simtrade进出口预算[1]

- 格式:ppt

- 大小:1.12 MB

- 文档页数:29

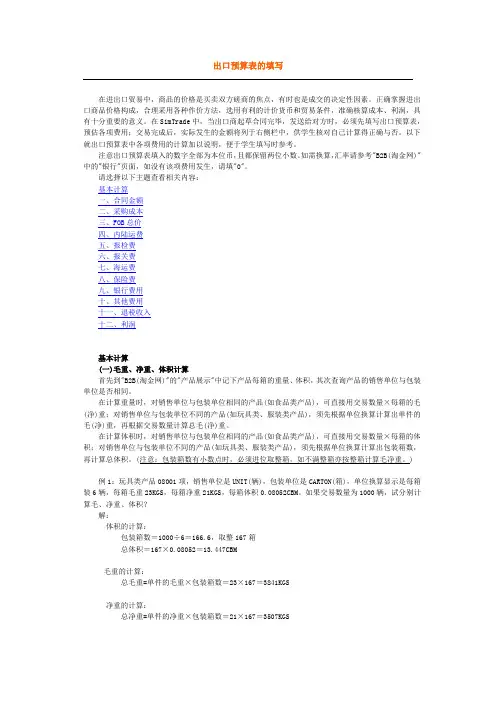

出口预算表的填写在进出口贸易中,商品的价格是买卖双方磋商的焦点,有时也是成交的决定性因素。

正确掌握进出口商品价格构成,合理采用各种作价方法,选用有利的计价货币和贸易条件,准确核算成本、利润,具有十分重要的意义。

在SimTrade中,当出口商起草合同完毕,发送给对方时,必须先填写出口预算表,预估各项费用;交易完成后,实际发生的金额将列于右侧栏中,供学生核对自己计算得正确与否。

以下就出口预算表中各项费用的计算加以说明,便于学生填写时参考。

注意出口预算表填入的数字全部为本位币,且都保留两位小数。

如需换算,汇率请参考"B2B(淘金网)"中的"银行"页面,如没有该项费用发生,请填"0"。

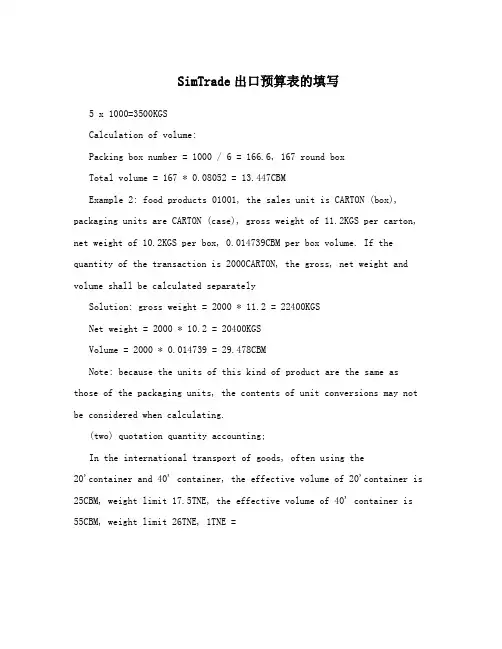

请选择以下主题查看相关内容:基本计算一、合同金额二、采购成本三、FOB总价四、内陆运费五、报检费六、报关费七、海运费八、保险费九、银行费用十、其他费用十一、退税收入十二、利润基本计算(一)毛重、净重、体积计算首先到"B2B(淘金网)"的"产品展示"中记下产品每箱的重量、体积,其次查询产品的销售单位与包装单位是否相同。

在计算重量时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的毛(净)重;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出单件的毛(净)重,再根据交易数量计算总毛(净)重。

在计算体积时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的体积;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出包装箱数,再计算总体积。

(注意:包装箱数有小数点时,必须进位取整箱,如不满整箱亦按整箱计算毛净重。

)例1:玩具类产品08001项,销售单位是UNIT(辆),包装单位是CARTON(箱),单位换算显示是每箱装6辆,每箱毛重23KGS,每箱净重21KGS,每箱体积0.08052CBM。

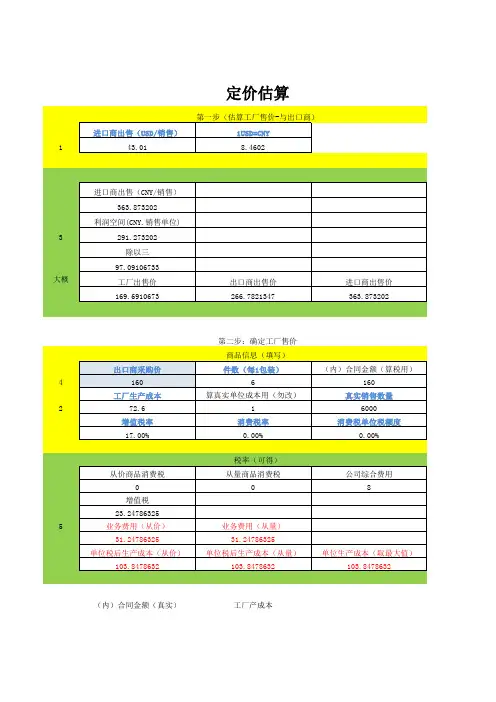

进出口价格计算案例第一部分工厂报价计算:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润SimTrade里,工厂在完成一笔业务的过程中,须缴纳的费用包括三项:增值税、消费税与公司综合费用。

