《税收学原理》思考题参考答案

- 格式:pdf

- 大小:257.26 KB

- 文档页数:23

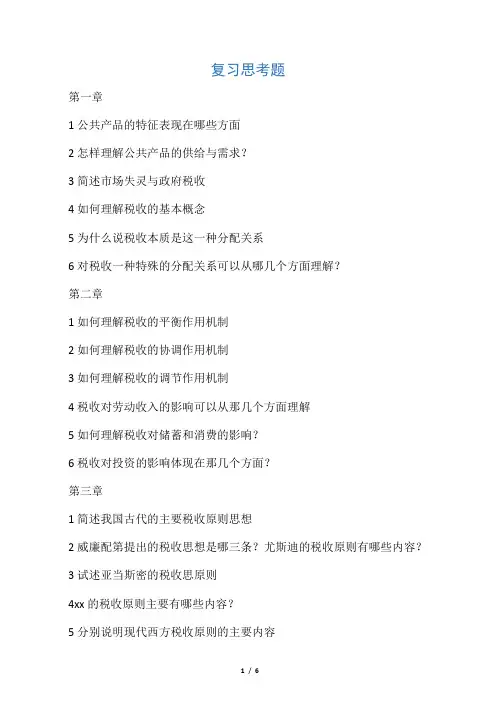

(0484)《税收学》复习思考题一、填空题1、以课税对象可分为、收益额、、资源和人身等五大类。

2、税率的三种主要形式包括、累进税率和。

3、纳税人是指税法规定的直接负有纳税义务的和。

4、增值税的基本税率为。

5、我国增值税实行凭扣税的办法。

6、凡在我国境内销售货物或者提供、劳务以及进口货物的单位和个人为增值税的纳税人。

7、增值税条例规定,从事货物批发或零售的纳税人,年应税销售额在----------- 万元以下的,为小规模纳税人。

8、营业税是实行比例税率。

9、扣缴义务人应当向的主管税务机关申报缴纳其扣缴的营业税税款。

10、企业承包给他人经营的,以为纳税人。

11、单位或者个人举行演出,由他人售票的,其应纳税额以为扣缴义务人。

二、判断题1、企业所得税的征税对象为所得额,它是企业实现的利润额,但不是企业的销售额或营业额。

()2、企业购买国债的利息收入,不计入应纳税所得额。

()3、企业所得税的征税对象是纳税人的收入总额扣除与纳税人取得收入有关的各项成本、费用和损失后的纯所得。

()4、保险公司给予纳税人的无赔款优待,准予扣除。

()5、个人取得执照,从事办学、医疗、咨询等有偿服务活动取得的所得,应缴纳个人所得税。

()6、个人担任董事职务所取得的董事费收入,属于工资薪金所得,按工资、薪金所得项目缴纳个人所得税。

()7、某著名摄影家去世后,其子女取得他的遗作稿费,可免交个人所得税。

()8、在计算个体工商户应纳税所得额时,可按规定扣除其交纳的增值税、消费税、营业税和城市维护建设费。

()9、个人转让专利权,其应纳营业税以转让者为扣缴义务人。

()10、以不动产投资入股,参与接受投资方利润分配、共同承担投资风险的行为,征营业税。

()11、我国现行流转税包括增值税、关税、车船使用税、营业税与消费税。

()12、计税依据是税目的计量单位和征收标准。

( )13、居民用煤炭制品按17%的税率征收增值税。

( )14、用于非应税项目的购进货物或者应税劳务,应视同销售计征增值税。

第八章税收原理一、重要概念1. 纳税人与负税人(tax payer and bearer)纳税人又称为纳税主体,指税法规定的负有纳税义务的单位和个人。

纳税人可以是自然人,也可以是法人。

负税人指最终负担税款的单位和个人。

在税收不转嫁的情况下,负税人与纳税人是一致的;在税收转嫁的情况下,负税人与纳税人不一致。

2. 起征点与免征额(tax threshold and exemption)起征点指税法规定的对课税对象开始征税的数额。

免征额指税法规定的对课税对象全部数额中免予征税的数额。

起征点与免征额有相同点,即当课税对象小于起征点和免征额时,都不予征税。

两者的本质区别在于,当课税对象大于起征点和免征额时,起征点制度要求对课税对象的全部数额征税,而免征额制度则要求仅对课税对象超过免征额部分征税。

3. 直接税与间接税(direct and indirect taxes)直接税指纳税人直接负担的税收,通常也是对人(包括自然人和法人)课征的税收,故也称对人税,纳税人和负税人相一致。

间接税是指纳税人能将税收转嫁给他人的税收,通常是对商品和服务的交易课征的税收,故也称对物税;在很多情况下,纳税人往往不是真正的负税人。

4. 税收转嫁与税收归宿(tax shifting and incidence)税收转嫁是指纳税人在名义上缴纳税款之后,主要以改变价格的方式将税收负担转移给他人的过程。

这就是说,最初纳税的人不一定是最终的实际承担者。

税收归宿是指税收负担的最终归着点或税收转嫁的最终结果。

每种税以及不同税种在不同的经济条件下,其转嫁的方式、转嫁的过程是不一样的,但每项税最终总是要由一定的人来负担的。

5. 局部均衡分析与一般均衡分析(partial and equilibrium analysis)所谓局部均衡分析,是指在其他条件不变的情况下分析一种商品或生产要素的供给与需求达到均衡时的价格决定。

换言之,局部均衡分析是假定某种商品或生产要素的价格只取决于它本身的供求状况,不受其他商品或生产要素的价格和供求状况的影响。

税收学原理第三版课后答案【1】学习长征精神写一篇红字“长征万里路遥迢,风萧萧,雨飘飘。

浩气比天,千军势如潮。

为雪国耻洒热血,真理在,恨难消。

梦断推窗听鼓角,冷月皎,流萤高。

身居京华,常盼归鸿早。

抽出心丝填旧句,写往事,万年骄。

”李志民在《江城子——忆长征》这首词中,它生动地描述了红军在长征中所经历的艰辛。

有人说“红军队伍是地球上一根长长的红飘带。

”是啊!红军在地球的每一个角落都留下了足迹。

湘江,一条碧绿的河流,如今却被鲜血染红,这血是我们红军所流,它时时提醒着人们保卫自己祖国,为祖国利益所战!在长征途中,红军需翻过一座座雪山,穿过一片片草地,红军不能因为累而停下脚步,因为此时此刻的每一分钟都可能涉及国家安全。

1927年8月1日周恩来、朱德、贺龙、叶挺、刘伯承等领导了著名的八一南昌起义,对国民党反动派的第一枪武装抵抗被打响。

在南昌起义影响下,全国暴发了秋收起义、广州起义、百色起义等大小武装起义100多次,建立了井冈山根据地、中央根据地、陕北根据地等十几个革命根据地到1930年,全国红军发展到10万人。

