根据信用证填单练习03备课讲稿

- 格式:docx

- 大小:15.38 KB

- 文档页数:3

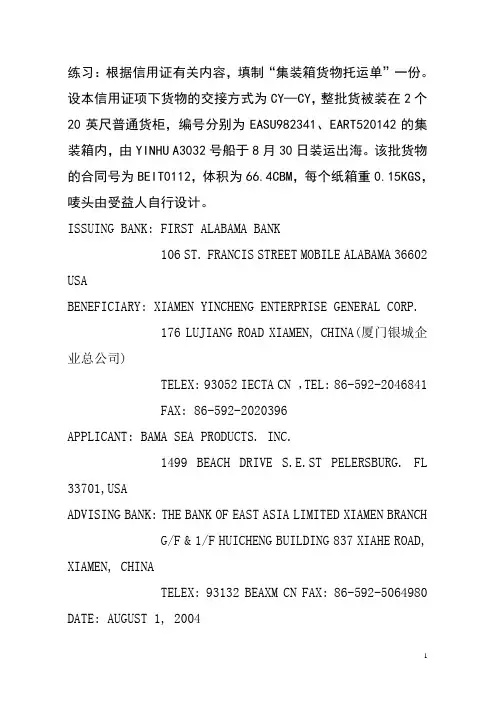

练习:根据信用证有关内容,填制“集装箱货物托运单”一份。

设本信用证项下货物的交接方式为CY—CY,整批货被装在2个20英尺普通货柜,编号分别为EASU982341、EART520142的集装箱内,由YINHU A3032号船于8月30日装运出海。

该批货物的合同号为BEIT0112,体积为66.4CBM,每个纸箱重0.15KGS,唛头由受益人自行设计。

ISSUING BANK: FIRST ALABAMA BANK106 ST. FRANCIS STREET MOBILE ALABAMA 36602 USABENEFICIARY: XIAMEN YINCHENG ENTERPRISE GENERAL CORP. 176 LUJIANG ROAD XIAMEN, CHINA(厦门银城企业总公司)TELEX: 93052 IECTA CN ,TEL: 86-592-2046841 FAX: 86-592-2020396APPLICANT: BAMA SEA PRODUCTS. INC.1499 BEACH DRIVE S.E.ST PELERSBURG. FL 33701,USAADVISING BANK: THE BANK OF EAST ASIA LIMITED XIAMEN BRANCH G/F & 1/F HUICHENG BUILDING 837 XIAHE ROAD, XIAMEN, CHINATELEX: 93132 BEAXM CN FAX: 86-592-5064980 DATE: AUGUST 1, 2004FORM OF DC: IRREVOCABLE L/C AT SIGHTAMOUNT: USD 170,450.00PARTIAL SHIPMENT: PERMITTEDTRANSSHIPMENT: PERMITTED ONLY FROM XIAMEN CHINA FORTRANSPORTATION TO LONG BEACH, CA. USA.WITH FINAL PORT OF DESTINATION TAMPA,FL,USA.SHIPMENT CONSISTS OF: 34000KGS CHINESE SAND SHRIMP OR BIGHARD SHELL SHRIMP.BLOCK FROZEN SHRIMP(PTO), PACKED 5X2KGS/CTN.(RAW, PEELED,TAIL ON)CONSISTING OF:KGS. SIZE(MM) UNIT PRICE(/KGS) TOTAL3000 71/90 USD6.60 USD19800.005000 91/110 USD6.35 USD31750.006000 111/130 USD5.45 USD32700.008000 131/150 USD4.55 USD36400.0012000 151/200 USD4.15 USD49800.00TOTAL AMOUNT OF USD170450.00 CFR TAMPA FL. U.S.A.THE LATEST SHIPMENT DATE IS AUGUST 31. 2004DOCUMENTARY REQUIREMENTS:1)FULL SET(3/3) CLEAN ON BOARD COMBINED TRANSPORT BILLSOF LADING CONSIGNED TO THE ORDER OF BAMA SEA PRODUCTSINC.,1499 BEACH DRIVE S.E., ST, PELERSBURG,FL.33701MARKED“FREIGHT PREPAID”NOTIFYING通知WILLIAMS CLARKE, INC., 603 NORTH FRIES AVENUE, WILMINGTON, CA 90744,USA. AND MUST INDICATE CONTAINER(S) NUMBER AND STATE THAT CONTAINER(S) HAVE BEEN MAINTAINED AT ZERO DEGREES FAHRENHEIT OR BELOW. IF COMBINED TRANSPORT BILLOF LADING IS PRESENTED, MUST BE INDICATE VESSEL NAME.2)BILLS OF LADING MUST ALL FREIGHT CHARGES PREPAID, INCLUDING FUEL ADJUSTMENT FEES (FAF)练习2题目要求和说明基本要求根据下述提供资料,制作集装箱托运单,要求格式清楚、内容完整。

