财务会计01第一章

- 格式:pptx

- 大小:164.53 KB

- 文档页数:5

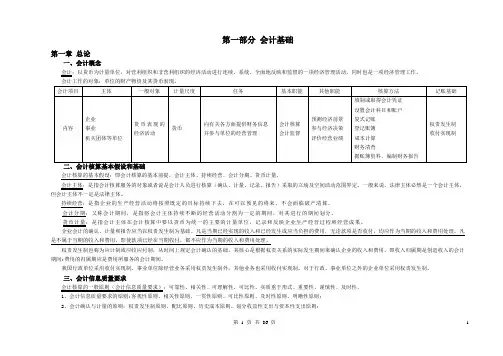

第一部分会计基础第一章总论一、会计概念会计:以货币为计量单位,对营利组织和非营利组织的经济活动进行连续、系统、全面地反映和监督的一项经济管理活动,同时也是一项经济管理工作。

会计工作的对象:单位的财产物资及其货币表现。

二、会计核算基本假设和基础会计核算的基本假设:即会计核算的基本前提,会计主体、持续经营、会计分期、货币计量。

会计主体:是指会计核算服务的对象或者说是会计人员进行核算(确认、计量、记录、报告)采取的立场及空间活动范围界定。

一般来说,法律主体必然是一个会计主体,但会计主体不一定是法律主体。

持续经营:是指企业的生产经营活动将按照既定的目标持续下去,在可以预见的将来,不会面临破产清算。

会计分期:又称会计期间,是指将会计主体持续不断的经营活动分割为一定的期间,对其进行的期间划分。

货币计量:是指会计主体在会计核算中要以货币为统一的主要的计量单位,记录和反映企业生产经营过程和经营成果。

企业会计的确认、计量和报告应当以权责发生制为基础。

凡是当期已经实现的收入和已经发生或应当负担的费用,无论款项是否收付,均应作为当期的收入和费用处理。

凡是不属于当期的收入和费用,即使款项已经在当期收付,都不应作为当期的收入和费用处理。

权责发生制也称为应计制或应收应付制,从时间上规定会计确认的基础,其核心是根据权责关系的实际发生期间来确认企业的收入和费用。

即收入归属期是创造收入的会计期间;费用的归属期应是费用所服务的会计期间。

我国行政单位采用收付实现制、事业单位除经营业务采用权责发生制外,其他业务也采用收付实现制。

对于行政、事业单位之外的企业单位采用权责发生制。

三、会计信息质量要求会计核算的一般原则(会计信息质量要求):可靠性、相关性、可理解性、可比性、实质重于形式、重要性、谨慎性、及时性。

1、会计信息质量要求的原则:客观性原则、相关性原则、一贯性原则、可比性原则、及时性原则、明晰性原则;2、会计确认与计量的原则:权责发生制原则、配比原则、历史成本原则、划分收益性支出与资本性支出原则;第 1 页共86 页 13、修正性原则:重要性原则、谨慎性原则。

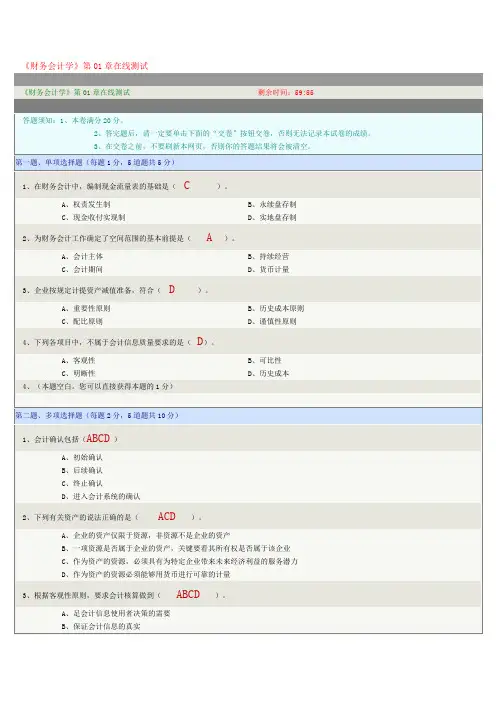

《财务会计学》第01章在线测试《财务会计学》第01章在线测试剩余时间:59:55答题须知:1、本卷满分20分。

2、答完题后,请一定要单击下面的“交卷”按钮交卷,否则无法记录本试卷的成绩。

3、在交卷之前,不要刷新本网页,否则你的答题结果将会被清空。

第一题、单项选择题(每题1分,5道题共5分)1、在财务会计中,编制现金流量表的基础是( C )。

A、权责发生制B、永续盘存制C、现金收付实现制D、实地盘存制2、为财务会计工作确定了空间范围的基本前提是( A )。

A、会计主体B、持续经营C、会计期间D、货币计量3、企业按规定计提资产减值准备,符合(D)。

A、重要性原则B、历史成本原则C、配比原则D、谨慎性原则4、下列各项目中,不属于会计信息质量要求的是( D)。

A、客观性B、可比性C、明晰性D、历史成本4、(本题空白。

您可以直接获得本题的1分)第二题、多项选择题(每题2分,5道题共10分)1、会计确认包括(ABCD)A、初始确认B、后续确认C、终止确认D、进入会计系统的确认2、下列有关资产的说法正确的是(ACD)。