蒋介石心有不甘,开始“围剿”,但是红军在周恩来、朱德指挥下,执行毛泽东的战略战术原则,胜利粉碎敌人四次“围剿”。

如今,提到红军的长征,我们不会感到羞耻,【2】学习长征精神写一篇红字我们现在的生活多么美好呀!你知道,是那些革命烈士牺牲了宝贵的生命,换来我们今天的幸福生活,让我们快乐地依偎在祖国的怀抱里。

那些革命先烈,多么伟大呀!他们用鲜血,把五星红旗染得鲜红。

他们用生命,换来现在的和平时代。

他们的尸体掉在通往胜利的路上。

他们用自己的躯体,建造了成功的大厦。

他们的英雄事迹,记录了革命的艰辛,可他们没有放弃,他们用坚定的信念,赢得了胜利女神的眷顾,在历史上写下了光辉的一页。

就如中国最早的马克思主义者李大钊;有“砍头不要紧,只要主义真”的夏明翰;还有伟大的抗日民族英雄杨靖宇;在烈火与热血中得到永生的叶挺;生的伟大,死的光荣的刘胡兰……他们为了挽救国家的危亡,为了实现国家的富强,这些爱国志士献出了宝贵的生命,可他们的精神却永远让我们铭记在心中;尽管先烈们每一个人的生命在历史长河中,都是平凡而渺小的。

第10章所得税和社会保险税设计原理10.1 复习笔记一、个人所得税原理1.个人所得税的纳税人和征税对象(1)个人所得税的纳税人个人所得税的纳税人可以概括为所有具有应税所得的自然人。

一般规则是合伙人、独资公司、个体经营者获得的经营性所得纳入个人所得税的征税范围,对股东分红收益要本着不重复课税原则加以处理。

(2)个人所得税的征税对象个人所得税是以所得为征税对象的,从各国的实践来看,征税对象的范围确定不仅受到征税所得学说的影响,还受一国经济发展水平、征管能力、法律制度、伦理道德等多方面的制约。

①关于征税所得有不同学说,包括:周期说或所得源泉说;净值说或纯资产增加说;净值加消费说;交易说。

②征税对象范围的确定规则A.通过交换并能以货币衡量的所得为征税所得;B.已变现的所得为征税所得。

(3)中国个人所得税征税对象范围的确定目前中国个人所得税征税对象范围包括工资薪金所得,个体工商户生产经营所得,个人从独资企业、合伙企业获得的生产经营所得,个人对企事业单位的承包经营、承租经营所得,劳务报酬所得,稿酬所得,特许权使用费所得,利息、股息、红利所得,财产租赁所得,财产转让所得,偶然所得和经国务院财政主管部门确定征税的其他所得。

2.个人所得税综合费用扣除规则(1)综合费用扣除的基本内容和方法①综合费用扣除的内容包括:A.为获得应税收入而支付的必要的成本费用;B.赡养纳税人本人及其家庭成员的最低生活费用。

②综合费用扣除的办法有两个:A.综合法;B.分别法。

③从各国个人所得税实践来看,个人所得税生计扣除有几种方法:A.所得减除法;B.税额抵扣法;C.家庭系数法。

(2)中国个人所得税工薪所得综合费用扣除的原则和标准①间接费用扣除的基本原则和标准:以人为本的原则;促进公益的原则;与企业所得税协调原则。

②生计费用扣除的基本原则和标准:最低生活费用不纳税。

3.个人所得税税率(1)个人所得税的税率制度①比例税率和累进税率比例税率下,纳税人无论应税所得多寡,均按照一个比例纳税,实际结果是纳税能力强的人负担轻,纳税能力弱的人负担重,而在累进税率下,根据所得多少,适用高低不等的税率,则相对公平。

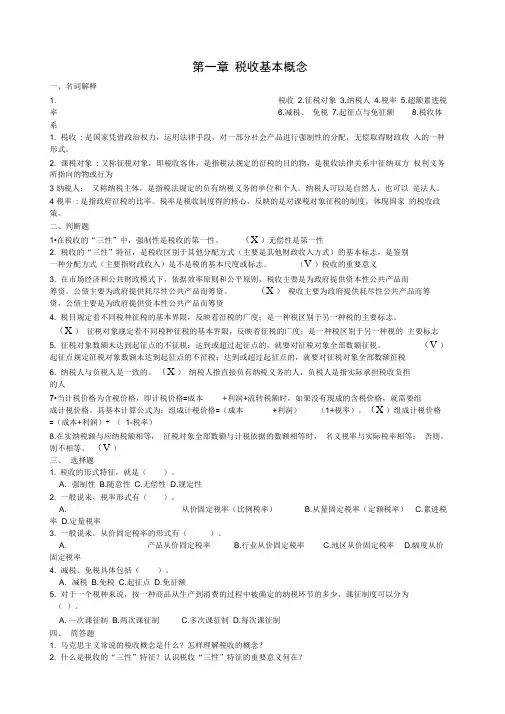

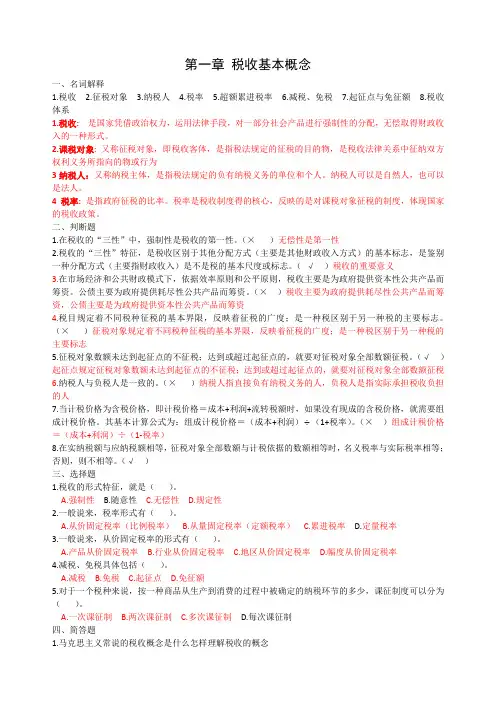

第一章税收基本概念一、名词解释1.税收2.征税对象3.纳税人4.税率5.超额累进税率6.减税、免税7.起征点与免征额8.税收体系1.税收:是国家凭借政治权力,运用法律手段,对一部分社会产品进行强制性的分配,无偿取得财政收入的一种形式。

2.课税对象: 又称征税对象,即税收客体,是指税法规定的征税的目的物,是税收法律关系中征纳双方权利义务所指向的物或行为3纳税人:又称纳税主体,是指税法规定的负有纳税义务的单位和个人。

纳税人可以是自然人,也可以是法人。

4税率:是指政府征税的比率。

税率是税收制度得的核心,反映的是对课税对象征税的制度,体现国家的税收政策。

二、判断题1.在税收的“三性”中,强制性是税收的第一性。

(×)无偿性是第一性2.税收的“三性”特征,是税收区别于其他分配方式(主要是其他财政收入方式)的基本标志,是鉴别一种分配方式(主要指财政收入)是不是税的基本尺度或标志。

