货银第一次纸质练习(答案)

- 格式:docx

- 大小:19.96 KB

- 文档页数:6

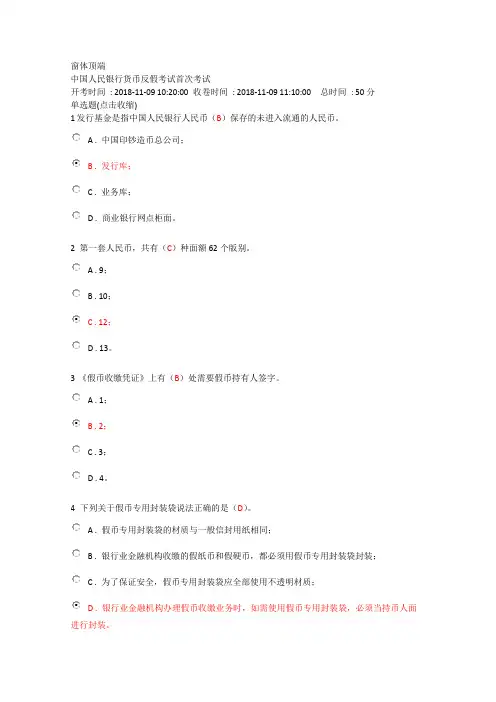

窗体顶端中国人民银行货币反假考试首次考试开考时间: 2018-11-09 10:20:00 收卷时间: 2018-11-09 11:10:00 总时间: 50分单选题(点击收缩)1 发行基金是指中国人民银行人民币(B)保存的未进入流通的人民币。

A . 中国印钞造币总公司;B . 发行库;C . 业务库;D . 商业银行网点柜面。

2 第一套人民币,共有(C)种面额62个版别。

A . 9;B . 10;C . 12;D . 13。

3 《假币收缴凭证》上有(B)处需要假币持有人签字。

A . 1;B . 2;C . 3;D . 4。

4 下列关于假币专用封装袋说法正确的是(D)。

A . 假币专用封装袋的材质与一般信封用纸相同;B . 银行业金融机构收缴的假纸币和假硬币,都必须用假币专用封装袋封装;C . 为了保证安全,假币专用封装袋应全部使用不透明材质;D . 银行业金融机构办理假币收缴业务时,如需使用假币专用封装袋,必须当持币人面进行封装。

5 “假币”印章篆刻内容为(C)。

A . “假币”字样,所在地省、自治区、直辖市简称和日期;B . “假币”字样,银行行号标识代码和日期;C . “假币”字样,所在地省、自治区、直辖市简称和银行行号标识代码;D . 所在地省、自治区、直辖市简称,银行行号标识代码和日期。

6 中国人民银行分支机构和中国人民银行授权的鉴定机构应当自收到鉴定申请之日起(C)个工作日内,通知收缴单位报送需要鉴定的货币。

A . 4;B . 5;C . 2;D . 3。

7 假币持有人如对被收缴的货币真伪有异议,可向(A )申请鉴定。

A . 中国人民银行;B . 公安机关;C . 中国印钞造币总公司。

8 根据《人民币鉴别仪通用技术条件》(GB_16999-2010),B级和C级点验钞机(B)定为鉴别一次。

A . 纸币任意一面鉴别一次;B . 纸币正反两面各鉴别一次;C . 按规定朝向鉴别一次。

9 有全国性分支机构的银行从2013年起,至多用(A)时间实现地市银行网点付出现金的全额清分。

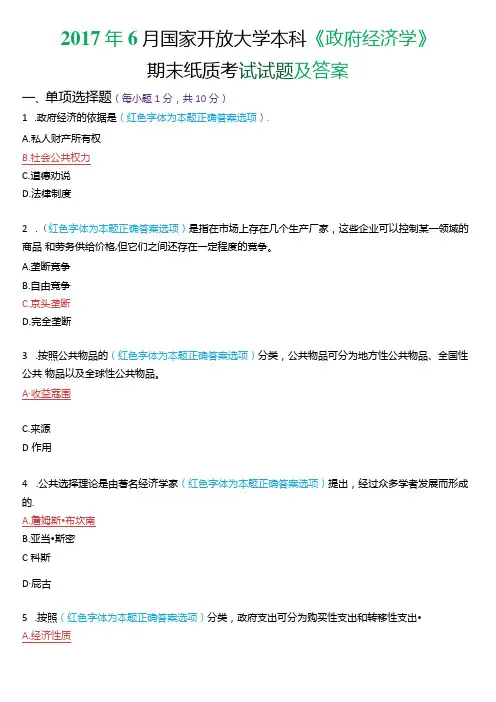

2017年6月国家开放大学本科《政府经济学》期末纸质考试试题及答案一、单项选择题(每小题1分,共10分)1.政府经济的依据是(红色字体为本题正确答案选项).A.私人财产所有权B.社会公共权力C.道德劝说D.法律制度2.(红色字体为本题正确答案选项)是指在市场上存在几个生产厂家,这些企业可以控制某一领域的商品和劳务供给价格,但它们之间还存在一定程度的竞争。

A.垄断竞争B.自由竞争C.京头垄断D.完全垄断3.按照公共物品的(红色字体为本题正确答案选项)分类,公共物品可分为地方性公共物品、全国性公共物品以及全球性公共物品。

A∙收益蔻围C.来源D作用4.公共选择理论是由著名经济学家(红色字体为本题正确答案选项)提出,经过众多学者发展而形成的.A.詹姆斯•布坎南B.亚当•斯密C科斯D∙屁古5.按照(红色字体为本题正确答案选项)分类,政府支出可分为购买性支出和转移性支出•A.经济性质B.政府职能C.预算管理体制D.预算编制方法6.(红色字体为本题正确答案选项)是指各级政府及其所属部门根据法律、法规规定,为支持特定公共基础设施建设和公共事业发展,向公民、法人和其他组织无偿征收的具有专项用途的财政资金.A.罚没收入B.政府性基金G债务收入D.国有资产收入7.我国现行个人所得税中的工资薪金所得采用(红色字体为本迤正确答案选项).A.单一比例税率8.差别比例税率C.全额累进税率D.超额累进税率8.彩票发行的审批权集中在(红色字体为本题正确答案选项).A国家体育总局B.民政部Ql务院D.财政部9根据(红色字体为本题正确答案选项)的不同,债务可以划分为公债与私债.A债务人B.债权人C.资金来源D.债务币种10.按照(红色字体为本题正确答案选项)分类,政府预算可以分为单式预算与复式预算.A.预算组织形式B.预算编制方法C∙预算编制的政策重点D.预算收支平衡的状况二、不定项选择题(每小题2分,共10分)11.政府经济活动的目的,是满足(红色字体为本题正确答案选项)需要.A.部分企业B.单独个人C社会公共D.政府部门12.下列项目中属于政府失灵表现的是(红色字体为本题正确答案选项).A政府决策信息的有限性B.市场及主体行为控制的有限性C政府机构控制能力的有限性D政府在决策过程中与立法机构协调的有限性13.下列项目中属于全国性公共物品的是(红色字体为本题正确答案选项).A.城市供电B.国昉C.跨市的公路D∙经济政策国际协调14.下列项目中能够产生消费的负外部效应的是(红色字体为本题正确答案选项).B.居民区附近机场飞机起落的噪音C.环境污染D.某人购买流感疫苗注射,以预防流行性感冒15.下列属于政府支出规模增长原因中的社会性因素的是(红色字体为本题正确答案选项). A人口状况B.文化背景C∙物价水平D.国家机构的行政效率三、判断题(每小题1分,共10分)16.正式的政府经济,是人类社会发展到出现了国家,有了政府,才产生的.[答案]正确17.在市场经济条件下,政府经济活动就是为了解决企业、个人不能或不能有效解决的问题,克服市场缺陷.[答案J正确18.与自由竞争相比,在垄断条件下,产量大于资源配置达到最优时的产量,而价格低于资源配置达到最优时的价格.[答案]错误19.经济发展通常是指一个国家或地区一定时期内国民生产总值或国民收入的增加,可用经济增长率或增长额来表示.[答案]错误20.私人物品的公共供给是指政府为了实现宏观经济社会政策目标,生产和供给部分私人物品.[答案]正确21.只有负外部效应才会导致资源配苣扭曲,正外部效应则不会。