A、企业的资产仅限于资源,非资源不是企业的资产B、一项资源是否属于企业的资产,关键要看其所有权是否属于该企业C、作为资产的资源,必须具有为特定企业带来未来经济利益的服务潜力D、作为资产的资源必须能够用货币进行可靠的计量3、根据客观性原则,要求会计核算做到(ABCD)。

A、足会计信息使用者决策的需要B、保证会计信息的真实C、准确反映企业的实际情况D、会计信息能够经受验证4、下列各项中,体现谨慎性要求的是(BD)。

A、无形资产摊销B、成本与市价孰低法C、固定资产采用历史成本计价D、债务重组中债权人对或有收益的会计处理5、我国会计准则规定的会计计量属性包括(ABCD)。

A、历史成本B、重置成本C、可变现净值D、现值和公允价值第三题、判断题(每题1分,5道题共5分)1、企业在一定期间发生亏损,会导致所有者权益减少。

财务会计课本一、引言财务会计是指通过收集、记录、分类、总结和报告企业日常经济事务的核算方法和过程。

财务会计不仅是企业重要的内部管理工具,也是向外部各方提供企业财务信息的重要方式。

本文档旨在介绍财务会计的基本概念、原则、方法,以及财务会计的主要任务和目标。

二、财务会计的概念和基本原则2.1 财务会计的概念财务会计是指通过记录、分类、总结和报告企业经济事务的核算方法。

它主要关注企业的经济活动、财务状况和经营成果。

2.2 财务会计的基本原则1.会计主体性原则:企业与业主之间必须相互区别,企业财务与个人财务必须分开核算。

2.会计持续性原则:企业活动应以人的一生为基点进行持续核算。

3.会计会计期间性原则:将经济事项划分为一定的会计期间进行核算和报告。

4.会计货币性原则:财务会计应以货币作为计量单位进行核算。

5.会计真实性原则:财务会计信息应真实、完整地反映企业的经济活动和财务状况。

三、财务会计的方法与流程3.1 财务会计的方法1.账务处理:通过记录原始凭证,将经济事项按照一定规则进行账务处理。

2.账户分类:将账务处理后的经济事项按照性质和用途进行分类,形成财务会计账户。

3.制作财务报表:根据账户分类的结果,编制财务报表,如资产负债表、利润表、现金流量表等。

3.2 财务会计的流程1.原始凭证的收集和登记:企业必须按照一定规则收集和登记各种经济事项的原始凭证。

2.原始凭证的审核和归档:对收集的原始凭证进行审核,确保其合法性和准确性,并进行归档保存。

3.账务处理和账户分类:通过将经济事项按照一定规则进行账务处理,形成财务会计账户。

4.编制财务报表:根据账户分类的结果,编制财务报表,反映企业的经济活动和财务状况。

5.财务报表的分析和解读:对编制好的财务报表进行分析和解读,为企业的决策提供依据。

四、财务会计的主要任务和目标4.1 主要任务1.记录和处理企业的经济活动:财务会计通过记录和处理企业的经济活动,确保账务的准确性和可靠性。

第一章外币会计1.对于以人民币作为记账本位币的企业,下列交易或事项中,不属于外币交易的是( ) 2015单A.以80万元人民币兑换美元B.以20万美元购入原材料一批C.为建造一项固定资产借款2000万美元D.以60万元人民币支付美国子公司员工的薪酬【答案】D P452.某企业的记账本位币为美元,根据我国会计准则规定,下列说法中错误的是()2016单A.该企业日常核算使用的货币为美元B.该企业的财务报表需要折算为人民币C.该企业以美元计价和结算的交易属于外币交易D.该企业以人民币计价和结算的交易属于外币交易【答案】C P453.什么是汇兑损益?汇兑损益有哪些常见类型?2012简【答案】 P47汇兑损益是指企业发生的外币业务在折合为记账本位币时,由于汇率的变动而产生的记账本位币的折算差额和不同于外币兑换发生的收付差额,给企业带来的收益或损失。