课题第二章信用证计划课时2教学n 的要求让学生了解信用证内容和惯例,学会阅读信用证重占八、、难r1!八、、信用证的阅读授课方法课堂教学授课手段无作业无复习提问无教学后记无学习目的:理解信用证的定义、性质、特点、种类与作用,掌握《UCP500》的相关规定。

正确分析理解信用证,掌握信用证修改所遵循的方法。

教学过程:一、关于上次课内容的复习提问(3分钟)。

二、引入本次课内容(2分钟)。

三、信用证开立、通知、审单的国际贸易惯例(40分钟)四、信用证申请书的填写(40分钟)五、整理一下已讲的内容并布置作业、下次课的预习任务。

(5分钟)教学重点与难点:1.信用证申请书的填写2.ISBP关于审单的具体规定教学内容:信用证的开立一、信用证的开立基础当进出口人在买卖合同中规定以信用证为支付方式时,应同时在合同的支付条款中对信用证的开出时间、开证行、信用证的种类、金额、到期FI和到期地点等作岀明确规定。

1、合同规定开证时间如:“在装运月份前XXX天开到出口人”、“不迟于X月XFI开到出口人”。

2、关于信用证的开证行如:规定信用证应“通过出口人可接受的银行开立”。

3、关于信用证的种类:在合同屮规定信卅证是即期的、远期的、是否需要汇栗、是否需要加具保兑,是否“可转让”,是否需要预支或部分预支等。

4、关于信用证金额:信用证金额是开证行承担责任的最高金额。

在实践屮,信用证金额一般规定为发票价值的100%。

如买卖合同屮对装运数量订有“约”数或“溢短装条款” 的,则应要求进口人在信卅证屮规定装运数量多交或少交的百分率或注明“约”数,同时对信用证金额作相应的增加或在金额前注明“约”数(“ABOUT”字样)。

