Chapter 5 A Closed-Economy One-Period Macro Model(中级宏观经济学,香港中文大学)

- 格式:ppt

- 大小:763.11 KB

- 文档页数:31

罗莫高级宏观经济学第5版英文资源Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce vulputate metus sed finibus interdum. Quisque tempus justo vel mi consequat, in ornare felis gravida. Suspendisse vel sapien et metus condimentum dignissim ut vel quam. Donec semper mi vitae orci ultrices, nec lacinia dolor placerat. Sed id condimentum elit. Aliquam id arcu eleifend, sollicitudin lectus eu, volutpat nulla.1. IntroductionThe fifth edition of Romer's Advanced Macroeconomics provides comprehensive resources for students studying macroeconomics at an advanced level. This article aims to summarize the English resources available in this edition.2. TextbookThe textbook serves as the foundation for understanding macroeconomics concepts. Romer's Advanced Macroeconomics provides clear explanations and in-depth analysis of various macroeconomic theories and models. It covers topics such as economic growth, business cycles, inflation, and monetary policy. The book includes numerous examples, charts, and graphs to enhance understanding.3. Lecture SlidesTo complement the textbook, Romer's Advanced Macroeconomics offers lecture slides that can be used by instructors during classroom or online sessions. These slides highlight key points from each chapter and providevisual aids to support student learning. The slides can be downloaded and customized to suit the instructor's teaching style.4. Practice QuestionsTo reinforce learning, the fifth edition includes a collection of practice questions. These questions cover a wide range of topics and difficulty levels, allowing students to test their understanding of macroeconomic concepts. Solutions to the practice questions are provided at the end of the book, enabling self-assessment and further learning.5. Case StudiesThe case studies in the textbook provide real-world applications of macroeconomic theories. These studies analyze economic events and policies, offering students a chance to apply their knowledge to practical situations. The case studies encourage critical thinking and help students develop a deeper understanding of macroeconomics.6. Online ResourcesIn addition to the textbook, Romer's Advanced Macroeconomics offers online resources. The official website provides supplementary materials, including data sets, additional readings, and interactive quizzes. Students can access these resources to further enhance their learning experience and deepen their understanding of macroeconomics.7. Instructor's ManualFor instructors, the fifth edition includes an instructor's manual. This manual provides guidance on teaching the course and offers suggestions forclassroom activities and assessments. It also contains additional resources, such as sample syllabi and lecture notes, to assist instructors in delivering the course effectively.8. ConclusionOverall, Romer's Advanced Macroeconomics, 5th edition, offers comprehensive English resources for students and instructors studying macroeconomics. The textbook, lecture slides, practice questions, case studies, online resources, and instructor's manual combine to create a rich learning experience. Whether used in a classroom or for self-study, these resources contribute to a thorough understanding of macroeconomic principles and their applications.Please note that the above content reflects a fictional article and does not provide actual resources for Romer's Advanced Macroeconomics, 5th edition.。

Lesson4 Is an Ivy League Diploma Worth It?花钱读常春藤名校值不值?1.如果愿意的话,施瓦茨(Daniel Schwartz)本来是可以去一所常春藤联盟(Ivy League)院校读书的。

他只是认为不值。

2.18 岁的施瓦茨被康奈尔大学(Cornell University)录取了,但他最终却去了纽约市立大学麦考利荣誉学院(City University of New York’s Macaulay Honors College),后者是免费的。

3.施瓦茨说,加上奖学金和贷款的支持,家里原本是可以付得起康奈尔的学费的。

但他想当医生,他觉得医学院是更有价值的一项投资。

私立学校医学院一年的花费动辄就要4 万5 美元。

他说,不值得为了一个本科文凭一年花5 万多美元。

4.助学贷款违约率日益攀升,大量的大学毕业生找不到工作,因此越来越多的学生认定,从一所学费不太贵的学校拿到的学位和从一所精英学校拿到的文凭没什么区别,并且不必背负贷款负担。

5.Robert Pizzo 越来越多的学生选择收费较低的公立大学,或选择住在家里走读以节省住房开支。

美国学生贷款行销协会(Sallie Mae)的一份报告显示,2010 年至2011 学年,家庭年收入10 万美元以上的学生中有近25%选择就读两年制的公立学校,高于上一学年12%的比例。

6.这份报告称,这样的选择意味着,在2010 至2011 学年,各个收入阶层的家庭在大学教育上的花费比上一年少9%,平均支出为21,889 美元,包括现金、贷款、奖学金等。