类型:(1)交易汇兑损益。

(2)兑换汇兑损益。

(3)调整外币汇兑损益。

(4)外币折算汇兑损益。

4.(2013核算题)2010年12月1日,甲公司出口自产商品一批,销售价格为100 000美元,已办理发货手续,当日即期汇率为1美元=7元人民币,约定于2011年2月10日付款。

假设不考虑相关税费,2010年12月31日的汇率为1美元=6.80元人民币,2011年2月10日的汇率为1美元=6.70元人民币。

要求:分别按照单一交易观和两项交易观当期确认法,做出上述业务在交易日、报表日和结算日的相关会计分录。

【答案】 P48(1)单一交易观交易日:借:应收账款 700 000贷:主营业务收入 700 000报表日:借:主营业务收入 20 000贷:应收账款 20 000结算日:借:主营业务收入 10 000贷:应收账款 10 000借:银行存款 670 000贷:应收账款 670 000(2)两项交易观交易日:借:应收账款 700 000贷:主营业务收入 700 000报表日:借:财务费用 20 000贷:应收账款 20 000结算日:借:财务费用 10 000贷:应收账款 10 000借:银行存款 670 000贷:应收账款 670 0005. 根据我国会计准则规定,企业实际收到的外币投资额在折算为记账本位币时,应采用的汇率是()2016单A.合同约定汇率B.交易发生日即期汇率C.资产负债表日即期汇率D.交易发生日即期汇率的近似汇率【答案】B P536.某公司外币业务采用交易发生日的即期汇率进行折算,按月计算汇兑损益。

第一章总论一、单项选择题1、会计的基本职能是()。

A 核算和监督B 分析和调节C 预测和决策D 核算和分析2、会计主要采用的计量尺度是()。

A 货币量度B 实物量度C 劳动量度D 以上都不是3、界定了会计核算和监督的空间范围的是()假设。

A 持续经营B 会计主体C 会计分期D 货币计量4、企业在对会计要素进行计量时,一般应当采用( )计量属性。

A 历史成本B 重置成本C 可变现净值D 现值5、不同企业发生的相同或者相似的交易或者事项,应当采用规定的会计政策,符合的是()原则。

A 可比性B 重要性C 谨慎性D 相关性6、从核算效益看,对所有会计事项不分轻重主次和繁简详略,采取完全相同方法,不符合()原则。

A 明晰性B 重要性C 相关性D 谨慎性7、我国《企业会计准则》规定,企业采用的确定收入和费用归属期的基础是()。

A 永续盘存制B 实地盘存制C 权责发生制D 收付实现制8、企业提供的会计信息应当与财务会计报告使用者的经济决策需要相关,有助于财务会计报告使用者对企业过去、现在或者未来的情况作出评价或者预测,符合()要求。

