惠普HP-12CP金融计算器快速指南

- 格式:pdf

- 大小:47.70 KB

- 文档页数:9

一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

当然,严格地讲,还有几个其它的重要指标需要设定:期初或期末年金(g BEG或g END),每年复利的次数(gi),和每年付款次数(g n)。

不过期初和期末在大多数情况下,是可以省略的,因为现金的流入一般默认为是在期末,而现金流出一般默认是在期初;因此只要自己把握好时间段,是可以不用设定的。

期初和期末的概念的前提,是把每一期当作当作一个时间段来看待;但时如果没有明确的提示之下,完全可以把每一期当作一个时间点来看待,这样就省却了设定期初和期末的工作。

这样做,更能够联系对现金流概念的敏感性。

下面通过一些例题,来把握货币时间价值的一些基本运算。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV, g END (后两项输入时为可选项)PV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV, g END(同上)FV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定(年)利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?析:银行向客户贷款所适用的利率均为年利率,但是如果是每月付款一次(就像大多数按揭的情形,如本题),就意味着是每月复利一次,所以需要用g n 和g i来解题。

这两个健是计算器已经设定好的,按下,就意味着年利转成月利,年数转化成月数。

当然,也可以先用年利计算出月利,然后直接按照月的期数计算,答案相同。

解答:1)20 g n, 6.39 g i, 100PV, 0 FV, g END ( 这里假设月末付款,如是月初,需按g BEG) PMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

金融计算易考通—HP12C 计算器软件使用说明书北京世纪中鸿科技有限责任公司2013年6月文件状态: 【 】草稿 【√】正式发布 【 】正在修改项目名称 金融计算易考通—HP12C 计算器软件 文档名称 使用说明书 文件标识 YGWY-Project- PM-UM 当前版本 V1.0 作者 高全静 完成时间 2013-6-7 页数密级中文档控制修改记录* 修改类型分为A—Added M—Modified D—Deleted 审阅人存档目录1概述 (4)1.1背景 (4)1.2应用领域与使用对象 (4)1.4参考资料 (4)1.5术语与缩写解释 (5)2系统综述 (5)2.1系统结构 (5)2.2系统功能简介 (5)2.3性能 (5)2.4版权声明 (5)3运行环境 (6)3.1硬件设备要求 (6)3.2支持软件 (6)3.3数据结构 (6)4系统操作说明 (6)4.1安装与初始化 (7)4.2计算器 (7)4.2.1业务需求描述 (7)4.2.2界面截屏以及界面字段解释 (7)4.2.3操作说明 (9)4.3计算器键盘 (10)4.3.1业务需求描述 (10)4.3.2界面截屏以及界面字段解释 (10)4.3.3操作说明 (13)4.4键盘布局 (13)4.4.1业务需求描述 (13)4.4.2界面截屏以及界面字段解释 (14)4.4.3操作说明 (16)4.5基本操作 (16)4.5.1业务需求描述 (16)4.5.2界面截屏以及界面字段解释 (16)4.5.3操作说明 (22)4.6功能教学 (23)4.6.1业务需求描述 (23)4.6.2界面截屏以及界面字段解释 (23)4.6.3操作说明 (27)4.7案例教学 (27)4.7.1业务需求描述 (27)4.7.2界面截屏以及界面字段解释 (28)4.7.3操作说明 (30)4.8选项 (31)4.8.1业务需求描述 (31)4.8.2界面截屏以及界面字段解释 (31)4.8.3操作说明 (32)1概述1.1背景1.编写本使用说明的目的是充分叙述本软件所能实现的功能及其运行环境,以便使用者了解本软件的使用范围和使用方法,并为软件的维护和更新提供必要的信息。

第1节入门操作第1节:入门操作 17第 1 节入 门 操 作计算器的开启与关闭开启HP 12C/12C Platinum 计算器,按;键1,再一次按;键,则关闭计算器。

如果8~17分钟内没有击键动作,计算器将会自动关闭。

低电压提示如果开机后计算器的左上角显示符号( ),则是提醒电池的容量不多了,需要及时地更换新电池了。

关于电池的更换信息,请参见附录F 。

键盘设置HP 12C/12C Platinum 的多数键具有2~3个功能。

它主要的功能以白色字符印在按键的表面,交替的功能则以金色印在键的上方,以蓝色印在键的下方。

启用这些交替的功能时,需先按相应的前缀键。

如上面的按键所示:主要的功能字符w 以白色印在按键的表面,直接按键就可以启用它的功能;(AMORT )摊销功能则以金色印在键的上方,启用摊销功能时,需先按金色的前缀键f ,然后按!键;(12×)功能则以蓝色印在键的下方,启用该功能时,需先按蓝色的前缀键g 然后按A 键。