5、关于到期FI和到期地点:开证行承担责任的期限应该明确。

到期地点是指一个付款交单、承兑交单的地点或除了白由议付信用证外的一个议付交单的地点。

一•般应规定信用证的有效地点为出口人所在地银行。

另外,买卖合同中应认真订好其它条款,譬如:品质条款、数量条款、包装条款、装运条款、保险条款、检验条款等,因为这些条款都会在信用证中反映出来。

信用证审核练习-单证2005年11月全国国际商务单证员培训认证考试国际商务单证缮制与操作试题根据合同审核信用证(30分)SALES CONTRACTBUYER: JAE & SONS PAPERS COMPANY NO.ST05-016203 LODIA HOTEL OFFICE 1546, DONG-GU, DA TE: AUGUST 08, 2005BUSAN, KOREA SIGNED AT: NANJING, CHINA SELLER: WONDER INTERNATIONAL COMPANY LIMITEDNO. 529, QIJIANG ROAD HE DONG DISTRICT,NANJING, CHINAThis Contract is made by the Seller; whereby the Buyers agree to buy and the Seller agrees to sell the under -mentioned commodity according to the terms and conditions stipulated below:1. COMMODITY: UNBLEACHED KRAET LINEBOARD.UNIT PRICE: USD390.00/PER METRIC TON, CFR BUSAN KOREATOTAL QUANTITY: 100METRIC TONS, ±10% ARE ALLOWED. PAYMENT TERM: BY IRREVOCABLE L/C 90 DAYS AFTER B/L DATE2. TOTAL VALUE: USD39,000.00 (SAY U.S.DOLLARS THIRTY NINETHOUSAND ONLY.*** 10% MORE ORLESS ALLOWED.)3. PACKING: To be packed in strong wooden case(s), suitable for long distanceocean transportation.4. SHIIPPING MARK: The Seller shall mark each package with fadeless paint the package number, gross weight, measurement and the wording: “KEEP AWAY FROM MOUSTURE”, “HANDLE WITH CARE”, etc. and the shipping mark: ST05-016BUSAN KOREA5. TIME OF SHIPMENT: BEFORE OCTOBER 02, 20056. PORT OF SHIPMENT: MAIN PORTS OF CHINA7. PORT OF DESTINATION: BUSAN, KOREA8. INSURANCE: To be covered by the Buyer after shipment. (F.O.B Terms)9. DOCUMENT:+ Signed invoice indicating LC No and Contract No.+ Full set (3/3) of clean on board ocean Bill of Lading marked “Freight to Collect”/ “Freight Prepaid” made out to order blank endorsed notifying the applicant.+ Packing List/Weight List indicating quantity/gross and net weight.+ Certificate of Origin.+ No solid wood packing certificate issued by manufacturer.10. OTHER CONDIGTIONS REQD IN LC:+ All banking charges outside the opening bank are for beneficiary’s a/c.+ Do not mention any shipping marks in your L/C.+ Partial and transshipment allowed.11. REMARKS: The last date of L/C opening:20 August, 2005.BANK OF KOREA LIMITED ,BUSANSEQUENCE OF TOTAL *27 : 1 / 1FORM OF DOC. CREDIT *40 A : IRREVOCABLE DOC. CREDIT NUMBER *20: S100-108085DATE OF ISSUE 31 C : 20050825EXPIRY *31 D : DATE 20051001 PLACE APPLICANT'S COUNTRY APPLICANT *50 : JAE & SONS PAPERS COMPANY203 LODIA HOTEL OFFICE 1564, DONG-GU, BUSAN, KOREA BENEFICIARY *59 : WONDER INTERNATIONAL COMPANYLIMITEDN0. 529, QIJIANG ROAD HE DONG DISTRICT ,NANNING, CHINAAMOUNT *32 B : CURRENCY HKD AMOUNT 39,000.00AVAILABLE WITH/BY *41D: ANY BANK IN CHINA BYNEGOTIATIONDRAFTS AT ... 42 C : DRAFT AT 90 DAYS AT SIGHTFOR FULL INVOICE COSTDRAWEE 42 A : BANK OF KOREA LIMITED ,BUSAN PARTIAL SHIPMENTS 43 P : NOT ALLOWEDTRANSSHIPMENT 43 T : NOT ALLOWEDLOADING IN CHARGE 44 A : MAIN PORTS OF CHINAFOR TRANSPORT TO ... 44 B : MAIN PORTS OF KOREA LATEST DATE OF SHIP. 44 C : 20051031SHIPMENT PERIOD 44 :DESCRIPT. OF GOODS 45 A :+COMMODITY: UNBLEACHED KRAET LINEBOARD.U/P: HKD 390.00/MTTOTAL: 100MT ±10% ARE ALLOWED.PRICE TERM: CIF BUSAN KOREACOUNTRY OF ORIGIN: P.R.CHINAPACKING: STANDARD EXPORT PACKINGSHIPPING MARK: ST05-016BUSAN KOREADOCUMENTS REQUIRED 46 A :1. COMMERCIAL INVOICE IN 3 COPIES INDICATING LC NO. & CONTRACTNO.ST05-0182. FULL SET OF CLEAN ON BOARD OCEAN BILL OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED FREIGHT TO COLLECT, NOTIFYING THE APPLICANT.3. PACKING LIST/WEIGHT LIST IN 3 COPIES INDICATINGQUANTITY/GROSS AND NET WEIGHTS4. CERTIFICATE OF ORIGIN IN 3 COPIESADDITIONAL COND. 47 B : ALL DOCUMENTS ARE TO BE PRESENTEDTOUS IN ONE LOT BY COURIER/SPEEDPOST.DETAILS OF CHARGES 71 B : ALL BANKING CHARGES OUTSIDE OFOPENING BANK ARE FORBENEFICIARY'S ACCOUNT. PRESENTATION PERIOD 48 : DOCUMENTS TO BE PRESETNED WITHIN21 DAYS AFTER THE DATE OFSHIPMENT BUT WITHIN THE VALIDITYOF THE CREDITCONFIRMATION *49 : WITHOUTINSTRUCTIONS 78 :+ WE HEREBY UNDERTAKE THAT DRAFTS DRAWN UNDER AND IN COMPL Y WITH THE TERMS AND CONDITIONS OF THIS CREDIT WILL BE PAIDMATURITY.SEND. TO REC. INFO. 72 : /SUBJECT U.C.P.1993 ICC PUBLICATION 500经审核信用证存在的问题如下:。

