chapter6-assignment

- 格式:pdf

- 大小:85.99 KB

- 文档页数:1

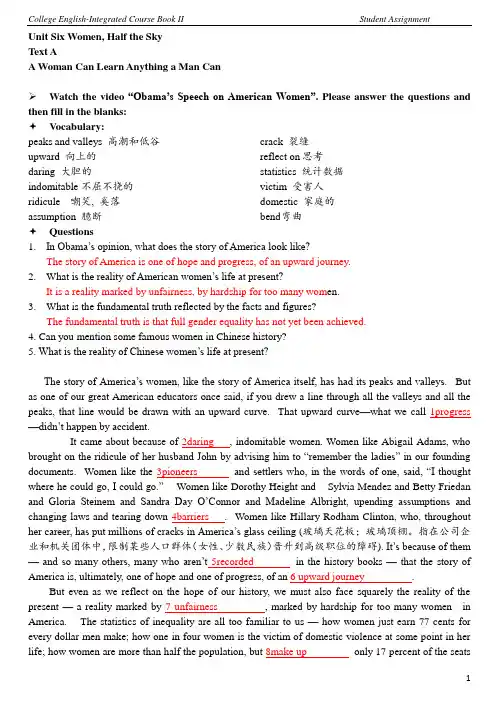

Unit Six Women, Half the SkyText AA Woman Can Learn Anything a Man CanWatch the video “Obama’s Speech on American Women”. Please answer the questions and then fill in the blanks:✦Vocabulary:peaks and valleys 高潮和低谷upward 向上的daring 大胆的indomitable不屈不挠的ridicule 嘲笑, 奚落assumption 臆断crack 裂缝reflect on 思考statistics 统计数据victim 受害人domestic 家庭的bend 弯曲✦Questions1.In Obama’s opinion, what does the story of America look like?The story of America is one of hope and progress, of an upward journey.2.Wha t is the reality of American women’s life at present?It is a reality marked by unfairness, by hardship for too many wom en.3.What is the fundamental truth reflected by the facts and figures?The fundamental truth is that full gender equality has not yet been achieved.4. Can you mention some famous women in Chinese history?5. What is the reality of Chinese women’s life at present?The story of America’s women, like the story of America itself, has had its peaks and valleys.But as one of our great American educators once said, if you drew a line through all the valleys and all the peaks, that line would be drawn with an upward curve. That upward curve—what we call 1progress —didn’t happen by accident.It came about because of 2daring , indomitable women. Women like Abigail Adams, who brought on the ridicule of her husband John by advising him to “remember the ladies” in our founding documents. Women like the 3pioneers and settlers who, in the words of one, said, “I thought where he could go, I could go.”Women like Dorothy Height and Sylvia Mendez and Betty Friedan and Gloria Steinem and Sandra Day O’Connor and Madeline Albright, upending assumptions and changing laws and tearing down 4barriers . Women like Hillary Rodham Clinton, who, throughout her career, has put millions of cracks in America’s glass ceiling (玻璃天花板;玻璃顶棚。

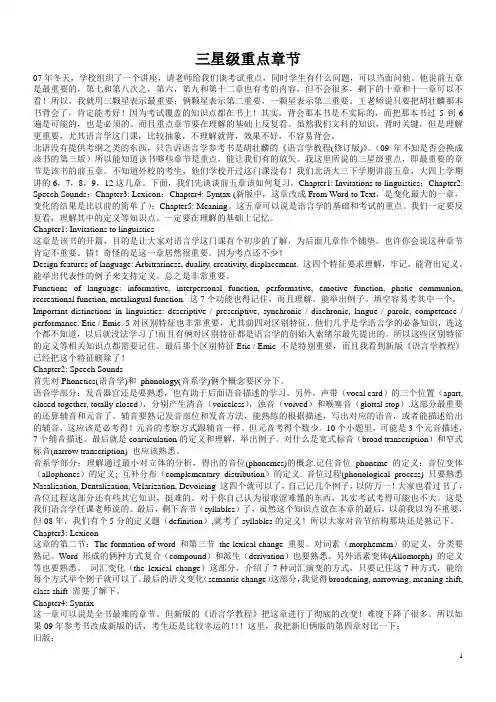

三星级重点章节07年冬天,学校组织了一个讲座,请老师给我们谈考试重点,同时学生有什么问题,可以当面问他。

他说前五章是最重要的,第七和第八次之,第六,第九和第十二章也有考的内容,但不会很多,剩下的十章和十一章可以不看!所以,我就用三颗星表示最重要;俩颗星表示第二重要,一颗星表示第三重要。

王老师说只要把胡壮麟那本书背会了,肯定能考好!因为考试覆盖的知识点都在书上!其实,背会那本书是不实际的,而把那本书过5到6遍是可能的,也是必须的。

而且重点章节要在理解的基础上反复看。

虽然我们文科的知识,背时关键,但是理解更重要,尤其语言学这门课,比较抽象,不理解就背,效果不好,不容易背会。

北语没有提供考纲之类的东西,只告诉语言学参考书是胡壮麟的《语言学教程(修订版)》。

(09年不知是否会换成该书的第三版)所以能知道该书哪些章节是重点,能让我们有的放矢。

我这里所说的三星级重点,即最重要的章节是该书的前五章。

不知道外校的考生,他们学校开过这门课没有!我们北语大三下学期讲前五章,大四上学期讲的6,7,8,9,12这几章。

下面,我们先谈谈前五章该如何复习。

Chapter1: Invitations to linguistics;Chapter2: Speech Sounds;Chapter3: Lexicon;Chapter4: Syntax (新版中,这章改成From Word to Text,是变化最大的一章,变化的结果是比以前的简单了);Chapter5: Meaning。

这五章可以说是语言学的基础和考试的重点。

我们一定要反复看,理解其中的定义等知识点。

一定要在理解的基础上记忆。

Chapter1: Invitations to linguistics这章是该书的开篇,目的是让大家对语言学这门课有个初步的了解,为后面几章作个铺垫。

也许你会说这种章节肯定不重要。

错!奇怪的是这一章居然很重要。

因为考点还不少!Design features of language: Arbitrariness, duality, creativity, displacement. 这四个特征要求理解,牢记,能背出定义。

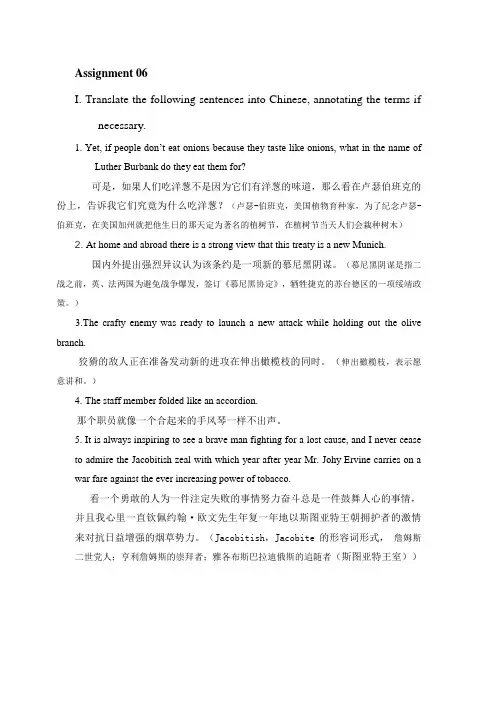

Assignment 06I. Translate the following sentences into Chinese, annotating the terms ifnecessary.1.Yet, if people don’t eat onions because they taste like onions, what in the name ofLuther Burbank do they eat them for?可是,如果人们吃洋葱不是因为它们有洋葱的味道,那么看在卢瑟伯班克的份上,告诉我它们究竟为什么吃洋葱?(卢瑟-伯班克,美国植物育种家,为了纪念卢瑟-伯班克,在美国加州就把他生日的那天定为著名的植树节,在植树节当天人们会栽种树木)2. At home and abroad there is a strong view that this treaty is a new Munich.国内外提出强烈异议认为该条约是一项新的慕尼黑阴谋。

(慕尼黑阴谋是指二战之前,英、法两国为避免战争爆发,签订《慕尼黑协定》,牺牲捷克的苏台德区的一项绥靖政策。

)3.The crafty enemy was ready to launch a new attack while holding out the olive branch.狡猾的敌人正在准备发动新的进攻在伸出橄榄枝的同时。