高收入家庭的大学教育支出降低了18%,平均为25,760 美元。

这份一年一度的报告是在对约1,600 名学生和家长进行问卷调查后完成的。

7.这种做法是有风险的。

顶级大学往往能吸引到那些已经不再去其他学校招聘的公司前来招聘。

在许多招聘者以及研究生院看来,精英学校的文凭还是更有吸引力的。

CHAPTER 55-1. Suppose the labor supply curve is upward sloping and the labor demand curve is downward sloping. The study of economic trends over a particular time period reveals that the wage recently fell while employment levels rose. Which curve must have shifted and in which direction to produce this effect?If the supply curve does not shift, all wage and employment movements must occur along the supply curve, so that the wage rate and the employment level must move in the same direction. Because the wage went down while employment went up in the situation described in the question, it must have been the case that the supply curve shifted outwards (to the right). We do not have enough information to determine whether the demand curve shifted as well.5-2. It takes time to produce a new economist, and prospective economists base their career decision by looking only at current wages across various professions. Further, the labor supply curve of economists is much more elastic than the labor demand curve. Suppose the market is now in equilibrium, but that the demand for economists suddenly rises because a new activist government in Washington wants to initiate many new programs that require the input of economists. Illustrate the trend in the employment and wages of economists as the market adjusts to this increase in demand.Initially, the market is in equilibrium at a wage w0 and an employment level of E0. The increase the demand for economists results in a new equilibrium wage of w1 and a new equilibrium employment level of E1. However, the demand for economists in the short-run is inelastic at E0, so the demand increase simply leads to a rise in the wage of economists (as indicated by point 1). In the next period, students believe this wage will persist and oversupply the market so that the cobweb leads to a new wage at point 2. In the next period, students undersupply (because the wage is too low) and the cobweb leads to a new wage at point 3, and so on. Because of the relative elasticities of supply and demand (as drawn), the cobweb is exploding and will never converge to a stable equilibrium.5-3. Suppose the supply curve of physicists is given by w = 10 + 5E , while the demand curve is given by w = 50 – 3E . Calculate the equilibrium wage and employment level. Suppose now that the demand for physicists increases and the new demand curve is given by w = 70 – 3E . Assume this market is subject to cobwebs. Calculate the wage and employment level in each round as the wage and employment levels adjust to the demand shock. (Recall that each round occurs on the demand curve – when the firm posts a wage and hires workers). What is the new equilibrium wage and employment level?The initial equilibrium is given by 10 + 5E = 50 – 3E . Solving these two equations simultaneously implies that w = $35 and E S = E D = 5. When demand increases to w = 70 – 3E , the new equilibrium wage is $47.5 and the equilibrium level of employment is 7.5.Round Wage Employment1 $55.0 52 $43.0 93 $50.2 6.64 $45.9 8.05 $48.4 7.26 $46.9 7.77 $47.8 7.48 $47.2 7.6The table gives the values for the wage and employment levels in each round. The values in the table are calculated by noting that in any given period the number of physicists is inelastically supplied, so that the wage is determined by the demand curve. Given this wage, the number of economists available in the next period is calculated. By round 7, the market wage rate is within 30 cents of the new equilibrium.01 w 1w 0W age5-4. The 1986 Immigration Reform and Control Act (IRCA) made it illegal for employers in the United States to knowingly hire illegal aliens. The legislation, however, has not reduced the flow of illegal aliens into the country. As a result, it has been proposed that the penalties against employers who break the law be increased substantially. Suppose that illegal aliens, who tend to be less skilled workers, are complements with native workers. What will happen to the wage of native workers if the penalties for hiring illegal aliens increase?A substantial increase in the penalties associated with hiring illegal aliens will likely reduce the number of illegal aliens entering the United States. The effect of this shift in the size of the illegal alien flow on the marginal product (and hence the demand curve) of native workers hinges on whether illegal aliens are substitutes or complements with natives. As it is assumed that natives and illegal aliens are complements, a cut in the number of illegal aliens reduces the value of the marginal product of natives, shifting down the demand for native labor, and decreasing native wages and employment.5-5. Suppose a firm is a perfectly discriminating monopsonist. The government imposes a minimum wage on this market. What happens to wages and employment?A perfectly discriminating monopsonist faces a marginal cost of labor curve that is identical to the supply curve. As a result, the employment level of a perfectly discriminating monopsonist equals theemployment level that would be observed in a competitive market (at E *) The imposition of a minimum wage at w MIN leads to the same result as in a competitive market: the firm will only want to hire E D workers as w MIN is now the marginal cost of labor, but E S workers will want to find work at the minimum wage. Thus, the wage increases, but employment falls.DollarsE w w *S D5-6. What happens to wages and employment if the government imposes a payroll tax on amonopsonist? Compare the response in the monopsonistic market to the response that would have been observed in a competitive labor market.Initially, the monopsonist hires E M workers at a wage of w M . The imposition of a payroll tax shifts the demand curve to VMP ′, and lowers employment to E ′ and the wage to w ′. Thus, the effect of imposing a payroll tax on a monopsonist is qualitatively the same as imposing a payroll tax in a competitive labor market: lower wages and employment. (It is interesting to note that the same result comes about if the payroll tax is placed on workers, so that the labor supply and marginal cost of labor curves shift as opposed to labor demand.)5-7. An economy consists of two regions, the North and the South. The short-run elasticity of labor demand in each region is –0.5. The within-region labor supply is perfectly inelastic. The labormarket is initially in an economy-wide equilibrium, with 600,000 people employed in the North and 400,000 in the South at the wage of $15 per hour. Suddenly, 20,000 people immigrate from abroad and initially settle in the South. They possess the same skills as the native residents and also supply their labor inelastically.(a) What will be the effect of this immigration on wages in each of the regions in the short run (before any migration between the North and the South occurs)?There will be no effect on the North’s labor supply in the short run, so the wage rate will not change there. In the South, labor supply will have increased by 5 percent, so the wage rate must fall by 5/(0.5) = 10 percent (recall that the elasticity of labor demand is -0.5, so a one percent decrease in wages would have been generated by a 0.5 percent expansion of the labor supply). The new hourly wage in the South, therefore, is $13.50 and total employment in the South is 420,000.DollarsEmploymentw M w ′(b) Suppose 1,000 native-born persons per year migrate from the South to the North in response to every dollar differential in the hourly wage between the two regions. What will be the ratio of wages in the two regions after the first year native labor responds to the entry of the immigrants?After the initial migration, we have seen that wages in the South are $13.50 while wages in the North are $15. This difference leads 1,500 natives migrating from the South to the North in the first year. Employment in the North after one year, therefore is 601,500. Moreover, as the elasticity of labor demand in the North is -0.5 and employment has increased by 0.25 percent, the Northern wage falls by 0.5 percent to roughly $14.93. Likewise, employment in the South after one year is 418,500. As the elasticity of labor demand is -0.5 and employment has decreased by 0.3571 percent, the Southern wage increases by0.71428 percent to roughly $13.60. Thus, the ratio of the Northern to Southern wage after one year is1.09779.