9.40'集装箱,CFS/CFS。

LETTER OF CREDITBasic Header appl ID: F APDU Id: 01 LT Addr: OCMMCNSHXXXXSession: 8533 Sequence: 142087Application Header Input/Output: 0 Msg Type: 700Input Time: 1622 Input Date: 001103Sender LT: BKKBTHBKEXXXBANGKOK BANK PUBLIC COMPANY LIMITEDBANCKOKInput Session: 5177 ISN: 800333 Output Date: 001103Output Time: 2033 Priority: NSequence Total * 27 1/1Form Doc Credit * 40 A IRREVOCABLEDoc Credit Num * 20 BKKB1103043Date of Issue 31 C 001103Date/Place Exp * 31 D Date 010114 Place BENEFICIARIES’ COUNTRYApplicant * 50 MOUN CO., LTDNO. 443, 249 ROADBANGKOK THAILANDBeneficiary * 59 /SHANGHAI FOREIGN TRADE CORP.SHANGHAI, CHINACurr Code, Amt * 32 B Code USD Amount 18.000,Avail With By * 41 D ANY BANK INCHINABY NEGOTIATIONDrafts At 42 C SIGHT IN DUPLICATE INDICATINGTHIS L/C NUMBERDrawee 43 D / /ISSUING BANKPartial Shipmts 43 P NOT ALLOWEDTransshipment 43 T ALLOWEDLoading on Brd 44 ACHINA MAIN FORT, CHINA44 BBANGKOK, THAILANDLatest Shipment 44 C 001220Goods Descript. 45 A2,000 KGS.ISONIAZID BP98AT USD9.00 PER KG C AND F BANGKOKDocs Required 46 ADOCUMENTS REQUIRED:+ COMMERCIAL INVOICE IN ONE ORIGINAL PLUS 5 COPIES INDICATINGF.O.B.V ALUE, FREIGHT CHARGES SEPARATELY AND THIS L/C NUMBER,ALL OF WHICH MUST BE MANUALLY SIGNED.+ FULL SET OF 3/3 CLEAN ON BOARD OCEAN BILLS OF LADING AND TWONON–NEGOTIABLE, COPIES MADE OUT TO ORDER OF BANGKOK BANKPUBLIC COMPANY LIMITED, BANGKOK MARKED FREIGHT PREPAID ANDNOTIFY APPLICANT AND INDICATING THIS L/C NUMBER.+ PACKING LIST IN ONE ORIGINAL PLUS 5 COPIES, ALL OF WHICHMUST BE MANUALLY SIGNED.dd. Conditions 47 AADDITIONAL CONDITION:A DISCREPANCY FEE OF USD50.00 WILL BE IMPOSED ON EACH SET OFDOCUMENTS PRESENTED FOR NEGOTIATION UNDER THIS L/C WITHDISCREPANCY. THE FEE WILL BE DEDUCTED FROM THE BILLAMOUNT.Charges 71 B ALL BANK CHARGES OUTSIDETHAILAND INCLUDING REIMBURSINGBANK COMMISSION AND DISCREPANCYFEE (IF ANY) ARE FORBENEFICIARIES’ ACCOUNT.Confirmat Instr * 49 WITHOUTReimburs. Bank 53 D / /BANGKOK BANK PUBLIC COMPANYLIMITED, NEW YORK BRANCH ON T/TBASISIns Paying bank 78DOCUMENTS TO BE DESPATCHED IN ONE LOT BY COURIER.ALL CORRESPONDENCE TO BE SENT TO/BANGKOK BANK PUBLICCOMPANYLIMITED HEAD OFFICE, 333 SILOM ROAD, BANGKOK 10500,THAILAND.Send Rec Info 72 REIMBURSEMENT IS SUBJECT TOICC URR 525Trailer MAC :CHK :DLM :--------------------------------------------------------------End of Message---------------------------------------------------------------。