(伸出橄榄枝,表示愿意讲和。

)4.The staff member folded like an accordion.那个职员就像一个合起来的手风琴一样不出声。

5.It is always inspiring to see a brave man fighting for a lost cause, and I never ceaseto admire the Jacobitish zeal with which year after year Mr. Johy Ervine carries on a war fare against the ever increasing power of tobacco.看一个勇敢的人为一件注定失败的事情努力奋斗总是一件鼓舞人心的事情,并且我心里一直钦佩约翰·欧文先生年复一年地以斯图亚特王朝拥护者的激情来对抗日益增强的烟草势力。

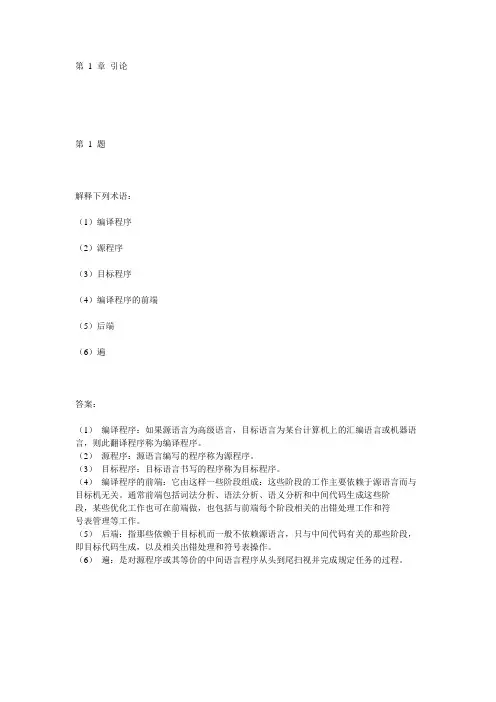

第1 章引论第1 题解释下列术语:(1)编译程序(2)源程序(3)目标程序(4)编译程序的前端(5)后端(6)遍答案:(1)编译程序:如果源语言为高级语言,目标语言为某台计算机上的汇编语言或机器语言,则此翻译程序称为编译程序。

(2)源程序:源语言编写的程序称为源程序。

(3)目标程序:目标语言书写的程序称为目标程序。

(4)编译程序的前端:它由这样一些阶段组成:这些阶段的工作主要依赖于源语言而与目标机无关。

通常前端包括词法分析、语法分析、语义分析和中间代码生成这些阶段,某些优化工作也可在前端做,也包括与前端每个阶段相关的出错处理工作和符号表管理等工作。

(5)后端:指那些依赖于目标机而一般不依赖源语言,只与中间代码有关的那些阶段,即目标代码生成,以及相关出错处理和符号表操作。

(6)遍:是对源程序或其等价的中间语言程序从头到尾扫视并完成规定任务的过程。

第2 题一个典型的编译程序通常由哪些部分组成?各部分的主要功能是什么?并画出编译程序的总体结构图。

答案:一个典型的编译程序通常包含8 个组成部分,它们是词法分析程序、语法分析程序、语义分析程序、中间代码生成程序、中间代码优化程序、目标代码生成程序、表格管理程序和错误处理程序。

其各部分的主要功能简述如下。

词法分析程序:输人源程序,拼单词、检查单词和分析单词,输出单词的机内表达形式。

语法分析程序:检查源程序中存在的形式语法错误,输出错误处理信息。

语义分析程序:进行语义检查和分析语义信息,并把分析的结果保存到各类语义信息表中。

中间代码生成程序:按照语义规则,将语法分析程序分析出的语法单位转换成一定形式的中间语言代码,如三元式或四元式。

中间代码优化程序:为了产生高质量的目标代码,对中间代码进行等价变换处理。

目标代码生成程序:将优化后的中间代码程序转换成目标代码程序。

表格管理程序:负责建立、填写和查找等一系列表格工作。

表格的作用是记录源程序的各类信息和编译各阶段的进展情况,编译的每个阶段所需信息多数都从表格中读取,产生的中间结果都记录在相应的表格中。

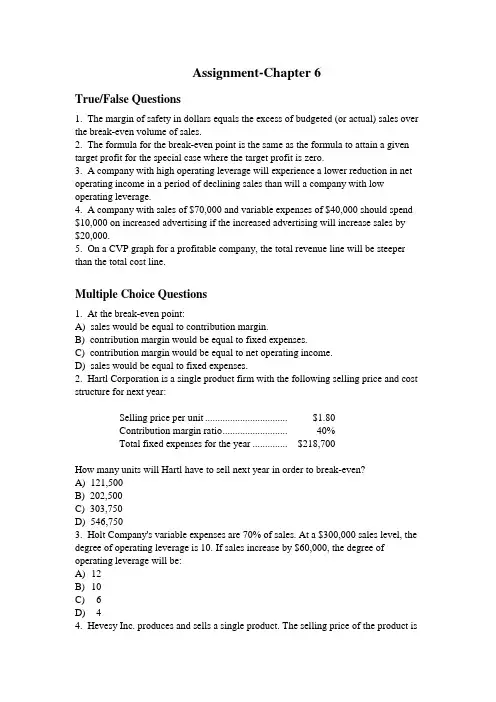

Assignment-Chapter 6True/False Questions1. The margin of safety in dollars equals the excess of budgeted (or actual) sales over the break-even volume of sales.2. The formula for the break-even point is the same as the formula to attain a given target profit for the special case where the target profit is zero.3. A company with high operating leverage will experience a lower reduction in net operating income in a period of declining sales than will a company with low operating leverage.4. A company with sales of $70,000 and variable expenses of $40,000 should spend $10,000 on increased advertising if the increased advertising will increase sales by $20,000.5. On a CVP graph for a profitable company, the total revenue line will be steeper than the total cost line.Multiple Choice Questions1. At the break-even point:A) sales would be equal to contribution margin.B) contribution margin would be equal to fixed expenses.C) contribution margin would be equal to net operating income.D) sales would be equal to fixed expenses.2. Hartl Corporation is a single product firm with the following selling price and cost structure for next year:Selling price per unit ................................. $1.80Contribution margin ratio.......................... 40%Total fixed expenses for the year .............. $218,700How many units will Hartl have to sell next year in order to break-even?A) 121,500B) 202,500C) 303,750D) 546,7503. Holt Company's variable expenses are 70% of sales. At a $300,000 sales level, the degree of operating leverage is 10. If sales increase by $60,000, the degree of operating leverage will be:A) 12B) 10C) 6D) 44. Hevesy Inc. produces and sells a single product. The selling price of the product is$200.00 per unit and its variable cost is $80.00 per unit. The fixed expense is $300,000 per month. The break-even in monthly unit sales is closest to:A) 2,500B) 1,500C) 3,750D) 2,5835. Which of the following strategies could be used to reduce the break-even point?Fixed expenses Contribution marginA) Increase IncreaseB) Decrease DecreaseC) Decrease IncreaseD) Increase DecreaseEssay Questions1. Spencer Company's most recent monthly contribution format income statement isgiven below:Sales .................................. $60,000Variable expenses.............. 45,000Contribution margin .......... 15,000Fixed expenses .................. 18,000Net operating loss .............. ($3,000)The company sells its only product for $10 per unit. There were no beginning or ending inventories.Required:a.What are total sales in dollars at the break-even point?b.What are total variable expenses at the break-even point?c.What is the company's contribution margin ratio?d.If unit sales were increased by 10% and fixed expenses were reduced by$2,000, what would be the company's expected net operating income?(Prepare a new income statement.)2. Belli-Pitt, Inc, produces a single product. The results of the company's operationsfor a typical month are summarized in contribution format as follows: Sales .................................. $540,000Variable expenses.............. 360,000Contribution margin .......... 180,000Fixed expenses .................. 120,000Net operating income ........ $ 60,000The company produced and sold 120,000 kilograms of product during the month. There were no beginning or ending inventories.Required:a.Given the present situation, compute1.The break-even sales in kilograms.2.The break-even sales in dollars.3.The sales in kilograms that would be required to produce net operatingincome of $90,000.4.The margin of safety in dollars.b.An important part of processing is performed by a machine that iscurrently being leased for $20,000 per month. Belli-Pitt has been offered an arrangement whereby it would pay $0.10 royalty per kilogramprocessed by the machine rather than the monthly lease.1.Should the company choose the lease or the royalty plan?2.Under the royalty plan compute break-even point in kilograms.3.Under the royalty plan compute break-even point in dollars.4.Under the royalty plan determine the sales in kilograms that would berequired to produce net operating income of $90,000.。