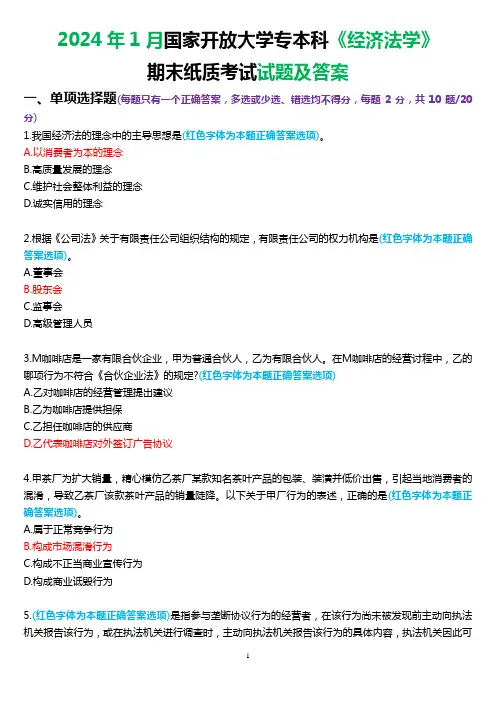

2024年1月国家开放大学专本科《经济法学》

期末纸质考试试题及答案

一、单项选择题(每题只有一个正确答案,多选或少选、错选均不得分,每题2分,共10题/20分)

1.我国经济法的理念中的主导思想是(红色字体为本题正确答案选项)。

A.以消费者为本的理念

B.高质量发展的理念

C.维护社会整体利益的理念

D.诚实信用的理念

2.根据《公司法》关于有限责任公司组织结构的规定,有限责任公司的权力机构是(红色字体为本题正确答案选项)。

A.董事会

B.股东会

C.监事会

D.高级管理人员

3.M咖啡店是一家有限合伙企业,甲为普通合伙人,乙为有限合伙人。

在M咖啡店的经营讨程中,乙的哪项行为不符合《合伙企业法》的规定?(红色字体为本题正确答案选项)

A.乙对咖啡店的经营管理提出建议

B.乙为咖啡店提供担保

C.乙担任咖啡店的供应商

D.乙代表咖啡店对外签订广告协议

4.甲茶厂为扩大销量,精心模仿乙茶厂某款知名茶叶产品的包装、装潢并低价出售,引起当地消费者的混淆,导致乙茶厂该款茶叶产品的销量陡降。

以下关于甲厂行为的表述,正确的是(红色字体为本题正确答案选项)。

A.属于正常竞争行为

B.构成市场混淆行为

C.构成不正当商业宣传行为

D.构成商业诋毁行为

5.(红色字体为本题正确答案选项)是指参与垄断协议行为的经营者,在该行为尚未被发现前主动向执法机关报告该行为,或在执法机关进行调查时,主动向执法机关报告该行为的具体内容,执法机关因此可

1。

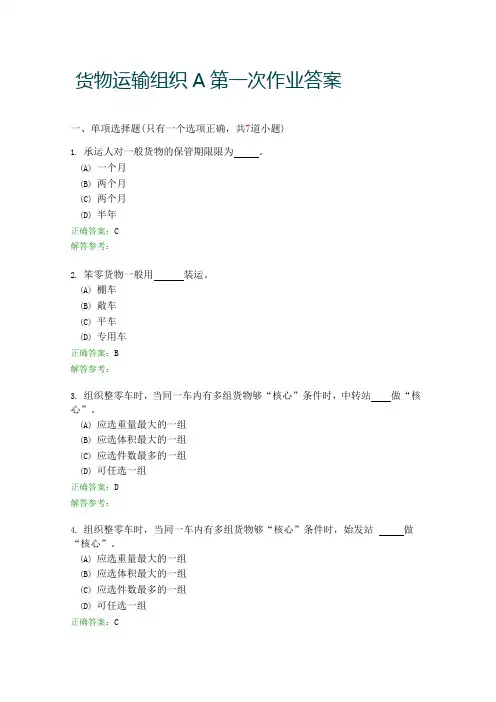

货物运输组织A第一次作业答案一、单项选择题(只有一个选项正确,共7道小题)1. 承运人对一般货物的保管期限限为。

(A) 一个月(B) 两个月(C) 两个月(D) 半年正确答案:C解答参考:2. 笨零货物一般用装运。

(A) 棚车(B) 敞车(C) 平车(D) 专用车正确答案:B解答参考:3. 组织整零车时,当同一车内有多组货物够“核心”条件时,中转站做“核心”。

(A) 应选重量最大的一组(B) 应选体积最大的一组(C) 应选件数最多的一组(D) 可任选一组正确答案:D解答参考:4. 组织整零车时,当同一车内有多组货物够“核心”条件时,始发站做“核心”。

(A) 应选重量最大的一组(B) 应选体积最大的一组(C) 应选件数最多的一组(D) 可任选一组正确答案:C解答参考:5. 1吨集装箱一般用装运。

(A) 棚车(B) 敞车(C) 集装箱专用平车(D) 普通平车正确答案:A解答参考:6. 为了真实反映计划期内运量和货种的变化对货车静载重的影响,可用哪种指标来考核在满载工作中铁路职工的主观努力程度(A) 重车动载重(B) 运用车动载重(C) 换算静载重(D) 货车静载重正确答案:C解答参考:7. 重车重心高度从轨面起,一股不超过(A) 1500mm(B) 1800mm(C) 2000mm(D) 2500mm正确答案:C解答参考:二、判断题(判断正误,共8道小题)8.按零担托运货物,一件体积最小不得小于0.02m3(一件重量10kg以上的除外),每批不得超过300件()正确答案:说法正确解答参考:9.铁路对押运人应收押运人乘车费。

()正确答案:说法正确解答参考:10.押运人数除特殊情况外,一般不超过3人。

()正确答案:说法错误解答参考:11.货物运输变更不允许变更一批货物中的一部分。

()正确答案:说法正确解答参考:12.一站整零车所装的货物,不得少于货车标记载重的60%或容积的90%。

()正确答案:说法错误解答参考:13.两站整零车,第一到站的货物不得少于货车标重的20%或容积的30%()正确答案:说法正确解答参考:14.两站整零车,第二到站的货物不得少于货车标重的50%或容积的60%()正确答案:说法错误解答参考:15.两站整零车,第一到站和第二到站间的距离必须受250km限制()正确答案:说法正确解答参考:(注意:若有主观题目,请按照题目,离线完成,完成后纸质上交学习中心,记录成绩。

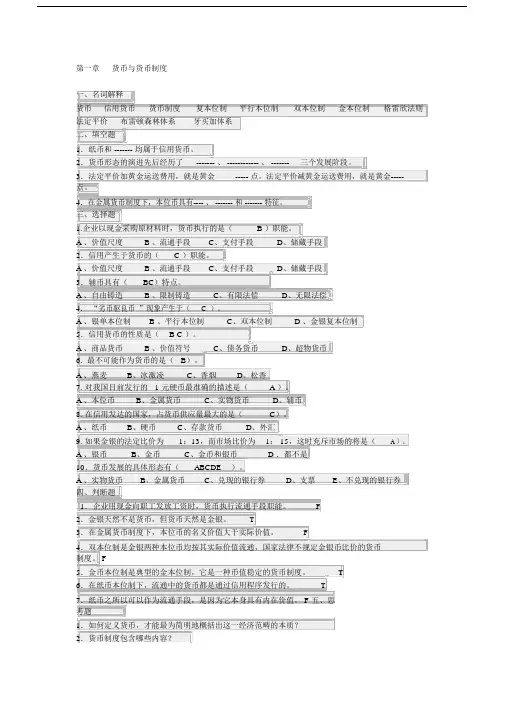

第一章货币与货币制度一、名词解释货币信用货币货币制度复本位制平行本位制双本位制金本位制格雷欣法则法定平价布雷顿森林体系牙买加体系二、填空题1.纸币和 ------- 均属于信用货币。