出厂价由制造成本、增值税、消费税、公司综合费用和利润构成:一、制造成本40.59RMB二、增值税进入"淘金网”的"税率"页,输入商品海关编码进行查询(例如输入商品01001的海关编码20031011,查到增值税率为17%,消费税0)。

如果一笔合同涉及到多项商品,则须分别计算再累加。

可得:商品增值税=内销合同金额/(1 +增值税率)>增值税率查得税率是17%。

三、消费税进入"淘金网”的"税率"页,输入商品海关编码进行查询,查得消费税税率为0。

四、公司综合费用在"淘金网”的”其他费用"中,查到工厂的公司综合费用为合同金额的5%,即0.05 >内销合同金额。

五、预期利润预期利润率设为20%,则预期利润为0.2 >内销合同金额。

设出厂价为B,则按照公式:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润B =C+B/(1+0.17) 0.17+ 0 + 0.05B+0.2BC=40.59 (CNY )则:B=40.59+0.1453B+0.05B+0.2B0.6047B=40.59B=67.12 (CNY )第二部分出口预算(以本币CNY做出口预算)不管是对出口商还是对进口商来说,他们想要节约运费,就需要尽可能在询盘前确定的数量能满足运费最少的条件。

一、确定报价数量1.按体积和重量分别出20英尺集装箱和40英尺集装箱的的最大装载量(取相对小的那个值,因为受到体积或重量的制约)例如:对商品01002(洋菇罐头(切片)的包装单位是CARTON(箱),销售单位是CARTON(箱), 中文描述:;每箱24罐,每罐560克英文描述:560GX24TINS/CTN1个体积单位=1个销售单位(体积单位出现在装箱单、提单等涉及运输的单据上,销售单位出现在各类销售合同上,注意区分。