(√)税收的重要意义3.在市场经济和公共财政模式下,依据效率原则和公平原则,税收主要是为政府提供资本性公共产品而筹资。

公债主要为政府提供耗尽性公共产品而筹资。

(×)税收主要为政府提供耗尽性公共产品而筹资,公债主要是为政府提供资本性公共产品而筹资4.税目规定着不同税种征税的基本界限,反映着征税的广度;是一种税区别于另一种税的主要标志。

(×)征税对象规定着不同税种征税的基本界限,反映着征税的广度;是一种税区别于另一种税的主要标志5.征税对象数额未达到起征点的不征税;达到或超过起征点的,就要对征税对象全部数额征税。

(√)起征点规定征税对象数额未达到起征点的不征税;达到或超过起征点的,就要对征税对象全部数额征税6.纳税人与负税人是一致的。

(×)纳税人指直接负有纳税义务的人,负税人是指实际承担税收负担的人7.当计税价格为含税价格,即计税价格=成本+利润+流转税额时,如果没有现成的含税价格,就需要组成计税价格。

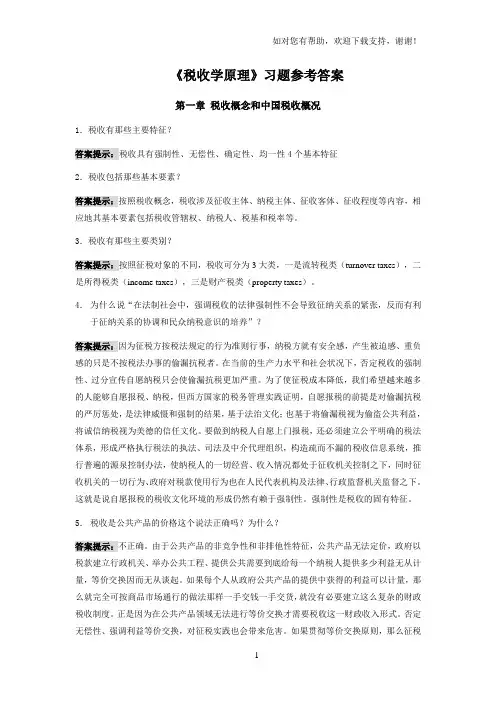

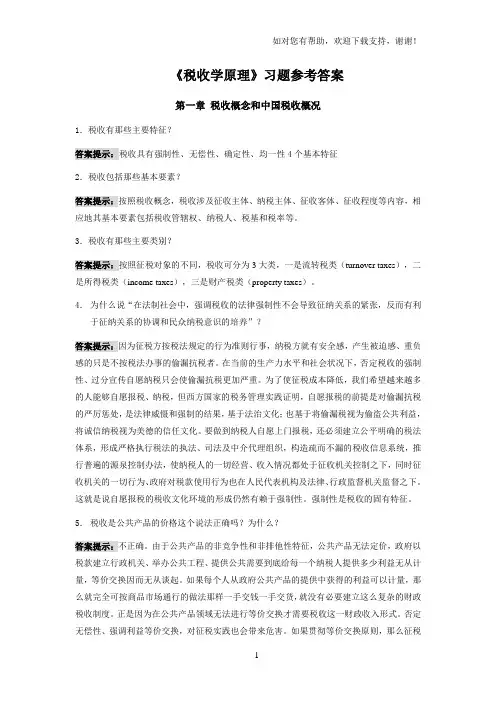

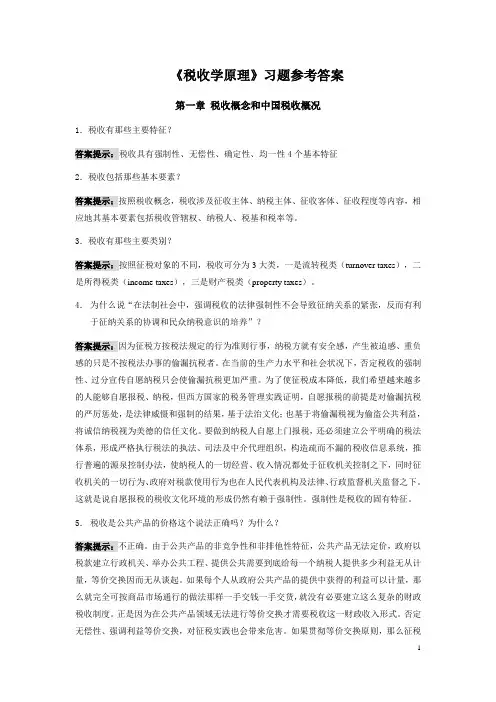

《税收学原理》习题参考答案第一章税收概念和中国税收概况1.税收有那些主要特征?答案提示:税收具有强制性、无偿性、确定性、均一性4个基本特征2.税收包括那些基本要素?答案提示:按照税收概念,税收涉及征收主体、纳税主体、征收客体、征收程度等内容,相应地其基本要素包括税收管辖权、纳税人、税基和税率等。

3.税收有那些主要类别?答案提示:按照征税对象的不同,税收可分为3大类,一是流转税类(turnover taxes),二是所得税类(income taxes),三是财产税类(property taxes)。

4.为什么说“在法制社会中,强调税收的法律强制性不会导致征纳关系的紧张,反而有利于征纳关系的协调和民众纳税意识的培养”?答案提示:因为征税方按税法规定的行为准则行事,纳税方就有安全感,产生被迫感、重负感的只是不按税法办事的偷漏抗税者。

在当前的生产力水平和社会状况下,否定税收的强制性、过分宣传自愿纳税只会使偷漏抗税更加严重。

为了使征税成本降低,我们希望越来越多的人能够自愿报税、纳税,但西方国家的税务管理实践证明,自愿报税的前提是对偷漏抗税的严厉惩处,是法律威慑和强制的结果,基于法治文化;也基于将偷漏税视为偷盗公共利益,将诚信纳税视为美德的信任文化。

要做到纳税人自愿上门报税,还必须建立公平明确的税法体系,形成严格执行税法的执法、司法及中介代理组织,构造疏而不漏的税收信息系统,推行普遍的源泉控制办法,使纳税人的一切经营、收入情况都处于征收机关控制之下,同时征收机关的一切行为、政府对税款使用行为也在人民代表机构及法律、行政监督机关监督之下。

这就是说自愿报税的税收文化环境的形成仍然有赖于强制性。

强制性是税收的固有特征。

5.税收是公共产品的价格这个说法正确吗?为什么?答案提示:不正确。

由于公共产品的非竞争性和非排他性特征,公共产品无法定价,政府以税款建立行政机关、举办公共工程、提供公共需要到底给每一个纳税人提供多少利益无从计量,等价交换因而无从谈起。