A 谨慎性B 可比性C 相关性D 及时性9、当一笔经济业务只涉及资产一方有关项目之间的金额发生增减变化,会计恒等式两边的总金额()。

A 同增B 同减C 不增不减D 一边增加,一边减少10、引起资产内部一个项目增加,另一个项目减少,而资产总额不变的经济业务是()。

A 用银行存款偿还短期借款B 收到投资者投入的机器一台C 收到外单位还来前欠货款D 收到销售产品收入二、多项选择题1、会计主体可以是()。

A 独立法人B 非法人C 企业中的某一特定部分D 企业集团2、下列项目中,符合谨慎性要求的有()。

A 对应收账款计提坏账准备B 固定资产折旧采用加速折旧法C 固定资产折旧采用直线法D 无形资产摊销采用直线法3、下列各项中属于会计核算方法的有()。

A 复式记账B 填制会计凭证C 登记账簿D 编制会计报表4、下列项目中,属于我国会计信息质量要求的有()。

查尔斯亨格瑞_财务会计_课后练习答案01CHAPTER 1COVERAGE OF LEARNING OBJECTIVESChapter 1 Accounting: The Language of Business1CHAPTER 11-1 Accounting is a process of identifying, recording, summarizing, and reporting economic information to decision makers.1-2 No. Accounting is about real information about real companies. In learning accounting it is helpful to see accounting reports from various companies. This helps put the rules and techniques of accounting into an understandable framework and provides familiarity with the diversity of practice.1-3 Examples of decisions that are likely to be influenced by financial statements include choosing where to expand or reduce operations, lending money, investing ownership capital, and rewarding mangers.1-4 Users of financial statements include managers, lenders, suppliers, owners, income tax authorities, and government regulators.1-5 The major distinction between financial accounting and management accounting is their use by two classes of decision makers. Management accounting is concerned mainly with how accounting can serve internal decision makers such as the chief executive officer and other executives. Financial accounting is concerned with supplying information to external users. 1-6 The balance sheet equation is Assets = Liabilities + Owners’ equity. It is the fundamental framework of accounting. The left side lists the resources of the organization, and the right side lists the claims against those resources.1-7 No. Every transaction should leave the balance sheet equation in balance. Accounting is often called ―double-entry‖because accountants must enter at least two numbers for eac h transaction to keep the equation in balance.1-8 This is true. When a company buys inventory for cash, one asset is traded for another, and neither total assets nor total liabilities change. Thus, the balance sheet equation stays in balance. When a company buys inventory on credit, both inventory and accounts payable increase. Thus, both total assets and total liabilities increase by the same amount, again keeping the balance sheet equation in balance.1-9 The evidence for a note payable includes a promissory note, but the evidence for an account payable does not. A note payable is generally to a lender while an account payable is generally to a supplier.1-10 Ownership shares in most large corporations are easily traded in the stock markets, corporate owners have limited liability, and the owners of sole proprietorships or partnerships are usually also managers in the company while most corporations hire professional managers.21-11 Limited liability means that corporate owners are not personally liable for the debts of the corporation. Creditors’claims can be satisfied only by the assets of the particular corporation.1-12 The corporation is the most prominent type of entity and corporations do by far the largest volume of business.1-13 Yes. In the United Kingdom corporations frequently use the word limited (Ltd.) in their name. In many countries whose laws trace back to Spain, the initials S.A. refer to a ―society anonymous,‖ meaning that multiple unidentified owners stand behind the company, which is essentially the same structure as a corporation.1-14 Almost all states forbid the issuance of stock at below par; thus, par values are customarily set at very low amounts and have no real importance in affecting economic behavior of the issuing entity.1-15 The board of directors is the elected link between stockholders and the actual managers.It is the board’s duty to ensure that managers act in the best interests of shareholders.1-16 In the U.S. GAAP is generally set by the Financial Accounting Standards Board. The SEC has formal authority for specifying accounting standards for companies with publicly held stock, as delegated by Congress, but it usually accepts the standards promulgated by the FASB. Internationally, a majority of countries accept IFRS as set by the International Accounting Standards Board as their GAAP.1-17 Until recently this was true. However, now the SEC allows companies headquartered outside the U. S. to report using IFRS.1-18 Audits have value because they add credibilit y to a company’s financial statements.Provided that auditors have the expertise to assess the accuracy of financial statements and the integrity to report any problems they discover, the investing public can put more faith in statements that are audited.1-19 A CPA is a certified public accountant. One becomes a CPA by a combination of