(c) What will be the effect of this immigration on wages and employment in each of the regions in the long run (after native workers respond by moving across regions to take advantage of whatever wage differentials may exist)? Assume labor demand does not change in either region.In the long run, people must move from the South to the North to equalize the wage rates in the two regions. Since the wages were equal in the two regions before the influx of immigrants, and they also must be equal after things settle down, the proportional decrease in the wage rate should be the same in the North and in the South. Because the elasticity of labor demand is the same in the two regions, this last observation implies that the percentage increase in employment in the North must be the same as the percentage increase in employment in the South. Thus, as 60 percent of the original workers were employed in the North, 60 percent of the 20,000 increase in Southern employment will eventually migrate to the North. In the long run, therefore, total Northern employment will be 612,000 while total Southern employment will be 408,000. (Note: there is no presumption that only immigrants further migrate to the North.) In each region, therefore, employment increases by 2 percent in the long run, i.e., 12,000 is 2 percent of 600,000 and 8,000 is 2 percent of 400,000. (This can also be seen immediately as 20,000 is 2 percent of the 1 million workers.) Now, given that the elasticity of labor demand is -0.5, the 2 percent increase in employment will cause the wage rate to fall by 4 percent. Hence, the long-run equilibrium hourly wage will be $14.40.5-8. Chicken Hut faces perfectly elastic demand for chicken dinners at a price of $6 per dinner. The Hut also faces an upward sloped labor supply curve ofE = 20w – 120,where E is the number of workers hired each hour and w is the hourly wage rate. Thus, the Hut faces an upward sloped marginal cost of labor curve ofMC E = 6 + 0.1E.Each hour of labor produces 5 dinners. (The cost of each chicken is $0 as the Hut receives two-day old chickens from Hormel for free.) How many workers should Chicken Hut hire each hour to maximize profits? What wage will Chicken Hut pay? What are Chicken Hut’s hourly profits?First, solve for the labor demand curve: VMP E = P x MP E = $6 x 5 = $30. Thus, every worker is valued at $30 per hour by Chicken Hut. Now, setting VMP E = MC E yields 30 = 6 + .1E which implies E* = 240. Thus, Chicken Hut will hire 240 workers every hour. Further, according to the labor supply curve, 240 workers can be hired at an hourly wage of $18. Finally, Chicken Hut’s profits are Π = 240(5)($6) –240($18) = $2,880.5-9. Polly’s Pet Store has a local monopoly on the grooming of dogs. The daily inverse demand curve for pet grooming is:P = 20 – 0.1Qwhere P is the price of each grooming and Q is the number of groomings given each day. This implies that Polly’s marginal revenue is:MR = 20 – 0.2Q.Each worker Polly hires can groom 20 dogs each day. What is Polly’s labor demand curve as a function of w, the daily wage that Polly takes as given?As each worker can groom 20 dogs each day, and using Q = 20E, we have thatVMP E = MR x MP E = ( 20 – 0.2Q ) (20) = (20 – 4E)(20) = 400 – 80E.Thus, as Polly’s demand for labor satisfies VMP E = w, we have that her labor demand curve isE = 5 – 0.0125w.5-10. The Key West Parrot Shop has a monopoly on the sale of parrot souvenir caps in Key West. The inverse demand curve for caps is:P = 30 – 0.4 Qwhere P is the price of a cap and Q is the number of caps sold per hour. Thus, the marginal revenue for the Parrot Shop is:MR = 30 – 0.8Q.The Parrot Shop is the only employer in town, and faces an hourly supply of labor given by:w = 0.9E + 5where w is the hourly wage rate and E is the number of workers hired each hour. The marginal cost associated with hiring E workers, therefore, is:MC E = 1.8E + 5.Each worker produces two caps per hour. How many workers should the Parrot Shop hire each hour to maximize its profit? What wage will it pay? How much will it charge for each cap?First, as Q = 2E, the labor demand curve isVMP E = MR x MP E = (30 – 0.8Q)(2) = 60 – 1.6Q = 60 – 3.2E.Setting VMP E equal to MC E and solving for E yields E = 11. Eleven workers can be hired at a wage of.9(11) + 5 = $14.99 per hour. The 11 workers make 22 caps each hour, and the 22 caps can be sold at a price of 30 – 0.4(22) = $21.20 each.5-11. Ann owns a lawn mowing company. She has 400 lawns she needs to cut each week. Her weekly revenue from these 400 lawns is $20,000. If given an 18-inch deck push mower, a low-skill worker can cut each lawn in two hours. If given a 60-inch deck riding mower, a low-skill worker can cut the lawn in 30 minutes. Low-skilled labor is supplied inelastically at $5.00 per hour. Each laborer works 8 hours a day and 5 days each week.(a) If Ann decides to have her workers use push mowers, how many push mowers will Ann rent and how many workers will she hire?As each worker can cut a lawn in 2 hours, it follows that each worker can cut 4 lawns in a day or 20 lawns in a week. Therefore, Ann would need to rent 20 push mowers and hire 20 workers in order to cut all 400 lawns each week.(b) If she decides to have her workers use riding mowers, how many riding mowers will Ann rent and how many workers will she hire?As each worker can cut a lawn in 30 minutes, it follows that each worker can cut 16 lawns in a day or 80 lawns in a week. Therefore, Ann would need to rent 5 riding mowers and hire 5 workers in order to cut all 400 lawns each week.(c) Suppose the weekly rental cost (including gas and maintenance) for each push mower is $250 and the weekly rental cost (including gas and maintenance) of each riding mower is $1,800. What equipment will Ann rent? How many workers will she employ? How much profit will she earn?If Ann uses push mowers, her weekly cost of mowers is $250(20) = $5,000 while her weekly labor cost is $5(20)(40) = $4,000. Under this scenario, her weekly profit is $11,000. If Ann uses riding mowers, her weekly cost of mowers is $1,800(5) = $9,000 while her weekly labor cost is $5(5)(40) = $1,000. Thus, under this scenario, her weekly profit is $10,000. Therefore, under these conditions, Ann will rent 20 push mowers and employ 20 low-skill workers.(d) Suppose the government imposes a 20 percent payroll tax (paid by employers) on all labor and offers a 20 percent subsidy on the rental cost of capital. What equipment will Ann rent? How many workers will she employ? How much profit will she earn?Under these conditions, the cost of labor has increased to $6.00 per hour, while the rental costs for a push mower and a riding mower have decreased to $200 and $1,440 respectively. Ann’s profits under the two options, therefore, arePush-Profit = $20,000 – $200(20) – $6(20)(40) = $11,200.Rider-Profit = $20,000 – $1,440(5) – $6(5)(40) = $11,600.Thus, under these conditions, Ann rents riding mowers, hires 5 low-skill workers, and earns a weekly profit of $11,600.5-12. In the United States, some medical procedures can only be administered to a patient by a doctor while other procedures can be administered by a doctor, nurse, or lab technician. What might be the medical reasons for this? What might be the economic reasons for this?The American Medical Association might argue that doctors have more training and experience than nurses, and therefore, are the only professionals who can make certain decisions or perform certain procedures.Economically, the AMA has an incentive to restrict the number of people who can practice medicine (or perform certain procedures) in order to keep doctor wages high. If nurses were allowed to do everything they were capable of, fewer doctors would be demanded, and doctor wages would fall. From an economic viewpoint, therefore, the AMA restricts the supply of doctors, which keeps doctor wages artificially high.WageW restW unrestRestricted Supply ofDoctorsUnrestricted Supplyof DoctorsL rest L unrest Services Provided by DoctorsLabor Market For Medical Services Provided by Doctors。