单证实训——信用证1. 引言信用证是国际贸易中常用的付款方式之一。

它是由买方的银行向卖方的银行发出的文件,承诺在卖方履行合同条件后支付货款。

对于国际贸易双方来说,了解信用证的操作和要求,具备相关的单证实训是非常重要的。

本文将介绍信用证的根本概念、操作流程以及相关的单证实训。

2. 信用证的定义信用证是一种由买方的银行向卖方的银行开立的付款方式,确保在卖方按照合同履行义务后支付货款。

信用证是在国际贸易中非常常见的付款方式,它有效地减少了买卖双方之间的信任风险,提高了交易的平安性。

3. 信用证的操作流程3.1 开立信用证开立信用证是指买方的银行根据买卖合同的要求,向卖方的银行发出信用证。

开立信用证的过程中,买方的银行会要求提供一系列的单证,以确保交易的顺利进行。

3.2 卖方出运货物在收到买方的信用证之后,卖方根据信用证的要求出运货物,并准备相应的单证。

3.3 卖端单证的准备卖方根据信用证的要求,准备相应的单证,包括商业发票、装箱单、提单、保险单等。

3.4 卖方提交单证给自己的银行卖方将准备好的单证提交给自己的银行。

银行会仔细审核单证的完整性和准确性,并对单证进行检查。

3.5 买方贷记账户买方的银行在确认单证无误后,将支付货款的金额从买方的账户中扣除,并将货款划入卖方的账户。

4. 单证实训在实际操作中,信用证的单证是非常重要的。

以下是一些常见的单证实训:4.1 商业发票的填写商业发票是卖方向买方提供的一种证明货物已经交付的单证。

在填写商业发票时,要确保商业发票的内容准确无误。

4.2 装箱单的填写装箱单是记录货物的装箱情况的单证。

在填写装箱单时,要确保包装数量和货物描述的准确性。

4.3 提单的填写提单是海运货物的装运单证。

在填写提单时,要确保收货人、装运日期、货物描述等信息的准确性。

4.4 保险单的填写保险单是保险公司出具的一种保险证明文件。

在填写保险单时,要确保货物描述、投保金额等信息的准确性。

5. 总结信用证是国际贸易中常用的付款方式之一,对于买卖双方来说都具有重要意义。

根据合同审核信用证练习1. 引言在国际贸易中,信用证是一种常见的支付方式。

合同审核信用证是指在签订合同之后,通过审核信用证的条款和要求,确保双方按合同履行责任并完成交易的过程。

本文将介绍根据合同审核信用证的练习,以提高审核信用证的能力和技巧。

2. 重要性合同审核信用证是国际贸易中非常重要的一环。

通过审核信用证,可以确保双方的权益得到保障,减少交易风险。

合同审核信用证还可以确保交易过程中的合规性,遵守国际贸易相关的法律法规。

因此,提高审核信用证的能力和技巧对于国际贸易的顺利进行至关重要。

3. 练习方法3.1. 学习信用证的基本知识在练习合同审核信用证之前,首先需要对信用证的基本知识有一定的了解。

包括信用证的定义、基本原则、种类等。

可以通过读书、参加培训课程以及阅读相关的学术文献来学习信用证的基本知识。

3.2. 分析合同中的条款和要求在练习合同审核信用证时,需要仔细分析合同中的条款和要求。

合同中对于信用证的要求通常较为详细,包括货物的描述、付款条款、装运方式等。

审核信用证时,需要与合同中的条款和要求进行对比,确保信用证的内容符合合同的要求。

3.3. 熟悉信用证的格式和内容信用证通常由发证银行开立,并包含了一些标准的格式和内容。

在练习合同审核信用证时,需要对信用证的格式和内容有一定的了解。

可以查阅相关的指南和规范,了解信用证的标准格式和常见内容。

3.4. 模拟审核信用证的案例为了提高审核信用证的能力和技巧,可以进行模拟审核信用证的案例练习。

可以选择一些实际的信用证案例,结合合同中的条款和要求以及对信用证的了解进行审核。

通过不断练习,可以熟悉审核信用证的流程和注意事项,并提高审核的准确性和效率。

4. 注意事项在练习合同审核信用证时,需要注意以下事项:•仔细阅读合同,确保对合同的要求有清晰的理解。

•关注信用证的有效期和修改条款,确保审核的信用证是最新版本。

•注意细节,特别是货物描述、数量、价格等关键信息的准确性。

信用证ISSUING BANK: CYPRUS POPULAR BANK LTD, LARNAKAADVISING BANK: BANK OF CHINA, SHANGHAI BRANCH.SEQUENCE OF TOTAL *27: 1/1FORM OF DOC. CREDIT *40A: IRREVOCABLEDOC. CREDIT NUMBER *20: 186/04/10014DATE OF ISSUE 31C: 040105EXPIRY *31D: DA TE 040229 PLACE CHINAAPPLICANT *50: LAIKI PERAGORA ORPHANIDES LTD.,020 STRATIGOU TIMAGIA A VE.,6046, LARNAKA,CYPRUSBENEFICIARY *59: SHANGHAI GARDEN PRODUCTS IMP.AND EXP. CO., LTD.27 ZHONGSHAN