education, qualifying experience, and the passing of a two-day national examination. A CA (chartered accountant) is the equivalent of a CPA in many parts of the world, including most former British Commonwealth countries.1-20 Public accountants must obey standards of independence and integrity. In addition, there are many more ethical standards that pertain to accountants. Some folks call accounting the moral guardian of companies. This reputation has been sullied recently by corporate scandals that went undetected (or, at least, unreported by accountants), but accountants are working to regain the high ethical regard they have traditionally maintained.Chapter 1 Accounting: The Language of Business31-21 No. The fundamental accounting principles apply equally to nonprofit (that is, not-for-profit) and profit-seeking organizations. Managers and accountants in hospitals, universities, government agencies, and other nonprofit organizations use financial statements. They need to raise and spend money, prepare budgets, and judge financial performance. Nonprofit organizations need to use their limited resources wisely, and financial statements are essential for judging their use of resources.1-22 Double-entry refers to the concept that every transaction involves two or more accounts with the effect being to retain the balance in the balance sheet equation. The double-entry concept is important because it emphasizes that there are assets and claims on assets. In the balance sheet, for example, borrowing money provides an asset, cash, and creates a liability. Inaddition to this conceptual benefit there is a clerical benefit. Maintaining a balanced relationship provides an indicator of errors. If the balance sheet equation does not balance, an error has been made.1-23 Historians are primarily concerned with events that have already occurred. In that sense,a company’s financial statements do report on history—transactions that are complete.The negative side of this is that many important things that affect the value of a firm are based on what will happen in the future. Thus, investors often worry about expectations and predictions. Of course, there is no way to agree on the accuracy of expectations and predictions. The positive side of historical financial statements is that they present a no-nonsense perspective on what actually happened, where the company was at a point in time, or what it accomplished over a period of time. It is easier to predict the future when you know where you are and how you got there. You might liken the importance of historical financial statements to the importance of navigation instruments. If you do not know where you are and where you are headed, it is very hard to get to where you want to go.Most people who refer to accountants as historians intend it as a criticism, although, as indicated above, a historical focus ensures that the data are measurable and verifiable.1-24 Such arguments are fun but can never be truly resolved. The notion behind the importance of the corporation is that for any substantial growth to occur there must be a system for organizing resources and using them over long periods of time. The corporate form of ownership helps companies raise large amounts of capital via stock issuance as well as borrowing. It allows us to separate ownership from management. It protects the personal assets of shareholders, and because their maximum losses can be limited, more risky undertakings can be financed. Finally, it has perpetual life so its activity is not disrupted by the death of any shareholder. Corporations operate under a set of established rules of behavior for entering into contracts and being sure that other parties can be relied upon to uphold their side of an agreement.Accounting helped corporations emerge as the dominant economic organization in the world. Without accounting it would be difficult to coordinate the activities of large corporations. It would be especially difficult to separate management from ownership if accounting did not provide information about the performance of managements.41-25 The auditor increases the value of financial statements by reassuring the reader of the statements that an―independent‖ and a ―qualified‖ third party has reviewed management’s disclosures and believes they fairly present the company’s performance.The fact that you personally do not recognize the name of the audit firm should not be a problem, because only CPAs can perform public audits and sign audit opinions. Every state has strict procedures for licensing CPAs, so such people are qualified. Nevertheless, audit firms develop reputations, and ones with a positive public image may give some financial statement users more confidence in the financial statements they audit.1-26 (10 min.) Amounts are in millions.1. Assets = Liabilities + Owners’ Equity$7 = $3 + $42. Assets and