2.货币形态的演进先后经历了------- 、 ------------ 、 ------- 三个发展阶段。

3.法定平价加黄金运送费用,就是黄金----- 点。

法定平价减黄金运送费用,就是黄金-----点。

4.在金属货币制度下,本位币具有---- 、 ------- 和 ------- 特征。

三、选择题1.企业以现金采购原材料时,货币执行的是( B )职能。

A 、价值尺度B 、流通手段C、支付手段D、储藏手段2.信用产生于货币的( C )职能。

A 、价值尺度B 、流通手段C、支付手段D、储藏手段3.辅币具有(BC)特点。

A 、自由铸造B 、限制铸造C、有限法偿D、无限法偿4.“劣币驱良币”现象产生于( C )。

A 、银单本位制B 、平行本位制C、双本位制 D 、金银复本位制5.信用货币的性质是( B C )。

A 、商品货币B 、价值符号C、债务货币D、超物货币6.最不可能作为货币的是( B)。

A 、燕麦B、冰激凌C、香烟D、松香7. 对我国目前发行的 1 元硬币最准确的描述是( A )。

A 、本位币B、金属货币C、实物货币D、辅币8. 在信用发达的国家,占货币供应量最大的是(C)。

A 、纸币B、硬币C、存款货币D、外汇9. 如果金银的法定比价为1:13,而市场比价为1: 15,这时充斥市场的将是( A )。

A 、银币B、金币C、金币和银币 D .都不是10.货币发展的具体形态有(ABCDE )。

A 、实物货币B、金属货币C、兑现的银行券D、支票E、不兑现的银行券四、判断题1.企业用现金向职工发放工资时,货币执行流通手段职能。

F2.金银天然不是货币,但货币天然是金银。

T3.在金属货币制度下,本位币的名义价值大于实际价值。

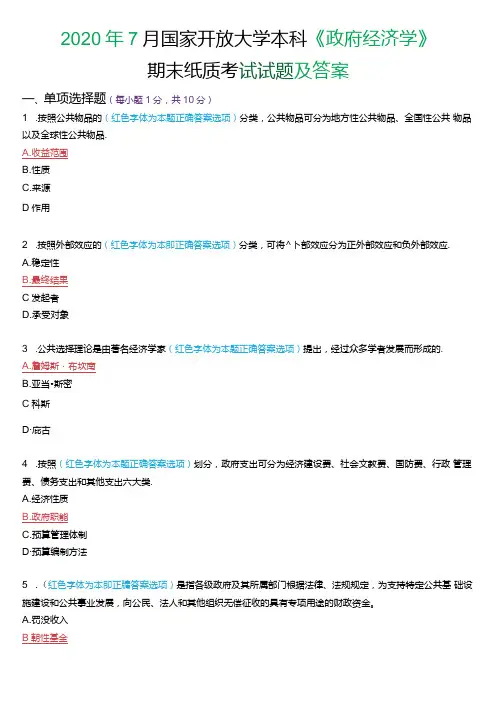

2020年7月国家开放大学本科《政府经济学》期末纸质考试试题及答案一、单项选择题(每小题1分,共10分)1 .按照公共物品的(红色字体为本题正确答案选项)分类,公共物品可分为地方性公共物品、全国性公共物品以及全球性公共物品.A.收益范围B.性质C.来源D作用2 .按照外部效应的(红色字体为本即正确答案选项)分类,可将^卜部效应分为正外部效应和负外部效应.A.稳定性B.最终结果C发起者D.承受对象3 .公共选择理论是由著名经济学家(红色字体为本题正确答案选项)提出,经过众多学者发展而形成的.A.詹姆斯・布坎南B.亚当•斯密C科斯D∙庇古4 .按照(红色字体为本题正确答案选项)划分,政府支出可分为经济建设费、社会文教费、国防费、行政管理费、债务支出和其他支出六大类.A.经济性质B.政府职能C.预算管理体制D∙预算编制方法5 .(红色字体为本即正牖答案选项)是指各级政府及其所属部门根据法律、法规规定,为支持特定公共基础设施建设和公共事业发展,向公民、法人和其他组织无偿征收的具有专项用途的财政资金。

A.罚没收入B朝性基金C.债务收入D.国有资产收入6 .按照(红色字体为本题正确答案选项)分类,可将税收收入分为货币税、实物税和力役税.A.税收管理体制B.课税对象的性质C.税负能否转嫁D.缴纳税收的形式7 .自来水公司根据每个居民户的用水数量,按每吨水一定价格收取水费,而不再考虑用水限额等问题的方法属于下列哪一种公共定价法?(红色字体为本题正确答案选项)A.单一定价法8 .二部定价法C.三部定价法D.高峰负荷定价法8 .按照(红色字体为本题正确答案选项)分类,公!责发行方法可以分为市场销售法和非市场销售法.A.政府在公债发行过程中同应募者之间的联系方式B公债发行对象C政府是否通过市场发行公债D.公债鲂规模9 .(红色字体为本即正确答案选项)是风睑管理的第一步,是指对所面临的以及潜在的风睑加以判断、分类和鉴定风险性质的过程.A.政府债务风险识别B.政府债务风睑评价C.政府债务风险管理效果评价D.政府债务风跄估测10.按照(红色字体为本题正确答案选项)分类,政府预算可以分为平衡预算与差额预算.A预算组织形式B.预算编制方法C.预算编制的政策重点D预算收支平衡的状况二、不定项选择题(每小题2分,共10分)IL下列属于有条件多数原则的是(红色字体为本题正确答案选项).A.120人参加投票,有31人赞成方案就可获得通过B.120人参加投票,有61人赞成方案就可获得通过CI20人参加投票,有81人赞成方案就崛得通过D.120人参加投票,120人全部赞成方案才可获得通过12 .下列属于流转税的优点的是(红色字体为本题正确答案选项).A.课征普遍B.有利于政府组织财政收入C税负易于转嫁D计征简便13 .根据对购进固定资产的价款的处理不同,可将增值税分为(红色字体为本题正确答案选项)。

2020年1月国家开放大学本科《政府经济学》期末纸质考试试题及答案一、单项选择题(每小题1分,共10分)1.政府经济活动的主体是(红色字体为本题正确答案选项).A.各级党委B.各级人大C.各级政协D.各级政府2.(红色字体为本题正确答案选项)是指在市场上存在几个生产厂家,这些企业可以控制某一领域的商品和劳务供给价格,但它们之间还存在一定程度的竞争。

A垄断竞争B.自由竞争C.京头垄断D.完全垄断3.企业在竞争中通过兼并、收购等方式,扩大生产规模和产品市场占有量,当其产量和市场份额足以控制市场价格和供求关系时所产生的垄断属于(红色字体为本题正确答案选项)。

A.天然垄断B.过度竞争产生的垄断C.技术进步产生的垄断D.自然垄断4.按照公共物品的(红色字体为本题正确答案选项)分类,公共物品可分为纯公共物品和准公共物品.A.收益范围B∙性质C.来源D作用5.我国预算年度是(红色字体为本即正确答案选项).A从当年1月1日至12月31日B.从当年4月1日至来年的3月31日U从当年9月1日至来年的8月31日D.从当年11月1日至来年的10月31日6.按照(红色字体为本题正确答案选项)分类,政府支出可分为经常性预算支出和资本性预算支出.A.经济性质B.政府职能C.预算管理体制D预算编制方法7.政府收入按(红色字体为本题正确答案选项)分类,可分为税收收入、债务收入、国有资产收入、行政事业性收费收入、罚没收入、政府性基金收入以及捐赠收入等。

A收入形式8.收入产业部门C.财政管理体制D.收入来源8.按照(红色字体为本题正确答案选项)分类,可将税收收入分为中央税、地方税和共享税.A.税负能否转嫁8.课税对象的性质C税收管理体制D.缴纳税收的形式9.按照(红色字体为本题正确答案选项)分类,公债可以分为有期公债和无期公债.A.发行地域B.债务期限的长短C.公债本位D.应募条件10.按照(红色字体为本题正确答案选项)分类,公债发行方法可以分为直接发行法和间接发行法.A政府在公债发行过程中同应募者之间的联系方式B.公债发行对象C.政府是否通过市场发行公债D∙公债发行规模二、不定项选择题(每小题2分,共10分)11.一个花卉生产企业扩大种植面枳、增加花卉品种,使周围养蜂的蜜蜂有了更多采集花粉的机会,增加了蜂蜜的产量,给养蜂人带来了收益,这种收益属于(红色字体为本题正确答案选项).A∙消费的负外部效应B.生产的负外部效应C.消费的正外部效应D.生产的正外部效应12.下列属于公共投资领域中基础设施投资的是(红色字体为本SI正确答案选项).A.原材料工业B.能源工业C水电煤气设施D.农业投资13.下列属于社会抚恤的是(红色字体为本题正确答案选项).A死亡频B.社会优待C伤残抚恤D.退役安置14.下列属于目前经国务院批)⅛发行的彩票的是(红色字体为本题正确答案选项).A.赛马彩票B.福利彩票D.斗鸡彩票15.下列属于政府决算管理环节的是(红色字体为本题正确答案选项).B.年终清理和结算C政府决算的编制D.政府决算的审查和批准三、判断题(每小Sgl分,共10分)16.政府经济活动仅仅关系到政府路线、方针、政策的执行以及政府职能的实现. [答案]错误17.为解决信息的不对称性对市场机制的干扰,就需要政府干预,通过制定实施有关法律制度,要求交易双方公开公平竞争、等价交换所需的信息,维护市场交易秩序.[答案]正确18.在开放经济条件下,居民和企业具有较大的流动性,地方公共物品的收益边界也是绝对的.[答案储误19.私人物品的公共供给是指政府为了实现宏观经济社会政策目标,生产和供给部分私人物品.[答案]正确20.有外部负效应的商品生产和销售量无法达到资源优化配皆时的市场需求,造成社会资源浪费。