DONGYI ROAD, SHANGHAI,CHINAAMOUNT *32B: CURRENCY USD AMOUNT 6115.00POS. / NEG. TOL. (%) 39A: 05/05A V AILABLE WITH/BY *41D: ANY BANKBY NEGOTIATIONDRAFT AT … 42C: A T SIGHTDRAWEE *42D: LIKICY2NXXX*CYPRUS POPULAR BANK LTD*LARNAKAPARTIAL SHIPMENT 43P: ALLOWEDTRANSSHIPMENT 43T: ALLOWEDLOADING IN CHARGE 44A: SHANGHAI PORTFOR TRANSPORT TO…. 44B: LIMASSOL PORTLATEST DATE OF SHIP. 44C: 040214DESCRIPT. OF GOODS 45A:WOODEN FLOWER STANDS AND WOODEN FLOWERPOTSAS PER S/C NO. E03FD121.CFR LIMASSOL PORT, INCOTERMS 2000DOCUMENTS REQUIRED 46A:+COMMERCIAL INVOICE IN QUADRUPLICATE ALL STAMPED AND SIGNED BY BENEFICIARY CERTIFYING THAT THE GOODS ARE OF CHINESE ORIGIN.+FULL SET OF CLEAN ON BOARD BILL OF LADING MADE OUT TO ORDEROF SHIPPER AND BLANK ENDORSED, MARKED FREIGHT PREPAID ANDNOTIFY APPLICANT.+PACKING LIST IN TRIPLICATE SHOWING PACKINGDETAILS SUCH AS CARTON NO AND CONTENTS OF EACHCARTON.STA TING THAT THE ORIGIAL INVOICE AND PACKINGLIST HA VE BEEN DISPATCHED TO THE APPLICANT BYCOURIER SERVISE 2 DAYS BEFORE SHIPMENT. ADDITIONAL COND. 47A:+EACH PACKING UNIT BEARS AN INDELIBLE MARK INDICATING THECOUNTRY OF ORIGIN OF THE GOODS. PACKING LIST TO CERTIFYTHIS.+INSURANCE IS BEING ARRANGED BY THE BUYER.+A USD50.00DISCREPANCY FEE, FOR BENEFICIARY’S ACCOUNT, WILL BEDEDUCTED FROM THE REIMBURSEMENT CLAIM FOR EACHPRESENTA TION OF DISCREPANT DOCUMENTS UNDER THISCREDIT.+THIS CREDIT IS SUBJECT TO THE U.C.P. FOR DOCUMENTARYCREDITS (1993 REVISION) I.C.C., PUBLICATION NO. 500. DETAILS OF CHARGES 71B: ALL BANK CHARGES OUTSIDE CYPRUS ARE FORTHE ACCOUNT OF THE BENEFICIARY.PRESENTA TION PERIOD 48: WITHIN 15 DAYS AFTER THE DA TE OF SHIPMENTBUT WITHIN THE V ALIDITY OF THE CREDIT. CONFIRMATION *49: WITHOUTINSTRUCTION 78: ON RECEIPT OF DOCUMENTS CONFIRMING TO THETERMS OF THIS DOCUMENTARY CREDIT, WE UNDERTAKETO REIMBURSE YOU IN THE CURRENCY OF THE CREDIT INACCORDANCE WITH YOUR INSTRUCTIONS, WHICH SHOULDINCLUDE YOUR UID NUMBER AND THE ABA CODE OF THERECEIVING BANK.相关资料:发票号码:04SHGD3029 发票日期:2004年2月9日提单号码:SHYZ042234 提单日期:2004年2月12日集装箱号码:FSCU3214999 集装箱封号:12953121x20’FCL, CY/CY船名:LT USODIMARE航次:V. 021W木花架,WOODEN FLOWER STANDS, H.S.CODE: 44219090.90,QUANTITY:350PCS, USD8.90/PC, 2pcs/箱, 共175箱。