《税收学》复习思考题一、名词解释外部效应外部性又称为溢出效应、外部影响或外差效应,指一个人或一群人的行动和决策使另一个人或一群人受损或受益的情况.经济外部性是经济主体(包括厂商或个人)的经济活动对他人和社会造成的非市场化的影响。

即社会成员(包括组织和个人)从事经济活动时其成本与后果不完全由该行为人承担.分为正外部性 (positive externality) 和负外部性(negative externality)。

正外部性是某个经济行为个体的活动使他人或社会受益,而受益者无须花费代价,负外部性是某个经济行为个体的活动使他人或社会受损,而造成负外部性的人却没有为此承担成本。

税负转嫁税负转嫁是指商品交换过程中,纳税人通过提高销售价格或压低购进价格的方法,将税负转嫁给购买者或供应者的一种经济现象。

一般包括前转和后转两种基本形式(还有消转与税收资本化)。

复合税制复合税制是指在一个课税主权范围内,同时课征两种以上的税收。

税制结构税制结构是指一个国家根据其生产力发展水平、社会经济结构、经济运行机制、税收征管水平等各方面情况,合理设置各个税类、税种和税制要素等而形成的相互协调、相互补充的税制体系和布局.税收政策税收政策是政府根据经济和社会发展的要求而确定的指导制定税收法令制度和开展税收工作的基本方针和基本准则。

税收政策是和预算政策一起发展的.税收政策的核心问题是税收负担问题。

公共产品公共产品(Public good)是私人产品的对称,是指具有消费或使用上的非竞争性和受益上的非排他性的产品。

一是非竞争性。

一部分人对某一产品的消费不会影响另一些人对该产品的消费,一些人从这一产品中受益不会影响其他人从这一产品中受益,受益对象之间不存在利益冲突. 二是非排他性。

是指产品在消费过程中所产生的利益不能为某个人或某些人所专有,要将一些人排斥在消费过程之外,不让他们享受这一产品的利益是不可能的.替代效应税收的替代效应,是指税收对纳税人在商品购买方面的影响,表现为当政府对不同的商品实行征税或不征税的区别对待时,会影响商品的相对价格,使纳税人减少对征税商品的购买量,而增加对无税商品的购买量,即以无税商品替代征税商品.单一税制所谓单一税制就是在一个税收主权范围内,课征某一种税作为政府税收收入的唯一来源税负归宿税负归宿指税负转嫁的最后结果或税收负担的最终落脚点,它表明转嫁的税负最后是由谁来承担的。

第4章税收治理的五项原则4.1复习笔记一、公平原则公平对税收十分重要,它是税收本质的客观要求。

税收是以国家公共权力主体对剩余产品价值的占有所形成的经济关系,征税过程是经济利益由个人、单位转向国家的过程。

如果把税款的使用考虑进去,那么税收是一种再分配的机制。

既然牵涉利益关系,就有多与少的问题,有各阶层人民向政府纳税是否平衡问题,有纳税人从政府分享到的利益是否平衡问题。

怎样解决这些问题,需要公平原则。

不考虑公平的税制必定是难以实行的税制。

1.中国古代税收公平思想(1)相地而衰征;(2)按纳税人劳动能力的强弱制定不同的征税等级;(3)以占有财产的数量为标准课税。

2.西方税收公平思想(1)受益原则;(2)支付能力原则;(3)社会公平原则。

3.中国社会经济文化条件下的税收公平原则(1)无差别待遇原则①同样条件纳同样税原则;②尽可能普遍课税原则;③对企业组织方式无差异原则;④税种相互配合原则;⑤避免累进课征原则。

(2)税款交纳与财政利益整体对称原则①较穷的阶层和较不发达的区域其所交纳的税收与获得的财政利益至少应当对称;②更多地实施税款专用的原则。

(3)有效的收入和财产再分配原则①机会平等下的中性原则;②机会不平等下有效干预原则。

二、效率原则1.中国古代税收效率思想(1)税收与经济的关系,主张在发展经济的基础上增加财政收入。

(2)税收的确实和便利,考虑尽量减少征税对经济发展的消极影响。

2.西方税收效率思想的发源(1)亚当·斯密本人的税收效率思想亚当·斯密税收效率思想体现在他的中性税收政策主张以及确实、便利、最少征收费用3个原则中。

(2)额外负担理论西方税收效率思想的第二个阶段是额外负担理论。

额外负担是指政府征税不仅导致纳税人(负税人)付出税款而造成的损失,而且由于征税过程影响了纳税人的决策和行为,如果结果使其境况或福利不如税前,那么就产生了超过已缴纳税收的福利损失。

(3)建立在福利经济学基础上的税收效率思想①福利经济学的创始人—庇古主张,如果一个经济单位边际私人纯产品超过边际社会纯产品时政府课以较高税收,使该部门缩小;反之则给予补助,以刺激其扩张,那么社会经济福利会增加。