在本手册中,交替的操作功能只以一个键名印刷显示(例如L 内操作此功能键前,必须先按金色的f 功能转换键。

操作此功能键,直接按键即可。

操作此功能键前,必须先按蓝色的g 功能转换键。

1. 注意开机键低;于其他的按键,有助于您的操作。

第1节:入门操作18部收益率的功能函数名),操作时需要按适当的前缀键(例如:按f L…)。

本手册中以金色的字符印在两个支架间的“CLEAR”标志是清除的意思(例如:清除H寄存器内数据的功能,手册中的操作印刷成为CLEAR H function…,或者f CLEAR H)。

如果错按了f或g前缀键,可以按f CLEAR X取消操作。

按f或g前缀键,相应的状态提示符f或g将显现,激活前缀字符颜色相应的功能键,当按下功能键后提示符消失。

数字的输入按十个数字键可以输入数字,就象在纸上写数字一样。

如输入带小数的数字,必须按小数点.输入。

数字的分隔符设置每三位数字的分隔符号可以设置,有圆点及逗号两种形式,默认状态下的小数点是圆点,每三位数的分隔符号是逗号。

HP12C财务计算器的使用简介HP12C财务计算器是一款被广泛应用于金融和会计领域的专业计算器。

HP12C采用逆波兰记法表示数学表达式,并且提供了多个功能键和专门设计的金融函数,方便用户进行复杂的财务计算。

本文档旨在介绍HP12C财务计算器的基本使用方法和常用功能,帮助用户快速掌握这款实用的工具。

基本操作开机与关机HP12C财务计算器使用双电源设计,可以通过太阳能或者电池供电。

当电池电量不足时,太阳能电池仍然可以提供足够的电力继续使用。

•开机:按下计算器上面的“ON”按钮,计算器即可开机;•关机:按住“ON”按钮不松手,计算器即可关机。

数字输入通过按键输入数字是HP12C财务计算器最常见的操作。

计算器的面板上共有10个数字键,分别对应0至9的数字。

•输入数字:直接按下对应的数字键即可。

逆波兰记法HP12C财务计算器采用逆波兰记法(RPN)表示数学表达式。

这种表达式形式不需要括号,通过操作符的位置来确定运算顺序。

例如,要计算2加3的结果,可以按下以下键序列:2 [ENTER]3 +计算器会依次执行加法运算,结果将会显示在屏幕上。

HP12C财务计算器支持常用四则运算,包括加法、减法、乘法和除法。

使用这些运算符时,需要注意逆波兰记法的输入顺序。

•加法:按下“+”键;•减法:按下“-”键;•乘法:按下“x”键;•除法:按下“÷”键。

存储器操作HP12C财务计算器提供了多个存储器,可以临时存储数据和结果。

存储器的编号从0到9,分别对应对应数字键上的小数字。

•存储数据:按下对应存储器的编号键(0到9),然后按下“STO”键;•读取数据:直接按下对应存储器的编号键(0到9)。

当需要清空计算器的输入或者结果时,可以使用以下方法:•清除当前数值:按下“CLX”;•清除整个栈:按下“f”和“CLx”。

常用金融函数HP12C财务计算器提供了多个专门的金融函数,方便用户进行复杂的财务计算。

下面介绍几个常用的函数。

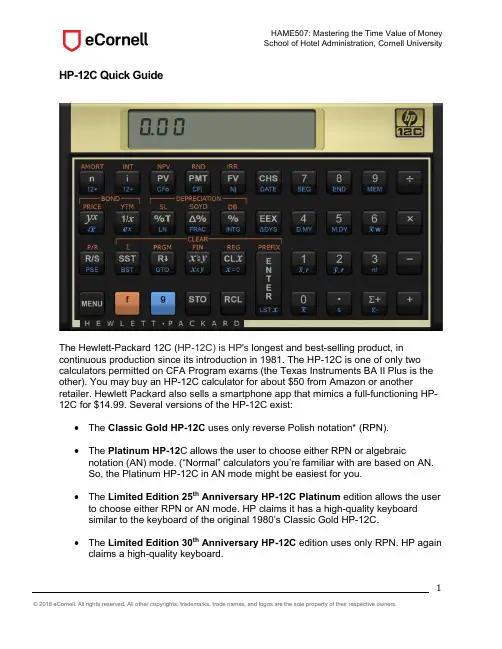

1HP-12C Quick GuideThe Hewlett-Packard 12C (HP-12C) is HP's longest and best-selling product, in continuous production since its introduction in 1981. The HP-12C is one of only two calculators permitted on CFA Program exams (the Texas Instruments BA II Plus is the other). You may buy an HP-12C calculator for about $50 from Amazon or anotherretailer. Hewlett Packard also sells a smartphone app that mimics a full-functioning HP-12C for $14.99. Several versions of the HP-12C exist:• The Classic Gold HP-12C uses only reverse Polish notation* (RPN).• The Platinum HP-12C allows the user to choose either RPN or algebraicnotation (AN) mode. (“Normal” calculators you’re familiar with are based on AN. So, the Platinum HP-12C in AN mode might be easiest for you.• The Limited Edition 25th Anniversary HP-12C Platinum edition allows the userto choose either RPN or AN mode. HP claims it has a high-quality keyboard similar to the keyboard of the original 1980’s Classic Gold HP-12C.• The Limited Edition 30th Anniversary HP-12C edition uses only RPN. HP againclaims a high-quality keyboard.2*The "Polish" in reverse Polish notation refers to the nationality of logician Jan Łukasiewicz, who invented Polish notation in the 1920s. Polish notation is parentheses-free and the inspiration for the idea of the recursive stack, a last-in, first-out computer memory store. Studies show that RPN calculators are superior to AN calculators in terms of speed and accuracy of operation. However, as noted above, you’ll likely be up and running faster with Platinum HP-12C in the familiar AN mode.What you will need to know for the purposes of this course is summarized in this quick guide. Keep it handy as a reference as you work through problems. The extensive instruction book included with your calculator is a valuable reference for the more sophisticated functions not covered in this guide. You can also find well-done tutorials on a number of financial calculators, including the HP-12C, at:/calculator_index .Basic Functions• Turning on your calculatorThe [ON] key–or [MENU] key on some HP-12C versions–in the bottom left corner turns the calculator on or off. If you do not use thecalculator for several minutes, it will turn itself off.• Changing the displayTo change the number of decimal places displayed, key [f] then the desired number of digits. For example, [f] [2] sets the display to two decimal places past the decimal point.The default values in the calculator are ‘.’ for the decimal point and ‘,’ as the separator between groups of three digits to the left, as in 30,000.00. To reverse these, turn off the calculator, then turn it back on while holding down the [.] key.• Changing signTo change the sign of the displayed value, key [CHS].Cash inflows (i.e., money going into your wallet)are entered as positive numbers. Cash outflows3(i.e., money coming out of your wallet) are entered as negative numbers.