SimTrade出口预算表的填写5 x 1000=3500KGSCalculation of volume:Packing box number = 1000 / 6 = 166.6, 167 round boxTotal volume = 167 * 0.08052 = 13.447CBMExample 2: food products 01001, the sales unit is CARTON (box), packaging units are CARTON (case), gross weight of 11.2KGS per carton, net weight of 10.2KGS per box, 0.014739CBM per box volume. If the quantity of the transaction is 2000CARTON, the gross, net weight and volume shall be calculated separatelySolution: gross weight = 2000 * 11.2 = 22400KGSNet weight = 2000 * 10.2 = 20400KGSVolume = 2000 * 0.014739 = 29.478CBMNote: because the units of this kind of product are the same as those of the packaging units, the contents of unit conversions may not be considered when calculating.(two) quotation quantity accounting;In the international transport of goods, often using the20'container and 40' container, the effective volume of 20'container is 25CBM, weight limit 17.5TNE, the effective volume of 40' container is 55CBM, weight limit 26TNE, 1TNE =1000KGS. The exporter proposes to calculate the quoted quantity in accordance with the maximum number of packages the container can accommodate in order to save sea freight.In the "gold rush net" product display in view of product details, according to the volume of products, packaging units, sales units, units converted to calculate the number of quotations.Example 1: 08003 (children Scooter), commodity sales unit UNIT (cars), packaging unit CARTON (box), unit conversion for 6 per box, each box volume is 0.0576CBM, the gross weight is 21KGS, try to calculate respectively the goods with maximum packing number and the corresponding number of quotations, 20'40' of the container transportation.Solution: per 20'containerBy volume the packing number is 25 / 0.0576 = 434.028By weight the packing number is 17.5 / 21 x 1000 = 833.33Whichever is smaller, so the maximum packing number rounding 434 boxes, the corresponding sales volume = 434 * 6 = 2604Per 40'containerBy volume the packing number is 55 / 0.0576 = 954.861By weight the packing number is 26 / 21 x 1000 = 1238.095Whichever is smaller, so the maximum packing number rounding 954 boxes, the corresponding sales volume = 954 * 6 = 5724Example 2: 01005 commodities (canned sweet corn), sales units and packaging units are CARTON (box), each box volume is 0.025736CBM, the gross weight is 20.196KGS, try to calculate respectively the maximumnumber of goods by 20', the number of cases and offer the export container transportation 40'.Solution: per 20'container:By volume packing number = 25 / 0.025736 = 971.402By weight packing number = 17.5 / 20.196 x 1000 = 866.51Whichever is smaller, so the maximum number of 866 rounded box packingAs the selling unit is the same as the packing unit, the quoted quantity of the goods is 866 cases.Per 40'container:By volume packing number = 55 / 0.025736 = 2137.084By weight packing number = 26 / 20.196 x 1000 = 1287.35Whichever is smaller, so the maximum number of 1287 rounded box packingAs the selling unit is the same as the packing unit, the quoted quantity of the goods is 1287 cases.[].I. contract amountThat is, the amount of the contract agreed upon by both parties, note that the cost currency shall be converted.For example: commodity 01005 "canned sweet corn", the contract value of USD16000, found that the current U.S. dollar (USD) exchange rate of 6.8261, try converting into local currency.Solution: contract amount = 16000 * 6.8261 = RMB 109217.6[].Two, procurement costsThrough mail and factory liaison, ask about the purchase price for cost accounting.For example: goods 01005 "sweet corn canned", the factory quoted price for each RMB80, purchase 971 only cost?Solution: procurement cost = 80 * 971 = RMB 77680[].Three, FOB total priceThat is, the total amount of FOB value of the goods ordered by both parties during the signing of the contract. The exporter should be considered in the export price, first calculate the purchasing cost, then plus expenses (which can be roughly estimated), and give a certain profit space, on the basis of the price, if not FOB price, to convert.Converted from CFR to FOB: FOB = CFR - ocean freightConverted from CIF to FOB: FOB = CIF - Ocean Freight - PremiumFor ocean freight and insurance, please refer to the following instructions.Note: the amount must be converted into the cost currency. The exchange rate can be found on the bank page of the gold rush net.Suppose, for example, that the total value of the contract FOB is USD26500, and in the "bank" page, the current dollar (USD) rate is found to be 6.8261.The amount to be filled in this column is: 26500 x 6.8261 =180891.65[].Four inland freightIn the "gold rush net" other costs, the inland freight rate wasRMB60/ cubic meters (Note: cubic meter or CBM).Available: inland freight = total volume of exported goods * 60The total volume algorithm, please refer to the basic calculations".[].Five. Inspection feeIn the "gold rush net" other costs, the inspection fee was found RMB200/ times.Availability: inspection fee = RMB200[].Six, customs feesIn the "gold rush net" other fees, check customs fees for RMB200/ times.Available: Customs fee = RMB200[].Seven, shipping chargesIn export transactions, exporters use CFR and CIF trade terms, and exporters have to pay for shipping charges. In the form of FOB, fill in the column "0"".In the export trade, the selection of container type and the method of goods packing are very important for exporters to reduce freight expenses. Size and weight of container,The loading, discharging and stack of the goods in the container are particular and need to be explored in practice.(I) basis of freight calculation;Freight unit (Freight Unit) means the basic unit used by a shipping company to calculate freight charges. Because of the wide variety of goods, the packing situation is different, the method of shipment is different, the calculation of freight standards vary.A: FCL containers in the container freight unit in the SimTrade20'container and 40' container two. The effective volume of the20'container is 25CBM, the weight limit is 17.5TNE, and the effective volume of the 40' container is 55CBM, and the weight limit is 26TNE, wherein 1TNE = 1000KGS;LCL: B by the ship to charge a higher price for the quasi tariff, often note on M/W or R/T, said the company will ship the goods weight or volume of two tons of tons of freight to choose the higher calculation.In LCL, the unit of freight is calculated as:1. weight ton (Weight Ton): one ton (1 TNE=1000KGM) for one tonof freight per gross gross weight of the goods;2. volume ton (Measurement Ton): according to total gross volume of goods, to a cubic meter (1 Cubic Meter), referred to as 1MTQ or 1CBM or 1CUM, also known as a product ton, as a freight ton.In the calculation of shipping time, the exporter must firstcalculate the volume of the goods according to the quantity quoted, and then to the "gold rush net" of the "freight inquiry" page, to find the goods should be approved at the port of destination tariff. If the quantity is just enough installed FCL (20'container or 40' container), directly take the freight for basic freight; if not installed FCL, with the total volume of products (or the total weight, take more freight LCL) * price to calculate shipping costs.