Chapter 6Questions and Problems for Discussion1. a. The annual business cycle for a plant and garden center might end in the late autumnindicating an October 31 or November 30 fiscal year end.b. A bakery has no obvious annual business cycle to suggest a particular taxable year.c. The annual cycle for a chimney cleaning business might end in late spring indicating anApril 30 fiscal year end, or the cycle might end in early autumn indicating a September30 fiscal year end.d. The annual cycle for a moving and transport business might end in late summerindicating an August 31 fiscal year end.e. A software consulting business has no obvious annual cycle to suggest a particulartaxable year.2. Corporation DB can elect a different overall method of accounting for each of its threebusiness ventures.3. This lucky event increased Firm LK’s net worth by $72,000 and, therefore, resulted in$72,000 recognized income to the firm.4. If the two corporations have different marginal tax rates, an intercompany transaction couldresult in a shift of income from the high tax entity to the low tax entity or a shift of adeduction from the low tax entity to the high tax entity. A method of accounting thataccomplishes such a shift and does not reflect an arm’s length transaction price between the related corporations is highly vulnerable to IRS challenge.5. Firms that provide audited financial statements to external users (investors, creditors,regulatory agencies, etc.) must prepare the statements in accordance with GAAP. The SEC requires publicly held corporations to follow GAAP in the preparation of financialstatements.6. No, the cash method does not require that the taxpayer receive currency. The receipt ofproperty (such as the case of wine) triggers income recognition based on the value of the property.7. Evidently, the increase in the after-tax cost of business lunches reduced KJ Inc.’s demandfor the service provided by Al’s Steak House. To the extent that the restaurant’sprofitability declined because of the aggregate reduction in demand by the businesscommunity, the restaurant’s owners bear the incidence of the indirect tax increase.8. The death benefits received by a corporate beneficiary under its key-person life Insurancepolicies are nontaxable. Therefore, the cost associated with the nontaxable income (the annual premiums on the policies) is nondeductible by the corporation. In contrast, if other parties (the officer’s spouse and children) are named as beneficiaries, the premiums paid by the corporation represent additional officers’ compensation, which is a deductiblebusiness expense.9. Under GAAP, income is not realized until earned. If a firm receives payment for goods orservices to be provided in a future year, the prepayment is recorded in a liability account as unearned revenue. Under the tax law, many prepayments of income must be included in taxable income, even if the income has not yet been earned. The GAAP treatment isconservative because it prevents an overstatement of book income. The tax treatment is conservative because it prevents an understatement of taxable income (financial ability to pay).10. a. Taxable income exceeds book income by $55 (disallowed 50 percent of meal expense).b. Book income exceeds taxable income by $700 ($3,500 tax-exempt interest $2,800nondeductible interest expense).c. Taxable income exceeds book income by $17,400 ($7,400 nondeductible lobbyingexpenses + $10,000 nondeductible political contribution).11. Under the cash method, income from the provision of goods and services is not recognizeduntil payment for the goods and services is received, an event that usually occurs after the income is earned under the accrual method. Thus, the cash method results in deferral from the year income is earned until the year payment is received. In a growing business, this annual deferral results is continuous. Therefore, in NPV terms, the tax cost associated with the cash method is less than the tax cost associated with the accrual method, even though each method results in the same total income recognition over the life of the business. 12. A deferred tax asset is similar to a prepaid tax resulting from an excess of taxable incomeover book income. The asset creates no independent value for the firm. A deferred taxliability is similar to a deferred tax resulting from an excess of book income over taxable income. The liability has no independent cost to the firm.13. A net operating loss suggests that a business is losing money. Most unprofitable businessventures don’t last for 20 years.14. A tax preference may take the form of an income item reported for financial statementpurposes but never included in gross income, or a tax deduction that is not based on an expense or loss reported for financial statement purposes. The resulting book/taxdifferences are permanent differences, which are more valuable than temporary differences in NPV terms.Application Problems1. a. Nello must recognize the $8,400 excess of the account payable over the settlementpayment ($23,400 - $15,000) as discharge-of-debt income. Nello’s tax cost of theincome is $2,940 ($8,400 × 35%), and its net cash outflow is $17,940 ($15,000 cashpaid + $2,940 tax cost).b. Bonview can deduct the $8,400 excess of the account receivable over the settlementpayment ($23,400 - $15,000) as a bad debt. Nello’s tax savings from the deduction is$2,520 ($8,400 × 30%), and its net cash inflow is $17,520 ($15,000 cash received +$2,520 tax savings).2. a. PT’s tax on $92,000 income is $19,530 ($13,750 + 34% [$17,000 excess income over$75,000]).b. In this case, PT must annualize the $92,000 income reported on the short-period return.$92,000 short-period income ⨯ (12 months ÷ 4 months) = $276,000 annualized income.The tax on $276,000 annualized income is $90,890 ($22,250 + 39%[$176,000 incomeover $100,000]). This tax must be deflated to reflect the four months of operations inthe short period.$90,890 ⨯ (4 months ÷ 12 months) = $30,297.3. a. Because the property and casualty insurance premium is deductible, the after-tax cost is$3,640 ($5,600 – [$5,600 × 35%]).b. Because the fine is nondeductible, the after-tax cost is $1,200.c. Because the life insurance premium is nondeductible, the after-tax cost is $3,700.d. Because the political contribution is nondeductible, the after-tax cost is $50,000.e. Because only 50 percent of the entertainment expense is deductible, the after-tax cost is$6,435 ($7,800 – [$3,900 × 35%]).4. Northwest Company is allowed a domestic production activities deduction equal to 6% ofnet income generated by the Portland plant. Consequently, its taxable income is computed as follows.Net income from Portland plant $3,100,000Net income from Vancouver plant 4,800,000Domestic production activities deduction(6% × $3,100,000) (186,000)Taxable income $7,714,0005. a. $22 taxable income. Although Firm B received $522 cash, the $500 principal repaymentwas a nontaxable return of investment. Only the $22 interest is income.b. No taxable income. Although Firm B received $600 cash, the receipt created a liabilityfor repayment of the deposit and did not increase net worth.c. No taxable income. Although Firm B received $10,000 cash, the receipt created aliability for repayment of the loan and did not increase net worth.d. $888 taxable income. Although Firm B earned only $180 of the prepaid rent this year,(15 days in December × $12), the income is recognized in the year payment is received.6. a. The recording of the account receivable had no effect on Firm F’s taxable income.b. The write-off of the account receivable had no effect on Firm F’s taxable income.7. Although Firm Q is a cash basis taxpayer and received only $10,000 cash, it recognizes the$23,400 total value of the cash and noncash payment as taxable income.8. a. As a cash basis taxpayer, RTY recognizes no income for the services performed and$4,000 prepaid rent income.b. As an accrual basis taxpayer, RTY recognizes $17,800 income for the servicesperformed and $4,000 of prepaid rent income.9. a. No deduction. The $50,000 results