• Mathematical calculationsThe primary difference between the HP-12C’s operation in RPN mode and AN calculators is the way operations are entered. On an AN calculator, you enter the operator between two numbers:[2] [+] [3] [=]On the HP-12C, you key:[2] [ENTER] [3] [+]The first number is entered into the “stack” memory by using [ENTER]. The second number is followed by the operator desired. Another example:Desired Calculation: What you key: What you see:(12 + 13) x 5 [1] [2] [ENTER] [1] [3] [+][5] [x]12.0025.00 125.00A bit of HP-12C terminology: The displayed value showing in the window is referred to as “x ”, i.e., the number in the “x ” register. When you key [ENTER] it moves “x ” into the “y ” register. You’ll see several keys that perform operations on “x ” and “y .” For example, the [y x ] key raises “y ” to the “x ” power. The [1/x ] key takes the inverse of “x .” Here are examples that use the [y x ] and [1/x ] keys:Desired Calculation: What you key:What you see:11065(.) [1] [.] [0] [6] [ENTER] [5] [y x ] [1/x ]1.061.34 0.7512001065(.) [1] [.] [0] [6] [ENTER][5] [y x ] [1/x ][1] [2] [0] [0] [x ] 1.06 1.34 0.75 896.714 In the examples that follow in this guide, keystrokes for numbers will be consolidated for ease of reading.• Accessing alternate functions:Many of the keys on the HP-12C perform more than one function. For example, take a closer look at the [PV] key. The [NPV] function above is accessed by first keying the gold [f] key. The [CF 0] function below is accessed by first keying the blue [g] key. For example, the sequence:[25] [g] [CF 0]enters 25 as the cash flow at time 0. The use of the [NPV] and [CF 0] keys is covered in this guide’s “Irregular Cash Flows”.• Storing numbers in memoryUp to twenty numbers may be placed into memory. The first ten ‘registers’ are accessed using the number keys [0] to [9], and thesecond ten using [.0] to [.9]. The [STO] key is for storage. Example: to enter 1.125 into the first memory slot, key[1.12] [ENTER] [5] [y x ] [STO] [0]If the display is set to two decimal places, 1.76 is displayed and also stored withoutrounding in R 0, register 0, and is available for use until the memory is cleared or another number is entered into R 0.To use the stored number in R 0, key [RCL] [0]. Example: to multiply 1000 by the 1.76 already stored in register 0, key[1000] [ENTER] [RCL] [0] [x]If the display is set to two decimal places, 1,762.34 is displayed.5• Clearing registers/memoryClear just the x register (i.e., the number that appears in the display window) by keying [CL X ]. This is useful when you make an error keying in a number.Clear the financial registers by keying [f] [FIN]. This sets all financial registers, including [n], [i], [PV], [PMT], and [FV], equal to zero. This is good form before you start any time value of money calculation.Keying [f] [REG] clears all registers, including any values stored in the x register, financial registers, and memory.6Time Value of MoneyFive keys in the upper left corner are used for many of the time value of money (TVM) calculations you’ll be introduced to in this course. [n] number of payments or time periods. [i] interest rate expressed as percent, e.g., 12% entered as [12] [i], not as [.12] [i]. [PV] present value, or value at time 0[PMT] payment, a constant amount paid or received each period. [FV] future value, specifically the value at time nGiven four of the above values, the fifth can be calculated.Example: You deposit $1,000 today into an account paying 4.00% per year. Compute the amount you will be able to withdraw in 5 years.Reminder: First, clear the financial registers by keying [f] [FIN].Data: What you key: What you see: n = 5 i = 4% PV = $1000 PMT = 0* compute FV[5] [n] [4] [i][1000] [CHS] [PV] [0] [PMT] [FV]5.004.00 -1,000.000.00 1,216.65*If [f] [FIN] is keyed to start, then the payment register would already be set to zero, so no need to key [0] [PMT].The HP-12C keeps track of cash flows moving in different directions by the using opposite signs. The $1,000 we deposit today (i.e., the present value) is entered as a negative number, and the $1,216.65 we withdraw in 5 years (i.e., the future value) is shown as a positive number. A good way to visualize how the flows are signed: If