根据合同审核信用证练习根据合同审核信用证练习双方基本信息甲方:(买方)地址:电话:传真:邮编:法定代表人:乙方:(卖方)地址:电话:传真:邮编:法定代表人:各方身份、权利、义务、履行方式、期限、违约责任1.甲方依据双方约定向乙方开立信用证,信用证金额为人民币(以下简称“RMB”)XXX元,用于支付以下合同的货款。

2.本合同有效期为X天,自双方签署之日起计算。

3.在信用证有效期内,乙方应按照合同规定履行发货、运输、保险等一系列相关义务,以确保货物按照合同规定的品质、数量、期限及要求进行交付。

4.甲方应按照信用证条款支付货款。

如甲方未在规定的时间内支付货款,则视为违约,应承担相应的违约责任。

5.乙方未能按照约定时间发货或未能履行其他相关义务,则视为违约,应承担相应的违约责任。

6.本合同涉及到的法律事宜均应遵守中国相关法律法规,并应按照合同约定进行解决。

明确各方的权力和义务1.甲方依据双方约定向乙方开立的信用证,是甲方履行支付货款义务的有效凭证。

2.乙方应确保发货、运输、保险等过程中的货物完好无损,并按照合同约定的时间、地点及方式进行交付。

3.甲方在收到货物后应及时进行验收,并且对货物质量、规格、数量等进行检查并确认符合合同规定。

明确法律效力和可执行性1.本合同是双方约定的有法律效力的文件,双方应当共同遵守。

2.本合同的任何条款如有违反中国相关的法律法规,无效。

3.本合同如有争议,应当协商解决。

双方如协商不成,则应按照双方之间约定的仲裁条款进行仲裁。

4.本合同的任何修改或变更必须经过双方协商一致,并签订书面协议后生效。

以上内容为本次根据合同审核信用证练习所需的主要内容,双方应根据实际情况进行具体补充和确认。

本合同经双方签署并盖章后生效。

授课日期####年#月#日学习目的:理解信用证的定义、性质、特点、种类与作用,掌握《UCP600》的相关规定。

正确分析理解信用证,掌握信用证修改所遵循的方法。

教学过程:一、关于上次课内容的复习提问(3分钟)。

二、引入本次课内容(2分钟)。

三、信用证概念(20分钟)四、信用证特点(20分钟)五、信用证当事人和业务流程(20分钟)六、信用证种类(20分钟)七、整理一下已讲的内容并布置作业、下次课的预习任务。

(5分钟)教学重点与难点:1.信用证的概念2.信用证的特点3.信用证的当事人和业务流程4.信用证的种类教学内容:一、信用证的概念(LETTER OF CREDIT ,简写为L/C)是银行应买方要求和指示向卖方开立的、在一定期限内凭规定的单据符合信用证条款,即期或在一个可以确定的将来日期,兑付一定金额的书面承诺。