(two) freight classification calculation method;A: Freight FCL FCL is divided into three parts, the total freightfee and = three.1. basic freightThe basic unit of basic freight freight FCL number = x2. port surchargePort surcharge port surcharge * FCL = unit number3. fuel surchargeFuel surcharge = unit fuel surcharge * FCL numberB LCL: LCL freight only basic freight, divided by volume and weight calculated in two ways1. by volume, X1 = unit, basic freight (MTQ) * total volume2. by weight, X2 = unit, basic freight (TNE) * gross weightTake the larger one in X1 and X2For example: 08003 (children Scooter) goods to be exported to Canada, Toronto port port. Try to calculate the number of transactions for 1000 and 2604 shipping charges respectively.Solution:The first step: calculate the volume and weight of the productIn the "Pan gold net" product display, we find that the volume ofthe commodity 08003 is 0.0576CBM per carton, gross weight of 21KGS per carton, 6 cars per carton. According to the product data, calculate the volume of the product first.The quoted quantity is 1000The total number of packing box = 1000 / 6 = 166.6, 167 round box, total volume = 167 x 0.0576 = 9.6CBMTotal gross weight = 1000 / 6 x 21 = 3500KGS = 3.5TNEThe quoted quantity is 2604The total number of packing box = 2604 / 6 = 434, total volume = 434 x 0.0576 = 24.998CBMTotal gross weight = 2604 / 6 x 21 = 9114KGS = 9.114TNEThe second step: check the freight rateIn the "gold rush net", "freight inquiry", the shipping to Toronto, Canada, the basic freight is: 20'per container USD3290, 40' containers per USD4410, LCL, per volume ton (MTQ) USD151, per ton (TNE) USD216;Port surcharge: USD132 per 20'container, USD176 per 40' container;Fuel surcharge is USD160 per 20'container, USD215 per 40' container;In addition, in the "gold rush net" in the "bank" page, can be found, the U. S. dollar exchange rate of 6.8261.The first step according to the calculated results, according to specifications of container (in freight calculated on the basis of that, the effective volume of 20'container is 25CBM, weight limit 17.5TNE, the effective volume of 40' container is 55CBM, weight limit 26TNE, 1TNE = 1000KGS), 1000 units of freight will be used for shipping LCL, 2604 vehicles fees should adopt the 20'container.1 the quantity quoted is 1000, and the basic freight by volume = 9.6 * 151 = 1449.6 (US dollars)By weight, the basic freight = 3.5 x 216 = 756 (US dollars)In comparison, the volume of freight is larger, shipping companies charge larger, the basic freight is USD1449.6Total freight = 1449.6 * 6.8261 = 9895.11 (RMB)2 the quoted quantity is 2604 pieces, because the volume and the weight are not more than one 20'container's volume and the limit weight, therefore installs a 20' container to be possibleTotal freight = 1 * (3290+132+160) * 6.8261= 3582 * 6.8261= 24451.09 (RMB)[].Eight, insurance premiumIn the export transaction, under the condition of "CIF", exporters need to inquire the premium rate on the "premium" page in the "gold rushnet", so as to calculate the insurance premium. In the form of "CFR" or "FOB", fill in "0" in this column". The formula is as follows: Insurance = insurance amount * insurance rateInsurance amount = CIF price * (1 + insurance plus rate)In the import and export trade, according to the relevant international practice, the insurance premium rate is usually 10%. The exporter may also agree with the insurance company on different insurance premium rates according to the importer's requirements.For example: CIF 03001 of the total price of the goods is USD8937.6, according to the requirements of the importer transaction price 110% covering institute cargo clauses (A) (insurance rate 0.8%) and war risk (insurance rate 0.08%), calculate the exporters due to the insurance cost?Explanation: the amount of insurance = 8937.6 * 110% = 9831.36 (US dollars)Insurance premium = 9831.36 x (0.8%0.08%) = 86.52 ($)The exchange rate for us dollars is 6.8261, RMB = 86.52 * 6.8261 = 590.59Note: 1.Since all risks (or A risks) cover all the additional coverage, the insurance company will not charge any additional coverage for all risks except for all risks (or A). In calculating the insured amount, the insurance premium for the general additional insurance may not be included.2. basic insurance can only choose one of them, special additional risks based on basic insurance on the insurance coverage, if at the same time, special additional risks of war risks and strike risk premium is calculated according to the only one, not cumulative (simultaneously against war risks and strike risk, the rate is 0.80 per thousand, instead of 1.60 per thousand).[].Nine, verification feesIn the "gold rush net" other costs, check out the write off fee of RMB10/ times.Availability: write off fee = RMB 10[].Ten, bank chargesDifferent methods of payment, bank fees are different (in which T/T export banks do not charge fees), usually for the total amount of X bank charges, in the "gold network" and "other expenses" can be found in the related rate.For example: when the total amount of the contract is USD28846.4,the bank charges are calculated in L/C, D/P and D/A respectively (modify a credit once the L/C method is assumed)Solution:The first step: query ratesRichard L/C in the "gold rush" "other expenses" page notification fees RMB200/ times, RMB100/ times, negotiating fees amendment rate of0.13% (minimum 200 yuan), D/A rate of 0.1% (the lowest 100 yuan, highest 2000 yuan), D/P rate of 0.1% (the lowest 100 yuan, highest 2000 yuan).The second step: inquires the exchange rateOn the bank page, the exchange rate of the dollar is 6.8261.The third step: calculate bank chargesL/C bank charges = 28846.4 * 0.13% * 6.8261 + 200 + 100 = 255.98 + 300 = 555.98D/P bank charges = 28846.4 * 0.1% * 6.8261 = 196.91D/A bank charges = 28846.4 * 0.1% * 6.8261 = 196.91[].Eleven, other expensesThis column includes the cost of a company: comprehensive cost, certificate of inspection fees, postage and certificate of origin certificate of inspection fees for books, which fill in the declaration form the exporter exit, inspection certificateapplication, such as health certificates, plant quarantine certificate, a certificate fee of 200 yuan; the postage is in the form of T/T exporters send documents to the importer in charge, $28 each.The above fees can be found in the "other charges" page of the "gold rush net", and accumulated in this column according to the actual conditions of this contract.For example: when the total amount of the contract under T/T isUSD8846.4, please calculate the amount that should be filled in thiscolumn. (assuming that a health certificate, a certificate of origin and a shipping document were sent to the importer) in this contractSolution:The first step: query ratesIn the "gold rush net" of the "other costs" page, check the exporter company comprehensive rate of 5%, to prove that RMB200/ copies of the book price, postage USD28/ times.The second step: inquires the exchange rateOn the bank page, the exchange rate of the dollar is 6.8261.The third step: calculate other expensesOther charges = 8846.4 x 5% x 6.8261 + 200 + 200 + 28 * 6.8261= 3019.32 + 400 + 191.13= 3610.45 (RMB)[].Twelve, tax refund incomeIn the "gold rush net" in the "tax rate" page, enter the commodity customs code for inquiries (for example, enter the commodity 10001 customs code 33041000, found that the export tax rebate rate of 17%, consumption tax from the price of 30%). If a contract involves a number of goods, it must be calculated separately and accumulated.Available: commodity export tax refund income = = VAT should be refunded + refund of consumption tax = purchasing cost / (1+ VAT rate) * export rebate rate + purchasing cost * consumption tax rate [].Thirteen, profitsThe above income and expenditure together to calculate, you can calculate.The calculation formula is: Profit = contract value + tax refund income - purchasing cost - inland freight - inspection fee - customs declaration - Ocean Freight - Premium - write off fees - bank charges - other fees[].。