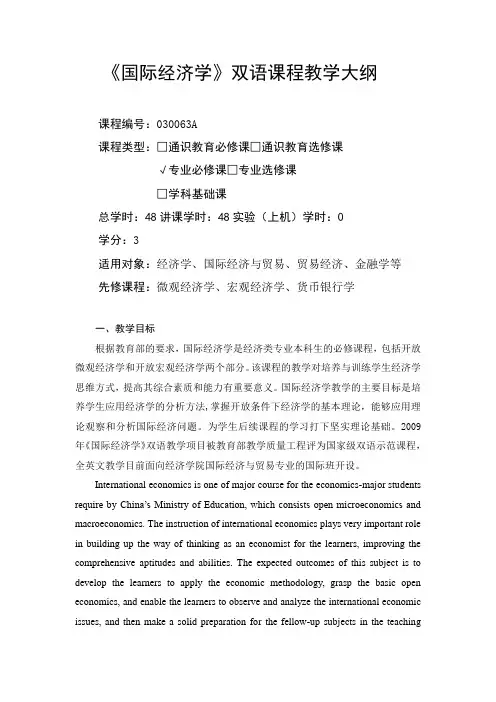

Economics, 18/ePaul A. Samuelson, Massachusetts Institute of Technology William D. Nordhaus, Yale UniversityISBN: 0072872055Copyright year: 2005Table of ContentsPart One: Basic Concepts1 The Fundamentals of EconomicsAppendix 1 How to Read Graphs2 Markets and Government in a Modern Economy3 Basic Elements of Supply and DemandPart Two: Microeconomics: Supply, Demand, and Product Markets4 Applications of Supply and Demand5 Demand and Consumer BehaviorAppendix 5 Geometrical Analysis of Consumer Equilibrium6 Production and Business Organization7 Analysis of CostsAppendix 7 Production, Cost Theory, and Decision of theFirm8 Analysis of Perfectly Competitive Markets9 Competition and Its Polar Case of Monopoly10 Oligopoly and Monopolistic Competition11 Uncertainty and Game TheoryPart Three: Factor Markets: Labor, Land, and Capital12 How Markets Determine Incomes13 The Labor Market14 Land and CapitalAppendix 14 Markets and Economic EfficiencyPart Four: Applied Microeconomics: International Trade, Government, and the Environment15 Comparative Advantage and Protectionism16 Government Taxation and Expenditure17 Promoting More Efficient Markets18 Protecting the Environment19 Efficiency vs. Equality: The Big TradeoffPart Five: Macroeconomics: Economic Growth and Business Cycles20 Overview of MacroeconomicsAppendix 20 Macroeconomic Data21 Measuring Economic Activity22 Consumption and Investment23 Business Fluctuations and the Theory of Aggregate Demand24 The Multiplier Model25 Money, Banking, and Financial Markets26 Central Banking and Monetary PolicyPart Six: Economic Growth and Macroeconomic Policy27 The Process of Economic Growth28 The Challenge of Economic Development29 Exchange Rates and the International Financial System30 Open-Economy MacroeconomicsPart Seven: Unemployment, Inflation, and Economic Policy31 Unemployment and the Foundations of Aggregate Supply32 Ensuring Price Stability33 The Warring Schools of Macroeconomics34 Policies for Growth and Stability。

Name:__________________________ Date: _____________1。

Compared to a closed economy, an open economy is one that:A)allows the exchange rate to float。

B)fixes the exchange rate.C)trades with other countries.D)does not trade with other countries。

2.The Mundell–Fleming model assumes that:A)prices are flexible, whereas the IS–LM model assumes that prices arefixed。

B)prices are fixed, whereas the IS–LM model assumes that prices are flexible.C)as in the IS–LM model, prices are fixed.D)as in the IS–LM model, prices are flexible。

3.The Mundell–Fleming model is a ______ model for a ______ open economy。

A)short-run; smallB)short—run; largeC)long-run; largeD)long-run; small4。

In the Mundell–Fleming model:A)the exchange rate system must have a floating exchange rate。

B)the exchange rate system must have a fixed exchange rate.C)it makes no difference whether the exchange rate system has a floatingor a fixed exchange rate。

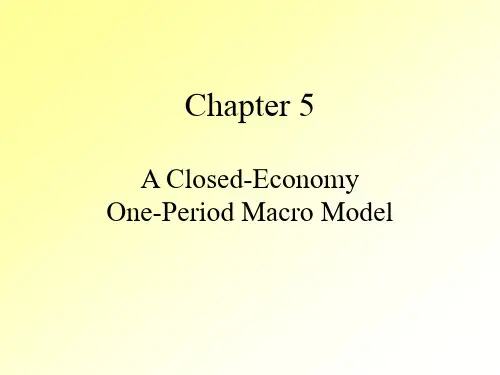

《国际经济学》双语课程教学大纲课程编号:030063A课程类型:□通识教育必修课□通识教育选修课√专业必修课□专业选修课□学科基础课总学时:48讲课学时:48实验(上机)学时:0学分:3适用对象:经济学、国际经济与贸易、贸易经济、金融学等先修课程:微观经济学、宏观经济学、货币银行学一、教学目标根据教育部的要求,国际经济学是经济类专业本科生的必修课程,包括开放微观经济学和开放宏观经济学两个部分。

该课程的教学对培养与训练学生经济学思维方式,提高其综合素质和能力有重要意义。

国际经济学教学的主要目标是培养学生应用经济学的分析方法,掌握开放条件下经济学的基本理论,能够应用理论观察和分析国际经济问题。

为学生后续课程的学习打下坚实理论基础。

2009年《国际经济学》双语教学项目被教育部教学质量工程评为国家级双语示范课程,全英文教学目前面向经济学院国际经济与贸易专业的国际班开设。

International economics is one of major course for the economics-major students require by China’s Ministry of Education, which consists open microeconomics and macroeconomics. The instruction of international economics plays very important role in building up the way of thinking as an economist for the learners, improving the comprehensive aptitudes and abilities. The expected outcomes of this subject is to develop the learners to apply the economic methodology, grasp the basic open economics, and enable the learners to observe and analyze the international economic issues, and then make a solid preparation for the fellow-up subjects in the teachingprogram. In 2009, this course was selected as the national bilingual teaching experimental course by China’s Ministry of Educ ation.二、教学内容及其与毕业要求的对应关系(一)教学内容本课程的主要内容是阐述国际经济学的基础知识。

