第3章 国际经济学

- 格式:pdf

- 大小:1.48 MB

- 文档页数:34

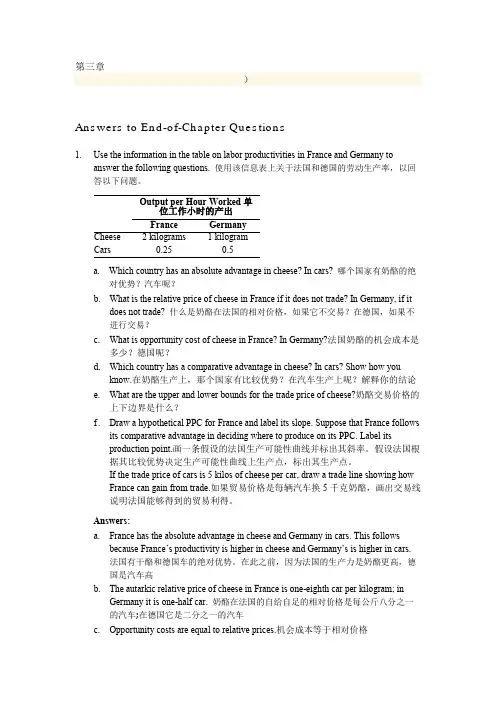

第三章)Answers to End-of-Chapter Questions1. Use the information in the table on labor productivities in France and Germany toanswer the following questions.使用该信息表上关于法国和德国的劳动生产率,以回答以下问题。

Output per Hour Worked单位工作小时的产出France GermanyCheese 2 kilograms 1 kilogramCars 0.25 0.5a. Which country has an absolute advantage in cheese? In cars?哪个国家有奶酪的绝对优势?汽车呢?b. What is the relative price of cheese in France if it does not trade? In Germany, if itdoes not trade?什么是奶酪在法国的相对价格,如果它不交易?在德国,如果不进行交易?c. What is opportunity cost of cheese in France? In Germany?法国奶酪的机会成本是多少?德国呢?d. Which country has a comparative advantage in cheese? In cars? Show how youknow.在奶酪生产上,那个国家有比较优势?在汽车生产上呢?解释你的结论e. What are the upper and lower bounds for the trade price of cheese?奶酪交易价格的上下边界是什么?f.Draw a hypothetical PPC for France and label its slope. Suppose that France followsits comparative advantage in deciding where to produce on its PPC. Label itsproduction point.画一条假设的法国生产可能性曲线并标出其斜率。

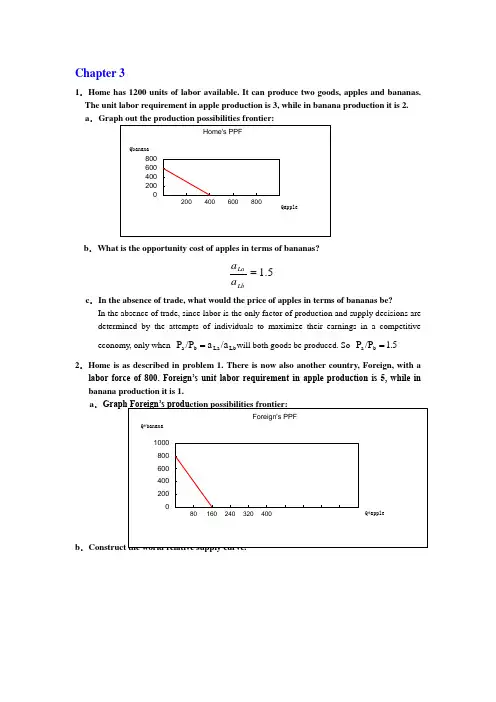

Chapter 31.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign’s unit labor requirement in apple production is 5, while in banana production it is 1.a .b .3.Now suppose world relative demand takes the following form: Demand for apples/demand for bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D -**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case? RD: yx 1=RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and importapples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor "remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case4.6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as much as it likes to the United State s, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $2.50 wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Kore a’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. So this pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.。

2.本国共有1200单位的劳动,能生产两种产品:苹果和香蕉。

苹果的单位产品劳动投入是3,香蕉的单位产品劳动投入是 2.a。

画出本国的生产可能性边界。

b.用香蕉衡量的苹果的机会成本是多少?c.贸易前,苹果对香蕉的相对价格是多少?为什么?a.b.c.在贸易前,当劳动是生产的唯一要素,且在竞争日益激烈的经济环境中,供给决策是由个人获得的最大收益决定时,只有当时,这两种货物才能被生产。