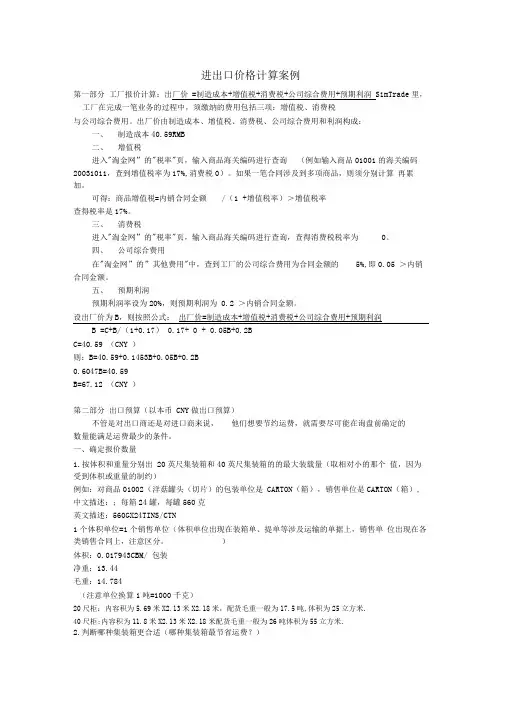

进出口价格计算案例第一部分工厂报价计算:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润SimTrade里,工厂在完成一笔业务的过程中,须缴纳的费用包括三项:增值税、消费税与公司综合费用。

出厂价由制造成本、增值税、消费税、公司综合费用和利润构成:一、制造成本40.59RMB二、增值税进入"淘金网"的"税率"页,输入商品海关编码进行查询(例如输入商品01001的海关编码20031011,查到增值税率为17%,消费税0)。

如果一笔合同涉及到多项商品,则须分别计算再累加。

可得:商品增值税=内销合同金额/(1+增值税率)×增值税率查得税率是17%。

三、消费税进入"淘金网"的"税率"页,输入商品海关编码进行查询,查得消费税税率为0。

四、公司综合费用在"淘金网"的"其他费用"中,查到工厂的公司综合费用为合同金额的5%,即0.05×内销合同金额。

五、预期利润预期利润率设为20%,则预期利润为0.2×内销合同金额。

设出厂价为B,则按照公式:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润B =C+B/(1+0.17)×0.17+ 0 + 0.05B+0.2BC=40.59(CNY)则:B=40.59+0.1453B+0.05B+0.2B0.6047B=40.59B=67.12(CNY)第二部分出口预算(以本币CNY做出口预算)不管是对出口商还是对进口商来说,他们想要节约运费,就需要尽可能在询盘前确定的数量能满足运费最少的条件。

一、确定报价数量1. 按体积和重量分别出20英尺集装箱和40英尺集装箱的的最大装载量(取相对小的那个值,因为受到体积或重量的制约)例如:对商品01002(洋菇罐头(切片)的包装单位是CARTON(箱),销售单位是CARTON(箱),中文描述:;每箱24罐,每罐560克英文描述:560Gx24TINS/CTN体积:0.017943CBM/包装净重:13.44毛重:14.784试分别体积和重量计算该商品用20英尺、40英尺集装箱运输出口时的最大包装数量和报价数量。