5ELASTICITY AND ITS APPLICATION WHAT’S NEW IN THE S EVENTH EDITION:There are no major changes to this chapter.LEARNING OBJECTIVES:By the end of this chapter, students should understand:the meaning of the elasticity of demand.what determines the elasticity of demand.the meaning of the elasticity of supply.what determines the elasticity of supply.the concept of elasticity in three very different markets (the market for wheat, the market for oil, and the market for illegal drugs).CONTEXT AND PURPOSE:Chapter 5 is the second chapter of a three-chapter sequence that deals with supply and demand and how markets work. Chapter 4 introduced supply and demand. Chapter 5 shows how much buyersand sellers respond to changes in market conditions. Chapter 6 will address the impact of government polices on competitive markets.The purpose of Chapter 5 is to add precision to the supply-and-demand model. We introduce the concept of elasticity, which measures the responsiveness of buyers and sellers to changes in economic variables such as prices and income. The concept of elasticity allows us to make quantitative observations about the impact of changes in supply and demand on equilibrium prices and quantities.KEY POINTS:The price elasticity of demand measures how much the quantity demanded responds to changes in the price. Demand tends to be more elastic if close substitutes are available, if the good is a luxury rather than a necessity, if the market is narrowly defined, or if buyers have substantial time to react to a price change.The price elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in price. If quantity demanded moves proportionately less than the price, then the elasticity is less than one, and demand is said to be inelastic.If quantity demanded moves proportionately more than the price, then the elasticity is greater than one, and demand is said to be elastic.Total revenue, the total amount paid for a good, equals the price of the good times the quantity sold. For inelastic demand curves, total revenue moves in the same direction as the price. For elastic demand curves, total revenue moves in the opposite direction as the price.The income elasticity of demand measures how much the quantity demanded responds tochanges in consumers’ income. The cross-price elasticity of demand measures how much the quantity demanded of one good responds to the price of another good.The price elasticity of supply measures how much the quantity supplied responds to changes in the price. This elasticity often depends on the time horizon under consideration. In most markets, supply is more elastic in the long run than in the short run.The price elasticity of supply is calculated as the percentage change in quantity supplied divided by the percentage change in price. If quantity supplied moves proportionately less than the price, then the elasticity is less than one, and supply is said to be inelastic.If quantity supplied moves proportionately more than the price, then the elasticity is greater than one, and supply is said to be elastic.The tools of supply and demand can be applied in many different kinds of markets. This chapter uses them to analyze the market for wheat, the market for oil, and the market for illegal drugs.CHAPTER OUTLINE:I. The Elasticity of DemandA. Definition of elasticity: a measure of the responsiveness of quantity demanded orquantity supplied to one of its determinants.B. The Price Elasticity of Demand and Its Determinants1. Definition of price elasticity of demand: a measure of how much the quantitydemanded of a good responds to a change in the price of that good, computed as thepercentage change in quantity demanded divided by the percentage change in price.2. Determinants of the Price Elasticity of Demanda. Availability of Close Substitutes: the more substitutes a good has, the moreelastic its demand.b. Necessities versus Luxuries: necessities are more price inelastic.c. Definition of the market: narrowly defined markets (ice cream) have moreelastic demand than broadly defined markets (food).d. Time Horizon: goods tend to have more elastic demand over longer time horizons.C. Computing the Price Elasticity of Demand1. Formula2. Example: the price of ice cream rises by 10% and quantity demanded falls by 20%.Price elasticity of demand = (20%)/(10%) = 23. Because there is an inverse relationship between price and quantity demanded (theprice of ice cream rose by 10% and the quantity demanded fell by 20%), the price elasticity of demand is sometimes reported as a negative number. We will ignorethe minus sign and concentrate on the absolute value of the elasticity.D. The Midpoint Method: A Better Way to Calculate Percentage Changes and Elasticities1. Because we use percentage changes in calculating the price elasticity of demand,the elasticity calculated by going from one point to another on a demand curvewill be different from an elasticity calculated by going from the second point tothe first. This difference arises because the percentage changes are calculatedusing a different base.a. A way around this problem is to use the midpoint method.b. Using the midpoint method involves calculating the percentage change in eitherprice or quantity demanded by dividing the change in the variable by themidpoint between the initial and final levels rather than by the initial levelitself.c. Example: the price rises from $4 to $6 and quantity demanded falls from 120 to80.% change in price = (6 −4)/5 × 100 = 40%% change in quantity demanded = (120 − 80)/100 x 100 = 40%price elasticity of demand = 40/40 = 1E. The Variety of Demand Curves1. Classification of Elasticitya. When the price elasticity of demand is greater than one, demand is defined tobe elastic.b. When the price elasticity of demand is less than one, the demand is defined tobe inelastic.c. When the price elasticity of demand is equal to one, the demand is said to haveunit elasticity.2. In general, the flatter the demand curve that passes through a given point, themore elastic the demand.3. Extreme Casesa. When the price elasticity of demand is equal to zero, the demand is perfectlyinelastic and is a vertical line.b. When the price elasticity of demand is infinite, the demand is perfectlyelastic and is a horizontal line.4. FYI: A Few Elasticities from the Real WorldF. Total Revenue and the Price Elasticity of Demand1. Definition of total revenue: the amount paid by buyers and received by sellers ofa good, computed as the price of the good times the quantity sold.2. If demand is inelastic, the percentage change in price will be greater than thepercentage change in quantity demanded.a. If price rises, quantity demanded falls, and total revenue will rise (becausethe increase in price will be larger than the decrease in quantity demanded).b. If price falls, quantity demanded rises, and total revenue will fall (becausethe fall in price will be larger than the increase in quantity demanded).3. If demand is elastic, the percentage change in quantity demanded will be greaterthan the percentage change in price.a. If price rises, quantity demanded falls, and total revenue will fall (becausethe increase in price will be smaller than the decrease in quantity demanded).b. If price falls, quantity demanded rises, and total revenue will rise (becausethe fall in price will be smaller than the increase in quantity demanded).4. If demand is unit elastic, the percentage change in price will be equal to thepercentage change in quantity demanded.a. If price rises, quantity demanded falls, and total revenue will remain the same(because the increase in price will be equal to the decrease in quantitydemanded).b. If price falls, quantity demanded rises, and total revenue will remain the same(because the fall in price will be equal to the increase in quantity demanded).G. Elasticity and Total Revenue along a Linear Demand Curve1. The slope of a linear demand curve is constant, but the elasticity is not.a. At points with a low price and a high quantity demanded, demand is inelastic.b. At points with a high price and a low quantity demanded, demand is elastic.2. Total revenue also varies at each point along the demand curve.H. Other Demand Elasticities1. Definition of income elasticity of demand: a measure of how much the quantitydemanded of a good responds to a change in consumers’ income, computed as the percentage change in quantity demanded divided by the percentage change in income.a. FormulaFigure 4Note that when demand is elastic and price falls, total revenue rises. Also point out that once demand is inelastic, any further decrease in price% change in quantity demandedIncome elasticity of demand =% change in incomeb. Normal goods have positive income elasticities, while inferior goods havenegative income elasticities.ALTERNATIVE CLASSROOM EXAMPLE:John’s income rises from $20,000 to $22,000 and the quantity of hamburger he buyseach week falls from 2 pounds to 1 pound.