in a benefit extending beyond the following taxableyear and must be capitalized.b. No deduction. Brillo must use the accrual method to account for purchases ofinventory. Thus, the $79,000 is capitalized to inventory.c. No deduction. The $1,800 cost of the refrigerator is capitalized to an asset account.d. $4,800 deduction.e. $22,300 deduction.10. a. Even though NC adopted the cash method as its overall method of accounting, it mustuse the accrual method to account for inventory purchases. Therefore, its cost of goods sold for its first taxable year is $254,400 ($319,000 purchases $64,600 inventory onhand at year-end), and it is using a hybrid method of accounting.b. $254,400 (no difference)11. a. LSG can deduct the entire $9,450 expenditure in 2009, the year of payment, because theexpenditure results in a benefit with a duration of less than 12 months and the benefitdoes not extend beyond 2010.b. LSG must capitalize the $9,450 expenditure because it results in a benefit with aduration of more than 12 months. LSG can amortize the capitalized expenditure at arate of $525 per month ($9,450 ÷ 18 months), and can amortize and deduct $1,050 in2009 ($525 × 2 months).12. a. Even as a cash basis taxpayer, Firm F can deduct only $4,720 of the interest payment(the interest relating to the four-month period from September 1 through December31).b. $4,720 (no difference)13. a. Under the cash method of accounting, Wahoo must recognize the entire $36,000prepayment as 2009 income.b. Even as an accrual basis taxpayer, Wahoo must recognize the entire $36,000prepayment as 2009 income.14. a. GreenUp should report $20,000 revenue in 2009, $65,000 revenue in 2010, and $15,000revenue in 2011 for financial statement purposes.b. Under the one-year deferral method, GreenUp must recognize $20,000 taxable incomein 2009 and $80,000 taxable income in 2010.15. Cornish cannot deduct an accrued expense that fails the all-events test. Cornish’s liabilityfor the accrued expense is fixed because it has a binding contract with the constructioncompany. The $65,000 amount of the accrual is an estimate; only $7,200 (the billed amount) is determinable with reasonable accuracy. Economic performance with respect to the$7,200 accrual has occurred because the construction company has provided the services to Cornish. Consequently, Cornish’s current year deduction is limited to $7,200.16. a. If KLP uses the cash method of accounting, it can deduct $100,000 in the year ofpayment.b. For financial statement purposes, KLP must accrue a $100,000 expense in the year thewinner was selected and its liability to pay the prize became fixed. However, because of the economic performance requirement for awards, prizes, or jackpots, KLP is notallowed a tax deduction until the year of payment.17. a. Economic performance with respect to Ernlo’s liability for the purchased oil does notoccur until the oil is delivered in October. Consequently, Ernlo can deduct the $12,450cost in its fiscal year ending June 30, 2010.b. Under the recurring item exception, Ernlo can deduct the $12,450 cost in its fiscal yearending June 30, 2009, because economic performance (delivery) occurred within 8½months after the close of the year.18. a. Economic performance with respect to HomeSafe’s liability for future service callsdoes not occur until HomeSafe provides the service. Consequently, HomeSafe cannotdeduct any of the $48,900 accrued expense in 2009. In 2010, it can deduct the $36,300cost of the service calls provided in 2010 (484 service calls × $75 cost per call).b. Under the recurring item exception, HomeSafe can deduct $27,150 of the $48,900accrued expense in 2009 (362 service calls made within 8½ months after the close of2009 × $75 cost per call). It can deduct $9,150 in 2010 (122 service calls made fromSeptember 16 through December 31 × $75 cost per call).19. a. BZD can deduct the $55,000 accrued compensation expense in 2009 because thecompensation was paid by March 15, 2010 (2½ months after year-end).b. BZD can deduct $20,000 of the $40,000 accrued bonus expense: the amount paid byMarch 15, 2010. The $20,000 bonus payment made on May 1, 2010, is deductible in2010.c. BZD cannot deduct any of the $219,700 accrued vacation pay expense because none ofthe expense was paid by March 15, 2010. BZD will deduct the expense in the year ofpayment.20. a. Deduction for accrued expense in 2008 $180,000Tax rate .352008 tax savings $63,000PV of 2010 payment($180,000 ⨯ .873 discount factor at 7%) (157,140)NPV of after-tax cost $(94,140)b. After-tax cost in 2010($180,000 payment - $63,000 tax savings) $(117,000)NPV of after-tax cost ($117,000 ⨯ .873 discount factor at 7%)$(102,141)21 a. Economic performance with respect to Extronic’s liability for state income tax occurswhen the tax is paid. Consequently, Extronic can deduct the $273,900 tax paid during2009 ($41,900 balance due of 2008 tax + $232,000 estimated tax payments).b. Under the recurring item exception, Extronic deducted the $41,900 accrued expensefor 2008 tax in 2008 because the liability was paid within 8½ months after the close of2008. It can deduct the $19,200 accrued 2009 expense because the liability was paidwithin 8½ months after the close of 2009. Consequently, Extronic’s 2009 deductionfor state income tax is $251,200 ($232,000 estimated tax payments + $19,200 accruedtax payable).22. a. Company N can deduct the $7,740 interest payment in 2010, the year in which relatedparty Creditor K recognized the payment as income.b. Company N can deduct the $7,740 interest expense in 2009. Even though Creditor K isa related party, it recognized the payment as income in 2009 under its accrual method ofaccounting.c. Company N can deduct the $7,740 interest expense in 2009 because Company N andCreditor K are unrelated.23. a If Mrs. T owns no Acme stock, she and Acme are not related parties. Thus, Acme candeduct the $20,000 bonus in 2009, the year in which the expense was accrued.b. If Mrs. T owns 63 percent of Acme’s stock, she and Acme are related parties. Thus,Acme must wait to deduct the $20,000 bonus until 2010, the year in which Mrs. Tincludes the payment in income.24. a. GK’s bad debt expense for financial statement purposes is $90,000, which is theaddition to the allowance for bad debts.b. GK’s tax deduction for bad debts is $77,300, the amount of actual write-offs ofaccounts receivable.25. a. For financial statement purposes, the $65,000 write-off was charged against theallowance for bad debts and did not reduce financial statement income. For taxpurposes, the $65,000 write-off was deducted in the computation of taxable income.b. For financial statement purposes, the $65,000 recovery was credited to the allowancefor bad debts and did not increase financial statement income. For tax purposes, the$65,000 recovery was included in taxable income under the tax benefit rule.26. EFG’s net book income before tax $500,000Bad debt expense per books $12,500Bad debt deduction (write-offs) (13,800)(1,300)Nondeductible fine 17,500Nondeductible contingent liability 50,000Advanced payment for inventory no differenceEFG’s taxable income $566,20027. a. 35% × $31,000 excess of book income over taxable income = $10,850 deferred taxliabilityb. No deferred tax asset or liability from permanent book/tax difference.c. 35% × $55,000 excess of taxable income over book income = $19,250 deferred taxasset28. a. GT’s tax expense is $238,000 (34% × $700,000 book income).b. GT’s tax payable is $275,400 (34% × $810,000 taxable income).c. The excess of tax payable over tax expense is a $37,400 net increase in deferred taxassets.29. a. Net income before tax $600,000Permanent book/tax differences 15,000$615,000Tax rate .34Corporation H’s tax expense $209,100b. Taxable income $539,000Tax rate .34Corporation H’s tax payable $183,260c. Tax expense $209,100Tax payable (183,260)Net increase in deferred tax liabilities $25,84030. a. Net income before tax $378,200Permanent book/tax differences (33,500)$344,700Tax rate .34Corporation H’s tax expense $117,198b. Taxable income $457,100Tax rate .34Corporation H’s tax payable $155,414c. Tax payable $155,414Tax expense (117,198)Net increase in deferred tax assets $38,216 31. Micro’s net book income before tax $505,100Domestic production activities deduction(6% × $319,600) (19,176) Prepaid royalty income 40,000Accrued bonus expense no differenceNOL carryforward deduction (21,400) Micro’s taxable income $504,52432. TRW’s taxable income for the eight-year period is computed as follows:2001 2002 2003 20042005 2006 2007 2008 Tax. income beforeNOL deduction20,000 158,000 81,000 (741,000)21,000 398,000 687,000 905,000 NOL deduction (158,000) (81,000) NA (21,000) (398,000) (83,000)Taxable income 20,000 -0- -0- -0- -0- 604,000 905,00033. a. 34% × $90,000 unfavorable temporary difference = $30,600 deferred tax assetb. 