SIMTRADE进出口计算

首先,SIMTRADE可以帮助企业计算进出口货物的价值。

在进口方面,用户可以输入货物的数量、单价和运输费用等信息,然后软件会自动计算

货物总价值。

在出口方面,用户可以输入货物的数量、单价和其他费用

(如包装费用、检验费用等),软件会自动计算货物的总价值。

其次,SIMTRADE还可以帮助企业计算进出口货物的税费。

用户可以

输入货物的种类和国际货物编码,软件会根据相应的税率计算出应缴纳的

关税和其他税费。

此外,软件还可以根据用户输入的货物价值和税率计算

出销项税和进项税。

此外,SIMTRADE还可以帮助企业计算进出口货物的运输费用。

用户

可以输入货物的重量、尺寸和目的地等信息,软件会根据相应的运输规则

和费率计算出运输费用。

此外,软件还可以提供货物跟踪服务,帮助企业

了解货物在运输过程中的实时位置和状态。

除了以上功能,SIMTRADE还提供了其他辅助功能,如货物报关、合

同管理和供应链管理等。

用户可以通过输入相关信息,软件会生成相应的

报关文件和合同文件。

此外,软件还可以帮助企业管理供应链,包括订单

管理、库存管理和物流管理等。

总之,SIMTRADE是一款功能强大的进出口计算软件,可以帮助企业

进行进出口业务的计算和分析。

它提供了多种功能,包括货物价值计算、

税费计算、运输费用计算等。

通过使用这些功能,企业可以更加高效地处

理进出口业务,提高业务效率和盈利能力。

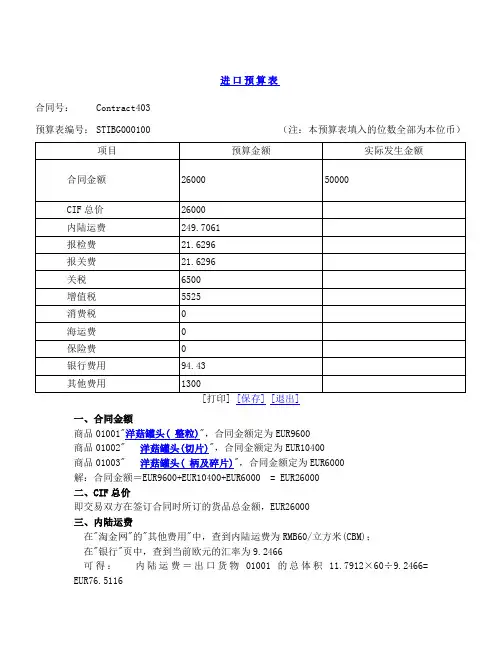

进口预算表合同号:Contract403预算表编号:STIBG000100 (注:本预算表填入的位数全部为本位币)] [保存][退出]一、合同金额商品01001"洋菇罐头( 整粒)",合同金额定为EUR9600商品01002"洋菇罐头(切片)",合同金额定为EUR10400商品01003"洋菇罐头( 柄及碎片)",合同金额定为EUR6000解:合同金额=EUR9600+EUR10400+EUR6000 = EUR26000二、CIF总价即交易双方在签订合同时所订的货品总金额,EUR26000三、内陆运费在"淘金网"的"其他费用"中,查到内陆运费为RMB60/立方米(CBM);在"银行"页中,查到当前欧元的汇率为9.2466可得:内陆运费=出口货物01001的总体积11.7912×60÷9.2466=EUR76.5116内陆运费=出口货物01002的总体积14.3544×60÷9.2466= EUR93.1439内陆运费=出口货物01032的总体积12.3366×60÷9.2466= EUR80.0506总运费=76.5116+93.1439+80.0506= EUR 249.7061四、报检费在"淘金网"的"其他费用"中,查到报检费率为RMB200/次,当前欧元的汇率为9.2466。

可得:报检费=200÷9.2466= EUR21.6296五、报关费在"淘金网"的"其他费用"中,查到报关费为RMB200/次,当前欧元的汇率为9.2466。

可得:报关费=200÷9.2466=EUR21.6296六、关税进入"淘金网"的"税率"页:商品01001、01002、01003的海关编码均为2003101100,输入海关编码查到进口优惠税率为25%可得:商品进口税=EUR26000×25%=EUR6500七、增值税进入"淘金网"的"税率"页:商品01001、01002、01003的海关编码均为2003101100,输入海关编码查到增值税率为17%可得:商品增值税=(26000+6500+0)×17%=EUR5525八、消费税进入"淘金网"的"税率"页:商品01001、01002、01003的海关编码均为2003101100,输入海关编码查到消费税为0从价商品消费税=0从量商品消费税=0九、海运费我方以CIF方式交易,因此海运费为0.十、保险费我方以CIF方式交易,因此海运费为0.十一、银行费用第1步:查询费率在"淘金网"的"其他费用"页中查得开证手续费率0.15%(最低200元),修改手续费率200RMB/次、付款手续费率0.13%(最低200元)第2步:计算银行费用(假设进口商的本币为美元)L/C方式下:开证手续费=26000×0.15%=EUR39修改手续费=200 /9.2466=EUR21.63付款手续费=26000×0.13%=EUR33.8所以L/C银行费用=开证手续费+修改手续费+付款手续费=EUR94.43十二、其他费用在"淘金网"的"其他费用"中,查到进口综合费用为合同金额的5%可得:进口综合费用=26000×5%=EUR1300。

出口在进出口贸易中,商品的价格是买卖双方磋商的焦点,有时也是成交的决定性因素。

正确掌握进出口商品价格构成,合理采用各种作价方法,选用有利的计价货币和贸易条件,准确核算成本、利润,具有十分重要的意义。

在SimTrade中,当出口商起草合同完毕,发送给对方时,必须先填写出口预算表,预估各项费用;交易完成后,实际发生的金额将列于右侧栏中,供学生核对自己计算得正确与否。

以下就出口预算表中各项费用的计算加以说明,便于学生填写时参考。

注意出口预算表填入的数字全部为本位币,且都保留两位小数。

如需换算,汇率请参考"淘金网"中的"银行"页面,如没有该项费用发生,请填"0"。

请选择以下主题查看相关内容:基本计算(一)毛重、净重、体积计算首先到"淘金网"的"产品展示"中记下产品每箱的重量、体积,其次查询产品的销售单位与包装单位是否相同。