you’re taking money out of your wallet and depositing, then it’s a negative sign. If you’re withdrawing money and putting it into your wallet, then it’s a positive sign.7Example: You invest $5,000 today and $1,000 at the end of each of the next 10 years. Compute the amount you will have after 10 years if the investment earns 8% per year.Data: What you key: What you see: n = 10 i = 8 PV = $5000 PMT = $1000 calculate FV[10] [n] [8] [i][5000] [CHS] [PV] [1000] [CHS] [PMT] [FV]10.008.00 -5,000.00 -1,000.00 25,281.19• Monthly cash flowsCar loans, home mortgages, student loans, and other loans typically have monthly payments. To input the number of monthly payments when you know the number ofyears, key [g] [n]. For example, the number of payments for a 30-year mortgage can be entered as [30] [g] [n]. 360 is displayed and entered into the n register.To input the monthly interest rate when you know the annual percentage rate (APR), key [g] [i]. For example, the monthly interest rate for a mortgage with 6.00% APR, compounded monthly, can be entered as [6] [g] [i]. 0.50 is displayed and entered into the i register.Example: Compute the monthly payment on a 30-year $200,000 mortgage with a 7.5% APR, compounded monthly?Data: What you key: What you see: n = 30 x 12 i = 7.5% ÷ 12PV = $200,000FV = 0* calculate PMT[30] [g] [12x] [7.5] [g] [12÷] [200000] [PV] [0] [FV] [PMT]360.000.63200,000.000.00 -1,398.43*If [f] [FIN] is keyed to start, then the payment register would already be set to zero, so no need to key [0] [FV].8• Payments at the end of the period versus the beginning of the periodFor payments that occur at the beginning of the period, key [g] [BEG]. To confirm that the HP-12C will now make calculations presuming payments occur at the beginning of each period, “BEGIN” appears at the bottom of the display.Most of the time, though, such as when we are dealing with car loans, home mortgages, or student loans, payments occur at the end of the period. To return to the HP-12C’s default mode of presuming payments occur at the end of the period, key [g] [END]. “BEGIN” will no longer appear at the bottom of the display.• Irregular cash flowsFor calculations that involve cash flows occurring at regular intervals but with differing amounts, we enter values using [g] functions [CF 0], [CFj], and [Nj]. We can thencalculate the net present value or internal rate of return by using [f] functions [NPV] and [IRR].Enter the cash flow at time 0 by keying the value followed by [g] [CF 0]. If there is no time 0 cash flow, key [0] [g] [CF 0]. For example, if the first cash flow is -1000, key [1000] [CHS] [g] [CF 0].Enter subsequent cash flows in order using [g] [CFj]. If subsequent cash flows are different, each must be entered separately. For example, if the next two cash flows are 400 and then 500, key [400] [g] [CFj] then [500] [g] [CFj].9If equal cash flows repeat, then the number of equal cash flows can be keyed using [g] [Nj]. For example, if the next five cash flows equal 300 each, key [300] [g] [CFj] [5] [g] [Nj].Up to 20 cash flows can be stored in CF 0 to CF 19. Note that these cash flow registers are shared with the 20 memory registers. If you key [1000] [CHS] [g] [CF 0], -1000 is entered into CF 0 and will overwrite the value in the R 0 register. If you then key [400] [g] [CFj], 400 is entered into CF 1 will overwrite the value in the R 1 register.Example: Following an initial investment of $1,000, you expect cash flows of $400 in one year, $500 in two years, and $600 in three years.Data: What you key: What you see: clear all registers enter CF 0 enter CF 1 enter CF 2 enter CF 3[f] [REG] [1000] [CHS] [g] [CF 0] [400] [g] [CFj] [500] [g] [CFj] [600] [g[ [CFj]0.00-1,000.00 400.00 500.00 600.00You can now perform NPV and IRR calculations using these stored values.To calculate the NPV of the investment, you first need to enter an interest rate using the [i] key. Then key [f] [NPV].Calculation of internal rate of return requires no additional information. Key [f] [IRR].10Example: Continuing the example from above, if the cost of capital is 14.5% per year, what is the NPV and IRR?Data: What you key: What you see:enter interest rate calculate NPV calculate IRR [14.5] [i] [f] [NPV] [f] [IRR] 14.50 130.43 21.65。