34% × $710,000 NOL carryforward = $241,400 deferred tax assetc. Negative tax expense $272,000 ($30,600 + $241,400). Negative tax expense can also becomputed by multiplying Rony’s $800,000 book loss by its 34 percent tax rate.34. a. Rony’s tax expense is $408,000 (34% × $1,200,000 book income).b. Rony’s tax payable is $136,000 (34% × $400,000 taxable income).c. Rony’s reduction in its deferred tax assets is $272,000.Issue Recognition Problems1. Must Corporation DS recognize the $15,000 discharged debt as income, even though thecancellation did not increase the insolvent corporation’s net worth?2. Is the discovery of the underlying painting a realization event that triggers $249,700 incomefor the theater company? Did the discovery of the underlying painting merely increase the value of the asset purchased for $300, an increase that does not represent realized income?3. Is BL Inc. required to request permission from the IRS to change from an incorrect to acorrect method of accounting?4. In which year (2009 or 2010) does Company A recognize the $160,000 income from theconsulting engagement? Because Company A used the cash method in 2009 (when theconsulting engagement was completed) and the accrual method in 2010 (when the cash was received), does the $160,000 income from the consulting engagement escape taxationentirely?5. Was Mr. RJ in constructive receipt of the $3,500 income in the earlier year because he couldhave picked up the check from the client’s receptionist if he had checked his phonemessages during the holidays?6. Assuming that Maxo accrues a liability for the $14,420 bill from the publisher, can it deductthe accrued expense? Does an accrued liability fail the all-events test if the taxpayer notifies the creditor that it is contesting the amount of the liability?7. Is $75,000 an arm’s length price for the advertising provided by HT to LT? Did HTundercharge for the service rendered to LT to shift income to a related party with a zero marginal tax rate?8. Does the $18,000 property tax refund represent either financial statement income or taxableincome to Firm K?9. Should Firm G have recognized $200,000 or only $150,000 income in 2007? If Firm Grecognized $200,000 income in 2007, can it deduct the $30,000 settlement paid in 2009? If Firm G recognized $200,000 income in 2007, can it request a $11,700 refund ($30,000 ⨯ 39 percent), or must it be content with a $10,200 tax savings from a 2009 deduction ($30,000 ⨯34 percent)?10. Can a taxpayer choose the carryback year in which an NOL is deducted or must an NOLcarryback be deducted in chronological order?11. Can BL deduct TM’s NOL carryforwards? If a taxpayer purchases a business thatgenerated NOL carryforwards, does the purchaser acquire the carryforwards along with all the other business properties?Research Problems1. Section 458 provides a special method of accounting available to publishers and distributorsof magazines, paperback books, and musical records, tapes, and discs. According to Section 458(a), accrual basis taxpayers can exclude the income realized on sales of these items that are returned before the close of the “merchandise return period.” According to Section 458(b)(7), the merchandise return period for magazines is the two-month and 15-day period after the close of the taxable year. According to Section 458(b)(6), the income excluded is limited to the refund paid by the taxpayer for the returned items. Based on these rules,Bontaine Inc. can exclude $82,717 (refund paid in January 2010 for December 2009 sales) from its 2009 taxable income.2. In CharlesSchwab Corp. v. Commissioner, 107 T.C. 282 (1996), aff’d, 161 F.3d 1231 (CA-9, 1998), cert. denied (1999), the Tax Court and the Ninth Circuit Court of Appeals held that discount brokerage houses must accrue commission income on the earlier trade date instead of the later settlement date. Based on this decision, CheapTrade should recognize $1,712,400 commission income in 2009.3. The answer to this research problem depends on whether Moleri has made an election underSection 461(c) and Reg. Sec. 1.461-1(c) to accrue real property tax ratably over the twelve months of the calendar year to which the tax relates. If this election is in effect, Molerideducts $17,395 (7 months × [$29,820 ÷ 12 months]) of the 2009 tax on its return for the fiscal year ending July 31, 2009. It also deducts the 5 months of its 2008 property taxpayment relating to August through December 2008. If this election is not in effect, Moleri deducts the entire 2009 tax because it paid the tax (i.e. economic performance occurred) during the year. Reg. Sec. 1.461-4(g)(6)(iii)(A).4. This case is based on U.S. Freightways Corp. v. Commissioner, 270 F. 3d 1137 (CA-7, 2001),rev’g 113 TC 329 (1999). The accrual basis freight company deducted its entire annual payment for permits and licenses, even when the annual term of the permit or licenseextended into the following year. The company based this accounting treatment on the regulatory rule allowing a deduction for prepaid expenses providing a benefit that does not extend substantially beyond the end of the year following the year of payment. The IRS argued that this “12-month” rule applied only to cash basis taxpayers. Although the Tax Court agreed with the IRS, the Seventh Circuit reversed the Tax Court and allowed the deduction. This decision paved the way for Reg. Sec. 1.263(a)-4(f) (promulgated on December 31, 2003), paragraph (f) of which provides a 12-month rule applying to both cash and accrual basis taxpayers. Under this regulation, Jetex Inc. can deduct $1,119,200 in 2009.Tax Planning Cases1. The net income deferred from 2009 until 2010 through use of the cash method iscomputed as follows.Accrual method:Income from billings $3,500,000Expenses incurred (800,000)Net income in 2009 $2,700,000Cash method:Cash received $2,900,000Expenses paid (670,000)Net income in 2009 (2,230,000)Income deferred until 2010 under cash method $470,000The value of this deferral is computed as follows.Tax on income deferred one year($470,000 ⨯ 34%) $159,800NPV of deferred tax($159,800 ⨯ .935 discount factor at 7%) (149,413)Decrease in tax cost from cash method $10,3872. a. Yes. VB’s positive taxable income in 2007 indicates that the corporation either carriedback its 2006 NOL or claimed it as a carryforward deduction in 2007.b. VB’s carryback of $170,000 of the 2009 NOL would generate the following refund.Tax paid in 2007 $10,000Tax after $60,000 NOL carryback -0-Refund $10,000Tax paid in 2008 $26,150Tax after $110,000 NOL carryback -0-Refund 26,150Total refund received $36,150The NPV of VB’s remaining $180,000 NOL carryforward into 2011 is computed asfollows.NOL carryforward deduction $180,000Projected 2011 marginal tax rate .34Projected tax savings from deduction $61,200NPV of tax savings($61,200 ⨯ .873 discount factor at 7%) $53,428The total value of the 2009 NOL is $89,578 ($36,150 + $53,428).c. The NPV of a $350,000 NOL carryforward into 2011 is computed as follows.NOL carryforward deduction $350,000Projected 2011 marginal tax rate .34Projected tax savings from deduction $119,000NPV of tax savings($119,000 .873 discount factor at 7%) $103,887To maximize the value of the NOL deduction, VB should give up the carryback and carry the 2009 NOL forward as a deduction to 2011.。