在计算重量时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的毛(净)重;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出单件的毛(净)重,再根据交易数量计算总毛(净)重。

在计算体积时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的体积;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出包装箱数,再计算总体积。

(注意:包装箱数有小数点时,必须进位取整箱。

)例1:玩具类产品08001项,销售单位是UNIT(辆),包装单位是CARTON(箱),单位换算显示是每箱装6辆,每箱毛重23KGS,每箱净重21KGS,每箱体积0.08052CBM。

如果交易数量为1000只,试分别计算毛、净重、体积?解:毛重的计算:单件的毛重=23÷6=3.833KGS总毛重=3.8333×1000=3833.3KGS净重的计算:单件的净重=21÷6=3.5KGS总净重=3.5×1000=3500KGS体积的计算:包装箱数=1000÷6=166.6,取整167箱总体积=167×0.08052=13.447CBM例2:食品类产品01001项,销售单位是CARTON(箱),包装单位也是CARTON(箱),每箱毛重11.2KGS,每箱净重10.2KGS,每箱体积0.014739CBM。

进出口价格计算案例第一部分工厂报价计算:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润SimTrade里,工厂在完成一笔业务的过程中,须缴纳的费用包括三项:增值税、消费税与公司综合费用。

出厂价由制造成本、增值税、消费税、公司综合费用和利润构成:一、制造成本40.59RMB二、增值税进入"淘金网”的"税率"页,输入商品海关编码进行查询(例如输入商品01001的海关编码20031011,查到增值税率为17%,消费税0)。

如果一笔合同涉及到多项商品,则须分别计算再累加。

可得:商品增值税=内销合同金额/(1 +增值税率)>增值税率查得税率是17%。

三、消费税进入"淘金网”的"税率"页,输入商品海关编码进行查询,查得消费税税率为0。

四、公司综合费用在"淘金网”的”其他费用"中,查到工厂的公司综合费用为合同金额的5%,即0.05 >内销合同金额。

五、预期利润预期利润率设为20%,则预期利润为0.2 >内销合同金额。

设出厂价为B,则按照公式:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润B =C+B/(1+0.17) 0.17+ 0 + 0.05B+0.2BC=40.59 (CNY )则:B=40.59+0.1453B+0.05B+0.2B0.6047B=40.59B=67.12 (CNY )第二部分出口预算(以本币CNY做出口预算)不管是对出口商还是对进口商来说,他们想要节约运费,就需要尽可能在询盘前确定的数量能满足运费最少的条件。

一、确定报价数量1.按体积和重量分别出20英尺集装箱和40英尺集装箱的的最大装载量(取相对小的那个值,因为受到体积或重量的制约)例如:对商品01002(洋菇罐头(切片)的包装单位是CARTON(箱),销售单位是CARTON(箱), 中文描述:;每箱24罐,每罐560克英文描述:560GX24TINS/CTN1个体积单位=1个销售单位(体积单位出现在装箱单、提单等涉及运输的单据上,销售单位出现在各类销售合同上,注意区分。

simtrade进出口商品经营方案simtrade进出口商品经营方案一、项目背景进出口贸易是国际经济合作的重要形式之一,也是促进国家经济发展和对外开放的重要手段。