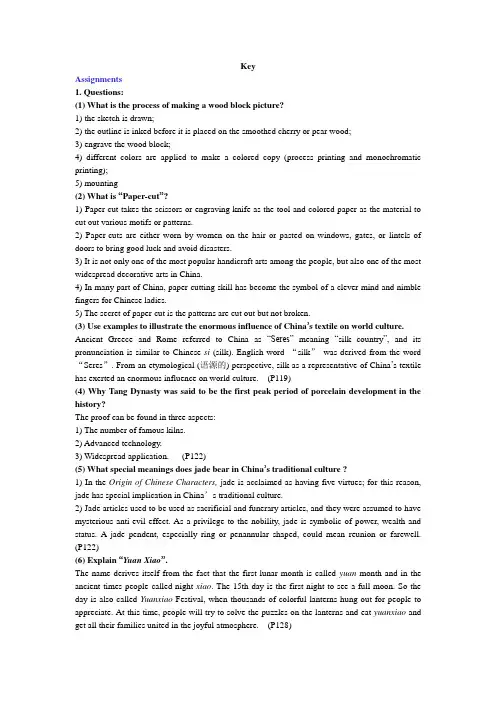

KeyAssignments1. Questions:(1) What is the process of making a wood block picture?1) the sketch is drawn;2) the outline is inked before it is placed on the smoothed cherry or pear wood;3) engrave the wood block;4) different colors are applied to make a colored copy (process printing and monochromatic printing);5) mounting(2) What is “Paper-cut”?1) Paper-cut takes the scissors or engraving knife as the tool and colored paper as the material to cut out various motifs or patterns.2) Paper-cuts are either worn by women on the hair or pasted on windows, gates, or lintels of doors to bring good luck and avoid disasters.3) It is not only one of the most popular handicraft arts among the people, but also one of the most widespread decorative arts in China.4) In many part of China, paper-cutting skill has become the symbol of a clever mind and nimble fingers for Chinese ladies.5) The secret of paper-cut is the patterns are cut out but not broken.(3) Use examples to illustrate the enormous influence of China’s textile on world culture. Ancient Greece and Rome referred to China as “Seres” meaning “silk country”, and its pronunciation is similar to Chinese si (silk). English word “silk”was derived from the word “Seres”. From an etymological (语源的) perspective, silk as a representative of China’s textile has exerted an enormous influence on world culture. (P119)(4) Why Tang Dynasty was said to be the first peak period of porcelain development in the history?The proof can be found in three aspects:1) The number of famous kilns.2) Advanced technology.3) Widespread application. (P122)(5) What special meanings does jade bear in China’s traditional culture ?1) In the Origin of Chinese Characters, jade is acclaimed as having five virtues; for this reason, jade has special implication in China’s traditional culture.2) Jade articles used to be used as sacrificial and funerary articles, and they were assumed to have mysterious anti-evil effect. As a privilege to the nobility, jade is symbolic of power, wealth and status. A jade pendent, especially ring or penannular shaped, could mean reunion or farewell. (P122)(6) Explain “Yuan Xiao”.The name derives itself from the fact that the first lunar month is called yuan month and in the ancient times people called night xiao. The 15th day is the first night to see a full moon. So the day is also called Yuanxiao Festival, when thousands of colorful lanterns hung out for people to appreciate. At this time, people will try to solve the puzzles on the lanterns and eat yuanxiao and get all their families united in the joyful atmosphere. (P128)(7) Why is “Tug-of-war” called “Bahe” in Chinese?1)Generally, there are two explanations. One is that the river is symbolic of the boundary line between the State of Ch u and the State of Han in China’s Western Han Dynasty.2)Another explanation is that it came from an ancient sacrificial service, the purpose of which was to pray for rainfalls in order to ensure harvest. Bahe meant “pulling the river of heaven to make wa ter fall onto earth”, a belief that man could conquer the heaven. (P137)2. Translation:Section 1:民间工艺folk handicraft木版年画block-printed Chinese New Year Pictures装裱mounting彩印process printing勾线技法sketching techniques求福避祸bring good luck and avoid disasters 剪纸paper-cut门签gate labels心灵手巧a clever mind and nimble fingers 高手master-hands国际风筝都International Capital Of Kites潍坊风筝节Weifang Kite Festival龙头蜈蚣风筝dragon-headed centipede “尊龙”传统the tradition of dragon worship 刺绣作品embroidery article双面绣Double-faced embroidery纺车spinning wheel织机weaving machine麻织品时期flax fabric period民间纺织folk textile印染printing and dyeing蜡染wax-dyeing扎染tie-dyeing陶瓷ceramics/ pottery and porcelain兵马俑terra cotta warriors and horses青瓷blue porcelain白瓷white porcelain唐三彩tricolored glazed pottery of the Tang Dynasty五大名窑five kilns紫砂壶the boccaro teapot金银玉器gold, silver and jade wares金缕玉衣jade clothes sewn with gold thread 避邪anti-evil 玉佩jade pendent竹木藤器bamboo, wood and rattan work木雕wood carving柳编wickerwork草编straw-knitted work泥塑clay figure modelling面塑dough figure modeling生肖zodiac animals八仙the eight immortals西游记Pilgrimage to the WestSection 2&3:烟花爆竹firecrackers and fireworks闹花灯lantern show元宵节Lantern Festival/ Yuanxiao Festival 猜灯谜solving the puzzles on the lanterns踩高跷stilts-walking舞龙dragon lantern dance锣鼓drums and gongs舞狮lion dance跑旱船boating dance/ land-boat dance花鼓colored drum dance腰鼓waist drum dance精通十八般武艺skill in wielding the 18 kinds of weapons文臣武将men of letters and men of military capacity太极拳shadow boxing中国象棋Chinese chess龙舟竞渡the dragon-boat race拔河tug-of-war。

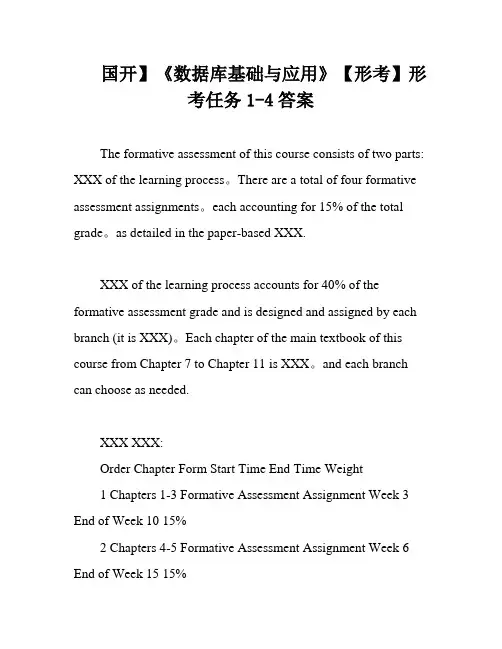

国开】《数据库基础与应用》【形考】形考任务1-4答案The formative assessment of this course consists of two parts: XXX of the learning process。

There are a total of four formative assessment assignments。

each accounting for 15% of the total grade。

as detailed in the paper-based XXX.XXX of the learning process accounts for 40% of the formative assessment grade and is designed and assigned by each branch (it is XXX)。

Each chapter of the main textbook of this course from Chapter 7 to Chapter 11 is XXX。

and each branch can choose as needed.XXX XXX:Order Chapter Form Start Time End Time Weight1 Chapters 1-3 Formative Assessment Assignment Week 3 End of Week 10 15%2 Chapters 4-5 Formative Assessment Assignment Week 6 End of Week 15 15%3 Chapters 6-8 Formative Assessment Assignment Week 9 End of Week 15 15%4 Chapters 9-11 XXX 10 End of Week 15 15%5 Daily Activity Learning Records Week 1 End of Week 16 40%Each formative assessment task is scored on a percentage basis。