二、信用证业务中存在的契约(1)在开证申请人(进口商)和信用证受益人(出口商)之间存在一份贸易合同。

由这份贸易合同带来了对支付信用的需要。

(2)在开证申请人和开证银行之间存在一份开证申请书。

由这份开证申请书保证了信用证下收进的单据和付出的款项将由开证申请人赎还。

(3)在开证银行与信用证受益人之间则由信用证锁定。

信用证保证了信用证受益人交到银行的符合规定的单据将必定得到支付。

三、信用证的特点1、信用证是一项独立文件。

信用证是银行与信用证受益人之间存在的一项契约,该契约虽然可以以贸易合同为依据而开立,但是一经开立就不再受到贸易合同的牵制。

银行履行信用证付款责任仅以信用证受益人满足了信用证规定的条件为前提,不受到贸易合同争议的影响。

2、信用证结算方式仅以单据为处理对象。

信用证业务中,银行对于受益人履行契约的审查仅针对受益人交到银行的单据进行的,单据所代表的实物是否好则不是银行关心的问题。

即便实物的确有问题,进口商对出口商提出索赔要求,只要单据没问题,对于信用证而言,受益人就算满足了信用证规定的条件,银行就可以付款。

根据信⽤证填单练习02题⽬要求和说明ISSUE OF DOCUMENTARY CREDITTO: BANK OF CHINA,SHANGHAI BRANCH,CHINAATTN: L/C DEPTFROM: COMMERCIAL BANK OF ETHIOPIA,ADDIS ABABA, ETHIOPIADA TE:15-01-2004WE HEREBY OPEN OUR IRREVOCABLE DOCUMENTARY LETTER OF CREDIT NO.LC/78563 FA VOURING M/S SHANGHAI CHEMICALS IMPORT AND EXPORT CORPORATION 16 JIANG Y AN LU SHANGHAI CHINA BY ORDER OF MAGIC INTERNA TIONAL PLC DEBRE ZEIT ROAD ADDIS ABABA ETHIOPIA TO THE EXTENT OF USD 31067.10 CFR ASSAB A V AILABLE BY NEGOTIATION WITH ANY BANK AGAINST THE DOCUMENTS DETAILED HEREIN AND BENEFICIARY’S DRAFTS AT 60 DAYS AFTER B/L DATE DRAWN ON OURSELVES FOR 100% OF THE INVOICE V ALUE.1.SIGNED COMMERCIAL INVOICES IN FIVE COPIES SHECIFYING FOB BALUE AND FREIGHT CHARGES AND ALL COPIES CERTIFIED BY THE CHINA COUNCIL FOR THE PROMOTION FO INTERNATIONAL TRADE INDICA TING EXCHANGE CONTROL LICENCE NO.749/000066 JANJUARY 02,20042.PACKING LIST IN FIVE COPIES INDICATING GROSS AND NET WEIGHT OF EACH ROLL3.FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING AND ONE NON-NEGOTIABLE COPY MADE OUT TO ORDER OF COMMERCIAL BANK FO ETHIOPIA AND NOTIFYING MAGIC INTERNATIONAL PLC MARKED FREIGHT PREPAID4.CERTIFICATE OF ORIGIN ISSUED BY THE CHINA COUNCIL FOR THE PROMOTION OF INTERNATIONAL TRADE IN TWO COPIESCOVERING SHIPMENT OF 120 ROLLS 100MMx4Px350 AND 30 ROLLS 125MMx4Px350 TRANSMISSION BELT AS PER CONTRACT NO.03PI/421/122 DA TED DEC 26 2003TERMS CFR ASSABINSURANCE COVERED LOCALL Y BY BUYERTHE EXPIRY PLACE OF THE CREDIT IS CHINAPARTIAL SHIPMENTS ARE NOT PERMITTEDTRANSHIPMENT ARE PERMITTEDSHIPMENT FROM SHANGHAI TO ASSAB NOT LATER THAN 21ST MARCH 2004THIS CREDIT IS VALID FOR NEGOTIATION NOT LATER THAN 5TH APRIL,2004ALL BANKING CHARGES OUTSIDE ETHIOPOA ARE FOR ACCOUNT OF THE BENEFICIARY PROCIDED THAT ALL TERMS AND CONDITIONS OF THE LETTER OF CREDIT HA VE BEEN COMPLIED WITH, WE UNDERTAKE TO HONOUR YOUR CLAIMS IN ACCORDANCE WITH YOUR INSTRUCTIONS V ALUE THREE BUSINESS DAYS FROM THE DATE OF RECEIPT OF THE SHIPPING DOCUMENTS AT OUR COUNTERSPLEASE FORW ARD THE ORIGINAL AND DUPLICATE SETS OF SHIPPING DOCUMENTS IN TWO SEPARA TE LOTS TO US BY DHL COURIER SERVICETHIS LETTER OF CREDIT IS SUBJECT TO UCP FOR DOCUMENTARY CREDITS (REVISION1993)I.C.C,PUBLICATION NO.500PLEASE TREAT THIS MESSAGE AS AN OPERATIVE CREDIT INSTRUMENT AND NO MAIL CONFIRMATION WILL FOLLOWPLEASE ADVISE THE BENEFICIARY。