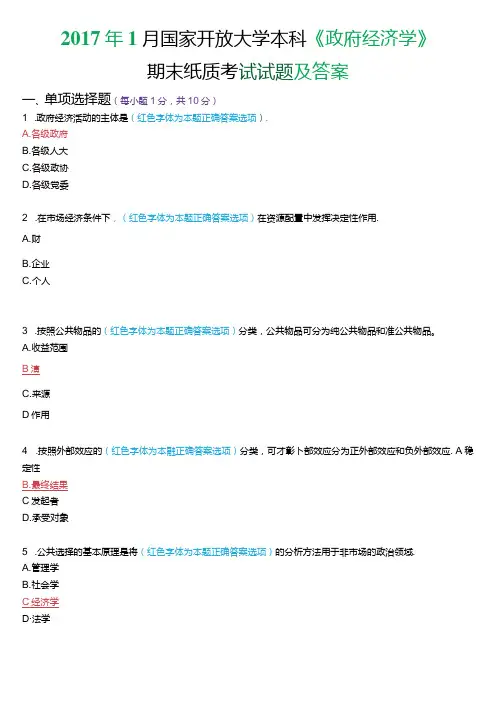

2017年1月国家开放大学本科《政府经济学》期末纸质考试试题及答案一、单项选择题(每小题1分,共10分)1 .政府经济活动的主体是(红色字体为本题正确答案选项).A.各级政府B.各级人大C.各级政协D.各级党委2 .在市场经济条件下,(红色字体为本题正确答案选项)在资源配置中发挥决定性作用.A.财B.企业C.个人3 .按照公共物品的(红色字体为本题正确答案选项)分类,公共物品可分为纯公共物品和准公共物品。

A.收益范围B演C.来源D作用4 .按照外部效应的(红色字体为本融正确答案选项)分类,可才彰卜部效应分为正外部效应和负外部效应. A稳定性B.最终结果C发起者D.承受对象5 .公共选择的基本原理是将(红色字体为本题正确答案选项)的分析方法用于非市场的政治领域.A.管理学B.社会学C经济学D∙法学6 .按照(红色字体为本迤正确答案选项)划分,政府支出可分为经济建设费、社会文教费、国防费、行政管理费和其他支出五大类.A经济性质B.政府职能C.预算管理体制D∙预算编制方法7 .社会救济的目标,是维持居民(红色字体为本题正确答案选项)生活水平需要.A.最低8 .最高C.基本D L股8 .政府收入按(红色字体为本题正确答案选项)分类,可分为税收收入、债务收入、国有资产收入、行政事业性收费收入、罚没收入、政府性基金收入以及捐赠收入等.A.收入形式B.收入产业部门C.财政管理体制D.收入来源9 .(红色字体为本即正确答案选项)是指国家规定知氐税率和最高税率,各地可以在此幅度内自行确定一个比例税率.A单一比例税率B.差别比例税率C幅度比例税率D.有起征点或免征额的比例税率10 .自来水公司根据卷个居民户的用水数量,按每吨水一定价格收取水费,而不再考虑用水限额等问迤的方法属于下列哪一种公共定价法?(红色字体为本题正确答案选项)A单一定价法B.二部定价法C.三部定价法D.高峰负荷定价法二、不定项选择题(每小题2分,共IO分)L一个花卉生产企业扩大种植面积、增加花卉品种,使周围养蜂的蜜蜂有了更多采集花粉的机会,增加了蜂蜜的产量,给养蜂人带来了收益,这种收益属于(红色字体为本题正确答案选项).A.消费的负外部效应B.生产的负外部效应C.消费的正外部效应D.生产的正外部效应12 .关于政府支出规模不断增长的原因,众多经济学家从不同角度、不同方面进行了诸多研究,得出了各种不同的结论.下列属于政府支出微观增长模型的是(红色字体为本题正确答案选项).A.阿道夫・瓦格纳的”政府支出不断上升的规律”B.皮考克和怀斯曼关于政府支出增长的理论C.马斯格雷夫和罗斯托的”政府支出增长的发展模型”D.鲍莫尔的•政府支出非均衡增长模型•13 .政府农业公共投资的领域应主要集中在(红色字体为本题正确答案选项)。

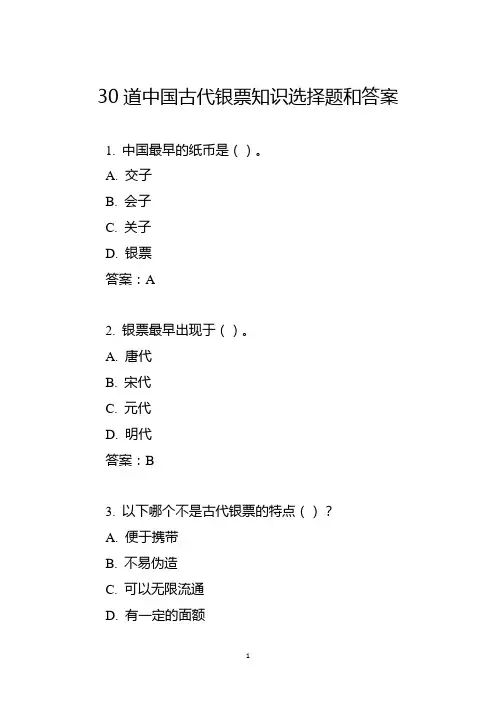

30道中国古代银票知识选择题和答案1. 中国最早的纸币是()。

A. 交子B. 会子C. 关子D. 银票答案:A2. 银票最早出现于()。

A. 唐代B. 宋代C. 元代D. 明代答案:B3. 以下哪个不是古代银票的特点()?A. 便于携带B. 不易伪造C. 可以无限流通D. 有一定的面额答案:C4. 古代银票的发行机构通常是()。

A. 政府B. 钱庄C. 票号D. 商人答案:A5. 以下关于古代银票的使用方法,表述正确的是()。

A. 可以直接用于购买商品B. 需要到指定的机构兑换银子C. 可以在任何地方兑换银子D. 可以用于缴纳赋税答案:B6. 古代银票上通常会有一些特殊的标记或图案,其主要作用是()。

A. 美观B. 防伪C. 代表发行机构D. 无特殊意义答案:B7. 以下哪个不是古代银票的防伪措施()?A. 采用特殊的纸张材料B. 使用复杂的印刷技术C. 加盖官方印章D. 无任何防伪措施答案:D8. 古代银票的面额通常是根据()来确定的。