% change in quantity demanded = (1−2)/ x 100 = %% change in income = (22,000 −20,000)/21,000 x 100 = %c. Necessities tend to have small income elasticities, while luxuries tend to havelarge income elasticities.2. Definition of cross-price elasticity of demand: a measure of how much the quantitydemanded of one good responds to a change in the price of another good, computedas the percentage change in the quantity demanded of the first good divided by the percentage change in the price of the second good.a. Formulab. Substitutes have positive cross-price elasticities, while complements havenegative cross-price elasticities.ALTERNATIVE CLASSROOM EXAMPLE:The price of apples rises from $ per pound to $ per pound. As a result, thequantity of oranges demanded rises from 8,000 per week to 9,500.% change in quantity of oranges demanded = (9,500 − 8,000)/8,750 x 100 = %% change in price of apples = − / x 100 = 40%II. The Elasticity of SupplyA. The Price Elasticity of Supply and Its Determinants1. Definition of price elasticity of supply: a measure of how much the quantitysupplied of a good responds to a change in the price of that good, computed as thepercentage change in quantity supplied divided by the percentage change in price.2. Determinants of the Price Elasticity of Supplya. Flexibility of sellers: goods that are somewhat fixed in supply (beachfrontproperty) have inelastic supplies.b. Time horizon: supply is usually more inelastic in the short run than in thelong run.B. Computing the Price Elasticity of Supply1. Formula2. Example: the price of milk increases from $ per gallon to $ per gallon and thequantity supplied rises from 9,000 to 11,000 gallons per month.% change in price = –/ × 100 = 10%% change in quantity supplied = (11,000 –9,000)/10,000 × 100 = 20%Price elasticity of supply = (20%)/(10%) = 2C. The Variety of Supply Curves1. In general, the flatter the supply curve that passes through a given point, themore elastic the supply.2. Extreme Casesa. When the elasticity is equal to zero, the supply is said to be perfectlyinelastic and is a vertical line.b. When the elasticity is infinite, the supply is said to be perfectly elastic andis a horizontal line.3. Because firms often have a maximum capacity for production, the elasticity ofsupply may be very high at low levels of quantity supplied and very low at highlevels of quantity supplied.III. Three Applications of Supply, Demand, and ElasticityA. Can Good News for Farming Be Bad News for Farmers1. A new hybrid of wheat is developed that is more productive than those used in thepast. What happens2. Supply increases, price falls, and quantity demanded rises.3. If demand is inelastic, the fall in price is greater than the increase in quantitydemanded and total revenue falls.4. If demand is elastic, the fall in price is smaller than the rise in quantitydemanded and total revenue rises.5. In practice, the demand for basic foodstuffs (like wheat) is usually inelastic.a. This means less revenue for farmers.b. Because farmers are price takers, they still have the incentive to adopt thenew hybrid so that they can produce and sell more wheat.c. This may help explain why the number of farms has declined so dramatically overthe past two centuries.d. This may also explain why some government policies encourage farmers todecrease the amount of crops planted.B. Why Did OPEC Fail to Keep the Price of Oil HighFigure 8Short Run Long Run1. In the 1970s and 1980s, OPEC reduced the amount of oil it was willing to supply toworld markets. The decrease in supply led to an increase in the price of oil and a decrease in quantity demanded. The increase in price was much larger in the short run than the long run. Why2. The demand and supply of oil are much more inelastic in the short run than thelong run. The demand is more elastic in the long run because consumers can adjust to the higher price of oil by carpooling or buying a vehicle that gets bettermileage. The supply is more elastic in the long run because non-OPEC producerswill respond to the higher price of oil by producing more.C. Does Drug Interdiction Increase or Decrease Drug-Related Crime1. The federal government increases the number of federal agents devoted to the waron drugs. What happensa. The supply of drugs decreases, which raises the price and leads to a reductionin quantity demanded. If demand is inelastic, total expenditure on drugs (equalto total revenue) will increase. If demand is elastic, total expenditure willfall.b. Thus, because the demand for drugs is likely to be inelastic, drug-relatedcrime may rise.2. What happens if the government instead pursued a policy of drug educationa. The demand for drugs decreases, which lowers price and quantity supplied. Totalexpenditure must fall (because both price and quantity fall).b. Thus, drug education should not increase drug-related crime.SOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. The price elasticity of demand is a measure of how much the quantity demanded of agood responds to a change in the price of that good, computed as the percentage change in quantity demanded divided by the percentage change in price.When demand is inelastic (a price elasticity less than 1), a price increase raisestotal revenue, and a price decrease reduces total revenue. When demand is elastic (a price elasticity greater than 1), a price increase reduces total revenue, and a price decrease increases total revenue. When demand is unit elastic (a price elasticity equal to 1), a change in price does not affect total revenue.2. The price elasticity of supply is a measure of how much the quantity supplied of agood responds to a change in the price of that good, computed as the percentage change in quantity supplied divided by the percentage change in price.The price elasticity of supply might be different in the long run than in theshort run because over short periods of time, firms cannot easily change the sizes Figure 9(a) Drug Interdiction (b) Drug Educationof their factories to make more or less of a good. Thus, in the short run, thequantity supplied is not very responsive to the price. However, over longerperiods, firms can build new factories, expand existing factories, close oldfactories, or they can enter or exit a market. So, in the long run, the quantitysupplied can respond substantially to a change in price.3. A drought that destroys half of all farm crops could be good for farmers (at leastthose unaffected by the drought) if the demand for the crops is inelastic. Theshift to the left of the supply curve leads to a price increase that will raisetotal revenue if the price elasticity of demand is less than 1.No one farmer would have an incentive to destroy her crops in the absence of adrought because she takes the market price as given. Only if all farmersdestroyed a portion of their crops together, for example through a governmentprogram, would this plan work to make farmers better off.Questions for Review1. The price elasticity of demand measures how much quantity demanded responds to achange in price. The income elasticity of demand measures how much quantitydemanded responds to changes in consumers' income.2. The determinants of the price elasticity of demand include the availability ofclose substitutes, whether the good is a necessity or a luxury, the breadth of thedefinition of the market, and the time horizon. Goods with close substitutes havegreater elasticities, luxury goods have greater price elasticities thannecessities, goods in more narrowly defined markets have greater elasticities, andthe elasticity of demand is greater the longer the time horizon.3. An elasticity greater than one means that demand is elastic. When the elasticityis greater than one, the percentage change in quantity demanded exceeds thepercentage change in price. When the elasticity equals zero, demand is perfectly inelastic. There is no change in quantity demanded when there is a change in price.4. Figure 1 presents a supply-and-demand diagram, showing the equilibrium price, P,the equilibrium quantity, Q, and the total revenue received by producers. Total revenue equals the equilibrium price times the equilibrium quantity, which is the area of the rectangle shown in the figure.Figure 15. If demand is elastic, an increase in price reduces total revenue. With elasticdemand, the quantity demanded falls by a greater percentage than the price rises.As a result, total revenue moves in the opposite direction as the price. Thus, if price rises, total revenue falls.6. A good with income elasticity less than zero is called an inferior good because asincome rises, the quantity demanded declines.7. The price elasticity of supply is calculated as the percentage change in quantitysupplied divided by the percentage change in price. It measures how much quantity supplied responds to changes in price.8. If a fixed quantity of a good is available and no more can be made, the priceelasticity of supply is zero. Regardless of the percentage change in price, therewill be no change in the quantity supplied.9. Destruction of half of the fava bean crop is more likely to hurt fava bean farmersif the demand for fava beans is very elastic. Destruction of half of the cropcauses the supply curve to shift to the left