount of risk. In the long run, an inability to earn at least average returns results in failure. Failure occurs because investors will choose to invest in firms that earn at least average returns andwill withdraw their investments from firms that earn less. Dynamic in nature, the strategic management process (战略治理过程)is the full set of commitments, decisions, and actions required for a firm to achieve strategic competitiveness and earn above-average returns. It is used to match the conditions of an ever-changing market and competitive structure with a firm’s continuously evolving resources, capabilities, and competencies.Figure 1.1 The Strategic Management ProcessNotes: the letter S in SWOT denotes strengths, Wweaknesses,O opportunities, T threats.1.1.2 The critique of the rational model1.Setting objectives is the cornerstone of strategic planning. But, incentive un-compatibility(激励不相容)usually leads to inconsistency between objectives that the firm has stated and objectives that the managers are actually pursuing.2.The predictability of the environment is the core assumption of strategic planning. But, irreversibility and uncertainty(不确定性)usually lead to the unpredictability of the environment.3.Another assumption of strategic planning is that strategists are rational. Virtually,stra tegists’ rationality is bounded(战略家的理性是有限的)and strategic formulation reflects the internal politics of the organization.1.2 The New Competitive Landscape1.2.1The Globalized CompetitionThe fundamental nature of competition in many of theworld’s industries is changing. The pace of this change is relentless and is increasing. Even determining the boundaries of an industry or a firm(行业或企业的边界) has become challenging. Consider, for example, how advances in interactive computer networks and telecommunications have blurred the definition of the “television”industry. Conventional sources of competitive advantage(传统的竞争优势的源泉) such as economies of scale(规模经济) and huge advertising budgets(巨额广告预算) are not as effective in the new competitive landscape. Moreover, the traditional managerial mind-set(传统的治理者心态) cannot lead a firm to strategic competitiveness in the new competitive landscape. In its place, managers must adopt a new mind-set ——one that values flexibility, speed, innovation, integration, and the challenges that evolve from constantly changing conditions(看重灵活性、速度、创新、整合和从不断变化的环境中产生的挑战的心态). Strategic flexibility(战略的敏捷性) is a set of capabilities firms use to respond to various demands and opportunities thatare a part of dynamic and uncertain competitive environments. Such flexibility means that a firm can match quickly its resources with an environmental opportunity(快速地使其资源与环境的机遇匹配).A global economy(全球经济) is one in which goods, services, people, and ideas move freely across geographic borders. It significantly expands and complicates a firm’s competitive environment. To achieve strategic competitiveness in the global economy, a firm must view the world as its marketplace.In globalized markets(全球化的市场) and industries, financial capital might be obtained in one national market and used to buy raw materials in another one. Manufacturing equipment bought from a third national market can be used to produce products that are sold in a fourth market. Thus, globalization increases the range of opportunities for firms competing in the new competitive landscape.The internationalization of markets and industries makes it increasingly difficult to think of some firms asdomestic companies(本国公司).Global competition has increased performance standards(绩效标准) in many dimensions, including those of quality, cost, productivity, production introduction time, and smooth, flowing operations.The development of newly industrialized countries(新兴工业化国家) is changing the global competitive landscape and significantly increasing competition in global markets. The economic development of Asian countries outside of Japan is increasing the significance of Asian markets. In the new competitive landscape, firms are challenged to develop the optimal level of globalization(最优的全球化水平).1.2.2Technological ChangesThere are three categories of technological trends and conditions through which technology is significantly altering the nature of competition(竞争的性质).·Increasing rate of technological change and diffusion(不断上升的技术变迁率和扩散率)Both the rate of technology changes and the speed at which new technologies become available and are used have increased substantially over the last 20 years. Perpetual innovation(持续的创新) is a term used to describe how rapidly and consistently new, information-intensive technologies (信息密集的技术)replace older ones. The shorter product life cycles(产品生命周期) resulting from these rapid diffusions of new technologies place a competitive premium on being able to quickly introduce new goods and services into the marketplace. In fact, when products become somewhat indistinguishable because of the widespread and rapid diffusion of technologies, speed to market(产品进入市场的速度) may be the only source of competitive advantage. Some evidence suggests that after only 12 to 18 months, companies likely will have gathered information about their competitors’R&D and product decisions. Often, merely a few weeks pass before a new American-made product introduced in U.S. markets is copied, manufactured, and shipped to the United States by one ormore companies in Asia.Today’s rate of technological diffusion stifles the protection firms possessed previously through their patents(专利). Patents are now thought by many to be an effective way of protecting proprietary technology(专利技术) primarily in the pharmaceutical and chemical industries only. Many firms competing in the electronics industry often do not apply for patents to prevent competitors from gaining access to the technological knowledge included in the patent application(包含在专利申请中的技术知识).