A. 市场需求B. 商品价格C. 银子的重量D. 政府规定答案:D9. 以下关于古代银票的发展历程,表述正确的是()。

A. 银票的出现标志着货币的发展进入了一个新阶段B. 银票的发展逐渐取代了实物货币的地位C. 随着时代的发展,银票的形制和使用方法也在不断变化D. 以上都是答案:D10. 古代银票的流通范围主要集中在()。

A. 城市B. 农村C. 全国各地D. 商业发达地区答案:D11. 以下关于古代银票的影响,表述正确的是()。

A. 促进了商业的发展B. 方便了人们的日常生活C. 加强了政府对经济的控制D. 以上都是答案:D12. 古代银票的作废通常是由于()。

A. 票面损坏B. 超过有效期C. 政府宣布作废D. 以上都是答案:D13. 以下哪个不是古代银票的收藏价值()?A. 历史文化价值B. 艺术价值C. 经济价值D. 使用价值答案:D14. 古代银票的鉴定方法主要包括()。

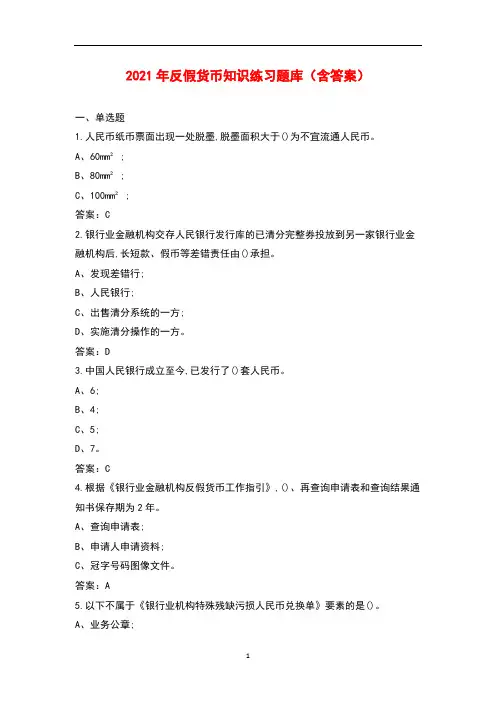

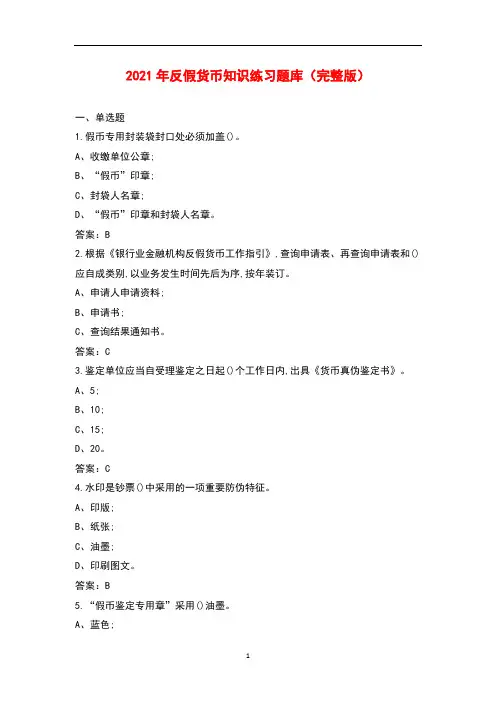

2021年反假货币知识练习题库(完整版)一、单选题1.假币专用封装袋封口处必须加盖()。

A、收缴单位公章;B、“假币”印章;C、封袋人名章;D、“假币”印章和封袋人名章。

答案:B2.根据《银行业金融机构反假货币工作指引》,查询申请表、再查询申请表和()应自成类别,以业务发生时间先后为序,按年装订。

A、申请人申请资料;B、申请书;C、查询结果通知书。

答案:C3.鉴定单位应当自受理鉴定之日起()个工作日内,出具《货币真伪鉴定书》。

A、5;B、10;C、15;D、20。

答案:C4.水印是钞票()中采用的一项重要防伪特征。

A、印版;B、纸张;C、油墨;D、印刷图文。

答案:B5.“假币鉴定专用章”采用()油墨。

A、蓝色;B、红色;C、黑色;D、白色。

答案:B6.残缺、污损人民币持有人对银行业机构认定的兑换结果有异议的,经持有人要求,银行业机构应出具认定证明并()该残缺、污损人民币。

A、没收;B、按持有人要求兑换;C、退回。

答案:C7.《人民币鉴别仪通用技术条件》(GB_16999-2010)中定义的C级点验钞机的漏辨率应小于等于()。

A、0.01%;B、0.02%;C、0.03%;D、0.04%。

答案:C8.银行业金融机构现金管理部门应将清分中心发现的()分开封装、随同电子和纸质文档一并解缴到中国人民银行当地分支机构。

A、伪造币和变造币B、人民币和外币C、纸币和硬币D、新类型假币与非新类型假币答案:A9.以下不属于《中国人民银行特殊残缺污损人民币鉴定书》要素的是()。

A、冠字号码;B、公章;C、证件号码。

答案:C10.()元及以下面额,如不适合使用机械清分,可以组织手工清分。

A、5;B、10;C、20。

答案:A11.2015年版第五套人民币100元较2005年版在票面图案上进行了优化,其中右上角的面额数字采用了()。

A、雕刻胶印印刷;B、雕刻凹印印刷;C、专用凸印印刷;D、丝网柔印印刷。

答案:B12.因防伪或者其他原因,需要改变人民币的印制材料、技术或者工艺的,由()决定。

货币防伪与鉴别测试题1.第五套人民币20元纸币背面中间部位在紫外光下显现O色荧光图案。

A.黄B.紫C绿DN2.第五套人民币1999年版100元纸币的冠字号码颜色是OOA.红色、黑色B.蓝色、黑色(正确答案)C.红色、蓝色D.绿色、蓝色3 .在第五套人民币纸张中,加入的无色荧光纤维在特定波长的紫外光下呈现O oA.蓝色和黄色B.红色和绿色C.红色和蓝色D.黄色和绿色4 .金融机构、公安机关收缴和没收的假币由O统一销毁。

A.中央银行B.公安机关C.法院D.商业银行5 .能辨别面额,票面剩余O,其图案、文字能按原样连接的残缺、污损人民币,金融机构应向持有人按原面额全额兑换。

A.二分之一(含二分之一)以上B.三分之二(含三分之二)以上C.四分之三(含四分之三)以上ID.五分之三(含五分之三)以上6.2015年版IOO元人民币纸币上没有O防伪特征。

A.安全线B.白水印C.固定水印D.隐形面额数字17 .第五套人民币2019年版50元、20元、10元、1元纸币增加(),取消正面右侧凹印手感线和背面右下角局部图案,票面年号改为“2019年”。

A.正面右侧装饰纹样8 .正面左侧装饰纹样C.背面右侧装饰纹样D.背面左侧装饰纹样9 .第三套人民币是O开始停止流通的。

A.1999年8月1日B.1999年12月1日C.2000年1月1日D.2000年7月1日(10 使用假币印章应采用()油墨。

A.蓝色B.红色C.绿色D.黑色11 .人民币印刷中最早采用凹印手感线防伪特征是OoA.2000年版IO元纸币B.1999年版100元纸币CI999年版1元纸币(正确?。

)D.2005年版20元纸币11 .经查实,某金融机构一次性发现并收缴了1元面额假人民币25张,但未报告人民银行和公安机关,按照规定,人民银行对该机构应处以OOAJOOO元以上5万元以下罚款(A答案)B.2000元以上5万元以下罚款C.5000元以上5万元以下罚款D.1万元以上10万元以下罚款12 .第五套人民币100元、50元纸币的光变面额数字的颜色变化分别是OoA.绿变金、绿变蓝B.绿变蓝、绿变金(正确答案)C.蓝变黄、绿变蓝D.绿变黑、绿变金13.第五套人民币2015年版100元纸币采用横竖双号码印刷,横号码左侧部分为红色,右侧部分为黑色,竖号码为O色。