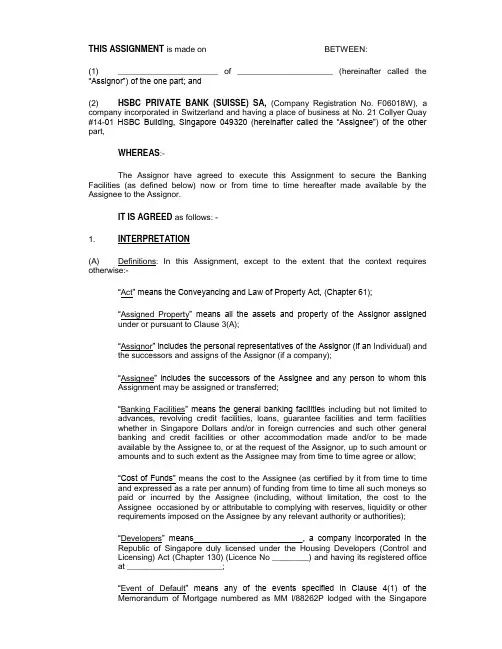

THIS ASSIGNMENT is made on BETWEEN:(1) ______________________ of _____________________ (hereinafter called the “Assignor”) of the one part; and(2) HSBC PRIVATE BANK (SUISSE) SA, (Company Registration No. F06018W), a company incorporated in Switzerland and having a place of business at No. 21 Collyer Quay #14-01 HSBC Building, Singapore 049320 (hereinafter called the “Assignee”) of the other part,WHEREAS:-The Assignor have agreed to execute this Assignment to secure the Banking Facilities (as defined below) now or from time to time hereafter made available by the Assignee to the Assignor.IT IS AGREED as follows: -1. INTERPRETATION(A) Definitions: In this Assignment, except to the extent that the context requires otherwise:-“Act” means the Conveyancing and Law of Property Act, (Chapter 61);“Assigned Property” means all the assets and property of the Assignor assigned under or pursuant to Clause 3(A);“Assignor” includes the personal representatives of the Assignor (if an i ndividual) and the successors and assigns of the Assignor (if a company);“Assignee” includes the successors of the Assignee and any person to whom this Assignment may be assigned or transferred;“Banking Facilities” means the general banking facilitie s including but not limited to advances, revolving credit facilities, loans, guarantee facilities and term facilities whether in Singapore Dollars and/or in foreign currencies and such other general banking and credit facilities or other accommodation made and/or to be made available by the Assignee to, or at the request of the Assignor, up to such amount or amounts and to such extent as the Assignee may from time to time agree or allow;“Cost of Funds” means the cost to the Assignee (as certified by it from time to time and expressed as a rate per annum) of funding from time to time all such moneys so paid or incurred by the Assignee (including, without limitation, the cost to the Assignee occasioned by or attributable to complying with reserves, liquidity or other requirements imposed on the Assignee by any relevant authority or authorities);“Developers” means________________________, a company incorporated in the Republic of Singapore duly licensed under the Housing Developers (Control and Licensing) Act (Chapter 130) (Licence No ________) and having its registered office at _____________________;Land Authority (which has been incorporated into the Mortgage (as defined below)); “Facility Documents” means any or all of the Assignee’s facility letters, the Assignee’s standard form documents executed by the Assignor under or in connection with the Banking Facilities or any part thereof, and any other document or agreement under or pursuant to which any moneys or liabilities whatsoever may, at any time (now or hereafter), be due, owing or payable by the Assignor to the Assignee, whether actually or contingently, solely or jointly or jointly and/or severally with another or others or as principal or as surety or otherwise, under or in connection with the Banking Facilities or any part thereof, and where documents are executed to guarantee or secure the obligations of the Assignor under or in connection with the Banking Facilities, the term “Facility Documents” shall include all such documents from time to time executed to guarantee or secure the obligations of the Assignor under or in connection with the Banking Facilities (and any reference to a Facility Document shall be a reference to that Facility Document as from time to time amended, modified or supplemented);“Mortgage” means a mortgage over the Property in such form as may be approved by the Assignee;“Principal Agreement” means the Agreement for Sale dated the _________ day of ____________________ 2004 made between the Developers of the one part and the Assignor of the other part, whereby the Developers agreed to sell and the Assignor agreed to purc hase the Property and all references to “Principal Agreement” shall be deemed to include references to the Principal Agreement as from time to time amended, modified or supplemented;“Property” means the property described in the Schedule;“Secured Debt” means (a) all sums (whether principal, interest, fee, commission or otherwise) which are or at any time may be or become due from or owing by the Assignor to the Assignee, or which the Assignor has covenanted to pay or discharge, whether actually or contingently, under or in connection with any of the Facility Documents and/or this Assignment and the Mortgage and (b) all other liabilities and moneys (whether principal, interest, fee, commission or otherwise) which now are or at any time hereafter may become due from or owing by, or be incurred by the Assignor to the Assignee, in whatever currency the same shall be denominated or owing, whether alone or jointly or jointly with any other person and on any account whatsoever, whether current or otherwise, and whether present, future, actual or contingent, and whether as principal debtor, guarantor, surety or otherwise howsoever, including (without limitation) interest and all liabilities in connection with foreign exchange transactions, paying, accepting, endorsing or discounting any cheques, notes or bills, or under bonds, guarantees, indemnities, documentary or other credits or any instruments whatsoever from time to time entered into by the Assignee, for or at the request of the Assignor;“Security Party” means any person (other than the Assignor or the Assignee) who is a party to any of the Facility Documents;“Singapore Dollar(s)” and “S$” mean the lawful currency of Singapore;“Title Document” means the Subsidiary Strata Certificate of Title or othe r document of title relating to the Property; andby the Developers in favour of the Assignor.(B) Mortgage: All terms and references used in this Assignment and which are defined or construed in the Mortgage but are not defined or construed in this Assignment shall have the same meaning and construction in this Assignment. All references in this Assignment to the Mortgage are references to the Mortgage as amended, modified or supplemented from time to time.(C) This Assignment: Except to the extent that the context otherwise requires, any reference to “this Assignment” includes this Assignment as from time to time amended, modified or supplemented and any document which is supplemental hereto or which is expressed to be collateral herewith or which is entered into pursuant to or in accordance with the terms hereof.(D) Headings and Clauses: The headings in this Assignment are inserted for convenience only and shall be ignored in construing this Assignment. Unless the context otherwise requires, words denoting the singular number only shall include the plural and vice versa and words importing the masculine gender shall include the feminine and neuter gender. Referen ces to the “Appendix”, “Clauses” and the “Schedule” are to be construed as references to the appendix to, clauses of, and the schedule to, this Assignment.(E) Assignor’s Obligations: Where more than one person constitutes the Assignor, all covenants, terms, warranties, undertakings, representations, stipulations and other provisions herein expressed to be made by the Assignor shall be deemed to be made by, and shall be binding, on them jointly and severally.(F) References to Assignor: Where more than one person constitutes the Assignor, all references herein to “the Assignor” shall where the context so admits, include references to any or all of them.2. COVENANT TO PAYIn consideration of the Assignee granting or agreeing to grant for the benefit of the Assignor, the Banking Facilities, the Assignor hereby covenant with the Assignee:-(i) to pay and discharge upon demand (in respect of the Banking Facilities which are expressed to be payable on demand) or on the due date thereof, all moneys, obligations and liabilities whatsoever which now are or at any time hereafter (whether on or after any such demand or otherwise) may be due from or owing or payable by, or to be incurred by, the Assignor to the Assignee, in whatever currency the same shall be denominated or owing whether alone or jointly or jointly with any other person and on any account whatsoever, whether current or otherwise, and whether present, future, actual or contingent and whether as principal debtor, guarantor, surety or otherwise howsoever or in any manner whatsoever and all other liabilities, whether certain or contingent, whether or not under, pursuant to or in connection with any of the Facility Documents including (without limitation) all liabilities in connection with paying, accepting, endorsing or discounting any cheques, notes or bills, or under guarantees, documentary or other credits or any instrument whatsoever from time to time entered into by the Assignee for or at the request of the Assignor, and all commission, discount and all banking, legal and other costs, charges and expenses whatsoever (on a full indemnity basis), and also interest on the foregoing;(ii) without prejudice to the generality of paragraph (i), and as a continuing obligation, to keep the Assignee fully indemnified on demand from and against any and all payments made by or on behalf of the Assignee under any documentary or other credits or guarantees issuedAssignee to the Assignor, and any expense, loss, damage, cost, claim or liability whatsoever which the Assignee may incur under or in connection with the said documentary or other credits or guarantees or any of the Facility Documents including, without limitation, any legal and other cost, charge or expense incurred by the Assignee in connection therewith;(iii) to pay interest or commissions on or in respect of the Banking Facilities at the rate(s) (hereinafter called the “Applicable Rate(s)”) and in accordance with the terms set out in the Facility Documents and further agree that save as may be otherwise provided in the Facility Documents:-(1) interest or commissions on or in respect of each of the Banking Facilitiesshall accrue from day to day on such basis and with such periodic rests as the Assignee may from time to time determine;(2) interest on any principal money for the time being owing, includingcapitalised interest, shall at or about the end of each month be capitalised and added for all purposes to the principal money then owing which shall thenceforth bear interest at the Applicable Rate(s) aforesaid and be secured and payable accordingly and all the covenants and conditions contained in or implied by this Assignment and all powers and remedies conferred on the Assignee by law or by this Assignment and all rules of law or equity in relation to the said principal money and interest shall equally apply to such capitalised arrears of interest and to interest on such arrears;(3) if and when a demand is made by or on behalf of the Assignee for paymentof all or any moneys herein covenanted to be paid or to be discharged in relation to the Banking Facilities which are expressed to be payable on demand or if any moneys payable in respect of the other Banking Facilities shall become due and/or the account current or otherwise of the Assignor shall be closed and a balance shall be owing or unpaid to the Assignee, the Assignor will, so long as the same or any part thereof shall remain owing or unpaid or undischarged to the Assignee by the Assignor pay to the Assignee interest thereon at the applicable default rate(s) specified in the relevant Facility Documents or if no such default rate is specified, at such rate(s) and with such periodic rests as the Assignee may from time to time determine, from the date of such demand being made until full payment is received by the Assignee (both before as well as after any demand, judgment, bankruptcy, death or insanity of the Assignor);(iv) to pay and discharge (on a full indemnity basis) on demand all costs, charges and expenses howsoever incurred by the Assignee or by any receiver or by any delegate or sub-delegate appointed by the Assignee pursuant to this Assignment in relation to this Assignment or such liabilities as aforesaid including (but without prejudice to the generality of the foregoing) remuneration payable to any such receiver, delegate or sub-delegate as aforesaid and all costs, charges and expenses incurred in the protection, realisation or enforcement of the security constituted by this Assignment or in insuring, inspecting, repairing, maintaining, completing, managing, letting, realising or exercising any other power, authority or discretion in relation to the Assigned Property or any part thereof incurred pursuant to this Assignment;(v) to pay interest on each of the foregoing costs, charges and expenses calculated day by day from demand until full discharge (both before as well as after any demand, judgment, bankruptcy, death or insanity of the Assignor) at the rate of 3% above the Costs of Funds with monthly rests or at such other rate or rates and with such other periodic rests as may from time to time be determined by the Assignee Provided that in relation to such costs, charges and expenses as are mentioned in paragraph (iv) above, interest shall accrue and be payable as from the date on which the same are incurred by the Assignee or by thebeing made therefor. Any interest payable under this paragraph (v) which is not paid in accordance with this paragraph (v) shall so for so long as it remains unpaid be added to the overdue sum and itself bear interest accordingly; and(vi) to perform, observe and be bound by all terms and conditions contained in or referred to in each of the Facility Documents.3. ASSIGNMENT(A) Assignment: The Assignor as beneficial owner, and as a continuing security for the payment and discharge of the Secured Debt and for the observance and performance by the Assignor of the Assignor’s obligations under the Facility Documents to which it is a party, hereby assign and agree to assign absolutely to the Assignee, free from all liens, charges and other encumbrances:-(i) all the present and future rights, interest, benefits, advantages, permits,licences and remedies which the Assignor have in, under or arising out of thePrincipal Agreement; and(ii) all the present and future estate, right, title and interest of the Assignor in and to the Property,subject to the proviso for redemption hereinafter contained, that is to say, Provided Always that if the whole of the Secured Debt shall be paid to the Assignee in full, the Assignee will thereafter, at the request and cost of the Assignor, reassign to the Assignor the Principal Agreement and all the estate, right, title and interest hereby assigned or otherwise discharge the security hereby created.