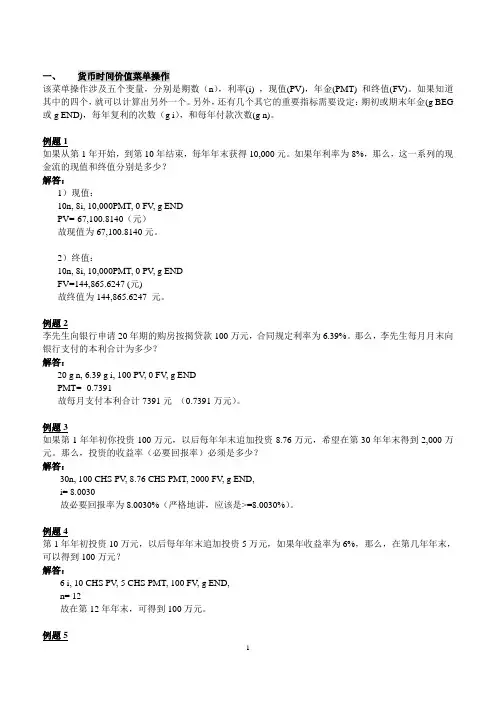

一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

另外,还有几个其它的重要指标需要设定:期初或期末年金(g BEG 或g END),每年复利的次数(g i),和每年付款次数(g n)。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV, g ENDPV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV, g ENDFV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?解答:20 g n, 6.39 g i, 100 PV, 0 FV, g ENDPMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

例题3如果第1年年初你投资100万元,以后每年年末追加投资8.76万元,希望在第30年年末得到2,000万元。

那么,投资的收益率(必要回报率)必须是多少?解答:30n, 100 CHS PV, 8.76 CHS PMT, 2000 FV, g END,i= 8.0030故必要回报率为8.0030%(严格地讲,应该是>=8.0030%)。