liabilities would increase by $1 million. Owners’ equity would be unaffected.1-27 (15-20 min.)June 2 Owners invested $6,000 additional cash in Sok ol’s Furniture Company.3 Owners invested an additional $4,000 into the company by contributingadditional store fixtures valued at $4,000.4 Sok ol’s Furniture Company purchased additional furniture inventory for$3,000 cash.5 Sok ol’s Furniture Company purchased furniture inventory on account for$6,000.6 Sok ol’s Furniture Company sold store fixtures for $3,000 cash.7 Sok ol’s Furniture Company purchased $6,000 of store fixtures, paying$5,000 cash now and agreeing to pay $1,000 later.8 Sok ol’s Furniture Company paid $2,000 on accounts payable.9 Sok ol’s Furniture Company returned $400 of merchandise (furnitureinventory) for credit against accounts payable.10 Owners withdrew $2,000 cash from Sokol’s Furniture Company.Chapter 1 Accounting: The Language of Business51-28 (10-20 min.)Sept. 2 Brisbane purchased $2,500 of store fixtures on account.3 Owner or owners withdrew $2,000 cash.4 Brisbane returned $5,000 of its inventory of computers for $5,000 creditagainst its accounts payable.5 Computers (inventory) valued at $7,000 were invested in the company byowners.8 Brisbane paid $500 on accounts payable.9 Brisbane purchased $3,500 of store fixtures, paying $1,000 now andagreeing to pay $2,500 later.10 Brisbane returned $300 of store fixtures for credit against accounts payable.1-29 (15-25 min.)ATLANTA CORPORATIONBalance SheetMarch 31, 20X1Liabilities andAssets Stockholders’ EquityCash $ 5,000 (a) Liabilities:Merchandise inventory 44,000 (b) Accounts payable $ 12,000 (f) Furniture and fixtures 2,000 (c) Notes payable 10,000 Machinery and equipment 27,000 (d) Long-term debt 27,000 (g) Land 39,000 (e) Total liabilities 49,000 Building 24,000 Stockholders’ equity:Total $141,000 Paid-in capital 92,000 (h)Total $141,000(a) Cash: 14,000 + 1,000 – 10,000 = 5,000(b) Merchandise inventory: 40,000 + 4,000 = 44,000(c) Furniture and fixtures: 3,000 – 1,000 = 2,000(d) Machinery and equipment: 15,000 + 12,000 = 27,000(e) Land: 14,000 + 25,000 = 39,000(f) Accounts payable: 8,000 + 4,000 = 12,000(g) Long-term debt: 12,000 + 15,000 = 27,000(h) Paid-in capital: 80,000 + 12,000 = 92,000Note: Event 5 requires no change in the balance sheet.61-30 (25-35 min.)LIVERPOOL COMPANYBalance SheetNovember 30, 20X1Liabilities andAssets Stockholders’ EquityCash £ 18,000 (a) Liabilities:Merchandise inventory 29,000 Accounts payable £ 9,000 (d) Furniture and fixtures 8,000 Notes payable 31,000 (e) Machinery and equip. 33,000 (b) Long-term debt payable 101,000 (f) Land 35,000 (c) Total liabilities 141,000 Building 241,000 Stockholders’ equity:Total £364,000 Paid-in Capital 223,000 (g)Total £364,000(a) Cash: 22,000 – 3,000 – 7,000 + 6,000 = 18,000(b) Machinery and equipment: 20,000 + 13,000 = 33,000(c) Land: 41,000 – 6,000 = 35,000(d) Accounts payable: 16,000 – 7,000 = 9,000(e) Notes payable: 21,000 + (13,000 – 3,000) = 31,000(f) Long-term debt payable: 124,000 – 23,000 = 101,000(g) Paid-in capital: 200,000 + 23,000 = 223,000Note: Event 4 requires no change in the balance sheet.1-31 (5-10 min.)1. Total liabilities = Total assets -stockholders’ equity= $798,000,000,000 - $105,000,000,000= $693,000,000,0002. Common stock, par value = $.07 × 10,536,897,000 = $737,582,790.Like other items on General Electric’s balance sheet, the amount would be rounded off to millions:Common stock, par value $738Chapter 1 Accounting: The Language of Business71-32 (20-30 min.) See Exhibit 1-32. Equipment and furniture could be in two separate accounts rather than combined. 1-33 (20-35 min.)1. See Exhibit 1-33.2. LMN CORPORATIONBalance SheetJanuary 31, 20X1(In Thousands of Dollars)Liabilities andAssets Stockholders’ EquityLiabilities:Cash $131 Note payable $ 30Accounts payable 106 Merchandise inventory 269 Total liabilities $136Stockholders’ equity:Equipment 36 Capital stock,$1 par, 30,000 sharesissued and outstanding $ 30Additional paid-in capitalin excess of par value 270 300 Total $436 Total $436 1-34 (20-35 min.)1. See Exhibit 1-34.2. AUTOPARTES MADRIDBalance SheetMarch 31, 20X1Assets Liabilities and Owners’ EquityCash €58,800 Liabilities:Inventory 16,600 Accounts payable € 4,500 Equipment 17,500 Note payable 9,000Total liabilities 13,500You, capital 79,400 Total €92,900 Total €92,900 8EXHIBIT 1–32MCLEAN SERVICES, INC.Analysis of April 20X1 Transactions(In Thousands of Dollars)Assets Liabilities and Stockholders’ EquityEquipment Note Accounts Paid-in Description of Transactions Cash + and Furniture = Payable + Payable + Capital1. Issuance of stock +50 = +502. Issuance of stock +20 = +203. Borrowing +35 = +354. Acquisition for cash –33 +33 =5. Acquisition on account +10 = +106. Payments to creditors – 4 = – 47. Sale of equipment + 8 – 8 =8. No entry =+56 +55 = +35 + 6 + 70111 111MCLEAN SERVICES, INC.Balance SheetApril 30, 20X1Assets