(B) Undertakings: The Assignor hereby undertake to the Assignee that:-(i) Payments: the Assignor shall pay all sums of money and other charges orpayments as and when the same are due under the Principal Agreement(including, but without limitation, any goods and services tax payablethereunder) and shall make all such payments and do all such acts as maybe required to obtain the grant to the Assignor of the Title Document and theTransfer relating to the Property, and produce to the Assignee as and whenrequired the issued receipts for all such payments and further the Assignorshall observe and perform all the covenants, undertakings, stipulations,terms and conditions therein contained and shall keep harmless andindemnify the Assignee in full against all actions, proceedings, claims,demands, losses, fees, expenses, damages, costs, liabilities and penaltieswhatsoever in relation thereto;(ii) Title Document: as soon as the Title Document relating to the Property shall have been issued the Assignor shall forthwith cause the Title Document andthe Transfer to be delivered to the Assignee and shall make all suchpayments and do all such acts as shall enable the Mortgage referred to insub-Clauses (C) and (D) below to be completed and perfected;(iii) Authority of Assignee: if the Assignor shall neglect or refuse to comply in any way with the provisions of paragraphs (i) and/or (ii) above, it shall belawful for the Assignee in the name of the Assignor or otherwise to demandand receive the Title Document and the Transfer from the Developers and tomake such payments and do such acts as shall enable the Mortgageand(iv) Notices and Communications: the Assignor shall keep the Assignee informed of any notice or communication relating to the Principal Agreement,the Title Document and the Property as and when the Assignor receive thesame which may affect the rights of the Assignee to the Assigned Property.(C) Mortgage: Contemporaneous with the execution of this Assignment the Assignor shall execute and deliver to the Assignee the Mortgage with the intent that, upon the delivery by the Developers to the Assignor of the Title Document and the Transfer relating to the Property, the Mortgage shall be registered and take effect as a first legal Mortgage over the Property accordingly.(D) Perfection of Mortgage: The Assignor further undertake to do all such acts as shall enable the Mortgage referred to in sub-Clause (C) above to be completed and perfected and further undertake that in the event that the Mortgage is not acceptable for registration the Assignor shall at their own cost and at the request of the Assignee, either (i) vary or amend the Mortgage so that the Mortgage so varied or amended, may be acceptable for registration or (ii) execute and deliver to the Assignee a fresh registrable legal mortgage over the Property in favour of the Assignee in substitution for the Mortgage in such form as may be acceptable for registration and containing substantially the terms and conditions contained in the Mortgage.(E) Terms of Mortgage: It is hereby expressly agreed and declared that notwithstanding that the Mortgage is inoperative as a legal mortgage of the Property pending the issue of the Title Document relating to the Property and registration of the Mortgage, all the covenants, undertakings, stipulations, terms and conditions as contained and referred to in the Mortgage shall be deemed to have full force and effect as if they were contained and referred to in this Assignment with the intent that the Mortgage and this Assignment shall be read as one document and the Assignor hereby covenant to perform and observe all such covenants, undertakings, stipulations, terms and conditions contained and referred to in the Mortgage.4. CONTINUING SECURITY(A) Continuing Obligations: The security created by this Assignment shall constitute and be a continuing security for the payment and discharge of the Secured Debt notwithstanding any intermediate payment or settlement of account or reduction or repayment of the same or any part or parts thereof for the time being owing, any account ceasing to be current or any fluctuation or existence of any credit balance at any time or other matter or thing whatsoever, and shall extend to cover all or any sum or sums of moneys which shall from time to time be owing to the Assignee under or in connection with any of the Facility Documents and/or this Assignment or otherwise. The security created by this Assignment shall be in addition to and shall not be in any way prejudiced or affected by any of the Facility Documents or any collateral or other security, guarantee, indemnity, right, remedy or lien of whatever nature which the Assignee may now or at any time hereafter have or any judgment or order obtained by the Assignee for or in respect of all or any part of the Secured Debt nor shall any of the Facility Documents or any such collateral or other security, guarantee, indemnity, right, remedy or lien be in any way prejudiced or affected by this Assignment.(B) Unconditionality of Security: The security created by this Assignment shall not be discharged or affected by (i) any time, indulgence, concession, waiver or consent at any time given to the Assignor, any Security Party or any other person, (ii) the Facility Documents, (iii) any amendment to any of the Facility Documents, this Assignment, the Mortgage, any of the Facility Documents, the Principal Agreement or any other agreement, security, guarantee, indemnity, right, remedy, lien or judgment, (iv) the making or absence of any demand on theabsence of enforcement of this Assignment, the Mortgage, any of the Facility Documents or any other agreement, security, guarantee, indemnity, right, remedy, lien or judgment, (vi) the taking, existence, release or discharge of this Assignment, the Mortgage, any of the Facility Documents or any other agreement, security, guarantee, indemnity, right, remedy, lien or judgment (including the release of any part of the Assigned Property), (vii) the death, insanity, bankruptcy, winding-up, amalgamation, reconstruction or reorganisation of the Assignor, any Security Party or any other person (or the commencement of any of the foregoing), (viii) the illegality, invalidity or unenforceability of or any defect in any provision of this Assignment, the Mortgage, any of the Facility Documents, the Principal Agreement or any other agreement, security, guarantee, indemnity, right, remedy, lien or judgment or any of the obligations of any of the parties thereunder or (ix) any other matter or thing whatsoever.(C) Continuation/Opening of New Accounts: In the event of the insolvency of the Assignor or of this Assignment ceasing for any reason to be binding on the Assignor or if the Assignee shall at any time receive notice (either actual or otherwise), of any subsequent mortgage, charge, assignment, hypothecation, pledge, lien or other like interest, matter, event or transaction affecting the Assigned Property or any part thereof, the Assignee may on receiving such notice forthwith open a new or separate account or accounts with the Assignor either alone or jointly or jointly with any other person or party. If the Assignee does not in fact open such new or separate account or accounts the Assignee shall nevertheless be deemed to have done so at the time when the Assignee received or was deemed to have received such notice (the “time of notic e”) and as from and after the time of notice all payments in account made by or on behalf of the Assignor to the Assignee shall (notwithstanding any legal or equitable rule of presumption to the contrary) be placed or deemed to have been placed to the credit of the new or separate account or accounts so opened or deemed to have been opened as aforesaid and shall not go in reduction of any part of the moneys owing to the Assignee under this Assignment at the time of notice. PROVIDED ALWAYS that nothing in this sub-Clause (C) contained shall prejudice the security which the Assignee otherwise would have had under this Assignment for the payment of the moneys costs charges and expenses secured or intended to be secured by this Assignment notwithstanding that the same may become due or owing or be incurred after the time of notice.(D) Consolidation of Accounts and Set-off: In addition to any lien right of set-off or other right which the Assignee may have the Assignee shall be entitled at any time and without notice to the Assignor to combine consolidate or merge all or any of the accounts and liabilities of the Assignor whether alone or jointly with any other person or party with or to the Assignee anywhere whether in Singapore or in any territory outside Singapore or set-off or transfer any sum or sums standing to the credit of one or more of such accounts in or towards satisfaction of any of the liabilities of the Assignor whether alone or jointly with any other person or party to the Assignee and whether as principal or surety on any other account or accounts whether in Singapore or in any territory outside Singapore or in any other respect whether such liabilities be absolute contingent primary collateral or secondary notwithstanding that the credit balances on such accounts and the liabilities on any other accounts may not be expressed in the same currency and the Assignee is hereby authorised to effect any necessary conversions at the Assignee's prevailing spot rate of exchange. (E) Suspense Account: Any amount received or recovered by the Assignee in respect of any amount received or recovered pursuant to this Assignment and/or any of the powers hereby conferred may be placed in a suspense account. That amount may be kept there (with any interest accrued being credited to that account) unless and until the Assignee is satisfied that it has irrevocably received or recovered the Secured Debt.5. UNDERTAKINGSThe Assignor hereby undertake to the Assignee that:-(i) Disposition: the Assignor will not (and will not agree, conditionally orunconditionally, to) sell, assign, transfer or otherwise dispose, or create (or agree, conditionally or unconditionally, to create) or have outstanding any security on or over any part of the Assigned Property or any interest in the Assigned Property, except for the security created by this Assignment;(ii) Impairment of Security: the Assignor will not take or omit to take any action the taking or omission of which may result in any alteration or impairment of this Assignment or of any of the rights created hereby;(iii) Title Document: the Assignor will at the Assignor’s own cost and expense obtain the grant to the Assignor of the Title Document and the Transfer pursuant to the Principal Agreement and will as soon as reasonably practicable upon the grant of the Title Document and the Transfer, notify the Assignee of such grant;(iv) Mortgage: the Assignor will as soon as practicable upon the grant of the Title Document and the Transfer, deliver the Title Document and the Transfer to the Assignee and will complete and perfect the Mortgage and do all such acts as the Assignee shall require for such purpose;(v) Performance: the Assignor will take such steps as are reasonably necessary or advisable to secure the due performance by the Developers of their obligations under the Principal Agreement;(vi) Principal Agreement: the Assignor will promptly and diligently perform and comply with the obligations on the Assignor’s part contained in the Principal Agreement, notify the Assignee of any breach of or default of which the Assignor has/have knowledge under the Principal Agreement and institute and prosecute all such proceedings as may be necessary or advisable to preserve or protect the Assignor’s interests and the interests of the Assignee in the Principal Agreement;(vii) Variation: the Assignor will not, except with the prior consent in writing of the Assignee make or agree to any amendment, modification or variation of the Principal Agreement, agree to any extension of time or period for any matter in the Principal Agreement, or release the Developers from any of their obligations thereunder or exercise any rights or powers of termination under the Principal Agreement or waive any breach of the Principal Agreement;(viii) Frustration: the Assignor will not make or agree to any claim that the Principal Agreement is frustrated or invalid;(ix) Exercise: the Assignor will at no time exercise any right or power conferred on the Assignor by the Principal Agreement in any manner which in the opinion of the Assignee is adverse to the interests of the Assignee under this Assignment;(x) Enforcement of Rights: the Assignor will do or permit to be done each and every act or thing which the Assignee may from time to time reasonably require to be done for the purpose of enforcing the rights of the Assignee under the Principal Agreement and this Assignment and will allow the Assignor’s name to be used as and when reasonably required by the Assignee for that purpose;。