所以,教科书问题的答案1. a。

生产可能性曲线是一条直线,截获苹果轴在400(1200/3)和香蕉轴上600(1200/2)。

b。

机会成本的苹果,香蕉是3/2而言。

它需要3个单位的劳动收获一个苹果,但是只有两个单位的劳动收获一根香蕉。

如果一个人foregoes收获一个苹果,这释放3个单位的劳动。

这3个单位的劳动就能够被用来收获1.5香蕉。

c。

劳动力流动,保证了每一个环节上常见的工资和竞争保证了货物的价格等于他们的生产成本。

因此,相对价格的相对成本相等时,它等于倍的工资单位劳动条件为苹果的工资倍除以单位劳动要求香蕉。

由于工资是平等的交叉,价格比率之比相等单位劳动要求,为苹果每2是3个香蕉。

2,3,6,7,11,14]。

生产可能性曲线是线性的,在苹果和拦截800/5相当于160(轴)和拦截踩在香蕉轴等于800(800/1)。

b。

世界相对供给曲线,建立确定供应苹果相对于供应的香蕉在每个相对价格。

最低的相对价格,比如苹果是收获3苹果每2个香蕉。

供给曲线是平的相对这个价钱。

苹果的最大数量的价格提供3/2在家里是400所提供的同时,以这样的价格,外国的丰收,800香蕉和没有苹果给最大相对供应以这个价格的1 / 2。

这种相对供应价格之间3/2适用任何和五日。

的价格是5,两国将在收成苹果。

供给曲线是又相对平坦的5。

因此,相关的供给曲线是一步成型,公寓,租金价格相对而言3/2供应为0到1 / 2,垂直的,从3/2数量相对半上升到5元,然后再从半无限地来讲一个。

第三章要素禀赋理论上章介绍了技术条件差异对国际贸易的决定作用,这章将放宽第二个条件,即放松各国相对要素禀赋相同这一假设,从要素禀赋差异的角度探讨国际贸易的起因与影响。

要素禀赋理论是由两位瑞典经济学赫克歇尔和俄林师生提出,后经萨缪尔森等人不断完善,该理论又称赫克歇尔-俄林模型或H-O模型。

第一节 H-O理论的基本内容一、H-O模型的提出1)李嘉图的比较利益说认为,比较利益产生自各国之间劳动生产率的差异。

国际贸易←价格差←成本差异←劳动生产率的相对差异2)后人以机会成本差异代替了劳动成本差异,形成了比较利益学说的当代理论的解释。

但仍未说明劳动生产率差异产生的原因。

3)如果两国相同要素的生产率相同,贸易是否会产生。

H-O模型从要素存量差异的角度对国际贸易进行分析。

其出发点有两个:1)不同国家的要素存量的比例是不同的;2)不同商品的生产所使用的要素比例是不同的。

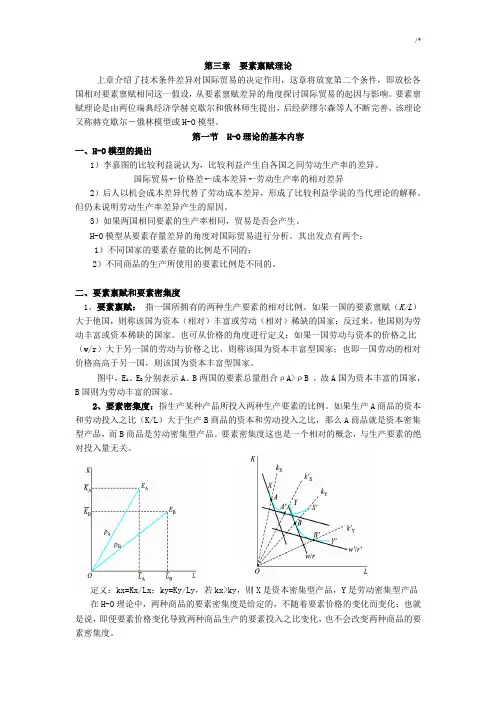

二、要素禀赋和要素密集度1、要素禀赋:指一国所拥有的两种生产要素的相对比例。

如果一国的要素禀赋(K/L)大于他国,则称该国为资本(相对)丰富或劳动(相对)稀缺的国家;反过来,他国则为劳动丰富或资本稀缺的国家。

也可从价格的角度进行定义:如果一国劳动与资本的价格之比(w/r)大于另一国的劳动与价格之比,则称该国为资本丰富型国家;也即一国劳动的相对价格高高于另一国,则该国为资本丰富型国家。