货币银行学第四章纸质练习姓名:班级:学号:请注意,答案写在下面的方框中,否则判为0分,谢谢合作。

1)Of the following measures of interest rates, which is considered by economists to be the most accurate?(a)The yield to maturity(b)The coupon rate(c)The current yield(d)The yield on a discount basisAnswer:A2)To claim that a lottery winner who is to receive $1 million per year for twenty years has won $20 million ignores the concept of(a)amortizing a loan.(b)par value.(c)deflation.(d)discounting the future.(e)face value.Answer:D3)With an interest rate of 5 percent, the present value of $100 next year is approximately(a)$100.(b)$105.(c)$95.(d)$90.Answer:C4)With an interest rate of 8 percent, the present value of $100 next year is approximately(a)$108.(b)$100.(c)$96.(d)$93.Answer:D5) A security that pays $52.50 in one year and $110.25 in two years, with an interest rate of5 percent, has a present value of(a)$150.(b)$162.50.(c)$200.(d)$300.(e)$400.Answer:A6)Which of the following are true of simple loans?(a)A simple loan requires the borrower to repay the principal and interest at the maturitydate.(b)Commercial loans to businesses are often of this type.(c)The borrower repays the loan by making the same payment every month.(d)Both (a) and (b) of the above.(e)Both (b) and (c) of the above.Answer:D7)If $1102.50 is the amount payable in two years for a $1000 simple loan made today, the interest rate is(a)2.5 percent.(b)5 percent.(c)10 percent.(d)12.5 percent.(e)20 percent.Answer:B8)If $22,050 is the amount payable in two years for a $20,000 simple loan made today, the interest rate is(a)5 percent.(b)10 percent.(c)22 percent.(d)25 percent.(e)205 percent.Answer:A9) A ______ pays the owner a fixed coupon payment every year until the maturity date, when the ______ value is repaid.(a)coupon bond; discount(b)discount bond; discount(c)coupon bond; face(d)discount bond; faceAnswer:C10)Which of the following are true for a coupon bond?(a)When the coupon bond is priced at its face value, the yield to maturity equals thecoupon rate.(b)The price of a coupon bond and the yield to maturity are negatively related.(c)The yield to maturity is greater than the coupon rate when the bond price is below thepar value.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer:D11)A consol paying $20 annually when the interest rate is 5 percent has a price of(a)$100.(b)$200.(c)$400.(d)$800.(e)$1000.Answer:C12)If a $10,000 coupon bond has a coupon rate of 5 percent, then the coupon payment every year is(a)$40.(b)$140.(c)$400.(d)$600.(e)none of the above.Answer:E13)Which of the following $1,000 face-value securities has the lowest yield to maturity?(a)A 15 percent coupon bond with a price of $600(b)A 15 percent coupon bond with a price of $800(c)A 15 percent coupon bond with a price of $1,000(d)A 15 percent coupon bond with a price of $1,200(e)A 15 percent coupon bond with a price of $1,500Answer:E14)Which of the following bonds would you prefer to be selling?(a)A $10,000 face-value security with a 6 percent coupon selling for $10,000(b)A $10,000 face-value security with a 6 percent coupon selling for $9,000(c)A $10,000 face-value security with a 6 percent coupon selling for $11,000(d)A $10,000 face-value security with a 7 percent coupon selling for $10,000(e)A $10,000 face-value security with a 7 percent coupon selling for $9,000Answer:C15)A ______ is bought at a price below its face value, and the ______ value is repaid at the maturity date.(a)coupon bond; discount(b)discount bond; discount(c)coupon bond; face(d)discount bond; faceAnswer:D16)Examples of discount bonds include(a)U.S. Treasury bills.(b)U.S. savings bonds.(c)U.S. Treasury notes.(d)all of the above.(e)only (a) and (b) of the above.Answer:E17)Which of the following are true for discount bonds?(a)A discount bond is bought at a price below its face value.(b)The purchaser receives the face value of the bond at the maturity date.(c)U.S. Treasury bonds and notes are examples of discount bonds.(d)All of the above.(e)Only (a) and (b) of the above.Answer:E18)If a $10,000 face-value discount bond maturing in one year is selling for $9,000, then its yield to maturity is(a)9 percent.(b)10 percent.(c)11 percent.(d)12 percent.Answer:C19)Which of the following are true for the current yield?(a)The current yield is defined as the yearly coupon payment divided by the price of thesecurity.(b)The formula for the current yield is identical to the formula describing the yield tomaturity for a consol.(c)The current yield will be a close approximation for the yield to maturity the shorterthe time to maturity, and the closer the bond price to its par value.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer:E20)For a bond selling for $4000, with a par value of $5000 and a coupon rate of 10 percent, the current yield is(a)5 percent.(b)10 percent.(c)12.5 percent.(e)25 percent.Answer:C21)The current yield on a $10,000, 10 percent coupon bond selling for $8,000 is(a)10.0 percent.(b)12.5 percent.(c)15.0 percent.(d)17.5 percent.Answer:B22)The current yield on a $10,000, 5 percent coupon bond selling for $5,000 is(a)5.0 percent.(b)7.5 percent.(c)10.0 percent.(d)12.5 percent.Answer:C23)The formula for the measure of the interest rate called the yield on a discount basis has two peculiarities:(a)it uses the percentage gain on the face value of the bill, rather than the percentagegain on the purchase price of the bill.(b)it ignores the time to maturity.(c)it puts the yield on the annual basis of a 360 day year.(d)both (a) and (b) of the above.(e)both (a) and (c) of the above.Answer:E24)A problem with the yield on discount basis is that it __________ the yield to maturity, and this __________ increases, the ___________ the maturity of the discount bond.(a)understates; understatement; longer(b)understates; understatement; shorter(c)overstates; overstatement; longer(d)overstates; overstatement; shorter(e)approximates; approximation; longerAnswer:A25)The yield on a discount basis of a 30-day, $1,000 Treasury bill selling for $950 is(a)5 percent.(b)10 percent.(c)20 percent.(d)50 percent.(e)none of the above.Answer:E26)The yield on a discount basis of a 180-day $1,000 Treasury bill selling for $950 is(b)20 percent.(c)25 percent.(d)40 percent.Answer:A27)When referring to changes in yields, a basis point equals(a)10 percent.(b)1 percent.(c)0.1 percent.(d)0.01 percent.(e)0.001 percent.Answer:D28)Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding?(a)5 percent(b)10 percent(c)15 percent(d)20 percentAnswer:C29)If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, which bond would you prefer to have been holding?(a)A bond with one year to maturity(b)A bond with five years to maturity(c)A bond with ten years to maturity(d)A bond with twenty years to maturityAnswer:A30)An equal increase in all bond interest rates(a)increases the price of a five-year bond more than the price of a ten-year bond.(b)increases the price of a ten-year bond more than the price of a five-year bond.(c)decreases the price of a five-year bond more than the price of a ten-year bond.(d)decreases the price of a ten-year bond more than the price of a five-year bond.(e)increases all bond prices by the same dollar amount.Answer:D31)The return on a 10 percent coupon bond that initially sells for $1,000 and sells for $950 next year is(a)-10 percent.(b)-5 percent.(c)0 percent.(d)5 percent.Answer:D32)Which of the following are generally true of all bonds?(a)The only bond whose return equals the initial yield to maturity is one whose time tomaturity is the same as the holding period.(b)A rise in interest rates is associated with a fall in bond prices, resulting in capitallosses on bonds whose terms to maturity are longer than the holding periods.(c)The longer a bond’s maturity, the greater is the size of th e price change associatedwith an interest rate change.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer:D33)The riskiness of an asset’s returns due to changes in interest rates is(a)uncertainty.(b)price risk.(c)asset risk.(d)interest-rate risk.(e)exchange-rate risk.Answer:D34)If you expect the inflation rate to be 15 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond is(a)7 percent.(b)22 percent.(c)-15 percent.(d)-8 percent.(e)none of the above.Answer:D35)When the interest rate on a Treasury Inflation Protected Security is 3 percent, and the yield on a nonindexed Treasury bond is 8 percent, the expected rate of inflation is(a)3 percent.(b)5 percent.(c)8 percent.(d)11 percent.(e)24 percent.Answer:B。

2021《反假货币知识竞赛》题库(试题82道含答案)1.手工清分应由金融机构营业网点组织柜面人员,对尚未配置清分设备或不宜采用清分设备清分的现金进行清点处理。

()A.正确B.错误正确答案:B2.根据《人民币当别仪通用技术条件》(GB_16999-2010),鉴别仪使用寿命一般为4年。

()A.正确B.错误正确答案:B3.每月初,报送行在携带假币实物到当地人民银行分支机构办理假币解缴业务前,须向当地人民银行分支机构发送假币信息电子比对文件。

()A.正确B.错误正确答案:B4.银行业金融机构在办理业务时,对收缴的假人民币纸币,应当面加盖“假币”字样的戳记。

()A.正确B.错误正确答案:A5.银行业金融机构反假货币联络会议召集人由国务院反假货币工作联席会议办公室主任担任。

()A.正确B.错误正确答案:A6.目前流通的英镑纸币共有5英镑、10英镑、20英镑、50英镑四种面额,与停止流通的英镑最明显的区别在于新钞有大不列颠女神像全息图。