Liabilities and Stockholders’ EquityNote payable $ 35,000 Cash $ 56,000 Account payable 6,000Equipment and furniture 55,000 Paid-in Capital 70,000Total $111,000 Total $111,000Chapter 1 Accounting: The Language of Business9EXHIBIT 1–33LMN CORPORATIONJanuary 20X1Analysis of Transactions(In Thousands of Dollars)Assets Liabilities + Owners’ EquityMerch- Capital Additionalandise Equip- Notes Accounts Stock Paid-in Description of Transactions Cash + Inventory + ment = Payable + Payable + (at par) + Capital1. Original incorporation +300 = + 30 + 2702. Inventory purchased –95 +95 =3. Inventory purchased +85 = + 854. Return of inventory tosupplier –11 = – 115. Purchase of equipment –10 +40 = +306. Sale of equipment + 4 – 4 =7. Payment to creditor –18 = – 188. Inventory purchased –50 +100 = + 509. No entry except ondetailed underlyingrecords ==Balance, January 31, 20X110EXHIBIT 1–34AUTOPARTES MADRIDAnalysis of TransactionsFor the Month Ended March 31, 20X1Assets Liabilities + Owner’s EquityEquip- Accounts Note You, Description of Transactions Cash + Inventory + ment = Payable + Payable + Capital1. Initial investment +75,000 = +75,0002. Inventory acquired for cash 10,000 +10,000 =3. Inventory acquired on credit + 8,000 = + 8,0004. Equipment acquired – 5,000 +15,000 = +10,0005. No entry =6. Tires for family – 600 = - 6007. Parts returned tosupplier for cash + 300 – 300 =8. No effect on total inventory =9. Parts returned tosupplier for credit – 500 = – 50010. Payment on note – 1,000 = –1,00011. Equipment acquired + 5,000 = +5,00012. Payment to creditors – 3,000 = –3,00013. No entry14. No entry15. Exchange of equipment + 2,500 – 4,000 =+ 1,500+ 58,800 +16,600 +17,500 = +4,500 + 9,000 +79,40092,900 92,900Chapter 1 Accounting: The Language of Business111-35 (25-40 min.) Note that transaction 9 is not covered directly in the text. However, it should be possible to figure out the accounting for it from similar items that are covered. However, some instructors may want to omit transaction 9.1. See Exhibit 1-35.2. FREIDA CRUZ, ATTORNEY-AT-LAWBalance SheetDecember 31, 20X0Liabilities andAssets Owner’s EquityLiabilities:Cash in bank $46,000 Note payable $ 3,000 Note receivable 2,000 Account payable 1,000 Rental damage deposit 1,000 Total liabilities $ 4,000 Legal supplies on hand 1,000 Owner’s equity:Computer 5,000 Freida Cruz, capital 55,000 Office furniture 4,000 Total liabilities andTotal assets $59,000 owner’s equity $59,000 1-36 (15-25 min.) See Exhibit 1-36.1-37 (20-35 min.)1. See Exhibit 1-37.2. NIKE, INC.Balance SheetJune 3, 2009(In Millions)Liabilities andAssets Owners’ EquityCash $ 2,424 Total liabilities $ 4,617 Inventories 2,400 Owners’ equity 8,783 Property, plant, and equipment 1,932 Other assets 6,644Total $13,400 Total $13,40012FREIDA CRUZ ATTORNEYAnalysis of Business Transactions(In Thousands of Dollars)Assets = Liabilities and Owner’s EquityOwner’s Cash Note Rental Legal Office Liabilities Equity Description in Receiv- Damage Supplies Furni- Note Account F. Cruz of Transactions Bank able Deposit on Hand Computer ture Payable Payable Capital 2. Openinginvestment +55 = +554. Rental deposit – 1 +1 =5. Purchased computer – 2 +5 = +36. Purchased supplies +1 = +17. Purchasedfurniture – 4 +4 =9. Note receivablefrom G. See – 2 +2 =Balance, December31, 20X0 +46 +2 +1 +1 +5 +4 = +3 +1 +5559 59General Comments:Transactions 1 and 3 are personal rather than business transactions.In transaction 4, no obligation (liability) is set up for the rent because it is not payable until January 2 and no rental services will occur until January.Transaction 8 requires no entry because no services have been performed during December.Chapter 1 Accounting: The Language of Business13WALGREEN COMPANYAnalysis of Transactions(In Millions of Dollars)Assets Liabilities and Stockholders’ EquityProperty Stock-Inven- and Other Notes Accounts Other holders’Description of Transactions Cash + tories + Assets = Payable + Payable + Liabilities + Equity Balance May 31 2,300 6,891 15,952 = 4,599 6,357 14,1871. Issuance of stock for cash +30 = + 302. Issuance of stock for equipment +42 = + 423. Borrowing +13 = +134. Acquisition of equipment for cash –18 +18 =5. Acquisition of inventory on account +94 = +946. Payments to creditors –35 = –357. Sale of equipment +2 - 2 =Balance June 2 2,292 6,985 16,010 = 13 4,658 6,357 14,25925,287 25,287WALGREEN COMPANYBalance SheetJune 2, 2009(In Millions of Dollars)Assets Liabilities and Stockholders’ EquityCash $ 2,292 Notes payable $ 13Inventories 6,985 Accounts payable 4,658Property and other assets 16,010 Other liabilities 6,357Stockholders’ equity 14,259 Total $25,287 Total $25,28714NIKE, INC. Analysis of Transactions (In Millions of Dollars)AssetsLiabilities and Owners’ EquityDescription of Transactions Cash + Inven-tories +Property,Plant, andEquip. +Other Assets=TotalLiabil-ities +Owners’EquityBalance May 31 2,291 2,357 1,958 