例题4第1年年初投资10万元,以后每年年末追加投资5万元,如果年收益率为6%,那么,在第几年年末,可以得到100万元?解答:6 i, 10 CHS PV, 5 CHS PMT, 100 FV, g END,n= 12故在第12年年末,可得到100万元。

例题5小王出租了一套房屋,每年租金收入2万元,年初收取。

金融计算器_H P-12C使用例题一、货币时间价值菜单操作该菜单操作涉及五个变量,分别是期数(n),利率(i) ,现值(PV),年金(PMT) 和终值(FV)。

如果知道其中的四个,就可以计算出另外一个。

另外,还有几个其它的重要指标需要设定:期初或期末年金(g BEG或g END),每年复利的次数(g i),和每年付款次数(g n)。

例题1如果从第1年开始,到第10年结束,每年年末获得10,000元。

如果年利率为8%,那么,这一系列的现金流的现值和终值分别是多少?解答:1)现值:10n, 8i, 10,000PMT, 0 FV,PV=-67,100.8140(元)故现值为67,100.8140元。

2)终值:10n, 8i, 10,000PMT, 0 PV,FV=144,865.6247 (元)故终值为144,865.6247 元。

例题2李先生向银行申请20年期的购房按揭贷款100万元,合同规定利率为6.39%。

那么,李先生每月月末向银行支付的本利合计为多少?解答:20 g n, 6.39 g i, 100 PV, 0 FV,PMT= -0.7391故每月支付本利合计7391元(0.7391万元)。

例题3如果第1年年初你投资100万元,以后每年年末追加投资8.76万元,希望在第30年年末得到2,000万元。

那么,投资的收益率(必要回报率)必须是多少?解答:30n, 100 CHS PV, 8.76 CHS PMT, 2000 FV,i= 8.0030故必要回报率为8.0030%(严格地讲,应该是>=8.0030%)。

例题4第1年年初投资10万元,以后每年年末追加投资5万元,如果年收益率为6%,那么,在第几年年末,可以得到100万元?解答:6 i, 10 CHS PV, 5 CHS PMT, 100 FV,n= 12故在第12年年末,可得到100万元。

例题5小王出租了一套房屋,每年租金收入2万元,年初收取。

HP-12CP简单教程一、键盘篇1、基础键::开关键,按一次开机,再按一次关机,关机后最后数据保留。

:上档键,能使用基本键以上黄色字体标识的功能。

如:下档键,能使用基本键以下蓝色字体标识的功能。

如:清除键。

:正负数转换键。

2、认识五个货币时间价值功能键:期数;:利率;:现值;:年金;:终值。

五个货币时间价值变量只要知道了其中四个数值,就可以求出第五个。

二、几个功能的实现1、清零。

各个变量的数据在每次计算后都会记忆,只有清零后才能开始新的计算。

依次按以下键,可实现清零。

---→。

2、四则运算1+1如何在计算器中实现?1+1本来是最简单的运算,但如果不了解HP-12CP计算器的计算规则,也难以实现。

如何在计算器中完成1+1的计算?请清零后依次按以下键。

---→---→---→例题:用HP-12CP计算器完成以下运算,3×6÷2+7---→---→---→---→---→---→---→得到最终结果:3、正负转换在输入数字的时候,如投资、存款、生活费用支出、房贷本息支出等都是现金流出,输入的符号应该为负;收入、赎回投资、借入本金等都是现金流入,输入的符号应该为正。

如何实现正负的转换呢,请看下例。

例:投资1000元在计算器中的如何输入?依次按以下键输入1000---→注意:正负方向一定要弄明白,如果方向反了,答案是算不出来的。

4、年和月的转换;年利率和月利率的转换在计算中我们往往涉及到投资周期为月的计算,年化月,我们可以简单的乘以12,年利率化为月利率也可以简单地除以12,但在计算器上有更简便的方法。

例:基金定投的投资期限为3年,投资周期为月,在计算器上如何输入?依次按以下键---→---→例:年利率为2.25,如何化成月利率计算?依次按以下键输入数字2.25---→---→注意:投资周期为月的,请务必记住化为月和月利率计算,否则无法获得正确答案。

三、综合运用由于综合运用比较复杂,边做例题边解释。