()A.正确B.错误正确答案:A7.不同面额美元上安全线位置不同,而且安全线上有缩微文字和紫外荧光防伪特征。

()A.正确B.错误正确答案:A8.100美元纸币正面主景图案是富兰克林头像,背面主景为白宫。

()A.正确B.错误正确答案:B9.在紫外光下,欧元纸币正面欧盟旗帜和欧洲中央银行行长签名变为黄色,欧盟旗帜上的星变为蓝色。

()A.正确B.错误正确答案:B10.美元纸张掺有红色和绿色彩色纤维。

()A.正确B.错误正确答案:B11.日元纸张呈淡黄色,并含有三桠皮纤维。

()A.正确B.错误正确答案:A12.目前流通港元只要由中国银行(香港)有限公司、香港上海汇丰银行两家银行负责发行。

()A.正确B.错误正确答案:B13.2004年版20美元采用了光变面额数字,其颜色变化为铜变绿。

()A.正确B.错误正确答案:A14.港元的荧光图案是早期主要的防伪手段之一,港人称之为荧光银码。

()A.正确B.错误正确答案:A15.2019年版第五套人民币5角硬币正背面内周缘由1999年版的圆形调整为多边形,有利于弱视群体利用触觉识别。

货币银行学第一,二章纸质练习姓名:班级:学号:1)Financial markets and institutions(a)involve the movement of huge flows of money.(b)affect the profits of businesses.(c)affect the types of goods and services produced in an economy.(d)do each of the above.(e)do only (a) and (b) of the above.2)Markets in which funds are transferred from those who have excess funds available to those who have a shortage of available funds are called(a)commodity markets.(b)fund-available markets.(c)derivative exchange markets.(d)financial markets.3)Financial markets promote economic efficiency by(a)channeling funds from investors to savers.(b)creating inflation.(c)causing recessions.(d)channeling funds from savers to investors.(e)reducing investment.4)The bond markets are important because(a)they are easily the most widely followed financial markets in the United States.(b)they are the markets where foreign exchange rates are determined.(c)they are the markets where interest rates are determined.(d)of each of the above.(e)of only (a) and (b) of the above.5)Compared to interest rates on long-term U.S. government bonds, interest rates on _____ fluctuate more and are lower on average.(a)medium-quality corporate bonds(b)low-quality corporate bonds(c)high-quality corporate bonds(d)three-month Treasury bills(e)none of the above6)An increase in interest rates on student loans(a)increases the cost of a college education.(b)reduces the cost of a college education.(c)has no effect on educational costs.(d)increases costs for students with no loans.(e)none of the above.7) A rising stock market index due to higher share prices(a)increases people’s wealth, but is unlikely to increase their willingness to spend.(b)increases people’s wealth and as a result may increase their willingness to spend.(c)increases the amount of funds that business firms can raise by selling newly-issuedstock.(d)both (b) and (c) of the above.8)Everything else constant, a stronger dollar will mean that(a)vacationing in England becomes more expensive.(b)vacationing in England becomes less expensive.(c)French cheese becomes more expensive.(d)Japanese cars become more expensive.9)In 1985 a Shetland sweater would have cost $130. With a weaker dollar, the same Shetland sweater would have cost(a)less than $130.(b)more than $130.(c)$130, since the exchange rate does not affect the prices that American consumers payfor foreign goods.(d)$130, since the demand for Shetland sweaters will decrease to prevent an increase inprice due to the stronger dollar.10)Banks, savings and loan associations, mutual savings banks, and credit unionslink those who want to save with these who want to invest.(a)hold a large proportion of individuals’ wealth.(b)have been adept at innovating in response to changes in the regulatory environment.(c)all of the above.(d)only (a) and (c) of the above.11)Money is defined as(a)anything that is generally accepted in payment for goods and services or in therepayment of debt.(b)bills of exchange.(c)a risk-free repository of spending power.(d)all of the above.(e)only (a) and (b) of the above.12)Which of the following are true statements?(a)Money or the money supply is defined as Federal Reserve notes.(b)The average price of goods and services in an economy is called the aggregate pricelevel.(c)The inflation rate is measured as the rate of change in the federal government budgetdeficit.(d)All of the above are true statements.(e)Only (a) and (b) of the above are true statements.13)Countries that experience very high rates of inflation have(a)balanced budgets.(b)budget surpluses.(c)falling money supplies.(d)constant money supplies.(e)rapidly growing money supplies.14)Budgets deficits can be a concern because they might(a)ultimately lead to higher inflation.(b)lead to higher interest rates.(c)lead to a slower rate of money growth.(d)cause all of the above to occur.(e)cause both (a) and (b) of the above to occur.15)Every financial market has the following characteristic:(a)It determines the level of interest rates.(b)It allows common stock to be traded.(c)It allows loans to be made.(d)It channels funds from lenders-savers to borrowers-spenders.16)Which of the following can be described as direct finance?(a)You take out a mortgage from your local bank.(b)You borrow $2500 from a friend.(c)A pension fund lends money to General Motors.(d)You buy shares in a mutual fund.(e)None of the above.17)Assume that you borrow $2000 at 10% annual interest to finance a new business project.For this loan to be profitable, the minimum amount this project must generate in annual earnings is(a)$400.(b)$201.(c)$200.(d)$199.(e)$101.18)Which of the following can be described as involving indirect finance?(a)A corporation takes out loans from a bank.(b)People buy shares in a mutual fund.(c)A corporation buys a short-term corporate security in a secondary market.(d)All of the above.(e)Only (a) and (b) of the above.19)Which of the following statements about the characteristics of debt and equity are true?(a)They can both be long-term financial instruments.(b)They both involve a claim on the issuer’s income.(c)They both enable a corporation to raise funds.(d)All of the above.(e)Only (a) and (b) of the above.20)A corporation acquires new funds only when its securities are sold(a)in the secondary market by an investment bank.(b)in the primary market by an investment bank.(c)in the secondary market by a stock exchange broker.(d)in the secondary market by a commercial bank.21)Which of the following statements about financial markets and securities are true?(a)Many common stocks are traded over-the-counter, although the largest corporationsusually have their shares traded at organized stock exchanges such as the New YorkStock Exchange.(b)A corporation acquires new funds only when its securities are first sold in theprimary market.(c)Money market securities are usually more widely traded than longer-term securitiesand so tend to be more liquid.(d)All of the above are true.(e)Only (a) and (b) of the above are true.22)In the United States loans from _____ are far _____ important for corporate finance than are securities markets.(a)government agencies; more(b)government agencies; less(c)financial intermediaries; more(d)financial intermediaries; less23)The presence of transaction costs in financial markets explains, in part, why(a)financial intermediaries and indirect finance play such an important role in financialmarkets.(b)equity and bond financing play such an important role in financial markets.(c)corporations get more funds through equity financing than they get from financialintermediaries.(d)direct financing is more important than indirect financing as a source of funds.24)The problem created by asymmetric information before the transaction occurs is called _____, while the problem created after the transaction occurs is called _____.(a)adverse selection; moral hazard(b)moral hazard; adverse selection(c)costly state verification; free-riding(d)free-riding; costly state verification25)Adverse selection is a problem associated with equity and debt contracts arising from(a)the lender’s relative lack of information about the borrower’s potential returns andrisks of his investment activities.(b)the lender’s inability to legally require sufficient collateral to cover a 100% loss if theborrower defaults.(c)the borrower’s lack of incentive to seek a loan for highly risky investments.(d)none of the above.26)An example of the problem of ______ is when a corporation that uses the funds raised from selling new shares of stock to pay for Caribbean cruises for all of its employees and their families.(a)adverse selection(b)moral hazard(c)risk sharing(d)credit risk(e)prudential supervision27)The primary source of funds of fire and casualty insurance companies include(a)commercial paper, stocks, and bonds.(b)premiums from policies.(c)savings deposits.(d)all of the above.28)A goal of the Securities and Exchange Commission is to reduce problems arising from(a)competition.(b)banking panics.(c)risk.(d)asymmetric information.(e)all of the above.29)The primary purpose of deposit insurance is to(a)improve the flow of information to investors.(b)prevent banking panics.(c)protect bank shareholders against losses.(d)protect bank employees from unemployment.(e)all of the above.30)An important feature of money market mutual fund shares is(a)deposit insurance.(b)the ability to write checks against shareholdings.(c)the ability to borrow against shareholdings.(d)claims on shares of corporate stock.(e)all of the above.。

货币防伪与鉴别赛题二一、单选题1、F序列50英镑纸币与E序列(初版)英镑纸币相比,下列说法正确的是()。

A、固定水印均为伊丽沙白女王头像B、白水印均为“£50”C、均有全埋式和3D开窗式两条安全线D、均有“£”对印图案E、均有全息图正确答案:A2、在紫外光下,可以看到欧元纸张中有明亮的()无色荧光纤维。

A、红、蓝、绿三色B、红、蓝双色C、红、黄、蓝三色D、蓝、绿双色E、黄、蓝双色正确答案:A3、欧元现钞是()开始发行的。

A、2000年1月1日B、2002年1月1日C、2001年1月1日D、2000年5月1日E、2002年5月1日正确答案:B4、到目前为止日元纸币上未采用的防伪技术是()。

A、防复印标记B、光变油墨C、对印D、安全线E、隐形图案正确答案:D5、日元纸币呈淡黄色,并含特有的()纤维。

A、棉B、蚕丝C、剑麻D、三桠皮E、亚麻正确答案:D6、第五套人民币5角硬币外缘为间断丝齿,共有()个丝齿段,每个丝齿段有()个齿距相等的丝尺。

A、6,8B、4,6C、8,4D、6,6E、8,6正确答案:A7、人民币印刷中最早采用凹印手感线防伪特征是()。

A、1999年版1元纸币B、1999年版100元纸币C、1999年版10元纸币D、2005年版100元纸币E、2005年版20元纸币正确答案:A8、第五套人民币100元、50元纸币的光变面额数字的颜色变化分别是()。