为了扩大企业的国际市场份额,提高竞争力,simtrade决定开展进出口商品经营。

二、目标与定位1. 目标:通过进出口贸易,实现企业销售额的增长和利润的提升。

2. 定位:成为一家专业、高效、可信赖的进出口商品经营企业。

三、市场分析1. 国内市场:中国拥有庞大的人口基数和快速增长的中产阶级消费群体,对高品质进口商品需求旺盛。

2. 国际市场:全球化趋势下,各国对于优质中国产品的需求不断增长,同时中国也需要引进先进技术和优质资源。

四、产品选择1. 进口商品:根据市场需求和竞争分析,选择具备竞争优势的产品进行进口。

例如高端消费品、电子产品等。

2. 出口商品:根据国内产业优势和市场需求,选择具备竞争力的产品进行出口。

例如机械设备、纺织品等。

五、供应链管理1. 供应商选择:与具备良好信誉和质量保证的供应商建立长期合作关系,确保产品质量和供货稳定性。

2. 采购管理:建立完善的采购体系,确保采购过程透明、高效,并进行供应链风险管理。

3. 货物运输:选择可靠的物流合作伙伴,确保货物安全快速到达目的地。

六、市场推广1. 品牌建设:通过市场调研和定位分析,确定合适的品牌形象,并进行品牌推广活动。

2. 销售渠道拓展:与国内外知名电商平台合作,开设线上销售渠道,并积极参加国际贸易展览会等活动,开拓线下销售渠道。

3. 客户关系管理:建立健全客户数据库,定期与客户进行沟通和维护,提供个性化服务。

七、风险管理1. 市场风险:密切关注国内外政策变化、经济形势等因素对进出口贸易的影响,并及时调整经营策略。

2. 供应链风险:建立风险评估机制,对供应商进行定期评估,并建立备选供应商,以应对可能的供货中断等问题。

3. 财务风险:合理规划资金运作,预防资金链断裂和汇率波动等带来的财务风险。

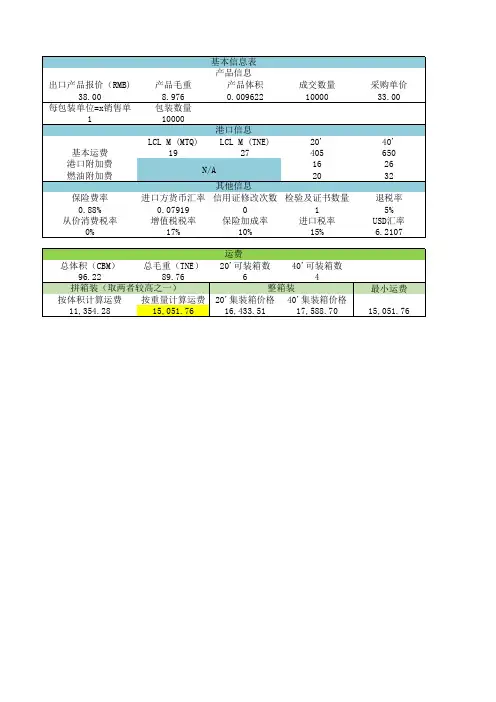

simtrade预算软件操作说明(仅适用于T/T,CIF)1.打开simtrade预算软件2.登录平台3.登录工厂后,不做任何操作,缩小网页窗口,在预算软件上,进入点“产品信息”即进入产品信息窗口:(以产品25002作为例子)a.选择“重新计算”,输入产品编号25002,再输入登录学号并在学号后加3,(因为工厂在第三个位子),)点“查看产品信息”分别填写:(复制后粘贴)产品名称,单位毛重,单位净重,单位数量,单位包装数量,欲购买(或生产)的总数(假如生产120个),海关代码;b.点“查看生产价格”,查看产品25002的生产价格,填写生产价格,填写欲进口的价格(这是出口商与工厂的合同单位价格,即出口商从工厂进口的价格)填写欲出口的价格(这是出口商与进口商的合同单位价格,即出口商出口给进口商的价格),缩小当前预算软件,打开工厂网页,退出工厂网页界面,登录进口商,同样不做任何操作,缩小网页窗口,还原预算软件窗口,点“查看市场价格”,查看25002的市场价格,填写市场价格;(每个进口商的同一个产品的市场价格可能不一样,即使是同一个币别的情况也是有不一样的价格)左边是生产价格,右边是印度的市场价格假设出口价格15000/个,进口价格20000/个C.拼箱单价运费查询:点击“运费查询”,输入进口商国家中文名称或者英文名称,点“查询”,比较各个港口的单位运费,选最少的单位运费,分别填写入MTQ,TNE中,比如印度,最少的拼箱单价运费是科尔切斯特港口60/MTQ 85/TNEd.查看税率:点“查看税率”,弹出产品税率网页,填写优惠税率,增值税率,退税率(网页显示的是百分数,填写时换成小数)e.查看汇率:点“查看汇率”,看银行当前显示的进口商所用币别的汇率,填写所看到的汇率,比如印度的是USD 填写看到的数字,即填写631.46F.计算以及保存:点“计算”即计算总毛重,总净重,总体积,总箱数。

市场价格也转换成人民币了。

精品文档出口在进出口贸易中,商品的价格是买卖双方磋商的焦点,有时也是成交的决定性因素。

正确掌握进出口商品价格构成,合理采用各种作价方法,选用有利的计价货币和贸易条件,准确核算成本、利润,具有十分重要的意义。

在SimTrade中,当出口商起草合同完毕,发送给对方时,必须先填写出口预算表,预估各项费用;交易完成后,实际发生的金额将列于右侧栏中,供学生核对自己计算得正确与否。

以下就出口预算表中各项费用的计算加以说明,便于学生填写时参考。

注意出口预算表填入的数字全部为本位币,且都保留两位小数。

如需换算,汇率请参考淘金网中的。

ぜ页面,如没有该项费用发生,请填银行请选择以下主题查看相关内容:基本计算毛重、净重、体积计算)(一首先到淘金网的产品展示中记下产品每箱的重量、体积,其次查询产品的销售单位与包装单位是否相同。

在计算重量时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的毛(净)重;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出单件的毛(净)重,再根据交易数量计算总毛(净)重。

在计算体积时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的体积;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出包装箱数,再计算总体积。

(注意:包装箱数有小数点时,必须进位取整箱。

)例1:玩具类产品08001项,销售单位是UNIT(辆),包装单位是CARTON(箱),单位换算显示是每箱装6辆,每箱毛重23KGS,每箱净重21KGS,每箱体积0.08052CBM。

如果交易数量为1000只,试分别计算毛、净重、体积?解:毛重的计算:单件的毛重=23÷6=3.833KGS总毛重=3.8333×1000=3833.3KGS净重的计算:单件的净重=21÷6=3.5KGS总净重=3.5×1000=3500KGS体积的计算:包装箱数=1000÷6=166.6,取整167箱总体积=167×0.08052=13.447CBM例2:食品类产品01001项,销售单位是CARTON(箱),包装单位也是CARTON(箱),每箱毛重11.2KGS,每箱净重10.2KGS,每箱体积0.014739CBM。