resulting in a higher price of favabeans. When demand is very elastic, an increase in price leads to a decrease intotal revenue because the decrease in quantity demanded outweighs the increase inprice.Quick Check Multiple Choice1. a2. b3. d4. c5. a6. cProblems and Applications1. a. Mystery novels have more elastic demand than required textbooks because mysterynovels have close substitutes and are a luxury good, while required textbooksare a necessity with no close substitutes. If the price of mystery novels wereto rise, readers could substitute other types of novels, or buy fewer novelsaltogether. But if the price of required textbooks were to rise, students wouldhave little choice but to pay the higher price. Thus, the quantity demanded ofrequired textbooks is less responsive to price than the quantity demanded ofmystery novels.b. Beethoven recordings have more elastic demand than classical music recordingsin general. Beethoven recordings are a narrower market than classical musicrecordings, so it is easier to find close substitutes for them. If the price of Beethoven recordings were to rise, people could substitute other classicalrecordings, like Mozart. But if the price of all classical recordings were torise, substitution would be more difficult. (A transition from classical musicto rap is unlikely!) Thus, the quantity demanded of classical recordings isless responsive to price than the quantity demanded of Beethoven recordings.c. Subway rides during the next five years have more elastic demand than subwayrides during the next six months. Goods have a more elastic demand over longertime horizons. If the fare for a subway ride was to rise temporarily, consumers could not switch to other forms of transportation without great expense orgreat inconvenience. But if the fare for a subway ride was to remain high for a long time, people would gradually switch to alternative forms of transportation.As a result, the quantity demanded of subway rides during the next six monthswill be less responsive to changes in the price than the quantity demanded ofsubway rides during the next five years.d. Root beer has more elastic demand than water. Root beer is a luxury with closesubstitutes, while water is a necessity with no close substitutes. If the price of water were to rise, consumers have little choice but to pay the higher price.But if the price of root beer were to rise, consumers could easily switch toother sodas or beverages. So the quantity demanded of root beer is moreresponsive to changes in price than the quantity demanded of water.2. a. For business travelers, the price elasticity of demand when the price oftickets rises from $200 to $250 is [(2,000 – 1,900)/1,950]/[(250 – 200)/225]= = . For vacationers, the price elasticity of demand when the price oftickets rises from $200 to $250 is [(800 – 600)/700] / [(250 – 200)/225] == .b. The price elasticity of demand for vacationers is higher than the elasticityfor business travelers because vacationers can choose a substitute more easilythan business travelers. For example, vacationers can choose a different mode of transportation (like driving or taking the train), a different destination, a different departure date, and a different return date. They may also choose to not travel at all. Business travelers are less likely to do so because their schedules are less adaptable.3. a. The percentage change in price is equal to – / x 100 = 20%. If the priceelasticity of demand is , quantity demanded will fall by 4% in the short run [ ]. If the price elasticity of demand is , quantity demanded will fall by 14% in the long run [].b. Over time, consumers can make adjustments to their homes by purchasingalternative heat sources such as natural gas or electric furnaces. Thus, they can respond more easily to the change in the price of heating oil in the long run than in the short run.4. If quantity demanded fell, price must have increased according to the law ofdemand. For a price increase to increase total revenue, the percentage increase in the price must be greater than the percentage decline in quantity demanded. Therefore, demand is inelastic.5. , a. The effect on the market for coffee beans is shown in Figure 2. When ahurricane destroys half of the crop, the supply of coffee beans decreases, the price of coffee beans increases, and the quantity decreases.QuantityPrice Figure 2Demand S 1 S 2b. The effect on the market for cups of coffee is shown in Figure 2. When theprice of coffee beans, an important input into the production of a cup ofcoffee, increases, the supply of cups of coffee decreases, the price of a cup of coffee increases, and the quantity decreases.Because cups of coffee have an inelastic demand, when the price of a cup ofcoffee increases, the total expenditure on coffee increases.c. The effect on the market for donuts is shown in Figure 3. When the price ofcoffee increases and the quantity demanded of coffee decreases, consumersdemand fewer donuts because coffee and donuts are complements. When demanddecreases, the price of donuts decreases.Because donuts have an inelastic demand, when the price of donuts decreases,the total expenditure on donuts decreases.6. a. If your income is $10,000, your price elasticity of demand as the price of DVDsrises from $8 to $10 is [(40 – 32)/36]/[(10 – 8)/9] = = 1. If your income is $12,000, the elasticity is [(50 – 45)/]/[(10 – 8)/9] = = .b. If the price is $12, your income elasticity of demand as your income increasesfrom $10,000 to $12,000 is [(30 – 24)/27]/[(12,000 – 10,000)/11,000] = = . Price Figure 3If the price is $16, your income elasticity of demand as your income increases from $10,000 to $12,000 is [(12 – 8)/10]/[(12,000 – 10,000)/11,000] = = .7. a. If Maria always spends one-third of her income on clothing, then her incomeelasticity of clothing demand is one, because maintaining her clothingexpenditures as a constant fraction of her income means the percentage changein her quantity of clothing must equal her percentage change in income.b. Maria's price elasticity of clothing demand is also one, because everypercentage point increase in the price of clothing would lead her to reduce her quantity purchased by the same percentage.c. Because Maria spends a smaller proportion of her income on clothing, then forany given price, her quantity demanded will be lower. Thus, her demand curvehas shifted to the left. Because she will again spend a constant fraction ofher income on clothing, her income and price elasticities of demand remain one.8. a. The percentage change in price (using the midpoint formula) is – / × 100%= %. Therefore, the price elasticity of demand is = , which is very elastic.b. Because the demand is inelastic, the Transit Authority's revenue rises when thefare rises.c. The elasticity estimate might be unreliable because it is only the first monthafter the fare increase. As time goes by, people may switch to other means oftransportation in response to the price increase. So the elasticity may belarger in the long run than it is in the short run.9. Walt's price elasticity of demand is zero, because he wants the same quantityregardless of the price. Jessie's price elasticity of demand is one, because he spends the same amount on gas, no matter what the price, which means hispercentage change in quantity is equal to the percentage change in price.10. a. With a price elasticity of demand of , reducing the quantity demanded ofcigarettes by 20% requires a 50% increase in price, because 20/50 = . With the price of cigarettes currently $2, this would require an increase in the priceto $ a pack using the midpoint method (note that ($ – $2)/$ = .50).b. The policy will have a larger effect five years from now than it does one yearfrom now. The elasticity is larger in the long run, because it may take sometime for people to reduce their cigarette usage. The habit of smoking is hardto break in the short run.c. Because teenagers do not have as much income as adults, they are likely to havea higher price elasticity of demand. Also, adults are more likely to beaddicted to cigarettes, making it more difficult to reduce their quantitydemanded in response to a higher price.11. To determine whether you should increase or decrease the price of admissions, youneed to know if the demand is elastic or inelastic. If demand is elastic, adecline in the price of admissions will increase total revenue. If demand isinelastic, an increase in the price of admissions will cause total revenue to rise.12. A worldwide drought could increase the total revenue of farmers if the priceelasticity of demand for grain is inelastic. The drought reduces the supply of grain, but if demand is inelastic, the reduction of supply causes a large increase in price. Total farm revenue would rise as a result. If there is only a drought in Kansas, Kansas’ production is not a large enough proportion of the total farm product to have much impact on the price. As a result, price does not change (or changes by only a slight amount), while the output by Kansas farmers declines, thus reducing their income.。