第六章属性文法和语法制导翻译本章要点1. 属性文法,基于属性文法的处理方法;2. S-属性文法的自下而上计算;3. L-属性文法的自顶向下翻译;4. 自下而上计算继承属性;本章目标掌握和理解属性方法、基于属性文法的处理方法、S-属性文法和自下而上计算、L-属性文法和自顶向下翻译、自下而上计算继承属性等内容。

本章重点1.语法制导翻译基本思想。

2.语义规则的两种描述方法:语法制导的定义和翻译方案。

语法制导的定义没有指明语义规则的计算次序,而翻译方案显式给出语义规则(或叫语义动作)的计算次序和位置。

3.基于属性文法的处理方法,综合属性定义(S属性定义)和L属性定义。

4.设计简单问题的语法制导定义和翻译方案,这是本章的重点和难点。

这种设计可看成是一种程序设计,是一种事件驱动形式的程序设计,因此它比一般的编程要难得多。

这里的事件是句子中各种语法结构的识别。

5.语义规则的三种计算方法:分析树方法、基于规则的方法和忽略规则的方法。

6.S属性的自下而上计算(边语法分析边属性计算,忽略规则的方法)。

7.L属性的自上而下计算(边语法分析边属性计算,忽略规则的方法)。

8.递归计算(先语法分析后属性计算,基于规则的方法)。

本章难点1. 设计简单问题的语法制导定义和翻译方案;作业题一、单项选择题:1. 文法开始符号的所有________作为属性计算前的初始值。

a. 综合属性b. 继承属性c. 继承属性和综合属性d. 都不是2. 对应于产生式A→XY继承属性Y.y的属性计算,可能正确的语义规则是________。

a. A.a:=f(X.x,Y.y);b. )Y.y:=f(A.a,Y.y);c. Y.y:=f(X.x);d. A.a:=f(Y.y);3. 描述文法符号语义的属性有两种,一种称为__ __,另一种称为__ ___。

a. L-属性b. R-属性c. 综合属性d. 继承属性4. 出现在产生式________和出现在产生式________不由所给的产生式的属性计算规则进行计算,而是由其他产生式的属性规则计算或者由属性计算器的参数提供。