·The Information Age(信息时代)Dramatic changes in information technology have occurred in recent years. Personal computers, cellular phones, artificial intelligence(人工智能), virtual reality(虚拟现实), and massive databases are a few examples of how information is used differently as a result of technological developments. Someone believes that electronic mail (E-mail) systems are the firstmanifestation of a revolution in the flow and management of information in companies throughout the world. An important outcome of these changes is that the ability to access and effectively use information has become an important source of competitive advantage in virtually all industries.·Increasing Knowledge Intensity(不断提高的知识密度) Knowledge is the basis of technology. In the new competitive landscape, knowledge is a critical organizational resource and is increasingly a valuable source of competitive advantage. Because of this, many companies now strive to transmute the accumulated knowledge of individual employees into a corporate asset(把个体性职员积存起来的知识转变成公司的资产).Figure 1.2 The New Competitive Landscape1.3The I/O model of Above-average ReturnsFrom the 1960s through the 1980s, the external environment was thought to be the primary determinants of strategies firms selected. The industrial organization model explains the dominant influence of the external environment on firms’ strategic actions. This model specifies that the industry chosen in which to compete has a stronger influence on a firm’s performance than do the choices managers make inside their organizations. Firm performance is believed to be predicted primarily by a range of an industry’s properties(行业属性), including economies of scale(规模经济),barriers to entry(进入壁垒), diversification(产品多元化), product differentiation(产品差异), and the degree of concentration(行业集中度). The I/O model has four underlying assumptions. First, the external environment is assumed to impose pressures and constraints that determine the strategies that would result in above-average returns. Second, most firms competing within a particular industry are assumed to control similar strategically relevant resources and pursue similar strategies. Third, it is assumed that resources used to implement strategies are highly mobile across firms. Because of resource mobility, any resource differences that might develop between firms will be short lived. Fourth, organizational decision makers are assumed to be rational and committed to acting in the firm’s best interests as shown by their profit maximizing behavior(利润最大化行为).The I/O model challenges firms to locate the most attractive industry in which to compete. Competitiveness generally can be increased only when firms find the industry with the highest profit potential(具有最高的利润潜能的行业) and learn how to use their resources to implement the strategy required by the structural characteristics in that industry(行业的结构特征所要求的战略). The five forces model of competition(竞争的五力模型) is an analytical tool used to help firms with this task. This model suggests that an industry’s potential profitability(行业的潜在的赢利性) is a function of interactions among five forces. A firm can use this model to understand an industry’s profit potential and the strategy that should be implemented to establish a defensible competitive position(可防卫的竞争位置). Typically, this model suggests that firms can earn above-average returns by implementing a cost leadership strategy(成本领先战略) or a differentiation strategy(差异化战略).Figure 1.3 The I/O Model of Superior Returns1.4The Resource-based Model of Above-average Returns The resource-based model (基于资源的模型) assumes that each organization is a bundle of unique resources and capabilities that provides the basis for its strategy and is the primary source of its returns. According to this model, differences in firms ’ performances across time are driven primarily by organization ’s unique resources and capabilities rather than by an industry ’s structural characteristics (企业绩效的跨时差异要紧是由组织的独特的资源的能力而非行业的特征驱动的).This model also assumes that over time, firms acquire different resources and develop unique capabilities. As such, all firms competing within a particular industry may not possess the same strategically relevant resources and capabilities. Another assumption of this model is that resources may not be highly mobile across firms. The differencesinresources(资源上的差异) form the basis of competitive advantage.Resources (资源)are inputs into a firm’s production process, such as capital equipment, the skills of individual employees, patents, finance, and talented managers. In general, a firm’s resources can be classified into three categories: physical, human, and organizational capital(实物资本、人力资本和组织资本). Individual resources alone may not yield a competitive advantage. In general, it is through the combination and integration of sets of resources that competitive advantages are formed(竞争优势是通过组合和整合资源集形成的). A capability(能力) is the capacity for a set of resources to integratively perform a task or an activity. Through continued use, capabilities become stronger and more difficulty for competitors to understand and imitate(通过持续的使用,能力变得更强和更加难以被对手理解和模仿). As