图中,E A、E B分别表示A、B两国的要素总量组合ρA>ρB ,故A国为资本丰富的国家,B国则为劳动丰富的国家。

2、要素密集度:指生产某种产品所投入两种生产要素的比例。

如果生产A商品的资本和劳动投入之比(K/L)大于生产B商品的资本和劳动投入之比,那么A商品就是资本密集型产品,而B商品是劳动密集型产品。

要素密集度这也是一个相对的概念,与生产要素的绝对投入量无关。

定义:kx=Kx/Lx;ky=Ky/Ly,若kx>ky,则X是资本密集型产品,Y是劳动密集型产品在H-O理论中,两种商品的要素密集度是给定的,不随着要素价格的变化而变化;也就是说,即便要素价格变化导致两种商品生产的要素投入之比变化,也不会改变两种商品的要素密集度。

国际经济学-第3章要素禀赋理论第三章要素禀赋理论一、多项选择题1、关于国际贸易对收入分配的影响,描述正确的有()A、出口将提高出口部门特定要素(或专门要素)所有者的收入B、出口将降低进口替代部门特定要素所有者的收入C、进口将提高进口替代部门特定要素所有者的收入D、出口导致共同使用的生产要素(可自由流动的生产要素)的报酬提高E、进口导致共同使用的生产要素(可自由流动的生产要素)的报酬降低2、关于“要素密集度”和“要素丰裕度”下列说法正确的是()A.要素密集度是针对产品而言的B.要素密集度是针对国家而言的C.要素丰裕度是针对国家而言的D.要素丰裕度是针对产品而言的E.要素密集度和要素丰裕度都是个相对的概念,都要视比较对象而定。

3、生产要素价格均等化理论认为国际贸易能够使各国相同的生产要素的价格达到均等化,然而现实远非如此,其原因是()A.国际贸易远不是自由的B.各国生产的产品并不相同C.各国生产的产品所使用的生产要素有差异D.国际贸易存在各种形式的交易成本E.生产要素并非都能得到充分利用4、根据斯托尔帕—萨谬尔逊定理,自由贸易将会使贸易参加国()A.商品价格均等化B.土地得到相同的报酬率C.所有工人得到相同的工资率D.生产要素价格均等化E.供给和需求模式趋同二、单项选择题1、根据要素禀赋理论中的有关定理,下列论述不正确的有()A、进口关税将提高进口竞争商品密集使用的生产要素的实际报酬B、进口关税将降低出口部门密集使用的生产要素的实际报酬C、商品的出口将提高出口部门密集使用的生产要素的实际报酬D、商品的进口将提高进口竞争商品密集使用的生产要素的实际报酬2、根据要素价格均等化原理,下列那个不是要素价格均等化的真正原因()A、商品价格未实现均等化B、关税、非关税壁垒等障碍C、运输成本的存在D、要素在国家之间的流动受到限制3、根据斯托泊—萨谬尔森定理,下列推论不正确的有()A、进口关税将提高进口商品密集使用的生产要素的实际报酬B、进口关税将降低出口部门密集使用的生产要素的实际报酬C、商品的出口将提高出口部门密集使用的生产要素的实际报酬D、商品的进口将提高进口部门密集使用的生产要素的实际报酬4、赫克歇尔—俄林模型认为国际贸易的根本原因是()A.各国生产要素禀赋不同B.各国劳动生产率不同C.各国技术水平不同D.各国产品技术含量不同5、一个部门产品价格水平的上升会使共同生产要素的价格水平()A.不变B.增加C.减少D.无影响6、在分析生产要素价格均等化过程中,有一系列的假设条件,下列不是其假设条件的()A.生产要素在一国范围内的各部门间自由流动B.生产要素在国与国之间自由流动C.生产要素充分利用D.不存在贸易障碍和运输费用7、在赫克歇尔—俄林模型中,国际贸易主要基于各国在()方面的差别。