Chapter 5: Foreign InvestmentTrue or False Questions1. The largest free zones are called free cities.2. Free trade areas are made up of two or more states.3. No tariffs or duties are paid in export processing zones.4. Bonded warehouses are intended to be places for trade and business.5. Manufacturing activities are allowed in bonded warehouses.6. Depriving a person or company of private property without compensation is called nationalization.7. Nondiscrimination guarantee is the assurance of a host state government that foreign investors will be able to take out of the state both the investment capital they brought in and the profits they earned.8. Choice-of-law clause promises foreign investors that the host government will not change its tax for a certain period of time.9. Once a foreign-owned enterprise is in full operation, it is usually subject to periodic monitoring.10. A debt security represents an ownership interest in a business.11. A bond is an equity security.12. A certificated security can be transferred by negotiation.13. An uncertificated security is one whose ownership is recorded only on the books of the issuer.14. Bearer securities are transferred simply by delivery of the certificate.15. Bearer securities are registered on the books of the issuer.16. In the United States, offerings of less than $1 million in a 12-month period are exempt from registration.17. Exempt securities typically include those issued by governmental bodies, by banks, and by not-for-profit corporations.18. The clearance and settlement procedure is uniform throughout the world.19. Euroclear is an international clearinghouse.20. To facilitate foreign trading in shares, brokerage firms use depository receipts.21. Depository receipts are non-negotiable instruments.22. If a company issues depository receipts, then the corresponding shares need to be sent abroad.23. Depository receipts are identical to the securities themselves.24. An insider is a person, such as a corporate officer, director, or majority shareholder, who has access to material nonpublic information about a company or the securities market.25. According to U.S. law, information is material when something is of significance to a reasonable person.Multiple Choice Questions26. Which of the following is true of closed sectors?A. They limit the percentage of foreign investment.B. They are not open to foreign investors.C. They have the highest tax rates.D. They are usually present in developing countries.27. The parts of a state’s economy that are not fully open to foreign investors are called ________.A. exclusive economic zonesB. special economic zonesC. closed sectorsD. restricted sectors28. The parts of a state’s economy in which foreigners are en couraged to invest are called ________.A. exclusive economic zonesB. special economic zonesC. foreign priority sectorsD. restricted sectors29. ________ are geographical areas wherein goods may be imported and exported free from customs tariffs and in which a variety of trade-related activities may be carried on.A. Foreign priority sectorsB. Closed sectorsC. Free zonesD. Exclusive economic zones30. The largest free zones are called ________.A. free trade areasB. free citiesC. free trade zonesD. subzones31. Which of the following is the oldest type of free zone?A. free trade areaB. free perimeterC. free cityD. special economic zone32. A free zone located within or near a port city is called a(n) ________.A. free trade zoneB. free retail zoneC. special economic zoneD. exclusive economic zone33. A(n) ________ is a special-purpose free zone associated with, but physically apart from, a free trade zone, in which limited-purpose trading activities are carried on.A. exclusive economic zoneB. closed sectorC. free trade areaD. subzone34. ________ are areas in international airports and harbors where travelers can buy goods free of local sales and excise taxes.A. Free retail zonesB. Export processing zonesC. Bonded warehousesD. Foreign priority sectors35. A(n) ________ is a facility at a port of entry where shippers can store goods until they clear customs.A. export processing zoneB. data warehouseC. bonded warehouseD. free retail zone36. Which of the following is true of bonded warehouses?A. They are operated by transportation firms.B. They are intended to be places for trade and business.C. They help shippers in avoiding tariffs and quotas.D. They are owned by the government.37. Acquisition by a state of property previously held by private persons or companies, usually in exchange for some consideration is called ________.A. expropriationB. nationalizationC. privatizationD. municipalization38. Depriving a person or company of private property without compensation is called ________.A. expropriationB. nationalizationC. privatizationD. municipalization39. Which of the following terms refers to the assurance of a host state government that foreign investors will be able to take out of the state both the investment capital they brought in and the profits they earned?A. nondiscrimination guaranteeB. repatriation guaranteeC. stabilization clauseD. appraisal right40. Which of the following terms refers to the assurance of a host government that foreign investors will be treated the same way as local investors?A. nondiscrimination guaranteeB. repatriation guaranteeC. stabilization clauseD. appraisal right41. ________ promise foreign investors that the host government will not change its tax, foreign exchange, or other legal régime for a certain period of time, or that changes subsequent to the establishment of an enterprise will not affect that enterprise.A. Nondiscrimination guaranteesB. Repatriation guaranteesC. Stabilization clausesD. Appraisal rights42. Which of the following is a characteristic of stabilization clauses?A. They can be changed by the mutual agreement of the parties.B. They can prevent a state from nationalizing a foreign investment.C. They can prevent a state from expropriating a foreign investment.D. They guarantee equality of treatment with regard to ownership rights, taxation, and, social matters.43. Which of the following statements is most likely to be true regarding the supervision of foreign investment?A. The foreign investor whose application has been approved by the host state is usually subject to some time limit in which to start construction and/or begin operation.B. Very few countries require investors to submit periodic reports during the start-up period.C. Once a foreign-owned enterprise is in full operation, it is usually not subject to periodic monitoring.D. Investment laws usually provide that any modification to an investment agreement, including an increase or decrease in the size or scope of a project, has to be approved by the home state.44. A ________ is a share in the ownership of a company that entitles its owner to rights in the company, including a proportionate part of the dividends and, upon liquidation, of the capital assets.A. debentureB. bondC. stockD. banknote45. A(n) ________ is a contractual obligation of a company to repay the holder the amount of his or her original investment plus interest at a specified future date.A. bondB. equityC. common stockD. capital stock46. Which of the following is true of a certificated security?A. Its ownership is recorded only on the books of the issuer.B. A bearer security is not a certificated security.C. It cannot be transferred by negotiation.D. It is dealt in on securities exchanges.47. A(n) ________ is someone who buys in good faith, pays value, and is unaware that the transferor is not the rightful owner.A. tipperB. bona fide purchaserC. tippeeD. insider48. Which of the following is true regarding an uncertificated security?A. A registered security is a type of an uncertificated security.B. Its ownership is recorded only on the books of the issuer.C. It is dealt in on securities exchanges.D. Most developed countries prevent companies from using uncertificated certificates.49. A(n) ________ is a printed statement given to prospective securities investors setting out a full, true, and plain disclosure of all material facts relating to the securities and the issuer.A. prospectusB. article of incorporationC. memorandum of associationD. charter50. ________ is a procedure by which a buyer turns over the purchase price and the seller turns over the securities in a securities transaction.A. ExpropriationB. Insider tradingC. Clearance and settlementD. Conformity assessment procedure51. A ________ is a negotiable instrument issued by a bank that represents a foreign company’s publicly traded securities and that, in turn, is traded on a local securities exchange.A. bill of exchangeB. banknoteC. promissory noteD. depository receipt52. ________ is the use of material nonpublic information about a company or the securities market to buy or sell securities for personal gain.A. Insider tradingB. SafeguardingC. DumpingD. Expropriation53. A(n) ________ is a person, such as a corporate officer, director, or majority shareholder, who has access to material nonpublic information about a company or the securities market.A. bona fide purchaserB. whistle-blowerC. insiderD. boundary spanner54. A ________ is a person who has access to material nonpublic information about a company or the securities market and who discloses it to someone who acts on that information.A. bona fide purchaserB. whistle-blowerC. boundary spannerD. tipper55. In the context of the securities market, a(n) ________ is a person who acts for his or her personal account on information knowing that the information is not available to the public.A. bona fide purchaserB. tippeeC. whistle-blowerD. boundary spanner56. The ________ is a law enacted by the United States in 1968 that authorizes the Securities and Exchange Commission to issue rules regulating takeover bids.A. National Banking ActB. Militia ActC. Williams ActD. Sarbanes-Oxley ActEssay Questions57. Describe the significance of foreign investment policies.58. What are the criteria for evaluating a foreign investment proposal?59. Differentiate between closed sectors and restricted sectors.60. What are the different types of free zones?61. What is a bonded warehouse?62. Differentiate between nationalization and expropriation.63. Explain appraisal rights.64. Differentiate between a registered security and a bearer security.65. What is a depository receipt?66. Describe the significance of the Williams Act.。