6,644 4,557 8,6931. Inventory purchased -28 +28 =2. Inventory purchased +19 = +193. Return of inventoryto supplier -4 = -44. Purchase of equipment -3 +14 = +115. Sale of equipment +40 -40 =6. No entry =7. Payment to creditor -16 = -168. Borrowed from bank +50 = +509. Issued common stock +90 = +9010. No entry except ondetailed underlyingrecords =Balance, June 3 2,424 2,400 1,932 6,644 =13,400 13,400Chapter 1 Accounting: The Language of Business15 REBECCA GURLEY, REALTORBalance SheetNovember 30, 20X1Liabilities andAssets Owners’ EquityCash $ 6,000 Liabilities:Undeveloped land 180,000 Accounts payable $ 6,000 Office furniture 16,000 (a) Mortgage payable 95,000 Franchise 18,000 (b) Total liabilities 101,000Owner’s equity:Rebecca Gurley, capital 119,000 (c) Total assets $220,000 Total liabilities andown er’s equity $220,000a.$17,000 – $1,000 = $16,000b. A franchise is an economic resource that has been purchased to benefit future operations.c.$220,000 – $101,000 = $119,000Note that Goldstein’s death may have considerable negative influence on future operations, but accounting does not formally measure its monetary impact. Moreover, transactions 3 and 4 are personal rather than business transactions.1-39 (10 min.)1. Cash would rise by $1,000 and the liability, Deposits, would rise by the same amount.2. Deposits are liabilities because Wells Fargo owes these amounts to depositors. They aredepositors’ claims on the assets of the bank.3. Loans Receivable would increase and Cash would decrease by $75,000.4. Deposits would decrease and Cash would decrease by $4,000.1-40 (10 min.) Amounts are in millions.1. a. Cash = Total assets - Noncash assets= €28,598 -€24,492= €4,106b. Stockholders’ equity= Total assets - Total liabilities= €28,598 -€22,495= €6,1032. Total liabilit ies and stockholders’ equity = total assets = €28,598.16UNITED TECHNOLOGIES CORPORATIONBalance SheetJune 30, 2009(In Millions of Dollars)Liabilities andAssets Stockholders’ EquityCash $ 4,196 (1) Accounts payable $ 4,599 Inventories 8,539 Other liabilities 24,819 Fixed assets 6,179 Long term debt 8,721 Other assets 37,811 Total liabilities 38,139Common stock $11,369Other stockholders’equity 7,037 (3)Total stockholders’equity 18,406 (2)Total liabilities andTotal assets $56,545 stockholders’ equity $56,545 Notations (1), (2), and (3) designate the answers to the requirements. (1) The $4,016 cash was computed by taking total assets minus all assets except cash. To calculate (2) and (3), note that total assets must equal tota l liabilities plus stockholders’ equity, $56,545. Furthermore, total liabilities is $4,599 + $24,819 + $8,721 = $38,139. Therefore, total stockholders’equity is $56,545 – $38,139 = $18,406, denoted by (2) above. Other stockholders’equity is $18,406 –$11,369 = $7,037, denoted by (3) above.Chapter 1 Accounting: The Language of Business17MACY’S, INC.Balance SheetAugust 1, 2009(In Millions of Dollars)Liabilities andAssets Share holders’ EquityCash $ 515 (a)Merchandise accountsInventories 4,634 payable $ 1,683 Property, plant, Long-term debt 8,632and equipment 10,046 Other liabilities 5,920Total liabilities $16,235 (b) Other assets 5,589 Shareholders’ equity 4,549 (c)Total liabilities andTotal assets $20,784 shareholders’ equity $20,784 Notations (a), (b), and (c) designate the answers to the requirements. Cash is calculated by subtracting the values given for the other assets from total assets: $20,784 - $4,634-$10,046 -$5,589 = $515. Cash is the smallest individual asset. Companies try to keep cash balances small because they do not earn large returns on cash accounts. To calculate (b), simply add the components $1,683 + $8,632 + $5,920. For (c), note that total liabilities and shareholde rs’ equity equals total assets, $20,784, so shareholders’ equity is $20,784 less total liabilities of $16,235, which equals $4,549.181.ABBOUD PARTNERSBalance SheetJune 15, 20X0Assets Liabilities and Owners’ EquityRental house $300,000 Mortgage loan $240,000Owners’ equityAdnan Abboud, Capital 30,000Gamal Abboud, Capital 30,000Total assets $300,000 Total liabilities and ow ners’equity $300,0002.ABBOUD CORPORATIONBalance SheetJune 15, 20X0Assets Liabilities & Stockholders’ EquityRental house $300,000 Mortgage loan $240,000Stockholders’ equityCommon stock, par value 2,000Additional paid-in capital 58,000Total assets $300,000 Total liabilities and sto ckholders’ equity $300,0001-44 (10 min.)1. The par value line would increase by 500,000,000 × $.01 = $5,000,000 and the number ofshares issued and outstanding would increase by 500 million. Additional paid-in capital would increase by 500,000,000 ×($6.00 – $.01) = $2,995,000,000.2. IBM shows all of its paid-in capital as a one-line item. Therefore, its common stock linewould increase by $120,000,000 and the number of issued and outstanding shares would increase by 1 million. Chapter 1 Accounting: The Language of Business19。