a source of competitive advantage, a resource should be valuable, rare, costly to imitate, and non-substitutable.Resources are valuable(有战略价值的) when they allow a firm to exploit opportunities and or/neutralize threats in its external environment; they are rare(稀有的) when possessed by few, if any, current and potential competitors; they are costly to imitate(模仿代价高昂的) when other firms either cannot obtain them or at a cost disadvantage to obtain them compared to the firm that already possesses them; they are non-substitutable(不可替代的) when they have no structural equivalents.The resource-based model of competitive advantage suggests that a firm’s unique resources and capabilities provide the basis for a strategy. The strategy chosen should allow the firm to best exploit its core competencies(最佳地利用其核心竞争力) relative to opportunities in the external environment. Core competencies(核心竞争力) are resources and capabilities that serve as a source of competitive advantage.Figure 1.4 The Resource-based Model of Superior Returns1.5Strategic Intent and Strategic MissionStrategic intent(战略意图) is the leveraging of a firm’s internal resources, capabilities, and core competencies to accomplish the firm’s goals in the competitive environment. Strategic intent reflects what a firm is capable of doing as a result of its core competencies and the unique ways they can be used to exploit a competitive advantage. The following examples are expression of strategic intent.“To become a high-performance multinational energy company——not the biggest, but the best.”“Its our strategic intent that customers worldwide view us as their most valued pharmaceutical partner.”“To be the top performer in everything.”“To catch up with and beat Caterpillar.”Strategic mission(战略使命) is a statement of a firm’s unique purpose and the scope of its operations in productand market terms. An effective strategic mission establishes a firm’s individuality and is exciting, inspiring, and relevant to all stakeholders(利害相关者). Together, strategic intent and strategic mission yield the insights required to formulate and implement the firm’s strategies(制定和执行企业战略所要求的洞见). When a firm is strategically competitive and earning above-average returns, it has the capacity to satisfy its stakeholders’interests(满足其利害相关者的利益).1.6StakeholdersStakeholders(企业的利害相关者) are the individuals and groups who can affect and are affected by the strategic outcomes achieved and who have enforceable claims on a firm’s performance(对企业绩效的可实施的要求权). Claims against an organization’s performance are enforced through a stakeholder’s ability to withhold participation essential to a firm’s survival, competitiveness, and profitability. Stakeholders continue to support an organization when its performance meets or exceeds theirexpectations. However, every stakeholder does not have the same level of influence. The more critical and valued a stakeholder’s participation is, the greater a firm’s dependency on it. Greater dependence, in turn, results in more potential influence for the stakeholder over a firm’s commitments, decisions, and actions.The stakeholders involved with a firm’s operations can be separated into three groups. Each of these stakeholder groups expects those making strategic decisions in a firm to provide the leadership through which their valued objectives will be accomplished(提供有助于实现他们看重的目标的领导). But these groups’ objectives often differ from one another, sometimes placing managers in situations where trade-offs have to be made(有时置经理于必须作出二难选择的情形中). It is important that those responsible for managing stakeholder relationships in a country outside their native land use a global mind-set. A global mind-set(全球心态) is the capacity to appreciate the beliefs, values, behaviors, and business practices ofindividuals and organizations from a variety of regions and cultures.The firm’s stakeholders and their interests Capital market stakeholders Goals and Objectives •Shareholders dividends, profit rate•Creditors security of loan Product market stakeholders:•Customers perceived value of the good or the service•Suppliers profitable sales, paymentfor goods, long-termrelationship•Host communities pollution, employment, aids, taxinside-organization stakeholders•Employees monetary and non-monetary interests•Managers monetary andnon-monetary interests1.7Organizational StrategistsSmall organizations may have a single strategist. In many cases, this person owns the firm and is deeply involved with its daily operations. At the other extreme, large, diversified firms(多元化的企业) have many top-level managers. In addition to the CEO and other top-level officials(e.g., chief operating officer and chief financial officer操作总监和财务总监), they have managers who are responsible for the performance of individual business units(个体性业务单位).Typically, stakeholders have high expectations of top-level managers, particularly the CEO. Some believe that every organizational failure is actually a failure of those who hold the final responsibility for the quality and effectiveness of a firm’s decisions and actions.复习题1.解释下列概念:战略竞争力、高于平均的回报、平均回报、风险、战略治理过程、激励不相容、有限理性、战略的敏捷性、资源、能力、核心竞争力、战略意图、战略使命、企业的利害相关者2. 战略竞争力概念中所隐含的前提性假设是什么?企业猎取可持续的战略竞争力的关键或曰前提是什么?什么决定着企业的战略竞争力可维持的时刻的长短?3.战略治理过程的理性模型有何不足?什么缘故各国战略治理教材仍把它作为要紧内容进行讲授?4.传统的企业竞争优势的源泉是什么?在新竞争情景中什么更重要?5.什么缘故讲市场和行业的国际化使要把某些公司看成本国公司越来越困难?6.什么缘故讲在技术快速扩散和传播的情况下,产品进入市场的速度或许是竞争优势的唯一源泉?7.什么缘故药品行业和化学行业的企业比较情愿申请专利,而电子行业的企业一般不情愿申请专利?8.什么缘故讲猎取和有效利用信息的能力已成为所有行业中的竞争优势的重要源泉?9.试述塑造新竞争情景的要紧力量。