THE ladies of Longbourn soon waited on those of Netherfield. The visit was returned in due form. Miss Bennet's pleasing manners grew on the good will of Mrs. Hurst and Miss Bingley; and though the mother was found to be intolerable and the younger sisters not worth speaking to, a wish of being better acquainted with them was expressed towards the two eldest. By Jane this attention was received with the greatest pleasure; but Elizabeth still saw superciliousness in their treatment of every body, hardly excepting even her sister, and could not like them; though their kindness to Jane, such as it was, had a value, as arising in all probability from the influence of their brother's admiration. It was generally evident whenever they met, that he did admire her; and to her it was equally evident that Jane was yielding to the preference which she had begun to entertain for him from the first, and was in a way to be very much in love; but she considered with pleasure that it was not likely to be discovered by the world in general, since Jane united with great strength of feeling a composure of temper and a uniform cheerfulness of manner, which would guard her from the suspicions of the impertinent. She mentioned this to her friend Miss Lucas."It may perhaps be pleasant," replied Charlotte, "to be able to impose on the public in such a case; but it is sometimes a disadvantage to be so very guarded. If a woman conceals her affection with the same skill from the object of it, she may lose the opportunity of fixing him; and it will then be but poor consolation to believe the world equally in the dark. There is so much of gratitude or vanity in almost every attachment, that it is not safe to leave any to itself. We can all begin freely -- a slight preference is natural enough; but there are very few of us who have heart enough to be really in love without encouragement. In nine cases out of ten, a woman had better shew more affection than she feels. Bingley likes your sister undoubtedly; but he may never do more than like her, if she does not help him on.""But she does help him on, as much as her nature will allow. If I can perceive her regard for him, he must be a simpleton indeed not to discover it too.""Remember, Eliza, that he does not know Jane's disposition as you do.""But if a woman is partial to a man, and does not endeavour to conceal it, he must find it out.""Perhaps he must, if he sees enough of her. But though Bingley and Jane meet tolerably often, it is never for many hours together; and as they always see each other in large mixed parties, it is impossible that every moment should be employed in conversing together. Jane should therefore make the most of every half hour in which she can command his attention. When she is secure of him, there will be leisure for falling in love as much as she chuses.""Your plan is a good one," replied Elizabeth, "where nothing is in question but the desire of being well married; and if I were determined to get a rich husband, or any husband, I dare say I should adopt it. But these are not Jane's feelings; she is not acting by design. As yet, she cannot even be certain of the degree of her own regard, nor of its reasonableness. She has known him only a fortnight. She danced four dances with him at Meryton; she saw him one morning at his own house, and has since dined in company with him four times. This is not quite enough to make her understand his character.""Not as you represent it. Had she merely dined with him, she might only have discovered whether he had a good appetite; but you must remember that four evenings have been also spent together -- and four evenings may do a great deal.""Yes; these four evenings have enabled them to ascertain that theyboth like Vingt-un better than Commerce; but with respect to any other leading characteristic, I do not imagine that much has been unfolded.""Well," said Charlotte, "I wish Jane success with all my heart; and if she were married to him to-morrow, I should think she had as good a chance of happiness as if she were to be studying his character for a twelvemonth. Happiness in marriage is entirely a matter of chance. If the dispositions of the parties are ever so well known to each other, or ever so similar before-hand, it does not advance their felicity in the least. They always contrive to grow sufficiently unlike afterwards to have their share of vexation; and it is better to know as little as possible of the defects of the person with whom you are to pass your life.""You make me laugh, Charlotte; but it is not sound. You know it is not sound, and that you would never act in this way yourself."Occupied in observing Mr. Bingley's attentions to her sister, Elizabeth was far from suspecting that she was herself becoming an object of some interest in the eyes of his friend. Mr. Darcy had at first scarcely allowed her to be pretty; he had looked at her without admiration at the ball; and when they next met, he looked at her only to criticise. But no sooner had he made it clear to himself and his friends that she had hardly a good feature in her face, than he began to find it was rendered uncommonly intelligent by the beautiful expression of her dark eyes. To this discovery succeeded some others equally mortifying. Though he had detected with a critical eye more than one failure of perfect symmetry in her form, he was forced to acknowledge her figure to be light and pleasing; and in spite of his asserting that her manners were not those of the fashionable world, he was caught by their easy playfulness. Of this she was perfectly unaware; -- to her he was only the man who made himself agreeable no where, and who had not thought her handsome enough to dance with.He began to wish to know more of her, and as a step towards conversing with her himself, attended to her conversation with others. His doing so drew her notice. It was at Sir William Lucas's, where a large party were assembled. "What does Mr. Darcy mean," said she to Charlotte, "by listening to my conversation with Colonel Forster?""That is a question which Mr. Darcy only can answer.""But if he does it any more, I shall certainly let him know that I see what he is about. He has a very satirical eye, and if I do not begin by being impertinent myself, I shall soon grow afraid of him."On his approaching them soon afterwards, though without seeming to have any intention of speaking, Miss Lucas defied her friend to mention such a subject to him, which immediately provoking Elizabeth to do it, she turned to him and said,"Did not you think, Mr. Darcy, that I expressed myself uncommonly well just now, when I was teazing Colonel Forster to give us a ball at Meryton?""With great energy; -- but it is a subject which always makes a lady energetic.""You are severe on us.""It will be her turn soon to be teazed," said Miss Lucas. "I am going to open the instrument, Eliza, and you know what follows.""You are a very strange creature by way of a friend! -- always wanting me to play and sing before any body and every body! -- If my vanity had taken a musical turn, you would have been invaluable, but as it is, I would really rather not sit down before those who must be in thehabit of hearing the very best performers." On Miss Lucas's persevering, however, she added, "Very well; if it must be so, it must." And gravely glancing at Mr. Darcy, "There is a fine old saying, which every body here is of course familiar with -- "Keep your breath to cool your porridge," -- and I shall keep mine to swell my song."Her performance was pleasing, though by no means capital. After a song or two, and before she could reply to the entreaties of several that she would sing again, she was eagerly succeeded at the instrument by her sister Mary, who having, in consequence of being the only plain one in the family, worked hard for knowledge and accomplishments, was always impatient for display.Mary had neither genius nor taste; and though vanity had given her application, it had given her likewise a pedantic air and conceited manner, which would have injured a higher degree of excellence than she had reached. Elizabeth, easy and unaffected, had been listened to with much more pleasure, though not playing half so well; and Mary, at the end of a long concerto, was glad to purchase praise and gratitude by Scotch and Irish airs, at the request of her younger sisters, who, with some of the Lucases and two or three officers, joined eagerly in dancing at one end of the room.Mr. Darcy stood near them in silent indignation at such a mode of passing the evening, to the exclusion of all conversation, and was too much engrossed by his own thoughts to perceive that Sir William Lucas was his neighbour, till Sir William thus began."What a charming amusement for young people this is, Mr. Darcy! -- There is nothing like dancing after all. -- I consider it as one of the first refinements of polished societies.""Certainly, Sir; -- and it has the advantage also of being in vogueamongst the less polished societies of the world. -- Every savage can dance."Sir William only smiled. "Your friend performs delightfully;" he continued after a pause, on seeing Bingley join the group; -- "and I doubt not that you are an adept in the science yourself, Mr. Darcy.""You saw me dance at Meryton, I believe, Sir.""Yes, indeed, and received no inconsiderable pleasure from the sight. Do you often dance at St. James's?""Never, sir.""Do you not think it would be a proper compliment to the place?""It is a compliment which I never pay to any place, if I can avoid it.""You have a house in town, I conclude?"Mr. Darcy bowed."I had once some thoughts of fixing in town myself -- for I am fond of superior society; but I did not feel quite certain that the air of London would agree with Lady Lucas."He paused in hopes of an answer; but his companion was not disposed to make any; and Elizabeth at that instant moving towards them, he was struck with the notion of doing a very gallant thing, and called out to her,"My dear Miss Eliza, why are not you dancing? -- Mr. Darcy, you must allow me to present this young lady to you as a very desirable partner.-- You cannot refuse to dance, I am sure, when so much beauty is before you." And taking her hand, he would have given it to Mr. Darcy, who, though extremely surprised, was not unwilling to receive it, when she instantly drew back, and said with some discomposure to Sir William,"Indeed, Sir, I have not the least intention of dancing. -- I entreat you not to suppose that I moved this way in order to beg for a partner."Mr. Darcy with grave propriety requested to be allowed the honour of her hand; but in vain. Elizabeth was determined; nor did Sir William at all shake her purpose by his attempt at persuasion."You excel so much in the dance, Miss Eliza, that it is cruel to deny me the happiness of seeing you; and though this gentleman dislikes the amusement in general, he can have no objection, I am sure, to oblige us for one half hour.""Mr. Darcy is all politeness," said Elizabeth, smiling."He is indeed -- but considering the inducement, my dear Miss Eliza, we cannot wonder at his complaisance; for who would object to such a partner?"Elizabeth looked archly, and turned away. Her resistance had not injured her with the gentleman, and he was thinking of her with some complacency, when thus accosted by Miss Bingley."I can guess the subject of your reverie.""I should imagine not.""You are considering how insupportable it would be to pass manyevenings in this manner -- in such society; and indeed I am quite of your opinion. I was never more annoyed! The insipidity and yet the noise; the nothingness and yet the self-importance of all these people! -- What would I give to hear your strictures on them!""Your conjecture is totally wrong, I assure you. My mind was more agreeably engaged. I have been meditating on the very great pleasure which a pair of fine eyes in the face of a pretty woman can bestow."Miss Bingley immediately fixed her eyes on his face, and desired he would tell her what lady had the credit of inspiring such reflections. Mr. Darcy replied with great intrepidity,"Miss Elizabeth Bennet.""Miss Elizabeth Bennet!" repeated Miss Bingley. "I am all astonishment. How long has she been such a favourite? -- and pray when am I to wish you joy?""That is exactly the question which I expected you to ask. A lady's imagination is very rapid; it jumps from admiration to love, from love to matrimony, in a moment. I knew you would be wishing me joy.""Nay, if you are so serious about it, I shall consider the matter as absolutely settled. You will have a charming mother-in-law, indeed, and of course she will be always at Pemberley with you."He listened to her with perfect indifference while she chose to entertain herself in this manner, and as his composure convinced her that all was safe, her wit flowed long.中文翻译浪博恩小姐们不久就去拜访尼是斐花园的小姐们了。