A、绿变金、绿变蓝B、绿变蓝、绿变金C、蓝变黄、绿变蓝D、绿变黑、绿变金E、绿变金、绿变蓝正确答案:B9、第五套人民币10元、5元、1元纸币的固定花卉水印分别是()图案。

A、玫瑰花、水仙花、兰花B、月季花、水仙花、兰花C、月季花、荷花、兰花D、玫瑰花、荷花、水仙花E、水仙花、月季花、兰花正确答案:B10、关于第五套人民币纸币中有无“胶印对印图案”这一防伪特征的说法正确的是()。

A、纸币上均有B、5元以上纸币均有C、10元以上纸币上均有D、20元以上纸币均有E、1999年版纸币除20元、1元外均有正确答案:D11、关于第五套人民币“雕刻凹版印刷”这一防伪特征的说法正确的是()。

货币银行学第一,二章纸质练习姓名:班级:学号:1)Financial markets and institutions(a)involve the movement of huge flows of money.(b)affect the profits of businesses.(c)affect the types of goods and services produced in an economy.(d)do each of the above.(e)do only (a) and (b) of the above.Answer:D2)Markets in which funds are transferred from those who have excess funds available to those who have a shortage of available funds are called(a)commodity markets.(b)fund-available markets.(c)derivative exchange markets.(d)financial markets.Answer:D3)Financial markets promote economic efficiency by(a)channeling funds from investors to savers.(b)creating inflation.(c)causing recessions.(d)channeling funds from savers to investors.(e)reducing investment.Answer:D4)The bond markets are important because(a)they are easily the most widely followed financial markets in the United States.(b)they are the markets where foreign exchange rates are determined.(c)they are the markets where interest rates are determined.(d)of each of the above.(e)of only (a) and (b) of the above.Answer:C5)Compared to interest rates on long-term U.S. government bonds, interest rates on _____ fluctuate more and are lower on average.(a)medium-quality corporate bonds(b)low-quality corporate bonds(c)high-quality corporate bonds(d)three-month Treasury bills(e)none of the aboveAnswer:D6)An increase in interest rates on student loans(a)increases the cost of a college education.(b)reduces the cost of a college education.(c)has no effect on educational costs.(d)increases costs for students with no loans.(e)none of the above.Answer:A7) A rising stock market index due to higher share prices(a)increases people’s wealth, but is unlikely to increase their willingness to spend.(b)increases people’s wealth and as a result may increase their willingness to spend.(c)increases the amount of funds that business firms can raise by selling newly-issuedstock.(d)both (b) and (c) of the above.Answer:D8)Everything else constant, a stronger dollar will mean that(a)vacationing in England becomes more expensive.(b)vacationing in England becomes less expensive.(c)French cheese becomes more expensive.(d)Japanese cars become more expensive.Answer:B9)In 1985 a Shetland sweater would have cost $130. With a weaker dollar, the same Shetland sweater would have cost(a)less than $130.(b)more than $130.(c)$130, since the exchange rate does not affect the prices that American consumers payfor foreign goods.(d)$130, since the demand for Shetland sweaters will decrease to prevent an increase inprice due to the stronger dollar.Answer:B10)Banks, savings and loan associations, mutual savings banks, and credit unions(a)link those who want to save with these who want to invest.(b)hold a large proportion of individuals’ wealth.(c)have been adept at innovating in response to changes in the regulatory environment.(d)all of the above.(e)only (a) and (c) of the above.Answer:D11)Money is defined as(a)anything that is generally accepted in payment for goods and services or in therepayment of debt.(b)bills of exchange.(c)a risk-free repository of spending power.(d)all of the above.(e)only (a) and (b) of the above.Answer:A12)Which of the following are true statements?(a)Money or the money supply is defined as Federal Reserve notes.(b)The average price of goods and services in an economy is called the aggregate pricelevel.(c)The inflation rate is measured as the rate of change in the federal government budgetdeficit.(d)All of the above are true statements.(e)Only (a) and (b) of the above are true statements.Answer:B13)Countries that experience very high rates of inflation have(a)balanced budgets.(b)budget surpluses.(c)falling money supplies.(d)constant money supplies.(e)rapidly growing money supplies.Answer:E14)Budgets deficits can be a concern because they might(a)ultimately lead to higher inflation.(b)lead to higher interest rates.(c)lead to a slower rate of money growth.(d)cause all of the above to occur.(e)cause both (a) and (b) of the above to occur.Answer:E15)Every financial market has the following characteristic:(a)It determines the level of interest rates.(b)It allows common stock to be traded.(c)It allows loans to be made.(d)It channels funds from lenders-savers to borrowers-spenders.Answer:D16)Which of the following can be described as direct finance?(a)You take out a mortgage from your local bank.(b)You borrow $2500 from a friend.(c)A pension fund lends money to General Motors.(d)You buy shares in a mutual fund.(e)None of the above.Answer:B17)Assume that you borrow $2000 at 10% annual interest to finance a new business project.For this loan to be profitable, the minimum amount this project must generate in annual earnings is(a)$400.(b)$201.(c)$200.(d)$199.(e)$101.Answer:B18)Which of the following can be described as involving indirect finance?(a)A corporation takes out loans from a bank.(b)People buy shares in a mutual fund.(c)A corporation buys a short-term corporate security in a secondary market.(d)All of the above.(e)Only (a) and (b) of the above.Answer:D19)Which of the following statements about the characteristics of debt and equity are true?(a)They can both be long-term financial instruments.(b)They both involve a claim on the issuer’s income.(c)They both enable a corporation to raise funds.(d)All of the above.(e)Only (a) and (b) of the above.Answer:D20)A corporation acquires new funds only when its securities are sold(a)in the secondary market by an investment bank.(b)in the primary market by an investment bank.(c)in the secondary market by a stock exchange broker.(d)in the secondary market by a commercial bank.Answer:B21)Which of the following statements about financial markets and securities are true?(a)Many common stocks are traded over-the-counter, although the largest corporationsusually have their shares traded at organized stock exchanges such as the New YorkStock Exchange.(b)A corporation acquires new funds only when its securities are first sold in theprimary market.(c)Money market securities are usually more widely traded than longer-term securitiesand so tend to be more liquid.(d)All of the above are true.(e)Only (a) and (b) of the above are true.Answer:D22)In the United States loans from _____ are far _____ important for corporate finance than are securities markets.(a)government agencies; more(b)government agencies; less(c)financial intermediaries; more(d)financial intermediaries; lessAnswer:C23)The presence of transaction costs in financial markets explains, in part, why(a)financial intermediaries and indirect finance play such an important role in financialmarkets.(b)equity and bond financing play such an important role in financial markets.(c)corporations get more funds through equity financing than they get from financialintermediaries.(d)direct financing is more important than indirect financing as a source of funds.Answer:A24)The problem created by asymmetric information before the transaction occurs is called _____, while the problem created after the transaction occurs is called _____.(a)adverse selection; moral hazard(b)moral hazard; adverse selection(c)costly state verification; free-riding(d)free-riding; costly state verificationAnswer:A25)Adverse selection is a problem associated with equity and debt contracts arising from(a)the lender’s relative lack of information about the borrower’s potential returns andrisks of his investment activities.(b)the lender’s inability to legally require sufficient collateral to cover a 100% loss if theborrower defaults.(c)the borrower’s lack of incentive to seek a loan for highly risky investments.(d)none of the above.Answer:A26)An example of the problem of ______ is when a corporation that uses the funds raised from selling new shares of stock to pay for Caribbean cruises for all of its employees and their families.(a)adverse selection(b)moral hazard(c)risk sharing(d)credit risk(e)prudential supervisionAnswer:B27)The primary source of funds of fire and casualty insurance companies include(a)commercial paper, stocks, and bonds.(b)premiums from policies.(c)savings deposits.(d)all of the above.Answer:B28)A goal of the Securities and Exchange Commission is to reduce problems arising from(a)competition.(b)banking panics.(c)risk.(d)asymmetric information.(e)all of the above.Answer:D29)The primary purpose of deposit insurance is to(a)improve the flow of information to investors.(b)prevent banking panics.(c)protect bank shareholders against losses.(d)protect bank employees from unemployment.(e)all of the above.Answer:B30)An important feature of money market mutual fund shares is(a)deposit insurance.(b)the ability to write checks against shareholdings.(c)the ability to borrow against shareholdings.(d)claims on shares of corporate stock.(e)all of the above.Answer:B。