企业战略管理外文翻译文献(文档含中英文对照即英文原文和中文翻译)企业战略管理与战略管理会计探析中英文翻译Strategic management and strategic management accounting literature translation in both Chinese and English[论文关键词]战略管理会计企业战略内容方法[key words] strategic management accounting strategy content method [论文摘要]战略管理会计是当今企业经营环境更加复杂多变、全球性市场竞争空前广泛激烈的情况下,为满足现代企业实施战略管理的特定信息需要而建立的新的管理会计信息系统。

本文从战略管理会计的内涵、目标及特点阐述到战略管理会计的主要内容和方法对战略管理会计进行论述。

/ paper pick to strategic management accounting is the enterprise management environment is more complex, an unprecedented high competitive global market, to meet the modern enterprise to implement strategic management specific information need and establish a new management accounting information system. This article from connotation, goals and characteristics of strategic management accounting to the main content of strategic management accounting and methods of strategic management accounting in this paper.一、从企业战略的高度来看战略管理会计One, from the perspective of the height of business strategy, strategic management accounting1981年,英国学者西蒙斯最早将管理会计与战略管理相结合,提出战略管理会计之说。

战略管理双语资料(共71页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--Chapter 1 Strateg ic Ma n a gem e nt a nd Str a tegic Com pe titiven e ss ................... 错误!未定义书签。

Management Process .............................................................................. 错误!未定义书签。

The Rational Model ....................................................................... 错误!未定义书签。

The critique of the rational model .................................................. 错误!未定义书签。

The New Competitive Landscape ........................................................... 错误!未定义书签。

Globalized Competition ................................................................. 错误!未定义书签。

Changes .......................................................................................... 错误!未定义书签。

I/O model of Above-average Returns ..................................................... 错误!未定义书签。