Chapter 6 答案Pragmatics1. Define the following terms briefly.(1)pragmatics: a branch of linguistics that studies language in use.(2)deixis: the marking of the orientation or position of entities and situationswith respect to certain points of reference such as the place (here/there) andtime (now/then) of utterance.(3)reference: (in semantics) the relationship between words and the things, actions,events, and qualities they stand for.(4)anaphora: a process where a word or phrase (anaphor) refers back to anotherword or phrase which was used earlier in a text or conversation.(5)presupposition: implicit assumptions about the world required to make anutterance meaningful or appropriate, e.g. “some tea has already been taken”is a presupposition of “Take some more tea!”(6) Speech Act Theory: The theory was proposed by J. L. Austin and has beendeveloped by J. R. Searle. Basically, they believe that language is not only usedto inform or to describe things, it is often used to “do things”, to performacts. In saying “Sorry”, you are performing an act of apology.(7)indirect speech act: an utterance whose literal meaning (location) and intendedmeaning (illocution) are different. For example, Can you pass thesalt? is literally a yes/no question but is usually uttered as a request or politedirective for action.(8)the Cooperative Principle: a principle proposed by the philosopher PaulGrice whereby those involved in communication assume that both partieswill normally seek to cooperate with each other to establish agreed meaning.It is composed of 4 maxims: quality, quantity, relation and manner.(9)the Politeness Principle: politeness is regarded by most interlocutors as ameans or strategy which is used by a speaker to achieve various purposes,such as saving face, establishing and maintaining harmonious social relationsin conversation. This principle requires speakers to “minimize the expressionof impolite beliefs”. It is composed of 6 maxims: Maxims of Tact, Generosity,Approbation, Modesty, Agreement and Sympathy.(10) conversational implicature: the use of conversational maxims in the CooperativePrinciple to produce extra meaning during conversation.2. Deictic expressions: I, now, you, that, here, tomorrow.3. Anaphoric expressions: she, him, it.4. (1) He bought the beer.(2) You have a watch.(3) We bought a car.5.Direct acts: (1)/(5); Indirect acts: (2)/(3)/(4)6.(a) The Maxim of Quality: (1) Do not say what you believe to be false;(2) Do notsay that for which you lack adequate evidence.(b) The Maxim of Quantity: (1) Make your contribution as informative as is required(for the current purpose of the exchange); (2) Do not make your contributionmore informative than is required.(c) The Maxim of Relation: Be relevant.(d) The Maxim of Manner: Be perspicuous (1) Avoid obscurity of expression;(2)Avoid ambiguity; (3) Be brief (avoid unnecessary prolixity); (4) Be orderly.7.The speaker is particularly careful about the maxim of Agreement in PP. The response begins with “well” rather than “no” in order to minimize disagreement between the speaker and hearer.8.It is an indirect speech act. Carol invites Lara to a party, but Lara wants to decline the invitation. To be polite, she doesn’t choose a directrefusal, instead she says “I’ve got an exam tomorrow” as a reasonable excuse to decline the invitation. In this way, she minimizes the expression of impolite beliefs, thus the utterance conforms to PP.。

tpo 6The reading passage expolres that communal online encyclopedias have three immportant problems. The professor's lecture deal with the same issue. However, she thinks that reading has ignorance about how far online encyclopedias have come.First even though the reading passage suggests that the communal encyclopedia often lack acadamic credentials. The professor argues that the traditional encyclopedias have error and not close to accurate. What's more, it's easy for errors to be correct in an online encyclopedia but the errors will remain decades in printed encyclopedia.Moreover, despite the statement in the reading that online encyclopedias give hackers the oppotunity to damage infromation in the enctclopedias. The professor contends that online encyclopedias have recogenized to protect their artiles. The n she support this statement with two stratgies. One is make the articles no one can change it. Another is haveing a special editor to monitor the articles. Finally, the professor asserts that the space is not limited for online encyclopedias,where as the author of reading claims that the communal encyclopdias focus too frequently and in too great depth. But the professor points out that traditonal encyclopedias have limited space and the jugements decides some people don't interest thing in it. On the contrast, the online encyclopdias can have both acadamic articles and people interests.a/d spend less time on cooking foods in 20 yearsNowadays,with the improvement of living standerds, citizens increasingly concern about thier diet. Eating is of vital importance to morden living, and this is where the controversary arises. Some people think that they will spend more time on cooking foods. From my perspective,however, i stick to the idea that cooklng time will be reduced substantially.I. high-tech kitchen equipents will help people save cooking time.a. microwave oven can heat food quicklyb. intergrated breakfast-maker make coffee and bake bread at the same time.II.fast food are getting populara.fast food became deliciousb.people don't have to choose fast food because of limited time.III.over cooked food may unhealth.a.knowing the improtance of healthy,more and more people become vegetarian. and many vegetables will lose nutritions afrer cooked.b.if meat over cooked, it will produce harmful substancea/d children to grow up in countryside or in big cityNowadays,with the development of social economy, people pay more attention onliving environment, especial who has children in thier home. And this is where the controcersary arises. Some people belive growing up in countryside can cultivate children various abilities, such as idependents, cooperations and adventure spirit. However, from my perspective, i stick to the idea that big city can provide far more benefits than countryside.。

第六章 循环码的译码 习题

1.设计一个由g (x )=x 4+x 3+1生成的[15,11]循环汉明码编译码器。

2.构造由第1题的[15,11]码缩短三位的[11, 8]码译码器。

3.证明g (x )=1+x 2+x 4+x 6+x 7+x 10生成一个[21,11]循环码,作出此码的伴随式计算电路,令

R (x )=1+x 5+x 17是接收多项式,计算R (x )的伴随式,列出R (x )的每一接收数据移入伴随式计算电路后,伴随式寄存器中的内容。

4.构造GF(2)上以α、α3为根的循环码,这里α∈GF(24)中的本原元。

求出该码的生成多项式

g (x )以及码长n 和k .。

设计出该码的编码电路,求计算伴随式的电路。

5.构造[15,5,7]码的译码器,它的生成多项式g (x )=1+x +x 2+x 4+x 5+x 8+x 10,该码能纠正3个错

误。

设用简单的捕错译码器译码。

(a )证明所有2个错误能被捕获;

(b )能捕获所有3个错误的图样吗?若不能,则有多少种3个错误图样不能被捕获; (c )作出该码的简单捕错译码器。

6.作出第5题中[15,5,7]码的修正捕错译码器,叙述其译码过程。

7.已知[17,9,5] QR 码的生成多项式g (x )=x 8+x 7+x 6+x 4+x 2+x +1,求出该码利用修正捕错译码的

{Q j (x )},并作出捕错译码器,说明译码过程。

8.考虑[31,5]极长码,它的一致校验多项式是h (x )=1+x 2+x 5,求正交于x 30码元位的全部正交多

项式。

画出该码的I 型和II 型大数逻辑译码器。

9.作出表6-4中的[21,11,6]码的I 型大数逻辑译码器。

10.构造p =3,d =3复数旋转码,画出编译码电路图。

11.第5题中的[15,5,7]码是一步大数逻辑可译码,画出该码的I 型或II 型大数逻辑译码器。

12.考虑[11,6]线性码,它的一致校验矩阵是

1

000111111010001101000

0100101010000100110010

000100011

1H ⎡⎤⎢⎥⎢⎥⎢⎥=⎢⎥⎢⎥⎢⎥⎣⎦

(a)证明该码的距离恰好为4。

(b)令E =(e 0,e 1,e 2,…,e 10)是错误矢量,求出以此错误矢量表示的伴随式码元。

(c )对i =5,6,7,8,9,10,求出正交于每一消息数据e i 的全部可能的一致校验和。

(d )该码是一步完备可正交码吗?

13.作出[15,7,5]码的CHS2译码器,已知接收R

%=(000007004400020),求发送码字。

14.作出利用CHS2算法译[17,9,5]码的软判决译码流程图。

1。