第11章财产税设计原理1.财产税主要特征是什么?答:财产税是对纳税人所有或占有的财产就其数量或价值额(例如价值总额,价值净额或收益额)征收的一类税收,主要形态包括对所有类别财产课征的一般财产税、主要对房屋土地等不动产课征的选择性财产税、对财产所有人死亡后遗留或生前赠与的财产课征的遗产和赠与税。

(1)财产税以财产的存在为前提,与财产交易无关,只要财产存在,无论财产是否发生转移(指非交易性转移)都要征税,是对纯收入存量征收的税。

(2)虽然财产税以财产的数量和价值为计税依据,但是除非出卖财产,纳税人也要用财产收益或其他收益支付税款,因此从支付的价值源泉而言,财产税与所得税类似。

2.房地产税为什么只能充当省级以下地方主体税?答:从世界各国的实践来看,房地产税一般是作为地方性税种而存在的,而且是作为省或州以下基层地方政府的税种。

房地产税不宜作为省一级的主体税种的主要原因在于:(1)征收难度大,管理成本高。

因为正规的财产税的税基以课税对象的市场价值为准。

一个省内部各地发展往往不平衡,房地产价格差别很大,很难找到一个全省统一的评估标准。

评估基准不一致,就难以公平课税,全省统一的房地产税就很难有效实施。

硬要推行,征收管理成本将很大。

(2)省范围大,将房地产税作为省税,获得的收入在全省范围内安排,无法与纳税人受益挂钩,起不到受益税的作用。

而美国的经验表明,受益税机制的存在是财产税克服其固有弊端的必要机制,在没有受益税机制的情况下,财产税不是良税,不宜做主体税。

(3)无法形成对税负的有效控制机制。

如果社区足够小、信息比较对称、迁移容易,当人们发现负担的房地产税超过政府以此为经费提供的公共产品利益时,在其他途径无效,且迁移的成本低于税收负担时,可选择迁移的方法来抵制,从而形成税负、政府提供的公共产品与纳税人偏好吻合的约束机制,减少房地产税的福利损失。

如果将房地产税作为省税,这种机制将不复存在。

3.房地产税要成为良性税种需要什么样的社会经济政治文化条件?答:房地产税要成为良性税种需要的社会、经济、政治、文化条件包括:(1)财产税必须是社区税或适用的区域范围足够小,以至于纳税人拥有近乎相同的能力和足够的信息了解用财产税所提供的公共产品的成本和效益。

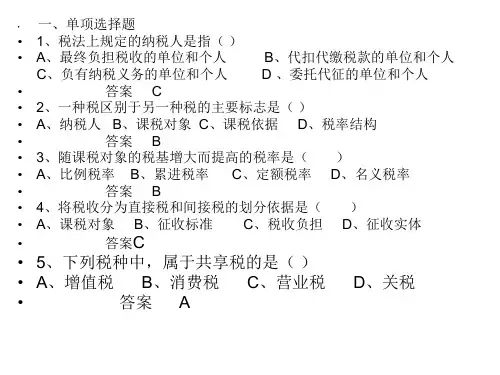

上海财大税收学思考习题上海财经大学税收学思考习题第一章税收导论一、单项选择题1.在税率计算公式中,如果随税基扩大,税率相应上升,这种税率形式可称为()A. 累进税率B. 累退税率C. 平均税率D. 递增税率2.在累进税制的情况下,平均税率随边际税率的提高而上升,但平均税率()边际税率A. 高于B. 低于C. 等于D. 无关于3.()的特点是税率不随着征税对象数额的变动而变动。

A. 边际税率B. 定额税率C. 累进税率D. 比例税率4.税收产生于()A. 原始社会B. 奴隶社会C. 封建社会D. 资本主义社会5.如果税收制度允许税前扣除,那么名义税率就会()实际税率A. 低于B. 高于C. 等于D. 无关于6.如果实行累进税制.在通货膨胀的情况下,名义税率则()实际负担率A. 低于B. 高于C. 等于D. 无关于7.行使征税权的主体是()。

A. 税务机关B. 个人C. 国家D. 企业二、多项选择题1.税收收入的特点是()。

A. 获得的非持续性B. 形成的稳定性C. 获得的持续性D. 来源的广泛性2.国家履行其公共职能的支出,或者说国家提供的公共产品具有()特点。

A. 非排斥性B. 非竞争性C. 竞争性D. 排斥性3.税收的特征可以概括为()。

A. 税收的强制性B. 税收的无偿性C. 税收的公共性D. 税收的规范性4.广义的税基可分为以下几类()。

A.国民收入型B.国民消费型C.国民财富型D.以商品销售额为课税基础5.国家征税是基于()。

A.行政管理权B.财产所有权C. 公共权力D.产权6.国家取得财政收入除了征收税收以外,还有()等多种形式。

A. 发行国债B. 收费C. 上缴利润D. 以上都不对7.我国在奴隶社会时期的财政收入是采用了()形式。

A. 贡B. 收费C. 助D. 彻三、判断题1. 效率角度分析,累退税率由于随着收入增加而上缴的税收占收入比例下降,因此对个人增加收入起到抑制作用。

()2在自然经济条件下的奴隶社会和封建社会,税收主要来自于农业收入,以货币形式为主。

第一章税收概论一、名词解释1.税收:是国家为了满足社会公共需要,凭借政治权力,按照法定标准,向居民和经济组织强制、无偿地征收取得的一种财政收入。

2.税收的强制性:是指国家凭借政治权力,以法律形式确定征纳双方的权利和义务关系。

3.税收的无偿性:是指国家征税以后,税款即归国家所有,既不需要再直接归还给纳税人,也不需要向纳税人支付任何报酬或代价。

4.税收的固定性:是指国家通过法律形式预先规定了征税对象和征税标准。

5.税收职能:是指由税收本质所决定,内在于税收分配过程中的功能。

6.税收筹集资金职能:是指税收所具有的从社会成员处强制性地取得一部分收入,为政府提供公共品,满足公共需要所需物质的功能。

7.税收资源配置职能:是指税收所具有的,在市场对经济资源基础配置的基础上,通过税收政策、制度,对市场所决定的资源配置,在公共部门、私人部门以及不同的私人部门之间进行重新组合安排的功能。

8.税收收入分配职能:是指税收所具有的影响社会成员收入分配格局的功能。

9.税收宏观调控职能:是指税收所具有的,通过一定的税收政策、制度,影响社会经济运行,促进社会经济稳定发展的功能。

二、问答题1.试述国家征税的主要目的。

答:国家征税的主要目的是为了满足社会公共需要,包括提供和平安定的社会环境,保持良好的社会秩序,兴建公共工程,举办公共事业等。

2.试述国家征税的依据。

答:国家征税的依据是政治权力。

国家凭借政治权力,也就是行政管理权,可以对其行政权力管辖范围内的个人和经济组织征税,以满足社会公共需要。

3.税收具体有哪些形式特征?答:税收具有强制性、无偿性和固定性三大特征。

4.税收如何产生?答:税收的产生取决于两个条件:一是国家的产生;二是私有财产制度的产生。

5.在税收发展过程中,征收形式有哪些变化?答:在奴隶社会和封建社会初期,税收的征收和缴纳形式基本上以力役形式和实物形式为主;在自然经济向商品货币经济过渡的漫长封建社会中,对土地课征的田赋长期以农产品实物为主;到商品经济发达的资本主义社会,税收的征收缴纳形式都以货币形式为主。